UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2018

[ ]TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 000-54803

(Exact name of registrant as specified in its charter)

|

|

|

|

Nevada

|

46-4199032

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

1135 Makawao Avenue, Suite 103-188

Makawao, Hawaii 96768

|

96768

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

(800) 379-0226

|

|

|

Registrant's telephone number

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

|

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

|

|

|

|

[ ]

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

|

|

|

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

Yes

|

[ ]

|

No

|

[ X]

|

The aggregate market value of Common Stock held by non-affiliates of the Registrant as of July 31, 2017 was $8,750,045 based on a closing price of $0.50 for the Common Stock on July 31, 2017, the closest available date to last business day of the Registrant's most recently completed second fiscal quarter. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date.

46,557,572 Common Shares outstanding as of October 31, 2018

DOCUMENTS INCORPORATED BY REFERENCE: None

2

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page

|

|

|

PART I

|

|

|

|

|

|

|

Item 1

|

Business

|

6

|

|

Item 1A

|

Risk Factors

|

23

|

|

Item 1B

|

Unresolved Staff Comments

|

23

|

|

Item 2

|

Properties

|

23

|

|

Item 3

|

Legal Proceedings

|

23

|

|

Item 4

|

Mine Safety Disclosures

|

24

|

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

Item 5

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

25

|

|

Item 6

|

Selected Financial Data

|

28

|

|

Item 7

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

28

|

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

33

|

|

Item 8

|

Financial Statements and Supplementary Data

|

33

|

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

34

|

|

Item 9A

|

Controls and Procedures

|

34

|

|

Item 9B

|

Other Information

|

35

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

36

|

|

Item 11

|

Executive Compensation

|

40

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

46

|

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

47

|

|

Item 14

|

Principal Accounting Fees and Services

|

49

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

Item 15

|

Exhibits, Financial Statement Schedules

|

50

|

|

|

|

|

|

|

SIGNATURES

|

51

|

3

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. When used in this Annual Report on Form 10-K, the words "may," "could," "estimate," "intend," "continue," "believe," "expect" or "anticipate" and similar expressions identify forward-looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, these plans, intentions, or expectations may not be achieved. Our actual results, performance, or achievements could differ materially from those contemplated, expressed, or implied, by the forward-looking statements contained in this Annual Report on Form 10-K. Important factors that could cause actual results to differ materially from our forward-looking statements are set forth in this Annual Report on Form 10-K. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this Annual Report on Form 10-K. Except as required by federal securities laws, we are under no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

|

|

· inability to raise additional financing for working capital until such time as we achieve profitable operations;

|

|

|

· inability to identify marketing approaches;

|

|

|

· deterioration in general or regional economic, market and political conditions;

|

|

|

· the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management to make estimates about matters that are inherently uncertain;

|

|

|

· adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations;

· adverse state or federal regulations that may affect the cannabis industry

|

|

· changes in U.S. GAAP or in the legal, regulatory and legislative environments in the markets in which we operate;

|

|

|

|

· inability to efficiently manage our operations;

|

|

|

· inability to achieve future operating results;

|

|

|

· our ability to recruit and hire key employees;

|

|

|

· the inability of management to effectively implement our strategies and business plans; and

|

|

|

· the other risks and uncertainties detailed in this report.

|

In this form 10-K references to "we", "us", "our", "ESSI", and "Eco Science"" mean Eco Science Solutions, Inc., a Nevada corporation. References to "Ga-Du" mean Ga-Du Corporation, our wholly owned subsidiary.

AVAILABLE INFORMATION

We file annual, quarterly and special reports and other information with the SEC. You can read these SEC filings and reports over the Internet at the SEC's website at www.sec.gov. You can also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, NE, Washington, DC 20549 on official business days between the hours of 10:00 am and 3:00 pm. Please call the SEC at (800) SEC-0330 for further information on the operations of the public reference facilities. We will provide a copy of our annual report to security holders, including audited financial statements, at no charge upon receipt to of a written request to us at Eco Science Solutions, Inc. 1135 Makawao Avenue, Suite 103-188 Makawao, Hawaii 96768.

4

PART I

|

BUSINESS

|

Corporate Overview

The Company's principal executive office is located at 1135 Makawao Avenue, Suite 103-188 Makawao, Hawaii 96768. The Company's telephone number is 800-379-0226. The Company's website is www.ecossi.com.

The Company's common stock symbol is "ESSI". During May 2017 the trading of ESSI shares on the public exchanges was suspended, and although the suspension has been lifted, a Form 15c2-11 with current information must be filed with the Financial Industry Regulatory Authority (FINRA) prior to the caveat emptor status being lifted, and before trading can resume. The Company is in the process of getting a Form 15c2-11 filed; as soon as it meets FINRA's criteria, it will be filed.

On February 14, 2014, the company effected a 1,000- for 1 reverse split. All share and per share figures herein reflect the impact of the split.

Corporate History

Formation and Business Development

The Company was incorporated in the state of Nevada on December 8, 2009, under the name Pristine Solutions, Inc. The Company's wholly owned subsidiary, Pristine Solutions Limited, was incorporated under the laws of Jamaica. The Company's original business plan focused on developing a network of sales points for the sale and service of tankless water heaters in Jamaica, through Pristine Solutions Limited. The Company's aim was to become the first tankless water heater company specializing in tankless-only products to enter the Jamaican market, and the only company in the Jamaican market offering solar-powered tankless water heater products. As part of its plan, on December 30, 2009, the Company entered into a distribution agreement with Zhongshan Guangsheng Industry Co., Ltd., of China ("Zhongshan"), the manufacturer of the tankless water heaters. Zhongshan manufactures the tankless water heaters under the brand Gleamous Electric Appliances.

On March 7, 2012, the Company filed a Certificate of Change with the State of Nevada increasing the shares of common stock from 100,000,000 to 650,000,000 common stock; par value $0.0001 and decreasing the shares of Preferred Stock from 100,000,000 to 50,000,000; par value $0.001.

On August 22, 2012, Christine Buchanan-McKenzie, the Company's former President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and a member of the Board of Directors, resigned from all positions with the Company. The resignation did not involve any disagreement with the Company on any matter relating to the Company's operations, policies or practices. On the same day, Mr. Michael Borkowski was appointed as President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and the sole member of the Board of Directors of the Company. Concurrently the Company determined to change its business focus.

On August 23, 2012, the Company changed its fiscal year from December 31 to January 31.

On August 23, 2012, the Company and its controlling stockholders entered into a Share Exchange Agreement (the "Share Exchange") with Eaton Scientific Systems, Ltd., a Nevada corporation ("ESSL") and the shareholders of ESSL (the "ESSL Shareholders"), whereby the Company acquired 25,000 shares of common stock (100%) of ESSL (the "ESSL Stock") from the ESSL Shareholders. In exchange for the ESSL Stock, the Company issued 25,000shares of its common stock to the ESSL Shareholders. In addition, the Company's Chief Executive Officer, Mr. Michael J. Borkowski, on behalf of the Company, entered into a Common Stock Purchase Agreement with the Company's controlling shareholder, and former President, Ms. Christine Buchanan-McKenzie, whereby the Company would purchase one hundred percent (100%), or 240,000 shares, of the Company's common shares owned by Mrs. Buchanan-McKenzie, at par value $.0001, and representing approximately 54.1% of the Company's total issued and outstanding shares. The Common Stock Purchase Agreement, and subsequent transaction closing, was completed on October 22, 2012. On October 23, 2012, the Common Stock Purchase Agreement was finalized, and a change in control of the Company took place.

5

In conjunction with the Share Exchange and Common Stock Purchase Agreement, the total shares held by the ESSL Shareholders are 265,000, or approximately 59.8% of the issued and outstanding common stock of the Company as of October 30, 2012. Certain ESSL shareholders owning a total of 135,779 shares of the Company's common stock, representing approximately 30.64% of the issued and outstanding common stock of the Company, entered into three (3) separate twenty-four (24) month Lock-Up Agreements. As a result of the Share Exchange and Common Stock Purchase Agreement, (i) there was a change in control of the Registrant; (ii) ESSL became the Company's wholly owned subsidiary; (iii) the ESSL became the Company's primary business, and (iv) on November 27, 2012, the Company changed its name to Eaton Scientific Systems, Inc.

Subsequently the Company determined to operate Eaton Scientific Systems, Ltd. ("Eaton Sub") a Nevada corporation and wholly owned subsidiary of the Company, as a privately held Company, until such time where it is sufficiently capitalized to increase the probability for its Clinical Trials of Homatropine ("Tropine 3") in oral suspension for the treatment of hot flash symptoms in pre-menopausal, menopausal and post-menopausal women, to be in a position to yield results that may provide the opportunity for a potential FDA approval for marketing to consumers in the US.

In October, 2013, the Company's Management was introduced to Domenic Marciano ("Marciano"). Marciano represented that he intended to acquire an exclusive license to a unique automotive product, the EcoFlora Spark Plug (the "EcoFlora Plug"), with a proprietary technology, and that the EcoFlora Plug has the potential to be uniquely positioned in the automotive parts business in the United States and International automotive parts marketplace.

On November 26, 2013, the Company and its Majority Shareholders (the "Majority Stockholders") entered into an Agreement for the Purchase of Common Stock (the "Stock Purchase Agreement") with Marciano whereby Marciano acquired 227,370 shares of the Company's common stock from the Majority Stockholders at par value $.0001, representing approximately 51.3% of the Company's total issued and outstanding shares, in exchange for cash in the amount of $22,737 (the "Cash Proceeds"). The Stock Purchase Agreement, and subsequent transaction closing, was completed on November 26, 2013, and a change in control of the Company took place.

In connection with the terms and conditions of the Stock Purchase Agreement and sale of 227,370 shares held by the Majority Stockholders:

1. Marciano appointed two new directors to the Company's board of directors; and

2. The "Lock-Up-Leak-Out" Agreements executed in October 2012 were cancelled by mutual agreement between the Board and the Company's Shareholders who were party to the Agreements.

3. The Majority Shareholders of the Company voted to "Spin-out" to its Shareholders, one hundred percent (100%) of the issued and outstanding shares of Eaton Scientific Systems Ltd., its operating subsidiary, as of the record date of November 25, 2013, on a one-for-one basis within sixty-days (60) of the Change of Control of the Company, or by January 25, 2014.

On December 4, 2013, the Company (the "Company") executed an Agreement of the License of Intellectual Property (the "License Agreement") dated November 4, 2013 with Eco Science Solutions International, Inc., a Canadian corporation ("ESS International"), for the exclusive license to the EcoFlora Plug, recently patented in the US and that has filed for Patent protection in Canada and the International community, based on its "Internal Pre-Combustion Chamber High Efficiency Spark Plug" technology. In connection with the License Agreement, the Company issued ESS International 2,500,000 shares of the Company's Series "A" Convertible Preferred Stock ("Preferred Stock"), in exchange for the exclusive license of the Patent Applications, in perpetuity. The Preferred Stock is convertible into common stock at a conversion rate of 10 common shares for each preferred share

On January 8, 2014, the Spin-out was complete, and Eaton Scientific Systems, Ltd. was no longer a subsidiary of the Company.

6

On February 14, 2014, the Company changed its name to Eco Science Solutions, Inc. and effected a 1000-to-1 reverse stock split. As a result, the total shares of common stock issued and outstanding was 443,001 with a par value of $0.0001.

On April 4, 2014, the Company received notice from Eco Science Solutions International, Inc. to convert 100% of the Series "A" preferred shares into restricted common shares on a 10 for 1 basis. As a result, on April 9, 2014, 25,000,000 shares of the Company's restricted common stock was issued, of which 19,866,668 shares were issued to the Company's chairman, Domenic Marciano, and 5,133,332 shares were issued to non-related parties. Subsequent to the conversion, Eco Science Solutions International, Inc. no longer holds any shares of the Company's capital stock, and Mr. Marciano holds 20,094,038 shares of the Company's common stock, which represents 62.53% of the total issued and outstanding shares of the Company's common stock on a fully diluted basis.

On October 7, 2014, the US Patent and Trademark Office ("USPTO") issued Patent #8,853,925 for the EcoFlora Plug, based on its "Internal Pre-Combustion Chamber High Efficiency Spark Plug" technology, and has patent pending applications both in Canada and worldwide.

Effective August 28, 2015, the Agreements of the License of Intellectual Property dated November 4, 2013, and entered into with Eco Science Solutions International, Inc. was terminated.

On August 31, 2015, the Company executed an Asset Purchase Agreement with Kensington Marketing, Inc., a Nevada corporation, dated August 28, 2015 (the "Purchase Agreement"), to purchase a certain technology application known as "Stay Hydrated." In exchange for the technology application, the Company will issue 1,500,000 restricted shares of the Company's common stock, valued at $150,000.

On September 3, 2015, 4,966,667 shares of the Company's issued and outstanding common stock were cancelled by the certificate holder. As a result of this transaction, the shares were returned to treasury, and the total issued and outstanding shares of common stock was reduced to 26,176,334 shares.

On November 1, 2015, the Company entered into a new Employment Agreement with Mr. Borkowski (the "2015 Employment Agreement"). The Employment Agreement is for a term of one (1) year, and includes compensation in the amount of $36,000 per year, compensation for certain travel expenses, and grants to purchase 2,000,000 shares of the Company's common stock at par, which vest quarterly beginning November 1, 2015, at 500,000 shares per vesting period through August 1, 2016 (the "2015 Stock Award"). In connection with the 2015 Stock Award, $160,000 has been recorded as deferred compensation, to be amortized over the next 9 months.

On November 19, 2015, in accordance with his 2015 Employment Agreement, the Company issued 500,000 shares of restricted common stock, valued at $40,000, to its President for cash in the amount of $500. As a result, additional paid in capital was reduced by $49,500.

On December 7, 2015, the Board of Directors approved the authorization of a 1 for 50 reverse stock split of the Company's outstanding shares of common stock. On December 11, 2015, the Company obtained the written consent of a stockholder, Domenic Marciano, an individual, holding 71% voting power of the Company's outstanding capital stock as of December 1, 2015, to effect the reverse stock split.

On December 9, 2015, in accordance with a certain Asset Purchase Agreement dated August 28, 2015, the Company issued 1,500,000 shares of restricted common stock, valued at $150,000.

7

On December 10, 2015, Mark Dilley resigned as a Director of the Company.

On December 15, 2015, Domenic Marciano, the Company's majority shareholder, sold his shares in a private transaction equally to Mr. Jeffery Taylor and to Mr. Don Taylor. Mr. Jeffery Taylor and Mr. Don Taylor are now the controlling shareholders of the Company and own the majority of issued and outstanding shares.

On December 17, 2015, Michael Borkowski resigned as Director, President and Chief Executive Officer of the Company.

Effective December 17, 2015, Mr. Jeffery Taylor was appointed to serve as Chief Executive Officer and President of the Company and Mr. Don Lee Taylor was appointed to serve as Chief Financial Officer of the Company.

On December 21, 2015 the Company entered into employment agreements with Mr. Jeffery Taylor and Mr. Don Lee Taylor for a period of 24 months, where after the contract may be renewed in one year terms at the election of both parties. Jeffery Taylor receives an annual gross salary of $115,000 and Don Lee Taylor receives an annual gross salary of $105,000 payable in equal installments on the last day of each calendar month and which may be accrued until such time as the Company has sufficient cash flow to settle amounts payable. Further under the terms of the respective agreements all inventions, innovations, improvements, know-how, plans, development, methods, designs, analyses, specifications, software, drawings, reports and all similar or related information (whether or not patentable or reduced to practice) which relate to any of the Company's actual or proposed business activities and which are created, designed or conceived, developed or made by the Executive during the Executive's past or future employment by the Company or any Affiliates, or any predecessor thereof ("Work Product"), belong to the Company, or its Affiliates, as applicable.

On January 1, 2016, the Company entered into a technology licensing and marketing support agreement with Separation Degrees – One, Inc. ("SDOI") that will result in the development, licensing and management of on-going technology solutions and marketing campaigns for ESSI's initiatives. Additionally, the Company entered into an Asset Purchase Agreement with SDOI wherein the Company acquired a proprietary messaging and customer relationship management software platform from SDOI.

On January 8, 2016, the Board of Directors authorized the withdrawal of the Reverse Split application with FINRA.

On January 11, 2016, the Company's Board of Directors (the "Board") authorized the creation of 1,000 shares of Series A Voting Preferred Stock. The holder of the shares of the Series A Voting Preferred Stock has the right to vote those shares of the Series A Voting Preferred Stock regarding any matter or action that is required to be submitted to the shareholders of the Company for approval. The vote of each share of the Series A Voting Preferred Stock is equal to and counted as 10 times the votes of all of the shares of the Company's (i) common stock, and (ii) other voting preferred stock issued and outstanding on the date of each and every vote or consent of the shareholders of the Company regarding each and every matter submitted to the shareholders of the Company for approval. The Agreement with SDOI was revised so that SDOI received 500,000 shares of Common Stock rather than Preferred Shares; no Preferred Shares were issued to SDOI. In addition to the issuance of the 500,000 shares of common stock as consideration for the Asset Purchase Agreement with SDOI, the Company agreed further to settle all invoices received for services rendered by SDOI, as well as advertising fees incurred, by way of issuance of common stock at a 30% discount to market as S-8 shares.

On January 11, 2016, Mr. Domenic Marciano tendered his resignation as Chairman of the Board of Directors of the Company, Secretary and Treasurer and Mr. Jeffery and Mr. Don Taylor were appointed to the Company's Board of Directors. Mr. Jeffery Taylor was appointed Secretary and Mr. Don Lee Taylor was appointed Treasurer.

Concurrently, on January 11, 2016, the Company cancelled the agreement with Kensington Marketing, cancelled 1,500,000 shares of Common Stock issued to Kensington Marketing, and returned the "Stay Hydrated" application the Company acquired in exchange for the 1,500,000 shares.

With the departure and appointment of new officers and directors of the Company, the direction of business the Company is focusing on changed. The Company determined to focus on eco-friendly products, development and businesses.

On February 26, 2016, the Company announced it had cancelled 1,000,000 shares of common stock, as part of a stock buyback program designed to increase current shareholder value by repurchasing and retiring existing outstanding common stock.

Under the stock repurchase program, and depending on market conditions, shares may be repurchased from time to time at prevailing market prices through open-market or negotiated transactions in accordance with all applicable securities laws and regulations. To remain in compliance with item 703 of Regulation S-K the Company, whether through an open market or private transaction, will at a minimum disclose on a quarterly basis all repurchases of equity securities.

To date, no further shares have been repurchased by the Company.

8

On April 1, 2016, the Company filed a Form S-8 to register 5,000,000 shares of Common Stock, $0.00001 par value per share, under its 2016 Equity Incentive Plan. A further S-8 was filed on November 23, 2016 to register an additional 5,000,000 shares of Common Stock at $0.00001 par value per share.

On January 10, 2017, the Company entered into a Cancellation and Release Agreement with SDOI wherein the Company agreed to issue 4,000,000 common shares to SDOI (or its designee) in exchange for the cancellation of the $1,920,424 worth of remaining outstanding invoices and fees owed to SDOI.

On January 15, 2017, Eco Science Solutions, Inc. entered into an Equity Purchase Agreement with Phenix Ventures, LLC, Under the terms of the Agreement, Phenix Ventures has agreed to purchase up to 10,000,000 Shares of the Company's Common Stock upon "Put Notices" of the Company, to Phenix Ventures. Additionally, pursuant to the terms of the Agreement, a Form S-1 Registration Statement was filed with the Securities and Exchange Commission on January 27, 2017, to register the 10,000,000 Shares. The Registration Statement was deemed effective on May 12, 2017. No shares have been sold under this offering.

A Complaint was filed against Gannon Giguiere, president of Phenix Ventures, in July 2018, by the SEC, which alleges Mr. Giguiere's involvement in certain activities, of which the Company, its' officers, board members, and others directly involved with the Company, have no knowledge of. Until the Complaint is resolved, no funding will be provided by Phenix Ventures to the Company.

To date, there have been no Put Notices and no funding available from Phenix Ventures under the Registration Statement; additionally, no shares have been issued pursuant to the registration statement

On April 16, 2017, the Company entered into a Sponsorship, Content Development and Licensing Agreement with Roaring Lion Tours, Inc., for the licensing and distribution right to content developed during Kaya Fest, in Miami, Florida on April 22, 2017. The arrangement allowed for the Company to sponsor the Kaya Festival as well as the right to use any audio and audio-visual content developed by the Kaya Festival. Roaring Lion Tour, Inc. develops inspirational and education content that further promotes the benefits of medical marijuana. Roaring Lion Tours is owned by Stephen Marley who is also the curator of Kaya Fest, a star-filled awareness and music festival that is focused on the creating public awareness of the many uses and medical benefits of the cannabis plant.

On June 21, 2017, Eco Science Solutions, Inc. (ESSI) entered into a Stock Purchase Agreement ("SPA") with the shareholders of Ga-Du Corporation, a Nevada corporation ("Ga-Du", "Sellers"), wherein, ESSI agreed to purchase, and Sellers agreed to sell 100% of the shares of capital stock of Ga-Du to ESSI, in exchange of fifteen million (15,000,000) shares of ESSI Common Stock, that shall be issued to Seller's, pursuant to the SPA. Among the additional material terms of the SPA was Seller's right to receive additional consideration in the form of cash payment(s) payable only upon the achievement of certain milestones (the "Milestone Payments") described in Exhibit B of the SPA provided that: (i) all of the Milestones must be reached within not more than twelve (12) months from the date of the execution of this Agreement; (ii) each Milestone shall be treated as distinct and the failure to reach any single Milestone shall not affect the availability of the Milestone Payment(s) related to any other Milestone(s).

Additionally, ESSI, on June 21, 2017, entered into Employment and/or Consulting Agreements with each of the Sellers. Pursuant to their respective agreements with the wholly owned subsidiary of ESSI, Ga-Du Corporation, John Lewis serves as the Chief Executive Officer of Ga-Du Corporation, Andy Tucker acts as Special Consultant to Ga-Du Corporation, Dante Jones serves as a Special Advisor to Ga-Du, and Wendy Maguire serves as the Vice President of Business Development of Ga-Du. Payment of compensation for these individuals has been deferred and is accruing at the rate of $10,000 per month. Further, ESSI entered into Employment Agreements with Michael D. Rountree, who serves as Chief Operating Officer of ESSI, and with S. Randall Oveson, who serves as the Chief Operating Officer of Ga-Du Corporation.

Each of the Employment and/or Consulting Agreements are for a term of two years, renewable upon mutual consent, with an annual salary of $120,000 per year.

Following the closing of the SPA, Ga-Du Corporation became a wholly owned subsidiary of ESSI, bringing to ESSI a Financial Services Platform, as well as Inventory Control and Advisory Software Platforms, and Retail Inventory Control, bringing important enterprise technologies in-house.

9

ESSI agreed to the issuance of 1,000,000 restricted shares of the Company's Common Stock to DEEPSEA SOLUTIONS, LLC, in consideration for arranging the transaction between the Company and Ga-Du Corporation Shareholders.

On June 21, 2017, and pursuant to the Stock Purchase Agreement, ESSI appointed L. John Lewis and S. Randall Oveson, both representatives of Ga-Du Corporation, to the Board of Directors, effective June 21, 2017.

On June 21, 2017, ESSI appointed Michael Rountree as Chief Operating Officer of ESSI.

On June 21, 2017, L. John Lewis was appointed Chief Executive Officer of Ga-Du Corporation, Wendy Maguire as Vice President of Business Development of Ga-Du Corporation, and S. Randall Oveson as Chief Operating Officer of Ga-Du Corporation.

On September 22, 2017, for the benefit of existing ESSI shareholders, and to allow for successful future capital raising, ESSI amended both the Stock Purchase Agreement and the Employment/Consultant Agreements previously entered into with the founders of Ga-Du Corporation on June 21, 2017.

The Amendment to the Stock Purchase Agreement eliminated the clause (paragraph 2.6) allowing for the issuance of 15,000,000 additional shares upon the acquisition of a banking interest and the Amendment to the Employment/Consultant Agreements eliminated the clause (paragraph 3(b) (Employment Agreement) and paragraph 6 (Consultant Agreement)) allowing the Ga-Du employees/consultants options to purchase shares of ESSI Common Shares, under those employment/consultant agreements.

Additionally, on September 22, 2017, and in order to avoid diluting the holdings of existing ESSI Shareholders, Jeffery and Don Taylor, CEO and CFO of ESSI, agreed to return 8,000,000 Shares each of ESSI's Common Stock of their own to the Company for cancellation, effective September 22, 2017.

Further, on September 22, 2017, Ga-Du Corporation entered into an Assignment Agreement with G&L Enterprises, wherein G&L Enterprises assigned, to Ga-Du Corporation, all of its rights, interest in, and obligations under a License and Master Marketing Agreement (LMMA) it entered into with Alliance Financial Network, Inc. ("AFN", "Alliance") on September 6, 2017. The basic terms of that Agreement are as follows:

Alliance provides certain financial and enterprise services to businesses and individuals, including the Cannabis Industry, on a programmatic or membership basis (the "Financial Program"), of which Alliance derives fees and income from enrolling companies in the Financial Program and providing a range of services, with respect to which AFN and Ga-Du may derive fees and income, for such clients (the "Members") according to the AFN pricing schedule (the "Fees").

Alliance Financial Network is registered with FinCEN (MSB Registration Number: 31000094744769) as a "non-bank financial institution", compliant with the AML/BSA guidelines of FinCEN, and is regulated by the IRS. Operating a mobile application known as eXPO™ electronic eXchange Portal, Alliance provides virtual financial and enterprise services to businesses and individuals, which are challenged in the traditional banking systems, generally are those that require more intensive compliance than banks are willing, or able to perform and/or which do not have the technical expertise or financial wherewithal to develop the range of FinTech solutions accounting and enterprise management softwares. One such industry is the cannabis industry; Alliance is configured to establish Membership relationships with businesses in this industry, following a full compliance audit on the business.

Ga-Du and ESSI agreed to issue two hundred thousand (200,000) restricted shares of ESSI common stock to Alliance. Alliance acknowledges that: (i) the shares are unregistered; (ii) the shares, when issued, will have restrictive language such that they may not be deposited for trading until they are registered, or, upon meeting certain criteria, they are exempt from registration; and (iii) the trading of ESSI shares on the public exchanges was suspended, and although the suspension has been lifted, a Form 15c2-11 with current information must be filed with the Financial Industry Regulatory Authority (FINRA) prior to the caveat emptor status being lifted.

10

Ga-Du shall have the exclusive right to undertake marketing responsibilities of all of Alliance's Financial Services and software to businesses in the Cannabis industry, initially in Florida, Massachusetts, Oregon and Washington, based on opportunities and licensing in those states, with plans to extend throughout the United States, provided that it shall not extend to any states where Cannabis sales have not been legalized by that state's laws.

Ga-Du shall be credited with and compensated with a share of all Cannabis related revenues received by Alliance regardless of the source of revenues, or the party that obtained a member/customer that generated the revenues.

Alliance provides all software platform(s) necessary to deliver the Financial Services, assure compliance with appropriate Federal Requirements and international money laundering restrictions, administer all compliance, enrollment, and collection of fees from the Members contracting with Alliance, provide any and all necessary marketing or other materials describing Alliance's services and program, will forward any required Sales Commissions to the appropriate recipients, and assure adequate customer service at all times.

Alliance is responsible for the functional operation of any software utilized in providing its services and for the administration and handling of monies and/or any credits relating thereto and, in the event of any claim, cause of action or lawsuit (together the "Claims") for failure to properly administer such responsibilities, Alliance shall have the sole obligation to defend such Claim(s) and shall fully indemnify, defend and hold harmless Ga-Du from and against such Claims.

Alliance maintains accounting and data concerning the income from the Cannabis Industry and will generate a monthly income statement as to each of the following revenue streams: (i) membership fees; (ii) cash depository fees; (iii) merchant processing and credit card fees; (iv) transfer fees; and (v) advertising fees.

Alliance and Ga-Du will split compensation derived from income generated from enrollees of Ga-Du as follows: (a) for income from point of sale payments to merchants, after deducting any Sales Commissions and cost basis (interchange and bank fees), Alliance will receive forty percent (40%), and Ga-Du shall receive sixty percent (60%); (b) for income from cash depository business deriving from the Cannabis industry, Alliance will receive sixty five percent (65%), and Ga-Du will receive thirty five percent (35%); (c) for income derived from membership fees from the Cannabis industry, Alliance and Ga-Du will split the revenue 40/60 as in (a) above; (d) for income generated from transfer fees, Alliance and Ga-Du will split the revenue on a 50/50 basis; and (e) for any other income derived from providing services to the Cannabis industry, Alliance and Ga-Du will split the income on an equal fifty/fifty basis, except that income derived from advertising fees paid by advertisers utilizing Alliance's kiosks will be split eighty-five percent (85%) to Alliance and fifteen percent (15%) to Ga-Du.

Additionally, the terms of the License and Master Marketing Agreement G&L entered into with Alliance included a $100,000 Convertible Promissory Note payable to G&L, based upon money G&L loaned to Alliance; the sole member of G&L Enterprises, L. John Lewis, is one of the founding members of Ga-Du Corporation.

On September 22, 2017, G&L Enterprises assigned the $100,000 Convertible Promissory Note to Ga-Du Corporation it entered into with Alliance Financial Network, Inc. on July 6, 2017. The terms of the Note are for one year with 12% interest, and following the above-referenced assignment, payable to the Ga-Du Corporation. Furthermore, the Note can, at Ga-Du's option, be converted upon maturity into 1.12% of the equity of Alliance.

11

On November 14, 2017, ESSI entered into an Endorsement Agreement with Mr. Stephen Marley. The terms of the Agreement allow for Mr. Marley to act as a Spokesperson for ESSI and to provide his endorsement of all ESSI products and services, domestically, and worldwide. The term of the Agreement is for one year, with automatic yearly renewals, unless terminated by either party with thirty days prior notice. Mr. Marley will be compensated in the amount of Ten Thousand Dollars ($10,000) per month, and the issuance of one million shares of restricted ESSI Common Shares.

On March 5, 2018, an Addendum to the LMMA entered into between Ga-Du, the Company and AFN. (d/b/a eXPOTM) ("Alliance", "eXPOTM"), and dated September 6, 2017, was entered into and agreed upon, wherein the LMMA was amended to reflect the right of Ga-Du to receive revenue from Colorado businesses; the LMMA originally excluded existing Colorado business as any revenue generating businesses.

The Addendum allows for the following split:

"With respect to the fee split between Alliance and Ga-Du as to income derived from cash depository business designated by eXPOTM as "Legacy Cash" deposited from businesses in the Cannabis industry, or other cash depository business brought in by Ga-Du, the Company shall receive fifty percent (50%) of all revenues and Ga-Du shall receive fifty percent (50%) of all such revenues (the "Cash Depository Revenues")".

Among other things, in exchange for the split, whereby Ga-Du is to receive 50% of all revenues, Ga-Du agreed to pay to Alliance $405,000 in three tranches, for operational expenses and business development in the State of Colorado as well as in other states. Ga-Du's CEO, L. John Lewis, personally advanced $170,000 of this sum to Alliance and the Company has entered into a Note dated July 31, 2018with Mr. Lewis to repay this sum. Mr Rountree personally advanced $35,000 of this sum during July and August 2018, and the amount has been recorded as related party payables.

Additionally, Ga-Du, from October 15, 2017, and going forward, is entitled to receive 10% of all of Alliance's net revenue earned from Colorado revenues.

The final payments were concluded making the Addendum Effective, and retroactive to March 5, 2018. Pursuant to AFN's record books, and accounting, the following amounts have been credited to Alliance: (1) Cumulative eXPOTM Credit Exchange (through October 31, 2018): $ 24,365,025 (2) Cumulative Cash Pick-Ups (through October 31, 2018): $11,546,079; and (3) Total Revenue (through October 31, 2018): $284,310. The amount payable through October 31, 2018, to Ga-Du is $28,431 (10% of net revenue generated by Colorado Business).

On April 1, 2018, the Company entered into a Sponsorship Agreement with Fruit of Life Productions, LLC. The terms of the Agreement allow the Company to sponsor Kaya Fest 2018, to be held in San Bernardino, California, and to be acknowledged by Fruit of Life Productions as a Sponsor at Kaya Fest. In return, the Company agrees to pay Fruit of Life Productions $250,000. Sponsorship benefits will include, among other things, the following:

(1) Main Stage named after ESSI; (2) Four 10x10 on site vendor booths; (3) Banner (10) placement in venue; (4) Audio/Video assets provided as promotional use for ESSI's Herbo; (5) Name and phrase of ESSI called out on stage between performers sets; (6) ESSI's logo and a link to ESSI on Kaya Fest website; (7) ESSI's logo on video wall; (8) ESSI's name and logo as presenting sponsor; (9) Banner at main entrance of venue; (10) On stage banner placement; and (11) ESSI's logo on all promotional print for Kaya Fest.

The term of the Agreement began on April 1, 2018, and will continue until April 30, 2018, at 11:59 p.m. at the closing of the Kaya Fest.Kaya Fest is a two-day Music and Awareness Festival named "one of the Top 10 Music Moments of 2017" by Miami New Times. Each year Kaya Fest invites an incredible roster of reggae-influenced artists to celebrate one love, unity, peace and "overstanding" alongside supporters from all over the world.

12

About Eco Science Solutions, Inc.

With headquarters in Maui, Hawaii, Eco Science Solutions, Inc. is a bio and software technology-focused Company targeting the multi billion-dollar health and wellness industry. As Consumers continue to take ownership of their health, wellness and alternative medicines they consume, there is a growing shift away from the sole dependence on large pharmaceutical companies and prescription drugs. Thus, in 2018 and beyond, there will be a growing need for both established and new health and wellness businesses to market to this increasing demand.

Eco Science Solutions, Inc. continues to focus on becoming a premier health, wellness and alternative medicines business by effectively servicing and connecting wisely conscious consumers with like-minded businesses. The Company's consumer initiatives are centered on education and connecting consumers with various holistic health, wellness and alternative medicine businesses. Its business initiatives are focused on developing technology solutions coupled with data analytics to help those very same holistic health and wellness businesses to be more effective in their abilities to connect, market, and sell to consumers.

Through our recent acquisition of Ga-Du, ESSI's core is now a 360-degree ecosystem for business location, localized communications between consumers and business operators, on-topic social networking, inventory management / selection, payment facilitation and delivery arrangement. The Company's holistic commerce and content platform enables health, wellness and alternative medicine enthusiasts to easily locate, access, and connect with others to facilitate the research of and purchasing of eco-science friendly products.

* Eco Science Solutions, Inc. is not in the business of growing, manufacturing, or distributing cannabis.

Our business has commenced generating modest revenues subsequent to our fiscal year ended January 31, 2018. We continue to build both consumer and enterprise technology, consumer package goods, invest in research & development and advertising to consumer and professional traffic for both our apps and web properties, as well as the marketing of our financial services partnership through AFN. Once we have gained a large enough audience the Company will begin to aggressively monetize its audience relationships through: 1) paid advertisements from business seeking exposure to users the Herbo services; 2) enterprise license agreements with professional customers; 3) sales of products targeting general health and wellness and alternative medicines and 4) successful marketing of our financial services to an expanded number of clients across various states in the US through our AFN partnership. Our recent acquisition of Ga-Du and the aforementioned marketing agreement with AFN allows us to offer certain financial and marketing services to businesses and individuals, including the Cannabis Industry, on a programmatic or membership basis (the "Financial Program"), from which AFN and Ga-Du derive fees and income from enrolling companies in the Financial Program and providing a range of services to our clients (the "Members") according to the AFN pricing schedule (the "Fees"). Under our agreements, Ga-Du was granted the exclusive right to undertake marketing responsibilities of Alliance's Financial Services to businesses in the Cannabis industry, initially in Michigan, Oregon and Washington, and subsequently, Colorado, with plans to extend throughout the United States, provided that it shall not extend to any states where Cannabis sales have not been legalized by that state's laws. Alliance and Ga-Du recently commenced business in the States of Florida, Montana, and Pennsylvania. Ga-Du is credited with all Cannabis related members and revenues that use Alliance's financial and marketing services, regardless of the source of revenue, or the party that enrolled the customer that generated the revenues, that are generated within any territory in which Ga-Du has commenced business. This business segment has recently allowed us to start generating fee based revenue subsequent to the fiscal year ended January 31, 2018.

The Company's Herbo apps, Fitrix app, UseHerbo.com and "The Pursuit of Fine Herb" original content also remain available for use, either through Apple and Google app stores or online through a web-browser or through social channels, such as Facebook, Instagram and YouTube.

According to the popular traffic measuring site Alexa, an Amazon.com Company, the useherbo.com domain is ranked 39,310 globally and 3,498 in the United States. The Herbo apps through the play stores or direct download to our beta users have an install base of over 50,000 users. The Fitrix app through the play stores or direct download to our beta users has an install base of approximately 22,500 users.

13

All current advertisers on the Herbo platform are being allowed to advertise at no charge. We have elected to pursue this strategy to allow for a concrete set of metrics to develop. Once these metrics have been developed, we will be properly prepared to set fair market advertising rates aligned with the media value of our audience. Management believes this "customer first" will benefit the success of retention and advertiser growth on a long-term basis.

While we have listed products for sale on the useherbo.com platform, we are simply redirecting users to other sites in where the product can be purchased. Right now the Company is investing our internal enterprise capabilities that will allow for us to best service, deliver and account for all transactions. Again, our driving focus is never to disappoint a customer with a poor experience so we are taking a slower approach to ensure that all enterprise systems and logistics are perfected before we begin monetizing our audience.

The following is to provide a road-map for how the Company intends to commence and generate revenue from its app portfolio, further enhance revenue generated from our marketing agreement and set out the anticipated costs to do so. Eco Science Solutions' core Initiatives remain centered on five main areas: 1) continued consumer and enterprise technology investment, 2) continued product development through Scientific Research and Development; 3) inventory build for distribution, and 4) strategic acquisitions that provide an accelerated time-frame to secure market share; 5) development of Sales, Customer and Finance personnel depth to support accelerated revenue growth in all areas, including under our LMMA.

Technology investment – Eco Science Solutions will continue to make investments in both e-commerce and mobile applications that facilitate B2C e-commerce opportunities. The Company's technology investments are centered on our platform that matches and connects consumers with desired products and/or providers, as well as providing for a convenient payment solution. Additionally, the Company is launching a turn-key Business to Business, Customer Resource Management System (B2B CRM) marketing solution to support health, wellness and alternative medicine businesses with their on-going efforts to market, attract, acquire and retain customers. The Company will expend amounts management deems appropriate to enhance technology development over the coming 12 months as may be required.

Scientific Research and Development investment – Eco Science Solutions has engaged in the development of DNA testing protocols for the purpose of evaluating a consumer's physical and mental needs. This continued investment effort will provide for a person by person mapping platform to best match the most suitable cannabis-related and/or dietary supplement products per ailment, thus maximizing the results of natural medication. The Company has budgeted up to $1 million for investment purposes in Scientific Research and Development investment over the next 12-month period.

Product formulation, inventory build and distribution – As Eco Science Solutions continues to accumulate data through its e-commerce and marketing solutions, the Company is in the process of development and distribution of unique products that include cannabis-related ingredients for alternative health and wellness interests. The Company has budgeted $1.25 million for investment purposes in Product development, inventory build and distribution over the next 12-month period.

Strategic acquisitions – Due to various hyper-growth trends in segments of the holistic health and wellness category, Eco Science Solutions believes that it will be presented with unique investment and acquisition opportunities that are both synergistic and accretive to the Company. The Management Team has already identified several candidates. The Company has not budgeted an exact dollar amount for investment purposes in Strategic acquisitions over the next 12-month period.

Sales, Customer and Finance personnel development - Additionally, the Company has budgeted up to $2 million for general working capital purposes, including the development of personnel and internal systems to support them over the next 12-month period. This includes costs assocaited with our current management team.

The Company has also budgeted $1.5 million in marketing and advertising investment for next 12-month period, to support the Eco Science Solutions, Herbo and Fitrix brands as well as our efforts under our marketing agreement with AFN.

It is anticipated by Management, that all of the above business segments and operations, along with additional investment where required, when fully implemented will allow us to increase revenues in fiscal 2019 and subsequent periods.

14

Operations of Ga-Du and the License and Master Marketing Agreement (LMMA)

Operations of Ga-Du

Our wholly owned subsidiary, Ga-Du, acquired in June 2017, offers the following suite of business functions and opportunities:

Financial Services Platform Summary

Ga-Du has developed multiple financial services applications. It has created a software platform that captures individual and business entity data. Ga-Du platform is a secure portal for account access and features incorporating current banking standards for operating and securing online data. In terms of Financial Services, the Ga-Du platform uses a strict and proprietary Know-Your-Customer (KYC) process, this ensures compliance regardless of the underlying usage. This software can be used for membership capture, registrations of various kinds, for customer accounts retention and marketing, and/or for bank accounts. In addition, the Ga-Du banking platform has been enhanced for mobile devices. The mobile payment platform accommodates the purchasing of products and services like those offered by ESSI, and/or a combined entity, as well as other products and services both inside and outside the cannabis industry. By targeting digital customers rather than brick-and-mortar customers, the digital Ga-Du platform acquired by ESSI is ready to provide banking services to any underserved area.

Inventory Control and Advisory Systems Business Summary

Retail marijuana is arguably the fastest growing segment of the cannabis industry. National monthly sales numbers seem to demonstrate, average year-over-year increases of over 100% for some years following legalization. However, cannabis retailers still face hurdles finding working capital due to the federal regulation of cannabis as a Schedule I drug. This lack of capital results in a potential market disruption opportunity. Because businesses have not had financial resources to develop their own effective business solutions of various kinds, they represent potential "soft targets" for Ga-Du software and enterprise processes for inventory control and other services. ESSI, through its acquisition of Ga-Du Corporation, will make available its Ga-Du solutions, advisory services, and inventory control systems (from raw materials to finished product) directly to licensed retail businesses, as well as work-flow analysis and management. Ga-Du has an experienced retail management team which has put in place similar as well as other services systems and processes for inventory acquisition and control. These systems and processes can be licensed to regulate marijuana retail businesses potentially, allowing the retail business to focus on the customer experience while letting ESSI provide the backend technology and systems. The Ga-Du Management team believes that combining the business customer network of ESSI with the technology and systems that Ga-Du has assembled, in a manner that can allow retail businesses rapid access to cutting-edge technology and retail-marijuana-specific inventory control solutions, may provide ESSI with an edge in the rapidly expanding area of cannabis advisory/business services.

Master marketing agreement and AFN

Through a recently executed License and Master Marketing Agreement between Ga-Du and AFN, Ga-Du has the the exclusive right to undertake marketing responsibilities of Alliance's Financial Services to businesses in the Cannabis industry, initially in Michigan, Oregon and Washington, and Colorado, with plans to extend throughout the United States, provided that it shall not extend to any states where Cannabis sales have not been legalized by that state's laws. Since Ga-Du and Alliance executed their agreement, Alliance has filed as a foreign corporation in Arizona Florida, Massachusetts, Montana, Nevada, Pennsylvania and Washington. The Companies are now offering, "Seed to CPA tracking" in all of those states and, full financial services in Florida, Massachusetts and Montana, with active approval initiatives in the other states.

Ga-Du shall be credited with all Cannabis related members and revenues that use Alliance's financial and marketing services, regardless of the source of revenue, or the party that enrolled the customer that generated the revenues, that are generated within any territory in which Ga-Du has commenced business.

15

Alliance Financial Network is registered with FinCEN (MSB Registration Number: 31000094744769) as a financial services institution, compliant with the AML/BSA guidelines of FinCEN, and is regulated by the IRS. Operating a mobile application known as eXPO™ electronic eXchange Portal, Alliance provides financial and marketing services to businesses and individuals, which are challenged in the traditional banking systems, and generally are those that require more intensive compliance then banks are willing, or able to perform. One such industry is the cannabis industry; Alliance is configured to establish Membership relationships businesses in this industry following a full compliance audit on the business, allowing licensed cannabis businesses an automated tax payment system and Internet banking services including wire transfers, ACH, electronic checks, armored pickup of cash, and bill pay, payroll services, and inventory control "seed to "CPA". For the Company's Enterprise Customers, through Alliance Financial Network, ESSI's Herbo offering is now able to bundle a greater portfolio of business services such as business accounting, business insurance, director insurance, employee payroll, inventory system, and credit/debit card management. Additionally, the Alliance Financial Network automated tax payment system can calculate and deliver state tax payments within 48hrs after the funds are made available in a taxpayer's account. This fast tax collection benefits dealings with the state the business operates in and helps the business remain compliant. The Alliance Financial Network solution is a federally registered solution ready to be used in all states, and uses an in-depth anti-laundering and "Know Your Customer" process, ensuring compliance with the Cole memo and all federal and state regulations. In addition to tax collection, this system can send reports to regulators which gives another level of visibility into the financial dealings of licensees. Further bundled into this software solution is the "seed to CPA" accounting system, which provides a frugal and efficient way for businesses to report and manage their finances. In terms of tax collection, account services, and business features, this software is unparalleled at providing fast, compliant, and traceable cash management solutions.

Under the agreements, Alliance will provide all software platform(s) necessary to deliver the Financial Services, assure compliance with appropriate Federal Requirements and international money laundering restrictions, administer all compliance, enrollment, and collection of fees from the Members contracting with Alliance, provide any and all necessary marketing or other materials describing Alliance's services and program, will forward any required Sales Commissions to the appropriate recipients, and assure adequate customer service at all times.

Alliance will be responsible for the functional operation of any software utilized in providing its services and for the administration and handling of monies and/or any credits relating thereto and, in the event of any claim, cause of action or lawsuit (together the "Claims") for failure to properly administer such responsibilities, Alliance shall have the sole obligation to defend such Claim(s) and shall fully indemnify, defend and hold harmless Ga-Du from and against such Claims.

Alliance will maintain accounting and data concerning the income from the Cannabis Industry and will generate a monthly income statement as to each of the following revenue streams: (i) membership fees; (ii) cash depository fees; (iii) merchant processing and credit card fees; (iv) transfer fees; and (v) advertising fees.

Alliance and Ga-Du will split compensation derived from income generated from enrollees of Ga-Du as follows: (a) for income from point of sale payments to merchants, after deducting any Sales Commissions and cost basis (interchange and bank fees), Alliance will receive forty percent (40%), and Ga-Du shall receive sixty percent (60%); (b) for income from cash depository business deriving from the Cannabis industry, Alliance will receive sixty five percent (65%), and Ga-Du will receive thirty five percent (35%); (c) for income derived from membership fees from the Cannabis industry, Alliance and Ga-Du will split the revenue 40/60 as in (a) above; (d) for income generated from transfer fees, Alliance and Ga-Du will split the revenue on a 50/50 basis; and (e) for any other income derived from providing services to the Cannabis industry, Alliance and Ga-Du will split the income on an equal fifty/fifty basis, except that income derived from advertising fees paid by advertisers utilizing Alliance's kiosks will be split eighty-five percent (85%) to Alliance and fifteen percent (15%) to Ga-Du.

We have recently begun generating revenues under this business segment and while presently modest, we expect this segment to be the leading revenue stream in the Company's portfolio over the coming 12 months.

16

Herbo and Fitrix Apps

Herbo

The Herbo apps include a database of over 14,000 alternative medicine locations and delivery services, doctors who provide evaluations, and local shops that sell relevant product. The Herbo app helps consumers find products and services that support the intake of alternative medicines for a more naturopathic way of living.

Consumers may use the UseHerbo ecommerce platform and access "The Pursuit of Fine Herb" original content. Under the direction and vision of our officers and directors, Jeff Taylor and Don Taylor, the Company continues to source and release into the market relevant products for sale coupled with unique original, educational content. Initially created and copyrighted content within two distinct channels: one branded Eco Science Solutions, which is focused on Legislative, Geo-political, Financial, , and general Macro-trends within the Cannabis marketplace; and one branded Herbo, which is focused on user-generated that is revolves around Daily lifestyle, Medical and Recreational Usage content, Reviews of Application, Products, Technologies and Commerce Options, Food Pairings and Edibles.

Image of Herbo application:

Highlighted features include:

|

·

|

BMI Calculator

|

|

·

|

Fitness Radio

|

|

·

|

Fitness Community Messenger

|

|

·

|

Weight loss Calculator

|

|

·

|

Smart Notebook, to log Food, Dietary Supplementation and Alternative Medication Intake

|

|

·

|

Smart Scheduling, to monitor Food, Dietary Supplementation and Alternative Medication Intake

|

|

·

|

Millions of Foods, Dietary Supplements and Alternative Medications to Learn From

|

A component of our business is involved with the medical marijuana category. As evidenced in the following services offered:

Herbo for Consumers

Consumers can use our Consumer-facing Herbo app with the following core e-commerce and social networking features: (1) location and directory listings of cannabis-related businesses that include physical dispensaries, delivery services, smoke shops and doctors; (2) product catalog of cannabis-related products that can be browsed; (3) e-wallet that stores credit cards and specialty gift cards, allowing for seamless electronic payments; (4) discrete messaging that allows for consumers to communicate directly with cannabis-related businesses; and (5) content streams that allow for consumer-generated and business-generated content to be captured and share amongst the Herbo community to build engagement and loyalty.

17

Herbo's e-commerce features allow consumers to locate, access, and buy premium cannabis-related products easily, conveniently and securely. Its social networking features focus on engaging and growing the Herbo community with like-minded enthusiasts.

Herbo for Business

Enterprise-focused app for marijuana businesses with the following core features: (1) claiming of business listing; (2) updating and management of business profile information; (3) messaging that allows for management of businesses to discretely communicate directly with cannabis enthusiasts; (4) updating and management of product catalog and product offerings; (5) affiliate marketing; and (6) customer relationship management tools that support the targeting and engagement of prospective, current, and past customers.

Herbo for Drivers

Herbo is currently accepting driver applications for its branded delivery service. Herbo Drivers will be able to receive, coordinate and provide same-day delivery services for consumer orders that are purchased on Herbo and desired immediately. The Herbo Drivers app integrates seamlessly with Herbo's consumer and business platforms to provide customers with enhanced visibility and tracking of their Herbo orders.

While Eco Science Solutions does not grow or distribute medical marijuana, certain professional customers of ours do. Thus, adverse regulatory legislation may have a material negative effect on our business.

Fitrix

The Fitrix app is a powerful and flexible companion, which helps users keep track of your day-to-day fitness routines, dietary habits and alternative medicine intake. Fitrix users can measure and track anything and everything when it comes to their health and wellness. One can track the accomplishment of custom created goals, monitor dietary, exercise and alternative medication schedules, be notified of important milestones, establish timelines to develop effective habits ... all leveraging a unique notebook and calendar.

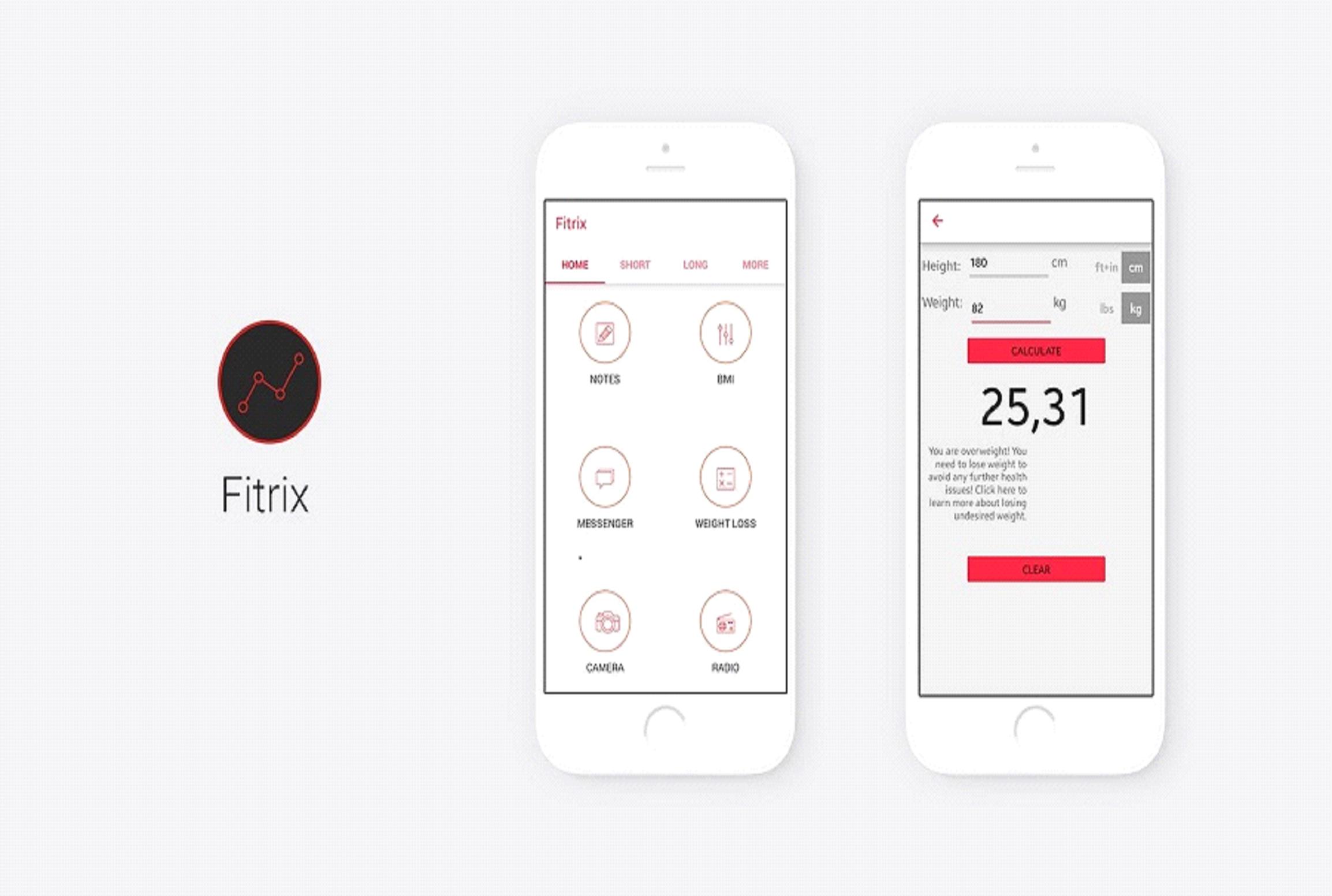

Image of Fitrix App:

For more information, please visit www.ecossi.com and/or www.useherbo.com.

Strategy

The Company's strategy is to: 1) generate revenue through paid advertisements from business seeking exposure to users of the Herbo services; 2) generate revenue through enterprise license agreements with professional customers and businesses; and 3) sales of consumer packaged goods targeting general health and wellness and alternative medicines.

18

Market

Our target market is the ever-growing social media consumer user market that is focused on entertainment and information delivery by way of focused content from online sources, downloading apps to promote and support their lifestyle choices and quick and easy solutions to convert their gained knowledge to action by key product purchase and location recommendations, all of which can be supported by our useful content generation for mass distribution to consumers, empowering enthusiasts in their pursuit and enjoyment of building and supporting eco-friendly businesses and living healthy lifestyles.

According to Statistica.com, a statistics portal that combines Statistics and Studies from over 18,000 sources, there were approximately 149.3 BN mobile app downloads, both free and paid in 2016 on smartphones, with app revenues totaling over $88.8 BN (Source: https://www.statista.com/statistics/271644/worldwide-free-and-paid-mobile-app-store-downloads/ and https://www.statista.com/statistics/269025/worldwide-mobile-app-revenue-forecast/). This is expected to increase to over 352 BN downloads in fiscal 2021 with projected revenues of over 188.9 BN.

According to a special report on Digital, Social and Mobile Worldwide users released in January 2017 by We Are Social Ltd. (https://wearesocial.com/uk/special-reports/digital-in-2017-global-overview) it is estimated as follows:

|

·

|

3.77 billion global internet users in 2017, equaling 50% penetration;

|

|

·

|

2.80 billion global social media users in 2017, equaling 37% penetration;

|

|

·

|

4.92 billion global mobile users in 2017, equaling 66% penetration;

|

|

·

|

2.56 billion global mobile social media users in 2017, equaling 34% penetration;

|

|

·

|

1.61 billion global e-commerce users in 2017, equaling 22% penetration;

|

Further according to their 2016 report (https://www.slideshare.net/wearesocialsg/digital-in-2016):

|

·

|

Internet users grew by 10% in 2016, up 354 million compared to 2015;

|

|

·

|

Active social media users increased by 21%, up 482 million versus 2015;

|

|

·

|

Unique mobile users grew by 5%, up 222 million over the past 12 months;

|

|

·

|

Mobile social media users grew by 30%, up an impressive 581 million in 2016.

|

19

The social applications market continues to grow with successful companies establishing focused services. For example, Facebook brought a person's "friends" in view, Pinterest socialized a browser's bookmarking feature and Waze socialized the GPS. Cornerstone networking consists of Facebook, Twitter, WordPress, Instagram, LinkedIn, Pinterest, YouTube, Skype and Tumblr. Our goal, supported by our owned and licensed technologies and based upon content created in house by our officers and directors, and available in various formats, is to provide consumers and enthusiasts easy access to connect with health-and-wellness businesses and like-minded enthusiasts, and to facilitate the research of and purchasing of eco-friendly products ... anytime, anywhere.

Competition

The market for social media applications and information and education based content sites is large and growing. As noted above in a special report on Digital, Social and Mobile Worldwide users released in January 2017 by We Are Social Ltd. there are over 2.80 billion global social media users in 2017, or 37% of the worlds population. The largest social media networks in the world, measured by active users, as of April 2018 according to a report by Statistica.com (https://www.statista.com/statistics/272014/global-social-networks-ranked-by-number-of-users/) were Facebook (2.23bn), WhatsApp and YouTube (1500mn), Chinese social network QZone (563mn), WeChat (980mn), Tumblr (794mn), Twitter (330mn) and Instagram (813mm). This market is extremely competitive and characterized by well-funded existing players, high capital inflows, and rapidly changing technologies. In addition to competitive and technological challenges, participants in the social media industry must remain flexible enough to accommodate changes in consumer preferences and tastes. We hope to reduce competition by targeting only those topics, concepts and content focused on building eco-friendly businesses and living healthy lifestyles, with our unique apps, channels and other social media efforts, including blogs.

Intellectual Property

None.

Government Regulations

Currently, there are approximately twenty states plus the District of Columbia that have laws and/or regulations that recognize in one form or another legitimate medical uses for cannabis and consumer use of cannabis in connection with medical treatment. Fifteen other states are considering legislation to similar effect. As of the date of this report, the policy and regulations of the Federal government and its agencies is that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of federal law and may or may not be permitted on the basis of state law.

The Department of Justice governs the use of cannabis under the Controlled Substances Act (CSA). Schedule 21 of the U.S. Code includes five established schedules of controlled substances known as schedules I, II, III, IV, and V. The Department of Justice has mandated that schedules established by this section shall be updated and republished on a semi-annual basis during the two-year period beginning one year after October 27, 1970 and shall be updated and republished on an annual basis thereafter. Schedule I includes cannabis in its listing. Substances included in Schedule I have the following characteristics:

(B) The drug or other substance has no currently accepted medical use in treatment in the United States;

(C) There is a lack of accepted safety for use of the drug or other substance under medical supervision.

20

We do not produce, market, or sell cannabis. We are limiting ourselves to states where the state law allows for the production of cannabis. Beyond the state law allowing for cannabis production our construction must comply with all state and local building requirements as well as zoning requirements. We work closely with the local authorities regarding zoning and work closely with the local building inspectors to comply in every way with building regulations.

The domestic recognized cannabis industry is estimated to be over $44 Billion in revenues opportunity over the next several years, with double-digit growth estimated for the foreseeable future.

The budgetary impact of removing cannabis from Schedule I of the Controlled Substances Act and legalizing its use in the United States could save billions by reducing government spending for prohibition enforcement in the criminal justice system. Additionally, billions in annual tax revenues could be generated through proposed taxation and regulation. It is estimated that for every $1 spent on medical and recreational cannabis, there is an infusion of approximately $2.60 to the local economy, which is termed the "marijuana multiplier" effect. With the current Administration hyper-focused on growing domestic job opportunities, the Company believes that the cannabis movement will be a boon for creating such job opportunities.

Eco Science Solutions, Inc. has no control of the legislative environment, while Management believes that the cannabis and cannabis related markets will only become more main-stream, it is important to indicate that the removal of cannabis from Schedule I of the Controlled Substances Act, the most tightly restricted category reserved for drugs that have "no currently accepted medical use," has been proposed repeatedly since 1972 and has not been granted.

Rescheduling proponents argue that cannabis does not meet the Controlled Substances Act's strict criteria for placement in Schedule I and so the government is required by law to permit medical use or to remove the drug from federal control altogether. The US government, on the other hand, maintains that cannabis is dangerous enough to merit Schedule I status. The dispute is based on differing views on both how the Act should be interpreted and what kinds of scientific evidence are most relevant to the rescheduling decision.