JPMorgan Exchange Traded Fund

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta,

Esq.

J.P. Morgan Investment Management Inc.

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

With copies to:

|

|

|

| Elizabeth A. Davin, Esq. |

|

Jon S. Rand Esq. |

| JPMorgan Chase & Co. |

|

Dechert LLP |

| 1111 Polaris Parkway |

|

1095 Avenue of the Americas |

| Columbus, OH 43240 |

|

New York, NY 10036 |

Registrant’s telephone number, including area code: (844) 457-6383

Date of fiscal year end: February 28

Date of reporting period: March 1, 2017 through August 31, 2017

Form

N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to

stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to

disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any

suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C.

Section 3507.

| ITEM 1. |

REPORTS TO STOCKHOLDERS. |

The following is a

copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

JPMorgan Exchange-Traded Funds

August 31, 2017 (Unaudited)

JPMorgan Disciplined High Yield ETF

JPMorgan Global

Bond Opportunities ETF

JPMorgan Ultra-Short Income ETF

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured

or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are

subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be,

and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P.

Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not NAV) through a brokerage account, and are not individually

redeemed from a Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

PRESIDENT’S LETTER

AUGUST 31, 2017 (Unaudited)

Dear Shareholders,

It is my great privilege to serve you as President of JPMorgan’s Exchange-Traded Funds, a business dedicated to providing advisors and investors with additional choices for constructing stronger

portfolios. We are proud to announce that J.P. Morgan Asset Management’s ETF business has reached an important milestone, surpassing $2 billion in assets under management (AUM) in August 2017, just seven months after we reached

$1 billion in AUM. Additionally, we’ve expanded our ETF offering with the launch of two active fixed income ETFs, complementing our existing innovative strategic beta and institutional-quality alternative strategies.

|

|

|

|

|

“We believe our fixed income strategies can help you build a properly diversified portfolio that moderates interest

rate risk and delivers risk-adjusted returns.” |

During the six months ending August 31, 2017, global financial markets generally provided positive returns. Despite

intermittent geo-political tensions, financial market volatility remained near historic lows and investor demand for both equity and fixed-income assets continued to reflect steady global economic growth. Our market strategists foresee further

global economic growth and slowly rising interest rates heading into 2018.

Within this environment, we believe our innovative, active fixed

income solutions can help you navigate changing markets in the following ways:

Seek to increase your income potential with high yield.

Through a rules-based approach to credit selection, JPMorgan

Disciplined High Yield ETF (JPHY) aims to deliver higher risk-adjusted returns than passive indexing options. JPHY provides diversification within a multi-asset portfolio through low

correlation to other asset classes.

Broaden the borders of your bond portfolio with JPMorgan Global Bond Opportunities ETF (JPGB).

Launched on April 5, 2017, the Global Bond Opportunities ETF seeks to deliver total returns by providing exposure across more than 15 fixed income sectors and 50 countries.

Leveraging J.P. Morgan’s Global Liquidity platform, JPMorgan Ultra-Short Income ETF (JPST) aims to deliver current income while managing risk. Launched May 17, 2017, JPST seeks an

attractive yield while focusing on active credit risk management in an effort to deliver stable returns, even in challenging environments.

We are

proud to bring J.P. Morgan’s experience and strong fixed income capabilities to the ETF market place. We are committed to building solutions that address your needs and help you build stronger portfolios. Thank you for your belief in our Firm

and our process.

Sincerely,

Joanna M. Gallegos

President, J.P. Morgan Exchange-Traded Funds

J.P.

Morgan Asset Management

1-844-4JPM-ETF or jpmorgan.com/etfs for more information

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2017 |

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

|

|

|

1 |

|

JPMorgan Disciplined High Yield ETF

FUND COMMENTARY

FOR THE SIX MONTHS ENDED

AUGUST 31, 2017 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

|

|

| Net Asset Value* |

|

|

3.19% |

|

| Market Price** |

|

|

3.49% |

|

| BofA Merrill Lynch U.S. High Yield Index |

|

|

3.08% |

|

| Bloomberg Barclays US Aggregate Bond Index |

|

|

2.74% |

|

|

|

| Net Assets as of 8/31/2017 |

|

$ |

35,897,042 |

|

| Duration as of 8/31/2017 |

|

|

4.04 years |

|

INVESTMENT OBJECTIVE***

The JPMorgan Disciplined High Yield ETF (the “Fund”) seeks to provide a high level of income. Capital appreciation is a secondary objective.

INVESTMENT APPROACH

The Fund invests in a

diversified portfolio of high-yield securities (also called “junk bonds”). Issuers may be domestic or foreign, but the Fund only invests in U.S. dollar-denominated investments.

HOW DID THE MARKET PERFORM?

High yield bonds generally outperformed investment grade corporate

bonds and U.S. Treasury bonds during the reporting period. Investor demand for high yield bonds was supported by low interest rates and growth in corporate earnings. U.S. companies sold new bonds at a record pace in 2017 — more than $1

trillion combined — in anticipation of U.S. Federal Reserve moves to raise interest rates over the course of the year.

While U.S.

financial market volatility remained historically low throughout the reporting period, there was a spike in volatility in early August 2017 amid tension between the U.S. and North Korea.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2017, the Fund posted

positive absolute performance and outperformed both the BofA Merrill Lynch U.S. High Yield Index (the “Benchmark”) and the Bloomberg Barclays US Aggregate Bond Index.

During the reporting period, bonds rated BB generally outperformed other rated debt and bonds rated CCC underperformed. The Fund’s overweight position in bonds rated BB and its lack of holdings in CCC

rated bonds contributed to absolute performance and performance relative to the Benchmark. To maintain sufficient liquidity, the Fund did not invest in bond issues of less than $500 million, which made a positive contribution to absolute and

relative performance.

The Fund does not invest in bonds issued by privately held companies, which detracted from absolute performance and

performance relative to the Benchmark, as bonds issued by publicly traded companies underperformed bonds issued by privately held companies during the reporting period. To maintain sufficient liquidity, the Fund did not invest in bonds of issuers

that had less than $1 billion in bonds outstanding, which detracted from relative performance.

HOW WAS THE FUND POSITIONED?

The Fund’s managers believe that bonds rated CCC generally

have materially higher volatility and default risk than bonds rates BB and B, while providing inadequate incremental return over a market cycle to justify the higher volatility. In addition, the managers believe bonds issued by private companies

have had a materially higher probability of default than similarly-rated bonds issued by public companies. Relative to the Benchmark, the Fund’s largest average overweight allocation was in bonds rated BB and its largest average underweight

allocation was in bonds rated CCC.

|

|

|

|

|

| PORTFOLIO COMPOSITION BY SECTOR**** |

|

| Consumer Discretionary |

|

|

26.3 |

% |

| Energy |

|

|

13.9 |

|

| Industrials |

|

|

10.2 |

|

| Telecommunication Services |

|

|

9.7 |

|

| Materials |

|

|

9.0 |

|

| Information Technology |

|

|

7.5 |

|

| Financials |

|

|

7.1 |

|

| Health Care |

|

|

6.8 |

|

| Consumer Staples |

|

|

3.4 |

|

| Utilities |

|

|

3.2 |

|

| Real Estate |

|

|

2.3 |

|

| Short-Term Investment |

|

|

0.6 |

|

| * |

|

The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $51.28 as of August 31, 2017. |

| ** |

|

Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at

market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Bats BZX Exchange, Inc. The

midpoint price was $51.66 as of August 31, 2017. |

| *** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** |

|

Percentages indicated are based on total investments as of August 31, 2017. The Fund’s composition is subject to change. |

|

|

|

|

|

|

|

|

|

|

|

| 2 |

|

|

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

AUGUST 31, 2017 |

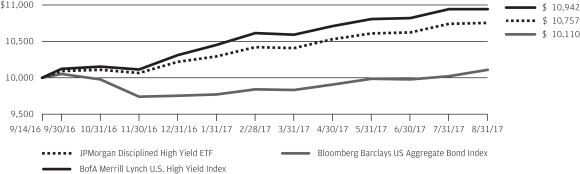

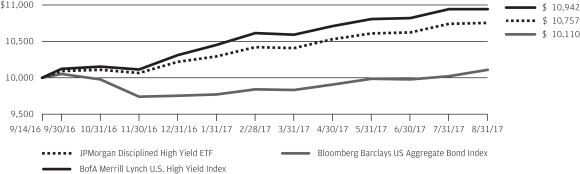

AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31, 2017 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

INCEPTION DATE |

|

|

SIX

MONTHS |

|

|

CUMULATIVE

SINCE

INCEPTION |

|

| JPMorgan Disciplined High Yield ETF |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Asset Value |

|

|

September 14, 2016 |

|

|

|

3.19 |

% |

|

|

7.57 |

% |

| Market Price |

|

|

|

|

|

|

3.49 |

% |

|

|

8.29 |

% |

LIFE OF FUND PERFORMANCE (9/14/16 TO 8/31/17)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded

funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may

be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund

commenced operations on September 14, 2016.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan

Disciplined High Yield ETF, the BofA Merrill Lynch U.S. High Yield Index and the Bloomberg Barclays US Aggregate Bond Index from September 14, 2016 to August 31, 2017. The performance of the Fund reflects the deduction of Fund expenses and

assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the BofA Merrill Lynch U.S. High Yield Index and the Bloomberg Barclays US Aggregate Index does not reflect the deduction of expenses associated with an

exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The BofA Merrill

Lynch U.S. High Yield Index is an unmanaged index, which measures the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The

Bloomberg Barclays US Aggregate Bond Index is an unmanaged index that represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond

market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Investors cannot invest directly in an index.

Fund performance reflects the partial waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would

have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset

values in accordance with accounting principles generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2017 |

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

|

|

|

3 |

|

JPMorgan Global Bond Opportunities ETF

FUND COMMENTARY

FOR THE PERIOD APRIL 5,

2017 (FUND INCEPTION DATE) THROUGH AUGUST 31, 2017 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

|

|

| Net Asset Value* |

|

|

2.46% |

|

| Market Price** |

|

|

2.90% |

|

| Bloomberg Barclays Multiverse Index |

|

|

5.25% |

|

|

|

| Net Assets as of 8/31/2017 |

|

$ |

107,379,224 |

|

| Duration as of 8/31/2017 |

|

|

2.88 years |

|

INVESTMENT OBJECTIVE***

The JPMorgan Global Bond Opportunities ETF (the “Fund”) seeks to provide total return.

INVESTMENT APPROACH

The Fund invests in bond

and currency sectors across developed and emerging markets without benchmark constraints. The Fund is flexible and opportunistic and the Fund’s adviser has broad discretion to shift the Fund’s exposures to strategies, sectors, countries or

currencies based on changing market conditions and its view of the best mix of investment opportunities.

HOW DID THE MARKET PERFORM?

During the reporting period, emerging market bonds generally outperformed bonds issued by the U.S. and other developed market nations amid

investor expectations for global economic growth and rising interest rates. In the U.S., high-yield bonds (also known as “junk bonds”) continued to outperform investment grade corporate debt and U.S. Treasury bonds. While U.S. financial

market volatility remained historically low throughout the reporting period, there was a brief spike in early August 2017 amid tension between the U.S. and North Korea.

HOW DID THE FUND PERFORM?

For the period April 5, 2017 to August 31, 2017, the Fund

posted a return of 2.46%. The Fund has an absolute return orientation and is not managed relative to a benchmark index. While the Fund is not managed to a benchmark, its return is compared to the Bloomberg Barclays Multiverse Index, which returned

5.25% for the reporting period.

The Fund’s allocations to high yield bonds, investment grade corporate bonds and emerging markets debt were

leading contributors to absolute performance. High yield bonds generally benefitted from investor demand for yield growth during the reporting period. The Fund’s allocation to securitized debt also contributed to absolute performance. The

Fund’s allocation to government debt securities detracted from absolute performance during the reporting period.

HOW WAS THE FUND

POSITIONED?

During the reporting period, the Fund invested opportunistically across different markets and sectors. The Fund’s managers

applied a flexible investment approach and did not manage to a benchmark. This allowed the Fund to shift its allocations based on changing market conditions. The Fund had exposure to a broad range of asset classes during the reporting period,

including high yield and investment grade corporate bonds, agency and non-agency mortgage-backed securities, asset-backed securities, commercial mortgage-backed securities, emerging markets debt,

convertible bonds and foreign government securities. At the end of the reporting period, the Fund’s largest allocations were to U.S. high yield bonds and investment grade corporate bonds and its smallest allocations were to agency

mortgage-backed securities and non-agency mortgage-backed/asset-backed securities.

|

|

|

|

|

| PORTFOLIO COMPOSITION BY COUNTRY**** |

|

| United States |

|

|

52.2 |

% |

| France |

|

|

3.6 |

|

| United Kingdom |

|

|

3.5 |

|

| Indonesia |

|

|

3.4 |

|

| Australia |

|

|

3.1 |

|

| Mexico |

|

|

2.8 |

|

| Italy |

|

|

2.8 |

|

| Turkey |

|

|

2.4 |

|

| Luxembourg |

|

|

2.4 |

|

| New Zealand |

|

|

2.1 |

|

| Spain |

|

|

2.0 |

|

| Brazil |

|

|

2.0 |

|

| Portugal |

|

|

1.8 |

|

| Netherlands |

|

|

1.7 |

|

| Germany |

|

|

1.6 |

|

| Canada |

|

|

1.5 |

|

| Ireland |

|

|

1.1 |

|

| South Africa |

|

|

1.0 |

|

| Other (each less than 1%) |

|

|

9.0 |

|

| * |

|

The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $51.13 as of August 31, 2017. |

| ** |

|

Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at

market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Bats BZX Exchange, Inc. The

midpoint price was $51.35 as of August 31, 2017. |

| *** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** |

|

Percentages indicated are based on total investments as of August 31, 2017. The Fund’s composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

|

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

AUGUST 31, 2017 |

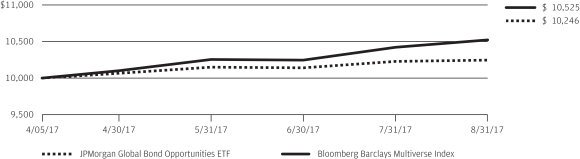

AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31, 2017 (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

INCEPTION DATE |

|

|

CUMULATIVE

SINCE

INCEPTION |

|

| JPMorgan Global Bond Opportunities ETF |

|

|

|

|

|

|

|

|

| Net Asset Value |

|

|

April 5, 2017 |

|

|

|

2.46 |

% |

| Market Price |

|

|

|

|

|

|

2.90 |

% |

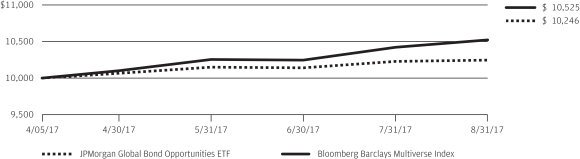

LIFE OF FUND PERFORMANCE (4/5/17 TO 8/31/17)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded

funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may

be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund

commenced operations on April 5, 2017.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Global

Bond Opportunities ETF and the Bloomberg Barclays Multiverse Index from April 5, 2017 to August 31, 2017. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain

distributions, if any. The performance of the Bloomberg Barclays Multiverse Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain

distributions of the securities included in the Index, if applicable.

The Bloomberg Barclays Multiverse Index is an unmanaged index, which measure of the global fixed-income bond

market that combines the Bloomberg Barclays Global Aggregate Index and the Bloomberg Barclays Global High Yield Index. The Bloomberg Barclays Global Aggregate Index measures grade debt from twenty-four different local currency markets. The Bloomberg

Barclays Global High-Yield Index measures the global high-yield fixed income markets. Investors cannot invest directly in an index.

Fund

performance reflects the partial waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this

section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The

returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles

generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2017 |

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

|

|

|

5 |

|

JPMorgan Ultra-Short Income ETF

FUND COMMENTARY

FOR THE PERIOD MAY 17,

2017 (FUND INCEPTION DATE) THROUGH AUGUST 31, 2017 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

|

|

| Net Asset Value* |

|

|

0.50% |

|

| Market Price** |

|

|

0.60% |

|

| BofA Merrill Lynch 3-Month U.S. Treasury Bill Index |

|

|

0.28% |

|

|

|

| Net Assets as of 8/31/2017 |

|

$ |

45,040,387 |

|

| Duration as of 8/31/2017 |

|

|

0.48 years |

|

INVESTMENT OBJECTIVE***

The JPMorgan Ultra-Short Income ETF (the “Fund”) seeks to provide current income while seeking to maintain a low volatility of principal.

INVESTMENT APPROACH

The Fund primarily invests mainly in investment-grade, U.S.

dollar-denominated fixed, variable and floating-rate debt. The Fund seeks to maintain a duration of one year or less, although under certain market conditions, the Fund’s duration may be longer than one year. The Fund’s adviser has broad

discretion to shift the Fund’s exposure to strategies and sectors based on changing market conditions and its view of the best mix of investment opportunities.

HOW DID THE FUND PERFORM?

For the period May 17, 2017 to August 31, 2017, the Fund

posted a positive absolute performance. While the Fund is not managed to a benchmark, its return is compared to the BofA Merrill Lynch 3-Month Treasury U.S. Bill Index (the “Index”). While the Fund held no U.S. Treasury securities during

the reporting period, the Index holds only U.S. Treasuries. The Fund outperformed the Index during the reporting period.

The Fund’s

allocations to investment grade corporate bonds and money market securities were leading contributors to both absolute performance and performance relative to the Index during the reporting period. The Fund’s allocations to collateralized loan

obligations, asset backed securities and commercial mortgage-backed securities also contributed to absolute and relative performance.

While the

Fund’s overall longer duration relative to the Index was a modest detractor from relative performance, the enhanced yield from longer-dated securities helped absolute performance. Duration measures the price sensitivity of a portfolio of bonds

to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates fall or rise, respectively, versus bonds with shorter duration.

HOW WAS THE FUND POSITIONED?

During reporting

period, the portfolio management team believed that interest rates would continue to move higher at a

slow pace, allowing the favorable fundamental and technical picture for corporate credit to persist. As such, the portfolio was positioned with an overall average duration of 0.50 years. In

descending order, the Fund’s largest allocations were in corporate bonds, money market securities, collateralized loan obligations, asset-backed securities and commercial mortgage-backed securities.

|

|

|

|

|

| PORTFOLIO COMPOSITION BY SECTOR**** |

|

| Financials |

|

|

31.7 |

% |

| Asset-Backed Securities |

|

|

16.1 |

|

| Health Care |

|

|

6.1 |

|

| Consumer Staples |

|

|

4.6 |

|

| Energy |

|

|

4.1 |

|

| Consumer Discretionary |

|

|

3.2 |

|

| Information Technology |

|

|

2.9 |

|

| Utilities |

|

|

2.8 |

|

| Real Estate |

|

|

2.7 |

|

| Telecommunication Services |

|

|

2.7 |

|

| Commercial Mortgage-Backed Securities |

|

|

2.7 |

|

| Certificates of Deposit |

|

|

1.4 |

|

| Industrials |

|

|

0.7 |

|

| Short-Term Investments |

|

|

18.3 |

|

| * |

|

The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $50.04 as of August 31, 2017. |

| ** |

|

Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at

market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Bats BZX Exchange, Inc. The

midpoint price was $50.09 as of August 31, 2017. |

| *** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** |

|

Percentages indicated are based on total investments as of August 31, 2017. The Fund’s composition is subject to change. |

|

|

|

|

|

|

|

|

|

|

|

| 6 |

|

|

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

AUGUST 31, 2017 |

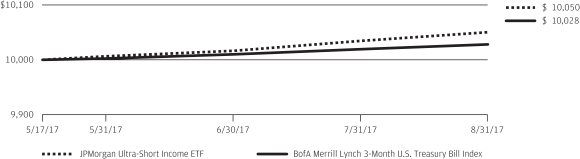

AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31, 2017 (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

INCEPTION DATE |

|

|

CUMULATIVE

SINCE

INCEPTION |

|

| JPMorgan Ultra-Short Income ETF |

|

|

|

|

|

|

|

|

| Net Asset Value |

|

|

May 17, 2017 |

|

|

|

0.50 |

% |

| Market Price |

|

|

|

|

|

|

0.60 |

% |

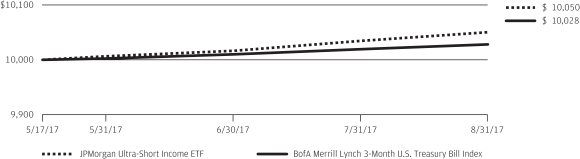

LIFE OF FUND PERFORMANCE (5/17/17 TO 8/31/17)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded

funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may

be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund

commenced operations on May 17, 2017.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan

Ultra-Short Income ETF and the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index from May 17, 2017 to August 31, 2017. The performance of the Fund reflects the deduction of Fund expenses and

assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index does not reflect the deduction of expenses associated

with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of

the securities included in the Index, if applicable. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at

the beginning of the month and held for a full month. The index is rebalanced monthly and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond 3 months from the rebalancing date. Investors cannot invest

directly in an index.

Fund performance reflects the partial waiver of the Fund’s fees and reimbursement of expenses for certain periods

since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or

sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns

shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2017 |

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

|

|

|

7 |

|

JPMorgan Disciplined High Yield ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF

AUGUST 31, 2017 (Unaudited)

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Corporate Bonds — 97.8% |

|

|

|

|

|

Consumer Discretionary — 25.9% |

|

|

|

|

|

|

|

|

Auto Components — 0.9% |

|

|

|

|

| |

150,000 |

|

|

American Axle & Manufacturing, Inc.,

6.500%, 04/01/27 (a) |

|

|

147,750 |

|

|

|

|

|

Goodyear Tire & Rubber Co. (The), |

|

|

|

|

| |

40,000 |

|

|

4.875%, 03/15/27 |

|

|

40,700 |

|

| |

40,000 |

|

|

5.000%, 05/31/26 |

|

|

41,750 |

|

| |

90,000 |

|

|

5.125%, 11/15/23 |

|

|

94,162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

324,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobile — 1.4% |

|

|

|

|

| |

400,000 |

|

|

Fiat Chrysler Automobiles NV (Netherlands),

5.250%, 04/15/23 |

|

|

424,000 |

|

| |

70,000 |

|

|

Tesla, Inc., 5.300%, 08/15/25 (a) |

|

|

68,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

492,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services — 0.2% |

|

|

|

|

| |

75,000 |

|

|

Service Corp. International,

5.375%, 05/15/24 |

|

|

79,781 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diversified Telecommunication

Services — 3.7% |

|

|

|

|

|

|

|

|

Altice Financing S.A. (Luxembourg), |

|

|

|

|

| |

200,000 |

|

|

6.625%, 02/15/23 (a) |

|

|

211,500 |

|

| |

250,000 |

|

|

7.500%, 05/15/26 (a) |

|

|

273,800 |

|

|

|

|

|

CCO Holdings LLC/CCO Holdings Capital Corp., |

|

|

|

|

| |

10,000 |

|

|

5.125%, 05/01/27 (a) |

|

|

10,300 |

|

| |

63,000 |

|

|

5.500%, 05/01/26 (a) |

|

|

65,677 |

|

| |

230,000 |

|

|

5.750%, 02/15/26 (a) |

|

|

243,154 |

|

| |

100,000 |

|

|

5.875%, 04/01/24 (a) |

|

|

106,250 |

|

| |

200,000 |

|

|

UPCB Finance IV Ltd. (Cayman Islands),

5.375%, 01/15/25 (a) |

|

|

207,500 |

|

| |

200,000 |

|

|

Virgin Media Secured Finance plc (United Kingdom), 5.250%,01/15/26 (a) |

|

|

208,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,326,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Real Estate Investment

Trusts (REITs) — 0.5% |

|

|

|

|

|

|

|

|

MGM Growth Properties Operating Partnership LP/MGP Finance Co-Issuer,

Inc., |

|

|

|

|

| |

70,000 |

|

|

4.500%, 09/01/26 |

|

|

71,225 |

|

| |

95,000 |

|

|

5.625%, 05/01/24 |

|

|

103,312 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

174,537 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HomeBuilders — 0.1% |

|

|

|

|

| |

25,000 |

|

|

Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp. (Canada),

6.125%, 07/01/22 (a) |

|

|

26,062 |

|

| |

26,000 |

|

|

Taylor Morrison Communities, Inc./Monarch Communities, Inc., 5.250%, 04/15/21 (a) |

|

|

26,606 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52,668 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure — 5.5% |

|

|

|

|

|

|

|

|

1011778 B.C. ULC/New Red Finance, Inc. (Canada), |

|

|

|

|

| |

55,000 |

|

|

4.625%, 01/15/22 (a) |

|

|

56,221 |

|

| |

205,000 |

|

|

6.000%, 04/01/22 (a) |

|

|

211,765 |

|

|

|

|

|

Aramark Services, Inc., |

|

|

|

|

| |

50,000 |

|

|

4.750%, 06/01/26 |

|

|

52,390 |

|

| |

50,000 |

|

|

5.000%, 04/01/25 (a) |

|

|

52,765 |

|

| |

50,000 |

|

|

5.125%, 01/15/24 |

|

|

53,125 |

|

|

|

|

|

Boyd Gaming Corp., |

|

|

|

|

| |

26,000 |

|

|

6.375%, 04/01/26 |

|

|

28,242 |

|

| |

65,000 |

|

|

6.875%, 05/15/23 |

|

|

69,875 |

|

| |

50,000 |

|

|

Caesars Entertainment Resort Properties LLC, 8.000%, 10/01/20 |

|

|

51,250 |

|

| |

115,000 |

|

|

ESH Hospitality, Inc., 5.250%, 05/01/25 (a) |

|

|

118,450 |

|

| |

125,000 |

|

|

Hilton Domestic Operating Co., Inc.,

4.250%, 09/01/24 |

|

|

128,162 |

|

|

|

|

|

Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp., |

|

|

|

|

| |

35,000 |

|

|

4.625%, 04/01/25 |

|

|

36,571 |

|

| |

35,000 |

|

|

4.875%, 04/01/27 |

|

|

37,013 |

|

| |

200,000 |

|

|

International Game Technology plc (United Kingdom), 6.250%, 02/15/22 (a) |

|

|

220,500 |

|

|

|

|

|

KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC, |

|

|

|

|

| |

30,000 |

|

|

4.750%, 06/01/27 (a) |

|

|

30,788 |

|

| |

38,000 |

|

|

5.000%, 06/01/24 (a) |

|

|

39,721 |

|

| |

95,000 |

|

|

5.250%, 06/01/26 (a) |

|

|

100,106 |

|

|

|

|

|

MGM Resorts International, |

|

|

|

|

| |

46,000 |

|

|

6.000%, 03/15/23 |

|

|

50,830 |

|

| |

115,000 |

|

|

6.625%, 12/15/21 |

|

|

129,088 |

|

| |

40,000 |

|

|

7.750%, 03/15/22 |

|

|

46,800 |

|

| |

26,000 |

|

|

NCL Corp. Ltd. (Bermuda),

4.750%, 12/15/21 (a) |

|

|

26,943 |

|

| |

50,000 |

|

|

Scientific Games International, Inc.,

7.000%, 01/01/22 (a) |

|

|

53,375 |

|

|

|

|

|

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., |

|

|

|

|

| |

50,000 |

|

|

4.250%, 05/30/23 (a) |

|

|

51,125 |

|

| |

70,000 |

|

|

5.250%, 05/15/27 (a) |

|

|

70,700 |

|

| |

235,000 |

|

|

5.500%, 03/01/25 (a) |

|

|

244,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,960,793 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Durables — 1.1% |

|

|

|

|

| |

55,000 |

|

|

Brookfield Residential Properties, Inc. (Canada), 6.500%, 12/15/20 (a) |

|

|

56,513 |

|

| |

50,000 |

|

|

CalAtlantic Group, Inc., 8.375%, 05/15/18 |

|

|

52,063 |

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

| 8 |

|

|

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

AUGUST 31, 2017 |

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Corporate Bonds — continued |

|

|

|

|

|

Household Durables — continued |

|

|

|

|

|

Lennar Corp., |

|

|

|

|

| |

20,000 |

|

|

4.125%, 01/15/22 |

|

|

20,600 |

|

| |

100,000 |

|

|

4.500%, 04/30/24 |

|

|

103,500 |

|

| |

27,000 |

|

|

4.750%, 11/15/22 |

|

|

28,215 |

|

|

|

|

|

PulteGroup, Inc., |

|

|

|

|

| |

26,000 |

|

|

4.250%, 03/01/21 |

|

|

27,011 |

|

| |

60,000 |

|

|

5.500%, 03/01/26 |

|

|

64,500 |

|

| |

55,000 |

|

|

Tempur Sealy International, Inc.,

5.500%, 06/15/26 |

|

|

56,768 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

409,170 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internet & Direct Marketing Retail — 0.4% |

|

|

|

|

|

|

|

|

Netflix, Inc., |

|

|

|

|

| |

25,000 |

|

|

4.375%, 11/15/26 (a) |

|

|

24,375 |

|

| |

26,000 |

|

|

5.500%, 02/15/22 |

|

|

27,950 |

|

| |

70,000 |

|

|

5.875%, 02/15/25 |

|

|

75,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

128,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Media — 9.9% |

|

|

|

|

|

|

|

|

Altice Luxembourg S.A. (Luxembourg), |

|

|

|

|

| |

200,000 |

|

|

7.625%, 02/15/25 (a) |

|

|

216,440 |

|

| |

200,000 |

|

|

7.750%, 05/15/22 (a) |

|

|

212,250 |

|

| |

200,000 |

|

|

Altice US Finance I Corp.,

5.500%, 05/15/26 (a) |

|

|

211,625 |

|

|

|

|

|

AMC Entertainment Holdings, Inc., |

|

|

|

|

| |

25,000 |

|

|

5.750%, 06/15/25 |

|

|

23,750 |

|

| |

70,000 |

|

|

5.875%, 11/15/26 |

|

|

65,712 |

|

|

|

|

|

AMC Networks, Inc., |

|

|

|

|

| |

20,000 |

|

|

4.750%, 12/15/22 |

|

|

20,625 |

|

| |

20,000 |

|

|

4.750%, 08/01/25 |

|

|

20,050 |

|

| |

90,000 |

|

|

5.000%, 04/01/24 |

|

|

92,812 |

|

| |

200,000 |

|

|

Cequel Communications Holdings I LLC/Cequel Capital Corp.,

7.750%, 07/15/25 (a) |

|

|

220,750 |

|

| |

65,000 |

|

|

Cinemark USA, Inc.,

4.875%, 06/01/23 |

|

|

64,838 |

|

|

|

|

|

Clear Channel Worldwide Holdings, Inc. |

|

|

|

|

| |

180,000 |

|

|

Series B, 6.500%, 11/15/22 |

|

|

184,950 |

|

| |

220,000 |

|

|

Series B, 7.625%, 03/15/20 |

|

|

219,175 |

|

|

|

|

|

CSC Holdings LLC, |

|

|

|

|

| |

200,000 |

|

|

10.125%, 01/15/23 (a) |

|

|

231,690 |

|

| |

167,000 |

|

|

10.875%, 10/15/25 (a) |

|

|

205,410 |

|

|

|

|

|

DISH DBS Corp., |

|

|

|

|

| |

100,000 |

|

|

5.875%, 07/15/22 |

|

|

107,813 |

|

| |

104,000 |

|

|

5.875%, 11/15/24 |

|

|

112,190 |

|

| |

180,000 |

|

|

6.750%, 06/01/21 |

|

|

198,675 |

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Media — continued |

|

| |

80,000 |

|

|

Nexstar Broadcasting, Inc.,

5.625%, 08/01/24 (a) |

|

|

82,800 |

|

| |

75,000 |

|

|

Quebecor Media, Inc. (Canada),

5.750%, 01/15/23 |

|

|

80,250 |

|

| |

70,000 |

|

|

Regal Entertainment Group,

5.750%, 03/15/22 |

|

|

72,618 |

|

| |

55,000 |

|

|

Sinclair Television Group, Inc.,

5.375%, 04/01/21 |

|

|

56,375 |

|

|

|

|

|

Sirius XM Radio, Inc., |

|

|

|

|

| |

36,000 |

|

|

5.375%, 04/15/25 (a) |

|

|

38,055 |

|

| |

135,000 |

|

|

6.000%, 07/15/24 (a) |

|

|

145,838 |

|

|

|

|

|

TEGNA, Inc., |

|

|

|

|

| |

40,000 |

|

|

5.125%, 10/15/19 |

|

|

40,600 |

|

| |

40,000 |

|

|

5.125%, 07/15/20 |

|

|

41,012 |

|

| |

25,000 |

|

|

6.375%, 10/15/23 |

|

|

26,531 |

|

| |

180,000 |

|

|

Unitymedia Hessen GmbH & Co. KG/Unitymedia NRW GmbH (Germany),

5.500%, 01/15/23 (a) |

|

|

186,300 |

|

|

|

|

|

Viacom, Inc., |

|

|

|

|

| |

50,000 |

|

|

(USD 3 Month LIBOR+3.895%),

5.875%, 02/28/57 (d) |

|

|

50,000 |

|

| |

50,000 |

|

|

(USD 3 Month LIBOR+3.899%),

6.250%, 02/28/57 (d) |

|

|

50,125 |

|

|

|

|

|

Videotron Ltd. (Canada), |

|

|

|

|

| |

28,000 |

|

|

5.000%, 07/15/22 |

|

|

29,960 |

|

| |

80,000 |

|

|

5.125%, 04/15/27 (a) |

|

|

82,400 |

|

| |

150,000 |

|

|

Ziggo Secured Finance BV (Netherlands),

5.500%, 01/15/27 (a) |

|

|

154,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,546,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multiline Retail — 0.7% |

|

|

|

|

| |

230,000 |

|

|

Dollar Tree, Inc.,

5.750%, 03/01/23 |

|

|

242,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail Consumer Discretionary — 0.3% |

|

|

|

|

|

|

|

|

QVC, Inc., |

|

|

|

|

| |

65,000 |

|

|

4.375%, 03/15/23 |

|

|

67,293 |

|

| |

25,000 |

|

|

4.850%, 04/01/24 |

|

|

26,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

93,374 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty Retail — 0.6% |

|

|

|

|

|

|

|

|

L Brands, Inc., |

|

|

|

|

| |

38,000 |

|

|

5.625%, 02/15/22 |

|

|

40,137 |

|

| |

90,000 |

|

|

6.625%, 04/01/21 |

|

|

98,100 |

|

| |

70,000 |

|

|

Penske Automotive Group, Inc.,

5.500%, 05/15/26 |

|

|

70,700 |

|

| |

26,000 |

|

|

Sally Holdings LLC/Sally Capital, Inc.,

5.625%, 12/01/25 |

|

|

26,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

235,490 |

|

|

|

|

|

|

|

|

|

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2017 |

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

|

|

|

9 |

|

JPMorgan Disciplined High Yield ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Corporate Bonds — continued |

|

|

|

|

|

Textiles, Apparel & Luxury Goods — 0.3% |

|

|

|

|

|

|

|

|

Hanesbrands, Inc., |

|

|

|

|

| |

32,000 |

|

|

4.625%, 05/15/24 (a) |

|

|

33,280 |

|

| |

80,000 |

|

|

4.875%, 05/15/26 (a) |

|

|

83,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

116,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Telecommunication Services — 0.3% |

|

| |

100,000 |

|

|

Inmarsat Finance plc (United Kingdom),

4.875%, 05/15/22 (a) |

|

|

101,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Consumer Discretionary |

|

|

9,285,049 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Staples — 3.3% |

|

|

|

|

|

|

|

|

Beverages — 0.2% |

|

|

|

|

| |

70,000 |

|

|

Cott Beverages, Inc.,

5.375%, 07/01/22 |

|

|

72,712 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food & Staples Retailing — 0.9% |

|

|

|

|

| |

20,000 |

|

|

Cott Holdings, Inc.,

5.500%, 04/01/25 (a) |

|

|

20,975 |

|

|

|

|

|

Rite Aid Corp., |

|

|

|

|

| |

165,000 |

|

|

6.125%, 04/01/23 (a) |

|

|

162,113 |

|

| |

32,000 |

|

|

9.250%, 03/15/20 |

|

|

33,120 |

|

| |

105,000 |

|

|

Tesco plc (United Kingdom),

6.150%, 11/15/37 (a) |

|

|

110,131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

326,339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food Products — 1.2% |

|

|

|

|

| |

100,000 |

|

|

B&G Foods, Inc.,

5.250%, 04/01/25 |

|

|

102,750 |

|

|

|

|

|

Lamb Weston Holdings, Inc., |

|

|

|

|

| |

16,000 |

|

|

4.625%, 11/01/24 (a) |

|

|

16,500 |

|

| |

16,000 |

|

|

4.875%, 11/01/26 (a) |

|

|

16,602 |

|

|

|

|

|

Post Holdings, Inc., |

|

|

|

|

| |

180,000 |

|

|

5.000%, 08/15/26 (a) |

|

|

180,000 |

|

| |

20,000 |

|

|

5.500%, 03/01/25 (a) |

|

|

20,800 |

|

| |

20,000 |

|

|

5.750%, 03/01/27 (a) |

|

|

20,700 |

|

| |

85,000 |

|

|

TreeHouse Foods, Inc.,

6.000%, 02/15/24 (a) |

|

|

89,888 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

447,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Products — 0.7% |

|

|

|

|

|

|

|

|

HRG Group, Inc., |

|

|

|

|

| |

52,000 |

|

|

7.750%, 01/15/22 |

|

|

54,470 |

|

| |

75,000 |

|

|

7.875%, 07/15/19 |

|

|

76,406 |

|

| |

105,000 |

|

|

Spectrum Brands, Inc.,

5.750%, 07/15/25 |

|

|

111,694 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

242,570 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Products — 0.3% |

|

|

|

|

| |

60,000 |

|

|

Avon International Operations, Inc.,

7.875%, 08/15/22 (a) |

|

|

62,633 |

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Products — continued |

|

|

|

|

|

Edgewell Personal Care Co., |

|

|

|

|

| |

20,000 |

|

|

4.700%, 05/19/21 |

|

|

21,300 |

|

| |

20,000 |

|

|

4.700%, 05/24/22 |

|

|

21,499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

105,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Consumer Staples |

|

|

1,194,293 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy — 13.7% |

|

|

|

|

|

|

|

|

Energy Equipment & Services — 1.7% |

|

|

|

|

|

|

|

|

Diamond Offshore Drilling, Inc., |

|

|

|

|

| |

35,000 |

|

|

4.875%, 11/01/43 |

|

|

23,975 |

|

| |

32,000 |

|

|

5.700%, 10/15/39 |

|

|

24,480 |

|

|

|

|

|

Ensco plc (United Kingdom), |

|

|

|

|

| |

35,000 |

|

|

4.500%, 10/01/24 |

|

|

25,725 |

|

| |

61,000 |

|

|

5.200%, 03/15/25 |

|

|

45,445 |

|

| |

38,000 |

|

|

5.750%, 10/01/44 |

|

|

24,415 |

|

| |

36,000 |

|

|

8.000%, 01/31/24 (a) |

|

|

32,400 |

|

|

|

|

|

Nabors Industries, Inc., |

|

|

|

|

| |

116,000 |

|

|

4.625%, 09/15/21 |

|

|

110,128 |

|

| |

76,000 |

|

|

5.000%, 09/15/20 |

|

|

76,000 |

|

| |

62,000 |

|

|

SESI LLC, 7.125%, 12/15/21 |

|

|

62,310 |

|

| |

36,100 |

|

|

Transocean Proteus Ltd. (Cayman Islands),

6.250%, 12/01/24 (a) |

|

|

37,815 |

|

|

|

|

|

Transocean, Inc. (Cayman Islands), |

|

|

|

|

| |

5,000 |

|

|

6.000%, 03/15/18 |

|

|

5,094 |

|

| |

40,000 |

|

|

6.800%, 03/15/38 |

|

|

30,600 |

|

| |

115,000 |

|

|

9.000%, 07/15/23 (a) |

|

|

122,475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

620,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil & Gas Services & Equipment — 0.2% |

|

|

|

|

| |

88,000 |

|

|

Rowan Co., Inc., 4.875%, 06/01/22 |

|

|

79,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels — 11.5% |

|

|

|

|

|

|

|

|

Andeavor Logistics LP/Tesoro Logistics Finance Corp., |

|

|

|

|

| |

40,000 |

|

|

5.250%, 01/15/25 |

|

|

42,400 |

|

| |

70,000 |

|

|

6.250%, 10/15/22 |

|

|

74,200 |

|

|

|

|

|

Antero Resources Corp., |

|

|

|

|

| |

100,000 |

|

|

5.125%, 12/01/22 |

|

|

100,250 |

|

| |

100,000 |

|

|

5.375%, 11/01/21 |

|

|

101,750 |

|

| |

60,000 |

|

|

5.625%, 06/01/23 |

|

|

61,050 |

|

|

|

|

|

Carrizo Oil & Gas, Inc., |

|

|

|

|

| |

55,000 |

|

|

6.250%, 04/15/23 |

|

|

53,350 |

|

| |

55,000 |

|

|

7.500%, 09/15/20 |

|

|

55,756 |

|

|

|

|

|

Cheniere Corpus Christi Holdings LLC, |

|

|

|

|

| |

60,000 |

|

|

5.125%, 06/30/27 (a) |

|

|

62,100 |

|

| |

114,000 |

|

|

5.875%, 03/31/25 |

|

|

122,550 |

|

| |

115,000 |

|

|

7.000%, 06/30/24 |

|

|

130,812 |

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

| 10 |

|

|

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

AUGUST 31, 2017 |

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Corporate Bonds — continued |

|

|

|

|

|

Oil, Gas & Consumable Fuels — continued |

|

|

|

|

| |

134,000 |

|

|

Chesapeake Energy Corp.,

8.000%, 12/15/22 (a) |

|

|

138,522 |

|

|

|

|

|

Concho Resources, Inc., |

|

|

|

|

| |

25,000 |

|

|

5.500%, 10/01/22 |

|

|

25,750 |

|

| |

140,000 |

|

|

5.500%, 04/01/23 |

|

|

144,200 |

|

|

|

|

|

CONSOL Energy, Inc., |

|

|

|

|

| |

170,000 |

|

|

5.875%, 04/15/22 |

|

|

170,000 |

|

| |

20,000 |

|

|

8.000%, 04/01/23 |

|

|

21,100 |

|

|

|

|

|

Continental Resources, Inc., |

|

|

|

|

| |

46,000 |

|

|

3.800%, 06/01/24 |

|

|

42,780 |

|

| |

100,000 |

|

|

4.500%, 04/15/23 |

|

|

98,500 |

|

| |

169,000 |

|

|

5.000%, 09/15/22 |

|

|

169,845 |

|

|

|

|

|

Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp., |

|

|

|

|

| |

40,000 |

|

|

5.750%, 04/01/25 |

|

|

40,500 |

|

| |

59,000 |

|

|

6.250%, 04/01/23 |

|

|

60,917 |

|

|

|

|

|

DCP Midstream Operating LP, |

|

|

|

|

| |

10,000 |

|

|

3.875%, 03/15/23 |

|

|

9,738 |

|

| |

35,000 |

|

|

5.350%, 03/15/20 (a) |

|

|

36,837 |

|

| |

20,000 |

|

|

(USD 3 Month LIBOR+3.850%),

5.850%, 05/21/43 (a) (d) |

|

|

18,550 |

|

|

|

|

|

Energy Transfer Equity LP, |

|

|

|

|

| |

35,000 |

|

|

5.500%, 06/01/27 |

|

|

37,275 |

|

| |

100,000 |

|

|

5.875%, 01/15/24 |

|

|

107,750 |

|

| |

105,000 |

|

|

7.500%, 10/15/20 |

|

|

118,519 |

|

| |

65,000 |

|

|

Genesis Energy LP/Genesis Energy Finance Corp.,

6.750%, 08/01/22 |

|

|

65,813 |

|

|

|

|

|

Gulfport Energy Corp., |

|

|

|

|

| |

35,000 |

|

|

6.000%, 10/15/24 (a) |

|

|

34,300 |

|

| |

20,000 |

|

|

6.375%, 05/15/25 (a) |

|

|

19,675 |

|

|

|

|

|

MEG Energy Corp. (Canada), |

|

|

|

|

| |

20,000 |

|

|

6.500%, 01/15/25 (a) |

|

|

18,575 |

|

| |

20,000 |

|

|

7.000%, 03/31/24 (a) |

|

|

15,900 |

|

|

|

|

|

Murphy Oil Corp., |

|

|

|

|

| |

10,000 |

|

|

4.000%, 06/01/22 |

|

|

9,800 |

|

| |

40,000 |

|

|

4.700%, 12/01/22 |

|

|

39,348 |

|

| |

40,000 |

|

|

6.875%, 08/15/24 |

|

|

42,250 |

|

|

|

|

|

Newfield Exploration Co., |

|

|

|

|

| |

70,000 |

|

|

5.375%, 01/01/26 |

|

|

73,150 |

|

| |

90,000 |

|

|

5.625%, 07/01/24 |

|

|

95,733 |

|

| |

26,000 |

|

|

5.750%, 01/30/22 |

|

|

27,430 |

|

| |

100,000 |

|

|

Oasis Petroleum, Inc.,

6.875%, 03/15/22 |

|

|

97,500 |

|

| |

35,000 |

|

|

Parsley Energy LLC/Parsley Finance Corp.,

5.375%, 01/15/25 (a) |

|

|

35,175 |

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels — continued |

|

| |

80,000 |

|

|

Peabody Energy Corp.,

6.375%, 03/31/25 (a) |

|

|

81,600 |

|

|

|

|

|

QEP Resources, Inc., |

|

|

|

|

| |

45,000 |

|

|

5.250%, 05/01/23 |

|

|

42,750 |

|

| |

55,000 |

|

|

6.875%, 03/01/21 |

|

|

57,063 |

|

|

|

|

|

Range Resources Corp., |

|

|

|

|

| |

65,000 |

|

|

4.875%, 05/15/25 |

|

|

62,237 |

|

| |

30,000 |

|

|

5.000%, 08/15/22 (a) |

|

|

29,550 |

|

| |

40,000 |

|

|

5.000%, 03/15/23 (a) |

|

|

39,304 |

|

| |

80,000 |

|

|

Rice Energy, Inc.,

6.250%, 05/01/22 |

|

|

83,200 |

|

| |

26,000 |

|

|

RSP Permian, Inc.,

6.625%, 10/01/22 |

|

|

26,975 |

|

| |

60,000 |

|

|

Seven Generations Energy Ltd. (Canada),

8.250%, 05/15/20 (a) |

|

|

62,400 |

|

|

|

|

|

SM Energy Co., |

|

|

|

|

| |

70,000 |

|

|

5.625%, 06/01/25 |

|

|

63,350 |

|

| |

30,000 |

|

|

6.125%, 11/15/22 |

|

|

28,350 |

|

| |

70,000 |

|

|

6.750%, 09/15/26 |

|

|

65,975 |

|

|

|

|

|

Southwestern Energy Co., |

|

|

|

|

| |

66,000 |

|

|

4.100%, 03/15/22 |

|

|

60,885 |

|

| |

24,000 |

|

|

5.800%, 01/23/20 |

|

|

24,720 |

|

| |

90,000 |

|

|

6.700%, 01/23/25 |

|

|

87,750 |

|

|

|

|

|

Sunoco LP/Sunoco Finance Corp., |

|

|

|

|

| |

70,000 |

|

|

6.250%, 04/15/21 |

|

|

72,800 |

|

| |

28,000 |

|

|

6.375%, 04/01/23 |

|

|

29,505 |

|

|

|

|

|

Targa Resources Partners LP/Targa Resources Partners Finance Corp., |

|

|

|

|

| |

65,000 |

|

|

4.125%, 11/15/19 |

|

|

65,731 |

|

| |

20,000 |

|

|

4.250%, 11/15/23 |

|

|

19,850 |

|

| |

35,000 |

|

|

6.750%, 03/15/24 |

|

|

37,888 |

|

|

|

|

|

Ultra Resources, Inc., |

|

|

|

|

| |

20,000 |

|

|

6.875%, 04/15/22 (a) |

|

|

19,675 |

|

| |

44,000 |

|

|

7.125%, 04/15/25 (a) |

|

|

42,900 |

|

|

|

|

|

Whiting Petroleum Corp., |

|

|

|

|

| |

85,000 |

|

|

5.000%, 03/15/19 |

|

|

84,150 |

|

| |

32,000 |

|

|

5.750%, 03/15/21 |

|

|

30,080 |

|

|

|

|

|

Williams Co., Inc. (The), |

|

|

|

|

| |

30,000 |

|

|

3.700%, 01/15/23 |

|

|

29,775 |

|

| |

115,000 |

|

|

4.550%, 06/24/24 |

|

|

117,588 |

|

|

|

|

|

WPX Energy, Inc., |

|

|

|

|

| |

100,000 |

|

|

6.000%, 01/15/22 |

|

|

103,125 |

|

| |

30,000 |

|

|

8.250%, 08/01/23 |

|

|

32,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,121,751 |

|

|

|

|

|

|

|

|

|

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| AUGUST 31, 2017 |

|

JPMORGAN EXCHANGE-TRADED FUNDS |

|

|

|

|

11 |

|

JPMorgan Disciplined High Yield ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

| PRINCIPAL AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Corporate Bonds — continued |

|

|

|

|

|

Refining & Marketing — 0.2% |

|

|

|

|

| |

60,000 |

|

|

PBF Holding Co. LLC/PBF Finance Corp.,

7.250%, 06/15/25 (a) |

|

|

59,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utilities — 0.1% |

|

|

|

|

| |

40,000 |

|

|

NGL Energy Partners LP/NGL Energy Finance Corp.,

7.500%, 11/01/23 (a) |

|

|

38,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Energy |

|

|