Exhibit

Annual Information Form

for the year ended June 30, 2018

September 24, 2018

DHX MEDIA LTD.

2018 ANNUAL INFORMATION FORM

TABLE OF CONTENTS

|

| | |

FORWARD LOOKING STATEMENTS | 3 |

|

| |

CORPORATE STRUCTURE | 4 |

|

| |

GENERAL DEVELOPMENT OF THE BUSINESS | 5 |

|

| |

BUSINESS OF THE COMPANY | 10 |

|

| |

REORGANIZATIONS | 24 |

|

| |

SOCIAL POLICIES | 24 |

|

| |

RISK FACTORS | 24 |

|

| |

DIVIDENDS AND DISTRIBUTIONS | 39 |

|

| |

DESCRIPTION OF CAPITAL STRUCTURE | 40 |

|

| |

RATINGS | 48 |

|

| |

MARKET FOR SECURITIES | 49 |

|

| |

SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 50 |

|

| |

DIRECTORS AND OFFICERS | 51 |

|

| |

LEGAL PROCEEDINGS | 57 |

|

| |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 57 |

|

| |

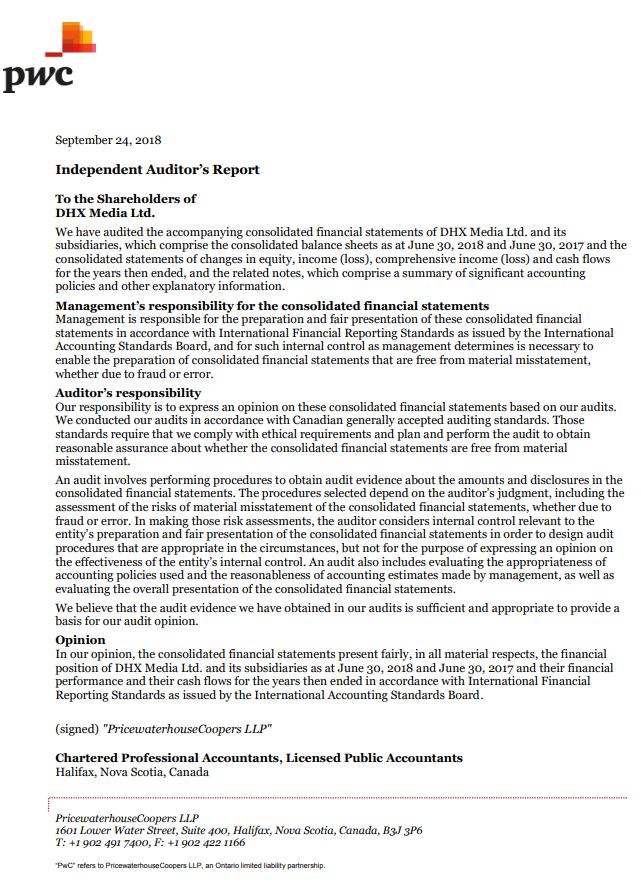

INTEREST OF EXPERTS | 57 |

|

| |

AUDITOR, TRANSFER AGENT AND REGISTRAR | 57 |

|

| |

MATERIAL CONTRACTS | 57 |

|

| |

ADDITIONAL INFORMATION | 60 |

|

| |

AUDIT COMMITTEE CHARTER | 61 |

|

All amounts following are expressed in Canadian dollars unless otherwise indicated.

FORWARD LOOKING STATEMENTS

This Annual Information Form and the documents incorporated by reference herein, if any, contain certain “forward-looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation (collectively herein referred to as “forward-looking statements”), including the “safe harbour” provisions of provincial securities legislation in Canada, the U.S. Private Securities Litigation Reform Act of 1995, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the, “U.S. Exchange Act”), and Section 27A of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”). These statements relate to future events or future performance and reflect the Company’s expectations and assumptions regarding the growth, results of operations, performance and business prospects and opportunities of the Company and its subsidiaries. Forward looking statements are often, but not always, identified by the use of words such as “may”, “would”, “could”, “will”, “should”, “expect”, “expects”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “pursue”, “continue”, “seek” or the negative of these terms or other similar expressions concerning matters that are not historical facts. In particular, statements regarding the Company or any of its subsidiaries’ objectives, plans and goals, including those related to future operating results, economic performance, and the markets and industries in which the Company operates are or involve forward-looking statements. Specific forward-looking statements in this document include, but are not limited to:

| |

• | the business strategies of DHX; |

| |

• | the future financial and operating performance of DHX and its subsidiaries; |

| |

• | the timing for implementation of certain business strategies and other operational activities of DHX; |

| |

• | the markets and industries, including competitive conditions, in which DHX operates; |

| |

• | regulatory changes and potential impacts on DHX and the markets and industries in which it operates; |

| |

• | DHX’s production pipeline and delivery dates; |

| |

• | the growth of DHX’s WildBrain business; and |

| |

• | the outlook for English kids television in Canada. |

Forward-looking statements are based on factors and assumptions that management believes are reasonable at the time they are made, but a number of assumptions may prove to be incorrect, including, but not limited to, assumptions about: (i) the Company’s future operating results, (ii) the expected pace of expansion of the Company’s operations, (iii) future general economic and market conditions, including debt and equity capital markets, (iv) the impact of increasing competition on the Company, (v) changes in the industries and changes in laws and regulations related to the industries in which the Company operates, (vi) consumer preferences, and (vii) the ability of the Company to execute on acquisition and other growth opportunities and realize the expected benefits therefrom. Although the forward-looking statements contained in this Annual Information Form and any documents incorporated by reference herein are based on what the Company considers to be reasonable assumptions based on information currently available to the Company, there can be no assurances that actual events, performance or results will be consistent with these forward-looking statements and these assumptions may prove to be incorrect.

A number of known and unknown risks, uncertainties and other factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking statements. In evaluating these statements, investors and prospective investors should specifically consider various risks, uncertainties and other factors which may cause actual events, performance or results to differ materially from any forward-looking statement.

This is not an exhaustive list of the factors that may affect any of the Company’s forward-looking statements. Please refer to a discussion of the above and other risk factors related to the business of the Company and the industry in which it operates that will continue to apply to the Company, which are discussed in the Company’s Management Discussion and Analysis for the year ended June 30, 2018 which is on file at www.sedar.com and attached as an exhibit to the Company’s annual report on Form 40-F filed with the SEC at www.sec.gov and under the heading “Risk Factors” contained in this Annual Information Form.

These forward-looking statements are made as of the date of this Annual Information Form or, in the case of documents incorporated by reference herein, if any, as of the date of such documents, and the Company does not intend, and does not assume any obligation, to update or revise them to reflect new events or circumstances, except in accordance with applicable securities laws. Investors and prospective investors of the Company’s securities are cautioned not to place undue reliance on forward-looking statements.

CORPORATE STRUCTURE

DHX Media Ltd. (the “Company” or “DHX”) was incorporated in Nova Scotia, Canada, under the Companies Act (Nova Scotia) on February 12, 2004 under the name Slate Entertainment Limited. The Company’s name was changed to The Halifax Film Company Limited on April 20, 2004, and again on March 17, 2006 to DHX Media Ltd.

On April 25, 2006, the Company was continued federally as a corporation under the Canada Business Corporations Act (the “CBCA”). Neither the Company’s Articles of Continuance, as amended from time to time (the “Articles of Continuance”), nor the Company’s By-Laws, as amended or otherwise supplemented from time to time (the “By-Laws”) contain any restriction on the objects of the Company.

Effective as of October 6, 2014, DHX’s Articles of Continuance were amended in accordance with the Articles of Amendment which were approved at a special meeting of shareholders on September 30, 2014 (the “Articles of Amendment”). Pursuant to the Articles of Amendment, DHX’s share capital structure was reorganized (the “Share Capital Reorganization”) in order to address concerns relating to Canadian ownership and control arising as a result of its indirect ownership of DHX Television (as defined below). The Share Capital Reorganization resulted in the creation of three new classes of shares, common voting shares (the “Common Voting Shares”), variable voting shares (the “Variable Voting Shares”, and together with the Common Voting Shares, the “Shares”), and non-voting shares (the “Non-Voting Shares”). Each outstanding common share in the capital of DHX (the “Common Shares”) which was not owned and controlled by a Canadian for the purposes of the Broadcasting Act (Canada) (the “Broadcasting Act”) was converted into one Variable Voting Share and each outstanding Common Share which was owned and controlled by a Canadian for the purposes of the Broadcasting Act was converted into one Common Voting Share. For additional information concerning DHX’s share capital refer to “Description of Capital Structure” below.

The Company is domiciled in Canada and its head and registered office is located at 1478 Queen Street, Halifax, Nova Scotia, Canada, B3J 2H7.

The following table lists the principal subsidiaries of the Company, the jurisdiction of formation of each subsidiary, and the percentage of voting securities beneficially owned or over which control or direction is exercised by the Company:1

|

| | |

Corporate Structure |

Subsidiary | Jurisdiction | Percentage of Voting Securities |

DHX Media (Halifax) Ltd. | Nova Scotia | 100% |

DHX Media (Toronto) Ltd. | Ontario | 100% |

DHX Media (Vancouver) Ltd. | British Columbia | 100% |

DHX SSP Holdings LLC | Delaware | 100% |

DHX PH Holdings LLC | Delaware | 51% |

Peanuts Holdings LLC | Delaware | 41% |

Peanuts Worldwide LLC | Delaware | 41% |

Shortcake IP Holdings LLC | Delaware | 100% |

Wild Brain Entertainment Inc. | Delaware | 100% |

Wild Brain International Limited | United Kingdom | 100% |

Wild Brain Family International Limited | United Kingdom | 100% |

The Copyright Promotions Licensing Group Limited | United Kingdom | 100% |

DHX Media (UK) Limited | United Kingdom | 100% |

DHX Worldwide Limited | United Kingdom | 100% |

DHX Television Ltd. | Canada | 100% |

Nerd Corps Entertainment Inc. | British Columbia | 100% |

______________

1 As depicted in the chart below, following the Peanuts Divestiture (as defined below) the Company indirectly owns 51% of DHX PH Holdings LLC which owns 80% of Peanuts Holdings LLC. Peanuts Holdings LLC owns 100% of Peanuts Worldwide LLC. Accordingly, on an aggregate basis, DHX owns an indirect interest in Peanuts Holdings LLC and Peanuts Worldwide LLC of approximately 41%.

The following chart depicts the corporate organizational structure of the Company and its principal subsidiaries (ownership of certain subsidiaries depicted below may be indirectly held through other wholly owned subsidiaries):

GENERAL DEVELOPMENT OF THE BUSINESS

DHX is a children’s content and brands company, headquartered in Canada and operating worldwide. The Company’s business is developing, producing, distributing, broadcasting, licensing, and further exploiting the rights for television and film programming and brands, primarily focusing on children’s, youth and family productions and brands. DHX has the following four integrated business lines:

| |

• | Production (including proprietary production and production service) |

| |

• | Distribution (including proprietary and third party content) |

| |

• | Consumer Products (including licensing its own intellectual property and representing third parties) |

On May 19, 2006, the Company’s Common Shares were listed on the Toronto Stock Exchange (the “TSX”) under the trading symbol “DHX”. Presently, and following the Share Capital Reorganization, the Company’s Variable Voting Shares and Common Voting Shares trade on the TSX under the symbols “DHX.A” and “DHX.B”, respectively. On June 23, 2015, the Company effected the listing of its Variable Voting Shares for trading on the NASDAQ Global Select Market (“NASDAQ”) under the trading symbol “DHXM”. On May 31, 2018, DHX’s Common Voting Shares and Variable Voting Shares began trading on the TSX under a single trading symbol “DHX”. Also on May 31, 2018, the Company effected the listing of its Common Voting Shares on NASDAQ, and the Variable Voting Shares and Common Voting Shares began trading on NASDAQ under a single ticker symbol “DHXM”.

On the same date as its initial listing on the TSX, the Company acquired all of the issued and outstanding shares in the capital of Decode Entertainment Inc. (now DHX Media (Toronto) Ltd.). The Company has also completed acquisitions of Studio B Entertainment Inc. (now DHX Media (Vancouver) Ltd.), imX Communications Inc., Wild Brain Entertainment Inc., the business of Cookie Jar Entertainment Inc., including its Copyright Promotions Licensing Group, Ragdoll Worldwide Limited (now DHX Worldwide Limited), the Epitome group of companies, DHX Television Ltd. (which holds the Family suite of television channels), a library of television and film programs consisting of approximately 1,200 half hours of predominantly children’s and family film and television programs, Nerd Corps Entertainment Inc., 80% of Whizzsis Limited, Peanuts and Strawberry Shortcake (which, at the time of acquisition, included an 80% controlling interest in Peanuts) and a 51% interest in Egg Head Studios LLC.

Significant Acquisitions and Other Recent Developments

Base Shelf Prospectus Filing

In connection with the Company’s listing of its Variable Voting Shares for trading on NASDAQ, on July 2, 2015, the Company filed a final short form base shelf prospectus with the securities commissions in each of the provinces of Canada, and a corresponding registration statement on Form F-10 with the SEC under the U.S. Securities Act and the U.S./Canada Multijurisdictional Disclosure System. The prospectus and associated filings qualified the Company to make offerings of Common Voting Shares, Variable Voting Shares, Non-Voting Shares, debt securities, warrants, and subscription receipts, or any combination thereof, having an aggregate offering amount of up to US$200 million in Canada and the United States over a 25-month period from the date of filing, which has since expired. On July 6, 2015, the Company announced the commencement of a marketed, underwritten public offering of 8,700,000 Variable Voting Shares and Common Voting Shares. On July 9, 2015, the Company announced that it would not proceed with the offering due to an assessment by management that the market conditions were not conducive for an offering on terms that would be in the best interests of shareholders.

Normal Course Issuer Bid

On October 5, 2015, the Company commenced a normal course issuer bid (the “NCIB”) to purchase up to an aggregate of 8,207,887 Shares on the open market through the facilities of the TSX and NASDAQ at the market price as of the time of the transaction, with daily purchases limited to 84,544 Shares per day (other than pursuant to applicable block purchase exceptions). To facilitate purchases under the NCIB, on January 13, 2016, the Company entered into an automatic share purchase plan with Canaccord Genuity Corp. The Company purchased and cancelled an aggregate of 659,000 Common Voting Shares for a gross amount of approximately $5.04 million under the NCIB, which expired on October 4, 2016.

DreamWorks Agreement

On December 8, 2015, the Company announced it had entered into a 5 year agreement with DreamWorks Animation ("DreamWorks") to co-produce 130 episodes of original animated children's content at DHX, which will air in Canada on DHX Television's suite of channels. In addition to the co-production activities, DHX Television licensed more than 1,000 half-hours of programming from DreamWorks, including Hail King Julien, The Mr. Peabody & Sherman Show, Dragons: Race to the Edge, and The Croods, among others. DHX Television also licensed 300 half-hours of teen content for exclusive broadcast in Canada on Family Channel and includes SVOD and mobile rights.

Mattel Agreements

On December 15, 2015, the Company entered into an agreement with Mattel, Inc. and certain of its affiliates (collectively, "Mattel"), pursuant to which DHX and Mattel agreed to fund, develop and produce various forms of new content for certain Mattel properties, including Bob the BuilderTM, Fireman SamTM, Little People®, and Polly PocketTM. DHX’s production arm works with Mattel to develop and produce the new content, while DHX’s distribution arm manages the global distribution of both the existing and new content, with Mattel responsible for global brand management and consumer products.

The Company subsequently announced, on April 19, 2016, an additional exclusive agreement with Mattel for the property Rainbow MagicTM covering multiple revenue streams and establishing the framework for DHX to produce and distribute a range of new multi-platform content inspired by such property. Under such agreement Mattel global brand management and global toy rights and the parties work together on consumer product licensing activities for the Rainbow MagicTM brand for territories in which DHX has a consumer products presence.

DHX Studios

On January 29, 2016, the Company announced the rebranding of its content-creation arm to DHX Studios. DHX Studios unites the Company’s development, production, and interactive operations under a single business unit and management team. The Company also announced that it will commence the construction of a 75,000 square foot leased studio in Vancouver. The studio will combine the Company's existing 2D and CGI animation studios in Vancouver.

WildBrain

On April 25, 2016, DHX announced the launch of WildBrain, the Company’s wholly owned and operated Multi-Platform Kids Network for kids from 2-10 years old, which connects content owners with advertisers on YouTube and other platforms and leverages DHX’s digital expertise to monetize children’s content.

Bought Deal Offering

On May 2, 2016, the Company closed a bought deal public offering (the “Bought Deal Offering”) comprised of both Variable Voting Shares and Common Voting Shares through a syndicate of underwriters (the “Underwriters”), pursuant to which the Company issued 8,667,000 Shares at a price of $7.50 per Share for aggregate gross proceeds of $65.0 million.

Additional Issuance of Senior Unsecured Notes

On May 13, 2016, the Company closed a private offering (the “Additional Notes Offering”) of an additional $50 million aggregate principal amount of its 5.875% Senior Unsecured Notes (the “Notes”) due December 2, 2021 through a syndicate of underwriters at a price of $975.00 per $1,000.00 principal amount, plus accrued interest from and including December 2, 2015 through May 13, 2016. Following the Additional Notes Offering, the Company had a total outstanding principal amount of $225 million of Notes.

In connection with the Company’s acquisition of Peanuts and Strawberry Shortcake, the Notes were redeemed effective July 11, 2017. Refer to “Redemption of Notes” below.

Iconix / Strawberry Shortcake Agreement

On May 17, 2016, the Company announced that it had entered into an agreement with Iconix Brand Group, Inc. (“Iconix”) to co-develop and co-produce a new animated series based on Strawberry Shortcake. Pursuant to such agreement, the new content would be produced and distributed globally by DHX with Iconix responsible for worldwide consumer products licensing for the brand. Concurrently, under a separate agreement, DHX was appointed the exclusive global distributor for Strawberry Shortcake content, including 108 half-hours.

With the Company’s acquisition of Strawberry Shortcake, the foregoing agreement has been terminated and the exploitation of Strawberry Shortcake has been rolled into the Company’s existing business structure. Refer to “Acquisition of Peanuts and Strawberry Shortcake” below.

Acquisition of Kiddyzuzaa

On March 3, 2017, the Company acquired 80% of the outstanding shares of Whizzsis Limited ("Kiddyzuzaa"), which owns and produces proprietary children's and family content and operates a children's and family focused YouTube channel.

Additional information concerning the Company’s acquisition of Kiddyzuzaa can be found in the Management Discussion and Analysis of the Company for the fiscal year ended June 30, 2018 on file at www.sedar.com and also filed on a Form 6-K with the SEC at www.sec.gov.

Acquisition of Peanuts and Strawberry Shortcake

On May 10, 2017, the Company announced that it had entered into agreements (the “Peanuts/SSC Acquisition Agreements”) to acquire (the “Peanuts/SSC Acquisition”) the entertainment division of Iconix, including an 80% equity interest in the company which holds all of the assets associated with Peanuts, Peanuts Holdings LLC (“Peanuts Holdings”), and a 100% equity interest in the company which holds all of the assets associated with Strawberry Shortcake, Shortcake IP Holdings LLC (“Shortcake Holdings”). Pursuant to the terms of the Peanuts/SSC Acquisition Agreements, the purchase price for the Peanuts/SSC Acquisition was approximately US$346.5 million including a preliminary working capital adjustment of approximately US$1.5 million which was paid in cash on closing and was subject to a final working capital adjustment. The Peanuts/SSC Acquisition was completed on June 30, 2017, and was financed through a combination of cash on hand, proceeds from a new senior secured credit facility, and proceeds from the Company’s offering of subscription receipts, and included the refinancing and repayment of the Company’s existing debt under its Notes and the Company’s senior secured credit facility existing prior to closing. For additional information concerning the Peanuts/SSC Acquisition and financing thereof refer to and “Acquisition of Peanuts and Strawberry Shortcake Financing” below.

A Business Acquisition Report (Form 51-102F4) was filed by the Company in respect of the Peanuts/SSC Acquisition on September 13, 2017 and is on file at www.sedar.com and was also filed on a Form 6-K with the SEC at www.sec.gov.

Acquisition of Peanuts and Strawberry Shortcake Financing

In connection with the Peanuts/SSC Acquisition, the Company entered into a senior secured credit facility with Royal Bank of Canada, as administrative agent, certain lenders party thereto, and RBC Capital Markets and Jefferies Finance LLC, as joint lead arrangers and joint bookrunners (the “Senior Credit Facilities”). The Senior Credit Facilities are primarily comprised of a US$30 million revolving credit facility and US$495 million term loan facility the proceeds of which, in addition to the proceeds from the Company’s offering of Subscription Receipts (as defined below), were used to finance the purchase price for the Peanuts/SSC Acquisition, refinance the Company’s previous indebtedness, and other general corporate purposes.

Also in connection with the Peanuts/SSC Acquisition, the Company completed a sale of 140,000 subscription receipts (the “Subscription Receipts”) on May 31, 2017 (the “Subscription Receipt Offering”). The Subscription Receipts were sold on a bought deal private placement basis at a price of $1,000 per Subscription Receipt for aggregate gross proceeds of $140 million, which included an upsize of the offering in the amount of $25 million as well as the exercise by the underwriters of an option to purchase an additional $15 million in Subscription Receipts. The net proceeds from the offering of Subscription Receipts were held in escrow until closing of the Peanuts/SSC Acquisition at which point they were released from escrow and used to finance the Peanuts/SSC Acquisition, refinance substantially all the Company’s indebtedness, and for general corporate purposes. At such time, each holder of Subscription Receipts received, for no additional consideration and subject to adjustment, one special warrant (the “Special Warrants”) that were subsequently automatically exercised, for no additional consideration, to acquire $1,000 principal amount of 5.875% senior unsecured convertible debentures of the Company (the “Convertible Debentures”). Each Convertible Debenture shall be convertible into Common Voting Shares or Variable Voting Shares of the Company, as applicable, at a price of $8.00 per share, subject to adjustment in certain events. The Special Warrants were automatically converted into Convertible Debentures on October 2, 2017, at which point the Convertible Debentures were listed and posted for trading on the TSX under the trading symbol “DHX.DB”. Refer to “Description of Capital Structure –Convertible Debentures” below.

The Senior Credit Facilities, Convertible Debentures and other indebtedness of the Company are further described in note 12 to the Company’s audited financial statements for the fiscal year ending June 30, 2018 and accompanying Management Discussion and Analysis which are on file with SEDAR at www.sedar.com and attached as an exhibit to the Company’s annual report on Form 40-F filed with the SEC at www.sec.gov. The credit agreement in respect of the Senior Credit Facilities is summarized under “Material Contracts” below.

Redemption of Notes

As part of the Company’s refinancing activities in connection with the Peanuts/SSC Acquisition, on July 11, 2017, the Company redeemed all of its outstanding Notes at a price equal to 100% of the $225 million principal amount, plus applicable premium and accrued and unpaid interest to, but excluding, the redemption date. The redemption price per $1,000 principal amount of the Notes was $1,066.12, including an applicable premium of $59.84 and interest of $6.28. Proceeds from the Senior Credit Facilities and the Subscription Receipt Offering were used to funds the redemption of the Notes.

New York Office

During its fiscal 2018, the Company entered into a lease agreement for office space in New York in connection with the Peanuts/SSC Acquisition transition and a relocation of its U.S. operations from Los Angeles to New York. The Company’s New York location and associated personnel operate the Peanuts and Strawberry Shortcake businesses, as well as provide a North American location for some of the Company’s other owned-brands licensing activities.

Acquisition of Ellie Sparkles

On September 15, 2017, the Company acquired 51% of the outstanding equity interests of Egg Head Studios LLC ("Ellie Sparkles"), which owns and produces proprietary children's and family content and operates a children's and family focused YouTube channel.

Additional information concerning the Company’s acquisition of Ellie Sparkles can be found in the Management Discussion and Analysis of the Company for the year ended June 30, 2018 on file at www.sedar.com and attached as an exhibit to the Company’s annual report on Form 40-F filed with the SEC at www.sec.gov.

Transition of Interactive Business

On September 30, 2017, DHX entered into a memorandum of understanding pursuant to which, among other things, it transitioned its interactive business to Epic Story Interactive (a new company formed by Ken Faier, former SVP with DHX). Under the memorandum of understanding, DHX licensed interactive rights (including rights to gaming apps) in certain of its properties of DHX to Epic Story Interactive for the purpose of developing, publishing and exploiting such interactive rights, with DHX to receive future royalties (including a minimum guarantee) from such exploitation. Epic Story Interactive agreed to assume the obligations and liabilities of DHX’s interactive business in connection with such transition.

Strategic Review

On October 2, 2017, the Company announced that its board of directors, supported by its management team, had commenced a process (the “Strategic Review”) to explore and evaluate potential strategic alternatives focused on maximizing shareholder value, including, among other things, the sale of part or all of the Company, a sale of some of the assets of the Company, a merger or other business combination with another party, or other strategic transactions. In connection with the Strategic Review, the Company formed a special committee of independent directors to consider and evaluate various strategic alternatives available to the Company. As part of the Strategic Review, the Company completed the Peanuts Divestiture (as defined and discussed in more detail below). The Company announced the completion of the Strategic Review concurrently with the filing of this Annual Information Form.

Management Changes

On February 26, 2018, the Company announced that Dana Landry was stepping down as Chief Executive Officer and from the board of directors and that Michael Donovan, Executive Chair, was appointed as Chief Executive Officer. On the same day, it was announced that Doug Lamb was appointed as Chief Financial Officer of the Company, replacing the former Chief Financial Officer, Keith Abriel.

On April 18, 2018, the Company announced that Aaron Ames was appointed as Chief Operating Officer, replacing Steven DeNure and Josh Scherba and Anne Loi were promoted to President and Chief Commercial Officer, respectively.

Partial Divestiture of Peanuts

On May 13, 2018, the Company announced that it had entered into a definitive agreement to sell (the “Peanuts Divestiture”) 49% of the Company’s 80% interest in Peanuts to Sony Music Entertainment (Japan) Inc. (“SMEJ”). The Peanuts Divestiture subsequently closed on July 23, 2018 following the satisfaction of the conditions to closing. The purchase price for the transaction was $235.6 million in cash, subject to customary working capital adjustments. The net proceeds from the Peanuts Divestiture were used to repay indebtedness outstanding under the Senior Credit Facilities of the Company.

As a result of the Peanuts Divestiture, the Company now indirectly owns 41% of the Peanuts business and SMEJ and members of the family of Charles M. Schulz own 39% and 20%, respectively. Also, in connection with the Peanuts Divestiture, Peanuts has expanded its relationship with Sony Creative Products Inc. (SMEJ’s consumer products division) by, among other things, extending the duration of the licensing and syndication agency agreement in respect of Peanuts in Japan.

BUSINESS OF THE COMPANY

Business Overview

DHX is a children’s content and brands company, headquartered in Canada and operating worldwide. DHX owns one of the largest independent libraries of children’s and family content (i.e. excluding libraries associated with a U.S. studio) and is home to some of the most viewed children’s TV stations in Canada. The Company’s extensive library and brands include many of the world’s most popular and recognizable characters and shows such as Peanuts, Teletubbies, Strawberry Shortcake, Caillou, Inspector Gadget, and the Degrassi franchise.

The Company is integrated across production, distribution, television broadcasting and consumer products with its production studios and operational locations in Halifax, Toronto, Vancouver, London and, New York. DHX licenses its own produced content globally for a set term, and then re-licenses it in various territories to create a continuing incremental revenue stream. DHX Television provides increased revenue stability, further diversification of operations and facilitates DHX’s ability to supply more original and other library content to audiences through some of the most watched children’s television channels in Canada. DHX’s consumer products operations are comprised of licensing intellectual property derived from programs produced in-house and owned brands, as well as additionally representing third party independently owned intellectual property.

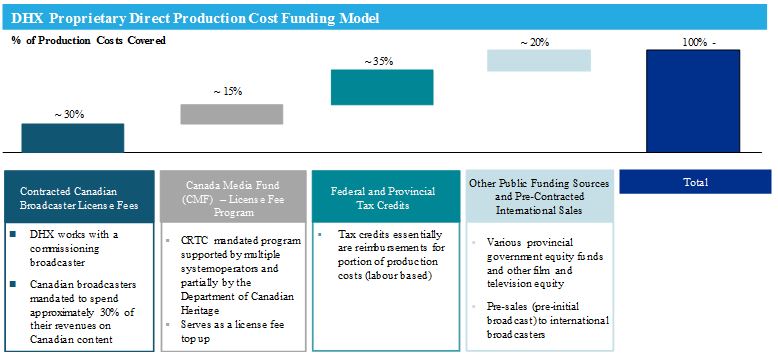

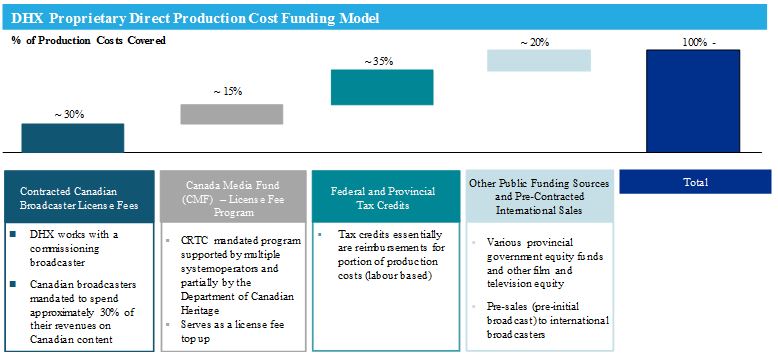

In fiscal 2018, the Company produced 103 half hours of proprietary content and 125 half hours of content based on third party titles for which the Company has distribution rights, through its own and third party studios, including animated and live-action content, which was added to the Company’s library. In addition to its animation production studios and operations in Halifax and Vancouver, the Company also maintains its own live action focused studio in Toronto and in fiscal 2018 produced 45 half hours of live action proprietary content. New content is created at low risk to DHX with 85% – 100% of third party direct production costs typically covered at “green lighting” from contracted Canadian broadcast licensing revenue, pre-sales and tax credits and other production incentives.

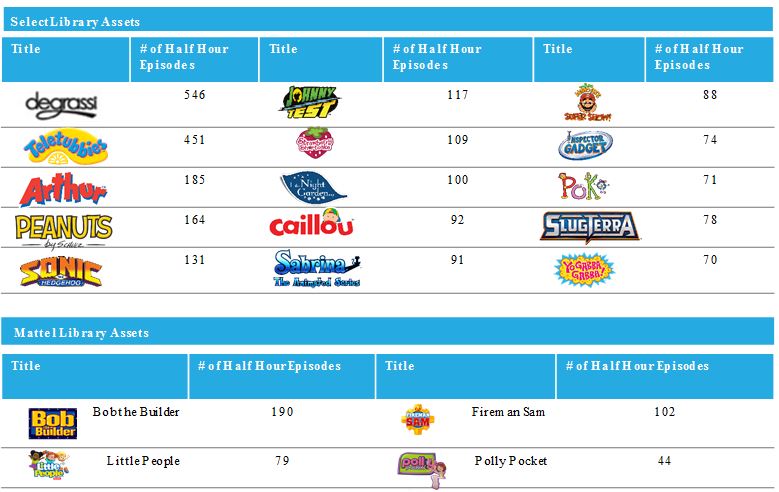

DHX’s library contains approximately 13,000 half hours of content (with approximately 500 titles) consisting of primarily children’s and family programming, which DHX estimates is the largest independent library (i.e. libraries not associated with a U.S. studio) of children’s content in the world. The titles owned or otherwise distributed by the Company appeal to a broad cross-section of audiences, from classic preschool programs targeted towards both genders, to up-to-date comedy titles and nostalgic titles for older audiences. Management believes that DHX’s library, combined with its production capabilities, make it a valuable “go to” supplier to a broad range of established and new TV channels and Over-The-Top Content (“OTT”)2 providers which are looking to deliver a wide range of programming to their viewers. DHX also generates distribution revenue through its ownership and operation of WildBrain, which the Company estimates is one of the largest networks of children’s channels on YouTube.

___________________

2 Refers to delivery of audio, visual, and other media over the Internet without an operator of multiple cable or direct-broadcast satellite television systems being involved in the control or distribution of the content.

DHX’s television business (“DHX Television”) is comprised of four children’s television channels, including Family Channel, Family Jr., Télémagino, and Family CHRGD. Combined, these channels represent some of the most viewed TV stations among children ages 2 to 17 in Canada.

DHX also generates revenue through its consumer products business line, which involves generating licensing royalties by exploiting its own intellectual property and brands, as well as generating commissions from the representation of third party brands through Copyright Promotions Licensing Group (“CPLG”), across toys, games, apparel, publishing and other categories. With the addition of the Peanuts and Strawberry Shortcake brands to its portfolio, DHX has expanded the size and scope of its consumer products activities.

The Company has three reportable segments which include (i) its production and distribution of content business, including proprietary production, production service, distribution of proprietary and third party content (including digital distribution on YouTube through WildBrain) and consumer products and other licensing of the Company’s owned intellectual property and certain other third party licensing arrangements, (ii) television broadcasting, and (iii) consumer products represented through CPLG. The breakdown of revenues by reportable segment for the two most recently completed fiscal years is as follows (amounts are expressed in thousands):

|

| | |

Year ended June 30 | 2017 | 2018 |

Content Business | $222,514 | $366,368 |

DHX Television | $57,384 | $55,014 |

Consumer Products Represented | $18,814 | $13,034 |

Total | $298,712 | $434,416 |

The Company’s Business Lines

The Company’s business is developing, producing, distributing, broadcasting, licensing, and further exploiting the rights for television and film programming and brands focusing primarily on children’s, youth and family productions and brands. DHX has the following four integrated business lines:

| |

• | Production (including proprietary production and production service) |

| |

• | Distribution (including proprietary and third party content) |

| |

• | Consumer Products (including licensing its own intellectual property and representing third parties) |

Production

Production Strategy

DHX has expertise in developing, producing, distributing and otherwise monetizing children’s, youth and family content worldwide and is integrated with its production studios and operations in Halifax, Toronto, and Vancouver. DHX’s production business focuses on programs, primarily animation, targeted at the children and youth age range that appeal to worldwide audiences and have the potential to generate multiple revenue streams. Management of the Company believes that children’s programming, especially animation, travels across cultures more easily than non-children’s programming as it can be more easily dubbed into other languages and can therefore be sold in numerous markets. Management also believes that animated children’s programming is particularly attractive due to the potential for longer-term revenue streams, including consumer products revenue, as it tends not to become dated as quickly as other forms of programming and consequently may be resold for viewing by successive generations of children. The Company’s youth-oriented productions include the multi-award winning Degrassi franchise as well as more recent popular programs such as Creeped Out and Massive Monster Mayhem. The Company believes that such youth-oriented programs are complementary to DHX’s primarily children’s and family library and are consistent with the Company’s strategy of focusing on properties which have international appeal and the potential for multiple revenue streams, including digital distribution and consumer products opportunities. Finally, the Company’s production strategy also includes the development of properties outside of its core area of children’s and youth programming, including live action comedy, such

as This Hour Has 22 Minutes. This additional diversification of its production slate provides the Company with alternative revenue streams, and access to different markets.

DHX believes that focusing on the production and development of high quality television programs will result in a consequential extension of the revenue generating life of the titles developed and produced, more viable consumer products opportunities, and increased profit on production. The Company also actively pursues co-production relationships in order to expand its output and access to international talent to create worldwide brands of value.

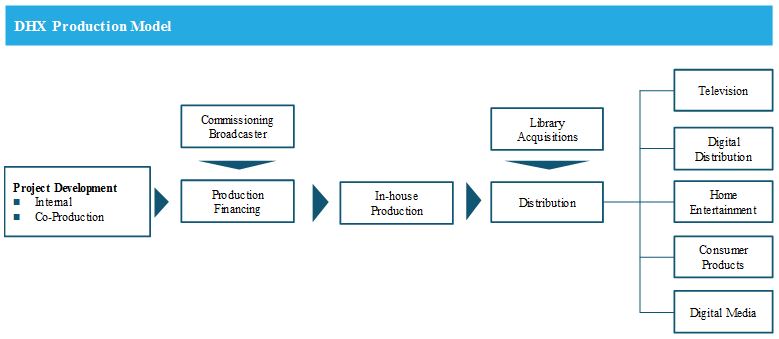

The Company maintains a disciplined approach to acquiring and perfecting key exploitation rights to its content and endeavors to own the majority of home entertainment and consumer products rights to its intellectual property. The following chart illustrates the production process employed by the Company:

Production Pipeline

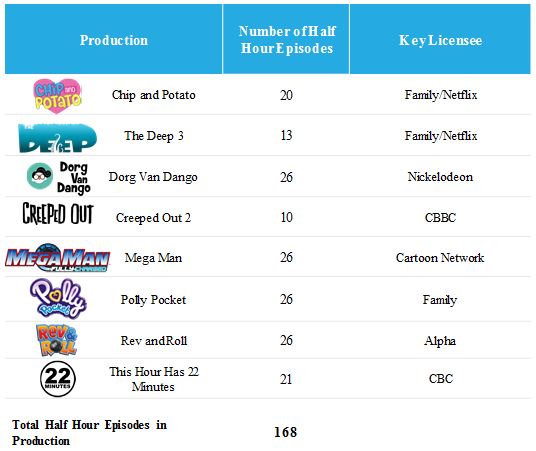

In fiscal 2018, the Company produced 103 half hours of proprietary content and 125 half hours of content based on third party titles for which the Company has distribution rights, through its own and third party studios, including animated and live-action content, which was added to the Company’s library. DHX has a robust production pipeline with 8 titles and 168 half-hour episodes of proprietary and third party owned content for which the Company holds distribution rights currently in production. The current production slate of the Company includes shows such as MegaMan, Rev and Roll, The Deep and Creeped Out. Additionally, the Company’s prime-time production slate includes the award-winning comedy series This Hour Has 22 Minutes, which has a 25-year history as a cultural icon in the Canadian market and is presently in its 26th season.

The following table illustrates proprietary programs and programs for which the Company holds distribution rights which are currently in production, including equivalent total number of half-hours for the season:3

___________________________

3 Episodes may not necessarily equal a half hour in length

Production Funding

The Company and its production subsidiaries employ a production funding model that is designed to ensure there is low capital risk associated with developing content while retaining long-term exploitation rights. DHX benefits from a Canadian regulatory environment that provides funding to cover the majority of the costs of developing and producing content prior to obtaining “green light” approval for production. The Company believes that this provides a distinct advantage over international peers that self-fund their productions. DHX maintains a “green light” policy which requires projects to have at least 85%–100% of the direct costs of production covered before entering the production phase. This is achieved through contracted Canadian broadcast licensing revenue, tax credits, other subsidies, and pre-sales.

Interim production financing is an additional component of the funding model for a typical production produced by the Company. The Company’s interim production financing is made up of credit facilities with various institutions which are secured by a combination of, among other things, production license fees, restricted cash balances and federal and provincial film tax credits receivable. Typically, upon collection of film tax credit receivables, the production financing is repaid.

Production Services

DHX also generates revenue from production services relationships. DHX provides production services, such as producing television shows and specials and animation and other similar services to third parties under contract and frequently on a repeat basis for established brands.

Distribution

DHX owns a library of globally recognized children’s and family content and associated brands with substantial scale and diversity. The Company’s library contains approximately 13,000 half hours of primarily animated programming across over 500 titles, making it, based on management’s estimates, one of the world’s largest independent libraries of children’s content (i.e. excluding libraries associated with a U.S. studio). The Company’s extensive library includes some of the world’s most popular and recognizable characters. The titles appeal to a broad cross-section of audiences, from classic preschool properties targeted towards both genders, to up-to-date comedy titles and nostalgic titles for older audiences. The Company believes that libraries of this breadth and depth are extremely difficult to replicate and estimates that replacement could take several decades with no assurances of created brands of a similar strength. With stable viewing hours for children and teens, the Company believes it is well positioned to continue to monetize its library through its existing relationships and new entrants.

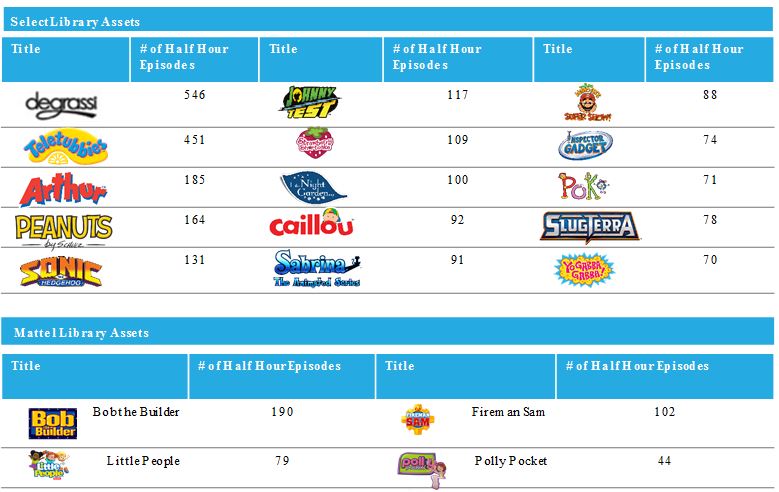

The following table illustrates select assets in the Company’s library:-4

__________________________________

4 Episodes may not necessarily equal half hour in length.

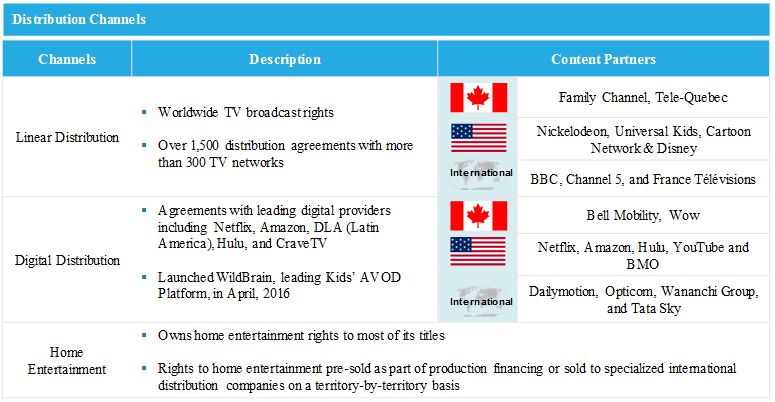

The Company’s distribution business line sells initial broadcast rights to individual broadcasters and other content exhibitors representing different “windows” of licensed rights in their respective territories, as well as packages of programs (“library” sales) to individual broadcasters and other content exhibitors, reuse rights to existing series with individual broadcasters and other content exhibitors, and pre-sells series that are in development. The Company maintains relationships with many broadcasters and other content exhibitors in the children and youth genres in major territories worldwide. The Company’s broad base of customers to date has been critical to the Company’s growth, enabling it to minimize the effects of downturns in any one market. DHX has long-standing relationships with many of the world’s distributors across broadcast television, cable, OTT and other digital channels. The Company manages its global distribution relationships through an in-house platform in order to effectively monetize its extensive library worldwide.

The Company’s content is primarily distributed through its international sales group, which is based in Toronto, with additional locations in Paris and Beijing. DHX is one of the largest independent producer of children’s content in Canada, one of the largest international suppliers into the U.S. market, and has a significant presence in key markets around the world, including Europe, Asia and South America, servicing 500 broadcasters and other content exhibition platforms globally. As noted above, the Company believes that children’s content, in particular animated content, travels across cultures more easily than other genres and that as a result the Company benefits from its focus on animated children’s shows for which it enjoys global recognition for many of its titles.

DHX’s distribution team is fully integrated with the Company’s development and production studios, which provide valuable market feedback at all stages of project development. Through this feedback, DHX is able to develop new content, including new titles and new seasons of existing titles, with broad appeal and significant market opportunity. The Company employs an advanced content rights management system which is used to manage all business aspects of distribution and maximize monetization of content.

DHX maintains a strong global presence at preeminent industry events, including MIP, MIPCOM, Licensing International Expo, American International Toy Fair, Licensing Show and others to continually identify opportunities to monetize its library globally.

Digital Distribution and WildBrain

The Company believes that the emergence and rapid growth of OTT platforms are creating substantial revenue generation opportunities for owners of high-quality, in-demand content and that DHX is well-positioned to benefit from this industry transformation.

The digital distribution of DHX’s library has been a source of significant growth for the Company as subscription video on demand (“SVOD”), transactional video on demand (“TVOD”), advertising video on demand (“AVOD”)5 and other OTT channels have increasingly looked, and are increasingly looking, to add high quality children’s content to their offerings. The Company has entered into agreements with leading digital providers including Netflix, Amazon, DLA (Latin America), Hulu and CraveTV and has entered into several international digital content deals with global channel operators in Europe, South America and Africa. The Company expects the rollout and growth of digital content to continue around the world.

DHX has also partnered with YouTube with respect to the monitoring and delivery of its content via YouTube (outside of DHX’s dedicated channels) creating an additional distribution revenue stream for the Company. The Company believes that the successful implementation of this strategy is indicative of DHX’s ability to monetize its content through AVOD delivery platforms such as YouTube. Additionally, DHX maintains its own branded advertising-based dedicated YouTube channels in order to enhance the Company’s digital footprint. DHX’s dedicated YouTube channels deliver a variety of DHX content to consumers, which generates advertising-based revenues for the Company.

___________________________________

5 Refers to internet-based services that give consumers free access to video content in exchange for being exposed to advertising (e.g. YouTube).

WildBrain is the Company’s wholly owned and operated multi-platform kids network for preschool and children, which connects content and brand owners with advertisers on YouTube and other platforms and leverages DHX’s library and digital expertise to produce and monetize children’s content. WildBrain has become one of the largest proprietary networks of kid’s content on YouTube and is expected to realize continued growth organically and through acquisitions such as Kiddyzuzaa and Ellie Sparkles.

Television Broadcasting

DHX’s television broadcasting business line, which operates as DHX Television, is comprised of four children’s television channels, including Family Channel, Family Jr., Télémagino, and Family CHRGD, which represent some of Canada’s most viewed children’s TV stations.

| |

• | Family Channel – Family Channel launched in 1988 and offers family television entertainment targeting kids 8-14 with a mix of top-rated Canadian and acquired series, movies and specials. |

| |

• | Family Jr. – Family Jr. launched in 2007 and offers English-language subscribers across Canada preschool television entertainment through a mix of Canadian series and popular preschool brands. |

| |

• | Télémagino – Télémagino launched in 2010 and offers French-language subscribers preschool entertainment through a mix of Canadian series and popular preschool brands. |

| |

• | Family CHRGD – Family CHRGD launched in 2011 and features animated and live-action programming for kids 6-12. |

In addition to linear television, each of the four channels also have multiplatform applications which allow for its content to be distributed across a number of platforms (including broadcast distribution undertakings (“BDUs”), online, and mobile), both on demand and streamed. All of the services are available in high definition. The primary target audience for these services consists of authenticated BDU subscribers, which avoids cannibalizing BDU-generated revenues. The four channels are also supported by popular websites designed to engage viewers and support their loyalty to the brands. The sites feature games, short and long form video content, contests, music videos, and micro-sites of the most popular shows. Traffic to the sites is monetized through advertising and sales sponsorships. The services are additionally present on social media platforms, including YouTube, Facebook and Twitter. DHX Television is headquartered in DHX’s Toronto offices.

On June 1, 2017, the Canadian Radio-television and Telecommunications Commission (the “CRTC”) called for renewal applications for all broadcasting licences and television services with licences expiring August 31, 2018. As such, the Company submitted licence renewal applications to the CRTC for Family Channel (and its multiplex, Family Jr.), Family CHRGD and Télémagino in August 2017. On July 5, 2018, the CRTC renewed DHX Television’s broadcasting licences for the English-language discretionary services Family Channel (and its multiplex, Family Jr.) and Family CHRGD, as well as the French‑language discretionary service Télémagino, from September 1, 2018 to August 31, 2023.

Integration of Operations (DHX Television)

The ownership of DHX Television has enabled the Company to increase integration between operating segments in the following ways:

| |

• | Liberating production of new DHX series from dependency on obtaining “green light” approval from third-party broadcasters; |

| |

• | Strengthening earnings as a result of reduced volatility through contractual customer relationships and streamlined production processes; |

| |

• | Increasing the amount of Canadian content production funding directed to DHX productions arising from the approval of the acquisition of DHX Television by the CRTC; and |

| |

• | Strengthening the platform to build awareness of DHX brands among children and youth across demographics, increasing loyalty and driving consumer products revenue. |

DHX Television maintains a content-driven strategy which is built upon the following: (i) commissioning new and original content, including utilizing the Company’s own proprietary animation and production teams; (ii) leveraging the Company’s 13,000 half-hour library; and (iii) augmenting its content strategy with new and compelling content supply agreements.

Consumer Products

The Company’s consumer products business involves licensing its owned intellectual property for royalties and representing third party owned intellectual property for commissions.

The Company’s consumer products owned business focuses its activities around the Company’s core slate of high-profile licensed properties and includes licensing, brand management and creative services teams. The Company licenses rights to merchandisers for fabrication of consumer products, such as toys, games and apparel, based on intellectual property owned by the Company. Some of DHX’s proprietary brands that are or have been leveraged in this owned consumer products business line include, among others, Peanuts, Strawberry Shortcake, Teletubbies, Yo Gabba Gabba!, Caillou, Johnny Test, In the Night Garden, and Twirlywoos. Licensing fees for these rights are generally paid as royalties and in many instances include non-refundable minimum guarantees. Additional revenue streams under this business line include revenues from music publishing rights, music retransmission rights and live tours.

CPLG is a subsidiary of the Company and the agent appointed for selected brands of DHX. CPLG is a leading entertainment, sport and brand licensing agency with offices in the UK, Europe, U.S., and Middle East. CPLG has approximately 40 years of experience in the licensing industry and has a representation portfolio which includes Sesame Street, Paramount and Pink Panther. CPLG provides each of its clients with dedicated licensing and marketing industry professionals and a fully-integrated product development, legal and accounting service. CPLG earns commissions on consumer products licensing from representing independently owned brands of film studios and other third parties as well as selected DHX brands.

The addition of Peanuts and Strawberry Shortcake to the Company’s global portfolio has increased the size and scale of the Company’s business, in particular, its consumer products business line.

Industry Overview

Production

Canada is a favorable jurisdiction for film and television production due to its supportive regulatory environment, including tax credit and other incentive regimes, Canadian content regulations and international co-production treaties. Major television broadcasting ownership groups (including Rogers Media, Bell Media and Corus Entertainment) are typically required by the CRTC to spend a percentage of their revenues on Canadian content. The Broadcasting Act also encourages independent production by directing BDU contributions and establishing requirements for Canadian programming expenditures.

Although the total film and television production in Canada realized an increase of 24% in 2016/2017 to production volume of $8.38 billion, children’s and youth production decreased by 16.9% to $521 million and Canadian animation production decreased by 19.9% to $266 million in 2016/2017. Both children’s and youth and animation saw a ten-year high in 2015/2016 and despite the single year declines in production in 2016/2017, the volume for the genres during such period was still above the ten-year average. Such declines are also mitigated by the global demand for screen-based content driven by the proliferation of new channels and platforms for delivery.6

Finally, the production industry in Canada also offers access to a highly skilled creative workforce and Canada has consistently enjoyed success in the animation production industry worldwide, with several independently produced Canadian programs achieving international recognition.

_____________________

6 Source: CMPA Profile 2017.

Distribution

DHX believes that the demand for content, in particular children’s and family programming, has increased significantly as a result of the proliferation of digital/non-linear distribution methods, including OTT and AVOD platforms, including YouTube. OTT deployments include aggregators such as Netflix and Hulu, standalone set-top boxes such as Apple TV and TiVo, internet-enabled “smart” TVs and other TV Everywhere7 initiatives. Since most digital/non-linear sales are currently non-exclusive, distributors, such as DHX, are able to take advantage of selling the same content to multiple channels in certain territories.

Television Broadcasting

The strong viewership dynamics of the children’s TV segment in Canada is supported by the fact that English kids TV represents approximately a 12% viewership share of total English Canadian pay specialty TV market.8

In March 2015, the CRTC released a series of decisions as the result of its Let’s Talk TV consultation which resulted in and will continue to result in changes to the regulatory framework for Canadian television services, including the services offered by the DHX Television Business. Among other things, the decisions will require BDUs to offer a small basic service package and to provide subscribers with the opportunity to purchase all discretionary television services on an à la carte basis.

Currently, Category A channels are required to be distributed in Canada by all larger cable and satellite BDUs, although terms of carriage are subject to negotiation. Category B channels are not required to be distributed by BDUs meaning that access to BDU platforms and terms of carriage are subject to negotiation. However, the CRTC is phasing out the distinction between Category A and Category B channels at the time of licence renewal. The distinction between Category A and Category B television services is being phased out, which started with the renewal of the licences held by larger vertically integrated broadcasting groups (such as Bell, Rogers and Corus) in 2017. These licensing categories are replaced by a single discretionary category of service. Discretionary services are not required to be distributed by BDUs and all terms of carriage are subject to negotiation. Category A licences for independent broadcasting companies (i.e. those that are not owned by or related to a BDU), such as DHX Television’s Family Channel Licence was phased out with its recent licence renewal.

The Let’s Talk TV decisions include a number of regulatory measures that are intended to provide support for non-vertically integrated broadcasting companies such as DHX Television. These include a requirement that BDUs distribute at least one independent discretionary television service for each related television service that they distribute, and the Wholesale Code that establishes principles to guide commercial negotiations between BDUs and television services regarding terms of carriage and related matters. The CRTC issued the Wholesale Code effective January 22, 2016 and licensed undertakings’ adherence with the Wholesale Code is now a formal regulatory requirement.

Other regulatory measures that flow from the Let’s Talk TV decision that are relevant to DHX include the removal of “genre” protection and regulated genre requirements as between Canadian programming services (which means that Canadian programming services may now compete directly with each other in all genres), the announcement that the CRTC will no longer require television services to enter into formal terms of trade with the independent production industry, and the ability for pay television services, such as Family Channel (was at that time), to broadcast advertising as of November 2, 2016.

In the view of management of the Company, the outlook for English kids TV in Canada remains stable and will continue to be a primary platform for content consumption.

Consumer Products

The global consumer products licensing industry operates in a mature market and can be highly lucrative given the low risk, high cash margins and passive nature of collecting royalty streams. Typically, companies will enter into licensing arrangements once their brands have achieved a reasonable level of market recognition through a content distribution platform or otherwise.

____________________________________

7 DHX employs the term “TV Everywhere” to describe authenticated OTT platforms on mobile devices.

8 Source: Numeris (Previously BBM Canada) (Broadcast Year 2017-2018).

The sale of licensed entertainment merchandise is a multi-billion dollar industry. In 2017, global revenue from trademark licensing was US$271.6 billion, with the United States and Canada remaining the largest market and accounting for 58% of the global total. Furthermore, entertainment and characters licensing continues to be the number one category, accounting for US$121.5 billion or 44.7% of the total global licensing market.9

Competitive Conditions

Production and Distribution

Although there is a multi-billion dollar children’s entertainment market worldwide, the production and distribution of children’s, youth and other genres of television, film and other media content is highly competitive. The Company competes with numerous Canadian domestic as well as international suppliers of media content, including vertically integrated major motion picture studios, television networks, and independent television production companies. Many of these competitors are significantly larger than DHX and have substantially greater resources, including easier access to capital. Canadian production companies typically also have access to the same favourable production financing environment in Canada employed by the Company and compete with the Company for program commissions from Canadian broadcasters. Additionally, the Company competes with other television and motion picture production companies for ideas and storylines created by third parties, as well as for actors, directors, writers and other key personnel required for a production.

The Company believes that the proliferation of digital/non-linear distribution of media content, including OTT, has reduced certain competitive pressures in the production and distribution of media content through the increased number of customers and distribution channels, an increase in the demand for programming and the existence of opportunity for non-exclusive deals in certain territories which permits the Company to sell the same content to multiple channels in the same territory.

Additionally, as noted above, the Company believes that the breadth and depth of the Company’s library would be extremely difficult to replicate. The Company estimates that replacement could take several decades with no assurances of created brands of a similar strength, advantageously positioning the Company relative to certain competitors.

Television Broadcasting

The competitive environment in the television industry has changed significantly over the past few years following the deployment of digital set-top boxes, the launch of numerous new television networks and the resulting fragmentation of the market. As a result, the channels comprising DHX Television compete for subscribers against other discretionary service operators such as Corus, Bell Media, Rogers Broadcasting and Quebecor. Furthermore, DHX Television competes for advertising revenues with the aforementioned operators and conventional television networks such as CBC, CTV, and Global as well as with other advertising media, including the internet. The multiplication of television networks has also resulted in increased competition for program content.

DHX Television also competes with several foreign and domestic digital/non-linear providers, including OTT, many of which are outside of the Canadian regulatory system and therefore have no Canadian content spending or on-air obligations, and charge no Canadian sales tax. The Company believes that the proliferation of digital/non-linear providers has increased the demand for, and cost of, high-quality content and increased audience fragmentation and competition for subscribers.

The Company also expects that the decisions coming from the Let’s Talk TV consultation have resulted and will continue to result in changes to the competitive conditions impacting the DHX Television Business. Refer to “Industry Overview – Television Broadcasting” above for additional information concerning the CRTC Let’s Talk TV hearings and associated decisions and their potential impact on the Company.

______________________

9 Source: Licensing Industry Merchandisers’ Association, LIMA Annual Global Licensing Survey 2017.

Consumer Products

The Company’s consumer products activities are also subject to a highly competitive environment. The Company competes with several large entertainment and toy companies as well as smaller domestic and international entertainment and toy developers and producers. The industry’s low barriers to entry result in opportunities for existing competitors and new entrants to develop and acquire entertainment and trademark properties that compete with the Company’s properties. Competition is based primarily on consumer preferences and extends to the Company’s ability to generate or otherwise acquire popular entertainment and trademark properties and secure licenses to exploit, and effectively distribute and market, such properties.

Customers

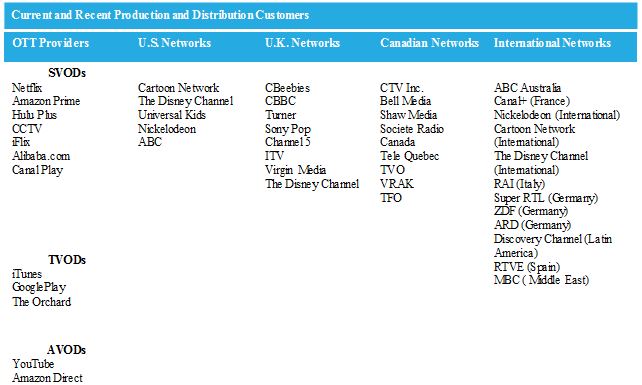

DHX’s target customers for its production and distribution business lines are, in large part, made up of conventional and specialty terrestrial and cable/satellite television broadcasters in the U.S., United Kingdom, Canada and other international markets. Additionally, the Company targets OTT and digital providers for its production and distribution business lines worldwide. Some of the OTT and digital providers that comprise DHX’s customer base include Netflix, Amazon, Hulu and CraveTV. The Company has sold programs to over 500 broadcasters and other rights buyers in over 150 countries.

The following chart lists certain of the Company’s current and recent production and distribution customers:

In addition to the above, the Company also provides production services to large brand owners looking to create content, such as Hasbro. Each of the four children’s television channels comprising DHX Television are carried by major BDUs in Canada, including as Bell, Cogeco, Telus, Rogers, Shaw Direct, Eastlink, Shaw and Videotron. The Company’s customer base also includes licensing agents in various international territories and other licensees for its consumer products activities.

Specialized Skill and Knowledge

DHX’s management team and employees bring together strong complementary skills, expertise and experience in various aspects of the television and film production, distribution, television broadcasting, programming, consumer products, and digital media industries, including production, financing, sales and marketing and have received numerous awards of excellence. For additional information concerning certain members of the management team, refer to “Directors and Officers” below.

Intangible Properties

DHX uses a number of trademarks, service marks and official marks for its products and services. Many of these brands and marks are owned and registered by the Company, and the Company believes those trademarks that are not registered are protected by common law. The Company may also license certain marks from third parties. The Company has taken affirmative legal steps to protect its owned and licensed trademarks and believes its trademark position is adequately protected. The exclusive rights to trademarks depend upon the Company’s efforts to use and protect such marks and the Company does so vigorously.

Distribution rights to television programming and films as well as ancillary rights are granted legal protection under the copyright laws and other laws of Canada, the United States and most foreign countries. These laws impose substantial civil and criminal sanctions for the unauthorized duplication and exhibition of film and television programming. The Company believes that it takes, and plans to continue taking, all appropriate and reasonable measures to secure, protect and maintain or obtain agreements from licensees to secure, protect and maintain copyright and other legal protections for all of the film and television programming produced and distributed by DHX under the laws of all applicable jurisdictions.

The Company can give no assurance that its actions to establish and protect its trademarks and other proprietary rights will be adequate to prevent imitation or copying of its filmed and animated entertainment by others or to prevent third parties from seeking to block sales of its filmed and animated entertainment as a violation of their trademarks and proprietary rights. Moreover, the Company can give no assurance that others will not assert rights in, or ownership of, its trademarks and other proprietary rights, or that the Company will be able to successfully resolve these conflicts. In addition, the laws of certain foreign countries may not protect proprietary rights to the same extent as do the laws of Canada and the United States.

The Company operates a comprehensive clearance and rights management system to both protect its rights and to ensure that works that DHX uses have the requisite clearances or licenses from the owners. A key element of contracts for copyright works is the term or time period of the license granted, which in the television sector can vary, but usually is for a time period such as one to three years. Rights management in a digital business environment is becoming increasingly complex due to challenges with definitions, semantics and taxonomic issues related to contractual rights.

Cycles and Seasonality

DHX’s operating results for any period are subject to cyclical or season fluctuations and dependent on factors such as the number and timing of film and television programs delivered, the budgets and financing cycles of broadcasters, overall demand for content, general advertising revenues and retail cycles associated with consumer spending activity, and the timing and level of success achieved by consumer products licensed and royalties paid in respect thereof, none of which can be predicted with certainty. Consequently, the Company’s results from operations may fluctuate materially from period-to-period and the results of any one period are not necessarily indicative of results for future periods. Refer to “Risk Factors” below.

Employees

At June 30, 2018, the Company had 505 full-time employees, 27 of which are based in Halifax, 182 at the Company’s facilities in Toronto, 2 in Los Angeles, 27 in New York, 81 in Vancouver and 186 are based in Europe. In addition, the Company retains individuals on a temporary contract basis, including directors, cast and crew, with the appropriate skills and background as required for particular projects under development or in production. During the year ended June 30, 2018, the Company retained approximately 862 temporary workers. Given the extent of the Company’s production portfolio, it is able to maintain its access to skilled animators, artists, lighting crews, directors and line producers, by being able to provide relatively constant work. There are a number of independent animation studios across the country that can be engaged on a “work for hire” basis that can be used to manage production capacity while minimizing fixed overhead costs.

Operations

DHX operates out of offices in Halifax, Toronto, Vancouver, London, and, most recently, New York with additional locations worldwide as depicted under “The Company’s Business Lines – Distribution” above. The additional offices worldwide primarily support the Company’s distribution and consumer products activities. The Company maintains animation studios in Halifax and Vancouver where it provides services and facilities for both its owned productions as well as for third parties. The Company also owns and operates a 98,400 square foot studio on a 4.3 acre site in Toronto used primarily for live-action productions produced by the Company.

A significant percentage of the Company’s consolidated revenue for the fiscal year ended June 30, 2018 was attributable to foreign operations (i.e. attributable to the Company’s entities outside of Canada). These consist primarily of revenues from the Company’s international content distribution, consumer products licensing of owned intellectual property and consumer products representation of third party brands. Revenue attributable to the consumer products represented segment for the year ended June 30, 2018 was comprised substantially of revenue from foreign operations.

REORGANIZATIONS

During fiscal year ended June 30, 2016, the Company completed a reorganization for tax planning purposes involving certain of its material subsidiaries which primarily involved, among other transactions, the dissolution of DHX Cookie Jar Inc., the transfer of substantially all of DHX Cookie Jar Inc.’s assets and liabilities to DHX Media (Toronto) Ltd., and the transfer of Cookie Jar Entertainment Holdings UK Ltd. (which holds CPLG) to DHX Worldwide Limited.

SOCIAL POLICIES

DHX is committed to fair dealing, honesty and integrity in all aspects of its business conduct and has implemented a Code of Business Conduct and Ethics applicable to all directors, officers, and employees of the Company which aims to demonstrate the Company’s commitment to conduct itself ethically and is available on DHX’s website at www.dhxmedia.com.

RISK FACTORS

The following are the specific and general risks that could affect the Company that each reader should carefully consider. Additional risks and uncertainties not presently known to the Company or that the Company does not currently anticipate will be material, may impair the Company’s business operations and its operating results and as a result could materially impact its business, results of operations, prospects and financial condition. Readers should additionally refer to the risk factors set out in the Company’s most recent annual Management Discussion and Analysis, which, together with the risk factors below, do not necessarily constitute an exhaustive list.

Risks Applicable to the Company’s Shares

The market prices for the Shares may be volatile as a result of factors beyond the Company’s control.

Securities markets have a high level of price and volume volatility, and the market price of shares of many companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. The market price of the Company’s Shares may be subject to significant fluctuation in response to numerous factors, including variations in its annual or quarterly financial results or those of its competitors, changes by financial research analysts in their recommendations or estimates of the Company’s earnings, conditions in the economy in general or in the broadcasting, film or television sectors in particular, unfavorable publicity changes in applicable laws and regulations, exercise of the Company’s outstanding options, or other factors. Moreover, from time to time, the stock markets on which the Company’s Shares will be listed may experience significant price and volume volatility that may affect the market price of the Company’s Shares for reasons unrelated to its economic performance. No prediction can be made as to the effect, if any, that future sales of Shares or the availability of Shares for future sale (including Shares issuable upon the exercise of stock options) will have on the market price of the Shares prevailing from time to time. Sales of substantial numbers of Shares, or the perception that such sales could occur, could adversely affect the prevailing price of the Company’s Shares.

As a result of any of these factors, the market price of the Shares may be volatile and, at any given point in time, may not accurately reflect the long term value of DHX. This volatility may affect the ability of holders of Shares to sell their Shares at an advantageous price.

DHX’s Common Voting Shares and Variable Voting Shares structure is unusual in the United States. As a result, brokers, dealers and other market participants may not understand the conversion features of the Common Voting Shares and Variable Voting Shares, which may negatively impact liquidity in the trading market for each class of Shares and may result in differences between the trading prices of each class of Shares that do not reflect differences in the underlying economic or voting interests represented by each class of Shares.

The Company may require additional capital in the future which may decrease market prices and dilute each shareholder’s ownership of the Company’s Shares.

The Company may require capital in the future in order to meet additional working capital requirements, to make capital expenditures, to take advantage of investment and/or acquisition opportunities or for other reasons (the specific risks of which are described in more detail below). Accordingly, the Company may need to raise additional capital in the future. The Company’s ability to obtain additional financing will be subject to a number of factors including market conditions and its operating performance. These factors may make the timing, amount, terms and conditions of additional financing unattractive or unavailable for the Company.

In order to raise such capital, the Company may sell additional equity securities in subsequent offerings and may issue additional equity securities. Sales or issuances of a substantial number of equity securities, or the perception that such sales could occur, may adversely affect prevailing market price for the securities. With any additional sale or issuance of equity securities, investors will suffer dilution of their voting power and the Company may experience dilution in its earnings per share. Capital raised through debt financing would require the Company to make periodic interest payments and may impose restrictive covenants on the conduct of the Company’s business. Furthermore, additional financings may not be available on terms favorable to the Company, or at all. The Company’s failure to obtain additional funding could prevent the Company from making expenditures that may be required to grow its business or maintain its operations.

The Company may issue additional Common Voting Shares and/or Variable Voting Shares, including upon the exercise of its currently outstanding convertible debentures, stock options and in accordance with the terms of the Company’s dividend reinvestment plan, employee share purchase plan and performance share unit plan. Accordingly, holders of Common Voting Shares and Variable Voting Shares may suffer dilution.

Voting rights of holders of Variable Voting Shares may be automatically decreased if votes attached to the Variable Voting Shares exceed certain limits under the Articles.