UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 |

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2015

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No.: 001-34839

Electromed, Inc.

(Exact name of Registrant as specified in its charter)

|

Minnesota (State or other jurisdiction of incorporation or organization) |

41-1732920 (IRS Employer Identification No.) |

500 Sixth Avenue NW, New Prague, MN 56071

(Address of principal executive offices)

(952) 758-9299

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock $0.01 par value | NYSE MKT | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ (Do not check if smaller reporting company) | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the Registrant as of December 31, 2014 was approximately $16,081,000 based upon the closing price of the Registrant’s common stock on such date.

There were 8,163,857 shares of the registrant’s common stock outstanding as of September 10, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for the registrant’s Fiscal 2016 Annual Meeting of Shareholders, to be filed within 120 days of June 30, 2015, are incorporated by reference into Part III of this Form 10-K.

Index to Annual Report on Form 10-K

| i |

INFORMATION REGARDING FORWARD LOOKING STATEMENTS

Statements contained in this Annual Report on Form 10-K that are not statements of historical fact should be considered forward-looking statements within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include, but are not limited to, statements regarding the following: our business strategy, including our intended level of investment in research and development and marketing activities; our expectations with respect to earnings, gross margins and sales growth, industry relationships, marketing strategies and international sales; our business strengths and competitive advantages; our plans and expectations with respect to international sales growth; our intent to retain any earnings for use in operations rather than paying dividends; our expectation that our products will continue to qualify for reimbursement and payment under government and private insurance programs; our intellectual property plans and practices; the expected impact of applicable regulations on our business; our beliefs about our manufacturing processes; our expectations and beliefs with respect to our employees and our relationships with them; our belief that our current facilities are adequate to support our growth plans; our expectations with respect to ongoing compliance with the terms of our credit facility; our expectations regarding the ongoing availability of credit and our ability to renew our line of credit; and our anticipated revenues, expenses, capital requirements and liquidity. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “ongoing,” “plan,” “potential,” “project,” “should,” “target,” “will,” “would,” and similar expressions, including the negative of these terms, are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Although we believe these forward-looking statements are reasonable, they involve risks and uncertainties that may cause actual results to differ materially from those projected by such statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results or our industry’s actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements.

Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| • | the competitive nature of our market; |

| • | the risks associated with expansion into international markets; |

| • | changes to Medicare, Medicaid, or private insurance reimbursement policies; |

| • | changes to health care laws; |

| • | changes affecting the medical device industry; |

| • | our need to maintain regulatory compliance and to gain future regulatory approvals and clearances; |

| • | our ability to protect and expand our intellectual property portfolio; |

| • | our ability to renew our line of credit or obtain additional credit as necessary; and |

| • | general economic and business conditions. |

This list of factors is not exhaustive, however, and these or other factors, many of which are outside of our control, could have a material adverse effect on us and our results of operations. Therefore, you should consider these risk factors with caution and form your own critical and independent conclusions about the likely effect of these risk factors on our future performance. Forward-looking statements speak only as of the date on which the statements are made, and we undertake no obligation to update any forward-looking statement for any reason, even if new information becomes available or other events occur in the future. You should carefully review the disclosures and the risk factors described in this and other documents we file from time to time with the Securities and Exchange Commission (the “SEC”), including our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth herein.

| ii |

Overview

Electromed, Inc. (“we,” “us,” “Electromed” or the “Company”) develops, manufactures, markets and sells innovative products that provide airway clearance therapy, including the SmartVest® Airway Clearance System (“SmartVest System”) and related products, to patients with compromised pulmonary function with a commitment to excellence and compassionate service. Our goal is to make High Frequency Chest Wall Oscillation (“HFCWO”) treatments as effective, convenient, and comfortable as possible, so our patients will adhere to their prescribed treatment schedule. Electromed was incorporated in Minnesota in 1992. Our common stock is listed on the NYSE MKT under the ticker symbol “ELMD.”

The SmartVest System features a programmable air pulse generator, a therapy garment worn over the upper body and a connecting hose, which together provide safe, comfortable, and effective airway clearance therapy. The SmartVest System generates HFCWO, also known as High Frequency Chest Compression, a technique for airway clearance therapy. The garment repeatedly compresses and releases the upper body at frequencies from 5 to 20 cycles per second creating a “mini cough”. Each compression (or oscillation) produces pulsations within the lungs that loosens secretions from the surfaces of the lung airways, thins mucus stuck in the lungs and propels them toward the mouth where they can be removed by normal coughing or suction.

HFCWO facilitates airway clearance by loosening and mobilizing respiratory secretions in a patient’s lungs. One factor of respiratory health is the ability to clear secretions from airways. Impaired airway clearance, when mucus cannot be expectorated, may result in labored breathing and/or inflammatory and immune systems boosting mucus production that invites bacteria trapped in stagnant secretions to cause infections. Studies show that HFCWO therapy is as effective an airway clearance method for patients who have cystic fibrosis or other forms of compromised pulmonary function as traditional chest physical therapy (“CPT”) administered by a respiratory therapist. However, HFCWO can be self-administered, relieving a caregiver of participation in the therapy, and eliminating the attendant cost of an in-home care provider. We believe that HFCWO treatments are cost-effective primarily because they reduce a patient’s risk of respiratory infections and other secondary complications, such as pneumonia, that are associated with impaired mucus transport and may be serious or life-threatening and often result in costly hospital visits.

The SmartVest System is designed for patient comfort and ease of use which promotes compliance with prescribed treatment schedules, leading to improved airway clearance and enhanced respiratory function. We offer a broad range of garments, referred to as vests and wraps, in sizes for children and adults that allow for tailored fit and function. User-friendly controls allow children and the elderly to administer their own daily therapy with minimal or no assistance. Our direct product support services provide patient and clinician education, training, and follow-up to ensure the product is integrated into each patient’s daily treatment regimen. Additionally, our reimbursement and billing departments assure we are working on behalf of the patient by processing their physician paperwork, providing clinical support as needed and billing Medicare or the applicable insurance provider on their behalf. We believe that the advantages of the SmartVest System and the Company’s customer services to the patient include:

| • | improved quality of life; |

| 1 |

| • | independence from a dedicated caregiver; | |

| • | consistent treatments at home; | |

| • | improved comfort during therapy; | |

| • | portability; and | |

| • | eligibility for reimbursement by private insurance, federal or state government programs or combinations of the foregoing. |

Our Products

Our products are primarily sold into the home health care market for patients with chronic lung issues, including bronchiectasis, cystic fibrosis and neuromuscular disease. We also sell our products in acute care settings (e.g., hospitals and clinics) when the patient is in a post-surgical or intensive care unit, or was admitted for a lung infection brought on by compromised airway clearance. Accordingly, our sales points of contact include adult pulmonology clinics, cystic fibrosis centers, neuromuscular clinics, pulmonary rehabilitation centers, hospitals and home health care centers.

We have received clearance to market the SmartVest System from the U.S. Food and Drug Administration (“FDA”) to promote airway clearance and improve bronchial drainage. In addition, Electromed is certified to apply the CE Mark for HFCWO device sales in all European Union countries and approved for HFCWO device sales in other, select international countries. The SmartVest System is available only with a physician’s prescription.

The SmartVest System

The SmartVest System consists of an inflatable therapy garment, a programmable air pulse generator and a patented single-hose that delivers air pulses from the generator to the garment. The SmartVest System is currently available in two models – SV2100 and SQL – both of which are sold into home care and institutional markets for use by patients and hospitals. The SmartVest SV2100 and SmartVest SQL deliver the same clinically effective HFCWO therapy. Additionally, both systems are designed for maximum comfort and lifestyle convenience, so patients can readily fit HFCWO therapy into their daily routines:

| • | Patented single-hose design: When the SmartVest System is in use, a single-hose delivers oscillations to the SmartVest garment, which we believe provides therapy in a more comfortable and unobtrusive manner than a two-hose system. Oscillations are delivered evenly from the base of the SmartVest garment, extending the forces upward and inward in strong but smooth cycles surrounding the chest. |

| • | Open system design with active inflate – active deflate: The active inflate – active deflate mechanism of the SmartVest System provides patients a more comfortable treatment experience by working in unison with patients to allow them to take deep breaths and breathe more easily without feeling restricted. |

| • | Soft-fabric garment is lightweight and comfortable: The SmartVest garment is lightweight and designed to resemble an article of clothing. Quick fit Velcro®-like closures allow for a secure, comfortable fit without bulky straps and buckles. The simple design creates a broad size adjustment range to insure a properly tailored fit. The SmartVest garment is available in a variety of colors and sizes to accommodate pediatric and adult patients. |

| 2 |

| • | Programmable generator with user friendly device operation: The SmartVest System generator uses an internal programmable memory feature to manage air pulse frequency, air pulse pressure and treatment time to be set as prescribed by the patient’s physician. The air pulse frequency can be adjusted from 5 to 20 cycles per second and the air pulse pressure can be adjusted from 0 to 100% of a maximal pressure range. |

| • | Patented Soft Start® and 360° garment oscillation coverage: Soft Start creates an upward flow of air that gently fills the garment while initiating the squeeze/release pulse, acclimating the patient to therapy and minimizing “vest creep.” All SmartVest garments provide 360° oscillation coverage, which delivers simultaneous treatment to all lobes of the lungs. |

The SmartVest SQL System

We

designed the SmartVest SQL with an array of features that make it easier to use and enable greater patient freedom as compared

to the SmartVest SV2100. In addition to incorporating the unique benefits of the SV2100, the SmartVest SQL was designed to be

significantly smaller, quieter, and lighter, and offer advanced generator programmability, constant bias pressure, and an enhanced

pause feature with save, lock and restore functionality:

| • | Smaller, quieter, lighter: The SmartVest SQL System is 25% smaller, 5db quieter and 25% lighter than the SmartVest SV2100, making it easier for patients to use and integrate HFCWO therapy into their daily lives. |

| • | Programmable ramp: The SmartVest SQL integrates fully featured programmable and adjustable ramp, which allows HFCWO therapy to start at a low frequency, ramp up, and then reduce the frequency during treatment. This allows clinicians greater flexibility to program patient-specific HFCWO therapy protocols. |

| • | Enhanced programmability: The SmartVest SQL features new programmability options for saving, locking and restoring protocols, providing an extra layer of security. Further, an enhanced pause feature allows the physician to program dedicated time(s) for the patient to clear secretions. |

| • | Constant bias pressure: Constant bias pressure ensures garment pressure remains the same as air pulse frequency changes during therapy. |

Other Products

We market the Single Patient Use (“SPU”) SmartVest® and SmartVest Wrap® to health care providers, particularly those working in intensive care units. Hospitals issue the SPU SmartVest or SmartVest Wrap to an individual patient for the duration of their stay. Both SPU products facilitate continuity of care because they introduce the patient to our product line and may encourage use of the SmartVest System for home care, which can be provided to patients with a chronic condition upon discharge. Both SPU products also provide full coverage pulsation.

Our Market

We estimate the current total served market for HFCWO in the United States is approximately $115 million based on independent market research. We believe our business model is supported by many market trends related to an aging population and growing awareness by physicians of diseases and conditions for which patients can benefit from using HFCWO therapy. Indications for when HFCWO should be prescribed are not specific to any one disease. A physician may elect to prescribe HFCWO when he or she believes the patient will benefit from improved airway clearance and external chest manipulation is the treatment of choice to enhance mucus transport and improve bronchial drainage.

| 3 |

The SmartVest System is routinely prescribed for patients with bronchiectasis, amyotrophic lateral sclerosis (“ALS”), cerebral palsy, cystic fibrosis, muscular dystrophy, quadriplegia and the combination of emphysema and chronic bronchitis commonly known as chronic obstructive pulmonary disease (“COPD”). The estimated patient populations in 2014 for diseases and conditions routinely prescribed HFCWO therapy are listed below. In the United States, the combined estimated total is over 16 million patients, although not all individuals with these conditions suffer from compromised pulmonary function. It was estimated that 190,000 unique cases of bronchiectasis were diagnosed in Medicare patients in 2007 and bronchiectasis prevalence increased 8.7% annually between 2000 and 20071.

| • | Cystic Fibrosis: In the United States, approximately 30,000 people are living with cystic fibrosis, and an estimated 1,000 new cases of cystic fibrosis are diagnosed each year. |

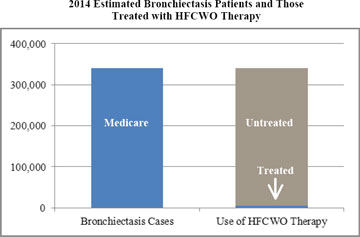

| • | Bronchiectasis: Based on historic growth in prevalence and assuming a constant growth rate, the estimated number of bronchiectasis diagnoses in 2014 exceeded 340,000. We believe that bronchiectasis, an irreversible lung condition that is the end result of repeated episodes of pulmonary inflammation and infection leading to permanently dilated bronchial airways, represents the fastest growing diagnostic category and greatest potential for HFCWO growth in the United States. |

| • | COPD: Estimates of COPD prevalence vary considerably, suggesting there are approximately 15 to 24 million people in the United States diagnosed with COPD. |

| • | Cerebral Palsy: An estimated 764,000 children and adults in the United States have cerebral palsy, and approximately 8,000 to 10,000 new cases of cerebral palsy are diagnosed each year. |

| • | ALS: Recent estimates suggest that as many as 30,000 people in the United States may be affected by ALS, and an estimated 5,600 people in the United States are diagnosed with ALS each year. |

1 Amy E. Seitz, MPH, et al. 2012. Trends in Bronchiectasis-Among Medicare Beneficiaries in the United States, 2000 to 2007. CHEST. 142(2): 432-439.

| 4 |

Marketing, Sales and Distribution

Our sales and marketing efforts are focused on building market awareness and acceptance of our products and services with physicians, clinicians, patients, and third party payers. The sale of the SmartVest System requires a physician’s prescription. As a result, we market to physicians and health care providers as well as directly to patients. The vast majority of our revenue comes from domestic home care sales through a physician referral model. We have established our own domestic sales force, which we believe is able to provide superior support and training to our customers. Our direct United States sales force works with physicians and clinicians in defined territories to help them understand our products and services and the value they provide to their respective patients. As of June 30, 2015, we had 28 sales representatives, including three regional sales managers, 24 clinical area managers (“CAMs”) and one institutional accounts manager. We have also developed a network of more than 300 respiratory therapists and health care professionals across the United States to assist with in-home SmartVest patient training on a non-exclusive independent contractor basis. These independent contractors are credentialed by the National Board for Respiratory Care as either Certified Respiratory Therapists or Registered Respiratory Therapists.

Of the $18.6 million of our 2015 revenue derived from the United States, approximately 90% represented home care and 10% represented institutional and governmental sales. Due to readmission penalties associated with the Patient Protection and Affordable Care Act, as reconciled by the Health Care and Education Reconciliation Act of 2010 (collectively the “PPACA”), for certain diseases and conditions, we believe opportunities for further growth exist for HFCWO therapy because the device used by a patient in an institution may influence the choice of device prescribed at discharge. We expect to achieve future sales, earnings, and overall market share growth by increasing home care referrals through building awareness of the choice patients and clinicians have of HFCWO devices, particularly for patients diagnosed with bronchiectasis,.

We generate sales leads through multiple channels that include participation in medical conferences, direct mailings and visits to pulmonology clinics and medical centers, participation with patient organizations such as the Cystic Fibrosis Foundation, maintenance of industry contacts in order to increase the visibility and acceptance of our products by physicians and health care professionals, as well as through patients by word of mouth and traffic to our website. In addition, we place advertisements in leading medical magazines and journals.

Additionally, because the availability of reimbursement is an important consideration for health care professionals and patients, we must also demonstrate the effectiveness of our products to public and private insurance providers. The availability of reimbursement exists primarily due to an established Healthcare Common Procedure Coding System code (“HCPC code”) for HFCWO. A HCPC code is assigned to services and products by the Centers for Medicare and Medicaid Services, (“CMS”). Because our product has an assigned HCPC code, a claim can be billed for reimbursement using that code.

International Marketing

Approximately 4.4% and 5.2% of net revenue was from sales outside the United States in fiscal 2015 and 2014, respectively. We sell our products outside the United States through independent distributors specializing in respiratory products. Through June 30, 2015, the majority of our distributors operated in exclusive territories. Our principal distributors are located in Europe, the Arab States of the Persian Gulf, Southeast Asia, and South and Central America. Units are sold at a fixed contract price with payments made directly from the distributor, rather than being tied to reimbursement rates of a patient’s insurance provider as is the case for domestic sales. Our sales strategy outside the United States is to focus our corporate resources on maintaining our current distributors with less emphasis on contracting with new distributors.

Third-Party Reimbursement

In the U.S., individuals who use the SmartVest System generally will rely on third-party payers, including private payers and governmental payers such as Medicare and Medicaid, to cover and reimburse all or part of the cost of using the SmartVest System. Approximately half of our homecare revenue is from commercial payers and one quarter is from each of the Medicare and Medicaid programs. Reimbursement for HFCWO therapy and the SmartVest System varies among public and private insurance providers.

| 5 |

Most patients are able to qualify for reimbursement and payment from Medicare, Medicaid, private insurance or combinations of the foregoing. We expect that subsequent generations of HFCWO products will also qualify for reimbursement under Medicare Plan B and most major health plans. However, some third-party payers must also approve coverage for new or innovative devices or therapies before they will reimburse health care providers who use the medical devices or therapies. In addition, we face the risk that new or modified products could have a lower reimbursement rate, or that the levels of reimbursement currently available for our existing products could decrease, which would hamper our ability to market and sell that product. Consequently, our sales will continue to depend in part on the availability of coverage and reimbursement from third-party payers, even though our devices may have been cleared for marketing by the FDA. The manner in which reimbursement is sought and obtained varies based upon the type of payer involved and the setting in which the procedure is furnished.

A key strategy to grow sales is achieving world class customer service and support for our patients and clinicians. We do this by establishing an effective reimbursement department to work on behalf of the patient by processing physician paperwork, seeking insurance authorization and processing claims. The skill and knowledge gained and offered by our reimbursement department is an important factor in building our revenue and serving patients’ financial interests. Our payment terms generally allow patients to acquire the SmartVest System over a period of 1 to 15 months, which is consistent with reimbursement procedures followed by Medicare and other third parties. The payment amount we receive for any single referral may vary based on a number of factors, including Medicare and third-party reimbursement processes and policies. The patient maintains the risk of reimbursement to the Company in the event of non-payment by third-party payers.

Our SmartVest System is reimbursed under HCPCS code E0483. Currently, Medicare total allowable for this billing code is approximately $12,000. The allowed amount for state Medicaid programs range from approximately $8,000 to $13,000, which is similar to commercial payers. Actual reimbursement from third party payers can vary, and can be significantly less than the full allowable. Deductions from the allowable amount including, co-pay’s, deductibles and/or maximums on DME equipment decrease the reimbursement received from the third party payer. Collecting a full allowable amount depends on our ability to obtain reimbursement from the patient’s secondary and/or supplemental insurance if the patent has additional coverage, or our ability to collect the amounts from the individual patients.

Research and Development

As of June 30, 2015, our research and development staff consisted of two full-time engineers and several consultants. We periodically engage consultants and contract engineering employees to supplement our development initiatives. Our team has a demonstrated record of developing new products that receive the appropriate product approvals and regulatory clearances around the world.

During the fiscal years ended June 30, 2015 and 2014, we incurred research and development expenses of approximately $316,000 and $466,000, respectively. As a result of our expected continued investment in enhancing the SmartVest System, we expect to spend approximately 2.0% to 4.0% of net revenue on research and development expenses over the long term.

Intellectual Property

As of June 30, 2015, we held 19 U.S. and 12 foreign issued patents covering the SmartVest System and its underlying technology, and had 30 pending U.S. and foreign patent applications. These patents and patent applications offer coverage in the field of air pressure pulse delivery to a human in support of airway clearance. Our first U.S. and foreign patents will expire in calendar 2016.

We generally pursue patent protection for patentable subject matter in our proprietary devices in foreign countries that we have identified as key markets for our products. These markets include the European Union, Canada, Japan, and other countries.

| 6 |

We also have received eight U.S. trademark and service mark registrations: SMARTVEST (stylized logo), SMARTVEST WRAP®, MEDPULSE (stylized logo), CREATING SUPERIOR CARE THROUGH INNOVATION®, MEDPULSE RESPIRATORY VEST SYSTEM®, SQL®, SMARTVEST SQL®, and MAKING LIFE’S IMPORTANT MOMENTS POSSIBLE-ONE BREATH AT A TIME®. We hold one pending application in Canada for SMARTVEST and have one pending international application through the Madrid Protocol for SMARTVEST designating China, European Union, India, Japan and Mexico.

Manufacturing

Our headquarters in New Prague, Minnesota includes a dedicated manufacturing and engineering facility of more than 10,000 square feet and we are certified on an annual basis to be compliant with ISO 13485 and ISO 9001 quality system standards. Our site has been regularly audited by the FDA and ISO, in accordance with their practices, and we maintain our operations in a manner consistent with their requirements for a medical device manufacturer. While components are outsourced to meet our detailed specifications, each SmartVest System is assembled, tested, and approved for final shipment at our manufacturing site in New Prague, consistent with FDA, Underwriters Laboratory (“UL”), and ISO standards. Many of our vendors are located within 100 miles of our headquarters, which enables us to closely monitor our component supply chain. We maintain established inventory levels for critical components and finished goods to assure continuity of supply.

Product Warranties

We provide a warranty on the SmartVest System that covers the cost of replacement parts and labor, or a new SmartVest System in the event we determine a full replacement is necessary. For home care SmartVest Systems initially purchased and currently located in the United States, we provide a lifetime warranty to the individual patient for whom the SmartVest System is prescribed. For sales to institutions within the United States, and for all international sales to we provide a three-year warranty.

Competition

The original HFCWO technology was licensed to American Biosystems, Inc. (now Advanced Respiratory, Inc. (“ARI”), part of Hill-Rom Holdings, Inc.) which, until the introduction of our original MedPulse Respiratory Vest System® in 2000, was the only manufacturer of a product with HFCWO technology cleared for market by the FDA (ARI’s The Vest®). In 2005, Respiratory Technologies, Inc., a privately held company doing business as RespirTech, received FDA clearance to market their HFCWO product, the inCourage® system (the “inCourage System”).

The Respin 11 (the “Respin 11”) by RespInnovation SAS and the AffloVest (the “AffloVest”) by International Biophysics Corporation are HFCWO products that also compete with our SmartVest System. The Respin 11 and AffloVest received FDA 510(k) clearance in 2012 and 2013, respectively. HFCWO product features and benefits such as, size, weight of the generator, reputation for patient and reimbursement services, and sales effectiveness of field personnel have become the key drivers of HFCWO product sales.

Alternative products for administering pulmonary therapy include: Positive Expiratory Pressure (“PEP”); Oscillatory PEP; Intrapulmonary Percussive Ventilation; CPT and breathing techniques. Physicians may prescribe some or all of these devices and techniques, depending upon each patient’s health status, severity of disease, compliance, or personal preference. We believe our primary competitive advantages over alternative treatments are patient comfort, ease of use, and the effectiveness of HFCWO treatment as compared to CPT and other alternative treatments. Because HFCWO is not “technique dependent,” as compared to most other pulmonary therapy products, therapy begins automatically once power is provided and remains consistent and controlled for the duration of treatment.

| 7 |

Governmental Regulation

Medicare and Medicaid

Recent government and private sector initiatives in the U.S. and foreign countries aim at limiting the growth of health care costs, including price regulation, competitive pricing, coverage and payment policies, comparative effectiveness of therapies, technology assessments, and managed-care arrangements, and are causing the marketplace to put increased emphasis on the delivery of more cost-effective medical devices. Government programs, including Medicare and Medicaid, have attempted to control costs by limiting the amount of reimbursement the program will pay for particular procedures or treatments, restricting coverage for certain products or services, and implementing other mechanisms designed to constrain utilization and contain costs. Many private insurance programs look to Medicare as a guide in setting coverage policies and payment amounts. These initiatives have created an increasing level of price sensitivity among our customers.

Home Medical Equipment Licensing

Although we do not fall under competitive bidding for Medicare, we often have the same licensing requirements of other durable medical equipment (“DME”) that do qualify for competitive bidding. In response to out-of-state business winning the competitive bidding process, which had a significant impact on small local DME businesses, many states have enacted regulations that require an in-state business presence, specifically through state Home Medical Equipment (“HME”) licensing boards or through state Medicaid programs. In order to do business with any patients in their state or to be a provider for their state Medicaid program, a DME provider must have an in-state presence. Other than our corporate office in Minnesota, we have an in-state presence in four other states and intend to gain in-state presence in at least one additional state in fiscal 2016. In-state presence requirements are different from state to state, but generally require a physical location that is staffed and open during regular business hours.

Product Regulations

Our medical devices are subject to regulation by numerous government agencies, including the FDA and comparable foreign regulatory agencies. To varying degrees, each of these agencies requires us to comply with laws and regulations governing the development, testing, manufacturing, labeling, marketing, and distribution of our medical devices, and compliance with these laws and regulations entails significant costs for us. Our regulatory and quality assurance departments provide detailed oversight of their areas of responsibility to support required clearances and approvals to market our products.

In addition to the clearances and approvals discussed below, we obtained ISO 9001 and ISO 13485 certification in January 2005, and receive annual certification of our compliance with ISO quality standards.

FDA Requirements

We have received clearance from the FDA to market our products, including the SmartVest System. We may be required to obtain additional FDA clearance before marketing a new or modified product in the U.S., either through the 510(k) clearance process or the more complex premarket approval process. The process may be time consuming and expensive, particularly if human clinical trials are required. Failure to obtain such clearances or approvals could adversely affect our ability to grow our business.

| 8 |

Continuing Product Regulation

In addition to its approval processes for new products, the FDA may require testing and post-market surveillance programs to monitor the effects of previously approved products that have been commercialized, and may prevent or limit further marketing of products based on the results of these post-marketing programs. At any time after approval of a product, the FDA may conduct periodic inspections to determine compliance with both the FDA’s Quality System Regulation (“QSR”) requirements and/or current medical device reporting regulations. Product approvals by the FDA can be withdrawn due to failure to comply with regulatory standards or the occurrence of unforeseen problems following initial approval. The failure to comply with regulatory standards or the discovery of previously unknown problems with a product or manufacturer could result in fines, delays or suspensions of regulatory clearances, seizures or recalls of products (with the attendant expenses), the banning of a particular device, an order to replace or refund the cost of any device previously manufactured or distributed, operating restrictions and criminal prosecution, as well as decreased sales as a result of negative publicity and product liability claims.

We must register annually with the FDA as a device manufacturer and, as a result, are subject to periodic FDA inspection for compliance with the FDA’s QSR requirements. These require us to adhere to certain extensive regulations. In addition, the federal Medical Device Reporting regulations require us to provide information to the FDA whenever there is evidence that reasonably suggests that a device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute to a death or serious injury. We also must maintain certain certifications in order to sell products internationally, and we undergo periodic inspections by notified bodies to obtain and maintain these certifications.

Advertising and marketing of medical devices, in addition to being regulated by the FDA, are also regulated by the Federal Trade Commission and by state regulatory and enforcement authorities. Recently, promotional activities for FDA-regulated products of other companies have been the subject of enforcement action brought under health care reimbursement laws and consumer protection statutes. Competitors and others can also initiate litigation relating to advertising and /or marketing claims. If the FDA determines that our promotional or training materials constitute promotion of an unapproved or uncleared claim of use, we may need to modify our training or promotional materials or be subject to regulatory or enforcement actions that may result in civil fines or criminal penalties. Other federal, state or foreign enforcement authorities might take action if they determine that our promotional or training materials constitute promotion of an unapproved use, which could result in significant fines or penalties.

European Union and Other Regions

European Union rules require that medical products receive the right to affix the Conformité Européenne (“European Conformity” or “CE”) mark The CE mark demonstrates adherence to quality standards and compliance with relevant European Union medical device directives. Products that bear the CE mark can be imported to, sold or distributed within the European Union. We obtained clearance to use the CE mark on our products in April 2005. Renewal of the CE mark is required every five years, and our notified body performs an annual audit to ensure that we are in compliance with all applicable regulations. We have maintained our CE mark in good standing since originally receiving it and most recently renewed it in January 2015. We also require all of our distributors in the European Union and other regions to comply with their home country regulations in our distributor agreements.

The 2010 Healthcare Reform Legislation, medical device excise tax and Federal Physician Payment Sunshine Act

U.S. healthcare reform legislation, the PPACA, was enacted into law in March 2010. The PPACA imposes a 2.3% excise tax on certain domestic sales of medical devices by manufacturers. To the extent that third-party payers and institutions will not absorb increased costs represented by the tax because of reimbursement or contract limitations, we are not able to offset the tax with increased revenue.

We are unable to predict the full impact of the PPACA as many of its provisions aimed at improving the quality and decreasing the costs of healthcare, are not effective for several years and regulatory details have not yet been fully established.

| 9 |

Federal Physician Payments Sunshine Act

The Federal Physician Payments Sunshine Act (Section 6002 of the PPACA, the “Sunshine Act”) was adopted on February 1, 2013, to create transparency for the financial relationship between medical device companies and physicians and/or teaching hospitals. The Sunshine Act requires all manufacturers of drugs and medical devices to annually report to the CMS any payments or any other “transfers of value” made to physicians and teaching hospitals, including but not limited to consulting fees, grants, clinical research support, royalties, honoraria, and meals. This information is then posted on a public website so that consumers can learn how much was paid to their physician by drug and medical device companies. The Sunshine Act requires ongoing data collection and annual management and reporting by us.

Fraud and Abuse Laws

Federal health care laws apply when we or our customers submit claims for items or services that are reimbursed under Medicare, Medicaid or other federally-funded health care programs. The principal applicable federal laws include:

| • | the False Claims Act, which prohibits the submission of false or otherwise improper claims for payment to a federally-funded health care program; |

| • | the Anti-Kickback Statute, which prohibits offers to pay or receive remuneration of any kind for the purpose of inducing or rewarding referrals of items or services reimbursable by a federal health care program; and |

| • | health care fraud statutes that prohibit false statements and improper claims to any third-party payer. |

There are often similar state false claims, anti-kickback, and anti-self referral and insurance laws that apply to state-funded Medicaid and other health care programs and private third-party payers. In addition, the U.S. Foreign Corrupt Practices Act can be used to prosecute companies in the U.S. for arrangements with physicians, or other parties outside the U.S. if the physician or party is a government official of another country and the arrangement violates the law of that country. Enforcement of all of these regulations has become increasingly stringent, particularly due to more prevalent use of the whistleblower provisions under the False Claims Act, which allow a private individual to bring actions on behalf of the federal government alleging that the defendant has submitted a false claim to the federal government and to share in any monetary recovery. If a governmental authority were to conclude that we are not in compliance with applicable laws and regulations, we and our officers and employees could be subject to severe criminal and civil penalties and exclusion from participation as a supplier of product to beneficiaries covered by Medicare or Medicaid.

HIPAA/HITECH and Other Privacy Regulations

Federal and state laws protect the confidentiality of certain patient health information, including patient records, and restrict the use and disclosure of such information. The Health Insurance Portability and Accountability Act of 1996 and its implementing regulations (“HIPAA”) and the Health Information Technology for Economic and Clinical Health Act (“HITECH”) set forth privacy and security standards that govern the use and disclosure of protected electronic health information by “covered entities”, which include healthcare providers, health plans and healthcare clearinghouses. Because we provide our products directly to patients and bill third-party payers such as Medicare, Medicaid, and insurance companies, we are a “covered entity” and must comply with these standards. Failure to comply with HIPAA/HITECH or any state or foreign laws regarding personal data protection may result in significant fines or penalties and/or negative publicity. In addition to federal regulations issued under HIPAA/HITECH, some states have enacted privacy and security statutes or regulations that, in some cases, are more stringent than those issued under HIPAA/HITECH. In those cases, it may be necessary to modify our planned operations and procedures to comply with the more stringent state laws. If we fail to comply with applicable state laws and regulations, we could be subject to additional sanctions.

The HIPAA/HITECH health care fraud and false statement statutes also prohibit, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any health care benefit program, including private payers, and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement or representation in connection with the delivery of or payment for health care benefits, items or services.

| 10 |

Environmental Laws

We are subject to various environmental laws and regulations both within and outside the U.S. Like other medical device companies, our operations involve the use of substances regulated under environmental laws, primarily manufacturing, sterilization, and disposal processes. We do not expect that compliance with environmental protection laws will have a material impact on our results of operations, financial position, or cash flows.

Employees

As of June 30, 2015, we employed 97 employees, 94 of whom were full-time. Of our 97 employees, 18% are respiratory therapists licensed by appropriate state professional organizations, including all of the employees in our Patient Services Department. We also retain more than 300 respiratory therapists and health care professionals on a non-exclusive independent contractor basis to provide training to our customers in the United States. None of our employees are covered by a collective bargaining agreement. We believe our relations with our employees are good.

As a smaller reporting company, we are not required to provide disclosure pursuant to this item.

Item 1B. Unresolved Staff Comments.

As a smaller reporting company, we are not required to provide disclosure pursuant to this item.

We own our principal headquarters and manufacturing facilities, consisting of approximately 24,000 square feet, which are located on an approximately 2.3 acre parcel in New Prague, Minnesota. This owned property is subject to a mortgage (see Note 5 to the Financial Statements, included in Part II, Item 8 of this Report for further information).We also lease approximately 20,000 square feet of warehouse and office space in a building adjacent to our manufacturing facilities. We believe that our current facilities are satisfactory for our long-term growth plans.

We may be party to legal actions, proceedings, or claims in the ordinary course of business. We are not aware of any actual or threatened litigation that would have a material adverse effect on our financial condition or results of operations.

| 11 |

Item 4. Mine Safety Disclosures.

None.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is listed on the NYSE MKT under the symbol “ELMD”. The following table sets forth the high and low sale prices of our common stock by quarter during the 2015 and 2014 fiscal years.

| 2015 Fiscal Year | ||

| Quarter Ended | High | Low |

| September 30 | $2.01 | $1.29 |

| December 31 | $2.74 | $1.23 |

| March 31 | $2.84 | $2.13 |

| June 30 | $2.60 | $1.68 |

| 2014 Fiscal Year | ||

| Quarter Ended | High | Low |

| September 30 | $1.40 | $0.90 |

| December 31 | $3.50 | $0.98 |

| March 31 | $3.29 | $1.35 |

| June 30 | $1.56 | $1.00 |

Holders

As of September 10, 2015, there were 118 registered holders of our common stock.

Dividends

We have never paid cash dividends on any of our common stock. We currently intend to retain any earnings for use in operations and do not anticipate paying cash dividends in the foreseeable future. Currently, the agreement governing our credit facility restricts our ability to pay dividends.

| 12 |

Recent Sales of Unregistered Equity Securities

None.

Purchase of Equity Securities by the Company and Affiliated Purchasers.

None.

Item 6. Selected Financial Data.

As a smaller reporting company, we are not required to provide disclosure pursuant to this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and the accompanying notes included elsewhere in this Report. The forward-looking statements include statements that reflect management’s beliefs, plans, objectives, goals, expectations, anticipations and intentions with respect to our future development plans, capital resources and requirements, results of operations, and future business performance. Our actual results could differ materially from those anticipated in the forward-looking statements included in this discussion as a result of certain factors, including, but not limited to, those discussed in the section entitled “Information Regarding Forward-Looking Statements” immediately preceding Part I of this Report.

Overview

Electromed, Inc. (“we,” “us,” “Electromed” or the “Company”) develops and provides innovative airway clearance products applying High Frequency Chest Wall Oscillation (“HFCWO”) technologies in pulmonary care for patients of all ages.

We manufacture, market and sell products that provide HFCWO, including the SmartVest® Airway Clearance System (“SmartVest System”) which includes our newest generation SmartVest SQL® and previous generation SV2100, and related products, to patients with compromised pulmonary function. The SmartVest SQL is smaller, quieter and lighter than our previous product, with enhanced programmability and ease of use. The SmartVest SQL was cleared for market by the FDA in December 2013 and launched exclusively to the domestic home care market in the second half of fiscal 2014. In the fourth quarter of fiscal 2015, we launched the SQL into the institutional and certain international markets. Our products are sold for both the home health care market and the institutional market for use by patients in hospitals, which we refer to as “institutional sales.” Since 2000, we have marketed the SmartVest System and its predecessor products to patients suffering from cystic fibrosis, bronchiectasis and repeated episodes of pneumonia. Additionally, we offer our products to a patient population that includes neuromuscular disorders such as cerebral palsy, muscular dystrophies, amyotrophic lateral sclerosis (“ALS”), the combination of emphysema and chronic bronchitis commonly known as chronic obstructive pulmonary disease (“COPD”), and patients with post-surgical complications or who are ventilator dependent or have other conditions involving excess secretion and impaired mucus transport.

The SmartVest System is often eligible for reimbursement from major private insurance providers, HMOs, state Medicaid systems, and the federal Medicare system, which is an important consideration for patients considering an HFCWO course of therapy. For domestic sales, the SmartVest System may be reimbursed under the Medicare-assigned billing code for HFCWO devices if the patient has cystic fibrosis, bronchiectasis (including chronic bronchitis or COPD that has resulted in a diagnosis of bronchiectasis), or any one of certain enumerated neuro-muscular diseases, and can demonstrate that another less expensive physical or mechanical treatment did not adequately mobilize retained secretions. Private payers consider a variety of sources, including Medicare, as guidelines in setting their coverage policies and payment amounts.

| 13 |

Our primary goals for fiscal 2016 include:

| • | deliver profitable growth; |

| • | grow quality referrals and increase the rate of reimbursement on referrals; |

| • | enhance our superior service model and world-class reimbursement support: and |

| • | maintain the highest standards of integrity, respect and privacy. |

Our key growth strategies include:

| • | offering innovation in HFCWO products and services; |

| • | enhancing our superior service model and world-class reimbursement support; |

| • | increasing lead generation by focusing on increasing awareness to physicians of the benefits of HFCWO with patients diagnosed with bronchiectasis and the symptoms of bronchiectasis yet undiagnosed; |

| • | executing broader third party payer coverage; |

| • | expanding our geographic footprint in institutions; and |

| • | treating our customers and patients with integrity and respect. |

Critical Accounting Policies and Estimates

During the preparation of our financial statements, we are required to make estimates, assumptions and judgments that affect reported amounts. Those estimates and assumptions affect our reported amounts of assets and liabilities, our disclosure of contingent assets and liabilities, and our reported revenues and expenses. We update these estimates, assumptions and judgments as appropriate, which in most cases is at least quarterly. We use our technical accounting knowledge, cumulative business experience, judgment and other factors in the selection and application of our accounting policies. While we believe the estimates, assumptions and judgments we use in preparing our financial statements are appropriate, they are subject to factors and uncertainties regarding their outcome and therefore, actual results may materially differ from these estimates. The following is a summary of our primary critical accounting policies and estimates. Please also refer to Note 1 to the Financial Statements, included in Part II, Item 8 of this Report.

Revenue Recognition and Allowance for Doubtful Accounts

Revenues are primarily recognized upon shipment when evidence of a sales arrangement exists, delivery has occurred and the selling price is determinable with collectability reasonably assured. Revenues from direct patient sales are recorded at the amount to be received from patients under their arrangements with third-party payers, including private insurers, prepaid health plans, Medicare and Medicaid. In addition, we record an estimate for selling price adjustments that often arise from changes in a patient’s insurance coverage, changes in a patient’s state of domicile, insurance company coverage limitations or patient death. We periodically review originally billed amounts and our collection history and make changes to the estimation process by considering any changes in recent collection or sales allowance experience, but have not made material adjustments to previously recorded revenues and receivables.

Other than the installment sales as discussed below, we expect to receive payment on the vast majority of accounts receivable within one year and therefore classify all receivables as current assets. However, in some instances, payment for direct patient sales can be delayed or interrupted resulting in a portion of collections occurring later than one year. In the event receivables are expected to be paid over longer intervals than one year, we recognize revenue under the installment method.

| 14 |

Certain third-party reimbursement agencies pay us on a monthly installment basis, which can span from 18 to 60 months. Wisconsin, California, and New York Medicaid constitute the majority of our installment method sales. Due to the length of time over which reimbursement is received, we believe that the inherent uncertainty of collection due to external factors noted above precludes us from making a reasonable estimate of revenue at the time the product is shipped. In certain circumstances, the patient must periodically attest that the unit continues to be utilized as a prerequisite to continued reimbursement coverage. Therefore, we believe the installment method is appropriate for these sales. If the third party reimbursement agency discontinues payment and we determine no further payments will be made from the patient, the carrying value of the account receivable is written off as a period adjustment against the previously recognized sales. Under the installment method, we do not record accounts receivable or revenue at the time of product shipment. We defer the revenue associated with the sale and, as each installment is received, that amount is recognized as revenue. Deferred costs associated with the sale are amortized to cost of revenue ratably over the estimated period in which collections are scheduled to occur.

Accounts receivable are also net of an allowance for doubtful accounts, which are accounts from which payment is not expected to be received although product was provided and revenue was earned. Management determines the allowance for doubtful accounts by regularly evaluating individual customer receivables and considering a customer’s financial condition and credit history. Receivables are written off when deemed uncollectible. Recoveries of receivables previously written off are recorded when received.

We request that customers return previously-sold units that are no longer in use to us in order to limit the possibility that such units would be resold by unauthorized parties or used by individuals without a prescription. The customer is under no obligation to return the product; however, we do reclaim the majority of previously sold units upon the discontinuance of patient usage. We obtained certification to recondition and resell returned units during fiscal 2015. Returned units can now be resold and will continue to be used for demonstration equipment and warranty replacement parts.

Valuation of Long-lived and Intangible Assets

Long-lived assets, primarily property and equipment and finite-life intangible assets, are evaluated for impairment whenever events or changes in circumstances indicate the carrying value of an asset may not be recoverable. In evaluating recoverability, the following factors, among others, are considered: a significant change in the circumstances used to determine the amortization period, an adverse change in legal factors or in the business climate, a transition to a new product or service strategy, a significant change in customer base, and a realization of failed marketing efforts. The recoverability of an asset or asset group is measured by a comparison of the unamortized balance of the asset or asset group to future undiscounted cash flows. If we believe the unamortized balance is unrecoverable, we would recognize an impairment charge necessary to reduce the unamortized balance to the estimated fair value of the asset group. The amount of such impairment would be charged to operations at the time of determination.

Property and equipment are stated at cost less accumulated depreciation. We use the straight-line method for depreciating property and equipment over their estimated useful lives, which range from 3 to 39 years. Our finite-life intangibles consist of patents and trademarks and their carrying costs include the original cost of obtaining the patents, periodic renewal fees, and other costs associated with maintaining and defending patent and trademark rights. Patents and trademarks are amortized over their estimated useful lives, generally 15 and 12 years, respectively, using the straight-line method.

Allowance for Excess and Slow-moving Inventory

An allowance for potentially slow-moving or excess inventories is made based on our analysis of inventory levels on hand and comparing it to expected future production requirements, sales forecasts and current estimated market values.

Income Taxes

We recognize deferred tax assets and liabilities based on the differences between the financial statement carrying amounts and the tax basis of assets and liabilities. We provide a valuation allowance for deferred tax assets if we determine, based on the weight of available evidence, that it is more likely than not that some or all of the deferred tax assets will not be realized. We would reverse a valuation allowance if we determine, based on the weight of all available evidence, including when cumulative losses become positive income, that it is more likely than not that some or all of the deferred tax assets will be realized.

| 15 |

Warranty Reserve

We provide a warranty on the SmartVest System that covers the cost of replacement parts and labor, or a new SmartVest System in the event we determine a full replacement is necessary. For home care SmartVest Systems initially purchased and currently located in the United States, we provide a lifetime warranty to the individual patient for whom the system is prescribed. For sales to institutions within the United States, and for all international sales, we provide a three-year warranty. We estimate, based upon a review of historical warranty claim experience, the costs that may be incurred under our warranty policies and record a liability in the amount of such estimate at the time a product is sold. The warranty cost is based upon future product performance and durability, and is estimated largely based upon historical experience. We estimate the average useful life of our products to be approximately five years. Factors that affect our warranty liability include the number of units sold, historical and anticipated rates of warranty claims, the product’s useful life, and cost per claim. At our discretion, based upon the cost to either repair or replace a product, we have occasionally replaced such products covered under warranty with a new model. We periodically assess the adequacy of our recorded warranty liability and make adjustments to the accrual as claims data and historical experience warrant.

Share-Based Compensation

Share-based payment awards consist of options and restricted stock issued to employees and directors for services. Expense for options is estimated using the Black-Scholes pricing model at the date of grant and expense for restricted stock is determined by the closing price on the day the grant is made. The portion of the award that is ultimately expected to vest is recognized on a straight-line basis over the requisite service or vesting period of the award. In determining the fair value of our share-based payment awards, we make various assumptions using the Black-Scholes pricing model, including expected risk free interest rate, stock price volatility, life and forfeitures. Please see Note 7 to the Financial Statements included in Part II, Item 8 of this Report for these assumptions.

Results of Operations

Fiscal Year Ended June 30, 2015 Compared to Fiscal Year Ended June 30, 2014

Revenues

Revenue for the twelve-month periods are summarized in the table below (dollar amounts in thousands).

| Twelve Months Ended June 30, | Increase | |||||||||||||||

| 2015 | 2014 | |||||||||||||||

| Total Revenue | $ | 19,408 | $ | 15,488 | $ | 3,920 | 25.3 | % | ||||||||

| Home Care Revenue | $ | 16,615 | $ | 12,997 | $ | 3,618 | 27.8 | % | ||||||||

| International Revenue | $ | 854 | $ | 801 | $ | 53 | 6.6 | % | ||||||||

| Government/Institutional Revenue | $ | 1,939 | $ | 1,690 | $ | 249 | 14.7 | % | ||||||||

Home Care Revenue. Our home care revenue increased by 27.8%, or approximately $3,618,000, in fiscal 2015 compared to fiscal 2014. The increase in revenue was caused by continued improvements in our reimbursement operations, including new third-party payer contracts and process improvements leading to faster approval cycle times, higher average selling price and greater referral to approval percentage, as well as higher referrals compared with the prior year.

| 16 |

International Revenue. International revenue increased by 6.6%, or $53,000 in fiscal 2015 compared to fiscal 2014. In fiscal 2015, sales increased in Central and South America, offset partially by a decrease in sales to the Middle East and Asia.

Government/Institutional Revenue. Government/institutional revenue increased by 14.7%, or approximately $249,000 in fiscal 2015 compared to fiscal 2014. Institutional revenue, which includes sales to distributors, group purchasing organization (“GPO”) members, and other institutions, increased by approximately $276,000 or 22.5%, from approximately $1,228,000 in fiscal 2014 to approximately $1,504,000 in fiscal 2015. Institutional revenue was offset by a $27,000 decrease in government sales, which decreased to approximately $435,000 in fiscal 2015.

Gross Profit

Gross profit increased to $13,600,000, or 70.1% of net revenues, for the fiscal year ended June 30, 2015, from approximately $10,634,000, or 68.7% of net revenues, for the fiscal year ended June 30, 2014. The increase in gross profit percentage resulted primarily from the increase in domestic home care revenue at higher average selling price and greater referral to approval percentage, as compared with the prior year. During fiscal 2015, the gross profit percentage was negatively affected by an impairment charge, included in cost of goods sold, taken on tooling that will no longer be used to produce SmartVest SQL parts as well as an increase in our reserve for obsolete inventory caused by a change in estimated future sales of the SV2100 product.

Manufacturing costs for the SmartVest SQL were reduced in fiscal 2015 to be in line with our previous products. As we implemented more cost effective manufacturing processes we recorded an impairment charge against the book value of the assets that will no longer be used. During fiscal 2015 these charges totaled approximately $118,000. Based on our current cost reduction projects we expect total additional charges in the future to be approximately $30,000.

We believe we can achieve additional cost reductions that will lower the cost of our SmartVest SQL to a cost significantly lower than our previous products and that will shorten the length of time that we phase out sales of our SV2100 product. Because of this, we recorded a reserve on certain SV2100 parts, that may no longer be utilized in production, of $110,000 during the fourth quarter of fiscal 2015.

We believe that as we continue to grow sales, we will be able to continue to leverage manufacturing costs and that gross margins, over the long-term, will continue at approximately 70%, although with fluctuations on a short-term basis due to average reimbursement based on the mix of referrals during any given period. Factors such as diagnoses that are not assured of reimbursement, insurance programs with lower allowable reimbursement amounts (for example, state Medicaid programs), and whether an individual patient meets prerequisite medical criteria for reimbursement, affect average reimbursement received on a short-term basis.

Operating Expenses

Selling, General and Administrative Expenses. Selling, general and administrative (“SG&A”) expenses for the fiscal year ended June 30, 2015 were approximately $11,974,000, compared to approximately $10,909,000 for the prior year, an increase of approximately $1,065,000, or 9.8%. SG&A payroll and compensation related expenses increased by approximately $697,000, or 12.0%, to approximately $6,508,000. The increase in fiscal 2015 was due to a combination of additional expenses related to commissions and bonuses based on higher revenue and profitability, a slight increase in number of employees and annual salary rate increases.

Advertising and marketing expenses, including tradeshows and event sponsorships decreased by approximately $163,000, or 32.7%, to approximately $336,000 in fiscal 2015, compared to approximately $499,000 in fiscal 2014. The decrease was primarily related to additional costs in the prior period related to the market launch of the SmartVest SQL, as well as targeting more cost-effective advertising. Travel, meals and entertainment expenses were approximately $1,169,000 for fiscal 2015 compared to $1,149,000 in the prior year, representing an increase of approximately $20,000, or 1.7%.

| 17 |

Legal and professional fees increased by approximately $40,000 to approximately $903,000, compared to approximately $863,000 in fiscal 2014. These fees are for services related to legal costs, reporting requirements, consulting, expenses related to information technology security and backup, and expenses for printing and other shareowner services. The increase in fees compared to fiscal 2014 was primarily due to an increase in consulting fees associated with sales training, information technology improvements, a contract employee, and outsourcing certain IT services. The increase in these fees was partially offset by a decrease in legal fees in connection with resolving litigation in the first quarter of fiscal 2014.

Recruiting fees increased by approximately $131,000 to approximately $222,000, compared to approximately $91,000 in fiscal 2014 due to the replacement of several underperforming sales people. In addition, SG&A expenses included $232,000 due to a 2.3% medical device excise tax that is assessed on certain domestic device sales, an increase of approximately $92,000 compared to fiscal 2014.

Research and Development Expenses. Research and development (“R&D”) expenses were approximately $316,000 and $466,000, or 1.6% and 3.0% of net revenues, for the fiscal years ended June 30, 2015 and 2014, respectively. The decrease of approximately $150,000 was due to finalizing the development and testing of the new SmartVest SQL in fiscal 2014. As a percentage of sales, we expect to spend approximately 2.0% to 4.0% of net revenues on research and development expenses over the long term.

Interest Expense

Interest expense increased to approximately $86,000 in fiscal 2015, compared to $79,000 in fiscal 2014, an increase of approximately $7,000. The increase in net interest expense resulted from a decrease in interest income compared to prior year.

Income Tax Expense / Benefit

Income tax expense was $132,000 in fiscal 2015, compared to income tax expense of $469,000 in fiscal 2014. The income tax expense for fiscal 2015 includes a current tax expense of $132,000. The income tax expense for fiscal 2014 included a current tax expense of $15,000 and a discrete tax expense of $454,000 due primarily to our decision to record a full valuation allowance against all of our net U.S. federal and state deferred tax assets during the quarter ended March 31, 2014. The effective tax rates, excluding the adjustments for the valuation allowance for the years ended June 30, 2015 and 2014, were 45.0% and 31.5%, respectively. The effective tax rates differ from the statutory federal rate due to the effect of state income taxes, research and development tax credits, the domestic production deduction and other permanent items that are non-deductible for tax purposes relative to the amount of taxable income.

Net Income/Loss

Net income for the twelve months ended June 30, 2015 was approximately $1,092,000, compared to net loss of approximately $1,289,000 in fiscal 2014. The increase in net income was primarily the result of an increase in domestic home care revenue, which was based on higher amount of approvals, an increase in gross margin percentage due to a higher average selling price per approval and lower cost of goods sold as we implemented cost reductions in the manufacturing process of the SmartVest SQL. Net income also increased due to the valuation allowance that was recorded against our net deferred tax assets during the prior year.

| 18 |

Liquidity and Capital Resources

Cash Flows and Sources of Liquidity

Cash Flows from Operating Activities

For the fiscal year ended June 30, 2015, our net cash provided by operating activities was approximately $2,781,000. Our net income of approximately $1,092,000 was adjusted for non-cash expenses of approximately $1,166,000. It was also adjusted by decreases in inventory, prepaid expenses and other assets of approximately $163,000 and $7,000 and an increase in other accrued liabilities of $384,000. Cash provided by operating activities was offset by an increase in accounts receivable of approximately $32,000.

For the fiscal year ended June 30, 2014, our net cash provided by operating activities was approximately $2,067,000. Our net loss of approximately $1,289,000 was adjusted for non-cash expenses of approximately $1,389,000. It was also adjusted by a decrease in accounts receivable, income tax receivable, prepaids and other assets of approximately $2,527,000, $538,000 and $60,000, respectively. Cash provided by operating activities was offset by an increase in inventory and a decrease in current liabilities of approximately $856,000 and $302,000, respectively.

Cash Flows from Investing Activities

For the fiscal year ended June 30, 2015, cash used in investing activities was approximately $624,000. Cash used in investing activities primarily consisted of approximately $523,000 in expenditures for property and equipment and $101,000 in payments for patent and trademark costs.

For the fiscal year ended June 30, 2014, cash used in investing activities was approximately $940,000. Cash used in investing activities primarily consisted of approximately $895,000 in expenditures for property and equipment and $45,000 in payments for patent and trademark costs.

Cash Flows from Financing Activities

For the fiscal year ended June 30, 2015, cash used in financing activities was approximately $61,000, consisting of $46,000 in principal payments on long-term debt and $15,000 in payments for deferred financing fees.

For the fiscal year ended June 30, 2014, cash used in financing activities was approximately $128,000 consisting of $93,000 in principal payments on long-term debt and $35,000 in payments for deferred financing fees.

Adequacy of Capital Resources

Our primary working capital requirements relate to adding employees to our sales force and support functions, continuing research and development efforts, and supporting general corporate needs, including financing equipment purchases and other capital expenditures incurred in the ordinary course of business. Based on our current operational performance, we believe our working capital of approximately $10.3 million and available borrowings under our existing credit facility will provide adequate liquidity for the next year. Our current line of credit expires on December 18, 2015. Based on our ability to service our debt and relationship with our lender, we believe that we will be able to renew our line of credit prior to December 18, 2015. However, we cannot guarantee that we will be able to procure additional financing upon favorable terms, if at all.

On December 18, 2014, we renewed our $2,500,000 revolving line of credit with Venture Bank, which was initially entered into on December 18, 2013 as part of our credit facility with Venture Bank. There was no outstanding principal balance on the line of credit as of June 30, 2015. Interest on the line of credit accrues at the prime rate plus 1.00%, with a floor of 4.50% (4.50% at June 30, 2015) and is payable monthly. The amount eligible for borrowing on the line of credit is limited to the lesser of $2,500,000 or 57.00% of eligible accounts receivable, and the line of credit expires on December 18, 2015, if not renewed. The line of credit is secured by a security interest in substantially all of our tangible and intangible assets.

| 19 |

As a part of our credit facility with Venture Bank, we also have a term loan which had an outstanding principal balance of approximately $1,241,000 and $1,280,000 at June 30, 2015 and June 30, 2014, respectively. The term loan bears interest at 5.00%, with monthly payments of principal and interest of approximately $8,600 and a final payment of principal and interest of approximately $1,095,000 is due on the maturity date of December 18, 2018. The term loan is secured by a mortgage on the Company’s real property.

Our credit facility with Venture Bank contains certain financial and nonfinancial covenants including a minimum tangible net worth covenant of not less than $10,125,000 and restrictions on our ability to incur certain additional indebtedness or pay dividends. We were in compliance with these covenants as of June 30, 2015.