UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-54165

Reven Housing REIT, Inc.

(Name of registrant as specified in its charter)

| Colorado | 84-1306078 | |||

| (State or Other Jurisdiction of Incorporation) |

(I.R.S. Employer Identification Number) |

7911 Herschel Avenue, Suite 201

La Jolla, CA 92037

(Address of principal executive offices)

(858) 459-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Act):

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company x | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1,152,795.

State the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 87,860,880 shares as of March 25, 2014.

TABLE OF CONTENTS

| Page | ||||

| PART I | ||||

| Item 1. | Business | 1 | ||

| Item 1A. | Risk Factors | 5 | ||

| Item 1B. | Unresolved Staff Comments | 5 | ||

| Item 2. | Properties | 5 | ||

| Item 3. | Legal Proceedings | 5 | ||

| Item 4. | Mine Safety Disclosures | 5 | ||

| PART II | ||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities | 5 | ||

| Item 6. | Selected Financial Data | 8 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 8 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 13 | ||

| Item 8. | Consolidated Financial Statements and Supplementary Data | 14 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 15 | ||

| Item 9A. | Controls and Procedures | 15 | ||

| Item 9B. | Other Information | 15 | ||

| PART III | ||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 16 | ||

| Item 11. | Executive Compensation | 20 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 22 | ||

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 23 | ||

| Item 14. | Principal Accountant Fees and Services | 24 | ||

| PART IV | ||||

| Item 15. | Exhibits and Consolidated Financial Statement Schedules | 26 | ||

| Signatures | 29 |

CAUTIONARY NOTICE

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Those forward-looking statements include our expectations, beliefs, intentions and strategies regarding the future. Such forward-looking statements relate to, among other things, our market, strategy, competition, development plans, financing, revenues, operations and compliance with applicable laws. These and other factors that may affect our financial results are discussed more fully in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this report. Market data used throughout this report is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information. Although we believe that such sources are reliable, we do not guarantee the accuracy or completeness of this information, and we have not independently verified such information. We caution readers not to place undue reliance on any forward-looking statements. We do not undertake, and specifically disclaim any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur, and we urge readers to review and consider disclosures we make in this and other reports that discuss factors germane to our business. See in particular our reports on Forms 10-K, 10-Q, and 8-K subsequently filed from time to time with the Securities and Exchange Commission.

PART I

| Item 1. | Business |

Overview

Reven Housing REIT, Inc. (the “Company”) is engaged in the acquisition, ownership and operation of portfolios of leased single-family homes in the United States. We operate our portfolio properties as single-family rentals, or SFRs, and we generate most of our revenue from rental income of the existing tenants of the SFRs we have acquired. Our business plan involves (i) acquiring portfolios of rented houses from investors who have bought them low, fixed and rented them; and (ii) receiving current income from profits from rentals and appreciation of houses. For our acquisitions, we employ strict underwriting procedures for operating costs, re-leasing costs and capital improvement costs and obtain third-party reports for physical condition and valuation due diligence.

As of the date of this report, we have invested an aggregate of approximately $14.2 million and own 168 homes in the Houston, Texas, metropolitan area and 9 homes in Atlanta, Georgia, metropolitan area. We intend to expand our acquisitions throughout the United States as we continue to evaluate new investment opportunities in different markets. As of the date of this report, our portfolio properties are 95% leased, of which 134 are subject to one year leases, 34 are subject to month-to-month leases and 9 are vacant and being marketed for leasing. All of our portfolio properties to date have been acquired from available cash on hand and are not subject to any liens or security interests.

We intend to take all necessary steps to qualify as a real estate investment trust (“REIT”) under the Internal Revenue Code, as amended (the “Code”). However, no assurance can be given that we will qualify or remain qualified as a REIT.

Our History

The Company was originally incorporated on April 26, 1995, in the State of Colorado under the name “Colorado Security Patrol Inc.” to provide a variety of security services on both a residential and commercial basis although the Company was not successful in generating sufficient revenues from this business. On March 12, 2007, the Company filed an amendment to its Articles of Incorporation changing its name to “Bureau of Fugitive Recovery, Inc.” and expanded its operations to include the tracking and apprehension of offenders who had failed to appear in court or had otherwise had their bond revoked.

| 1 |

Since the change in control transaction in which Chad M. Carpenter, our current Chairman of the Board, President and Chief Executive Officer, acquired a majority of the issued and outstanding shares of our common stock on July 2, 2012, the Company has been engaged in its current real estate business. In connection with the change in our business direction, on July 5, 2012, our shareholders, on the recommendation of the Company’s board of directors, approved an amendment of the Company’s Restated Articles of Incorporation to change the Company’s name to “Reven Housing REIT, Inc.” from “Bureau of Fugitive Recovery, Inc.” The Company filed the Articles of Amendment with the Colorado Secretary of State effectively changing its name to “Reven Housing REIT, Inc.” on August 9, 2012.

In this report, unless expressly provided otherwise, “Reven,” the “Company,” “we,” “us,” and “our” refer to Reven Housing REIT, Inc., a Colorado corporation, and its wholly-owned subsidiaries.

Our Business

We are engaged in the acquisition of portfolios of tenant occupied single-family homes throughout the United States. We operate our portfolio properties as single-family rentals, or SFRs, and we generate most of our revenue from rental income of the existing tenants of the SFRs we have acquired. Our investment objective is to provide current cash flow yield therefore all SFR portfolios must be fixed, leased and occupied.

Acquisition Criteria

| Portfolio Size Sought: | 25-500 rented homes per transaction | ||

| Gross Rental Yield: | Class A Gross Rental Yield = 12% + | ||

| Class B Gross Rental Yield = 14%+ | |||

| Expenses: | 50 percent or less (including property management, maintenance, tax, insurance, vacancy, homeowner’s association fees, and credit loss) | ||

| Tenants: | Tenants must not be in default or late on rent payments | ||

| Maintenance: | All deferred maintenance must be fixed or will be deducted from the purchase price | ||

| Management: | Preference for hiring existing property management |

Target Markets

We invest in markets that we believe have more upside value through the potential for rent increases and appreciation of the homes due to the dislocation caused by the Great Recession and the current positive economic drivers in these markets. We are currently targeting the following markets:

| Houston, TX | Phoenix, AZ | Las Vegas, NV | |||

| Dallas, TX | Atlanta, GA | San Jose, CA | |||

| Fort Lauderdale, FL | Los Angeles, CA | Anaheim, CA | |||

| Denver, CO | San Francisco, CA | Tucson, AZ | |||

| Austin, TX | San Antonio, TX | Fort Worth-Arlington, TX | |||

| Salt Lake City, UT | Raleigh, NC | Miami, FL | |||

| Louisville, KY | Oklahoma City, OK | Virginia Beach, NC | |||

| Tampa, FL | Richmond, VA | Charlotte, NC | |||

| Nashville, TN | Indianapolis, IN | Tulsa, OK | |||

| San Diego, CA |

| 2 |

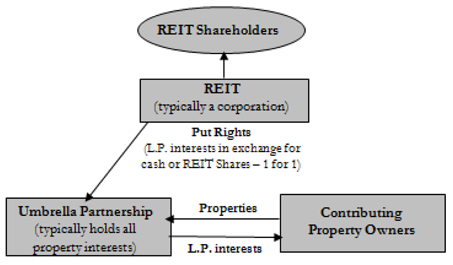

The UPREIT Option

As part of our business plan, we may structure future portfolio acquisitions using an UPREIT structure. An owner selling a portfolio of homes in a single transaction may be able to qualify for capital gains tax treatment. Specifically, an acquisition of a portfolio that is structured as a contribution to the REIT’s operating partnership (the “UPREIT OP”) in exchange for the UPREIT OP’s limited partnership units (in lieu of cash) can be a tax-free transaction. The limited partnership units would be able to participate in any distributions from rentals and in any stock appreciation if the REIT grows net operating income and the homes appreciate over time. The diagram below illustrates an example of the UPREIT structure.

If and when we qualify as a REIT, we intend to implement the UPREIT structure at an appropriate time. However, no assurance can be given that we will qualify or remain qualified as a REIT, and furthermore, there can be no assurances that we will implement the UPREIT structure and be successful in executing our business plan utilizing the UPREIT structure.

Competition

We face competition from many entities engaged in real estate investment activities, including individuals, other real estate investment companies including newly formed REITs, and real estate limited partnerships. Our competitors may enjoy significant competitive advantages that result from, among other things, having substantially more available capital, a lower cost of capital and enhanced operating efficiencies. Further, the market for the rental of properties is highly competitive. We also face competition from new home builders, investors and speculators, as well as homeowners renting their properties.

| 3 |

Employees

As of March 19, 2014, we employed 2 employees, who are not represented by labor unions. We believe that our relationship with our employees is satisfactory.

Available Information

Our website is located at www.revenhousingreit.com. The information on or accessible through our website is not part of this annual report on Form 10-K. A copy of this annual report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports and other information regarding our filings at www.sec.gov.

| 4 |

| Item 1A. | Risk Factors |

As a "smaller reporting company" defined in Item 10(f)(1) of Regulation S-K, we are electing scaled disclosure reporting obligations and therefore are not required to provide the information requested by this item.

| Item 1B. | Unresolved Staff Comments |

We have no unresolved staff comments.

| Item 2. | Properties |

Since we commenced our real estate investment activities in October 2012, we have acquired portfolios in Georgia and Texas. As of the date of this report, we own 168 homes in the Houston, Texas metropolitan area and 9 in the Atlanta, Georgia, metropolitan area. Our portfolio properties are 95% leased, of which 134 are subject to one year leases, 34 are subject to month-to-month leases and 9 are vacant and being marketed for leasing.

The following table presents summary statistics of our single-family homes by MSA and metro division. The table includes our entire portfolio of single-family homes.

Total Portfolio of Single-Family Homes—Summary Statistics

(as of March 25, 2014)

| MSA / Metro Division | Number of Homes | Aggregate Investment | Average Investment Per Home | Percent Leased | Average Age (years) | Average Size (square feet) | ||||||||||||||||||

| Atlanta, GA | 9 | $ | 606,838 | $ | 67,426 | 66 | % | 21 | 1,516 | |||||||||||||||

| Houston, TX | 168 | $ | 13,569,460 | $ | 80,771 | 95 | % | 45 | 1,435 | |||||||||||||||

| Total / Weighted Average | 177 | $ | 14,176,298 | $ | 80,092 | 95 | % | 44 | 1,439 | |||||||||||||||

| Item 3. | Legal Proceedings |

As of the date of this report, there are no pending legal proceedings to which we or our properties are subject.

| Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities |

Market Information

Our common stock has been quoted on the OTC Bulletin Board (“OTCBB”) since December 2010. From December 2010 to August 2012, our common stock was quoted on the OTCBB under the symbol BRFG. Since August 2012, our common stock has been quoted under the symbol RVEN. There had been no trading of our common stock until December 2012. However, we consider our common stock to be “thinly traded” and any reported sale prices may not be a true market-based valuation of the common stock.

| 5 |

The following table sets forth the quarterly high and low sales prices of our common shares as reported on the OTCBB for the periods indicated.

| High | Low | |||||||

| 2013: | ||||||||

| First Quarter | $ | 1.00 | $ | 1.00 | ||||

| Second Quarter | $ | 1.00 | $ | 0.35 | ||||

| Third Quarter | $ | 0.40 | $ | 0.35 | ||||

| Fourth Quarter | $ | 0.47 | $ | 0.38 | ||||

| 2012: | ||||||||

| First Quarter | N/A | N/A | ||||||

| Second Quarter | N/A | N/A | ||||||

| Third Quarter | N/A | N/A | ||||||

| Fourth Quarter | $ | 1.02 | $ | 1.02 | ||||

Holders of Record

As of March 19, 2014, there were approximately 78 holders of record of our common stock.

Dividend Policy

We have never declared or paid cash dividends on our common stock. We presently intend to retain earnings to finance the operation and expansion of our business. In the event we qualify and elect to be taxed as a REIT, as defined under the Internal Revenue Code, we will be required to make cash dividends to our stockholders consistent with applicable rules under the Code. However, no assurance can be given that we will qualify or remain qualified as a REIT.

Equity Compensation Plan Information

In December 2013, we adopted, and our stockholders approved, our Amended and Restated 2012 Incentive Compensation Plan (the “2012 Plan”), pursuant to which 33,000,000 shares of our common stock are reserved for issuance to employees, directors, consultants, and other service providers. The 2012 Plan allows for incentive awards to eligible recipients consisting of:

| · | options to purchase shares of common stock, that qualify as incentive stock options within the meaning of the Internal Revenue Code; |

| · | non-statutory stock options that do not qualify as incentive options; |

| · | restricted stock awards; and |

| · | stock appreciation rights. |

As of the date of this report, we have not granted any options under our 2012 Plan nor have we granted any non-Plan options. All 33,000,000 shares of our common stock initially reserved for issuance under our 2012 Plan remain available for future issuance to employees, directors, consultants, and other service providers. The following table sets forth certain information as of December 31, 2013 about our 2012 Plan and the non-Plan options.

| 6 |

| Plan Category | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | (b) Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | (c) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected In Column (a)) | |||||||||

| Equity compensation plan approved by security holders | -0- | $ | N/A | 33,000,000 | ||||||||

| Equity compensation plan not approved by security holders | -0- | $ | N/A | -0- | ||||||||

| Total | -0- | $ | N/A | 33,000,000 | ||||||||

Recent Sales of Unregistered Securities

On January 3, 2013, we issued convertible promissory notes to certain accredited investors in the aggregate principal amount of $500,000 (the “January Notes”). The maturity date of the January Notes was the earlier of December 31, 2013 or the date on which we consummated an equity financing in which we sold shares of our capital stock with an aggregate sales price of $5,000,000 or more (a “Qualified Equity Financing”). The January Notes bore interest at a rate of 10 percent per annum payable in full on the maturity date. In connection with the issuance of the January Notes, we also issued to the investors five-year warrants exercisable for shares of our capital stock issued in the Qualified Equity Financing (the “January Warrants”). The exercise price of the January Warrants was the same as the price per share of the equity securities sold to investors in the Qualified Equity Financing, and each Warrant provided for 100% warrant coverage on the principal amount of the related January Note. Because we consummated a Qualified Equity Financing prior to December 31, 2013, the holders of the January Notes at their option could convert the outstanding principal and accrued interest under the January Notes into shares of our capital stock issued in the Qualified Equity Financing at the same price and on the same terms as the investors in such financing, and the January Warrants could be exercised for such shares of capital stock at the same price and on the same terms as the investors in the Qualified Equity Financing. We relied on an exemption from the registration requirements of the Securities Act for the offer and sale of the January Notes, the January Warrants and the underlying securities pursuant to Section 4(2) of the Securities Act and Rule 505 of Regulation D promulgated thereunder.

On September 27, 2013, we entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with certain accredited investors in connection with a proposed private placement of up to 125,000,000 shares of our common stock at a price of $0.20 per share, for aggregate proceeds of up to $25 million. There have been three closings pursuant to the Stock Purchase Agreement, described below. In connection with this private placement, we entered into a Convertible Promissory Note Conversion Agreement (the “Note Conversion Agreement”) on September 27, 2013 with certain holders of our outstanding 10% Convertible Promissory Notes (the “Bridge Notes”).

First Closing. On September 27, 2013, we issued an aggregate of 55,000,000 shares of our common stock to the investors in the Stock Purchase Agreement for gross proceeds of $11,000,000. Also on September 27, 2013, we issued an aggregate of 4,510,880 shares of our common stock to the investors in the Note Conversion Agreement in exchange for cancellation of Bridge Notes in the aggregate principal amount of $902,176. These shares were issued in reliance on an exemption from registration provided by Section 4(a)(2) of the Securities Act, and Rule 506 promulgated thereunder.

Second Closing. On October 30, 2013, we issued an aggregate of 11,500,000 shares of our common stock to the investors in the Stock Purchase Agreement for gross proceeds of $2,300,000. These shares were issued in reliance on an exemption from registration provided by Section 4(a)(2) of the Securities Act, and Rule 506 promulgated thereunder.

| 7 |

Third Closing. On November 22, 2013, we issued an aggregate of 8,500,000 shares of our common stock to the investors in the Stock Purchase Agreement for gross proceeds of $1,700,000. These shares were issued in reliance on an exemption from registration provided by Section 4(a)(2) of the Securities Act, and Rule 506 promulgated thereunder.

| Item 6. | Selected Financial Data |

As a "smaller reporting company" defined in Item 10(f)(1) of Regulation S-K, we are electing scaled disclosure reporting obligations and therefore are not required to provide the information requested by this item.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The information contained in this report contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events and similar expressions. Forward-looking statements may be identified by use of words such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” or “potential” or similar words or phrases which are predictions of or indicate future events or trends. Statements such as those concerning potential acquisition activity, investment objectives, strategies, opportunities, other plans and objectives for future operations or economic performance are based on the Company’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties, including the Company’s ability to successfully (i) acquire real estate investment properties in the future, (ii) to execute future agreements or understandings concerning the Company’s acquisition of real estate investment properties and (iii) be able to raise the capital required to acquire any such properties. Any of these statements could prove to be inaccurate and actual events or investments and results of operations could differ materially from those expressed or implied. To the extent that the Company’s assumptions differ from actual results, the Company’s ability to meet such forward-looking statements, including its ability to invest in a diversified portfolio of quality real estate investments, may be significantly and negatively impacted. You are cautioned not to place undue reliance on any forward-looking statements and the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, future events or other changes.

Overview

We are an internally-managed real estate investment company focused on the acquisition, leasing, and management of recently renovated and stabilized single-family properties in select markets in the United States. Our objective is to generate attractive risk-adjusted returns for our stockholders over the long term through dividends and capital appreciation. We generate virtually all of our revenue by leasing our portfolio of single-family properties. As of December 31, 2013, we owned 159 single-family properties, of which 150 are in the Houston, Texas metropolitan area and 9 are in the Atlanta, Georgia metropolitan area.

The Company was formerly known as the Bureau of Fugitive Recovery Inc. On July 2, 2012, Chad M. Carpenter purchased an aggregate of 5,999,300 shares of the outstanding common stock of the Company from certain of the Company’s stockholders in a private transaction. In connection with the transaction, an aggregate of 1,650,000 shares of the Company’s outstanding common stock were returned to treasury for cancellation. Immediately upon the closing of the transaction, Mr. Carpenter became the majority shareholder of the Company and beneficially owned stock representing 71.8% of the outstanding voting shares of the Company.

As a result of the above change in control and management, the Company entered into the business of acquiring portfolios of occupied and rented single-family houses throughout the United States. This business plan involves (i) acquiring portfolios of rented houses from investors; (ii) receiving income from rental property activity; and (iii) future profits from sale of rental property at appreciated values. The Company also changed its name to Reven Housing REIT, Inc. In November 2012, the Company made its first acquisition of 5 rental homes. In 2013, the Company completed the purchase of an additional 154 homes.

| 8 |

The Company intends to convert to a Maryland corporation and to take all necessary steps to qualify, and elect to be taxed as, a real estate investment trust (“REIT”) under the Internal Revenue Code, as soon as practicable. However, no assurance can be given that we will qualify or remain qualified as a REIT.

Recent Highlights

On September 27, 2013, the Company entered into a stock purchase agreement with King APEX Group II, Ltd. and King APEX Group III, Ltd., which are funds managed by Allied Fortune (“HK”) Management Limited, a Hong Kong based funds management company, in connection with a private placement of up to 125,000,000 shares of its common stock at a price of $0.20 per share, for aggregate gross proceeds of up to $25 million. Under the terms of the stock purchase agreement, a total of 75,000,000 shares at a gross price of $15,000,000 were completed through December 31, 2013. Cash proceeds after offering expenses were $14,539,082, plus an additional non-cash expense of $50,000 representing additional deferred costs relating to the private placement resulting in net proceeds of $14,489,082.

As a result of the issuance of the 75,000,000 shares to King APEX Group II, Ltd. and King Apex Group III, Ltd., the two funds under common control collectively own approximately 85.4% of the Company’s outstanding voting shares and Mr. Carpenter now owns approximately 9.5% of the Company’s outstanding voting shares.

Reven Housing Georgia, LLC (a wholly owned subsidiary of Reven Housing REIT, Inc.) completed the acquisition of nine residential homes. The nine homes are located in various cities in Georgia. Five of these homes were purchased in 2012 and the remaining four homes were purchased on January 10, 2013.

On October 4, 2013, Reven Housing Texas, LLC (a wholly owned subsidiary of Reven Housing REIT, Inc.) entered into a purchase and sale agreement for the purchase of a portfolio of 170 single family homes located in the Houston, Texas metropolitan area. On October 31, 2013, the Company closed and completed the purchase of 150 of the homes at a total cost of $11,971,797 including closing expenses.

The following table represents the Company’s net investment in the homes:

| Investment | ||||||||||||||||||||||||

| Number | Residential | Total | Accumulated | In Real Estate | ||||||||||||||||||||

| of Homes | Land | Homes | Investment | Depreciation | Net | |||||||||||||||||||

| Purchased during 2012: | ||||||||||||||||||||||||

| Georgia | 5 | $ | 67,019 | $ | 276,391 | $ | 343,410 | $ | (1,400 | ) | $ | 342,010 | ||||||||||||

| Total at December 31, 2012 | 5 | 67,019 | 276,391 | 343,410 | (1,400 | ) | 342,010 | |||||||||||||||||

| Purchased during 2013: | ||||||||||||||||||||||||

| Georgia | 4 | 52,631 | 210,797 | 263,428 | (16,800 | ) | 246,628 | |||||||||||||||||

| Texas | 150 | 2,394,359 | 9,577,438 | 11,971,797 | (58,000 | ) | 11,913,797 | |||||||||||||||||

| Total at December 31, 2013 | 159 | $ | 2,514,009 | $ | 10,064,626 | $ | 12,578,635 | $ | (76,200 | ) | $ | 12,502,435 | ||||||||||||

| 9 |

Net investment in homes, as shown above, consists of the following as of December 31:

| 2012 | 2013 | |||||||||||||||

| Number | Investment | Number | Investment | |||||||||||||

| of Homes | Net | of Homes | Net | |||||||||||||

| Leased | 5 | $ | 342,010 | 146 | $ | 11,579,899 | ||||||||||

| Vacant | - | - | 13 | 922,536 | ||||||||||||

| 5 | $ | 342,010 | 159 | $ | 12,502,435 | |||||||||||

The Company plans to continue to acquire and manage single family homes with a focus on long term earnings growth and appreciation in asset value. As the Company’s first significant portfolio acquisition was completed on October 31, 2013, we anticipate that our revenue will increase significantly in 2014 as it will be our first full year of meaningful operations under our new business plan.

Our Company’s ability to identify and acquire single-family properties that meet our investment criteria will be affected by home prices in our markets, the inventory of properties available through our acquisition channels, competition for our target assets, our capital available for investment, and the cost of that capital. The housing market environment in our markets remains attractive for single-family property acquisitions and rentals. Pricing for housing in certain markets remains attractive and demand for housing is growing. At the same time, we continue to face relatively steady competition for new properties and residents from local operators and institutional managers. Housing prices across all of our core markets have appreciated over the past year. Despite these gains, we believe housing in certain of our markets continues to provide attractive acquisition opportunities and remains inexpensive relative to replacement cost and affordability metrics.

We anticipate continued strong rental demand for single-family homes. While new building activity has begun to increase, it remains below historical averages and we believe substantial under-investment in residential housing over the past years will create upward pressure on home prices and rents as demand exceeds supply.

Our results of operations and financial condition will be affected by numerous factors, many of which are beyond our control. The key factors we expect to impact our results of operations and financial condition include our pace and costs of acquisitions, rental rates, the varying costs of external property management, occupancy levels, rates of resident turnover, turnover costs, changes in homeownership rates, changes in homeowners’ association fees, insurance costs, real estate taxes, our expense ratios, and our capital structure.

Results of Operations

Comparisons of 2013 results of operation to 2012 presented in our consolidated financial statements are not generally meaningful as we did not have substantial rental operations in 2012. Operations and activity did not increase significantly until the fourth quarter of 2013 when we purchased an additional 150 homes, and raised equity through our private placement activities as mentioned above.

For the year ended December 31, 2013, the Company had total rental income of $342,243 and rental expenses of $136,679, resulting in net operating income from rentals of $205,564. General and administrative expenses totaled $366,071. Legal and accounting totaled $195,156. Interest expense on the retirement of our convertible notes payable was $77,004. Depreciation on our home investments totaled $74,800. Amortization of discount on notes payable was $563,253. This resulted in a net loss of $1,070,720. As the convertible notes were paid off or converted on September 27, 2013, we do not expect to incur future amortization charges relating to note discounts in 2014.

| 10 |

For the year ended December 31, 2012, the Company had total rental income of $6,750. Rental expenses were $1,006, resulting in net operating income from rentals of $5,744. Legal and accounting expenses totaled $396,797, general and administrative expenses were $132,261. Legal and accounting expenses were paid primarily for services necessary for the Company’s change of operations and for developing documents necessary to pursue future acquisitions and capital activities. Interest, depreciation and amortization of discount on notes payable totaled $71,188. Income from discontinued operations was $334. As a result, the Company had a net loss of $594,168 for the year ended December 31, 2012.

Liquidity and Capital Resources

Our liquidity and capital resources as of December 31, 2013 consisted of cash of $2,134,510. As of December 31, 2012, the cash balance was $5,763. The liquidity position at December 31, 2013 resulted primarily from the excess of funds raised from the Company’s private placement over funds invested in the purchase of home inventory. The Company used $336,806 for operating activities in 2013. This resulted from a net loss of $1,070,720, after adding back the amortization of debt discount of $563,253, depreciation of $74,800, and the net change in operating assets and liabilities of $95,861. The Company used $140,778 in operations in 2012.

In 2013, the Company invested $12,235,225 in new homes and made escrow deposits and incurred prepaid expenses for future acquisitions of $151,128 totaling $12,386,353 of cash used for investing activities. For the year ended December 31, 2012, the Company used $343,410 of cash in investing activities to acquire homes. Note that subsequent to year end, on January 31, 2014, the Company purchased an additional 18 homes in Houston, Texas and used $1,541,371 of cash.

The Company had net cash provided by financing activities of $14,851,906 in 2013 derived from $14,539,082 of net proceeds from the issuance of common stock, $500,000 from the issuance of convertible notes payable, less payments of convertible notes payable of $152,176, and deferred stock issuance costs of $35,000. For the year ended December 31, 2012, the Company received $554,352 of proceeds from convertible notes payable, paid $15,000 of convertible notes payable, and had $50,000 of deferred stock issuance costs resulting in $489,352 of net cash provided by financing activities. Thus 2012 operating and investing activities were financed primarily from the issuance of convertible notes payable.

The Company’s future acquisition activity relies primarily on its ability to raise funds from the further issuance of common shares combined with new loan transactions secured by its current and future home inventories. The Company remains focused on acquiring new capital. The Company believes its current cash balance combined with its estimated future net rental revenue is sufficient to fund its operating activities in 2014.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

Revenue Recognition

Property is leased under rental agreements of generally one year and revenue is recognized over the lease term on a straight-line basis.

| 11 |

Property Acquisitions

The Company accounts for its acquisitions of real estate in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 805, Accounting for Business Combinations, Goodwill, and Other Intangible Assets, which requires the purchase price of acquired properties be allocated to the acquired tangible assets and liabilities, consisting of land, building, and identified intangible assets, consisting of the value of above-market and below-market leases, the value of in-place leases, unamortized lease origination costs and security deposits, based in each case on their fair values.

The Company allocates the purchase price to tangible assets of an acquired property (which includes land and building) based on the estimated fair values of those tangible assets, assuming the property was vacant. Fair value for land and building is based on the purchase price for these properties. The Company also considers information obtained about each property as a result of its pre-acquisition due diligence, marketing and leasing activities in estimating the fair values of the tangible and intangible assets and liabilities acquired.

The total value allocable to intangible assets acquired, which consists of unamortized lease origination costs and in-place leases (including an above-market or below-market component of an acquired in-place lease), are allocated based on management’s evaluation of the specific characteristics of each tenant’s lease and the Company’s overall relationship with that respective tenant. Characteristics considered by management in allocating these values include the nature and extent of the existing business relationships with the tenant, growth prospects for developing new business with the tenant, the remaining term of the lease and the tenant’s credit quality, among other factors. For acquisitions made in 2012 and 2013, management has determined that no value is required to be allocated to intangible assets, as the leases assumed are short-term with values that are insignificant.

Land, Buildings and Improvements

Land, buildings and improvements are recorded at cost and depreciated over estimated useful lives of approximately 27.5 years using the straight-line method. Maintenance and repair costs are charged to operations as incurred.

The Company assesses the impairment of long-lived assets, whenever events or changes in business circumstances indicate that carrying amounts of the assets may not be fully recoverable. When such events occur, management determines whether there has been impairment by comparing the asset’s carrying value with its fair value, as measured by the anticipated undiscounted net cash flows of the asset. Should impairment exist, the asset is written down to its estimated fair value. The Company has not recognized any impairment losses through December 31, 2013.

Warrant Issuance and Note Conversion Feature

The Company accounts for the proceeds from the issuance of convertible notes payable with detachable stock purchase warrants and embedded conversion features in accordance with FASB ASC 470-20, Debt with Conversion and Other Options. Under FASB ASC 470-20, the proceeds from the issuance of a debt instrument with detachable stock purchase warrants shall be allocated to the two elements based on the relative fair values of the debt instrument without the warrants and of the warrants themselves at the time of issuance. The portion of the proceeds allocated to the warrants is accounted for as additional paid-in capital and the remaining proceeds are allocated to the debt instrument which resulted in a discount to debt which is amortized and charged as interest expense over the term of the note agreement. Additionally, pursuant to FASB ASC 470-20, the intrinsic value of the embedded conversion feature of the convertible notes payable is included in the discount to debt and amortized and charged to interest expense over the life of the note agreement.

| 12 |

Income Taxes

We intend to elect to be taxed as a REIT, as defined in the Internal Revenue Code, commencing with our taxable year ended December 31, 2014. However, no assurance can be given that we will qualify or remain qualified as a REIT. In the event we qualify and elect to be taxed as a REIT, we will not be subject to federal income tax provided that our distributions to our stockholders equal or exceed our REIT taxable income and satisfy all other requirements under the Internal Revenue Code.

However, qualification and taxation as a REIT depend upon our ability to meet the various qualification tests imposed under the Internal Revenue Code related to the percentage of income that we earn from specified sources, the percentage of our assets that fall within specified categories, the diversity of our capital stock ownership, and the percentage of our earnings that we distribute. Accordingly, no assurance can be given that we will be organized or be able to operate in a manner so as to qualify or remain qualified as a REIT. If we fail to qualify as a REIT in any taxable year, we will be subject to federal and state income tax (including any applicable alternative minimum tax) on our taxable income at regular corporate tax rates, and we may be ineligible to qualify as a REIT for four subsequent tax years. Even if we qualify as a REIT, we may be subject to certain state or local income taxes.

The tax benefit of uncertain tax positions is recognized only if it is “more likely than not” that the tax position will be sustained, based solely on its technical merits, with the taxing authority having full knowledge of relevant information. The measurement of a tax benefit for an uncertain tax position that meets the “more likely than not” threshold is based on a cumulative probability model under which the largest amount of tax benefit recognized is the amount with a greater than 50% likelihood of being realized upon ultimate settlement with the taxing authority, having full knowledge of all the relevant information. As of December 31, 2012 and 2013, we had no unrecognized tax benefits. We do not anticipate a significant change in the total amount of unrecognized tax benefits during 2014.

Off-Balance Sheet Arrangements

The registrant had no material off-balance sheet arrangements as of December 31, 2013.

New Accounting Pronouncements

The registrant has adopted all recently issued accounting pronouncements. The adoption of the accounting pronouncements, including those not yet effective, is not anticipated to have a material effect on the financial position or results of operations of the registrant.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

As a "smaller reporting company" defined in Item 10(f)(1) of Regulation S-K, we are electing scaled disclosure reporting obligations and therefore are not required to provide the information requested by this item.

| 13 |

| Item 8. | Consolidated Financial Statements and Supplementary Data |

Index To Consolidated Financial Statements

| Page | |

| Report of Independent Registered Public Accounting Firm | F-1 |

| Consolidated Balance Sheets at December 31, 2012 and 2013 | F-2 |

| Consolidated Statements of Operations for the Years Ended December 31, 2012 and 2013 | F-3 |

| Consolidated Statements of Changes In Stockholders’ (Deficit) Equity for the Years Ended December 31, 2012 and 2013 | F-4 |

| Consolidated Statements of Cash Flows for the Years Ended December 31, 2012 and 2013 | F-5 |

| Notes to Consolidated Financial Statements | F-6 |

| 14 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Reven Housing REIT, Inc.

We have audited the accompanying consolidated balance sheets of Reven Housing REIT, Inc. and Subsidiaries (the “Company”) as of December 31, 2013 and 2012, and the related consolidated statements of operations, changes in stockholders’ (deficit) equity, and cash flows for each of the years in the two-year period then ended. The Company’s management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Reven Housing REIT, Inc. as of December 31, 2013 and 2012, and the results of its operations and its cash flows for each of the years in the two-year period then ended in conformity with accounting principles generally accepted in the United States of America.

| /s/ PKF | |

| San Diego, California | PKF |

| March 25, 2014 | Certified Public Accountants |

| A Professional Corporation |

| F-1 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31, 2012 and 2013

| 2012 | 2013 | |||||||

| ASSETS | ||||||||

| Investment in real estate: | ||||||||

| Land | $ | 67,019 | $ | 2,514,009 | ||||

| Buildings and improvements | 276,391 | 10,064,626 | ||||||

| 343,410 | 12,578,635 | |||||||

| Accumulated depreciation | (1,400 | ) | (76,200 | ) | ||||

| Investment in real estate, net | 342,010 | 12,502,435 | ||||||

| Cash | 5,763 | 2,134,510 | ||||||

| Rents and other receivables | 3,375 | 10,053 | ||||||

| Escrow deposits and prepaid expenses | - | 151,128 | ||||||

| Deferred stock issuance costs | 50,000 | 35,000 | ||||||

| Total Assets | $ | 401,148 | $ | 14,833,126 | ||||

| LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY | ||||||||

| Convertible notes payable - officer, net of debt discount of $123,430 in 2012, and $0 in 2013 | $ | 128,746 | $ | - | ||||

| Convertible notes payable, net of debt discount of $122,364 in 2012, and $0 in 2013 | 127,635 | - | ||||||

| Convertible notes payable - shareholders, net of debt discount of $25,539 in 2012, and $0 in 2013 | 26,638 | - | ||||||

| Accounts payable and accrued expenses | 119,978 | 347,179 | ||||||

| Accrued interest and security deposits | 14,770 | 156,985 | ||||||

| Related party advance | 266,877 | - | ||||||

| Total Liabilities | 684,644 | 504,164 | ||||||

| Commitments (Note 9) | ||||||||

| Stockholders' (Deficit) Equity | ||||||||

| Preferred stock, $.001 par value; 25,000,000 shares authorized; No shares issued & outstanding | - | - | ||||||

| Common stock, $.001 par value; 600,000,000 shares authorized; 8,350,000 shares issued & outstanding at December 31, 2012 and 87,860,880 at December 31, 2013 | 8,350 | 87,861 | ||||||

| Additional paid-in capital | 349,513 | 15,953,180 | ||||||

| Accumulated deficit | (641,359 | ) | (1,712,079 | ) | ||||

| Total Stockholders' (Deficit) Equity | (283,496 | ) | 14,328,962 | |||||

| Total Liabilities and Stockholders' (Deficit) Equity | $ | 401,148 | $ | 14,833,126 | ||||

The accompanying notes are an integral part of the consolidated financial statements.

| F-2 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Years Ended December 31, 2012 and 2013

| 2012 | 2013 | |||||||

| Rental income | $ | 6,750 | $ | 342,243 | ||||

| Operating expenses: | ||||||||

| Rental expenses | 1,006 | 136,679 | ||||||

| General and administrative | 132,261 | 366,071 | ||||||

| Legal and accounting | 396,797 | 195,156 | ||||||

| Interest expense | 13,258 | 77,004 | ||||||

| Amortization of discount on notes payable | 56,530 | 563,253 | ||||||

| Depreciation expense | 1,400 | 74,800 | ||||||

| Total operating expenses | 601,252 | 1,412,963 | ||||||

| Loss from continuing operations | (594,502 | ) | (1,070,720 | ) | ||||

| Income from discontinued operations, net of taxes | 334 | - | ||||||

| Net loss | $ | (594,168 | ) | $ | (1,070,720 | ) | ||

| Net loss per share from continuing operations | ||||||||

| (Basic and fully diluted) | $ | (0.06 | ) | $ | (0.04 | ) | ||

| Net loss per share from discontinued operations | ||||||||

| (Basic and fully diluted) | $ | - | $ | - | ||||

| Weighted average number of common shares outstanding | 9,170,492 | 26,732,284 | ||||||

The accompanying notes are an integral part of the consolidated financial statements.

| F-3 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ (DEFICIT) EQUITY

For the Years Ended December 31, 2012 and 2013

| Common Stock | Additional | Accumulated | ||||||||||||||||||

| Shares | Amount | Paid-in Capital | Deficit | Total | ||||||||||||||||

| Balance at December 31, 2011 | 10,000,000 | $ | 10,000 | $ | 20,000 | $ | (47,191 | ) | $ | (17,191 | ) | |||||||||

| Shares returned to treasury | (1,650,000 | ) | (1,650 | ) | 1,650 | - | - | |||||||||||||

| Fair value of note conversion feature and warrants issued | - | - | 327,863 | - | 327,863 | |||||||||||||||

| Net loss for the year | - | - | - | (594,168 | ) | (594,168 | ) | |||||||||||||

| Balance at December 31, 2012 | 8,350,000 | 8,350 | 349,513 | (641,359 | ) | (283,496 | ) | |||||||||||||

| Fair value of note conversion feature and warrants issued | - | - | 291,920 | - | 291,920 | |||||||||||||||

| Shares issued on conversion of notes | 4,510,880 | 4,511 | 897,665 | - | 902,176 | |||||||||||||||

| Issuances of shares | 75,000,000 | 75,000 | 14,414,082 | - | 14,489,082 | |||||||||||||||

| Net loss for the year | - | - | - | (1,070,720 | ) | (1,070,720 | ) | |||||||||||||

| Balance at December 31, 2013 | 87,860,880 | $ | 87,861 | $ | 15,953,180 | $ | (1,712,079 | ) | $ | 14,328,962 | ||||||||||

The accompanying notes are an integral part of the consolidated financial statements.

| F-4 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31, 2012 and 2013

| 2012 | 2013 | |||||||

| Cash Flows From Operating Activities: | ||||||||

| Net loss | $ | (594,168 | ) | $ | (1,070,720 | ) | ||

| Net income from discontinued operations | (334 | ) | - | |||||

| Adjustments to reconcile net loss to net cash used for operating activities: | ||||||||

| Amortization of debt discount | 56,530 | 563,253 | ||||||

| Depreciation expense | 1,400 | 74,800 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Rents and other receivables | (3,375 | ) | (6,678 | ) | ||||

| Accounts payable, accrued expenses, accrued interest and security deposits | 131,958 | 369,416 | ||||||

| Related party advances | 266,877 | (266,877 | ) | |||||

| Net cash used for operating activities - continuing operations | (141,112 | ) | (336,806 | ) | ||||

| Net cash provided for operating activities - discontinued operations | 334 | - | ||||||

| Net cash used for operating activities | (140,778 | ) | (336,806 | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Acquisition of residential homes | (343,410 | ) | (12,235,225 | ) | ||||

| Escrows deposits and prepaid expenses | - | (151,128 | ) | |||||

| Net cash used for investing activities | (343,410 | ) | (12,386,353 | ) | ||||

| Cash Flows From Financing Activities: | ||||||||

| Proceeds from convertible notes payable | 554,352 | 500,000 | ||||||

| Payment of convertible notes payable | (15,000 | ) | (152,176 | ) | ||||

| Deferred stock issuance costs | (50,000 | ) | (35,000 | ) | ||||

| Net proceeds from common stock issuance | - | 14,539,082 | ||||||

| Net cash provided by financing activities | 489,352 | 14,851,906 | ||||||

| Net Increase In Cash | 5,164 | 2,128,747 | ||||||

| Cash at the Beginning of the Year | 599 | 5,763 | ||||||

| Cash at the End of the Year | $ | 5,763 | $ | 2,134,510 | ||||

| Supplemental Disclosure of Non-Cash Investing and Financing Activities: | ||||||||

| Debt discount for allocation of proceeds to warrants and beneficial conversion feaure of debt | $ | 327,863 | $ | 291,920 | ||||

| Conversion of debt to common shares | $ | - | $ | 902,176 | ||||

| Deferred costs of common stock issuance | $ | - | $ | 50,000 | ||||

| Supplemental Disclosure: | ||||||||

| Cash paid for interest | $ | 2,790 | $ | 88,821 | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

The accompanying notes are an integral part of the consolidated financial statements.

| F-5 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2012 and 2013

NOTE 1. ORGANIZATION, OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Reven Housing REIT, Inc. and Subsidiaries (the “Company”) (formerly known as Bureau of Fugitive Recovery, Inc.) was incorporated in the State of Colorado on April 26, 1995. The Company previously provided bounty hunting services for bail bond businesses through July 2, 2012.

On July 2, 2012 Chad M. Carpenter purchased an aggregate of 5,999,300 shares of the outstanding common stock of the Company from certain of the Company’s stockholders in a private transaction. In connection with the transaction, an aggregate of 1,650,000 shares of the Company’s outstanding common stock were returned to treasury for cancellation. Immediately upon the closing of the transaction, Mr. Carpenter became the majority shareholder and Chief Executive Officer of the Company and beneficially owned stock representing 71.8 percent of the outstanding voting shares of the Company.

The Company formally changed its name from Bureau of Fugitive Recovery, Inc. to “Reven Housing REIT, Inc.” and commenced activities to acquire portfolios of occupied and rented single-family houses throughout the United States in accordance with its new business plan. The Company’s business plan involves (i) acquiring portfolios of rented houses from investors; and (ii) receiving income from rental property activity and future profits from sale of rental property at appreciated values.

Discontinued Operations

On July 2, 2012, the Company discontinued operations related to the Bureau of Fugitive Recovery, Inc. upon Chad M. Carpenter becoming the majority shareholder of the Company. Accordingly, the former operations are classified as discontinued operations in the accompanying consolidated statements of operations.

Basis of Accounting

The accompanying consolidated financial statements are presented in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Principles of Consolidation

The accompanying financial statements consolidate the accounts of the Company and its wholly-owned subsidiaries, Reven Housing Georgia, LLC and Reven Housing Texas, LLC. All significant inter-company transactions have been eliminated in consolidation.

New Accounting Pronouncements

The Company has adopted all recently issued accounting pronouncements. The adoption of the accounting pronouncements, including those not yet effective, is not anticipated to have a material effect on the financial position or results of operations of the Company.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less as cash equivalents.

Rents and Other Receivables

Rents and other receivables represent the amount of rent receivables, security deposits and net rental funds which are held by the property manager on behalf of the Company, net of any allowance for amounts deemed uncollectible.

Deferred Stock Issuance Costs

Deferred stock issuance costs represent amounts paid for consulting services and other offering expenses in conjunction with the future raising of additional capital to be performed within one year. These costs are charged against additional paid-in capital as a cost of the stock issuance upon closing of the respective stock placement.

Concentration of Risk

Financial instruments, which potentially subject the Company to concentrations of credit risk, consist of cash. The Company’s cash in excess of the Federal Deposit Insurance Corporation insured limits at December 31, 2013, were approximately $1,911,000. The Company does not believe it is exposed to any significant credit risk due to the quality nature of the financial instruments in which the money is held.

| F-6 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2012 and 2013

NOTE 1. ORGANIZATION, OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Warrant Issuance and Note Conversion Feature

The Company accounts for the proceeds from the issuance of convertible notes payable with detachable stock purchase warrants and embedded conversion features in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 470-20, Debt with Conversion and Other Options. Under FASB ASC 470-20, the proceeds from the issuance of a debt instrument with detachable stock purchase warrants shall be allocated to the two elements based on the relative fair values of the debt instrument without the warrants and of the warrants themselves at the time of issuance. The portion of the proceeds allocated to the warrants is accounted for as additional paid-in capital and the remaining proceeds are allocated to the debt instrument which resulted in a discount to debt which is amortized and charged as interest expense over the term of the note agreement. Additionally, pursuant to FASB ASC 470-20, the intrinsic value of the embedded conversion feature of the convertible notes payable is included in the discount to debt and amortized and charged to interest expense over the life of the note agreement.

Revenue Recognition

Property is leased under rental agreements of generally one year and revenue is recognized over the lease term on a straight-line basis.

Income Taxes

The Company intends to elect to be taxed as a REIT, as defined in the Internal Revenue Code, commencing with the taxable year ended December 31, 2014. Management believes that the Company will be able to satisfy the requirements for qualification as a REIT. Accordingly, the Company is not expecting to be subject to federal income tax, provided that it qualifies as a REIT and distributions to the stockholders equal or exceed REIT taxable income.

However, qualification and taxation as a REIT depend upon the Company’s ability to meet the various qualification tests imposed under the Internal Revenue Code related to the percentage of income that are earned from specified sources, the percentage of assets that fall within specified categories, the diversity of capital stock ownership, and the percentage of earnings that are distributed. Accordingly, no assurance can be given that the Company will be organized or be able to operate in a manner so as to qualify or remain qualified as a REIT. If the Company fails to qualify as a REIT in any taxable year, it will be subject to federal and state income tax (including any applicable alternative minimum tax) on its taxable income at regular corporate tax rates, and the Company may be ineligible to qualify as a REIT for four subsequent tax years. Even if the Company qualifies as a REIT, it may be subject to certain state or local income taxes.

The tax benefit of uncertain tax positions is recognized only if it is “more likely than not” that the tax position will be sustained, based solely on its technical merits, with the taxing authority having full knowledge of relevant information. The measurement of a tax benefit for an uncertain tax position that meets the “more likely than not” threshold is based on a cumulative probability model under which the largest amount of tax benefit recognized is the amount with a greater than 50% likelihood of being realized upon ultimate settlement with the taxing authority, having full knowledge of all the relevant information. As of December 31, 2012 and 2013, the Company had no unrecognized tax benefits. The Company does not anticipate a significant change in the total amount of unrecognized tax benefits during 2014.

Incentive Compensation Plan

During 2012, the Company established the 2012 Incentive Compensation Plan, which was subsequently amended and restated in December 2013 (“2012 Plan”). The 2012 Plan allows for the grant of options and other awards representing up to 33,000,000 shares of the Company’s common stock. Such awards may be granted to officers, directors, employees, consultants and other persons who provide services to the Company or any related entity. Under the 2012 Plan, options may be granted at an exercise price greater than or equal to the market value at the date of the grant, for owners of 10% or more of the voting shares, at an exercise price of not less than 110% of the market value. Awards are exercisable over a period of time as determined by a committee designated by the Board of Directors, but in no event longer than ten years. No awards have been granted as of December 31, 2013.

| F-7 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2012 and 2013

NOTE 1. ORGANIZATION, OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Net Loss Per Share

Net loss per share is computed by dividing the net loss by the weighted average number of shares of common stock outstanding. Warrants, stock options, and common stock issuable upon the conversion of the Company's preferred stock (if any), are not included in the computation if the effect would be anti-dilutive and would increase the earnings or decrease loss per share. For the year ended December 31, 2012 there were no shares that were potentially dilutive. For the year ended December 31, 2013, potentially dilutive securities excluded from the calculations were 5,271,760 shares issuable upon exercise of outstanding warrants granted in conjunction with the convertible notes.

Financial Instruments

The carrying value of the Company’s financial instruments, as reported in the accompanying consolidated balance sheets, approximates fair value.

Security Deposits

Security deposits represent amounts deposited by tenants at the inception of the lease.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the balance sheet dates and reported amounts of expenses for the periods presented. Accordingly, actual results could differ from those estimates. Significant estimates include assumptions used to value warrants and conversion features associated with convertible notes payable (Note 3). Further, significant estimates include assumptions used to determine the allocation of purchase prices of property acquisitions (Note 1).

Property Acquisitions

The Company accounts for its acquisitions of real estate in accordance with FASB ASC 805, Accounting for Business Combinations, Goodwill, and Other Intangible Assets, which requires the purchase price of acquired properties be allocated to the acquired tangible assets and liabilities, consisting of land, building, and identified intangible assets, consisting of the value of above-market and below-market leases, the value of in-place leases, unamortized lease origination costs and security deposits, based in each case on their fair values.

The Company allocates the purchase price to tangible assets of an acquired property (which includes land and building) based on the estimated fair values of those tangible assets, assuming the property was vacant. Fair value for land and building is based on the purchase price for these properties. The Company also considers information obtained about each property as a result of its pre-acquisition due diligence, marketing and leasing activities in estimating the fair values of the tangible and intangible assets and liabilities acquired.

The total value allocable to intangible assets acquired, which consists of unamortized lease origination costs and in-place leases (including an above-market or below-market component of an acquired in-place lease), are allocated based on management’s evaluation of the specific characteristics of each tenant’s lease and the Company’s overall relationship with that respective tenant. Characteristics considered by management in allocating these values include the nature and extent of the existing business relationships with the tenant, growth prospects for developing new business with the tenant, the remaining term of the lease and the tenant’s credit quality, among other factors. For acquisitions made in 2012 and 2013, management has determined that no value is required to be allocated to intangible assets, as the leases assumed are short-term with values that are insignificant.

| F-8 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2012 and 2013

NOTE 1. ORGANIZATION, OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Land, Buildings and Improvements

Land, buildings and improvements are recorded at cost and depreciated over estimated useful lives of approximately 27.5 years using the straight-line method. Maintenance and repair costs are charged to operations as incurred.

The Company assesses the impairment of long-lived assets, whenever events or changes in business circumstances indicate that carrying amounts of the assets may not be fully recoverable. When such events occur, management determines whether there has been impairment by comparing the asset’s carrying value with its fair value, as measured by the anticipated undiscounted net cash flows of the asset. Should impairment exist, the asset is written down to its estimated fair value. The Company has not recognized any impairment losses through December 31, 2013.

Reclassifications

Certain amounts for 2012 have been reclassified to conform to the current year’s presentation.

NOTE 2. RESIDENTIAL HOMES, NET

Reven Housing Georgia, LLC (a wholly owned subsidiary of Reven Housing REIT, Inc.) completed the acquisition of nine residential homes. The nine homes are located in various cities in Georgia. Five of these homes were purchased in 2012 and the remaining four homes were purchased on January 10, 2013.

On October 4, 2013, Reven Housing Texas, LLC (a wholly owned subsidiary of Reven Housing REIT, Inc.) entered into a purchase and sale agreement for the purchase of a portfolio of 170 single family homes located in the Houston, Texas metropolitan area. On October 31, 2013, the Company closed and completed the purchase of 150 of the homes at a total cost of $11,971,797 including closing expenses (Note 10).

Residential homes purchased by the Company are recorded at cost. The Homes are depreciated over the estimated useful lives using the straight-line method for financial reporting purposes. The estimated useful life for the residential homes is estimated to be 27.5 years. The Homes are leased on short-term leases expiring on various dates over the coming year.

The following table represents the Company’s net investment in the homes and allocates purchase price in accordance with ASC 805:

| Investment | ||||||||||||||||||||||||

| Number | Residential | Total | Accumulated | In Real Estate | ||||||||||||||||||||

| of Homes | Land | Homes | Investment | Depreciation | Net | |||||||||||||||||||

| Purchased during 2012: | ||||||||||||||||||||||||

| Georgia | 5 | $ | 67,019 | $ | 276,391 | $ | 343,410 | $ | (1,400 | ) | $ | 342,010 | ||||||||||||

| Total at December 31, 2012 | 5 | 67,019 | 276,391 | 343,410 | (1,400 | ) | 342,010 | |||||||||||||||||

| Purchased during 2013: | ||||||||||||||||||||||||

| Georgia | 4 | 52,631 | 210,797 | 263,428 | (16,800 | ) | 246,628 | |||||||||||||||||

| Texas | 150 | 2,394,359 | 9,577,438 | 11,971,797 | (58,000 | ) | 11,913,797 | |||||||||||||||||

| Total at December 31, 2013 | 159 | $ | 2,514,009 | $ | 10,064,626 | $ | 12,578,635 | $ | (76,200 | ) | $ | 12,502,435 | ||||||||||||

Net investment in homes, as shown above, consists of the following as of December 31:

| 2012 | 2013 | |||||||||||||||

| Number | Investment | Number | Investment | |||||||||||||

| of Homes | Net | of Homes | Net | |||||||||||||

| Leased | 5 | $ | 342,010 | 146 | $ | 11,579,899 | ||||||||||

| Vacant | - | - | 13 | 922,536 | ||||||||||||

| 5 | $ | 342,010 | 159 | $ | 12,502,435 | |||||||||||

| F-9 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2012 and 2013

NOTE 3. CONVERTIBLE NOTES PAYABLE

The Company issued convertible promissory notes (the “Notes”) to certain accredited investors, shareholders, and officers in the aggregate principal amount of $1,054,352. Of this total, $500,000 was issued on January 3, 2013 in order to fund the four residential homes purchased in January 2013 and to pay operating expenses. The maturity date for the Notes was the earlier of December 31, 2013, or upon the Company raising $5 million or more of equity capital. The Notes bore interest at a rate of 10 percent per annum payable in full on the maturity date and were unsecured. Upon the Company successfully raising additional capital, the Notes could be exchanged by the holders for such securities of the Company at the same price and on the same terms and conditions being offered to the other investors in such financing, and the principal and accrued interest under the Notes could be applied towards the purchase price of such security. The Notes could be prepaid in whole or in part at the Company’s option without penalty.

Of the total Notes, $652,176 were issued to an officer, $350,000 were issued to accredited investors, and $52,176 to shareholders.

On September 27, 2013, in connection with the Company’s sale of common stock through a private placement (Note 5), convertible notes with a principal balance of $902,176 were exchanged for 4,510,880 shares of common stock at a conversion price of $0.20 per share and retired. Also in connection with the private placement, notes with a principal balance of $152,176 were paid in full with cash payments. Additionally, the Company paid accrued interest of $82,071 on all the convertible notes with cash payments.

Warrant Issuance and Note Conversion Feature

In connection with the issuance of the above Notes, the Company also issued to the investors 5-year detachable warrants exercisable for shares of the Company’s common stock (the “Warrants”). The exercise price of the Warrants is at the same price per share as the price of the equity securities sold to investors in the qualified equity financing, and each Warrant provides for 100% warrant coverage on the principal amount of the related Note.

The fair value of the Warrants and debt beneficial conversion feature were determined using the Monte-Carlo simulation valuation model that uses assumptions for expected volatility, expected dividends, and the risk-free interest rate. Expected volatilities were based on weighted averages of the selected peer group of thirteen companies as the Company has limited trading history and were estimated over the expected term of the Warrants. The risk-free rate was based on the U.S. Treasury yield curve at the date of issuance for the period of the expected term.

Accordingly, the fair value of the proceeds attributable to Warrants of $309,892 and the debt beneficial conversion feature of $309,891 totaling $619,783, was recorded as an increase in additional paid-in capital and as a corresponding discount to the convertible notes payable. Of the total debt discount of $619,783, $327,863 and $291,920 was recorded to additional paid-in capital and debt discount during 2012 and 2013, respectively. The discount was amortized over the term of the convertible notes payable using the interest method. In connection with the Company’s private placement of common stock and the corresponding conversion and retirement of the Notes, all remaining discount was recognized as an expense as of September 27, 2013. Amortization of the discount amounted to $56,530 and $563,253 and is included as a separate expense on the Consolidated Statements of Operations for the years ended December 31, 2012 and 2013, respectively.

A summary of the assumptions used to value the warrants and the beneficial conversion feature are as follows:

| 2012 | 2013 | |||||||

| 0.79 | % | 1.40 | % | |||||

| Risk -free interest rate | 48 | % | 47 | % | ||||

| Expected stock volatility | 5 | 5 | ||||||

| Time to expiration (years) | $ | 1.00 | $ | 0.20 | ||||

| Fair value of common stock | $ | 0.00 | $ | 0.00 | ||||

| Expected dividends | ||||||||

| F-10 |

REVEN HOUSING REIT, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2012 and 2013

NOTE 4. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

At December 31, 2012 and 2013, accounts payable and accrued expenses consisted of the following:

| 2012 | 2013 | |||||||

| Accounts payable | $ | - | $ | 89,666 | ||||

| Accrued property taxes | - | 196,141 | ||||||

| Accrued legal fees | 119,978 | 61,372 | ||||||

| $ | 119,978 | $ | 347,179 | |||||

NOTE 5. STOCKHOLDERS’ EQUITY