UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

J.P. Morgan Investment Management Inc.

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

With copies to:

| Elizabeth A. Davin, Esq. |

Jon S. Rand, Esq. | |

| JPMorgan Chase & Co. |

Dechert LLP | |

| 1111 Polaris Parkway |

1095 Avenue of the Americas | |

| Columbus, OH 43240 |

New York, NY 10036 |

Registrant’s telephone number, including area code: 1-844-457-6383

Date of fiscal year end: June 30

Date of reporting period: July 1, 2022 through December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

| Fund |

Ticker |

Listing Exchange |

| JPMorgan ActiveBuilders U.S. Large Cap Equity ETF |

JUSA |

NYSE Arca |

| JPMorgan Active Growth ETF |

JGRO |

NYSE Arca |

| JPMorgan Active Value ETF |

JAVA |

NYSE Arca |

| JPMorgan Equity Premium Income ETF |

JEPI |

NYSE Arca |

| JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ |

Nasdaq Stock Market® LLC |

| |

|

| 1 | |

| 2 | |

| 3 | |

| 3 | |

| 6 | |

| 9 | |

| 12 | |

| 15 | |

| 18 | |

| 37 | |

| 44 | |

| 46 | |

| 56 | |

| 57 | |

| 61 |

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from a Fund. Shares may only be subscribed and redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

February 13, 2023 (Unaudited)

|

“Investors may face continued economic and geopolitical challenges in the year ahead. However, some of the acute risks encountered in 2022 appear to have receded and last year’s reset in asset prices may provide attractive investment opportunities.” — Brian S. Shlissel |

President - J.P. Morgan Exchange-Traded Funds

J.P. Morgan Asset Management

1-844-4JPM-ETF or jpmorgan.com/etfs for more information

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

1 |

SIX MONTHS ENDED December 31, 2022 (Unaudited)

| 2 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

SIX MONTHS ENDED DECEMBER 31, 2022 (Unaudited)

| REPORTING PERIOD RETURN: |

|

| Net Asset Value * |

3.28% |

| Market Price **

|

3.45% |

| S&P 500 Index |

2.31% |

| Net

Assets as of 12/31/2022 |

$24,075,020 |

| Fund Ticker |

JUSA |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

3 |

SIX MONTHS ENDED DECEMBER 31, 2022 (Unaudited) (continued)

| TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS | |

| 1. |

Microsoft Corp. |

6.0% |

| 2. |

Apple, Inc. |

5.2

|

| 3. |

AbbVie, Inc. |

2.8 |

| 4. |

UnitedHealth Group, Inc. |

2.7

|

| 5. |

Amazon.com, Inc. |

2.3 |

| 6. |

Alphabet, Inc., Class A |

2.1

|

| 7. |

ConocoPhillips |

2.0 |

| 8. |

Coca-Cola Co. (The) |

1.7

|

| 9. |

Deere & Co. |

1.6 |

| 10. |

NextEra Energy, Inc. |

1.6

|

| PORTFOLIO COMPOSITION BY SECTOR AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS |

| Information Technology |

23.0% |

| Health Care |

18.4 |

| Financials |

12.2 |

| Consumer Discretionary |

11.9 |

| Industrials |

9.9 |

| Communication Services |

5.7 |

| Energy |

5.5 |

| Consumer Staples |

4.7 |

| Utilities |

3.2 |

| Materials |

3.2 |

| Real Estate |

1.9 |

| Short-Term Investments |

0.4 |

| 4 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

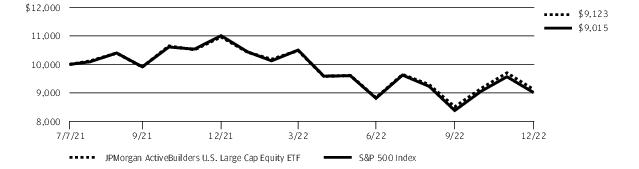

| |

INCEPTION DATE |

SIX MONTHS* |

1 YEAR |

SINCE INCEPTION |

| JPMorgan ActiveBuilders U.S. Large Cap Equity ETF |

|

|

|

|

| Net

Asset Value |

July

7, 2021 |

3.28% |

(16.78)% |

(6.00)% |

| Market Price |

|

3.45 |

(16.89) |

(6.02) |

| | |

| * |

Not annualized. |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

5 |

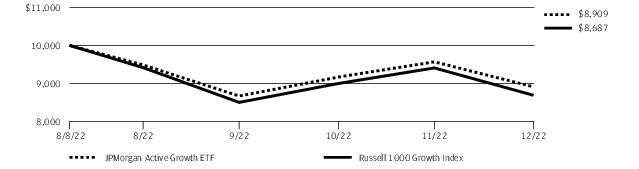

FOR THE PERIOD AUGUST 8, 2022 (FUND INCEPTION) THROUGH DECEMBER 31, 2022 (Unaudited)

| REPORTING PERIOD RETURN: |

|

| Net Asset Value * |

(10.91)% |

| Market Price **

|

(10.91)% |

| Russell 1000 Growth Index |

(13.13)% |

| Net

Assets as of 12/31/2022 |

$139,938,629 |

| Fund Ticker |

JGRO |

Shares of SVB Financial Group, a regional banking and financial services company, fell after the company reported lower-than-expected revenue for the third quarter of 2022 and amid investor concern about the company’s exposure to the information technology sector. Shares of Catalent, a pharmaceuticals maker, fell after the company reported lower-than-expected earnings and revenue for the third quarter of 2022 and lowered its forecast for the full year. Shares of Visa, a credit card and financial transactions processor, rose after the company reported better-than-expected earnings and revenue for its fiscal fourth quarter, increased its quarterly dividend by 20% and unveiled a $12 billion share repurchase plan.

| 6 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS | |

| 1. |

Apple, Inc. |

7.9% |

| 2. |

Microsoft Corp. |

7.8

|

| 3. |

Alphabet, Inc., Class C |

3.6 |

| 4. |

Amazon.com, Inc. |

3.3

|

| 5. |

UnitedHealth Group, Inc. |

2.7 |

| 6. |

Deere & Co. |

2.6

|

| 7. |

Regeneron Pharmaceuticals, Inc. |

2.3 |

| 8. |

Eli Lilly & Co. |

2.2

|

| 9. |

Charles Schwab Corp. (The) |

2.0 |

| 10. |

McKesson Corp. |

1.9

|

| PORTFOLIO COMPOSITION BY SECTOR AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS |

| Information Technology |

33.5% |

| Health

Care |

21.5 |

| Consumer Discretionary |

13.1 |

| Industrials |

9.5 |

| Financials |

6.0 |

| Communication Services |

4.4 |

| Energy |

3.3 |

| Consumer Staples |

3.1 |

| Materials |

1.5 |

| Short-Term Investments |

4.1 |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

7 |

FOR THE PERIOD AUGUST 8, 2022 (FUND INCEPTION) THROUGH DECEMBER 31, 2022 (Unaudited) (continued)

| |

INCEPTION DATE |

CUMULATIVE SINCE

INCEPTION |

| JPMorgan Active Growth ETF |

|

|

| Net

Asset Value |

August 8, 2022 |

(10.91)% |

| Market Price |

|

(10.91) |

| 8 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

SIX MONTHS ENDED DECEMBER 31, 2022 (Unaudited)

| REPORTING PERIOD RETURN: |

|

| Net Asset Value * |

7.94% |

| Market Price **

|

8.12% |

| Russell 1000 Value Index |

6.11% |

| Net

Assets as of 12/31/2022 |

$302,386,680 |

| Fund Ticker |

JAVA |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

9 |

SIX MONTHS ENDED DECEMBER 31, 2022 (Unaudited) (continued)

| TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS | |

| 1. |

Bristol-Myers Squibb Co. |

2.9% |

| 2. |

Wells Fargo & Co. |

2.7

|

| 3. |

Exxon Mobil Corp. |

2.5 |

| 4. |

Berkshire Hathaway, Inc., Class B |

2.4

|

| 5. |

Raytheon Technologies Corp. |

2.0 |

| 6. |

AbbVie, Inc. |

2.0 |

| 7. |

Chevron Corp. |

1.9 |

| 8. |

Bank of America Corp. |

1.9

|

| 9. |

Charter Communications, Inc., Class A |

1.4 |

| 10. |

ConocoPhillips |

1.4

|

| PORTFOLIO COMPOSITION BY SECTOR AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS |

| Financials |

21.1% |

| Health Care |

17.9 |

| Industrials |

12.2 |

| Energy |

9.2 |

| Consumer Discretionary |

7.1 |

| Consumer Staples |

6.7 |

| Communication Services |

5.5 |

| Materials |

5.2 |

| Information Technology |

5.1 |

| Utilities |

4.7 |

| Real Estate |

3.0 |

| Short-Term Investments |

2.3 |

| 10 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| |

INCEPTION DATE |

SIX MONTHS* |

1 YEAR |

SINCE INCEPTION |

| JPMorgan Active Value ETF |

|

|

|

|

| Net

Asset Value |

October 4, 2021 |

7.94% |

(0.78)% |

4.32% |

| Market Price |

|

8.12 |

(0.88) |

4.28 |

| | |

| * |

Not annualized. |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

11 |

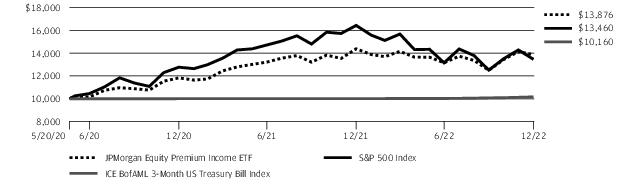

SIX MONTHS ENDED December 31, 2022 (Unaudited)

| REPORTING PERIOD RETURN: |

|

| Net Asset Value * |

5.48% |

| Market Price **

|

5.56% |

| S&P 500 Index |

2.31% |

| ICE

BofAML 3-Month US Treasury Bill Index |

1.32% |

| Net Assets as of 12/31/2022 |

$17,485,138,199 |

| Fund Ticker |

JEPI |

| 12 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| **** |

Equity-Linked Notes that are linked to the S&P 500 Index. |

| TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS | |

| 1. |

AbbVie, Inc. |

1.6% |

| 2. |

Progressive Corp. (The) |

1.6 |

| 3. |

Exxon Mobil Corp. |

1.6 |

| 4. |

UnitedHealth Group, Inc. |

1.5

|

| 5. |

Coca-Cola Co. (The) |

1.5 |

| 6. |

Hershey Co. (The) |

1.5

|

| 7. |

PepsiCo, Inc. |

1.5 |

| 8. |

Honeywell International, Inc. |

1.4

|

| 9. |

Bristol-Myers Squibb Co. |

1.4 |

| 10. |

Eli Lilly & Co. |

1.4

|

| PORTFOLIO COMPOSITION BY SECTOR AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS |

| Industrials |

12.4% |

| Health Care |

12.3 |

| Consumer Staples |

11.6 |

| Information Technology |

10.8

|

| Financials |

10.3 |

| Utilities |

7.8 |

| Consumer Discretionary |

5.6 |

| Communication Services |

3.7 |

| Materials |

3.3 |

| Energy |

2.8 |

| Real Estate |

2.6 |

| Other ****

|

15.3 |

| Short-Term Investments |

1.5 |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

13 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

| |

INCEPTION DATE |

SIX MONTHS* |

1 YEAR |

SINCE INCEPTION |

| JPMorgan Equity Premium Income ETF |

|

|

|

|

| Net

Asset Value |

May

20, 2020 |

5.48% |

(3.54)% |

13.34% |

| Market Price |

|

5.56 |

(3.52) |

13.36 |

| | |

| * |

Not annualized. |

| 14 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

SIX MONTHS ENDED DECEMBER 31, 2022 (Unaudited)

| REPORTING PERIOD RETURN: |

|

| Net Asset Value * |

(2.96)% |

| Market Price **

|

(3.51)% |

| Nasdaq-100 Index® |

(4.46)% |

| ICE

BofAML 3-Month US Treasury Bill Index |

1.32% |

| Net Assets as of 12/31/2022 |

$1,004,291,637 |

| Fund Ticker |

JEPQ |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

15 |

SIX MONTHS ENDED DECEMBER 31, 2022 (Unaudited) (continued)

| **** |

Equity-Linked Notes that are linked to the Nasdaq-100 Index. |

| ELN |

Equity-Linked Note |

| TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS | |

| 1. |

Microsoft Corp. |

10.5% |

| 2. |

Apple, Inc. |

8.8

|

| 3. |

Alphabet, Inc., Class C |

6.6 |

| 4. |

Amazon.com, Inc. |

5.0

|

| 5. |

UBS AG, ELN, 97.50%, 2/7/2023, (linked to Nasdaq-100 Index) (Switzerland) |

4.6 |

| 6. |

Citigroup Global Markets Holdings, Inc., ELN, 103.55%, 1/31/2023, (linked to Nasdaq-100 Index) |

4.1

|

| 7. |

BofA Finance LLC, ELN, 91.38%, 1/10/2023, (linked to Nasdaq-100 Index) |

3.5 |

| 8. |

BNP Paribas, ELN, 92.00%, 1/24/2023, (linked to Nasdaq-100 Index) |

3.0

|

| 9. |

NVIDIA Corp. |

2.4 |

| 10. |

Tesla, Inc. |

2.1

|

| PORTFOLIO COMPOSITION BY SECTOR AS OF December 31,

2022 |

PERCENT OF TOTAL

INVESTMENTS |

| Information Technology |

39.4% |

| Communication Services |

12.3 |

| Consumer Discretionary |

11.6 |

| Health Care |

6.2 |

| Consumer Staples |

5.3 |

| Industrials |

3.7 |

| Utilities |

1.6 |

| Real

Estate |

0.4 |

| Energy |

0.4 |

| Other ****

|

17.3 |

| Short-Term Investments |

1.8 |

| 16 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| |

INCEPTION DATE |

SIX MONTHS* |

SINCE INCEPTION |

| JPMorgan Nasdaq Equity Premium Income ETF |

|

|

|

| Net

Asset Value |

May

3, 2022 |

(2.96)% |

(11.04)% |

| Market Price |

|

(3.51) |

(11.01) |

| | |

| * |

Not annualized. |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

17 |

AS OF December 31, 2022 (Unaudited)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — 99.4% | ||

| Aerospace & Defense — 1.7% | ||

| General Dynamics Corp. |

303 |

75,177 |

| Northrop Grumman Corp. |

269 |

146,769 |

| Raytheon Technologies Corp. |

1,520 |

153,399 |

| Textron, Inc. |

380 |

26,904

|

| |

|

402,249 |

| Air Freight & Logistics — 0.9% | ||

| United Parcel Service, Inc., Class B |

1,193 |

207,391 |

| Airlines — 0.2% | ||

| Southwest Airlines Co. * |

1,119 |

37,677

|

| Auto Components — 0.0% ^ | ||

| Magna International, Inc. (Canada) |

210 |

11,798

|

| Automobiles — 1.0% | ||

| Tesla, Inc. * |

2,027 |

249,686 |

| Banks — 4.2% | ||

| Bank of America Corp. |

3,879 |

128,473 |

| Citigroup, Inc. |

817 |

36,953 |

| Citizens Financial Group, Inc. |

438 |

17,244 |

| Fifth Third Bancorp |

756 |

24,804 |

| M&T Bank Corp. |

170 |

24,660 |

| PNC Financial Services Group, Inc. (The) |

287 |

45,329 |

| SVB Financial Group * |

205 |

47,179 |

| Truist Financial Corp. |

6,049 |

260,288 |

| US Bancorp |

4,333 |

188,962 |

| Wells Fargo & Co. |

5,719 |

236,138 |

| |

|

1,010,030 |

| Beverages — 2.5% | ||

| Coca-Cola Co. (The) |

6,508 |

413,974 |

| Constellation Brands, Inc., Class A |

135 |

31,286 |

| Monster Beverage Corp. * |

929 |

94,322 |

| PepsiCo, Inc. |

382 |

69,012 |

| |

|

608,594 |

| Biotechnology — 5.9% | ||

| AbbVie, Inc. |

4,132 |

667,772 |

| Alnylam Pharmaceuticals, Inc. * |

112 |

26,617 |

| Amgen, Inc. |

513 |

134,734 |

| Biogen, Inc. * |

126 |

34,892 |

| BioMarin Pharmaceutical, Inc. * |

67 |

6,934 |

| Neurocrine Biosciences, Inc. * |

61 |

7,286 |

| Regeneron Pharmaceuticals, Inc. * |

494 |

356,416 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Biotechnology — continued | ||

| Seagen, Inc. * |

225 |

28,915 |

| Vertex Pharmaceuticals, Inc. * |

558 |

161,139 |

| |

|

1,424,705 |

| Building Products — 1.0% | ||

| Masco Corp. |

357 |

16,661 |

| Trane Technologies plc |

1,289 |

216,668 |

| |

|

233,329 |

| Capital Markets — 4.8% | ||

| Ameriprise Financial, Inc. |

374 |

116,452 |

| BlackRock, Inc. |

117 |

82,910 |

| Blackstone, Inc. |

456 |

33,831 |

| Charles Schwab Corp. (The) |

2,109 |

175,595 |

| CME Group, Inc. |

182 |

30,605 |

| Goldman Sachs Group, Inc. (The) |

146 |

50,134 |

| Intercontinental Exchange, Inc. |

334 |

34,265 |

| Morgan Stanley |

3,970 |

337,529 |

| MSCI, Inc. |

52 |

24,189 |

| Raymond James Financial, Inc. |

182 |

19,447 |

| S&P Global, Inc. |

634 |

212,352 |

| State Street Corp. |

185 |

14,350 |

| T. Rowe Price Group, Inc. |

284 |

30,973 |

| |

|

1,162,632 |

| Chemicals — 2.0% | ||

| Air Products and Chemicals, Inc. |

274 |

84,463 |

| Axalta Coating Systems Ltd. * |

2,294 |

58,428 |

| DuPont de Nemours, Inc. |

212 |

14,550 |

| Eastman Chemical Co. |

1,067 |

86,897 |

| Linde plc (United Kingdom) |

190 |

61,974 |

| PPG Industries, Inc. |

1,066 |

134,039 |

| Sherwin-Williams Co. (The) |

161 |

38,210 |

| |

|

478,561 |

| Commercial Services & Supplies — 0.1% | ||

| Cintas Corp. |

22 |

9,936 |

| Republic Services, Inc. |

203 |

26,185 |

| |

|

36,121 |

| Communications Equipment — 0.1% | ||

| Motorola Solutions, Inc. |

66 |

17,009 |

| Construction Materials — 0.6% | ||

| Martin Marietta Materials, Inc. |

35 |

11,829 |

| Vulcan Materials Co. |

763 |

133,609 |

| |

|

145,438 |

| 18 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Consumer Finance — 0.6% | ||

| American Express Co. |

742 |

109,631 |

| Capital One Financial Corp. |

490 |

45,550

|

| |

|

155,181 |

| Containers & Packaging — 0.1% | ||

| Avery Dennison Corp. |

54 |

9,774 |

| Ball Corp. |

331 |

16,927

|

| |

|

26,701 |

| Diversified Financial Services — 0.8% | ||

| Berkshire Hathaway, Inc., Class B * |

638 |

197,078 |

| Diversified Telecommunication Services — 0.4% | ||

| Verizon Communications, Inc. |

2,196 |

86,522

|

| Electric Utilities — 2.4% | ||

| Entergy Corp. |

148 |

16,650 |

| FirstEnergy Corp. |

233 |

9,772 |

| NextEra Energy, Inc. |

4,553 |

380,631 |

| PG&E Corp. * |

3,775 |

61,381 |

| Xcel Energy, Inc. |

1,689 |

118,416 |

| |

|

586,850 |

| Electrical Equipment — 1.2% | ||

| Eaton Corp. plc |

1,687 |

264,774 |

| Rockwell Automation, Inc. |

124 |

31,939 |

| |

|

296,713 |

| Electronic Equipment, Instruments & Components — 0.4% | ||

| Amphenol Corp., Class A |

945 |

71,952 |

| Corning, Inc. |

226 |

7,219 |

| TE Connectivity Ltd. (Switzerland) |

83 |

9,528 |

| |

|

88,699 |

| Energy Equipment & Services — 0.7% | ||

| Baker Hughes Co. |

5,586 |

164,955 |

| Entertainment — 0.3% | ||

| Netflix, Inc. * |

133 |

39,219 |

| Walt Disney Co. (The) * |

279 |

24,239 |

| |

|

63,458 |

| Equity Real Estate Investment Trusts (REITs) — 1.9% | ||

| AvalonBay Communities, Inc. |

74 |

11,953 |

| Camden Property Trust |

65 |

7,272 |

| Equinix, Inc. |

33 |

21,616 |

| Equity LifeStyle Properties, Inc. |

188 |

12,145 |

| Host Hotels & Resorts, Inc. |

1,425 |

22,871 |

| Prologis, Inc. |

2,454 |

276,639 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Equity Real Estate Investment Trusts (REITs) — continued | ||

| SBA Communications Corp. |

129 |

36,160 |

| Sun Communities, Inc. |

119 |

17,017 |

| UDR, Inc. |

435 |

16,848 |

| Ventas, Inc. |

966 |

43,518

|

| |

|

466,039 |

| Food & Staples Retailing — 0.4% | ||

| Costco Wholesale Corp. |

120 |

54,780 |

| Walmart, Inc. |

335 |

47,500

|

| |

|

102,280 |

| Food Products — 0.3% | ||

| Hershey Co. (The) |

41 |

9,495 |

| Mondelez International, Inc., Class A |

1,019 |

67,916 |

| |

|

77,411 |

| Health Care Equipment & Supplies — 2.6% | ||

| Abbott Laboratories |

359 |

39,415 |

| Baxter International, Inc. |

479 |

24,415 |

| Becton Dickinson and Co. |

144 |

36,619 |

| Boston Scientific Corp. * |

4,961 |

229,545 |

| Dexcom, Inc. * |

298 |

33,745 |

| Intuitive Surgical, Inc. * |

596 |

158,149 |

| Medtronic plc |

868 |

67,461 |

| Zimmer Biomet Holdings, Inc. |

345 |

43,987 |

| |

|

633,336 |

| Health Care Providers & Services — 5.3% | ||

| Centene Corp. * |

411 |

33,706 |

| Cigna Corp. |

188 |

62,292 |

| CVS Health Corp. |

956 |

89,090 |

| Elevance Health, Inc. |

181 |

92,848 |

| HCA Healthcare, Inc. |

421 |

101,023 |

| Humana, Inc. |

133 |

68,121 |

| McKesson Corp. |

465 |

174,431 |

| UnitedHealth Group, Inc. |

1,229 |

651,591 |

| |

|

1,273,102 |

| Hotels, Restaurants & Leisure — 2.4% | ||

| Airbnb, Inc., Class A * |

139 |

11,885 |

| Booking Holdings, Inc. * |

38 |

76,581 |

| Chipotle Mexican Grill, Inc. * |

49 |

67,987 |

| Expedia Group, Inc. * |

168 |

14,717 |

| Marriott International, Inc., Class A |

916 |

136,383 |

| McDonald's Corp. |

972 |

256,151 |

| Yum! Brands, Inc. |

93 |

11,911 |

| |

|

575,615 |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

19 |

AS OF December 31, 2022 (Unaudited) (continued)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Household Durables — 0.2% | ||

| Lennar Corp., Class A |

265 |

23,982 |

| Newell Brands, Inc. |

937 |

12,256 |

| Toll Brothers, Inc. |

143 |

7,139

|

| |

|

43,377 |

| Household Products — 0.8% | ||

| Colgate-Palmolive Co. |

583 |

45,935 |

| Kimberly-Clark Corp. |

194 |

26,335 |

| Procter & Gamble Co. (The) |

827 |

125,340 |

| |

|

197,610 |

| Industrial Conglomerates — 0.4% | ||

| Honeywell International, Inc. |

400 |

85,720

|

| Insurance — 1.7% | ||

| Aon plc, Class A |

56 |

16,808 |

| Chubb Ltd. |

237 |

52,282 |

| Globe Life, Inc. |

101 |

12,176 |

| Hartford Financial Services Group, Inc. (The) |

617 |

46,787 |

| Loews Corp. |

348 |

20,299 |

| Marsh & McLennan Cos., Inc. |

131 |

21,678 |

| MetLife, Inc. |

538 |

38,935 |

| Progressive Corp. (The) |

941 |

122,057 |

| Prudential Financial, Inc. |

296 |

29,440 |

| Travelers Cos., Inc. (The) |

274 |

51,372 |

| |

|

411,834 |

| Interactive Media & Services — 4.1% | ||

| Alphabet, Inc., Class A * |

5,706 |

503,441 |

| Alphabet, Inc., Class C * |

3,836 |

340,368 |

| Meta Platforms, Inc., Class A * |

1,274 |

153,313 |

| |

|

997,122 |

| Internet & Direct Marketing Retail — 2.4% | ||

| Amazon.com, Inc. * |

6,534 |

548,856 |

| Etsy, Inc. * |

95 |

11,379 |

| MercadoLibre, Inc. (Brazil) * |

27 |

22,848 |

| |

|

583,083 |

| IT Services — 3.1% | ||

| Accenture plc, Class A |

243 |

64,842 |

| Automatic Data Processing, Inc. |

322 |

76,913 |

| Cognizant Technology Solutions Corp., Class A |

696 |

39,804 |

| FleetCor Technologies, Inc. * |

134 |

24,613 |

| International Business Machines Corp. |

809 |

113,980 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| IT Services — continued | ||

| Mastercard, Inc., Class A |

967 |

336,255 |

| Visa, Inc., Class A |

467 |

97,024

|

| |

|

753,431 |

| Life Sciences Tools & Services — 0.6% | ||

| Danaher Corp. |

166 |

44,060 |

| Thermo Fisher Scientific, Inc. |

194 |

106,834 |

| |

|

150,894 |

| Machinery — 2.4% | ||

| Deere & Co. |

918 |

393,602 |

| Dover Corp. |

560 |

75,829 |

| Otis Worldwide Corp. |

338 |

26,469 |

| Parker-Hannifin Corp. |

254 |

73,914 |

| |

|

569,814 |

| Media — 0.7% | ||

| Charter Communications, Inc., Class A * |

102 |

34,588 |

| Comcast Corp., Class A |

3,097 |

108,302 |

| Trade Desk, Inc. (The), Class A * |

488 |

21,877 |

| |

|

164,767 |

| Metals & Mining — 0.5% | ||

| Freeport-McMoRan, Inc. |

2,689 |

102,182 |

| Nucor Corp. |

91 |

11,995 |

| |

|

114,177 |

| Multiline Retail — 0.9% | ||

| Dollar General Corp. |

661 |

162,771 |

| Target Corp. |

314 |

46,799 |

| |

|

209,570 |

| Multi-Utilities — 0.8% | ||

| Ameren Corp. |

219 |

19,474 |

| CenterPoint Energy, Inc. |

718 |

21,533 |

| CMS Energy Corp. |

777 |

49,207 |

| Public Service Enterprise Group, Inc. |

886 |

54,285 |

| Sempra Energy |

243 |

37,553 |

| |

|

182,052 |

| Oil, Gas & Consumable Fuels — 4.8% | ||

| Cheniere Energy, Inc. |

251 |

37,640 |

| Chevron Corp. |

479 |

85,976 |

| ConocoPhillips |

4,006 |

472,708 |

| Coterra Energy, Inc. |

492 |

12,088 |

| Diamondback Energy, Inc. |

322 |

44,043 |

| EOG Resources, Inc. |

934 |

120,972 |

| Exxon Mobil Corp. |

2,365 |

260,859 |

| 20 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Oil, Gas & Consumable Fuels — continued | ||

| Phillips 66 |

119 |

12,386 |

| Pioneer Natural Resources Co. |

428 |

97,751 |

| Valero Energy Corp. |

80 |

10,149

|

| |

|

1,154,572 |

| Personal Products — 0.1% | ||

| Estee Lauder Cos., Inc. (The), Class A |

71 |

17,616

|

| Pharmaceuticals — 3.9% | ||

| Bristol-Myers Squibb Co. |

4,740 |

341,043 |

| Eli Lilly & Co. |

822 |

300,721 |

| Johnson & Johnson |

859 |

151,742 |

| Merck & Co., Inc. |

656 |

72,783 |

| Pfizer, Inc. |

1,211 |

62,052 |

| |

|

928,341 |

| Professional Services — 0.7% | ||

| Booz Allen Hamilton Holding Corp. |

69 |

7,212 |

| Equifax, Inc. |

88 |

17,104 |

| Leidos Holdings, Inc. |

733 |

77,104 |

| Verisk Analytics, Inc. |

318 |

56,101 |

| |

|

157,521 |

| Road & Rail — 1.4% | ||

| CSX Corp. |

1,841 |

57,034 |

| Norfolk Southern Corp. |

707 |

174,219 |

| Uber Technologies, Inc. * |

3,451 |

85,343 |

| Union Pacific Corp. |

127 |

26,298 |

| |

|

342,894 |

| Semiconductors & Semiconductor Equipment — 5.6% | ||

| Advanced Micro Devices, Inc. * |

2,925 |

189,452 |

| Analog Devices, Inc. |

768 |

125,975 |

| ASML Holding NV (Registered), NYRS (Netherlands) |

164 |

89,610 |

| Broadcom, Inc. |

26 |

14,537 |

| Enphase Energy, Inc. * |

86 |

22,787 |

| Lam Research Corp. |

234 |

98,350 |

| Microchip Technology, Inc. |

301 |

21,145 |

| Micron Technology, Inc. |

139 |

6,947 |

| NVIDIA Corp. |

1,354 |

197,874 |

| NXP Semiconductors NV (China) |

2,029 |

320,643 |

| QUALCOMM, Inc. |

127 |

13,962 |

| Teradyne, Inc. |

758 |

66,211 |

| Texas Instruments, Inc. |

1,113 |

183,890 |

| |

|

1,351,383 |

| Software — 8.4% | ||

| Adobe, Inc. * |

145 |

48,797 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Software — continued | ||

| Cadence Design Systems, Inc. * |

59 |

9,478 |

| DocuSign, Inc. * |

132 |

7,315 |

| Fortinet, Inc. * |

144 |

7,040 |

| Intuit, Inc. |

399 |

155,299 |

| Microsoft Corp. |

6,048 |

1,450,431 |

| Oracle Corp. |

2,674 |

218,573 |

| Salesforce, Inc. * |

315 |

41,766 |

| Synopsys, Inc. * |

222 |

70,882 |

| Workday, Inc., Class A * |

141 |

23,594

|

| |

|

2,033,175 |

| Specialty Retail — 4.1% | ||

| AutoNation, Inc. * |

88 |

9,442 |

| AutoZone, Inc. * |

105 |

258,949 |

| Best Buy Co., Inc. |

330 |

26,469 |

| Burlington Stores, Inc. * |

64 |

12,977 |

| Home Depot, Inc. (The) |

309 |

97,601 |

| Lowe's Cos., Inc. |

1,766 |

351,858 |

| O'Reilly Automotive, Inc. * |

76 |

64,146 |

| TJX Cos., Inc. (The) |

2,083 |

165,807 |

| |

|

987,249 |

| Technology Hardware, Storage & Peripherals — 5.3% | ||

| Apple, Inc. |

9,702 |

1,260,581 |

| Seagate Technology Holdings plc |

422 |

22,201 |

| |

|

1,282,782 |

| Textiles, Apparel & Luxury Goods — 0.9% | ||

| NIKE, Inc., Class B |

1,485 |

173,760 |

| Tapestry, Inc. |

865 |

32,939 |

| |

|

206,699 |

| Tobacco — 0.5% | ||

| Altria Group, Inc. |

516 |

23,586 |

| Philip Morris International, Inc. |

951 |

96,251 |

| |

|

119,837 |

| Wireless Telecommunication Services — 0.3% | ||

| T-Mobile US, Inc. * |

456 |

63,840 |

| Total Common Stocks (Cost $25,502,902) |

|

23,928,520 |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

21 |

AS OF December 31, 2022 (Unaudited) (continued)

| INVESTMENTS |

SHARES |

VALUE($) |

| Short-Term Investments — 0.4% | ||

| Investment Companies — 0.4% | ||

| JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (a) (b)

(Cost $108,080) |

108,080 |

108,080 |

| Total Investments — 99.8% (Cost $25,610,982) |

|

24,036,600 |

| Other Assets Less Liabilities — 0.2% |

|

38,420 |

| NET ASSETS — 100.0% |

|

24,075,020 |

| Percentages indicated are based on net assets. |

| Abbreviations |

|

| NYRS |

New York Registry Shares |

| ^ |

Amount rounds to less than 0.1% of net assets. | |

| * |

Non-income producing security. |

|

| (a) |

Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

|

| (b) |

The rate shown is the current yield as of December 31, 2022. |

|

| DESCRIPTION |

NUMBER OF

CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL

AMOUNT ($) |

VALUE AND

UNREALIZED APPRECIATION

(DEPRECIATION) ($) |

| Long Contracts |

|

|

|

|

|

| Micro E-mini S&P 500 Index |

6 |

03/17/2023 |

USD |

115,830 |

(2,051) |

| Abbreviations |

|

| USD |

United States Dollar |

| 22 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

AS OF December 31, 2022 (Unaudited)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — 95.9% | ||

| Air Freight & Logistics — 0.7% | ||

| United Parcel Service, Inc., Class B |

5,414 |

941,170

|

| Automobiles — 1.6% | ||

| Tesla, Inc. * |

18,242 |

2,247,050 |

| Banks — 0.8% | ||

| First Republic Bank |

3,191 |

388,951 |

| SVB Financial Group * |

3,107 |

715,045

|

| |

|

1,103,996 |

| Beverages — 2.5% | ||

| Coca-Cola Co. (The) |

29,946 |

1,904,865 |

| Constellation Brands, Inc., Class A |

3,118 |

722,597 |

| Monster Beverage Corp. * |

8,872 |

900,774

|

| |

|

3,528,236 |

| Biotechnology — 8.1% | ||

| AbbVie, Inc. |

15,807 |

2,554,569 |

| Alnylam Pharmaceuticals, Inc. * |

4,429 |

1,052,552 |

| Amgen, Inc. |

6,978 |

1,832,702 |

| Exact Sciences Corp. * |

12,301 |

609,023 |

| Exelixis, Inc. * |

17,889 |

286,940 |

| Horizon Therapeutics plc * |

10,303 |

1,172,481 |

| Moderna, Inc. * |

350 |

62,867 |

| Natera, Inc. * |

6,065 |

243,631 |

| Regeneron Pharmaceuticals, Inc. * |

4,379 |

3,159,405 |

| Seagen, Inc. * |

2,848 |

365,996 |

| |

|

11,340,166 |

| Building Products — 1.3% | ||

| Trane Technologies plc |

10,885 |

1,829,660 |

| Capital Markets — 4.5% | ||

| Blackstone, Inc. |

14,419 |

1,069,745 |

| Charles Schwab Corp. (The) |

34,038 |

2,834,004 |

| Morgan Stanley |

14,993 |

1,274,705 |

| MSCI, Inc. |

613 |

285,149 |

| S&P Global, Inc. |

2,321 |

777,396 |

| |

|

6,240,999 |

| Chemicals — 0.3% | ||

| Sherwin-Williams Co. (The) |

1,938 |

459,946 |

| Commercial Services & Supplies — 0.6% | ||

| Copart, Inc. * |

14,439 |

879,191 |

| Communications Equipment — 0.2% | ||

| Arista Networks, Inc. * |

2,418 |

293,424 |

| Construction & Engineering — 1.0% | ||

| Quanta Services, Inc. |

10,033 |

1,429,703 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Consumer Finance — 0.1% | ||

| Capital One Financial Corp. |

1,745 |

162,215

|

| Electrical Equipment — 1.3% | ||

| AMETEK, Inc. |

6,314 |

882,192 |

| Hubbell, Inc. |

2,379 |

558,304 |

| Rockwell Automation, Inc. |

1,490 |

383,779

|

| |

|

1,824,275 |

| Electronic Equipment, Instruments & Components — 1.3% | ||

| Amphenol Corp., Class A |

11,413 |

868,986 |

| Keysight Technologies, Inc. * |

2,768 |

473,522 |

| Zebra Technologies Corp., Class A * |

1,591 |

407,948

|

| |

|

1,750,456 |

| Energy Equipment & Services — 0.2% | ||

| Baker Hughes Co. |

9,216 |

272,149 |

| Entertainment — 0.1% | ||

| Take-Two Interactive Software, Inc. * |

893 |

92,988 |

| Health Care Equipment & Supplies — 2.7% | ||

| Cooper Cos., Inc. (The) |

2,017 |

666,961 |

| Dexcom, Inc. * |

8,928 |

1,011,007 |

| Insulet Corp. * |

1,880 |

553,453 |

| Intuitive Surgical, Inc. * |

5,680 |

1,507,188 |

| |

|

3,738,609 |

| Health Care Providers & Services — 6.5% | ||

| Centene Corp. * |

4,365 |

357,974 |

| CVS Health Corp. |

11,078 |

1,032,359 |

| HCA Healthcare, Inc. |

5,120 |

1,228,595 |

| McKesson Corp. |

7,211 |

2,704,990 |

| UnitedHealth Group, Inc. |

7,228 |

3,832,141 |

| |

|

9,156,059 |

| Hotels, Restaurants & Leisure — 2.7% | ||

| Airbnb, Inc., Class A * |

1,601 |

136,885 |

| Aramark |

13,628 |

563,382 |

| Booking Holdings, Inc. * |

331 |

667,058 |

| Chipotle Mexican Grill, Inc. * |

326 |

452,322 |

| Hilton Worldwide Holdings, Inc. |

5,848 |

738,953 |

| Marriott International, Inc., Class A |

5,870 |

873,984 |

| Royal Caribbean Cruises Ltd. * |

6,065 |

299,793 |

| |

|

3,732,377 |

| Household Durables — 0.2% | ||

| Garmin Ltd. |

3,569 |

329,383 |

| Insurance — 0.6% | ||

| Progressive Corp. (The) |

6,837 |

886,827 |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

23 |

AS OF December 31, 2022 (Unaudited) (continued)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Interactive Media & Services — 4.0% | ||

| Alphabet, Inc., Class C * |

56,677 |

5,028,950 |

| Bumble, Inc., Class A * |

17,155 |

361,113 |

| Match Group, Inc. * |

1,050 |

43,564 |

| Meta Platforms, Inc., Class A * |

720 |

86,645 |

| Snap, Inc., Class A * |

1,704 |

15,251

|

| |

|

5,535,523 |

| Internet & Direct Marketing Retail — 3.6% | ||

| Amazon.com, Inc. * |

54,512 |

4,579,008 |

| Etsy, Inc. * |

1,216 |

145,652 |

| MercadoLibre, Inc. (Brazil) * |

336 |

284,337

|

| |

|

5,008,997 |

| IT Services — 4.5% | ||

| Automatic Data Processing, Inc. |

4,024 |

961,173 |

| Block, Inc., Class A * |

459 |

28,843 |

| Cognizant Technology Solutions Corp., Class A |

8,667 |

495,666 |

| Global Payments, Inc. |

4,776 |

474,352 |

| Globant SA * |

2,508 |

421,745 |

| International Business Machines Corp. |

7,531 |

1,061,043 |

| Mastercard, Inc., Class A |

6,993 |

2,431,676 |

| MongoDB, Inc. * |

2,374 |

467,298 |

| Shopify, Inc., Class A (Canada) * |

389 |

13,502 |

| |

|

6,355,298 |

| Life Sciences Tools & Services — 1.2% | ||

| Mettler-Toledo International, Inc. * |

399 |

576,735 |

| Thermo Fisher Scientific, Inc. |

1,992 |

1,096,974 |

| |

|

1,673,709 |

| Machinery — 3.4% | ||

| Deere & Co. |

8,372 |

3,589,579 |

| Ingersoll Rand, Inc. |

13,245 |

692,051 |

| Toro Co. (The) |

4,384 |

496,269 |

| |

|

4,777,899 |

| Media — 0.4% | ||

| Trade Desk, Inc. (The), Class A * |

12,334 |

552,933 |

| Metals & Mining — 1.2% | ||

| Freeport-McMoRan, Inc. |

43,058 |

1,636,204 |

| Multiline Retail — 0.3% | ||

| Target Corp. |

2,938 |

437,880 |

| Oil, Gas & Consumable Fuels — 3.1% | ||

| Cheniere Energy, Inc. |

7,302 |

1,095,008 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Oil, Gas & Consumable Fuels — continued | ||

| ConocoPhillips |

16,314 |

1,925,052 |

| EOG Resources, Inc. |

9,651 |

1,249,997 |

| |

|

4,270,057 |

| Personal Products — 0.6% | ||

| Estee Lauder Cos., Inc. (The), Class A |

3,305 |

820,004

|

| Pharmaceuticals — 3.0% | ||

| Eli Lilly & Co. |

8,460 |

3,095,006 |

| Jazz Pharmaceuticals plc * |

3,153 |

502,304 |

| Royalty Pharma plc, Class A |

14,847 |

586,754

|

| |

|

4,184,064 |

| Professional Services — 0.9% | ||

| Equifax, Inc. |

3,098 |

602,127 |

| Verisk Analytics, Inc. |

3,829 |

675,512 |

| |

|

1,277,639 |

| Road & Rail — 0.2% | ||

| Old Dominion Freight Line, Inc. |

1,185 |

336,279 |

| Semiconductors & Semiconductor Equipment — 5.7% | ||

| Advanced Micro Devices, Inc. * |

21,568 |

1,396,959 |

| ASML Holding NV (Registered), NYRS (Netherlands) |

848 |

463,347 |

| Enphase Energy, Inc. * |

1,021 |

270,524 |

| Entegris, Inc. |

5,646 |

370,321 |

| Lam Research Corp. |

1,795 |

754,439 |

| Marvell Technology, Inc. |

9,647 |

357,325 |

| NVIDIA Corp. |

14,200 |

2,075,188 |

| QUALCOMM, Inc. |

6,885 |

756,937 |

| SolarEdge Technologies, Inc. * |

2,626 |

743,867 |

| Texas Instruments, Inc. |

3,547 |

586,035 |

| Wolfspeed, Inc. * |

3,714 |

256,415 |

| |

|

8,031,357 |

| Software — 13.9% | ||

| Confluent, Inc., Class A * |

17,333 |

385,486 |

| Crowdstrike Holdings, Inc., Class A * |

2,553 |

268,805 |

| HubSpot, Inc. * |

1,113 |

321,802 |

| Intuit, Inc. |

4,168 |

1,622,269 |

| Microsoft Corp. |

45,257 |

10,853,534 |

| Oracle Corp. |

19,723 |

1,612,158 |

| Palo Alto Networks, Inc. * |

6,014 |

839,193 |

| Salesforce, Inc. * |

3,169 |

420,178 |

| ServiceNow, Inc. * |

1,669 |

648,023 |

| Synopsys, Inc. * |

5,102 |

1,629,017 |

| Workday, Inc., Class A * |

651 |

108,932 |

| 24 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Software — continued | ||

| Zoom Video Communications, Inc., Class A * |

7,161 |

485,086 |

| Zscaler, Inc. * |

1,979 |

221,450

|

| |

|

19,415,933 |

| Specialty Retail — 4.1% | ||

| AutoZone, Inc. * |

871 |

2,148,043 |

| Burlington Stores, Inc. * |

3,787 |

767,852 |

| CarMax, Inc. * |

3,181 |

193,691 |

| Lowe's Cos., Inc. |

9,354 |

1,863,691 |

| Ross Stores, Inc. |

1,447 |

167,953 |

| Tractor Supply Co. |

2,738 |

615,968

|

| |

|

5,757,198 |

| Technology Hardware, Storage & Peripherals — 7.9% | ||

| Apple, Inc. |

85,051 |

11,050,676 |

| Textiles, Apparel & Luxury Goods — 0.6% | ||

| NIKE, Inc., Class B |

3,941 |

461,136 |

| Tapestry, Inc. |

10,932 |

416,291 |

| |

|

877,427 |

| Total Common Stocks (Cost $138,182,203) |

|

134,237,956 |

| INVESTMENTS |

SHARES |

VALUE($) |

| Short-Term Investments — 4.1% | ||

| Investment Companies — 4.1% | ||

| JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (a) (b)

(Cost $5,698,329) |

5,698,329 |

5,698,329 |

| Total Investments — 100.0% (Cost $143,880,532) |

|

139,936,285 |

| Other Assets Less Liabilities — 0.0% ^ |

|

2,344 |

| NET ASSETS — 100.0% |

|

139,938,629 |

| Percentages indicated are based on net assets. |

| Abbreviations |

|

| NYRS |

New York Registry Shares |

| ^ |

Amount rounds to less than 0.1% of net assets. | |

| * |

Non-income producing security. |

|

| (a) |

Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

|

| (b) |

The rate shown is the current yield as of December 31, 2022. |

|

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

25 |

AS OF December 31, 2022 (Unaudited)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — 97.6% | ||

| Aerospace & Defense — 3.2% | ||

| General Dynamics Corp. |

9,023 |

2,238,697 |

| Northrop Grumman Corp. |

2,471 |

1,348,202 |

| Raytheon Technologies Corp. |

59,638 |

6,018,667 |

| |

|

9,605,566 |

| Air Freight & Logistics — 1.3% | ||

| FedEx Corp. |

9,608 |

1,664,106 |

| GXO Logistics, Inc. * |

3,379 |

144,249 |

| United Parcel Service, Inc., Class B |

12,148 |

2,111,808 |

| |

|

3,920,163 |

| Airlines — 0.9% | ||

| Delta Air Lines, Inc. * |

50,420 |

1,656,801 |

| Southwest Airlines Co. * |

33,141 |

1,115,858 |

| |

|

2,772,659 |

| Banks — 9.4% | ||

| Bank of America Corp. |

169,702 |

5,620,530 |

| Citigroup, Inc. |

64,137 |

2,900,917 |

| Citizens Financial Group, Inc. |

16,015 |

630,511 |

| Fifth Third Bancorp |

62,183 |

2,040,224 |

| First Republic Bank |

7,723 |

941,356 |

| M&T Bank Corp. |

6,109 |

886,172 |

| PNC Financial Services Group, Inc. (The) |

9,810 |

1,549,391 |

| Truist Financial Corp. |

37,643 |

1,619,778 |

| US Bancorp |

92,406 |

4,029,826 |

| Wells Fargo & Co. |

200,535 |

8,280,090 |

| |

|

28,498,795 |

| Beverages — 1.0% | ||

| Coca-Cola Co. (The) |

9,684 |

615,999 |

| Keurig Dr Pepper, Inc. |

15,555 |

554,691 |

| Monster Beverage Corp. * |

7,188 |

729,798 |

| PepsiCo, Inc. |

6,820 |

1,232,101 |

| |

|

3,132,589 |

| Biotechnology — 5.4% | ||

| AbbVie, Inc. |

37,219 |

6,014,963 |

| Amgen, Inc. |

3,589 |

942,615 |

| Biogen, Inc. * |

3,765 |

1,042,604 |

| BioMarin Pharmaceutical, Inc. * |

12,647 |

1,308,838 |

| Neurocrine Biosciences, Inc. * |

2,462 |

294,061 |

| Regeneron Pharmaceuticals, Inc. * |

5,425 |

3,914,083 |

| Vertex Pharmaceuticals, Inc. * |

9,622 |

2,778,641 |

| |

|

16,295,805 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Building Products — 0.5% | ||

| Carrier Global Corp. |

36,816 |

1,518,660 |

| Capital Markets — 4.5% | ||

| BlackRock, Inc. |

5,172 |

3,665,034 |

| Charles Schwab Corp. (The) |

12,621 |

1,050,825 |

| Goldman Sachs Group, Inc. (The) |

5,092 |

1,748,491 |

| Intercontinental Exchange, Inc. |

8,740 |

896,637 |

| Morgan Stanley |

39,769 |

3,381,160 |

| Raymond James Financial, Inc. |

8,047 |

859,822 |

| S&P Global, Inc. |

2,825 |

946,206 |

| T. Rowe Price Group, Inc. |

9,572 |

1,043,922 |

| |

|

13,592,097 |

| Chemicals — 2.8% | ||

| Air Products and Chemicals, Inc. |

7,885 |

2,430,630 |

| Axalta Coating Systems Ltd. * |

108,683 |

2,768,156 |

| Chemours Co. (The) |

54,477 |

1,668,086 |

| PPG Industries, Inc. |

11,987 |

1,507,245 |

| |

|

8,374,117 |

| Commercial Services & Supplies — 0.3% | ||

| Republic Services, Inc. |

7,268 |

937,499 |

| Construction Materials — 0.6% | ||

| Vulcan Materials Co. |

10,350 |

1,812,389 |

| Consumer Finance — 1.3% | ||

| American Express Co. |

20,045 |

2,961,649 |

| Capital One Financial Corp. |

10,011 |

930,622 |

| |

|

3,892,271 |

| Containers & Packaging — 0.4% | ||

| Ball Corp. |

11,400 |

582,996 |

| Sealed Air Corp. |

14,396 |

718,072 |

| |

|

1,301,068 |

| Diversified Financial Services — 2.4% | ||

| Berkshire Hathaway, Inc., Class B * |

23,397 |

7,227,333 |

| Electric Utilities — 1.9% | ||

| Entergy Corp. |

4,837 |

544,163 |

| NextEra Energy, Inc. |

44,332 |

3,706,155 |

| Xcel Energy, Inc. |

20,417 |

1,431,436 |

| |

|

5,681,754 |

| Electrical Equipment — 1.0% | ||

| Eaton Corp. plc |

11,473 |

1,800,687 |

| Rockwell Automation, Inc. |

4,429 |

1,140,778 |

| |

|

2,941,465 |

| 26 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Entertainment — 0.1% | ||

| Walt Disney Co. (The) * |

4,994 |

433,879

|

| Equity Real Estate Investment Trusts (REITs) — 3.0% | ||

| Alexandria Real Estate Equities, Inc. |

2,550 |

371,459 |

| AvalonBay Communities, Inc. |

2,710 |

437,719 |

| Equity LifeStyle Properties, Inc. |

38,646 |

2,496,532 |

| Host Hotels & Resorts, Inc. |

44,683 |

717,162 |

| Prologis, Inc. |

12,564 |

1,416,340 |

| SBA Communications Corp. |

3,333 |

934,273 |

| Ventas, Inc. |

57,047 |

2,569,967 |

| |

|

8,943,452 |

| Food & Staples Retailing — 2.4% | ||

| BJ's Wholesale Club Holdings, Inc. * |

17,126 |

1,133,056 |

| Performance Food Group Co. * |

23,598 |

1,377,887 |

| US Foods Holding Corp. * |

49,616 |

1,687,937 |

| Walmart, Inc. |

21,514 |

3,050,470 |

| |

|

7,249,350 |

| Food Products — 1.4% | ||

| Bunge Ltd. |

12,286 |

1,225,774 |

| Lamb Weston Holdings, Inc. |

8,618 |

770,104 |

| Mondelez International, Inc., Class A |

35,050 |

2,336,083 |

| |

|

4,331,961 |

| Health Care Equipment & Supplies — 2.5% | ||

| Baxter International, Inc. |

27,960 |

1,425,121 |

| Becton Dickinson and Co. |

4,854 |

1,234,372 |

| Boston Scientific Corp. * |

33,807 |

1,564,250 |

| Medtronic plc |

17,608 |

1,368,494 |

| Zimmer Biomet Holdings, Inc. |

15,795 |

2,013,863 |

| |

|

7,606,100 |

| Health Care Providers & Services — 4.6% | ||

| Cardinal Health, Inc. |

11,513 |

885,004 |

| Centene Corp. * |

40,468 |

3,318,781 |

| Cigna Corp. |

6,408 |

2,123,227 |

| CVS Health Corp. |

10,547 |

982,875 |

| Elevance Health, Inc. |

2,932 |

1,504,028 |

| Humana, Inc. |

3,364 |

1,723,007 |

| UnitedHealth Group, Inc. |

6,202 |

3,288,176 |

| |

|

13,825,098 |

| Hotels, Restaurants & Leisure — 1.5% | ||

| Booking Holdings, Inc. * |

558 |

1,124,526 |

| Darden Restaurants, Inc. |

6 |

830 |

| Domino's Pizza, Inc. |

828 |

286,819 |

| McDonald's Corp. |

5,670 |

1,494,215 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Hotels, Restaurants & Leisure — continued | ||

| Royal Caribbean Cruises Ltd. * |

28,854 |

1,426,253 |

| Yum! Brands, Inc. |

2,429 |

311,107

|

| |

|

4,643,750 |

| Household Durables — 0.5% | ||

| DR Horton, Inc. |

9,429 |

840,501 |

| KB Home |

12,761 |

406,438 |

| Newell Brands, Inc. |

29,524 |

386,174

|

| |

|

1,633,113 |

| Household Products — 0.6% | ||

| Procter & Gamble Co. (The) |

12,371 |

1,874,949 |

| Industrial Conglomerates — 0.7% | ||

| Honeywell International, Inc. |

10,177 |

2,180,931 |

| Insurance — 3.5% | ||

| Chubb Ltd. |

8,086 |

1,783,772 |

| Hartford Financial Services Group, Inc. (The) |

36,986 |

2,804,648 |

| Loews Corp. |

11,979 |

698,735 |

| Marsh & McLennan Cos., Inc. |

4,561 |

754,754 |

| MetLife, Inc. |

18,615 |

1,347,168 |

| Progressive Corp. (The) |

19,593 |

2,541,408 |

| Prudential Financial, Inc. |

6,878 |

684,086 |

| |

|

10,614,571 |

| Interactive Media & Services — 2.3% | ||

| Alphabet, Inc., Class C * |

32,511 |

2,884,701 |

| Meta Platforms, Inc., Class A * |

32,535 |

3,915,262 |

| |

|

6,799,963 |

| IT Services — 0.8% | ||

| Fiserv, Inc. * |

6,992 |

706,681 |

| FleetCor Technologies, Inc. * |

3,811 |

700,005 |

| International Business Machines Corp. |

7,809 |

1,100,210 |

| |

|

2,506,896 |

| Machinery — 2.8% | ||

| AGCO Corp. |

6,105 |

846,702 |

| Deere & Co. |

3,945 |

1,691,458 |

| Dover Corp. |

15,345 |

2,077,867 |

| Parker-Hannifin Corp. |

10,103 |

2,939,973 |

| Stanley Black & Decker, Inc. |

12,917 |

970,325 |

| |

|

8,526,325 |

| Media — 2.7% | ||

| Charter Communications, Inc., Class A * |

12,254 |

4,155,331 |

| Comcast Corp., Class A |

114,041 |

3,988,014 |

| |

|

8,143,345 |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

27 |

AS OF December 31, 2022 (Unaudited) (continued)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Metals & Mining — 1.4% | ||

| Alcoa Corp. |

41,451 |

1,884,777 |

| Freeport-McMoRan, Inc. |

61,284 |

2,328,792 |

| |

|

4,213,569 |

| Multiline Retail — 0.5% | ||

| Dollar General Corp. |

5,598 |

1,378,508 |

| Multi-Utilities — 2.8% | ||

| Ameren Corp. |

26,068 |

2,317,966 |

| CenterPoint Energy, Inc. |

61,317 |

1,838,897 |

| CMS Energy Corp. |

26,140 |

1,655,446 |

| Public Service Enterprise Group, Inc. |

44,555 |

2,729,885 |

| |

|

8,542,194 |

| Oil, Gas & Consumable Fuels — 9.2% | ||

| Chevron Corp. |

31,384 |

5,633,114 |

| ConocoPhillips |

34,966 |

4,125,988 |

| Coterra Energy, Inc. |

6 |

148 |

| Diamondback Energy, Inc. |

16,031 |

2,192,720 |

| EOG Resources, Inc. |

28,679 |

3,714,504 |

| EQT Corp. |

20,065 |

678,799 |

| Exxon Mobil Corp. |

68,855 |

7,594,707 |

| Hess Corp. |

25,316 |

3,590,315 |

| Valero Energy Corp. |

2,770 |

351,402 |

| |

|

27,881,697 |

| Pharmaceuticals — 5.4% | ||

| Bristol-Myers Squibb Co. |

122,888 |

8,841,792 |

| Elanco Animal Health, Inc. * |

24,925 |

304,583 |

| Eli Lilly & Co. |

3,130 |

1,145,079 |

| Johnson & Johnson |

15,715 |

2,776,055 |

| Merck & Co., Inc. |

5,175 |

574,166 |

| Pfizer, Inc. |

52,396 |

2,684,771 |

| |

|

16,326,446 |

| Road & Rail — 0.9% | ||

| CSX Corp. |

78,332 |

2,426,725 |

| Knight-Swift Transportation Holdings, Inc. |

5,736 |

300,624 |

| |

|

2,727,349 |

| Semiconductors & Semiconductor Equipment — 3.0% | ||

| Analog Devices, Inc. |

14,150 |

2,321,025 |

| Lam Research Corp. |

1,804 |

758,221 |

| NXP Semiconductors NV (China) |

20,655 |

3,264,110 |

| Qorvo, Inc. * |

7,419 |

672,458 |

| Texas Instruments, Inc. |

12,078 |

1,995,527 |

| |

|

9,011,341 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Software — 0.7% | ||

| Coupa Software, Inc. * |

6 |

475 |

| Microsoft Corp. |

6,471 |

1,551,875 |

| Oracle Corp. |

5,761 |

470,904

|

| |

|

2,023,254 |

| Specialty Retail — 3.1% | ||

| AutoZone, Inc. * |

657 |

1,620,280 |

| Home Depot, Inc. (The) |

5,846 |

1,846,518 |

| Lowe's Cos., Inc. |

13,246 |

2,639,133 |

| O'Reilly Automotive, Inc. * |

1,334 |

1,125,936 |

| TJX Cos., Inc. (The) |

27,707 |

2,205,477 |

| |

|

9,437,344 |

| Technology Hardware, Storage & Peripherals — 0.6% | ||

| Apple, Inc. |

3,838 |

498,671 |

| Seagate Technology Holdings plc |

26,910 |

1,415,735 |

| |

|

1,914,406 |

| Textiles, Apparel & Luxury Goods — 1.5% | ||

| Kontoor Brands, Inc. |

19,177 |

766,888 |

| NIKE, Inc., Class B |

13,721 |

1,605,494 |

| Tapestry, Inc. |

52,448 |

1,997,220 |

| |

|

4,369,602 |

| Tobacco — 1.3% | ||

| Philip Morris International, Inc. |

38,735 |

3,920,369 |

| Trading Companies & Distributors — 0.6% | ||

| WESCO International, Inc. * |

13,868 |

1,736,274 |

| Wireless Telecommunication Services — 0.3% | ||

| T-Mobile US, Inc. * |

6,860 |

960,400 |

| Total Common Stocks (Cost $286,593,258) |

|

295,260,666 |

| 28 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| INVESTMENTS |

SHARES |

VALUE($) |

| Short-Term Investments — 2.3% | ||

| Investment Companies — 2.3% | ||

| JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (a) (b)

(Cost $6,913,734) |

6,913,734 |

6,913,734 |

| Total Investments — 99.9% (Cost $293,506,992) |

|

302,174,400 |

| Other Assets Less Liabilities — 0.1% |

|

212,280 |

| NET ASSETS — 100.0% |

|

302,386,680 |

| Percentages indicated are based on net assets. |

| * |

Non-income producing security. |

| (a) |

Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| (b) |

The rate shown is the current yield as of December 31, 2022. |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

29 |

AS OF December 31, 2022 (Unaudited)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — 82.7% | ||

| Aerospace & Defense — 1.7% | ||

| General Dynamics Corp. |

598,009 |

148,372,013 |

| Raytheon Technologies Corp. |

879,084 |

88,717,157 |

| Textron, Inc. |

750,173 |

53,112,249

|

| |

|

290,201,419 |

| Air Freight & Logistics — 1.3% | ||

| United Parcel Service, Inc., Class B |

1,262,428 |

219,460,483 |

| Banks — 1.2% | ||

| US Bancorp |

5,015,920 |

218,744,271 |

| Beverages — 3.7% | ||

| Coca-Cola Co. (The) |

4,094,080 |

260,424,429 |

| Constellation Brands, Inc., Class A |

364,128 |

84,386,664 |

| Keurig Dr Pepper, Inc. |

1,279,750 |

45,635,885 |

| PepsiCo, Inc. |

1,402,253 |

253,331,027 |

| |

|

643,778,005 |

| Biotechnology — 3.4% | ||

| AbbVie, Inc. |

1,774,713 |

286,811,368 |

| Regeneron Pharmaceuticals, Inc. * |

241,685 |

174,373,311 |

| Vertex Pharmaceuticals, Inc. * |

485,234 |

140,125,874

|

| |

|

601,310,553 |

| Building Products — 1.2% | ||

| Trane Technologies plc |

1,275,207 |

214,349,545 |

| Capital Markets — 2.5% | ||

| CME Group, Inc. |

1,061,385 |

178,482,502 |

| Intercontinental Exchange, Inc. |

1,366,899 |

140,230,168 |

| S&P Global, Inc. |

375,415 |

125,741,500 |

| |

|

444,454,170 |

| Chemicals — 3.0% | ||

| Air Products and Chemicals, Inc. |

587,173 |

181,001,949 |

| Ecolab, Inc. |

215,007 |

31,296,419 |

| Linde plc (United Kingdom) |

703,942 |

229,611,801 |

| PPG Industries, Inc. |

618,592 |

77,781,758 |

| |

|

519,691,927 |

| Consumer Finance — 0.8% | ||

| American Express Co. |

903,896 |

133,550,634

|

| Containers & Packaging — 0.3% | ||

| Avery Dennison Corp. |

327,715 |

59,316,415 |

| Diversified Financial Services — 1.0% | ||

| Berkshire Hathaway, Inc., Class B * |

565,237 |

174,601,709

|

| Diversified Telecommunication Services — 0.6% | ||

| Verizon Communications, Inc. |

2,456,933 |

96,803,160 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Electric Utilities — 2.9% | ||

| Alliant Energy Corp. |

1,363,543 |

75,281,209 |

| Duke Energy Corp. |

219,111 |

22,566,242 |

| Evergy, Inc. |

662,651 |

41,700,627 |

| NextEra Energy, Inc. |

2,701,183 |

225,818,899 |

| Xcel Energy, Inc. |

2,081,413 |

145,927,866 |

| |

|

511,294,843 |

| Electrical Equipment — 1.1% | ||

| Eaton Corp. plc |

1,239,108 |

194,478,001 |

| Electronic Equipment, Instruments & Components — 0.7% | ||

| Keysight Technologies, Inc. * |

695,640 |

119,003,135 |

| Entertainment — 0.1% | ||

| Electronic Arts, Inc. |

162,398 |

19,841,788 |

| Equity Real Estate Investment Trusts (REITs) — 2.6% | ||

| Camden Property Trust |

292,801 |

32,758,576 |

| Mid-America Apartment Communities, Inc. |

199,990 |

31,396,430 |

| Prologis, Inc. |

1,011,015 |

113,971,721 |

| Public Storage |

307,446 |

86,143,295 |

| SBA Communications Corp. |

355,205 |

99,567,513 |

| Sun Communities, Inc. |

515,986 |

73,785,998 |

| UDR, Inc. |

369,849 |

14,324,252 |

| |

|

451,947,785 |

| Food & Staples Retailing — 1.0% | ||

| Costco Wholesale Corp. |

173,620 |

79,257,530 |

| Walmart, Inc. |

709,597 |

100,613,759 |

| |

|

179,871,289 |

| Food Products — 2.3% | ||

| Archer-Daniels-Midland Co. |

354,085 |

32,876,792 |

| Hershey Co. (The) |

1,110,002 |

257,043,163 |

| Mondelez International, Inc., Class A |

1,740,480 |

116,002,992

|

| |

|

405,922,947 |

| Health Care Equipment & Supplies — 0.3% | ||

| Boston Scientific Corp. * |

1,124,908 |

52,049,493 |

| Health Care Providers & Services — 2.4% | ||

| Centene Corp. * |

580,687 |

47,622,141 |

| Elevance Health, Inc. |

198,805 |

101,981,001 |

| UnitedHealth Group, Inc. |

499,133 |

264,630,334 |

| |

|

414,233,476 |

| Hotels, Restaurants & Leisure — 2.0% | ||

| Chipotle Mexican Grill, Inc. * |

20,217 |

28,050,885 |

| Domino's Pizza, Inc. |

131,896 |

45,688,775 |

| 30 |

J.P. Morgan Exchange-Traded Funds |

December 31, 2022 |

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Hotels, Restaurants & Leisure — continued | ||

| McDonald's Corp. |

518,657 |

136,681,679 |

| Yum! Brands, Inc. |

1,033,150 |

132,325,852 |

| |

|

342,747,191 |

| Household Products — 3.7% | ||

| Colgate-Palmolive Co. |

2,837,591 |

223,573,795 |

| Kimberly-Clark Corp. |

1,390,219 |

188,722,229 |

| Procter & Gamble Co. (The) |

1,559,706 |

236,389,041 |

| |

|

648,685,065 |

| Industrial Conglomerates — 1.4% | ||

| Honeywell International, Inc. |

1,174,466 |

251,688,064 |

| Insurance — 4.5% | ||

| Aon plc, Class A |

531,808 |

159,616,853 |

| Arthur J Gallagher & Co. |

604,408 |

113,955,084 |

| Progressive Corp. (The) |

2,116,452 |

274,524,989 |

| Travelers Cos., Inc. (The) |

1,320,385 |

247,558,984

|

| |

|

795,655,910 |

| Interactive Media & Services — 1.0% | ||

| Alphabet, Inc., Class A * |

1,990,840 |

175,651,813 |

| Internet & Direct Marketing Retail — 0.6% | ||

| Amazon.com, Inc. * |

1,226,702 |

103,042,968 |

| IT Services — 6.3% | ||

| Accenture plc, Class A |

843,649 |

225,119,299 |

| Automatic Data Processing, Inc. |

638,957 |

152,621,269 |

| FleetCor Technologies, Inc. * |

311,893 |

57,288,506 |

| Jack Henry & Associates, Inc. |

1,074,164 |

188,580,232 |

| Mastercard, Inc., Class A |

700,176 |

243,472,200 |

| Visa, Inc., Class A |

1,095,584 |

227,618,532

|

| |

|

1,094,700,038 |

| Life Sciences Tools & Services — 1.1% | ||

| Thermo Fisher Scientific, Inc. |

363,814 |

200,348,732 |

| Machinery — 1.7% | ||

| Deere & Co. |

217,246 |

93,146,395 |

| Dover Corp. |

1,043,348 |

141,279,752 |

| Otis Worldwide Corp. |

745,638 |

58,390,912 |

| |

|

292,817,059 |

| Media — 1.6% | ||

| Charter Communications, Inc., Class A * |

168,741 |

57,220,073 |

| Comcast Corp., Class A |

6,385,958 |

223,316,951 |

| |

|

280,537,024 |

| INVESTMENTS |

SHARES |

VALUE($) |

| | ||

| Multi-Utilities — 4.9% | ||

| Ameren Corp. |

1,317,715 |

117,171,218 |

| CMS Energy Corp. |

1,327,444 |

84,067,029 |

| Consolidated Edison, Inc. |

582,179 |

55,487,480 |

| Dominion Energy, Inc. |

886,954 |

54,388,019 |

| DTE Energy Co. |

840,746 |

98,812,877 |

| Public Service Enterprise Group, Inc. |

2,827,856 |

173,262,737 |

| Sempra Energy |

776,851 |

120,054,554 |

| WEC Energy Group, Inc. |

1,571,739 |

147,366,249 |

| |

|

850,610,163 |

| Oil, Gas & Consumable Fuels — 2.8% | ||

| Chevron Corp. |

803,155 |

144,158,291 |

| ConocoPhillips |

387,539 |

45,729,602 |

| EOG Resources, Inc. |

169,113 |

21,903,516 |

| Exxon Mobil Corp. |

2,446,720 |

269,873,216 |

| |

|

481,664,625 |

| Pharmaceuticals — 4.9% | ||

| Bristol-Myers Squibb Co. |

3,484,785 |

250,730,281 |

| Eli Lilly & Co. |

682,861 |

249,817,868 |

| Johnson & Johnson |

866,678 |

153,098,669 |

| Merck & Co., Inc. |

1,865,287 |

206,953,592 |

| |

|

860,600,410 |

| Professional Services — 0.4% | ||

| Booz Allen Hamilton Holding Corp. |

351,409 |

36,729,268 |

| Leidos Holdings, Inc. |

242,431 |

25,501,317 |

| |

|

62,230,585 |

| Road & Rail — 3.6% | ||

| CSX Corp. |

1,155,689 |

35,803,245 |

| Norfolk Southern Corp. |

829,526 |

204,411,797 |

| Old Dominion Freight Line, Inc. |

605,049 |

171,700,805 |

| Union Pacific Corp. |

1,058,335 |

219,149,429 |

| |

|

631,065,276 |

| Semiconductors & Semiconductor Equipment — 1.7% | ||

| Analog Devices, Inc. |

500,252 |

82,056,336 |

| Texas Instruments, Inc. |

1,324,832 |

218,888,743 |

| |

|

300,945,079 |

| Software — 2.0% | ||

| Adobe, Inc. * |

123,451 |

41,544,965 |

| Intuit, Inc. |

246,534 |

95,955,963 |

| Microsoft Corp. |

881,358 |

211,367,276

|

| |

|

348,868,204 |

| December 31, 2022 |

J.P. Morgan Exchange-Traded Funds |

31 |

AS OF December 31, 2022 (Unaudited) (continued)

| INVESTMENTS |

SHARES |

VALUE($) |

| Common Stocks — continued | ||

| Specialty Retail — 2.8% | ||

| AutoZone, Inc. * |

52,236 |

128,823,378 |

| Lowe's Cos., Inc. |

1,072,233 |

213,631,703 |

| O'Reilly Automotive, Inc. * |

166,129 |

140,217,860 |

| |

|

482,672,941 |

| Technology Hardware, Storage & Peripherals — 0.1% | ||

| Apple, Inc. |

184,474 |

23,968,707

|

| Textiles, Apparel & Luxury Goods — 0.2% | ||

| NIKE, Inc., Class B |

343,172 |

40,154,556

|

| Tobacco — 0.9% | ||

| Altria Group, Inc. |

1,500,039 |

68,566,783 |

| Philip Morris International, Inc. |

890,744 |

90,152,200

|

| |

|

158,718,983 |

| Wireless Telecommunication Services — 0.4% | ||

| T-Mobile US, Inc. * |

478,826 |

67,035,640 |

| Total Common Stocks (Cost $14,074,511,976) |

|

14,459,314,081 |

| |

PRINCIPAL

AMOUNT($) |

|

| Equity-Linked Notes — 15.2% | ||

| Barclays Bank plc, ELN, 63.40%, 1/23/2023, (linked to S&P 500 Index) (United Kingdom) (a) |

45,052 |

179,776,852 |

| BNP Paribas, ELN, 60.40%, 1/10/2023, (linked to S&P 500 Index) (a) |

49,061 |

191,718,123 |

| BNP Paribas, ELN, 66.70%, 1/20/2023, (linked to S&P 500 Index) (a) |

46,024 |

183,347,190 |

| BNP Paribas, ELN, 67.10%, 1/24/2023, (linked to S&P 500 Index) (a) |

43,637 |

172,955,686 |

| BNP Paribas, ELN, 70.90%, 1/31/2023, (linked to S&P 500 Index) (a) |

48,399 |

188,755,132 |

| BofA Finance LLC, ELN, 64.70%, 1/9/2023, (linked to S&P 500 Index) (b) |

42,891 |

167,503,509 |

| BofA Finance LLC, ELN, 67.30%, 1/27/2023, (linked to S&P 500 Index) (b) |

44,484 |

172,185,108 |

| BofA Finance LLC, ELN, 71.70%, 2/7/2023, (linked to S&P 500 Index) (b) |

45,463 |

177,605,301 |

| Canadian Imperial Bank of Commerce, ELN, 64.11%, 1/6/2023, (linked to S&P 500 Index) (Canada) (b) |

40,428 |

157,010,628 |

| Canadian Imperial Bank of Commerce, ELN, 72.23%, 2/6/2023, (linked to S&P 500 Index) (Canada) (b) |

48,107 |

181,952,701 |

| INVESTMENTS |

PRINCIPAL

AMOUNT($) |

VALUE($) |

| | ||

| Morgan Stanley BV, ELN, 68.54%, 1/18/2023, (linked to S&P 500 Index) (b) |

42,891 |

170,257,969 |