FLEXSHARES® TRUST

FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND DEFENSIVE INDEX FUND

NYSE Arca, Inc.: IQDE

FLEXSHARES® QUALITY DIVIDEND DYNAMIC INDEX FUND

NYSE Arca, Inc.: QDYN

50 South LaSalle Street

Chicago, Illinois 60603

855-353-9383

IMPORTANT SHAREHOLDER INFORMATION

The enclosed Joint Prospectus/Information Statement is being provided to inform you that each of FlexShares® International Quality Dividend Defensive Index Fund and FlexShares® Quality Dividend Dynamic Index Fund (each, a “Target Fund” and together, the “Target Funds”), each a series of FlexShares® Trust (the “Trust”) will each be reorganized with and into other series of the Trust (each, an “Acquiring Fund” and together, the “Acquiring Funds”), as follows (each, a “Reorganization” and together, the “Reorganizations”), on or about June 30, 2023 (“Reorganization Date”):

| Target Funds | Acquiring Funds | |

| FlexShares® International Quality Dividend Defensive Index Fund, a series of FlexShares® Trust | FlexShares® International Quality Dividend Index Fund, a series of FlexShares® Trust | |

| FlexShares® Quality Dividend Dynamic Index Fund, a series of FlexShares® Trust | FlexShares® Quality Dividend Index Fund, a series of FlexShares® Trust |

The Joint Prospectus/Information Statement discusses the Reorganizations and provides you with information that you should consider. The Board of Trustees of Trust approved the Reorganizations and concluded that each Reorganization is in the best interests of each Target Fund and its shareholders.

Please review the information in the Joint Prospectus/Information Statement. You do not need to take any action regarding your account because no shareholder vote is required. On the Reorganization Date, your shares of the Target Fund(s) will be converted automatically at their net asset value into shares of the corresponding Acquiring Fund (except for any fractional shares of your Target Fund(s), for which you will receive cash in lieu of fractional shares of the corresponding Acquiring Fund).

If you have any questions, please call the Trust toll-free at 855-353-9383.

FLEXSHARES® TRUST

50 South LaSalle Street

Chicago, Illinois 60603

855-353-9383

JOINT PROSPECTUS/INFORMATION STATEMENT

Dated June 9, 2023

Acquisition of the Assets of:

FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND DEFENSIVE INDEX FUND

NYSE Arca, Inc.: IQDE

(a series of FlexShares® Trust)

By and in exchange for shares of:

FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND INDEX FUND

NYSE Arca, Inc.: IQDF

(a series of FlexShares® Trust)

Acquisition of the Assets of:

FLEXSHARES® QUALITY DIVIDEND DYNAMIC INDEX FUND

NYSE Arca, Inc.: QDYN

(a series of FlexShares® Trust)

By and in exchange for shares of:

FLEXSHARES® QUALITY DIVIDEND INDEX FUND

NYSE Arca, Inc.: QDF

(a series of FlexShares® Trust)

This Joint Prospectus/Information Statement is being furnished to shareholders of FlexShares® International Quality Dividend Defensive Index Fund and FlexShares® Quality Dividend Dynamic Index Fund (each, a “Target Fund” and together, the “Target Funds”). Each Target Fund is a series of FlexShares® Trust (the “Trust”). Each of the Target Funds will be reorganized into its corresponding series of the Trust (each an “Acquiring Fund” and together the “Acquiring Funds”), as indicated below (each, a “Reorganization” and together, the “Reorganizations”), on or about June 30, 2023 (“Reorganization Date”):

| Target Funds | Acquiring Funds | |

| FlexShares® International Quality Dividend Defensive Index Fund, a series of FlexShares® Trust | FlexShares® International Quality Dividend Index Fund, a series of FlexShares® Trust | |

| FlexShares® Quality Dividend Dynamic Index Fund, a series of FlexShares® Trust | FlexShares® Quality Dividend Index Fund, a series of FlexShares® Trust |

The Target Funds and Acquiring Funds together are referred to as the “Funds,” and each, a “Fund.”

Pursuant to an Agreement and Plan of Reorganization (the “Agreement and Plan”): (i) all of a Target Fund’s assets, property, receivables goodwill and other intangible property, any deferred or prepaid expenses shown as an asset on the books of such Target Fund as of the closing time of the applicable Reorganization, and all interests, rights, privileges and powers, other than such Target Fund’s rights under the Agreement and Plan on the Reorganization Date of the applicable Reorganization (“Assets”) will be acquired by the corresponding

i

Acquiring Fund, and (ii) each Acquiring Fund will assume the liabilities of the corresponding Target Fund, in exchange for shares of the Acquiring Fund, plus cash in lieu of fractional shares, if any. According to the Agreement and Plan, each Target Fund will be liquidated and dissolved following its Reorganization. The Board of Trustees of the Trust (the “Board”) has approved the Agreement and Plan and each Reorganization. Shareholders of the Target Funds are not required to and are not being asked to approve the Agreement and Plan or the Reorganizations. Pursuant to the Agreement and Plan, shareholders of a Target Fund will receive Acquiring Fund shares, plus cash in lieu of fractional shares, if any, that have the equivalent aggregate net asset value (“NAV”) to their shares of the Target Fund.

The investment objectives, principal investment strategies, and principal risks of each Target Fund are similar to, but also differ in certain respects from, those of the related Acquiring Fund. This Joint Prospectus/Information Statement provides important information regarding such differences, as well as similarities, that shareholders should consider in determining whether an investment in the Acquiring Fund(s) is appropriate for them.

Shares of the Funds are listed for trading on NYSE Arca, Inc. (“NYSE Arca”). The market price for a share of a Fund may be different from that Fund’s most recent NAV per share.

Each Fund is a diversified series of the Trust. Northern Trust Investments, Inc. (“NTI” or the “Investment Adviser”), a subsidiary of Northern Trust Corporation, serves as the Investment Adviser of each of the Funds.

This Joint Prospectus/Information Statement sets forth the information that you should know about the Reorganizations. You should retain this Joint Prospectus/Information Statement for future reference. A Statement of Additional Information dated June 9, 2023 (the “Statement of Additional Information” or “SAI”), relating to this Joint Prospectus/Information Statement, contains additional information about the Acquiring Funds and the Reorganizations, and has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated herein by reference.

The prospectuses of the Target Funds and the Acquiring Funds are intended to provide you with information about the Funds and are incorporated herein by reference. Relevant information about the Funds’ prospectuses is as follows:

| Target Fund Prospectus | Acquiring Fund Prospectus | |

| FlexShares® International Quality Dividend Defensive Index Fund – dated March 1, 2023 (1933 Act File No. 333-173967) |

FlexShares® International Quality Dividend Index Fund – dated March 1, 2023 (1933 Act File No. 333-173967) | |

|

FlexShares® Quality Dividend Dynamic Index Fund – dated March 1, 2023 (1933 Act File No. 333-173967) |

FlexShares® Quality Dividend Index Fund – dated March 1, 2023, |

The Funds’ prospectuses, annual and semiannual reports and their SAIs are available free on the Trust’s website at flexshares.com, and upon request by calling the Funds at 1-855-FLEXETF (1-855-353-9383) or by sending an email request to: info@flexshares.com.

Other information about the Funds is available on the EDGAR Database on the SEC’s internet site at sec.gov. You may also obtain copies of this information, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov.

ii

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Joint Prospectus/Information Statement. Any representation to the contrary is a criminal offense.

JOINT PROSPECTUS/INFORMATION STATEMENT

TABLE OF CONTENTS

| 1 | ||||

| COMPARISON OF INVESTMENT OBJECTIVES, STRATEGIES, RISKS, AND INVESTMENT RESTRICTIONS |

1 | |||

| 1 | ||||

| 14 | ||||

| 14 | ||||

| 16 | ||||

| What are the general tax consequences of the Reorganizations? |

16 | |||

| 17 | ||||

| 19 | ||||

| Where can I find more financial information about the Funds? |

24 | |||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 35 |

iii

At a meeting held on March 23, 2023, the Board, including a majority of the Trustees who are not “interested persons” (as defined by the Investment Company Act of 1940 (the “1940 Act”)) (the “Independent Trustees”), on behalf of each of the Funds, considered the proposal to reorganize each Target Fund with and into its corresponding Acquiring Fund, and approved the Agreement and Plan with respect to each Reorganization.

The Reorganizations will result in your Target Fund shares being exchanged for Acquiring Fund shares equal in value to (but having a different price per share than) your shares of the Target Fund(s), plus cash in lieu of fractional shares, if any. This means that you will cease to be a Target Fund shareholder and will become an Acquiring Fund shareholder. This exchange will occur on a date agreed upon by the parties to the Agreement and Plan, which is currently anticipated to occur on or around the Reorganization Date.

For the reasons set forth below under “Reasons for the Reorganization,” the Board has determined that participation by each Fund in its Reorganization is in the best interests of each Target Fund and its corresponding Acquiring Fund. The Board has also concluded that the interests of the existing shareholders of each Fund will not be diluted as a result of the Reorganizations.

COMPARISON OF INVESTMENT OBJECTIVES, STRATEGIES, RISKS, AND INVESTMENT RESTRICTIONS

How do the investment objectives, principal investment strategies, principal risks, and fundamental investment restrictions of the Target Funds compare against those of the Acquiring Funds?

This section will help you compare the investment objectives, principal investment strategies, principal risks, and fundamental investment restrictions of the Target Funds and the Acquiring Funds. More complete information about a Fund may be found in that Fund’s prospectus and SAI. For a complete description of an Acquiring Fund’s investment objectives, principal investment strategies, and principal risks, you should read the Acquiring Fund’s prospectus.

REORGANIZATION OF FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND DEFENSIVE INDEX FUND INTO FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND INDEX FUND

Investment Objectives. Each Fund is a passively managed index exchange traded fund (“ETF”) that seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of each Fund’s respective underlying index (each, an “Underlying Index”). The Target Fund and Acquiring Fund have similar, but not identical, principal investment objectives, as described in each of their Prospectuses, and included below.

| FlexShares® International Quality Dividend Defensive Index Fund (Target Fund) | FlexShares® International Quality Dividend Index Fund (Acquiring Fund) | |

| The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust International Quality Dividend Defensive IndexSM (the “IQDE Underlying Index”). | The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust International Quality Dividend IndexSM (the “IQDF Underlying Index”). |

The IQDE Underling Index and the IQDF Underlying Index both select constituents from the Northern Trust International Large Cap Index (the “Parent Index”), a float-adjusted market-capitalization weighted index of non-US domiciled large- and mid-capitalization companies.

1

The IQDE Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, provide exposure to a high-quality income-oriented universe of long-only international securities issued by non-U.S.-based companies, with an emphasis on long-term capital growth and a targeted overall beta that is generally between 0.5 to 1.0 times that of the Parent Index.

The IQDF Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, provide exposure to a high-quality income-oriented universe of long-only international securities issued by non-U.S.-based companies, with an emphasis on long-term capital growth and a targeted overall beta that is similar to that of the Parent Index.

Each Fund’s investment objective is nonfundamental, and may be changed without shareholder approval.

As part of the Reorganization, the Target Fund must transfer its portfolio securities, investments and other assets to the Acquiring Fund as of the closing time of its Reorganization or as soon as practicable thereafter. Because the Target Fund holds certain emerging markets securities that are not eligible for transfer in-kind to the Acquiring Fund, the Target Fund will dispose of those emerging markets securities for cash prior to the closing time of its Reorganization. To the extent that it does so, the Target Fund may be unable to fully meet its investment objective as described above.

Principal Investment Strategies. The Target Fund and Acquiring Fund have substantially similar principal investment strategies, except that the Target Fund and Acquiring Fund have different underlying indices that target different market beta exposure to the same parent index, as described above. The Acquiring Fund’s principal investment strategies are included below. Information about the Target Fund’s principal investment strategies is incorporated by reference from the current prospectus of the Target Fund and is available free on the Trust’s website at flexshares.com, and upon request by calling the Trust at 1-855-FLEXETF (1-855-353-9383) or by sending an email request to: info@flexshares.com.

FlexShares® International Quality Dividend Index Fund (Acquiring Fund)

The Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, provide exposure to a high-quality income-oriented universe of long-only international securities issued by non-U.S.- based companies, with an emphasis on long-term capital growth and a targeted overall beta that is similar to that of the Northern Trust International Large Cap Index (the “Parent Index”), a float-adjusted market-capitalization weighted index of non-US domiciled large- and mid-capitalization companies. Beta represents the market sensitivity, relative to a given market index and time period, and is one measure of volatility.

To derive the Underlying Index, NTI, acting in its capacity as the index provider (the “Index Provider”), begins with all securities in the Parent Index and then removes those securities that rank in the lowest quintile of quality based on a proprietary scoring model, as well as those which do not pay a dividend. The core components of the proprietary quality scoring model are based on quantitative ranking and various metrics obtained from company filings. These scores have three components: (i) management efficiency (e.g., corporate finance activities and corporate governance); (ii) profitability (e.g., reliability and sustainability of financial performance); and (iii) cash flow (e.g., cash flow generation). The Index Provider then uses an optimization process to select and weight eligible securities in order to (a) maximize the overall quality score relative to the Parent Index; (b) attain an aggregate dividend yield in excess of the Parent Index; and (c) achieve the desired beta target. The optimization process also includes sector, industry group, region, country, single-security weight and turnover constraints to assist in reducing the Underlying Index’s overall active risk exposure to any one single factor. As of December 31, 2022, there were 196 issues in the Underlying Index. The Underlying Index is governed by transparent, objective rules for security selection, exclusion, rebalancing and adjustments for corporate actions and is reconstituted quarterly. The Fund generally reconstitutes its portfolio in accordance with the Underlying Index.

2

NTI uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” its Underlying Index and does not seek temporary defensive positions when markets decline or appear overvalued.

NTI uses a representative sampling strategy to manage the Fund. “Representative sampling” is investing in a representative sample of securities that collectively has an investment profile similar to the Underlying Index. The Fund may or may not hold all of the securities that are included in the Underlying Index. The Fund reserves the right to invest in substantially all of the securities in its Underlying Index in approximately the same proportions (i.e., replication) if NTI determines that it is in the best interest of the Fund.

Under normal circumstances, the Fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of the Underlying Index and in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) (collectively “Depositary Receipts”) based on the securities in the Underlying Index. The Fund may also invest up to 20% of its assets in cash and cash equivalents, including shares of money market funds advised by NTI or its affiliates, futures contracts, options on futures contracts and foreign currency contracts, as well as securities not included in the Underlying Index, but which NTI believes will help the Fund track its Underlying Index.

The Underlying Index is created and sponsored by NTI, as the Index Provider. NTI also serves as the investment adviser to the Fund. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

From time to time the Fund may focus its investments (i.e., invest more than 15% of its total assets) in one or more particular countries or geographic regions.

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated.

Principal Investment Risks. As with any investment, you could lose all or part of your investment in a Fund, and a Fund’s performance could trail that of other investments. Each Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment objective. Each risk noted below is considered a principal risk of investing in a Fund, regardless of the order in which it appears. The significance of each risk factor below may change over time and you should review each risk factor carefully. Each Fund’s principal risks, as listed in their prospectuses, are included below.

The principal investment risks for the Target Fund and Acquiring Fund are identical. Even though the Target Fund and Acquiring Fund share the same types of risks, the degree of such risks may vary. Each Fund’s relative risk/return profile cannot be determined by the following risk descriptions and comparisons alone. However, the Target Fund and Acquiring Fund share a substantially similar risk/return profile.

Equity Securities Risk is the risk that the values of the equity securities owned by the Fund may be more volatile and underperform other asset classes and the general securities markets.

Mid Cap Stock Risk is the risk that stocks of mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies, and may lack sufficient market liquidity. Mid-sized companies may have limited product lines or financial resources, and may be dependent upon a particular niche of the market, or may be dependent upon a small or inexperienced management group. Securities

3

of smaller companies may trade less frequently and in lower volume than the securities of larger companies, which could lead to higher transaction costs. Generally, the smaller the company size, the greater the risk.

Foreign Securities Risk is the risk that investing in foreign (non-U.S.) securities may result in the Fund experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to less liquid markets and adverse economic, political, diplomatic, financial, and regulatory factors. Foreign governments may impose limitations on foreigners’ ownership of interests in local issuers, restrictions on the ability to repatriate assets, and may also impose taxes. Any of these events could cause the value of the Fund’s investments to decline. Foreign banks, agents and securities depositories that hold the Fund’s foreign assets may be subject to little or no regulatory oversight over, or independent evaluation, of their operations. Additional costs associated with investments in foreign securities may include higher custodial fees than those applicable to domestic custodial arrangements and transaction costs of foreign currency conversions. Unless the Fund has hedged its foreign currency exposure, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. For instance, forward foreign currency exchange contracts, if used by the Fund, could reduce performance if there are unanticipated changes in currency exchange rates.

Emerging Markets Risk is the risk that emerging markets are generally subject to greater market volatility, political, social and economic instability, uncertain trading markets and more governmental limitations on foreign investments than more developed markets. In addition, companies operating in emerging markets may be subject to lower trading volumes and greater price volatility than companies in more developed markets. Emerging market economies may be based on only a few industries, may be highly vulnerable to changes in local and global trade conditions, and may suffer from extreme and volatile debt burdens or inflation rates. Companies in emerging market countries generally may be subject to less stringent regulatory, disclosure, financial reporting, accounting, auditing and recordkeeping standards than companies in more developed countries. As a result, information, including financial information, about such companies may be less available and reliable, which can impede the Fund’s ability to evaluate such companies. Securities law and the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably, and the ability to bring and enforce actions (including bankruptcy, confiscatory taxation, expropriation, nationalization of a company’s assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures and practices such as share blocking), or to obtain information needed to pursue or enforce such actions, may be limited. Investments in emerging market securities may be subject to additional transaction costs, delays in settlement procedures, unexpected market closures, and lack of timely information.

Geographic Risk is the risk that if the Fund invests a significant portion of its total assets in certain issuers within the same country or geographic region, an adverse economic, business or political development affecting that country or region may affect the value of the Fund’s investments more, and the Fund’s investments may be more volatile, than if the Fund’s investments were not so concentrated in such country or region.

Concentration Risk is the risk that, if the Fund is concentrated in a particular industry or group of industries, the Fund is likely to present more risks than a fund that is broadly diversified over several industries or groups of industries. Compared to the broad market, an individual industry may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory changes.

Dividend Risk is the risk that an issuer of stock held by the Fund may choose not to declare a dividend or the dividend rate might not remain at current levels. Dividend paying stocks might not experience the same level of earnings growth or capital appreciation as non-dividend paying stocks. The Fund’s performance during a broad market advance could suffer because dividend paying stocks may not experience the same capital appreciation as non-dividend paying stocks.

4

Volatility Risk is the risk that the actual level of volatility experienced by the Fund may be greater or lower than the targeted overall volatility of the Underlying Index. Although the Underlying Index is designed to have a targeted overall volatility that is lower than that of the Parent Index, there is no guarantee that it will have the targeted overall volatility. The Fund will continue to seek to track the Underlying Index even if the Underlying Index does not have the targeted overall volatility. There is also the risk that the Fund may experience volatility greater or lower than that of the Underlying Index as a result of tracking error. A portfolio of securities with greater volatility is generally considered to have a higher risk profile than a portfolio with lower volatility.

Quality Factor Risk is the risk that the past performance of companies that have exhibited quality characteristics does not continue or the returns on securities issued by such companies may be less than returns from other styles of investing or the overall stock market. There may be periods when quality investing is out of favor and during which time the Fund’s performance may suffer.

Depositary Receipts Risk Foreign securities may trade in the form of depositary receipts. In addition to investment risks associated with the underlying issuer, depositary receipts may expose the Fund to additional risks associated with non-uniform terms that apply to depositary receipt programs, including credit exposure to the depository bank and to the sponsors and other parties with whom the depository bank establishes the programs, currency, political, economic, market risks and the risks of an illiquid market for depositary receipts. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. Depositary receipts may not track the price of the underlying foreign securities on which they are based, may have limited voting rights, and may have a distribution subject to a fee charged by the depository. As a result, equity shares of the underlying issuer may trade at a discount or premium to the market price of the depositary receipts.

Market Risk is the risk that the value of the Fund’s investments may increase or decrease in response to expected, real or perceived economic, political or financial events in the U.S. or global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in response to changing market conditions, inflation, changes in interest rates, lack of liquidity in the bond or equity markets, or volatility in the equity markets. Market disruptions caused by local or regional events such as war, acts of terrorism, the spread of infectious illness (including epidemics and pandemics) or other public health issues, recessions or other events or adverse investor sentiment could have a significant impact on the Fund and its investments and could result in the Fund’s shares trading at increased premiums or discounts to the Fund’s NAV. During periods of market disruption or other abnormal market conditions, the Fund’s exposure to the risks described elsewhere in this summary will likely increase. Market disruptions, regulatory restrictions or other abnormal market conditions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track its Underlying Index or cause delays in the Underlying Index’s rebalancing or reconstitution schedule. During any such delay, it is possible that the Underlying Index and, in turn, the Fund will deviate from the Underlying Index’s stated methodology and therefore experience returns different than those that would have been achieved under a normal rebalancing or reconstitution schedule.

Index Risk is the risk that the Fund would not necessarily buy or sell a security unless that security is added to or removed from, respectively, the Underlying Index, even if that security generally is underperforming, because unlike many investment companies, the Fund does not utilize an investing strategy that seeks returns in excess of the Underlying Index. Additionally, the Fund rebalances and/or reconstitutes its portfolio in accordance with the Underlying Index, and, therefore, any changes to the Underlying Index’s rebalance and/or reconstitution schedule will result in corresponding changes to the Fund’s rebalance and/or reconstitution schedule.

Tracking Error Risk is the risk that the Fund’s performance may vary from the performance of the Underlying Index as a result of creation and redemption activity, transaction costs, expenses and other factors.

5

Sampling Risk is the risk that the Fund’s use of a representative sampling approach may result in increased tracking error because the securities selected for the Fund in the aggregate may vary from the investment profile of the Underlying Index. Additionally, the use of a representative sampling approach may result in the Fund holding a smaller number of securities than the Underlying Index, and, as a result, an adverse development to an issuer of securities that the Fund holds could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Underlying Index.

Authorized Participant Concentration Risk is the risk that the Fund may be adversely affected because it has a limited number of institutions that act as authorized participants (“Authorized Participants”). Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. To the extent that these institutions exit the business or are unable or unwilling to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able or willing to step forward to create or redeem Creation Units (as defined below), Fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting. This risk may be heightened because of its investments in non- U.S. securities.

Calculation Methodology Risk is the risk that the Underlying Index’s calculation methodology or sources of information may not provide an accurate assessment of included issuers or correct valuation of securities, nor is the availability or timeliness of the production of the Underlying Index guaranteed. A security included in the Underlying Index may not exhibit the characteristic or provide the specific exposure for which it was selected and consequently a Fund’s holdings may not exhibit returns consistent with that characteristic or exposure.

Market Trading Risk is the risk that the Fund faces because its shares are listed on a securities exchange, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. ANY OF THESE FACTORS MAY LEAD TO THE FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of its listing exchange, make trading in the shares inadvisable. The market prices of Fund shares will generally fluctuate in accordance with changes in its NAV, changes in the relative supply of, and demand for, Fund shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings.

Derivatives Risk is the risk that derivatives may pose risks in addition to and greater than those associated with investing directly in securities, currencies and other instruments, may be illiquid or less liquid, more volatile, more difficult to value and leveraged so that small changes in the value of the underlying instrument may produce disproportionate losses to the Fund. Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not perform its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

| ☐ | Futures Contracts Risk is the risk that there will be imperfect correlation between the change in market value of the Fund’s securities and the price of futures contracts, which may result in the strategy not working as intended; the possible inability of the Fund to sell or close out a futures contract at the desired time or price; losses due to unanticipated market movements, which potentially are unlimited; and the possible inability of NTI to correctly predict the direction of securities’ prices, interest rates, currency exchange rates and other economic factors, which may make the Fund’s returns more volatile or increase the risk of loss. |

| ☐ | Options Contracts Risk Options contracts give the holder of the option the right to buy (or to sell) a position in a security or in a contract to the writer of the option, at a certain price. They are subject to correlation risk because there may be an imperfect correlation between the options and the securities markets that cause a given transaction to fail to achieve its objectives. The successful use of options depends on the investment adviser’s ability to predict correctly future |

6

| price fluctuations and the degree of correlation between the options and securities markets. Exchanges can limit the number of positions that can be held or controlled by the Fund or the investment adviser, thus limiting the ability to implement the Fund’s strategies. |

| ☐ | Forward Foreign Currency Contracts Risk is the risk that, if forward prices increase, a loss will occur to the extent that the agreed upon purchase price of the currency exceeds the price of the currency that was agreed to be sold. |

Securities Lending Risk is the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral.

Valuation Risk is the risk that the sale price the Fund could receive for a portfolio security may differ from the Fund’s valuation of the security, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. In addition, the value of the securities in the Fund’s portfolio may change on days when shareholders will not be able to purchase or sell the Fund’s shares.

It is possible to lose money on an investment in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation, any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank.

Fundamental Investment Restrictions. The Target Fund and Acquiring Fund have adopted identical fundamental investment restrictions. The fundamental investment restrictions of the Funds, which are enumerated below, may be changed with respect to a Fund only by a vote of the holders of a majority of such Fund’s outstanding shares. The term “majority of the outstanding shares” of either the Trust or a particular Fund or another investment portfolio of the Trust means, the vote of the lesser of: (i) 67% or more of the shares of the Trust or such Fund or portfolio present at a meeting, if the holders of more than 50% of the outstanding shares of the Trust or such Fund or portfolio are present or represented by proxy; or (ii) more than 50% of the outstanding shares of the Trust or such Fund or portfolio.

No Fund may:

1. Make loans, except through: (a) the purchase of debt obligations in accordance with the Fund’s investment objective and strategies; (b) repurchase agreements with banks, brokers, dealers and other financial institutions; (c) loans of securities; and (d) loans to affiliates of the Fund to the extent permitted by law.

2. Purchase or sell real estate or real estate limited partnerships, but this restriction shall not prevent a Fund from investing directly or indirectly in portfolio instruments secured by real estate or interests therein or from acquiring securities of real estate investment trusts or other issuers that deal in real estate.

3. Purchase or sell physical commodities unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the Funds: (i) from purchasing or selling options, futures contracts or other derivative instruments; or (ii) from investing in securities or other instruments backed by physical commodities).

4. Act as underwriter of securities, except as a Fund may be deemed to be an underwriter under the Securities Act in connection with the purchase and sale of portfolio instruments in accordance with its investment objective and portfolio management strategies.

5. Borrow money, except that to the extent permitted by applicable law: (a) a Fund may borrow from banks, other affiliated investment companies and other persons, and may engage in reverse repurchase agreements and other transactions which involve borrowings, in amounts up to 33 1/3% of its total assets (including the amount borrowed) or such other percentage permitted by law; (b) a Fund may borrow up to an additional 5% of its total

7

assets for temporary purposes; (c) a Fund may obtain such short-term credits as may be necessary for the clearance of purchases and sales of portfolio securities; and (d) a Fund may purchase securities on margin. If due to market fluctuations or other reasons a Fund’s borrowings exceed the limitations stated above, the Trust will promptly reduce the borrowings of a Fund in accordance with the 1940 Act.

6. Issue any senior security, except as permitted under the 1940 Act, as amended and as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time.

7. Concentrate its investments (i.e., invest 25% or more of its total assets in the securities of a particular industry or group of industries), except that a Fund will concentrate to approximately the same extent that its Underlying Index concentrates in the securities of such particular industry or group of industries. For purposes of this limitation, securities of the U.S. government (including its agencies and instrumentalities), repurchase agreements collateralized by U.S. government securities, and securities of state or municipal governments and their political subdivisions are not considered to be issued by members of any industry.

8. With respect to 75% of the Fund’s assets (i) purchase securities of any issuer (except securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements involving such securities) if, as a result, more than 5% of the total assets of the Fund would be invested in the securities of any one issuer, or (ii) acquire more than 10% of the outstanding voting securities of any one issuer.

REORGANIZATION OF FLEXSHARES® QUALITY DIVIDEND DYNAMIC INDEX FUND INTO FLEXSHARES® QUALITY DIVIDEND INDEX FUND

Investment Objectives. Each Fund is a passively managed index ETF that seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of each Fund’s respective underlying index (each, an “Underlying Index”). The Target Fund and Acquiring Fund have similar, but not identical, principal investment objectives, as described in each of their Prospectuses, and included below.

| FlexShares® Quality Dividend Dynamic Index Fund (Target Fund) |

FlexShares® Quality Dividend Index Fund (Acquiring Fund) | |

| The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Quality Dividend Dynamic IndexSM (the “QDYN Underlying Index”). |

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Quality Dividend IndexSM (the “QDF Underlying Index”). |

The QDYN Underling Index and the QDF Underlying Index both select constituents from the Northern Trust 1250 Index (the “Parent Index”), a float-adjusted market-capitalization weighted index of U.S. domiciled large- and mid-capitalization companies.

The QDYN Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, provide exposure to a high quality income-oriented universe of long-only U.S. equity securities, with an emphasis on long-term capital growth and a targeted overall beta that is generally between 1.0 to 1.5 times that of the Parent Index.

The QDF Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, provide exposure to a high-quality income-oriented universe of long-only U.S. equity securities, with an emphasis on long-term capital growth and a targeted overall beta that is similar to that of the Parent Index.

Each Fund’s investment objective is nonfundamental, and may be changed without shareholder approval.

8

Principal Investment Strategies. The Target Fund and Acquiring Fund have substantially similar principal investment strategies, except that the Target Fund and Acquiring Fund have different underlying indices that target different market beta exposure to the same parent index, as described above. Because the components of the QDYN Underlying Index and the QDF Underlying Index, and the degree to which these components represent certain industries or sectors, may change over time, the QDYN Underlying Index and the QDF Underlying Index may be concentrated to different extents. As of December 31, 2022, the QDF Underlying Index was concentrated in the Information Technology sector, whereas the QDYN Underlying Index had no specific sector concentration at that time. The Acquiring Fund’s principal investment strategies are included below. Information about the Target Fund’s principal investment strategies is incorporated by reference from the current prospectus of the Target Fund and is available free on the Trust’s website at flexshares.com, and upon request by calling the Trust at 1-855-FLEXETF (1-855-353-9383) or by sending an email request to: info@flexshares.com.

FlexShares® Quality Dividend Index Fund (Acquiring Fund)

The Underlying Index is designed to reflect the performance of a selection of companies that, in aggregate, provide exposure to a high-quality income-oriented universe of long-only U.S. equity securities, with an emphasis on long-term capital growth and a targeted overall beta that is similar to that of the Northern Trust 1250 Index (the “Parent Index”), a float-adjusted market-capitalization weighted index of U.S. domiciled large- and mid-capitalization companies. Beta represents the market sensitivity, relative to a given market index and time period, and is one measure of volatility.

To derive the Underlying Index, NTI, acting in its capacity as the index provider (the “Index Provider”), begins with all securities in the Parent Index and then removes those securities that rank in the lowest quintile of quality based on a proprietary scoring model, as well as those which do not pay a dividend. The core components of the proprietary quality scoring model are based on quantitative ranking and various metrics obtained from company filings. These scores have three components: (i) management efficiency (e.g., corporate finance activities and corporate governance); (ii) profitability (e.g., reliability and sustainability of financial performance); and (iii) cash flow (e.g., cash flow generation). The Index Provider then uses an optimization process to select and weight eligible securities in order to (a) maximize the overall quality score relative to the Parent Index; (b) attain an aggregate dividend yield in excess of the Parent Index; and (c) achieve the desired beta target. The optimization process also includes sector, industry group, single-security weight and turnover constraints to assist in reducing the Underlying Index’s overall active risk exposure to any one single factor. As of December 31, 2022, there were 131 issues in the Underlying Index. The Underlying Index is governed by transparent, objective rules for security selection, exclusion, rebalancing and adjustments for corporate actions and is reconstituted quarterly. The Fund generally reconstitutes its portfolio in accordance with the Underlying Index.

NTI uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund does not try to “beat” its Underlying Index and does not seek temporary defensive positions when markets decline or appear overvalued.

NTI uses a representative sampling strategy to manage the Fund. “Representative sampling” is investing in a representative sample of securities that collectively has an investment profile similar to the Underlying Index. The Fund may or may not hold all of the securities that are included in the Underlying Index. The Fund reserves the right to invest in substantially all of the securities in its Underlying Index in approximately the same proportions (i.e., replication) if NTI determines that it is in the best interest of the Fund.

Under normal circumstances, the Fund will invest at least 80% of its total assets (exclusive of collateral held from securities lending) in the securities of the Underlying Index. The Fund may also invest up to 20% of its assets in cash and cash equivalents, including shares of money market funds advised by NTI or its affiliates, futures contracts and options on futures contracts, as well as securities not included in the Underlying Index, but which NTI believes will help the Fund track its Underlying Index.

9

The Underlying Index is created and sponsored by NTI, as the Index Provider. NTI also serves as the investment adviser to the Fund. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the collateral received).

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Underlying Index is concentrated. As of December 31, 2022, the Underlying Index was concentrated in the Information Technology sector. The components of the Underlying Index, and the degree to which these components represent certain industries or sectors, may change over time.

Principal Investment Risks. As with any investment, you could lose all or part of your investment in a Fund, and a Fund’s performance could trail that of other investments. Each Fund is subject to certain risks, including the principal risks noted below, any of which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment objective. Each risk noted below is considered a principal risk of investing in a Fund, regardless of the order in which it appears. The significance of each risk factor below may change over time and you should review each risk factor carefully. Each Fund’s principal risks, as listed in their prospectuses, are included below.

The principal investment risks for the Target fund and Acquiring Fund are substantially similar. More specifically, both Funds are subject to the same principal investment risks except that only the Acquiring Fund currently discloses Information Technology Sector Risk as a principal investment risk. Even though the Target Fund and Acquiring Fund share the same types of risks, the degree of such risks may vary. Each Fund’s relative risk/return profile cannot be determined by the following risk descriptions and comparisons alone. However, the Target Fund and Acquiring Fund share a substantially similar risk/return profile.

Equity Securities Risk is the risk that the values of the equity securities owned by the Fund may be more volatile and underperform other asset classes and the general securities markets.

Mid Cap Stock Risk is the risk that stocks of mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies, and may lack sufficient market liquidity. Mid-sized companies may have limited product lines or financial resources, and may be dependent upon a particular niche of the market, or may be dependent upon a small or inexperienced management group. Securities of smaller companies may trade less frequently and in lower volume than the securities of larger companies, which could lead to higher transaction costs. Generally, the smaller the company size, the greater the risk.

Concentration Risk is the risk that, if the Fund is concentrated in a particular industry or group of industries, the Fund is likely to present more risks than a fund that is broadly diversified over several industries or groups of industries. Compared to the broad market, an individual industry may be more strongly affected by changes in the economic climate, broad market shifts, moves in a particular dominant stock or regulatory changes.

| ☐ | Information Technology Sector Risk (Acquiring Fund) is the risk that securities of technology companies may be subject to greater price volatility than securities of companies in other sectors. These securities may fall in and out of favor with investors rapidly, which may cause sudden selling and dramatically lower market prices. Technology securities also may be affected adversely by changes in technology, consumer and business purchasing patterns, government regulation and/or obsolete products or services. |

Dividend Risk is the risk that an issuer of stock held by the Fund may choose not to declare a dividend or the dividend rate might not remain at current levels. Dividend paying stocks might not experience the same level

10

of earnings growth or capital appreciation as non-dividend paying stocks. The Fund’s performance during a broad market advance could suffer because dividend paying stocks may not experience the same capital appreciation as non-dividend paying stocks.

Volatility Risk is the risk that the actual level of volatility experienced by the Fund may be greater or lower than the targeted overall volatility of the Underlying Index. Although the Underlying Index is designed to have a targeted overall volatility that is greater than that of the Parent Index, there is no guarantee that it will have the targeted overall volatility. The Fund will continue to seek to track the Underlying Index even if the Underlying Index does not have the targeted overall volatility. There is also the risk that the Fund may experience volatility greater or lower than that of the Underlying Index as a result of tracking error. A portfolio of securities with greater volatility is generally considered to have a higher risk profile than a portfolio with lower volatility.

Quality Factor Risk is the risk that the past performance of companies that have exhibited quality characteristics does not continue or the returns on securities issued by such companies may be less than returns from other styles of investing or the overall stock market. There may be periods when quality investing is out of favor and during which time the Fund’s performance may suffer.

Market Risk is the risk that the value of the Fund’s investments may increase or decrease in response to expected, real or perceived economic, political or financial events in the U.S. or global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in response to changing market conditions, inflation, changes in interest rates, lack of liquidity in the bond or equity markets, or volatility in the equity markets. Market disruptions caused by local or regional events such as war, acts of terrorism, the spread of infectious illness (including epidemics and pandemics) or other public health issues, recessions or other events or adverse investor sentiment could have a significant impact on the Fund and its investments and could result in the Fund’s shares trading at increased premiums or discounts to the Fund’s NAV. During periods of market disruption or other abnormal market conditions, the Fund’s exposure to the risks described elsewhere in this summary will likely increase. Market disruptions, regulatory restrictions or other abnormal market conditions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track its Underlying Index or cause delays in the Underlying Index’s rebalancing or reconstitution schedule. During any such delay, it is possible that the Underlying Index and, in turn, the Fund will deviate from the Underlying Index’s stated methodology and therefore experience returns different than those that would have been achieved under a normal rebalancing or reconstitution schedule.

Index Risk is the risk that the Fund would not necessarily buy or sell a security unless that security is added to or removed from, respectively, the Underlying Index, even if that security generally is underperforming, because unlike many investment companies, the Fund does not utilize an investing strategy that seeks returns in excess of the Underlying Index. Additionally, the Fund rebalances and/or reconstitutes its portfolio in accordance with the Underlying Index, and, therefore, any changes to the Underlying Index’s rebalance and/or reconstitution schedule will result in corresponding changes to the Fund’s rebalance and/or reconstitution schedule.

Tracking Error Risk is the risk that the Fund’s performance may vary from the performance of the Underlying Index as a result of creation and redemption activity, transaction costs, expenses and other factors.

Sampling Risk is the risk that the Fund’s use of a representative sampling approach may result in increased tracking error because the securities selected for the Fund in the aggregate may vary from the investment profile of the Underlying Index. Additionally, the use of a representative sampling approach may result in the Fund holding a smaller number of securities than the Underlying Index, and, as a result, an adverse development to an issuer of securities that the Fund holds could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Underlying Index.

11

Authorized Participant Concentration Risk is the risk that the Fund may be adversely affected because it has a limited number of institutions that act as authorized participants (“Authorized Participants”). Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund and none of those Authorized Participants is obligated to engage in creation and/or redemption transactions. To the extent that these institutions exit the business or are unable or unwilling to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able or willing to step forward to create or redeem Creation Units (as defined below), Fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting.

Calculation Methodology Risk is the risk that the Underlying Index’s calculation methodology or sources of information may not provide an accurate assessment of included issuers or correct valuation of securities, nor is the availability or timeliness of the production of the Underlying Index guaranteed. A security included in the Underlying Index may not exhibit the characteristic or provide the specific exposure for which it was selected and consequently a Fund’s holdings may not exhibit returns consistent with that characteristic or exposure.

Market Trading Risk is the risk that the Fund faces because its shares are listed on a securities exchange, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. ANY OF THESE FACTORS MAY LEAD TO THE FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of its listing exchange, make trading in the shares inadvisable. The market prices of Fund shares will generally fluctuate in accordance with changes in its NAV, changes in the relative supply of, and demand for, Fund shares, and changes in the liquidity, or the perceived liquidity, of the Fund’s holdings.

Derivatives Risk is the risk that derivatives may pose risks in addition to and greater than those associated with investing directly in securities, currencies and other instruments, may be illiquid or less liquid, more volatile, more difficult to value and leveraged so that small changes in the value of the underlying instrument may produce disproportionate losses to the Fund. Derivatives are also subject to counterparty risk, which is the risk that the other party to the transaction will not perform its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

| ☐ | Futures Contracts Risk is the risk that there will be imperfect correlation between the change in market value of the Fund’s securities and the price of futures contracts, which may result in the strategy not working as intended; the possible inability of the Fund to sell or close out a futures contract at the desired time or price; losses due to unanticipated market movements, which potentially are unlimited; and the possible inability of NTI to correctly predict the direction of securities’ prices, interest rates, currency exchange rates and other economic factors, which may make the Fund’s returns more volatile or increase the risk of loss. |

| ☐ | Options Contracts Risk Options contracts give the holder of the option the right to buy (or to sell) a position in a security or in a contract to the writer of the option, at a certain price. They are subject to correlation risk because there may be an imperfect correlation between the options and the securities markets that cause a given transaction to fail to achieve its objectives. The successful use of options depends on the investment adviser’s ability to predict correctly future price fluctuations and the degree of correlation between the options and securities markets. Exchanges can limit the number of positions that can be held or controlled by the Fund or the investment adviser, thus limiting the ability to implement the Fund’s strategies. |

Securities Lending Risk is the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral.

12

It is possible to lose money on an investment in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation, any other government agency, or The Northern Trust Company, its affiliates, subsidiaries or any other bank.

Fundamental Investment Restrictions. The Target Fund and Acquiring Fund have adopted identical fundamental investment restrictions. The fundamental investment restrictions of the Funds, which are enumerated below, may be changed with respect to a Fund only by a vote of the holders of a majority of such Fund’s outstanding shares. The term “majority of the outstanding shares” of either the Trust or a particular Fund or another investment portfolio of the Trust means, the vote of the lesser of: (i) 67% or more of the shares of the Trust or such Fund or portfolio present at a meeting, if the holders of more than 50% of the outstanding shares of the Trust or such Fund or portfolio are present or represented by proxy; or (ii) more than 50% of the outstanding shares of the Trust or such Fund or portfolio.

No Fund may:

1. Make loans, except through: (a) the purchase of debt obligations in accordance with the Fund’s investment objective and strategies; (b) repurchase agreements with banks, brokers, dealers and other financial institutions; (c) loans of securities; and (d) loans to affiliates of the Fund to the extent permitted by law.

2. Purchase or sell real estate or real estate limited partnerships, but this restriction shall not prevent a Fund from investing directly or indirectly in portfolio instruments secured by real estate or interests therein or from acquiring securities of real estate investment trusts or other issuers that deal in real estate.

3. Purchase or sell physical commodities unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the Funds: (i) from purchasing or selling options, futures contracts or other derivative instruments; or (ii) from investing in securities or other instruments backed by physical commodities).

4. Act as underwriter of securities, except as a Fund may be deemed to be an underwriter under the Securities Act in connection with the purchase and sale of portfolio instruments in accordance with its investment objective and portfolio management strategies.

5. Borrow money, except that to the extent permitted by applicable law: (a) a Fund may borrow from banks, other affiliated investment companies and other persons, and may engage in reverse repurchase agreements and other transactions which involve borrowings, in amounts up to 33 1/3% of its total assets (including the amount borrowed) or such other percentage permitted by law; (b) a Fund may borrow up to an additional 5% of its total assets for temporary purposes; (c) a Fund may obtain such short-term credits as may be necessary for the clearance of purchases and sales of portfolio securities; and (d) a Fund may purchase securities on margin. If due to market fluctuations or other reasons a Fund’s borrowings exceed the limitations stated above, the Trust will promptly reduce the borrowings of a Fund in accordance with the 1940 Act.

6. Issue any senior security, except as permitted under the 1940 Act, as amended and as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time.

7. Concentrate its investments (i.e., invest 25% or more of its total assets in the securities of a particular industry or group of industries), except that a Fund will concentrate to approximately the same extent that its Underlying Index concentrates in the securities of such particular industry or group of industries. For purposes of this limitation, securities of the U.S. government (including its agencies and instrumentalities), repurchase agreements collateralized by U.S. government securities, and securities of state or municipal governments and their political subdivisions are not considered to be issued by members of any industry.

8. With respect to 75% of the Fund’s assets (i) purchase securities of any issuer (except securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements involving such

13

securities) if, as a result, more than 5% of the total assets of the Fund would be invested in the securities of any one issuer, or (ii) acquire more than 10% of the outstanding voting securities of any one issuer.

What is the historical turnover of each of the Funds?

The following tables show each Fund’s portfolio turnover rates for the past three fiscal years:

| Target Fund | Fiscal Year

Ended 10/31/22* |

Fiscal Year

Ended 10/31/21* |

Fiscal Year Ended 10/31/20* | |||

|

FlexShares® International Quality Dividend Defensive Index Fund |

65% | 65% | 75% | |||

|

FlexShares® Quality Dividend Dynamic Index Fund |

48% | 53% | 77% |

*In-kind transactions are not included in portfolio turnover calculations.

| Acquiring Fund | Fiscal Year Ended 10/31/22* |

Fiscal Year Ended 10/31/21* |

Fiscal Year Ended 10/31/20* | |||

|

FlexShares® International Quality Dividend Index Fund |

69% | 68% | 74% | |||

|

FlexShares® Quality Dividend Index Fund |

40% | 51% | 75% |

*In-kind transactions are not included in portfolio turnover calculations.

The potential alignment of securities in an Acquiring Fund’s portfolio following its Reorganization may increase portfolio turnover for that Acquiring Fund, which may generate additional costs associated with portfolio turnover. While each Reorganization will be structured as a tax-free reorganization, the repositioning of a combined portfolio after a Reorganization is completed may result in capital gains due to the realignment of the combined portfolio in keeping with each Acquiring Fund’s investment strategy and policies.

What are the fees and expenses of each Fund and what are the anticipated fees and expenses after the Reorganization?

The tables below describe the fees and expenses that you may pay if you buy, hold and sell shares of the Funds, followed by those estimated to be charged with respect to the Acquiring Funds after the Reorganization. Under the Funds’ Investment Advisory Agreement, each Fund pays NTI a unitary management fee and NTI pays most of the expenses of each Fund, including the cost of transfer agency, custody, fund administration, legal, audit and other services. However, each Fund is not responsible for the following expenses: fee payments under the Investment Advisory Agreement, interest expenses, distribution fees and expenses paid by the Funds under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act (“12b-1 Fees”), brokerage commissions and other trading expenses, fees and expenses of the independent trustees and their independent legal counsel, taxes and other extraordinary costs such as (i) dividend expenses on short sales; (ii) non-routine items, including litigation expenses and proxy expenses; and (iii) expenses that the Fund has incurred but did not actually pay due to an expense offset arrangement, if applicable. The operating expenses shown for the Funds are based on expenses incurred during the Funds’ 12-month period ended October 31, 2022. You will also incur usual and

14

customary brokerage commissions and fees to financial intermediaries when buying or selling shares of a Fund in the secondary market, which are not reflected in the examples that follows:

REORGANIZATION OF FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND DEFENSIVE INDEX FUND INTO FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND INDEX FUND

| Target Fund | Acquiring Fund |

Pro Forma Combined (2) |

||||||||||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||||

|

Management Fees |

0.47% | 0.47% | 0.47% | |||||||||

|

Distribution (12b-1) Fees |

0.00% | 0.00% | 0.00% | |||||||||

|

Other Expenses |

0.01% | 0.01% | 0.01% | |||||||||

|

Total Annual Fund Operating Expenses |

0.48% | 0.48% | 0.48% | |||||||||

|

Expense Reimbursement (1) |

-0.01% | -0.01% | -0.01% | |||||||||

|

Total Annual Fund Operating Expenses After Expense Reimbursement |

0.47% | 0.47% | 0.47% | |||||||||

| (1) | NTI has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than 12b-1 Fees, Tax Expenses, Extraordinary Expenses, and Acquired Fund Fees and Expenses) to the extent the “Total Annual Fund Operating Expenses” exceed 0.47%. This contractual limitation may not be terminated before March 1, 2024, without the approval of the Board. The Board may terminate the contractual agreement at any time if it determines that it is in the best interest of the Fund and its shareholders. |

| (2) | Pro forma information for the twelve-month perioded ended October 31, 2022, has been prepared to give effect to the proposed Reorganization pursuant to the Agreement and Plan as if it had been consummated on October 31, 2022. |

REORGANIZATION OF FLEXSHARES® QUALITY DIVIDEND DYNAMIC INDEX FUND INTO FLEXSHARES® QUALITY DIVIDEND INDEX FUND

| Target Fund | Acquiring Fund |

Pro Forma Combined (2) |

||||||||||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||||

|

Management Fees |

0.37% | 0.37% | 0.37% | |||||||||

|

Distribution (12b-1) Fees |

0.00% | 0.00% | 0.00% | |||||||||

|

Other Expenses |

0.01% | 0.01% | 0.01% | |||||||||

|

Total Annual Fund Operating Expenses |

0.38% | 0.38% | 0.38% | |||||||||

|

Expense Reimbursement (1) |

-0.01% | -0.01% | -0.01% | |||||||||

|

Total Annual Fund Operating Expenses After Expense Reimbursement |

0.37% | 0.37% | 0.37% | |||||||||

| (1) | NTI has contractually agreed to reimburse a portion of the operating expenses of the Fund (other than 12b-1 Fees, Tax Expenses, Extraordinary Expenses, and Acquired Fund Fees and Expenses) to the extent the “Total Annual Fund Operating Expenses” exceed 0.37%. This contractual limitation may not be terminated before March 1, 2024 without the approval of the Board. The Board may terminate the contractual agreement at any time if it determines that it is in the best interest of the Fund and its shareholders. |

| (2) | Pro forma information for the twelve-month perioded ended October 31, 2022, has been prepared to give effect to the proposed Reorganization pursuant to the Agreement and Plan as if it had been consummated on October 31, 2022. |

15

After factoring in applicable expense reimbursements, it is anticipated that each Target Fund shareholder will pay comparable total annual fund operating expenses as Acquiring Fund shareholders after the applicable Reorganization.

How can I compare the costs of investing in Target Fund shares with the cost of investing in Acquiring Fund shares of the comparable class?

The following Examples are intended to help you compare the cost of investing in a Target Fund with the cost of investing in the corresponding Acquiring Fund, both before and after the applicable Reorganization. The Examples assume that you invest $10,000 in the applicable Fund for the time periods indicated and then sell all of your shares at the end of those periods. In addition, the Examples assume that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the expense reimbursement arrangement for one year). Although your actual costs may be higher or lower, based on these assumptions, the costs would be:

REORGANIZATION OF FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND DEFENSIVE INDEX FUND INTO FLEXSHARES® INTERNATIONAL QUALITY DIVIDEND INDEX FUND

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

|

Target Fund |

$48 | $153 | $268 | $603 | ||||||||||||

|

Acquiring Fund |

$48 | $153 | $268 | $603 | ||||||||||||

|

Pro forma Acquiring Fund (after the Reorganization)(1) |

$48 | $153 | $268 | $603 | ||||||||||||

| (1) | Pro forma information for the twelve-month perioded ended October 31, 2022, has been prepared to give effect to the proposed Reorganization pursuant to the Agreement as if it had been consummated on October 31, 2022. |

REORGANIZATION OF FLEXSHARES® QUALITY DIVIDEND DYNAMIC INDEX FUND INTO FLEXSHARES® QUALITY DIVIDEND INDEX FUND

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

|

Target Fund |

$38 | $121 | $212 | $479 | ||||||||||||

|

Acquiring Fund |

$38 | $121 | $212 | $479 | ||||||||||||

|

Pro forma Acquiring Fund (after the Reorganization)(1) |

$38 | $121 | $212 | $479 | ||||||||||||

| (1) | Pro forma information for the twelve-month perioded ended October 31, 2022, has been prepared to give effect to the proposed Reorganization pursuant to the Agreement as if it had been consummated on October 31, 2022. |

What are the general tax consequences of the Reorganizations?

Each Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes and the delivery of a legal opinion to that effect is a condition of closing of each Reorganization (although there can be no assurance that the Internal Revenue Service (“IRS”) will adopt a similar position). However, the receipt by Target Fund Shareholders of cash in lieu of fractional shares of the corresponding Acquiring Fund prior to the closing of the Reorganization will result in the recognition of gain or loss to such shareholders unless they hold Target Fund Shares in a tax-advantaged account. This means that, subject to the limited exceptions described below under the heading “What are the tax consequences of each Reorganization,” Target Fund shareholders will not recognize any gain or loss for federal income tax purposes as a result of the exchange of all of their Target Fund shares for Acquiring Fund shares pursuant to the Reorganizations. (Notwithstanding the foregoing, shareholders should review “Repositioning of the Target Fund’s Portfolio Assets” below for important information on the possible realization of capital gain by the Target Funds.) Prior to the closing of the Reorganizations, each Target Fund will distribute to its shareholders, in one or more distributions, all of its income and gains (net of available capital loss carryovers) not previously distributed for taxable years ending on or prior to the date of closing of the Reorganization. You should consult your tax advisor regarding the effect, if

16

any, of the distribution(s) and Reorganizations in light of your individual circumstances. You should also consult your tax advisor about the state and local tax consequences of the Reorganizations, if any, because the information about tax consequences in this Joint Prospectus/Information Statement relates to the federal income tax consequences of the Reorganizations only. For more information, please see the section “What are the tax consequences of each Reorganization” below.

Repositioning of a Target Fund’s Portfolio Assets

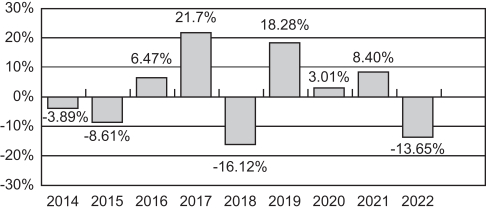

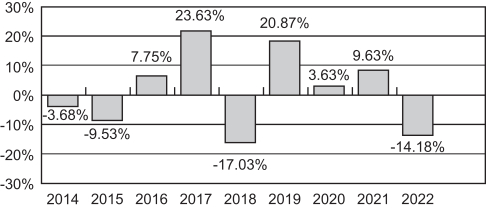

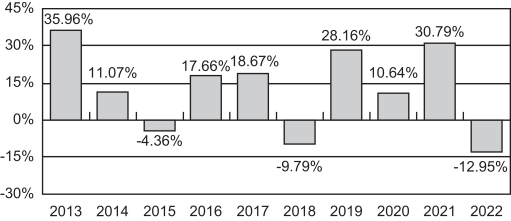

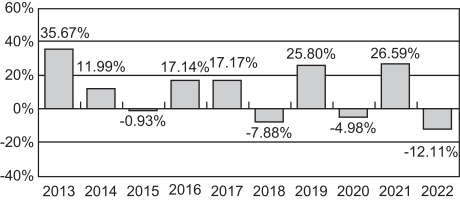

As described in more detail in “What are the tax consequences of each Reorganization” below, a portion of the portfolio assets of the FlexShares® International Quality Dividend Defensive Index Fund (“International Target Fund”) may be disposed of in connection with its Reorganization as distinct from normal portfolio turnover. Because the International Target Fund holds certain emerging markets securities that are not eligible for transfer to its corresponding Acquiring Fund, the International Target Fund will dispose of those emerging markets securities for cash prior to the Closing Time of its Reorganization. Based on the current fair market value of such securities and their cost basis to the International Target Fund, such Fund anticipates realizing a loss on the disposition of such securities. Such repositioning of the International Target Fund’s portfolio assets is anticipated to occur before the closing of its Reorganization. The FlexShares® Quality Dividend Dynamic Index Fund anticipates that any sales of portfolio securities by its corresponding Acquiring Fund as a result of its Reorganization (as distinct from normal portfolio turnover) will likely not result in any significant amounts of capital gains to be distributed to shareholders by the Acquiring Fund. Any other portfolio turnover incident to each Reorganization is not expected to result in the recognition of capital gains that a Fund must distribute to its shareholders because of the manner in which such repositioning will be accomplished.