FlexShares Trust

0001491978 FLEXSHARES TRUST false 497 N-1A 2023-07-31 2023-07-31 2022-10-31 The "Total Annual Fund Operating Expenses" may not correlate to the ratio of expenses to average net assets as reported in the "Financial Highlights" section of the Prospectus, which reflects the operating expenses of the Fund and does include "Acquired Fund Fees and Expenses." Northern Trust Investments, Inc. (“NTI”) has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than 12b-1 Fees, Tax Expenses, Extraordinary Expenses, and Acquired Fund Fees and Expenses to the extent the “Total Annual Fund Operating Expenses” exceed 0.35%. This contractual limitation may not be terminated before March 1, 2024 without the approval of the Fund’s Board of Trustees. NTI has also contractually agreed to waive Management Fees or reimburse certain expenses in an amount equal to the sum of (a) any Acquired Fund Fees and Expenses, if any, incurred by the Fund that are attributable to the Fund’s investment in Acquired Funds managed by NTI or an investment adviser controlling, controlled by, or under common control with NTI (“Affiliated Funds”); and (b) 0.05% or such lesser amount in Acquired Fund Fees and Expenses incurred by the Fund that are attributable to the Fund’s investment in Acquired Funds that are not Affiliated Funds, until March 1, 2024. The Trust’s Board of Trustees may terminate the contractual arrangements at any time if it determines that it is in the best interest of the Fund and its shareholders. 3.87 1.27 9.29 8.75 1.82 13.55 0001491978 2023-03-01 2023-03-01 0001491978 fst:S000055516Member 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:AssetBackedAndMortgageBackedSecuritiesRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:AuthorizedParticipantConcentrationRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:BloombergUsAggregateBondIndexOneMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:C000174705Member 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:C000174705Member rr:AfterTaxesOnDistributionsAndSalesMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:C000174705Member rr:AfterTaxesOnDistributionsMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:CreditOrDefaultRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:DebtExtensionRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:DerivativesRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:ForeignSecuritiesRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:GeographicRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:HedgingRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:HighPortfolioTurnoverRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:IncomeRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:InterestRateMaturityRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:LiquidityRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:ManagementRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:MarketRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:MarketTradingRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:PrepaymentOrCallRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member rr:RiskLoseMoneyMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member rr:RiskNotInsuredDepositoryInstitutionMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:SectorRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:SecuritiesLendingRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:UnderlyingFundRiskMember 2023-03-01 2023-03-01 0001491978 fst:S000055516Member fst:USGovernmentSecuritiesRiskMember 2023-03-01 2023-03-01 iso4217:USDxbrli:pure

FlexShares® Trust Prospectus

| |

|

|

FlexShares® US Quality Low Volatility Index Fund |

|

|

FlexShares® Developed Markets ex-US Quality Low Volatility Index Fund |

|

|

FlexShares® Emerging Markets Quality Low Volatility Index Fund |

|

|

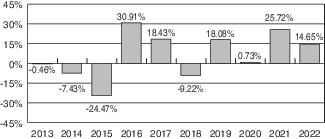

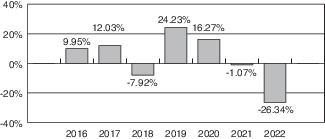

FlexShares® Morningstar US Market Factor Tilt Index Fund |

|

|

FlexShares® Morningstar Developed Markets ex-US Factor Tilt Index Fund |

|

|

FlexShares® Morningstar Emerging Markets Factor Tilt Index Fund |

|

|

FlexShares® US Quality Large Cap Index Fund |

|

|

FlexShares® STOXX® US ESG Select Index Fund (formerly, FlexShares® STOXX® US ESG Impact Index Fund) |

|

|

FlexShares® STOXX® Global ESG Select Index Fund (formerly, FlexShares® STOXX® Global ESG Impact Index Fund) |

|

|

FlexShares® ESG & Climate US Large Cap Core Index Fund |

|

|

FlexShares® ESG & Climate Developed Markets ex-US Core Index Fund |

|

|

FlexShares® ESG & Climate Emerging Markets Core Index Fund |

|

|

FlexShares® Morningstar Global Upstream Natural Resources Index Fund |

|

|

FlexShares® STOXX® Global Broad Infrastructure Index Fund |

|

|

FlexShares® Global Quality Real Estate Index Fund |

|

|

FlexShares® Real Assets Allocation Index Fund |

|

The Nasdaq Stock Market LLC |

FlexShares® Quality Dividend Index Fund |

|

|

FlexShares® Quality Dividend Defensive Index Fund |

|

|

FlexShares® International Quality Dividend Index Fund |

|

|

FlexShares® International Quality Dividend Defensive Index Fund |

|

|

FlexShares® International Quality Dividend Dynamic Index Fund |

|

|

FlexShares® iBoxx 3-Year Target Duration TIPS Index Fund |

|

|

FlexShares® iBoxx 5-Year Target Duration TIPS Index Fund |

|

|

FlexShares® Disciplined Duration MBS Index Fund |

|

|

FlexShares® Credit-Scored US Corporate Bond Index Fund |

|

The Nasdaq Stock Market LLC |

FlexShares® Credit-Scored US Long Corporate Bond Index Fund |

|

|

FlexShares® High Yield Value-Scored Bond Index Fund |

|

|

FlexShares® ESG & Climate Investment Grade Corporate Core Index Fund |

|

|

Prospectus dated March 1, 2023, As Amended July 31, 2023.

An investment in a Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”), any other government agency, or The Northern Trust Company, or its affiliates, subsidiaries or any other bank. An investment in a Fund involves investment risks, including possible loss of principal.

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Fund Summaries

FlexShares® US Quality Low Volatility Index Fund

Investment Objective

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Quality Low Volatility IndexSM (the “Underlying Index”).

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Under the Fund’s Investment Advisory Agreement, the Fund is responsible for the following expenses: interest expenses, brokerage commissions and other trading expenses, fees and expenses of the independent trustees and their independent legal counsel, taxes and other extraordinary costs such as litigation and other expenses not incurred in the ordinary course of business. You will also incur usual and customary brokerage commissions and fees to financial intermediaries when buying or selling shares of the Fund in the secondary market, which are not reflected in the example that follows:

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |

|

Distribution (12b-1) Fees |

|

| |

|

Total Annual Fund Operating Expenses |

|

| |

|

Total Annual Fund Operating Expenses After Expense Reimbursement |

|

(1)

Northern Trust Investments, Inc. (“NTI”) has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than 12b-1 Fees, Tax Expenses, Extraordinary Expenses, and Acquired Fund Fees and Expenses) to the extent the “Total Annual Fund Operating Expenses” exceed 0.22%. This contractual limitation may not be terminated before March 1, 2024 without the approval of the Fund’s Board of Trustees. The Fund’s Board of Trustees may terminate the contractual agreement at any time if it determines that it is in the best interest of the Fund and its shareholders.

Example

The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods.

The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the expense reimbursement arrangement for one year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. Portfolio turnover may vary from year to year, as well as within a year. During the most recent fiscal year, the Fund’s portfolio turnover rate was 48% of the average value of its portfolio.

Principal Investment Strategies

The Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to the Northern Trust 1250 Index (the “Parent Index”), a float-adjusted market capitalization weighted index of U.S. domiciled large- and mid-capitalization companies. In addition, the Underlying Index is designed to select companies from the Parent Index that exhibit financial strength, stability and enhanced risk-return characteristics, which NTI believes can provide equity-market participation while seeking to protect against downside risks during certain market environments.

To derive the Underlying Index, NTI, acting in its capacity as the index provider (the “Index Provider”) ranks all constituents of the Parent Index using a Northern Trust proprietary quality factor. This factor is a quantitative ranking based on: (a) management efficiency (e.g., corporate finance activities and corporate governance); (b) profitability (e.g., reliability and sustainability of financial performance); and (c) cash flow (e.g., cash flow generation). The Index Provider then excludes the lowest quintile of con

FlexShares® US Quality Low Volatility Index Fund (cont.)

stituents ranked according to the quality factor and uses an optimization process to select and weight eligible securities in order to (a) seek to reduce overall portfolio volatility and (b) maximize the overall quality factor relative to the Parent Index. The optimization also includes sector, industry group, single-security weight, historical beta (i.e. market sensitivity, relative to the Parent Index), liquidity and turnover constraints so that these characteristics of the Underlying Index vary within acceptable bands relative to the Parent Index.

As of December 31, 2022, the Underlying Index was comprised of 127 constituent securities with market capitalizations ranging from $3.6 billion to $2.4 trillion. The Underlying Index is governed by published, objective rules for security selection, exclusion, weighting, rebalancing and adjustments for corporate actions. It is reconstituted quarterly. The Fund generally reconstitutes its portfolio in accordance with the Underlying Index.

NTI uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued.

NTI uses a representative sampling strategy to manage the Fund. “Representative sampling” is investing in a representative sample of securities that collectively has an investment profile similar to the Underlying Index. The Fund may or may not hold all of the securities that are included in the Underlying Index. The Fund reserves the right to invest in substantially all of the securities in its Underlying Index in approximately the same proportions (i.e., replication) if NTI determines that it is in the best interest of the Fund.

Under normal circumstances, the Fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of the Underlying Index. The Fund may also invest up to 20% of its assets in cash and cash equivalents, including shares of money market funds advised by NTI or its affiliates, futures contracts and options on futures contracts, as well as securities not included in the Underlying Index, but which NTI believes will help the Fund track its Underlying Index.

The Underlying Index is created and sponsored by NTI, as the Index Provider. NTI also serves as the investment adviser to the Fund. The Index Provider determines the

composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated.

Principal Risks

As with any investment, you could lose all or part of your investment in the Fund, and the Fund’s performance could trail that of other investments. The Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund’s net asset value (“NAV”), trading price, yield, total return and ability to meet its investment objective. Each risk noted below is considered a principal risk of investing in the Fund, regardless of the order in which it appears. The significance of each risk factor below may change over time and you should review each risk factor carefully.

Equity Securities Risk is the risk that the values of the equity securities owned by the Fund may be more volatile and underperform other asset classes and the general securities markets.

Low Volatility Risk is the risk that although the Underlying Index is designed to have overall volatility that is lower than that of the Parent Index, there is no guarantee it will be successful. Securities or other assets in the Fund’s portfolio may be subject to price volatility and the prices may not be any less volatile than the market as a whole and could be more volatile. The market prices of the securities or other assets in the Fund’s portfolio may fluctuate, sometimes rapidly and unpredictably. The Fund will continue to seek to track the Underlying Index even if the Underlying Index does not have lower overall volatility than the Parent Index. There is also the risk that the Fund may experience volatility greater than that of the Parent Index as a result of tracking error. A portfolio of securities with greater volatility is generally considered to have a higher risk profile than a portfolio with lower volatility.

FlexShares® US Quality Low Volatility Index Fund (cont.)

Quality Factor Risk is the risk that the past performance of companies that have exhibited quality characteristics does not continue or the returns on securities issued by such companies may be less than returns from other styles of investing or the overall stock market. There may be periods when quality investing is out of favor and during which time the Fund's performance may suffer.

Concentration Risk is the risk that, if the Fund is concentrated in a particular industry or group of industries, the Fund is likely to present more risks than a fund that is broadly diversified over several industries or groups of industries. Compared to the broad market, an individual industry may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory changes.

Market Risk is the risk that the value of the Fund’s investments may increase or decrease in response to expected, real or perceived economic, political or financial events in the U.S. or global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in response to changing market conditions, inflation, changes in interest rates, lack of liquidity in the bond or equity markets, or volatility in the equity markets. Market disruptions caused by local or regional events such as war, acts of terrorism, the spread of infectious illness (including epidemics and pandemics) or other public health issues, recessions or other events or adverse investor sentiment could have a significant impact on the Fund and its investments and could result in the Fund’s shares trading at increased premiums or discounts to the Fund’s NAV. During periods of market disruption or other abnormal market conditions, the Fund’s exposure to the risks described elsewhere in this summary will likely increase. Market disruptions, regulatory restrictions or other abnormal market conditions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track its Underlying Index or cause delays in the Underlying Index’s rebalancing or reconstitution schedule. During any such delay, it is possible that the Underlying Index and, in turn, the Fund will deviate from the Underlying Index’s stated methodology and therefore experience returns different than those that would have been achieved under a normal rebalancing or reconstitution schedule.

Index Risk is the risk that the Fund would not necessarily buy or sell a security unless that security is added to or removed from, respectively, the Underlying Index, even if that security generally is underperforming, because unlike many investment companies, the Fund does not utilize an investing strategy that seeks returns in excess of the Underlying Index. Additionally, the Fund rebalances and/or reconstitutes its portfolio in accordance with the Underlying Index, and, therefore, any changes to the Underlying Index’s rebalance and/or reconstitution schedule will result in corresponding changes to the Fund’s rebalance and/or reconstitution schedule.

Tracking Error Risk is the risk that the Fund’s performance may vary from the performance of the Underlying Index as a result of creation and redemption activity, transaction costs, expenses and other factors.

Sampling Risk is the risk that the Fund’s use of a representative sampling approach may result in increased tracking error because the securities selected for the Fund in the aggregate may vary from the investment profile of the Underlying Index. Additionally, the use of a representative sampling approach may result in the Fund holding a smaller number of securities than the Underlying Index, and, as a result, an adverse development to an issuer of securities that the Fund holds could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Underlying Index.

Authorized Participant Concentration Risk is the risk that the Fund may be adversely affected because it has a limited number of institutions that act as authorized participants (“Authorized Participants”). Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. To the extent that these institutions exit the business or are unable or unwilling to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able or willing to step forward to create or redeem Creation Units (as defined below), Fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting.

Calculation Methodology Risk is the risk that the Underlying Index’s calculation methodology or sources of information may not provide an accurate assessment of

FlexShares® US Quality Low Volatility Index Fund (cont.)

included issuers or correct valuation of securities, nor is the availability or timeliness of the production of the Underlying Index guaranteed. A security included in the Underlying Index may not exhibit the characteristic or provide the specific exposure for which it was selected and consequently a Fund’s holdings may not exhibit returns consistent with that characteristic or exposure.

Market Trading Risk is the risk that the Fund faces because its shares are listed on a securities exchange, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. ANY OF THESE FACTORS MAY LEAD TO THE FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of its listing exchange, make trading in the shares inadvisable. The market prices of Fund shares will generally fluctuate in accordance with changes in its NAV, changes in the relative supply of, and demand for, Fund shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings.

Derivatives Risk is the risk that derivatives may pose risks in addition to and greater than those associated with investing directly in securities, currencies and other instruments, may be illiquid or less liquid, more volatile, more difficult to value and leveraged so that small changes in the value of the underlying instrument may produce disproportionate losses to the Fund. Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not perform its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

•Futures Contracts Risk is the risk that there will be imperfect correlation between the change in market value of the Fund’s securities and the price of futures contracts, which may result in the strategy not working as intended; the possible inability of the Fund to sell or close out a futures contract at the desired time or price; losses due to unanticipated market movements, which potentially are unlimited; and the possible inability of NTI to correctly predict the direction of securities’ prices, interest rates, currency exchange rates and other

economic factors, which may make the Fund’s returns more volatile or increase the risk of loss.

•Options Contracts Risk Options contracts give the holder of the option the right to buy (or to sell) a position in a security or in a contract to the writer of the option, at a certain price. They are subject to correlation risk because there may be an imperfect correlation between the options and the securities markets that cause a given transaction to fail to achieve its objectives. The successful use of options depends on the investment adviser’s ability to predict correctly future price fluctuations and the degree of correlation between the options and securities markets. Exchanges can limit the number of positions that can be held or controlled by the Fund or the investment adviser, thus limiting the ability to implement the Fund’s strategies.

Mid Cap Stock Risk is the risk that stocks of mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies, and may lack sufficient market liquidity. Mid-sized companies may have limited product lines or financial resources, and may be dependent upon a particular niche of the market, or may be dependent upon a small or inexperienced management group. Securities of smaller companies may trade less frequently and in lower volume than the securities of larger companies, which could lead to higher transaction costs. Generally the smaller the company size, the greater the risk.

Securities Lending Risk is the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral.

It is possible to lose money on an investment in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation, any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank.

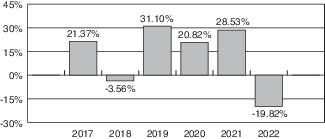

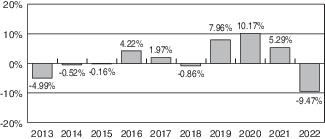

Fund Performance

The bar chart and table that follow show how the Fund has performed on a calendar year basis and provide an indication of the risks of investing in the Fund by showing (A) changes in the Fund’s performance from year to year, (B)

FlexShares® US Quality Low Volatility Index Fund (cont.)

how the Fund’s average annual returns compare with those of a broad measure of market performance, and (C) an additional index with characteristics relevant to the Fund. Past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated information on the Fund’s performance results can be obtained by visiting flexshares.com.

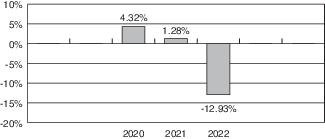

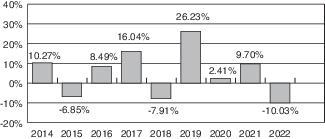

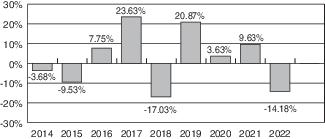

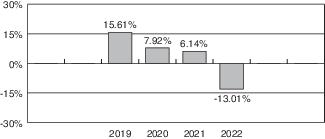

Calendar Year Total Returns

For the period shown in the bar chart above:

Best Quarter (6/30/2020): 15.80%

Worst Quarter (3/31/2020): -18.55%

Average Annual Total Returns

(for the periods ended December 31, 2022)

| |

|

|

|

| |

|

|

|

After Taxes on Distributions |

|

|

|

After Taxes on Distributions and Sale of Shares |

|

|

|

| |

|

|

|

Northern Trust Quality Low Volatility IndexSM* |

|

|

|

*

Reflects no deduction for fees, expenses or taxes.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement plans. After-tax returns may exceed the return before taxes due to an assumed tax benefit from realizing a capital loss on a sale of Fund shares.

Management

Investment Adviser and Portfolio Managers. NTI, a subsidiary of Northern Trust Corporation, serves as the Investment Adviser of the Fund. Robert Anstine, a Senior Vice President of NTI, and Brendan Sullivan, a Vice President of NTI, have served as Portfolio Managers of the Fund since its inception in July 2019.

Purchase and Sale of Fund Shares

The Fund is an exchange-traded fund (commonly referred to as an “ETF”). The Fund’s shares may be issued and redeemed only by certain large institutions, referred to as “Authorized Participants,” that enter into agreements with the Fund’s principal underwriter. Retail investors may acquire and sell Fund shares in the secondary market through a broker-dealer. The price of Fund shares is based on market price, and because ETF shares trade at market prices rather than NAV, shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (“the bid-ask spread”). Recent information, including information about the Fund’s NAV, market price, premiums and discounts, and bid-ask spreads, is included on the Fund’s website at flexshares.com.

Tax Information

The Fund’s distributions are generally taxable to you as ordinary income, qualified dividends, capital gains, or a combination of the three, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. Distributions may be taxable upon withdrawal from tax-advantaged accounts.

Payments to Brokers-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), NTI and its related companies may pay the intermediary for activities related to the marketing and promotion of the Fund. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson

FlexShares® US Quality Low Volatility Index Fund (cont.)

to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FlexShares® Developed Markets ex-US Quality Low Volatility Index Fund

Investment Objective

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Developed Markets ex-US Quality Low Volatility IndexSM (the “Underlying Index”).

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Under the Fund’s Investment Advisory Agreement, the Fund is responsible for the following expenses: interest expenses, brokerage commissions and other trading expenses, fees and expenses of the independent trustees and their independent legal counsel, taxes and other extraordinary costs such as litigation and other expenses not incurred in the ordinary course of business. You will also incur usual and customary brokerage commissions and fees to financial intermediaries when buying or selling shares of the Fund in the secondary market, which are not reflected in the example that follows:

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |

|

Distribution (12b-1) Fees |

|

| |

|

Total Annual Fund Operating Expenses |

|

| |

|

Total Annual Fund Operating Expenses After Expense Reimbursement |

|

(1)

Northern Trust Investments, Inc. (“NTI”) has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than 12b-1 Fees, Tax Expenses, Extraordinary Expenses, and Acquired Fund Fees and Expenses) to the extent the “Total Annual Fund Operating Expenses” exceed 0.32%. This contractual limitation may not be terminated before March 1, 2024 without the approval of the Fund’s Board of Trustees. The Fund’s Board of Trustees may terminate the contractual agreement at any time if it determines that it is in the best interest of the Fund and its shareholders.

Example

The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods.

The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the expense reimbursement arrangement for one year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. Portfolio turnover may vary from year to year, as well as within a year. During the most recent fiscal year, the Fund’s portfolio turnover rate was 56% of the average value of its portfolio.

Principal Investment Strategies

The Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to a broad universe of securities domiciled in developed market countries, excluding the U.S. (the “Parent Index”). The Parent Index is a subset of the Northern Trust Global Index, where eligible securities are limited to those domiciled in non-U.S. developed market countries and designated as large- and mid-capitalization companies by NTI, acting in its capacity as the index provider (the “Index Provider”). In addition, the Underlying Index is designed to select companies from the Parent Index that exhibit financial strength, stability and enhanced risk-return characteristics, which NTI believes can provide equity-market participation while seeking to protect against downside risks during certain market environments.

To derive the Underlying Index, the Index Provider ranks all constituents of the Parent Index using a Northern Trust proprietary quality factor. This factor is a quantitative ranking based on: (a) management efficiency (e.g., corporate finance activities and corporate governance); (b) profitability (e.g., reliability and sustainability of financial performance); and (c) cash flow (e.g., cash flow generation).

FlexShares® Developed Markets ex-US Quality Low Volatility Index Fund (cont.)

The Index Provider then excludes the lowest quintile of constituents ranked according to the quality factor and uses an optimization process to select and weight eligible securities in order to (a) seek to reduce overall portfolio volatility and (b) maximize the overall quality factor relative to the Parent Index. The optimization also includes sector, industry group, country, region, single-security weight, historical beta (i.e. market sensitivity, relative to the Parent Index), liquidity and turnover constraints so that these characteristics of the Underlying Index vary within acceptable bands relative to the Parent Index.

As of December 31, 2022, the Underlying Index was comprised of 172 constituent securities with market capitalizations ranging from $3.9 billion to $360 billion. The Underlying Index is governed by published, objective rules for security selection, exclusion, weighting, rebalancing and adjustments for corporate actions and is reconstituted quarterly. The Fund generally reconstitutes its portfolio in accordance with the Underlying Index.

NTI uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued.

NTI uses a representative sampling strategy to manage the Fund. “Representative sampling” is investing in a representative sample of securities that collectively has an investment profile similar to the Underlying Index. The Fund may or may not hold all of the securities that are included in the Underlying Index. The Fund reserves the right to invest in substantially all of the securities in its Underlying Index in approximately the same proportions (i.e., replication) if NTI determines that it is in the best interest of the Fund.

Under normal circumstances, the Fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of the Underlying Index and in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) (collectively “Depositary Receipts”) based on the securities in the Underlying Index. The Fund may also invest up to 20% of its assets in cash and cash equivalents, including shares of money market funds advised by NTI or its affiliates, futures contracts, options on futures contracts and forward currency contracts, as well as securities not included in the Underlying Index, but which NTI believes will help the Fund track its Underlying Index.

The Underlying Index is created and sponsored by NTI, as the Index Provider. NTI also serves as the investment adviser to the Fund. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

From time to time the Fund may focus its investments (i.e., invest more than 15% of its total assets) in one or more particular countries or geographic regions. As of December 31, 2022, the Fund focused its investments in Japan.

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated.

Principal Risks

As with any investment, you could lose all or part of your investment in the Fund, and the Fund’s performance could trail that of other investments. The Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund’s net asset value (“NAV”), trading price, yield, total return and ability to meet its investment objective. Each risk noted below is considered a principal risk of investing in the Fund, regardless of the order in which it appears. The significance of each risk factor below may change over time and you should review each risk factor carefully.

Equity Securities Risk is the risk that the values of the equity securities owned by the Fund may be more volatile and underperform other asset classes and the general securities markets.

Depositary Receipts Risk Foreign securities may trade in the form of depositary receipts. In addition to investment risks associated with the underlying issuer, depositary receipts may expose the Fund to additional risks associated with non-uniform terms that apply to depositary receipt programs, including credit exposure to the depository bank and to the sponsors and other parties with whom the depository bank establishes the programs, currency, political, economic, market risks and the risks of an illiquid mar

FlexShares® Developed Markets ex-US Quality Low Volatility Index Fund (cont.)

ket for depositary receipts. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. Depositary receipts may not track the price of the underlying foreign securities on which they are based, may have limited voting rights, and may have a distribution subject to a fee charged by the depository. As a result, equity shares of the underlying issuer may trade at a discount or premium to the market price of the depositary receipts.

Low Volatility Risk is the risk that although the Underlying Index is designed to have overall volatility that is lower than that of the Parent Index, there is no guarantee it will be successful. Securities or other assets in the Fund’s portfolio may be subject to price volatility and the prices may not be any less volatile than the market as a whole and could be more volatile. The market prices of the securities or other assets in the Fund’s portfolio may fluctuate, sometimes rapidly and unpredictably. The Fund will continue to seek to track the Underlying Index even if the Underlying Index does not have lower overall volatility than the Parent Index. There is also the risk that the Fund may experience volatility greater than that of the Parent Index as a result of tracking error. A portfolio of securities with greater volatility is generally considered to have a higher risk profile than a portfolio with lower volatility.

Quality Factor Risk is the risk that the past performance of companies that have exhibited quality characteristics does not continue or the returns on securities issued by such companies may be less than returns from other styles of investing or the overall stock market. There may be periods when quality investing is out of favor and during which time the Fund's performance may suffer.

Foreign Securities Risk is the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to less liquid markets and adverse economic, political, diplomatic, financial, and regulatory factors. Foreign governments may impose limitations on foreigners’ ownership of interests in local issuers, restrictions on the ability to repatriate assets, and may also impose taxes. Any of these events could cause the value of the Fund’s investments to decline. Foreign banks, agents and securities depositories that hold the Fund’s foreign assets may be subject to little

or no regulatory oversight over, or independent evaluation, of their operations. Additional costs associated with investments in foreign securities may include higher custodial fees than those applicable to domestic custodial arrangements and transaction costs of foreign currency conversions. Unless the Fund has hedged its foreign currency exposure, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. For instance, forward foreign currency exchange contracts, if used by the Fund, could reduce performance if there are unanticipated changes in currency exchange rates.

Geographic Risk is the risk that if the Fund invests a significant portion of its total assets in certain issuers within the same country or geographic region, an adverse economic, business or political development affecting that country or region may affect the value of the Fund’s investments more, and the Fund’s investments may be more volatile, than if the Fund’s investments were not so concentrated in such country or region.

•Japan Investment Risk is the risk of investing in securities of Japanese issuers. The Japanese economy may be subject to considerable degrees of economic, political and social instability, which could negatively impact Japanese issuers. In recent times, Japan’s economic growth rate has remained low, and it may remain low in the future. In addition, Japan is subject to the risk of natural disasters, such as earthquakes, volcanic eruptions, typhoons and tsunamis, which could negatively affect the securities of Japanese companies held by the Fund.

Market Risk is the risk that the value of the Fund’s investments may increase or decrease in response to expected, real or perceived economic, political or financial events in the U.S. or global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in response to changing market conditions, inflation, changes in interest rates, lack of liquidity in the

FlexShares® Developed Markets ex-US Quality Low Volatility Index Fund (cont.)

bond or equity markets, or volatility in the equity markets. Market disruptions caused by local or regional events such as war, acts of terrorism, the spread of infectious illness (including epidemics and pandemics) or other public health issues, recessions or other events or adverse investor sentiment could have a significant impact on the Fund and its investments and could result in the Fund’s shares trading at increased premiums or discounts to the Fund’s NAV. During periods of market disruption or other abnormal market conditions, the Fund’s exposure to the risks described elsewhere in this summary will likely increase. Market disruptions, regulatory restrictions or other abnormal market conditions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track its Underlying Index or cause delays in the Underlying Index’s rebalancing or reconstitution schedule. During any such delay, it is possible that the Underlying Index and, in turn, the Fund will deviate from the Underlying Index’s stated methodology and therefore experience returns different than those that would have been achieved under a normal rebalancing or reconstitution schedule.

Index Risk is the risk that the Fund would not necessarily buy or sell a security unless that security is added to or removed from, respectively, the Underlying Index, even if that security generally is underperforming, because unlike many investment companies, the Fund does not utilize an investing strategy that seeks returns in excess of the Underlying Index. Additionally, the Fund rebalances and/or reconstitutes its portfolio in accordance with the Underlying Index, and, therefore, any changes to the Underlying Index’s rebalance and/or reconstitution schedule will result in corresponding changes to the Fund’s rebalance and/or reconstitution schedule.

Tracking Error Risk is the risk that the Fund’s performance may vary from the performance of the Underlying Index as a result of creation and redemption activity, transaction costs, expenses and other factors.

Sampling Risk is the risk that the Fund’s use of a representative sampling approach may result in increased tracking error because the securities selected for the Fund in the aggregate may vary from the investment profile of the Underlying Index. Additionally, the use of a representative sampling approach may result in the Fund holding a smaller number of securities than the Underlying Index,

and, as a result, an adverse development to an issuer of securities that the Fund holds could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Underlying Index.

Authorized Participant Concentration Risk is the risk that the Fund may be adversely affected because it has a limited number of institutions that act as authorized participants (“Authorized Participants”). Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. To the extent that these institutions exit the business or are unable or unwilling to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able or willing to step forward to create or redeem Creation Units (as defined below), Fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting. This risk may be heightened because of its investments in non-U.S. securities.

Calculation Methodology Risk is the risk that the Underlying Index’s calculation methodology or sources of information may not provide an accurate assessment of included issuers or correct valuation of securities, nor is the availability or timeliness of the production of the Underlying Index guaranteed. A security included in the Underlying Index may not exhibit the characteristic or provide the specific exposure for which it was selected and consequently a Fund’s holdings may not exhibit returns consistent with that characteristic or exposure.

Market Trading Risk is the risk that the Fund faces because its shares are listed on a securities exchange, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. ANY OF THESE FACTORS MAY LEAD TO THE FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of its listing exchange, make trading in the shares inadvisable. The market prices of Fund shares will generally fluctuate in accordance with changes in its NAV, changes in the relative supply of, and demand for, Fund shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings.

FlexShares® Developed Markets ex-US Quality Low Volatility Index Fund (cont.)

Derivatives Risk is the risk that derivatives may pose risks in addition to and greater than those associated with investing directly in securities, currencies and other instruments, may be illiquid or less liquid, more volatile, more difficult to value and leveraged so that small changes in the value of the underlying instrument may produce disproportionate losses to the Fund. Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not perform its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

•Futures Contracts Risk is the risk that there will be imperfect correlation between the change in market value of the Fund’s securities and the price of futures contracts, which may result in the strategy not working as intended; the possible inability of the Fund to sell or close out a futures contract at the desired time or price; losses due to unanticipated market movements, which potentially are unlimited; and the possible inability of NTI to correctly predict the direction of securities’ prices, interest rates, currency exchange rates and other economic factors, which may make the Fund’s returns more volatile or increase the risk of loss.

•Options Contracts Risk Options contracts give the holder of the option the right to buy (or to sell) a position in a security or in a contract to the writer of the option, at a certain price. They are subject to correlation risk because there may be an imperfect correlation between the options and the securities markets that cause a given transaction to fail to achieve its objectives. The successful use of options depends on the investment adviser’s ability to predict correctly future price fluctuations and the degree of correlation between the options and securities markets. Exchanges can limit the number of positions that can be held or controlled by the Fund or the investment adviser, thus limiting the ability to implement the Fund’s strategies.

•Forward Foreign Currency Contracts Risk is the risk that, if forward prices increase, a loss will occur to the extent that the agreed upon purchase price of the currency exceeds the price of the currency that was agreed to be sold.

Concentration Risk is the risk that, if the Fund is concentrated in a particular industry or group of industries, the Fund is likely to present more risks than a fund that is

broadly diversified over several industries or groups of industries. Compared to the broad market, an individual industry may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory changes.

Mid Cap Stock Risk is the risk that stocks of mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies, and may lack sufficient market liquidity. Mid-sized companies may have limited product lines or financial resources, and may be dependent upon a particular niche of the market, or may be dependent upon a small or inexperienced management group. Securities of smaller companies may trade less frequently and in lower volume than the securities of larger companies, which could lead to higher transaction costs. Generally the smaller the company size, the greater the risk.

Securities Lending Risk is the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral.

It is possible to lose money on an investment in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation, any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank.

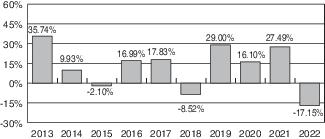

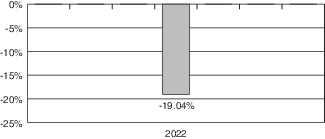

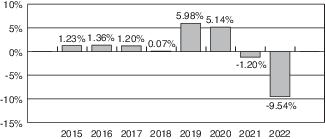

Fund Performance

The bar chart and table that follow show how the Fund has performed on a calendar year basis and provide an indication of the risks of investing in the Fund by showing (A) changes in the Fund’s performance from year to year, (B) how the Fund’s average annual returns compare with those of a broad measure of market performance, and (C) an additional index with characteristics relevant to the Fund. Past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated information on the Fund’s performance results can be obtained by visiting flexshares.com.

FlexShares® Developed Markets ex-US Quality Low Volatility Index Fund (cont.)

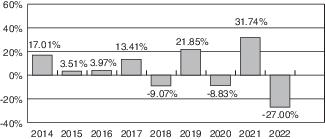

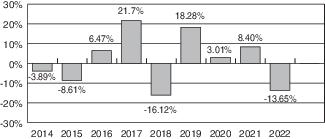

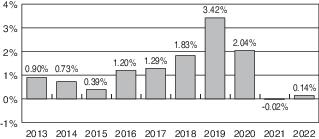

Calendar Year Total Returns

For the period shown in the bar chart above:

Best Quarter (12/31/2022): 11.68%

Worst Quarter (3/31/2020): -17.11%

Average Annual Total Returns

(for the periods ended December 31, 2022)

| |

|

|

|

| |

|

|

|

After Taxes on Distributions |

|

|

|

After Taxes on Distributions and Sale of Shares |

|

|

|

| |

|

|

|

Northern Trust Developed Markets ex-US Quality Low Volatility IndexSM* |

|

|

|

*

Reflects no deduction for fees, expenses or taxes.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement plans. After-tax returns may exceed the return before taxes due to an assumed tax benefit from realizing a capital loss on a sale of Fund shares.

Management

Investment Adviser and Portfolio Managers. NTI, a subsidiary of Northern Trust Corporation, serves as the Investment Adviser of the Fund. Robert Anstine, a Senior Vice

President of NTI, and Brendan Sullivan, a Vice President of NTI, have served as Portfolio Managers of the Fund since its inception in July 2019.

Purchase and Sale of Fund Shares

The Fund is an exchange-traded fund (commonly referred to as an “ETF”). The Fund’s shares may be issued and redeemed only by certain large institutions, referred to as “Authorized Participants,” that enter into agreements with the Fund’s principal underwriter. Retail investors may acquire and sell Fund shares in the secondary market through a broker-dealer. The price of Fund shares is based on market price, and because ETF shares trade at market prices rather than NAV, shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (“the bid-ask spread”). Recent information, including information about the Fund’s NAV, market price, premiums and discounts, and bid-ask spreads, is included on the Fund’s website at flexshares.com.

Tax Information

The Fund’s distributions are generally taxable to you as ordinary income, qualified dividends, capital gains, or a combination of the three, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. Distributions may be taxable upon withdrawal from tax-advantaged accounts.

Payments to Brokers-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), NTI and its related companies may pay the intermediary for activities related to the marketing and promotion of the Fund. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

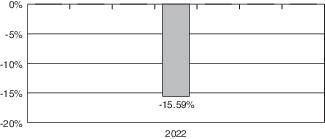

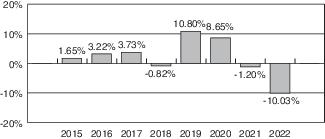

FlexShares® Emerging Markets Quality Low Volatility Index Fund

Investment Objective

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Emerging Markets Quality Low Volatility IndexSM (the “Underlying Index”).

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Under the Fund’s Investment Advisory Agreement, the Fund is responsible for the following expenses: interest expenses, brokerage commissions and other trading expenses, fees and expenses of the independent trustees and their independent legal counsel, taxes and other extraordinary costs such as litigation and other expenses not incurred in the ordinary course of business. You will also incur usual and customary brokerage commissions and fees to financial intermediaries when buying or selling shares of the Fund in the secondary market, which are not reflected in the example that follows:

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |

|

Distribution (12b-1) Fees |

|

| |

|

Total Annual Fund Operating Expenses |

|

| |

|

Total Annual Fund Operating Expenses After Expense Reimbursement |

|

(1)

Northern Trust Investments, Inc. (“NTI”) has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than 12b-1 Fees, Tax Expenses, Extraordinary Expenses, and Acquired Fund Fees and Expenses) to the extent the “Total Annual Fund Operating Expenses” exceed 0.40%. This contractual limitation may not be terminated before March 1, 2024 without the approval of the Fund’s Board of Trustees. The Fund’s Board of Trustees may terminate the contractual agreement at any time if it determines that it is in the best interest of the Fund and its shareholders.

Example

The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods.

The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the expense reimbursement arrangement for one year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. Portfolio turnover may vary from year to year, as well as within a year. During the most recent fiscal year, the Fund’s portfolio turnover rate was 53% of the average value of its portfolio.

Principal Investment Strategies

The Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to a broad universe of securities domiciled in emerging market countries, (the “Parent Index”). The Parent Index is a subset of the Northern Trust Global Index, limited to those securities domiciled in emerging markets and designated as large- and mid-capitalization companies by NTI, acting in its capacity as the index provider (the “Index Provider”). In addition, the Underlying Index is designed to select companies from the Parent Index that exhibit financial strength, stability and enhanced risk-return characteristics, which NTI believes can provide equity-market participation while seeking to protect against downside risks during certain market environments.

To derive the Underlying Index, the Index Provider ranks all constituents of the Parent Index using a Northern Trust proprietary quality factor. This factor is a quantitative ranking based on: (a) management efficiency (e.g., corporate finance activities and corporate governance); (b) profitability (e.g., reliability and sustainability of financial per

FlexShares® Emerging Markets Quality Low Volatility Index Fund (cont.)

formance); and (c) cash flow (e.g., cash flow generation). The Index Provider then excludes the lowest quintile of constituents ranked according to the quality factor and uses an optimization process to select and weight eligible securities in order to (a) seek to reduce overall portfolio volatility and (b) maximize the overall quality factor relative to the Parent Index. The optimization also includes sector, industry group, country, single-security weight, historical beta (i.e. market sensitivity, relative to the Parent Index), liquidity and turnover constraints so that these characteristics of the Underlying Index vary within acceptable bands relative to the Parent Index.

As of December 31, 2022, the Underlying Index was comprised of 152 constituent securities with market capitalizations ranging from $1.8 billion to $404 billion. The Underlying Index is governed by published, objective rules for security selection, exclusion, weighting, rebalancing and adjustments for corporate actions and is reconstituted quarterly. The Fund generally reconstitutes its portfolio in accordance with the Underlying Index.

NTI uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued.

NTI uses a representative sampling strategy to manage the Fund. “Representative sampling” is investing in a representative sample of securities that collectively has an investment profile similar to the Underlying Index. The Fund may or may not hold all of the securities that are included in the Underlying Index. The Fund reserves the right to invest in substantially all of the securities in its Underlying Index in approximately the same proportions (i.e., replication) if NTI determines that it is in the best interest of the Fund.

Under normal circumstances, the Fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of the Underlying Index and in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) (collectively “Depositary Receipts”) based on the securities in the Underlying Index. The Fund may also invest up to 20% of its assets in cash and cash equivalents, including shares of money market funds advised by NTI or its affiliates, futures contracts,

options on futures contracts and forward currency contracts, as well as securities not included in the Underlying Index, but which NTI believes will help the Fund track its Underlying Index.

The Underlying Index is created and sponsored by NTI, as the Index Provider. NTI also serves as the investment adviser to the Fund. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

From time to time the Fund may focus its investments (i.e., invest more than 15% of its total assets) in one or more particular countries or geographic regions. As of December 31, 2022, the Fund focused its investments in China and Taiwan.

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated.

Principal Risks

As with any investment, you could lose all or part of your investment in the Fund, and the Fund’s performance could trail that of other investments. The Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund’s net asset value (“NAV”), trading price, yield, total return and ability to meet its investment objective. Each risk noted below is considered a principal risk of investing in the Fund, regardless of the order in which it appears. The significance of each risk factor below may change over time and you should review each risk factor carefully.

Equity Securities Risk is the risk that the values of the equity securities owned by the Fund may be more volatile and underperform other asset classes and the general securities markets.

Mid Cap Stock Risk is the risk that stocks of mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established compa

FlexShares® Emerging Markets Quality Low Volatility Index Fund (cont.)

nies, and may lack sufficient market liquidity. Mid-sized companies may have limited product lines or financial resources, and may be dependent upon a particular niche of the market, or may be dependent upon a small or inexperienced management group. Securities of smaller companies may trade less frequently and in lower volume than the securities of larger companies, which could lead to higher transaction costs. Generally the smaller the company size, the greater the risk.

Depositary Receipts Risk Foreign securities may trade in the form of depositary receipts. In addition to investment risks associated with the underlying issuer, depositary receipts may expose the Fund to additional risks associated with non-uniform terms that apply to depositary receipt programs, including credit exposure to the depository bank and to the sponsors and other parties with whom the depository bank establishes the programs, currency, political, economic, market risks and the risks of an illiquid market for depositary receipts. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. Depositary receipts may not track the price of the underlying foreign securities on which they are based, may have limited voting rights, and may have a distribution subject to a fee charged by the depository. As a result, equity shares of the underlying issuer may trade at a discount or premium to the market price of the depositary receipts.

Low Volatility Risk is the risk that although the Underlying Index is designed to have overall volatility that is lower than that of the Parent Index, there is no guarantee it will be successful. Securities or other assets in the Fund’s portfolio may be subject to price volatility and the prices may not be any less volatile than the market as a whole and could be more volatile. The market prices of the securities or other assets in the Fund’s portfolio may fluctuate, sometimes rapidly and unpredictably. The Fund will continue to seek to track the Underlying Index even if the Underlying Index does not have lower overall volatility than the Parent Index. There is also the risk that the Fund may experience volatility greater than that of the Parent Index as a result of tracking error. A portfolio of securities with greater volatility is generally considered to have a higher risk profile than a portfolio with lower volatility.

Quality Factor Risk is the risk that the past performance of companies that have exhibited quality characteristics does not continue or the returns on securities issued by such

companies may be less than returns from other styles of investing or the overall stock market. There may be periods when quality investing is out of favor and during which time the Fund's performance may suffer.

Emerging Markets Risk is the risk that emerging markets are generally subject to greater market volatility, political, social and economic instability, uncertain trading markets and more governmental limitations on foreign investments than more developed markets. In addition, companies operating in emerging markets may be subject to lower trading volumes and greater price volatility than companies in more developed markets. Emerging market economies may be based on only a few industries, may be highly vulnerable to changes in local and global trade conditions, and may suffer from extreme and volatile debt burdens or inflation rates. Companies in emerging market countries generally may be subject to less stringent regulatory, disclosure, financial reporting, accounting, auditing and recordkeeping standards than companies in more developed countries. As a result, information, including financial information, about such companies may be less available and reliable, which can impede the Fund’s ability to evaluate such companies. Securities law and the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably, and the ability to bring and enforce actions (including bankruptcy, confiscatory taxation, expropriation, nationalization of a company’s assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures and practices such as share blocking), or to obtain information needed to pursue or enforce such actions, may be limited. Investments in emerging market securities may be subject to additional transaction costs, delays in settlement procedures, unexpected market closures, and lack of timely information.

Foreign Securities Risk is the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to less liquid markets and adverse economic, political, diplomatic, financial, and regulatory factors. Foreign governments may impose limitations on foreigners’ ownership of interests in local issuers, restrictions on the ability to repatriate assets, and may also impose taxes. Any of these events could cause the value of the Fund’s investments to

FlexShares® Emerging Markets Quality Low Volatility Index Fund (cont.)

decline. Foreign banks, agents and securities depositories that hold the Fund’s foreign assets may be subject to little or no regulatory oversight over, or independent evaluation, of their operations. Additional costs associated with investments in foreign securities may include higher custodial fees than those applicable to domestic custodial arrangements and transaction costs of foreign currency conversions. Unless the Fund has hedged its foreign currency exposure, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. For instance, forward foreign currency exchange contracts, if used by the Fund, could reduce performance if there are unanticipated changes in currency exchange rates.

Geographic Risk is the risk that if the Fund invests a significant portion of its total assets in certain issuers within the same country or geographic region, an adverse economic, business or political development affecting that country or region may affect the value of the Fund’s investments more, and the Fund’s investments may be more volatile, than if the Fund’s investments were not so concentrated in such country or region.

•China Investment Risk is the risk associated with investments in companies located or operating in China, such as nationalization, expropriation, or confiscation of property; alteration or discontinuation of economic reforms; and considerable degrees of economic, political and social instability. Investors in Chinese markets generally experience difficulties in obtaining information necessary for investigations into and/or litigation against Chinese companies, as well as in obtaining and/or enforcing judgements due to a lack of publicly available information; and there are generally limited legal remedies for shareholders. Internal social unrest or confrontations with other neighboring countries, including military conflicts, may disrupt economic development in China and result in a greater risk of currency fluctuations, currency convertibility, interest rate fluctuations and higher rates of inflation. Export growth continues to be a major driver of China’s rapid economic growth. As a result, a reduction in

spending on Chinese products and services, the institution of additional tariffs or other trade barriers, including as a result of heightened trade tensions between China and the U.S., or a downturn in any of the economies of China’s key trading partners may have an adverse impact on the Chinese economy. Although the Public Company Accounting Oversight Board (“PCAOB”) in 2021 had determined the PCAOB was unable to inspect or investigate audit firms headquartered in mainland China and Hong Kong, in December 2022 the PCAOB announced that it had been able to secure complete access to inspect and investigate audit firms in China for the first time in history. Certain securities issued by companies located or operating in China, such as China A-shares, are subject to trading restrictions and suspensions, quota limitations and sudden changes in those limitations, and operational, clearing and settlement risks.

•Taiwan Investment Risk is the risk of investing in securities of Taiwanese issuers. Specifically, Taiwan’s geographic proximity and history of political contention with China have resulted in ongoing tensions between the two countries, which may materially affect the Taiwanese economy and its securities market. Investments in securities of Taiwanese companies are subject to Taiwan’s heavy dependence on exports. Reductions in spending on Taiwanese products and services, labor shortages, institution of tariffs or other trade barriers, or a downturn in any of the economies of Taiwan’s key trading partners, including the United States, may have an adverse impact on the Taiwanese economy and the values of Taiwanese companies.

Market Risk is the risk that the value of the Fund’s investments may increase or decrease in response to expected, real or perceived economic, political or financial events in the U.S. or global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in response to changing market conditions, inflation, changes in interest rates, lack of liquidity in the bond or equity markets, or volatility in the equity markets. Market disruptions caused by local or regional events such as war, acts of terrorism, the spread of infectious illness (including epidemics and pandemics) or other public health issues, recessions or other events or adverse investor sentiment could have a significant impact on the Fund and

FlexShares® Emerging Markets Quality Low Volatility Index Fund (cont.)

its investments and could result in the Fund’s shares trading at increased premiums or discounts to the Fund’s NAV. During periods of market disruption or other abnormal market conditions, the Fund’s exposure to the risks described elsewhere in this summary will likely increase. Market disruptions, regulatory restrictions or other abnormal market conditions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track its Underlying Index or cause delays in the Underlying Index’s rebalancing or reconstitution schedule. During any such delay, it is possible that the Underlying Index and, in turn, the Fund will deviate from the Underlying Index’s stated methodology and therefore experience returns different than those that would have been achieved under a normal rebalancing or reconstitution schedule.