UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☑ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under § 240.14a-12 |

ATOSSA THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☑ |

Fee not required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

Atossa Therapeutics, Inc.

107 Spring Street

Seattle, Washington 98104

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 4, 2023 at 6:00 A.M. Pacific Time

Virtual Meeting to be Held Live via the Internet at: http://www.viewproxy.com/AtossaTherapeutics/2023/htype.asp

Technical Support Contact: VirtualMeeting@viewproxy.com or call 1-866-612-8937

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Atossa Therapeutics, Inc., a Delaware corporation (the “Company”), which will be held virtually on May 4, 2023, at 6:00 A.M. Pacific Time. The Annual Meeting will be held in a virtual only meeting format via live audio webcast. For more information, see “General Information—About the Meeting – What do I need to do to virtually attend the Annual Meeting via live audio webcast?” Only stockholders of record who held Atossa Common Stock at the close of business on the record date, March 16, 2023 (the “Record Date”), may attend virtually, view the list of stockholders of record and vote online at the Annual Meeting, including at any adjournment or postponement thereof.

At the Annual Meeting, you will be asked to consider and vote upon: (1) the election of two Class II directors named in the Proxy Statement; (2) the ratification of the selection of BDO USA LLP (“BDO”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023; (3) an advisory (non-binding) vote on the Company’s executive compensation; and (4) the transaction of any other business that may properly come before the meeting or any adjournment or postponement thereof.

No other items of business are expected to be considered at the meeting and, pursuant to the Company’s Bylaws, no other director nominees will be entertained. The enclosed Proxy Statement more fully describes the details of the business to be conducted at the Annual Meeting. After careful consideration, our Board of Directors has unanimously approved the proposals and recommends that you vote FOR each nominee and FOR each of the other proposals. After reading the Proxy Statement and our other proxy materials, please vote online, by telephone or by returning your proxy card or your voting instruction form. YOUR SHARES WILL NOT BE VOTED UNLESS YOU VOTE IN ONE OF THE WAYS DESCRIBED OR IF YOU ATTEND AND VOTE AT THE VIRTUAL ANNUAL MEETING.

A copy of the Company’s 2022 Annual Report has been mailed with this Proxy Statement to all stockholders entitled to notice of and to vote at the virtual Annual Meeting.

We look forward to seeing you at the Annual Meeting.

Sincerely,

Steven C. Quay, M.D., Ph.D.

Chairman of the Board, President and

Chief Executive Officer

March 30, 2023

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY OR YOUR VOTING INSTRUCTION FORM AND RETURN IT AT YOUR EARLIEST CONVENIENCE, OR PLEASE VOTE IN ONE OF THE OTHER WAYS DESCRIBED IN THE PROXY STATEMENT. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY REVOKE YOUR PROXY AT ANY TIME BEFORE THE FINAL VOTE AT THE ANNUAL MEETING. YOUR LAST SUBMITTED VOTE IS THE ONE THAT WILL BE COUNTED. PLEASE NOTE THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE VIRTUAL MEETING, YOU MUST OBTAIN A LEGAL PROXY ISSUED IN YOUR NAME FROM YOUR BROKER (PREFERABLY AT LEAST FIVE DAYS BEFORE THE ANNUAL MEETING).

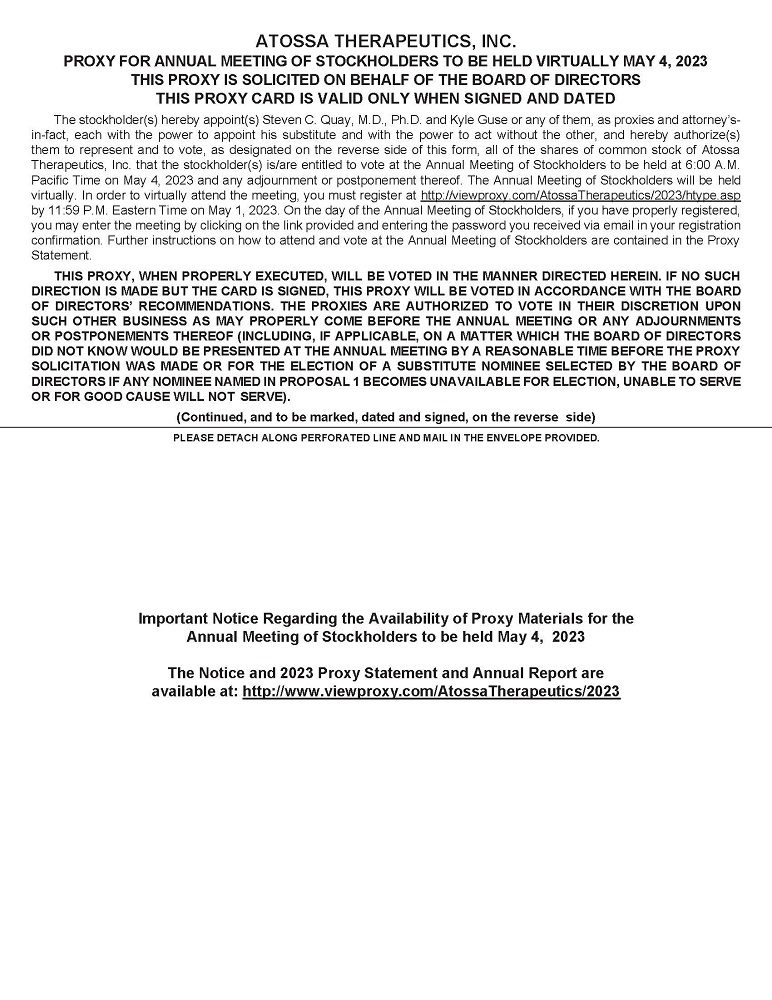

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD VIRTUALLY ON MAY 4, 2023: THIS PROXY STATEMENT, THE NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND THE ANNUAL REPORT ARE AVAILABLE AT HTTP://WWW.VIEWPROXY.COM/ATOSSATHERAPEUTICS/2023. WE ENCOURAGE YOU TO REVIEW ALL OF THE IMPORTANT INFORMATION CONTAINED IN THE PROXY MATERIALS BEFORE VOTING.

107 Spring Street

Seattle, Washington 98104

PROXY STATEMENT FOR

2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 4, 2023 AT 6:00 A.M. PACIFIC TIME

VIRTUAL MEETING

TO BE HELD LIVE VIA THE INTERNET AT: http://www.viewproxy.com/AtossaTherapeutics/2023/htype.asp

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Atossa Therapeutics, Inc. (“Atossa” or the “Company”) for use at the Company’s 2023 Annual Meeting of Stockholders. This year’s Annual Meeting will be held in a virtual only meeting format via live audio webcast. For more information, see “General Information—How do I attend and vote shares at the virtual Annual Meeting?” This Proxy Statement and the accompanying form of proxy will be mailed to our stockholders on or about March 30, 2023.

For a proxy to be effective, it must be properly executed and received prior to the Annual Meeting. Each proxy properly executed and tendered will, unless otherwise directed by the stockholder (in which case, proxies will be voted as directed), be voted “for” each of the nominees and each of the other proposals described in this Proxy Statement and at the discretion of the proxy holder(s) with regard to all other matters that may properly come before the meeting or at any adjournments or postponements thereof.

The Company will pay all costs of soliciting proxies. We will provide copies of this Proxy Statement, notice of Annual Meeting and accompanying materials to brokerage firms, fiduciaries, and custodians for forwarding to beneficial owners and may reimburse these parties for their costs of forwarding these materials. Our directors, officers and employees may also solicit proxies by telephone, facsimile, or personal solicitation; however, we will not pay them additional compensation for any of these services. We have retained Alliance Advisors, a proxy solicitation firm, at an estimated cost of at least $7,000.

Only holders of record of our common stock (the “Common Stock”), at the close of business on business on March 16, 2023 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. On the Record Date, there were a total of 126,624,110 shares of Common Stock issued and outstanding. Each share of Common Stock is entitled to one vote on all matters to be voted upon at the Annual Meeting. Holders of Common Stock do not have the right to cumulative voting in the election of directors. The presence, virtually or by proxy, of the holders of a majority of the outstanding shares of Common Stock on the Record Date will constitute a quorum for the transaction of business at the Annual Meeting. If there is no quorum, the meeting chair or the holders of a majority of shares of Common Stock present at the Annual Meeting, either in person or by proxy, may adjourn the meeting to another time or date.

Persons who hold shares of Common Stock directly on the Record Date and not through a broker, bank or other financial institution (e.g., your shares of Common Stock are registered directly in your name with our transfer agent) (“record holders”) may vote by the following methods:

|

● |

Vote by proxy - You may complete, sign and return a proxy card; |

|

● |

Proxy Vote by Internet - Go to http://www.FCRvote.com/ATOS to complete an electronic proxy card. Have your proxy card available when you access the website. Your vote must be received by 11:59 P.M. Eastern Daylight Time on May 3, 2023, to be counted; |

|

| ● | Proxy Vote by Phone - You may use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Daylight Time on May 3, 2023 by calling the toll-free number 1-866-402-3905. Have your proxy card in hand when you call and then follow the instructions; or | |

| ● | Vote at the Annual Meeting - You may virtually attend the Annual Meeting and vote online during the meeting. |

Persons who hold shares of Common Stock indirectly on the Record Date through a brokerage firm, bank, or other financial institution (“beneficial holders”) must return a voting instruction form to have their shares voted on their behalf (or obtain a “legal proxy” to vote during the Annual Meeting as described below). Brokerage firms, banks or other financial institutions that do not receive voting instructions from beneficial holders will only be able to vote shares on behalf of the beneficial holders with respect to proposals considered to be “routine” and are not entitled to vote shares on behalf of the beneficial holders with respect to “non-routine” proposals (referred to as a “broker non-vote”). Whether a proposal is considered routine or non-routine is subject to stock exchange rules and final determination by the stock exchange. Even with respect to routine matters, some brokerage firms, banks or other financial institutions are choosing not to exercise discretionary voting authority. As a result, beneficial holders are urged to direct their brokerage firm, bank or other financial institution how to vote their shares on all proposals to ensure that their vote is counted.

Abstentions and broker non-votes will be counted for the purpose of determining the presence or absence of a quorum but will not be counted for the purpose of determining the number of votes cast on a given proposal. The required vote for each of the proposals expected to be acted upon at the Annual Meeting is described below:

Proposal No. 1 — Election of directors. Directors are elected by a plurality of the votes cast, with the nominees obtaining the most votes being elected. Because there is no minimum vote required, votes that are withheld and broker non-votes, if any, are not counted as votes cast and will have no effect on the outcome.

Proposal No. 2 — Ratification of selection of independent registered public accounting firm. This proposal must be approved by a majority of the votes cast. As a result, abstentions and broker non-votes, if any, will have no effect on the outcome.

Proposal No. 3 — Advisory (non-binding) vote to approve executive compensation. This advisory proposal must be approved by a majority of the votes cast. As a result, abstentions and broker non-votes, if any, will have no effect on the outcome.

We encourage you to vote by returning your proxy or voting instruction form or if you are a record holder by voting on-line or via phone prior to the meeting. Voting in advance of the meeting helps ensure that your shares will be voted and reduces the likelihood that the Company will be forced to incur additional expenses soliciting proxies for the Annual Meeting. Any record holder of our Common Stock may revoke their form of proxy at any time prior to the closing of the polls at the Annual Meeting by:

|

● |

executing and submitting a later-dated proxy; |

|

● |

submitting new proxy instructions via phone or the Internet; |

|

● |

delivering a written revocation to the Corporate Secretary at the address set forth above; or |

|

● |

voting online at http://www.FCRvote.com/ATOS during the virtual Annual Meeting. However, your virtual attendance at the Annual Meeting will not, by itself, revoke your proxy. |

Your last submitted vote is the one that will be counted.

Beneficial holders of our Common Stock who wish to change or revoke their voting instructions should contact their brokerage firm, bank or other financial institution for information on how to do so. Beneficial holders who wish to attend the Annual Meeting virtually and vote during the virtual meeting should contact their brokerage firm, bank or other financial institution holding shares of Atossa on their behalf in order to obtain a “legal proxy” (preferably at least five days before the Annual Meeting), which will allow them to vote during the meeting virtually. Without a legal proxy, beneficial holders cannot vote at the virtual Annual Meeting because their brokerage firm, bank or other financial institution may have already voted or returned a broker non-vote on their behalf.

FOR TECHNICAL SUPPORT PRIOR TO OR DURING THE ANNUAL MEETING, PLEASE CONTACT:

VirtualMeeting@viewproxy.com or call 1-866-612-8937

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Certificate of Incorporation of the Company provides that the Board is to be divided into three classes nearly equal in number as reasonably possible, with directors in each class serving three-year terms. The total Board size is currently fixed at six directors. Currently, the Class II directors (whose terms expire at this Annual Meeting) are Stephen J. Galli, M.D. and Richard I. Steinhart. The Class III directors (whose terms expire at the 2024 Annual Meeting of Stockholders) are Shu-Chih Chen, Ph.D. and H. Lawrence Remmel, Esq. The Class I directors (whose terms expire at the 2025 Annual Meeting of Stockholders) are Steven C. Quay, M.D., Ph.D. and Gregory L. Weaver. Class II directors elected at the Annual Meeting will hold office until the 2026 Annual Meeting of Stockholders and until their successors are elected and qualified, unless they resign, or their seats become vacant due to death, removal, or other cause in accordance with the Bylaws of the Company.

As described below, the Board has nominated Stephen J. Galli, M.D. and Richard I. Steinhart for reelection as Class II directors at the Annual Meeting. Both nominees have indicated their willingness and ability to serve if elected. Should either of the nominees become unavailable for election at the Annual Meeting, unable to serve or, for good cause, unwilling to serve, the persons named on the enclosed proxy as proxy holders may vote all proxies given in response to this solicitation for the election of a substitute nominee chosen by the Board, or the Board may decrease the size of the Board.

Nomination of Directors

The Nominating and Governance Committee, which acts as the Company’s nominating committee, reviews and recommends to the Board potential nominees for election to the Board. In reviewing potential nominees, the Nominating and Governance Committee considers the qualifications of each potential nominee in light of the Board’s existing and desired mix of experience and expertise. Specifically, the Nominating and Governance Committee considers each potential nominee’s personal and professional ethics, integrity and values, business acumen, interest in the Company and commitment to representing the long-term interests of the stockholders. The Nominating and Governance Committee also seeks to have a Board that encompasses a range of talents, ages, skills, diversity, and expertise sufficient to provide sound and prudent oversight with respect to the operations and interests of the business. These criteria are set forth in our Corporate Governance Guidelines, a copy of which is available on our website at https://atossatherapeutics.com/investors/.

After reviewing the qualifications of potential Board candidates, the Nominating and Governance Committee presents its recommendations to the Board, which selects the final director nominees. Upon the recommendation of the Nominating and Governance Committee, the Board nominated Stephen J. Galli, M.D. and Richard I. Steinhart for reelection as Class II directors. The Company did not pay any fees to any third parties to identify or assist in identifying or evaluating nominees for the Annual Meeting.

It is the Nominating and Governance Committee’s policy to consider written recommendations from stockholders for director candidates. The Nominating and Governance Committee considers stockholder nominees in the same manner and using the same criteria as nominees recommended by other sources. Any such recommendations should be submitted to the committee as described under “Stockholder Communications” and should include the same information required under our Bylaws for nominating a director, as described under “Stockholder Proposals.”

Although the Nominating and Governance Committee may consider whether nominees contribute to a mix of Board members that represents a diversity of background and experience, which is not only limited to race, gender, or national origin, we have no formal policy regarding board diversity. The Nominating and Governance Committee assesses its effectiveness in balancing these considerations in connection with its annual evaluation of the composition of the Board.

Nominees and Incumbent Directors

The Nominating and Governance Committee has recommended, and the Board has nominated, Stephen M. Galli, M.D., and Richard I. Steinhart to be reelected Class II directors at the Annual Meeting. The following table sets forth the following information for these nominees and the Company’s continuing directors: the year each was first elected a director of the Company; their respective ages as of the date of filing of this Proxy Statement; the positions currently held with the Company; the year their current term will expire; and their current class.

|

Nominee/Director Name |

Age |

Position(s) with the Company |

Year |

Current |

||||

|

Nominees for Class II Directors: |

||||||||

|

Stephen J. Galli, M.D. (2011) |

76 |

Director |

2023 |

II |

||||

|

Richard I. Steinhart (2014) |

65 |

Director |

2023 |

II |

||||

|

Continuing Directors |

||||||||

|

Shu-Chih Chen, Ph.D. (2009) |

61 |

Director |

2024 |

III |

||||

| H. Lawrence Remmel, Esq. (2012) | 71 | Director | 2024 | III | ||||

|

Gregory L. Weaver (2013) |

66 |

Director |

2025 |

I |

||||

|

Steven C. Quay, M.D., Ph.D. (2009) |

72 |

Chairman of the Board of Directors, President, and Chief Executive Officer |

2025 |

I |

Class II Directors Nominated for Election

The following persons have been nominated by the Board to be elected as Class II directors at the 2023 Annual Meeting.

Stephen J. Galli, M.D. Dr. Galli has served as a director of the Company since July 2011. Dr. Galli has been a Professor of Pathology and of Microbiology & Immunology and the Mary Hewitt Loveless, M.D., Professor, Stanford University School of Medicine, Stanford, California since February 1999. He served as Chair of the Department of Pathology at Stanford University School of Medicine from 1999 to 2016. Before joining Stanford, he was on the faculty of Harvard Medical School. He holds 14 U.S. patents and has over 400 publications. He is past president of the American Society for Investigative Pathology, past president of the Collegium Internationale Allergologicum, and current president of the Pluto Club (Association of University Pathologists). In addition to receiving several awards for his research, he was recognized with the 2010 Stanford University President’s Award for Excellence through Diversity for his recruitment and support of women and underrepresented minorities at Stanford University. He received his B.A. degree in biology, magna cum laude, from Harvard College in 1968 and his M.D. degree from Harvard Medical School in 1973 and completed a residency in anatomic pathology at the Massachusetts General Hospital in 1977. Dr. Galli has been selected to serve on the Company’s Board of Directors because of his qualifications as a professor and physician, and his specialized expertise as a pathologist.

Richard I. Steinhart. Mr. Steinhart has served as a director of the Company since March 2014. Mr. Steinhart is currently the Senior Vice President and Chief Financial Officer of BioXcel Therapeutics, Inc., a clinical-stage biopharmaceutical company, which he joined in October 2017. From October 2015 to June 2017, he was Vice President and Chief Financial Officer of Remedy Pharmaceuticals, Inc., a privately held pharmaceuticals company. From January 2014 until he joined Remedy Pharmaceuticals, Mr. Steinhart acted as an independent financial consultant to various companies in the biotechnology and medical device industries. From April 2006 to December 2013, Mr. Steinhart was an executive at MELA Sciences, Inc., serving as its Senior Vice President, Chief Financial Officer, Treasurer and Secretary. From 1992 to 2006, Mr. Steinhart was Managing Director at Forest St. Capital/SAE Ventures. Earlier, he served as Vice President and Chief Financial Officer at Emisphere Technologies from 1991 to 1992 and as General Partner and Chief Financial Officer of CW Group Inc. Mr. Steinhart is a Member of the Board of Directors of Actinium Pharmaceuticals where he is Chairman of the Audit Committee. From 2004 to 2012, Mr. Steinhart was a Member of the Board of Directors of Manhattan Pharmaceuticals and was Chairman of the Audit Committee. Mr. Steinhart received his B.B.A. and M.B.A. degrees from Pace University. Mr. Steinhart has been selected to serve on the Company's Board of Directors because of his qualifications as a business executive and audit committee financial expert, and his prior experience as a Chief Financial Officer, director and committee member of public companies.

Class III Directors Continuing in Office Until 2024

Shu-Chih Chen, Ph.D. Dr. Chen has served as a director since April 2009. She was a founder of the Company and served as Chief Scientific Officer of the Company since it was incorporated in April 2009 through August 2014. Prior to joining the Company, she was an Associate Professor at National Yang Ming University, Taipei, Taiwan, and served as the principal investigator of an NIH RO1 grant, studying tumor suppression by gap junction protein connexin 43, at the Department of Molecular Medicine at Northwest Hospital, Seattle, WA. She has two issued U.S. patents and 20 pending U.S. patent applications related to cancer therapeutics. Dr. Chen received her Ph.D. degree in microbiology and public health from Michigan State University in 1992 and has published extensively on molecular oncology. She received her B.S. degree in medical technology from National Yang Ming University, Taipei, Taiwan in 1984. Dr. Chen has been selected to serve on the Company’s Board of Directors because of her role as a founder of the Company and her qualifications in medical technology and as a professor and researcher in the field of cancer therapeutics.

H. Lawrence Remmel, Esq. Mr. Remmel has served as a director of the Company since February 2012. He is currently a partner of the law firm Pryor Cashman LLP, located in New York City, where he chairs the Banking and Finance practice group. Mr. Remmel joined Pryor Cashman in 1988. His practice includes corporate and banking financings, issues relating to the Investment Company Act of 1940, and intellectual property and licensing issues, in particular in the biotechnology and biocosmeceutical areas. Mr. Remmel previously served on the Board of Advisors of CytoDel, LLC, an early-stage bio-pharmaceutical company developing products for bio-defense, neuronal drug delivery, and musculoskeletal and aesthetic medicine. In February 2018, he became a director of CytoDel, Inc., the successor to CytoDel LLC. In March 2019 he became a director of Aufbau Holdings Limited, an Irish limited company, developing therapeutics in ophthalmology and other areas. He was an associate of the law firm Reboul, MacMurray, Hewitt, Maynard & Kristol from 1984 to 1988, and began his legal career at Carter, Ledyard & Milburn, where he was an associate from 1979 to 1984. He was admitted to the New York bar in 1980 and is a member of the New York State Bar Association. He received his J.D. from the Washington & Lee University School of Law in 1979 and his B.A. from Princeton University in 1975. He currently is a doctoral candidate in the Graduate School of Life Sciences of the University of Utrecht, in the Department of Clinical and Translational Oncology, with a thesis project in hyperplasia and early-stage breast cancer. Mr. Remmel has been selected to serve on the Company’s Board of Directors because of his substantial experience as a corporate attorney advising biotechnology companies and his familiarity with the fiduciary duties and the regulatory requirements affecting publicly traded companies.

Class I Directors Continuing in Office Until 2025

Steven C. Quay, M.D., Ph.D. Dr. Quay has served as Chief Executive Officer, President and Chairman of the Board of Directors of the Company since the Company was incorporated in April 2009. Dr. Quay is certified in Anatomic Pathology with the American Board of Pathology, and completed both an internship and residency in anatomic pathology at Massachusetts General Hospital, a Harvard Medical School teaching hospital, and is a former faculty member of the Department of Pathology, Stanford University School of Medicine. Dr. Quay is a named inventor on 89 U.S. patents, 810 published international patent applications, and on patents covering seven pharmaceutical products that have been approved by the U.S. Food and Drug Administration. Dr. Quay received an M.D. in 1977 and a Ph.D. in 1975 from the University of Michigan. He received his B.A. degree in biology, chemistry and mathematics from Western Michigan University in 1971. He has been selected to serve on the Company’s Board of Directors because of his role as a founder of the Company, as well as his qualifications as a physician and the principal researcher overseeing the research, preclinical, clinical and regulatory development of the Company’s pharmaceutical programs.

Gregory L. Weaver. Mr. Weaver has served as a director of the Company since October 2013. Mr. Weaver currently serves as Chief Financial Officer of IntelliSense, Inc., a technology company providing advanced sensing and display solutions, which he joined in August, 2022. Mr. Weaver previously served as Chief Financial Officer of the following publicly traded biotech companies: Atai Life Sciences (Nasdaq: ATAI), a clinical-stage biopharmaceutical company, from July 2020 to August 2022 and Eloxx Pharmaceuticals, Inc. (Nasdaq: ELOX), a biotech company, from September 2017 to March 2020. Mr. Weaver previously served as the Chief Financial Officer from October 2015 to August 2017 of ProMetic Life Sciences, and from January to October 2015, of Oryzon Genomics. Mr. Weaver received his undergraduate degree in finance from Trinity University and his MBA from Boston College. Mr. Weaver has been selected to serve on the Company’s Board of Directors because of his qualifications as a business executive and audit committee financial expert, and his current and prior experience as a Chief Financial Officer, director, and committee member of public companies. From 2014 to January 2020, Mr. Weaver served on the board of directors of Egalet Corp., a publicly traded biotech company, and from September 2014 to January 2015 on the board of directors of Oryzon Genomics, a publicly traded biotech company.

Vote Required

The two nominees who receive the highest number of affirmative votes cast will be elected as Class II directors. Votes that are withheld and broker non-votes, if any, are not counted as votes cast and will not affect the election of directors.

Holders of proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made but the card is signed, “FOR” the election of all nominees named in this Proxy Statement.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES IDENTIFIED ABOVE.

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

Our Audit Committee has selected BDO, USA, LLP (“BDO”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023, and has further directed that we submit the selection of BDO for ratification by our stockholders at the Annual Meeting.

The Company is not required to submit the selection of our independent registered public accounting firm for stockholder approval but is doing so as a matter of a good corporate practice. However, if the stockholders do not ratify this selection, the Audit Committee will reconsider its selection of BDO. Even if the selection is ratified, our Audit Committee may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that the change would be in the best interests of the Company and our stockholders.

The Audit Committee reviews and pre-approves all audit and non-audit services performed by the Company's independent registered public accounting firm, as well as the fees charged for such services, in order to assure that these services do not impair the auditor’s independence. This generally involves approval of the performance of specific services subject to a cost limit for all such services. This general approval is reviewed, and if necessary modified, at least annually. Management must obtain the specific prior approval of the committee for each engagement of our auditor to perform other audit-related or other non-audit services. The committee does not delegate its responsibility to approve services performed by our auditor to any member of management. The committee has delegated authority to the committee chair to pre-approve certain audit or non-audit services to be provided to us by our auditor. Any approval of services by the committee chair pursuant to this delegated authority is reported to the committee at its next regularly scheduled meeting.

BDO has audited our annual financial statements as of December 31, 2022 and 2021. Representatives of BDO are expected to be present virtually at the Annual Meeting or by telephone, will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate stockholder questions.

All fees incurred in fiscal 2022 for services rendered by BDO were approved in accordance with the Audit Committee’s pre-approval practices. In its review of non-audit service fees, the Audit Committee considers, among other things, the possible impact of the performance of such services on the auditor’s independence. The Audit Committee has determined that services performed by BDO in the fiscal year ended December 31, 2022 were compatible with maintaining the auditor’s independence. Additional information concerning the Audit Committee and its activities can be found in the following sections of this Proxy Statement: “Board Committees” and “Report of the Audit Committee.”

Fees for Independent Registered Public Accounting Firm

The following is a summary of the fees billed and expected to be billed to the Company by BDO for professional independent audit services rendered for the fiscal years ended December 31, 2022 and 2021 and the fees billed to the Company by BDO for all other services rendered for fiscal 2022 and 2021:

|

2022 |

2021 |

|||||||

|

Audit Fees: |

||||||||

|

Consists of fees billed for the audit of our annual financial statements and the review of the financial statements included in our quarterly reports on Form 10-Q, and services that are normally provided by BDO in connection with statutory and regulatory filings or engagements for that fiscal year, including consents and expenses. |

$ |

219,750 |

$ |

325,500 |

||||

|

Audit-Related Fees: Consists of fees billed for assurance services reasonably related to the performance of the audit or review of our financial statements. |

20,000 |

— |

||||||

|

Tax Fees |

— |

— |

||||||

|

All Other Fees |

— |

— |

||||||

|

Total Fees |

$ |

239,750 |

$ |

325,500 |

||||

Vote Required

Ratification of the selection of the independent registered public accounting firm requires the affirmative vote of a majority of the votes cast. Abstentions and broker non-votes, if any, are not counted as votes cast, and they will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NO. 2.

PROPOSAL NO. 3

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

Background

In accordance with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are providing our stockholders with the opportunity to cast an advisory (non-binding) vote to approve executive compensation (a so-called “say-on-pay” vote).

The advisory vote to approve executive compensation is a non-binding vote on the compensation of the Company’s “named executive officers,” as described in the tabular disclosure regarding such compensation under the caption “Executive Compensation” and the accompanying narrative disclosure set forth in this Proxy Statement. The advisory vote to approve executive compensation is not a vote on the Company’s general compensation policies or compensation of the Company’s Board of Directors. We are required to hold the advisory vote to approve executive compensation at least once every three years.

Our philosophy in setting compensation policies for executive officers has two fundamental objectives: (1) to attract and retain a highly skilled team of executives and (2) to align our executives’ interests with those of our stockholders by rewarding short-term and long-term performance and tying compensation to increases in stockholder value. The Compensation Committee believes that executive compensation should be directly linked both to improvements in corporate performance (so-called “pay for performance”) and accomplishments that are expected to increase stockholder value.

The vote under this Proposal No. 3 is advisory, and therefore not binding on the Company, the Board or our Compensation Committee. However, our Board, including our Compensation Committee, values the opinions of our stockholders and, to the extent there is any significant vote against the executive officer compensation as disclosed in this proxy statement, we will consider the outcome of the vote when making future compensation decisions for our named executive officers.

Our Board’s current policy is to hold an advisory vote to approve our executive compensation on an annual basis, and accordingly, after the Annual Meeting, the next advisory vote to approve executive compensation is expected to occur at our 2024 Annual Meeting.

Stockholders will be asked at the Annual Meeting to approve the following resolution pursuant to this Proposal No. 3:

RESOLVED, that the stockholders of Atossa Therapeutics, Inc. approve, on an advisory basis, the compensation of the Company’s “named executive officers” (as defined in the Proxy Statement), as such compensation is described in the tabular disclosure regarding such compensation under the caption “Executive Compensation” and the accompanying narrative disclosure, set forth in the Company’s definitive proxy statement for the 2023 Annual Meeting of Stockholders.

Vote Required

Advisory approval of this resolution requires the affirmative vote of a majority of the votes cast. Abstentions and broker non-votes, if any, are not counted as votes cast, and they will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS RECOMMENDS AN ADVISORY VOTE “FOR” PROPOSAL NO. 3.

CORPORATE GOVERNANCE

Director Independence

We believe that the Company benefits from having a strong and independent Board. For a director to be considered independent, the Board must determine, in accordance with the Nasdaq listing rules, that the director does not have any direct or indirect material relationship with the Company that would affect his or her exercise of independent judgment. On an annual basis, the Board reviews the independence of all directors under guidelines established by Nasdaq and in light of each director’s background, employment and affiliations with the Company and members of management, as well as significant holdings of Company securities. This review considers all known relevant facts and circumstances in making an independence determination. Based on this review, the Board has made an affirmative determination that all directors, other than Drs. Quay and Chen, are “independent directors” as defined by the Nasdaq listing rules. The Board determined that Dr. Quay is not independent because of his status as the Company’s President and Chief Executive Officer and that Dr. Chen is not independent because of her marriage to Dr. Quay. The independent board members meet regularly in executive sessions without the non-independent members and without management.

Corporate Code of Business Conduct and Ethics

We believe that our Board and committees, led by a group of strong and independent directors, provide the necessary leadership, wisdom and experience that the Company needs in making sound business decisions. We have adopted a Code of Business Conduct and Ethics that applies to all of our officers, directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. Our Corporate Code of Business Conduct and Ethics helps clarify the operating standards and ethics that we expect of all of our officers, directors and employees. Waivers of our Corporate Code of Business Conduct and Ethics may only be granted by the Board or the Audit Committee and amendments of the Code may only be made by the Board. We intend to publicly announce any such waivers or amendments promptly on our website, to the extent required by applicable rules and regulations. In furthering our commitment to these principles, we invite you to review our Corporate Code of Business Conduct and Ethics located on our website at www.atossatherapeutics.com.

Stockholder Communications

Generally, stockholders and other interested parties who have questions or concerns regarding the Company should contact our Investor Relations representative at 866-893-4927. However, any party who wishes to address questions regarding the business or affairs of the Company directly with the Board, or any individual director, should direct his or her questions in writing to the Chairman of the Board, Atossa Therapeutics, Inc., 107 Spring Street, Seattle, WA 98104. Upon receipt of any such communications, the correspondence will be reviewed by our Corporate Secretary, who will determine whether the communication is appropriate for presentation to the Board or the individual director, and if so determined by our Corporate Secretary, will be directed to the appropriate person, including individual directors. The purpose of this screening is to allow the Board to avoid having to consider irrelevant or inappropriate communications (such as advertisements, solicitations and hostile communications).

BOARD OF DIRECTORS AND COMMITTEES

Director Attendance

During fiscal 2022, our Board met nine times. Each director attended at least 75% of the aggregate of the meetings of the Board and meetings of the committees on which he or she was a member in our last fiscal year.

Although the Company does not have a formal policy on meeting attendance, the Company generally expects all directors to attend Annual Meetings of stockholders, absent unusual circumstances. All members of the Board were present virtually or on the telephone at the 2022 Annual Meeting.

Board Leadership Structure

The Board currently combines the role of Chairman of the Board with the role of Chief Executive Officer. The Board believes this leadership model, together with four of the other five Board members being independent, all key committees of the Board being comprised solely of, and chaired by, independent directors, and the Company’s established governance guidelines, provides an effective leadership structure for the Company. Combining the Chairman and Chief Executive Officer roles fosters clear accountability, effective decision-making, and aligns corporate strategy with the Company’s day-to-day operations. In addition, to ensure effective independent oversight of the Company, the Board holds executive sessions of the independent directors of the Board at every meeting.

Dr. Quay has served as Chairman and Chief Executive Officer since the Company was incorporated in April 2009. The independent directors believe that because Dr. Quay manages the Company on a day-to-day basis as Chief Executive Officer and President, his direct involvement in the Company’s operations makes him uniquely qualified to lead the Board in effective decision-making and to efficiently align the Company’s day-to-day operations with the Board’s objectives. The Board believes that its programs for overseeing risks, as described below, would be effective under a variety of leadership frameworks. Accordingly, the Board’s risk oversight function did not significantly impact its selection of the current leadership structure.

Board Risk Oversight

The Board has overall responsibility for the oversight of the Company’s risk management process, which is designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. Risk management includes not only understanding company-specific risks and the steps management implements to manage those risks, but also what level of risk is acceptable and appropriate for the Company. Management is responsible for establishing our business strategy, identifying, and assessing the related risks and implementing appropriate risk management practices. The Board periodically reviews our business strategy and management’s assessment of the related risk and discusses with management the appropriate level of risk for the Company. The Board also delegates oversight to Board committees to oversee selected elements of risk as set forth below.

Board Committees

Our Board has a separately designated Audit Committee, Compensation Committee and Nominating and Governance Committee. Members serve on these committees until their resignation or until otherwise determined by our Board. Each of these committees is comprised solely of independent directors, is empowered to retain outside advisors as it deems appropriate and regularly reports its activities to the full Board.

Audit Committee. The Audit Committee is comprised of Messrs. Steinhart (Chairman), Weaver and Remmel. The Audit Committee selects the Company’s independent registered public accounting firm, approves its compensation, oversees and evaluates the performance of the independent registered public accounting firm, oversees the accounting and financial reporting policies and internal control systems of the Company, reviews the Company’s interim and annual financial statements, independent registered public accounting firm reports and management letters, and performs other duties, as specified in the Audit Committee Charter, a copy of which is available on the Company’s website at www.atossatherapeutics.com. Additionally, the Audit Committee is involved in the oversight of the Company’s risk management through its review of policies relating to risk assessment and management. The Audit Committee met five times in fiscal 2022. All members of the Audit Committee satisfy the additional independence standards under the Nasdaq listing rules and the rules and regulations established by the Securities and Exchange Commission (“SEC”) applicable to directors serving on audit committees, and the Board has determined that each of Messrs. Steinhart and Weaver qualify as an “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K and that Mr. Remmel is “financially literate” under Nasdaq listing rules.

Compensation Committee. The Compensation Committee is comprised of Messrs. Weaver (Chairman), Steinhart and Dr. Galli. The Compensation Committee reviews and recommends the compensation arrangements for management, or approves such arrangements if so directed by the Board, establishes and reviews general compensation policies, administers the Company’s equity compensation plans and reviews and recommends to the Board the compensation paid to non-employee directors for their service on the Board. Our Chief Executive Officer makes recommendations to the Compensation Committee regarding the corporate and individual performance goals and objectives relevant to executive compensation and executives’ performance in light of such goals and objectives and recommends other executives’ compensation levels to the Compensation Committee based on such evaluations. The Compensation Committee may delegate authority to grant awards under our Stock Option and Incentive Plan to the Chief Executive Officer, but it has not historically done so. The Compensation Committee considers these recommendations and then makes an independent decision regarding officer compensation levels and awards. The Chief Executive Officer is not present when his compensation is evaluated. The Compensation Committee has the authority to engage outside advisors, such as compensation consultants, to assist it in carrying out its responsibilities. The Compensation Committee engaged StreeterWyatt Analytics in 2022 to provide advice regarding the amount and form of executive and director compensation. The Compensation Committee has engaged Aon Consulting, Inc. together with StreeterWyatt Analytics the (“Compensation Consultants”) to provide similar services for fiscal 2023. The Compensation Committee has determined that (1) both of the Compensation Consultants satisfy applicable independence criteria, and (2) none of the Compensation Consultants’ work with the Company raises any conflicts of interest, in each case under applicable Nasdaq listing rules and the rules and regulations established by the SEC. The Compensation Committee met six times in fiscal 2022. A copy of the Compensation Committee Charter is available on the Company’s website at www.atossatherapeutics.com. All members of the Compensation Committee satisfy the additional independence standards under the Nasdaq listing rules and the rules and regulations established by the SEC applicable to directors serving on compensation committees.

Compensation Committee Interlocks

None of the members of our Compensation Committee has at any time during the prior three years been one of our officers or employees. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Nominating and Governance Committee. The Nominating and Governance Committee is comprised of Dr. Galli (Chairman) and Mr. Remmel. The Nominating and Governance Committee identifies and nominates candidates for election to the Board, establishes policies under which stockholders may recommend a candidate for consideration for nomination as a director, annually reviews and evaluates the performance, operations, size and composition of the Board and periodically assesses and reviews the Company’s Corporate Governance Guidelines and recommends any appropriate changes thereto. The Nominating and Governance Committee met two times in fiscal 2022. A copy of the Nominating and Governance Committee Charter is available on our website at www.atossatherapeutics.com. All members of the Nominating and Governance Committee satisfy the current Nasdaq independence standards.

EXECUTIVE OFFICERS

Our current executive officers and their respective ages and positions as of the date of filing of this Proxy Statement are set forth in the following table. Biographical information for Dr. Quay is set forth above under Proposal No. 1 (Election of Directors).

|

Name |

Age |

Position |

||

|

Executive Officers: |

||||

|

Steven C. Quay, M.D., Ph.D. |

72 |

Chairman of the Board, President and Chief Executive Officer |

||

|

Kyle Guse, Esq., CPA (inactive) |

59 |

Chief Financial Officer, General Counsel and Secretary |

Kyle Guse, Esq., CPA (inactive). Mr. Guse has served as Chief Financial Officer, General Counsel and Secretary since January 2013. His experience includes more than 25 years of counseling life sciences and other rapid growth companies through all aspects of finance, corporate governance, securities laws and commercialization. Mr. Guse has practiced law at several of the largest international law firms, including from January 2012 through January 2013 as a partner at Baker Botts LLP and, prior to that, from October 2007 to January 2012, as a partner at McDermott Will & Emery LLP. Before working at McDermott Will & Emery, Mr. Guse previously served as a partner at Heller Ehrman LLP. Mr. Guse began his career as an accountant at Deloitte and he is an inactive Certified Public Accountant and member of the Bar in the State of California. Mr. Guse earned a B.S. in business administration and an M.B.A. from California State University, Sacramento, and a J.D. from Santa Clara University School of Law.

BENEFICIAL OWNERS AND MANAGEMENT

Based on information available to us and filings with the SEC, the following table sets forth certain information regarding the beneficial ownership (as defined by Rule 13d-3 under the Exchange Act) of our outstanding Common Stock for (i) each of our directors and nominees, (ii) each of our “named executive officers,” as defined in Executive Compensation below, (iii) all of our current directors and executive officers as a group, and (iv) persons known to us to beneficially hold more than 5% of our outstanding Common Stock. The following information is presented as of March 16, 2023 or such other date as may be reflected below.

Beneficial ownership and percentage ownership are determined in accordance with the rules of the SEC and include voting or investment power with respect to shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose. Under these rules, shares of Common Stock issuable under stock options or warrants that are exercisable within 60 days of March 16, 2023 are deemed outstanding for the purpose of computing the percentage ownership of the person holding the options or warrant(s), but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. To our knowledge and subject to applicable community property rules, and except as otherwise indicated below, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned. Unless otherwise noted, the address of each person listed on the table is c/o Atossa Therapeutics, Inc., 107 Spring Street, Seattle, Washington 98104.

|

Shares Beneficially Owned |

||||||||

|

Name of Beneficial Owner |

Number |

Percent of Class (1) |

||||||

|

Steven C. Quay, M.D. Ph.D.(2) |

6,735,431 |

5.1 |

% |

|||||

|

Kyle Guse, Esq., CPA (3) |

2,669,323 |

2.1 |

% |

|||||

|

Shu-Chih Chen, Ph.D.(4) |

270,255 |

* |

||||||

|

Stephen J. Galli, M.D.(5) |

242,198 |

* |

||||||

|

Gregory L. Weaver(6) |

101,302 |

* |

||||||

|

Richard I. Steinhart(7) |

239,922 |

* |

||||||

|

H Lawrence Remmel, Esq.(8) |

250 |

* |

||||||

|

All current executive officers and directors as a group (7 persons) |

10,258,681 |

7.8 |

% |

|||||

|

Other 5% Beneficial Owners: |

||||||||

|

CVI Investments, Inc. and Heights Capital Management, Inc.(9) |

7,762,500 |

6.1 |

% |

|||||

|

* |

Less than one percent. |

|

(1) |

Based on 126,789,451 shares of Common Stock and preferred stock, on an as-converted to Common Stock basis, issued and outstanding as of March 16, 2023. |

|

(2) |

Consists of (i) 2,659 shares of Common Stock directly owned by Dr. Quay, (ii) 24,157 shares of Common Stock owned by Ensisheim Partners LLC, (iii) 6,704,070 shares of Common Stock issuable upon the exercise of stock options held by Dr. Quay and exercisable within 60 days after March 16, 2023, (iv) 8 shares of Preferred B Stock convertible into 2,273 shares of Common Stock, and (v) 2,272 warrants exercisable into 2,272 shares of Common Stock. Drs. Quay and Chen share voting and investment power over the securities held by Ensisheim. Ensisheim is solely owned and controlled by Drs. Quay and Chen, and, as a result, Drs. Quay and Chen are deemed to be beneficial owners of the shares held by this entity. |

|

(3) |

Consists of (i) 2,663,945 shares of Common Stock issuable upon the exercise of stock options held by Mr. Guse and exercisable within 60 days of March 16, 2023, (ii) 833 shares of Common Stock held by Mr. Guse, (iii) 8 shares of Preferred B Stock convertible into 2,273 shares of Common Stock and (iv) 2,272 warrants exercisable into 2,272 shares of Common Stock. |

|

(4) |

Consists of (i) 24,157 shares of Common Stock owned by Ensisheim, and (ii) 241,553 shares of Common Stock issuable upon the exercise of stock options held by Dr. Chen and exercisable within 60 days after March 16, 2023, (iii) 8 shares of Preferred B Stock, convertible into 2,273 shares of Common Stock and (iv) 2,272 warrants exercisable into 2,272 shares of Common Stock. Drs. Quay and Chen share voting and investment power over the securities held by Ensisheim. Ensisheim is solely owned and controlled by Drs. Quay and Chen, and, as a result, Drs. Quay and Chen are deemed to be beneficial owners of the shares held by this entity. |

|

(5) |

Consists of (i) 98 shares of Common Stock held by Dr. Galli, and (ii) 242,100 shares of Common Stock issuable upon the exercise of stock options held by Dr. Galli and exercisable within 60 days of March 16, 2023. |

|

(6) |

Consists of (i) 101,246 shares of Common Stock issuable upon the exercise of stock options held by Mr. Weaver and exercisable within 60 days of March 16, 2023 and (ii) 56 shares of Common Stock held by Mr. Weaver. |

|

(7) |

Consists of 239,922 shares of Common Stock issuable upon the exercise of stock options held by Mr. Steinhart and exercisable within 60 days of March 16, 2023. |

|

(8) |

Consists of (i) 250 shares of Common Stock held by Mr. Remmel and (ii) 11 shares of Common Stock held by Mr. Remmel’s spouse. Mr. Remmel disclaims beneficial ownership of the 11 shares of Common Stock held by his spouse. |

|

(9) |

Based on information set forth in a Schedule 13G/A filed with the SEC on February 14, 2022, by CVI Investments, Inc. (“CVI”) and Heights Capital Management, Inc. (“Heights Capital”). Consists of (i) no shares for which CVI and Heights Capital have sole dispositive power, (ii) 7,762,500 shares for which CVI and Heights Capital have shared dispositive power, (iii) no shares for which CVI and Heights Capital have sole voting power, and (iv) 7,762,500 shares for which CVI and Heights Capital have shared voting power. CVI’s business address is P.O. Box 309GT, Ugland House, South Church Street, George Town, Grand Cayman, KY1-1104, Cayman Islands. Heights Capital’s business address is 101 California Street, Suite 3250, San Francisco, California 94111. and the address of Heights Capital is 101 California Street, Suite 3250, San Francisco, California 94111. |

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

Transactions with Related Parties

Other than compensation arrangements described below under the captions “Director Compensation” and “Executive Compensation,” we are not and have not been a party to any transactions since January 1, 2021 or any currently proposed transactions between us and certain “related parties,” which are generally considered to be our directors and executive officers, nominees for director, holders of 5% or more of our outstanding Common Stock and members of their immediate families.

Related-Party Transaction Review and Approval

Related party transactions that the Company is required to disclose publicly under the federal securities laws require prior approval by the Company’s independent directors without the participation of any director who may have a direct or indirect interest in the transaction in question. Related parties include directors, nominees for director, principal stockholders, executive officers and members of their immediate families. For these purposes, a “transaction” includes all financial transactions, arrangements or relationships, ranging from extending credit to the provision of goods and services for value and includes any transaction with a company in which a director, executive officer, immediate family member of a director or executive officer, or principal stockholder (that is, any person who beneficially owns five percent or more of any class of the Company’s voting securities) has an interest by virtue of a 10% or greater equity ownership. The Company’s policies and procedures regarding related party transactions are not part of a formal written policy, but rather, represent a course of practice determined to be appropriate by the Board of Directors of the Company.

DIRECTOR COMPENSATION

Non-employee director compensation is generally reviewed and set annually at the Board meeting held in connection with the Annual Stockholder Meeting. The non-employee directors of the Company received the following for service on the Board from May 2022 through May 2023:

|

● |

upon joining the Board, an initial fee of $50,000 in cash; |

|

● |

an annual cash payment of $50,000 for each board member; and |

|

● |

an annual grant of options exercisable for 50,000 shares. |

In addition to the above, annual compensation for service on the Audit Committee is $20,000 for the Chair and $15,000 for each committee member, paid in cash quarterly. Annual compensation for service on the Compensation Committee and Nominating and Governance Committee is $15,000 for the Chair and $10,000 for each committee member, paid in cash quarterly. The independent board members are also reimbursed on a case-by-case basis up to a pre-set amount for actual out of pocket expenses for graduate level course work in fields related to the business of the Company.

The employee directors receive no compensation for their board service. Pursuant to the policies of Pryor Cashman, the law firm of which Mr. Remmel is a partner, the compensation Mr. Remmel receives for his services as a director (other than expense reimbursement) is paid to the firm directly. All directors receive reimbursement for reasonable travel expenses. The following table sets forth information regarding compensation earned by our non-employee directors during the fiscal year ended December 31, 2022:

|

Name |

Fees Earned or Paid in Cash |

Option Awards Dollar Amount(1) |

Options Awards Number of Shares |

All Other Compensation(2) |

Total |

Option Awards(3) |

||||||||||

|

Shu-Chih Chen, Ph.D. |

$ |

50,000 |

$ |

39,370 |

50,000 |

$ |

— |

$ |

89,370 |

241,553 |

||||||

|

Stephen Galli, M.D. |

$ |

75,000 |

$ |

39,370 |

50,000 |

$ |

40,000 |

$ |

154,370 |

242,100 |

||||||

|

H. Lawrence Remmel, Esq. (4) |

$ |

75,000 |

$ |

39,370 |

50,000 |

$ |

— |

$ |

114,370 |

0 |

||||||

|

Richard Steinhart |

$ |

80,000 |

$ |

39,370 |

50,000 |

$ |

— |

$ |

119,370 |

239,922 |

||||||

|

Gregory L. Weaver |

$ |

80,000 |

$ |

39,370 |

50,000 |

$ |

— |

$ |

119,370 |

101,246 |

||||||

|

(1) |

The value of the awards has been computed in accordance with Accounting Standards Codification Topic 718, Compensation - Stock Compensation ("ASC 718"). Assumptions used in the calculations for these amounts are included in the notes to our financial statements included in our Annual Report for the fiscal year ended December 31, 2022. Option awards consist of 2022 annual option grants, to purchase shares of Common Stock with an exercise price of $0.93, which was the fair value of our common shares at the time of grant. Options vest quarterly over a year. |

|

(2) |

Represents payment to Dr. Galli in 2022 for consulting services he provided to the Company in connection with our investment in Dynamic Cell Therapies, Inc., which closed in December 2022. |

|

(3) |

The shares reported in this column represent the aggregate number of option awards outstanding as of December 31, 2022. |

|

(4) |

The compensation Mr. Remmel receives for his services as a director in the form of an option grant is assigned to the Pryor Cashman law firm of which Mr. Remmel is a partner. |

EXECUTIVE COMPENSATION

Remuneration of Officers

Our Compensation Committee is responsible for reviewing and evaluating key executive employee base salaries, setting goals and objectives for executive bonuses and administering benefit plans. The Compensation Committee provides advice and recommendations to our Board of Directors on such matters.

Summary Compensation Table

The following table sets forth the compensation earned by our President and Chief Executive Officer and Chief Financial Officer (together, the “Named Executive Officers”) for fiscal years 2022 and 2021:

|

Name and Position |

Year |

Salary |

Option Awards (1) |

Nonequity Incentive Plan Compensation (2) |

All Other Compensation (3) |

Total |

||||||||||||

|

Steven C. Quay, MD., Ph.D. |

President and Chief |

|||||||||||||||||

|

Executive Officer |

||||||||||||||||||

|

2022 |

$ |

705,910 |

$ |

2,019,697 |

$ |

402,369 |

$ |

32,900 |

$ |

3,160,876 |

||||||||

|

2021 |

$ |

659,000 |

$ |

4,707,913 |

$ |

494,250 |

$ |

31,400 |

$ |

5,892,563 |

||||||||

|

Kyle Guse |

Chief Financial Officer, |

|||||||||||||||||

|

General Counsel and Secretary |

||||||||||||||||||

|

2022 |

$ |

466,658 |

$ |

788,918 |

$ |

239,395 |

$ |

32,900 |

$ |

1,527,871 |

||||||||

|

2021 |

$ |

456,700 |

$ |

2,108,013 |

$ |

205,515 |

$ |

31,400 |

$ |

2,801,628 |

||||||||

|

(1) |

The value of the option awards has been computed in accordance with ASC 718. Assumptions used in the calculations for these amounts are included in the notes to our financial statements included in our Annual Report. The options vest quarterly over two years from the date of grant. |

|

(2) |

Amounts represent the annual performance bonus. |

|

(3) |

Amounts represent the 401(k) match made by the Company on behalf of the Named Executive Officer and reimbursements under our wellness program. |

Outstanding Equity Awards at Fiscal Year-End

The following table shows information regarding our outstanding equity awards at December 31, 2022 for the Named Executive Officers under the Company’s Incentive Plans:

|

Name |

Grant Date |

Number of Securities Underlying Unexercised Options Exercisable |

Number of Securities Underlying Unexercised Options Unexercisable |

Option Exercise Price |

Option Expiration Date |

|||||||

|

Steven Quay |

President and Chief Executive |

|||||||||||

|

Officer |

||||||||||||

|

3/11/2013 |

246 |

0 |

$ |

1,182.60 |

3/11/2023 |

|||||||

|

5/6/2014 |

1,389 |

0 |

$ |

219.60 |

5/6/2024 |

|||||||

|

3/16/2015 |

1,528 |

0 |

$ |

338.40 |

3/16/2025 |

|||||||

|

5/18/2016 |

3,163 |

0 |

$ |

47.34 |

5/18/2026 |

|||||||

|

5/24/2017 |

47,992 |

0 |

$ |

5.64 |

5/24/2027 |

|||||||

|

5/17/2019 |

2,300,000 |

0 |

$ |

1.36 |

5/17/2029 |

|||||||

|

4/9/2020 |

1,500,000 |

0 |

$ |

1.48 |

4/9/2030 |

|||||||

|

5/14/2021 |

1,425,000 |

(1) |

475,000 |

$ |

2.90 |

5/14/2031 |

||||||

|

2/24/2022 |

712,500 |

(1) |

1,187,500 |

$ |

1.25 |

2/24/2032 |

||||||

|

Kyle Guse |

Chief Financial Officer, General |

|||||||||||

|

Counsel and Secretary |

||||||||||||

|

1/4/2013 |

2,778 |

0 |

$ |

739.80 |

1/4/2023 |

|||||||

|

6/4/2013 |

334 |

0 |

$ |

775.80 |

6/4/2023 |

|||||||

|

1/8/2014 |

778 |

0 |

$ |

396.00 |

1/8/2024 |

|||||||

|

5/6/2014 |

1,112 |

0 |

$ |

219.60 |

5/6/2024 |

|||||||

|

3/16/2015 |

1,056 |

0 |

$ |

338.40 |

3/16/2025 |

|||||||

|

5/18/2016 |

6,056 |

0 |

$ |

47.34 |

5/18/2026 |

|||||||

|

5/24/2017 |

41,280 |

0 |

$ |

5.64 |

5/24/2027 |

|||||||

|

5/17/2019 |

800,000 |

0 |

$ |

1.36 |

5/17/2029 |

|||||||

|

4/9/2020 |

590,000 |

0 |

$ |

1.48 |

4/9/2030 |

|||||||

|

5/14/2021 |

637,500 |

(1) |

212,500 |

$ |

2.90 |

5/14/2031 |

||||||

|

2/24/2022 |

280,001 |

(1) |

466,666 |

$ |

1.25 |

2/24/2032 |

||||||

|

(1) |

Option vests quarterly over two years from the date of grant. |

PAY VERSUS PERFORMANCE

As required by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of SEC Regulation S-K, we are providing the following specified disclosures regarding the relationship between the compensation actually paid to our executive officers and certain measures of financial performance. The following table reports the compensation of Steven Quay, our Chairman and CEO (our Principal Executive Officer, or “PEO”) and the average compensation of the other Named Executive Officers (our “Non-PEO NEOs”) as reported in the Summary Compensation Table for the past two fiscal years, as well as their “compensation actually paid” as calculated pursuant to the SEC rules (referred to as “CAP”).

|

Value of Initial Fixed $100 Investment Based On |

||||||||||||||||||||||||

|

Year |

Summary Compensation Table Total for PEO (1) |

Compensation Actually Paid to PEO (1)(2) |

Summary Compensation Table Total for Non-PEO NEO (1) |

Compensation Actually Paid to Non-PEO NEO (1)(3) |

Total Shareholder Return(4) |

Net Loss |

||||||||||||||||||

|

2022 |

$ | 3,160,876 | $ | 2,971,123 | $ | 1,527,871 | $ | 1,445,374 | $ | (44 | ) | $ | (26,960,000 | ) | ||||||||||

|

2021 |

$ | 5,892,563 | $ | 5,705,285 | $ | 2,801,628 | $ | 2,726,119 | $ | 68 | $ | (20,606,000 | ) | |||||||||||

|

(1) |

Dr. Steven Quay is our PEO and Mr. Kyle Guse is our only Non-PEO NEO for each of the years shown. |

|

(2) |

The table below shows the amount of CAP to our PEO, as computed in accordance with Item 402(v) of SEC regulation S-K. The dollar amounts reported do not reflect actual amount of compensation earned by or paid to our PEO during the applicable year, and the Compensation Committee did not consider CAP in making any executive compensation decisions with respect to our PEO. In accordance with SEC rules, these amounts reflect the “Total” compensation as set forth in the Summary Compensation Table for each year, adjusted as shown below. Equity values are calculated in accordance with FASB ASC Topic 718, and the valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

|

Year |

Summary Compensation Table Total for PEO |

Stock Awards in SCT (A) |

Stock Award Adjustments (B) |

Compensation Actually Paid to PEO |

||||||||||||

|

2022 |

$ | 3,160,876 | $ | (2,019,697 | ) | $ | 1,829,944 | $ | 2,971,123 | |||||||

|

2021 |

$ | 5,892,563 | $ | (4,707,913 | ) | $ | 4,520,635 | $ | 5,705,285 | |||||||

|

(A) |

Represents the amounts reported in the Option Awards column in the Summary Compensation Table ( “SCT”) for the applicable year. |

|

(B) |

Represents the stock award adjustments (deductions and additions) for PEO stock awards for each applicable year calculated as follows: |

|

Year |

Year-End Fair Value of Outstanding and Unvested Equity Awards Granted During the Year |

Year-over-Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years |

Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year |

Year-over-Year Change in the Fair Value of Equity Awards Granted in Prior Years that Vested in the Year |

Total Equity Award Adjustments |

|||||||||||||||

|

2022 |

$ | 1,226,109 | $ | (50,510 | ) | $ | 755,829 | $ | (101,484 | ) | $ | 1,829,944 | ||||||||

|

2021 |

$ | 3,454,245 | $ | (36,544 | ) | $ | 1,176,146 | $ | (73,212 | ) | $ | 4,520,635 | ||||||||

|

(3) |

The table below shows CAP for the Non-PEO NEO, as computed in accordance with Item 402(v) of SEC Regulation S-K. The dollar amounts reported do not reflect the actual amount of compensation earned by or paid to our Non-PEO NEO during the applicable year, and the Compensation Committee did not consider CAP in making any executive compensation decisions with respect to our Non-PEO NEO. In accordance with SEC rules, these amounts reflect the “Total” compensation as set forth in the Summary Compensation Table for each year, adjusted as shown below. Equity values are calculated in accordance with FASB ASC Topic 718, and the valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. |

|

Year |

Summary Compensation Table Total for Non-PEO NEO |

Stock Awards in SCT (A) |

Stock Award Adjustments (B) |

Compensation Actually Paid to Non-PEO NEO |

||||||||||||

|

2022 |

$ | 1,527,871 | $ | (788,918 | ) | $ | 706,421 | $ | 1,445,374 | |||||||

|

2021 |

$ | 2,801,628 | $ | (2,108,013 | ) | $ | 2,032,504 | $ | 2,726,119 | |||||||

|

(A) |

Represents the amounts reported in the Option Awards column in the Summary Compensation Table for the applicable year. |

|

(B) |

Represents the stock award adjustments (deductions and additions) for our Non-PEO NEO stock awards for the applicable year calculated as follows: |

|

|

|

Year |

Year-End Fair Value of Outstanding and Unvested Equity Awards Granted During the Year |

Year-over-Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years |

Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Year |

Year-over-Year Change in the Fair Value of Equity Awards Granted in Prior Years that Vested in the Year |

Total Equity Award Adjustments |

|||||||||||||||

|

2022 |

$ | 480,268 | $ | (22,448 | ) | $ | 293,960 | $ | (45,359 | ) | $ | 706,421 | ||||||||

|

2021 |

$ | 1,547,312 | $ | (13,620 | ) | $ | 526,170 | $ | (27,358 | ) | $ | 2,032,504 | ||||||||

|

(4) |

Total Shareholder Return (“TSR”) is calculated by dividing (a) the sum of (i) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (ii) the difference between the Company’s share price at the end of each fiscal year shown and the beginning of the measurement period, by (b) the Company’s share price at the beginning of the measurement period. The beginning of the measurement period for each year in the table is December 31, 2020. |

Description of Certain Relationships between Information Presented in the Pay versus Performance Table

While the Company utilizes several performance measures to align executive compensation with Company performance, all of those Company measures are not presented in the Pay versus Performance table. Moreover, the Company generally seeks to incentivize long-term performance, and therefore does not specifically align the Company’s performance measures with compensation that is actually paid (as computed in accordance with SEC rules) for a particular year. In accordance with SEC rules, the Company is providing the following descriptions of the relationships between information presented in the Pay versus Performance table.

Compensation Actually Paid and Cumulative TSR

Compensation Actually Paid and Net Loss

Employment Agreements

Employment Agreement with Steven Quay, M.D., Ph.D.

The Company has entered into an employment agreement with Dr. Quay on September 27, 2010, to act as the Company’s Chief Executive Officer. The agreement provided for an initial base salary of $250,000, which was amended over the years and has been subsequently increased to $705,910 for 2022, with an annual target bonus of up to 50% of Dr. Quay’s then-current base salary, payable upon the achievement of performance goals to be established annually by the Compensation Committee.

The goals for fiscal 2022 included (1) 50% enrollment in the Endoxifen Phase 2 clinical study in women with mammographic breast density study, (2) submit investigational new drug (IND) application and receive a “may proceed letter” from the FDA for the neoadjuvant (Z)-endoxifen clinical study, (3) complete transfer and manufacturing campaign of (Z)-endoxifen, (4) complete a Phase 1 clinical study of one of the components of AT-H201 inhalation therapy, and (5) accomplish one or more specified "stretch goals." On March 1, 2023, the Compensation Committee reviewed the performance of Dr. Quay for 2022 against these goals and determined that his bonus for 2022 was 114% of potential, or $402,369.

During the employment term, the Company will make available to Dr. Quay employee benefits provided to other key employees and officers of the Company. To the extent these benefits are based on length of service with the Company, Dr. Quay will receive full credit for prior service with the Company. Participation in health, hospitalization, disability, dental and other insurance plans that the Company may have in effect for other executives, all of which shall be paid for by the Company with contribution by Dr. Quay as set for the other executives, as and if appropriate.

Dr. Quay has also agreed that, for the period commencing on the date of his employment agreement with the Company and during the term of his employment and for a period of 12 months following voluntary termination of his employment with the Company that he will not compete with the Company in the United States. The employment agreement also contains provisions relating to confidential information and assignment of inventions, which require Dr. Quay to refrain from disclosing any proprietary information and to assign to the Company any inventions which directly concern the ForeCYTE Breast Aspirator, or future products, research, or development, or which result from work they perform for the Company or using its facilities.

Employment Agreement with Kyle Guse

The Company has entered into an employment agreement with Mr. Guse to act as the Company’s Chief Financial Officer, General Counsel and Secretary. The agreement was amended on May 18, 2016 and provided for a base salary of $364,000, which was amended over the years and has been increased to $466,658 for 2022, with an annual target bonus of up to 45% of Mr. Guse’s then-current base salary, payable upon the achievement of performance goals to be established annually by the Compensation Committee. Mr. Guse also received a new-hire option grant, which fully vested over an initial four-year period.