August 24, 2017

Securities and Exchange Commission

Division of Corporate Finance

100 F Street, NE

Washington, DC 20549

| Attn: | Melissa Raminpour, Branch Chief |

| Re: | Sino Agro Food, Inc. |

Form 10-K for the Year Ended December 31, 2016

Filed March 16, 2017

File No. 0-54191

Dear Ms. Melissa Raminpour:

Sino Agro Food, Inc. (the “Company”) hereby submits its response to certain matters raised by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in its letter of comments dated July 25, 2017 (the “Comment Letter”) relating to the Annual Report on Form 10-K (the “Form 10-K”) referenced above.

The Company is hereby filing an amendment (the “Amended Form 10-K”) to the Form 10-K. In addition, the Company is submitting this response to the Comment Letter with the Amended Form 10-K.

The Company’s responses are numbered to correspond to the Staff’s comments. For your convenience, each of the Staff’s comments contained in the Comment Letter has been restated below in its entirety, with the Company’s response set forth immediately beneath such comment.

Form 10-K for the Year Ended December 31, 2016

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation, page 51

Part A. Audited Income Statements of Consolidated results of Operations for the year ended December 31….. page 54

Comment No. 1. With respect to the EBITDA and EBIT presentations, please remove these measures from the income statement presentation pursuant to Item 10(e)(1)(ii)(C) and (D) of Regulation S-K. Please refer to Question 102.10 of the Compliance and Disclosure Interpretations issued by the Division of Corporation Finance regarding Non-GAAP Financial Measures issued on May 17, 2016. You may separately provide a reconciliation of these measures and include all disclosures required by Item 10(e)(1)(i) of Regulation S-K. In your response, please provide us with your proposed revisions to your disclosures.

Response No. 1. The Company agrees with the Commission’s assessment and reasons meriting this action, and will remove references or statements to EBITDA and EBIT measures from the income statement presentation. Also, the Company intends to refrain from including Non-GAAP Financial Measures in future periodic reports and other filings to be made with the Commission.

Please reference page 54 for the revised disclosure.

Comment No .2. If the purpose of this tabular presentation is to provide free cash flow and/or net debt measures, please remove the presentation and replace it with reconciliations and disclosures that comply with Item 10(e)(1)(i) of Regulation S-K and Question 102.07 of the Compliance and Disclosure Interpretations issued by the Division of Corporation Finance regarding Non-GAAP Financial Measures issued on May 17, 2016. In your response, please provide us with your proposed revisions to your disclosures.

Response No. 2. The Company has decided to remove this and any related Non-GAAP Financial Measure from the 10-K.

Please reference page 76 for the revised disclosure.

Comment No .3. Please tell us your basis that your disclosure controls and procedures and internal control over financial reporting (ICFR) were effective as of December 31, 2016 and that there has been no change in your ICFR that occurred during the last fiscal quarter, given the restatement described in your Form 10-Q/A filed on March 16, 2017. As part of your response, specifically address your consideration of PCAOB Standard 5 with respect to internal control deficiencies or material weaknesses and amend your Form 10-K for the year ended December 31, 2016 and Form 10-Q for the period ended March 31, 2017, as appropriate.

Response No. 3. “We have evaluated our internal control over financial reporting, and there has been no change in our internal control over financial reporting that occurred during the third fiscal quarter (Q3) of fiscal year ended December 31, 2016 that has materially affected, or is reasonably likely to materially affect our internal control over financial reporting.”

Comment No. 4. Additionally, please amend your management’s report on ICFR to refer to the most recent fiscal year in the last sentence where you describe the conclusion reached on the effectiveness of ICFR. Furthermore, please revise to disclose the specific Committee of Sponsoring Organizations of the Treadway Commission (COSO) framework (i.e. 2013 COSO framework) that you used to assess the effectiveness of ICFR.

Response No. 4. The Company acknowledges its oversight in reporting this item, and will proceed to amend the “yellow highlighted” date in the following:

Our management assessed the effectiveness of our internal control over financial reporting as of December 31, 2016. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) (2013 framework) in Internal Control-Integrated Framework. Based on our assessment, we believe that, as of December 31, 2016, the Company’s internal control over financial reporting was effective.

Please reference page 86 for the revised disclosure.

Comment No. 5. We note that the principal audit fees and audit-related fees for 2016 were not updated with the amounts. Please tell us and revise to disclose the amount of audit fees for 2016.

Response No. 5. The item below has been revised and being disclosed as follows:

| ITEM 14 | PRINCIPAL ACCOUNTING FEES AND SERVICES |

(1) Principal Audit Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountants ECOVIS David Yeung Hong Kong with respect to FYE 2016 and FYE 2015 (“Ecovis”), for our audit of annual financial statements and review of financial statements included in our quarterly reports or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were:

| Ecovis | 2016 | $ | 189,000 | |||

| Ecovis | 2015 | $ | 180,000 |

(2) Audit-Related Fees

The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountants that are reasonably related to the performance of the audit or review of our financial statements and are not reported in the preceding paragraph:

| Ecovis | 2016 | $ | 0 | |||

| Ecovis | 2015 | $ | 0 |

Please reference page 92 for the revised disclosure.

Comment No. 6. Please be advised that the correction of a material misstatement in previously issued financial statements should be recognized in the auditor’s report on the audited financial statements through the addition of an explanatory paragraph in accordance with paragraph 9 of PCAOB Auditing Standard No. 6. In this regard, your independent accountants’ reports should be revised accordingly, and the financial statements should include all of the disclosures required by ASC 250-10-50-7 to 10.

Response No. 6.

We inserted the below paragraph in the auditors’ report and added note 33 – Reinstatement of consolidated financial statements.

“The Company has restated its consolidated statement of balance sheet, consolidated statement of income and other comprehensive income and consolidated statement of cash flows to correct an error related to accounting for disposal of the fishery division – sale of fishery of the company as a discontinued operation. The effects of that restatement are explained in note 33 to the consolidated financial statements.”

| 33. | RESTATEMENT OF CONSOLIDATED FINANCIAL STATEMENTS |

The Company has restated its consolidated statement of balance sheet, consolidated statement of income and other comprehensive income and consolidated statement of cash flows to correct an error related to accounting for disposal of the fishery division – sale of goods of the company operated by subsidiaries - TRW and JFD as discontinued operations.

| (i) | CONSOLIDATED BALANCE SHEET |

SINO AGRO FOOD, INC.

CONSOLIDATED BALANCE SHEET

AS AT DECEMBER 31, 2016 (EXTRACT)

| 2015 | 2015 | |||||||||||||

| Note | As reported | Prior year adjustment | As restated | |||||||||||

| Plant and equipment | ||||||||||||||

| Plant and equipment, net of accumulated depreciation | 12 | $ | 104,258,769 | $ | (9,020,669 | ) | $ | 95,238,100 | ||||||

| Non-currents assets held for sale | 13 | 9,020,669 | 9,020,669 | |||||||||||

| Construction in progress | 14 | 72,788,769 | 72,788,769 | |||||||||||

| Total plant and equipment | $ | 177,047,538 | $ | 177,047,538 | ||||||||||

Note: $9,020,669 is classified as non-current assets held for sale from property and equipment.

| (ii) | CONSOLIDATED STATEMENT OF INCOME AND OTHER COMPREHENSIVE INCOME |

SINO AGRO FOOD, INC

CONSOLIDATED STATEMENT OF INCOME AND OTHER COMPREHENSIVE INCOME

(EXTRACT)

FOR THE YEAR ENDED DECEMBER 31, 2016

| Note | 2015 | Prior year | 2015 | 2014 | Prior year | 2014 | |||||||||||||||||||||

| As reported | adjustment | (Restated) | As reported | adjustment | (Restated) | ||||||||||||||||||||||

| Continuing operations | |||||||||||||||||||||||||||

| Revenue | |||||||||||||||||||||||||||

| - Sale of goods | $ | 336,786,554 | * | $ | (85,404,016 | ) | $ | 251,382,538 | $ | 322,654,081 | * | $ | (105,775,887 | ) | $ | 216,878,194 | |||||||||||

| - Consulting and service income from development contracts | 90,374,144 | 90,374,144 | 80,112,541 | 80,112,541 | |||||||||||||||||||||||

| - Commission income | 1,892,786 | 1,892,786 | 1,567,751 | 1,567,751 | |||||||||||||||||||||||

| 429,053,484 | 343,649,468 | 404,334,373 | 298,558,486 | ||||||||||||||||||||||||

| Cost of goods sold | (260,843,884 | )* | 67,152,999 | (193,690,885 | ) | (230,753,652 | )* | 76,925,056 | (153,828,596 | ) | |||||||||||||||||

| Cost of services | (57,046,350 | ) | (57,046,350 | ) | (44,241,900 | ) | (44,241,900 | ) | |||||||||||||||||||

| Gross profit | 111,163,250 | 92,192,233 | 129,338,821 | 100,487,990 | |||||||||||||||||||||||

| General and administrative expenses | (18,640,717 | )* | 896,395 | (17,744,322 | ) | (15,616,278 | )* | 612,961 | (15,003,317) | ||||||||||||||||||

| Net income from operations | 92,522,533 | 75,167,911 | 113,722,543 | 85,484,673 | |||||||||||||||||||||||

| Other income (expenses) | |||||||||||||||||||||||||||

| Government grant | 2,891,482 | 2,891,482 | 537,787 | 537,787 | |||||||||||||||||||||||

| Other income | 483,299 | 483,299 | 443,575 | 443,575 | |||||||||||||||||||||||

| Gain on extinguishment of debts | 4 | 132,000 | 132,000 | 270,586 | 270,586 | ||||||||||||||||||||||

| Interest expense | (4,270,322 | )* | 619 | (4,269,703 | ) | (761,299 | )* | 238 | (761,061 | ) | |||||||||||||||||

| Net income (expenses) | (763,541 | ) | (762,922 | ) | 490,649 | 490,887 | |||||||||||||||||||||

| Net income before income taxes | 91,758,992 | 74,404,989 | 114,213,192 | 85,975,560 | |||||||||||||||||||||||

| Provision for income taxes | 5 | - | - | - | - | ||||||||||||||||||||||

| Net income from continuing operations | 91,758,992 | 74,404,989 | 114,213,192 | 85,975,560 | |||||||||||||||||||||||

| Less: Net (income) loss attributable to non - controlling interest | (25,403,462 | ) | 1,599,424 | (23,804,038 | ) | (22,148,582 | ) | 2,456,648 | (19,691,934 | ) | |||||||||||||||||

| Net income from continuing operations attributable to Sino Agro Food, Inc. and subsidiaries | 66,355,530 | 50,600,951 | 92,064,610 | 66,283,626 | |||||||||||||||||||||||

| Discontinued operations | |||||||||||||||||||||||||||

| Net income from discontinued operations | 6 | - | 17,354,003 | 17,354,003 | - | 28,237,632 | 28,237,632 | ||||||||||||||||||||

| Net gain from disposal of subsidiaries, TRW and JFD | 6 | - | - | - | - | ||||||||||||||||||||||

| Less: Net (income) loss attributable to the non - controlling interest | 6 | - | (1,599,424 | ) | - | (2,456,648 | ) | ||||||||||||||||||||

| Net income of discontinued operations attributable to the Sino Agro Food, Inc. and subsidiaries | - | 15,754,579 | - | 25,780,984 | |||||||||||||||||||||||

| Net income attributable to the Sino Agro Food, Inc. and subsidiaries | $ | 66,355,530 | $ | 66,355,530 | $ | 92,064,610 | $ | 92,064,610 | |||||||||||||||||||

| Earnings per share attributable to Sino Agro Food, Inc. and subsidiaries common stockholders: | |||||||||||||||||||||||||||

| - from continuing operations | |||||||||||||||||||||||||||

* Net income of discontinued operation -sale of fishery division of $17,354,006 (2015) and $28,237,632 (2014 are reclassified from net income from continuing operations

33. RESTATEMENT OF CONSOLIDATED FINANCIAL STATEMENT (CONTINUED)

| (iii) | CONSOLIDATED STATEMENT OF CASH FLOWS |

SINO AGRO FOOD, INC.

CONSOLIDATED STATEMENT OF CASH FLOWS (EXTRACT)

FOR THE YEAR ENDED DECEMBER 31, 2016

| 2015 | Prior

year adjustment | 2015 | 2014 | Prior

year adjustment | 2014 | |||||||||||||||||||

| As reported | (Restated) | As reported | (Restated) | |||||||||||||||||||||

| Cash flows from operating activities | ||||||||||||||||||||||||

| Net income for the year | $ | 91,758,992 | * | $ | (91,758,992 | ) | $ | 114,213,192 | * | $ | (114,213,192 | ) | ||||||||||||

| - Continuing operations | 74,404,989 | $ | 74,404,989 | 85,975,560 | $ | 85,975,560 | ||||||||||||||||||

| - Discontinued operations | 17,354,003 | 17,354,003 | 28,237,632 | 28,237,632 | ||||||||||||||||||||

| Adjustments to reconcile net income for the year to net cash from operations: | ||||||||||||||||||||||||

| Depreciation | 2,866,527 | 2,866,527 | 2,457,131 | 2,457,131 | ||||||||||||||||||||

| Amortization | 1,950,824 | 1,950,824 | 2,210,257 | 2,210,257 | ||||||||||||||||||||

| Gain on deemed disposal of subsidiaries | - | - | - | - | ||||||||||||||||||||

| Gain on extinguishment of debts | (132,000 | ) | (132,000 | ) | (270,586 | ) | (270,586 | ) | ||||||||||||||||

| Share based compensation costs | 363,181 | 363,181 | 659,686 | 659,686 | ||||||||||||||||||||

| Other amortized cost arising from convertible notes and others | 5,451,612 | 5,451,612 | 906,682 | 906,682 | ||||||||||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||||||||||

| Decrease increase in inventories | (16,880,714 | ) | (16,880,714 | ) | (37,819,790 | ) | (37,819,790 | ) | ||||||||||||||||

| Decrease (increase) in cost and estimated earnings in excess of billings on uncompleted contacts | (1,306,885 | ) | (1,306,885 | ) | 663,296 | 663,296 | ||||||||||||||||||

| (Increase) decrease in deposits and prepaid expenses | 4,651,244 | 4,651,244 | (23,320,658 | ) | (23,320,658 | ) | ||||||||||||||||||

| (Decrease) increase in due to a director | 3,005,115 | 3,005,115 | 3,488,291 | 3,488,291 | ||||||||||||||||||||

| (Decrease) increase in accounts payable and accrued expenses | (12,793,276 | ) | (12,793,276 | ) | 11,083,641 | 11,083,641 | ||||||||||||||||||

| Increase in other payables | 3,691,261 | 3,691,261 | 13,933,571 | 13,933,571 | ||||||||||||||||||||

| Decrease (increase) in accounts receivable | (31,171,347 | ) | (31,171,347 | ) | (22,445,129 | ) | (22,445,129 | ) | ||||||||||||||||

| Increase in tax payable | - | - | - | - | ||||||||||||||||||||

| (Decrease) increase in billings in excess of costs and estimated earnings on uncompleted contracts | 640,126 | 640,126 | 4,913,624 | 4,913,624 | ||||||||||||||||||||

| Increase in amount due from unconsolidated equity investee | - | - | - | - | ||||||||||||||||||||

| Decrease (increase) in other receivables | (7,475,327 | ) | (7,475,327 | ) | (48,522,489 | ) | (48,522,489 | ) | ||||||||||||||||

| Net cash provided by operating activities | $ | 44,619,333 | $ | 44,619,333 | $ | 22,150,719 | $ | 22,150,719 | ||||||||||||||||

Please reference page F-48 to F-50 for the revised disclosure.

Comment No. 7. On page 12 you state that the cattle grown by the company are primarily Simmental, Charolais, and Angus and in general, local farmers buy 12 to 15 month old cattle from the Company’s cattle agents, and the company commits to repurchasing the cattle between 21 months to 24 months old. Please tell us and revise your disclosure to describe the accounting for the sale of cattle and the respective repurchase obligations.

Response No. 7.

Generally, the Company commits to repurchasing the cattle between 21-month to 24-month old under mutual understanding without written contract and the amount involved was immaterial. The company accounted for the sale of cattle in accordance with ASC 605. Local farmers purchase 12 to 15-month cattle from the Company’s cattle agent at market price. The Company had no legal obligations to repurchase all 21-month to 24-month old cattle from local farmers at market price. However, the Company was likely to purchase those cattle at market price due to mutual understanding reached with the local farmers. There was no special accounting procedure for the above purchase.

Please reference page 12 for the revised disclosure.

Comment No. 8. Please explain how you determined this transaction was within the scope of ASC 205-20 and how you plan to account for the remaining investment in TRW (i.e., cost method or equity method investment). In your response, please confirm the names of any third parties obtaining ownership of TRW and JFD, the ownership percentage held by the company in TRW and JFD prior to and subsequent to the disposal transaction, and the holdings in Note 2 are correct as of December 31, 2016 (we note there are two line items for JFD that report different ownership holdings). Also tell us if the discontinued operations presented in Note 6(a) are representative of TRW and/or JFD. We may have further comment upon reviewing your response.

Response No. 8. Due to the multiple issues raised in this comment, the Company has split up its responses in an effort to provide the Staff with a clear response.

8. A) Please explain how you determined this transaction was within the scope of ASC 205-20… Also tell us if the discontinued operations presented in Note 6(a) are representative of TRW and/or JFD. We may have further comment upon reviewing your response.

Since the Company’s interests in subsidiaries – TRW and JFD decreased from 75% to 23.89% through the issuance of 99,990,000 TRW common shares at fair value of $3.41 per, the above transactions constituted a deemed disposal of subsidiaries – TRW and JFD. Original fishery division –sale of goods operated by TRW and JFD was discontinued on October 5, 2016, and such transaction was within the scope of ASC 205-20.

B) How you plan to account for the remaining investment in TRW (i.e., cost method or equity method investment).

The Company used equity method investment to account for investments in TRW and JFD (the “TRW group”). The company planned to review quarterly financial reports of the TRW group and share its quarterly results starting from January 2017 as well as its disclosed summarized audited information on the assets, liabilities and results of the TRW group operations in its 2017 10K financial report. The Company will review the consolidated balance sheet of the TRW group, and shall account for impairment loss, if necessary.

C) In your response, please confirm the names of any third parties obtaining ownership of TRW and JFD, the ownership percentage held by the company in TRW and JFD prior to and subsequent to the disposal transaction.

New introduced investors were Mr. Chen Guang Xian, Mr. Hong Eng Seng, ZhongShan City Longze Aquaculture Co Ltd, Zhongshan A Power Agriculture Development Co, Ltd representing the remaining 76.11% ownership in the TRW group.

D) the holdings in Note 2 are correct as of December 31, 2016 (we note there are two line items for JFD that report different ownership holdings).

Note 2 (extract) was amended as below

REPORTING ENTITIES

| Name of subsidiaries | Percentage of interest | ||||

Tri-way Industries Limited (“TRW”) |

(2015: 75%) (reclassified as unconsolidated equity investee on October 5, 2016) |

||||

| Jiang Men City A Power Fishery Development Co., Limited (“JFD”) | (2015: 75%) (reclassified as unconsolidated equity investee on October 5, 2016) |

||||

Name of unconsolidated equity investees |

Percentage of interest | ||||

| Tri-way Industries Limited (“TRW”) | 23.89% (2015: 75%) held directly (reclassified as unconsolidated equity investee on October 5, 2016) | ||||

| Jiang Men City A Power Fishery Development Co., Limited (“JFD”) |

100% (2015: 75%) held indirectly (reclassified as unconsolidated equity investee on October 5, 2016) |

Please reference page F-10 for the revised disclosure.

Comment No. 9. In light of the materiality of the gain that was recognized with respect to the discontinued operations, please tell us how the fair value of TRW and JFD of $81.4 million was determined and explain why it is disclosed as the fair value of the interest retained rather than the interest sold. Please also explain why the net assets in the gain calculation are those of only TRW and not also of JFD. Also tell us how you determined it was appropriate to recognize the gain in 2016 when it appears from your disclosure that the transaction is not expected to settle until on or before April 30, 2017. ASC 205-20-45-3C indicates a gain or loss recognized on a disposal of a discontinued operation shall be calculated in accordance with the guidance in other Subtopics.

Response No. 9. Due to the multiple issues raised in this comment, the Company has split up its responses in an effort to provide the Staff with a clear response.

9. A) In light of the materiality of the gain that was recognized with respect to the discontinued operations, please tell us how the fair value of TRW and JFD of $81.4 million was determined and explain why it is disclosed as the fair value of the interest retained rather than the interest sold.

| Fair value of net assets of TRW and JFD | ||||

| after acquiring new aqua farms and license | $ | 63,538,480 | ||

| Add: Prepayments to aqua farm’s owners | $ | 54,333,550 | ||

| Less: Negotiated rebate to farm owners | $ | -36,504,033 | ||

| Fair value of interest retained in TRW and JFD | $ | 81,367,997 | ||

The Company has decided it is in the best interest of its shareholders to retain (rather than sell) the $81.4 million interest it holds in TRW, maintaining its holdings in TRW on an investment in associate basis, its decision primarily based on TRW’s growth and development prospects over the next 5-years.

B) Please also explain why the net assets in the gain calculation are those of only TRW and not also of JFD.

As of August 15, 2017, JFD (Aquafarm 1), became 100% owned by TRW. As of October 5, 2016, Aquafarms 2 through 5 had been acquired by TRW, adding to its holdings in JFD (Aquafarm 1), and from that point forward, all assets of Aquafarms 1 through 5 are attributable to and owned by TRW.

C) Also tell us how you determined it was appropriate to recognize the gain in 2016 when it appears from your disclosure that the transaction is not expected to settle until on or before April 30, 2017. ASC 205-20-45-3C indicates a gain or loss recognized on a disposal of a discontinued operation shall be calculated in accordance with the guidance in other Subtopics.

According to ASC 205-20-45-3C, a gain or loss recognized on the disposal (or loss recognized on classification as held for sale) of a discontinued operation shall be calculated in accordance with the guidance in other Subtopics. For example, if a discontinued operation is within the scope of Topic 360 on property, plant, and equipment, an entity shall follow the guidance in paragraphs 360-10-35-37 through 35-45 and 360-10-40-5 for calculating the gain or loss recognized on the disposal (or loss on classification as held for sale) of the discontinued operation.

The disposal of the Company’s assets and related agreements between TRW and itself, as well as between TRW and the owners of Aquafarms 2 through 5 had been put into effect as of October 5, 2016. The settlement of shares (i.e., legal recording), on the other hand, required additional documentation to be submitted, and therefore required additional time beyond the effective date of the carve-out /disposal (October 5, 2016), with the share settlement haven taken effect on May 10, 2017.

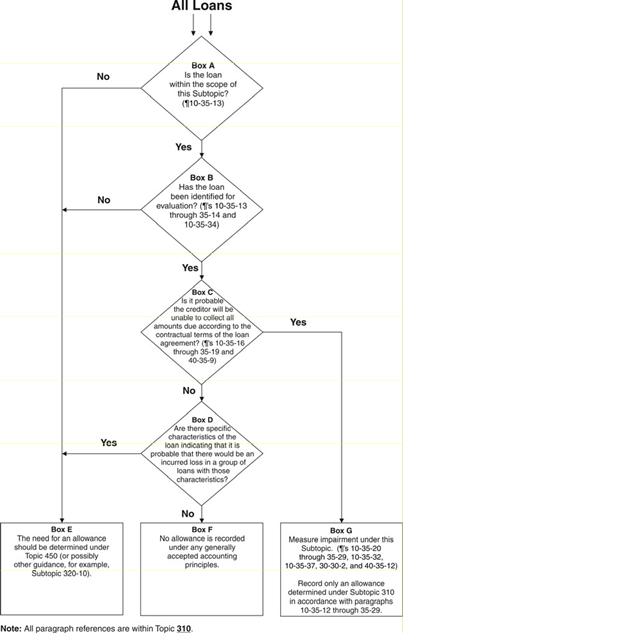

Comment No. 10 We note that there have been no bad debts during the three years presented in the financial statements and that you have determined that all amounts are collectible. We further note your analysis of collection on page 71. Please provide us with a more detailed analysis pursuant to ASC 310-10-35 as to why you did not record a bad debt reserve for receivables in the over 91 day categories for (1) Consulting and Service totaling CA, (2) Sales of Live Fish, eels and prawns (from Farms CA), and (3) Sales of Beef (QZH). In your response, please tell us the amounts of historical write-offs, if any, for the past three years. We may have further comment upon reviewing your response.

Response No. 10.

The company reviewed accounts receivable according to the below procedure.

Accounts receivable comprised few customers. They are old customers and settled our debts punctually according to our credit terms as shown below in Ref. A. There were not any bad record for settlement and no historical write-offs for the past three years. According to our records, all accounts receivable over the 91-day category were fully settled in Q1 and Q2 2017.

Reference A—our credit terms

| ¨ | For CA, Consulting and Services are within 120 days under normal conditions and for bigger and continuing projects are up to 365 days. |

| ¨ | For CA, Sale of Goods are within 90-days for normal wholesalers and distributors and for some large supermarket chain stores can be extended up to 120-days. |

| ¨ | For QZH, sales of beef are within 90-days and for some large supermarket chain stores can be extended up to 120-days. |

Comment No. 11 In light of the fluctuations in the trading price of your common stock, for the issuance of stock for services, these transactions should be valued at the fair value of the services rendered if more reliably measurable than the market value of your common stock pursuant to ASC 505-50-30. Please tell us what the amount of the fair value of the services rendered would be if a more reliably measure was used. We may have further comment upon reviewing your response.

Response No. 11.

Yes, we valued services rendered at fair value in a dollar amount and calculated the number of shares to be issued in consideration of the market value of SIAF on the date of issuance.

During the year ended December 31, 2016

The fair value of service for employee compensation was $7,169,823 and its calculated number of shares issued at the market price of SIAF on the date of issuance at $5.98 per share (i.e.: $7,169,823/$5.98 per share = 1,198,967 shares).

The fair value of service for service compensation was $794,066 and its calculated number of shares issued at the market price of SIAF on date of issuance at $5.98 per share (i.e.: $794,066/$5.98 per share = 132,787 shares)

Per 10K:

| a) | There were 337,688, 174,874 and 60,301 shares paid to Solomon Lee, Tan Paoy Tan and Chen Bor Hann, respectively, on May 10, 2016 for services rendered (for 6 years that were accrued but not issued) during year 2007 to 2012 calculated at $5.97 / share. |

On May 10, 2016, the Company issued directors and employees a total of 1,199,068 shares of common stock valued at fair value of $5.98 per share for services rendered to the Company. The fair values of the common stock issued were determined by using the trading price of the Company’s common stock on the date of issuance of $5.98 per share. On the same date, the Company issued professionals a total of 132,787 shares of common stock valued at fair value of $5.98 per share for services rendered to the Company. The fair values of the common stock issued were determined by using the trading price of the Company’s common stock on the date of issuance of $5.98 per share.

Will be amended to read:

| (i) | On May 10, 2016, the Company issued directors and employees a total of 1,199,068 shares of common stock at fair value for services rendered of $7,169,823, among which there were 337,688, 174,874 and 60,301 shares paid to Solomon Lee, Tan Paoy Tan and Chen Bor Hann, respectively, for services rendered (6 years accrued, but not issued) during FY2007 through FY2012 in the amount of $2,019,374, 1,045,746 and $360,599, respectively. |

| (ii) | On the same date, the Company issued professionals a total of 132,787 shares of common stock at fair value for services rendered, totaling $794,066. |

Please reference page 91 and F-46 for the revised disclosure.

Per 10K:

| b) | On December 15, 2014, the Company issued professionals a total of 80,739 shares of common stock valued at fair value of range from $9.90 per share for services rendered to the Company. The fair values of the common stock issued were determined by using the trading price of the Company’s common stock on the date of issuance of $9.90 per share. |

Will be amended to read:

On December 15, 2014, the Company issued to professionals a total of 80,739 shares of common stock at fair value for services rendered, totaling $799,312.

Please reference page F-46 for the revised disclosure.

Per 10K:

c). On May 6, 2015, the Company issued directors and employees a total of 47,787 shares of common stock valued at fair value of $15.20 per share for services rendered to the Company. The fair values of the common stock issued were determined by using the trading price of the Company’s common stock on the date of issuance of $15.20 per share.

Will be amended to read:

On May 6, 2015, the Company issued to directors and employees a total of 47,787 shares of common stock at fair value for services rendered, totaling $726,360.

Please reference page F-46 for the revised disclosure.

The Company hereby acknowledges that:

| • | Staff comments or changes to disclosure in response to Staff comments in the filings reviewed by the Staff do not foreclose the Commission from taking any action with respect to the filing; |

| • | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; and |

| • | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Should you have any questions regarding the foregoing, please do not hesitate to contact the undersigned at (202) 556-4466 or our counsel Marc Ross or Henry Nisser at (212) 930-9700.

| Very truly yours, | |

| /s/ Daniel Ritchey | |

| Daniel Ritchey | |

| Chief Financial Officer |