UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 20-F

¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2013 | |

OR | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________. | |

OR | |

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report _________________ | |

Commission file number 001-34760 | |

THE CASH STORE FINANCIAL SERVICES INC. |

(Exact name of Registrant as specified in its charter) |

ONTARIO, CANADA |

(Jurisdiction of incorporation or organization) |

15511-123 Avenue |

Edmonton, Alberta Canada T5V 0C3 |

(Address of principal executive offices) |

Contact: Craig Warnock |

15511-123 Avenue |

Edmonton, Alberta Canada T5V 0C3 |

(780) 408-5110 |

Craig.Warnock@csfinancial.ca |

(Name, telephone, e-mail and/or facsimile number and address of Company contact person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of Each Class | Name of each exchange on which registered |

Common shares, no par value | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act

None |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Number of outstanding shares of The Cash Store Financial Services Inc.’s only class of issued capital stock as at September 30, 2013: 17,571,813 Common Shares Without Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large Accelerated Filer ¨ | Accelerated Filer ¨ | Non-Accelerated Filer þ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | þ |

International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ |

Other | ¨ |

If other has been checked in response to the previous question, indicate by check mark which financial statement item Registrant has elected to follow:

Item 17 ¨ Item 18 ¨

If this report is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

NOT APPLICABLE

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

In order to help our investors understand our current results and future prospects, The Cash Store Financial Services Inc.’s (“Cash Store Financial” or “the Company”) Form 20-F for the fiscal year 2013 includes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States federal securities legislation. Management refers to these types of statements collectively, as “forward-looking information.” Forward-looking information includes, but is not limited to, information with respect to our objectives, strategies, operations and financial results, competition as well initiatives to grow revenue or reduce retention payments.

Forward-looking information can generally be identified by the use of words such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases. They may also be identified by statements that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied. These risks and uncertainties may include (but are not limited to) changes in economic and political conditions, legislative or regulatory developments, technological developments, third party arrangements, competition, litigation, market conditions, the availability of alternative transactions, shareholder, legal, regulatory and court approvals and third party consents and other factors described under the heading "Risk Factors".

Management has attempted to identify the important factors that could cause actual results to differ materially from those contained in forward-looking information, but other factors unknown to us at the time of writing could cause results to vary. There can be no assurance that forward-looking information will prove to be accurate. Actual results could differ materially. Management cautions readers not to place undue reliance on forward-looking information. Unless required by law, the Company does not undertake to update any forward-looking information.

NOTE

Cash Store Financial is a Canadian corporation and is not affiliated with Cottonwood Financial Ltd. or the outlets Cottonwood Financial Ltd. operates in the United States under the name “Cash Store”. Cash Store Financial does not conduct business under the name “Cash Store” in the United States and does not own or provide any consumer lending services in the United States.

TABLE OF CONTENTS

ITEM 1. | ||

ITEM 2. | ||

ITEM 3. | ||

A. | ||

B. | ||

C. | ||

D. | ||

ITEM 4. | ||

A. | ||

B. | ||

C. | ||

D. | ||

ITEM 4A. | ||

ITEM 5. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

F. | ||

G. | ||

ITEM 6. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

ITEM 7. | ||

A. | ||

B. | ||

C. | ||

ITEM 8. | ||

A. | ||

B. | ||

ITEM 9. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

F. | ||

i

ITEM 10. | ||

A. | ||

B. | ||

C. | ||

D. | ||

E. | ||

F. | ||

G. | ||

H. | ||

I. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

ITEM 15. | ||

ITEM 16A. | ||

ITEM 16B. | ||

ITEM 16C. | ||

ITEM 16D. | ||

ITEM 16E. | ||

ITEM 16F. | ||

ITEM 16G. | ||

ITEM 17. | ||

ITEM 18. | ||

ITEM 19. | ||

ii

PART 1

ITEM 1. | IDENTITY OF BOARD OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

(a) | Board of Directors and Senior Management |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended, and as such, there is no requirement to provide any information under this item.

(b) | Advisors |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended, and as such, there is no requirement to provide any information under this item.

(c) | Auditor |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended, and as such, there is no requirement to provide any information under this item.

ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

ITEM 3. | KEY INFORMATION |

A. | Selected Financial Data |

Years Ended | ||||||||||||||||||||

(In thousands of Canadian Dollars, except share and per share data) | June 30 2009 | Sept 30 2010 (1) | Sept 30 2011 | Sept 30 2012 | Sept 30 2013 | |||||||||||||||

REVENUE | ||||||||||||||||||||

Loan fees | $ | 122,572 | $ | 170,659 | $ | 136,623 | $ | 137,994 | $ | 152,430 | ||||||||||

Other income | 27,933 | 49,859 | 53,276 | 49,418 | 38,335 | |||||||||||||||

150,505 | 220,518 | 189,899 | 187,412 | 190,765 | ||||||||||||||||

OPERATING EXPENSES | ||||||||||||||||||||

Salaries and benefits | 46,721 | 72,049 | 67,017 | 65,944 | 58,653 | |||||||||||||||

Provision for loan losses | 49 | 788 | 2,559 | 31,004 | 36,607 | |||||||||||||||

Retention payments | 17,988 | 28,167 | 26,786 | 9,968 | 11,659 | |||||||||||||||

Selling, general and administrative | 19,414 | 25,020 | 24,109 | 23,595 | 20,449 | |||||||||||||||

Rent | 11,372 | 18,026 | 18,427 | 18,940 | 18,581 | |||||||||||||||

Advertising and promotion | 3,894 | 5,607 | 5,941 | 5,180 | 6,307 | |||||||||||||||

Depreciation of property and equipment | 4,679 | 7,006 | 6,803 | 6,843 | 6,366 | |||||||||||||||

104,117 | 156,663 | 151,642 | 161,474 | 158,622 | ||||||||||||||||

OPERATING MARGIN | 46,388 | 63,855 | 38,257 | 25,938 | 32,143 | |||||||||||||||

CORPORATE AND OTHER EXPENSES | ||||||||||||||||||||

Corporate expenses | 16,625 | 21,124 | 18,641 | 22,684 | 38,142 | |||||||||||||||

Interest expense | — | — | 616 | 12,339 | 18,583 | |||||||||||||||

Depreciation of property and equipment | 1,149 | 1,132 | 1,146 | 835 | 1,794 | |||||||||||||||

Amortization of intangible assets | 185 | 923 | 965 | 5,138 | 7,517 | |||||||||||||||

Branch closure costs | — | — | — | 1,574 | 123 | |||||||||||||||

Impairment of property and equipment | — | — | — | 3,425 | 1,236 | |||||||||||||||

Premium paid to acquire the loan portfolio | — | — | — | 36,820 | — | |||||||||||||||

Class action settlements | 6,910 | 11,685 | — | |||||||||||||||||

INCOME (LOSS) BEFORE INCOME TAXES | 21,519 | 28,991 | 16,889 | (56,877 | ) | (35,252 | ) | |||||||||||||

1

Years Ended | ||||||||||||||||||||

(In thousands of Canadian Dollars, except share and per share data) | June 30 2009 | Sept 30 2010 (1) | Sept 30 2011 | Sept 30 2012 | Sept 30 2013 | |||||||||||||||

PROVISION FOR INCOME TAXES | ||||||||||||||||||||

Current (recovery) | 4,407 | 11,196 | 6,157 | (3,571 | ) | (12,429 | ) | |||||||||||||

Deferred (recovery) | 2,465 | (2,068 | ) | 153 | (9,784 | ) | 12,709 | |||||||||||||

6,872 | 9,128 | 6,310 | (13,355 | ) | 280 | |||||||||||||||

NET INCOME (LOSS) AND COMPREHENSIVE INCOME (LOSS) | $ | 14,647 | $ | 19,863 | $ | 10,579 | $ | (43,522 | ) | $ | (35,532 | ) | ||||||||

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING | ||||||||||||||||||||

Basic | 17,957,710 | 16,913,213 | 17,259 | 17,432 | 17,564 | |||||||||||||||

Diluted | 18,039,976 | 17,522,246 | 17,663 | 17,432 | 17,564 | |||||||||||||||

BASIC EARNINGS (LOSS) PER SHARE | ||||||||||||||||||||

Net income (loss) and comprehensive income (loss) | $ | 0.82 | $ | 1.17 | $ | 0.61 | $ | (2.50 | ) | $ | (2.02 | ) | ||||||||

DILUTED EARNINGS (LOSS) PER SHARE | ||||||||||||||||||||

Net income (loss) and comprehensive income (loss) | $ | 0.81 | $ | 1.13 | $ | 0.60 | $ | (2.50 | ) | $ | (2.02 | ) | ||||||||

CONSOLIDATED BALANCE SHEET INFORMATION (as of end of period) | ||||||||||||||||||||

Working Capital | $ | 9,667 | $ | 8,379 | $ | 11 | $ | 58,720 | $ | 35,564 | ||||||||||

Total Assets | 83,796 | 116,414 | 123,291 | 202,444 | 164,585 | |||||||||||||||

Total Debt | 1,029 | 994 | (3,258 | ) | 129,641 | 130,623 | ||||||||||||||

Total Shareholders’ Equity | 2,959 | 9,882 | 9,082 | 137,375 | 137,161 | |||||||||||||||

(1) | In 2010, the Company changed its fiscal year end from June 30 to September 30. The fiscal year end change resulted in a 15-month reporting period from July 1, 2009 to September 30, 2010. |

Exchange rate information

The following table sets forth, for the periods and dates indicated, certain information concerning U.S. dollar/Canadian dollar exchange rates expressed in $1.00. On November 30, 2013, the interbank rate between US dollars and Canadian dollars as reported by the Bank of Canada was US$1.0599/CAD$1.00.

Year ended December 31: | High | Low | Year end | Average (1) | ||||||||

2008 (2) | 0.7711 | 1.0289 | 0.8166 | 0.9381 | ||||||||

2009 (2) | 0.7692 | 0.9716 | 0.9555 | 0.8757 | ||||||||

2010 (2) | 0.9278 | 1.0054 | 1.0054 | 0.9710 | ||||||||

2011 (2) | 0.9430 | 1.0583 | 0.9833 | 1.0110 | ||||||||

2012 (2) | 0.9599 | 1.0299 | 1.0051 | 1.0004 | ||||||||

2013 (3) | 0.9839 | 1.0599 | 1.0599 | 1.0270 | ||||||||

(1) | The average rate of exchange on the last business day of each month during the year. Expressed in USD/CAD. |

(2) | Based on the noon buying rate in New York City for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York. |

(3) | Through to November 30, 2013. |

2

Exchange rate information for the months of (1) | High | Low | ||||

June 2013 | 1.0518 | 0.9508 | ||||

July 2013 | 1.0432 | 1.0375 | ||||

August 2013 | 1.0432 | 1.0385 | ||||

September 2013 | 1.0363 | 1.0322 | ||||

October 2013 | 1.0384 | 1.0345 | ||||

November 2013 | 1.0415 | 1.0599 | ||||

(1) | The average rate of exchange on the last business day of each month during the year. Expressed in USD/CAD. |

B. | Capitalization and Indebtedness |

Not applicable.

C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

D. | Risk Factors |

The following is a brief discussion of those distinctive or special characteristics of Cash Store Financial’s operations and industry which may have a material impact on Cash Store Financial’s financial performance.

Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of the Company’s common stock.

Regulatory Environment

Consumer Lending Regulations

The Company’s business is subject to federal, provincial and foreign laws and regulations in Canada and the UK. These regulations may change at any time and may impose significant limitations on the way the Company conducts or expands its business. These regulations govern lending and collection practices and, in some cases, allowable interest rates and rate caps.

As the Company introduces new products and services, it may become subject to additional laws and regulations. Future legislation or regulations may restrict the Company’s ability to operate the way it does today or its ability to expand operations and may have a negative effect on the Company’s business, results of operations and financial condition. Governments at the national and local levels may seek to impose new licensing requirements or interpret or enforce existing requirements in new ways. The Company is currently, and may in the future be, subject to litigation and regulatory proceedings which could generate adverse publicity or cause the Company to incur substantial expenditures or modify the way the Company conducts its business. Changes in laws or regulations, or a failure to comply with applicable laws and regulations, may have a material adverse effect on the business, prospects, results of operations, and financial condition of the Company.

In May 2007, the Canadian federal government enacted a bill clarifying that the providers of certain payday loans were not governed by the criminal interest rate provisions of the Criminal Code of Canada (the “Criminal Code”), granting lenders (other than most federally-regulated financial institutions) an exemption from the criminal interest rate provisions of the Criminal Code if their loans fell within certain dollar amount and time frame maximums. In order for payday loan companies to rely on the exemption, provincial governments are required to enact legislation, subject to approval by the federal government that includes a licensing regime for payday lenders, measures to protect consumers and maximum allowable limits on the total cost of borrowing.

In Canada, the provinces that have enacted specific payday loans legislation pursuant to this federal exemption are British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, and Nova Scotia.

3

Ontario

In keeping with the Company's product growth strategic objective, on February 1, 2013 the Company launched its suite of line of credit products in Ontario, and payday loans are no longer being offered in that province. Effective July 4, 2013, the Company allowed its payday loan licenses to expire in Ontario.

With respect to the new line of credit offerings, on April 29, 2013 the Company filed an application in Ontario courts seeking a declaration that the Basic line of credit was not subject to the Payday Loans Act.

On February 4, 2013, the Registrar for payday loans in Ontario issued a proposal to revoke the payday lending licenses of the Cash Store Inc. and Instaloans Inc. Sections 13(2) and 14(1) of the Payday Loans Act provide that licensees are entitled to a hearing before the License Appeal Tribunal in respect of the Registrar’s proposal. The Company filed an Appeal with the License Appeal Tribunal on February 19, 2013, however, as the Company allowed its payday licenses to expire in Ontario effective July 4, 2013, this appeal was withdrawn effective August 15, 2013.

Previous to the February 4, 2013 proposal of the Registrar for payday loans, the Company submitted an application for judicial review in the Ontario Courts, seeking a declaration that certain provisions of the regulations made under the Ontario Payday Loans Act are void and unenforceable. This application was heard on October 2, 2013. On November 5, 2013, the Court dismissed the application. On November 22, 2013 the Company filed a Notice of Motion for leave to Appeal.

On June 7, 2013, the Ontario Ministry of Consumer Services filed an application in Ontario courts seeking a declaration that the Basic Line of Credit is subject to the Payday Loans Act and that the Company must obtain a broker license to offer this product. This application was heard on November 29, 2013 and a decision has not yet been rendered. Concurrently, the Ontario Ministry of Consumer Services has proposed amended regulations which may capture the lines of credit under the existing Payday Loans Act and may require the Company to re-apply for licenses to continue to offer the products. The new regulations do not propose a rate cap for the lines of credit. The regulator is currently considering industry feedback on the proposed amendments and the content and timing of such amended regulations is not yet known.

The Company remains committed to maintaining ongoing dialogue with the Ontario Ministry of Consumer Services with respect to its concerns. The Company maintains that its operations in Ontario are in compliance with all applicable laws.

British Columbia

On March 23, 2012, the Company was issued a compliance order (the “Order”) and administrative penalty from Consumer Protection BC. The Order directs the Company to refund to all borrowers with loan agreements negotiated with the Company or its subsidiaries between November 1, 2009 and the date of the order, the amount of any issuance fee charged, required or accepted for or in relation to the issuance of a cash card. The Order also directed the Company to pay an administrative penalty of $25 in addition to costs. On November 30, 2012, Consumer Protection BC issued a supplementary compliance order directing that unclaimed refund amounts, to a maximum of $1.1 million be deposited into a consumer protection fund. On December 14, 2012, the Company filed a Petition for Judicial Review in the British Columbia Supreme Court seeking an order quashing or setting aside the Order and Supplemental Order, and seeking declarations that it had not contravened sections 112.04(1)(f) of the Business Practices and Consumer Protection Act, or section 17 and 19 of the Payday Loan Regulation. The Petition was heard by the Court on June 26, 27, and 28, 2013. A decision has not yet been released. The estimated exposure with respect to this order is between $248,000 and $1.1 million including penalties, legal costs and additional costs. The balance of the accrued liability related to this order as at September 30, 2013 is $187 (2012 - $248).

United Kingdom

In April of 2014 the Financial Conduct Authority ("FCA") will assume responsibility for regulating the payday loans sector. The FCA has proposed new payday lender measures that will include limiting to two the number of loan rollovers and the number of times that lenders can access a borrower’s bank account for payment, both of which have an implementation date of July 1, 2014. The FCA will also require a borrower affordability assessment before payday lenders can extend a loan and will require that lenders include clear risk warnings on advertisements. In addition, the FCA plans to put in place dedicated supervision and enforcement teams. The FCA opened its proposed rules for comment and is expected to publish final guidance in February 2014.

On November 25, 2013, legislators in the UK announced that a rate cap setting power for payday loans will be included through amendments to the Banking Reform Bill which is currently before the House of Lords. It has been reported that the

4

rate cap will be set by the FCA and address the total cost of borrowing. The Banking Reform Bill is expected to receive final reading on December 9, 2013 and rate caps are expected to come into force during 2015.

NYSE Listing Standards

On April 2, 2013, the Company received notice from the New York Stock Exchange (“NYSE”) that it is not in compliance with certain NYSE standards for continued listing of its common shares. Specifically, the Company is below the NYSE’s continued listing criteria because its average total market capitalization over a recent 30 consecutive trading day period was less than $50 million at the same time that reported shareholders’ equity was less than $50 million. Under the NYSE’s continued listing criteria, a NYSE listed company must maintain average market capitalization of not less than $50 million over a 30 consecutive trading day period or reported shareholders’ equity of not less than $50 million.

The Company submitted a plan to the NYSE demonstrating its ability to achieve compliance with the listing standards within 18 months of receiving the notice. On August 29, 2013, the Company was notified that the NYSE accepted the Company's plan to achieve compliance within 18 months of receipt of the April 2, 2013 letter.

During such 18-month period, the Company’s common shares will continue to be listed and traded on the NYSE, subject to quarterly progress reviews by the NYSE and compliance with other NYSE continued listing standards.

The NYSE plan of compliance does not impact the Company’s listing on the Toronto Stock Exchange (“TSX”) and the Company’s common shares will continue to be listed and traded on the TSX, subject to compliance with TSX listing standards.

Legal Proceedings

The Company is subject to various asserted and unasserted claims during the course of business of which the outcome of many of these matters is currently not determinable. Due to the uncertainty surrounding the litigation process, unless otherwise stated below, the Company is unable to reasonably estimate the range of loss, if any, in connection with the asserted and unasserted legal actions against it. The Company believes that it has conducted business in accordance with applicable laws and is defending each claim vigorously. In addition to the litigation and claims discussed below, the Company is involved in routine litigation and administrative proceedings arising in the normal course of business.

The resolution of any current or future legal proceeding could cause the Company to have to refund fees and/or interest collected, refund the principal amount of advances, pay damages or other monetary penalties and/or modify or terminate operations in particular jurisdictions. The Company may also be subject to adverse publicity. Defense of any legal proceedings, even if successful, requires substantial time and attention of senior officers and other management personnel that would otherwise be spent on other aspects of the business and requires the expenditure of significant amounts for legal fees and other related costs. Settlement of lawsuits may also result in significant payments and modifications to operations. Any of these events could have a material adverse effect on business, prospects, results of operations and financial condition of the Company.

Class proceedings related to consumer lending activities

British Columbia - March 5, 2004 Claim

On March 5, 2004, an action under the Class Proceedings Act was commenced in the Supreme Court of British Columbia by Andrew Bodnar and others proposing that a class action be certified on his own behalf and on behalf of all persons who have borrowed money from the defendants, The Cash Store Financial and All Trans Credit Union Ltd. The action stems from the allegations that all payday loan fees collected by the defendants constitute interest and therefore violate s. 347 of the Criminal Code of Canada (the “Code”). On May 25, 2006, the claim in British Columbia was affirmed as a certified class proceeding of Canada by the British Columbia Court of Appeal. In fiscal 2007, the plaintiffs in the British Columbia action brought forward an application to have certain of the Company’s customers’ third-party lenders added to the claim. On March 18, 2008, another action commenced in the Supreme Court of British Columbia by David Wournell and others against The Cash Store Financial, Instaloans Inc., and others in respect of the business carried out under the name Instaloans since April 2005. Collectively, the above actions are referred to as the “British Columbia Related Actions”.

5

On May 12, 2009, the Company settled the British Columbia Related Actions in principle and on February 28, 2010 the settlement was approved by the Court. Under the terms of the court approved settlement, the Company was to pay to the eligible class members who were advanced funds under a loan agreement and who repaid the payday loan plus brokerage fees and interest in full, or who met certain other eligibility criteria, a maximum estimated amount including legal expenses of $18.8 million, consisting of $9.4 million in cash and $9.4 million in credit vouchers. The credit vouchers can be used to pay existing outstanding brokerage fees and interest, to pay a portion of brokerage fees and interest which may arise in the future through new loans advanced, or can be redeemed for cash from January 1, 2014 to June 30, 2014. The credit vouchers are not transferable and have no expiry date. After approved legal expenses of $6.4 million were paid in March 2010, the balance of the settlement amount remaining to be disbursed was $12.4 million, consisting of $6.2 million of cash and $6.2 million of vouchers.

By September 30, 2010, the Company received approximately 6,300 individual claims representing total valid claims in excess of the settlement fund. As the valid claims exceed the balance of the remaining settlement fund, under the terms of the settlement agreement, the entire settlement fund of $12.4 million was mailed to claimants in November 2012 in the form of cash and vouchers on a pro-rata basis. As at September 30, 2013, $5.1 million of the $6.1 million cheques issued had been cashed and $0.6 million of vouchers had been redeemed.

In arriving at the liability recorded at the balance sheet date, the voucher portion of the settlement fund of $6.2 million has been discounted using a discount rate of 16.2%. During the year ended September 30, 2013, the Company recorded accretion expense of $0.9 million ($0.7 million in the year ended September 30, 2012 and $0.6 million in the year ended September 30, 2011) in interest expense. The total liability related to the settlement at September 30, 2013 is $6.2 million (September 30, 2012- $11.3 million).

British Columbia - September 11, 2012 Claim

On September 11, 2012, an action under the British Columbia Class Proceedings Act was commenced in the Supreme Court of British Columbia by Roberta Stewart against The Cash Store Financial Services Inc., The Cash Store Inc. and Instaloans Inc. claiming on behalf of the plaintiff and class members who, on or after November 1, 2009 borrowed a loan from the Company in British Columbia, and that the Company charged, required or accepted an amount that is in excess of 23% of the amount loaned of the principal which is contrary to s. 17(1) of the Payday Loans Regulation and s. 112.02(2) of the Business Practices Consumer Protection Act (“BPCPA”) and charged, required or accepted an amount in relation to each cash card issued to a class member which is contrary to s. 112.04(1)(f) of the BPCPA; made the provision of each payday loan contingent on class members purchasing a cash card and services related thereto, contrary to s. 19(1) of the Payday Loans Regulation and s. 112.08(1)(m) of the BPCPA; and discounted the amount in the payday loan agreement to be the loan amount borrowed, by deducting and withholding from the loan advance an amount representing a portion of the total costs of credit, contrary to s.112.08(1)(e) of the BPCPA.

The Class members seek an order, pursuant to s.112.10(2) and s. 172(3)(a) of the BPCPA, requiring that the Company refund all monies paid in excess of the Loan principal of each payday loan, including the Cash Card Fee Amounts, the Loan Fees, and any other fees or charges collected by the Company in relation to the payday loan, damages for conspiracy, and interest pursuant to the Court Order Interest Act at the rate of 30% compounded annually, as set out in the payday loan agreements or such other rate as the Court considers appropriate.

The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

Alberta - January 19, 2010 Claim

A statement of claim was served in Alberta by Shaynee Tschritter and Lynn Armstrong alleging that the Company was in breach of s. 347 of the Code (the interest rate provision) and certain provincial consumer protection statutes.

On January 19, 2010, the plaintiffs in the Alberta action brought forward an application to have a related subsidiary, as well as certain of the Company's customers’ third-party lenders, directors and officers added to the claim.

The Company agreed to a motion to certify the class proceeding if the third party lenders, officers and directors were removed as defendants. Class counsel agreed to the Company’s proposal. Consequently, the certification motion was granted in November of 2011.

6

The Company believes that it conducted its business in accordance with applicable laws and is defending the action vigorously. The likelihood of loss, if any, is not determinable at this time.

Alberta - September 18, 2012 Claim

On September 18, 2012, an action under the Alberta Class Proceedings Act was commenced in the Alberta Court of Queen's Bench by Kostas Efthimiou against The Cash Store Inc., Instaloans Inc., and The Cash Store Financial Services Inc. on behalf of all persons who, on or after March 1, 2010, borrowed a loan from the Cash Store or Instaloans that met the definition of a "payday loan" proposing that the Company has violated s. 11 and 12 of the Payday Loan Regulations in that all amounts charged to and collected from the Plaintiff and Class members by the Company in relation to the payday loans advanced to the Plaintiff and Class members in excess of the loan principal are Unlawful Charges under the Payday Loan Regulation and therefore seek restitution of or damages for the Unlawful Charges paid by the Plaintiff and Class members, repayment of the Unlawful Charges paid by the Plaintiff and Class members, damages for conspiracy, interest on all amounts found to be owing and any such associated legal costs.

The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

Saskatchewan

On October 9, 2012, an action under the Saskatchewan Class Actions Act was commenced in the Saskatchewan Court of Queen’s Bench by John Ironbow against The Cash Store Financial Services Inc., The Cash Store Inc. and Instaloans Inc. on behalf of all persons who, on or after January 1, 2012, borrowed a loan from the Company that met the definition of a “payday loan” proposing that the Company has made payday loans contingent on the supply of other goods or services contrary to s. 29 of the Payday Loans Act, charged or received amounts which are not provided for in the Payday Loans Act or Payday Loans Regulation, contrary to s. 23(5) of the Act, deducting or withholding from the initial advance an amount representing a portion of the cost of borrowing or other charges, contrary to s. 25 of the Payday Loans Act and charging or receiving an amount in excess of 23% of the loan principal, contrary to s. 23(1) and (4) of the Act and s. 14(1) of the Regulation. The plaintiff seeks restitution of damages for unlawful charges paid by the plaintiff and class members, repayment of unlawful charges paid by the plaintiff and class members, damages, interest on all amounts found to be owing and any such associated legal costs.

The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

Manitoba - April 23, 2010 Claim

On April 23, 2010, an action under the Manitoba Class Proceedings Act was commenced in the Manitoba Court of Queen’s Bench ("Manitoba Court") by Scott Meeking against The Cash Store Financial Services Inc., The Cash Store Inc. and 1152919 Alberta Ltd o/a Instaloans, proposing that a class action be certified on his own behalf and on behalf of all persons in Manitoba and others outside the province who obtained a payday loan from Cash Store or Instaloans. The action stems from the allegations that all payday loan fees collected by the defendants constitute interest and therefore violate s. 347 of the Criminal Code.

A class proceeding in Ontario in McCutcheon v. The Cash Store Inc. et al. was certified in 2006 and settled in 2008. That decision affected Manitoba residents, and presumptively resolved claims with respect to loans borrowed by Mr. Meeking, and other Manitoba residents, on or before December 2, 2008.

The Company asked the Manitoba court to enforce the Ontario settlement against Mr. Meeking. On September 9, 2013, the Manitoba Court of Appeal agreed that the Ontario Superior Court of Justice had properly exercised jurisdiction over Manitoba residents, including Mr. Meeking and his prospective class members, and enforced the Ontario settlement relating to borrowers of payday loans from the Company. However, it concluded that the Ontario judgment is not enforceable in Manitoba against Instaloans customers and for signature and title loans (as opposed to payday loans), as the Manitoba court determine Ontario had not given proper notice to Manitoba residents.

On September 12, 2013, the Manitoba Court certified Mr. Meeking’s claim as a class proceeding. On October 11, 2013, the Company applied for leave to appeal the certification decision.

7

On November 8, 2013, the Company filed an application for leave to appeal to the Supreme Court of Canada, seeking to appeal the Manitoba Court of Appeal decision that declined to enforce the Ontario settlement against Instaloans customers. The plaintiffs have also filed an application for leave to appeal to the Supreme Court of Canada, seeking to set aside the portion of the Manitoba Court of Appeal decision that enforced the Ontario settlement.

The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

Manitoba - November 1, 2012 Claim

On November 1, 2012, an action was commenced in Manitoba under The Class Proceedings Act by Sheri Rehill against The Cash Store Financial Services Inc., The Cash Store Inc., Instaloans Inc. and other defendants, on behalf of all persons who, on or after October 18, 2010, borrowed a loan from the Company in Manitoba where that loan met the definition of a “payday loan” as defined by the Payday Loans Act, S.S. 2007, c. P-4.3. The action alleges that the Company made loans contingent on the purchase of another product or service, contrary to s. 154.2 of the Consumer Protection Act, R.S.M. 1987, c. C-200, as am. (CPA), discounted the principal amount of loans by deducting or withholding an amount representing a portion of the cost of credit from the initial advance, contrary to s. 154.1 of the CPA and charging, requiring and accepting amounts in excess of the 17% total cost of credit limit contrary to s. 147(1) of the CPA and s. 13.1 of the Payday Loan Regulation, Man. Reg. 99/2007, as am. The plaintiff pleads for restitution and repayment of all amounts paid by borrowers as a cost of credit for their payday loans, damages for an alleged conspiracy, and interest on all amounts alleged to be owing.

The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

Ontario - August 1, 2012 Claim

On August 1, 2012, an action under the Ontario Class Proceedings Act was commenced in the Ontario Supreme Court of Justice by Timothy Yeoman against The Cash Store Financial Services Inc., The Cash Store Inc. and Instaloans Inc. and other defendants, claiming on behalf of the plaintiff and class members who entered into payday loan transactions with the Company in Ontario between September 1, 2011 and the date of judgment, that the Company operated an unlawful business model as the Company did not provide borrowers with the option to take their payday loan in an immediate liquid form and thereby misrepresenting the total cost of borrowing as the cost of additional services and devices should have been included.

The class members plead entitlement to damages and costs of investigation and prosecution pursuant to s. 36 of the Competition Act inclusive of the fees, interest and other amounts that the Company charged to the class members.

By Court order dated August 27, 2013, the plaintiff was permitted to amend the claim to add additional defendants. This amendment further claims that the Company’s lines of credit, offered since February 1, 2013, are payday loans subject to the Payday Loans Act, and are being offered without a payday loans license. The amendment claims that the Company acted in an unlawful conspiracy with the additional defendants.

The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

Ontario - July 5, 2012 Claim

On July 5, 2012, The Cash Store Inc. and Instaloans Inc. were charged with the offence of acting as a lender without being licensed as a lender and without having received notice in writing from the Registrar of the licence, contrary to section 6(1) of the Payday Loans Act, 2008, c.9 in Guelph (The Cash Store Inc.), Brantford, and Sarnia, Ontario (Instaloans Inc.). The charges were laid in each of the three jurisdictions on July 5, 2012 as a result of investigations made by the Ministry of Consumer Services relating to consumer complaints made by three consumers.

On November 18, 2013, Instaloans Inc. and The Cash Store Inc. pleaded guilty and were convicted of the offence of acting as a lender without being licensed as a lender and without having received notice in writing from the Registrar of the licence, contrary to section 6(1) of the Payday Loans Act, 2008, c.9 in Brantford, Sarnia, and Guelph, Ontario, respectively. As a result of this plea, The Cash Store and Instaloans Inc. agreed to pay $50 per conviction, in addition to a victim fee surcharge of 25%, for a total fine of $188.

8

Investor class proceedings

Canada

On June 3, 2013, a statement of claim brought under the Alberta Class Proceedings Act was commenced in the Alberta Court of Queen's Bench by Darren Hughes against The Cash Store Financial Services Inc. and certain of its present and former directors and officers. The plaintiff alleges, among other things, that the Company made misrepresentations during the period from November 24, 2010 to May 24, 2013 regarding the Company's internal controls over financial reporting and the value of the loan portfolio acquired from third-party lenders, losses on its internal consumer loan portfolio, and its liability associated with the settlement of the March 5, 2004 British Columbia Class Action

On June 4, 2013, a statement of claim brought under the Ontario Class Proceedings Act was commenced in the Ontario Superior Court of Justice by David Fortier against The Cash Store Financial Services Inc. and certain of its present and former directors and officers. The plaintiff alleges, among other things, that the Company made misrepresentations during the period from November 24, 2010 to May 24, 2013 regarding the Company's internal controls over financial reporting and the value of the loan portfolio acquired from third-party lenders, losses on its internal consumer loan portfolio, and its liability associated with the settlement of the March 5, 2004 British Columbia Class Action.

On July 11, 2013, a statement of claim brought under the Quebec Class Proceedings Act was commenced in the Quebec Superior Court of Justice by Marianne Dessis and Jean-Jacques Fournier against The Cash Store Financial Services Inc. and certain of its present and former directors and officers. The plaintiff alleges, among other things, that the Company made misrepresentations during the period from November 24, 2010 to May 24, 2013 regarding the Company's internal controls over financial reporting and the value of the loan portfolio acquired from third-party lenders, losses on its internal consumer loan portfolio, and its liability associated with the settlement of the March 5, 2004 British Columbia Class Action.

As at September 30, 2013, the Company has reached an agreement with the plaintiffs' counsel whereby the plaintiffs will proceed with the Ontario June 4, 2013 claim and seek a stay of the Alberta and Quebec claims.

Following the stay of the related Alberta claim, an amended statement of claim was issued on October 17, 2013, which, among other things, adds a statutory claim under the Alberta Securities Act. The plaintiffs’ motion seeking leave to pursue a secondary market liability claim under Part XXIII.1 of the Ontario Securities Act and to certify the claim as a class action under the Ontario Class Proceedings Act is currently scheduled to be heard by the Ontario Superior Court of Justice on May 20 and 21, 2014.

The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

United States

On May 20, 2013, Globis Capital Partners, L.P. filed a civil claim against the Company and Gordon J. Reykdal, Chief Executive Officer, in the United States District Court of the Southern District of New York for alleged violations of Sections 10(a) and 20(a) of the Securities Exchange Act of 1934 claiming unspecified damages.

On June 27, 2013, proposed class action proceedings for violation of U.S. federal securities laws were commenced by lead plaintiff Charles Nutsch in the United States District Court of the Southern District of New York against the The Cash Store Financial Services Inc. and certain of its present and former officers on behalf of purchasers of the common stock of The Cash Store Financial Services Inc. during the period between November 24, 2010 and May 13, 2013, inclusive. The proposed class actions concern alleged misrepresentations made in the Company's quarterly and annual financial statements between November 24, 2010 and May 13, 2013. In particular, the complaints allege that the Company overvalued the consumer loan portfolio acquired from third-party lenders, overstated its net income, understated losses on its internal consumer loans portfolio, and understated its liabilities associated with the settlement of the British Columbia class action.

By order dated July 9, 2013, the court consolidated the May 20, 2013 and June 27, 2013 actions for pretrial purposes. On September 17, 2013, the Court issued an order appointing Globis Capital Partners L.P. and Globis Overseas Funds Ltd. as lead plaintiffs in the class action. The Company is vigorously defending this action and the likelihood and amount of liability, if any, is not determinable at this time.

9

Other claims

Ontario - October 1, 2010 Claim

The Cash Store Financial Services Inc., The Cash Store Inc. and Instaloans Inc. commenced an action in the Superior Court of Ontario against National Money Mart Company (“Money Mart”) on October 1, 2010 for trade-mark infringement under sections 7, 19, 20 and 22 of the Trade-Marks Act, misrepresentation in the form of false and misleading advertising contrary to sections 52 and 74.01 of the Competition Act and the common law tort of passing off. The action relates to a national negative advertising campaign launched by Money Mart featuring the use of the Company’s registered trade-marks alongside negative statements comparing the Company's payday loan products to Money Mart’s loan products. Statements made in the Money Mart advertising campaign include, among other things, that the Company’s loan products are more expensive and less convenient than Money Mart’s and involve more forms and hassle. The Company seeks injunctive relief as well as $60,000 in damages in its Statement of Claim. Money Mart filed its statement of defense on May 2, 2011. The parties have settled a discovery plan and the next step in the action is to proceed to discoveries.

The likelihood and amount of gain (or loss), if any, is not determinable at this time.

Ontario - August 31, 2011 Application

On August 31, 2011, in response to regulatory amendments to come into force on September 1, 2011, The Cash Store Financial Services Inc., The Cash Store Inc. and Instaloans Inc. commenced an Application for Judicial Review in the Ontario Superior Court of Justice. The Application sought an order declaring that certain of the new amended regulations are outside the scope of the regulation-making authority under the Payday Loans Act, 2008, and were made without due process. The hearing was held on October 2, 2013. On November 5, 2013 the Court dismissed the Company’s application. The Company filed a notice of motion for leave to appeal to the Court of Appeal on November 22, 2013.

Ontario - June 7, 2013 Application

On June 7, 2013, an application was commenced in the Ontario Superior Court of Justice pursuant to section 54(1) of the Payday Loans Act, 2008, by the Director designated under the Ministry of Consumer and Business Services Act, naming The Cash Store Financial Services Inc., The Cash Store Inc. and Instaloans Inc. as respondents. The application seeks a declaration that the basic line of credit product offered constitutes a ‘payday loan’ under subsection 1(1) of the Payday Loans Act, and seeks orders requiring the Company to obtain a payday loan broker license and restraining the Company from acting as a loan broker of the basic line of credit without a broker’s license. The Application was heard by the Ontario Superior Court of Justice on November 29, 2013. It is unknown when a decision on this matter will be been rendered.

The Company has vigorously defended this application and the likelihood and amount of liability, if any, is not determinable at this time.

Alberta - September 18, 2013 Claim

On September 18, 2013, an action in the Court of Queen’s Bench of Alberta was commenced against the Company, certain of its officers and affiliates, including The Cash Store Inc., certain of its associated companies, including The Cash Store Australia Holdings Inc. and RTF Financial Holdings Inc., and other corporate defendants, seeking repayment of certain funds advanced to the Company, its affiliates and the associated companies by Assistive Financial Corp.("Assistive"), a former related party third-party lender. An application for interim relief, including the appointment of an inspector, was brought by the plaintiffs and is currently scheduled to be heard by the Court of Queen’s Bench of Alberta on December 12, 2013. The action by Assistive also seeks damages equivalent to $110.0 million together with interest thereon at the rate of17.5% per year.

The Company believes the action is wholly without merit and intends to vigorously defend itself. The likelihood and amount of liability, if any, is not determinable at this time.

Special Investigation

The Company’s Audit Committee was made aware of written communications that contained questions about the acquisition of the consumer loan portfolio from third-party lenders in late January 2012 (the “Transaction”) and included allegations regarding the existence of undisclosed related party transactions in connection with the Transaction. In response to this allegation, legal counsel to a special committee of independent directors of the Company (the “Special Committee”) retained an independent

10

accounting firm to conduct a special investigation. The investigation followed a review conducted by the Company’s internal auditor under the direction of the Audit Committee of the Board, and the restatement by the Company in December 2012 of its unaudited interim quarterly financial statements and MD&A for periods ended March 31, 2012 and June 30, 2012.

The investigation covered the period from December 1, 2010 to January 15, 2013 and was carried out over four months. It involved interviews of current and former officers, directors, employees and advisors of the Company and a review of relevant documents and agreements as well as electronically stored information obtained from Company computers and those of employees, former employees and directors most likely to have information relevant to the investigation.

The Special Committee has reported its findings on the allegations to the Board of Directors and, consistent with the recommendation made to the Board of Directors by the Special Committee, the Board of Directors has determined that no further corrections or restatements of previously reported financial statements and other public disclosures are required in relation to the Transaction.

Reliance on Third-Party Lenders

The Company’s business depends on the willingness of third-party lenders to make significant funds available for lending to the Company’s customers and to purchase loans that the Company has made. There are no assurances that existing or new third-party lenders will continue to make funds available. Any reduction or withdrawal of funds could have a material adverse impact on the Company’s results of operations and financial condition.

Refer to Item 5.E. Off-Balance Sheet Arrangements for a description of arrangements with third-party lenders.

Liquidity & Capital Resources

The Company requires continued access to capital. A significant reduction in cash flows from operations or access to funding to support the Company’s consumer lending products could materially and adversely affect the Company’s ability to achieve the Company’s planned growth and operating results.

As of September 30, 2013, the Company had approximately $127 million in senior secured notes debt and on November 29, 2013 the Company entered into a credit agreement that provided an additonal $12.0 million in debt financing. If cash flows and capital resources are insufficient to fund the debt service obligations and to satisfy working capital and other liquidity needs, the Company may be forced to reduce or delay capital expenditures, seek additional capital or seek to restructure or refinance indebtedness. These alternative measures may not be successful or may not permit the Company to meet its scheduled debt service obligations. In the absence of such operating results and resources, the Company could face substantial liquidity problems and might be required to sell material assets or operations to attempt to meet its debt service and other obligations. If the Company is unable to make the required payments on its debt obligations, the Company would be in default under the terms of its indebtedness which could result in an acceleration of the repayment obligations. Any such default, or any attempt to alter the business plans and operations to satisfy the obligations under the Company’s indebtedness, could materially adversely affect the Company’s business, prospects, results of operations and financial condition.

Competition

The payday loans industry is highly fragmented and very competitive. Competition may increase as the industry consolidates. In addition to other unsecured consumer lending and cheque cashing stores and online lenders, the Company competes with banks and other financial services entities and retail businesses that offer consumer loans, cash cheques, sell money orders, provide money transfer services or offer other products and services offered by the Company. Some competitors have larger and more established customer bases in other provinces and substantially greater financial and other resources than the Company has. As a result, the Company could lose market share and revenues could decline, thereby affecting the Company’s ability to generate sufficient cash flow to service indebtedness and fund operations.

Foreign Currency

UK operations have been funded to date by loans from the Canadian company. These loans are currently not hedged, thus they are vulnerable to currency exchange rate fluctuations between the British Pound and the Canadian Dollar. Upon consolidation,

11

as exchange rates vary, net sales and other operating results may differ materially from expectations, and the Company may record significant gains or losses on the remeasurement of intercompany balances. A 542 basis point increase/decrease in the exchange rate would increase/decrease net loss by approximately $1.3 million.

Growth Management

The Company’s expansion strategy, which in part contemplates the addition of new branches, and developing new products and distribution channels for the Company’s products in Canada and the UK is subject to significant risks. Continued growth in this manner is dependent upon a number of factors, including the ability to hire, train and retain an adequate number of experienced management employees, the availability of adequate financing for expansion activities, the ability to obtain any government permits and licenses that may be required, the ability to identify and overcome cultural and linguistic differences which may impact market practices within a given geographic region, and other factors, some of which are beyond the Company’s control.

There can be no assurance that the Company will be able to successfully grow its business or that the current business, results of operations and financial condition will not suffer if the Company is unable to do so. Expansion beyond the geographic areas where the Company’s branches are presently located will increase demands on management and divert their attention. In addition, expansion into new products and services will present new challenges to the business and will require additional management time.

Ability to Attract and Retain Qualified Employees

The Company’s future success depends to a significant degree on the members of its executive management team and their ability to execute on the growth strategies and provide expertise in developing international operations. The loss of the services of one or more members of the executive management team could harm the Company’s business and future development. Continued growth also depends on the Company’s ability to attract and retain additional skilled management personnel. If the Company is unable to attract and retain the requisite personnel as needed in the future, operating results and growth could suffer.

Changes to UK Business, Regulatory or Political climate

The Company’s growth plans include significant expansion in the UK. Changes in the business, regulatory or political environment, shareholder proposals, or significant fluctuations in currency exchange rates could affect the Company’s ability to expand or continue operations there, which could have a material adverse impact on the Company’s prospects, results of operations and cash flows.

Negative Public Perception

The media often portrays payday loan companies as predatory or abusive, which could negatively affect the Company’s business. Consumer advocacy groups, certain media reports, and some regulators and elected officials in the provinces in which the Company conducts business have from time to time advocated governmental action to prohibit or severely restrict certain types of payday lending. These efforts have often focused on lenders that charge consumers imputed interest rates and fees that are higher than those charged by credit card issuers to more creditworthy consumers and otherwise characterize the Company’s products and services as being predatory or abusive toward consumers. If consumers accept this negative characterization, demand for the Company’s loans could significantly decrease. In addition, media coverage and public statements that assert some form of corporate wrongdoing can lower morale, make it more difficult to attract and retain qualified employees, management and directors, divert management attention and increase expenses. These trends could adversely affect the business, prospects, results of operations and financial condition of the Company.

Valuation of Consumer Loans and Advances

The Company maintains an allowance for credit losses for anticipated losses on consumer loans and advances and loans and advances in default. To estimate the appropriate level of credit loss reserves, the Company considers known and relevant internal and external factors that affect loan collectability, including the amount of outstanding loans owed, historical loss trends, current collection patterns and current economic trends. These reserves are estimates, and if actual credit losses are

12

materially greater than loan loss reserves, the Company’s results of operations and financial condition could be adversely affected.

Share Price Volatility

The price of common shares has been subject to significant fluctuations and may continue to fluctuate or decline. Over the course of the twelve months ended September 30, 2013, the market price of the Company’s common shares on the TSX has been as high as $5.73, and as low as $1.50.

The market price of the Company’s common shares has been, and is likely to continue to be, subject to significant fluctuations due to a variety of factors, including quarterly variations in operating results, operating results which vary from the expectations of securities analysts and investors, changes in financial estimates, changes in market valuations of competitors, announcements by the Company or its competitors of a material nature, additions or departures of key personnel, changes in applicable laws and regulations governing consumer protection and lending practices, the effects of litigation, future sales of common shares, and general stock market price and volume fluctuations. In addition, general political and economic conditions such as a recession, or interest rate or currency rate fluctuations may adversely affect the market price of the common shares of many companies, including that of the Company. A significant decline in the Company’s share price could result in substantial losses for individual shareholders and could lead to costly and disruptive securities litigation.

Unauthorized Disclosure of Confidential Data

In the normal course of business, the Company is required to manage, use, and store large amounts of personally identifiable information, consisting primarily of confidential personal and financial data regarding customers. The Company also depends on its IT networks and systems, and those of third parties, to process, store, and transmit this information. As a result, the Company is subject to numerous laws and regulations designed to protect this information, such as Canadian federal and provincial laws governing the protection of financial or other individually identifiable information. Security breaches involving files and infrastructure could lead to unauthorized disclosure of confidential information, as well as shutdowns or disruptions of the Company’s systems.

If any person, including the Company’s employees or those of third-party vendors, negligently disregards or intentionally breaches the Company’s established controls with respect to such data or otherwise mismanages or misappropriates that data, the Company could be subject to costly litigation, monetary damages, fines, and/or criminal prosecution. Unauthorized disclosure of sensitive or confidential customer data by any person, whether through systems failure, unauthorized access to IT systems, fraud, misappropriation, or negligence, could result in negative publicity, damage to the Company’s reputation, and a loss of customers. Any unauthorized disclosure of personally identifiable information could subject the Company to liability under data privacy laws and adversely affect the business prospects, results of operations, and financial condition of the Company.

Dividends

The Company ceased paying dividends in the fourth quarter of FY2012 and may not pay dividends on its common shares within the next fiscal year. Therefore, any return on an investment in common shares of the Company may come only from an increase in the market value of the common shares of the Company. The Board of Directors reviews the Company’s dividend distribution policy on a quarterly basis. This review includes evaluating the financial position, profitability, cash flow and other factors that the Board of Directors considers relevant. The ability to declare and pay dividends is subject to compliance with a restricted payment covenant stipulated in the Indenture.

Internal Control Over Financial Reporting

As of September 30, 2013, an evaluation was carried out under the supervision of and with the participation of management, including the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of disclosure controls and procedures as defined in Rule 13a- 15(e) and Rule 15d - 15(e) under the 1934 Act, as amended, and in NI 52-109. Based on this evaluation, the Chief Executive Officer and Chief Financial Officer concluded that disclosure controls and procedures were not effective due to material weaknesses in the Company’s internal control over financial reporting.

13

Unless and until these issues are corrected, the Company's ability to report financial results or other information required to be disclosed on a timely and accurate basis may be adversely affected. In addition, remedying this matter will require additional management time and resources and cause the Company to incur additional costs. Further, the Company cannot provide any assurance that it will not identify additional control deficiencies that may constitute significant deficiencies or material weaknesses in its internal controls in the future.

ITEM 4. | INFORMATION ON THE COMPANY |

A. | History and Development of the Company |

The legal name of the Company is The Cash Store Financial Services Inc. The commercial names of the Company are “Cash Store Financial” and “Instaloans.”

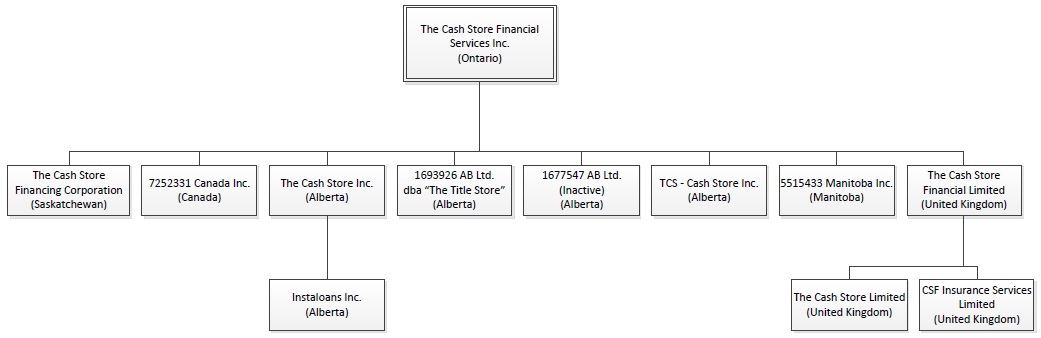

The Company was incorporated on February 23, 2001, under the Business Corporations Act (Ontario) (the “OBCA”), as B&B Capital Corporation. On August 1, 2001, B&B Capital Corporation changed its name to “Rentcash Inc.” and subsequently amalgamated with Larkfield Capital Corp. (“Larkfield”), under the OBCA, effective January 17, 2002 (the “Amalgamation”), with the amalgamated company continuing as Rentcash Inc. Larkfield was incorporated under the Company Act (British Columbia) on May 15, 2000, under the name Willow Creek Capital Corp. (“Willow Creek”). The name of Willow Creek was changed to “Larkfield Capital Corp.” on August 24, 2000, and Larkfield was subsequently continued into Ontario under the OBCA, effective January 15, 2002.

Pursuant to the Amalgamation, each common share of Rentcash was exchanged for one common share of the Company, and each three common shares of Larkfield were exchanged for one common share of the Company.

On April 22, 2005, the Company acquired the business assets and assumed certain liabilities of the Instaloans Group of Companies (“Instaloans”) for total cash consideration of $39.8 million. At the time of acquisition Instaloans operated 99 Canadian storefronts in the payday and short-term loan industry.

The Company changed its name on March 31, 2008, from Rentcash Inc. to “The Cash Store Financial Services Inc.” in connection with the spin-off of its rental division. Cash Store Financial’s common shares (the “Common Shares”) are traded on the Toronto Stock Exchange (“TSX”) under the symbol “CSF”. On June 8, 2010, the Company began trading its shares on the New York Stock Exchange (“NYSE”) under the symbol “CSFS”.

On March 31, 2008, pursuant to a plan of arrangement, the Company separated its rental business and certain of its assets and liabilities into an independent, publicly-traded company. Each existing shareholder of Cash Store Financial received one common share of Insta-Rent for each Common Share held on March 31, 2008.

On April 28, 2010, the Company’s board of directors (the "Board") approved a change in its fiscal year end from June 30 to September 30.

The registered office of the Company is located at Scotia Plaza, Suite 2100, 40 King Street West, Toronto, Ontario M5H 3C2. The head office of the Company is located at 15511 - 123 Avenue, Edmonton, Alberta T5V 0C3.

The Company’s agent in the United States is National Corporate Research, Ltd. 10 East 40th Street, 10th Floor New York, New York 10016 (212) 947-7200.

B. | Business Overview |

Nature of Company

The Company, under its “Cash Store Financial”, “Instaloans” and "The Title Store" banners, provides consumers with alternative financial products and services, serving everyday people for whom traditional banking may be inconvenient or unavailable. The Company acts as both a broker and lender of short term advances and offers a range of other products and services to help customers meet their day to day financial service needs. The Company employs a combination of payday loans and lines of credit as its primary consumer lending product offerings and earns fees and interest income on these consumer lending products. The Company also offers a wide range of financial products and services including bank accounts, prepaid MasterCard and private label credit and debit cards, cheque cashing, money transfers, payment insurance and prepaid phone cards. The Company has agency arrangements with a variety of companies to provide these products.

14

The table below illustrates the Company’s primary consumer lending offerings summarized by jurisdiction since October 1, 2011:

Jurisdiction | Branches | Oct 1, 2011 to Jan 31, 2012 | Feb 1, 2012 to Sep 30, 2012 | Oct 1, 2012 to Jan 31, 2013 | Feb 1, 2013 to Present | |||||

British Columbia, Alberta Saskatchewan Nova Scotia | 278 | Payday Loans (Brokered) | Payday Loans (Direct Lending) | |||||||

Manitoba | 25 | Payday Loans (Brokered) | Payday Loans (Direct Lending) | Lines of Credit (Brokered) | ||||||

Ontario | 174 | Payday Loans (Brokered) | Payday Loans (Direct Lending) | Lines of Credit (Brokered) | ||||||

New Brunswick Newfoundland Prince Edward Isl. Yukon / NWT | 33 | Payday Loans (Brokered) | ||||||||

United Kingdom | 27 | Payday Loans (Direct Lending) | ||||||||

Products and Services

Consumer Loans & Line of Credit | |

Payday | - Bridge loans to help our clients span temporary cash shortfalls or meet emergency or unexpected expenses - Short-term non-collateralized loans - Range from $100 to $1500. |

Signature | - Short-term loan against a government source of income (Child Tax, Disability, Pension, Employment Insurance) |

Lines of Credit | - Up to $5000 unsecured - Helps customers to rebuild their credit - Customers borrow as needed and repay at any time - Minimum payments are due at regular intervals - Introduced early in FY2012 |

Injury Claims | - Immediate cash for personal injury claims awaiting payout - Provided by Rhino Legal Finance Inc. |

Diversified Financial Products | |

Bank Accounts: Standard & Premium | - Provided by DC Bank - Gives customers access to a variety of services - CDIC insured |

Cheque Cashing | - Fast turn around - Funds transferred electronically; branches do not hold cash |

Prepaid Credit Card | - Supplied by DC Bank and MasterCard - Provides the convenience of a credit card without interest - Can be used online |

Prepaid Debit Card | - Supplied by DC Bank - Preloaded with funds for daily transactional needs and access to cash at ATMs |

Money Transfer | - Provided by RIA Financial Services - Provides an easy and reliable way to pay bills or send and receive funds worldwide |

Payment Insurance | - Covers outstanding loan balances in the event of unexpected events such as: involuntary unemployment, accidental injury, critical illness, death, dismemberment |

Payday loans – direct lending

The Company typically arranges for advances to customers that range from $100 to $1,500. In order to receive an advance, a customer is required to provide proof of income, copies of recent bank statements, current proof of residence and current telephone and utility bills. The customer must then either write a cheque or execute a pre-authorized debit agreement for the amount of the advance plus loan fees. Deposit of the cheque is deferred until the due date of the loan, which is the customer’s next payday (normally 7 to 14 days but no later than 31 days).

15

Payday loans – brokering

For loans that the Company brokers on behalf of customers, the application process and documentation requirements are similar to those for direct lending. After an application is completed and other relevant information is obtained from a customer, the Company brokers the customer’s loan request to third-party lenders. Based on approval criteria established by the third-party lenders, the customers’ eligibility for an advance is assessed. If the customer is approved, the Company provides the lender’s loan documentation to the customer. Upon fulfillment of the loan documentation requirements, the Company is authorized by the lender to forward the cash advance to the customer on behalf of the lender. When an advance becomes due and payable, the customer must make repayment of the principal and interest owing to the lender through the Company, which, in turn, remits the funds to the third-party lender. If there is difficulty with the collection process, the customer’s account may be turned over to an independent collection agency.

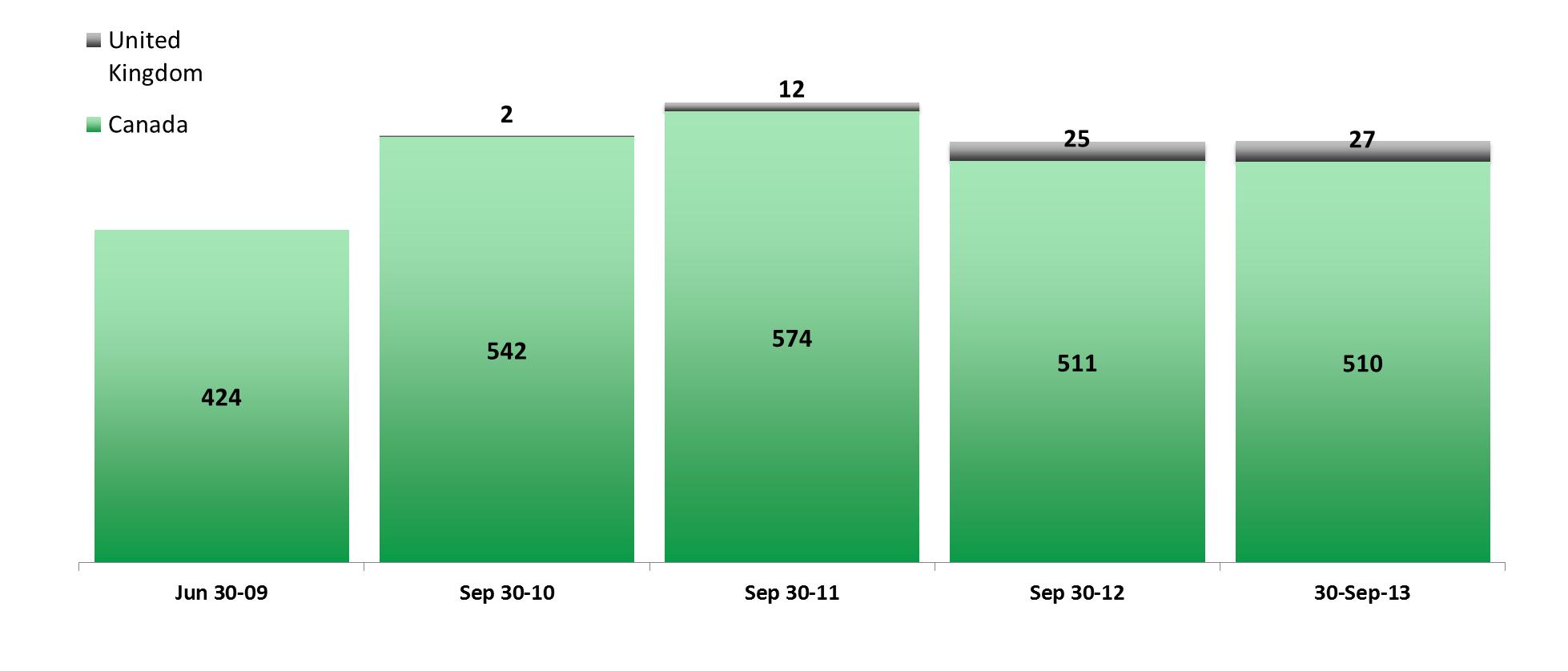

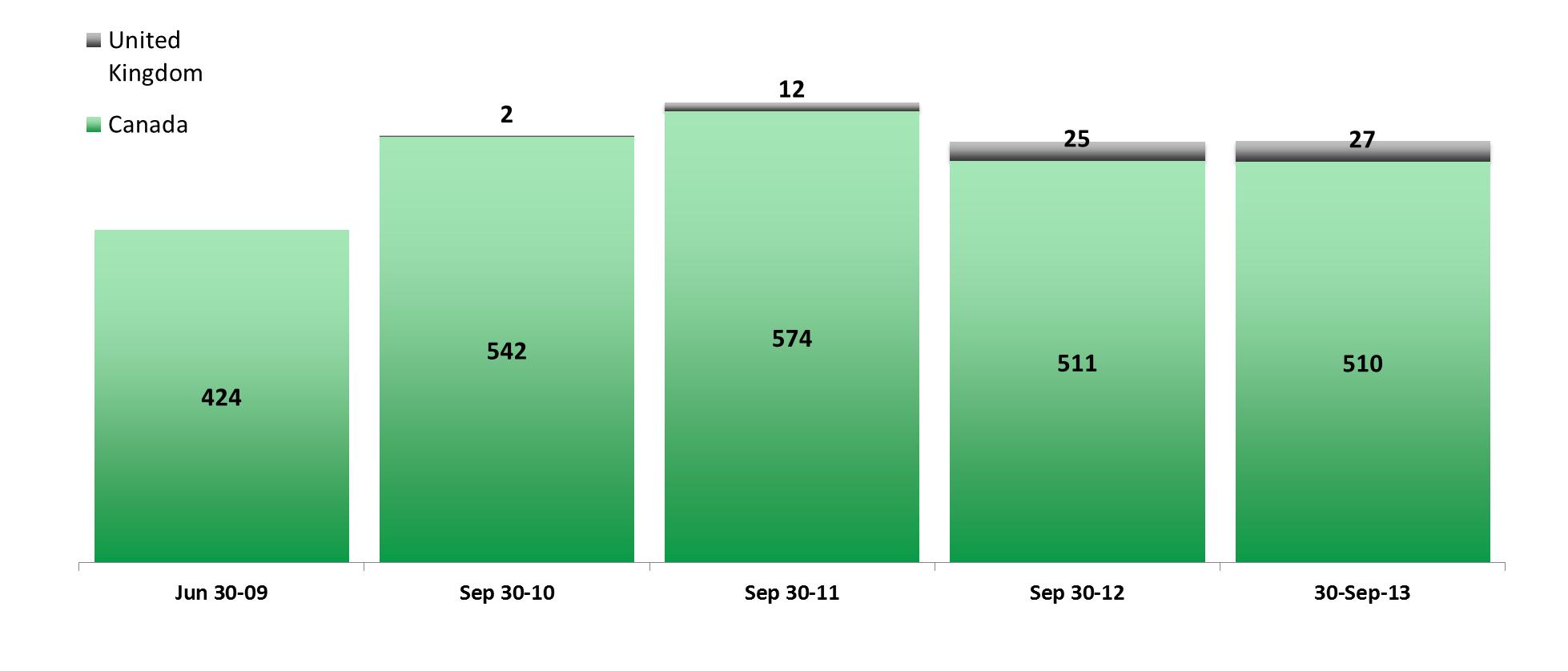

Principal Markets

The Company conducts business in Canada and the United Kingdom. As at September 30, 2013, the Company operated 537 (September 30, 2012 - 536) short-term advance branches across Canada (510 branches) and the United Kingdom (27 branches). The Company operates branches in all Canadian provinces and territories except Quebec and Nunavut. The following chart presents the geographic distribution of the Company’s branches:

Branches | ||

British Columbia | 97 | |

Alberta | 122 | |

Saskatchewan | 34 | |

Manitoba | 25 | |

Ontario | 174 | |

New Brunswick | 14 | |

Nova Scotia | 25 | |

Prince Edward Island | 3 | |

Newfoundland and Labrador | 13 | |

Northwest Territories | 2 | |

Yukon | 1 | |

United Kingdom | 27 | |

Total | 537 | |

Revenue Breakdown

September 30, 2011 | September 30, 2012 | September 30, 2013 | |||||||

Canada | 187,356 | 177,186 | 180,412 | ||||||

United Kingdom | 2,543 | 10,226 | 10,353 | ||||||

189,899 | 187,412 | 190,765 | |||||||

The Company also has investments in the following foreign operations:

• | 18.3% of the outstanding common shares of The Cash Store Australia Holdings Inc., which operated payday loan branches in Australia under the name “The Cash Store Pty.” ("Pty"). The Cash Store Australia Holdings Inc. is publicly listed on the TSX Venture exchange under the symbol “AUC”. In December of 2012 the Alberta, Ontario and British Columbia Securities Commissions issued cease trade orders in respect of the shares of AUC for failure to file financial statements. On September 13, 2013 Pty appointed a voluntary administrator pursuant to Section 436A of the Australian Corporations Act 2001. In the opinion of the directors of Pty, Pty is insolvent. The Administrator has taken control of the operations and assets of Pty and the application to have the cease trade orders revoked have been withdrawn by AUC. |

• | 15.7% of the outstanding common shares of RTF Financial Holdings Inc., a private company in the business of short-term lending by utilizing highly automated mobile technology (SMS text message lending). RTF Financial Holdings Inc. currently operates in the UK. |

16

Seasonality

The Company’s business is not significantly affected by seasonality. Typically the Company’s strongest revenues are in its third and fourth fiscal quarters (which correspond with tax season and the summer months) followed by the Company’s first fiscal quarter (Christmas/holiday season). The Company’s second fiscal quarter is typically the weakest. In addition to seasonal demand, quarterly results are impacted by the number and timing of new branch openings.

Raw Materials

Not Applicable.

Marketing Channels

The Company sells consumer lending products and services directly to consumers through its network of physical branches. Products and services where the Company acts as agent on behalf of other providers are also sold directly to consumers through the Company’s branch network and the Company earns fee and commission revenue. The Company does not employ special sales methods for its products and services.

The Company markets its products and services directly to consumers through a variety of channels, including newspaper, billboards, radio, television, mail drops, search engine marketing, search engine optimization, social media, community involvement and sponsorships.

Dependence

The Company’s business depends on the willingness of third-party lenders to make significant funds available for lending to the Company’s customers and to purchase loans that the Company has made. There are no assurances that existing or new third-party lenders will continue to make funds available. Any reduction or withdrawal of funds could have a material adverse impact on the Company’s results of operations and financial condition.

Refer to Off-Balance Sheet Arrangements for a description of arrangements with third-party lenders.

Competitive Position

The Company has a market share of approximately one third of all payday loan branches in Canada. The Company estimates there are approximately 1,500 short-term advance branches across Canada. The Company’s biggest competitor is DFC Global Corp. (“Dollar Financial”), a U.S.-based public company. Dollar Financial operates approximately 489 branches in Canada under the banner “Money Mart”. “Cash Money” is the next largest operator in Canada with approximately 120 branches. The remainder of the payday loans market consists of small, single store operations and regional operations that may have a number of payday loan advance centres in a given region. Competition also comes from companies, such as cheque cashers, pawnshops, rental stores and others, that offer the payday loan service as an ancillary service. Several companies also provide payday loans via the Internet.

In addition to other unsecured consumer lending and cheque cashing stores and online lenders, the Company competes with banks and other financial services entities and retail businesses that offer consumer loans and lines of credit, cash cheques, sell money orders, provide money transfer services or offer other products and services offered by the Company.

The Company estimates that the UK market for small, unsecured short-term consumer loans is served by approximately 1,200 store locations as well as numerous online lenders.

Some of the Company's competitors have larger and more established customer bases in other provinces and substantially greater financial and other resources than the Company.

Competitive Strengths

Management believes that the Company has a number of competitive strengths that provide a solid base for continued growth.