UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number:

ATOSSA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| | |

| | (Zip Code) |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: (

Former name, former address and former fiscal year, if changed since last report: N/A

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| | | The |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “a smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The number of shares of the registrant’s common stock, $0.18 par value per share, outstanding as of November 8, 2023, was

ATOSSA THERAPEUTICS, INC.

QUARTERLY REPORT

FORM 10-Q

INDEX

| ITEM 1. |

||

| Condensed Consolidated Balance Sheets as of September 30, 2023 and December 31, 2022 |

||

| ITEM 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| ITEM 3 |

||

| ITEM 4. |

||

| ITEM 1. |

||

| ITEM 1A. |

||

| ITEM 2. |

||

| ITEM 3. |

||

| ITEM 4. |

||

| ITEM 5. |

||

| ITEM 6. |

||

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except for par value)

(Unaudited)

| As of September 30, | As of December 31, | |||||||

| 2023 | 2022 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Restricted cash | ||||||||

| Prepaid expenses | ||||||||

| Research and development rebate receivable | ||||||||

| Other current assets | ||||||||

| Total current assets | ||||||||

| Investment in equity securities | ||||||||

| Other assets | ||||||||

| Total Assets | $ | $ | ||||||

| Liabilities and Stockholders' Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses | ||||||||

| Payroll liabilities | ||||||||

| Other current liabilities | ||||||||

| Total current liabilities | ||||||||

| Total Liabilities | ||||||||

| Commitments and contingencies (Note 15) | ||||||||

| Stockholders' equity | ||||||||

| Series B convertible preferred stock - $ par value; shares authorized; share issued and outstanding as of September 30, 2023 and December 31, 2022 | ||||||||

| Additional paid-in capital - Series B convertible preferred stock | ||||||||

| Common stock - $ par value; shares authorized; and shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | ||||||||

| Additional paid-in capital - common stock | ||||||||

| Treasury stock, at cost; and shares of common stock at September 30, 2023 and December 31, 2022, respectively | ( | ) | ||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total Stockholders' Equity | ||||||||

| Total Liabilities and Stockholders' Equity | $ | $ | ||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(amounts in thousands, except for per share amounts)

(Unaudited)

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Operating expenses | ||||||||||||||||

| Research and development | $ | $ | $ | $ | ||||||||||||

| General and administrative | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Operating loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Impairment charge on investment in equity securities | ( | ) | ||||||||||||||

| Interest income | ||||||||||||||||

| Other expense, net | ( | ) | ( | ) | ( | ) | ||||||||||

| Loss before income taxes | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income taxes | ||||||||||||||||

| Net loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||||||||||

| Comprehensive loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Loss per share of common stock - basic and diluted | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Weighted average shares outstanding - basic and diluted | ||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(amounts in thousands)

(Unaudited)

| Series B Convertible Preferred Stock | Common Stock | Treasury Stock | ||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Additional Paid-in Capital | Shares | Amount | Additional Paid-in Capital | Amount | Accumulated Deficit | Accumulated Other Comprehensive Loss | Total Stockholders' Equity | |||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||

| Compensation cost for stock options granted | - | - | ||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||

| Compensation cost for stock options granted | - | - | ||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||

| Compensation cost for stock options granted | - | - | ||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at September 30, 2022 | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||||||||||

| Series B Convertible Preferred Stock | Common Stock | Treasury Stock | ||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Additional Paid-in Capital | Shares | Amount | Additional Paid-in Capital | Amount | Accumulated Deficit | Accumulated Other Comprehensive Loss | Total Stockholders' Equity | |||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||

| Compensation cost for stock options granted | - | - | ||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at March 31, 2023 | $ | $ | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||

| Common stock repurchased | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Compensation cost for stock options granted | - | - | ||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at June 30, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||

| Common stock repurchased | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Compensation cost for stock options granted | - | - | ||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at September 30, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in thousands)

(Unaudited)

| For the Nine Months Ended September 30, | ||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Compensation cost for stock options granted | ||||||||

| Impairment charge on investment in equity securities | ||||||||

| Depreciation and amortization | ||||||||

| Disposal of assets | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses | ( | ) | ||||||

| Research and development rebate receivable | ||||||||

| Other current assets | ||||||||

| Other assets | ( | ) | ||||||

| Accounts payable | ( | ) | ( | ) | ||||

| Accrued expenses | ( | ) | ||||||

| Payroll liabilities | ( | ) | ( | ) | ||||

| Other current liabilities | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Deposit on investment in equity securities | ( | ) | ||||||

| Purchase of furniture and equipment | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Common stock repurchased | ( | ) | ||||||

| Net cash used in financing activities | ( | ) | ||||||

| Effect of exchange rate change on cash | ( | ) | ||||||

| NET DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | ( | ) | ( | ) | ||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING BALANCE | ||||||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, ENDING BALANCE | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES | ||||||||

| Reconciliation of cash, cash equivalents and restricted cash | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Restricted cash | ||||||||

| Total cash, cash equivalents and restricted cash shown in the Condensed Consolidated Balance Sheets | $ | $ | ||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(amounts in thousands, except for per share amounts)

NOTE 1: NATURE OF OPERATIONS

Atossa Therapeutics, Inc. (the Company) was incorporated on April 30, 2009, in the State of Delaware to develop and market medical devices, laboratory tests and therapeutics to address breast health conditions. The Company is focused on developing proprietary innovative medicines in areas of significant unmet medical need in oncology, with a current focus on breast cancer and other breast conditions. The Company's fiscal year ends on December 31.

NOTE 2: LIQUIDITY AND CAPITAL RESOURCES

The Company has incurred net losses and negative operating cash flows since inception. For the nine months ended September 30, 2023, the Company recorded a net loss of $

NOTE 3: SUMMARY OF ACCOUNTING POLICIES

Basis of Presentation

The accompanying Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States (GAAP) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. They do not include all information and notes required by GAAP for complete financial statements. However, except as disclosed herein, there has been no material changes in the information disclosed in the Notes to Consolidated Financial Statements included in the Annual Report on Form 10-K of the Company for the year ended December 31, 2022. The year-end Condensed Consolidated Balance Sheet presented in this report was derived from audited consolidated financial statements but does not include all disclosures required by GAAP. All amounts in the Condensed Consolidated Financial Statements and the notes thereto have been presented in thousands, except for par value and other per share data.

In the opinion of management, all adjustments (including normal recurring accruals) considered necessary for a fair presentation have been included and have been prepared on the same basis as the annual consolidated financial statements. Operating results for the nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023.

Reclassification

Interest income has been reclassified from other expense, net to conform to the current year presentation.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

Segments

The Company operates as a segment. Operating segments are identified as the components of an enterprise for which separate discrete financial information is available for evaluation by the chief operating decision maker in making decisions regarding resource allocation and in assessing performance. To date, the Company's chief operating decision maker has made such decisions and assessed performance at the Company-level as a single segment.

Cash and Cash Equivalents

Cash and cash equivalents include unrestricted cash and all highly liquid instruments with maturities of three months or less at the date of purchase.

Investments in Equity Securities

The Company currently has one investment in non-marketable securities. This investment does not have a readily determinable fair value, so the Company has elected to measure the investment at cost in accordance with Accounting Standards Codification (ASC) 321 – Equity. At each reporting period, the Company performs an assessment to determine if it still qualifies for this measurement alternative. The Company considers qualitative impairment factors in determining if there are any signs of impairment.

Once a decline in fair value is determined, an impairment charge is recorded to Impairment charge on investment in equity securities in the Condensed Consolidated Statement of Operations and Comprehensive Loss and a new basis in the investment is established. If market, industry, and/or investee conditions deteriorate, the Company may incur future impairments. Refer to Note 4.

Other Assets

Other assets consist primarily of prepaid clinical and non-clinical costs which are long term in nature.

Fair Value Measurements

The Company records financial assets and liabilities measured on a recurring and non-recurring basis, as well as all non-financial assets and liabilities subject to fair value measurement at the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants.

The accounting guidance establishes a hierarchy for inputs used in measuring fair value that minimizes the use of unobservable inputs by requiring the use of observable market data when available. Observable inputs are inputs that market participants would use in pricing the asset or liability based on active market data. Unobservable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances.

The fair value hierarchy is broken down into the three input levels summarized below:

● Level 1 —Valuations are based on quoted prices in active markets for identical assets or liabilities and readily accessible by us at the reporting date.

● Level 2 —Valuations based on inputs other than the quoted prices in active markets that are observable either directly or indirectly in active markets.

● Level 3 —Valuations based on unobservable inputs in which there are little or no market data, which require the Company to develop its own assumptions.

The carrying amounts reflected in the accompanying Condensed Consolidated Balance Sheets for cash and cash equivalents, restricted cash, prepaid expenses, research and development rebate receivable, other current assets, accounts payable, accrued expenses, payroll liabilities and other current liabilities approximate their fair values due to their short-term nature. Refer to Note 10.

Research and Development

Research and development (R&D) costs are generally expensed as incurred. R&D expenses include, for example, manufacturing expenses for the Company's drugs under development, expenses associated with preclinical studies, clinical trials and associated salaries, bonuses, stock-based compensation and benefits. The Company has entered into various research and development contracts with research institutions, clinical research organizations (CROs), clinical manufacturing organizations (CMOs) and other companies. Payments for these activities are based on the terms of the individual agreements, which may differ from the timing of costs incurred, and payments made in advance of performance are reflected in the Condensed Consolidated Balance Sheets as prepaid expenses. The Company records accruals for estimated costs incurred for ongoing research and development activities as reflected in the Condensed Consolidated Balance Sheets as accrued expenses. When evaluating the adequacy of the accrued expenses, the Company analyzes progress of the services, including the phase or completion of events, invoices received and contracted costs. Significant judgments and estimates may be used in determining the prepaid expense or accrued expense balances at the end of any reporting period. Actual results could differ from the Company’s estimates.

R&D expenses also include an allocation of the CEO's salary and related benefits, including bonus and non-cash stock-based compensation expense, based on an estimate of his total hours spent on R&D activities. The Company's CEO is involved in the development of the Company's drug candidates and oversight of the related clinical trial activity and also acts as the Company's chief medical officer.

Stock-based Payments

The Company measures and recognizes compensation expense for all stock-based payment awards made to employees, officers, non-employee directors, and other key persons providing services to the Company, currently limited to stock options. Stock compensation expense is based on the estimated grant date fair value and is recognized as an expense over the requisite service period. The Company has made a policy election to recognize forfeitures when they occur.

The fair value of each stock option grant is estimated using the Black-Scholes option-pricing model, which requires assumptions regarding the expected volatility of the stock options, the expected life of the options, an expectation regarding future dividends on the Company’s common stock, and an estimate of the appropriate risk-free interest rate. The Company’s expected common stock price volatility assumption is based upon the historical volatility of its stock price. The Company has elected the simplified method for the expected life assumption for stock option grants, which averages the contractual term of the options of

Foreign Currency Translation and Transactions

The majority of the Company's operations occur in entities that have the U.S. dollar as their functional currency. Subsidiary assets and liabilities translated into U.S. dollars at rates of exchange in effect at the end of the period. Expense amounts are translated using the average exchange rates for the period.

NOTE 4: INVESTMENT IN EQUITY SECURITIES

On December 23, 2022, the Company completed its investment in Dynamic Cell Therapies, Inc. (DCT) a U.S. private company that is in the pre-clinical stage of developing novel Chimeric Antigen Receptor (CAR) T-cell therapies based on technology licensed from a leading U.S. cancer treatment and research institution. In total, the Company paid $

The Company considered qualitative impairment factors in determining if there were any signs of impairment of this investment on the balance sheet dates. Specifically, the Company considered the additional adverse changes in the general market condition of the industry in which DCT operates and continued concerns about the investee’s ability to continue as a going concern, due to negative cash flows from operations during the three and six months ended June 30, 2023. Based on these impairment indicators, the Company performed a quantitative fair value measurement as of June 30, 2023. The impairment of the Company's investment in equity securities required the estimation of fair value using unobservable inputs (a Level 3 fair value estimate). The Company used the dynamic options approach, which requires assumptions regarding the expected average volatility of comparable companies, the expected term of its investment, and an estimation of an appropriate risk-free interest rate over the term of its investment. The expected stock price volatility assumption is based upon the average historic volatility of comparable public clinical stage immunotherapy or CAR-T companies. The expected term of the Company's investment is

NOTE 5: RESTRICTED CASH

The Company's restricted cash balance of $

NOTE 6: PREPAID EXPENSES

Prepaid expenses consisted of the following:

| As of September 30, | As of December 31, | |||||||

| 2023 | 2022 | |||||||

| Prepaid research and development | $ | $ | ||||||

| Prepaid insurance | ||||||||

| Professional services | ||||||||

| Other | ||||||||

| Total prepaid expenses | $ | $ | ||||||

NOTE 7: RESEARCH AND DEVELOPMENT REBATE RECEIVABLE

On May 23, 2017, the Company formed a wholly owned subsidiary in Australia called Atossa Genetics AUS Pty Ltd. The purpose of this subsidiary is to perform R&D activities, including some of the Company's clinical trials. Australia offers an R&D cash rebate of $0.435 per dollar spent on qualified R&D activities incurred in the country. For entities with over 80% of revenue from passive sources, the rate increases to $0.485 per dollar. The Australian R&D tax incentive program is a self-assessment process, and as such, the Australian Government has the right to review the Company’s program and related expenditures for a period of four years. If such a review were to occur, and as a result of the review and failure of a related appeal, a qualified program and related expenditures could be disqualified, and the respective R&D rebates of $

During the three and nine months ended September 30, 2023, the Company incurred qualified R&D expenses in Australia of $

The Company records the R&D rebate credit in the period in which it incurs the associated R&D cost. The rebate reduced the Research and development expense line item in the Condensed Consolidated Statements of Operations and Comprehensive Loss by $

NOTE 8: ACCRUED EXPENSES

Accrued expenses consisted of the following:

| As of September 30, | As of December 31, | |||||||

| 2023 | 2022 | |||||||

| Research and development | $ | $ | ||||||

| Professional Services | ||||||||

| Total accrued liabilities | $ | $ | ||||||

NOTE 9: PAYROLL LIABILITIES

Payroll liabilities consisted of the following:

| As of September 30, | As of December 31, | |||||||

| 2023 | 2022 | |||||||

| Accrued bonuses | $ | $ | ||||||

| Accrued vacation | ||||||||

| Accrued payroll | ||||||||

| Total payroll liabilities | $ | $ | ||||||

NOTE 10: FAIR VALUE OF FINANCIAL INSTRUMENTS

The following tables present the Company’s fair value hierarchy for all of its financial assets and liabilities, by major security type, measured at fair value on a recurring basis:

| September 30, 2023 | Estimated Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||

| Assets: | ||||||||||||||||

| Money market account | $ | $ | $ | $ | ||||||||||||

| December 31, 2022 | Estimated Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||

| Assets: | ||||||||||||||||

| Money market account | $ | $ | $ | $ | ||||||||||||

There were no transfers into or out of Level 3 for the three and nine months ended September 30, 2023. The Company did have any financial liabilities subject to fair value measurements on a recurring basis as of September 30, 2023 and December 31, 2022.

NOTE 11: STOCKHOLDERS’ EQUITY

Common Stock

The Company is authorized to issue a total of

On May 19, 2014, the Company adopted a stockholder rights agreement, pursuant to which all stockholders of record on May 26, 2014 received a non-taxable distribution of

Share Repurchases

On June 27, 2023, the Board of Directors (the Board) authorized a program to repurchase common stock, par value $

Series Convertible Preferred Stock

The Company has designated

Series B Convertible Preferred Stock

Conversion. Each share of Series B convertible preferred stock is convertible at the Company's option at any time, or at the option of the holder at any time, into the number of shares of the Company's common stock determined by dividing the $

Fundamental Transactions. In the event the Company effects certain mergers, consolidations, sales of substantially all of its assets, tender or exchange offers, reclassifications or share exchanges in which its common stock is effectively converted into or exchanged for other securities, cash or property, the Company consummates a business combination in which another person acquires

Dividends. Holders of Series B convertible preferred stock shall be entitled to receive dividends (on an as-if-converted-to-common-stock basis) in the same form as dividends actually paid on shares of the common stock when, as and if such dividends are paid on shares of common stock.

Voting Rights. Except as otherwise provided in the certificate of designation or as otherwise required by law, the Series B convertible preferred stock has no voting rights.

Liquidation Preference. Upon the Company's liquidation, dissolution or winding-up, whether voluntary or involuntary, holders of Series B convertible preferred stock will be entitled to receive out of the Company's assets, whether capital or surplus, the same amount that a holder of common stock would receive if the Series B convertible preferred stock were fully converted (disregarding for such purpose any conversion limitations under the certificate of designation) to common stock, which amounts shall be paid pari passu with all holders of common stock.

Redemption Rights. The Company is not obligated to redeem or repurchase any shares of Series B convertible preferred stock. Shares of Series B convertible preferred stock are not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous provisions.

Conversion of Series B Convertible Preferred Stock

During the three and nine months ended September 30, 2023 and 2022, there were no conversions of Series B convertible preferred stock.

2021 and 2020 Warrants

The terms and conditions of the warrants are as follows:

Exercisability. Each warrant is exercisable at any time and will expire between and

Cashless Exercise. If at any time there is no effective registration statement registering, or the prospectus contained therein is not available for issuance of, the shares issuable upon exercise of the warrant, the holder may exercise the warrant on a cashless basis. When exercised on a cashless basis, a portion of the warrant is cancelled in payment of the purchase price payable in respect of the number of shares of the Company's common stock purchasable upon such exercise.

Exercise Price. Each warrant represents the right to purchase share of common stock. In addition, the exercise price per share is subject to adjustment for stock dividends, distributions, subdivisions, combinations or reclassifications, and for certain dilutive issuances. Subject to limited exceptions, a holder of warrants will not have the right to exercise any portion of the warrant to the extent that, after giving effect to the exercise, the holder, together with its affiliates, and any other person acting as a group together with the holder or any of its affiliates, would beneficially own in excess of

Transferability. Subject to applicable laws and restrictions, a holder may transfer a warrant upon surrender of the warrant to us with a completed and signed assignment in the form attached to the warrant. The transferring holder will be responsible for any tax liability that may arise as a result of the transfer.

Exchange Listing. The Company does not intend to apply to list the warrants on any securities exchange or recognized trading system.

Rights as Stockholder. Except as set forth in the warrant, the holder of a warrant, solely in such holder’s capacity as a holder of a warrant, will not be entitled to vote, to receive dividends or to any of the other rights of the Company's stockholders.

Warrants Outstanding

As of September 30, 2023, warrants to purchase

| Outstanding Warrants to Purchase Shares | Exercise Price Per Share | Expiration Date | |||||||

| December 2020 warrants | $ | December 11, 2024-June 21, 2025 | |||||||

| January 2021 warrants | $ | July 8, 2025 | |||||||

| March 2021 warrants | $ | September 22, 2025 | |||||||

Warrant Activity

There were warrant exercises during the three and nine months ended September 30, 2023 and 2022.

NOTE 12: NET LOSS PER SHARE

Basic net loss per share of common stock is computed by dividing net loss attributable to common stockholders by the weighted average number of shares of common stock outstanding. In addition, in computing the dilutive effect of convertible securities, the numerator is adjusted to add back any convertible preferred dividends. Diluted net loss per share of common stock is computed by dividing net loss attributable to common stockholders by the weighted average number of shares of common stock that would have been outstanding during the period assuming the issuance of shares of common stock for all potential dilutive shares of common stock outstanding. Potential shares of common stock consist of potential future exercises of outstanding stock options and common stock warrants. Because the inclusion of potential shares of common stock would be anti-dilutive for all periods presented, they have been excluded from the calculation.

The Company’s common stock warrants and preferred stock contractually entitle the holders of such securities to participate in dividends but do not contractually require the holders of such securities to participate in losses of the Company. Accordingly, in periods in which the Company reports a net loss, such losses are not allocated to such participating securities. In periods in which the Company reports a net loss attributable to common stockholders, diluted net loss per share attributable to common stockholders is the same as basic net loss per share attributable to common stockholders, since dilutive shares of common stock are not assumed to have been issued if their effect is anti-dilutive. The Company reported a net loss attributable to common stockholders for the three and nine months ended September 30, 2023 and 2022.

The following table sets forth the weighted average number of common share equivalents excluded from the calculation of net loss per diluted share because including them would be anti-dilutive:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Options to purchase common stock | ||||||||||||||||

| Series B convertible preferred stock | ||||||||||||||||

| Warrants to purchase common stock | ||||||||||||||||

NOTE 13: INCOME TAXES

Deferred income tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial reporting and tax bases of assets and liabilities and are measured using enacted tax rates in effect for the year in which those temporary differences are expected to be recovered or settled. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized.

As a result of the Company’s cumulative losses, management has concluded that a full valuation allowance against the Company’s net deferred tax assets is appropriate.

NOTE 14: CONCENTRATION OF CREDIT RISK

Financial instruments that potentially subject the Company to a concentration of credit risk consist primarily of deposits of cash and cash equivalents including those deposited in money market deposit accounts. Accounts at each institution that contain specified types of deposits are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250. As of September 30, 2023 and December 31, 2022, the Company had deposits of $

NOTE 15: COMMITMENTS AND CONTINGENCIES

Lease Commitments

The Company evaluates all contractual agreements at inception to determine if they contain a lease. Lease liabilities are measured at the present value of lease payments not yet paid, using a discounted cash flow model that requires the use of a discount rate, or incremental borrowing rate. Leases with a term of 12 months or less are considered short-term operating leases and no asset or liability is recognized.

The Company's operating lease consists of an office lease. On November 22, 2022, the Company entered into an operating lease for office space for monthly rent of $

The Company had lease expense under its office lease during the three and nine months ended September 30, 2023 of $

Litigation and Contingencies

The Company is party to various legal proceedings from time to time. On August 18, 2023, Intas Pharmaceuticals LTD. (the Petitioner) filed a Petition for Post Grant Review (PGR) with the U.S. Patent and Trademark Office (the PGR Petition), seeking to invalidate one of the Company's issued patents (U.S. Patent No. 11,572,334) titled “Methods for Making and Using Endoxifen” (the Patent) on the grounds of anticipation and obviousness. The Company intends to contest the Petition and believes that the Patent was properly granted and is valid and enforceable. However, there can be no assurance that the Company will prevail in contesting the Petition. The PGR proceedings, as of the date of this filing, the Company does not believe that there are any other pending legal proceedings or other loss contingencies that will, individually or in aggregate, have a material adverse effect on its financial position, results of operations or cash flows.

Contractual Obligations

Contractual obligations represent the Company's future cash commitments and liabilities under agreements with third party clinical trial service providers. Apart from contracts with a third party clinical trial service provider, such agreements are cancellable upon written notice by the Company. The non-cancellable contracts expire upon completion of the study and release of the final report, or the contracts may be terminated by the clinical trial service provider, by the FDA or another governmental agency. As of September 30, 2023, the Company's estimated non-cancellable commitment was $

NOTE 16: STOCK-BASED COMPENSATION

On March 24, 2020, the Board approved the adoption of the 2020 Stock Incentive Plan (the 2020 Plan) to provide for the grant of equity-based awards to employees, officers, non-employee directors and other key persons providing services to the Company. No awards may be granted under the 2020 Plan after the date that is 10 years from the date of stockholder approval. An aggregate of

On September 28, 2010, the Board approved the adoption of the 2010 Stock Option and Incentive Plan (the 2010 Plan) to provide for the grant of equity-based awards to employees, officers, non-employee directors and other key persons providing services to the Company. Awards of incentive stock options could be granted under the 2010 Plan until September 2020. Awards may no longer be granted under this plan.

The Company did grant options to purchase shares of common stock during the three months ended September 30, 2023. The Company granted

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| General and administrative | $ | $ | $ | $ | ||||||||||||

| Research and development | ||||||||||||||||

| Total stock compensation expense | $ | $ | $ | $ | ||||||||||||

In accordance with the May 26, 2023 severance agreement with the Company's former General Counsel and Chief Financial Officer (CFO), percent of the shares of common stock underlying the CFO's then unvested options accelerated upon his termination. For the nine months ended September 30, 2023, the Company recorded $

Options issued and outstanding as of September 30, 2023 and related activities during the nine months ended September 30, 2023 were as follows:

| Number of Underlying Shares | Weighted-Average Exercise Price Per Share | Weighted-Average Contractual Life Remaining in Years | Aggregate Intrinsic Value | |||||||||||||

| Outstanding as of January 1, 2023 | $ | |||||||||||||||

| Granted | $ | $ | ||||||||||||||

| Exercised | ||||||||||||||||

| Forfeited | ( | ) | $ | |||||||||||||

| Expired | ( | ) | $ | |||||||||||||

| Outstanding as of September 30, 2023 | $ | $ | ||||||||||||||

| Exercisable as of September 30, 2023 | $ | $ | 24 | |||||||||||||

| Vested and expected to vest | $ | $ | ||||||||||||||

On September 30, 2023, there were

NOTE 17: DEFINED CONTRIBUTION PLAN

The Company has a defined contribution plan to which employees of the Company may defer contributions for income tax purposes. Participants are eligible to receive employer matching contributions up to

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (dollar amounts in thousands, except per share amounts)

The following discussion of our financial condition and results of operations should be read in conjunction with the Condensed Consolidated Financial Statements and the related notes included elsewhere in this report. This discussion contains forward-looking statements, which are based on assumptions about the future of our business. Actual results, outcomes and the timing of results or outcomes could differ materially from those contained in the forward-looking statements. Please read “Forward-Looking Statements” included below for additional information regarding forward-looking statements.

Forward-Looking Statements

This report contains, in addition to historical information, certain information, assumptions and discussions that may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). We have made these statements in reliance on the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are subject to certain risks and uncertainties which could cause actual results, outcomes and the timing of results or outcomes to differ materially from those projected or anticipated. Although we believe our assumptions underlying our forward-looking statements are reasonable as of the date of this report, we cannot assure you that the forward-looking statements set out in this report will prove to be accurate. We may identify these forward-looking statements by the use of forward-looking words such as “expect,” “potential,” “continue,” “may,” “will,” “should,” “could,” “would,” “seek,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “future,” or the negative versions of these words or other comparable words. All statements other than statements of historical fact, including statements regarding guidance, industry prospects, or future results of operations or financial position made in this report are forward-looking. Forward-looking statements contained in this report include, but are not limited to, statements about:

| ● |

the impact of inflation, rising interest rates, general economic slowdown or a recession, the prospect of a shutdown of the U.S. federal government, foreign exchange rate volatility, financial institution instability, changes in monetary policy and increasing geopolitical instability, including the conflict in Ukraine, the conflict in Israel and surrounding areas and rising tensions between China and Taiwan, on our business, our ability to access capital markets, our operating costs and our supply chain; |

|

|

|

||

| ● |

whether we can obtain approval from the U.S. Food and Drug Administration (FDA), and foreign regulatory bodies, to continue our clinical trials, including our planned (Z)-endoxifen trials, and to sell, market and distribute our therapeutics under development; |

|

|

|

||

| ● |

our ability to identify and partner with organizations to commercialize any of our products once they are approved for marketing; |

|

|

|

||

| ● |

our ability to successfully initiate and complete clinical trials of our products under development, including our proprietary (Z)-endoxifen (an active metabolite of Tamoxifen); |

|

|

|

||

| ● |

the success, costs and timing of our development activities, such as clinical trials, including whether our studies using our (Z)-endoxifen therapies will enroll a sufficient number of subjects in a timely fashion or be completed in a timely fashion or at all; |

|

|

|

||

| ● | whether we will successfully complete our clinical trial of oral (Z)-endoxifen in women with mammographic breast density and our trials of (Z)-endoxifen in women with breast cancer, and whether the studies will meet their objectives; |

|

|

|

||

| ● |

our ability to contract with third-party suppliers, manufacturers and service providers, including clinical research organizations, and their ability to perform adequately; |

|

|

|

||

| ● |

our ability to successfully develop and commercialize new therapeutics currently in development, or new therapeutics that we might identify in the future, and within the time frames we currently expect; |

|

|

|

||

| ● |

our ability to successfully defend litigation and other similar complaints that may be brought in the future, in a timely manner and within the coverage, scope and limits of our insurance policies; |

|

|

|

||

| ● |

our ability to establish and maintain intellectual property rights covering our products; |

|

|

|

||

| ● |

our increased risk of theft or misappropriation of our intellectual property and other proprietary technology outside of the U.S.; |

|

|

|

||

| ● |

our expectations regarding, and our ability to satisfy, federal, state and foreign regulatory requirements; |

|

| ● | our ability to regain compliance with the continued listing requirements of the Nasdaq Capital Market (Nasdaq); | |

|

|

||

| ● |

the accuracy of our estimates of the size and characteristics of the markets that our products and services may address; |

|

|

|

||

| ● |

whether final study results will vary from preliminary study results that we may announce; |

|

|

|

||

| ● |

our expectations as to future financial performance, expense levels and capital sources; |

|

|

|

||

| ● |

our ability to attract and retain key personnel; |

|

| ● |

our ability to execute our share repurchase program as planned; and | |

|

|

||

| ● |

our ability to raise capital. |

These and other forward-looking statements made in this report are presented as of the date of the filing of this report. We have discussed certain important factors, risks and uncertainties in the section titled “ITEM 1A. RISK FACTORS,” that we believe could cause our actual results, events or outcomes, or the timing of these results or outcomes, to differ materially from our anticipated results, events or outcomes, or the anticipated timing of these results or outcomes. Our forward-looking statements do not reflect the potential impact of any new information, future events or circumstances that may affect our business after the date of this report. Except as required by law, we do not intend to update any forward-looking statements after the date on which the statement is made, whether as a result of new information, future events or circumstances or otherwise.

Company Overview

We are a clinical-stage biopharmaceutical company developing proprietary innovative medicines in areas of significant unmet medical need in oncology, with a current focus on breast cancer and other breast conditions. Our lead drug candidate under development is oral (Z)-endoxifen, which we are developing in two settings: one to treat estrogen receptor positive (ER+), human epidermal growth factor receptor 2 (HER2-) breast cancer by reducing tumor cell activity prior to surgery and another one to reduce dense breast tissue in women. Reducing tumor cell activity in the neoadjuvant (prior to surgery) setting could make surgery more effective and reduce the risk of recurrence. There are currently limited neoadjuvant treatment options for ER+ breast cancer. More than an estimated 10 million women in the U.S. and millions more worldwide have high breast density, which reduces the ability of mammograms to detect cancer and increases the risk of breast cancer. There is no FDA-approved treatment for breast density.

We have been granted three U.S. patents and one international patent covering our proprietary (Z)-endoxifen, and we have numerous applications pending in the U.S. and in other major countries. We have patent protection covering our proprietary (Z)-endoxifen through November 17, 2038.

Our business strategy is to advance our programs through clinical studies, including potentially with partners, and opportunistically add programs in areas of high unmet medical need through acquisition, minority investment, collaboration or internal development.

Summary of Leading Programs

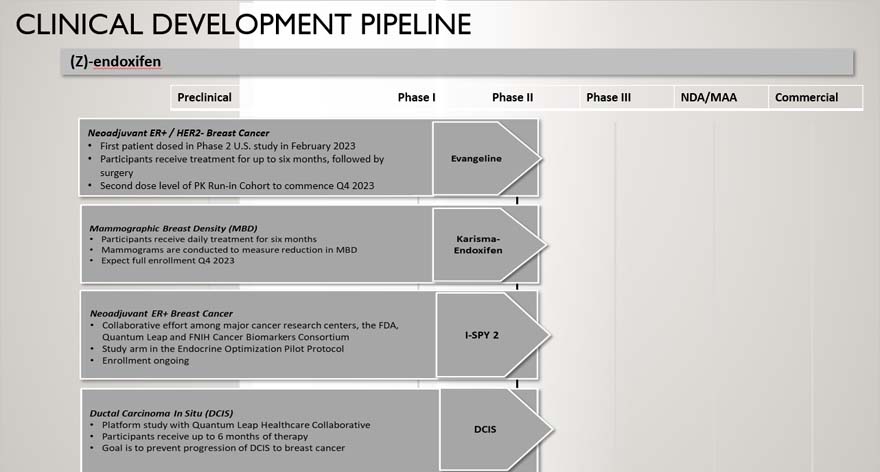

The following is a summary of the status of our major clinical development programs:

(Z)-endoxifen. (Z)-endoxifen is an active metabolite of tamoxifen, which is an FDA-approved drug to treat and prevent breast cancer in high-risk women. It is also referred to as a Selective Estrogen Receptor Modulator (SERM). We are developing a proprietary form of (Z)-endoxifen which is administered orally for the potential treatment of breast cancer and reduction of breast density. We have completed four Phase 1 clinical studies (including a study in men) and two Phase 2 clinical studies with our proprietary (Z)-endoxifen (including oral and topical formulations). We have also completed significant pre-clinical development and have developed clinical manufacturing capabilities through qualified third parties.

(Z)-endoxifen for Women with Breast Density. Mammographic breast density (MBD) is an emerging public health issue affecting over 10 million women in the U.S. alone. Dense breast tissue makes mammography less effective. When women with MBD are diagnosed with breast cancer, it is often later stage, which makes treatment outcomes suboptimal. Studies conducted by others have also shown that MBD increases the risk of developing breast cancer and that reducing MBD may reduce the incidence of breast cancer.

In December 2021, we commenced a Phase 2 study of our proprietary oral (Z)-endoxifen. The study, known as the Karisma-(Z)-endoxifen study, is a Phase 2, randomized, double-blind, placebo-controlled, dose-response study of our proprietary oral (Z)-endoxifen in healthy premenopausal women with measurable breast density. The primary objective of the study is to determine the dose-response relationship of daily (Z)-endoxifen on breast density reduction. Secondary endpoints will assess safety and tolerability. The study also includes an exploratory endpoint to assess durability of the breast density changes. The study is being conducted in Stockholm, Sweden and will include approximately 240 participants, at full enrollment, who will receive daily doses of oral (Z)-endoxifen or placebo for six months after they enroll.

Based on input from the FDA and Swedish Medical Products Agency, reduction in MBD may not be an approvable indication unless we can demonstrate that our (Z)-endoxifen also reduces the incidence of breast cancer. We may therefore conduct additional studies of (Z)-endoxifen to assess its correlation with the risk of breast cancer and/or reduction in the incidence of new breast cancers.

(Z)-endoxifen for Neoadjuvant Treatment of Breast Cancer. We are also developing (Z)-endoxifen to treat ER+ HER2- breast cancer in the neoadjuvant setting, which is the administration of a therapy before the main treatment, which is usually surgery. Although there are neoadjuvant treatments for breast cancers that are not ER+, there are few neoadjuvant treatments for ER+ breast cancer which comprises about 78% of all breast cancers.

In October 2022, we received authorization from the U.S. FDA for our Investigational New Drug (IND) application for oral (Z)-endoxifen. The study, “A Randomized Phase 2 Noninferiority Trial of (Z)-endoxifen and Exemestane + Goserelin as Neoadjuvant Treatment in Premenopausal Women with ER+/HER2- Breast Cancer,” also known as “EVANGELINE.” The study is an open-label, randomized, Phase 2 study designed to investigate (Z)-endoxifen for the neoadjuvant treatment of premenopausal women ages 18 and older with early stage (Grade 1 or 2) ER+/HER2- breast cancer. In July 2023, Health Canada issued a "No Objection Letter" following our Clinical Trial Application for our Phase 2 EVANGELINE study. This means we can begin to open sites and enroll patients in our Phase 2 EVANGELINE study throughout Canada.

The study is expected to enroll approximately 180 patients at up to 25 sites. EVANGELINE is a two-part study consisting of a PK Run-in Cohort and a Treatment Cohort. The primary objective of the Treatment Cohort is to evaluate the endocrine sensitive disease (ESD) rate, measured by Ki-67 (a proliferation marker prognostic for disease free survival), after four weeks of treatment with (Z)-endoxifen compared to treatment with current standard of care, exemestane + goserelin. Exemestane is an aromatase inhibitor designed to block the synthesis of estrogen and slow the growth of ER+ cancers. Goserelin is a medication given to block the ovaries from making estrogen, also called ovarian function suppression.

In June 2023, the first arm of the PK Run-in Cohort of the Phase 2 EVANGELINE study was fully enrolled. The first dose group consists of six patients, all of whom were treated with (Z)-endoxifen at 40 mg/day for four weeks. Eligible subjects could continue an optional treatment extension for up to a total of 6 months of treatment. The goal of the PK run-in cohort is to identify the appropriate dose of (Z)-endoxifen to deliver the steady state plasma concentrations required to effectively target PKC beta 1 inhibition and enhance (Z)-endoxifen’s antitumor mechanism of action. While the 40 mg/day dose was well tolerated and did not meet any pre-specified toxicity criteria after 4 weeks on drug, the dose did not achieve optimal plasma concentrations. Therefore, per protocol, the 80 mg/day dose level will commence. Identifying the optimal dose is an important milestone as it can allow us to initiate the Treatment Cohort and activate additional sites, which may increase the speed of recruitment for the EVANGELINE study.

In March 2023, a second Phase 2 trial investigating oral (Z)-endoxifen as a neoadjuvant treatment for women diagnosed with locally advanced ER+ breast cancer was initiated. This trial is a study arm in the ongoing I‑SPY 2 clinical trial. The I-SPY 2 TRIAL is a collaborative effort among academic investigators from major cancer research centers across the United States, Quantum Leap Healthcare Collaborative, the U.S. FDA, and the Foundation for the National Institutes of Health (FNIH) Cancer Biomarkers Consortium. Approximately 20 patients will be treated with (Z)-endoxifen for up to 24 weeks prior to surgery. Enrollment is ongoing in the Phase 2 I-SPY clinical trial.

Z)-endoxifen for Ductal Carcinoma In Situ. Ductal carcinoma in situ (DCIS) is a pre-cancerous lesion of the breast. It rarely produces symptoms, or a breast lump one can feel, typically being detected through screening mammography. In some cases, DCIS may become invasive and spread to other tissues, but there is no way of determining which lesions will remain stable without treatment, and which will go on to become invasive. This uncertainty can result in aggressive and unnecessary treatment approaches that can have harmful side effects without significant benefit.

In October 2023, Quantum Leap Healthcare Collaborative announced the initiation of the Phase 2 DCIS: Re-Evaluating Conditions for Active Surveillance Suitability as Treatment (RECAST) study. (Z)-endoxifen is being investigated as part of this platform trial, which offers women with DCIS six months of neoadjuvant treatment with the intent of determining their suitability for long-term active surveillance without surgery. Approximately 100 patients will be treated with (Z)-endoxifen. The study incorporates both a neoadjuvant therapy phase, with patients at high risk for progression to invasive disease proceeding to surgery, followed by an extended surveillance phase for low-risk patients.

Inhaled HNAC(AT-H201). AT-H201 was under development as a potential treatment for COVID-19; however, due to the rapidly shifting treatment landscape and introduction of effective vaccines and treatments, in late 2022 we shifted our focus to the treatment of patients with compromised lung function due to the damaging effects of cancer treatment. We concluded our study in healthy volunteers with AT-H201 in the first quarter of 2023 and we do not expect to advance the program further as we focus on our (Z)-endoxifen programs.

Investment in CAR-T Company

On December 23, 2022, we closed our previously announced investment in Dynamic Cell Therapies, Inc. (DCT), a privately-held, venture capital-backed, developer of CAR-T therapies. DCT is in the pre-clinical phase of developing controllable CAR-T cells to address difficult-to-treat cancers. Its platform technology of dynamic control of engineered T-cells is designed to improve the safety, efficacy, and durability of CAR-T cell therapies. While its initial focus is hematologic malignancies, DCT's innovative approach could also have broad applicability in solid tumors and autoimmune diseases. Our investment in DCT resulted in our owning approximately 19% of the outstanding capital stock of DCT. See Note 4.

Research and Development Phase

We are in the research and development phase and are not currently marketing any products. We do not anticipate generating revenue unless and until we develop and launch our pharmaceutical programs.

Commercial Lease Agreements

On November 22, 2022, we entered into an operating lease with WW 107 Spring Street LLC for office space in Seattle, Washington. We agreed to pay monthly rent of $2 for a term of 12 months beginning January 1, 2023. On June 26, 2023, we terminated the existing lease without additional cost and entered a new operating lease for monthly rent of $3 for a term of 12 months commencing July 1, 2023, for a larger office space at the same location.

Critical Accounting Policies and Significant Estimates

Our management’s discussion and analysis of our financial condition and results of operations is based on our Condensed Consolidated Financial Statements, which have been prepared in accordance with accounting principles generally accepted in the United States, (U.S. GAAP). The preparation of these Condensed Consolidated Financial Statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities and expenses. We base our estimates on our historical experience, known trends and events, and on various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Our actual results may differ from these estimates under different assumptions or conditions.

We believe that the following accounting policies are the most critical to the judgments and estimates used in the preparation of our Condensed Consolidated Financial Statements.

Investments in Equity Securities

Our investment in DCT Series Seed Preferred Stock does not have a readily determinable fair value, so we have elected to measure the investment at cost less impairment. As part of preparing our Condensed Consolidated Financial Statements, we considered qualitative impairment factors in determining if an impairment analysis is required. Specifically, we considered the adverse change in the general market condition of the industry in which DCT operates and concerns about the investee’s ability to continue as a going concern, due to negative cash flows from operations. Based on these impairment indicators, we performed a fair value measurement using a dynamic options approach. The Company used the dynamic options approach, which requires assumptions regarding the expected average volatility of comparable companies, the expected term of our investment, and an estimation of an appropriate risk-free interest rate over the term of our investment. The expected stock price volatility assumption is based upon the average historic volatility of comparable public clinical stage immunotherapy or CAR-T companies. The expected term of our investment is 3.5 years and the risk-free interest rate used is based upon prevailing short-term interest rates over the expected term of the investment. The dynamic options approach was weighted at a 50% outcome probability. An adjusted book value approach was also considered and also weighted at a 50% probability due to DCT's limited cash on hand, status of current fundraising efforts and the estimated timing of a deemed liquidation event occurring as of June 30, 2023. The resulting quantitative valuation concluded that the investment was impaired, and accordingly, an impairment charge of $2,990 was recorded in the Condensed Consolidated Statements of Operations as of June 30, 2023. No indicators of additional impairment were noted and therefore, no impairment charges were recorded during the three months ended September 30, 2023.

While assumptions used to calculate and account for the investment in non-marketable equity securities represent management’s best estimates, these estimates involve inherent uncertainties and the application of management’s judgement. If underlying assumptions and estimates change, our investment may be impaired further in future periods.

Research and Development Expenses

As part of the process of preparing our Condensed Consolidated Financial Statements, we are required to estimate our accrued research and development expenses. This process involves reviewing open contracts and work orders, communicating with our applicable personnel to identify services that have been performed on our behalf, and estimating the associated cost incurred for the services, including, in some cases, when we have not yet been invoiced or otherwise notified of actual costs. R&D costs are generally expensed as incurred. R&D expenses include, for example, manufacturing expense for our drugs under development, expenses associated with preclinical studies, clinical trials and associated salaries, bonuses, stock-based compensation and benefits. R&D expenses also include an allocation of the CEO's salary and related benefits, including bonus and non-cash stock-based compensation expense, based on an estimate of his total hours spent on research and development activities.

We have entered into various research and development contracts with CROs, CMOs and other companies. The majority of our service providers invoice us monthly for services performed, however, payments under some of these contracts may be required in advance of the services being performed, for example when a contract requires an initial payment at the outset of the contract. Payments made in advance of performance of services are reflected in the Condensed Consolidated Balance Sheets as prepaid expenses.

We base our expenses related to preclinical studies and clinical trials on our estimates of the services received and efforts expended pursuant to quotes and contracts with CROs and other companies that conduct and manage preclinical studies and clinical trials on our behalf. The financial terms of these vary from contract to contract and may result in uneven payment flows. There may be instances in which payments made to our vendors exceed the level of services provided and result in a prepayment of the expense. In accruing service fees, we estimate the time period over which services will be performed and the level of effort to be expended in each period. If the actual timing of the performance of services or the level of effort varies from the estimate, we adjust the accrual or prepaid expense accordingly. We estimate our accrued expenses as of each balance sheet date in the Condensed Consolidated Financial Statements based on facts and circumstances known to us at that time. However, additional information may become available to us, which may allow us to make a more accurate estimate in future periods. If we do not identify costs that we have begun to incur or if we underestimate or overestimate the level of services performed or the costs of these services, our actual expenses could differ from our estimates.

Stock-Based Compensation

We measure all stock option awards granted to employees, non-employee directors and consultants based on the fair value on the date of grant, and we recognize compensation expense over the requisite service period, which is generally the vesting period of the award. The straight-line method of expense recognition is applied to all awards with service-only conditions. We account for forfeitures as they occur.

The fair value of each option grant is estimated using the Black-Scholes option-pricing model, which requires assumptions regarding the expected volatility of the price of our common stock, the expected life of the options, an expectation regarding future dividends on our common stock, an estimate of the appropriate risk-free interest rate and the expected term. Our expected common stock price volatility assumption is based upon the historic volatility of our stock price. The expected life for stock option grants is based on an average of the contractual term of the options of 10 years with the average vesting term of one to four years. The dividend yield assumption of zero is based upon the fact that we have never paid cash dividends and presently have no intention of paying cash dividends in the future. The risk-free interest rate used for each grant is based upon prevailing short-term interest rates over the expected lives of the options.

While assumptions used to calculate and account for stock-based compensation awards represent management’s best estimates, these estimates involve inherent uncertainties and the application of management’s judgement. As a result, if revisions are made to our underlying assumptions and estimates, our stock-based compensation expense could vary significantly from period to period.

Results of Operations

Comparison of the Three Months Ended September 30, 2023 and 2022

Revenue and Cost of Revenue:

For the three months ended September 30, 2023 and 2022, we had no source of sustainable revenue and no associated cost of revenue.

Operating Expenses:

The following table provides a breakdown of major categories within Research and Development (R&D) and General and Administrative (G&A) expenses for the three months ended September 30, 2023 and 2022, together with the dollar and percentage change in those categories:

| September 30, 2023 |

September 30, 2022 |

Change |

% Change |

|||||||||||||

| Research and Development |

||||||||||||||||

| Clinical and non-clinical trials |

$ | 3,365 | $ | 3,663 | $ | (298 | ) | (8%) |

||||||||

| Compensation |

763 | 1,050 | (287 | ) | (27%) |

|||||||||||

| Professional fees and other |

339 | 447 | (108 | ) | (24%) |

|||||||||||

| Research and Development Total |

$ | 4,467 | $ | 5,160 | $ | (693 | ) | (13%) |

||||||||

| General and Administrative |

||||||||||||||||

| Compensation |

$ | 1,534 | $ | 1,743 | $ | (209 | ) | (12%) |

||||||||

| Legal and professional fees |

946 | 699 | 247 | 35% |

||||||||||||

| Insurance and other |

521 | 603 | (82 | ) | (14%) |

|||||||||||

| General and Administrative Total |

$ | 3,001 | $ | 3,045 | $ | (44 | ) | (1%) |

||||||||

Total operating expenses were $7,468 for the three months ended September 30, 2023, which was a decrease of $737, or 9%, from the three months ended September 30, 2022. Factors contributing to the decreased operating expenses for the three months ended September 30, 2023 are explained below.

Research and Development Expenses: R&D expenses for the three months ended September 30, 2023 were $4,467, a decrease of $693 from R&D expenses for the three months ended September 30, 2022 of $5,160. (Z)-endoxifen is our one product candidate for which the company incurs R&D expense and therefore R&D expenses have not been further disaggregated. Key changes were as follows:

| • |

The decrease in R&D expense was attributed primarily to decreased spending on clinical and non-clinical trials of $298 compared to the prior year period due to decreased spending on (Z)-endoxifen trial costs. |

| • |

The decrease in R&D compensation expense for the three months ended September 30, 2023 compared to the prior year period was primarily attributable to the decrease in non-cash stock-based compensation expense of $300 due to the weighted average fair value of options amortizing in 2023 being lower quarter over quarter. |

| • |

The decrease in R&D professional fees for the three months ended September 30, 2023 compared to the prior year period was primarily attributable to the higher consulting fees in 2022 related to our immunotherapy research. |

G&A Expenses: G&A expenses for the three months ended September 30, 2023, were $3,001, a decrease of $44 from total G&A expenses for the three months ended September 30, 2022 of $3,045. Key changes were as follows:

| • |

The decrease in G&A compensation expense of $209 for the three months ended September 30, 2023 compared to the prior year period, was primarily attributable to the decrease in non-cash stock-based compensation expense of $440 due to the weighted average fair value of options amortizing in 2023 being lower quarter over quarter. This decrease for the three months ended September 30, 2023 was partially offset by an increase of $231 in cash compensation due to increase headcount compared to the prior year period. |

| • |

G&A legal and professional fees increased by $247 for the three months ended September 30, 2023 compared to the prior year period due to an increase in legal fees for patent-related activity of $76 and an increase in professional fees of $171 due to higher investor relations costs. |

Interest Income: Interest income was $1,274 for the three months ended September 30, 2023, an increase of $1,080 from interest income of $194 for the three months ended September 30, 2022. The increase was due to the higher average balance invested in money market funds of $41,905 and higher average interest rates for the three months ended September 30, 2023 compared to the prior year period.

Income Taxes: We did not record an income tax expense or benefit for the three months ended September 30, 2023 and 2022 due to uncertainty regarding utilization of our net operating loss carryforwards and our history of losses.

Comparison of the Nine Months Ended September 30, 2023 and 2022

Revenue and Cost of Revenue:

For the nine months ended September 30, 2023 and 2022, we had no source of sustainable revenue and no associated cost of revenue.

Operating Expenses:

The following table provides a breakdown of major categories within R&D and G&A expenses for the nine months ended September 30, 2023 and 2022, together with the dollar and percentage change in those categories:

| September 30, 2023 |

September 30, 2022 |

Change |

% Change |

|||||||||||||

| Research and Development |

||||||||||||||||

| Clinical trials |

$ | 8,239 | $ | 6,772 | $ | 1,467 | 22% |

|||||||||

| Compensation |

2,696 | 3,249 | (553 | ) | (17%) |

|||||||||||

| Professional fees and other |

745 | 776 | (31 | ) | (4%) |

|||||||||||

| Exclusivity agreements |

- | (700 | ) | 700 | (100%) |

|||||||||||

| Research and Development Total |

$ | 11,680 | $ | 10,097 | $ | 1,583 | 16% |

|||||||||

| General and Administrative |

||||||||||||||||

| Compensation |

$ | 6,153 | $ | 5,573 | $ | 580 | 10% |

|||||||||

| Legal and professional fees |

2,835 | 2,044 | 791 | 39% |

||||||||||||

| Insurance and other |

1,690 | 1,839 | (149 | ) | (8%) |

|||||||||||

| General and Administrative Total |

$ | 10,678 | $ | 9,456 | $ | 1,222 | 13% |

|||||||||

Total operating expenses were $22,358 for the nine months ended September 30, 2023, which was an increase of $2,805, or 14%, from the nine months ended September 30, 2022. Factors contributing to the increased operating expenses for the nine months ended September 30, 2023 are explained below.

Research and Development Expenses: R&D expenses for the nine months ended September 30, 2023, were $11,680, an increase of $1,583 from total R&D expenses for the nine months ended September 30, 2022 of $10,097. Key changes were as follows:

| • |

The increase in R&D expense was primarily due to increased spending on clinical and non-clinical trials of $1,467 compared to the prior year period due to increased spending on (Z)-endoxifen trial costs. |

| • |

The decrease in R&D compensation expense for the nine months ended September 30, 2023 compared to the prior year period was primarily due to a decrease in non-cash stock-based compensation of $588. Non-cash stock-based compensation decreased compared to the prior year period due to the weighted average fair value of options amortizing in 2023 being lower period over period. |

| • |

An exclusivity agreement refund in the prior year period of $1,000 from a research institution with which the Company had an exclusive right to negotiate for the acquisition of worldwide rights of two oncology programs. No exclusivity payments were made or refunded during the nine months ended September 30, 2023. |

G&A Expenses: G&A expenses for the nine months ended September 30, 2023, were $10,678, an increase of $1,222 from total G&A expenses for quarter ended September 30, 2022 of $9,456. Key changes were as follows:

| • |

The increase in G&A compensation expense of $580 for the nine months ended September 30, 2023 compared to the prior year period partially due to an increase in cash compensation expense of $1,133, offset by a decrease in non-cash stock-based compensation of $553. The increase in compensation expense compared to the prior year period was primarily driven by salary and bonus severance costs for our former General Counsel and Chief Financial Officer (CFO) of $554, an increase of $579 due to compensation for new employees as well as an increase in salaries, bonus and benefits overall. Non-cash stock-based compensation decreased by $553 in part due to a decrease in other employee non-cash stock-based compensation expense of $873 due to the decrease in the weighted average fair value of options amortizing in 2023 was lower period over period. This decrease was partially offset by the acceleration of expense recognized for options granted to the CFO of $320. |

| • |

G&A legal and professional fees increased by $791 for the nine months ended September 30, 2023 compared to the prior year period due to an increase in legal fees for higher patent-related activity of $421 and an increase in professional fees of $370 primarily due to higher investor relations costs. |

Interest Income: Interest income was $3,107 for the nine months ended September 30, 2023, an increase of $2,900 from interest income of $207 for the nine months ended September 30, 2022. The increase was due to the higher average balance invested in a money market funds of $44,513 and higher average interest rates for the nine months ended September 30, 2023 compared to the prior year period.

Impairment Charge on Investment in Equity Securities: For the nine months ended September 30, 2023, we wrote down our investment in DCT by $2,990 due to an impairment. For the nine months ended September 30, 2022 there was no investment in equity securities or related impairment. Refer to Note 4.

Income Taxes: We did not record an income tax expense or benefit for the nine months ended September 30, 2023 and 2022 due to uncertainty regarding utilization of our net operating loss carryforwards and our history of losses.

Liquidity and Capital Resources

We have incurred net losses and negative operating cash flows since inception. For the nine months ended September 30, 2023, we recorded a net loss of $22,340 and used $15,370 of cash in operating activities. As of September 30, 2023, we had $94,031 in unrestricted cash and cash equivalents and working capital of $94,204. We believe we have sufficient cash and cash equivalents to fund our projected operating requirements for at least the next 12 months.

Cash Flows

As of September 30, 2023, we had cash, cash equivalents and restricted cash of $94,141.

Net Cash Flows from Operating Activities: Net cash used in operating activities was $15,370 for the nine months ended September 30, 2023, compared to net cash used of $16,237 for the same period in 2022, a decrease of $867. Cash used in operating activities during 2023 primarily related our net loss of $22,340, adjusted for non-cash items such as non-cash stock-based compensation expense of $4,102, non-cash impairment charge on investment in equity securities of $2,990 and net cash outflows from a change in our operating assets and liabilities of $131. Cash used in operating activities during 2022 primarily related to our net loss of $19,469, adjusted for non-cash share-based compensation expense of $5,243 and net cash outflows from a change in our operating assets and liabilities of $2,020.

Net Cash Flows from Investing Activities: Net cash used in investing activities was $14 for the nine months ended September 30, 2023, compared to net cash used in investing activities of $2,719 for the nine months ended September 30, 2022. Current period cash used in investing activities was primarily related to purchases of new computers while prior period cash used in investing activities was primarily related to the deposit on investment in equity securities of $2,700.

Net Cash Flows from Financing Activities: Net cash used in financing activities was $1,475 for the repurchase of common stock under the Share Repurchase Program for the nine months ended September 30,2023. No cash was used in financing activities during the nine months ended September 30, 2022.

Funding Requirements

We expect to incur ongoing operating losses for the foreseeable future as we continue to develop our planned therapeutic programs, including related clinical studies and other programs in the pipeline. Our future funding requirements will depend on many factors, including:

| • |