Summary Prospectus

FlexShares®

Real Assets Allocation

Index Fund

| March 1, 2023, As Amended July 31, 2023

|

Ticker: ASET |

Stock Exchange: The Nasdaq Stock Market LLC |

Before you invest, you may want to review the Fund’s complete Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s complete Prospectus and other information about the Fund online at www.flexshares.com/prospectus. You can also get this information at no cost by calling 1-855-FLEXETF (1-855-353-9383) or by sending an e-mail request to info@flexshares.com. The Fund’s complete Prospectus and Statement of Additional Information, both dated March 1, 2023, as amended July 31, 2023, are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Investment Objective

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Real Assets

Allocation IndexSM (the “Underlying Index”).

Fees And Expenses Of The Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the

Fund. Under the Fund’s Investment Advisory Agreement, the Fund is responsible for

the following other expenses: interest expenses, brokerage commissions and other trading

expenses, fees and expenses of the independent trustees and their independent legal

counsel, taxes and other extraordinary costs such as litigation and other expenses not

incurred in the ordinary course of business. You will also incur usual and customary brokerage commissions and fees to financial intermediaries when buying or selling shares of the Fund in the secondary

market, which are not reflected in the example that follows:

| Annual Fund Operating Expenses (expenses that you pay each

year as a percentage of the value of your investment) | |

| Management Fees |

0.57% |

| Distribution (12b-1) Fees |

0.00% |

| Other Expenses |

0.01% |

| Acquired Fund Fees and Expenses(1) |

0.46% |

| Total Annual Fund Operating Expenses |

1.04% |

| Expense Reimbursement(2) |

-0.47% |

| Total Annual Fund Operating Expenses After Expense

Reimbursement |

0.57% |

(1)

The “Total Annual Fund Operating Expenses” may not correlate

to the ratio of expenses to average net assets as reported in the

"Financial Highlights" section of the Prospectus, which reflects the

operating expenses of the Fund and does include “Acquired Fund Fees

and Expenses.”

(2)

Northern Trust Investments, Inc. (“NTI”) has contractually agreed to

reimburse a portion of the operating expenses of the Fund (other than 12b-1 Fees, Tax Expenses, Extraordinary Expenses, and Acquired Fund Fees and Expenses (“Acquired

Fund Fees and Expenses”)) to the extent the “Total Annual Fund Operating

Expenses” exceed 0.57%. This contractual limitation may not be terminated before March 1, 2024 without the approval of the Fund’s Board of Trustees. NTI also has contractually agreed

until March 1, 2024 to waive a portion of its Management Fees and/or reimburse certain operating expenses in an amount equal to the Acquired Fund Fees and Expenses attributable to the

Fund’s investments in the Underlying Fund (as defined below). The Fund’s Board of Trustees may terminate the contractual agreements at any time if it determines that it is in the best

interest of the Fund and its shareholders.

Example

The

following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods

indicated and then redeem all of your shares at the end of those periods. The Example

also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the expense reimbursement arrangement for one year). Although

your actual costs may be higher or lower, based on these assumptions your costs would

be:

| 1 Year |

$58 |

| 3 Years |

$284 |

| 5 Years |

$528 |

| 10 Years |

$1 ,228 |

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or

“turns over” its portfolio). A higher portfolio turnover rate may indicate

higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the

Fund’s performance. Portfolio turnover may vary from year to year, as well as

within a year. During the most recent fiscal year, the Fund’s portfolio turnover

rate was 7% of the average value of its portfolio.

www.flexshares.com

FlexShares®

Real Assets Allocation Index Fund

Page 2

Principal

Investment Strategies

The Fund is a fund of funds and seeks its investment objective by investing primarily in the shares of other FlexShares® ETFs (each an “Underlying Fund” and together, the “Underlying Funds”) that are eligible for inclusion in the Underlying

Index and listed below, rather than in securities of individual companies. The Underlying

Funds themselves seek investment results corresponding to their own respective

underlying indexes. The Underlying Funds invest primarily in separate sets of securities representing or providing exposures to global “real assets.” Real assets are defined by the Index

Provider as physical or tangible assets. Examples of real assets include but are not limited to commodities, precious metals, oil, and real estate. Each Underlying Fund has its own risk

profile and will contribute differently to the overall risk profile of the Fund. Each

of the Underlying Funds invests in equity securities that are traded in or are issued by companies domiciled in global developed or emerging markets (including the U.S.). Certain of the Underlying Funds may

invest in publicly-traded units of master limited partnerships (“MLPs”) and

real estate investment trusts (“REITs”).

The Underlying Index is designed to reflect the performance of an optimized allocation to the

Underlying Funds that is intended to provide exposures to certain real assets and

minimize overall volatility of investment in the Underlying Funds.

As of December 31, 2022, the Underlying Index was comprised of the following Underlying Funds, each

of which invests primarily in equity securities: a 51.79% weight to FlexShares® STOXX® Global Broad Infrastructure Index Fund, a 25.35% weight to FlexShares® Morningstar Global Upstream Natural Resources Index Fund and a 22.86% weight to FlexShares® Global Quality Real Estate Index Fund. The Underlying Index was constituted and is

rebalanced at least annually using a rules-based methodology. The Underlying Index may

be rebalanced semi-annually if the volatility of investment in the Underlying Funds surpasses a minimum threshold. The weights of each Underlying Fund, and the degree to which each Underlying

Fund represents exposure to certain real assets, may change over time as the Underlying

Index and the underlying indexes of the Underlying Funds are reconstituted and/or rebalanced (which may be quarterly) and their component securities fluctuate in value. The Fund generally

reconstitutes and/or rebalances its portfolio in accordance with the Underlying

Index.

NTI uses a

“passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” the index it tracks and does not seek

temporary defensive positions when markets decline or appear overvalued.

NTI

generally intends to replicate the constituent securities of the Fund’s Underlying Index. “Replication” is an indexing strategy in which a fund invests in substantially all of the securities in its underlying index in

approximately the same proportions as in the underlying index. NTI may use a

“representative sampling” strategy in certain circumstances, such as when it may not be possible or practicable to fully implement a replication strategy. Representative sampling is investing in a representative

sample of securities that collectively has an investment profile similar to the

Underlying Index.

Under normal circumstances, the Fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of

the Underlying Index. The Fund may also invest up to 20% of its assets in cash and cash

equivalents, including shares of money market funds advised by NTI or its affiliates, futures contracts and options on futures contracts, as well as securities not included in the Underlying Index, but

which NTI believes will help the Fund track its Underlying Index.

The Underlying Index is created and sponsored by NTI. NTI also serves as the investment adviser to

the Fund and the Underlying Funds. NTI, as the Index Provider, determines the

composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral

received).

From time to time the Fund may focus its investments (i.e., invest more than 15% of its total assets) in one or more particular countries or geographic

regions.

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying

Index is concentrated.

Principal Risks

As with any investment, you could lose all or part of your investment in the Fund, and the Fund’s performance could trail that of other investments. The

Fund is subject to certain risks, including the principal risks noted below, any of

www.flexshares.com

FlexShares®

Real Assets Allocation Index Fund

Page 3

which may adversely

affect the Fund’s net asset value (“NAV”), trading price, yield, total return and ability to meet its investment objective. Because the Fund will significantly invest in Underlying Funds, the

risks described below are also applicable to the Underlying Funds, and to the extent

that the Fund invests directly in securities and other instruments, the risks described below are also directly applicable to the Fund. Each risk noted below is considered a principal risk of investing

in the Fund, regardless of the order in which it appears. The significance of each risk

factor below may change over time and you should review each risk factor carefully.

Concentration Risk is the risk that, if the Fund is concentrated in a particular industry or group of industries, the Fund is likely to present more risks than a

fund that is broadly diversified over several industries or groups of industries.

Compared to the broad market, an individual industry may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory

changes.

•Global Natural Resources Risk is the risk that the Fund is subject to the risks associated with investment in the global natural resources sector in

addition to the general risk of the stock market. The natural resources sector can be

significantly affected by events relating to U.S. and foreign political and economic developments and environmental and other government regulations, as well as other factors including, but not

limited to: commodity price volatility, technological developments and natural or

man-made disasters. Declines in the demand for, or prices of, natural resources generally

would be expected to contribute to declines in the value of the Fund’s or

Underlying Fund’s equity securities. Such declines may occur quickly and without warning and may negatively impact the value of the Fund and your investment.

•Infrastructure-Related

Companies Risk is the risk that the Fund is subject to the risks associated with investment in infrastructure-related companies in addition to the general risk of the stock market. Risks

associated with infrastructure-related companies include: (a) realized revenue volume

may be significantly lower than projected and/or there will be cost overruns; (b) infrastructure project sponsors will alter their terms making a project no longer economical; (c) macroeconomic

factors such as low gross domestic product (“GDP”) growth or high nominal

interest rates will raise the average cost of infrastructure funding; (d) government

regulation may affect rates charged to infrastructure customers; (e) government

budgetary constraints will impact infrastructure projects; (f) special tariffs will be

imposed; and (g) changes in tax laws, regulatory policies or accounting standards

could be unfavorable. Other risks include environmental damage due to a company’s

operations or an accident, a natural disaster, changes in market sentiment towards infrastructure and terrorist acts. Any of these events could cause the value of the Fund’s or Underlying

Fund’s investments in infrastructure-related companies to decline.

MLP Risk is the risk that accompanies an investment in MLP units. The risks of investing in an MLP are similar to those of investing in a partnership,

including more flexible governance structures, which could result in less protection

for investors, such as the Fund, than investments in a corporation. An investor in an

MLP normally would not be liable for the debts of the MLP beyond the amount that the

investor has contributed but may not be shielded from liability to the same extent that

a shareholder of a corporation would be. MLPs are also subject to risks related to

potential conflicts of interest between the MLP and the MLP’s general partner and

cash flow risks. MLPs that concentrate in a particular industry or a particular geographic region are subject to risks associated with such industry or region. MLPs may also be sensitive to

changes in interest rates and during periods of interest rate volatility, limited

capital markets access and/or low commodities pricing and may not provide attractive

returns.

MLP Tax Risk. An MLP is a public limited partnership or limited liability company taxed as a partnership under

the Internal Revenue Code of 1986. MLPs taxed as partnerships do not pay U.S. federal

income tax at the partnership level, subject to the application of certain partnership audit rules. A change in current tax law, or a change in the underlying business mix of a given MLP,

however, could result in an MLP being classified as a corporation for U.S. federal

income tax purposes, which would have the effect of reducing the amount of cash available for distribution by the MLP and, as a result, could result in a reduction of the value of the Fund’s investment

(and the Fund), and, consequently, lower income.

Real Estate Securities Risk is the risk that the Fund or an Underlying Fund is subject to the risks associated with investment in the real estate sector in

addition to the general risk of the stock market. Investing in securities of real

estate companies will make an Underlying Fund, and the Fund, more susceptible to risks

associated with the ownership of real estate and with the real estate industry in

general, as well as risks that relate specifically to the way in which real estate

companies are organized and operated. Real estate companies may have lower trading volumes and may be subject to more abrupt or erratic price movements

www.flexshares.com

FlexShares®

Real Assets Allocation Index Fund

Page 4

than the overall

securities markets. The value of real estate securities may underperform other sectors of the economy or broader equity markets. To the extent that an Underlying Fund, and the Fund, concentrates its

investments in the real estate sector, it may be subject to greater risk of loss than

if it were diversified across different industry sectors.

REIT Risk is the risk that the Fund’s investments may be affected by factors affecting REITs and the

real estate sector generally. Investing in REITs involves certain unique risks in

addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks

affecting such industries and regions. REITs may have limited financial resources, may

trade less frequently and in lower volume, engage in dilutive offerings or become more volatile than other securities. By investing in REITs through the Fund, a shareholder will bear expenses of the

REITs in addition to expenses of the Fund. In addition, REITs could possibly fail to

(i) qualify for favorable tax treatment under applicable tax law, or (ii) maintain their exemption from registration under the Investment Company Act of 1940.

Equity Securities Risk is the risk that the values of the equity securities owned by the Fund may be more volatile and underperform other asset classes and

the general securities markets.

Fund of Funds Risk is the risk that the Fund’s investment performance largely depends on the investment performance of the Underlying Funds in which it

primarily invests. The Fund’s NAV will change with changes in the value of the

Underlying Funds and other securities in which the Fund invests based on their market valuations. An investment of the Fund is subject to the risks associated with the Underlying Funds that comprise

the Underlying Index. There is the risk that the Index Provider’s evaluations and

assumptions regarding the asset classes represented by the Underlying Funds in the Underlying Index at any given time may be incorrect based on actual market conditions.

An

investment in the Fund will entail more costs and expenses than direct investments in the Underlying Funds. The Fund will indirectly pay a proportional share of the expenses of the Underlying Funds in which

it invests (including operating expenses and management fees), in addition to the fees

and expenses it pays directly. As the Fund’s allocation to the Underlying Funds changes from time to time, or to the extent that the expense ratio of the Underlying Funds changes, the weighted

average operating expenses borne by the Fund may increase or decrease.

Tax

Risk is the risk that, because the Fund invests in the Underlying Funds, the

Fund’s realized losses on sales of shares of the Underlying Funds may be indefinitely or permanently deferred as “wash sales.” Distributions of short-term capital gains by the Underlying

Funds will be recognized as ordinary income by the Fund and would not be offset by the

Fund’s capital loss carryforwards, if any. Capital loss carryforwards of the Underlying Funds, if any, would not offset net capital gains of the Fund. Each of these effects is caused by the Fund’s

investment in the Underlying Funds and may result in distributions to Fund shareholders

being of higher magnitudes and less likely to qualify for lower capital gain tax rates than if the Fund were to invest otherwise.

Model Risk is the risk that the asset allocation model used to calculate the Underlying Index will not achieve its intended results.

Momentum Risk is the risk that securities that have had higher recent price performance compared to other

securities may be more volatile than a broad cross-section of securities or that

returns on securities that have previously exhibited price momentum are less than returns on other securities or the overall stock market. Momentum can turn quickly and cause significant variation

from other types of investments. An Underlying Fund may follow an index that selects

constituent securities based on a “momentum” factor.

Value Investing Risk is the risk that an Underlying Fund’s investment in companies whose securities are believed to be undervalued, relative to their

underlying profitability, will not appreciate in value as anticipated.

Quality Factor Risk is the risk that the past performance of companies that have exhibited quality characteristics does not continue or the returns on securities

issued by such companies may be less than returns from other styles of investing or the

overall stock market. There may be periods when quality investing is out of favor and during which time the Fund's performance may suffer.

Foreign Securities Risk is the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value

than a fund that invests exclusively in securities of U.S. companies, due to less

liquid markets and adverse economic, political, diplomatic, financial, and regulatory factors. Foreign governments may impose limitations on foreigners’ ownership of interests in local issuers, restrictions

on the ability to repatriate assets, and may also impose taxes. Any of these events

could cause the value of the Fund’s investments to

www.flexshares.com

FlexShares®

Real Assets Allocation Index Fund

Page 5

decline. Foreign banks, agents and securities depositories that hold the Fund’s foreign assets may be subject to little or no regulatory oversight over,

or independent evaluation, of their operations. Additional costs associated with investments in foreign securities may include higher custodial fees than those applicable to domestic custodial

arrangements and transaction costs of foreign currency conversions. Unless the Fund has

hedged its foreign currency exposure, foreign securities risk also involves the risk of

negative foreign currency rate fluctuations, which may cause the value of securities

denominated in such foreign currency (or other instruments through which the Fund has

exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. For

instance, forward foreign currency exchange contracts, if used by the Fund, could

reduce performance if there are unanticipated changes in currency exchange

rates.

Emerging Markets Risk is the risk that emerging markets are generally subject to greater market volatility, political,

social and economic instability, uncertain trading markets and more governmental

limitations on foreign investments than more developed markets. In addition, companies

operating in emerging markets may be subject to lower trading volumes and greater price

volatility than companies in more developed markets. Emerging market economies may be

based on only a few industries, may be highly vulnerable to changes in local and global trade conditions, and may suffer from extreme and volatile debt burdens or inflation rates. Companies in emerging

market countries generally may be subject to less stringent regulatory, disclosure,

financial reporting, accounting, auditing and recordkeeping standards than companies in more developed countries. As a result, information, including financial information, about such companies may be

less available and reliable, which can impede the Fund’s ability to evaluate such

companies. Securities law and the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably, and the ability to bring and enforce actions

(including bankruptcy, confiscatory taxation, expropriation, nationalization of a

company’s assets, restrictions on foreign ownership of local companies,

restrictions on withdrawing assets from the country, protectionist measures and practices such as share blocking), or to obtain information needed to pursue or enforce such actions, may be limited.

Investments in emerging market securities may be subject to additional transaction

costs, delays in settlement procedures, unexpected market closures, and lack of timely information.

Geographic Risk is the risk that if the Fund invests a significant portion of its total assets in certain issuers

within the same country or geographic region, an adverse economic, business or

political development affecting that country or region may affect the value of the Fund’s investments more, and the Fund’s investments may be more volatile, than if the Fund’s investments

were not so concentrated in such country or region.

•Canada Investment Risk. is the risk that the Fund is particularly sensitive to political, economic and social conditions in affecting Canada. The Canadian economy is especially dependent on the demand for, and

supply of, natural resources, and the Canadian market is relatively concentrated in

issuers involved in the production and distribution of natural resources, particularly

the production of metals. Any adverse events that affect Canada’s major

industries may have a negative impact on the overall Canadian economy and the Fund.

•United Kingdom Investment Risk is the risk that investments in issuers located in the United Kingdom (“UK”) may subject the Fund to

regulatory, political, currency, security and economic risk specific to the UK. The UK

has one of the largest economies in Europe and is heavily dependent on trade with the European Union (“EU”). As a result, the UK economy may be impacted by changes to the economic health of

EU member countries. In 2016, the UK voted to leave the EU (commonly known as

“Brexit”), and on January 31, 2020, the UK officially withdrew from the EU. The precise impact on the UK’s economy as a result of its departure from the EU depends to a large degree

on its ability to conclude favorable trade deals with the EU and other countries. While

new trade deals may boost economic growth, such growth may not be able to offset the

increased costs of trade with the EU resulting from the UK’s loss of its

membership in the EU single market.

Market Risk is the risk that the value of the Fund’s investments may increase or decrease in response to

expected, real or perceived economic, political or financial events in the U.S. or

global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other

potentially adverse effects in response to changing market conditions, inflation,

changes in interest rates, lack of liquidity in the bond or equity markets, or volatility in the equity markets. Market disruptions caused by local or regional events such as war, acts of terrorism, the spread of

infectious illness (including epidemics and pandemics) or other public health issues,

recessions or other events or adverse investor sentiment could have a significant impact on the Fund and

www.flexshares.com

FlexShares®

Real Assets Allocation Index Fund

Page 6

its investments and

could result in the Fund’s shares trading at increased premiums or discounts to the Fund’s NAV. During periods of market disruption or other abnormal market conditions, the Fund’s exposure

to the risks described elsewhere in this summary will likely increase. Market

disruptions, regulatory restrictions or other abnormal market conditions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track its Underlying

Index or cause delays in the Underlying Index’s rebalancing or reconstitution schedule. During any such delay, it is possible that the Underlying Index and, in turn, the Fund will deviate

from the Underlying Index’s stated methodology and therefore experience returns

different than those that would have been achieved under a normal rebalancing or reconstitution schedule.

Index Risk is the risk that the Fund would not necessarily buy or sell a security unless that security is added to or removed from, respectively, the

Underlying Index, even if that security generally is underperforming, because unlike

many investment companies, the Fund does not utilize an investing strategy that seeks

returns in excess of the Underlying Index. Additionally, the Fund rebalances and/or

reconstitutes its portfolio in accordance with the Underlying Index, and, therefore,

any changes to the Underlying Index’s rebalance and/or reconstitution schedule will result in corresponding changes to the Fund’s rebalance and/or reconstitution schedule.

Tracking Error Risk is the risk that the Fund’s performance may vary from the performance of the Underlying

Index as a result of creation and redemption activity, transaction costs, expenses and

other factors.

Authorized Participant Concentration Risk is the risk that the Fund may be adversely affected because it has a limited number of institutions that act as authorized participants (“Authorized Participants”).

Only an Authorized Participant may engage in creation or redemption transactions

directly with the Fund and none of those Authorized Participants is obligated to engage

in creation and/or redemption transactions. To the extent that these institutions exit

the business or are unable or unwilling to proceed with creation and/or redemption

orders with respect to the Fund and no other Authorized Participant is able or willing

to step forward to create or redeem Creation Units (as defined below), Fund shares may

trade at a discount to NAV and possibly face trading halts and/or delisting.

Calculation Methodology Risk is the risk that the Underlying Index’s calculation methodology or sources of information may not provide an accurate

assessment of included issuers or correct valuation of securities, nor is the

availability or

timeliness of the production of the Underlying Index guaranteed. A security included in the Underlying Index may not exhibit the characteristic or provide the specific exposure for which it was selected

and consequently a Fund's holdings may not exhibit returns consistent with that

characteristic or exposure.

Market Trading Risk is the risk that the Fund and the Underlying Funds face because their shares are listed on a securities exchange, including the

potential lack of an active market for Fund shares, losses from trading in secondary

markets, periods of high volatility and disruption in the creation/redemption process of the Fund or Underlying Fund. ANY OF THESE FACTORS MAY LEAD TO THE FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Trading

in Fund shares may be halted due to market conditions or for reasons that, in the view of its listing exchange, make trading in the shares inadvisable. The market prices of Fund shares will generally fluctuate in

accordance with changes in its NAV, changes in the relative supply of, and demand for,

Fund shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings.

Derivatives Risk is the risk that derivatives may pose risks in addition to and greater than those associated with

investing directly in securities, currencies and other instruments, may be illiquid or

less liquid, more volatile, more difficult to value and leveraged so that small changes in the value of the underlying instrument may produce disproportionate losses to the Fund. Derivatives are

also subject to counterparty risk, which is the risk that the other party to the

transaction will not perform its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in

more traditional securities and instruments.

•Futures Contracts Risk is the risk that there will be imperfect correlation between the change in market value of the Fund’s securities and the price of futures contracts, which may result in the

strategy not working as intended; the possible inability of the Fund to sell or close

out a futures contract at the desired time or price; losses due to unanticipated market movements, which potentially are unlimited; and the possible inability of NTI to correctly predict the direction of

securities’ prices, interest rates, currency exchange rates and other economic

factors, which may make the Fund’s returns more volatile or increase the risk of loss.

www.flexshares.com

FlexShares®

Real Assets Allocation Index Fund

Page 7

•Options Contracts Risk Options contracts give the holder of the option the right to buy (or to sell) a position in a security or in a contract to the writer of the option, at a certain price. They are subject to

correlation risk because there may be an imperfect correlation between the options and

the securities markets that cause a given transaction to fail to achieve its objectives.

The successful use of options depends on the investment adviser’s ability to

predict correctly future price fluctuations and the degree of correlation between the

options and securities markets. Exchanges can limit the number of positions that can be

held or controlled by the Fund or the investment adviser, thus limiting the ability to

implement the Fund’s strategies.

•Forward Foreign Currency Contracts

Risk is the risk that, if forward prices increase, a loss will occur to the extent that the agreed upon purchase price of the currency exceeds the price of the currency that

was agreed to be sold.

Interest Rate Risk is the risk that during periods of rising interest rates, the Fund’s yield (and the market

value of its securities) will tend to be lower than prevailing market rates; in periods

of falling interest rates, the Fund’s yield (and the market value of its securities) will tend to be higher. Increases in interest rates typically lower the present value of a REIT’s future

earnings stream, and may make financing property purchases and improvements more

costly. Because the market price of REIT stocks may change based upon investors’

collective perceptions of future earnings, the value of the Fund may decline when investors anticipate or experience rising interest rates.

In general, securities with longer maturities or durations are more sensitive to interest rate changes. Changing interest rates, including rates that fall

below zero, may have unpredictable effects on the markets and the Fund’s investments, may result in heightened market volatility, may impact the liquidity of fixed-income securities and

of the Fund, and may detract from Fund performance. A low or negative interest rate

environment could cause the Fund’s earnings to fall below the Fund’s expense ratio, resulting in a low or negative yield and a decline in the Fund’s NAV. A general rise in interest rates may

cause investors to move out of fixed income securities on a large scale, which could

adversely affect the price and liquidity of fixed income securities and could also

result in increased redemptions for the Fund.

Mid and Small Cap Stock Risk is the risk that stocks of mid-sized and smaller companies may be more volatile than stocks of larger, more established

companies, and may lack sufficient market liquidity. Mid-sized and small companies may

have limited product lines or financial

resources, may be dependent upon a particular niche of the market, or may be dependent upon a small

or inexperienced management group. Securities of smaller companies may trade less

frequently and in lower volume than the securities of larger companies, which could lead to higher transaction costs. Generally the smaller the company size, the greater the risk.

Securities Lending Risk is the risk that the Fund may lose money because the borrower of the loaned securities fails

to return the securities in a timely manner or at all. The Fund could also lose money

in the event of a decline in the value of collateral provided for loaned securities or a

decline in the value of any investments made with cash collateral.

Valuation Risk is the risk that the sale price the Fund or an Underlying Fund could receive for a portfolio

security may differ from the Fund’s or the Underlying Fund’s valuation of

the security, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. In addition, the value of the securities in the Fund’s or an Underlying

Fund’s portfolio may change on days when shareholders will not be able to

purchase or sell the Fund’s shares.

It is possible to lose money on an investment in the Fund. An

investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation, any other government agency, or The

Northern Trust Company, its affiliates, subsidiaries or any other bank.

Fund Performance

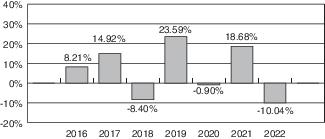

The bar chart and table that follow show how the Fund has performed on a calendar year basis and

provide an indication of the risks of investing in the Fund by showing (A) changes in

the Fund’s performance from year to year, (B) how the Fund’s average annual returns compare with those of a broad measure of market performance, and (C) an additional index with characteristics relevant

to the Fund. Past performance (before and after taxes) does not necessarily indicate

how the Fund will perform in the future. Updated information on the Fund’s performance results can be obtained by visiting flexshares.com.

www.flexshares.com

FlexShares®

Real Assets Allocation Index Fund

Page 8

Calendar Year Total Returns

For the periods in the bar chart above:

Best Quarter (3/31/2019): 14.27%

Worst Quarter (3/31/2020): -23.50%

Average Annual Total Returns

(for the periods ended December 31, 2022)

| |

One Year |

Five Year |

Since Inception of Fund |

Inception Date of Fund |

| Before Taxes |

-10.04% |

3.68% |

5.53% |

11/23/2015 |

| After Taxes on

Distributions |

-10.63% |

2.87% |

4.65% |

— |

| After Taxes on

Distributions and Sale of

Shares |

-5.55% |

2.67% |

4.12% |

— |

| MSCI ACWI Index* |

-18.36% |

5.22% |

7.64% |

— |

| Northern Trust Real

Assets Allocation

IndexSM* |

-9.94% |

3.81% |

5.66% |

— |

*

Reflects no deduction for fees, expenses or taxes.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors who hold shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement plans. After-tax returns may exceed the

return before taxes due to an assumed tax benefit from realizing a capital loss on a

sale of Fund shares.

Management

Investment Adviser and Portfolio Managers. NTI, a subsidiary of Northern Trust Corporation, serves as the Investment Adviser of the Fund. Robert Anstine, a Senior Vice President of NTI, and Brendan Sullivan, a Vice

President of NTI, have served as Portfolio Managers of the Fund since its inception in

November 2015 and June 2016, respectively.

Purchase and Sale of Fund Shares

The Fund is an exchange-traded fund (commonly referred to as an “ETF”). The Fund’s

shares may be issued and redeemed only by certain large institutions, referred to as

“Authorized Participants,” that enter into agreements with the Fund’s

principal underwriter. Retail investors may acquire and sell Fund shares in the secondary market through a broker-dealer. The price of Fund shares is based on market price, and because ETF shares

trade at market prices rather than NAV, shares may trade at a price greater than NAV (a

premium) or less than NAV (a discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the

lowest price a seller is willing to accept for shares of the Fund (ask) when buying or

selling shares in the secondary market (“the bid-ask spread”). Recent information, including information about the Fund’s NAV, market price, premiums and discounts, and bid-ask spreads, is included on the

Fund’s website at flexshares.com.

Tax Information

The

Fund’s distributions are generally taxable to you as ordinary income, qualified dividends, capital gains, or a combination of the three, unless you are investing through a tax-advantaged arrangement, such as a

401(k) plan or an individual retirement account. Distributions may be taxable upon

withdrawal from tax-advantaged accounts.

Payments to Brokers-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank),

NTI and its related companies may pay the intermediary for activities related to the

marketing and promotion of the Fund. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your financial intermediary’s website

for more information.

www.flexshares.com