|

|

|

UNITED STATES

|

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

¨

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended ______________

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

x

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report: July 30, 2011

Commission file number: 000-53939

Sino Oil & Gas Pipe Holdings Limited

(Formerly Rich Mountain Enterprises Ltd.)

(Exact name of Registrant as Specified in its Charter)

British Virgin Islands

(Jurisdiction of Incorporation or Organization)

No 1. Road, Yuci Industrial Park,

Jin Zhong City,

Shanxi Province, 030600,

People’s Republic of China

(Address of Principal Executive Offices)

Xudong Liu

Tel: +86 (354) 3966-203

Fax: +86 (354) 3966-200

No 1. Road, Yuci Industrial Park,

Jin Zhong City,

Shanxi Province, 030600,

People’s Republic of China

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

|

None

|

None

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares, par value $0.01 per share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of July 30, 2011 was: 12,000,000 ordinary shares par value $0.01 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

x U.S. GAAP International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ¨

SINO OIL & GAS PIPE HOLDINGS LIMITED

(FORMERLY RICH MOUNTAIN ENTERPRISES LIMITED)

FORM 20-F SHELL COMPANY REPORT

TABLE OF CONTENTS

|

PART I

|

||

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

2

|

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

3

|

|

ITEM 3.

|

KEY INFORMATION

|

3

|

|

ITEM 4.

|

INFORMATION ON THE COMPANY

|

22

|

|

ITEM 4a.

|

UNRESOLVED STAFF COMMENTS

|

52

|

|

ITEM 5.

|

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

52

|

|

ITEM 6.

|

DIRECTORS, SENIOR MANAGEMENT, AND EMPLOYEES

|

79

|

|

ITEM 7.

|

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

81

|

|

ITEM 8.

|

FINANCIAL INFORMATION

|

82

|

|

ITEM 9.

|

THE OFFER AND LISTING

|

82

|

|

ITEM 10.

|

ADDITIONAL INFORMATION

|

83

|

|

ITEM 11.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

88

|

|

ITEM 12.

|

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

89

|

|

PART II

|

||

|

ITEM 13.

|

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

|

89

|

|

ITEM 14.

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

89

|

|

ITEM 15.

|

CONTROLS AND PROCEDURES

|

90

|

|

ITEM 16.

|

RESERVED

|

90

|

|

ITEM 16a.

|

AUDIT COMMITTEE FINANCIAL EXPERT

|

90

|

|

ITEM 16b.

|

CODE OF ETHICS

|

90

|

|

ITEM 16c.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

90

|

|

ITEM 16d.

|

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

|

90

|

|

ITEM 16e.

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

|

90

|

|

ITEM 16f.

|

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT

|

90

|

|

ITEM 16g.

|

CORPORATE GOVERNANCE

|

91

|

|

PART III

|

||

|

ITEM 17.

|

FINANCIAL STATEMENTS

|

92

|

|

ITEM 18.

|

FINANCIAL STATEMENTS

|

92

|

|

ITEM 19.

|

EXHIBITS

|

92

|

i

CERTAIN INFORMATION

In this shell company report on Form 20-F, unless otherwise indicated, “we,” “us,” “our,” the “Company” , the “Shell Company” and “Sino Oil & Gas” refer to Sino Oil & Gas Pipe Holdings Limited, formerly RICH MOUNTAIN ENTERPRISES LTD., a company organized in the British Virgin Islands, and its subsidiaries and consolidated entities, subsequent to the business combination referred to below. The “business combination” refers to the share exchange between the Shell Company and the shareholders of RISE KING MANAGEMENT LIMITED, Or RISE KING, resulting in(i) each of the RISE KING Shareholders shall sell, transfer, convey, assign and deliver to the Shell Company each share of its RISE KING Stock free and clear of all Liens, in exchange for 140 newly issued ordinary shares of Shell Company Stock and (ii) the Shell Company Shareholder shall sell, transfer, convey, assign and deliver to the RISE KING Shareholders all of the capital stock of the Shell Company issued and outstanding on the Closing Date free and clear of all Liens in exchange for an aggregate of $200,000 (which is equal to $0.04 per share) in cash, which was consummated on July 30, 2011.

Unless the context indicates otherwise, all references to “China” refer to the People’s Republic of China. All references to “Renminbi” or “RMB” are to the legal currency of the People’s Republic of China and all references to “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States. This report contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. We make no representation that the Renminbi or U.S. dollar amounts referred to in this report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On July 30, 2011, the cash buying rate announced by the People’s Bank of China was RMB 6.4282 to $1.00.

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects” and elsewhere in this report.

1

PART I

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

1.A. Directors and Senior Management

The following table lists the members of the Company’s board of directors:

|

Name

|

Age

|

Position(s)

|

||

|

Xudong Liu

|

31

|

Chairman

|

||

|

Ning Li

|

42

|

Director

|

||

|

Lizi Liu

|

46

|

Director

|

The business address for each of our directors is: No. 1 Road, Yuci Industrial Park. Jinzhong City, Shanxi Province, P.R.C..

The following table lists the senior management of the Company:

|

Name

|

Age

|

Position(s)

|

||

|

Ning Li

|

42

|

CEO

|

||

|

Hongteng Yang

|

55

|

CFO

|

The business address for each of the members of senior management is: No. 1 Road, Yuci Industrial Park. Jinzhong City, Shanxi Province, P.R.C..

See Item 6.A. – Directors and Senior Management below for more information about our directors and executive officers.

1.B. Advisors

The Company’s legal advisors in the People’s Republic of China are: Dacheng Law Offices, 30/F, China Development Bank Building, No. 500 Pudongnan Road, Shanghai 200120, China.

The Company’s legal advisors in the United States are: Kramer Levin Naftalis & Frankel LLP, 1177 Avenue of the Americas, New York, NY 10036.

1.C. Auditors

The Company’s auditors are: Weinberg & Company, P.A. 6100 Glades Road. Suite 205 Boca Raton, Florida 33434, U.S.A. See Item 16.F – Change in Registrant’s Certifying Accountant below for information about the change in our auditor following the business combination.

Weinberg & Company, P.A. has confirmed that it is independent with respect to the Company under the guidelines of the SEC and the Independence Standards Board.

2

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

Not Applicable.

|

ITEM 3.

|

KEY INFORMATION

|

3.A. Selected Financial Data

The following selected financial information should be read in connection with, and is qualified by reference to, our consolidated financial statements and their related notes and the section entitled “Operating and Financial Review and Prospectus,” each of which is included elsewhere in this report. The consolidated statements of operations and comprehensive income data for the fiscal years ended April 30, 2010 and 2009 and the balance sheets data as of April 30, 2010 and 2009 are derived from the audited consolidated financial statements included elsewhere in this report. The consolidated statements of operations and comprehensive income data for the fiscal years ended April 30, 2008, 2007 and 2006 and the balance sheets data as of April 30, 2008, 2007 and 2006 have been derived from unaudited financial statements that are not included in this report. Our historical results for any of these periods are not necessarily indicative of results to be expected in any future period.

The current corporate structure was completed as of April, 2011. Before the completion of the structure, all the companies included in this structure were under common control of the same major shareholder, Mr. Xudong Liu. The Company believes that it is proper to present the selected financial data “as if” the structure was completed at the beginning of the earliest period presented below.

3

|

Consolidated Statements of Income (loss) and Comprehensive Income (loss)

Years Ended April 30,

|

||||||||||||||||||||

|

2010

(Audited)

|

2009

(Audited)

|

2008

(Unaudited)

|

2007

(Unaudited)

|

2006

(Unaudited)

|

||||||||||||||||

|

Revenue, net

|

$ | 146,835,283 | $ | 152,511,228 | $ | 108,001,988 | $ | 82,288,351 | $ | 59,750,922 | ||||||||||

|

Cost of goods sold

|

(123,110,120 | ) | (130,600,207 | ) | (91,842,042 | ) | (70,256,431 | ) | (52,637,924 | ) | ||||||||||

|

Gross profit

|

23,725,163 | 21,911,021 | 16,159,946 | 12,031,920 | 7,112,998 | |||||||||||||||

|

Selling and marketing expenses

|

(3,952,504 | ) | (5,878,246 | ) | (5,776,583 | ) | (3,885,392 | ) | (2,038,229 | ) | ||||||||||

|

General and administrative expenses

|

(3,003,542 | ) | (2,387,684 | ) | (1,706,053 | ) | (1,341,527 | ) | (1,180,585 | ) | ||||||||||

|

Research and development expenses

|

(33,111 | ) | (11,713 | ) | - | - | - | |||||||||||||

|

Total Operating Expenses

|

(6,989,157 | ) | (8,277,643 | ) | (7,482,636 | ) | (5,226,919 | ) | (3,218,814 | ) | ||||||||||

|

Income from operations

|

16,736,006 | 13,633,378 | 8,677,310 | 6,805,001 | 3,894,184 | |||||||||||||||

|

Interest expense

|

(9,765,845 | ) | (9,216,142 | ) | (7,819,587 | ) | (5,470,828 | ) | (4,672,549 | ) | ||||||||||

|

Interest income

|

2,438,152 | 2,673,890 | 478,004 | 308,463 | 30,340 | |||||||||||||||

|

Other income (expense), net

|

36,313 | (91,537 | ) | 2,071,238 | (26,268 | ) | 85,849 | |||||||||||||

|

Income (loss) before income taxes

|

9,444,626 | 6,999,589 | 3,406,965 | 1,616,368 | (662,176 | ) | ||||||||||||||

|

Income taxes

|

(2,868,260 | ) | (2,026,906 | ) | (1,124,300 | ) | (862,654 | ) | - | |||||||||||

|

Net income (loss)

|

6,576,366 | 4,972,683 | 2,282,665 | 753,714 | (662,176 | ) | ||||||||||||||

|

Net income attributable to non-controlling interest

|

(10,824 | ) | (6,079 | ) | (21,900 | ) | 19,004 | 29,291 | ||||||||||||

|

Net income (loss) attributable to controlling interest

|

6,565,542 | 4,966,604 | 2,260,765 | 772,718 | (632,885 | ) | ||||||||||||||

|

Other comprehensive income (loss)

|

13,358 | (116,373 | ) | (1,242,438 | ) | (503,885 | ) | - | ||||||||||||

|

Comprehensive Income (loss)

|

$ | 6,578,900 | $ | 4,850,231 | $ | 1,018,327 | $ | 268,833 | $ | (632,885 | ) | |||||||||

4

|

Balance Sheets Data (at end of fiscal year )

|

April 30,

|

|||||||||||||||||||

|

(in U.S. Dollars)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||

|

Audited

|

Audited

|

Unaudited

|

Unaudited

|

Unaudited

|

||||||||||||||||

|

Cash and cash equivalents

|

$ | 6,413,448 | $ | 1,980,229 | $ | 5,657,767 | $ | 4,890,833 | $ | 3,917,200 | ||||||||||

|

Total current assets

|

164,811,655 | 142,642,497 | 103,905,033 | 83,718,634 | 68,204,529 | |||||||||||||||

|

Total assets

|

267,779,636 | 231,862,383 | 207,360,029 | 161,709,216 | 140,633,103 | |||||||||||||||

|

Total liabilities

|

220,461,001 | 191,133,463 | 171,137,837 | 136,533,283 | 115,706,999 | |||||||||||||||

|

Total shareholders’ equity

|

47,318,635 | 40,728,920 | 36,222,192 | 25,175,933 | 24,926,104 | |||||||||||||||

|

Total liabilities and shareholders’ equity

|

267,779,636 | 231,862,383 | 207,360,029 | 161,709,216 | 140,633,103 | |||||||||||||||

5

3.A.3. Exchange Rates

Not Applicable.

3.B. Capitalization and Indebtedness

The following table sets forth our capitalization and indebtedness as of January 31, 2011 on an actual basis. This information should be read in conjunction with our consolidated financial statements and the notes relating to such statements appearing elsewhere in this report.

|

January 31,

|

||||

|

Cash:

|

2011

|

|||

|

Cash and cash equivalents

|

$ | 2,801,465 | ||

|

Restricted cash (1)

|

50,114,660 | |||

|

Debt:

|

||||

|

Notes payable (1)

|

55,436,601 | |||

|

Short-term bank loans (2)

|

112,798,503 | |||

|

Product and other financing arrangements(3)

|

36,321,376 | |||

|

Shareholders’ equity:

|

||||

|

Common stock, $1 par value

|

50,000 | |||

|

Accumulated other comprehensive income

|

2,203,445 | |||

|

Additional paid-in capital

|

52,584,504 | |||

|

Retained deficit

|

(303,993 | ) | ||

|

Non-controlling interest

|

114,688 | |||

|

Total shareholders’ equity

|

$ | 54,648,644 | ||

(1) Restricted cash represents amounts held by a bank as security for bank acceptance notes and domestic letters of credit financing and therefore is not available for the Company’s use until such time as the bank acceptance notes and domestic letters of credit have been fulfilled or expired, normally within a three and twelve month period. All the notes payable are subject to bank charges of 0.05% of the principal amount as commission on each loan transaction.

(2) Short-term bank loans are obtained from local banks in China. All the short-term bank loans are repayable within one year and are secured by property, plant and equipment and land use rights owned by us, as well as by guarantees made by our related and unrelated parties.

(3) The liabilities are due to two unrelated parties. The balances represent funds received to support our Company’s business operations. The inventory described in the product financing arrangements was not shipped to unrelated parties and the title did not pass to unrelated parties. However, the unrelated parties have the right to request the shipment if our Company do not perform our repurchase obligation. Such transaction was also secured by a land use right and the additional paid in capital.

3.C. Reasons For The Offer And Use Of Proceeds

Not Applicable.

3.D. Risk Factors

You should carefully consider the risks described below in evaluating our business before investing in our ordinary shares. If any of the following risks were to occur, our business, results of operations and financial condition could be harmed. In that case, the trading price of our ordinary shares could decline and you might lose all or part of your investment in our ordinary shares. You should also refer to the other information set forth in this report, including our consolidated financial statements and the related notes and the section captioned “Operating and Financial Review and Prospects” before deciding whether to invest in our ordinary shares.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Our revenue is generated substantially from the sale of a single product.

We generate a significant majority of our revenue from the sale of SSAW and ERW pipes. For the year ended 30 April 2009 and 30 April 2010, sales of SSAW pipes accounted for 57.5% and 83.7% of the Group’s revenue, respectively. Approximately 70% of large-diameter petroleum and natural gas pipelines in China are constructed using SSAW pipes, however, ERW pipes are commonly used as sub-pipelines which are limited by the coil width and are thinner in wall thickness and smaller in diameter . A shift in market preference for other types of pipes among pipeline operators or a substantial reduction in pipe price for SSAW pipe or ERW pipe may result in lost sales. To the extent that we are not able to replace sales lost to other types of pipes, our business, financial condition and results of operations would be adversely affected. If we cannot expand our product offering to include other pipes as planned or other products in the future, our source of revenue will remain concentrated on SSAW pipes and our financial condition, results of operations and growth prospects may be adversely affected.

6

Our revenue largely depends on public spending on petroleum and natural gas pipeline infrastructure.

We believe our revenue and sales volume increased significantly during the Period, in part, as a result of favorable government policies that have supported substantial public spending on petroleum and natural gas pipeline infrastructure, including a fiscal stimulus plan in 2008 in response to the global economic crisis. We cannot assure you that government support for pipeline infrastructure spending will remain as strong or at sufficient levels to sustain our current sales volume or growth rates. A reduction in pipeline spending may reduce demand for our products and adversely affect our financial condition, results of operations and growth prospects.

We are vulnerable to the delay or rescheduling of petroleum and natural gas pipeline projects.

We derive a substantial majority of our revenue from sales of high-grade SSAW pipes, which have enjoyed greater demand in recent years due to the continued development and growth of the PRC economy, active exploration and production activities by petroleum and natural gas companies, and favorable government energy policies, which in turn have resulted in the construction of more petroleum and natural gas pipelines.

Planned and ongoing petroleum and natural gas pipeline projects can be delayed or rescheduled for a number of reasons including, among other factors, changes in the business strategy of pipeline operators, technical difficulties, natural disasters, delays in regulatory approval or budget constraints. We believe that our ongoing projects and the projects for which we have secured supply contracts will contribute significantly to our revenue and profitability. However, should any of the major projects to which we plan to supply line pipes be delayed or rescheduled, our financial forecasts for the year ending 30 April 2011 could become materially inaccurate.

The delay or rescheduling of such projects might also lead to the termination of supply contracts for our products. In the event that our supply contracts are terminated, our business, financial condition and results of operations may be materially and adversely affected.

We are exposed to risks arising from credit terms extended to our customers.

We are exposed to the risk of payment delays and defaults by our two major customers, namely the Company A and the Company B, arising from the credit terms granted to these customers. As of April 30, 2009 and April 30, 2010, the accounts receivables balance of SXGL, inclusive of retention money withheld by customers to guarantee against major quality defects in our delivered products, was $15.6 million and $35.2 million, respectively. Our credit terms vary by customers. Credit terms that are extended to domestic customers for our SSAW pipes and ERW pipes are generally 60 days. Payments by overseas customers for our overseas sales of SSAW or ERW pipes are generally made by letter of credit. For the year ended April 30, 2009 and April 30, 2010, the accounts receivable turnover days for the company were 43 days and 63 days, respectively.

There may be a time gap between the maturity of our payables and receivables. To the extent that our receivable turnover days exceed our payable turnover days, we may be required to raise additional working capital. In addition, we cannot assure you that we will be able to maintain or improve current payment terms with our major customers, who have substantial bargaining power over us.

7

We cannot guarantee the timeliness of our customers’ payments or that such customers will be able to perform their obligations. Any inability on the part of our domestic customers to settle their payments in a timely manner may adversely affect our financial performance and cash flow.

We may fail to secure supply contracts for new projects through competitive bidding.

Our revenue is generated on a project basis from pipeline projects that are non-recurring in nature. Approximately 80% of contracts of the SXGL, based on contract value, were secured through bidding and negotiation, our financial performance is dependent on our ability to maintain our bidding eligibility, submit competitive bids and continually secure supply contracts.

In addition, due to the nature of the PRC petroleum and natural gas pipeline industry, the value of projects that we are able to secure may fluctuate from year to year. We cannot assure you that we will continue to secure new supply contracts or that these supply contracts will be profitable. If we are unable to secure profitable supply contracts, our business, financial performance and financial position will be adversely affected.

Fluctuations in global petroleum and natural gas prices could lead to reduced demand for our products and services.

Our primary product, SSAW pipes, is used to transport petroleum and natural gas. Demand for SSAW pipes directly correlates with, among other things, the level of demand and prices for petroleum and natural gas. Fluctuations, especially a sustained period of decline, in petroleum and natural gas prices would affect the investment policies and capital spending by petroleum and natural gas companies which in turn could reduce the level of demand for our products and services and adversely affect our financial condition and results of operations.

We cannot predict the future movement of petroleum and natural gas prices nor can we provide any assurance that these prices will otherwise remain at sufficiently high levels to support demand for our products. Any sustained decline in the prices of petroleum and natural gas may reduce the willingness of petroleum and natural gas companies to invest in petroleum and natural gas pipeline projects, which may have a detrimental effect on demand for or prices of our products and, as a result, materially and adversely affect our results of operations and financial condition.

We may experience shortages of or price increases in raw materials.

Our production depends on our ability to obtain adequate supplies of raw material on commercially acceptable terms and in a timely manner. A shortage of any of our key raw materials may increase the prices of such materials and reduce our profit margins to the extent that we are unable to pass these price increases to our customers. Raw material purchases accounted for 91% and 88% of the cost of sales of SXGL for the year ended April 30, 2009 and April 30, 2010, respectively.

The principal raw material in our operations and production of SSAW and ERW pipes is hot-rolled steel coils/Strip. The price of steel has historically fluctuated significantly in line with supply and demand, price fluctuations in iron ore and coking coal and government policies on steel and related industries, among other factors.

For the year ended April 30, 2009 and April 30, 2010, raw material purchases from the five largest suppliers of SXGL, which are all Independent Third Parties, accounted for approximately 56.4% and 38.1%, respectively. We have not entered into any long-term supply agreement with these suppliers, and cannot assure you we will be able to procure sufficient supplies of raw materials on acceptable terms.

8

Failure to compete effectively in our industry may adversely affect our business and prospects.

We face competition in the domestic PRC market from a number of manufacturers that produce steel pipes that are similar to, or can be used as substitutes for, our products. Our major competitors for SSAW pipes include Baoji Petroleum Steel Pipe Co., Ltd., The Steel Pipe Works Of North China Petroleum, Shandong Shengli Steel Pipe Co., Ltd. , Shashi Steel Pipe Works of Jianghan Petroleum Administration Bureau, SINOPEC. , and Shanghai BSW Petro-Pipe Co., Ltd. The majority of these competitors are all units of CNPC which may have priority by virtue of their affiliation with CNPC when demand for line pipes is limited.

Our ability to compete depends on our ability to offer sufficient quantities of high quality products that are suitable for our customers’ needs at competitive prices. In addition, our competitiveness depends on our ability to maintain our track record of short lead-times, timely deliveries, low transportation costs and superior customer service. Competitive pressure may require us to reduce our prices and therefore adversely affect our profit margins and results of operations. Our failure to compete effectively could materially and adversely affect our business, financial condition, results of operations and market position.

Any significant downtime in our production facilities would adversely affect our business.

Our business requires substantial investments in complex production facilities and the uninterrupted operation of specialized manufacturing equipment. Our production facilities require periodic shutdowns for repair and maintenance. Major maintenance of our production facilities occurs approximately each year for a month each time.

Substantial damage to our production facilities from extraordinary events, such as earthquakes, floods and fires, or resulting consequences and disruptions, could be costly and time-consuming to repair and may disrupt our production. Any disruption or delay in our production may require us to incur additional expenses in order to produce sufficient inventory and could impair our ability to meet the demand of customers and cause our customers to cancel orders, any of which could negatively affect our reputation and results of operations.

We may incur significant costs in relation to warranties provided to our customers.

We may incur significant costs in relation to warranties provided to certain of our customers. Consistent with industry practice, we allow our SSAW pipe customers to retain 5% to 10% of the purchase price for sales of goods for a warranty period ranging from 12 to 18 months after delivery as a warranty provision against any major quality defects in our delivered products. We also warrant our SSAW pipes to be free of certain defects, and we guarantee the quality of our products for the warranty period, during which we will rectify any defects.

The warranty arrangement requires that the money retained by our customers be paid to us if there are no major quality issues with our products during the warranty period. Historically, we have recovered all of the money retained by our customers as it became due. We cannot assure you, however, that we can maintain our historical recovery rate for retention money in the future.

9

We have limited insurance coverage.

The insurance industry in China is in an early stage of development compared with countries such as the United States. Insurance companies in China offer limited commercial insurance products. Consistent with what we believe to be customary practice in the petroleum and natural gas steel pipe industry in China, we do not have any product liability, business interruption, or litigation insurance coverage for our operations. Any uninsured loss or damage to property, litigation or business disruption may cause us to incur substantial costs and the diversion of resources, which could have a material adverse effect on our financial condition and results of operations. The occurrence of certain incidents including earthquake, fire, severe weather, war, floods, power outages and the consequences, damages and disruptions resulting from them may not be covered adequately or at all by our insurance policies. If we were to incur substantial liabilities that are not covered by our insurance policies or if our business operations were interrupted for a substantial period of time, we could incur costs and losses that could materially and adversely affect our business, financial condition, results of operations and business prospects.

Our expansion plans require significant and continual capital expenditures, for which we may not have adequate financial resources.

Our expansion plans will require us to make substantial capital expenditures and assume consequential risks. We may need to raise additional funds through bank borrowing or the issuance of debt or equity securities to finance these capital expenditures. However, our ability to obtain additional financing in the future is subject to a variety of factors, including, but not limited to:

|

|

·

|

obtaining the necessary PRC Government approvals to repatriate funds that are raised overseas;

|

|

|

·

|

our future financial condition, results of operations and cash flows;

|

|

|

·

|

general market conditions for capital raising activities by similar companies; and

|

|

|

·

|

economic, political and other conditions in China and elsewhere.

|

We may be unable to obtain additional financing in a timely manner or on acceptable terms or at all. Moreover, the utilization of debt, equity or other capital resources may not create value for us or our Shareholders. Further financing activities or the remittance of the proceeds into China may also require PRC regulatory approvals, which may not be granted in a timely manner or at all. If adequate funding is delayed or not available, our ability to develop and expand our business may be adversely affected and if we have to divert our capital resources allocated for other uses to finance our capital expenditure plans, our operating results and financial condition may also be adversely affected.

Our business operations and financial condition may be adversely affected by present or future environmental, health and safety laws and regulations or enforcement.

As a company with substantially all of its operations in China, we are subject to various periodic inspections, examinations, inquiries and audits by PRC regulatory authorities in accordance with applicable PRC environmental, health and safety laws and regulations, as part of maintaining or renewing the various licenses, certificates and permits required for conducting business. As the PRC environmental, health and safety laws and regulations continue to change, we cannot guarantee that we will continue to be in compliance with all applicable laws or that we will not incur additional costs to comply with such laws and regulations. Failure to comply with any of these laws and regulations could result in the untimely delivery of goods, delayed receipt of revenue, loss of income, the accrual of substantial costs and fines and the suspension or termination of our contracts. Any limitations or costs incurred as a result of our non-compliance with environmental, health and safety laws and regulations may have a material adverse effect on our business, financial condition and results of operations.

10

Protectionist measures such as initiation of anti-dumping and anti-subsidy proceedings and imposition of anti-dumping and/or countervailing duties by governments in our overseas markets could materially and adversely affect our export sales.

During the Period, we did not generate a large portion of revenue from overseas sales of our SSAW pipes outside China. The overseas sales of our SSAW or ERW pipes to North America and Europe area for the year ended April 30, 2009 and April 30, 2010 accounted for 6.6% and 0.3% of total sales of SXGL, respectively. We, however, may enter into overseas sales in the future and such sales may trigger anti-dumping or anti-subsidy proceedings, or both, in the countries where our products are sold.

Anti-dumping and anti-subsidy proceedings have been initiated by local producers in countries such as the United States and EU in relation to steel products. These proceedings have resulted in the imposition of significant penalties, anti-dumping or countervailing duties, or a combination of the foregoing. These and other similar measures could trigger trade disputes in the international steel product markets. While the majority of our overseas customers are from Africa and other Asia countries, , we cannot guarantee that our plans to expand overseas will not increase the risk of protectionist investigations or proceedings against us. Any such investigation or proceeding would divert significant time and resources from us if unsuccessful and impede access to export markets for our products and limit our growth opportunities if successful.

Failure to protect our corporate name and reputation effectively may affect our business and financial performance.

We believe that we have an established corporate name and reputation that are widely recognized by peers and customers in our industry. We consider our corporate name and reputation to be vital in promoting recognition and customer loyalty. Any major defects in our products or any adverse publicity regarding us may harm our corporate image and reputation and cause our customers to lose confidence in our products, which would in turn adversely affect the number of projects we may secure and have a negative impact on our business and financial performance.

We may not successfully obtain and maintain the necessary regulatory permits, approvals or clearance for the manufacture and sale of our products in certain markets.

The manufacture of petroleum and natural gas line pipes is regulated by the government, industry organizations and international standardization bodies, which set requirements and standards for the manufacturing, functionality and safety performance of our products. Our adherence to such requirements and standards can be expensive, which can result in increased manufacturing and development costs. Although we have been advised by our PRC legal advisers, Dacheng Law Offices, that we possessed all necessary regulatory permits, approvals and clearances for the manufacture and sale of our products, any failure to maintain such permits and approvals could have a material adverse effect on our business and prospects. In addition, extensive government regulation and the related delays in seeking the appropriate approvals can significantly delay the introduction of new products, which could materially and adversely affect our market competitiveness. Even if we do obtain approval from the appropriate authorities, it may be granted on a limited basis or subject to modification of our products, which could increase operation costs.

We cannot guarantee that we will receive the necessary regulatory approvals to market our products in the countries and markets where we may seek approval in the future. Moreover, even if we obtain the requisite approvals for our current products, we cannot guarantee that we will remain compliant with these countries’ regulations in the future. Any failure to do so may result in a variety of actions against us, including penalties, injunctions, suspension of production, loss of regulatory approvals, product recalls and termination of distribution.

11

Our levels of indebtedness and interest payment obligations may adversely affect our business.

Our current levels of debt and the instability in debt markets may affect our ability to secure funding for current operations and future production expansion. Historically, we have primarily relied upon short-term borrowings to fund a portion of our capital expenditures and operations. As of April 30, 2010, our total bank borrowings amounted to $104 million. We recorded net current liabilities of $191 million and $220 million as of April 30, 2009 and April 30, 2010, respectively, primarily due to a combine effect of operating activity and financing needs.

We may seek additional financing in the form of loans for planned capital expenditures and future expansion plans. The level of our indebtedness and the amount of our interest payments could limit our ability to obtain the necessary financing or obtain favorable terms for the financing to fund future capital expenditures and working capital. A shortage of such funds could restrict our ability to prepare for organic and acquisitive growth, or to react to changing market conditions. Such limitations on our debt financing could reduce our competitiveness and increase our exposure and sensitivity to adverse economic and industry conditions, which could have an adverse effect on our financial condition and results of operations.

Our products may subject us to product liability claims.

We may be subject to product liability claims under the laws of applicable jurisdictions where our products are installed if our products are defective and result in our customers’ or any third parties’ financial loss or personal injury. We do not carry product liability insurance to protect us against these claims. Although we were not subject to any product liability claims during the Period, we cannot assure you that we will not be subject to future product liability claims or that if any such claim is successful, our business and results of operations will not be materially and adversely affected. Further, we may be held liable for any damages or losses incurred in connection with or arising from defects in our products. Even if claims are not brought against us or our customers or if the claims fail, our business relationship with customers may be undermined as a result of any alleged product failure, which in turn may result in the loss of future business.

Our manufacturing processes involve inherent risks and occupational hazards.

Our business operations, particularly our manufacturing activities, involve risks and occupational hazards that are inherent to the manufacturing industry and which cannot be completely eliminated through preventive efforts. During the X-ray inspection of line pipes, our employees may be exposed to hazards caused by inhalation of chemical substances or radiation. We cannot assure you that accidents, which may result in property damage, severe personal injuries or even fatalities, will not occur at our production facilities. The occurrence of any of the foregoing events may have an adverse effect on our business, financial condition and results of operations.

Power shortages or substantial increase in energy costs could have an adverse impact on our operations.

We consume substantial amounts of electricity in our production process. Our production schedules may be affected by power shortages and blackout periods as we do not have backup generators at our production facilities. If the PRC Government imposes restrictions on the use of electricity due to power shortages, thereby disrupting our power supply, or if we are otherwise unable to obtain adequate supplies of electricity to meet our production requirements, our operations may be disrupted and our production and delivery schedules may be adversely affected. During the Period, we did not experience any material disruption to our production due to power shortages. In addition, our ability to pass increased energy costs along to our customers may be limited by pressures from competition and customer resistance. We cannot assure you that we will be able to recover the substantial cost increases of energy by raising the prices of our products.

12

Risks Related to Our Business

Our operations are cash intensive, and our business could be adversely affected if we fail to maintain sufficient levels of liquidity and working capital.

Historically, we have spent a significant amount of cash on our operational activities, principally to maintain adequate levels of inventory. We finance our operations primarily through operating profit, short-term bank borrowings from local banks in the PRC. If we fail to continue to generate sufficient cash flow, we may not have sufficient liquidity to fund our operating costs and our business could be adversely affected.

Our short-term loans are from Chinese banks and are generally secured by our inventories and/or guarantees by third parties. The term of almost all such loans is one year or less. Historically, we have rolled over such loans on an annual basis. However, we may not have sufficient funds available to pay all of our borrowings upon maturity in the future. Failure to roll over our short-term borrowings at maturity or to service our debt could result in the imposition of penalties, including increases in interest rates, legal actions against us by our creditors, or even insolvency.

If available liquidity is not sufficient to meet our operating and loan obligations as they come due, our plans include considering pursuing alternative financing arrangements, reducing expenditures as necessary, or limiting our plans for expansion to meet our cash requirements. However, there is no assurance that, if required, we will be able to raise additional capital, reduce discretionary spending or efficiently limit our expansion to provide the required liquidity. Currently, the capital markets for small capitalization companies are extremely difficult and banking institutions have become stringent in their lending requirements. Accordingly, we cannot be sure of the availability or terms of any third party financing. If we are unable to raise additional financing, we may be unable to implement our long-term business plan, develop or enhance our products, take advantage of future opportunities or respond to competitive pressures on a timely basis. In the alternative, if we raise capital by issuing equity or convertible debt securities, such issuances could result in substantial dilution to our shareholders.

As we expand our operations, we may need to establish a more diverse supplier network for our materials. The failure to secure a more diverse and reliable supplier network could have an adverse effect on our financial condition.

We currently purchase almost all of our materials from a small number of suppliers. During fiscal years 2009 and 2010, we purchased approximately 56.4% and 38.1%, respectively, of our raw materials from our top five suppliers. As we increase the scale of our operations, we may need to establish a more diverse supplier network, while attempting to continue to leverage our purchasing power to obtain favorable pricing and delivery terms. However, in the event that we need to diversify our supplier network, we may not be able to procure a sufficient supply of high quality raw materials at a competitive price, which could have an adverse effect on our results of operations, financial condition and cash flows.

Furthermore, despite our efforts to control our supply of hot-rolled steel Coils/Strip and maintain good relationships with our existing suppliers, we could lose one or more of our existing suppliers at any time. The loss of one or more key suppliers could increase our reliance on higher cost or lower quality supplies, which could negatively affect our profitability. Any interruptions to, or decline in, the amount or quality of our raw materials could materially disrupt our production and adversely affect our business, financial condition and financial prospects.

13

We are subject to various risks and uncertainties that might affect our ability to procure high quality raw materials.

Our performance depends on our ability to procure high quality raw materials on a timely basis from our suppliers. Our supplies are subject to certain risks, including availability of materials, labor disputes, inclement weather, natural disasters, and general economic and political conditions, which might limit the ability of our suppliers to provide us with high quality merchandise on a timely basis. Furthermore, for these or other reasons, one or more of our suppliers might not adhere to our quality control standards, and we might not identify the deficiency. Our suppliers’ failure to supply quality materials at a reasonable cost on a timely basis could reduce our net sales, damage our reputation and have an adverse effect on our financial condition.

Our inability to manage our growth may have a material adverse effect on our business, results of operations and financial condition.

We have experienced significant growth since we began operations in 2000. Our revenues have declined from approximately $152,511,228 in the year ended April 30, 2009 to approximately $146,835,283 in the year ended April 30, 2010.

We expect our growth to continue to place significant demands on both our management and our resources. This requires us to continuously evolve and improve our operational, financial and internal controls across our organization. In particular, continued expansion increases the challenges we face in:

|

|

·

|

recruiting, training and retaining sufficient skilled sales and management personnel;

|

|

|

·

|

adhering to our high quality and process execution standards;

|

|

|

·

|

maintaining high levels of customer satisfaction;

|

|

|

·

|

creating and managing economies of scale;

|

|

|

·

|

maintaining and managing costs to correspond with timeliness of revenue recognition; and

|

|

|

·

|

developing and improving our internal administrative infrastructure, including our financial, operational and communication systems, processes and controls.

|

Any inability to manage our growth may have a material adverse effect on our business, results of operations and financial condition.

Our quarterly results may fluctuate because of many factors and, as a result, investors should not rely on quarterly operating results as indicative of future results.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the value of our securities. Quarterly operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in quarterly operating results could cause the value of our securities to decline. Investors should not rely on quarter-to-quarter comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in future periods our results of operation may be below the expectations of public market analysts and investors. Factors that may affect our quarterly results include:

|

|

·

|

vulnerability of our business to a general economic downturn in China;

|

|

|

·

|

fluctuation and unpredictability of costs related to our raw materials;

|

|

|

·

|

changes in the laws of the PRC that affect our operations;

|

|

|

·

|

competition from our competitors;

|

|

|

·

|

our ability to obtain all necessary government certifications and/or licenses to conduct our business; and

|

|

|

·

|

development of a public trading market for our securities.

|

14

Our success depends in large part upon our senior management and key personnel and our inability to attract or retain these individuals could materially and adversely affect our business, results of operations and financial condition.

We are highly dependent on our senior management, including Mr. Xudong Liu and Mr. Ning Li. Our future performance will be dependent upon the continued service of members of our senior management. Competition for senior management in our industry is intense, and we may not be able to retain our senior management and key personnel or attract and retain new senior management and key personnel in the future, which could materially and adversely affect our business, results of operations and financial condition.

One shareholder owns a large percentage of our outstanding stock and could significantly influence the outcome of our corporate matters.

Currently, Xudong Liu, beneficially owns approximately 63.6% of our outstanding ordinary shares. As our majority shareholder, Xudong Liu is able to exercise significant influence over all matters that require shareholder approval, including the election of directors to our board and approval of significant corporate transactions that we may consider, such as a merger or other sale of our company or our assets. This concentration of ownership in our shares by Xudong Liu will limit your ability to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control over us.

Our business could be materially adversely affected if we cannot protect our intellectual property rights.

We have developed trademarks, patents, know-how, trade names and other intellectual property rights that are of significant value to us. However, the legal regime governing intellectual property in the PRC is still evolving and the level of protection of intellectual property rights in the PRC may differ from those in other jurisdictions. Thus, it may be difficult to enforce our rights relating to our intellectual property. In the event of the occurrence of any unauthorized use of, or other infringement to, our intellectual property, potential sales of our products might be diverted to such unauthorized sellers and could cause potential damage to, or dilute the value of, such rights or our brand.

Our inability to maintain appropriate internal financial reporting controls and procedures could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. As a public company, we have significant requirements for enhanced financial reporting and internal controls. We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and, for many companies, a report by the independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not in the future identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to comply with Sarbanes-Oxley and meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

15

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We expect the rules and regulations to which public companies are subject, including Sarbanes-Oxley, to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements.

Risks Related to Our Corporate Structure

The PRC government may determine that our corporate structure is not in compliance with applicable PRC laws, rules and regulations.

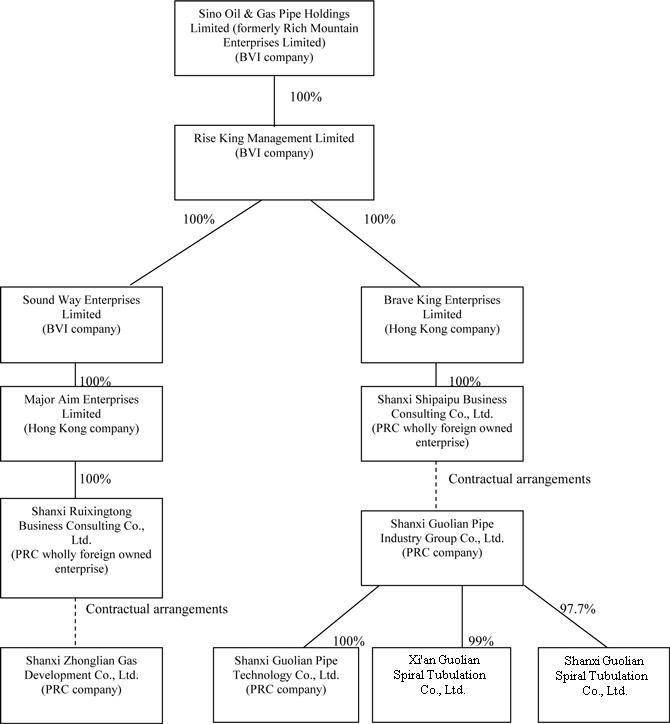

Our wholly owned subsidiaries, Shangxi Shipaipu and Shanxi Ruixingtng, manage and operate our business through Shanxi Guolian Pipe Industry Group Co., Ltd., or SXGL, and Shanxi Zhonglian Gas Development Co., Ltd., or Shanxi Zhonglian, two PRC companies that we control. SXGL is 89% owned by Xudong Liu, our Chairman, and 11% owned by his uncle, Lizi Liu, who is also the Vice President of the Board of Directors of SXGLSXGL. Shanxi Zhonglian is wholly owned by Juan Kong. Shanxi Shipaipu and Shanxi Ruixingtong operate SXGL and Shanxi Zhonglian business pursuant to contractual arrangements , which arrangements we also refer to throughout this report as the VIE Agreements. Almost all economic benefits and risks arising from these operations have been transferred to Shanxi Shipaipu and Shanxi Ruixingtong under these agreements.

Shanxi Ruixingtong Business Consulting Co., Ltd., or Shanxi Ruixingtong, a wholly owned subsidiary of our subsidiary SOUND WAY ENTERPRISES LIMITED, or SWEL, a company incorporated under the laws of the British Virgin Islands, manages and operates our business through Shanxi Zhonglian Gas Development Co., Ltd., or Shanxi Zhonglian, a PRC company owned by Juan Kong. Shanxi Ruixingtong operates Shanxi Zhonglian’s business pursuant to contractual arrangements with Shanxi Zhonglian and Juan Kong, which arrangements we also refer to throughout this report as the VIE Agreements. Almost all economic benefits and risks arising from Shanxi Zhonglian’s operations have been transferred to Shanxi Ruixingtong under these agreements.

Details of the VIE Agreements are set out below in Item 4A – “History and Development of the Company – Contractual Arrangements.”

There are risks involved in the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. If the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

|

|

·

|

imposing economic penalties;

|

|

|

·

|

discontinuing or restricting the operations of Shanxi Shipaipu, Shanxi Ruixingtong, SXGL or Shanxi Zhonglian SXGL;

|

|

|

·

|

imposing conditions or requirements in respect of the VIE Agreements with which SXGL or Shanxi Ruixingtong may not be able to comply;

|

|

|

·

|

requiring our company to restructure the relevant ownership structure or operations;

|

|

|

·

|

taking other regulatory or enforcement actions that could adversely affect our company’s business; and

|

16

|

|

·

|

revoking the business licenses and/or the licenses or certificates of SXGL, Shanxi Ruixingtong,or SXGL or Shanxi ZhonglianSXGL, and voiding the VIE Agreements.

|

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of SXGL and Shanxi Zhonglian, which would have a material adverse impact on our business, financial condition and results of operations.

Our ability to manage and operate SXGL and Shanxi Zhonglian under the VIE Agreements may not be as effective as direct ownership.

We conduct our businesses in the PRC, and generate all of our revenues, through the VIE Agreements. Our plans for future growth are based on growing the operations of SXGL and Shanxi Zhonglian. However, the VIE Agreements may not be as effective in providing us with control over SXGL and Shanxi Zhonglian as direct ownership. Under the current VIE arrangements, as a legal matter, if SXGL or Shanxi Zhonglian fails to perform its obligations under these contractual arrangements, we may have to (a) incur substantial costs and resources to enforce such arrangements and (b) seek legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we fail to effectively control SXGL or Shanxi Zhonglian, such failure would have an adverse effect on our ability to achieve our business objectives and grow our revenues.

The shareholders of SXGL or Shanxi Zhonglian may breach, or cause SXGL or Shanxi Zhonglian to breach, the VIE Agreements.

Mr. Xudong Liu, the primary shareholder of SXGL and Ms. Juan Kong, the shareholder of Shanxi Zhonglian, may breach, or cause SXGL or Shanxi Zhonglian to breach, the VIE Agreements because their respective equity interests in SXGL and Shanxi Zhonglian are greater than their equity interests in our company. As a result, any of these individuals may breach a contract with us if he believes that such breach will lead to greater economic benefit for him. If any of these individuals was to breach, or cause SXGL or Shanxi Zhonglian to breach, the VIE Agreements for this reason or any other reason, we may have to rely on legal or arbitral proceedings to enforce our contractual rights, including specific performance, injunctive relief or claiming damages. Such arbitral and legal proceedings may cost us substantial financial and other resources, and result in disruption of our business, and we cannot assure you that the outcome will be in our favor.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through payments that we receive from SXGL and Shanxi Zhonglian pursuant to the VIE Agreements. We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes which could result in our being subject to higher tax liability.

Risks Related to Doing Business in China

Changes in China’s political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have a negative effect are:

|

|

·

|

level of government involvement in the economy;

|

|

|

·

|

control of foreign exchange;

|

|

|

·

|

methods of allocating resources;

|

|

|

·

|

balance of payments position;

|

|

|

·

|

international trade restrictions; and

|

17

|

|

·

|

international conflict.

|

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in a number of ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy, and weak corporate governance and the lack of a flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of OECD member countries.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised, and continues to exercise, substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as (0.8)%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

You may have difficulty enforcing judgments against us.

Our assets are located, and our operations are conducted, in the PRC. In addition, all of our directors and officers are nationals and residents of the PRC and a substantial portion of their assets are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts because China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest.

18

Most of our revenues are denominated in Renminbi, which is not freely convertible for capital account transactions and may be subject to exchange rate volatility.

We are exposed to the risks associated with foreign exchange controls and restrictions in China, as our revenues are primarily denominated in Renminbi, which is currently not freely exchangeable. The PRC government imposes control over the convertibility between Renminbi and foreign currencies. Under the PRC foreign exchange regulations, payments for “current account” transactions, including remittance of foreign currencies for payment of dividends, profit distributions, interest and operation-related expenditures, may be made without prior approval but are subject to procedural requirements. Strict foreign exchange control continues to apply to “capital account” transactions, such as direct foreign investment and foreign currency loans. These capital account transactions must be approved by, or registered with, the PRC State Administration of Foreign Exchange, or SAFE. Further, capital contribution by an offshore shareholder to its PRC subsidiaries may require approval by the Ministry of Commerce in China or its local counterparts. We cannot assure you that we will be able to meet all of our foreign currency obligations to remit profits out of China or to fund operations in China.

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or Circular 142, to regulate the conversion by foreign invested enterprises, or FIEs, of foreign currency into Renminbi by restricting how the converted Renminbi may be used. Circular 142 requires that Renminbi converted from the foreign currency-dominated capital of a FIE may be used only for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Compliance with Circular 142 may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business.

Fluctuation in the value of the Renminbi and of the U.S. dollar may have a material adverse effect on investments in our ordinary shares.

Any significant revaluation of the Renminbi may have a material adverse effect on the U.S. dollar equivalent amount of our revenues and financial condition as well as on the value of, and any dividends payable on, our ordinary shares in foreign currency terms. For instance, a decrease in the value of Renminbi against the U.S. dollar could reduce the U.S. dollar equivalent amounts of our financial results, the value of your investment in our ordinary shares and the dividends we may pay in the future, if any, all of which may have a material adverse effect on the prices of our common shares. All of our revenues are denominated in Renminbi. Any further appreciation of the Renminbi against the U.S. dollar may result in significant exchange losses.

Prior to 1994, the Renminbi experienced a significant net devaluation against most major currencies, and there was significant volatility in the exchange rate during certain periods. Upon the execution of the unitary managed floating rate system in 1994, the Renminbi was devalued by 50% against the U.S. dollar. Since 1994, the Renminbi to U.S. dollar exchange rate has largely stabilized. On July 21, 2005, the People’s Bank of China announced that the exchange rate of U.S. dollar to Renminbi would be adjusted from $1 to RMB8.27 to $1 to RMB8.11, and it ceased to peg the Renminbi to the U.S. dollar. Instead, the Renminbi would be pegged to a basket of currencies, whose components would be adjusted based on changes in market supply and demand under a set of systematic principles. On September 23, 2005, the PRC government widened the daily trading band for Renminbi against non-U.S. dollar currencies from 1.5% to 3.0% to improve the flexibility of the new foreign exchange system. Since the adoption of these measures, the value of Renminbi against the U.S. dollar has fluctuated on a daily basis within narrow ranges, but overall has further strengthened against the U.S. dollar. In June 2010, the Chinese government announced its intention to allow the Renminbi to fluctuate within the June 2005 parameters. There remains significant international pressure on the PRC government to further liberalize its currency policy, which could result in a further and more significant appreciation in the value of the Renminbi against the U.S. dollar. The Renminbi may be revalued further against the U.S. dollar or other currencies, or may be permitted to enter into a full or limited free float, which may result in an appreciation or depreciation in the value of the Renminbi against the U.S. dollar or other currencies.

19

China’s legal system is different from those in some other countries.

China is a civil law jurisdiction. Under the civil law system, prior court decisions may be cited as persuasive authority but do not have binding precedential effect. Although progress has been made in the promulgation of laws and regulations dealing with economic matters, such as corporate organization and governance, foreign investment, commerce, taxation and trade, China’s legal system remains less developed than the legal systems in many other countries. Furthermore, because many laws, regulations and legal requirements have been recently adopted, their interpretation and enforcement by the courts and administrative agencies may involve uncertainties. Sometimes, different government departments may have different interpretations. Licenses and permits issued or granted by one government authority may be revoked by a higher government authority at a later time. Government authorities may decline to take action against unlicensed operators which may work to the disadvantage of licensed operators, including us. The PRC legal system is based in part on government policies and internal rules that may have a retroactive effect. We may not be aware of our violation of these policies and rules until some time after the violation. Changes in China’s legal and regulatory framework, the promulgation of new laws and possible conflicts between national and provincial regulations could adversely affect our financial condition and results of operations. In addition, any litigation in China may result in substantial costs and diversion of resources and management attention.

Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification would likely result in unfavorable tax consequences to us and our non-PRC shareholders.

China passed a New Enterprise Income Tax Law, or the New EIT Law, which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with de facto management bodies within China is considered a resident enterprise, meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 clarified that dividends and other income paid by such resident enterprises will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC enterprise shareholders. This recent circular also subjects such resident enterprises to various reporting requirements with the PRC tax authorities.