Exhibit 10.2

EXHIBIT “C”

Attached to and made part of that certain Development Agreement, dated effective May 6, 2011 by and between Gulfport Energy Corporation, Windsor Ohio, LLC and Rhino Exploration, LLC

A.A.P.L. FORM 610-1982

MODEL FORM OPERATING AGREEMENT

OPERATING AGREEMENT

DATED

May 6, 2011,

|

|

year |

|

OPERATOR |

Gulfport Energy Corporation |

|

CONTRACT AREA |

See Exhibit “A” |

|

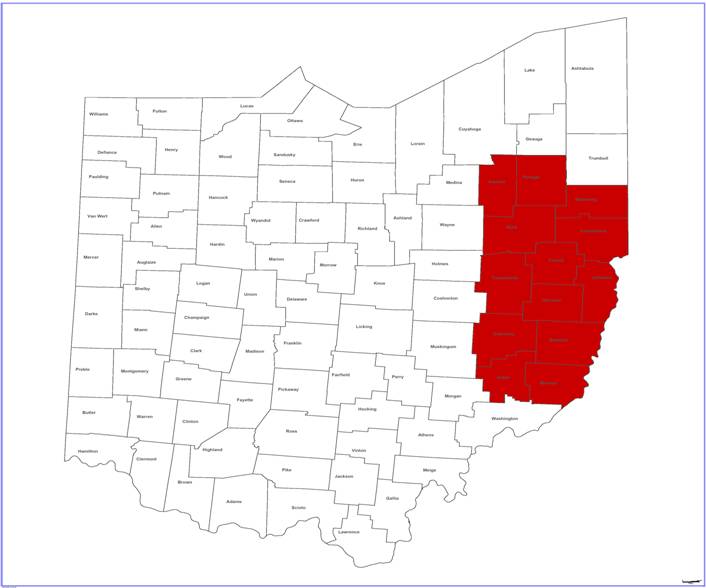

COUNTY OR PARISH OF |

|

Belmont, Carroll, Columbiana, Guernsey, Harrison, Jefferson, Mahoning, Monroe, Noble, Portage, Stark, Summit and Tuscarawas |

|

STATE OF |

|

Ohio |

|

|

|

|

|

|

|

|

|

|

|

COPYRIGHT 1982 — ALL RIGHTS RESERVED AMERICAN ASSOCIATION OF PETROLEUM LANDMEN, 4100 FOSSIL CREEK BLVD., FORT WORTH, TEXAS, 76137-2791, APPROVED FORM. A.A.P.L. NO. 610 — 1982 REVISED |

|

|

|

|

TABLE OF CONTENTS

|

Article |

|

Title |

Page | |||

|

|

|

|

|

| ||

|

I. |

|

DEFINITIONS |

1 | |||

|

II. |

|

EXHIBITS |

1 | |||

|

III. |

|

INTERESTS OF PARTIES |

2 | |||

|

|

|

A. |

OIL AND GAS INTERESTS |

2 | ||

|

|

|

B. |

INTERESTS OF PARTIES IN COSTS AND PRODUCTION |

2 | ||

|

|

|

C. |

EXCESS ROYALTIES, OVERRIDING ROYALTIES AND OTHER PAYMENTS |

2 | ||

|

|

|

D. |

SUBSEQUENTLY CREATED INTERESTS |

2 | ||

|

IV. |

|

TITLES |

2 | |||

|

|

|

A. |

TITLE EXAMINATION |

2-3 | ||

|

|

|

B. |

LOSS OF TITLE |

3 | ||

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

3. |

Other Losses |

3 | |

|

V. |

|

OPERATOR |

4 | |||

|

|

|

A. |

DESIGNATION AND RESPONSIBILITIES OF OPERATOR |

4 | ||

|

|

|

B. |

RESIGNATION OR REMOVAL OF OPERATOR AND SELECTION OF SUCCESSOR |

4 | ||

|

|

|

|

1. |

Resignation or Removal of Operator |

4 | |

|

|

|

|

2. |

Selection of Successor Operator |

4 | |

|

|

|

C. |

EMPLOYEES |

4 | ||

|

|

|

D. |

DRILLING CONTRACTS |

4 | ||

|

VI. |

|

DRILLING AND DEVELOPMENT |

4 | |||

|

|

|

A. |

INITIAL WELL |

4-5 | ||

|

|

|

B. |

SUBSEQUENT OPERATIONS |

5 | ||

|

|

|

|

1. |

Proposed Operations |

5 | |

|

|

|

|

2. |

Operations by Less than All Parties |

5-6-7 | |

|

|

|

|

3. |

Stand-By Time |

7 | |

|

|

|

|

4. |

Sidetracking |

7 | |

|

|

|

C. |

TAKING PRODUCTION IN KIND |

7 | ||

|

|

|

D. |

ACCESS TO CONTRACT AREA AND INFORMATION |

8 | ||

|

|

|

E. |

ABANDONMENT OF WELLS |

8 | ||

|

|

|

|

1. |

Abandonment of Dry Holes |

8 | |

|

|

|

|

2. |

Abandonment of Wells that have Produced |

8-9 | |

|

|

|

|

3. |

Abandonment of Non-Consent Operations |

10 | |

|

VII. |

|

EXPENDITURES AND LIABILITY OF PARTIES |

10 | |||

|

|

|

A. |

LIABILITY OF PARTIES |

10 | ||

|

|

|

B. |

LIENS AND PAYMENT DEFAULTS |

10 | ||

|

|

|

C. |

PAYMENTS AND ACCOUNTING |

10 | ||

|

|

|

D. |

LIMITATION OF EXPENDITURES |

10-11 | ||

|

|

|

|

1. |

Drill or Deepen |

10-11 | |

|

|

|

|

2. |

Rework or Plug Back |

11 | |

|

|

|

|

3. |

Other Operations |

11 | |

|

|

|

E. |

RENTALS, SHUT-IN WELL PAYMENTS AND MINIMUM ROYALTIES |

11 | ||

|

|

|

F. |

TAXES |

11 | ||

|

|

|

G. |

INSURANCE |

12 | ||

|

VIII. |

|

ACQUISITION, MAINTENANCE OR TRANSFER OF INTEREST |

12 | |||

|

|

|

A. |

SURRENDER OF LEASES |

12 | ||

|

|

|

B. |

RENEWAL OR EXTENSION OF LEASES |

12 | ||

|

|

|

C. |

ACREAGE OR CASH CONTRIBUTIONS |

12-13 | ||

|

|

|

D. |

MAINTENANCE OF UNIFORM INTEREST |

13 | ||

|

|

|

E. |

WAIVER OF RIGHTS TO PARTITION |

13 | ||

|

|

|

|

|

| ||

|

IX. |

|

INTERNAL REVENUE CODE ELECTION |

13 | |||

|

X. |

|

CLAIMS AND LAWSUITS |

14 | |||

|

XI. |

|

FORCE MAJEURE |

14 | |||

|

XII. |

|

NOTICES |

14 | |||

|

XIII. |

|

TERM OF AGREEMENT |

14 | |||

|

XIV. |

|

COMPLIANCE WITH LAWS AND REGULATIONS |

15 | |||

|

|

|

A. |

LAWS, REGULATIONS AND ORDERS |

15 | ||

|

|

|

B. |

GOVERNING LAW |

15 | ||

|

|

|

C. |

REGULATORY AGENCIES |

15 | ||

|

XV. |

|

OTHER PROVISIONS |

16 | |||

|

XVI. |

|

MISCELLANEOUS |

20 | |||

OPERATING AGREEMENT

THIS AGREEMENT, entered into by and between Gulfport Energy Corporation, hereinafter designated and referred to as “Operator”, and the signatory party or parties other than Operator, sometimes hereinafter referred to individually herein as “Non-Operator”, and collectively as “Non-Operators”.

WITNESSETH:

WHEREAS, the parties to this agreement are owners of oil and gas leases and/or oil and gas interests in the land identified in Exhibit “A”, and the parties hereto have reached an agreement to explore and develop these leases and/or oil and gas interests for the production of oil and gas to the extent and as hereinafter provided,

NOW, THEREFORE, it is agreed as follows:

ARTICLE I.

DEFINITIONS

As used in this agreement, the following words and terms shall have the meanings here ascribed to them:

A. The term “oil and gas” shall mean oil, gas, casinghead gas, gas condensate, and all other liquid or gaseous hydrocarbons and other marketable substances produced therewith, unless an intent to limit the inclusiveness of this term is specifically stated.

B. The terms “oil and gas lease”, “lease” and “leasehold” shall mean the oil and gas leases covering tracts of land lying within the Contract Area which are owned by the parties to this agreement.

C. The term “oil and gas interests” shall mean unleased fee and mineral interests in tracts of land lying within the Contract Area which are owned by parties to this agreement.

D. The term “Contract Area” shall mean all of the lands, oil and gas leasehold interests and oil and gas interests intended to be developed and operated for oil and gas purposes under this agreement. Such lands, oil and gas leasehold interests and oil and gas interests are described in Exhibit “A”.

E. The term “drilling unit” shall mean the area fixed for the drilling of one well by order or rule of any state or federal body having authority. If a drilling unit is not fixed by any such rule or order, a drilling unit shall be the drilling unit as established by the pattern of drilling in the Contract Area or as fixed by express agreement of the Drilling Parties.

F. The term “drillsite” shall mean the oil and gas lease or interest on which a proposed well is to be located.

G. The terms “Drilling Party” and “Consenting Party” shall mean a party who agrees to join in and pay its share of the cost of any operation conducted under the provisions of this agreement.

H. The terms “Non-Drilling Party” and “Non-Consenting Party” shall mean a party who elects not to participate in a proposed operation.

Unless the context otherwise clearly indicates, words used in the singular include the plural, the plural includes the singular, and the neuter gender includes the masculine and the feminine.

ARTICLE II.

EXHIBITS

The following exhibits, as indicated below and attached hereto, are incorporated in and made a part hereof:

x A. Exhibit “A”, shall include the following information: Plat Only

(1) Identification of lands subject to this agreement,

(2) Restrictions, if any, as to depths, formations, or substances,

(3) Percentages or fractional interests of parties to this agreement,

(4) Oil and gas leases and/or oil and gas interests subject to this agreement,

(5) Addresses of parties for notice purposes.

x B. Exhibit “B”, Form of Lease.

x C. Exhibit “C”, Accounting Procedure.

x D. Exhibit “D”, Insurance.

x E. Exhibit “E”, Gas Balancing Agreement.

x F. Exhibit “F”, Non-Discrimination and Certification of Non-Segregated Facilities.

o G. Exhibit “G”, Tax Partnership.

If any provision of any exhibit, except Exhibits “E” and “G”, is inconsistent with any provision contained in the body of this agreement, the provisions in the body of this agreement shall prevail.

ARTICLE III.

INTERESTS OF PARTIES

A. Oil and Gas Interests:

If any party owns an oil and gas interest in the Contract Area, that interest shall be treated for all purposes of this agreement and during the term hereof as if it were covered by the form of oil and gas lease attached hereto as Exhibit “B”, and the owner thereof shall be deemed to own both the royalty interest reserved in such lease and the interest of the lessee thereunder.

B. Interests of Parties in Costs and Production:

Unless changed by other provisions, all costs and liabilities incurred in operations under this agreement shall be borne and paid, and all equipment and materials acquired in operations on the Contract Area shall be owned, by the parties as their interests are set forth in Exhibit “A”. In the same manner, the parties shall also own all production of oil and gas from the Contract Area subject to the payment of royalties as provided by law to the extent of the owners interest which shall be borne as hereinafter set forth.

Regardless of which party has contributed the lease(s) and/or oil and gas interest(s) hereto on which royalty is due and payable, each party entitled to receive a share of production of oil and gas from the Contract Area shall bear and shall pay or deliver, or cause to be paid or delivered, to the extent of its interest in such production, the royalty amount stipulated hereinabove and shall hold the other parties free from any liability therefor. No party shall ever be responsible, however, on a price basis higher than the price received by such party, to any other party’s lessor or royalty owner, and if any such other party’s lessor or royalty owner should demand and receive settlement on a higher price basis, the party contributing the affected lease shall bear the additional royalty burden attributable to such higher price.

Nothing contained in this Article III.B. shall be deemed an assignment or cross-assignment of interests covered hereby.

C. Excess Royalties, Overriding Royalties and Other Payments:

Unless changed by other provisions, if the interest of any party in any lease covered hereby is subject to any royalty, overriding royalty, production payment or other burden on production in excess of the amount stipulated in Article III.B., such party so burdened shall assume and alone bear all such excess obligations and shall indemnify and hold the other parties hereto harmless from any and all claims and demands for payment asserted by owners of such excess burden.

D. Subsequently Created Interests:

If any party should hereafter create an overriding royalty, production payment or other burden payable out of production attributable to its working interest hereunder, or if such a burden existed prior to this agreement and is not set forth in Exhibit “A”, or was not disclosed in writing to all other parties prior to the execution of this agreement by all parties, or is not a jointly acknowledged and accepted obligation of all parties (any such interest being hereinafter referred to as “subsequently created interest” irrespective of the timing of its creation and the party out of whose working interest the subsequently created interest is derived being hereinafter referred to as “burdened party”), and:

1. If the burdened party is required under this agreement to assign or relinquish to any other party, or parties, all or a portion of its working interest and/or the production attributable thereto, said other party, or parties, shall receive said assignment and/or production free and clear of said subsequently created interest and the burdened party shall indemnify and save said other party, or parties, harmless from any and all claims and demands for payment asserted by owners of the subsequently created interest; and,

2. If the burdened party fails to pay, when due, its share of expenses chargeable hereunder, all provisions of Article VII.B. shall be enforceable against the subsequently created interest in the same manner as they are enforceable against the working interest of the burdened party.

ARTICLE IV.

TITLES

A. Title Examination:

Title examination shall be made on the drillsite and laterals of any proposed well prior to commencement of drilling operations or, if the Drilling Parties so request, title examination shall be made on the leases and/or oil and gas interests included, or planned to be included, in the drilling unit around such well. The opinion will include the ownership of the working interest, minerals, royalty, overriding royalty and production payments under the applicable leases. At the time a well is proposed, each party contributing leases and/or oil and gas interests to the drillsite, or to be included in such drilling unit, shall furnish to Operator all abstracts (including federal lease status reports), title opinions, title papers and curative material in its possession free of charge. All such information not in the possession of or made available to Operator by the parties, but necessary for the examination of the title, shall be obtained by Operator. Operator shall cause title to be examined by attorneys on its staff or by outside attorneys. Copies of all title opinions shall be furnished to each party hereto. The cost incurred by Operator in this title program shall be borne as follows:

o Option No. 1: Costs incurred by Operator in procuring abstracts and title examination (including preliminary, supplemental, shut-in gas royalty opinions and division order title opinions) shall be a part of the administrative overhead as provided in Exhibit “C”, and shall not be a direct charge, whether performed by Operator’s staff attorneys or by outside attorneys.

x Option No. 2: Costs incurred by Operator in procuring abstracts and fees paid outside attorneys and lease brokers for title examination (including preliminary, supplemental, shut-in gas royalty opinions and division order title opinions) shall be borne by the Drilling Parties in the proportion that the interest of each Drilling Party bears to the total interest of all Drilling Parties as such interests appear in Exhibit “A”. Operator shall make no charge for services rendered by its staff attorneys or other personnel in the performance of the above functions.

Each party shall be responsible for securing curative matter and pooling amendments or agreements required in connection with leases or oil and gas interests contributed by such party. Operator shall be responsible for the preparation and recording of pooling designations or declarations as well as the conduct of hearings before governmental agencies for the securing of spacing or pooling orders. This shall not prevent any party from appearing on its own behalf at any such hearing.

No well shall be drilled on the Contract Area until after (1) the title to the drillsite or drilling unit has been examined as above provided, and (2) the title has been approved by the examining attorney or title has been accepted by all of the parties who are to participate in the drilling of the well.

B. Loss of Title:

1. Failure of Title: Should any oil and gas interest or lease, or interest therein, be lost through failure of title, which loss results in a reduction of interest from that shown on Exhibit “A”, the party contributing the affected lease or interest shall have ninety (90) days from final determination of title failure to acquire a new lease or other instrument curing the entirety of the title failure, which acquisition will not be subject to Article VIII.B., and failing to do so, this agreement, nevertheless, shall continue in force as to all remaining oil and gas leases and interests: and,

(a) The party whose oil and gas lease or interest is affected by the title failure shall bear alone the entire loss and it shall not be entitled to recover from Operator or the other parties any development or operating costs which it may have theretofore paid or incurred, but there shall be no additional liability on its part to the other parties hereto by reason of such title failure;

(b) There shall be no retroactive adjustment of expenses incurred or revenues received from the operation of the interest which has been lost, but the interests of the parties shall be revised on an acreage basis, as of the time it is determined finally that title failure has occurred, so that the interest of the party whose lease or interest is affected by the title failure will thereafter be reduced in the Contract Area by the amount of the interest lost;

(c) If the proportionate interest of the other parties hereto in any producing well theretofore drilled on the Contract Area is increased by reason of the title failure, the party whose title has failed shall receive the proceeds attributable to the increase in such interest (less costs and burdens attributable thereto) until it has been reimbursed for unrecovered costs paid by it in connection with such well;

(d) Should any person not a party to this agreement, who is determined to be the owner of any interest in the title which has failed, pay in any manner any part of the cost of operation, development, or equipment, such amount shall be paid to the party or parties who bore the costs which are so refunded;

(e) Any liability to account to a third party for prior production of oil and gas which arises by reason of title failure shall be borne by the party or parties whose title failed in the same proportions in which they shared in such prior production; and,

(f) No charge shall be made to the joint account for legal expenses, fees or salaries, in connection with the defense of the interest claimed by any party hereto, it being the intention of the parties hereto that each shall defend title to its interest and bear all expenses in connection therewith.

2. Loss by Non-Payment or Erroneous Payment of Amount Due: If, through mistake or oversight, any rental, shut-in well payment, minimum royalty or royalty payment, is not paid or is erroneously paid, and as a result a lease or interest therein terminates, there shall be no monetary liability against the party who failed to make such payment. Unless the party who failed to make the required payment secures a new lease covering the same interest within ninety (90) days from the discovery of the failure to make proper payment, which acquisition will not be subject to Article VIII.B., the interests of the parties shall be revised on an acreage basis, effective as of the date of termination of the lease involved, and the party who failed to make proper payment will no longer be credited with an interest in the Contract Area on account of ownership of the lease or interest which has terminated. In the event the party who failed to make the required payment shall not have been fully reimbursed, at the time of the loss, from the proceeds of the sale of oil and gas attributable to the lost interest, calculated on an acreage basis, for the development and operating costs theretofore paid on account of such interest, it shall be reimbursed for unrecovered actual costs theretofore paid by it (but not for its share of the cost of any dry hole previously drilled or wells previously abandoned) from so much of the following as is necessary to effect reimbursement:

(a) Proceeds of oil and gas, less operating expenses, theretofore accrued to the credit of the lost interest, on an acreage basis, up to the amount of unrecovered costs;

(b) Proceeds, less operating expenses, thereafter accrued attributable to the lost interest on an acreage basis, of that portion of oil and gas thereafter produced and marketed (excluding production from any wells thereafter drilled) which, in the absence of such lease termination, would be attributable to the lost interest on an acreage basis, up to the amount of unrecovered costs, the proceeds of said portion of the oil and gas to be contributed by the other parties in proportion to their respective interest; and,

(c) Any monies, up to the amount of unrecovered costs, that may be paid by any party who is, or becomes, the owner of the interest lost, for the privilege of participating in the Contract Area or becoming a party to this agreement.

3. Other Losses: All losses incurred, other than those set forth in Articles IV.B.1. and IV.B.2. above, shall be joint losses and shall be borne by all parties in proportion to their interests. There shall be no readjustment of interests in the remaining portion of the Contract Area.

ARTICLE V.

OPERATOR

A. Designation and Responsibilities of Operator:

Gulfport Energy Corporation shall be the Operator of the Contract Area, and shall conduct and direct and have full control of all operations on the Contract Area as permitted and required by, and within the limits of this agreement. It shall conduct all such operations in a good and workmanlike manner, but it shall have no liability as Operator to the other parties for losses sustained or liabilities incurred, except such as may result from gross negligence or willful misconduct.

B. Resignation or Removal of Operator and Selection of Successor:

1. Resignation or Removal of Operator: Operator may resign at any time by giving written notice thereof to Non-Operators. If Operator terminates its legal existence, no longer owns an interest hereunder in the Contract Area, or is no longer capable of serving as Operator, Operator shall be deemed to have resigned without any action by Non-Operators, except the selection of a successor. Operator may be removed if it fails or refuses to carry out its duties hereunder, or becomes insolvent, bankrupt or is placed in receivership, by the affirmative vote of two (2) or more Non-Operators owning a majority interest based on ownership as shown on Exhibit “A” remaining after excluding the voting interest of Operator. Such resignation or removal shall not become effective until 7:00 o’clock A.M. on the first day of the calendar month following the expiration of ninety (90) days after the giving of notice of resignation by Operator or action by the Non-Operators to remove Operator, unless a successor Operator has been selected and assumes the duties of Operator at an earlier date. Operator, after effective date of resignation or removal, shall be bound by the terms hereof as a Non-Operator. A change of a corporate name or structure of Operator or transfer of Operator’s interest to any single subsidiary, parent or successor corporation shall not be the basis for removal of Operator.

2. Selection of Successor Operator: Upon the resignation or removal of Operator, a successor Operator shall be selected by the parties. The successor Operator shall be selected from the parties owning an interest in the Contract Area at the time such successor Operator is selected. The successor Operator shall be selected by the affirmative vote of two (2) or more parties owning a majority interest based on ownership as shown on Exhibit “A”; provided, however, if an Operator which has been removed fails to vote or votes only to succeed itself, the successor Operator shall be selected by the affirmative vote of two (2) or more parties owning a majority interest based on ownership as shown on Exhibit “A” remaining after excluding the voting interest of the Operator that was removed.

C. Employees:

The number of employees used by Operator in conducting operations hereunder, their selection, and the hours of labor and the compensation for services performed shall be determined by Operator, and all such employees shall be the employees of Operator.

D. Drilling Contracts:

All wells drilled on the Contract Area shall be drilled on a competitive contract basis at the usual rates prevailing in the area. If it so desires, Operator may employ its own tools and equipment in the drilling of wells, but its charges therefor shall not exceed the prevailing rates in the area and the rate of such charges shall be agreed upon by the parties in writing before drilling operations are commenced, and such work shall be performed by Operator under the same terms and conditions as are customary and usual in the area in contracts of independent contractors who are doing work of a similar nature.

ARTICLE VI.

DRILLING AND DEVELOPMENT

A. Initial Well:

On or before the 1st day of March, (year) 2012, Operator shall commence the drilling of a well for oil and gas at the following location:

As proposed pursuant to the terms of this Agreement.

and shall thereafter continue the drilling of the well with due diligence to

Test the Utica/Point Pleasant Formation

unless granite or other practically impenetrable substance or condition in the hole, which renders further drilling impractical, is encountered at a lesser depth, or unless all parties agree to complete or abandon the well at a lesser depth.

Operator shall make reasonable tests of all formations encountered during drilling which give indication of containing oil and gas in quantities sufficient to test, unless this agreement shall be limited in its application to a specific formation or formations, in which event Operator shall be required to test only the formation or formations to which this agreement may apply.

If, in Operator’s judgment, the well will not produce oil or gas in paying quantities, and it wishes to plug and abandon the well as a dry hole, the provisions of Article VI.E.1. shall thereafter apply.

B. Subsequent Operations:

1. Proposed Operations: Should any party hereto desire to drill any well on the Contract Area other than the well provided for in Article VI.A., or to rework, deepen or plug back a dry hole drilled at the joint expense of all parties or a well jointly owned by all

the parties and not then producing in paying quantities, the party desiring to drill, rework, deepen or plug back such a well shall give the other parties written notice of the proposed operation, specifying the work to be performed, the location, proposed depth, objective formation and the estimated cost of the operation. The parties receiving such a notice shall have thirty (30) days after receipt of the notice within which to notify the party wishing to do the work whether they elect to participate in the cost of the proposed operation. If a drilling rig is on location, notice of a proposal to rework, plug back or drill deeper may be given by telephone and the response period shall be limited to twenty-four (24) forty-eight (48) hours, exclusive of Saturday, Sunday, and legal holidays. Failure of a party receiving such notice to reply within the period above fixed shall constitute an election by that party not to participate in the cost of the proposed operation. Any notice or response given by telephone shall be promptly confirmed in writing.

If all parties elect to participate in such a proposed operation, Operator shall, within ninety (90) days after expiration of the notice period of thirty (30) days (or as promptly as possible after the expiration of the twenty-four (24) forty-eight (48) hour period when a drilling rig is on location, as the case may be), actually commence the proposed operation and complete it with due diligence at the risk and expense of all parties hereto; provided, however, said commencement date may be extended upon written notice of same by Operator to the other parties, for a period of up to thirty (30) additional days if, in the sole opinion of Operator, such additional time is reasonably necessary to obtain permits from governmental authorities, surface rights (including rights-of-way) or appropriate drilling equipment, or to complete title examination or curative matter required for title approval or acceptance. Notwithstanding the force majeure provisions of Article XI, if the actual operation has not been commenced within the time provided (including any extension thereof as specifically permitted herein) and if any party hereto still desires to conduct said operation, written notice proposing same must be resubmitted to the other parties in accordance with the provisions hereof as if no prior proposal had been made.

2. Operations by Less than All Parties: If any party receiving such notice as provided in Article VI.B.1. or VII.D.1. (Option No. 2) elects not to participate in the proposed operation, then, in order to be entitled to the benefits of this Article, the party or parties giving the notice and such other parties as shall elect to participate in the operation shall, within ninety (90) days after the expiration of the notice period of thirty (30) days (or as promptly as possible after the expiration of the twenty-four (24) forty-eight (48) hour period when a drilling rig is on location, as the case may be) actually commence the proposed operation and complete it with due diligence. Operator shall perform all work for the account of the Consenting Parties; provided, however, if no drilling rig or other equipment is on location, and if Operator is a Non-Consenting Party, the Consenting Parties shall either: (a) request Operator to perform the work required by such proposed operation for the account of the Consenting Parties, or (b) designate one (1) of the Consenting Parties as Operator to perform such work. Consenting Parties, when conducting operations on the Contract Area pursuant to this Article VI.B.2., shall comply with all terms and conditions of this agreement. Nothing contained herein shall prohibit Operator or the participatory parties from actually commencing the proposed operation before the expiration of the notice period, nor shall the timing of such commencement affect in any way the validity of a party’s election or deemed election.

If less than all parties approve any proposed operation, the proposing party, immediately after the expiration of the applicable notice period, shall advise the Consenting Parties of the total interest of the parties approving such operation and its recommendation as to whether the Consenting Parties should proceed with the operation as proposed. Each Consenting Party, within twenty-four (24) forty-eight (48) hours (exclusive of Saturday, Sunday and legal holidays) after receipt of such notice, shall advise the proposing party of its desire to (a) limit participation to such party’s interest as shown on Exhibit “A” or (b) carry its proportionate part of Non-Consenting Parties’ interests, and failure to advise the proposing party shall be deemed an election under (a). In the event a drilling rig is on location, the time permitted for such a response shall not exceed a total of twenty-four (24) forty-eight (48) hours (inclusive of Saturday, Sunday and legal holidays). The proposing party, at its election, may withdraw such proposal if there is insufficient participation and shall promptly notify all parties of such decision.

The entire cost and risk of conducting such operations shall be borne by the Consenting Parties in the proportions they have elected to bear same under the terms of the preceding paragraph. Consenting Parties shall keep the leasehold estates involved in such operations free and clear of all liens and encumbrances of every kind created by or arising from the operations of the Consenting Parties. If such an operation results in a dry hole, the Consenting Parties shall plug and abandon the well and restore the surface location at their sole cost, risk and expense. If any well drilled, reworked, deepened or plugged back under the provisions of this Article results in a producer of oil and/or gas in paying quantities, the Consenting Parties shall complete and equip the well to produce at their sole cost and risk,

and the well shall then be turned over to Operator and shall be operated by it at the expense and for the account of the Consenting Parties. Upon commencement of operations for the drilling, reworking, deepening or plugging back of any such well by Consenting Parties in accordance with the provisions of this Article, each Non-Consenting Party shall be deemed to have relinquished to Consenting Parties, and the Consenting Parties shall own and be entitled to receive, in proportion to their respective interests, all of such Non-Consenting Party’s interest in the well and share of production therefrom until the proceeds of the sale of such share, calculated at the well, or market value thereof if such share is not sold, (after deducting production taxes, excise taxes, royalty, overriding royalty and other interests not excepted by Article III.D. payable out of or measured by the production from such well accruing with respect to such interest until it reverts) shall equal the total of the following:

(a) 100% of each such Non-Consenting Party’s share of the cost of any newly acquired surface equipment beyond the wellhead connections (including, but not limited to, stock tanks, separators, treaters, pumping equipment and piping), plus 100% of each such Non-Consenting Party’s share of the cost of operation of the well commencing with first production and continuing until each such Non-Consenting Party’s relinquished interest shall revert to it under other provisions of this Article, it being agreed that each Non-Consenting Party’s share of such costs and equipment will be that interest which would have been chargeable to such Non-Consenting Party had it participated in the well from the beginning of the operations; and

(b) 400% of that portion of the costs and expenses of drilling, reworking, deepening, plugging back, testing and completing, after deducting any cash contributions received under Article VIII.C., and 400% of that portion of the cost of newly acquired equipment in the well (to and including the wellhead connections), which would have been chargeable to such Non-Consenting Party if it had participated therein.

An election not to participate in the drilling or the deepening of a well shall be deemed an election not to participate in any reworking or plugging back operation proposed in such a well, or portion thereof, to which the initial Non-Consent election applied that is conducted at any time prior to full recovery by the Consenting Parties of the Non-Consenting Party’s recoupment account. Any such reworking or plugging back operation conducted during the recoupment period shall be deemed part of the cost of operation of said well and there shall be added to the sums to be recouped by the Consenting Parties one hundred percent (100%) of that portion of the costs of the reworking or plugging back operation which would have been chargeable to such Non-Consenting Party had it participated therein. If such a reworking or plugging back operation is proposed during such recoupment period, the provisions of this Article VI.B. shall be applicable as between said Consenting Parties in said well.

During the period of time Consenting Parties are entitled to receive Non-Consenting Party’s share of production, or the proceeds therefrom, Consenting Parties shall be responsible for the payment of all production, severance, excise, gathering and other taxes, and all royalty, overriding royalty and other burdens applicable to Non-Consenting Party’s share of production not excepted by Article III.D.

In the case of any reworking, plugging back or deeper drilling operation, the Consenting Parties shall be permitted to use, free of cost, all casing, tubing and other equipment in the well, but the ownership of all such equipment shall remain unchanged; and upon abandonment of a well after such reworking, plugging back or deeper drilling, the Consenting Parties shall account for all such equipment to the owners thereof, with each party receiving its proportionate part in kind or in value, less cost of salvage.

Within sixty (60) days after the completion of any operation under this Article, the party conducting the operations for the Consenting Parties shall furnish each Non-Consenting Party with an inventory of the equipment in and connected to the well, and an itemized statement of the cost of drilling, deepening, plugging back, testing, completing, and equipping the well for production; or, at its option, the operating party, in lieu of an itemized statement of such costs of operation, may submit a detailed statement of monthly billings. Each month thereafter, during the time the Consenting Parties are being reimbursed as provided above, the party conducting the operations for the Consenting Parties shall furnish the Non-Consenting Parties with an itemized statement of all costs and liabilities incurred in the operation of the well, together with a statement of the quantity of oil and gas produced from it and the amount of proceeds realized from the sale of the well’s working interest production during the preceding month. In determining the quantity of oil and gas produced during any month, Consenting Parties shall use industry accepted methods such as, but not limited to, metering or periodic well tests. Any amount realized from the sale or other disposition of equipment newly acquired in connection with any such operation which would have been owned by a Non-Consenting Party had it participated therein shall be credited against the total unreturned costs of the work done and of the equipment purchased in determining when the interest of such Non-Consenting Party shall revert to it as above provided; and if there is a credit balance, it shall be paid to such Non-Consenting Party.

If and when the Consenting Parties recover from a Non-Consenting Party’s relinquished interest the amounts provided for above, the relinquished interests of such Non-Consenting Party shall automatically revert to it, and, from and after such reversion, such Non-Consenting Party shall own the same interest in such well, the material and equipment in or pertaining thereto, and the production therefrom as such Non-Consenting Party would have been entitled to had it participated in the drilling, reworking, deepening or plugging back of said well. Thereafter, such Non-Consenting Party shall be charged with and shall pay its proportionate part of the further costs of the operation of said well in accordance with the terms of this agreement and the Accounting Procedure attached hereto.

Notwithstanding the provisions of this Article VI.B.2., it is agreed that without the mutual consent of all parties, no wells shall be completed in or produced from a source of supply from which a well located elsewhere on the Contract Area is producing, unless such well conforms to the then-existing well spacing pattern for such source of supply.

The provisions of this Article shall have no application whatsoever to the drilling of the initial well described in Article VI.A. except (a) as to Article VII.D.1. (Option No. 2), if selected, or (b) as to the reworking, deepening and plugging back of such initial well after if has been drilled to the depth specified in Article VI.A. if it shall thereafter prove to be a dry hole or, if initially completed for production, ceases to produce in paying quantities.

3. Stand-By Time: When a well which has been drilled or deepened has reached its authorized depth and all tests have been completed, and the results thereof furnished to the parties, stand-by costs incurred pending response to a party’s notice proposing a reworking, deepening, plugging back or completing operation in such a well shall be charged and borne as part of the drilling or deepening operation just completed. Stand-by costs subsequent to all parties responding, or expiration of the response time permitted, whichever first occurs, and prior to agreement as to the participating interests of all Consenting Parties pursuant to the terms of the second grammatical paragraph of Article VI.B.2., shall be charged to and borne as part of the proposed operation, but if the proposal is subsequently withdrawn because of insufficient participation, such stand-by costs shall be allocated between the Consenting Parties in the proportion each Consenting Party’s interest as shown on Exhibit “A” bears to the total interest as shown on Exhibit “A” of all Consenting Parties.

4. Sidetracking: Except as hereinafter provided, those provisions of this agreement applicable to a “deepening” operation shall also be applicable to any proposal to directionally control and intentionally deviate a well from vertical so as to change the bottom hole location (herein call “sidetracking”), unless done to straighten the hole or to drill around junk in the hole or because of other mechanical difficulties. Any party having the right to participate in a proposed sidetracking operation that does not own an interest in the affected well bore at the time of the notice shall, upon electing to participate, tender to the well bore owners its proportionate share (equal to its interest in the sidetracking operation) of the value of that portion of the existing well bore to be utilized as follows:

(a) If the proposal is for sidetracking an existing dry hole, reimbursement shall be on the basis of the actual costs incurred in

the initial drilling of the well down to the depth at which the sidetracking operation is initiated.

(b) If the proposal is for sidetracking a well which has previously produced, reimbursement shall be on the basis of the well’s salvable materials and equipment down to the depth at which the sidetracking operation is initiated, determined in accordance with the provisions of Exhibit “C”, less the estimated cost of salvaging and the estimated cost of plugging and abandoning.

In the event that notice for a sidetracking operation is given while the drilling rig to be utilized is on location, the response period shall be limited to twenty-four (24) forty-eight (48) hours, exclusive of Saturday, Sunday and legal holidays; provided, however, any party may request and receive up to eight (8) additional days after expiration of the twenty-four (24) forty-eight (48) hours within which to respond by paying for all stand-by time incurred during such extended response period. If more than one party elects to take such additional time to respond to the notice, stand by costs shall be allocated between the parties taking additional time to respond on a day-to-day basis in the proportion each electing party’s interest as shown on Exhibit “A” bears to the total interest as shown on Exhibit “A” of all the electing parties. In all other instances the response period to a proposal for sidetracking shall be limited to thirty (30) days.

C. TAKING PRODUCTION IN KIND:

Each party shall have the right to take in kind or separately dispose of its proportionate share of all oil and gas produced from the Contract Area, exclusive of production which may be used in development and producing operations and in preparing and treating oil and gas for marketing purposes and production unavoidably lost. Any extra expenditure incurred in the taking in kind or separate disposition by any party of its proportionate share of the production shall be borne by such party. Any party taking its share of production in kind shall berequired to pay for only its proportionate share of such part of Operator’s surface facilities which it uses.

Each party shall execute such division orders and contracts as may be necessary for the sale of its interest in production from the Contract Area, and, except as provided in Article VII.B., shall be entitled to receive payment directly from the purchaser thereof for its share of all production.

In the event any party shall fail to make the arrangements necessary to take in kind or separately dispose of its proportionate share of the oil produced from the Contract Area, Operator shall have the right, subject to the revocation at will by the party owning it, but not the obligation, to purchase such oil or sell it to others at any time and from time to time, for the account of the non-taking party at the best price obtainable in the area for such production. Any such purchase or sale by Operator shall be subject always to the right of the owner of the production to exercise at any time its right to take in kind, or separately dispose of, its share of all oil not previously delivered to a purchaser. Any purchase or sale by Operator of any other party’s share of oil shall be only for such reasonable periods of time as are consistent with the minimum needs of the industry under the particular circumstances, but in no event for a period in excess of one (1) year.

In the event one or more parties’ separate disposition of its share of the gas causes split-stream deliveries to separate pipelines and/or deliveries which on a day-to-day basis for any reason are not exactly equal to a party’s respective proportionate share of total gas sales to be allocated to it, the balancing or accounting between the respective accounts of the parties shall be in accordance with any gas balancing agreement between the parties hereto, whether such an agreement is attached as Exhibit “E”, or is a separate agreement.

D. Access to Contract Area and Information:

Each party shall have access to the Contract Area at all reasonable times, at its sole cost and risk to inspect or observe operations, and shall have access at reasonable times to information pertaining to the development or operation thereof, including Operator’s books and records relating thereto. Operator, upon request, shall furnish each of the other parties with copies of all forms or reports filed with governmental agencies, daily drilling reports, well logs, tank tables, daily gauge and run tickets and reports of stock on hand at the first of each month, and shall make available samples of any cores or cuttings taken from any well drilled on the Contract Area. The cost of gathering and furnishing information to Non-Operator, other than that specified above, shall be charged to the Non-Operator that requests the Information.

E. Abandonment of Wells:

1. Abandonment of Dry Holes: Except for any well drilled or deepened pursuant to Article VI.B.2., any well which has been drilled or deepened under the terms of this agreement and is proposed to be completed as a dry hole shall not be plugged and abandoned without the consent of all parties. Should Operator, after diligent effort, be unable to contact any party, or should any party fail to reply within twenty-four (24) forty-eight (48) hours (exclusive of Saturday, Sunday and legal holidays) after receipt of notice of the proposal to plug and abandon such well, such party shall be deemed to have consented to the proposed abandonment. All such wells shall be plugged and abandoned in accordance with applicable regulations and at the cost, risk and expense of the parties who participated in the cost of drilling or deepening such well. Any party who objects to plugging and abandoning such well shall have the right to take over the well and conduct further operations in search of oil and/or gas subject to the provisions of Article VI.B.

2. Abandonment of Wells that have Produced: Except for any well in which a Non-Consent operation has been conducted hereunder for which the Consenting Parties have not been fully reimbursed as herein provided, any well which has been completed as a producer shall not be plugged and abandoned without the consent of all parties. If all parties consent to such abandonment, the well shall be plugged and abandoned in accordance with applicable regulations and at the cost, risk and expense of all the parties hereto. If, within thirty (30) days after receipt of notice of the proposed abandonment of any well, all parties do not agree to the abandonment of such well, those wishing to continue its operation from the interval(s) of the formation(s) then open to production shall tender to each of the other parties its proportionate share of the value of the well’s salvable material and equipment, determined in accordance with the provisions of Exhibit “C”, less the estimated cost of salvaging and the estimated cost of plugging and abandoning. Each abandoning party shall assign the non-abandoning parties, without warranty, express or implied, as to title or as to quantity, or fitness for use of the equipment and material, all of its interest in the well and related equipment, together with its interest in the leasehold estate as to, but only as to, the interval or intervals of the formation or formations then open to production. If the interest of the abandoning party is or includes an oil and gas interest, such party shall execute and deliver to the non-abandoning party or parties an oil and gas lease, limited to the interval or intervals of the formation or formations then open to production, for a term of one (1) year and so long thereafter as oil and/or gas is produced from the interval or intervals of the formation or formations covered thereby, such lease to be on the form attached as Exhibit

required to pay for only its proportionate share of such part of Operator’s surface facilities which it uses.

Each party shall execute such division orders and contracts as may be necessary for the sale of its interest in production from the Contract Area, and, except as provided in Article VII.B., shall be entitled to receive payment directly from the purchaser thereof for its share of all production.

In the event any party shall fail to make the arrangements necessary to take in kind or separately dispose of its proportionate share of the oil and gas produced from the Contract Area, Operator shall have the right, subject to the revocation at will by the party owning it, but not the obligation, to purchase such oil and gas or sell it to others at any time and from time to time, for the account of the non-taking party at the best price obtainable in the area for such production. Any such purchase or sale by Operator shall be subject always to the right of the owner of the production to exercise at any time its right to take in kind, or separately dispose of, its share of all oil and gas not previously delivered to a purchaser. Any purchase or sale by Operator of any other party’s share of oil and gas shall be only for such reasonable periods of time as are consistent with the minimum needs of the industry under the particular circumstances, but in no event for a period in excess of one (1) year. Notwithstanding the foregoing, Operator shall not make a sale, including one into interstate commerce, of any other party’s share of gas production without first giving such other party thirty (30) days notice of such intended sale.

D. Access to Contract Area and Information:

Each party shall have access to the Contract Area at all reasonable times, at its sole cost and risk to inspect or observe operations, and shall have access at reasonable times to information pertaining to the development or operation thereof, including Operator’s books and records relating thereto. Operator, upon request, shall furnish each of the other parties with copies of all forms or reports filed with governmental agencies, daily drilling reports, well logs, tank tables, daily gauge and run tickets and reports of stock on hand at the first of each month, and shall make available samples of any cores or cuttings taken from any well drilled on the Contract Area. The cost of gathering and furnishing information to Non-Operator, other than that specified above, shall be charged to the Non-Operator that requests the Information.

E. Abandonment of Wells:

1. Abandonment of Dry Holes: Except for any well drilled or deepened pursuant to Article VI.B.2., any well which has been drilled or deepened under the terms of this agreement and is proposed to be completed as a dry hole shall not be plugged and abandoned without the consent of all parties. Should Operator, after diligent effort, be unable to contact any party, or should any party fail to reply within forty-eight (48) hours (exclusive of Saturday, Sunday and legal holidays) after receipt of notice of the proposal to plug and abandon such well, such party shall be deemed to have consented to the proposed abandonment. All such wells shall be plugged and abandoned in accordance with applicable regulations and at the cost, risk and expense of the parties who participated in the cost of drilling or deepening such well. Any party who objects to plugging and abandoning such well shall have the right to take over the well and conduct further operations in search of oil and/or gas subject to the provisions of Article VI.B.

2. Abandonment of Wells that have Produced: Except for any well in which a Non-Consent operation has been conducted hereunder for which the Consenting Parties have not been fully reimbursed as herein provided, any well which has been completed as a producer shall not be plugged and abandoned without the consent of all parties. If all parties consent to such abandonment, the well shall be plugged and abandoned in accordance with applicable regulations and at the cost, risk and expense of all the parties hereto. If, within thirty (30) days after receipt of notice of the proposed abandonment of any well, all parties do not agree to the abandonment of such well, those wishing to continue its operation from the interval(s) of the formation(s) then open to production shall tender to each of the other parties its proportionate share of the value of the well’s salvable material and equipment, determined in accordance with the provisions of Exhibit “C”, less the estimated cost of salvaging and the estimated cost of plugging and abandoning. Each abandoning party shall assign the non-abandoning parties, without warranty, express or implied, as to title or as to quantity, or fitness for use of the equipment and material, all of its interest in the well and related equipment, together with its interest in the leasehold estate as to, but only as to, the interval or intervals of the formation or formations then open to production. If the interest of the abandoning party is or includes an oil and gas interest, such party shall execute and deliver to the non-abandoning party or parties an oil and gas lease, limited to the interval or intervals of the formation or formations then open to production, for a term of one (1) year and so long thereafter as oil and/or gas is produced from the interval or intervals of the formation or formations covered thereby, such lease to be on the form attached as Exhibit

“B”. The assignments or leases so limited shall encompass the “drilling unit” upon which the well is located. The payments by, and the assignments or leases to, the assignees shall be in a ratio based upon the relationship of their respective percentage of participation in the Contract Area to the aggregate of the percentages of participation in the Contract Area of all assignees. There shall be no readjustment of interests in the remaining portion of the Contract Area.

Thereafter, abandoning parties shall have no further responsibility, liability, or interest in the operation of or production from the well in the interval or intervals then open other than the royalties retained in any lease made under the terms of this Article. Upon request, at its election, Operator shall continue to operate the assigned well for the account of the non-abandoning parties at the rates and charges contemplated by this agreement, plus any additional cost and charges which may arise as the result of the separate ownership of the assigned well. Upon proposed abandonment of the producing interval(s) assigned or leased, the assignor or lessor shall then have the option to repurchase its prior interest in the well (using the same valuation formula) and participate in further operations therein subject to the provisions hereof.

3. Abandonment of Non-Consent Operations: The provisions of Article VI.E.1. or VI.E.2 above shall be applicable as between Consenting Parties in the event of the proposed abandonment of any well excepted from said Articles; provided, however, no well shall be permanently plugged and abandoned unless and until all parties having the right to conduct further operations therein have been notified of the proposed abandonment and afforded the opportunity to elect to take over the well in accordance with the provisions of this Article VI.E.

ARTICLE VII.

EXPENDITURES AND LIABILITY OF PARTIES

A. Liability of Parties:

The liability of the parties shall be several, not joint or collective. Each party shall be responsible only for its obligations, and shall be liable only for its proportionate share of the costs of developing and operating the Contract Area. Accordingly, the liens granted among the parties in Article VII.B. are given to secure only the debts of each severally. It is not the intention of the parties to create, nor shall this agreement be construed as creating, a mining or other partnership or association, or to render the parties liable as partners.

B. Liens and Payment Defaults:

Each Non-Operator grants to Operator a lien upon its oil and gas rights in the Contract Area, and a security interest in its share of oil and/or gas when extracted and its interest in all equipment, to secure payment of its share of expense, together with interest thereon at the rate provided in Exhibit “C”. To the extent that Operator has a security interest under the Uniform Commercial Code of the state, Operator shall be entitled to exercise the rights and remedies of a secured party under the Code. The bringing of a suit and the obtaining of judgment by Operator for the secured indebtedness shall not be deemed an election of remedies or otherwise affect the lien rights or security interest as security for the payment thereof. In addition, upon default by any Non-Operator in the payment of its share of expense, Operator shall have the right, without prejudice to other rights or remedies, to collect from the purchaser the proceeds from the sale of such Non-Operator’s share of oil and/or gas until the amount owed by such Non-Operator, plus interest, has been paid. Each purchaser shall be entitled to rely upon Operator’s written statement concerning the amount of any default. Operator grants a like lien and security interest to the Non-Operators to secure payment of Operator’s proportionate share of expense.

If any party fails or is unable to pay its share of expense within sixty (60) days after rendition of a statement therefor by Operator, the non-defaulting parties, including Operator, shall, upon request by Operator, pay the unpaid amount in the proportion that the interest of each such party bears to the interest of all such parties. Each party so paying its share of the unpaid amount shall, to obtain reimbursement thereof, be subrogated to the security rights described in the foregoing paragraph.

C. Payments and Accounting:

Except as herein otherwise specifically provided, Operator shall promptly pay and discharge expenses incurred in the development and operation of the Contract Area pursuant to this agreement and shall charge each of the parties hereto with their respective proportionate shares upon the expense basis provided in Exhibit “C”. Operator shall keep an accurate record of the joint account hereunder, showing expenses incurred and charges and credits made and received.

Operator, at its election, shall have the right from time to time to demand and receive from the other parties payment in advance of their respective shares of the estimated amount of the expense to be incurred in operations hereunder during the next succeeding month, which right may be exercised only by submission to each such party of an itemized statement of such estimated expense, together with an invoice for its share thereof. Each such statement and invoice for the payment in advance of estimated expense shall be submitted on or before the 20th day of the next preceding month. Each party shall pay to Operator its proportionate share of such estimate within thirty (30) fifteen (15) days after such estimate and invoice is received. If any party fails to pay its share of said estimate within said time, the amount due shall bear interest as provided in Exhibit “C” until paid. Proper adjustment shall be made monthly between advances and actual expense to the end that each party shall bear and pay its proportionate share of actual expenses incurred, and no more.

D. Limitation of Expenditures:

1. Drill or Deepen: Without the consent of all parties, no well shall be drilled or deepened, except any well drilled or deepened pursuant to the provisions of Article VI.B.2. of this agreement. Consent to the drilling or deepening shall include:

x Option No. 1: All necessary expenditures for the drilling or deepening, testing, completing and equipping of the well, including

necessary tankage and/or surface facilities.

o Option No. 2: All necessary expenditures for the drilling or deepening and testing of the well. When such well has reached its authorized depth, and all tests have been completed, and the results thereof furnished to the parties, Operator shall give immediate notice to the Non-Operators who have the right to participate in the completion costs. The parties receiving such notice shall have forty-eight (48) hours (exclusive of Saturday, Sunday and legal holidays) in which to elect to participate in the setting of casing and the completion attempt. Such election, when made, shall include consent to all necessary expenditures for the completing and equipping of such well, including necessary tankage and/or surface facilities. Failure of any party receiving such notice to reply within the period above fixed shall constitute an election by that party not to participate in the cost of the completion attempt. If one or more, but less than all of the parties, elect to set pipe and to attempt a completion, the provisions of Article VI.B.2. hereof (the phrase “reworking, deepening or plugging back” as contained in Article VI.B.2. shall be deemed to include “completing”) shall apply to the operations thereafter conducted by less than all parties.

2. Rework or Plug Back: Without the consent of all parties, no well shall be reworked or plugged back except a well reworked or plugged back pursuant to the provisions of Article VI.B.2. of this agreement. Consent to the reworking or plugging back of a well shall include all necessary expenditures in conducting such operations and completing and equipping of said well, including necessary tankage and/or surface facilities.

3. Other Operations: Without the consent of all parties, Operator shall not undertake any single project reasonably estimated to require an expenditure in excess of Fifty-Thousand Dollars ($50,000.00) except in connection with a well, the drilling, reworking, deepening, completing, recompleting, or plugging back of which has been previously authorized by or pursuant to this agreement; provided, however, that, in case of explosion, fire, flood or other sudden emergency, whether of the same or different nature, Operator may take such steps and incur such expenses as in its opinion are required to deal with the emergency to safeguard life and property but Operator, as promptly as possible, shall report the emergency to the other parties. If Operator prepares an authority for expenditure (AFE) for its own use, Operator shall furnish any Non-Operator so requesting an information copy thereof for any single project costing in excess of Fifty-Thousand Dollars ($50,000.00) but less than the amount first set forth above in this paragraph.

E. Rentals, Shut-in Well Payments and Minimum Royalties:

Rentals, shut-in well payments and minimum royalties which may be required under the terms of any lease shall be paid by the party or parties who subjected such lease to this agreement at its or their expense. In the event two or more parties own and have contributed interests in the same lease to this agreement, such parties may designate one of such parties to make said payments for and on behalf of all such parties. Any party may request, and shall be entitled to receive, proper evidence of all such payments. In the event of failure to make proper payment of any rental, shut-in well payment or minimum royalty through mistake or oversight where such payment is required to continue the lease in force, any loss which results from such non-payment shall be borne in accordance with the provisions of Article IV.B.2.

Operator shall notify Non-Operator of the anticipated completion of a shut-in gas well, or the shutting in or return to production of a producing gas well, at least five (5) days (excluding Saturday, Sunday and legal holidays), or at the earliest opportunity permitted by circumstances, prior to taking such action, but assumes no liability for failure to do so. In the event of failure by Operator to so notify Non-Operator, the loss of any lease contributed hereto by Non-Operator for failure to make timely payments of any shut-in well payment shall be borne jointly by the parties hereto under the provisions of Article IV.B.3.

F. Taxes:

Beginning with the first calendar year after the effective date hereof, Operator shall render for ad valorem taxation all property subject to this agreement which by law should be rendered for such taxes, and it shall pay all such taxes assessed thereon before they become delinquent. Prior to the rendition date, each Non-Operator shall furnish Operator information as to burdens (to include, but not be limited to, royalties, overriding royalties and production payments) on leases and oil and gas interests contributed by such Non-Operator. If the assessed valuation of any leasehold estate is reduced by reason of its being subject to outstanding excess royalties, overriding royalties or production payments, the reduction in ad valorem taxes resulting therefrom shall inure to the benefit of the owner or owners of such leasehold estate, and Operator shall adjust the charge to such owner or owners so as to reflect the benefit of such reduction. If the ad valorem taxes are based in whole or in part upon separate valuations of each party’s working interest, then notwithstanding anything to the contrary herein, charges to the joint account shall be made and paid by the parties hereto in accordance with the tax value generated by each party’s working interest. Operator shall bill the other parties for their proportionate shares of all tax payments in the manner provided in Exhibit “C”.

If Operator considers any tax assessment improper, Operator may, at its discretion, protest within the time and manner prescribed by law, and prosecute the protest to a final determination, unless all parties agree to abandon the protest prior to final determination. During the pendency of administrative or judicial proceedings, Operator may elect to pay, under protest, all such taxes and any interest and penalty. When any such protested assessment shall have been finally determined, Operator shall pay the tax for the joint account, together with any interest and penalty accrued, and the total cost shall then be assessed against the parties, and be paid by them, as provided in Exhibit “C”.

Each party shall pay or cause to be paid all production, severance, excise, gathering and other taxes imposed upon or with respect to the production or handling of such party’s share of oil and/or gas produced under the terms of this agreement.

G. Insurance:

At all times while operations are conducted hereunder, Operator shall comply with the workmen’s compensation law of the state where the operations are being conducted; provided, however, that Operator may be a self-insurer for liability under said compensation laws in which event the only charge that shall be made to the joint account shall be as provided in Exhibit “C”. Operator shall also carry or provide insurance for the benefit of the joint account of the parties as outlined in Exhibit “D”, attached to and made a part hereof. Operator shall require all contractors engaged in work on or for the Contract Area to comply with the workmen’s compensation law of the state where the operations are being conducted and to maintain such other insurance as Operator may require.

In the event automobile public liability insurance is specified in said Exhibit “D”, or subsequently receives the approval of the parties, no direct charge shall be made by Operator for premiums paid for such insurance for Operator’s automotive equipment.

ARTICLE VIII.

ACQUISITION, MAINTENANCE OR TRANSFER OF INTEREST

A. Surrender of Leases:

The leases covered by this agreement, insofar as they embrace acreage in the Contract Area, shall not be surrendered in whole or in part unless all parties consent thereto.

However, should any party desire to surrender its interest in any lease or in any portion thereof, and the other parties do not agree or consent thereto, the party desiring to surrender shall assign, without express or implied warranty of title, all of its interest in such lease, or portion thereof, and any well, material and equipment which may be located thereon and any rights in production thereafter secured, to the parties not consenting to such surrender. If the interest of the assigning party is or includes an oil and gas interest, the assigning party shall execute and deliver to the party or parties not consenting to such surrender an oil and gas lease covering such oil and gas interest for a term of one (1) year and so long thereafter as oil and/or gas is produced from the land covered thereby, such lease to be on the form attached hereto as Exhibit “B”. Upon such assignment or lease, the assigning party shall be relieved from all obligations thereafter accruing, but not theretofore accrued, with respect to the interest assigned or leased and the operation of any well attributable thereto, and the assigning party shall have no further interest in the assigned or leased premises and its equipment and production other than the royalties retained in any lease made under the terms of this Article. The party assignee or lessee shall pay to the party assignor or lessor the reasonable salvage value of the latter’s interest in any wells and equipment attributable to the assigned or leased acreage. The value of all material shall be determined in accordance with the provisions of Exhibit “C”, less the estimated cost of salvaging and the estimated cost of plugging and abandoning. If the assignment or lease is in favor of more than one party, the interest shall be shared by such parties in the proportions that the interest of each bears to the total interest of all such parties.

Any assignment, lease or surrender made under this provision shall not reduce or change the assignor’s, lessor’s or surrendering party’s interest as it was immediately before the assignment, lease or surrender in the balance of the Contract Area; and the acreage assigned, leased or surrendered, and subsequent operations thereon, shall not thereafter be subject to the terms and provisions of this agreement.

B. Renewal or Extension of Leases:

If any party secures a renewal of any oil and gas lease subject to this agreement, all other parties shall be notified promptly, and shall have the right for a period of thirty (30) days following receipt of such notice in which to elect to participate in the ownership of the renewal lease, insofar as such lease affects lands within the Contract Area, by paying to the party who acquired it their several proper proportionate shares of the acquisition cost allocated to that part of such lease within the Contract Area, which shall be in proportion to the interests held at that time by the parties in the Contract Area.

If some, but less than all, of the parties elect to participate in the purchase of a renewal lease, it shall be owned by the parties who elect to participate therein, in a ratio based upon the relationship of their respective percentage of participation in the Contract Area to the aggregate of the percentages of participation in the Contract Area of all parties participating in the purchase of such renewal lease. Any renewal lease in which less than all parties elect to participate shall not be subject to this agreement.

Each party who participates in the purchase of a renewal lease shall be given an assignment of its proportionate interest therein by the acquiring party.

The provisions of this Article shall apply to renewal leases whether they are for the entire interest covered by the expiring lease or cover only a portion of its area or an interest therein. Any renewal lease taken before the expiration of its predecessor lease, or taken or contracted for within six (6) months after the expiration of the existing lease shall be subject to this provision; but any lease taken or contracted for more than six (6) months after the expiration of an existing lease shall not be deemed a renewal lease and shall not be subject to the provisions of this agreement.

The provisions in this Article shall also be applicable to extensions of oil and gas leases.

C. Acreage or Cash Contributions:

While this agreement is in force, if any party contracts for a contribution of cash towards the drilling of a well or any other operation on the Contract Area, such contribution shall be paid to the party who conducted the drilling or other operation and shall be applied by it against the cost of such drilling or other operation. If the contribution be in the form of acreage, the party to whom the contribution is made shall promptly tender an assignment of the acreage, without warranty of title, to the Drilling Parties in the proportions

said Drilling Parties shared the cost of drilling the well. Such acreage shall become a separate Contract Area and, to the extent possible, be governed by provisions identical to this agreement. Each party shall promptly notify all other parties of any acreage or cash contributions it may obtain in support of any well or any other operation on the Contract Area. The above provisions shall also be applicable to optional rights to earn acreage outside the Contract Area which are in support of a well drilled inside the Contract Area.

If any party contracts for any consideration relating to disposition of such party’s share of substances produced hereunder, such consideration shall not be deemed a contribution as contemplated in this Article VIII.C.

D. Maintenance of Uniform Interests:

For the purpose of maintaining uniformity of ownership in the oil and gas leasehold interests covered by this agreement, no party shall sell, encumber, transfer or make other disposition of its interest in the leases embraced within the Contract Area and in wells, equipment and production unless such disposition covers either:

1. the entire interest of the party in all leases and equipment and production; or

2. an equal undivided interest in all leases and equipment and production in the Contract Area.

Every such sale, encumbrance, transfer or other disposition made by any party shall be made expressly subject to this agreement and shall be made without prejudice to the right of the other parties.

If, at any time the interest of any party is divided among and owned by four or more co-owners, Operator, at its discretion, may require such co-owners to appoint a single trustee or agent with full authority to receive notices, approve expenditures, receive billings for and approve and pay such party’s share of the joint expenses, and to deal generally with, and with power to bind, the co-owners of such party’s interest within the scope of the operations embraced in this agreement; however, all such co-owners shall have the right to enter into and execute all contracts or agreements for the disposition of their respective shares of the oil and gas produced from the Contract Area and they shall have the right to receive, separately, payment of the sale proceeds thereof.

E. Waiver of Rights to Partition:

If permitted by the laws of the state or states in which the property covered hereby is located, each party hereto owning an undivided interest in the Contract Area waives any and all rights it may have to partition and have set aside to it in severalty its undivided interest therein.

F. Preferential Right to Purchase: