UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2016

[ ]TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 000-54803

(Exact name of registrant as specified in its charter)

|

Nevada

|

46-4199032

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

1135 Makawao Avenue, Suite 103-188

Makawao, Hawaii 96768

|

96768

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

(800) 379-0226

|

|

| Registrant's telephone number | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

|

[X]

|

No

|

[ ]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

[ ]

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes

|

[ ]

|

No

|

[ X]

|

The aggregate market value of Common Stock held by non-affiliates of the Registrant as of July 31, 2015 was $2,572,356 based on a closing price of $0.26 for the Common Stock on July 31, 2015, the closest available date to last business day of the Registrant’s most recently completed second fiscal quarter. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

Indicate the number of shares outstanding of each of the registrant’s

classes of common stock as of the latest practicable date.

29,123,233 Common Shares issued and outstanding as of May 12, 2016

DOCUMENTS INCORPORATED BY REFERENCE: None

2

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1

|

Business

|

5 |

|

Item 1A

|

Risk Factors

|

12 |

|

Item 1B

|

Unresolve Staff Comments

|

12 |

|

Item 2

|

Properties

|

12 |

|

Item 3

|

Legal Proceedings

|

12 |

|

Item 4

|

Mine Safety Disclosures

|

|

|

PART II

|

||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13 |

|

Item 6

|

Selected Financial Data

|

15 |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15 |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

20 |

|

Item 8

|

Financial Statements and Supplementary Data

|

20 |

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

21 |

|

Item 9A

|

Controls and Procedures

|

21 |

|

Item 9B

|

Other Information

|

22 |

|

PART III

|

||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

23 |

|

Item 11

|

Executive Compensation

|

25 |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

29 |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

30 |

|

Item 14

|

Principal Accounting Fees and Services

|

31 |

|

PART IV

|

||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

32 |

|

SIGNATURES

|

33 |

3

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. When used in this Annual Report on Form 10-K, the words "may," "could," "estimate," "intend," "continue," "believe," "expect" or "anticipate" and similar expressions identify forward-looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, these plans, intentions, or expectations may not be achieved. Our actual results, performance, or achievements could differ materially from those contemplated, expressed, or implied, by the forward-looking statements contained in this Annual Report on Form 10-K. Important factors that could cause actual results to differ materially from our forward-looking statements are set forth in this Annual Report on Form 10-K. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this Annual Report on Form 10-K. Except as required by federal securities laws, we are under no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

|

· inability to raise additional financing for working capital until such time as we achieve profitable operations;

|

|

|

· inability to identify marketing approaches;

|

|

· deterioration in general or regional economic, market and political conditions;

|

|

|

· the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management to make estimates about matters that are inherently uncertain;

|

|

· adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations;

|

|

|

· changes in U.S. GAAP or in the legal, regulatory and legislative environments in the markets in which we operate;

|

|

· inability to efficiently manage our operations;

|

|

|

· inability to achieve future operating results;

|

|

· our ability to recruit and hire key employees;

|

|

|

· the inability of management to effectively implement our strategies and business plans; and

|

|

· the other risks and uncertainties detailed in this report.

|

In this form 10-K references to "ESSI", "the Company", "we", "us", and "our" refer to Eco Science Solutions, Inc.

AVAILABLE INFORMATION

We file annual, quarterly and special reports and other information with the SEC. You can read these SEC filings and reports over the Internet at the SEC's website at www.sec.gov. You can also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, NE, Washington, DC 20549 on official business days between the hours of 10:00 am and 3:00 pm. Please call the SEC at (800) SEC-0330 for further information on the operations of the public reference facilities. We will provide a copy of our annual report to security holders, including audited financial statements, at no charge upon receipt to of a written request to us at Eco Science Solutions, Inc. 1135 Makawao Avenue, Suite 103-188 Makawao, Hawaii 96768.

4

PART I

Corporate Overview

The Company’s principal executive office is located at 1135 Makawao Avenue, Suite 103-188 Makawao, Hawaii 96768. The Company’s telephone number is 800-379-0226. The Company’s website is www.ecossi.com.

The Company’s common stock is traded on the OTC Markets Pink Sheets under the symbol “ESSI”.

On February 14, 2014 the company effected a 1,000 reverse split. All share and per share figures herein reflect the impact of the split.

Corporate History

Formation and Development

The Company was incorporated in the state of Nevada on December 8, 2009, under the name Pristine Solutions, Inc. The Company’s wholly owned subsidiary, Pristine Solutions Limited, was incorporated under the laws of Jamaica. The Company’s original business plan focused on developing a network of sales points for the sale and service of tankless water heaters in Jamaica, through Pristine Solutions Limited. The Company’s aim was to become the first tankless water heater company specializing in tankless-only products to enter the Jamaican market, and the only company in the Jamaican market offering solar-powered tankless water heater products. As part of its plan, on December 30, 2009, the Company entered into a distribution agreement with Zhongshan Guangsheng Industry Co., Ltd., of China (“Zhongshan”), the manufacturer of the tankless water heaters. Zhongshan manufactures the tankless water heaters under the brand Gleamous Electric Appliances.

On March 7, 2012, the Company filed a Certificate of Change with the State of Nevada increasing the shares of common stock from 100,000,000 to 650,000,000 common stock; par value $0.0001 and decreasing the shares of Preferred Stock from 100,000,000 to 50,000,000; par value $0.001.

On August 22, 2012, Christine Buchanan-McKenzie, the Company’s former President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and a member of the Board of Directors, resigned from all positions with the Company. The resignation did not involve any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. On the same day, Mr. Michael Borkowski was appointed as President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and the sole member of the Board of Directors of the Company.

On August 23, 2012, the Company changed its fiscal year from December 31 to January 31.

On August 23, 2012, the Company and its controlling stockholders entered into a Share Exchange Agreement (the “Share Exchange”) with Eaton Scientific Systems, Ltd., a Nevada corporation (“ESSL”) and the shareholders of ESSL (the “ESSL Shareholders”), whereby the Company acquired 25,000shares of common stock (100%) of ESSL (the “ESSL Stock”) from the ESSL Shareholders. In exchange for the ESSL Stock, the Company issued 25,000shares of its common stock to the ESSL Shareholders. In addition, the Company’s Chief Executive Officer, Mr. Michael J. Borkowski, on behalf of the Company, entered into a Common Stock Purchase Agreement with the Company’s controlling shareholder, and former President, Ms. Christine Buchanan-McKenzie, whereby the Company would purchase one hundred percent (100%), or 240,000shares, of the Company’s common shares owned by Mrs. Buchanan-McKenzie, at par value $.0001, and representing approximately 54.1% of the Company’s total issued and outstanding shares. The Common Stock Purchase Agreement, and subsequent transaction closing, was completed on October 22, 2012. On October 23, 2012, the Common Stock Purchase Agreement was finalized, and a change in control of the Company took place.

5

In conjunction with the Share Exchange and Common Stock Purchase Agreement, the total shares held by the ESSL Shareholders are 265,000, or approximately 59.8% of the issued and outstanding common stock of the Company as of October 30, 2012. Certain ESSL shareholders owning a total of 135,779shares of the Company’s common stock, representing approximately 30.64% of the issued and outstanding common stock of the Company, entered into three (3) separate twenty-four (24) month Lock-Up Agreements. As a result of the Share Exchange and Common Stock Purchase Agreement, (i) there was a change in control of the Registrant; (ii) ESSL became the Company’s wholly owned subsidiary; (iii) the ESSL became the Company’s primary business, and (iv) on November 27, 2012, the Company changed its name to Eaton Scientific Systems, Inc.

Subsequently the Company determined to operate Eaton Scientific Systems, Ltd. (“Eaton Sub”) a Nevada corporation and wholly owned subsidiary of the Company, as a privately held Company, until such time where it is sufficiently capitalized to increase the probability for its Clinical Trials of Homatropine (“Tropine 3”) in oral suspension for the treatment of hot flash symptoms in pre-menopausal, menopausal and post menopausal women, to be in a position to yield results that may provide the opportunity for a potential FDA approval for marketing to consumers in the US.

In October, 2013, the Company’s Management was introduced to Domenic Marciano (“Marciano”). Marciano represented that he intended to acquire an exclusive license to a unique automotive product, the EcoFlora Spark Plug (the “EcoFlora Plug”), with a proprietary technology, and that the EcoFlora Plug has the potential to be uniquely positioned in the automotive parts business in the United States and International automotive parts marketplace.

On November 26, 2013, the Company and its Majority Shareholders (the “Majority Stockholders”) entered into an Agreement for the Purchase of Common Stock (the “Stock Purchase Agreement”) with Marciano whereby Marciano acquired 227,370shares of the Company’s common stock from the Majority Stockholders at par value $.0001, representing approximately 51.3% of the Company’s total issued and outstanding shares, in exchange for cash in the amount of $22,737 (the “Cash Proceeds”). The Stock Purchase Agreement, and subsequent transaction closing, was completed on November 26, 2013, and a change in control of the Company took place.

In connection with the terms and conditions of the Stock Purchase Agreement and sale of 227,370shares held by the Majority Stockholders:

1. Marciano appointed two new directors to the Company’s board of directors; and

2. The “Lock-Up-Leak-Out” Agreements executed in October 2012 were cancelled by mutual agreement between the Board and the Company’s Shareholders who were party to the Agreements.

3. The Majority Shareholders of the Company have voted to “Spin-out” to its Shareholders, one hundred percent (100%) of the issued and outstanding shares of Eaton Scientific Systems Ltd., its operating subsidiary, as of the record date of November 25, 2013, on a one-for-one basis within sixty-days (60) of the Change of Control of the Company, or by January 25, 2014.

On December 4, 2013, the Company (the “Company”) executed an Agreement of the License of Intellectual Property (the “License Agreement”) dated November 4, 2013 with Eco Science Solutions International, Inc., a Canadian corporation (“ESS International”), for the exclusive license to the EcoFlora Plug, recently patented in the US and that has filed for Patent protection in Canada and the International community, based on its "Internal Pre-Combustion Chamber High Efficiency Spark Plug" technology. In connection with the License Agreement, the Company issued ESS International 2,500,000 shares of the Company’s Series “A” Convertible Preferred Stock (“Preferred Stock”), in exchange for the exclusive license of the Patent Applications, in perpetuity. The Preferred Stock is convertible into common stock at a conversion rate of 10 common shares for each preferred share

On January 8, 2014, the Spin-out was complete, and Eaton Scientific Systems, Ltd. was no longer a subsidiary of the Company.

On February 14, 2014, the Company changed its name to Eco Science Solutions, Inc. and effected a 1000-to-1 reverse stock split. As a result, the total shares of common stock issued and outstanding was 443,001 with a par value of $0.0001.

On April 4, 2014, the Company received notice from Eco Science Solutions International, Inc. to convert 100% of the Series “A” preferred shares into restricted common shares on a 10 for 1 basis. As a result, on April 9, 2014, 25,000,000 shares of the Company’s restricted common stock was issued, of which 19,866,668 shares were issued to the Company’s chairman, Domenic Marciano, and 5,133,332 shares were issued to non-related parties. Subsequent to the conversion, Eco Science Solutions International, Inc. no longer holds any shares of the Company’s capital stock, and Mr. Marciano holds 20,094,038 shares of the Company’s common stock, which represents 62.53% of the total issued and outstanding shares of the Company’s common stock on a fully diluted basis.

On October 7, 2014, the US Patent and Trademark Office (“USPTO”) issued Patent #8,853,925 for the EcoFlora Plug, based on its "Internal Pre-Combustion Chamber High Efficiency Spark Plug" technology, and has patent pending applications both in Canada and worldwide.

Effective August 28, 2015, the Agreements of the License of Intellectual Property dated November 4, 2013, and entered into with Eco Science Solutions International, Inc. was terminated.

On August 31, 2015, the Company executed an Asset Purchase Agreement with Kensington Marketing, Inc., a Nevada corporation, dated August 28, 2015 (the "Purchase Agreement"), to purchase a certain technology application known as “Stay Hydrated.” In exchange for the technology application, the Company will issue 1,500,000 restricted shares of the Company's common stock, valued at $150,000.

On September 3, 2015, 4,966,667 shares of the Company’s issued and outstanding common stock were cancelled by the certificate holder. As a result of this transaction, the shares were returned to treasury, and the total issued and outstanding shares of common stock was reduced to 26,176,334 shares.

6

On November 1, 2015, the Company entered into a new Employment Agreement with Mr. Borkowski (the “2015 Employment Agreement”). The Employment Agreement is for a term of one (1) year, and includes compensation in the amount of $36,000 per year, compensation for certain travel expenses, and grants to purchase 2,000,000 shares of the Company’s common stock at par, which vest quarterly beginning November 1, 2015, at 500,000 shares per vesting period through August 1, 2016 (the “2015 Stock Award”). In connection with the 2015 Stock Award, $160,000 has been recorded as deferred compensation, to be amortized over the next 9 months.

On November 19, 2015, in accordance with his 2015 Employment Agreement, the Company issued 500,000 shares of restricted common stock, valued at $40,000, to its President for cash in the amount of $500. As a result, additional paid in capital was reduced by $49,500.

On December 7, 2015, the Board of approved the authorization of a 1 for 50 reverse stock split of the Company’s outstanding shares of common stock. On December 11, 2015, the Company obtained the written consent of a stockholder, Domenic Marciano, an individual, holding 71% voting power of the Company’s outstanding capital stock as of December 1, 2015, to effect the reverse stock split.

On December 9, 2015, in accordance with a certain Asset Purchase Agreement dated August 28, 2015, the Company issued 1,500,000 shares of restricted common stock, valued at $150,000.

On December 10, 2015, Mark Dilley resigned as a Director of the Company.

On December 15, 2015, Domenic Marciano, the Company’s majority shareholder, sold his shares in a private transaction equally to Mr. Jeffery Taylor and to Mr. Don Taylor. Mr. Jeffery Taylor and Mr. Don Taylor are now the controlling shareholders of the Company and own the majority of issued and outstanding shares.

On December 17, 2015, Michael Borkowski resigned as Director, President and Chief Executive Officer of the Company.

Effective December 17, 2015, Mr. Jeffery Taylor was appointed to serve as Chief Executive Officer and President of the Company and Mr. Don Lee Taylor was appointed to serve as Chief Financial Officer of the Company.

On December 21, 2015 the Company entered into employment agreements with Mr. Jeffery Taylor and Mr. Don Lee Taylor for a period of 24 months, where after the contract may be renewed in one year terms at the election of both parties. Jeffery Taylor shall receive an annual gross salary of $115,000 and Don Lee Taylor shall receive an annual gross salary of $105,000 payable in equal installments on the last day of each calendar month and which may be accrued until such time as the Company has sufficient cash flow to settle amounts payable. Further under the terms of the respective agreements all inventions, innovations, improvements, know-how, plans, development, methods, designs, analyses, specifications, software, drawings, reports and all similar or related information (whether or not patentable or reduced to practice) which relate to any of the Company’s actual or proposed business activities and which are created, designed or conceived, developed or made by the Executive during the Executive’s past or future employment by the Company or any Affiliates, or any predecessor thereof (“Work Product”), belong to the Company, or its Affiliates, as applicable.

On January 1, 2016, the Company entered into a technology licensing and marketing support agreement with Separation Degrees – One, Inc. (“SDOI”) that will result in the development, licensing and management of on-going technology solutions and marketing campaigns for ESSI’s initiatives. Under the terms of the agreement, the Company will issue to SDOI 1,000 Series A Preferred Shares in consideration for the Licensing Agreement, as well as S-8 shares to cover monthly service charges including ongoing project and planned technical development/maintenance, production and staging server administration, ongoing marketing services and monthly advertising management. Monthly services shall be invoiced at a flat rate of $35,000 per month and shall be settled by the issuance of shares of common stock at a 30% discount to the market close on the date of payment due (the 1st of every month), or a share price of $0.01 whichever is greater.

On January 4, 2016 the Company entered into a further agreement with SDOI for the purchase of a discrete communications software platform, including custom developed libraries, the consideration for which was the issuance of 500,000 shares of common stock.

On January 8, 2016, the Board of Directors authorized the withdrawal of the Reverse Split application with FINRA.

On January 11, 2016, Mr. Domenic Marciano tendered his resignation as Chairman of the Board of Directors of the Company, Secretary and Treasurer and Mr. Jeffery and Mr. Don Taylor were appointed to the Company’s Board of Directors. Mr. Jeffery Taylor was appointed Secretary and Mr. Don Lee Taylor was appointed Treasurer.

On January 11, 2016, the Company’s Board of Directors (the “Board”) authorized the creation of 1,000 shares of Series A Voting Preferred Stock. The holder of the shares of the Series A Voting Preferred Stock has the right to vote those shares of the Series A Voting Preferred Stock regarding any matter or action that is required to be submitted to the shareholders of the Company for approval. The vote of each share of the Series A Voting Preferred Stock is equal to and counted as 10 times the votes of all of the shares of the Company’s (i) common stock, and (ii) other voting preferred stock issued and outstanding on the date of each and every vote or consent of the shareholders of the Company regarding each and every matter submitted to the shareholders of the Company for approval. The Series A Voting Preferred Stock will not be convertible into Common Stock.

7

Concurrently, on January 11, 2016, the Company cancelled the agreement with Kensington Marketing, cancelled 1,500,000 shares of Common Stock issued to Kensington Marketing, and returned the “Stay Hydrated” application the Company acquired in exchange for the 1,500,000 shares.

On January 12, 2016, the Company filed an Amendment to the Articles of Incorporation designating 1,000 of its authorized 50,000,000 Preferred Shares as Series A Voting Preferred Shares.

With the departure and appointment of officers and directors of the Company, the direction of business the Company is focusing on has changed. The Company is focused on eco-friendly products, development and businesses. The Company will focus first on e-commerce for the cannabis industry and will launch an e-commerce marketplace platform via a downloadable application where consumers can search for local dispensaries, delivery services, doctors and related cannabis products.

On February 26, 2016 the Company announced it had canceled 1,000,000 shares of common stock, as part of a stock buyback program designed to increase current shareholder value by repurchasing and retiring existing outstanding common stock.

Under the stock repurchase program, and depending on market conditions, shares may be repurchased from time to time at prevailing market prices through open-market or negotiated transactions in accordance with all applicable securities laws and regulations. To remain in compliance with item 703 of Regulation S-K the Company, whether through an open market or private transaction, will at a minimum disclose on a quarterly basis all repurchases of equity securities.

On April 1, 2016 the Company filed a Form S-8 to register 5,000,000 shares of Common Stock, $0.00001 par value per share, under its 2016 Equity Incentive Plan.

About Eco Science Solutions, Inc.

Founded in 2009, and currently headquartered in Hawaii, Eco Science Solutions, Inc. is a technology-focused Company targeting the multi-billion-dollar health and wellness industry.

From enterprise software solutions, entertaining and useful content generation for mass distribution to consumer apps for daily use, the Company develops technical solutions that empower enthusiasts in their pursuit and enjoyment of building eco-friendly businesses and living healthy lifestyles.

Eco Science’s core services span business location, localized communications between consumers and business operators, social networking, educational content, e-commerce, and delivery.

The Company’s licensed e-commerce platform enables health-and-wellness enthusiasts to easily locate, access, and connect with health-and-wellness businesses and like-minded enthusiasts, and to facilitate the research of and purchasing of eco-friendly products … anytime, anywhere.

Eco Science Solutions’ initial offering was the launch of “The Pursuit of Fine Herb Original Content” on its Eco Science Solutions and Herbo YouTube channels.

Under the direction and vision of our officers and directors, Jeff Taylor and Don Taylor, the Company is releasing originally created and copyrighted content within two distinct YouTube channels: one branded Eco Science Solutions, which is focused on Legislative, Geo-political, Financial, Commercial Growing / Distributing, and general Macro-trends within the Cannabis marketplace; and one branded Herbo, which is focused on Daily lifestyle and Consumption, Medical and Recreational Usage, Reviews of Application, Products, Technologies and Commerce Options, Food Pairings and Edibles.

Shareholders may view The Pursuit of Fine Herb Original Content through www.ecossi.com or www.useherbo.com respectively. Users can also locate our content on the Company's other popular social media outlets such as Facebook and Vine.

The Company is currently in development of a larger series of productions made for streaming episodes inclusive of celebrity interviews, comedic skits and relevant music pertaining to anything and everything impacting someone In Pursuit of Fine Herb.

8

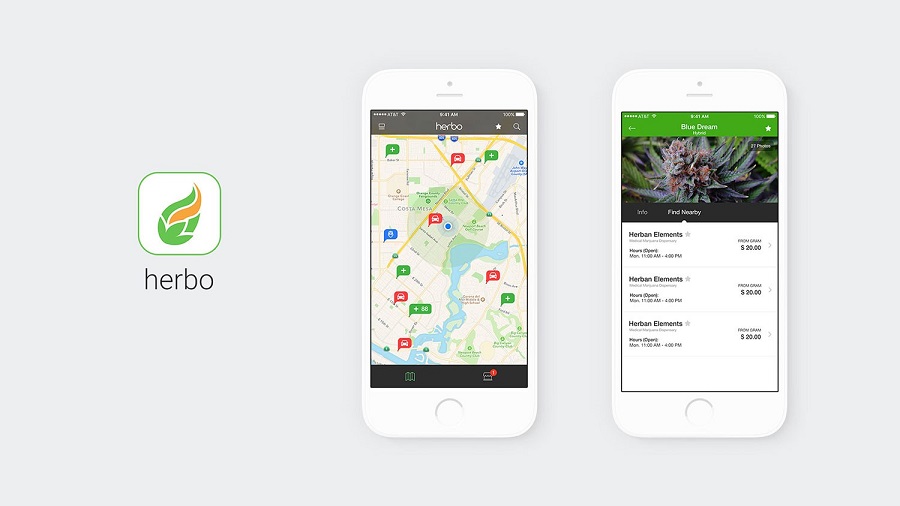

In addition, consumers may use the Herbo app, with a database of over 14,000 alternative medicine locations and delivery services, doctors who provide evaluations, and local shops that sell relevant product. The Herbo app helps consumers find products and services that support the intake of alternative medicines for a more naturopathic way of living.

Image of Herbo application:

Following the launch of Herbo, management has recently introduced “Fitrix”, a powerful and flexible companion which helps users keep track of your day to day fitness routines, dietary habits and alternative medicine intake.

Fitrix users can measure and track anything and everything when it comes to their Health and their Wellness. One can track the accomplishment of custom created goals, monitor dietary, exercise and alternative medication schedules, be notified of important milestones, establish timelines to develop effective habits ... all leveraging a unique notebook and calendar.

9

Highlighted features include:

|

·

|

BMI Calculator

|

|

·

|

Fitness Radio

|

|

·

|

Fitness Community Messenger

|

|

·

|

Weight loss Calculator

|

|

·

|

Smart Notebook, to log Food, Dietary Supplementation and Alternative Medication Intake

|

|

·

|

Smart Scheduling, to monitor Food, Dietary Supplementation and Alternative Medication Intake

|

|

·

|

Millions of Foods, Dietary Supplements and Alternative Medications to Learn From

|

Image of Fitrix App:

For more information, please visit www.ecossi.com and/or www.useherbo.com.

10

Strategy

The Company’s monetization strategy is to: 1) generate revenue through paid advertisements from business seeking exposure to users the Herbo services; 2) sales of consumer packaged goods targeting general health and wellness and alternative medicines.

Market

Our target market is the ever-growing social media consumer user market that is focused on entertainment and information delivery by way of focused content from online sources such as YouTube, downloading apps to promote and support their lifestyle choices and quick and easy solutions to convert their gained knowledge to action by key product purchase and location, all of which can be supported by our useful content generation for mass distribution to consumers, empowering enthusiasts in their pursuit and enjoyment of building eco-friendly businesses and living healthy lifestyles.

According to Statistica.com, a statistics portal that combines Statistics and Studies from over 18,000 sources, there were approximately 179,628,000,000 mobile app downloads in 2015 on smartphones, with app revenues totaling over $41,000,000,000. (Source: http://www.statista.com/statistics/266488/forecast-of-mobile-app-downloads/). This is expected to increase to over 268,000,000,000 downloads in fiscal 2017 with projected revenues of over 50 billion dollars.

According to a special report on Digital, Social and Mobile Worldwide users released in January 2015 by We Are Social Ltd. (http://wearesocial.com/uk/special-reports/digital-social-mobile-worldwide-2015) it is estimated that over 3 Billion users (representing approximately 42% of the world’s population), up 7% from the same report issued in January 2014, are using social technologies.

The social applications market continues to grow with successful companies establishing focused services. For example, Facebook brought a person's "friends" in view, Pinterest socialized a browser's bookmarking feature and Waze socialized the GPS. Cornerstone networking consists of Facebook, Twitter, WordPress, Instagram, LinkedIn, Pinterest, YouTube, Skype and Tumblr. Our goal, supported by our owned and licensed technologies and based upon content created in house by our officers and directors, and available in various formats, is to provide consumers and enthusiasts easy access to connect with health-and-wellness businesses and like-minded enthusiasts, and to facilitate the research of and purchasing of eco-friendly products … anytime, anywhere.

Competition

The market for social media applications and information and education based content sites is large and growing. According to various media venues, it is speculated that nearly over one in four people around the world are using social technologies (42% of the world’s population according to the study by We Are Social (http://wearesocial.com/uk/special-reports/digital-social-mobile-worldwide-2015). The largest social media networks in the world, measured by active users, as of January 2016 according to a report by Statistica.com (http://www.statista.com/statistics/272014/global-social-networks-ranked-by-number-of-users/) were Facebook (1.55bn), WhatsApp (900mm), Chinese social network QZone (653mn), WeChat (650mn), Tumblr (555mn), Twitter (320mn) and Instagram (400mm). This market is extremely competitive and characterized by well-funded existing players, high capital inflows, and rapidly changing technologies. In addition to competitive and technological challenges, participants in the social media industry must remain flexible enough to accommodate changes in consumer preferences and tastes. We hope to reduce competition by targeting only those topics, concepts and content focused on building eco-friendly businesses and living healthy lifestyles, with our unique apps, channels and other social media efforts, including blogs.

Intellectual Property

None.

Government Regulations

Our business as presently conducted is not subject to any unique or industry related governmental regulations.

Facilities

The Company’s corporate headquarters are located at 1135 Makawao Avenue, Suite 103-188 Makawao, Hawaii 96768.

Employees

As of January 31, 2016, the Company had 2 employees, inclusive of our executive officers and directors.

11

Research and Development

There will be an ongoing requirement to undertake research and development as our existing apps and future apps are presented to the marketplace. The extent of the costs are unable to be determined at this time as they are dependent on numerous factors including: increased competition in our area of operation; demand for unique content and functionality; upgrades and changes to operating systems where our apps are downloaded, to name a few. Presently, costs associated with ongoing project and planned technical development/maintenance for our licensed technology are included in our monthly service costs payable to SDOI.

Reports to Security Holders

The Company is not required to deliver an annual report to its stockholders, but will voluntarily send an annual report, together with the Company’s annual audited financial statements upon request. The Company is required to file annual, quarterly and current reports, proxy statements, and other information with the Securities and Exchange Commission. The Company’s Securities and Exchange Commission filings are available to the public over the Internet at the SEC's website at www.sec.gov.

The public may read and copy any materials filed by the Company with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company is an electronic filer. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The Internet address of the site is www.sec.gov.

|

ITEM 1A.

|

RISK FACTORS

|

The Company is a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and is not required to provide the information under this item.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

|

ITEM 2.

|

PROPERTIES

|

The Company’s corporate headquarters are located at 1135 Makawao Avenue, Suite 103-188 Makawao, Hawaii 96768. We have entered into a two-year lease commencing April 1, 2016 for a total of 253 square feet of office and 98 square feet of reception space. Monthly base rent for the period April 1, 2016 to March 31, 2017 is $526.50 per month and increases to $552.83 per month for the subsequent year ending March 31, 2018. Operating costs for the first year of the lease are estimated at $258.06 per month. The Company has remitted a security deposit in the amount of $817.24 in respect of the lease. Further our officers and directors have executed a personal guarantee in respect of the aforementioned lease agreement.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

The Company knows of no material, existing or pending legal proceedings against it, nor is the Company involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which its director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to its interest.

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

Not applicable

12

PART II

|

ITEM 5.

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

The Company’s Common Stock is quoted on the OTC Markets Pink Sheets under the trading symbol “ESSI”, which was issued to the Company on January 3, 2013. Because the Company is quoted on the OTC Markets Pink Sheets, its securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

The high and low prices of the Company’s common shares, as adjusted for stock splits, for the periods indicated below are as follows:

|

Quarter Ended

|

High

|

Low

|

|

January 31, 2016

|

$0.24

|

$0.004

|

|

October 31, 2015

|

$0.08

|

$0.0035

|

|

July 31, 2015

|

$0.06

|

$0.0032

|

|

April 30, 2015

|

$0.20

|

$0.0031

|

|

January 31, 2015

|

$0.25

|

$0.18

|

|

October 31, 2014

|

$0.20

|

$0.20

|

|

July 31, 2014

|

$0.48

|

$0.43

|

|

April 30, 2014

|

$0.38

|

$0.38

|

The Company’s common stock is subject to rules adopted by the Commission regulating broker dealer practices in connection with transactions in “penny stocks.” Those disclosure rules applicable to “penny stocks” require a broker dealer, prior to a transaction in a “penny stock” not otherwise exempt from the rules, to deliver a standardized list disclosure document prepared by the Securities and Exchange Commission. That disclosure document advises an investor that investment in “penny stocks” can be very risky and that the investor’s salesperson or broker is not an impartial advisor but rather paid to sell the shares. The disclosure contains further warnings for the investor to exercise caution in connection with an investment in “penny stocks,” to independently investigate the security, as well as the salesperson with whom the investor is working and to understand the risky nature of an investment in this security. The broker dealer must also provide the customer with certain other information and must make a special written determination that the “penny stock” is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Further, the rules require that, following the proposed transaction, the broker provide the customer with monthly account statements containing market information about the prices of the securities.

These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for its common stock. Many brokers may be unwilling to engage in transactions in its common stock because of the added disclosure requirements, thereby making it more difficult for stockholders to dispose of their shares.

Record Holders

The Company’s common shares are issued in registered form. Empire Stock Transfer Inc., 1859 Whitney Mesa Drive, Henderson, NV 89014, (702) 818-5898, is the registrar and transfer agent for the Company’s common shares.

As of January 31, 2016, the Empire Stock Transfer Inc. shareholders' list of the Company’s common shares showed 97 registered shareholders and 28,226,349 shares outstanding, all of which have been recorded by the Company.

Re-Purchase of Equity Securities

On February 26, 2016 the Company announced it had canceled 1,000,000 shares of common stock, as part of a stock buyback program designed to increase current shareholder value by repurchasing and retiring existing outstanding common stock.

Under the stock repurchase program, and depending on market conditions, shares may be repurchased from time to time at prevailing market prices through open-market or negotiated transactions in accordance with all applicable securities laws and regulations. To remain in compliance with item 703 of Regulation S-K the Company, whether through an open market or private transaction, will at a minimum disclose on a quarterly basis all repurchases of equity securities.

13

Dividends

The Company has not declared any dividends on its common stock since the Company’s inception. There is no restriction in the Company’s Articles of Incorporation and Bylaws that will limit its ability to pay dividends on its common stock. However, the Company does not anticipate declaring and paying dividends to its shareholders in the near future.

Equity Compensation Plan Information

On September 1, 2012, the board of directors of the Company adopted the 2012 Employee Stock Option Plan (the “2012 Plan”). Under the 2012 Plan, 25,000,000 restricted shares of common stock have been reserved for issuance upon exercise of options granted from time to time under the stock option plan. The 2012 Plan is intended to assist the Company in securing and retaining key employees, directors and consultants by allowing them to participate in the Company’s ownership and growth through the grant of incentive and non-qualified options. Under the 2012 Plan, the Company may grant incentive stock options only to key employees and employee directors, or the Company may grant non-qualified options to employees, officers, directors and consultants. Subject to the provisions of the 2012 Plan, the board of directors will determine who shall receive options, and the number of shares of common stock that may be purchased under the options.

The following table represents the number of options currently granted under the 2012 Employee Stock Option Plan:

|

Options Outstanding

|

|||||||||

|

Remaining

|

Exercise Price

|

Weighted

|

|||||||

|

Number of

|

Contractual Life

|

times Number

|

Average

|

||||||

|

Exercise Price

|

Shares

|

(in years)

|

of Shares

|

Exercise Price

|

|||||

| $ | 0.10 |

5,000,000

|

1.60

|

$

|

500,000

|

$0.10

|

|||

| $ | 0.25 |

1,500,000

|

1.60

|

375,000

|

$0.25

|

||||

|

6,500,000

|

$

|

875,000

|

$0.20

|

||||||

As of January 31, 2016 and January 31, 2015, the Company has granted a total of 6,500,000 options to purchase common stock shares. In connection with the options granted, a total of $2,665,000 has been recorded as deferred compensation, of which $153,750 and $205,000 has been expensed during the fiscal years ended January 31, 2016 and January 31, 2015, respectively. There remains $0 and $153,250 of deferred compensation as of January 31, 2016 and January 31, 2015, respectively.

Subsequent to the fiscal year end, in accordance with the terms of the underlying option agreements, all outstanding stock options expired unexercised.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

The Company did not purchase any shares of its common stock or other securities during the years ended January 31, 2016 or 2015. See above, Re-Purchase of Equity Securities for details on certain shares repurchased by the Company subsequent to the fiscal year ended January 31, 2016 as part of a Buyback program.

14

Recent Sales of Unregistered Securities

Common Stock

On October 28, 2015, in accordance with his 2014 Employment Agreement, the Company issued 250,000 shares of restricted common stock, valued at $100,000, to its President for cash in the amount of $250. As a result, additional paid in capital was reduced by $24,750.

On December 9, 2015, in accordance with a certain Asset Purchase Agreement dated August 28, 2015, the Company issued 1,500,000 shares of restricted common stock, valued at $150,000.

On November 19, 2015, in accordance with his 2015 Employment Agreement, the Company issued 500,000 shares of restricted common stock, valued at $40,000, to its President for cash in the amount of $500. As a result, additional paid in capital was reduced by $49,500.

On January 11, 2016, the Company cancelled the agreement with Kensington Marketing, cancelled 1,500,000 shares of Common Stock issued to Kensington Marketing, and returned the “Stay Hydrated” application the Company acquired in exchange for the 1,500,000 shares.

On January 12, 2016, $3,900 of principal from a convertible note was converted into 1,300,000 shared of the Company’s common stock at a rate of $0.003 per share.

On March 18, 2016, Mike Hogue was issued a total of 100,000 shares of common stock in relation to a consulting agreement. The shares were valued at market on the date of the contract, February 1, 2016, for a total of $250,000.

On April 6, 2016 the Company issued a total of 1,200,000 shares of common stock valued at $0.01 per share in relation to a consulting agreement with SDOI.

On May 9, 2016 the Company issued 596,884 shares of common stock to an unrelated third party in respect to the assignment of the remaining balance of a convertible note in the principal amount of $96,100. Upon assignment the conversion terms of the note were amended from $0.003 per share to a 40% discount to market based on the date immediately prior to the notice of conversion. As a result the shares were issued in full settlement of the principal value of the note at 0.161 per share.

Series A Voting Preferred Shares

On January 1, 2016 the Company entered into a Technology Licensing and Marketing Agreement whereunder it agreed to issue a total of 1,000 shares of Series A Voting Preferred Stock to a third party.

On January 11, 2016, the Company’s Board of Directors (the “Board”) authorized the creation of 1,000 shares of Series A Voting Preferred Stock. The holder of the shares of the Series A Voting Preferred Stock has the right to vote those shares of the Series A Voting Preferred Stock regarding any matter or action that is required to be submitted to the shareholders of the Company for approval. The vote of each share of the Series A Voting Preferred Stock is equal to and counted as 10 times the votes of all of the shares of the Company’s (i) common stock, and (ii) other voting preferred stock issued and outstanding on the date of each and every vote or consent of the shareholders of the Company regarding each and every matter submitted to the shareholders of the Company for approval. The Series A Voting Preferred Stock will not be convertible into Common Stock.

Exemption From Registration. The shares of Common Stock referenced herein were issued in reliance upon an exemption from registration afforded either under Section 4(2) of the Securities Act for transactions by an issuer not involving a public offering, or Regulation D promulgated thereunder, or Regulation S for offers and sales of securities outside the U.S.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

As a “smaller reporting company”, the Company is not required to provide the information required by this Item.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion should be read in conjunction with the Company’s audited consolidated financial statements and the related notes for the year ended January 31, 2016, and 2015, that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect the Company’s plans, estimates and beliefs. The Company’s actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report.

The Company’s consolidated financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

15

Overview of Current Operations

Results of Operations for the years ended January 31, 2016 and 2015

During the fiscal years ended January 31, 2016 and 2015, the Company has not generated any revenues.

As at January 31, 2016 and 2015, the Company had $6,706 and $13,322 in cash and total current assets.

During the fiscal year ended January 31, 2016, the Company incurred total operating expenses of $652,818, of which $493,750 was stock-based compensation as a result of the issuance of certain stock options in fiscal year 2015, as compared to total operating expenses of $1,071,782, of which 945,000 was stock-based compensation as a result of the issuance of certain stock options in fiscal year 2014 for the same period in the prior fiscal year.

In addition, the company recorded interest expense of $28,338 and $18,554 in respect of certain convertible note agreements. During fiscal 2016 the Company incurred a loss on the divestiture of a technology application acquired in August 2015 called “Stay Hydrated” of $150,000 when new management determined to cancel the agreement and return the technology to the original holders in exchange for the return and cancellation of 1,500,000 shares, as it was not in-line with the objectives of the Company moving forward. There was no comparative expense in fiscal 2015. Further, the Company determined to impair the value of its newly acquired discrete communications software platform, which was recorded as an intangible asset valued at $3,500 based on the fair market value of the 500,000 shares of stock issuable under the acquisition agreement on the date of the transaction, following an evaluation of the technology at the fiscal year end which determined recovery of the value of the asset was indeterminate during the present stage of the Company’s execution of its revised business focus to operate in the eco friendly technology sector using social media sites and offering apps to generate advertising revenues and download fees.

The net loss in fiscal 2016 totaled $834,706 as compared to $1,090,336 in 2015.

The Company used net cash in operations of $72,866 and $140,066 respectively during the twelve month periods ended January 31, 2016 and 2015, recorded no cash used in or provided by investing activities, and received cash from financing activities of $66,250 and $147,704, predominantly as a result of related party loans.

Plan of Operation

We have recently changed the focus of our business to operate in the eco friendly technology sector using social media sites and offering apps to generate advertising revenues and download fees. The Company's need for ongoing capital by way of loans, sale of equity and/or convertible notes is expected to continue during the current fiscal year until we can establish revenues from operations. We are presently financing ongoing licensing support and maintenance fees associated with our newly commenced business focus by the issuance of shares of common stock for services at a discount to our market price. There are no assurances additional capital will be available to the Company on acceptable terms.

Future funding could result in potentially dilutive issuances of equity securities, the incurrence of debt, contingent liabilities and/or amortization expenses related to goodwill and other intangible assets, which could materially adversely affect the Company's business, results of operations and financial condition. Any future funding might require the Company to obtain additional equity or debt financing, which might not be available on terms favorable to the Company, or at all, and such financing, if available, might be dilutive.

Going Concern

These financial statements have been prepared on a going concern basis, which implies that the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated significant revenues to date and has never paid any dividends and is unlikely to pay dividends or generate significant earnings in the immediate or foreseeable future. As at January 31, 2016, the Company had a working capital deficit of $662,306 and an accumulated deficit of $9,845,094. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability to raise equity or debt financing, and the attainment of profitable operations from the Company's future business. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern.

(See Financial Footnote 1.)

Liquidity and Capital Resources

As of January 31, 2016, the Company had total current assets of $6,706, and total current liabilities of $688,211. The Company has limited financial resources available outside loans from its officers and directors and funds it has obtained through use of convertible debt instruments and loans with third parties. While the Company is working towards generating revenue to offset some of its existing operating expenditures, it is possible that without realization of additional capital, it would be unlikely for the Company to continue as a going concern. In order for the Company to remain a Going Concern it may need to find additional capital. Additional working capital may be sought through additional debt or equity private placements, additional notes payable to banks or related parties (officers, directors or stockholders), or from other available funding sources at market rates of interest, or a combination of these. The ability to raise necessary financing will depend on many factors, including the nature and prospects of any business to be acquired and the economic and market conditions prevailing at the time financing is sought. During the most recently completed fiscal year management has obtained additional funding with success, however there is no guarantee we will be able to continue to obtain financing if and when required. The current economic downturn may make it difficult to find new capital sources for the Company should they be required.

16

Future Financings

We anticipate continuing to rely related party and third party loans and/or equity sales of our common shares and/or shares for services rendered in order to continue to fund our business operations in the event of ongoing operational shortfalls. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any of additional sales of our equity securities or arrange for debt or other financing to fund our research and development activities.

Revenue

The Company has recently launched the first applications and channels in respect of our major business activity. As yet we are unable to predict when we may commence generating revenues from these operations.

Cost of sales

Costs of sales are expected to include licensing, marketing and maintenance fees in respect to our proprietary software platform and licensed software services. In addition, we can expect to incur fees associated with gaining followers for our YouTube channels and the advertising of our downloadable applications.

General and Administrative Expenses

|

For the year ended

|

||||||||||||

|

January 31,

|

||||||||||||

|

|

2016

|

2015

|

Variances

|

|||||||||

|

Legal, accounting and audit fees

|

$ | 14,602 | $ | 39,449 | $ | (24,849 | ) | |||||

|

Management and consulting fees

|

55,083 | 22,300 | 32,783 | |||||||||

|

Research, development, and promotion

|

74,750 | 45,534 | 29,216 | |||||||||

|

Transfer agent and filing fees

|

2,309 | 3,620 | (1,311 | ) | ||||||||

|

Office supplies and other general expenses

|

12,324 | 15,879 | (3,555 | ) | ||||||||

|

Total general and administrative expenses

|

$ | 159,068 | $ | 126,782 | $ | 32,284 | ||||||

Personnel

As of January 31, 2016, and as of the date of this filing, the Company had no employees, excluding its executive officers and directors.

Contractual Obligations

As a “smaller reporting company”, the Company is not required to provide tabular disclosure obligations.

Off-Balance Sheet Arrangements

The Company has no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

17

Critical Accounting Policies

The discussion and analysis of the Company’s financial condition and results of operations are based upon the Company’s consolidated audited financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. The Company believes that understanding the basis and nature of the estimates and assumptions involved with the following aspects of the Company’s financial statements is critical to an understanding of its consolidated financial statements.

|

Use of Estimates

|

The preparation of consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to long-lived assets and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

|

Cash and Cash Equivalents

|

The Company considers all highly liquid instruments with maturity of three months or less at the time of purchase to be cash equivalents. As of January 31, 2016 and January 31, 2015, respectively, the Company had no cash equivalents.

Technology and licensing rights (Intangible assets)

Technology and licensing rights are recorded at cost and capitalized, and are reviewed for impairment at a minimum of once per year or whenever events or changes in circumstances suggest a need for evaluation.

Impairment of Long-Lived Assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable through the estimated undiscounted cash flows expected to result from the use and eventual disposition of the assets. Whenever any such impairment exists, an impairment loss will be recognized for the amount by which the carrying value exceeds the fair value. During the years ended January 31, 2016 and 2015, there was $3,500 and $nil impairment of long-lived asset, respectively.

Fair Value Measurements

Pursuant to ASC 820, Fair Value Measurements and Disclosures and ASC 825, Financial Instruments, an entity is required to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 and 825 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 and 825 prioritizes the inputs into three levels that may be used to measure fair value:

|

Level 1

|

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

|

|

Level 2

|

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

|

|

Level 3

|

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

|

The Company’s financial instruments consist principally of cash, accounts payable, and accrued liabilities. Pursuant to ASC 820 and 825, the fair value of cash is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. The recorded values of all other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

Revenue Recognition

The Company recognizes revenue in accordance with ASC 605, Revenue Recognition. Revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, the service has been provided, and collectability is reasonably assured. As of January 31, 2016, no revenue has been recognized, as the Company has not commenced revenue generating operations.

Cost of Revenue

Costs of revenue consist of the direct expenses incurred in order to generate revenue. Such costs are recorded as incurred. Our cost of revenue will consist consists primarily of fees associated with the operation of our social media venues and fulfillment of specific customer advertising campaigns related to our downloadable apps.

18

Stock-Based Compensation

The Company records stock-based compensation in accordance with ASC 718, Share-Based Payments, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. Equity instruments issued to employees and the cost of the services received as consideration are measured and recognized based on the fair value of the equity instruments issued.

Basic and Diluted Net Income (Loss) Per Share

The Company computes net income (loss) per share in accordance with ASC 260, Earning per Share. ASC 260 requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive.

Recently issued accounting pronouncements

In February 2015, the FASB issued ASU No. 2015-02, Consolidation (Topic 810), Amendments to the Consolidation Analysis that meant to clarify the consolidation reporting guidance in GAAP. This guidance is to be applied using a retrospective method or a modified retrospective method, as outlined in the guidance, and is effective for annual periods, and interim periods within those annual periods, beginning after December 15, 2015. Early application is permitted. The Company has adopted the guidance and the adoption of this standard did not have an impact on the Company's consolidated financial position or results of operations.

In April 2015, the FASB issued ASU 2015-03, Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs, which requires an entity to present debt issuance costs related to a debt liability as a direct deduction from the debt liability rather than as an asset. ASU 2015-03 is effective retrospectively for fiscal years, and interim reporting periods within those years, beginning after December 15, 2015. As the Company does not currently have any debt obligations, the adoption of this standard will not impact the presentation of certain financial statement line items within the Company's balance sheets, results of operations, and related disclosures.

In September 2015, the FASB issued ASU 2015-16, Business Combinations (Topic 805): Simplifying the Accounting Measurement-Period Adjustments, which eliminates the requirement for an entity to retrospectively adjust the financial statements for measurement-period adjustments that occur in periods after a business combination is completed. ASU 2015-16 is effective prospectively for fiscal years, and interim reporting periods within those years, beginning after December 15, 2015. The adoption of this standard will not have an impact on the Company's financial position and results of operations.

In November 2015, the FASB issued ASU 2015-17, Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes, to simplify the presentation of deferred income taxes. The amendments in ASU 2015-17 require that deferred tax liabilities and assets be classified as non-current in a classified statement of financial position. The current requirement that deferred tax liabilities and assets of a tax-paying component of an entity be offset and presented as a single amount is not affected by the amendments in the update. ASU 2015-17 is effective for fiscal years beginning after December 15, 2016, and interim periods within those years, and may be applied either prospectively to all deferred tax liabilities and assets or retrospectively to all periods presented. The adoption of this standard will not have an impact on the Company's financial position.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments - Overall: Recognition and Measurement of Financial Assets and Financial Liabilities. This new standard provides guidance on how entities measure certain equity investments and present changes in the fair value. This standard requires that entities measure certain equity investments that do not result in consolidation and are not accounted for under the equity method at fair value and recognize any changes in fair value in net income. ASU 2016-01 is effective for fiscal years beginning after December 31, 2017. The Company is currently evaluating the provisions of this guidance and assessing its impact on the Company's financial statements and disclosures.

19

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

As a “smaller reporting company”, the Company is not required to provide the information required by this Item.

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

The Company’s consolidated audited financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. The following consolidated audited financial statements are filed as part of this annual report:

| Page | |

|

Reports of Independent Registered Public Accounting Firms

|

F-1 & F-2

|

|

|

|

|

Balance Sheets as at January 31, 2016 and 2015

|

F-3

|

|

|

|

|

Statements of Operations for the years ended January 31, 2016 and 2015

|

F-4

|

|

|

|

|

Statements of Changes in Stockholders' Deficit for the years ended January 31, 2016 and 2015

|

F-5

|

|

|

|

|

Statement of Cash Flows for the years ended January 31, 2016 and 2015

|

F-6

|

|

|

|

|

Notes to the Consolidated Financial Statements for the years ended January 31, 2016 and 2015

|

F-7 to F-18

|

20

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Eco Science Solutions, Inc.:

We have audited the accompanying consolidated balance sheets of Eco Science Solutions, Inc. (“the Company”) as of January 31, 2016 and the related statement of operations, stockholders’ equity (deficit) and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statement referred to above present fairly, in all material respects, the financial position of Eco Science Solutions, Inc., as of January 31, 2016, and the results of its operations and its cash flows for the year then ended, in conformity with generally accepted accounting principles in the United States of America.

The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the Company's internal control over financial reporting. Accordingly, we express no such opinion.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience negative cash flows from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ B F Borgers CPA PC

B F Borgers CPA PC

Lakewood, CO

May 17, 2016

F-1

PCAOB Registered Auditors – www.sealebeers.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Eco Science Solutions, Inc.

We have audited the accompanying consolidated balance sheets of Eco Science Solutions, Inc. as of January 31, 2014 and 2015, and the related consolidated statements of operations, stockholders’ equity (deficit), and cash flows for each of the years in the two-year period ended January 31, 2015. Eco Science Solutions, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Eco Science Solutions, Inc. as of January 31, 2014 and 2015, and the results of its operations and its cash flows for each of the years in the two-year period ended January 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has no revenues, has negative working capital at January 31, 2015, has incurred recurring losses and recurring negative cash flow from operating activities, and has an accumulated deficit which raises substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Seale and Beers, CPAs

Seale and Beers, CPAs

Las Vegas, Nevada

April 29, 2015