UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

J.P. Morgan Investment Management Inc.

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

With copies to:

| Elizabeth A. Davin, Esq. JPMorgan Chase & Co. 1111 Polaris Parkway Columbus, OH 43240 |

Jon S. Rand, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: October 31

Date of reporting period: November 1, 2018 through April 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

J.P. Morgan Exchange-Traded Funds

April 30, 2019 (Unaudited)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.jpmorganfunds.com and you will be notified by mail each time a report is posted and provided with a website to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker dealer, bank, or retirement plan).

Alternatively, you may elect to receive paper copies of all future reports free of charge by contacting your financial intermediary. Your election to receive paper reports will apply to all funds held within your account(s).

|

| President’s Letter | 1 | |||

| Market Overview | 2 | |||

| 3 | ||||

| 6 | ||||

| 9 | ||||

| 12 | ||||

| 15 | ||||

| 17 | ||||

| 20 | ||||

| 23 | ||||

| 26 | ||||

| 29 | ||||

| 32 | ||||

| 35 | ||||

| 38 | ||||

| 41 | ||||

| 44 | ||||

| 47 | ||||

| 50 | ||||

| Schedules of Portfolio Investments | 53 | |||

| Financial Statements | 164 | |||

| Financial Highlights | 182 | |||

| Notes to Financial Statements | 188 | |||

| Schedule of Shareholder Expenses | 214 | |||

| Board Approval of Initial Management Agreement | 216 | |||

| Board Approval of Investment Advisory Agreements | 218 | |||

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from a Fund. Shares may only be subscribed and redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

JUNE 15, 2019 (Unaudited)

| 1 | Ignites.com as of November 28, 2018. |

| 2 | ETF.com Award winners are selected by a majority vote of the ETF.com Awards Selection Committee, a group of independent ETF experts. Voting was completed by January 14, 2019, and results were announced March 28, 2019. |

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 1 | ||||||

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| 2 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

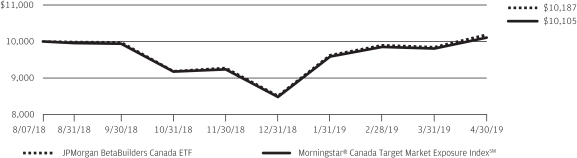

JPMorgan BetaBuilders Canada ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan BetaBuilders Canada ETF |

||||

| Net Asset Value* | 10.94% | |||

| Market Price** | 10.79% | |||

| Morningstar® Canada Target Market Exposure IndexSM | 10.08% | |||

| Net Assets as of 4/30/2019 | $ | 3,737,007,734 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 3 | ||||||

JPMorgan BetaBuilders Canada ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 4 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||

| INCEPTION DATE | SIX MONTHS* | CUMULATIVE SINCE INCEPTION |

||||||||||

| JPMorgan BetaBuilders Canada ETF |

||||||||||||

| Net Asset Value |

August 7, 2018 | 10.94% | 1.87% | |||||||||

| Market Price |

10.79% | 1.87% | ||||||||||

| * | Not annualized. |

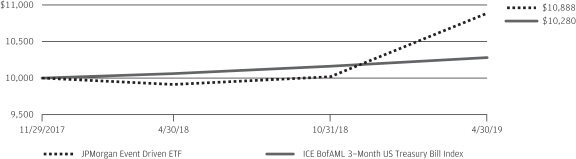

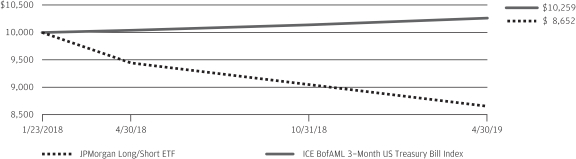

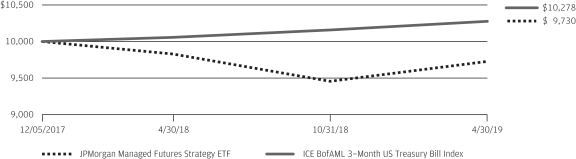

LIFE OF FUND PERFORMANCE (8/7/18 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 5 | ||||||

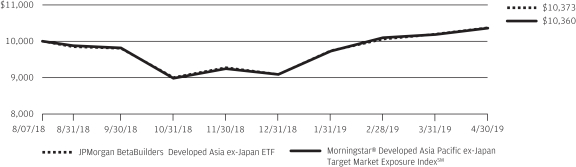

JPMorgan BetaBuilders Developed Asia ex-Japan ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan BetaBuilders Developed Asia ex-Japan ETF |

||||

| Net Asset Value* | 15.22% | |||

| Market Price** | 15.39% | |||

| Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM | 15.33% | |||

| Net Assets as of 4/30/2019 | $ | 1,285,022,228 | ||

| 6 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 7 | ||||||

JPMorgan BetaBuilders Developed Asia ex-Japan ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||

| INCEPTION DATE | SIX MONTHS* | CUMULATIVE SINCE INCEPTION |

||||||||||

| JPMorgan BetaBuilders Developed Asia ex-Japan ETF |

| |||||||||||

| Net Asset Value |

August 7, 2018 | 15.22% | 3.73% | |||||||||

| Market Price |

15.39% | 3.93% | ||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (8/7/18 TO 4/30/19)

| 8 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan BetaBuilders Europe ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan BetaBuilders Europe ETF |

||||

| Net Asset Value* | 9.03% | |||

| Market Price** | 8.97% | |||

| Morningstar® Developed Europe Target Market Exposure IndexSM | 8.58% | |||

| Net Assets as of 4/30/2019 | $ | 4,325,127,726 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 9 | ||||||

JPMorgan BetaBuilders Europe ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 10 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||

| INCEPTION DATE | SIX MONTHS* | CUMULATIVE SINCE INCEPTION |

||||||||||

| JPMorgan BetaBuilders Europe ETF |

| |||||||||||

| Net Asset Value |

June 15, 2018 | 9.03% | (0.51)% | |||||||||

| Market Price |

8.97% | (0.34)% | ||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (6/15/18 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 11 | ||||||

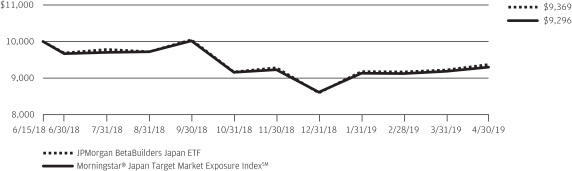

JPMorgan BetaBuilders Japan ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan BetaBuilders Japan ETF |

||||

| Net Asset Value* | 2.23% | |||

| Market Price** | 2.19% | |||

| Morningstar® Japan Target Market Exposure IndexSM | 1.47% | |||

| Net Assets as of 4/30/2019 | $ | 3,479,513,336 | ||

| 12 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 13 | ||||||

JPMorgan BetaBuilders Japan ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||

| INCEPTION DATE | SIX MONTHS* | CUMULATIVE SINCE INCEPTION |

||||||||||

| JPMorgan BetaBuilders Japan ETF |

||||||||||||

| Net Asset Value |

June 15, 2018 | 2.23% | (6.31 | )% | ||||||||

| Market Price |

2.19% | (6.51 | )% | |||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (6/15/18 TO 4/30/19)

| 14 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

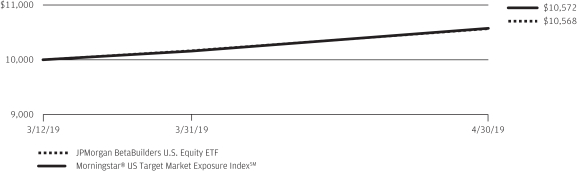

JPMorgan BetaBuilders U.S. Equity ETF

FUND COMMENTARY

FOR THE PERIOD MARCH 12, 2019 (INCEPTION DATE) THROUGH APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan BetaBuilders U.S. Equity ETF |

||||

| Net Asset Value* | 5.68% | |||

| Market Price** | 5.70% | |||

| Morningstar® US Target Market Exposure IndexSM | 5.72% | |||

| Net Assets as of 4/30/2019 | $ | 31,796,923 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 15 | ||||||

JPMorgan BetaBuilders U.S. Equity ETF

FUND COMMENTARY

FOR THE PERIOD MARCH 12, 2019 (INCEPTION DATE) THROUGH APRIL 30, 2019 (Unaudited) (continued)

| TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||

| INCEPTION DATE | CUMULATIVE SINCE INCEPTION |

|||||||

| JPMorgan BetaBuilders U.S. Equity ETF | ||||||||

| Net Asset Value |

March 12, 2019 | 5.68% | ||||||

| Market Price |

5.70% | |||||||

LIFE OF FUND PERFORMANCE (3/12/19 TO 4/30/19)

| 16 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

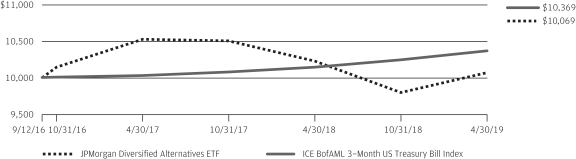

JPMorgan Diversified Return Emerging Markets Equity ETF

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan Diversified Return Emerging Markets Equity ETF |

||||

| Net Asset Value* | 9.10% | |||

| Market Price** | 9.83% | |||

| JP Morgan Diversified Factor Emerging Markets Equity Index (net of foreign withholding taxes) | 9.29% | |||

| FTSE Emerging Index (net of foreign withholding taxes) | 14.60% | |||

| MSCI Emerging Markets Index (net of foreign withholding taxes) | 13.76% | |||

| Net Assets as of 4/30/2019 | $ | 331,055,025 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 17 | ||||||

JPMorgan Diversified Return Emerging Markets Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 18 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan Diversified Return Emerging Markets Equity ETF | ||||||||||||||||

| Net Asset Value |

January 7, 2015 | 9.10% | (3.30)% | 4.58% | ||||||||||||

| Market Price |

9.83% | (3.00)% | 4.71% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (1/07/15 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 19 | ||||||

JPMorgan Diversified Return Europe Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: |

||||

| JPMorgan Diversified Return Europe Equity ETF |

||||

| Net Asset Value* | 8.08% | |||

| Market Price** | 7.72% | |||

| JP Morgan Diversified Factor Europe Equity Index (net of foreign withholding taxes) | 7.73% | |||

| FTSE Developed Europe Index (net of foreign withholding taxes) | 8.38% | |||

| MSCI Europe Index (net of foreign withholding taxes) | 8.48% | |||

| Net Assets as of 4/30/2019 | $ | 17,222,507 | ||

| 20 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 21 | ||||||

JPMorgan Diversified Return Europe Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan Diversified Return Europe Equity ETF |

||||||||||||||||

| Net Asset Value |

December 18, 2015 | 8.08% | (3.18)% | 6.67% | ||||||||||||

| Market Price |

7.72% | (3.49)% | 6.63% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (12/18/15 TO 4/30/19)

| 22 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan Diversified Return Global Equity ETF |

||||

| Net Asset Value* | 7.57% | |||

| Market Price** | 7.56% | |||

| JP Morgan Diversified Factor Global Developed Equity Index (net of foreign withholding taxes) | 7.38% | |||

| FTSE Developed Index (net of foreign withholding taxes) | 8.69% | |||

| MSCI World Index (net of foreign withholding taxes) | 8.83% | |||

| Net Assets as of 4/30/2019 | $ | 210,914,261 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 23 | ||||||

JPMorgan Diversified Return Global Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 24 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan Diversified Return Global Equity ETF |

||||||||||||||||

| Net Asset Value |

June 16, 2014 | 7.57% | (0.88)% | 5.81% | ||||||||||||

| Market Price |

7.56% | (0.91)% | 5.79% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (6/16/14 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 25 | ||||||

JPMorgan Diversified Return International Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan Diversified Return International Equity ETF |

||||

| Net Asset Value* | 6.03% | |||

| Market Price** | 6.33% | |||

| JP Morgan Diversified Factor International Equity Index (net of foreign withholding taxes) | 5.78% | |||

| FTSE Developed ex North America Index (net of foreign withholding taxes) | 7.22% | |||

| MSCI EAFE Index (net of foreign withholding taxes) | 7.45% | |||

| Net Assets as of 4/30/2019 | $ | 1,728,099,358 | ||

| 26 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 27 | ||||||

JPMorgan Diversified Return International Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan Diversified Return International Equity ETF |

||||||||||||||||

| Net Asset Value |

November 5, 2014 | 6.03% | (4.94)% | 4.53% | ||||||||||||

| Market Price |

6.33% | (5.08)% | 4.54% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (11/5/14 TO 4/30/19)

| 28 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

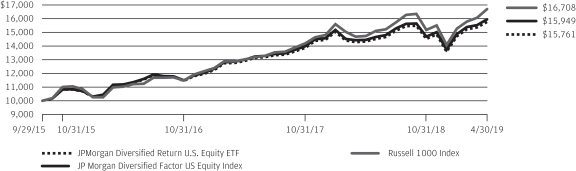

JPMorgan Diversified Return U.S. Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan Diversified Return U.S. Equity ETF |

||||

| Net Asset Value* | 8.46% | |||

| Market Price** | 8.45% | |||

| JP Morgan Diversified Factor US Equity Index | 8.53% | |||

| Russell 1000 Index | 10.00% | |||

| Net Assets as of 4/30/2019 | $ | 682,905,362 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 29 | ||||||

JPMorgan Diversified Return U.S. Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 30 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan Diversified Return U.S. Equity ETF | ||||||||||||||||

| Net Asset Value |

September 29, 2015 | 8.46% | 9.96% | 13.53% | ||||||||||||

| Market Price |

8.45% | 9.93% | 13.53% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (9/29/15 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 31 | ||||||

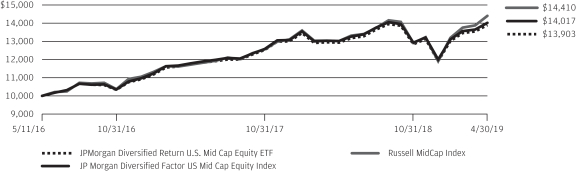

JPMorgan Diversified Return U.S. Mid Cap Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan Diversified Return U.S. Mid Cap Equity ETF |

||||

| Net Asset Value* | 8.21% | |||

| Market Price** | 8.21% | |||

| JP Morgan Diversified Factor US Mid Cap Equity Index | 8.34% | |||

| Russell Midcap Index | 11.65% | |||

| Net Assets as of 4/30/2019 | $ | 167,021,038 | ||

| 32 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 33 | ||||||

JPMorgan Diversified Return U.S. Mid Cap Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan Diversified Return U.S. Mid Cap Equity ETF |

||||||||||||||||

| Net Asset Value |

May 11, 2016 | 8.21% | 7.59% | 11.74% | ||||||||||||

| Market Price |

8.21% | 7.59% | 11.74% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (5/11/16 TO 4/30/19)

| 34 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan Diversified Return U.S. Small Cap Equity ETF |

||||

| Net Asset Value* | 6.65% | |||

| Market Price** | 6.61% | |||

| JP Morgan Diversified Factor US Small Cap Equity Index | 6.78% | |||

| Russell 2000 Index | 6.06% | |||

| Net Assets as of 4/30/2019 | $ | 174,106,929 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 35 | ||||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 36 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan Diversified Return U.S. Small Cap Equity ETF |

||||||||||||||||

| Net Asset Value |

November 15, 2016 | 6.65% | 7.99% | 10.63% | ||||||||||||

| Market Price |

6.61% | 7.89% | 10.61% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (11/15/16 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 37 | ||||||

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan U.S. Dividend ETF | ||||

| Net Asset Value* | 8.86% | |||

| Market Price** | 8.94% | |||

| JP Morgan US Dividend Index | 9.04% | |||

| Russell 1000 Index | 10.00% | |||

| Net Assets as of 4/30/2019 | $ | 30,630,705 | ||

| 38 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 39 | ||||||

JPMorgan U.S. Dividend ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan U.S. Dividend ETF |

||||||||||||||||

| Net Asset Value |

November 8, 2017 | 8.86% | 11.21% | 8.13% | ||||||||||||

| Market Price |

8.94% | 11.16% | 8.12% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (11/8/17 TO 4/30/19)

| 40 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

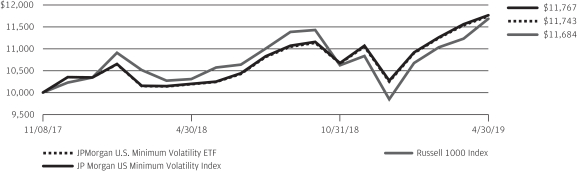

JPMorgan U.S. Minimum Volatility ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan U.S. Minimum Volatility ETF | ||||

| Net Asset Value* | 10.07% | |||

| Market Price** | 10.14% | |||

| JP Morgan US Minimum Volatility Index | 10.20% | |||

| Russell 1000 Index | 10.00% | |||

| Net Assets as of 4/30/2019 | $ | 41,258,938 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 41 | ||||||

JPMorgan U.S. Minimum Volatility ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 42 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan U.S. Minimum Volatility ETF |

||||||||||||||||

| Net Asset Value |

November 8, 2017 | 10.07% | 15.17% | 11.52% | ||||||||||||

| Market Price |

10.14% | 15.21% | 11.57% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (11/8/17 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 43 | ||||||

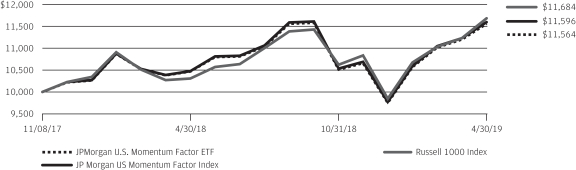

JPMorgan U.S. Momentum Factor ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan U.S. Momentum Factor ETF | ||||

| Net Asset Value* | 9.96% | |||

| Market Price** | 10.03% | |||

| JP Morgan US Momentum Factor Index | 10.01% | |||

| Russell 1000 Index | 10.00% | |||

| Net Assets as of 4/30/2019 | $ | 39,748,855 | ||

| 44 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 45 | ||||||

JPMorgan U.S. Momentum Factor ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan U.S. Momentum Factor ETF |

||||||||||||||||

| Net Asset Value |

November 8, 2017 | 9.96% | 10.45% | 10.36% | ||||||||||||

| Market Price |

10.03% | 10.48% | 10.44% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (11/8/17 TO 4/30/19)

| 46 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

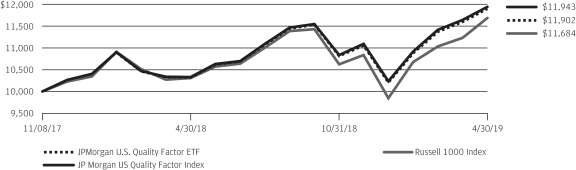

JPMorgan U.S. Quality Factor ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan U.S. Quality Factor ETF | ||||

| Net Asset Value* | 10.04% | |||

| Market Price** | 10.08% | |||

| JP Morgan US Quality Factor Index | 10.21% | |||

| Russell 1000 Index | 10.00% | |||

| Net Assets as of 4/30/2019 | $ | 52,108,696 | ||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 47 | ||||||

JPMorgan U.S. Quality Factor ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| 48 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan U.S. Quality Factor ETF |

|

|||||||||||||||

| Net Asset Value |

November 8, 2017 | 10.04% | 15.25% | 12.54% | ||||||||||||

| Market Price |

10.08% | 15.25% | 12.56% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (11/8/17 TO 4/30/19)

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 49 | ||||||

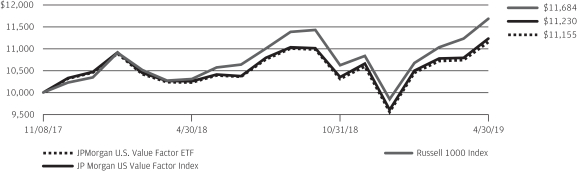

JPMorgan U.S. Value Factor ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| JPMorgan U.S. Value Factor ETF | ||||

| Net Asset Value* | 8.17% | |||

| Market Price** | 8.25% | |||

| JP Morgan US Value Factor Index | 8.49% | |||

| Russell 1000 Index | 10.00% | |||

| Net Assets as of 4/30/2019 | $ | 56,620,137 | ||

| 50 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 51 | ||||||

JPMorgan U.S. Value Factor ETF

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2019 (Unaudited) (continued)

| AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2019 (Unaudited) |

||||||||||||||||

| INCEPTION DATE | SIX MONTHS* | 1 YEAR | SINCE INCEPTION |

|||||||||||||

| JPMorgan U.S. Value Factor ETF |

|

|||||||||||||||

| Net Asset Value |

November 8, 2017 | 8.17% | 9.06% | 7.69% | ||||||||||||

| Market Price |

8.25% | 9.05% | 7.75% | |||||||||||||

| * | Not annualized. |

LIFE OF FUND PERFORMANCE (11/8/17 TO 4/30/19)

| 52 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan BetaBuilders Canada ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 53 | ||||||

JPMorgan BetaBuilders Canada ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 54 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION)($) |

|||||||||||||||

| Long Contracts |

| |||||||||||||||||||

| S&P/TSX 60 Index | 110 | 06/2019 | CAD | 16,303,352 | 301,989 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 301,989 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| CAD | — Canadian Dollar | |

| TSX | — Toronto Stock Exchange |

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 55 | ||||||

JPMorgan BetaBuilders Developed Asia ex-Japan ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 56 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 57 | ||||||

JPMorgan BetaBuilders Developed Asia ex-Japan ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 58 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION)($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| Hang Seng Index |

14 | 05/2019 | HKD | 2,634,179 | 3,548 | |||||||||||||||

| MSCI Singapore Index |

28 | 05/2019 | SGD | 780,031 | 7,389 | |||||||||||||||

| SPI 200 Index |

2 | 05/2019 | AUD | 222,095 | (2,119 | ) | ||||||||||||||

| SPI 200 Index |

43 | 06/2019 | AUD | 4,781,094 | 83,453 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 92,271 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 59 | ||||||

JPMorgan BetaBuilders Europe ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 60 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 61 | ||||||

JPMorgan BetaBuilders Europe ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 62 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 63 | ||||||

JPMorgan BetaBuilders Europe ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 64 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 65 | ||||||

JPMorgan BetaBuilders Europe ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 66 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

| |||||||||||||||||||

| EURO STOXX 50 Index |

568 | 06/2019 | EUR | 22,023,886 | 1,002,817 | |||||||||||||||

| FTSE 100 Index |

141 | 06/2019 | GBP | 13,569,998 | 329,521 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 1,332,338 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 67 | ||||||

JPMorgan BetaBuilders Japan ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 68 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 69 | ||||||

JPMorgan BetaBuilders Japan ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 70 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 71 | ||||||

JPMorgan BetaBuilders Japan ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 72 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 73 | ||||||

JPMorgan BetaBuilders Japan ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

Abbreviations

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| TOPIX Index |

306 | 06/2019 | JPY | 44,597,244 | 452,088 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 452,088 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| 74 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan BetaBuilders U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 75 | ||||||

JPMorgan BetaBuilders U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 76 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 77 | ||||||

JPMorgan BetaBuilders U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 78 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 79 | ||||||

JPMorgan BetaBuilders U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 80 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 81 | ||||||

JPMorgan BetaBuilders U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 82 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 83 | ||||||

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 84 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 85 | ||||||

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 86 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 87 | ||||||

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 88 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 89 | ||||||

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 90 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 91 | ||||||

JPMorgan Diversified Return Emerging Markets Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 92 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| MSCI Emerging Markets E-Mini Index |

15 | 06/2019 | USD | 809,475 | 30,614 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 30,614 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 93 | ||||||

JPMorgan Diversified Return Europe Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 94 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 95 | ||||||

JPMorgan Diversified Return Europe Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 96 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 97 | ||||||

JPMorgan Diversified Return Europe Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 98 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

Abbreviations

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

|

|||||||||||||||||||

| EURO STOXX 50 Index | 6 | 06/2019 | EUR | 232,647 | 14,859 | |||||||||||||||

| FTSE 100 Index | 1 | 06/2019 | GBP | 96,241 | 3,028 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 17,887 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 99 | ||||||

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 100 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 101 | ||||||

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 102 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 103 | ||||||

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 104 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 105 | ||||||

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 106 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 107 | ||||||

JPMorgan Diversified Return Global Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| MSCI EAFE E-Mini Index |

7 | 06/2019 | USD | 670,565 | 32,081 | |||||||||||||||

| S&P 500 E-Mini Index |

1 | 06/2019 | USD | 147,475 | 10,610 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 42,691 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| 108 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan Diversified Return International Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 109 | ||||||

JPMorgan Diversified Return International Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 110 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 111 | ||||||

JPMorgan Diversified Return International Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 112 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 113 | ||||||

JPMorgan Diversified Return International Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 114 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| MSCI EAFE E-Mini Index |

105 | 06/2019 | USD | 10,058,475 | 300,098 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 300,098 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| EAFE | — Europe, Australasia, and Far East | |

| MSCI | — Morgan Stanley Capital International | |

| USD | — United States Dollar |

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 115 | ||||||

JPMorgan Diversified Return U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 116 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 117 | ||||||

JPMorgan Diversified Return U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 118 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 119 | ||||||

JPMorgan Diversified Return U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 120 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 121 | ||||||

JPMorgan Diversified Return U.S. Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

|

Futures contracts outstanding as of April 30, 2019: |

||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| S&P 500 E-Mini Index |

11 | 06/2019 | USD | 1,622,225 | 65,403 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 65,403 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| USD | — United States Dollar |

SEE NOTES TO FINANCIAL STATEMENTS.

| 122 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan Diversified Return U.S. Mid Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 123 | ||||||

JPMorgan Diversified Return U.S. Mid Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 124 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 125 | ||||||

JPMorgan Diversified Return U.S. Mid Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 126 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 127 | ||||||

JPMorgan Diversified Return U.S. Mid Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 128 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| S&P Midcap 400 E-Mini Index |

2 | 06/2019 | USD | 394,580 | 14,916 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 14,916 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| USD | — United States Dollar |

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 129 | ||||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 130 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 131 | ||||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 132 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 133 | ||||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 134 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 135 | ||||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 136 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 137 | ||||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 138 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 139 | ||||||

JPMorgan Diversified Return U.S. Small Cap Equity ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 140 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

Abbreviations

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| Russell 2000 E-Mini Index |

4 | 06/2019 | USD | 318,680 | 5,167 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 5,167 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 141 | ||||||

JPMorgan U.S Dividend ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 142 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 143 | ||||||

JPMorgan U.S Dividend ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 144 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| Russell 1000 E-Mini Index |

1 | 06/2019 | USD | 81,635 | 4,305 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 4,305 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| USD | — United States Dollar |

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 145 | ||||||

JPMorgan U.S. Minimum Volatility ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 146 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 147 | ||||||

JPMorgan U.S. Minimum Volatility ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 148 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| Russell 1000 E-Mini Index |

1 | 06/2019 | USD | 81,635 | 4,305 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 4,305 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| USD | — United States Dollar |

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 149 | ||||||

JPMorgan U.S. Momentum Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 150 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 151 | ||||||

JPMorgan U.S. Momentum Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 152 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 153 | ||||||

JPMorgan U.S. Momentum Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

|

|||||||||||||||||||

| Russell 1000 E-Mini Index | 1 | 06/2019 | USD | 81,635 | 2,755 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 2,755 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| USD | — United States Dollar |

SEE NOTES TO FINANCIAL STATEMENTS.

| 154 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan U.S. Quality Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 155 | ||||||

JPMorgan U.S. Quality Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 156 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 157 | ||||||

JPMorgan U.S. Quality Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| Russell 1000 E-Mini Index |

1 | 06/2019 | USD | 81,635 | 4,305 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 4,305 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

| USD | — United States Dollar |

SEE NOTES TO FINANCIAL STATEMENTS.

| 158 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

JPMorgan U.S. Value Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 159 | ||||||

JPMorgan U.S. Value Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 160 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 161 | ||||||

JPMorgan U.S. Value Factor ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF APRIL 30, 2019 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 162 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| Futures contracts outstanding as of April 30, 2019: | ||||||||||||||||||||

| DESCRIPTION | NUMBER OF CONTRACTS |

EXPIRATION DATE |

TRADING CURRENCY |

NOTIONAL AMOUNT ($) |

VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

|||||||||||||||

| Long Contracts |

||||||||||||||||||||

| Russell 1000 E-Mini Index |

2 | 06/2019 | USD | 163,270 | 5,610 | |||||||||||||||

|

|

|

|||||||||||||||||||

| 5,610 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

Abbreviations

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 163 | ||||||

STATEMENTS OF ASSETS AND LIABILITIES

AS OF APRIL 30, 2019 (Unaudited)

| JPMorgan BetaBuilders Canada ETF |

JPMorgan |

JPMorgan Europe ETF |

JPMorgan Japan ETF |

|||||||||||||

| ASSETS: |

| |||||||||||||||

| Investments in non-affiliates, at value |

$ | 3,719,570,824 | $ | 1,275,981,035 | $ | 4,284,746,913 | $ | 3,434,662,462 | ||||||||

| Investments of cash collateral received from securities loaned, at value (Note 2.D.) |

175,374,510 | 5,629,387 | 273,946,690 | 4,939,149 | ||||||||||||

| Restricted cash |

36,000 | 10,800 | 181,900 | 40,300 | ||||||||||||

| Cash |

— | 8,648 | 22,970 | 1,404,544 | ||||||||||||

| Foreign currency, at value |

8,602,622 | 6,446,620 | 21,512,879 | 10,406,404 | ||||||||||||

| Deposits at broker for futures contracts |

684,482 | 439,184 | 2,197,213 | 1,373,069 | ||||||||||||

| Segregated cash balance with Authorized Participant for deposit securities |

114,993 | — | — | — | ||||||||||||

| Deferred offering costs (Note 2.G.) |

4,589 | 4,234 | 1,751 | 1,715 | ||||||||||||

| Receivables: |

||||||||||||||||

| Investment securities sold |

9,846,341 | — | — | — | ||||||||||||

| Fund shares sold |

— | 103,111,295 | — | — | ||||||||||||

| Dividends from non-affiliates |

7,588,659 | 1,107,513 | 13,234,527 | 30,641,125 | ||||||||||||

| Tax reclaims |

676,656 | 3,954 | 3,189,954 | 940,667 | ||||||||||||

| Securities lending income (Note 2.D.) |

293,379 | 29,075 | 166,827 | 17,551 | ||||||||||||

| Variation margin on futures contracts |

— | — | 140,660 | 357,126 | ||||||||||||

| Due from Adviser |

185,833 | 201,189 | 317,640 | 7,770 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

3,922,978,888 | 1,392,972,934 | 4,599,659,924 | 3,484,791,882 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| LIABILITIES: |

||||||||||||||||

| Payables: |

||||||||||||||||

| Due to custodian |

191,063 | — | — | — | ||||||||||||

| Investment securities purchased |

— | 102,075,823 | — | — | ||||||||||||

| Collateral received on securities loaned (Note 2.D.) |

175,374,510 | 5,629,387 | 273,946,690 | 4,939,149 | ||||||||||||

| Fund shares redeemed |

9,892,807 | — | — | — | ||||||||||||

| Variation margin on futures contracts |

26,547 | 24,221 | — | — | ||||||||||||

| Accrued liabilities: |

||||||||||||||||

| Administration fees |

206,393 | 72,884 | 244,763 | 207,970 | ||||||||||||

| Custodian, Accounting and Transfer Agent fees |

115,822 | 103,206 | 263,492 | 64,977 | ||||||||||||

| Trustees’ and Chief Compliance Officer’s fees |

5,810 | 3,057 | 7,967 | 10,127 | ||||||||||||

| Professional fees |

28,124 | 28,305 | 32,587 | 34,096 | ||||||||||||

| Collateral upon return of deposit securities |

114,993 | — | — | — | ||||||||||||

| Other |

15,085 | 13,823 | 36,699 | 22,227 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

185,971,154 | 107,950,706 | 274,532,198 | 5,278,546 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets |

$ | 3,737,007,734 | $ | 1,285,022,228 | $ | 4,325,127,726 | $ | 3,479,513,336 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET ASSETS: |

| |||||||||||||||

| Paid-in-Capital |

$ | 3,648,422,717 | $ | 1,204,221,305 | $ | 4,074,556,303 | $ | 3,491,510,144 | ||||||||

| Total distributable earnings (loss) |

88,585,017 | 80,800,923 | 250,571,423 | (11,996,808 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Net Assets |

$ | 3,737,007,734 | $ | 1,285,022,228 | $ | 4,325,127,726 | $ | 3,479,513,336 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding number of shares |

| |||||||||||||||

| (unlimited number of shares authorized — par value $0.0001) |

151,100,000 | 50,000,000 | 177,200,000 | 150,800,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, per share |

$ | 24.73 | $ | 25.70 | $ | 24.41 | $ | 23.07 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of investments in non-affiliates |

$ | 3,625,591,611 | $ | 1,200,561,015 | $ | 4,075,286,279 | $ | 3,508,884,161 | ||||||||

| Cost of foreign currency |

8,580,880 | 6,493,276 | 21,416,943 | 10,389,508 | ||||||||||||

| Investment securities on loan, at value |

167,876,062 | 5,345,743 | 256,352,424 | 4,734,944 | ||||||||||||

| Cost of investment of cash collateral |

175,374,510 | 5,629,387 | 273,946,690 | 4,939,149 | ||||||||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 164 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| JPMorgan BetaBuilders U.S. Equity ETF |

JPMorgan |

JPMorgan Diversified Return Europe Equity ETF |

JPMorgan Diversified Return Global Equity ETF |

|||||||||||||

| ASSETS: |

| |||||||||||||||

| Investments in non-affiliates, at value |

$ | 31,185,755 | $ | 329,807,378 | $ | 16,847,286 | $ | 209,747,624 | ||||||||

| Investments in affiliates, at value |

585,121 | — | — | 52,770 | ||||||||||||

| Investments of cash collateral received from securities loaned, at value (Note 2.D.) |

— | 746,461 | 295,789 | 3,438,708 | ||||||||||||

| Restricted cash |

— | 44,100 | 5,700 | 7,700 | ||||||||||||

| Cash |

— | 5,696,797 | 31,807 | 254,609 | ||||||||||||

| Foreign currency, at value |

— | 152,978 | 32,860 | 166,964 | ||||||||||||

| Deposits at broker for futures contracts |

— | 158,000 | 27,000 | 85,000 | ||||||||||||

| Segregated cash balance with Authorized Participant for deposit securities |

— | 1,458,914 | — | — | ||||||||||||

| Prepaid expenses |

— | — | — | 81 | ||||||||||||

| Receivables: |

||||||||||||||||

| Investment securities sold |

— | 2,788 | — | 264 | ||||||||||||

| Fund shares sold |

— | 16,554,793 | — | — | ||||||||||||

| Dividends from non-affiliates |

26,415 | 409,923 | 58,973 | 738,942 | ||||||||||||

| Dividends from affiliates |

191 | 594 | — | 182 | ||||||||||||

| Tax reclaims |

— | — | 323,013 | 118,846 | ||||||||||||

| Securities lending income (Note 2.D.) |

— | 898 | 427 | 2,886 | ||||||||||||

| Variation margin on futures contracts |

— | — | 1,543 | 50 | ||||||||||||

| Due from Adviser |

2 | — | — | — | ||||||||||||

| Due from Authorized Participant |

— | 1,249,294 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

31,797,484 | 356,282,918 | 17,624,398 | 214,614,626 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| LIABILITIES: |

| |||||||||||||||

| Payables: |

||||||||||||||||

| Due to custodian |

59 | — | — | — | ||||||||||||

| Investment securities purchased |

— | 22,409,540 | — | 71,642 | ||||||||||||

| Collateral received on securities loaned (Note 2.D.) |

— | 746,461 | 295,789 | 3,438,708 | ||||||||||||

| Variation margin on futures contracts |

— | 1,800 | — | — | ||||||||||||

| Accrued liabilities: |

||||||||||||||||

| Investment advisory fees |

— | 34,635 | 19,350 | 33,516 | ||||||||||||

| Management fees (Note 3.A.) |

502 | — | — | — | ||||||||||||

| Administration fees |

— | 18,740 | 1,069 | 12,990 | ||||||||||||

| Custodian, Accounting and Transfer Agent fees |

— | 125,642 | 37,923 | 51,614 | ||||||||||||

| Trustees’ and Chief Compliance Officer’s fees |

— | 3,161 | 224 | 3,638 | ||||||||||||

| Deferred foreign capital gains tax |

— | 350,899 | — | — | ||||||||||||

| Professional fees |

— | 45,249 | 31,816 | 61,048 | ||||||||||||

| Collateral upon return of deposit securities |

— | 1,458,914 | — | — | ||||||||||||

| Other |

— | 32,852 | 15,720 | 27,209 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

561 | 25,227,893 | 401,891 | 3,700,365 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets |

$ | 31,796,923 | $ | 331,055,025 | $ | 17,222,507 | $ | 210,914,261 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET ASSETS: |

| |||||||||||||||

| Paid-in-Capital |

$ | 30,208,910 | $ | 322,662,869 | $ | 17,942,958 | $ | 201,622,879 | ||||||||

| Total distributable earnings (loss) |

1,588,013 | 8,392,156 | (720,451 | ) | 9,291,382 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Net Assets |

$ | 31,796,923 | $ | 331,055,025 | $ | 17,222,507 | $ | 210,914,261 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding number of shares |

| |||||||||||||||

| (unlimited number of shares authorized — par value $0.0001) |

600,000 | 6,000,000 | 300,000 | 3,500,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, per share |

$ | 52.99 | $ | 55.18 | $ | 57.41 | $ | 60.26 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of investments in non-affiliates |

$ | 29,706,269 | $ | 306,166,023 | $ | 17,510,046 | $ | 198,961,006 | ||||||||

| Cost of investments in affiliates |

537,281 | — | — | 52,770 | ||||||||||||

| Cost of foreign currency |

— | 152,955 | 32,863 | 167,133 | ||||||||||||

| Investment securities on loan, at value |

— | 697,890 | 281,824 | 3,277,393 | ||||||||||||

| Cost of investment of cash collateral |

— | 746,461 | 295,789 | 3,438,708 | ||||||||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| APRIL 30, 2019 | J.P. MORGAN EXCHANGE-TRADED FUNDS | 165 | ||||||

STATEMENTS OF ASSETS AND LIABILITIES

AS OF APRIL 30, 2019 (Unaudited) (continued)

| JPMorgan Diversified Return International Equity ETF |

JPMorgan Diversified Return U.S. Equity ETF |

JPMorgan |

JPMorgan Diversified Return U.S. Small Cap Equity ETF |

|||||||||||||

| ASSETS: |

| |||||||||||||||

| Investments in non-affiliates, at value |

$ | 1,715,105,323 | $ | 681,519,098 | $ | 166,643,779 | $ | 173,702,635 | ||||||||

| Investments in affiliates, at value |

569,515 | 825,121 | 328,616 | 388,121 | ||||||||||||

| Investments of cash collateral received from securities loaned, at value (Note 2.D.) |

43,167,119 | 24,660,085 | 2,975,516 | 8,176,564 | ||||||||||||

| Restricted cash |

43,200 | 15,950 | 4,500 | 18,900 | ||||||||||||

| Cash |

1,343,873 | — | — | — | ||||||||||||

| Foreign currency, at value |

344,993 | — | — | — | ||||||||||||

| Deposits at broker for futures contracts |

629,000 | 198,000 | 37,000 | 63,000 | ||||||||||||

| Receivables: |

||||||||||||||||

| Investment securities sold |

1,112 | — | — | — | ||||||||||||

| Dividends from non-affiliates |

9,912,640 | 607,367 | 104,869 | 42,831 | ||||||||||||

| Dividends from affiliates |

2,490 | 1,309 | 450 | 452 | ||||||||||||

| Tax reclaims |

1,545,165 | — | — | — | ||||||||||||

| Securities lending income (Note 2.D.) |

63,262 | 3,727 | 201 | 3,931 | ||||||||||||

| Variation margin on futures contracts |

— | 3,630 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

1,772,727,692 | 707,834,287 | 170,094,931 | 182,396,434 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| LIABILITIES: |

| |||||||||||||||

| Payables: |

||||||||||||||||

| Due to custodian |

— | 2,513 | — | — | ||||||||||||

| Investment securities purchased |

455,608 | — | — | — | ||||||||||||

| Collateral received on securities loaned (Note 2.D.) |

43,167,119 | 24,660,085 | 2,975,516 | 8,176,564 | ||||||||||||

| Variation margin on futures contracts |

2,798 | — | 739 | 1,760 | ||||||||||||

| Accrued liabilities: |

||||||||||||||||

| Investment advisory fees |

374,029 | 45,330 | 14,908 | 22,016 | ||||||||||||

| Administration fees |

106,862 | 41,383 | 10,192 | 9,613 | ||||||||||||

| Custodian, Accounting and Transfer Agent fees |

149,352 | 29,244 | 15,991 | 28,765 | ||||||||||||

| Trustees’ and Chief Compliance Officer’s fees |

22,557 | 7,007 | 1,460 | 980 | ||||||||||||

| Professional fees |

185,799 | 74,589 | 32,600 | 34,011 | ||||||||||||

| Other |

164,210 | 68,774 | 22,487 | 15,796 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

44,628,334 | 24,928,925 | 3,073,893 | 8,289,505 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets |

$ | 1,728,099,358 | $ | 682,905,362 | $ | 167,021,038 | $ | 174,106,929 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET ASSETS: |

| |||||||||||||||

| Paid-in-Capital |

$ | 1,700,451,981 | $ | 603,995,895 | $ | 152,571,329 | $ | 164,343,730 | ||||||||

| Total distributable earnings (loss) |

27,647,377 | 78,909,467 | 14,449,709 | 9,763,199 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Net Assets |

$ | 1,728,099,358 | $ | 682,905,362 | $ | 167,021,038 | $ | 174,106,929 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Outstanding number of shares |

||||||||||||||||

| (unlimited number of shares authorized — par value $0.0001) |

31,000,000 | 9,100,000 | 2,500,000 | 5,550,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, per share |

$ | 55.75 | $ | 75.04 | $ | 66.81 | $ | 31.37 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of investments in non-affiliates |

$ | 1,662,869,693 | $ | 606,269,219 | $ | 152,716,855 | $ | 167,837,752 | ||||||||

| Cost of investments in affiliates |

569,515 | 825,121 | 328,616 | 388,121 | ||||||||||||

| Cost of foreign currency |

343,672 | — | — | — | ||||||||||||

| Investment securities on loan, at value |

37,115,611 | 24,018,945 | 2,875,507 | 7,819,428 | ||||||||||||

| Cost of investment of cash collateral |

43,167,119 | 24,660,085 | 2,975,516 | 8,176,164 | ||||||||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 166 | J.P. MORGAN EXCHANGE-TRADED FUNDS | APRIL 30, 2019 | ||||

| JPMorgan U.S. Dividend ETF |

JPMorgan U.S. Minimum Volatility ETF |

JPMorgan |

JPMorgan U.S. Quality Factor ETF |

JPMorgan U.S. Value Factor ETF |

||||||||||||||||

| ASSETS: |

|

|||||||||||||||||||

| Investments in non-affiliates, at value |

$ | 30,578,326 | $ | 41,184,845 | $ | 39,704,340 | $ | 52,047,512 | $ | 56,541,667 | ||||||||||

| Investments in affiliates, at value |

33,272 | 74,511 | 58,474 | 48,603 | 74,332 | |||||||||||||||

| Investments of cash collateral received from securities loaned, at value (Note 2.D.) |

— | — | 183,685 | 276,387 | 79,891 | |||||||||||||||

| Restricted cash |

1,800 | 2,400 | 800 | 1,200 | 4,200 | |||||||||||||||

| Deposits at broker for futures contracts |

12,000 | 8,000 | 8,000 | 12,000 | 20,000 | |||||||||||||||

| Prepaid expenses |

58 | — | — | — | — | |||||||||||||||

| Receivables: |

||||||||||||||||||||

| Dividends from non-affiliates |

49,518 | 34,281 | 24,020 | 43,788 | 65,779 | |||||||||||||||

| Dividends from affiliates |

35 | 85 | 108 | 53 | 211 | |||||||||||||||

| Securities lending income (Note 2.D.) |

19 | 5 | 20 | 15 | 22 | |||||||||||||||

| Variation margin on futures contracts |

83 | 83 | 75 | 79 | 175 | |||||||||||||||

| Due from Adviser |

5,032 | 5,275 | 5,023 | 5,103 | 5,183 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Assets |

30,680,143 | 41,309,485 | 39,984,545 | 52,434,740 | 56,791,460 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES: |

| |||||||||||||||||||

| Payables: |

||||||||||||||||||||

| Due to custodian |

— | — | 2,743 | — | — | |||||||||||||||

| Investment securities purchased |

— | — | — | — | 38,813 | |||||||||||||||

| Collateral received on securities loaned (Note 2.D.) |

— | — | 183,685 | 276,387 | 79,891 | |||||||||||||||

| Accrued liabilities: |

||||||||||||||||||||

| Administration fees |

1,881 | 2,167 | 2,412 | 2,931 | 3,603 | |||||||||||||||

| Custodian, Accounting and Transfer Agent fees |

10,171 | 10,564 | 9,046 | 8,796 | 11,020 | |||||||||||||||

| Trustees’ and Chief Compliance Officer’s fees |

390 | 415 | 379 | 424 | 331 | |||||||||||||||

| Professional fees |

29,228 | 29,116 | 29,192 | 29,034 | 29,244 | |||||||||||||||

| Other |

7,768 | 8,285 | 8,233 | 8,472 | 8,421 | |||||||||||||||

|

|