MCP 12.31.2014 10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014 |

or |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number 001-34827

Molycorp, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) | | 27-2301797 (I.R.S. Employer Identification No.) |

5619 Denver Tech Center Parkway, Suite 1000 Greenwood Village, Colorado (Address of principal executive offices) | | 80111 (Zip Code) |

(303) 843-8040

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed by reference to the price at which the common equity was last sold as of the last business day of the registrant's most recently completed second fiscal quarter: $497,386,528

As of March 13, 2015, the registrant had 277,955,182 shares of common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Items 10, 11, 12, 13 and 14 of Part III is incorporated by reference from portions of the registrant's definitive proxy statement relating to its 2015 annual meeting of stockholders to be filed within 120 days after December 31, 2014.

MOLYCORP, INC.

INDEX

|

| | |

| | PAGE |

| | |

| | |

PART I |

| | |

| | |

| | |

| | |

| | |

| | |

PART II |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART III |

| | |

| | |

| | |

| | |

| | |

PART IV |

| | |

| |

DEFINITIONS

The following table includes acronyms and abbreviations used in this Annual Report on Form 10-K as well as definitions of certain rare earths, rare metals and mining terms often used in our public filings. Unless the context requires otherwise, references in this Annual Report on Form 10-K to “Molycorp,” “we,” “our” or “us” refer to Molycorp, Inc. and its consolidated subsidiaries.

|

| |

ARO | Asset Retirement Obligation. |

ASC | Accounting Standards Codification. |

ASP | Average Selling Price. |

Assay | The analysis of the proportions of metals in ore, or the testing of an ore or mineral for composition, purity, weight, or other properties of commercial interest. |

ASU | Accounting Standards Update. |

Bastnasite | Bastnasite is a mixed-lanthanide fluoro-carbonate mineral (Ln F CO3) that currently provides the bulk of the world's supply of the light REEs. Bastnasite and monazite are the two most common sources of REEs. Bastnasite is found in carbonatites, igneous carbonate rocks that melt at unusually low temperatures. |

Board | Molycorp's Board of Directors. |

Bonded magnet | Bonded neodymium-magnets are prepared by melt spinning a thin ribbon of the NdFeB alloy. The ribbon contains randomly oriented Nd2Fe14B nano-scale grains. This ribbon is then pulverized into particles, mixed with a polymer and either compression or injection molded into bonded magnets. Bonded magnets offer less flux than sintered magnets, but can be net-shape formed into intricately shaped parts and do not suffer significant eddy current losses. |

Cerium | Cerium (Ce) is a soft, silvery, ductile metal which easily oxidizes in air. Cerium is the most abundant of the REEs, and is found in a number of minerals, including monazite and bastnasite. Cerium has two relatively stable oxidation states, enabling both the storage of oxygen and its widespread use in catalytic converters. Cerium is widely used in the glass polish industry and in many other applications. |

CHP | Combined Heat and Power. |

Concentrate | Concentrate is a mineral processing product that generally describes the material that is produced after crushing and grinding ore, effecting significant separation of gangue (waste) minerals from the desired metal and/or metal minerals, and discarding the waste minerals. The resulting “concentrate” of minerals typically has an order of magnitude higher content of minerals than the beginning ore material. |

Cut-off grade | Cut-off grade is the lowest grade of mineralized material that qualifies as ore in a given deposit. The grade above which minerals are considered economically mineable considering the following parameters: estimates over the relevant period of mining costs, ore treatment costs, general and administrative costs, refining costs, royalty expenses, by-product credits, process and refining recovery rates and price. |

Didymium | Didymium is a natural and unseparated combination of neodymium and praseodymium, which is approximately 75% neodymium and 25% praseodymium, depending on the ore. |

Dysprosium | Dysprosium (Dy) is a REE with a metallic silver lust. A few percent of Dy is often added to high-power NdFeB magnets to increase their resistance to demagnetization. A minor use of dysprosium is in the magnetostrictive alloy, based on DyTbFe, called terfenol-D. |

EBITDA | Earnings Before Interest, Taxes, Depreciation and Amortization. |

Europium | Europium (Eu) is a REE with luminescent properties. Excitation of the europium atom, by absorption of energy, results in a visible emission. Almost all practical uses of europium utilize this luminescent behavior. |

Exchange Act | Securities Exchange Act of 1934, as amended. |

FASB | Financial Accounting Standards Board. |

FCC | Fluid Catalytic Cracking. |

GAAP | Accounting principles generally accepted in the United States. |

Gadolinium | Gadolinium (Gd) is a REE that absorbs neutrons and therefore is used for shielding and controlling neutron radiography and in nuclear reactors. Because of its paramagnetic properties, solutions of organic gadolinium complexes and gadolinium compounds are popular intravenous contrast enhancing agents for medical Magnetic Resonance Imaging (MRI). Gadolinium is sometimes added to samarium cobalt magnets to make their magnetic properties less temperature dependent. |

Gallium | Gallium is a rare metal not found in nature, but it is easily obtained by smelting. Very pure gallium metal has a brilliant silvery color and its solid metal fractures conchoidally like glass. Almost all gallium is used for microelectronics. |

|

| |

Grade | The average REE content, as determined by assay of a metric ton of ore. |

HREE | Heavy rare earth element. |

Indium | Indium is a rare, very soft, malleable and easily fusible post-transition metal that is chemically similar to gallium and thallium, and shows intermediate properties between these two. Indium's current primary application is to form transparent electrodes from indium tin oxide (ITO) in liquid crystal displays and touchscreens, and this use largely determines its global mining production. It is widely used in thin-films to form lubricated layers. It is also used for making particularly low melting point alloys, and is a component in some lead-free solders. |

Lanthanum | Lanthanum (La) is the first member of the Lanthanide series of REEs. Lanthanum is a strategically important REE due to its use in FCCs, which are used in the production of transportation and aircraft fuel. Lanthanum is also used in fuel cells, batteries, and many other products. |

LED | Light-emitting diode. |

LREC | Light rare earth concentrate (purified and unseparated). |

LREE | Light rare earth element. |

MD&A | Management's Discussion and Analysis of Financial Condition and Results of Operations. |

Mill | A processing plant that produces a concentrate of the valuable minerals contained in an ore. |

Mineralization | The process or processes by which a mineral or minerals are introduced into a rock, resulting in a valuable or potentially valuable deposit. |

Molycorp Canada | Molycorp Minerals Canada ULC (formerly Neo Material Technologies Inc.). |

Mountain Pass | The Molycorp Minerals, LLC rare earth minerals mining and processing facility located in Mountain Pass, California. |

Monazite | Monazite is a reddish-brown phosphate mineral. Monazite minerals are typically accompanied by concentrations of uranium and thorium. This has historically limited the processing of monazite, however this mineral is becoming more attractive because it typically has slightly elevated concentrations of mid-to heavy rare earths as compared to rare earth-containing minerals such as bastnasite. |

mt | Metric Ton = 2,205 pounds. |

Niobium | Niobium is a rare, soft, grey, ductile transition metal found in the mineral pyrochlore, the main commercial source for niobium, and columbite. Niobium is used mostly in alloys, the largest part in special steel such as that used in gas pipelines. Although alloys contain only a maximum of 0.1% of niobium, that small percentage improves the strength of the steel. The temperature stability of niobium-containing superalloys is important for its use in jet and rocket engines. Niobium is also used in various superconducting materials, among other applications. |

NdFeB | Neodymium-iron-boron alloy. |

NdPr | Neodymium/Praseodymium. |

Nd2O3 | Neodymium(III) oxide or neodymium sesquioxide is the chemical compound composed of neodymium and oxygen. |

Neodymium | Neodymium (Nd) is a REE used in a wide variety of applications, particularly as a key constituent of NdFeB permanent magnets and as an additive to capacitor dielectrics. NdFeB magnets have a relatively high power/weight ratio, and are used in a large variety of motors, generators, sensors and computer hard disk drives. Capacitors containing neodymium are found in cellular telephones, computers and nearly all other electronic devices. A minor application of neodymium is in lasers. |

Neo PowdersTM | NdFeB magnet powders. |

Ore | That part of a mineral deposit which could be economically and legally extracted or produced at the time of reserve determination. |

Overburden | In surface mining, overburden is the material that overlays an ore deposit. Overburden is removed prior to mining. |

Praseodymium | Praseodymium (Pr) is a REE that generally comprises about 4% of the lanthanide content of bastnasite and is used in several applications, including in NdFeB magnetic materials and as a coloring pigment in photographic filters, airport signal lenses, and welder's glasses. |

Probable reserves | Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

|

| |

Proven reserves | Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established. |

REE | Rare earth element. |

Recovery | The percentage of contained metal actually extracted from ore in the course of processing such ore. |

REO | Rare earth oxide. |

Reserves | That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Same definition as 'ore'. |

Rhenium | Rhenium is a silvery-white, heavy, third-row transition metal. With an estimated average concentration of 1 part per billion (ppb), rhenium is one of the rarest elements in the Earth's crust. The free element has the third-highest melting point and highest boiling point of any element. Rhenium resembles manganese chemically and is obtained as a by-product of molybdenum and copper ore's extraction and refinement. Nickel-based superalloys of rhenium are used in the combustion chambers, turbine blades, and exhaust nozzles of jet engines. These alloys contain up to 6% rhenium, making jet engine construction the largest single use for the element, with the chemical industry's catalytic uses being next-most important. |

Samarium | Samarium (Sm) is a REE predominantly used to produce samarium-cobalt magnets. Although these magnets are slightly less powerful than NdFeB magnets at room temperature, samarium cobalt magnets can be used over a wider range of temperatures and are less susceptible to corrosion. |

SEC | Securities and Exchange Commission. |

SEG | Samarium, europium, gadolinium. |

Sintered magnet | Sintered NdFeB-magnets are prepared by the raw materials being melted in a furnace, cast into a mold and cooled to form ingots. The ingots are pulverized and milled to tiny particles, which then undergo a process of liquid-phase sintering whereby the powder is magnetically aligned into dense blocks which are then heat-treated, cut to shape, surface treated and magnetized. |

Tantalum | Tantalum is a rare, hard, blue-gray, lustrous transition metal that is highly corrosion resistant. It is part of the refractory metals group, which are widely used as minor component in alloys. The chemical inertness of tantalum makes it a valuable substance for laboratory equipment and a substitute for platinum, but its main use today is in tantalum capacitors in electronic equipment such as mobile phones, DVD players, video game systems and computers. |

Terbium | Terbium (Tb) is a REE used primarily as a phosphor, either in fluorescent lamps or x-ray screens. It can replace dysprosium in NdFeB magnets but usually does not because of its cost. A minor use of terbium is in the magnetostrictive alloy, based on DyTbFe, called terfenol-D. |

Ton | 2,000 pounds. |

Yttrium | Yttrium (Y), although not a lanthanide series element, is often considered to be a REE and its behavior is similar to heavy REEs. It is predominantly utilized in lighting applications and ceramics. Other uses include resonators, lasers, microwave communication devices and other electronic devices. |

Zirconium oxide | Zirconium oxide is a white amorphous powder that is insoluble in water and highly refractory, used as a pigment for paints, a catalyst, and an abrasive. |

PART I

Our Business

We are a leading rare earths producer that operates a vertically integrated, global supply chain that combines a world-class rare earths resource with manufacturing facilities on three continents that can produce a wide variety of custom engineered, advanced rare earth materials from rare earth elements. Our vertically integrated business allows us to operate multiple product supply chains, serve as a supplier of advanced rare earths and rare metal materials, and provide price visibility to customers worldwide.

Rare earth products are critical inputs in hundreds of existing and emerging applications. A few examples of these include the following: clean energy technologies, such as hybrid and electric vehicles, energy-saving motors, pumps and compressors used in a wide variety of high-efficiency appliances and other durable goods, and wind power turbines; multiple high-tech uses, including mobile devices, fiber optics, lasers, and hard disk drives; critical defense applications, such as guidance and control systems and global positioning systems; and advanced water treatment technologies for use in industrial, municipal, and recreational applications. Global demand for REEs is projected by industry analysts to steadily increase both due to continuing growth in existing applications and increased innovation and development of new end uses. We have made significant investments, and expect to continue to invest, in developing technologically advanced applications and proprietary applications for individual REEs.

Our Mountain Pass facility is a core component of our vertical integration strategy and is home to one of the world's largest and richest deposits of rare earths (including light, mid, and heavy rare earths). Rare earth production has been conducted at Mountain Pass for over 60 years. At our Mountain Pass facility, we perform rare earth minerals extraction to produce LREC; separated rare earth oxides, including Lanthanum, Cerium, and Neodymium-Praseodymium ("NdPr"); heavy rare earth concentrates, which include Samarium, Europium, Gadolinium, Terbium, Dysprosium, and others; and a line of proprietary rare earth-based water treatment products, including SorbX® and PhosFIX™. We sell Lanthanum oxide from our Mountain Pass facility to manufacturers of FCC catalysts for the petroleum refining industry. Rare earths like Lanthanum typically comprise between 2-4% of FCC catalyst materials delivering important benefits to the petroleum refining process, such as increased catalyst activity and stability, increased gasoline yield and reduced production of liquefied petroleum gas. The combination of these processing benefits helps the refinery industry save energy resources and reduce its impact on the environment.

We also own several of the leading rare earth processing facilities in the world. We are a leading global producer, processor, and developer of Neo Powders™, rare earths, and zirconium-based engineered materials and applications, as well as a variety of rare metals and their compounds. These products are essential in many of today's high-technology applications. Neo Powders™ are used in the production of high-performance, bonded NdFeB permanent magnets, which are found in micro motors, precision motors, sensors, and other applications requiring high levels of magnetic strength, flexibility, small size, and reduced weight. We also manufacture a line of mixed rare earth/zirconium oxides and reclaim, refine, and market high-value rare metals and their compounds. These include Gallium, Indium, and Rhenium used in wireless, LED, flat panel display, turbine, solar, and catalyst applications. In addition to the Mountain Pass facility, our operations include subsidiaries, joint ventures, and majority-owned manufacturing facilities in the following locations:

|

| |

- Jiangyin, Jiangsu Province, China; | - Sagard, Germany; |

- Zibo, Shandong Province, China; | - Peterborough, Ontario, Canada; |

- Tianjin, China; | - Tolleson, Arizona; |

- Hyeongok: Industrial Zone in South Korea; | - Blanding, Utah; and |

- Korat, Thailand; | - Quapaw, Oklahoma. |

- Sillamäe, Estonia; | |

Additionally, we conduct research and product development through laboratories in Singapore and Abingdon, United Kingdom.

THE GLOBAL FOOTPRINT OF MOLYCORP'S VERTICALLY INTEGRATED SUPPLY CHAIN

Reportable Segments

Our business is organized into four reportable segments: (1) Resources; (2) Chemicals and Oxides; (3) Magnetic Materials and Alloys; and (4) Rare Metals. See Note 4 in Item 8 of this Annual Report on Form 10-K for financial information regarding our reportable segments.

The Resources segment includes our operations at the Mountain Pass facility, as described above.

The Chemicals and Oxides segment includes the following productions: rare earths from our Molycorp Silmet AS, or Molycorp Silmet, facility in Sillamäe, Estonia; separated heavy rare earth oxides and other custom engineered materials from our majority-owned Jiangyin Jia Hua Advanced Material Resources Co., Ltd. facility, or Molycorp Jiangyin, in Jiangyin, Jiangsu Province, China; and rare earths, salts of REEs, zirconium-based engineered materials, and mixed rare earth/zirconium oxides from our majority-owned Zibo Jia Hua Advanced Material Resources Co., Ltd. facility, or Molycorp Zibo, in Zibo, Shandong Province, China. At our Chemicals and Oxides segment, we develop and sell rare-earth based oxides for all the major emission catalysts manufacturers. Several factors are driving an increasing demand for emission catalysts, including the following: the accelerating shift of vehicle production to the BRIC countries (Brazil, India, Russia and China); the continuous development of new emission catalytic solutions; and an overall tightening of environmental regulations around the world. Other applications that utilize rare earths and zirconium-based materials we produce at our Chemicals and Oxides segment include computers, television display panels, optical lenses, mobile phones, electronic chips, and many others.

The Magnetic Materials and Alloys segment includes the production of Neo Powders™ through our wholly-owned manufacturing facilities in Tianjin, China, and Korat, Thailand, under the Molycorp Magnequench brand. This operating segment also includes manufacturing of Neodymium and Samarium magnet alloys and other specialty alloy products and rare earth metals at our Molycorp Metals and Alloys, Inc., or MMA, facility in Tolleson, Arizona. Neo Powders™ are used in the production of high performance, bonded NdFeB permanent magnets, which are found in micro motors, precision motors, sensors, and other applications requiring high levels of magnetic strength, flexibility, small size, reduced weight, and energy efficient performance.

The Rare Metals segment produces, reclaims, refines, and markets high value niche metals and their compounds that include Gallium, Indium, Rhenium, Tantalum, and Niobium. Operations in this segment are distributed in several locations: Quapaw, Oklahoma; Blanding, Utah; Peterborough, Ontario, Canada; Sagard, Germany; Hyeongok Industrial Zone in South Korea; and Sillamäe, Estonia. Applications from products made in this segment include wireless technologies, LED, flat panel display, turbine, solar, catalyst, steel additive, electronics applications, and others. The growing adoption of LED applications, which require the use of Gallium trichloride, is allowing the Rare Metals segment to benefit from the decline in certain rare earth phosphor applications.

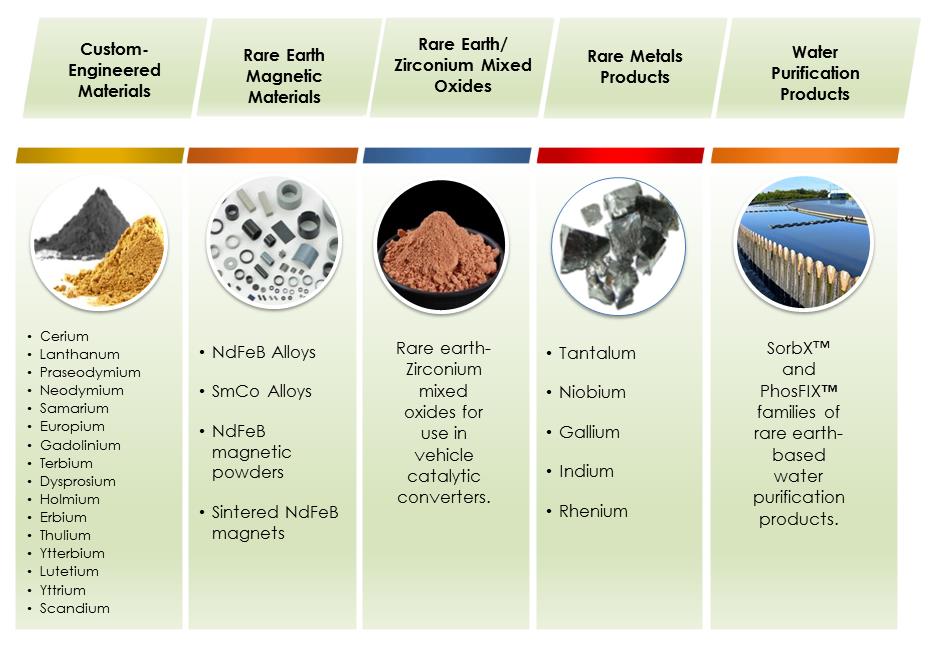

Our Products

Our vertically integrated manufacturing supply chain allows us to provide a variety of rare earth products for customers around the globe. Currently, we produce custom engineered materials from rare earth elements, with purity levels of up to 6N (99.9999%), and from five rare metals at purity levels of up to 8N (99.999999%).

Our Corporate History and Structure

Molycorp Minerals, LLC, a Delaware limited liability company formerly known as Rare Earth Acquisitions LLC, was formed on June 12, 2008 to purchase the Mountain Pass, California rare earths deposit and associated assets from Chevron Mining Inc., a subsidiary of Chevron Corporation. Prior to the acquisition, the Mountain Pass facility was owned by Chevron Mining Inc. and, before 2005, by Unocal Corporation. Molycorp, LLC, which was the parent of Molycorp Minerals, LLC, was formed on September 9, 2009 as a Delaware limited liability company. Molycorp, Inc. was formed on March 4, 2010 as a new Delaware corporation and was not, prior to the date of the consummation of its initial public offering, conducting any material activities.

The members of Molycorp, LLC contributed either (a) all of their member interests in Molycorp, LLC or (b) all of their equity interests in entities that held member interests in Molycorp, LLC (and no other assets or liabilities) to Molycorp, Inc. in

exchange for shares of Molycorp, Inc. Class A common stock. Additionally, all of the holders of profits interests in Molycorp Minerals, LLC, which were represented by incentive shares, contributed all of their incentive shares to Molycorp, Inc. in exchange for shares of Molycorp, Inc. Class B common stock. Accordingly, Molycorp, LLC and Molycorp Minerals, LLC became subsidiaries of Molycorp, Inc., which we refer to as the Corporate Reorganization. Following the Corporate Reorganization, Molycorp, LLC was merged with and into Molycorp Minerals, LLC. Immediately prior to the consummation of Molycorp, Inc.’s initial public offering, all of the shares of Class A common stock and Class B common stock were converted into shares of common stock.

On April 1, 2011, we completed the acquisition of a 90.023% controlling stake in AS Silmet, which is now known as Molycorp Silmet. On October 24, 2011, we acquired the remaining 9.977% ownership interest in Molycorp Silmet. This acquisition provides us with a European base of operations and significantly increases our annual capacity to produce rare earth products by approximately 3,000 mt. Molycorp Silmet began sourcing rare earth feedstocks for the manufacturing of its products from our Mountain Pass facility in 2013. Molycorp Silmet's production includes Neodymium oxide, which is used in the manufacturing of NdFeB permanent rare earth magnets, and rare metals, such as Tantalum and Niobium.

On April 15, 2011, we acquired Santoku America, Inc., which is now known as MMA. This acquisition provides us with access to certain intellectual property related to the development, processing, and manufacturing of Neodymium and Samarium magnet alloy products.

On November 28, 2011, we formed the Intermetallics Japan, or IMJ, joint venture to manufacture and to sell NdFeB permanent rare earth magnets using a technology licensed from Intermetallics, Inc., a partnership between Mitsubishi, Daido and Dr. Masato Sagawa, co-inventor of the NdFeB magnet. Concurrently with the formation of this joint venture, we entered into a supply agreement with Mitsubishi (acting as the procurement agent) and Daido to sell to the joint venture certain rare earth products at the conditions set forth in the supply agreement. In December 2014, we considered an offer from Daido to buy-out Mitsubishi and our proportional share of the investment in IMJ. See more information on the potential disposal of our investment in IMJ in Item 7 and Item 8 of this Annual Report on Form 10-K.

On June 11, 2012, we completed the acquisition of all of the outstanding equity of Neo Material Technologies Inc., formerly referred to as Neo or Neo Materials and now Molycorp Minerals Canada ULC or Molycorp Canada. This acquisition allowed us to become a leading global producer, processor, and developer of Neo Powders™, rare earths and zirconium-based engineered materials and applications, and rare metals and their compounds.

Modernization and Expansion of our Mountain Pass Facility

Our production ramp-up at the Mountain Pass facility has taken longer than expected, which has led to lower than anticipated production volumes, revenues, and cash flows over the last three years, and delayed our realization of the benefits of our vertical integration strategy while our other operations continued to purchase raw materials from third parties rather than accepting delivery of products from our Mountain Pass facility. These production delays were the result of several factors related to the start-up of complex, multi-stage mining and chemical manufacturing facilities, including the following: certain defective engineering work that required additional engineering, procurement, and construction to correct; delays in the delivery of critical parts and equipment; production bottlenecks during start-up and optimization resulting in delays in bringing the leach and multi-stage crack processes up to initial run rate capacity; and issues with our Chlor-Alkali plant combined with constraints in the commercial availability of hydrochloric acid ("HCl"), as further discussed below.

At the end of the third quarter of 2014, we placed into service an expanded leach system at our Mountain Pass facility. The improvements made to the leach system include the installation of additional leach tanks, a technology that has been proven to increase the system's retention capacity. As we ramp up the leach system toward commercial production, we are addressing certain construction and installation issues that have been identified with the system. While operations of the new leach system are expected to be limited in the near term due to these construction and installation issues, together with constraints with on-site production and market availability of HCl, we expect that, once it is fully operational and sufficient supplies of HCl are available, the expanded leach system will help us increase rare earth production and lower operating costs.

On-site production of HCl has been hampered by quality issues with the brine feedstock that our Chlor-Alkali plant transforms into HCl and other chemical reagents necessary for the production of rare earths. However, during the fourth quarter of 2014, engineers at our Mountain Pass facility identified a process change that, in combination with certain new equipment, should reduce the impurity level of the brine feedstock and restore the operational efficiency of our Chlor-Alkali plant. However, it will take several months of optimization before we can fully resume on-site production of HCl. In the meantime, our Chlor-Alkali plant will continue to treat wastewater produced during the separation of rare earths, which is helping to lower the costs that we incur for the removal and disposal of wastewater.

Rare Earths Industry Overview

Pricing for REEs has experienced significant volatility over the past several years due to a number of factors, including: a severe contraction by China of rare earths it allowed for export starting in 2010; China's continuing efforts to institute stronger environmental reforms across its rare earth industry, encourage industry consolidation, reduce illegal mining operations, and constrict rare earth production; a build-up of stockpiles by rare earth consumers and government entities in reaction to China's export restrictions; and a general lack of certainty among rare earth customers regarding the reliability of the future supply of REEs. Downward pressure on REE pricing continued through 2014. In December 2014, the Chinese government announced that it would no longer impose quotas on the export of rare earths from China. However, the Chinese government also announced that government-issued licenses would be required to legally export rare earths from China, and that such exports would be allowed only through specified Chinese declaration ports. On January 21, 2015, the Chinese Ministry of Commerce announced that it intended to abolish current rare earth export duties on or before May 2, 2015.

Except for Lanthanum and Cerium, prices for other REEs remain generally higher than historic (pre-2010) levels, although they have fallen significantly from the peak levels seen in 2011.

Average Free On Board ("FOB") China $/Kg of most common REEs Oxide 99%

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | 2014 |

| 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | Q1 | | Q2 | | Q3 | | Q4 |

Lanthanum | $ | 8 |

| | $ | 6 |

| | $ | 23 |

| | $ | 101 |

| | $ | 21 |

| | $ | 8 |

| | $ | 6 |

| | $ | 6 |

| | $ | 5 |

| | $ | 5 |

|

Cerium | $ | 4 |

| | $ | 4 |

| | $ | 21 |

| | $ | 99 |

| | $ | 21 |

| | $ | 8 |

| | $ | 6 |

| | $ | 6 |

| | $ | 4 |

| | $ | 4 |

|

Praseodymium | $ | 27 |

| | $ | 15 |

| | $ | 46 |

| | $ | 195 |

| | $ | 112 |

| | $ | 91 |

| | $ | 122 |

| | $ | 121 |

| | $ | 118 |

| | $ | 110 |

|

Neodymium | $ | 27 |

| | $ | 15 |

| | $ | 47 |

| | $ | 230 |

| | $ | 117 |

| | $ | 72 |

| | $ | 70 |

| | $ | 69 |

| | $ | 64 |

| | $ | 57 |

|

Terbium | $ | 650 |

| | $ | 350 |

| | $ | 530 |

| | $ | 2,300 |

| | $ | 1,922 |

| | $ | 920 |

| | $ | 978 |

| | $ | 903 |

| | $ | 794 |

| | $ | 757 |

|

Dysprosium | $ | 110 |

| | $ | 100 |

| | $ | 225 |

| | $ | 1,450 |

| | $ | 979 |

| | $ | 555 |

| | $ | 463 |

| | $ | 411 |

| | $ | 320 |

| | $ | 296 |

|

Source: Metal-Pages, Asian Metal. Prices have been rounded.

Regarding global rare earths demand forecasts, IMCOA(1) estimates global demand for rare earths to grow from an estimate of 136,000 mt in 2014 to approximately 168,000 mt in 2017, which represents approximately a 7% compound annual growth rate, or CAGR. IMCOA estimates that global rare earths demand for rare earths will increase further by 2020 to approximately 210,000 mt, representing a CAGR of about 8% over the 2014-2020 period.

On the supply side, China has dominated the global supply of rare earths for the last seventeen years and, according to IMCOA, will continue to do so through at least 2017. IMCOA forecasts that global rare earths supply will increase to 242,500 mt in 2017, with China producing approximately 75% of that total. IMCOA also estimates that approximately 20% of Chinese production in 2017 will be sourced from illegal mining.

(1) IMCOA means the Industrial Minerals Company of Australia Pty Ltd, a rare-earth market consultant. IMCOA states that its data is accurate to within 20% of the stated amounts.

Rare Earths End-Use Markets

REEs have unique properties that make them vital to many existing applications upon which society has become dependent, as well as to many emerging applications. Examples include the following:

•Clean-Energy Technologies: hybrid and electric vehicles, wind power turbines, energy-saving motors and compressors used in a wide variety of high-efficiency appliances and other durable goods, and compact fluorescent lighting;

•High-Technology Applications: computers, laptops, smart phones and other mobile devices, digital music players, hard disk and optical drives used for data storage, “ear bud” speakers and microphones, fiber optics, lasers, optical temperature sensors, and many other applications; and

•Advanced Water Treatment: industrial, municipal, military, homeland security, and other applications in domestic and foreign markets.

As illustrated in the following table, each of our operating segment targets the needs of several value-added, end-use REE markets across multiple industry sectors:

|

| | | |

Operating Segment | Locations | Products | Examples of the end-markets we serve |

Resources | •Mountain Pass, California | •LREC •Separated Rare Earth Oxides •NdPr •Heavy Rare Earth Concentrate •SorbX® •PhosFIX™ | •Oil Refinery Catalysts •Glass Polishing •Automotive and Emission Catalysts •Hybrid and Electric Vehicles •Water Purification •Energy Efficiency Lighting |

Chemicals & Oxides | •Sillamäe, Estonia •Zibo, China •Jiangyin, China | •Rare Earth Oxides •Mixed Oxides •Zirconium-based products | •Automotive and Emission Catalysts •Hybrid and Electric Vehicles •Consumer Electronics •Communication Systems •High-End Optics •Energy Efficiency Lighting |

Magnetic Materials & Alloys | •Korat, Thailand •Tianjin, China •Tolleson, Arizona | •Neo Powders™

•NdFeB Alloys

•SmCo Alloys | •Computing

•Automotive •Hybrid and Electric Vehicles •Aerospace

•Health Care •Industrial Motors •Wind Power Generation •Battery Technologies •Consumer Electronics •Home Appliance |

Rare Metals | •Sillamäe, Estonia •Sagard, Germany •Peterborough, Canada •Blanding, Utah •Quapaw, Oklahoma •Hyongeok, South Korea | •Niobium •Tantalum •Gallium •Indium •Rhenium | •Computing •Electronic Controls •Steel Additives •Industrial Applications •Photovoltaics •Super Alloys |

Customers

We sell a variety of rare earths and rare metal materials, including high-purity and custom-engineered rare earth products, directly to customers and through distributors in multiple countries. The geographic distribution of our revenues based on our customers' locations for the years ended December 31, 2014, 2013 and 2012, was as follows:

|

| | | | | | | | | | | |

| Years Ended December 31, |

(In thousands) | 2014 | | 2013 | | 2012 |

Asia: | | | | | |

China | $ | 162,980 |

| | $ | 199,021 |

| | $ | 118,086 |

|

Japan | 100,468 |

| | 99,952 |

| | 160,942 |

|

Thailand | 19,585 |

| | 17,129 |

| | 7,674 |

|

Hong Kong | — |

| | 8,815 |

| | 4,793 |

|

South Korea | 14,451 |

| | 12,418 |

| | 3,828 |

|

Singapore | 150 |

| | 54 |

| | 212 |

|

North America | 89,769 |

| | 92,066 |

| | 103,555 |

|

Europe | 86,285 |

| | 113,549 |

| | 117,907 |

|

Other | 1,924 |

| | 11,386 |

| | 10,699 |

|

Total | $ | 475,612 |

| | $ | 554,390 |

| | $ | 527,696 |

|

See Note 4 in Item 8 of this Annual Report on Form 10-K for a breakdown of long-lived tangible assets by country as of December 31, 2014 and 2013.

Product and Customers Concentrations

Resources Segment

There were no significant sales by customer or by product at the Resources segment relative to consolidated revenues in any year of the three-year period ended December 31, 2014. We define as significant sales that are 10% or more of consolidated revenues.

Chemicals and Oxides Segment

Sales of cerium products within the Chemicals and Oxides segment accounted for approximately 11%, 9% and 15% of consolidated revenues in 2014, 2013 and 2012, respectively. There were no significant sales by customer in this segment in any of these periods.

Magnetic Materials and Alloys Segment

Sales of Neo Powders™ within the Magnetic Materials and Alloys segment were approximately 44%, 41% and 25% of consolidated revenues in 2014, 2013 and 2012, respectively. Neo Powders™ were introduced into Molycorp's product mix with the Molycorp Canada acquisition in June 2012.

Sales of Neo Powders™ to Daido Electronics, a subsidiary of one of IMJ’s shareholders, totaled $62.3 million, $56.5 million and $32.9 million in 2014, 2013 and for the period from June 12, 2012 to December 31, 2012, respectively. At December 31, 2014 and 2013, we had accounts receivable from Daido Electronics of $6.3 million and $7.5 million, respectively.

Rare Metals Segment

There were no significant sales by product or by customer at the Rare Metals segment relative to consolidated revenues in any year of the three-year period ended December 31, 2014.

Seasonality

Sales of our rare earths, salts of REEs, zirconium-based engineered materials, and mixed rare earth/zirconium oxides products from our Chemicals and Oxides segment are affected by the typical manufacturing slowdown across Asia during the Chinese New Year and Spring Festival holidays. In addition to the impacts of these holidays, first quarter sales in the Magnetic Materials and Alloys segment are typically weaker than the following periods due to the fact that the first quarter of each year coincides with the end of the fiscal year for most Japanese companies in the supply chain predominantly served by that segment. The effort by these Japanese companies to draw down inventory levels near to their year-end closing typically results in lower shipments of products from the Magnetic Materials and Alloys segment. However, third quarter sales for Neo Powders™, the most significant product in the Magnetic Materials and Alloys segment, are typically stronger than the other periods of the year, as the supply chains increase production in order to meet an anticipated increase in demand for the Christmas holiday season later in the year. Sales of our rare earths, LREC and heavy rare earth concentrates from our Resources segment are affected by a combination of the factors described above. Additionally, in certain of our segments, particularly Magnetic Materials and Alloys, prices are set at a one quarter lag, so improvements in our results will lag any market improvements.

Sources and Availability of Raw Materials

Resources Segment

The principal raw materials used by our Resources segment operations include rare earth ore mined on site, natural gas (which our CHP plant converts into efficient and reliable supplies of electricity and steam), HCl, sodium hydroxide (also known as caustic soda), and water. As indicated above, due to constraints with our on-site production and with commercial market availability of HCl, operations of the new leach system at our Mountain Pass facility are expected to be limited in the near term. A significant increase in the price, or further decrease in the commercial availability, of HCl, could materially increase our operating costs and adversely affect some of our profit margins from quarter to quarter in our Resources segment. We may not be able to pass on higher prices that we pay for commercial HCl to our customers in the form of sales price increases.

Chemicals and Oxides Segment

Main feedstock materials in this segment include LREC, SEG and enriched Eu clay. The following table illustrates some key statistics on the procurement of feedstock materials at our Chemicals and Oxides segment over the last two years:

|

| | | | | | |

| | 2014 | | 2013 |

LREC | | | | |

| Volume (mt) | 9,655 |

| | 7,611 |

|

| Average grade (%) | 40 | % | | 42 | % |

| Supplied by third party (%) | 43 | % | | 56 | % |

| | | | |

SEG | | | | |

| Volume (mt) | 592 |

| | 656 |

|

| Average grade (%) | 20 | % | | 21 | % |

| Supplied by third party (%) | — | % | | — | % |

| | | | |

Europium clay | | | | |

| Volume (mt) | 1,060 |

| | 446 |

|

| Average grade (%) | 92 | % | | 92 | % |

| Supplied by third party (%) | 100 | % | | 100 | % |

| | | | |

Starting in 2013, we have gradually increased shipments of LREC from our Mountain Pass facility to our Chemicals and Oxides segment. However, third-party suppliers of LREC, SEG and Eu clay, both in China and in Europe, continued to deliver feedstock materials to our Chemicals and Oxides operations. Even though we believe there are adequate internal and external sources of rare earth feedstock for our Chemicals and Oxides operations, we currently do not have long-term supply contracts with our main third-party suppliers. Prices for LREC generally follow the price trend of the light REEs, which have significantly declined over the last three years. Refer to the table above in the "Rare Earths Industry Overview" section for the average FOB China prices per kilogram of the most common REEs. The volatility in China FOB prices trails the volatility in China domestic prices, which are the prices our third-party feedstock material purchases are denominated in. In addition to the main feedstock materials described above, our operations at the Chemicals and Oxides segment utilize electricity, mineral acid, nitric acid, sulphuric acid, tributylphosphate, and water. We purchase these commodities in the open market through multiple suppliers and, as a result, could be subject to significant volatility in the cost or availability of these materials, which we may not be able to pass to our customers in the form of price increases for our products. A significant increase in the price, or decrease in the availability, of electricity and chemical reagents in this segment could materially increase our operating costs and adversely affect our profit margins from quarter to quarter.

Magnetic Materials and Alloys Segment

Main feedstock materials in this segment include: LREE in both 99% oxide and 99% metal form, such as La, Ce, Nd, Pr, mixed Nd/Pr and Sm; HREE, such as Dy metal 99%; mixed Dy-Iron metal; and non-REE materials, such as Iron, Iron-Boron, Iron-Niobium, Aluminum, and Cobalt. The following table illustrates some key statistics on the procurement of feedstock materials at our Magnetic Materials and Alloys segment over the last two years:

|

| | | | | | |

| | 2014 | | 2013 |

LREE oxides | | | | |

| Volume (mt) | 366 |

| | 343 |

|

| Average grade (%) | 99 | % | | 99 | % |

| Supplied by third party (%) | — | % | | — | % |

LREE metals | | | | |

| Volume (mt) | 1,319 |

| | 1,316 |

|

| Average grade (%) | 99 | % | | 99 | % |

| Supplied by third party (%) | 99 | % | | 98 | % |

HREE metals | | | | |

| Volume (mt) | 11 |

| | 17 |

|

| Average grade (%) | 99 | % | | 99 | % |

| Supplied by third party (%) | 100 | % | | 100 | % |

Non-REE feedstock material | | | | |

| Volume (mt) | 4,345 |

| | 4,182 |

|

| Average grade (%) | 99 | % | | 99 | % |

| Supplied by third party (%) | 100 | % | | 100 | % |

| | | | |

We purchase the majority of the LREE and HREE metal feedstock from two suppliers in China that have consistently delivered their material on time over a number of years. The Magnetic Materials and Alloys segment procures part of the LREE oxide feedstock from our Molycorp Jiangyin and Molycorp Zibo facilities in China, and in part from our Mountain Pass facility. The oxide feedstock is generally converted into the corresponding metal form through arrangements with some of our business partners. Our suppliers of non-REE feedstock materials have consistently fulfilled our purchase orders over the past several years.

China domestic prices and FOB China prices for LREE and HREE have declined substantially since their peak in 2011. Refer to the table above in the "Rare Earths Industry Overview" section for the average FOB China prices per kilogram of most common REEs. China domestic prices for REE trail the trend in FOB China prices. As for non-REE feedstock materials, prices have been less volatile than REE prices over the last two years.

Historically, our Magnetic Materials and Alloys segment has been able to adjust the price of the products it sells to reflect changes in the cost of feedstock materials it purchases. However, the segment could still be subject to future volatility in the cost or availability of these raw materials, and it may not be able to pass increased prices for its feedstock procurements through to its customers in the form of higher end-product prices. A significant increase in the price, or decrease in the availability, of these feedstock materials could materially increase our operating costs and adversely affect our profit margins from quarter to quarter.

Rare Metals Segment

Main feedstock materials in this segment include: Iron-Niobium-Tantalite, Tantalite, Columbite, Niobium-Hydroxide, Gallium scrap feedstock and Gallium metal 99.99%, or GaM. The following table illustrates some key statistics on the procurement of feedstock materials at our Rare Metals segment over the last two years:

|

| | | | | | |

| | 2014 | | 2013 |

| | (mt) |

Tantalum and Niobium production | | |

| FeNbTa | 215 |

| | 186 |

|

| Tantalite | — |

| | 4 |

|

| Columbite | 11 |

| | 57 |

|

| Niobium Hydroxide | 8 |

| | 9 |

|

| | | | |

Gallium production | | | | |

| Scrap feedstock | 13 |

| | 13 |

|

| GaM | 57 |

| | 46 |

|

In our Rare Metals segment we purchase feedstock materials primarily from various third-party suppliers, which have consistently fulfilled our purchase orders. Since June 2012, we have purchased GaM mostly from our Ingal Stade joint venture, an investment we had acquired as part of the Molycorp Canada acquisition. However, as of December 2014 we have decided to cease purchasing GaM from Ingal Stade as the joint venture can no longer provide this rare metal at a competitive price. See Note 10 in Item 8 of this Annual Report on Form 10-K for more information on the impairment of our investment in Ingal Stade. Although prices for gallium scrap feedstock have been relatively more stable than prices of GaM, prices for GaM have declined, on average, by approximately 15% over the last two years. Prices for the feedstock materials used in our Tantalum and Niobium production have been historically more volatile with average price increases during the last two years of 36% for Tantalum feedstock, and 62% for Niobium feedstock. In January 2014, our Molycorp Silmet facility received a certification by the Electronic Industry Citizenship Coalition, or EICC, that its purchases of tantalum comply with the Conflict Free Smelter, or CFS, program assessment protocol through July 2014. The EICC CFS certification was renewed through July 2015. The audit cycle to renew this certification occurs during the second quarter of each year.

Competition

Our ability to compete successfully across all of our reportable segments depends upon a number of factors including the following: market presence; low production costs; supply reliability; maintenance and improvement of quality; properties and purity of products; access to capital; and the pricing policies of our competitors.

Once we reach higher run rates for the rare earths we produce at our Resource segment, and increase other downstream productions through our Chemicals and Oxides and our Magnetic Materials and Alloys segments, the increased supply of rare earth products may lead our competitors, primarily various Chinese producers, to engage in predatory pricing behavior. Any increase in the amount of rare earth products exported from other nations and increased competition, whether legal or illegal, may result in price reductions, reduced margins and loss of potential market share, any of which could materially adversely affect our profitability. As a result of these factors, we may not be able to compete effectively against current and future competitors.

Patents, Trademarks and Licenses

We rely on a combination of trade secret protection, nondisclosure and licensing agreements, patents, and trademarks to establish and protect our proprietary intellectual property rights. We utilize trade secret protection and nondisclosure agreements to protect our proprietary rare earths technology. We also have a proven technology and product development group and hold a number of U.S. and foreign patents and patent applications.

We intend to rely on patented products and applications, such as the use of rare earths in water treatment, and related licensing agreements to establish proprietary markets for low demand REEs. These patents, patent applications and licensing agreements may not translate into market acceptance of these products. These intellectual property rights also may be challenged or infringed upon by third parties or we may be unable to maintain, renew or enter into new license agreements with third-party owners of intellectual property on reasonable terms. In addition, our intellectual property may be subject to infringement or other unauthorized use outside of the United States. In such case, our ability to protect our intellectual property

rights by legal recourse or otherwise may be limited, particularly in countries where laws or enforcement practices are undeveloped or do not recognize or protect intellectual property rights to the same extent as the United States. Unauthorized use of our intellectual property rights or inability to preserve existing intellectual property rights could adversely impact our competitive position and results of operations. The loss of our patents could reduce the value of the related products.

Research and Development

We invest significant resources to improve the efficiency of our rare earths processing operations, develop new applications for individual REEs, research value-added rare earth and rare metal applications, and perform exploratory drilling. We spent $15.3 million, $23.2 million and $27.8 million on research and development for the years ended December 31, 2014, 2013 and 2012, respectively. Our spending in research and development is largely correlated to the revenues we generate in two of our foreign facilities within the Chemicals and Oxides and Magnetic Materials and Alloys segments. Despite the decline in revenues over the last few years, we continue to dedicate resources to research and develop new applications for our products, and to provide technical solutions to our customers that allow a more efficient and profitable use of our products.

Employees

As of December 31, 2014:

| |

• | we have a combined workforce of approximately 2,500 employees, including scientists, engineers, chemists, technologists and highly skilled workers in 22 locations across 10 countries; |

| |

• | 282 employees, or approximately 59% of the workforce at our Mountain Pass facility, were represented by the United Steelworkers of America. Our contract with the United Steelworkers of America expires in March 2015, but ratification is pending for its renewal until March 2018; and |

| |

• | 155 employees, or approximately 28% of the workforce at our Molycorp Silmet facility, were unionized employees. Our contract with the labor union in Estonia is automatically renewed each year unless either party desires to make an amendment. |

We have not experienced any work stoppages at our Mountain Pass or Molycorp Silmet facilities due to labor disputes, and we consider our overall employee relations to be good.

Environmental, Health and Safety Matters

Our operations are subject to numerous and detailed international, national, federal, state and local laws, regulations and permits affecting the mining and mineral processing industry, including those pertaining to employee health and safety, environmental permitting and licensing, air quality standards, greenhouse gas, or GHG, emissions, water usage and disposal, pollution, waste management, plant and wildlife protection, handling and disposal of radioactive substances, remediation of soil and groundwater contamination, land use, reclamation and restoration of properties, the discharge of materials into the environment and groundwater quality and availability. Most of our efforts to comply with environmental laws, regulations and permits relate to the mining and processing operations at our Mountain Pass facility. Our operations at Molycorp Silmet are subject to the environmental laws, regulations and permits applicable in Estonia, whose requirements are shaped by Estonia's membership in the European Union. We are also subject to Chinese, Canadian, Korean and Thai national and local environmental protection regulations with respect to our operations in those countries.

These international, national, federal, state and local laws, regulations and permits have had, and will continue to have, a significant effect on our results of operations and competitive position and have become increasingly stringent over time. Future laws, regulations or permits, as well as the interpretation or enforcement of existing requirements, may require substantial increases in capital or operating costs or otherwise delay, limit or prohibit our current or future operations.

We retain, both within Molycorp and outside Molycorp, the services of reclamation and environmental, health and safety, or EHS, professionals to review our operations and assist with environmental compliance, including with respect to product management, solid and hazardous waste management and disposal, water and air quality, asbestos abatement, drinking water quality, reclamation requirements, radiation control and other EHS issues. Despite our emphasis on compliance, through training and established policies, there is no assurance that we have been or will be at all times in compliance with such requirements.

Environmental Expenditures

We have spent, and anticipate that we will continue to spend, financial and managerial resources to comply with environmental requirements. At our Mountain Pass facility, we incurred approximately $19.1 million, $25.9 million and $26.8

million in 2014, 2013 and 2012, respectively, and expect to incur approximately $11.8 million in 2015, for ongoing operating environmental expenditures, including salaries, monitoring, compliance, reporting and permits. Included in the amounts above are approximately $10.7 million, $21.0 million and $22.1 million, respectively, for the removal and disposal of wastewater generated in excess of the existing evaporation capability of all ponds. The expenditures for removal and disposal of excess wastewater were incurred to allow the facilities under construction at Mountain Pass to become fully operational. We estimate that we will incur approximately $4.2 million for wastewater transportation and disposal costs in 2015.

The costs we anticipate to incur as part of our on-going mine reclamation activities at the Mountain Pass facility, which we expect to continue throughout closure and post-closure periods of our mining operations, are included in asset retirement obligation disclosure at Note 13 in Item 8 of this Annual Report on Form 10-K.

We incurred environmental expenditures at our other operating facilities totaling approximately $6.9 million in 2014, and expect to incur approximately $8.9 million in 2015, in the aggregate. However, we may have to incur additional environmental capital and operating costs associated with future possible modernization and expansion plans related to these other operations.

Permits and Approvals

Numerous governmental permits and approvals are required for our current and future operations.

We hold conditional use and minor use permits from the County of San Bernardino, which currently allow continued operations of our Mountain Pass facility through 2042. We have secured all permits necessary to allow construction and operations at our Mountain Pass facility, including permits to operate specific facilities or operating units from the Lahontan Regional Water Quality Control Board and the Mojave Desert Air Quality Management District.

To obtain, maintain and renew these and other environmental permits, we may be required to conduct environmental studies and collect and present to governmental authorities data pertaining to the potential impact that our current or future operations may have upon the environment. We may be unable to obtain additional permits unless we are able to avoid or mitigate those impacts. The permitting processes and development of supporting materials, including any environmental impact statements, may be costly and time-consuming. Any failure to obtain, maintain or renew required permits may delay, limit or prohibit current or future operations. These permit processes and requirements, and the interpretation and enforcement thereof, change frequently, and any such future changes could materially adversely affect our mining operations and results of operations.

Our Molycorp Silmet facility has an Integrated Environmental Permit, which controls its operations in general, and Radiation Practice Licenses for the management of radioactive materials. The Integrated Environmental Permit is renewed annually or in between annual renewals when and if we expand our operations in that facility. The Radiation Practice Licenses for the facility have been renewed with an effective date of January 1, 2019.

Our MMA facility does not currently require an air permit or a wastewater discharge permit. Should we expand operations at that facility, any industrial processes that are added that require permitting will be reviewed and authorized by Maricopa County, Arizona, where the MMA facility is located.

Our Molycorp Jiangyin and Molycorp Zibo facilities produce waste water from their solvent extraction processes. Both facilities were inspected in 2014 as part of an environmental audit and have received the Chinese Ministry of Environmental Protection's approval for compliance with applicable environmental laws. However, there is no assurance that Chinese national or local authorities will not impose additional regulations which would require additional expenditures that may have a material adverse effect on the profitability of the joint ventures.

Mine Health and Safety Laws

The Federal Mine Safety and Health Act of 1977, as amended by the Mine Improvement and New Emergency Response Act of 2006, and the regulations adopted by the California Occupational Safety and Health Administration, impose stringent health and safety standards on numerous aspects of mining operations, including training of mine personnel, mining procedures, blasting, the equipment used in mining operations and other matters at our Mountain Pass facility.

We maintain a rigorous safety program. Our Mountain Pass employees and contractors are required to complete 24 hours of initial health and safety training, as well as annual refresher sessions, which cover all of the potential hazards that may be present at the facility. During the training, our commitment to a safe work environment is reinforced through our Stop Work Authority program, which allows any employee or contractor at the facility to stop work that they deem to be unsafe.

The safety performance record of our Mountain Pass facility is reflected in the following table, which compares rates for all lost time, restricted work and medical treatment incidents per 200,000 hours worked with average rates for mining operations, as determined by the Mine Safety and Health Administration, or MSHA:

|

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | |

| 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014(a) |

Mountain Pass | 0.86 |

| | 1.33 |

| | 1.66 |

| | 0.00 |

| | 1.76 |

| | 1.46 |

|

MSHA Rates for Operators | 2.95 |

| | 2.83 |

| | 2.73 |

| | 2.68 |

|

| 2.56 |

| | 2.38 |

|

(a) For the period January 1 - November 30, 2014. | | | | | | | | | | | |

We believe that our commitment to a safe working environment at our Mountain Pass facility provides us with a competitive advantage in attracting and retaining employees.

Our focus on safety extends to all of our operations. From January through November 2014, our Total Reportable Incident Rate for our operating facilities was 1.46. This compares favorably to industry averages, such as the 2014 MSHA all incident rate for Mines, Mills and Shops of 2.6, and the 2013 Occupational Safety and Health Administration Total Recordable incident rate for Natural Resources and Mining of 3.7.

Surface Mining Control and Reclamation Relating to our Mountain Pass Facility

Our San Bernardino County conditional use and minor use permits, along with the approved mine reclamation plan and state laws and regulations establish operational, reclamation and closure standards for all aspects of our surface mining operations at our Mountain Pass facility. Comprehensive environmental protection and reclamation standards must be met during the course of and upon completion of mining activities, and our failure to meet such standards may subject us to fines, penalties or other sanctions.

Our Mountain Pass facility reclamation obligations require that we take certain reclamation actions concurrent with mining and that we restore the surface area upon completion of mining in 2042. Financial assurances are generally required to secure the performance of these reclamation obligations. To satisfy these financial assurance requirements, we typically obtain surety bonds, which are renewable on a yearly basis. Although we expect to continue to obtain and renew such bonds, it has become increasingly difficult for mining companies to secure new or renew existing surety bonds without the posting of partial or full collateral. In addition, surety bond costs have increased while the market terms of surety bonds have generally become less favorable. It is possible that surety bond issuers may refuse to provide or renew bonds or may demand additional collateral upon those issuances or renewals. Our inability to obtain or failure to maintain or renew these bonds could have a material adverse effect on our business and results of operations.

As of December 31, 2014, we had financial assurance requirements of $28.8 million related to our Mountain Pass facility that were satisfied with surety bonds, which we have placed with California state and regional agencies.

In the second quarter of each year, we are required to provide the State of California with an updated estimate of the costs associated specifically with the mine reclamation. This estimate is reviewed and approved by the State of California, after which we are responsible for making any necessary changes to surety bonds placed with the State of California.

The U.S. Environmental Protection Agency, or EPA, has announced its intention to establish a new financial assurance program for hardrock mining, extraction and processing facilities under the Federal Comprehensive Environmental Response Compensation and Liability Act or the “Superfund” law, which may require us to establish additional bonds or other sureties. We cannot predict the effect of any such requirements on our operations at this time.

Asset retirement obligations for accounting purposes can be, and often are, greater than the amount of surety bonds placed with local authorities.

Water Usage and Pollution Control

The federal Clean Water Act and similar national, state and local laws and regulations affect surface mining and processing operations, including operations at our Mountain Pass facility, by imposing restrictions on the discharge of pollutants, including tailings and other material, into waters. These requirements are complex and subject to amendments, legal challenges and changes in implementation. Recent court decisions, regulatory actions and proposed legislation have created uncertainty over the jurisdiction and permitting requirements of the federal Clean Water Act. Individual or general permits under Section 404 of the Clean Water Act are required if we discharge dredged or fill materials into jurisdictional waters of the United States. In addition, our Lahontan Regional Water Quality Control Board permit for our Mountain Pass facility establishes treatment

standards for wastewater discharges to engineered impoundments, and requires regular monitoring and reporting on the performance of the Mountain Pass wastewater management operations.

All of the melting and pouring operations used in the production of metals and alloys at MMA utilize vacuum induction melting, or VIM, furnaces. VIM furnace operations do not generate any significant quantities of wastewater and, therefore, there is no industrial wastewater discharge permit required for the facility.

The discharge of wastewater by Molycorp Silmet operations are governed by its Integrated Environmental Permit.

We are also subject both to Chinese national and local environmental protection regulations, which currently impose a graduated schedule of fees for the discharge of waste substances, require the payment of fines for discharges exceeding the standards, and provide for the closure of any facility that fails to comply with orders requiring it to cease or remedy certain activities causing environmental damage. Our Chinese joint ventures, Molycorp Jiangyin and Molycorp Zibo, produce waste water from their rare earths recovery operations. In the case of Molycorp Jiangyin, its expansion in 1995 included an upgrading of its waste water processing and treatment procedures, as a result of which its waste water passes all environmental requirements. Molycorp Jiangyin pays an agreed fee once a year for the discharge of waste waters. In the case of Molycorp Zibo, the plant was designed to make use of waste water discharge facilities of an adjacent petrochemical complex, which has a variable monthly charge based on usage. Molycorp Zibo is also obliged to pay a monthly environmental administration fee to the municipal government of Linzi. Waste water has met the requirements set by local authorities for all environmental standards. Both Molycorp Jiangyin and Molycorp Zibo were inspected in 2014 as part of an environmental audit and have received the Chinese Ministry of Environmental Protection's approval for compliance with applicable environmental laws. However, there is no assurance that Chinese national or local authorities will not impose additional regulations which would require additional expenditures that may have a material adverse effect on the profitability of the joint ventures.

Air Pollution Control

The federal Clean Air Act and similar national, state and local laws and regulations affect our surface mining and processing operations at our Mountain Pass facility as well as our other domestic U.S. facilities, both directly and indirectly. We currently operate and maintain numerous air pollution control devices at our Mountain Pass facility under permits from the California Mojave Desert Air Quality Management District, or MDAQMD. We generally must obtain permits before we install new sources of air pollution. The process may require us to perform air quality studies and to obtain emission offset credits, which can be costly and time consuming to procure. In addition, the increased emissions from the CHP plant and other combustion sources at our Mountain Pass facility triggered permit requirements under Title V of the Clean Air Act. As a result, in February 2013, we submitted the Title V Federal Operating Permit application to the MDAQMD. In June 2014, the U.S. Supreme Court ruled that the EPA could not treat GHG as an air pollutant for the purposes of determining whether a source is required to obtain Title V permit. Because of this ruling, our Mountain Pass facility is no longer required to obtain Title V permit. The regulations of the California Air Resources Board still require us to retrofit or replace off-road, on-road and forklift vehicles to achieve fleet emission standards for nitrogen oxides and particulate matter.

Our GHG emissions at Mountain Pass are subject to California's cap-and-trade regulations. Additional GHG emission related requirements are in various stages of development. For example, the U.S. Congress is considering various legislative proposals to address climate change. In addition, EPA has issued regulations, including the "Tailoring Rule," that subject GHG emissions from stationary sources to the Prevention of Significant Deterioration provisions of the federal Clean Air Act. California is also implementing regulations pursuant to its Global Warming Solutions Act that establish a state-wide cap-and-trade program for GHG emissions. Any such regulations could require us to modify existing permits or obtain new permits, purchase emissions credits, implement additional pollution control technology, curtail operations or increase significantly our operating costs, any of which could adversely affect our business, financial condition, reputation, operating performance and product demand. However, such regulations might also present opportunities for our industry to the extent that they increase the demand for rare earth products used in clean-technology applications, such as hybrid and electric vehicles and wind power turbines. Our Mountain Pass operations consume significant amounts of energy and, accordingly, are subject to fluctuations in energy costs. These costs may increase significantly in part as an indirect result of GHG and other air emission regulations applicable to third-party power suppliers.

The Integrated Environmental Permit issued to Molycorp Silmet regulates the discharge of air pollution in accordance with the requirements of Estonian laws and regulations. Our operations in China, Canada and Thailand are subject to the air pollution control provisions of those countries.

Hazardous and Radioactive Substances and Wastes

We generate and manage solid and hazardous waste at our operations.

In reference to operations at our Mountain Pass facility, the federal Comprehensive Environmental Response Compensation and Liability Act, known as CERCLA, and analogous federal and state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to have contributed to the actual or threatened release of a "hazardous substance" into the environment. Persons who are or were responsible for such releases of hazardous substances under CERCLA, which can include waste generators, site owners, lessees and others, may be subject to joint and several liability for the costs of remediating such hazardous substances and for damages to natural resources. Accordingly, we may be subject to liability under CERCLA and similar federal and state laws for properties that we currently own, lease or operate or that we or our predecessors have previously owned, leased or operated, and sites to which we or our predecessors sent waste materials. Pursuant to a 1998 clean up and abatement order issued by the Lahontan Regional Water Quality Control Board, we have conducted and are continuing to conduct various investigatory, monitoring and remedial activities related to contamination at and around our Mountain Pass facility. These activities include groundwater investigations, soil remediation and the operation of groundwater monitoring and recovery wells, installation of water treatment systems and evaporation ponds. Also, prior to our acquisition of the Mountain Pass facility, leaks in a wastewater pipeline from the facility to offsite evaporation ponds on the Ivanpah dry lake bed caused contamination. However, that contamination is being remediated by Chevron Mining Inc., who retained ownership of the ponds following its sale of the Mountain Pass facility to us and has completed remediation of the pipeline. Chevron Corporation and its subsidiaries continue to work with the relevant state and federal agencies to complete the remediation work associated with the offsite evaporation ponds.

Although Chevron Mining Inc. is obligated to indemnify us for certain potential environmental losses associated with activities that occurred prior to our purchase of the Mountain Pass facility, the amount of such indemnity is limited and may not be sufficient to cover such losses.

In 2009, the EPA announced that it is developing financial responsibility requirements under CERCLA for certain facilities within the hardrock mining industry. If applicable to our current or future operations at our Mountain Pass facility, these requirements could impose on us significant additional costs or obligations.

Ores that contain REEs also contain naturally occurring radioactive material substances, such as thorium and uranium. The mining of REE-containing ore and the processing of REEs involves the handling and disposal of such materials. Accordingly, we are subject to extensive safety, health and environmental laws, regulations and permits regarding radioactive materials. Significant costs, obligations or liabilities may be incurred with respect to such requirements, and any future changes in such requirements (or the interpretation or enforcement thereof) may have a material adverse effect on our business or results of operations. One such permit pursuant to which our Mountain Pass facility currently operates is a Radioactive Materials License issued and administered by the California Department of Public Health Radiologic Health Branch. The license is a broad scope license, which provides for the safe management of radioactive materials at our Mountain Pass facility under the direction of the Radiation Safety Officer with oversight from a Radiation Safety Committee. A failure to maintain or renew this license could materially adversely affect our business or results of operations. The current license expires in 2020.

Demolition of structures in connection with the expansion and modernization of a manufacturing facility generates waste in addition to that associated with processing and ongoing remediation activities. The modernization and expansion of our Mountain Pass facility, and possible future modernization and expansion of other facilities we own around the world, will result in additional costs to handle, store and dispose of such wastes.