| THE CASH STORE FINANCIAL SERVICES INC. |

| CONSOLIDATED FINANCIAL STATEMENTS |

| For the twelve and fifteen months ended September 30, 2011 and |

| September 30, 2010 |

| (Restated) |

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL STATEMENTS

The accompanying consolidated financial statements and management’s discussion and analysis (MD&A) are the responsibility of management and have been approved by the Board of Directors. The consolidated financial statements and MD&A have been prepared by management in accordance with Canadian generally accepted accounting principles and include some amounts based on management’s best estimates and informed judgments. When alternative accounting methods exist, management has chosen those it considers most appropriate in the circumstances.

The Cash Store Financial Services Inc. maintains a system of internal controls to provide reasonable assurance that transactions are properly authorized, financial records are accurate and reliable and the Company’s assets are properly accounted for and adequately safeguarded.

The Board of Directors is responsible for ensuring that management fulfills its responsibility for financial reporting and is ultimately responsible for reviewing and approving the financial statements. The Board of Directors carries out its responsibility for the financial statements through its Audit Committee. This Committee meets periodically with management and the independent external auditors to review the financial statements and the MD&A and to discuss audit, financial and internal control matters. The Company’s independent external auditors have full and free access to the Audit Committee. The Audit Committee is responsible for approving the remuneration and terms of engagement of the Company’s independent external auditors. The consolidated financial statements have been subject to an audit by the Company’s internal auditors and the Company’s external auditors, KPMG LLP, in accordance with generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States) on behalf of the shareholders.

The consolidated financial statements and MD&A have, in management’s opinion, been properly prepared within reasonable limits of materiality and within the framework of the significant accounting policies summarized in note 1 of the notes to the consolidated financial statements.

| Signed "Gordon J. Reykdal” | Signed "Craig Warnock” | |

| Gordon J. Reykdal | Craig Warnock, CMA | |

| Chairman and | Chief Financial Officer | |

| Chief Executive Officer |

May 24, 2013

Edmonton, Alberta, Canada

| Page 2 |

|

|||

| KPMG LLP | Telephone | (780) 429-7300 | |

| Chartered Accountants | Fax | (780) 429-7379 | |

| 10125 – 102 Street | Internet | www.kpmg.ca | |

| Edmonton AB T5J 3V8 | |||

| Canada |

REPORT OF Independent REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of The Cash Store Financial Services Inc.

We have audited The Cash Store Financial Services Inc.’s internal control over financial reporting as of September 30, 2011, based on the criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Cash Store Financial Services Inc.'s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting (“ICFR”) included in Management’s Report on Internal Control over Financial Reporting included in Form 40-F for the year ended September 30, 2011. Our responsibility is to express an opinion on The Cash Store Financial Services Inc.'s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements.

| Page 3 |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our report dated November 16, 2011, we expressed an unqualified opinion that The Cash Store Financial Services Inc. maintained, in all material respects, effective internal control over financial reporting as of September 30, 2011, based on the criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As described in the following paragraph, material weaknesses were subsequently identified as a result of the restatement of the previously issued financial statements. As a result, management has revised its assessment, as presented in the accompanying Management's Report on Internal Control Over Financial Reporting, to conclude that The Cash Store Financial Services Inc.’s internal control over financial reporting was not effective as of September 30, 2011. Accordingly, our present opinion on the effectiveness of The Cash Store Financial Services Inc. internal control over financial reporting as of September 30, 2011 as expressed herein, is different from that expressed in our previous report.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. Management has identified two material weaknesses: 1) management did not design and implement effective ICFR related to the identification, assessment and disclosure or related parties and related party disclosures, and 2) management determined that the Company did not design and implement effective ICFR related to the review and interpretation of complex legal agreements. We also have audited, in accordance with Canadian generally accepted auditing standards, the consolidated balance sheets of The Cash Store Financial Services Inc. as of September 30, 2011 and 2010, and the related consolidated statements of operations and comprehensive income, retained earnings, and cash flows for the year ended September 30, 2011 and the fifteen months ended September 30, 2010. With respect to the consolidated financial statements for the year ended September 30, 2011, we also conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). These material weaknesses were considered in determining the nature, timing, and extent of audit tests applied in our audit of the 2011 consolidated financial statements, and this report does not affect our report dated November 16, 2011, except for the restatement of previously reported results discussed in Note 3 to the consolidated financial statements, which is as of May 24, 2013, in which we expressed an unqualified opinion on those consolidated financial statements.

| Page 4 |

In our opinion, because of the effect of the aforementioned material weaknesses on the achievement of the objectives of the control criteria, The Cash Store Financial Services Inc. has not maintained, in all material respects, effective internal control over financial reporting as of September 30, 2011, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission.

Signed “KPMG LLP”

Chartered Accountants

Edmonton, Canada

November 16, 2011, except for the effect of the material weaknesses described in Management’s

Report on Internal Control Over Financial Reporting, which is as of May 24, 2013

| Page 5 |

|

|||

| KPMG LLP | Telephone | (780) 429-7300 | |

| Chartered Accountants | Fax | (780) 429-7379 | |

| 10125 – 102 Street | Internet | www.kpmg.ca | |

| Edmonton AB T5J 3V8 | |||

| Canada |

Independent auditors’ report of registered public accounting firm

To the Shareholders and Board of Directors of The Cash Store Financial Services Inc.

We have audited the accompanying consolidated financial statements of The Cash Store Financial Services Inc., which comprise the consolidated balance sheets as at September 30, 2011 and 2010, the consolidated statements of operations and comprehensive income, retained earnings, and cash flows for the year ended September 30, 2011 and the fifteen months ended September 30, 2010, and notes, comprising a summary of significant accounting policies and other explanatory information.

Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with Canadian generally accepted accounting principles, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards. With respect to the consolidated financial statements for the year ended September 30, 2011, we also conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we comply with ethical requirements and plan and perform an audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

| KPMG LLP, is a Canadian limited liability partnership and a member firm of the KPMG | |

| network of independent member firms affiliated with KPMG International Cooperative | |

| (“KPMG LLP”), a Swiss entity. | |

| KPMG Canada provides services to KPMG LLP. |

| Page 6 |

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of The Cash Store Financial Services Inc. as of September 30, 2011 and 2010, and its consolidated results of operations and its consolidated cash flows for the year ended September 30, 2011 and the fifteen months ended September 30, 2010, in accordance with Canadian generally accepted accounting principles.

Restatement of the previously reported results

Without modifying our opinion, we draw attention to Note 3 to the consolidated financial statements as at and for the year ended September 30, 2011 which indicates that these consolidated financial statements and the September 30, 2010 comparative information have been restated from those on which we originally reported on November 16, 2011 and more extensively discusses the reason for the restatement.

Other Matter

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), The Cash Store Financial Services Inc.’s internal control over financial reporting as of September 30, 2011, based on the criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and our report dated November 16, 2011, except for the effects of the material weaknesses described in the sixth paragraph of our report which is as of May 24, 2013, expressed an adverse opinion thereon.

Signed “KPMG LLP”

Chartered Accountants

Edmonton, Canada

November 16, 2011, except for the restatement discussed in Note 3, which is as of May 24, 2013

| Page 7 |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME |

| (in thousands, except share and per share amounts) |

| Year ended | Fifteen months ended | |||||||

| September 30 2011 | September 30 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| REVENUE | ||||||||

| Loan fees | $ | 136,623 | $ | 170,659 | ||||

| Other income - Note 6 | 53,276 | 49,859 | ||||||

| 189,899 | 220,518 | |||||||

| EXPENSES | ||||||||

| Salaries and benefits | 77,136 | 84,614 | ||||||

| Selling, general and administrative | 31,691 | 32,550 | ||||||

| Interest expense | 616 | - | ||||||

| Retention payments | 26,786 | 28,167 | ||||||

| Rent | 19,074 | 18,553 | ||||||

| Advertising and promotion | 5,865 | 6,109 | ||||||

| Provision for loan losses - Note 24 | 2,559 | 788 | ||||||

| Depreciation of property and equipment | 7,950 | 8,138 | ||||||

| Amortization of intangible assets | 965 | 923 | ||||||

| Class action settlements - Note 14 | 368 | 11,685 | ||||||

| 173,010 | 191,527 | |||||||

| INCOME BEFORE INCOME TAXES | 16,889 | 28,991 | ||||||

| PROVISION FOR INCOME TAXES - NOTE 12 | ||||||||

| Current | 6,157 | 11,196 | ||||||

| Future (recovery) | 153 | (2,068 | ) | |||||

| 6,310 | 9,128 | |||||||

| NET INCOME AND COMPREHENSIVE INCOME | $ | 10,579 | $ | 19,863 | ||||

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING - Note 18 | ||||||||

| Basic | 17,259,196 | 16,913,213 | ||||||

| Diluted | 17,663,380 | 17,522,246 | ||||||

| BASIC EARNINGS PER SHARE | ||||||||

| Net income and comprehensive income | $ | 0.61 | $ | 1.17 | ||||

| DILUTED EARNINGS PER SHARE | ||||||||

| Net income and comprehensive income | $ | 0.60 | $ | 1.13 | ||||

See accompanying notes to the consolidated financial statements

| Page 8 |

| CONSOLIDATED BALANCE SHEETS |

| (in thousands) |

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| ASSETS | ||||||||

| Cash - Note 5 | $ | 19,291 | $ | 19,639 | ||||

| Other receivables - Note 6 | 12,575 | 9,140 | ||||||

| Consumer loans receivable, net - Note 7 | 4,781 | 4,460 | ||||||

| Prepaid expenses and other assets | 4,370 | 2,135 | ||||||

| Current future income taxes | 3,000 | 2,783 | ||||||

| 44,017 | 38,157 | |||||||

| Long-term receivable - Note 6 | 681 | 450 | ||||||

| Deposits and other assets | 857 | 684 | ||||||

| Future income taxes - Note 12 | 2,468 | 2,381 | ||||||

| Property and equipment - Note 9 | 25,589 | 24,986 | ||||||

| Intangible assets - Note 10 | 10,578 | 10,648 | ||||||

| Goodwill - Note 11 | 39,133 | 39,108 | ||||||

| $ | 123,323 | $ | 116,414 | |||||

| LIABILITIES | ||||||||

| Accounts payable and accrued liabilities - Note 13 | $ | 29,537 | $ | 24,997 | ||||

| Income taxes payable | 138 | 2,116 | ||||||

| Current portion of deferred revenue - Note 15 | 1,135 | 1,277 | ||||||

| Current portion of deferred lease inducements | 490 | 427 | ||||||

| Current portion of obligations under capital leases - Note 16 | 659 | 961 | ||||||

| 31,959 | 29,778 | |||||||

| Deferred revenue - Note 15 | 4,976 | 5,916 | ||||||

| Deferred lease inducements | 1,082 | 1,039 | ||||||

| Obligations under capital leases - Note 16 | 636 | 991 | ||||||

| Future income taxes - Note 12 | 2,388 | 1,936 | ||||||

| 41,041 | 39,660 | |||||||

| SHAREHOLDERS' EQUITY | ||||||||

| Share capital - Note 17 | 46,149 | 43,468 | ||||||

| Contributed surplus - Note 19 | 4,178 | 3,981 | ||||||

| Retained earnings | 31,955 | 29,305 | ||||||

| 82,282 | 76,754 | |||||||

| $ | 123,323 | $ | 116,414 | |||||

| Commitments - Note 21 | |

| Contingencies - Note 22 | |

| Subsequent event - Note 26 | |

| Approved by the Board: | |

| Signed "Gordon J. Reykdal" | Signed "J. Albert Mondor" |

| Director | Director |

See accompanying notes to the consolidated financial statements

| Page 9 |

| CONSOLIDATED STATEMENTS OF RETAINED EARNINGS |

| (in thousands) |

| Year ended | Fifteen months ended | |||||||

| September 30 2011 | September 30 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| RETAINED EARNINGS, BEGINNING OF PERIOD | $ | 29,305 | $ | 20,978 | ||||

| Dividends on common shares - Note 20 | (7,929 | ) | (9,120 | ) | ||||

| Shares repurchased - Note 17 (a) | - | (2,416 | ) | |||||

| Net income and comprehensive income for the period | 10,579 | 19,863 | ||||||

| RETAINED EARNINGS, END OF PERIOD | $ | 31,955 | $ | 29,305 | ||||

See accompanying notes to the consolidated financial statements

| Page 10 |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (in thousands) |

| Year ended | Fifteen months ended | |||||||

| September 30 2011 | September 30 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| Cash provided by (used in): | ||||||||

| OPERATING ACTIVITIES | ||||||||

| Net income | $ | 10,579 | $ | 19,863 | ||||

| Items not affecting cash: | ||||||||

| Depreciation of property and equipment | 7,950 | 8,138 | ||||||

| Amortization of intangible assets | 965 | 923 | ||||||

| Provision for loan losses - Note 24 | 2,559 | 788 | ||||||

| Equity loss on investments - Note 8 | - | 540 | ||||||

| Stock-based compensation - Note 19 | 786 | 1,098 | ||||||

| Future income taxes (recovery) | 153 | (2,068 | ) | |||||

| 22,992 | 29,282 | |||||||

| Change in non-cash operating items: | ||||||||

| Other receivables and long-term receivables | (3,666 | ) | (6,662 | ) | ||||

| Prepaid expenses, deposits and other assets | (2,408 | ) | (841 | ) | ||||

| Income taxes receivable | - | 150 | ||||||

| Accounts payable and accrued liabilities | 5,195 | 10,232 | ||||||

| Income taxes payable | (1,978 | ) | 2,116 | |||||

| Deferred revenue | (1,082 | ) | 7,047 | |||||

| Deferred lease inducements | 106 | 720 | ||||||

| Cash generated by operating activities | 19,159 | 42,044 | ||||||

| INVESTING ACTIVITIES | ||||||||

| Consumer loans receivable, net | (2,881 | ) | (4,985 | ) | ||||

| Business acquisitions - Note 4 | (25 | ) | (5,276 | ) | ||||

| Cash restricted - Note 5 | - | (1,757 | ) | |||||

| Purchase of intangible assets | (895 | ) | (2,648 | ) | ||||

| Purchase of property and equipment | (9,091 | ) | (17,440 | ) | ||||

| Purchase of long-term investments | - | (360 | ) | |||||

| Cash used in investing activities | (12,892 | ) | (32,466 | ) | ||||

| FINANCING ACTIVITIES | ||||||||

| Repayment of obligations under capital leases | (778 | ) | (156 | ) | ||||

| Dividends paid on common shares - Note 20 | (7,929 | ) | (9,120 | ) | ||||

| Issuance of common shares | 2,092 | 2,397 | ||||||

| Shares repurchased | - | (3,336 | ) | |||||

| Cash used in financing activities | (6,615 | ) | (10,215 | ) | ||||

| (DECREASE) INCREASE IN CASH | (348 | ) | (637 | ) | ||||

| CASH, BEGINNING OF PERIOD | 13,382 | 14,019 | ||||||

| CASH, END OF PERIOD | $ | 13,034 | $ | 13,382 | ||||

| Supplemental cash flow information: | ||||||||

| Interest paid | $ | 147 | $ | 210 | ||||

| Interest received | 30 | 8 | ||||||

| Income taxes paid (inclusive of tax refunds) | 8,132 | 8,891 | ||||||

See accompanying notes to the consolidated financial statements

| Page 11 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Explanatory Note

These consolidated financial statements as initially reported have been amended and restated to correct for certain errors. Refer to Note 3 for a description of the nature and amount of the restatement adjustments.

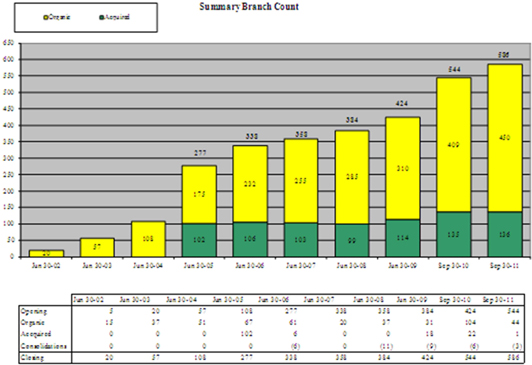

Nature of Business

The Cash Store Financial Services Inc. (the “Company”) operates under two branch banners: The Cash Store Financial and Instaloans, who act as brokers and lenders to facilitate short-term advances and provide other financial services, to income-earning consumers. As at September 30, 2011, the Company operated 586 (2010 – 544) branches. The Company has operations in Canada and the United Kingdom.

The Cash Store Financial is a Canadian corporation that is not affiliated with Cottonwood Financial Ltd. or the outlets Cottonwood Financial Ltd. who operates in the United States under the name "Cash Store." The Cash Store Financial does not do business under the name "Cash Store" in the United States and does not own or provide any consumer lending services in the United States.

Change in Fiscal Year

In 2010, the Company changed its fiscal year end from June 30 to September 30. The fiscal year end change results in a 15 month comparative reporting period from July 1, 2009 to September 30, 2010.

Note 1 – Significant Accounting Policies

| (a) | Basis of Presentation |

These consolidated financial statements have been prepared by management in accordance with Canadian generally accepted accounting principles (Canadian GAAP) and differ in certain respects from accounting principles generally accepted in the United States of America (U.S. GAAP), as described in Note 28. The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All significant inter-company balances and transactions have been eliminated.

All figures are presented in Canadian dollars, unless otherwise disclosed.

| (b) | Use of Estimates |

The preparation of the consolidated financial statements in conformity with Canadian and U.S. GAAP requires management to make estimates and assumptions that affect the reported assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Certain estimates, such as those related to allowance for consumer loan losses, property and equipment, goodwill and intangible asset, income taxes, accrued liabilities related to the class action lawsuits, depend upon subjective or complex judgments about matters that may be uncertain, and changes in

| Page 12 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 1 – Significant Accounting Policies (continued)

| (b) | Use of Estimates (continued) |

those estimates could materially impact the consolidated financial statements. Actual results could differ from those estimates made by management.

| (c) | Business Combinations |

The Company accounts for all business combinations using the acquisition method. Acquisition related costs which include finder’s fees, advisory, legal, accounting, valuation, other professional or consulting fees, and administrative costs are expensed as incurred.

| (d) | Revenue Recognition |

Revenue arising from brokering short-term advances for customers is recognized once all services have been rendered, all advance amounts have been received by the customer, and the brokerage fee has been received by the Company. Revenue from this source is recorded in Loan fees in the statement of operations.

Revenue arising from direct lending of short-term advances to customers is recognized on a constant yield basis ratably over the term of the related loan.

Revenue from the Company’s cheque cashing, money order sales, money transfer, bill payment services and other miscellaneous services is recognized when the transactions are completed at the point-of-sale in the branch and the related fee charged by the Company has been received. Revenue from the Company’s banking and non-sufficient funds fees are recognized when collected.

Revenue from each of these sources is recorded in Other income in the statement of operations.

| (e) | Retention Payments |

When the Company acts as a broker on behalf of income earning consumers seeking short-term advances, the funding of short-term advances is provided by independent third party lenders. The advances provided by the third party lenders are repayable by the customer to the third party lenders and represent assets of the lenders; accordingly, they are not included on the Company’s balance sheet.

To facilitate the short term advance business, the Company has entered into written agreements with third party lenders who are prepared to consider lending to the Company’s customers. Pursuant to these agreements, the Company provides services to the lenders related to the collection of documents and information as well as loan collection services. Under the terms of the Company’s agreements with third party lenders, responsibility for losses suffered on account of uncollectible loans rests with the third party lender, unless the Company has not properly performed its duties as set forth under the terms of the agreement. The significant duties under the terms of the agreements generally include ensuring that any proposed loan was applied for through an authorized outlet, ensuring each potential customer meets the loan selection criteria as set forth by the third party lender prior to approval and release of funding, satisfying the documentation requirements in a full and timely manner, providing loan management services throughout the term of the loan, and providing collection services on behalf of the third party lender for all loans funded which are not paid in full by the due date, all of which while ensuring information system integrity is maintained. In the event the Company does not properly perform its duties and the lenders make a claim as required under the agreement, the Company may be liable to the lenders for losses they have incurred. A liability is recorded when it is determined that the Company has a liability under the agreement.

| Page 13 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 1 – Significant Accounting Policies (continued)

| (e) | Retention Payments (continued) |

The Company’s Board of Directors regularly approves a resolution which authorizes management to pay a maximum amount of retention payments per quarter to third party lenders as consideration to those lenders that continue to be willing to fund advances to the Company’s customers. While the third party lenders have not been guaranteed a return, the decision has been made to voluntarily make retention payments to the lenders to lessen the impact of loan losses experienced by the third party lenders. Retention payments are recorded in the period in which a commitment is made to a lender pursuant to the resolution approved by the Board of Directors.

| (f) | Provision for Loan Losses |

Loans in default consist of direct lending short-term consumer loans originated by the Company which are past due. The Company defines a past due or delinquent account whereby payment has not been received in full from the customer on or before the maturity date of the loan. A provision for loan losses is recorded when the Company no longer has reasonable assurance of timely collection of the full amount of principal and interest (included in loan fee). In determining whether the Company will be unable to collect all principal and interest payments due, the Company assesses relevant internal and external factors that affect loan collectability, including the amount of outstanding loans owed to the Company, historical percentages of loans written off, current collection patterns and other current economic trends. The provision for loan losses reduces the carrying amount of consumer loan receivables to their estimated realizable amounts. The provision is primarily based upon models that analyze specific portfolio statistics, and also reflect, to a lesser extent, management judgement regarding overall accuracy. The analytical model takes into account several factors, including the number of transactions customers complete and charge-off and recovery rate. The provision is reviewed monthly, and any additional provision as a result of historical loan performance, current and expected collection patterns and current economic trends is included in the provision for the loan losses at that time. If the loans remain past due for an extended period of time, an allowance for the entire amount of the loan is recorded and the loan is ultimately written off. The Company’s policy for charging off uncollectible consumer loans is to write the loan off when a loan remains in default status for an extended period of time without any extended payment arrangements made, typically 210 days. Loans to customers who file for bankruptcy are written off upon receipt of the bankruptcy notice.

| (g) | Stock Based Compensation |

The Company has a stock based compensation plan, which is described in Note 17 (b). The Company accounts for all stock based compensation payments that are settled by the issuance of equity in accordance with a fair value-based method of accounting. Stock based compensation awards are recognized in the financial statements over the period in which the related services are rendered, which is usually the vesting period of the option, or as applicable, over the period to the date an employee is eligible to retire, whichever is shorter, with a corresponding increase recorded in contributed surplus. The fair value is calculated using the Black-Scholes option-pricing model. When options are exercised, the proceeds received by the Company, together with the amount in contributed surplus associated with the exercised options, are credited to share capital.

| Page 14 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 1 – Significant Accounting Policies (continued)

| (h) | Earnings Per Share |

Basic earnings per share are computed by dividing net income by the weighted average number of common shares outstanding during each reporting period. Diluted earnings per share are computed similar to basic earnings per share except that the weighted average shares outstanding are increased to include additional shares from the assumed exercise of stock options and warrants, if dilutive. The number of additional shares is calculated by assuming that outstanding stock options and warrants were exercised, and that proceeds from such exercises were used to acquire common shares at the average market price during the reporting period.

| (i) | Consumer Loans Receivable |

Unsecured short-term and longer-term advances that the Company originates on its own behalf are reflected on the balance sheet in consumer loans receivable. Consumer loans receivable are reported net of a provision. In regulated jurisdictions, interest is charged on consumer loans commencing upon default; however, it is not recorded as income until payment is received in full or partially from the consumer. In unregulated jurisdictions, interest is charged on consumer loans over the period of the loan and is recorded in income as it is earned.

| (j) | Income Taxes |

Income taxes are accounted for under the asset and liability method. Future income tax assets and liabilities are recognized for the future income tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Future income tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on future income tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment or substantive enactment date. A valuation allowance is recorded against any future income tax assets if it is more likely than not that the asset will not be realized.

| (k) | Long-term Investments |

The Company applies the equity method of accounting for its investments in The Cash Store Australia Holdings Inc. and RTF Financial Holdings Inc. These investments are recorded at cost plus the Company’s share of net income or loss to date.

| (l) | Property and Equipment |

Property and Equipment are recorded at cost. Depreciation is recorded using the rates and methods outlined in the table below.

| Rate | Method | |||||||

| Computer hardware | 25 | % | Straight-line | |||||

| Computer software | 20 | % | Straight-line | |||||

| Fixtures, furniture, and equipment | 20 | % | Straight-line | |||||

| Signs | 20 | % | Straight-line | |||||

| Buildings | 4 | % | Straight-line | |||||

| Vehicles | 20 | % | Straight-line | |||||

Leasehold improvements are depreciated based on the straight-line basis over the shorter of the lease term, including renewal options that are reasonably assured and the estimated useful life of the asset.

| Page 15 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 1 – Significant Accounting Policies (continued)

| (m) | Intangible Assets |

Intangible assets acquired individually or as part of a group of other assets are initially recognized and measured at cost. The cost of a group of intangible assets acquired in a transaction, including those acquired in a business combination that meet the specified criteria for recognition apart from goodwill, is allocated to the individual assets acquired based on their fair values.

Both internal and external costs incurred to purchase and develop computer software are capitalized after the preliminary project stage is completed and management authorizes the computer software project.

Intangible assets with finite useful lives are amortized over their estimated useful lives. Intangible assets with indefinite useful lives are not amortized and are tested for impairment annually on July 1st of each year, or more frequently if events or changes in circumstances indicate that such assets might be impaired.

The amortization methods and estimated useful lives of intangible assets, which are reviewed annually, are as follows:

| Customer list, contracts and relationships | Straight-line – 3 years |

| Computer software | Straight-line – 5 years |

| Non-compete agreements | Term of the agreements |

| Brand name | Indefinite life |

| (n) | Goodwill |

Goodwill represents the residual amount that results when the purchase price of an acquired business exceeds the sum of the amounts allocated to the assets acquired, less liabilities assumed, based on their fair values. Goodwill is allocated as of the date of the business combination to the Company’s reporting units that are expected to benefit from the business combination. Goodwill is initially recognized as an asset at cost and is subsequently measured at cost less any accumulated impairment losses.

Goodwill is not amortized and is tested for impairment annually on July 1st of each year, or more frequently if events or changes in circumstances indicate it may be impaired. The impairment test is carried out in two steps. In the first step, the carrying amount of the reporting unit is compared to its fair value. When the fair value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not to be impaired and the second step of the impairment test is unnecessary. The second step is carried out when the carrying amount of a reporting unit exceeds its fair value, in which case the implied fair value of the reporting unit’s goodwill is compared with its carrying amount to measure the amount of the impairment loss, if any. The implied fair value of goodwill is determined in the same manner as the value of goodwill is determined in a business combination described in the preceding paragraph, using the fair value of the reporting unit as if it were the purchase price.

When the carrying amount of the reporting unit’s goodwill exceeds the implied fair value of the goodwill, an impairment loss is recognized in an amount equal to the excess.

| Page 16 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 1 – Significant Accounting Policies (continued)

| (o) | Accounting for the Impairment of Long-Lived Assets |

Long-lived assets and identifiable intangibles subject to amortization are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is assessed by a comparison of the carrying amount of a group of assets to the sum of future undiscounted cash flows expected to be generated from the use and eventual disposition of the group of assets. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the group of assets exceeds the fair value of the group of assets. Any assets to be disposed of by sale are reported at the lower of carrying amount or fair value less costs to sell. Such assets are not depreciated while they are classified as held-for-sale.

| (p) | Deferred Revenue |

The Company has entered into a long-term services contract for which the Company received advance payments. These advance payments are recorded as deferred revenue and recognized as revenue over the life of the contract.

| (q) | Deferred Lease Inducements |

The Company has received various inducements to lease space for its branches. The inducements are amortized over the remaining terms of the respective leases and recorded as a reduction to rent expense.

| (r) | Leases |

Leases are classified as capital or operating depending upon the terms and conditions of the contracts. Obligations under capital leases are recorded as an asset with a corresponding liability. Asset values recorded under capital leases are depreciated on a straight-line basis over the estimated useful life. Obligations under capital leases are reduced by lease payments net of imputed interest. Computer and phone operating lease expenses are recorded in selling, general, and administrative expenses. Branch leases are recorded in rent.

| (s) | Fair Value of Financial Instruments |

The Company’s financial instruments consist of cash, other receivables, consumer loans receivables less any allowance for loan losses, accounts payable and accrued liabilities, all of which are short-term in nature and their fair value approximates their carrying value. The fair value of obligations under capital leases carrying amounts are determined by estimating future cash flows on a borrowing-by-borrowing basis, and discounting these future cash flows using a rate which takes into account the Company’s spread for credit risk at year-end for similar terms and types of debt arrangements.

| Page 17 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 2 – Changes in Accounting Policies and Practices

There have been no changes in accounting policies and practices under Canadian GAAP that have impacted these annual consolidated financial statements.

Recent Accounting Pronouncements Not Yet Adopted

International Financial Reporting Standards (IFRS)

The Accounting Standards Board of the Canadian Institute of Chartered Accountants previously announced its decision to require all publicly accountable enterprises to report under International Financial Reporting Standards (“IFRS”) for years beginning on or after January 1, 2011. However, National Instrument 52-107 allows Securities and Exchange Commission (“SEC”) registrants, such as the Company, to file financial statements with Canadian securities regulators that are prepared in accordance with U.S. GAAP. The Company has decided to adopt U.S. GAAP instead of IFRS as its primary basis of financial reporting commencing in fiscal 2012.

The decision to adopt U.S. GAAP was made to enhance communication with shareholders and improve the comparability of financial information reported with its U.S. based competitors and peer group.

Note 3 – Restatement of Previously Reported Results

| a) | These consolidated financial statements for the year ended September 30, 2011 and fifteen months ended September 30, 2010, as initially reported, have been amended and restated to correct for an error resulting from the misunderstanding of the settlement terms and conditions of the March 5, 2004 British Columbia Class Action claim, which resulted in the application of an accounting principle to measure and record the liability as at September 30, 2010 and subsequent reporting periods, that was not appropriate in the circumstances. The restatement impacts the twelve months ended September 30, 2011 and the fifteen months ended September 30, 2010. The restatement resulted in a reduction in net income in the fifteen months ended September 30, 2010 of $6,601 and an increase in net income in the year ended September 30, 2011 of $1,537. |

The effect of the restatement on the consolidated statement of operations and comprehensive income for the twelve months ended September 30, 2011 and fifteen-month period ended September 30, 2010 is as follows:

| Year ended September 30 2011 | 15 months ended September 30 2010 | |||||||||||||||||||||||

| As Reported | Adjustments | Restated | As Reported | Adjustments | Restated | |||||||||||||||||||

| Interest expense | - | $ | 616 | 616 | $ | - | $ | - | $ | - | ||||||||||||||

| Class action settlements | $ | 3,206 | $ | (2,838 | ) | $ | 368 | 2,915 | 8,770 | 11,685 | ||||||||||||||

| INCOME BEFORE INCOME TAXES | 14,667 | 2,222 | 16,889 | 37,761 | (8,770 | ) | 28,991 | |||||||||||||||||

| PROVISION FOR INCOME TAXES - Future (recovery) | (532 | ) | 685 | 153 | 101 | (2,169 | ) | (2,068 | ) | |||||||||||||||

| NET INCOME AND COMPREHENSIVE INCOME | 9,042 | 1,537 | 10,579 | 26,464 | (6,601 | ) | 19,863 | |||||||||||||||||

| BASIC EARNINGS PER SHARE | $ | 0.52 | $ | 0.09 | $ | 0.61 | $ | 1.56 | $ | (0.39 | ) | $ | 1.17 | |||||||||||

| DILUTED EARNINGS PER SHARE | 0.51 | 0.09 | 0.60 | 1.51 | (0.38 | ) | 1.13 | |||||||||||||||||

| Page 18 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 3 – Restatement of Previously Reported Results (continued)

The effect of the restatement on the consolidated balance sheets as at September 30, 2011 and 2010 is as follows:

| September 30 2011 | September 30 2010 | |||||||||||||||||||||||

| As Reported | Adjustments | Restated | As Reported | Adjustments | Restated | |||||||||||||||||||

| Other receivables | $ | 12,575 | $ | - | $ | 12,575 | $ | 9,940 | $ | (800 | ) | $ | 9,140 | |||||||||||

| Current future income taxes | 1,516 | 1,484 | 3,000 | 614 | 2,169 | 2,783 | ||||||||||||||||||

| Future income taxes | 2,468 | - | 2,468 | 2,381 | - | 2,381 | ||||||||||||||||||

| Accounts payable and accrued liabilities | 22,989 | 6,548 | 29,537 | 17,027 | 7,970 | 24,997 | ||||||||||||||||||

| Future income tax liabilities | 2,388 | - | 2,388 | 1,936 | - | 1,936 | ||||||||||||||||||

| Retained earnings | 37,019 | (5,064 | ) | 31,955 | 35,906 | (6,601 | ) | 29,305 | ||||||||||||||||

The effect of the restatement on the consolidated statement of cash flows for the twelve months ended September 30, 2011 and fifteen-month period ended September 30, 2010 is as follows:

| Year ended September 30 2011 | 15 months ended September 30 2010 | |||||||||||||||||||||||

| As Reported | Adjustments | Restated | As Reported | Adjustments | Restated | |||||||||||||||||||

| Net income | $ | 9,042 | $ | 1,537 | $ | 10,579 | $ | 26,464 | $ | (6,601 | ) | $ | 19,863 | |||||||||||

| Future income taxes (recovery) | (532 | ) | 685 | 153 | 101 | (2,169 | ) | (2,068 | ) | |||||||||||||||

| Other receivables and long-term receivables | (2,866 | ) | (800 | ) | (3,666 | ) | (7,462 | ) | 800 | (6,662 | ) | |||||||||||||

| Accounts payable and accrued liabilities | 6,617 | $ | (1,422 | ) | 5,195 | 2,262 | 7,970 | 10,232 | ||||||||||||||||

Note 5, 6(a), 12, 13, 14(b), 24(c)(iii), 24(c)(iv) and 28(G) have been restated to reflect the related note disclosures.

| b) | Independent of the restatement outlined in Note 3 a) above, we have also restated Note 23(c) Related Party Transactions - Third party Lenders, to disclose related party transactions with a privately held entity that raises capital and provides advances to the Company’s customers (third-party lender). The privately held entity is controlled by the father of Cameron Schiffner, the Senior Vice President of Operations of the Company. The addition of this disclosure did not impact the previously reported financial position or results of operations of the Company. |

Note 4 – Business Acquisitions

On October 16, 2010, the Company acquired all the business assets of Dash for Cash representing one branch in Manitoba for total cash consideration of $25 all of which was allocated to Goodwill. Dash for Cash operated in the short-term advances industry.

On April 26, 2010, the Company acquired all the business assets of 101019134 Saskatchewan Ltd. (EZ Cash), representing 14 branches in Saskatchewan, for total cash consideration of $4,476. EZ Cash operated in the short-term advances industry.

On September 1, 2009, the Company acquired all the business assets of Affordable Payday Loans (APL) representing eight branches in Ontario and two branches in Alberta for total cash consideration of $800. Affordable Payday Loans operated in the short-term advances industry.

| Page 19 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 4 – Business Acquisitions (continued)

The combined purchase price allocation for the fifteen months ended September 30, 2010, is detailed in the following table below.

| Net assets acquired at assigned values | ||||

| Property and equipment | $ | 36 | ||

| Non-compete and other intangible assets | 392 | |||

| Goodwill | 4,881 | |||

| Accounts payable and accrued liabilities | (33 | ) | ||

| $ | 5,276 | |||

Revenues and earnings since the acquisitions date and pro-forma information as if the acquisitions were completed as of the dates described below, are as follows:

| 2011 | 2010 | |||||||||||||||

| As reported (1) | Pro forma (2) | As reported (1) | Pro forma (2) | |||||||||||||

| Operating revenues | $ | 189,899 | $ | 189,899 | $ | 220,518 | $ | 226,540 | ||||||||

| Net income | 9,042 | 9,042 | 26,464 | 27,578 | ||||||||||||

| Net income per Common Share | ||||||||||||||||

| - Basic | 0.52 | 0.52 | 1.56 | 1.63 | ||||||||||||

| - Diluted | $ | 0.51 | $ | 0.51 | $ | 1.51 | $ | 1.57 | ||||||||

(1) Operating revenues and net income for the year ended September 30, 2011, include $72 related to the acquisition of Dash into Cash and for the fifteen months ended September 30, 2010, include $4,627 and $854, respectively, in respect of the acquisitions of APL and EZ Cash.

(2) Pro forma amounts for the year ended September 30, 2011, reflect Dash into Cash as if it was acquired on October 1, 2010. Pro forma amounts for the fifteen months ended September 30, 2010, reflect APL and EZ Cash as if they were acquired on July 1, 2009.

The acquisition costs related to the business acquisitions are not significant. Goodwill related to the business acquisitions are 75% tax deductible.

| Page 20 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 5 – Cash

The significant components of cash are as follows:

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Restated | ||||||||

| Note 3 | ||||||||

| Cash | $ | 13,034 | $ | 13,382 | ||||

| Restricted cash | 6,257 | 6,257 | ||||||

| $ | 19,291 | $ | 19,639 | |||||

Restricted cash includes $6,257 (2010 - $6,257) in funds to facilitate claims related to the British Columbia class action lawsuit settlement (Note 14 (b)). Subsequent to year end, the total amount transferred to a third-party administrator was $6,257.

Approximately $3,611 (2010 - $2,697) was cash in transit as a result of pre-authorized debit, facilitated by a third-party.

Note 6 – Other Receivables and Other Income

| (a) | Other Receivables |

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| Due from investee corporations | $ | 61 | $ | 492 | ||||

| Due from suppliers | 11,143 | 7,223 | ||||||

| Other | 2,052 | 1,875 | ||||||

| $ | 13,256 | $ | 9,590 | |||||

| Long term portion: | ||||||||

| Other | 681 | 450 | ||||||

| $ | 12,575 | $ | 9,140 | |||||

Due from Suppliers

Due from suppliers includes $11,143 (2010 - $7,223) of short term receivables from our main suppliers of bank accounts, debit and prepaid mastercard and insurance products that have occurred in the normal course of business.

Other

Amounts included in Other receivables are from the sale of a business and amounts due in the normal course of business. Included with long-term receivables is an amount of $681 (2010 - $450).

| Page 21 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 6 – Other Receivables and Other Income (continued)

| (b) | Other Income |

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Agency fee income | $ | 46,809 | $ | 36,706 | ||||

| Other income | 6,467 | 13,153 | ||||||

| $ | 53,276 | $ | 49,859 | |||||

Note 7 – Consumer Loans Receivable

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Short-term advances receivable | $ | 6,799 | $ | 3,644 | ||||

| Term loans receivable | 765 | 1,327 | ||||||

| Allowance for consumer loan losses | (2,783 | ) | (511 | ) | ||||

| $ | 4,781 | $ | 4,460 | |||||

Note 8 – Long-Term Investments

| (a) | The Cash Store Australia Holdings Inc. |

The Company owns 3,000,000 shares, or approximately 18.3% of the outstanding common shares of The Cash Store Australia Holdings Inc. (AUC) acquired at a price of $0.06 per share. The carrying amount of this investment is $nil (2010 - $nil). Of the 3,000,000 common shares, 450,000 common shares are subject to escrow provisions that prevent the Company from selling these shares until the following dates:

| Date | Percentage | Common Shares | ||||||

| March 8, 2012 | 15 | % | 450,000 | |||||

Included in selling, general, and administrative expenses is the Company’s share of AUC’s loss of $nil (2010 - $180).

| (b) | RTF Financial Holdings Inc. |

The Company owns 6,000,000 shares, or approximately 15.7%, of RTF Financial Holdings Inc. (RTF) acquired at a price of $0.06 per share. The carrying amount of this investment is $nil (2010 - $nil).

Included in selling, general, and administrative expenses is the Company’s share of RTF’s loss of $nil (2010 - $360).

| Page 22 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 9 – Property and Equipment

| September 30 | ||||||||||||

| 2011 | ||||||||||||

| Accumulated | Net Book | |||||||||||

| Cost | Depreciation | Value | ||||||||||

| Leasehold improvements | $ | 28,887 | $ | 15,491 | $ | 13,396 | ||||||

| Fixtures, furniture, and equipment | 12,421 | 6,195 | 6,226 | |||||||||

| Computer hardware | 6,463 | 3,596 | 2,867 | |||||||||

| Signs | 7,533 | 4,670 | 2,863 | |||||||||

| Buildings | 132 | 20 | 112 | |||||||||

| Vehicle | 77 | 15 | 62 | |||||||||

| Land | 51 | - | 51 | |||||||||

| Computer software | 241 | 229 | 12 | |||||||||

| $ | 55,805 | $ | 30,216 | $ | 25,589 | |||||||

| September 30 | ||||||||||||

| 2010 | ||||||||||||

| Accumulated | Net Book | |||||||||||

| Cost | Depreciation | Value | ||||||||||

| Leasehold improvements | $ | 27,359 | $ | 13,509 | $ | 13,850 | ||||||

| Fixtures, furniture, and equipment | 11,578 | 5,475 | 6,103 | |||||||||

| Computer hardware | 5,538 | 2,949 | 2,589 | |||||||||

| Signs | 6,014 | 3,821 | 2,193 | |||||||||

| Buildings | 132 | 15 | 117 | |||||||||

| Vehicle | 75 | 4 | 71 | |||||||||

| Land | 51 | - | 51 | |||||||||

| Computer software | 242 | 230 | 12 | |||||||||

| $ | 50,989 | $ | 26,003 | $ | 24,986 | |||||||

Depreciation expense for the twelve months ended September 30, 2011 includes a write off of property and equipment of $65 (2010 - $61).

Cost and accumulated depreciation of property and equipment as at September 30, 2011 included $13,866 of fully depreciated assets.

| Page 23 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 9 – Property and Equipment (continued)

Assets under capital lease included above:

| 2011 | ||||||||||||

| Accumulated | Net Book | |||||||||||

| Cost | Depreciation | Value | ||||||||||

| Computer hardware | $ | 2,171 | $ | 1,163 | $ | 1,008 | ||||||

| Fixtures, furniture and equipment | 903 | 653 | 250 | |||||||||

| $ | 3,074 | $ | 1,816 | $ | 1,258 | |||||||

| 2010 | ||||||||||||

| Accumulated | Net Book | |||||||||||

| Cost | Depreciation | Value | ||||||||||

| Computer hardware | $ | 2,050 | $ | 1,064 | $ | 986 | ||||||

| Fixtures, furniture and equipment | 903 | 587 | 316 | |||||||||

| $ | 2,953 | $ | 1,651 | $ | 1,302 | |||||||

Depreciation of property and equipment for the twelve months ended September 30, 2011, includes $165 (2010 - $821) relating to assets under capital leases.

During the twelve months ended September 30, 2011, additions to property and equipment included $121 (2010 - $683) of assets that were acquired by means of capital lease and $nil (2010 - $47) of assets that were acquired by way of vehicle financing.

Note 10 – Intangible Assets

| September 30 | ||||||||||||

| 2011 | ||||||||||||

| Accumulated | Net Book | |||||||||||

| Cost | Amortization | Value | ||||||||||

| Customer contracts, relationships, lists and other | $ | 962 | $ | 917 | $ | 45 | ||||||

| Non-compete agreements | 507 | 249 | 258 | |||||||||

| Computer software | 6,717 | 1,742 | 4,975 | |||||||||

| Brand name | 5,300 | - | 5,300 | |||||||||

| $ | 13,486 | $ | 2,908 | $ | 10,578 | |||||||

| 2010 | ||||||||||||

| Accumulated | Net Book | |||||||||||

| Cost | Amortization | Value | ||||||||||

| Customer contracts, relationships, lists and other | $ | 952 | $ | 887 | $ | 65 | ||||||

| Non-compete agreements | 507 | 175 | 332 | |||||||||

| Computer software | 5,832 | 881 | 4,951 | |||||||||

| Brand name | 5,300 | - | 5,300 | |||||||||

| $ | 12,591 | $ | 1,943 | $ | 10,648 | |||||||

| Page 24 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 |

(in thousands, except share and per share amounts)

Note 10 – Intangible Assets (continued)

During the twelve months ended September 30, 2011, the Company acquired $nil in non-compete agreements (2010 - $330) and $nil in customer contracts, relationships, lists and other (2010 - $62) as part of the business acquisitions (Note 4).

Included in computer software are assets under development with a cost of $262 (2010 - $3,274). These assets have not been amortized in the twelve months ended September 30, 2011.

Cost and accumulated amortization of intangibles as at September 30, 2011 included $305 of fully amortized intangible assets.

Note 11 – Goodwill

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Balance, beginning of period | $ | 39,108 | $ | 34,554 | ||||

| Goodwill acquired - Note 3 | 25 | 4,881 | ||||||

| Disposal of goodwill | - | (327 | ) | |||||

| Balance, end of period | $ | 39,133 | $ | 39,108 | ||||

Note 12 – Income Taxes

| (a) | Provision for Income Taxes |

The income tax provision differs from the amount that would be computed by applying the federal and provincial statutory income tax rates of 28.0% (2010 – 29.1%) to income as a result of the following:

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| Income before income taxes | $ | 16,889 | $ | 28,991 | ||||

| Computed tax expense at statutory income tax rates | $ | 4,729 | $ | 8,436 | ||||

| Change in enacted tax rates | (31 | ) | (1 | ) | ||||

| Adjustment for prior year immaterial errors | 1,180 | - | ||||||

| Stock-based compensation | 206 | 319 | ||||||

| Permanent differences and other | 226 | 374 | ||||||

| Total income tax provision | $ | 6,310 | $ | 9,128 | ||||

| Page 25 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 | |

| (in thousands, except share and per share amounts) | |

Note 12 – Income Taxes (continued)

| (b) | Future Income Taxes |

The tax effects that give rise to significant portions of the future income tax assets and liabilities are presented below:

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| Current: | ||||||||

| Accrued liability for class action settlements and other temporary differences | $ | 2,562 | $ | 2,783 | ||||

| Loan loss provision | 438 | - | ||||||

| $ | 3,000 | $ | 2,783 | |||||

| Non-current: | ||||||||

| Losses available to be carried forward | 193 | - | ||||||

| Property and equipment, intangible assets and goodwill | 320 | 192 | ||||||

| Deferred lease inducements | 308 | 381 | ||||||

| Deferred revenue | 1,647 | 1,808 | ||||||

| $ | 2,468 | $ | 2,381 | |||||

| Property and equipment, intangible assets and goodwill | $ | (2,388 | ) | $ | (1,936 | ) | ||

In assessing the realizability of future income tax assets, management considers whether it is more likely than not that some portion or all of the future tax assets will not be realized. The ultimate realization of future income tax assets is dependent upon the generation of future taxable income during the period in which those temporary differences become deductible. Based upon management assessment, management believes it is more likely than not that the Company will realize the benefits of these deductible differences. The amount of the future income tax asset considered realizable, however, could be reduced in the near term if estimates of future taxable income during the carry-forward period are reduced.

Note 13 – Accounts Payable and Accrued Liabilities

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Restated | Restated | |||||||

| Note 3 | Note 3 | |||||||

| Trade accounts payable and accrued liabilities | $ | 6,937 | $ | 5,733 | ||||

| Class action settlements Note 14 (a), (b), (c), and (d) | 10,733 | 10,123 | ||||||

| Accrued salaries and benefits | 2,808 | 2,725 | ||||||

| Amounts due to third party lenders | 8,487 | 5,647 | ||||||

| Other | 572 | 769 | ||||||

| $ | 29,537 | $ | 24,997 | |||||

| Page 26 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 | |

| (in thousands, except share and per share amounts) | |

Note 13 – Accounts Payable and Accrued Liabilities (continued)

The amounts due to third party lenders reflects funds made available by lenders but not yet advanced to customers, any liability under the lending agreement, including any paid retention payments, as well as loan repayment and interest amounts collected from customers. Amounts due to third party lenders are non-interest bearing, unsecured and have no specified repayment terms.

Note 14 – Class Action Settlements

| (a) | Ontario and the rest of Canada with the exception of British Columbia and Alberta |

On April 13, 2004, a legal proceeding was commenced against The Cash Store Financial and Instaloans Inc., by Thompson McCutcheon (the “Plaintiff”), a customer. The Plaintiff obtained an order pursuant to the Class Proceedings Act, 1992, S.O. 1992 c.6 (the “Class Proceeding Act”), as amended, certifying the action as a class proceeding and appointing him as the representative of the class. The Plaintiff asserted that the defendants were in breach of the Criminal Code of Canada and the Fair Trading Act as the aggregate of all charges, including interest, broker fees and card fees, was in excess of those allowed by law. The Statement of Claim stated that the members of the Class would seek to recover all amounts charged, collected or received by the defendants at a criminal rate of interest and/or at an excessive rate, as well as damages, costs and interest.

On December 2, 2008, the Ontario Superior Court of Justice certified the class action lawsuit as a class proceeding under the Act, and granted approval of the settlement that had been agreed to between the Company and the representative Plaintiff on behalf of the Class. The settlement does not constitute any admission of liability by The Cash Store Financial.

Under the terms of the settlement, the Company is to pay to the class a minimum of $750 and a maximum of $1,500 in cash and a minimum of $750 and a maximum of $1,500 in credit vouchers to those customers of The Cash Store Financial and Instaloans, exclusive of Alberta and British Columbia, who were advanced funds under a loan agreement and who repaid the payday loan plus brokerage fees and interest in full. The credit vouchers may be used to pay existing outstanding brokerage fees and interest or to pay a portion of brokerage fees and interest which may arise in the future through new loans advanced. The credit vouchers are fully transferable and have no expiry date. Based on our estimate of the rate of take-up of the available cash and vouchers, a total provision of $2,010 was previously recorded to cover the estimated costs of the settlement, including legal fees and other costs. During the year ended June 30, 2009, the Company paid the legal fees and costs of the class. On August 6, 2009, the claims process was concluded and we issued $750 in vouchers and $750 in cheques to the class members as full and final satisfaction of all claims. As at September 30, 2011, the remaining accrual is $46 (2010 - $52).

| Page 27 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 | |

| (in thousands, except share and per share amounts) | |

Note 14 – Class Action Settlements (continued)

| (b) | British Columbia (restated – Note 3) |

On March 5, 2004, an action under the Class Proceedings Act was commenced in the Supreme Court of British Columbia by Andrew Bodnar and others proposing that a class action be certified on his own behalf and on behalf of all persons who have borrowed money from the defendants, The Cash Store Financial and All Trans Credit Union Ltd. The action stems from the allegations that all payday loan fees collected by the defendants constitute interest and therefore violate s. 347 of the Criminal Code of Canada (the “Code”). On May 25, 2006, the claim in British Columbia was affirmed as a certified class proceeding of Canada by the B.C. Court of Appeal. In fiscal 2007, the plaintiffs in the British Columbia action brought forward an application to have certain of the Company’s customers’ third-party lenders added to the claim. On March 18, 2008, another action commenced in the Supreme Court of British Columbia by David Wournell and others against The Cash Store Financial, Instaloans Inc., and others in respect of the business carried out under the name Instaloans since April 2005. Collectively, the above actions are referred to as the “British Columbia Related Actions”.

On May 12, 2009, the Company settled the British Columbia Related Actions in principle and on February 28, 2010 the settlement was approved by the Court. Under the terms of the court approved settlement, the Company is to pay to the eligible class members who were advanced funds under a loan agreement and who repaid the payday loan plus brokerage fees and interest in full, or who met certain other eligibility criteria, a maximum estimated amount including legal expenses of $18,800, consisting of $9,400 in cash and $9,400 in credit vouchers. The credit vouchers can be used to pay existing outstanding brokerage fees and interest, to pay a portion of brokerage fees and interest which may arise in the future through new loans advanced, or can be redeemed for cash from January 1, 2014 to June 30, 2014. The credit vouchers are not transferable and have no expiry date. After approved legal expenses of $6,438 were paid in March 2010, the balance of the settlement amount remaining to be disbursed was $12,362, consisting of $6,181 of cash and $6,181 of vouchers.

By September 30, 2010, the Company received approximately 6,300 individual claims representing total valid claims in excess of the settlement fund. As the valid claims exceed the balance of the remaining settlement fund, under the terms of the settlement agreement, the entire settlement fund of $12,362 will be disbursed to claimants on a pro-rata basis.

In arriving at the liability recorded at the balance sheet date, the voucher portion of the settlement fund of $6,181 has been discounted using a discount rate of 16.2%. During the twelve months ended September 30, 2011, the Company recorded accretion expense of $616 (fifteen months ended September 30, 2010 - $nil) in interest expense. The total liability related to the settlement at September 30, 2011 is $10,587 (2010- $9,971).

| (c) | Alberta |

The Company has been served in prior fiscal periods with a Statement of Claim issued in Alberta alleging that we are in breach of s. 347 of the Code (the interest rate provision) and certain provincial consumer protection statutes.

The certification motion has been pending since fiscal 2006 and has not yet been heard. On January 19, 2010, the plaintiffs in the Alberta action brought forward an application to have a related subsidiary, as well as certain of our customers’ third-party lenders, directors and officers added to the Claim.

The Company has agreed to a motion to certify the class proceeding if the third party lenders, officers and directors are removed as defendants. Class counsel has agreed to the Company’s proposal.

The Company believes that it conducted its business in accordance with applicable laws and is defending the action vigorously. As at September 30, 2011, a total of $100 (2010 - $100) has been accrued. However, the likelihood of loss, if any, is not determinable at this time.

| Page 28 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 | |

| (in thousands, except share and per share amounts) | |

Note 14 – Class Action Settlements (continued)

| (d) | Manitoba |

On April 23, 2010, an action under the Manitoba Class Proceedings Act was commenced in the Manitoba Court of Queen’s Bench by Scott Meeking against The Cash Store Financial and Instaloans proposing that a class action be certified on his own behalf and on behalf of all persons in Manitoba and others outside the province who elect to claim in Manitoba and who obtained a payday loan from The Cash Store Financial or Instaloans. The action stems from the allegations that all payday loan fees collected by the defendants constitute interest and therefore violate s. 347 of the Criminal Code of Canada.

The Company conducts business in accordance with applicable laws and is defending the action vigorously. Further it will be maintained that most of the proposed class members are bound by the judgment in the settlement of the Ontario class action in 2008, as approved by the Ontario Superior Court of Justice and that accordingly the action should be dismissed. However, the likelihood of loss, if any, is not determinable at this time.

Note 15 – Deferred Revenue

| September 30 | September 30 | |||||||

| 2011 | 2010 | |||||||

| Current | $ | 1,135 | $ | 1,277 | ||||

| Long-term | 4,976 | 5,916 | ||||||

| $ | 6,111 | $ | 7,193 | |||||

On September 1, 2010, the Company entered into an agreement with Ria Financial Services, a division of Euronet Worldwide Inc. (NASDAQ: EEFT), to supply money transfer services across the Company’s network of The Cash Store Financial and Instaloans branches in Canada.The Company received a $7,000 signing bonus, which will be recognized into revenue over the next seven years, which is the length of the agreement.

| Page 29 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 | |

| (in thousands, except share and per share amounts) | |

Note 16 – Obligations under Capital Leases

The Company has financed certain office furniture, equipment, and printers by entering into capital leasing and financing arrangements.

| 2011 | ||||||||||||

| Aggregate | Less Imputed | |||||||||||

| Due | Interest | Net | ||||||||||

| Various leases - repayable in monthly instalments totalling $57 including imputed interest ranging from nil - 19.8%; due to mature between 2012 - 2015; secured by leased assets with an aggregate carrying amount of $1,258. | $ | 1,421 | $ | 126 | $ | 1,295 | ||||||

| Less current portion | 761 | 102 | 659 | |||||||||

| $ | 660 | $ | 24 | $ | 636 | |||||||

| 2010 | ||||||||||||

| Aggregate | Less Imputed | |||||||||||

| Due | Interest | Net | ||||||||||

| Various leases - repayable in monthly instalments totalling $59 including imputed interest ranging from nil - 19.8%; due to mature between 2011 - 2014; secured by leased assets with an aggregate carrying amount of $1,302. Included in leases is a one time payment of $368 due in 2011. | $ | 2,167 | $ | 215 | $ | 1,952 | ||||||

| Less current portion | 1,081 | 120 | 961 | |||||||||

| $ | 1,086 | $ | 95 | $ | 991 | |||||||

The capital lease repayments are due as follows:

| Aggregate | Less Imputed | |||||||||||

| Due | Interest | Net | ||||||||||

| 2012 | $ | 749 | $ | 90 | $ | 659 | ||||||

| 2013 | 433 | 40 | 393 | |||||||||

| 2014 | 233 | 13 | 220 | |||||||||

| 2015 | 27 | 4 | 23 | |||||||||

| $ | 1,442 | $ | 147 | $ | 1,295 | |||||||

During the twelve months ended September 30, 2011, the Company incurred interest charges related to capital leases in the amount of $147 (2010 - $179). These have been included in selling, general, and administrative expenses.

| Page 30 |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE TWELVE AND FIFTEEN MONTHS ENDED SEPTEMBER 30, 2011 AND SEPTEMBER 30, 2010 | |

| (in thousands, except share and per share amounts) | |

Note 17 – Share Capital

| (a) | Issued share capital |

| 2011 | 2010 | |||||||||||||||

| Number of Shares | Amount | Number of Shares | Amount | |||||||||||||

| Authorized: | ||||||||||||||||

| Unlimited common shares with no par value | ||||||||||||||||

| Issued: | ||||||||||||||||

| Balance, beginning of period | 17,085,727 | $ | 43,468 | 16,959,492 | $ | 40,222 | ||||||||||

| Transfer from contributed surplus for stock options exercised - Note 19 | - | 572 | - | 1,769 | ||||||||||||

| Options exercised | 183,487 | 939 | 514,034 | 2,397 | ||||||||||||

| Warrants exercised | 150,000 | 1,170 | - | - | ||||||||||||

| Shares repurchased | - | - | (387,799 | ) | (920 | ) | ||||||||||

| Balance, end of period | 17,419,214 | $ | 46,149 | 17,085,727 | $ | 43,468 | ||||||||||

For the year ended September 30, 2011, the Company did not purchase and subsequently cancel any common shares (2010 – 387,799 common shares at a cost of $3,336).

| (b) | Options to Employees and Directors |

The Company has an incentive stock option plan for certain employees, officers and directors. Options issued under the plan have vesting terms that vary depending on date granted and other factors. All stock options must be exercised over specified periods not to exceed five years from the date granted.

| 2011 | 2010 | |||||||||||||||

| Total Options for Shares | Weighted Average Price | Total Options for Shares | Weighted Average Price | |||||||||||||

| Outstanding, beginning of year | 1,019,322 | $ | 8.07 | 1,128,356 | $ | 4.72 | ||||||||||

| Granted | 155,000 | 12.96 | 460,000 | 12.18 | ||||||||||||

| Exercised | (183,487 | ) | 5.12 | (514,034 | ) | 4.66 | ||||||||||

| Expired | (10,000 | ) | 5.52 | - | - | |||||||||||

| Forfeited | (1,667 | ) | 8.80 | (55,000 | ) | 5.69 | ||||||||||

| Outstanding, end of year | 979,168 | 9.42 | 1,019,322 | 8.07 | ||||||||||||

| Exercisable, end of year | 505,832 | $ | 6.84 | 321,644 | $ | 5.00 | ||||||||||

At September 30, 2011, the range of exercise prices, the weighted average exercise price, and weighted average remaining contractual life are as follows:

| Fiscal Year Granted | Number Outstanding | Weighted Average Remaining Term | Weighted Average Exercise Price | Number Exercisable | ||||||||||||

| 2008 | 238,600 | 14 mos. | $ | 3.81 | 238,600 | |||||||||||

| 2009 | 169,733 | 30 mos. | 6.65 | 124,735 | ||||||||||||

| 2010 | 415,835 | 40 mos. | 12.45 | 142,497 | ||||||||||||

| 2011 | 155,000 | 58 mos. | 12.96 | - | ||||||||||||

| 979,168 | 35 mos. | $ | 9.42 | 505,832 | ||||||||||||