UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

For the transition period from _____________ to _____________

STRATEGIC MINING CORPORATION

(Name of small business issuer specified in its charter)

|

Wyoming

|

000-53961

|

88-0432539

|

||

|

(State or other jurisdiction

|

(Commission File No.)

|

(I.R.S. Employer

|

||

|

of incorporation)

|

Identification No.)

|

36 Toronto Street, suite 1170

Toronto, ON, Canada M5C 2C5

(Address of principal executive offices)

(former name or former address, if changed since last report)

416 840-9843

(Registrant’s telephone number)

Securities registered pursuant to Section 12(g) of the Act:

Common stock, $0.001 par value

(Title of class)

Indicate by check mark is the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicated by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. o Yes x No

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes oNo

Indicate by checkmark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files. o Yes x No

Indicate by checkmark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K(section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporate by reference in Part III of this From 10-K or any amendment to this Form 10-K._____

Indicate by checkmark wither the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.)

o Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of registrant’s most recently completed second fiscal quarter, June 30, 2011was approximately $6,333,731

The number of shares outstanding of each of the registrant’s classes of common stock, as of May 14, 2012 was 250,895,851 shares.

TABLE OF CONTENTS

|

PART I

|

||

| ITEM 1 – | 1 | |

| ITEM 1A – | 9 | |

| ITEM 1B – | 13 | |

| ITEM 2 – | 13 | |

| ITEM 3 - | 13 | |

| ITEM 4 – | 13 | |

|

PART II

|

||

| ITEM 5 – | 14 | |

| ITEM 6 – | 16 | |

| ITEM 7 – | 16 | |

| ITEM 7A – | 20 | |

| ITEM 8 – | F-1 | |

| ITEM 9 – | 21 | |

| ITEM 9A – | 21 | |

| ITEM 9B – | 22 | |

|

PART III

|

||

| ITEM 10 – | 23 | |

| ITEM 11 – | 23 | |

| ITEM 12 – | 25 | |

| ITEM 13 - | 26 | |

| ITEM 14 – | 27 | |

|

PART IV

|

||

| ITEM 15 - | 27 | |

Item 1. BUSINESS

FORWARD LOOKING STATEMENTS

This annual report and the exhibits attached hereto contain "forward-looking statements". Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “believes” or “does not believe”, "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

–risks related to our mineral operations being subject to government regulation;

–risks related to our ability to obtain additional capital to develop our resources, if any;

–risks related to mineral exploration activities;

–risks related to the fluctuation of prices for precious and base metals, such as gold, silver and copper;

–risks related to the competitive industry of mineral exploration;

–risks related to our title and rights in our mineral properties;

–risks related to the possible dilution of our common stock from additional financing activities; and

–risks related to fluctuations of the price of our shares of common stock.

BUSINESS DEVELOPMENT

Strategic Mining Corporation (the “Company”) was originally incorporated in Delaware on August 24, 1995 as Infocenter Inc. On February 28, 2000, the Company changed its name to Green Dolphin Systems Corp. and new corporate officers were appointed. On January 10, 2006, the Board of Directors adopted a resolution authorizing the assignment of all the assets of Green Dolphin Systems Corp. to Penta Deltex, Ltd., a Canadian corp., in exchange for the forgiveness of $263,717 in debt owing to Nicholas Plessas and an additional $153,683 owing to Penta Deltex, and assumption by Penta Deltex of all obligations owed by Green Dolphin Systems Corp. to suppliers and on other accounts payable. As the result of the above settlements of debts, Green Dolphin Systems Corp. effectively ceased operations on January 10, 2006.

On April 26, 2004, the SEC temporarily suspended trading of the common stock of the Company on the over-the–counter bulletin board, because it appeared to the SEC that “there was a lack of current and accurate information concerning the securities of (the Company) because of questions regarding the accuracy of assertions by (the company) and by others, in press releases and public statements to investors concerning, among other things, (the company’s) business relationship with a national restaurant chain.”

The Company cooperated with the SEC in its investigation, and the investigation was subsequently closed with no enforcement action taken. All records obtained by the SEC in the investigation have been returned to the Company. The Company subsequently filed new public information disclosures with FINRA, and now trades on the over-the-counter bulletin board under the trading symbol SMNG.

1

The Company, under former management, stopped filing reports with the Securities and Exchange Commission in the first quarter of 2006. On August 16, 2006, it filed a form 15-12g to terminate its registration under the 1934 Act.

On December 1, 2006, the Company changed its name to Gold Coast Mining Corp. and new corporate officers were appointed shortly after. On November 13, 2009, the Company changed its domicile and was reincorporated in the State of Wyoming. On November 23, 2009, the Company changed its name to Strategic Mining Corporation. The Company’s fiscal year end is December 31. The Company has never been in bankruptcy or receivership.

On January 17, 2007 the Company issued 97,100,000 shares of its common stock to unrelated parties in exchange for various mining rights. The issuance of the 97,100,000 represented approximately 97.5% of the then outstanding shares. The transaction resulted in a change in control of the entity.

The issuance of shares and change in control has been accounted for as a reverse acquisition followed by a recapitalization of the Company’s equity structure. The stockholders obtaining control in the transaction is considered the accounting acquirer for financial reporting purposes. Accordingly, the equity section of the financial statements have been presented displaying the recapitalization of shares held by the individuals obtaining control followed by the issuance of shares to the minority stockholders.

In February 2010, the Company amended its articles of incorporation to authorize 25 million shares of preferred convertible stock. On March 4, 2010 the board of directors designated rights and preferences of the preferred stock as “Series A Convertible Preferred Stock,” with voting rights per preferred share equal to ten shares of common stock and conversion rights of each preferred share to convert to one share of preferred common stock.

BUSINESS

The Company is an exploration stage mining company engaged in the exploration of gold mining properties in the regions of Vietnam and Guinea, West Africa. The Company has generated no revenues to date and have incurred losses of $2,707,794 from January 17, 2007 (inception) to December 31, 2011. There can be no assurance that any economically producible mineral deposits exist, and further exploration will be required before a final evaluation as to the economic and legal feasibility of each property is determined.

2

Properties

Guinea, West Africa

Siguiri Property

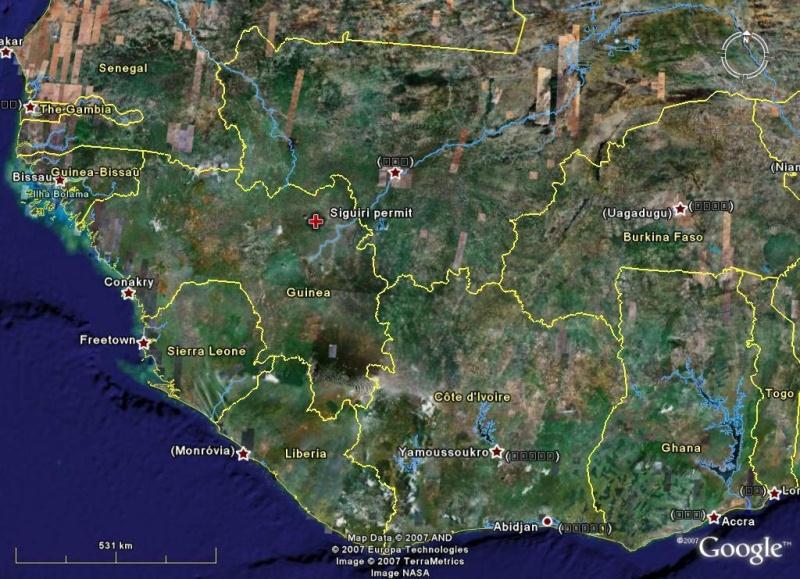

On January 14, 2007, the Company entered into an joint venture agreement with Gold River of Africa Corporation (“Gold River”), whereby the Company acquired certain exploration equipment and a mining claim in Guinea, West Africa, in exchange for 50,000,000 shares of Company’s common stock (the “Siguiri Exploration Permit” and the “Siguiri project”). This resulted in Gold River holding more than 10% of Company stock and becoming a related party for reporting purposes. The Company’s interest in the joint venture remains at 100% as long as all costs associated with the joint venture are paid directly by the Company or indirectly through Gold River. The Siguiri Exploration Permit comprises 103 square kilometers in the Prefecture of Siguiri of Guinea, approximately 492 kilometers north east of the of Conakry, the capital of the country, near the city of Siguiri. The permit area is centered on 11 degrees 16 minutes 20 seconds north, 9 degrees, 36 minutes 20 seconds west in the Prefecture of Siguiri in north central Guinea. Siguiri is the second largest city in Guinea and is the supply center for the mining industry in northern Guinea.

The Company holds 100% interest in the joint venture’s two-year Siguiri Exploration Permit issued by the Republic of Guinea #2009/1031 dated May 2009 to Gold River. The Guinea government is entitled to a 15% royalty on all extracted minerals. Exploration permits are issued for two years and a one-time fee is paid for the permit. Otherwise, there are no annual fees for the permit, but taxes are due annually to the government.

3

The Company applied for an extension of the Siguiri permit in May 2011 to allow further evaluation work and preparation for mining of placer gold deposits. During the change in governments in Guinea and related turmoil in 2011, the extension was put on hold by the government and the Company’s permit and rights to the property through the joint venture remained in question until the matter could be resolved with the new government. The permit extension was granted in April 2012 after government review of all outstanding exploration permits and activities in those permit areas. Receipt of the permit document from Guinea is pending.

In 2007, the Company commissioned an independent geologist to conduct due diligence sampling and mapping of the permit area that had potential for gold in Birimian sedimentary to metasedimentary volcanic rocks, similar to most major gold deposits in Guinea and West Africa. The geological study, published in July 2007, concluded that the geomorphology and distribution of elluvial and alluvial placer gold indicated a lode source of gold within the permit area, warranting further exploration.

The source of lode gold in the permit area is obscured by an extensive lateritic cap of residual alumina and iron oxides. This material was formed during a long period of intense tropical weathering and almost fully mantles the underlying bedrock or saprolite. There are two hills within the permit area that have similar relief to the silicified mineralized zones at the SAG mine 35 kilometers to the northeast. Abundant quartz float is present on the hillside surfaces, below the level of laterite cap on the hill. In one case, quartz vein material outcrops near the top of the hill, with some samples positively assayed for gold greater than 0.10 grams per ton.

Adjacent to the hills are elluvial and alluvial gold concentrations that have been worked historically and are currently being worked by artisanal miners. The elluvial deposits are at the base of the slope where gold float and a quartz vein sample assayed positively for gold.

A program of termite mound sampling was undertaken to screen the remainder of the permit area. This sampling tested positive for gold in the area where artisanal mining of the alluvium was present as well as areas where it was not being conducted.

The report, prepared pursuant to the Canadian standard, NI 43-101, recommended a two stage program of further exploration. The first stage entails completion of the termite mound sampling, detailed geological mapping, and geochemical soil sampling. The second stage recommended entails reverse circulation drilling and sampling in areas showing positive assays from the first stage.

The author preparing the NI 43-101 report conducted due diligence sampling in December of 2006. According to sampling guidelines, to ensure chain of custody, the samples were in his possession at all times. When the location of a potential sample was reached, the following protocol was followed:

|

1. Plastic sample bags were labeled with indelible ink.

|

|

2. A field sample tag with the same number as written on the outside of the bag was put into the plastic sample bag with the sample.

|

|

3. The sample was collected and the sample bag closed and sealed with a single-use cable tie.

|

|

4. The author carried the sample to camp, and it remained in the author’s possession until submitted to SGS Guinee laboratory in Siguiri, Guinea.

|

All QA/QC protocols are defined by the Canadian Instrument 43-101 which the company has adopted and adheres to the same guidelines regarding its sample acquisition procedures.

Management recommends that continued exploration of the permit area should comprise completion of the termite mound sampling to identify areas of anomalous gold beneath the laterite cap. After completion of the termite mound sampling, a reverse circulation drilling program is recommended, with core drilling to be done in selected areas to provide detailed subsurface geologic information where possible. Should the termite mound sampling indicate more extensive areas of anomalous gold, a high-resolution airborne geophysical survey (magnetometer, electromagnetic and radiometric survey) should be undertaken over the entire permit area to identify underlying structures and delineate additional areas for future drilling. For the proposed drilling program the target areas appears to be:

4

1) Northwest to southeast drilling across both the assumed structural and stratigraphic fabrics in the permit area.

2) Northwest to southeast drilling across the topographic highs with silicified rocks and surrounded by alluvial and elluvial artisanal workings possibly derived from the silicified areas.

The properties are without known reserves and the proposed program is exploratory in nature.

Evaluation and Acquisition -- Dinguiraye Property

On February 11, 2011, the Company entered into a Letter of Intent with Gold River of Africa Corporation (“Gold River”), related to the proposed acquisition of an option to acquire an undivided 100% interest in the eastern one-third of the Paramangui Exploration Permit (the “Dinguiraye property”) located in north-central Guinea, West Africa in the Prefecture of Dinguiraye. Gold River holds a 100% interest in the Paramangui Exploration Permit issued by the Republic of Guinea #A2006/3480/MMG/SGG and dated July 24, 2006. There are no annual fees for the permit. The size of the exploration permit is 166.6 square kilometers.

The Letter of Intent was binding and granted to the Company, after a due diligence period of up to April 30, 2011, approval of the board of directors of the Company and the board of directors of Gold River, (the “Effective Date”), the right to acquire the Dinguiraye property upon the issuance of 15,000,000 shares of Company common stock. The due diligence period entitled the Company to undertake a comprehensive program of due diligence with regard to the Dinguiraye property and all exploration that had been conducted thereon to date. An extension of the allowable due diligence period was made by mutual consent of the Company and Gold River until 31 December 2011. However, this option was cancelled by mutual consent of the Company and Gold River on December 23, 2011.

5

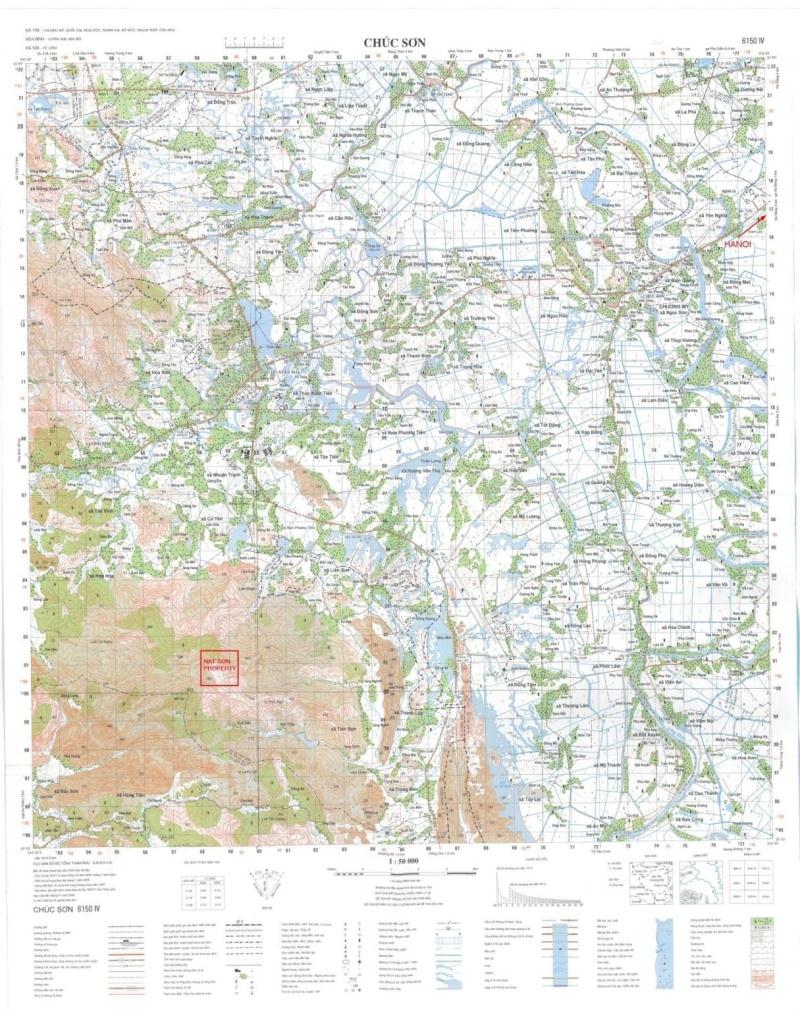

Vietnam Property

On October 22, 2009, the Company entered into a binding letter of intent (“Joint Venture” or “Joint Venture Agreement”) with Ba Dinh Mineral Company Limited (“Ba Dinh”), which was signed on behalf of Ba Dinh by former director and CEO Todd Sterck, before he was appointed as our CEO and director, whereby Ba Dinh agreed to sell us 51% of the assets associated with the mining claims known as the “Nat Son” Exploration Property. The retention of mineral rights is conditioned upon the Company putting a best effort into exploring and developing the property. The Nat Son exploration property consists of approximately 102 hectares of land in northern Vietnam. Exploration interest in the property is based on the presence of gold-silver bearing quartz-arsenopyrite veins which are exposed at the surface and within rudimentary underground mine workings. The veins are known to extend well beyond the current property boundaries and have been examined and sampled over a strike length of 4.0 km. The Nat Son property is located 50 km southwest of Hanoi in Nat Son Commune, Kim Boi District, Hoa Binh Province and is accessible by road.

6

Mineral rights were issued by the Peoples Committee of Hoa Binh Province to Ba Dinh Construction and Consulting Joint Stock Company, a different legal entity than Ba Dinh Mineral Company Limited. The Peoples Committee of Hoa Binh Province issued an Exploration Permit to Ba Dinh on June 9th, 2009 No.: 39/QÐ – UBND. This permit is valid for five years from the issue date and in renewable for an additional five years. The permitted area of interest covers 40 hectares in Nat Son Commune, Hoa Binh Province Vietnam. The Company is responsible for all Exploration and Exploitation Costs. There are no annual fees or dues associated with the Nat Son Property. The total land area of the Nat Son Property is 103 hectares with 40 hectares approved for exploitation.

A dispute arose in October, 2011 concerning the status of joint work on the Nat Son property in Vietnam between the Company and Ba Dinh as a result of key partners in Ba Dinh disagreeing with the Company about the status of their stock holdings in the Company. Management, in consultation with legal counsel, has determined that the arguments by those key partners have no legal merit and may expose those partners to litigation should they not desist and should they fail to comply with documentation requests from the Company. Ba Dinh has been notified of this finding. The Company is awaiting their response and delivery of key property documents on Nat Son to the Company for its records and safe-keeping. This dispute may result in a disruption or change of our drilling plan on the Nat Son property for 2012. To date, Ba Dinh has not completed a transfer of the title to the Nat Son property to the Company, per the agreement between the parties, and the Company has sought the assistance of Vietnamese counsel to enforce the binding letter of intent.

Counsel was retained for initial investigations in Vietnam to determine what the true state of the project was during the first quarter of 2012. As a result of these investigations, it was determined that a valid exploration permit has been granted to Ba Dinh Construction and Consulting Joint Stock Company by the provincial authorities and is in effect until June 2014. However, investigations are continuing regarding the status of ownership and/or leasing of the Nat Son property by Ba Dinh. Also, Ba Dinh officers continue to be unresponsive, thereby putting the viability of the joint venture in question.

There is not enough information available on the legal status of the Joint Venture Agreement with Ba Dinh and the Nat Son property to determine whether or not Ba Dinh has performed according to the requirements of the Joint Venture Agreement. Therefore, the project has been written off in the fourth quarter of 2011 to allow for possible permanent impairment of the project. Management’s opinion on this matter is that the project still is potentially viable, but that all joint venture activities with Ba Dinh may need to cease if a mutually agreeable solution cannot be reached. Should the joint venture agreement be formally dissolved, the Company may pursue legal options in Vietnam during 2012 to recover payments made to Ba Dinh for expenses that they have not documented adequately or for which official documentation has not been provided for the project.

To date the Company and Ba Dinh have built crew housing and a core shack. The Company also had a new road completed from Luong Son village to the property site. A draft Technical Report compliant with Canadian standard N1 43-101 was prepared by “qualified person” M. Hassan Alief on the property in September 2009, and in December 2009 a final report was issued by Mr. Alief based on two weeks of detailed field work. As a result of the field work, the Company’s geological consultants recommended a detailed drill program to test the subsurface potential of the property.

A geochemical report was completed by consultant Bob Marvin. To date there have been no subsurface improvements and no equipment is on site. Water is available by artesian springs on the property and power will be by generator.

The NI 43-101 report concluded that the Nat Son property is centered on a 2 to 3 square kilometer area of strong to intense sericite-kaolinite-quartz-anhydrite alteration of Triassic age clastic and volcanic rocks. Strongly gold mineralized, arsenopyrite rich, quartz veins occur within this envelope. The veins, mineralization and alteration appear to be focused around a series of strongly altered, andesite porphyry intrusions. Mineralized veins on the Nat Son property occur in two distinct sets: an apparently dominant east-northeast set and a secondary north-south set.

7

The author preparing the NI 43-101 report collected 14 samples. The samples were in his position at all times. Thirteen samples were taken to the office of DHL in Hanoi, directly, and shipped to ALS Chemex in Vancouver, BC, Canada. The samples were analyzed for a 33 element suite and gold. The chain of custody meets the requirements necessary for NI 43-101 technical report purposes. One sample collected from the old operations next to the adit Number Two consisted of pulverized material. DHL did not accept the sample because it could not ship the pulverized material out of Vietnam. That sample was taken by Todd Sterck to Arlington, Washington, and shipped to ALS Chemex from there. The result of chemical analysis for this sample is shown in the table listing all other analyses with a caveat that the chain of custody cannot be verified. All QA/QC protocols are defined by NI 43-101 which the company has adopted and adheres to the same guidelines regarding its future sample acquisition procedures.

The drilling that is planned will be the first depth testing of the ore bearing veins at Nat Son. The results of the planned drilling should provide critical data that will enable a rough resource calculation to be made and provide the basis for further, more detailed exploration of the property.

Pending legal review, management has recommended that the Company undertake an exploration program to pursue the gold, lead and zinc targets on and in the vicinity of the old workings. These targets include zones of higher grade mineralization encountered in old adits to date, new conceptual targets premised on the recognition that the mineralization are related in time and space to faults in limestone. The following activities are deemed to be essential components of this program based on the NI 43-101 report:

1. Clean up and make old adits, drifts and winzes safe for inspection, mapping and sampling.

2. Map and sample the old workings.

3. Send samples to ALS Chemex for analysis, making sure of sample integrity and chain of custody.

4. Although surface outcrops are very few, making use of satellite imagery to put together a structural picture of the area along with lithology is recommended.

5. Because of paucity of outcrops in the property, a geophysical exploration program was suggested to outline the underlying structures and possible mineralized areas.

6. The geology of the property needs to be mapped using a GPS system with detailed notes describing lithologies, mineralization, alteration, and structural and stratigraphic details.

The property is without known reserves and the proposed program is exploratory in nature.

Employees

We currently employ two management level employees, working as part-time contractors. The Company may require additional employees in the future. There is intense competition for capable, experienced personnel and there is no assurance the Company will be able to obtain new qualified employees when required.

The Company believes its relations with its employees are good.

Patents

The Company holds no patents for any products.

Government Regulation

Our activities will be subject to various federal, foreign and local laws and regulations governing prospecting, exploration, production, labor standards, occupational health and mine safety, control of toxic substances, and other matters involving environmental protection and taxation. It is possible that future changes in these laws or regulations could have a significant impact on our business, causing those activities to be economically re-evaluated at that time.

8

Environmental Risks

Minerals exploration and mining are subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Insurance against environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production, is not generally available to us (or to other companies in the minerals industry) at a reasonable price. To the extent that we may become subject to environmental liabilities, the remediation of any such liabilities would reduce funds otherwise available to us and could have a material adverse effect on our financial condition. Laws and regulations intended to ensure the protection of the environment are constantly changing, and are generally becoming more restrictive.

Competition

There is aggressive competition within the minerals industry to discover, acquire and mine mineral properties considered to have commercial potential. In addition, we compete with others in efforts to obtain financing to acquire and explore mineral properties.

The Company competes in Guinea with other more established gold mining companies in the area, such as Cassidy Gold Corporation, and AngloGold Ashanti.

Item 1A. RISK FACTORS

We are subject to various risks which may materially harm our business, financial condition and results of operations. You should carefully consider the risks and uncertainties described below and the other information in this filing before deciding to purchase our common stock. If any of these risks or uncertainties actually occurs, our business, financial condition or operating results could be materially harmed. In that case, the trading price of our common stock could decline and you could lose all or part of your investment.

Because Most of Our Operations Will Be Located Outside the U.S., U.S. Investors May Experience Difficulties In Attempting To Enforce Judgments Based Upon U.S. Federal Securities Laws. U.S. Laws and/or Judgments Might Not Be Enforced Against Us In Foreign Jurisdictions.

Most of our operations and assets will be located outside of the United States. As a result, it may be difficult or impossible for U.S. investors to enforce judgments of U.S. courts for civil liabilities against us or against any of our individual directors or officers. In addition, U. S. investors should not assume that courts in the countries in which our operations or assets are located (i) would enforce judgments of U.S. courts obtained in actions against us based upon the civil liability provisions of applicable U.S. federal and state securities laws or (ii) would enforce, in original actions, liabilities against us based upon these laws.

Mining activities involve a high degree of risk.

Our operations on our properties will be subject to all the hazards and risks normally encountered in the mining deposits of gold. These hazards and risks include, without limitation, unusual and unexpected geologic formations, seismic activity, rock bursts, pit-wall failures, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and legal liability. Milling operations, if any, are subject to various hazards, including, without limitation, equipment failure and failure of retaining dams around tailings disposal areas, which may result in environmental pollution and legal liability.

The parameters that would be used at our properties in estimating possible mining and processing efficiencies would be based on the testing and experience our management has acquired in operations elsewhere. Various unforeseen conditions can occur that may materially affect estimates based on those parameters. In particular, past mining operations indicate that care must be taken to ensure that proper mineral grade control is employed and that proper steps are taken to ensure that mining operations are executed as planned to avoid mine grade dilution, resulting in uneconomic material being fed to a mill. Other unforeseen and uncontrollable difficulties may occur in planned operations at our properties which could lead to failure of the operation.

9

If we make a decision to exploit either of our properties based on gold mineralization that may be discovered and proven, we plan to process the resource using technology that has been demonstrated to be commercially effective at other geologically similar gold deposits elsewhere in the world. These techniques may not be as efficient or economical as we project, and we may never achieve profitability.

We may be adversely affected by fluctuations in gold and silver prices.

The value and price of our securities, our financial results, and our exploration activities may be significantly adversely affected by declines in the price of gold and other precious metals. Gold prices fluctuate widely and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the United States dollar against foreign currencies on the world market, global and regional supply and demand for gold, and the political and economic conditions of gold producing countries throughout the world. The price for gold fluctuates in response to many factors beyond anyone’s ability to predict. The prices that would be used in making any resource estimates at our properties would be disclosed and would probably differ from daily prices quoted in the news media. Percentage changes in the price of gold cannot be directly related to any estimated resource quantities at any of our properties, as they are affected by a number of additional factors. For example, a ten percent change in the price of gold may have little impact on any estimated resource quantities and would affect only the resultant cash flow. Because any future mining would occur over a number of years, it may be prudent to continue mining for some periods during which cash flows are temporarily negative for a variety of reasons, including a belief that a low price of gold is temporary and/or that a greater expense would be incurred in temporarily or permanently closing a mine there.

Mineralized material calculations and life-of-mine plans, if any, using significantly lower gold and precious metal prices could result in material write-downs of our investments in mining properties and increased reclamation and closure charges.

In addition to adversely affecting any of our mineralized material estimates and its financial aspects, declining metal prices may impact our operations by requiring a reassessment of the commercial feasibility of a particular project. Such a reassessment may be the result of a management decision related to a particular event, such as a cave-in of a mine tunnel or open pit wall. Even if any of our projects may ultimately be determined to be economically viable, the need to conduct such a reassessment may cause substantial delays in establishing operations or may interrupt on-going operations, if any, until the reassessment can be completed.

Estimates of mineralized material are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineralized material within the earth using statistical sampling techniques. Estimates of any mineralized material on any of our properties would be made using samples obtained from appropriately placed trenches, test pits and underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated.

Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to commercially viable operations in the future.

10

Future legislation and administrative changes to the Vietnamese and Guinean mining laws could prevent us from exploring our properties.

Vietnamese and Guinean laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations.

We are a relatively young company with limited operating history

Because we are a young company, it is difficult to evaluate our business and prospects. At this stage of our business operations, even with our good faith efforts, potential investors have a high probability of losing their investment. Our future operating results will depend on many factors, including the ability to generate sustained and increased demand and acceptance of our products, the level of our competition, and our ability to attract and maintain key management and employees. Whereas management believes their estimates of projected occurrences and events are within the timetable of their business plan, there can be no guarantees or assurances that the results anticipated will occur.

We may require additional funds to operate in accordance with our business plan.

We may not be able to obtain additional funds that we may require. We do not presently have adequate cash from operations or financing activities to meet our long-term needs. If unanticipated expenses, problems, and unforeseen business difficulties occur, which result in material delays, we will not be able to operate within our budget. If we do not achieve our internally projected sales revenues and earnings, we will not be able to operate within our budget. If we do not operate within our budget, we will require additional funds to continue our business. If we are unsuccessful in obtaining those funds, we cannot assure our ability to generate positive returns to the Company. Further, we may not be able to obtain the additional funds that we require on terms acceptable to us, if at all. We do not currently have any established third-party bank credit arrangements. If the additional funds that we may require are not available to us, we may be required to curtail significantly or to eliminate some or all of our acquisition, exploration, development, or sales and marketing programs.

If we need additional funds, we may seek to obtain them primarily through equity or debt financings. Such additional financing, if available on terms and schedules acceptable to us, if available at all, could result in dilution to our current stockholders and to you. We may also attempt to obtain funds through arrangement with corporate partners or others. Those types of arrangements may require us to relinquish certain rights to our mineral or intellectual property or to resulting products.

Our Auditor has raised substantial doubt about our ability to continue as a going concern

The report of our independent auditor regarding our audited financial statements for the period ended December 31, 2011 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are that we have an accumulated deficit since inception and have no revenues. Our future is dependent upon our ability to obtain financing and upon successful exploration and future development and production stages on our mining claims and mineral concessions. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough capital to remain operational for an indefinite period of time.

Potential investors should also be aware of the difficulties normally encountered in the exploration stage of mining companies and the high rate of failure of such enterprises. Our auditor's concern may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment. Persons who cannot afford to lose their entire investment should not invest in the Company’s securities.

We compete with larger, better capitalized competitors in the mining industry.

The mining industry is acutely competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of exploration-stage properties, or properties capable of producing precious metals. Many of these companies have greater financial resources, operational experience and technical capabilities than us. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms we consider acceptable or at all. Consequently, our revenues, operations and financial condition and possible future revenues could be materially adversely affected by actions by our competitors.

11

Risks Relating to Our Common Stock

We do not expect to pay dividends for the foreseeable future.

For the foreseeable future, it is anticipated that earnings, if any, that may be generated from our operations will be used to finance our operations and that cash dividends will not be paid to holders of our common stock.

We expect to be subject to SEC regulations and changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and other trading market rules, which are creating uncertainty for public companies.

We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we intend to invest appropriate resources to comply with evolving standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

Our common stock is traded on the over-the-counter bulletin board, is illiquid and subject to price volatility unrelated to our operations.

Our shares of common stock are currently traded on the over-the-counter bulletin board. Many institutional investors have investment policies which prohibit them from trading in stocks on the over-the-counter bulletin board. As a result, stock quoted on the bulletin board generally have limited trading volume and exhibit a wider spread between the bid/ask quotations than stock traded on national exchanges.

In addition, the stock market is subject to extreme price and volume fluctuations. The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, our quarterly operating results, operating results of our competitors, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. Certain of these factors can have a significant effect on the market price for our stock for reasons that are unrelated to our operating performance.

Our common stock is subject to penny stock rules.

Our common stock is subject to Rule 15g-1 through 15g-9 under the Exchange Act, which imposes certain sales practice requirements on broker-dealers which sell our common stock to persons other than established customers and “accredited investors” (generally, individuals with net worth's in excess of $1,000,000 or annual incomes exceeding $200,000 (or $300,000 together with their spouses). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. This rule adversely affects the ability of broker-dealers to sell our common stock and the ability of our stockholders to sell their shares of common stock.

Additionally, our common stock is subject to the SEC regulations for “penny stock.” Penny stock includes any equity security that is not listed on a national exchange and has a market price of less than $5.00 per share, subject to certain exceptions. The regulations require that prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule set forth by the SEC relating to the penny stock market must be delivered to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for the common stock. The regulations also require that monthly statements be sent to holders of penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. These requirements adversely affect the market liquidity of our common stock.

12

Issuance of additional securities.

Our Board of Directors has authority to issue additional shares of common stock or other securities without the consent or vote of our stockholders. The issuance of additional shares, whether in respect of a transaction involving a business opportunity or otherwise, may have the effect of further diluting the proportionate equity interest and voting power of our stockholders. In the event of such future acquisitions, we could issue equity securities which would dilute current stockholders' percentage ownership, incur substantial debt or assume contingent liabilities. Such actions by the Board of Directors could materially adversely affect our operating results and/or the value of our common stock.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 2. PROPERTIES

Guinea, West Africa

The Siguiri exploration permit comprises 103 square kilometers, approximately 492 kilometers northeast of the of Conakry, the capital of the country, near the city of Siguiri. The permit area is centered on 11 degrees 16 minutes 20 seconds north, 9 degrees, 36 minutes 20 seconds west in the Prefecture of Siguiri in north central Guinea. Siguiri is the second largest city in Guinea and is the supply center for the mining industry in northern Guinea.

Vietnam Property

The Nat Son exploration property is located in northern Vietnam in a position approximately 50 km southwest of Hanoi. Exploration interest in the property is based on the presence of gold-silver bearing quartz-arsenopyrite veins which are exposed at surface and within rudimentary underground mine workings. The veins are now known to extend well beyond the current property boundaries and have been examined and sampled over a strike length of 4.0 km.

Item 3. LEGAL PROCEEDINGS

A dispute arose in October, 2011 concerning the status of joint work on the Nat Son property in Vietnam between the Company and Ba Dinh Mineral Company Limited as a result of key partners in Ba Dinh disagreeing with the Company about the status of their stock holdings in the Company. Management, in consultation with legal counsel, has determined that the arguments by those key partners have no legal merit and may expose those partners to litigation should they not desist and should they fail to comply with documentation requests from the Company. Ba Dinh has been notified of this finding. The Company is awaiting their response and delivery of key property documents on Nat Son to the Company for its records and safe-keeping. This dispute may result in a disruption or change of our drilling plan on the Nat Son property for 2012. To date, Ba Dinh has not completed a transfer of the title to the Nat Son property to the Company, per the agreement between the parties, and the Company has sought the assistance of Vietnamese counsel to enforce the binding letter of intent.

Ba Dinh has been notified of this finding and has not responded to further inquiries. To the best of our knowledge, no other legal action by or against the Company has been threatened.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

13

PART II

Item 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades publicly on the over the counter bulletin board under the symbol "SMNG." During the fiscal year ended December 31, 2011, our common stock traded part of that year publicly on the OTC Markets Pink Sheets. The over the counter bulletin board and the pink sheets are regulated quotation services that display real-time quotes, last-sale prices and volume information in over-the-counter equity securities. The over the counter bulletin board and pink sheet securities are traded by a community of market makers that enter quotes and trade reports. This market is extremely limited and any prices quoted may not be a reliable indication of the value of our common stock.

The following table sets forth the high and low bid prices per share of our common stock for the periods indicated as reported on the over the counter (OTC) Markets Pink Sheets and OTC Bulletin Board:

|

|

High

|

Low

|

||||||

|

FISCAL YEAR ENDED DECEMBER 31, 2011

|

||||||||

|

Fourth Quarter

|

$

|

0.04

|

$

|

0.01

|

||||

|

Third Quarter

|

$

|

0.04

|

$

|

0.01

|

||||

|

Second Quarter

|

$

|

0.06

|

$

|

0.04

|

||||

|

First Quarter

|

$

|

0.14

|

$

|

0.05

|

||||

|

FISCAL YEAR ENDED DECEMBER 31, 2010

|

||||||||

|

Fourth Quarter

|

$

|

0.17

|

$

|

0.03

|

||||

|

Third Quarter

|

$

|

0.09

|

$

|

0.02

|

||||

|

Second Quarter

|

$

|

0.23

|

$

|

0.03

|

||||

|

First Quarter

|

$

|

0.35

|

$

|

0.10

|

||||

The quotes represent inter-dealer prices, without adjustment for retail mark-up, mark-down or commission and may not necessarily represent actual transactions. The trading volume of our securities fluctuates and may be limited during certain periods. As a result of these volume fluctuations, the liquidity of an investment in our securities may be adversely affected.

Holders

As of March 31, 2012, there were 181,236,792 shares of common stock outstanding held by approximately 201 holders of record.

Dividends

Our board of directors has not declared a dividend on our common stock during the last three fiscal years or the subsequent interim period and we do not anticipate the payments of dividends in the near future as we intend to reinvest our profits to grow our business.

Penny Stock Status

The Company’s common stock is a "penny stock," as the term is defined by Rule 3a51-1 of the Securities Exchange Act of 1934. This makes it subject to reporting, disclosure and other rules imposed on broker-dealers by the Securities and Exchange Commission requiring brokers and dealers to do the following in connection with transactions in penny stocks:

1. Prior to the transaction, to approve the person's account for transactions in penny stocks by obtaining information from the person regarding his or her financial situation, investment experience and objectives, to reasonably determine based on that information that transactions in penny stocks are suitable for the person, and that the person has sufficient knowledge and experience in financial matters that the person or his or her independent advisor reasonably may be expected to be capable of evaluating the risks of transactions in penny stocks. In addition, the broker or dealer must deliver to the person a written statement setting forth the basis for the determination and advising in highlighted format that it is unlawful for the broker or dealer to effect a transaction in a penny stock unless the broker or dealer has received, prior to the transaction, a written agreement from the person. Further, the broker or dealer must receive a manually signed and dated written agreement from the person in order to effectuate any transactions is a penny stock.

14

2. Prior to the transaction, the broker or dealer must disclose to the customer the inside bid quotation for the penny stock and, if there is no inside bid quotation or inside offer quotation, he or she must disclose the offer price for the security transacted for a customer on a principal basis unless exempt from doing so under the rules.

3. Prior to the transaction, the broker or dealer must disclose the aggregate amount of compensation received or to be received by the broker or dealer in connection with the transaction, and the aggregate amount of cash compensation received or to be received by any associated person of the broker dealer, other than a person whose function in solely clerical or ministerial.

4. The broker or dealer who has effected sales of penny stock to a customer, unless exempted by the rules, is required to send to the customer a written statement containing the identity and number of shares or units of each such security and the estimated market value of the security. The imposition of these reporting and disclosure requirements on a broker or dealer makes it unlawful for the broker or dealer to effect transactions in penny stocks on behalf of customers. Brokers or dealers may be discouraged from dealing in penny stocks, due to the additional time, responsibility involved, and, as a result, this may have a deleterious effect on the market for the company's stock.

Unregistered Sales of Securities

The following securities were issued by Strategic Mining Corporation within the fiscal year and were not registered under the Securities Act:

In July 2011 the Company executed a six month agreement with a communication firm to provide investor relations and corporate communication services. The Company issued 2,000,000 shares of common stock at $0.04 per share, the value of the shares as of the date of issuance, for a total value of $80,000.

On 4 August 2011, the Company converted 4,000,000 restricted Class A Convertible Preferred Shares into 4,000,000 shares of the Company’s Common stock. The conversion price was $0.015 per share, in accordance with the Convertible Preferred Share original subscription.

On 5 October 2011, the Company executed an agreement with Rathbourne Mercantile Ltd. to provide investor relations and corporate communication services. The Company issued 500,000 shares of common stock at $0.0171 per share, the value of the shares as of the date of issuance, a total value of $8,550.

During the first quarter of 2012 the Company entered into a debt assumption agreement with Asher Enterprises Inc. for assumption of $66,000 of debt originally held by Magma Gold Corporation. This assumption was for original debt older than six months and was convertible to common stock in portions and with timing at the discretion of the assuming company. In March 2012 the Company issued 15,829,295 shares of common stock to Asher Enterprises Inc. in exchange for this debt assumption.

During the first quarter of 2012 the Company entered into a debt assumption agreement with Redwood Management LLC for assumption of $182,708 of debt originally held by Frank Brodzik. This assumption was for original debt older than six months and was convertible to common stock in portions and with timing at the discretion of the assuming company. The Company issued 51,268,777 shares of common stock to Redwood Management LLC through May 14, 2012 in exchange for $121,000 of this debt assumption.

In March 2012, the Company cancelled 14,350,030 shares of common stock which were previously issued in the prior fiscal year in settlement of loans payable to related parties. The Company has assumed the original debt in the amount of $292,180 in exchange for the cancellation of the shares.

15

The process of initiating a Reserve Equity Financing (the “REF Agreement”) with AGS Capital Corp., for a total available financing of $5,000,000, commenced in the first quarter of 2012. This required issuance of 2,325,581 in restricted common stock to AGS Capital Corp. in exchange for $20,000 in services to allow for preparation of the related documents and discussions.

Additional restricted shares of common stock of 30,978,934 were issued to AGS Capital Corp. in the second quarter 2012 as commitment required under the REF Agreement. Advances on the total available financing have not been requested pending completion of the 10K filing and subsequent first quarter 10Q filing.

Proceeds from the above-referenced sales were used for administrative and corporate expenses, including legal, accounting, consulting and finance activities, as well as research, travel and acquisition and exploration expenses

Item 6. SELECTED FINANCIAL DATA

The registrant is a smaller reporting company, pursuant to Rule 229.10(f)(1), and is not required to report this information. The financial statements of the issuer are attached.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Certain statements contained in this annual filing, including, without limitation, statements containing the words “believes”, “anticipates”, “expects” and words of similar import, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the following: international, national and local general economic and market conditions: demographic changes; the ability of the Company to sustain, manage or forecast its growth; the ability of the Company to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other factors referenced in this and previous filings.

Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. The following discussion and analysis should be read in conjunction with our Financial Statements and notes appearing elsewhere in this report.

Results of Operations

The Company is an exploration stage mining company with no revenues since entering the exploration stage.

Twelve Months Ended December 31, 2011 Compared To The Twelve Months Ended December 31, 2010

Revenues

There were no revenues in either twelve month period ended December 31, 2011 and December 31, 2010.

Operating Expenses

Interest expenses for the twelve months ended December 31, 2011 were $11,004 and $61,139 for the twelve months ended December 31, 2010. The decrease during the twelve months ended December 31, 2011, was primarily attributed to decreases in interest bearing loans payable and related accrued interest costs and debt converted to shares.

16

Professional fees for the twelve months ended December 31, 2011 were $44,355 and $50,175 for the twelve months ended December 31, 2010. The decrease during the twelve months ended December 31, 2011, were primarily attributed to additional professional fees in the prior period relating to filing of the Company’s Form 10A and quarterly financial statements preparation which were not required during the corresponding periods of 2011.

Exploration costs for the twelve months ended December 31, 2011 were $209,139 and $234,454 for the twelve months ended December 31, 2010. The increase during the twelve months ended December 31, 2011 was primarily attributed to ongoing activity in Guinea and briefly increased exploration activity in Vietnam, including the commencement of drilling related program training in Nat Son, Vietnam.

Consulting expenses for the twelve months ended December 31, 2011 were $229,901 and $323,116 for the twelve months ended December 31, 2010. The expenses during the twelve months ended December 31, 2011, were primarily due to (i) a new consulting contract granted to Ken Baird commencing on May 23, 2011 for $6,000 per month, and stock option expenses of $5,000 on the amortization of 5,000 stock options vested during the quarter in association with certain consulting contracts and (ii) additional investor relations costs during the year.

Net Loss

We recorded a net loss of $1,051,278 for the twelve months ended December 31, 2011, as compared to a net loss of $668,884 for the twelve months ended December 31, 2010. The increase in net loss is primarily attributed to adjustments for impairments of exploration properties and equipment.

Liquidity and Capital Resources

At December 31, 2011, we had an accumulated deficit of $2,707,794 and a working capital deficit of $519,602.

For the year ended December 31, 2011, net cash used in operating activities amounted to $162,271, as compared to $676,952 for the year ended December 31, 2010. The decrease in the cash used in operating activities was primarily due to an increase in our accounts payable.

For the year ended December 31, 2011, net cash used in investing activities amounted to $25,000, as compared to $404,697 for the year ended December 31, 2010. The cash used in investing activities in 2011 related to the further acquisition of mining claims for the Nat Son property in Vietnam.

For the year ended December 31, 2011, net cash provided in financing activities amounted to $185,203, as compared to $1,083,567 for the year ended December 31, 2010. The decrease in cash provided from financing activities was due to a decrease in proceeds from issuance of common stock from $245,100 to $Nil and reductions in proceeds on assumption of debt and proceeds from related party loans from $834,467 to $185,203.

A total of $142,500 was raised through equity financing through April 30, 2012 for company operations. Also during the first quarter of 2012, an additional $248,782 in Company debt was transferred from previous debt holders to debt assumption companies for subsequent conversion in 2012 to stock. These debt assumptions will ultimately remove this debt from the Company accounts as those conversions to shares of common stock take place.

17

We will need to raise additional capital through equity or debt financing in the next twelve months in order to fund our planned operations and repay, restructure, or refinance our debt obligations. Our current operating plans for the next fiscal year are to meet our existing customer commitments, expand our exploration and engineering capabilities, and continue to develop innovative solutions for our customers. Although we will have to raise additional funds through the issuance of debt and/or equity during the next twelve months, there can be no assurance that financing will be available, or if available, that such financing will be upon terms acceptable to us. The process of initiating a Reserve Equity Financing (the “REF Agreement”) with AGS Capital Corp. (“AGS”), for a total available financing of $5,000,000, commenced in the first quarter of 2012. This required issuance of 2,325,581 in restricted shares of common stock to AGS in exchange for $20,000 in services to allow for preparation of the related documents and discussions. Additional restricted shares of common stock of 30,978,934 were issued to AGS in the second quarter 2012 as commitment shares required under the REF Agreement. Advances on the total available financing have not been requested pending completion of the 10K filing and subsequent first quarter 2012 10Q filing.

The Company has focused since its inception on forming its corporate structure, developing its business plan and raising capital. The Company is an exploration stage company with a plan of operations as set forth below.

Plan of Operations

Our current plan of operations is to complete further exploration, drilling and mapping on our various properties, as follows:

Guinea, West Africa

The geologist’s report on the Siguiri exploration permit recommended a two stage program of further exploration. The proposed plan for the first stage entails completion of a 3 month program of termite mound sampling, geological mapping, and geophysical and geochemical surveys budgeted at $630,000. The second stage entails a 12 month program of reverse circulation drilling sampling in areas showing positive assays, totaling $1.2M. It is anticipated that the first stage will commence in the first half of 2012, and the second will continue for a 15 to 18 month duration tentatively to be completed in 2013. During the three month rainy season, no work will be performed.

In addition, upon arrangement of financing for such operations, it is anticipated that equipment and personnel necessary to begin placer mining operations within the Siguiri permit area will be identified and engaged as possible to bring available placer gold deposits in the property into production as soon as possible. Exact timing of these operations is dependent on timing of financing, availability of equipment and personnel in a timely fashion, and permitting of such operations by the Guinea government.

The Company holds 100% interest in the joint venture’s two-year Siguiri Exploration Permit issued by the Republic of Guinea #2009/1031 dated May 2009 to Gold River . The Guinea government is entitled to a 15% royalty on all extracted minerals. Exploration permits are issued for two years and a one-time fee is paid for the permit. Otherwise, there are no annual fees for the permit, but taxes are due annually to the government.

The Company applied for an extension of the Siguiri permit in May 2011 to allow further evaluation work and preparation for mining of placer gold deposits. During the change in governments in Guinea and related turmoil in 2011, the extension was put on hold by the government and the Company’s permit and rights to the property through the joint venture remained in question until the matter could be resolved with the new government. The permit extension was granted in April 2012 after government review of all outstanding exploration permits and activities in those permit areas. Receipt of the permit document from Guinea is pending.

Nat Son, Vietnam

The geologist’s report on the Nat Son property recommended a detailed drill program to test the subsurface potential of the property. The recommended work program will include geological mapping, geochemical and geophysical surveys and a drilling program spanning twelve months budgeted at $1.6 million. A small drilling program began in mid-2011, but was suspended due to equipment and personnel problems and extremely adverse weather conditions. The program was planned to re-commence by Winter of 2011, however, operations were suspended due to a dispute that arose with Ba Dinh in October 2011. This dispute may result in a disruption or change of our drilling plan on the Nat Son property for 2012. Assuming positive resolution of this dispute, a drilling program would be initiated that would require another twelve months. There will be a work stoppage during the two month rainy season.

18

The amount of work undertaken, and timing of the work, is dependent upon the successful raising of equity capital to fund the projects. Should the capital be available, it is anticipated that the recommended work programs outlined will take between two to three years to accomplish.

During the next twelve months, the Company plans to satisfy its cash requirements by additional equity financing. The Company intends to undertake private placements of its common stock in order to raise future development and operating capital. The Company depends upon capital to be derived from future financing activities such as subsequent offerings of its stock. There can be no assurance that the Company will be successful in raising the capital it requires through the sale of its common stock.

The Company does not contemplate any product research and development, but it does anticipate additional exploration and development costs on its properties. The Company anticipates an increase in labor force to explore and develop its properties which will be sought from outside contract labor.

The dispute which arose in October, 2011 concerning the status of joint work on the Nat Son property in Vietnam between the Company and Ba Dinh Mineral Company Limited as a result of key partners in Ba Dinh disagreeing with the Company about the status of their stock holdings in the Company resulted in management, in consultation with legal counsel, to determine that the arguments by the key partners had no legal merit and may expose those partners to litigation should they not desist and should they fail to comply with documentation requests from the Company. Ba Dinh has been notified of this finding. The Company is awaiting their response and delivery of key property documents on Nat Son to the Company for its records and safe-keeping. This dispute may result in a disruption or change of our drilling plan on the Nat Son property for 2012. To date, Ba Dinh has not completed a transfer of the title to the Nat Son property to the Company, per the agreement between the parties.

Vietnamese counsel was retained for initial investigations in Vietnam to determine what the true state of the project was during the first quarter of 2012. As a result of these investigations, it was determined that a valid exploration permit has been granted to Ba Dinh Construction Investment and Consulting Joint Stock Company by the provincial authorities and is in effect until 9 June 2014. However, investigations are continuing regarding the status of ownership and/or leasing of the Nat Son property by Ba Dinh Mineral Company Limited. Also, Ba Dinh officers continue to be unresponsive, thereby putting the viability of the Joint Venture in question. Legal recourse in Vietnam continues to be investigated during the first half of 2012.

There is not enough information available on the legal status of the joint venture agreement with Ba Dinh and the Nat Son property to determine whether or not Ba Dinh has performed according to the requirements of the joint venture agreement. Therefore, the project has been written down in the fourth quarter of 2011 to allow for possible permanent impairment of the project. Management’s opinion on this matter is that the project still is potentially viable, but that all joint venture activities with Ba Dinh may need to cease if a mutually agreeable solution cannot be reached. Should the joint venture be formally dissolved, the Company may pursue legal options in Vietnam during 2012 to recover payments made to Ba Dinh for expenses that they have not documented adequately or for which official documentation has not been provided for the project.

Dinguiraye Property

The option period for potential acquisition of the Dinguiraye property was extended in May 2011 by verbal agreement with Gold River until December 31, 2011. The Company decided on December 23, 2011 to not continue due diligence on the Dinguiraye property and cancelled the option agreement with Gold River by mutual consent. The Company chose to do this to be able to focus efforts and exploration funds on the Siguiri Property instead.

19

Off-Balance Sheet Arrangements

The Company has no off balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Estimates and Policies

Use of Estimates

The preparation of financial statement in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of revenues and expenses during the period, reported amounts of assets and liabilities, and the disclosure of contingent assets and liabilities at the date of the financial statements. On an ongoing basis, management reviews its estimates, including those related to personal injury and other claims, environmental claims, depreciation, and income taxes, based upon currently available information. Actual results could differ from these estimates.

Stock-Based Compensation

FASB ASC 505-50 establishes standards for the accounting for transactions in which an entity exchanges its equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments. FASB ASC 505-50 focuses primarily on accounting for transactions in which an entity obtains employee services in share-based payment transactions. FASB ASC 505-50 requires that the compensation cost relating to share-based payment transactions be recognized in the financial statements. That cost will be measured based on the fair value of the equity or liability instruments issued.

The Company’s accounting policy for equity instruments issued to consultants and vendors in exchange for goods and services follows the provisions of EITF 96-18, “Accounting for Equity Instruments That are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services” and EITF 00-18, “Accounting Recognition for Certain Transactions Involving Equity Instruments Granted to Other Than Employees.” The measurement date for the fair value of the equity instruments issued is determined at the earlier of (i) the date at which a commitment for performance by the consultant or vendor is reached or (ii) the date at which the consultant or vendor’s performance is complete. In the case of equity instruments issued to consultants, the fair value of the equity instrument is recognized over the term of the consulting agreement. Stock-based compensation related to non-employees is accounted for based on the fair value of the related stock or options or the fair value of the services, which ever is more readily determinable in accordance with FASB ASC 505-50.

Income taxes

The Company accounts for its income taxes in accordance with FASB ASC 740, which requires recognition of deferred tax assets and liabilities for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in operations in the period that includes the enactment date.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company’s business activities contain elements of risk. The Company considers a principal type of market risk to be a valuation risk. All assets are valued at fair value as determined in good faith by or under the direction of the Board of Directors.

20

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Strategic Mining Corporation

We have audited the accompanying balance sheet of Strategic Mining Corporation (the “Company”) as of December 31, 2011, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the year ended December 31, 2011 and for the period from the date of inception (January 17, 2007) through December 31, 2011. Strategic Mining Corporation’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.