Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark one) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2013 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Commission File No. 001-34686

HAWAIIAN TELCOM HOLDCO, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

16-1710376 (I.R.S. Employer Identification No.) |

1177 Bishop Street

Honolulu, Hawaii 96813

(Address of principal executive offices) (Zip Code)

808-546-4511

(Registrant's telephone number, including area code)

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

| Common Stock, par value $0.01 per share |

The NASDAQ Stock Market, LLC |

|

|---|---|---|

| (Title of class) | (Name of each exchange on which registered) |

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer ý | Non-Accelerated Filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's common stock held by non-affiliates as of June 30, 2013 was $193,551,150.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ý No o

As of March 13, 2014, 10,517,002 shares of the registrant's common stock, $0.01 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of registrant's Proxy Statement dated March 14, 2014 (Part III of Form 10-K)

HAWAIIAN TELCOM HOLDCO, INC.

TABLE OF CONTENTS

i

This Annual Report on Form 10-K contains certain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, any statement, projection or estimate that includes or references the words "believes", "anticipates", "intends", "expects", or any similar expression falls within the safe harbor of forward-looking statements contained in the Reform Act. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. Forward-looking statements by us are based on estimates, projections, beliefs, and assumptions of management and are not guarantees of future performance. Such forward-looking statements may be contained in this Form 10-K under "Item 1A—Risk Factors" and "Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere. In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. Additional risks that we may currently deem immaterial or that are not currently known to us could also cause the forward-looking events discussed in this Form 10-K not to occur as described. Except as otherwise required by applicable securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason after the date of this Form 10-K.

ii

Business Overview

Hawaiian Telcom Holdco, Inc. (the "Company") is the largest full-service provider of communications services and products in Hawaii. We operate two primary business segments:

Telecommunications. This segment provides local telephone service including voice and data transport, enhanced custom calling features, network access, directory assistance and private lines. In addition, the Telecommunications segment provides high-speed Internet, long distance services, next-generation television service, next-generation Internet protocol (IP)-based network services, customer premises equipment, data solutions, managed services, billing and collection, wireless services, and pay telephone services. Our services are offered on all of Hawaii's major islands, except for our next-generation television service, which currently is available only on the island of Oahu. As of March 1, 2014, our telecommunications operations served approximately 372,100 local access lines, of which 50% served residential customers and 49% served business customers, with the remaining 1% serving other customers; 190,200 long distance lines, of which 61% served residential customers and 39% served business customers; and 111,800 high-speed Internet lines, which served 91,500 retail residential lines, 19,400 retail business lines, and 900 wholesale business and resale lines.

Data Center Colocation. This segment consists of data center services including colocation and virtual private cloud.

History and Organizational Structure

General

The Company was incorporated in Delaware in 2004. Originally incorporated in Hawaii in 1883 as Mutual Telephone Company, our Hawaiian Telcom, Inc. subsidiary has a strong heritage of over 130 years as Hawaii's communications carrier. From 1967 to May 1, 2005, we operated as a division of Verizon Communications Inc. (Verizon) or its predecessors. On May 2, 2005, the Verizon businesses conducted in Hawaii (comprised of Verizon Hawaii Inc. and carved-out components of Verizon Information Services, GTE.NET LLC (dba Verizon Online), Bell Atlantic Communications Inc. (dba Verizon Long Distance) and Verizon Select Services, Inc. (collectively, the "Verizon Hawaii Business")) were transferred to Verizon Holdco LLC, which then was merged (the "2005 Acquisition") with and into Hawaiian Telcom Communications, Inc., a Delaware corporation and wholly-owned subsidiary of the Company. As a result of the 2005 Acquisition, we became a stand-alone provider of communications services, operating as Hawaiian Telcom, Inc. (fka Verizon Hawaii Inc.) and Hawaiian Telcom Services Company, Inc., both wholly-owned subsidiaries of Hawaiian Telcom Communications, Inc.

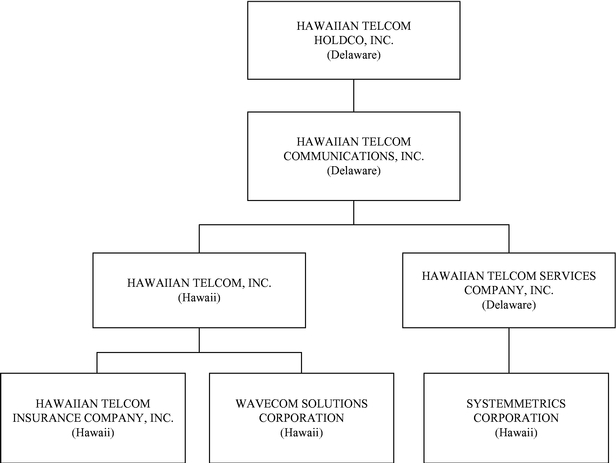

Hawaiian Telcom, Inc., a Hawaii corporation, operates our regulated local exchange carrier business. Hawaiian Telcom Services Company, Inc., a Delaware corporation, operates other businesses including long distance, Internet, television, advanced communications and network services, managed services, data center services including colocation and virtual private cloud, cloud-based services, and wireless businesses. SystemMetrics Corporation, a Hawaii corporation acquired in September 2013, provides data center services including colocation and virtual private cloud. Wavecom Solutions Corporation, a wholly-owned subsidiary of Hawaiian Telcom, Inc. and a Hawaii corporation, provides voice, data and converged services.

1

The following is a chart of our organizational structure.

Bankruptcy Proceedings

On December 1, 2008, the Company, Hawaiian Telcom Communications, Inc., Hawaiian Telcom, Inc., Hawaiian Telcom Services Company, Inc. and certain other affiliates (collectively, the "Debtors") filed voluntary petitions for relief under chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (later transferred to the United States Bankruptcy Court for the District of Hawaii (the "Bankruptcy Court")) in order to facilitate a balance sheet restructuring. In November 2009, the Bankruptcy Court confirmed the Debtors' chapter 11 plan of reorganization (the "Plan of Reorganization") and entered a written confirmation order (the "Confirmation Order") on December 30, 2009.The Plan of Reorganization became effective, and the Company and other Debtors emerged from chapter 11, on October 28, 2010.

Industry Overview

The telecommunications industry is comprised of companies involved in the transmission of voice, data and video communications over various media and through various technologies. There are two predominant types of local telephone service providers, or carriers, in the telecommunications industry: incumbent local exchange carriers (ILECs) and competitive local exchange carriers (CLECs). An ILEC refers to the regional Bell operating companies (RBOCs), which were the local telephone companies created from the breakup of AT&T in 1984, as well as small and midsize independent telephone companies, such as Hawaiian Telcom, Inc., Cincinnati Bell Inc. and Consolidated Communications, Inc., which sell local telephone service. These ILECs were the traditional monopoly providers of local telephone service prior to the passage of the Telecommunications Act of 1996. On the other hand, a

2

CLEC is a competitor to local telephone companies that has been granted permission by a state regulatory commission to offer local telephone service in an area already served by an ILEC.

In recent years, the U.S. telecommunications industry has undergone significant structural changes. Many of the largest service providers have achieved growth through acquisitions and mergers, while an increasing number of competitive providers have restructured or entered bankruptcy to obtain protection from creditors. Since 2001, capital in the form of public financing has been generally difficult to obtain for new entrants and competitive providers. Capital constraints have caused a number of competitive providers to change their business plans, resulting in consolidation. Despite these changes, the demand for telecommunications services, particularly data services, has not diminished, and telecommunications companies increasingly bundle services and provide integrated offerings for end-user customers.

Hawaii's telecommunications industry remains active, and demand for telecommunications services is strong, due in part to the comparative advantage provided by the State's geographic position. With its location between the mainland United States and Asia, Hawaii has been and will likely continue to be a surfacing location for cables running between the two continents. Hawaii is also connected to the mainland United States and Asia via several satellite networks.

Our Business Strategy

Our primary objective is to grow our business with a focus on delivering superior service to our customers, so that we can be recognized as the number one service provider of innovative "Always OnSM" communications, information and entertainment solutions to the people and businesses of Hawaii. The key elements of our business strategy include the following:

- •

- Further leverage our broadband

network. Our broadband network is the foundation for our services to our customers, and we continue to expand its footprint and invest

in advanced technology platforms that support advanced communications and network services. We completed the build out of our Multiprotocol Label Switching (MPLS) core network statewide and continue

to deploy both fiber-to-the-node (FTTN) and fiber-to-the-premise (FTTP) access technologies to enhance and expand the speed and reach of our broadband network. We are deploying high-speed technologies

such as VDSL2, Gigabit Passive Optical Network (GPON), and Metro Ethernet to deliver new broadband services such as our next-generation television to consumers, and Voice over Internet Protocol

(VoIP), Internet protocol Virtual Private Network (IP-VPN), managed services, data center services including colocation and virtual private cloud, and cloud-based services to businesses. In both

customer segments, we continue to enhance our services by adding new service options, features and functionality.

- •

- Drive a customer- and sales-focused

organization. Our customer operations team allows us to more effectively focus on our customers and strive to ensure the successful

delivery of our services. We strive to deliver a consistent and comprehensive customer experience.

- •

- Deliver new and innovative products and solutions to attract and retain customers. We have successfully added, and expect to continue to add, new products and services to our customer offerings. We offer a full range of services, including voice, Internet, television, data, customer premises equipment (CPE), wireless, advanced communications and network services, managed services, data center services including colocation and virtual private cloud, and cloud-based services supported by the reach and reliability of our network and Hawaii's only 24x7 state-of-the-art network operations center. Our suite of IP-based services, such as our business VoIP and IP-VPN services, better positions us to compete for new customers and drive winback opportunities while also allowing us to improve retention of existing customers by migrating them from legacy services. Our next-generation television service, Hawaiian Telcom TV, is an important growth component for our consumer products portfolio and critical to our strategy to

3

- •

- Improve operating profitability and capital efficiencies. We maintain a disciplined approach to managing operating expenses and capital spending. Our focus on driving operational improvements in our business has resulted in cost savings, and we have identified several key initiatives that we believe will further improve our cost structure. In addition, we continue to review and renegotiate contracts with key IT and outsource suppliers, which has led to additional cost savings. We manage our capital expenditures to optimize returns through disciplined planning and targeted investment of capital. Our strategy will be to continue to make strategic investments in our business in order to position us for long-term growth.

win the home and capture a share of the significant television and entertainment market opportunity.

In furtherance of our growth strategy, on September 30, 2013, we completed the acquisition of SystemMetrics Corporation (SystemMetrics) for $16.3 million in cash, net of cash acquired and purchase price adjustments. Of the total purchase price, $11.9 million was payable at closing with the balance subject to an earn-out over a three year period. SystemMetrics is a leading provider of data center services in the State of Hawaii. The acquisition increased the scale and scope of our existing data center operations by adding a state-of-the art facility in Honolulu with 6,500 square feet of data center capacity and room for expansion. The acquisition complements our existing portfolio of business service offerings and enables us to diversify further our revenue base, and followed our acquisition of Wavecom Solutions Corporation ("Wavecom") on December 31, 2012. Wavecom is an information and communications technology company and facilities-based competitive local exchange carrier headquartered in Honolulu that provides voice, data and converged services to small and medium-sized business and carrier customers through a six-island subsea and terrestrial fiber network. By adding Wavecom's fiber capacity and business capabilities to our network and operations, we enhanced our ability to serve growing customer demand for high-speed Internet bandwidth and next-generation, end-to-end solutions, and improved redundancy and diversity statewide. In addition, we assumed ownership of a new, largely under-utilized 8,000 square foot data center which enhanced our opportunities in managed hosting, colocation, and cloud services.

Our Competitive Strengths

We believe the following are among our core competitive strengths and enable us to differentiate ourselves in the marketplace and help us successfully execute our business strategy:

- •

- Strong Local

Presence. We have been serving Hawaii's communities for over 130 years and employ approximately 1,400 employees statewide. Each

year, we donate to various local charities and our employees volunteer thousands of hours of community service. We understand our customers' needs because they are our needs as well. We share Hawaii's

history, heritage, and values. We are locally managed, making us more competitive and responsive to Hawaii's consumers and businesses.

- •

- Growth-Oriented Product

Portfolio. We are the only communications service provider in our market that can provide such a broad array of services to both

consumers and business customers that includes voice, Internet, data, CPE, wireless, advanced communications and IP-based network services, managed services, data center services including colocation

and virtual private cloud, and cloud-based services. Our expanding service suite, including high-quality enhanced data networking services such as our business VoIP and IP-VPN services, and our

managed services, are targeted at the key growth areas in our marketplace. Our next-generation television service, employing Microsoft® Mediaroom™, is targeted at capturing a

share of the significant video and entertainment market opportunity that we did not address previously.

- •

- Advanced Network Infrastructure. We own the State's most extensive and reliable communications network, including the broadest fiber optic cable network consisting of approximately 143,098

4

- •

- Strong Management Team. We have assembled an experienced management team that we believe is well-qualified to lead our Company and execute our strategy. Our management team has significant operational experience in the telecommunications industry combined with extensive knowledge of our local market, which will be a critical driver of our success going forward.

strand miles of fiber optic cable and more than 11,584 route miles of copper wire distribution lines. Our mature and highly-secure statewide MPLS backbone is the largest IP network in the State and allows us to deliver advanced IP-based services to well over 90% of the State's population. Our network is supported by Hawaii's only 24x7 state-of-the-art network operations center. We continue to push fiber deeper into the network and to enhance and expand the speed and reach of our broadband network, which we believe will enable us to offer new products and services that will generate growth in our business and allow us to compete more effectively in the marketplace.

Our Products and Services

Telecommunications

Local Exchange Services

Our local exchange carrier business generates revenue from local network services, network access services and certain other services, each of which is described below.

Local Network Services

Our traditional local network service enables customers to originate and receive telephone calls within a defined "exchange" area. We provide basic local services on a retail basis to residential and business customers, generally for a fixed monthly recurring charge. Basic local service also includes non-recurring charges to customers for the installation of new products and services. Basic local exchange services are enhanced with a variety of value-added services such as call waiting, caller ID, voice messaging, three-way calling, call forwarding and speed dialing. Value-added services may be purchased individually or as part of a package offering for a monthly recurring charge. We also offer other local exchange services, such as local private line and inside wire maintenance. The rates that can be charged to customers for basic local and certain other services are regulated by the HPUC. We charge business customers higher rates to recover a portion of the costs of providing local service to residential customers, as is customary in the industry. See "—Regulation" for further discussion of regulatory matters.

Network Access Services

Our network access services are offered in connection with the origination and termination of long distance, or toll, calls that typically involve more than one company in the provision of end-to-end long distance service. Since toll calls are generally billed to the customer originating the call, a mechanism is required to compensate each company providing services relating to the call. This mechanism is the access charge, which we bill to each interexchange carrier for the use of our facilities to access our customers. In addition, we bill a component of access charges directly to our customers. Our network access services generate intrastate access revenue when an intrastate long distance call that involves us and an interexchange carrier is originated and terminated within Hawaii. This access charge is regulated by the HPUC. Similarly, our network access services generate interstate access revenue when an interstate long distance call is originated from a Hawaii local calling area served by us and is terminated in a local calling area in another state and vice versa. Interstate access charges are regulated by the FCC. We also offer special access voice and data services, which are a key area of growth driven by demand for increasing bandwidth from business and wholesale customers. Special access services include switched and non-switched (or dedicated) services such as point-to-point single channel circuits,

5

Synchronous Optical Network (SONET) and Time Division Multiplexing (TDM) transport services, as well as IP-based private networks. See "—Regulation" for further discussion of access charges.

Long Distance Services

We provide long distance services to transmit international calls, interLATA (Local Access Transport Area) domestic calls, and regional toll calls made to points outside a customer's local calling area but within our local service area (intraLATA toll). In Hawaii, each of the islands is a local calling area, and calls between the islands are intraLATA toll calls. Other long distance services include 800-number services and wide area telecommunication services, or WATS, private line services, and operator services associated with long distance calls. As of March 1, 2014, we served approximately 190,200 long distance lines, of which 61% served residential customers and 39% served business customers.

Internet Services

We provide high-speed Internet (HSI) access to our residential and business customers. Our data network enables us to provide extensive high-speed network access. We have HSI available in 79 of our 86 central offices. As of March 1, 2014, we served approximately 91,500 retail residential HSI lines, 19,400 retail business HSI lines, and 900 wholesale business and resale HSI lines.

Managed and Cloud-Based Services

We provide managed services as an end-to-end solution that manages, monitors, and supports a business' network, customer premise equipment (CPE), and corporate data security. As business networks become more complex, the amount of time and capital businesses must spend to support their networks increases accordingly. Our managed services enable customers to focus on their core business by leaving the day-to-day management of their networks to us. Our managed services product portfolio consists of managed network and security services, colocation services, IT professional services, and security consulting.

Advanced Communications and Network Services

The role of business communication providers is evolving. Consistent with this, we have expanded into application-centric, advanced communications and network services. Our advanced communications and network services include Routed Network Service, a high-performance IP virtual private networking service for business customers; Enhanced Internet Protocol Data Service, a multipoint switched Ethernet service; and Hosted PBX, a business VoIP service that provides businesses with a complete, converged communication solution in a hosted package.

Next-Generation Television Service

We introduced our next-generation television service on the island of Oahu in June 2011. During 2013, we continued to invest in our network to provide integrated digital video, high-speed broadband and voice services to new and existing customers. Our Hawaiian Telcom TV service is expected to be a critical growth component for our consumer products portfolio and an anticipated anchor of our service bundling strategy. With television, we are now able to market a triple play bundle in certain areas of the island of Oahu. We had strong Hawaiian Telcom TV growth, with more than 8,500 subscribers added in 2013, and ended the year with approximately 18,400 subscribers. We also enabled approximately 55,000 households in 2013, which is a record for us, increasing our cumulative total to approximately 120,000 households on Oahu as of the end of 2013. Enabling households means these homes can subscribe to our next generation network services, including our Hawaiian Telcom TV service.

6

Wireless Services

We offer wireless services pursuant to a mobile virtual network operator (MVNO) services agreement with Sprint Spectrum, L.P. (Sprint). That agreement allows us to resell Sprint wireless services, including access to Sprint's nationwide personal communication service (PCS) wireless network to residential and business customers in Hawaii under the Hawaiian Telcom® brand name. The services agreement with Sprint was effective as of May 2009 and recently was renewed by us for a one-year term expiring in May 2015.

Other Telecommunications Services

We seek to capitalize on our local presence and network infrastructure by offering other services to customers and interexchange carriers. Sales and maintenance of customer premises equipment to the business markets are an important source of local exchange revenues. Customer premises equipment services are also an area of potential growth as attractive contracts with major equipment providers allow us to offer complete voice and data network and management solutions. For the wholesale or carrier market, we offer services including operator services, billing and collection services and space and power rents for colocation services. We also offer public pay telephone services at approximately 4,450 locations throughout the State of Hawaii.

Data Center Colocation

We provide colocation and virtual private cloud data center services. Colocation enables our customers to install and remotely operate their IT equipment in our state-of-the art facilities. Virtual private cloud services include the use of shared virtualized computing resources and a variety of customer control features and services, including back-up storage. We also provide related professional services, including planning, design, implementation and support services, to enable our customers to transition seamlessly and easily manage their IT solutions.

Markets and Customers

Telecommunications

We have been a telecommunications provider in Hawaii for more than 130 years. Our market consists of 86 central offices serving an area of approximately 6,263 square miles on the islands of Oahu, Maui, Hawaii, Kauai, Molokai and Lanai. We are the incumbent provider of local exchange services within this area and own the State's most extensive local telecommunications network, with approximately 372,100 local access lines served as of March 1, 2014, of which 50% served residential customers, 49% served business customers, and the remaining 1% served other customers. Other customers include (1) interexchange carriers that pay for access to long distance calling customers located within our local service area and (2) CLECs that pay for wholesale access to our network to provide competitive local service on either a resale or unbundled network element (UNE) basis as prescribed under the Communications Act of 1934, as amended (the "Communications Act"). We also provide wireless services in the State of Hawaii. It is estimated that there are approximately 1.3 million wireless subscribers in Hawaii and that currently less than 1% of these subscribers utilize us as their wireless provider.

Our market is characterized by high population density, with approximately 70% of the state's population concentrated on Oahu over an area of approximately 598 square miles, or 1,600 persons per square mile. In addition, 39% of the households in Hawaii reside in multi-dwelling units (MDUs)—44% on Oahu—compared with 26% in the U.S. overall. This concentration of customers and commerce provides opportunities to leverage our network infrastructure to deliver products and services efficiently and in a cost-effective manner and to market and sell our services more effectively. Given Hawaii's geographic location, its distance from the mainland United States and the diversity of its population

7

(approximately 38% being of Asian descent), Hawaii residents and businesses have telecommunications needs that may be different from those on the mainland United States. Furthermore, in 2013, the median household income in Hawaii is estimated to exceed the national average household income by approximately $15,000. For the foregoing reasons, our strategy is to leverage the distinctive qualities of the Hawaii market to develop customized, local marketing strategies.

Our business marketplace is dominated by several key industries. The federal government accounts for approximately 24% of gross state product. With the U.S. Pacific Command, one of the largest U.S. unified service commands, based in Hawaii, the federal government is one of our largest customers. The hospitality industry and financial institutions also account for a significant portion of our business. The operations of these leading sectors are communications intensive, and we believe that they are dependent on our modern, reliable services. Hawaii's small business market (in the aggregate) is also a key driver of Hawaii's economy—approximately 95% of the companies in Hawaii employ fewer than 50 employees, and these businesses make up a market of approximately 36,000 businesses. We believe that these business customers represent an underserved segment that we are targeting aggressively with new product and service offerings.

Data Center Colocation

We believe there is a significant growth opportunity to provide data center services, including colocation and virtual private cloud, to businesses across the State of Hawaii. There are two important trends driving the growth in the adoption of data center services—the increasing use of cloud-based technologies by business customers to run their most important business functions, and the increasing demand for outsourced solutions. Market research estimates the Hawaii data center services opportunity to be over $100 million annually. At present, the percentage of businesses in Hawaii that use colocation and virtual private cloud services is small compared to utilization in similarly-sized mainland U.S. markets.

Competition

The telecommunications industry is highly competitive. We experience competition from many communications service providers, including the local cable operator Oceanic Time Warner (Oceanic), wireless carriers, long distance providers, competitive local exchange carriers, Internet service providers, Internet information providers, over-the-top hybrid voice providers, and other companies that offer network services and managed enterprise solutions. Many of these companies have a strong market presence, brand recognition, and existing customer relationships, all of which contribute to competition that may affect our future revenue growth. We expect competition to intensify as a result of the entrance of new competitors and the rapid development of new technologies, products and services.

Oceanic, a subsidiary of Time Warner Cable Inc., the second largest cable operator in the United States, is one of our most significant competitors. Approximately 89% of the households in Hawaii (93% of households on Oahu) subscribe to Oceanic's cable television service. Oceanic also has the majority share of the high-speed Internet market in Hawaii, which it uses as a platform to offer voice services utilizing VoIP technology, and markets its cable, high-speed Internet, and voice services through competitive bundled offerings. In addition, Oceanic has targeted communications service offerings to small and medium-sized businesses.

Wireless communications services continue to constitute a significant source of competition, especially as wireless carriers expand and improve their network coverage and continue to lower their prices. As a result, some customers have chosen to completely forego use of traditional wireline phone service and instead rely solely on wireless services. We anticipate the wireless substitution trend will continue, and could pose additional threat to our high-speed Internet product, particularly if wireless service rates continue to decline and the wireless service providers upgrade their networks to

8

4G technology and are able to deliver faster data speeds. Over-the-top hybrid providers, such as Skype and Magic Jack, also offer the capability to provide local voice and long distance calls using an Internet-equipped personal computer.

The advanced communications and network services business, as well as the managed services, data center services including colocation and virtual private cloud, and cloud-based services businesses, are highly competitive due to the absence of significant barriers to entry. The emergence of non-traditional, application-centric players in the market is redefining the role of service providers in these fields. We currently compete for business customers with vendors such as tw telecom of hawaii l.p., NetEnterprise Inc., Tri-net Solutions, L.L.C., Dell SecureWorks, Perimeter E-Security, World Wide Technology, Inc., and other traditional and non-traditional carriers.

We are uniquely positioned in the State to bundle data center services with network, managed services, data communications equipment and support services for an end-to-end, statewide solution. Due to the high cost of commercial real estate in the State of Hawaii, there is a limited inventory of colocation data center space available for Hawaii businesses. There are numerous other providers of cloud-based software, including system integrators in Hawaii and web-based service providers, that offer software subscriptions and virtual machines on cloud-based servers housed in data centers on the mainland U.S. and internationally. However, such out-of-state solutions raise concerns regarding response latency, the higher cost of private network connectivity from Hawaii if required for improved responsiveness, and data security.

We employ a number of strategies to combat the competitive pressures. Our strategies are focused on preserving and generating new revenues through customer retention, upgrading and upselling services to existing customers, new customer growth, winbacks of former customers, new product and feature deployment, and by managing our profitability and cash flow through targeted reductions in operating expenses and efficient deployment of capital. Key to success in these strategies is continued enhancement and expansion in the speed and reach of our broadband network, which we believe will enable us to offer new products and services that will generate growth in our business and allow us to compete more effectively in the marketplace. Another key is a focus on enhancing the customer experience, as we believe exceptional customer service will differentiate us from our competition. Customers expect industry leading service from their service providers. As technologies and services evolve, the requirement of the carrier to excel in this area is crucial for customer retention.

Network Architecture and Technology

Our strategy is to enhance and expand the most technologically advanced broadband communications network in the state of Hawaii and to position ourselves as a key hub for critical trans-Pacific traffic. Pursuing such a strategy has enabled us, among other things, to continue being the market leader in Hawaii for advanced communications and network services and managed and cloud-based services. In 2013, we invested approximately $72 million in our network including significant expenditures to expand the reach, capacity, and resiliency of our IP-based packet and broadband network. Significant strides were made in 2013 to add hundreds of miles to our state-leading fiber network and continuing our transformation toward an optical, IP-based broadband network. The acquisition of Wavecom Solutions Corporation in December 2012 alone added over 500 route miles of additional fiber infrastructure into our network.

9

Packet Optical Network

Our statewide MPLS network is unmatched in reach, capacity, security, resiliency, and reliability in Hawaii. Consisting of 8 core routers and 40 service edge routers meshed throughout the island chain, we offer a wide range of Layer 2 and Layer 3 MPLS services with many advanced features to meet our customers' needs, including advanced traffic engineering support of intelligent QoS, Service OAM capabilities, multiple access technologies, standards based routing protocols, Internet access across a single physical connection, support for IPv6, carrier grade Ethernet, and up to 40Gb/100Gb Ethernet access. Driven by continued high-bandwidth demands from our high-speed Internet service, next-generation television service, wireless backhaul, and other retail and wholesale business requirements, in 2013 we continued to expand our next-generation packet-optical transport network. This next-generation platform combines WDM transport, ROADMs, SONET/SDH ADMs, and centralized carrier Ethernet switching in a single converged device allowing us to meet the growing bandwidth needs at an affordable price while accommodating traditional SONET-based services for transition from our legacy services. Additional new packet-optical nodes were deployed in the State in 2013, resulting in packet-optical nodes deployed throughout the State on all six major islands. Our current backbone infrastructure consists of two border routers with diverse trans-Pacific links to mainland carriers, 19 Frame Relay switches and 12 asynchronous transfer mode (ATM) switches. There are also 1,000 Synchronous Optical Network (SONET) rings in service.

Our telecommunication infrastructure includes more than 15,000 sheath miles of fiber optic cable and copper wire distribution lines. Submarine and deep-sea fiber optic cables connect the islands of Kauai, Oahu, Maui, Molokai, Lanai and Hawaii, while digital microwave radios provides additional inter-island connections. In addition to our owned or leased interisland cables between Oahu, Kauai, Maui, Hawaii, Molokai, and Lanai, we are connected by trans-Pacific fiber optic cables between the Hawaiian islands and to the U.S. Mainland which provide ring diversity to protect our communications between the islands and high-speed broadband links in and out of the State.

Voice Network

We continue to add services and features via our VoIP application servers to provide Hawaii businesses the communication tools they need to compete locally and globally. New services such as Hosted PBX were introduced to our business customers in 2012, thereby expanding our Business All-in-One (BAiO) offering to customers with the need for a larger-scale solution.

As of March 1, 2014, we owned 107 local base and remote switches and five tandem switches serving approximately 364,600 total lines on the islands of Hawaii, Kauai, Lanai, Maui, Molokai and Oahu. All of our access lines are served by digital switches provided predominantly by Alcatel-Lucent and Genband. Since 2002, we have updated our infrastructure to meet the technological needs of our customers. Our switches on every island are linked through a combination of extensive aerial, underground and undersea cable, as well as microwave facilities, allowing us to provide our services to customers in a very challenging geographical territory. Our signal transfer points (STPs) are next-generation IP router based, ensuring a smooth migration to IP.

Access Infrastructure

We continue our aggressive investment to transform our access network to a high-speed, fiber-based broadband network and added 55,000 households to our next-generation broadband network in 2013. In 2013, we accelerated deployment of fiber-to-the-premise (FTTP) solutions to serve new (greenfield) multi-dwelling unit (MDU) and single-family subdivision developments. By laying fiber and utilizing various passive optical network components from these developments to our central offices, we can further leverage the capabilities of our MPLS backbone, provide higher bandwidth services to our customers, including our television service, and reduce maintenance costs. We also continued to expand

10

our fiber network deeper into neighborhoods, shortening over 28,300 customer loops in 2013 to 3,000 feet or less using FTTN technology and expanded our fiber networks to approximately 289 cell sites across the state of Hawaii to provide backhaul services to our wireless carrier customers. These network enhancements allowed the increased penetration and expansion of higher broadband services including our television service.

Next-Generation Television Service

The implementation of IP-based television service is driving one of the largest network transformations in the telecommunications industry. We introduced our next-generation television service on the island of Oahu in July 2011, deploying the service to both copper-fed and fiber-fed customers and converting entire MDU complexes to our new service. Utilizing Microsoft® Mediaroom™ middleware, we provide a wide range of content and multimedia services over our IP-based network and provide our customers with new viewing experiences and applications. We continue to see strong demand for our television service as we expand our footprint to additional areas on the island of Oahu.

Network Surveillance and Operations

Our statewide network infrastructure is monitored and managed by our world-class Network Operations Center (NOC) located in Honolulu. The NOC provides surveillance 24x7, 365 days a year, for our statewide network consisting of 86 central offices, associated interoffice facilities, and microwave radio towers. Our network infrastructure for voice, data, and video is monitored proactively with state-of-the-art performance and fault management systems. Customer networks are also monitored proactively in the NOC upon request. We have a customer service center which also operates on a 24x7, 365 days a year basis to handle customer inquiries and repairs, and provide call completion services. All customer installations and repairs requiring a field technician are offered during extended hours and coordinated by our Dispatch Center. All construction activity, for both outside and inside plant, is coordinated by our engineering operations team located at our main office on Oahu.

In addition to our network infrastructure, we operate a wide range of equipment from large boom trucks to small passenger vehicles, mobile generators, and other miscellaneous trailers, tools and test equipment. We own or lease most of our administrative and maintenance facilities, central offices, remote switching platforms, and transport and distribution network facilities. Our assets are located primarily in the state of Hawaii.

Information Technology and Support Systems

A number of IT-related initiatives, beginning in 2010 and continuing to the present, are aimed at delivering advanced technologies to our customers as well as delivering a superior customer service experience. Our systems have evolved and we continue to focus our strategy towards customer- centric architectures. This approach focuses on delivering end-to-end system solutions based on customer improvement initiatives integrated into product development. The service delivery mechanisms are comprised of a mixture of commercial off-the-shelf systems, internally-designed and developed systems purpose built for functions such as inventory and network activation, and select niche applications that offer optimal capabilities and flexibility at the network layer.

As part of our ongoing commitment to customer service, we implemented improvements in 2013 to our website that include new online billing features and a redesigned residential web portal, and enhanced customer interaction by introducing a web chat feature for communicating with our customer contact center. We are planning improvements to our customer contact center systems to further improve the customer experience. In addition, we improved our service qualification systems in 2013

11

and intend to provide our sales force with new system capabilities in 2014 in support of our next-generation network.

We continue to focus efforts on flow-through automation from order entry through billing, and in 2013 we implemented improvements which reduced manual processing of complex orders, increased productivity, and enhanced overall data quality. We plan to make further improvements in 2014 through consolidation of order entry process and systems. We improved our field dispatch systems in 2013 to increase dispatch efficiency, and we plan to make further improvements in 2014 in our fiber-based systems to support our next-generation network.

To improve the cost and efficiency of our internal IT services, we are continuing the process of consolidating our two data centers and implementing a state-of-the-art virtualization platform to support our growing computing needs. This effort has lowered the operating costs and energy consumption at our data centers and improved the efficiency, scalability, and reliability of our operations. We expect to complete the data center consolidation process in 2014.

We have aggressively pursued initiatives to reduce our cyber security-related risks. In 2013, we continued to expand the scope of our most advanced security controls and deployed additional controls into key areas of our network. We continue to make technology and resource investments to improve further our security posture in critical areas. These and other changes reflect our on-going commitment to securing our information assets and protecting sensitive data held and carried by our information systems.

As is the case with other telecommunications companies, we are an on-going target for cyber criminals. However, there were no noteworthy cyber security incidents during 2013. Our information security team continues to work closely with law enforcement at the federal, state and local levels, and we adjust our protection schemes as necessary. We remain committed to invest appropriately in initiatives that reduce our cyber security risk.

In addition to our cyber security efforts in the Company and in the State of Hawaii, we have participated in the national effort to secure cyberspace. Our security personnel have attended working sessions facilitated by the National Institute of Standards and Technology (NIST) to develop the cyber security framework that is mandated in President Obama's Executive Order 13636. We also are an active member of US Telecom Association's cyber security working group and participate in the activities of the FCC's Communications Security, Reliability and Interoperability Council (CSRIC). The mission of CSRIC is to provide recommendations to the FCC to ensure, among other things, optimal security and reliability of communications systems, including telecommunications, media, and public safety.

Employees

As of March 1, 2014, we employed approximately 1,400 full-time employees in Hawaii. Of the total employees, 55% were represented by the International Brotherhood of Electrical Workers (IBEW) Local 1357. In January 1, 2013, a new five-year collective bargaining agreement with IBEW Local 1357 went into effect. We believe that management currently has a constructive relationship with the represented and non-represented employee group.

Insurance

We have insurance to cover risks incurred in the ordinary course of business, including errors and omissions, general liability, property coverage (which includes business interruption), director and officers and employment practices liability, auto, crime, fiduciary and worker's compensation insurance in amounts typical of similar operators in our industry and with reputable insurance providers. Central office equipment, buildings, furniture and fixtures and certain operating and other equipment are

12

insured under a blanket property insurance program. This program provides substantial coverage against "all risks" of loss including fire, windstorm, flood, earthquake, and other perils not specifically excluded by the terms of the policies. As is typical in the telecommunications industry, we are self-insured for damage or loss to certain of our transmission facilities, including our buried, undersea and above-ground transmission lines. We believe that our insurance coverage is adequate; however, if we become subject to substantial uninsured liabilities due to damage or loss to such facilities, our financial results may be adversely affected.

Regulation

Federal and State Regulation of Telecommunications Services

Our telephone operations generally are subject to the jurisdiction of the FCC with respect to interstate services and the HPUC with respect to intrastate services. The following summary does not purport to describe all current and proposed applicable federal and state regulation.

Competition

We face increasing competition in all areas of our business. Regulatory changes brought on by the 1996 amendments to the Communications Act, regulatory and judicial actions, and the development of new technologies, products and services have created opportunities for alternative telecommunication service providers, many of which are subject to fewer regulatory constraints than our ILEC. We are unable to predict definitively the impact that the ongoing changes in the telecommunications industry will ultimately have on our business, results of operations or financial condition. The financial impact will depend on several factors, including the timing, extent and success of competition in our markets, the timing and outcome of various regulatory proceedings and any appeals, the timing, extent and success of our pursuit of new opportunities resulting from the amendments to the Communications Act and technological advances, and any changes in the state or federal laws or regulations governing communications.

Universal Service

As a provider of interstate telecommunications, we are required to contribute to federal universal service programs. The FCC adjusts the contribution amount quarterly and may increase or decrease this amount depending on demand for support and the total base of contributors. Pending proposals to change the contribution methodology could increase or reduce our total obligation to this funding. We also draw Interstate Access Support from this funding, which is frozen and subject to phase out, as further described below.

On December 31, 2007, we filed a petition with the FCC requesting a waiver to determine our eligibility to receive federal high-cost loop support according to our average line costs per wire center instead of our statewide average line costs. In Order and Further Notice of Proposed Rulemaking WC Docket No. 10-90, FCC 11-161, which was released on November 18, 2011, the FCC denied our petition on the grounds that the reforms adopted in the Order could provide the relief we had sought in our waiver petition, and to the extent they did not, we could seek additional targeted support through a request for waiver of the new rules.

In November 2011, the FCC released its "Connect America Fund" Order which adopted a number of proposals relating to reforming existing universal service support mechanisms. Among other things, the Order transforms the FCC's universal service and intercarrier compensation systems into a new Connect America Fund ("CAF"), which will fund broadband deployment in areas unserved by an unsubsidized wireline competitor and eventually will replace all existing high-cost support for voice services. For price cap carriers such as our subsidiary Hawaiian Telcom, Inc., CAF support first will be distributed pursuant to a forward-looking cost model to carriers that make a state-wide commitment to

13

meet minimum broadband deployment obligations established by the FCC. If the price cap carrier declines to make that commitment, CAF support will be distributed in accordance with competitive bidding open to all eligible carriers. In the interim, until the CAF is fully operational, a price cap carrier's Interstate Access Support will be frozen at current levels, but continued receipt of such funds is conditioned on the carrier meeting FCC broadband deployment obligations including speed and other technical parameters of service. In addition, the FCC will make an additional $300 million in CAF funding available to price cap carriers willing to commit to meeting these broadband public interest requirements. A number of details, such as the makeup and results of the cost model used to determine support levels, are still to be developed. In addition, a number of petitions for reconsideration of the FCC's Order, as well as multiple appeals, have been filed. The FCC awarded Hawaiian Telcom, Inc. approximately $402,000 in CAF Phase I Round 1support and approximately $1 million in CAF Phase I Round 2 support. We do not know when the CAF proceeding will be concluded, how the FCC will implement the programs, or how accurate the CAF Phase II cost model will be, and therefore do not know how this proceeding ultimately will impact our universal service support level or the outcome or timing of the petitions or appeals.

Government Regulation of Retail Rates

The FCC and the HPUC are the two agencies that regulate our telecommunications services. In general, the FCC regulates interstate service, and the HPUC regulates intrastate service. The HPUC has, slowly over time, reduced its rate regulation of some of our services. The HPUC classifies all regulated telecommunications services as fully competitive, partially competitive, or non-competitive.

In 2009, the Hawaii State Legislature passed Act 180, which it clarified with an amendment in 2010 (Act 8). As amended, Act 180 requires that the HPUC treat all intrastate retail telecommunications services, including intrastate toll (i.e., inter-island), central exchange (Centrex), most residential and business local exchange services, integrated service digital network (ISDN) private lines and special assemblies, and directory assistance, as "fully competitive" under the HPUC's rules with certain qualifications. In addition, HPUC approval and cost support filings are no longer required to establish or reduce rates or to bundle service offerings; however, all service offerings must be priced above the service's long-run incremental cost, and the HPUC can require us to provide such cost support demonstrating compliance with its costing rules at any time. If the HPUC is not satisfied, it retains the ability to investigate the offering and to suspend the offering pending the outcome of its investigation. In addition, HPUC approval is required in order to increase the rate for a service to a level that is greater than the rate for the retail service in the tariff at the time of implementation of either Act 180 or Act 8, whichever is applicable. In 2012, the Hawaii State Legislature passed Act 74, which further leveled the regulatory playing field in intrastate retail telecommunications services by providing us with pricing flexibility to increase rates higher than the above-mentioned appropriate tariffed rate for any retail telecommunications service except basic exchange service without approval from the HPUC. HPUC approval still is required to increase rates for basic exchange service (i.e., single-line residential and single-line business services). Competitive forces, however, may cause us to be unable to raise our local rates in the future.

The classification of retail local exchange intrastate services as fully competitive and the ability to bundle the services with other fully or partially competitive services or other services that are not within the HPUC's jurisdiction enable us to charge a discounted rate for bundled service offerings and have helped us to be more competitive. Pricing flexibility has allowed us to increase the monthly charge for non-published numbers.

State and Federal Regulation of Long Distance Services

We are subject to certain conditions imposed by the HPUC and the FCC on the manner in which we conduct our long distance operations. For example, we are prohibited from joint ownership of local

14

and long-distance telephone transmission or switching facilities. The HPUC is responsible for ensuring that our ILEC does not discriminate against other long distance providers.

Federal Requirements

As an ILEC, we are subject to a number of access and interconnection requirements under federal law. Among other things, an ILEC must negotiate in good faith with other carriers requesting interconnection and access to UNEs and must offer its competitors access to UNEs, such as local loops and inter-office transport, at regulated rates. However, we are no longer required to provide our competitors with access to switching UNEs, or the combination of loop, transport and switching UNEs known as the UNE Platform (UNE-P). The FCC also has limited our obligation to unbundle fiber facilities to multiple dwelling units, such as apartment buildings, and to homes and offices deployed in fiber-to-the-curb and fiber-to-the-premises arrangements. In addition, federal law regulates competitors' requests to colocate facilities within our central offices and to have access to our subscriber list information in order to produce competing directories, and other matters, including the manner in which we must protect our customers' information. The FCC currently is examining its pricing standard for UNEs and may modify other aspects of its UNE rules as market conditions change. The FCC also has imposed specific rules regarding the manner and time within which a customer's telephone number must be ported to a competing carrier's service.

Interstate and Intrastate Access Charges

The rates that we can charge for interstate access are regulated by the FCC. The FCC has made various reforms to the existing rate structure for access charges, which, combined with the development of competition, have generally caused the aggregate amount of access charges paid by long-distance carriers to decrease over time. For example, the FCC has instituted caps on the per-minute rate we can charge for our switched access services as well as on our monthly subscriber line charges (SLCs). The FCC has adopted rules for special access services that provide for pricing flexibility and ultimately the removal of services from price regulation when prescribed competitive thresholds are met. We currently have pricing flexibility for certain special access services offered throughout our territory. On May 18, 2008, the FCC granted our request for pricing flexibility for certain special access services offered on the neighbor islands. We also have pricing flexibility for certain special access services offered on Oahu. On December 18, 2012, the FCC released an order establishing mandatory data collection for price cap carriers such as Hawaiian Telcom, Inc. If approved by the Office of Management and Budget, the data collection will seek detailed information concerning carrier services provided to enterprise and wholesale customers, including special access services. The FCC also will seek comment on a proposal for using the data collected to evaluate competition in the market for special access services. This review is being conducted to help the FCC decide whether to modify the special access pricing rules for price cap carriers, including whether the pricing flexibility rules should be modified or eliminated. We do not know when this proceeding will be concluded or what impact it will have on price cap carriers.

Our intrastate access rates are set forth in an interim tariff approved by the HPUC in 1995 and are based on our embedded costs. Although it has been the HPUC's intention to initiate a proceeding to adopt permanent access rates based on a forward-looking cost methodology, the HPUC has not yet initiated a proceeding to do so.

Our interstate and intrastate access charge levels will be fundamentally affected by the FCC's reform of intercarrier compensation, described below.

Federal Framework for Intercarrier Compensation

In its "Connect America Fund" Order (see "—Universal Service" above) that reformed universal service, the FCC also fundamentally restructured the regulatory regime for intercarrier compensation.

15

Intercarrier compensation consists of state and interstate access charges and local reciprocal compensation. Among other things, this comprehensive reform unifies state and interstate intercarrier charges in certain circumstances, provides a mechanism to replace intercarrier revenues lost through rate unification, and resolves prospectively a number of outstanding disputes among carriers regarding interconnection and compensation obligations. In particular, the FCC required that most intercarrier compensation be eliminated, and that a system of "bill & keep" replace it whereby the carrier would have to seek recovery of its costs entirely from its own end users. In the interim, the FCC capped most existing intercarrier compensation rates and established a phase-down of those rates over a six-year period for price cap companies such as Hawaiian Telcom, Inc. To partially offset the resulting decrease in revenues, the Commission authorized carriers (1) to assess its end user customers a limited recovery charge that would increase over time as intercarrier compensation rates decline, and (2) to receive CAF support in limited amounts subject to specific requirements, to be phased out over a three-year period beginning in 2017. Hawaiian Telcom, Inc. does not receive any such intercarrier compensation CAF support. Finally, the FCC decided that interstate access charges should apply to VoIP or other Internet protocol- based service providers on a prospective basis, subject to the same interim phase-down requirements described above. The FCC found that carriers should have the opportunity to make up for any loss of revenues either through the established recovery mechanisms or through the sale of additional services, such as broadband and television services. A number of petitions for reconsideration of the FCC's order, as well as multiple court appeals, have been filed. In July 2012, Hawaiian Telcom, Inc. implemented the first phase of the intercarrier compensation reform, including reducing by fifty percent the amount by which intrastate terminating switched access rates exceed interstate rates, and offsetting most of the resulting revenue loss by implementing a monthly recurring access recovery charge for certain classes of customers. In July 2013, Hawaiian Telcom, Inc. implemented the second phase of the intercarrier compensation reform, including reducing intrastate terminating switched access rates to interstate rates, and offsetting a portion of the resulting revenue loss by implementing a monthly recurring access recovery charge for certain classes of customers. The intercarrier compensation portion of the FCC's order is also subject to a number of petitions for reconsideration and court appeals. We do not know the timing or outcome of such petitions or appeals.

The FCC has found that Internet-bound traffic is not subject to reciprocal compensation under Section 251(b)(5) of the Communications Act. Instead, the FCC established a federal rate cap for this traffic, which is and will remain $0.0007 per minute until the FCC decides otherwise.

Federal Regulatory Classification of Broadband and Internet Services

The FCC has been considering whether, and under what circumstances, services that employ Internet protocol are "telecommunications services" subject to regulations that apply to other telecommunications services, but it has not definitively ruled on the issue and instead has made a series of decisions addressing specific services and regulations. For example, some VoIP providers must comply with the federal wiretap law and with FCC requirements to provide enhanced 911 emergency calling capabilities, ensure disability access and provide local number portability. Certain VoIP providers are exempt from state telecommunications market entry regulation. As a result, our VoIP competitors are less regulated than we are.

In September 2005, the FCC ruled that ILECs like ours may offer dedicated broadband Internet access service as an information service. As a result, we are no longer required to offer the underlying broadband transmission capacity used to provide our HSI service on a tariffed, common carrier basis to competing Internet Service Providers (ISPs). This decision gives us greater flexibility in how we offer and price such transmission capacity. It also puts us on more even footing with our cable competitors in the broadband market since the FCC had previously held that high-speed Internet access service delivered using cable television facilities constitutes an information service not subject to common carrier regulations, a determination that was upheld by the United States Supreme Court.

16

In March 2006, a request of Verizon that sought forbearance from Title II regulation for certain specified advanced broadband special access services was deemed granted by operation of law. This forbearance grant was applicable to us since Hawaiian Telcom Communications, Inc. was part of Verizon when the original Verizon petition for forbearance was filed. This action permits us to deregulate covered advanced broadband special access services, giving us greater flexibility in our pricing and terms and conditions of offering. In October 2011, tw telecom of hawaii l.p. and others filed a petition requesting the FCC to reverse in part the forbearance deemed granted to Verizon by operation of law. We filed comments in opposition to the petition. In November 2012, the Ad Hoc Telecommunications Users Committee and others filed a petition requesting the FCC to reverse in part the forbearance for Verizon and other grants of forbearance by the FCC related to advanced broadband special access services. There is no definite timeframe for an FCC decision on these petitions.

In February 2009, Congress enacted a law that required the FCC to establish a national broadband plan to promote broadband service availability to all Americans. This plan was released by the FCC in March 2010 and contained recommendations on how to promote the provision of broadband in unserved and underserved areas of the country, including an increase in the speed at which current customers can obtain broadband services. It also addressed how to increase the adoption of broadband services by those consumers who currently do not have access to those services. The FCC announced that there will be additional rulemakings to implement the recommendations of the plan. The comprehensive reforms to universal service and intercarrier compensation detailed earlier in this section were a partial response to that plan. It is not known how the broadband plan will impact our business operations given that not all of the proposed actions have been taken.

In December 2010, the FCC adopted "net neutrality" rules, termed "open Internet" rules, that would bar Internet service providers from blocking or slowing Web content sent to homes and businesses. The rules continue to treat broadband Internet access services under the FCC's Title I authority, but adopted as rules the existing guidelines applicable to Internet service providers. The FCC also adopted three additional rules concerning blocking, non-discrimination, and transparency. The no-blocking rule prohibits a fixed broadband Internet access service provider from blocking lawful content, applications, services, or devices, subject to reasonable network management. The anti-discrimination rule prohibits a fixed broadband Internet access service provider from unreasonably discriminating in the transmission of lawful network traffic over a consumer's broadband Internet access services, subject to reasonable network management. Wireless broadband providers are not subject to these two rules, but only to a scaled-back version of the no-blocking rule applicable to fixed providers. The transparency rule requires all Internet access service providers to disclose publicly accurate information regarding their network management practices, performance, and commercial terms of service so that consumers are able to make informed choices and device providers are able to develop, market, and maintain Internet offerings. The anti-discrimination and no-blocking rules were recently vacated by a federal court of appeals, but the public disclosure requirement remains in place. We do not know how the FCC will respond to this court decision.

Video Services Regulation

Through our Hawaiian Telcom Services Company, Inc. subsidiary, we began to provide television service on the island of Oahu in July 2011. We are regulated as a cable TV operator under federal and state law. As the non-dominant video service provider in the state of Hawaii, we face the risk that we will be unable to obtain access to programming that we need in order to compete with Oceanic Time Warner (Oceanic), the dominant cable TV provider on the island. Some of this programming is owned by the parent company of Oceanic, which may or may not be required to provide access to us under the FCC's program access rules.

17

In December 2011, Oceanic filed a petition with the FCC seeking to be declared free from rate regulation for its basic cable TV services on Oahu. The state of Hawaii opposed Oceanic's petition. If the petition is granted, Oceanic would have more flexibility to raise or lower prices for its services and become more competitively nimble. We do not know when the FCC will act on the petition or whether the petition will be granted.

In October 2012, the FCC issued an order lifting the program access rule ban on exclusive contracts between any cable operator and any cable-affiliated programming vendor. It also issued a separate notice seeking comment on whether (1) to establish a rebuttable presumption that an exclusive contract for a cable-affiliated Regional Sports Network (RSN) is an unfair act; (2) it should establish a standstill provision during an RSN-related complaint; and (3) the presumptions for RSNs should be extended to a cable-affiliated national sports network. The FCC found a preemptive prohibition on exclusive contracts is no longer necessary and that a case-by-case process will remain in place to assess the impact of individual exclusive contracts. The FCC order provides a 45-day answer period for all complaints and a six-month deadline for it to act on a complaint alleging a denial of programming. The order also incorporates safeguards regarding RSNs, by establishing a rebuttable presumption that an exclusive contract involving a cable-affiliated RSN has the "purpose or effect" of "significantly hindering or preventing" the complainant from providing television services, placing the burden of proof on the distributor.

In December 2012, the FCC granted a complaint filed by the Mauna Kea Broadcasting Company with the FCC seeking to place its over-the-air broadcasting station KLEI-TV on both Oceanic's and our television systems. The order required us to place KLEI-TV on channel 6, which is already occupied by another programming station. Both Oceanic and Hawaiian Telcom Services Company, Inc. have filed a petition for reconsideration of this decision, which effectively stays the mandate of the order until all appeals are resolved. We cannot predict when or how the FCC will resolve this petition.

Other Federal and State Regulatory Proceedings

The FCC has been exploring whether to modify its rules requiring utilities to provide telecommunications carriers and cable television companies with access to their poles, ducts, and rights of way. In April 2010, the FCC adopted new pole attachment rules that, among other things, require access to poles and conduit within a shorter period of time, and further limit make ready costs. In addition, these new rules change the rates for pole attachments by mandating that broadband attachers pay pole attachment rates that are closer to existing cable TV rates, than higher rates applicable to telecommunications carriers. These rules also for the first time allow telephone companies to demand reasonable rates from utility pole owners. These rules tend to increase the burdens and costs of pole and conduit owners such as us. The rules were upheld on appeal in February 2013.

In May 2011, the HPUC closed a proceeding it had opened in October 2006 to examine our service quality and performance levels and standards in relation to our wholesale and retail customers. In closing the proceeding, the HPUC adopted stipulations entered into by the parties to the proceeding in which (i) the parties agreed there were no outstanding issues that needed to be addressed by the HPUC and that the proceeding could be closed without further HPUC action, and (ii) we and tw telecom of hawaii l.p. agreed to work collaboratively to address or resolve informally certain identified service-related and reporting issues between the two companies. In addition, pursuant to the HPUC order closing the proceeding, all periodic service quality reports required in connection with the proceeding were discontinued by July 2012.

In October 2012, the FCC approved a deal between Verizon Wireless and the cable company owners of SpectrumCo, which allows joint marketing agreements between Verizon Wireless and these cable companies to cross-sell each other's services. In Hawaii, Verizon Wireless and Oceanic Time Warner began their joint marketing efforts in October 2012.

18

In December 2012, the FCC and the HPUC approved the transfer of licenses and facilities from Wavecom Solutions Corporation (Wavecom) to Hawaiian Telcom, Inc. in connection with Hawaiian Telcom, Inc.'s acquisition of Wavecom. In connection with these approvals, Hawaiian Telcom, Inc. agreed to freeze for seven years certain enterprise customer prices in twelve specific buildings in Hawaii where both Hawaiian Telcom, Inc. and Wavecom owned telecommunications facilities, but subject to exemptions including an exemption for a building if two other fiber-based facilities carriers provided facilities to that building. In addition, Hawaiian Telcom, Inc. agreed that, until Wavecom's transport facilities are transferred to other subsidiaries of the Company, if Hawaiian Telcom, Inc. uses the Wavecom transport facilities to provide its own retail services, it will make available such facilities to competitors if capacity is not available in existing facilities or in other specified circumstances. These conditions potentially could impact our revenues, but the impact is not expected to affect financial performance materially.

Environmental, Health and Safety Regulations

We are subject to various environmental, health and safety laws and regulations that govern our operations and may adversely affect our costs. Some of our properties use, or may have used in the past, on-site facilities or underground storage tanks for the storage of hazardous materials that could create the potential for the release of hazardous substances or contamination of the environment. We cannot predict with any certainty our future capital expenditure requirements for environmental regulatory compliance, although we have not currently identified any of our facilities as requiring major expenditures for environmental remediation or to achieve compliance with environmental regulations.

Business Transactions

Agreement Relating to IT Support Services