Table of Contents

As filed with the Securities and Exchange Commission on March 6, 2015

Registration No. 333-201176

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO

FORM S-1 ON FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ELEVEN BIOTHERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 26-2025616 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

215 First Street, Suite 400

Cambridge, MA 02142

(617) 871-9911

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Abbie C. Celniker, Ph.D.

President and Chief Executive Officer

Eleven Biotherapeutics, Inc.

215 First Street, Suite 400

Cambridge, MA 02142 (617) 871-9911

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

David E. Redlick, Esq.

Richard A. Hoffman, Esq.

Wilmer Cutler Pickering Hale and Dorr LLP

60 State Street

Boston, Massachusetts 02109

(617) 526-6000

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do no check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

On December 19, 2014, we filed a registration statement with the Securities and Exchange Commission, or the SEC, on Form S-1 (File no. 333-201176). The registration statement was declared effective by the SEC on December 31, 2014 to initially register for resale by the selling stockholders identified in the prospectus an aggregate of 2,615,520 shares of our common stock, par value $0.001 per share that were privately issued to the selling stockholders in connection with a private placement completed on December 2, 2014. This post-effective amendment is being filed to (i) convert the Registration Statement on Form S-1 to a Registration Statement on Form S-3 and (ii) update certain other information in the prospectus relating to the offering and sale of the shares that were registered for resale on the Form S-1.

No additional securities are being registered under this post-effective amendment. All applicable registration and filing fees were paid at the time of the original filing of the registration statement on December 19, 2014.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders named in this prospectus are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 6, 2015

PRELIMINARY PROSPECTUS

Eleven Biotherapeutics, Inc.

2,615,520 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 1,743,680 shares of our common stock that we sold to the selling stockholders and 871,840 shares of common stock that are issuable upon the exercise of outstanding warrants to purchase our common stock issued to the selling stockholders in connection with a private placement completed on December 2, 2014. We will not receive any proceeds from the sale of these shares by the selling stockholders.

We are not selling any shares of common stock and will not receive any proceeds from the sale of the shares under this prospectus. Upon the exercise of the warrants for 871,840 shares of our common stock by payment of cash, however, we will receive the exercise price of the warrants, which is $15.00 per share. The warrants covered by the registration statement of which this prospectus is a part have a net exercise provision that allows the holders to receive a reduced number of shares of our common stock, equal to the aggregate fair value less the total exercise price of the warrant shares being purchased upon conversion, without paying the exercise price in cash.

We have agreed to bear all of the expenses incurred in connection with the registration of these shares. The selling stockholders will pay or assume brokerage commissions and similar charges, if any, incurred for the sale of shares of our common stock.

The selling stockholders identified in this prospectus, or their pledgees, donees, transferees or other successors-in-interest, may offer the shares from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the methods of sale that may be used by the selling stockholders, see the section entitled “Plan of Distribution” on page 52. For a list of the selling stockholders, see the section entitled “Selling Stockholders” on page 50.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Our common stock is traded on the NASDAQ Global Market under the symbol “EBIO.” On March 5, 2015, the closing sale price of our common stock on the NASDAQ Global Market was $11.58 per share. You are urged to obtain current market quotations for the common stock.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 10.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and are eligible for reduced public company disclosure requirements. See “Summary—Implications of Being an Emerging Growth Company.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2015.

Table of Contents

We are responsible for the information contained in this prospectus. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. The selling stockholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| Page | ||||

| 1 | ||||

| 9 | ||||

| 10 | ||||

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA |

48 | |||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

Table of Contents

This summary highlights information contained elsewhere in this prospectus or incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2014 and our other filings with the SEC listed in the section of this prospectus entitled “Incorporation of Documents By Reference.” This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 10 and our financial statements and the related notes thereto in our most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q, which are incorporated by reference herein, before making an investment decision.

Company Overview

We are a clinical-stage biopharmaceutical company with a proprietary protein engineering platform, called AMP-Rx, that we apply to the discovery and development of protein therapeutics to treat diseases of the eye. Our therapeutic approach is based on the role of cytokines in diseases of the eye, our understanding of the structural biology of cytokines and our ability to rationally design and engineer proteins to modulate the effects of cytokines. Cytokines are cell signaling molecules found in the body that can have important inflammatory effects. We believe cytokines play a major role in the pathology underlying many eye diseases and that protein therapeutics are an effective means of modulating the effects of cytokines in diseases of the eye. We have used our AMP-Rx platform to rationally design, engineer and generate a pipeline of innovative protein therapeutic candidates that target cytokines we believe are central to diseases of the eye. We are conducting research and development programs directed at both diseases of the front of the eye, such as dry eye disease and allergic conjunctivitis, and diseases of the back of the eye, such as diabetic macular edema, or DME, and uveitis.

Our most advanced product candidate is EBI-005. We designed, engineered and generated EBI-005 using our AMP-Rx platform and are developing EBI-005 as a topical treatment for dry eye disease and allergic conjunctivitis. Our EBI-005 program is based on the role that elevated levels of the inflammatory cytokine interleukin-1, or IL-1, play in the initiation and maintenance of the inflammation and pain associated with dry eye disease and the itching associated with allergic conjunctivitis. We hold worldwide commercialization rights to EBI-005.

In 2013, we completed a Phase 1b/2a clinical trial of EBI-005 in patients with moderate to severe dry eye disease. We believe that the results of this trial, together with the results of a separate Phase 1/2 clinical trial conducted by one of our scientific co-founders using another IL-1 receptor antagonist in patients with moderate to severe dry eye disease and published in the peer-reviewed journal JAMA Ophthalmology in 2013, supported our initiation of a pivotal Phase 3 clinical program in January 2014 to further evaluate EBI-005.

- 1 -

Table of Contents

Our current pivotal Phase 3 clinical program consists of two Phase 3 clinical trials evaluating the safety and efficacy of EBI-005 for the treatment of moderate to severe dry eye disease and a separate clinical trial evaluating the safety of treatment with EBI-005 for one year. We initiated the first of these Phase 3 clinical trials in patients with dry eye disease in early 2014. We expect to have top-line data from our first Phase 3 trial available in the second quarter of 2015. If the results of both our Phase 3 trials and our separate safety trial are favorable, we plan to submit a Biologics License Application, or BLA, to the U.S. Food and Drug Administration, or FDA, seeking approval of EBI-005 for the treatment of dry eye disease in the United States by the end of 2016. We also initiated a Phase 2 clinical trial in February 2014 to evaluate the use of EBI-005 in patients with allergic conjunctivitis, for which we announced top-line data in October 2014.

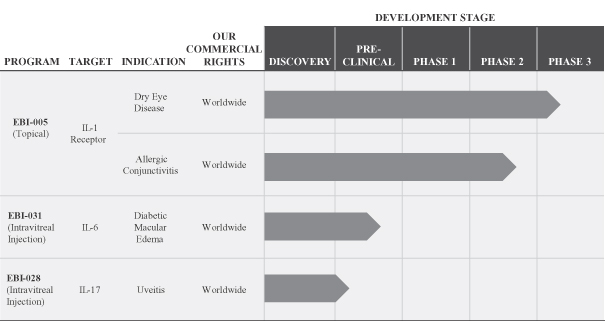

Our preclinical product candidates include EBI-031, an anti-interleukin-6, or IL-6, antibody for the treatment of DME, a serious disease of the central portion of the retina known as the macula, and EBI-028 for the treatment of uveitis, which is an inflammatory disease of the middle layer of the eye known as the uvea. We plan to initiate studies of EBI-031 necessary to support the filing of an investigational new drug application, or IND, with the FDA by the end of 2015. We plan to continue to study EBI-028 in preclinical models to further optimize this product candidate for potential use in humans.

The following table summarizes key information about our product development programs.

We are led by a management team with extensive experience in the pharmaceutical industry. Our President and Chief Executive Officer, Abbie C. Celniker, Ph.D., brings more than 20 years of experience in leading protein therapeutic discovery and development companies and programs. The cornerstone of our biological approach is based on the research of one of our co-founders, Reza Dana, M.D., who is currently a Professor of Ophthalmology and the Claes Dohlman Chair in Ophthalmology at Harvard Medical School.

- 2 -

Table of Contents

Our Approach

Until recently, ocular therapies generally have been developed based on a limited understanding of the biology underlying the initiation and maintenance of the disease state. As a result, many of the therapies for eye diseases were not the result of rational drug design, but instead were ophthalmic formulations of pharmaceuticals that were originally developed and approved for non-ocular diseases, such as steroids and antihistamines. We believe that this limited understanding of the biology of eye diseases impeded the discovery and development of innovative ophthalmic therapeutics.

Over the past 15 years, researchers have been developing a greater understanding of the key proteins and pathways involved in ocular disease. For instance, the understanding of the protein pathways involved in the retinal disease wet age-related macular degeneration, or wet AMD, has led to the successful development of drugs such as Lucentis and Eylea that have dramatically improved the outcomes for many patients. We believe that we can apply similar advances in the understanding of other protein pathways involved in eye diseases to the discovery and development of new treatments for these diseases.

We apply a rational, biology-based approach to the discovery and development of novel protein therapeutics for patients suffering from eye diseases. Our therapeutic approach is based on the role of cytokines in diseases of the eye, our understanding of the structural biology of cytokines and our ability to rationally design proteins to modulate the effects of cytokines.

AMP-Rx is our proprietary platform that we use to design, engineer and generate novel protein therapies that modulate key molecular targets we believe are responsible for the initiation or maintenance of an ocular disease. We begin by analyzing the target and identifying the protein-based approaches we may use to modulate the target. We then generate protein candidates and model protein/target interactions to inform an iterative protein optimization technique. We use this process to modify protein drugs to meet design specifications for improved biological and drug-like properties. We have established a collaboration with ThromboGenics, N.V., or ThromboGenics, in which we apply our AMP-Rx platform to design and engineer innovative ophthalmic medicines.

Dry Eye Disease

Dry eye disease affects the ocular surface and is characterized by symptoms of dryness, pain, discomfort and irritation. If dry eye disease is left untreated or becomes severe, patients may suffer chronic ocular pain and distortion of vision that can significantly reduce their quality of life. Dry eye disease often is classified as mild, moderate or severe based primarily on clinical symptom severity. Dry eye disease is one of the leading causes of patient visits to eye care professionals in the United States. According to Market Scope, LLC, or Market Scope, a publisher of research and analysis on the ophthalmic market, approximately 68 million people in the United States, European Union, Japan and other developed markets have dry eye disease, including approximately 26 million people who suffer from the moderate to severe form of dry eye disease. According to Market Scope, approximately 19 million people in the United States have dry eye disease, including approximately seven million people who suffer from the moderate to severe form of dry eye disease.

- 3 -

Table of Contents

The current standard of care for moderate to severe dry eye disease includes artificial tears and topical anti-inflammatory and immune-modulating drugs. The anti-inflammatory and immune-modulating drug market for the treatment of moderate to severe dry eye disease consists primarily of Restasis, which is approved for use in the United States, and off-label use of corticosteroids. Restasis, which had annual worldwide sales of more than $1 billion in 2014, is not approved for the treatment of the symptoms of dry eye disease, but only for increasing tear production in patients whose tear production is presumed to be suppressed due to ocular inflammation associated with dry eye disease. In clinical trials, approximately 15% of Restasis-treated patients versus approximately 5% of vehicle-treated patients demonstrated statistically significant increases in tear production at six months after initiation of treatment in patients whose tear production was presumed to be suppressed due to ocular inflammation. Approximately 17% of patients reported ocular burning following the use of Restasis. We believe that there remains a significant unmet medical need for new treatments for patients suffering from moderate to severe dry eye disease.

EBI-005 – a Novel IL-1 Receptor Antagonist

Our most advanced product candidate is EBI-005, a recombinant protein which binds with the IL-1 receptor and blocks, or antagonizes, IL-1 receptor signaling on many cell types in the eye. We are developing EBI-005 as a topical, eye-drop treatment for dry eye disease and allergic conjunctivitis. When the IL-1 receptor is blocked by EBI-005, the IL-1 receptor is unable to transmit the biological signals that we believe are responsible for many of the signs and symptoms of ocular surface inflammatory diseases, such as pain, discomfort, itching and inflammation. We have designed, engineered and generated EBI-005 using our AMP-Rx platform to have the following product attributes that we believe improve its utility as a topical therapeutic:

| • | Rapid onset of action. We have designed EBI-005 to be a potent blocker of IL-1. In a biochemical study of receptor binding, EBI-005 bound up to 500 times more strongly to the IL-1 receptor than the natural ligands IL-1ß and IL-1Ra. We believe this may result in a rapid onset of symptomatic relief. |

| • | Comfortable for patients. We have optimized EBI-005 for topical, ophthalmic delivery and have formulated it with a preservative-free comfortable solution, or vehicle, for delivery as an eye drop. We believe patient comfort is an important factor in patient compliance and physician recommendation of a topical drug for diseases of the ocular surface. |

| • | Convenient dosing. We have designed EBI-005 to bind tightly to the IL-1 receptor and block it for an extended period of time. We have measured the duration of this receptor binding in biochemical studies outside the body, or in vitro. Based on these tests and our understanding of the natural cycling of the IL-1 receptor from the cell surface to the cell interior, we believe EBI-005 remains bound to an IL-1 receptor during the entire period the receptor is present on the surface of a cell. We believe a long duration of receptor binding may allow for a convenient dosing schedule. |

| • | Stable dosage form. We designed EBI-005 to be a thermally stable protein product. In well-controlled analytical tests, EBI-005 was stable for up to five months at room temperature. We believe room temperature stability without the need for refrigeration is an important convenience for patients. |

- 4 -

Table of Contents

In 2013, we completed a Phase 1b/2a clinical trial of EBI-005 in patients with moderate to severe dry eye disease. We designed our Phase 1b/2a clinical trial of EBI-005 principally to assess safety in dry eye disease patients and secondarily, to measure efficacy in order to inform the design of our pivotal clinical trials. In our Phase 1b/2a trial, EBI-005 was generally well tolerated. While we did not power our Phase 1b/2a trial to measure efficacy with statistical significance, and the differences from baseline that we observed in the EBI-005 treatment groups were not statistically significant when compared to differences from baseline in patients who received vehicle control, we observed the following results, among others, in this trial:

| • | on the primary efficacy endpoint of change in patient symptoms as assessed by a patient questionnaire called the ocular surface disease index, or OSDI, an improvement in patients treated with EBI-005 from baseline at six weeks; |

| • | on the secondary efficacy endpoint of change in total corneal fluorescein staining, or CFS, a measure of ocular surface injury, an improvement in patients treated with EBI-005 from baseline at six weeks; |

| • | on the painful or sore eyes question of the OSDI, a greater improvement from baseline at six weeks in patients treated with EBI-005 compared to improvement from baseline at six weeks in patients in the vehicle control group; and |

| • | fewer artificial tears used by patients treated with EBI-005 compared with patients in the vehicle control group, and this difference was statistically significant. |

We believe these results were clinically relevant.

In early 2014, we initiated our pivotal Phase 3 clinical program that consists of two Phase 3 clinical trials to evaluate the safety and efficacy of EBI-005 from baseline at 12 weeks at a concentration of 5 mg/ml for the treatment of moderate to severe dry eye disease and a separate clinical trial evaluating the safety of treatment with EBI-005 at the same concentration for one year. We have designed our pivotal Phase 3 clinical program based on the results we observed in our Phase 1b/2a clinical trial of EBI-005. We initiated the first of our Phase 3 trials in patients with moderate to severe dry eye disease in early 2014. We expect to have top-line data from our first Phase 3 trial available in the second quarter of 2015. We currently intend to initiate our second Phase 3 trial after reviewing top-line data from our first Phase 3 trial. We expect to initiate our separate clinical trial evaluating the safety of treatment with EBI-005 for one year by the end of 2014. If the results of both of our Phase 3 trials and our separate safety trial are favorable, we plan to submit a BLA with the FDA seeking approval of EBI-005 for the treatment of dry eye disease in the United States in the second half of 2016.

In addition to our clinical development of EBI-005 in dry eye disease, we initiated and completed a Phase 2 clinical trial in 2014 of EBI-005 in patients with allergic conjunctivitis, including patients who have not responded adequately to antihistamines or mast cell stabilizers. Allergic conjunctivitis is an inflammatory disease of the conjunctiva, the membrane covering the inside of the eyelids and sclera, the white part of the eye, primarily from a reaction to allergy-causing substances such as pollen or pet dander. We designed the Phase 2 study to evaluate the safety and efficacy of EBI-005 compared to vehicle-control in two models of allergen challenge adapted to evaluate the late phase response of allergy. The two models were a modified environmental exposure chamber model, or EEC, and a modified direct conjunctival allergen challenge model, or CAPT.

- 5 -

Table of Contents

Our Strategy

Our goal is to become a leading biopharmaceutical company focused on developing and commercializing novel protein therapeutics to treat diseases of the eye. The key elements of our strategy in support of this goal are to:

| • | Complete clinical development of and seek marketing approval for EBI-005 for the treatment of dry eye disease. If the results of both of our Phase 3 trials and our separate safety trial are favorable, we plan to submit a BLA to the FDA seeking approval of EBI-005 for the treatment of dry eye disease in the United States by the end of 2016. |

| • | Expand the use of EBI-005 for additional ocular indications. In 2014, we completed a Phase 2 clinical trial to assess the potential therapeutic benefit of EBI-005 for the treatment of allergic conjunctivitis in patients who have not responded adequately to antihistamines or mast cell stabilizers. Based in part on the discussions with the FDA’s Division of Transplant and Ophthalmology Products in February 2015 and the scientific advice we received from the European Medicine Agency’s Committee for Medicinal Products for Human Use, we now believe that the CAPT model alone is not an appropriate model for the conduct of our pivotal trials. We intend to use a natural environmental study design for further clinical development of EBI-005 for the treatment of allergic conjunctivitis. |

| • | Maximize commercial potential of EBI-005. We hold worldwide commercialization rights to EBI-005 and may decide to build our own focused, specialty sales force in order to commercialize EBI-005 in the United States ourselves. We intend to enter into strategic collaborations for the development and commercialization of EBI-005 outside of the United States. |

| • | Advance EBI-031 for the treatment of diabetic macular edema. Our most advanced preclinical product candidate is EBI-031, an optimized version of an anti-interleukin-6, or IL-6, antibody we referred to as EBI-029, for the treatment of DME. We are undertaking the necessary CMC development work and nonclinical safety studies to support the submission of an IND. If the results of these efforts and our additional preclinical Studies of EBI-031 are favorable, we intend to submit an IND to the FDA by the end of 2015 for the purpose of conducting clinical trials of EBI-031. |

| • | Apply AMP-Rx platform to build a pipeline of product candidates for the treatment of eye diseases. We use our AMP-Rx platform to rationally design, engineer and generate a pipeline of innovative protein therapeutic candidates that target cytokines that we believe are central to diseases of the eye. |

| • | Pursue collaborative and other strategic opportunities. We have established a collaboration with ThromboGenics, a European based, publicly held biopharmaceutical company focused on developing and commercializing innovative ophthalmic medicines. We plan to evaluate opportunities to enter into other collaborations that may contribute to our ability to advance our product candidates and to progress concurrently a range of discovery and development programs. |

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus. These risks include the following:

| • | We depend heavily on the success of EBI-005. Our ability to generate product revenues, which we do not expect will occur before 2017, if ever, will depend heavily on our obtaining marketing approval for and commercializing EBI-005. |

- 6 -

Table of Contents

| • | Our Phase 3 clinical program evaluating EBI-005 may not be successful. In our Phase 1b/2a trial of EBI-005, neither of the doses of EBI-005 tested achieved statistically significant superiority compared to vehicle control based on any primary or secondary efficacy endpoints, including those we intend to use for our planned Phase 3 clinical trials. We have based many elements of the design of the protocol for our planned Phase 3 clinical trials, including key eligibility criteria and the co-primary endpoints we expect to use, on retrospective subgroup analyses that we performed on the results of our Phase 1b/2a clinical trial. These retrospective subgroup analyses may not be predictive of the results of these Phase 3 trials. |

| • | We are an early stage company. We currently have no commercial products, and all of our product candidates, other than EBI-005, are still in preclinical development. |

| • | We have not yet demonstrated our ability to successfully complete a pivotal Phase 3 clinical trial, obtain marketing approvals, manufacture at commercial scale, or arrange for a third party to do so on our behalf, or conduct sales, marketing and distribution activities necessary for successful product commercialization. If we are unable to obtain required marketing approvals for, commercialize, obtain and maintain patent protection for or gain market acceptance by physicians, patients and third-party payors of EBI-005 or any of our other product candidates, or experience significant delays in doing so, our business will be materially harmed. |

| • | We face substantial competition. There are a number of products and therapies in preclinical research and clinical development by third parties to treat dry eye disease. Some patients with moderate to severe dry eye disease are effectively treated by the current standard of care therapies, some of which are available in generic form or offered at relatively low prices. We also would face competition with respect to EBI-005 if anakinra, another IL-1 blocker approved for subcutaneous administration for the treatment of rheumatoid arthritis, was available commercially for the treatment of dry eye disease. |

| • | We have incurred significant losses since our inception and will need substantial additional funding. As of December 31, 2014, we had an accumulated deficit of $91.8 million. We expect to incur significant expenses and operating losses over the next several years. |

Our Corporate Information

We were incorporated under the laws of the state of Delaware on February 25, 2008 under the name NewCo LS14, Inc. We subsequently changed our name to DeNovo Therapeutics, Inc. in September 2008 and again to Eleven Biotherapeutics, Inc. in February 2010. Our principal executive offices are located at 215 First Street, Suite 400, Cambridge, Massachusetts 02142, and our telephone number is (617) 871-9911. Our website address is www.elevenbio.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

- 7 -

Table of Contents

In this prospectus, unless otherwise stated or the context otherwise requires, references to “Eleven,” “we,” “us,” “our” and similar references refer to Eleven Biotherapeutics, Inc. Eleven Biotherapeutics, AMP-Rx and the Eleven logo are our trademarks. The copyright to the Ocular Surface Disease Index and the registered trademark Restasis are the property of Allergan, Inc. The registered trademark Kineret is the property of Swedish Orphan Biovitrum AB. The other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

Implications of Being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we may remain an emerging growth company until December 31, 2019. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. In particular, in this prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

- 8 -

Table of Contents

| Common stock offered by the selling stockholders | 2,615,520 shares, including 871,840 shares of our common stock issuable upon exercise of warrants at an exercise price of $15.00 per share | |

| Common stock outstanding | 18,058,287 shares | |

| Use of proceeds | We will not receive any proceeds from the sale of shares in this offering. | |

| Risk Factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

| NASDAQ Global Market symbol | “EBIO” | |

The number of shares of our common stock outstanding is based on 18,058,287 shares of our common stock outstanding as of December 31, 2014 and excludes the following:

| • | 1,438,528 shares of our common stock issuable upon the exercise of stock options outstanding as of December 31, 2014 at a weighted average exercise price of $4.93 per share; |

| • | 27,500 shares of our common stock issuable upon exercise of warrants held by our venture debt lender, Silicon Valley Bank, and Life Science Loans, LLC, and 27,500 additional shares of our common stock issuable upon exercise of such warrants following such date, if any, that the Company draws down the second tranche under the loan facility with Silicon Valley Bank; |

| • | 871,840 shares of our common stock issuable upon exercise of warrants held by the selling stockholders at an exercise price of $15 per share; |

| • | 465,579 shares of our common stock available for future issuance under our 2014 Stock Incentive Plan, or the 2014 Plan, as of December 31, 2014, and an additional 722,331 shares of our common stock reserved on January 1, 2015 for issuance under our 2014 Stock Incentive Plan; and |

| • | 157,480 shares of our common stock available for future issuance under our 2014 Employee Stock Purchase Plan. |

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or warrants described above.

- 9 -

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of the following risks actually occur, our business, prospects, operating results and financial condition could suffer materially. In such event, the trading price of our common stock could decline and you might lose all or part of your investment.

Risks Related to Our Financial Position and Need For Additional Capital

We have incurred significant losses since our inception. We expect to incur losses over the next several years and may never achieve or maintain profitability.

Since inception, we have incurred significant operating losses. Our net loss was $34.2 million for the year ended December 31, 2014, $18.0 million for the year ended December 31, 2013 and $19.7 million for the year ended December 31, 2012. As of December 31, 2014, we had an accumulated deficit of $91.8 million. To date, we have financed our operations primarily through private placements of our common stock and preferred stock and convertible bridge notes, venture debt borrowings and our initial public offering, or IPO, and, to a lesser extent, from a collaboration. All of our revenue to date has been collaboration revenue, which we first began to generate in 2013. We have devoted substantially all of our financial resources and efforts to research and development, including preclinical studies and, beginning in 2012, clinical trials. We are still in the early stages of development of our product candidates, and we have not completed development of any drugs. We expect to continue to incur significant expenses and operating losses over the next several years. Our net losses may fluctuate significantly from quarter to quarter and year to year.

- 10 -

Table of Contents

We anticipate that our expenses will increase substantially as compared to prior periods in connection with conducting our pivotal Phase 3 clinical program, consisting of two Phase 3 clinical trials evaluating the safety and efficacy of EBI-005, our most advanced product candidate, for the treatment of moderate to severe dry eye disease and a separate clinical trial evaluating the safety of treatment with EBI-005 for one year, and, if successful, seeking marketing approval for EBI-005 for this indication in the United States. We began randomizing and treating patients in our first Phase 3 trial in January 2014.

We received scientific advice from the European Medicine Agency’s, or EMA, Committee for Medicinal Products for Human Use, or CHMP, that indicates that the requirements for European registration in dry eye disease will differ from the requirements for registration in the United States and our pivotal Phase 3 clinical program is not consistent with the advice of the CHMP. We plan to further discuss with the EMA a registration plan for EBI-005 in moderate to severe dry eye disease for the European Union. We may be required to conduct additional clinical trials to support an application for marketing approval of EBI-005 in the European Union. We anticipate that our expenses will increase substantially if we pursue, alone or in collaboration with third parties, the development of and seek marketing approval for EBI-005 for the treatment of moderate to severe dry eye disease in the European Union.

Our expenses will also increase if and as we:

| • | pursue the development of EBI-005 for the treatment of allergic conjunctivitis or additional indications or for use in other patient populations or, if it is approved, seek to broaden the label for EBI-005; |

| • | continue the research and development of our other product candidates, including EBI-031 for the treatment of diabetic macular edema; |

| • | seek to discover and develop additional product candidates; |

| • | in-license or acquire the rights to other products, product candidates or technologies for the treatment of ophthalmic diseases; |

| • | seek marketing approvals for any product candidates that successfully complete clinical trials; |

| • | establish sales, marketing and distribution capabilities and scale up and validate external manufacturing capabilities to commercialize any products for which we may obtain marketing approval; |

| • | maintain, expand and protect our intellectual property portfolio; |

| • | hire additional clinical, quality control, scientific and management personnel; |

| • | expand our operational, financial and management systems and personnel, including personnel to support our clinical development, manufacturing and planned future commercialization efforts and our operations as a public company; and |

| • | increase our insurance coverage as we expand our clinical trials and commence commercialization of EBI-005. |

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. Our expenses will increase substantially if:

| • | we are required by the United States Food and Drug Administration, or FDA, or EMA to perform studies in addition to those currently expected; or |

| • | if there are any delays in enrollment of patients in, continuing or completing our clinical trials or the development of EBI-005 or any other product candidates that we may develop. |

- 11 -

Table of Contents

Our ability to become and remain profitable depends on our ability to generate revenue. We do not expect to generate significant revenue unless and until we obtain marketing approval for, and commercialize, EBI-005, which we do not expect will occur before 2017, if ever. This will require us to be successful in a range of challenging activities, including:

| • | completing and obtaining favorable results from our pivotal Phase 3 clinical program for EBI-005 for the treatment of moderate to severe dry eye disease; |

| • | subject to obtaining favorable results from our pivotal Phase 3 clinical program for EBI-005, applying for and obtaining marketing approval for EBI-005 in the United States; |

| • | establishing sales, marketing and distribution capabilities, either ourselves or through collaboration or other arrangements with third parties, to effectively market and sell EBI-005 in the United States; |

| • | initiating and obtaining favorable results from registration trials of EBI-005 for the treatment of moderate to severe dry eye disease in the European Union; |

| • | subject to obtaining favorable results from registration trials for EBI-005 in the European Union, applying for and obtaining marketing approval for EBI-005 in the European Union; |

| • | establishing collaboration, distribution or other marketing arrangements with third parties to commercialize EBI-005 in markets outside the United States; |

| • | achieving an adequate level of market acceptance of EBI-005; |

| • | protecting our rights to our intellectual property portfolio related to EBI-005; and |

| • | ensuring the manufacture of commercial quantities of EBI-005. |

Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business, maintain our research and development efforts, diversify our product offerings or even continue our operations. A decline in the value of our company could also cause you to lose all or part of their investment.

We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We expect to devote substantial financial resources to our ongoing and planned activities, particularly completing our pivotal Phase 3 clinical program evaluating EBI-005 for the treatment of moderate to severe dry eye disease and, if successful, seeking marketing approval for EBI-005. We expect to devote additional financial resources to the clinical development of EBI-005 as we initiate and conduct additional clinical trials of EBI-005 for the treatment of dry eye disease in the European Union and for the treatment of allergic conjunctivitis or other diseases and to functions associated with operating as a public company. We also expect to devote additional financial resources to conducting research and development, if we determine to proceed into clinical development, initiating clinical trials of, and seeking regulatory approval for, our other product candidates. In addition, if we obtain regulatory approval for any of our product candidates, we would need to devote substantial financial resources to commercialization efforts, including product manufacturing, marketing, sales and distribution. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

Our future capital requirements will depend on many factors, including:

| • | the progress, costs and outcome of our pivotal Phase 3 clinical program for EBI-005 and of any clinical activities for regulatory review of EBI-005 outside of the United States; |

- 12 -

Table of Contents

| • | the costs and timing of process development and manufacturing scale up and validation activities associated with EBI-005; |

| • | the costs, timing and outcome of regulatory review of EBI-005 in the United States, the European Union and in other jurisdictions; |

| • | the costs and timing of commercialization activities for EBI-005 if we receive, or expect to receive, marketing approval, including the costs and timing of establishing product sales, marketing, distribution and outsourced manufacturing capabilities; |

| • | subject to receipt of marketing approval, the amount of revenue received from commercial sales of EBI-005; |

| • | the progress, costs and outcome of developing EBI-005 for the treatment of additional indications or for use in other patient populations, including any clinical trials to assess the potential therapeutic benefit of EBI-005 for the treatment of allergic conjunctivitis; |

| • | our ability to establish collaborations on favorable terms, if at all, particularly licensing, manufacturing, marketing and distribution arrangements for our product candidates; |

| • | the scope, progress, results and costs of preclinical development, laboratory testing and, if we determine to proceed into clinical development, clinical trials of our other product candidates; |

| • | the success of our collaboration with ThromboGenics; |

| • | the costs and timing of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending any intellectual property-related claims; and |

| • | the extent to which we in-license or acquire rights to other products, product candidates or technologies for the treatment of ophthalmic diseases. |

As of December 31, 2014, we had cash and cash equivalents of $54.1 million. We believe that our cash and cash equivalents as of December 31, 2014 will enable us to fund our operating expenses, debt service obligations and capital expenditure requirements into 2016, without giving effect to any potential milestone payments we may receive under our existing collaboration and license agreement with ThromboGenics. We have based this estimate on assumptions that may prove to be wrong, and we could use our capital resources sooner than we currently expect. We are planning to spend significant funds to complete our Phase 3 clinical program evaluating EBI-005 and to submit a Biologics License Application, or BLA, to the FDA seeking approval of EBI-005 for the treatment of dry eye disease in the United States by the end of 2016. We also are planning to spend significant funds on other development programs, including possible additional clinical trials of EBI-005 for the treatment of allergic conjunctivitis. At this time we cannot reasonably estimate the remaining costs necessary to prepare and submit the BLA seeking approval of EBI-005 and commercialize EBI-005 for the treatment of dry eye disease, including commercial manufacturing of EBI-005, or the nature, timing or costs of the efforts necessary to complete the development of EBI-005 for the treatment of allergic conjunctivitis or another disease or to complete the development of any other product candidate we may develop.

Identifying potential product candidates and conducting preclinical testing and clinical trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data or results required to obtain regulatory approval and achieve product sales. Our commercial revenues, if any, will be derived from sales of EBI-005 or any other products that we successfully develop, none of which we expect to be commercially available for several years, if at all. In addition, if approved, EBI-005 or any other product candidate that we develop or any product that we in-license may not achieve commercial success. Accordingly, we will need to obtain substantial additional financing to achieve our business objectives. Adequate additional financing may not be available to us on acceptable terms, or at all. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans.

- 13 -

Table of Contents

Raising additional capital may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of equity offerings, debt financings, government or other third-party funding, collaborations, strategic alliances, licensing arrangements and marketing and distribution arrangements. We do not have any committed external source of funds other than funding under our existing collaboration and license agreement with ThromboGenics in the form of research funding. Under this collaboration, we also may receive potential milestone payments upon the achievement of specified development, regulatory and other milestones and royalties with respect to future sales of collaboration products by ThromboGenics. ThromboGenics may terminate our existing collaboration for convenience on short notice. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as holders of our common stock. For example, in December 2014, we issued and sold in a private placement an aggregate of 1,743,680 shares of our common stock, plus warrants to purchase a total of 871,840 additional shares of common stock, which resulted in dilution to our existing stockholders.

Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Our pledge of specified assets as collateral to secure our obligations under our existing loan and security agreement with our venture debt lender, Silicon Valley Bank, may limit our ability to obtain additional debt financing.

If we raise additional funds through government or other third-party funding, collaborations, strategic alliances, licensing arrangements or marketing and distribution arrangements, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market products or product candidates that we would otherwise prefer to develop and market ourselves.

Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

We are an early-stage company. We were incorporated and commenced active operations in early 2008, and our operations to date have been limited to organizing and staffing our company, acquiring rights to intellectual property, business planning, raising capital, developing our technology, identifying potential product candidates, undertaking preclinical studies and, beginning in 2012, conducting clinical trials of EBI-005. All of our product candidates, other than EBI-005, are still in preclinical development. We have not yet demonstrated our ability to successfully complete a pivotal Phase 3 clinical trial, obtain marketing approvals, manufacture at commercial scale, or arrange for a third party to do so on our behalf, or conduct sales, marketing and distribution activities necessary for successful product commercialization. Consequently, any predictions about our future success or viability may not be as accurate as they could be if we had a longer operating history.

In addition, as a new business, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. We will need to transition at some point from a company with a research and development focus to a company capable of supporting commercial activities. We may not be successful in such a transition.

We expect our financial condition and operating results to continue to fluctuate significantly from quarter-to-quarter and year-to-year due to a variety of factors, many of which are beyond our control. Accordingly, you should not rely upon the results of any quarterly or annual periods as indications of future operating performance.

- 14 -

Table of Contents

Risks Related to the Discovery and Development of Our Product Candidates

We depend heavily on the success of EBI-005, our most advanced product candidate, which we are developing for the treatment of moderate to severe dry eye disease. If we are unable to successfully complete our pivotal Phase 3 clinical program and obtain marketing approvals for EBI-005, or experience significant delays in doing so, or if after obtaining marketing approvals, we fail to commercialize EBI-005, our business will be materially harmed.

We have invested a significant portion of our efforts and financial resources in the development of EBI-005 for the treatment of patients with moderate to severe dry eye disease and for other disease indications. There remains a significant risk that we will fail to successfully develop EBI-005. In 2013, we completed a Phase 1b/2a clinical trial to evaluate the safety, tolerability and biological activity of EBI-005 in patients with moderate to severe dry eye disease. In 2014, we completed a Phase 2 clinical trial to evaluate the safety, tolerability and biological activity of EBI-005 in patients with allergic conjunctivitis. Our pivotal Phase 3 clinical program in dry eye disease will consist of two Phase 3 clinical trials evaluating EBI-005 for the treatment of moderate to severe dry eye disease and a separate clinical trial evaluating the safety of treatment with EBI-005 for one year. We began randomizing and treating patients in our first Phase 3 trial in January 2014. We do not expect to have initial, top-line data from our first Phase 3 trial available until the second quarter of 2015. The timing of the availability of such top-line data and the completion of our pivotal Phase 3 clinical program is dependent, in part, on our ability to locate and enroll a sufficient number of eligible patients in our pivotal Phase 3 clinical program on a timely basis. Even if the results of both of our Phase 3 clinical trials evaluating EBI-005 for the treatment of moderate to severe dry eye disease and our separate safety trial are favorable, we do not plan to submit a BLA to the FDA seeking approval of EBI-005 for the treatment of dry eye disease in the United States by the end of 2016. We cannot accurately predict when or if EBI-005 will prove effective or safe in humans or whether it will receive marketing approval. Our ability to generate product revenues, which we do not expect will occur before 2017, if ever, will depend heavily on our obtaining marketing approval for and commercializing EBI-005.

The success of EBI-005 will depend on several factors, including the following:

| • | completing and obtaining favorable results from our pivotal Phase 3 clinical program for EBI-005; |

| • | initiating and obtaining favorable results from registration trials of EBI-005 for the treatment of moderate to severe dry eye disease in the European Union; |

| • | applying for and receiving marketing approvals from applicable regulatory authorities for EBI-005; |

| • | making arrangements with third-party manufacturers for commercial quantities of EBI-005 and receiving regulatory approval of our manufacturing processes and our third-party manufacturers’ facilities from applicable regulatory authorities; |

| • | establishing sales, marketing and distribution capabilities and launching commercial sales of EBI-005, if and when approved, whether alone or in collaboration with others; |

| • | acceptance of EBI-005, if and when approved, by patients, the medical community and third-party payors; |

| • | effectively competing with other therapies, including the existing standard of care; |

| • | maintaining a continued acceptable safety profile of EBI-005 following approval; |

| • | obtaining and maintaining coverage and adequate reimbursement from third-party payors; |

| • | obtaining and maintaining patent and trade secret protection and regulatory exclusivity; and |

| • | protecting our rights in our intellectual property portfolio related to EBI-005. |

- 15 -

Table of Contents

Successful development of EBI-005 for additional indications, such as allergic conjunctivitis, or for use in broader patient populations and our ability, if it is approved, to broaden the label for EBI-005 will depend on similar factors. If we do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize EBI-005, which would materially harm our business.

If clinical trials of EBI-005 or any other product candidate that we develop fail to demonstrate safety and efficacy to the satisfaction of the FDA, the EMA or other regulatory authorities or do not otherwise produce favorable results, we may incur additional costs or experience delays in completing, or ultimately be delayed or unable to complete, the development and commercialization of EBI-005 or any other product candidate.

Before obtaining marketing approval from regulatory authorities for the sale of any product candidate, including EBI-005, we must complete preclinical development and then conduct extensive clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. A failure of one or more clinical trials can occur at any stage of testing. The outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval of their products.

We will be required to demonstrate the safety of treatment with EBI-005 for one year in a separate safety trial in order to support marketing approval of EBI-005 for the treatment of dry eye disease in the United States. To meet this requirement, we initiated a safety trial with no fewer than 100 patients who will be treated with EBI-005 for one year. We cannot predict the results of this safety trial because we have no clinical data on the safety of EBI-005 when administered for a period longer than six weeks and only limited clinical safety data on the effects of EBI-005 when formulated with the vehicle being used in our pivotal Phase 3 clinical program.

In general, the FDA requires two adequate and well controlled clinical trials demonstrating effectiveness on two primary endpoints for marketing approval of a dry eye disease drug. One of these co-primary endpoints must be a sign of dry eye disease and the other must be a symptom of dry eye disease. We are not aware of any investigational dry eye disease drug in development that has met these criteria. Regulatory authorities outside the United States, in particular in the European Union, have not issued public guidance on the requirements for approval of a dry eye drug. We have received scientific advice from the CHMP regarding European registration requirements for EBI-005 for the treatment of moderate to severe dry eye disease. The scientific advice indicates that the requirements for registration in the European Union will differ from the requirements for registration in the United States and our pivotal Phase 3 clinical program is not consistent with the advice of the CHMP. Our pivotal Phase 3 clinical program also may not be sufficient to support an application for marketing approval in other jurisdictions outside the United States.

Our Phase 1b/2a trial evaluated EBI-005 for the treatment of moderate to severe dry eye disease. In our Phase 1b/2a trial, neither of the doses of EBI-005 tested achieved statistically significant superiority compared to vehicle control based on any primary or secondary efficacy endpoints, including those we intend to use for our Phase 3 clinical trials.

Retrospective subgroup analyses that we performed on the results of our Phase 1b/2a clinical trial may not be predictive of the results of our pivotal Phase 3 clinical program. We have based many elements of the design of the protocol for our Phase 3 clinical trials on retrospective subgroup analyses, including our expected use of improvement in pain and discomfort as measured by the painful or sore eyes question of the ocular surface disease index, or OSDI, as the co-primary endpoint measuring a patient symptom. In our Phase 1b/2a trial, we used total OSDI scores as a secondary efficacy endpoint. Although we believe that the retrospective analyses

- 16 -

Table of Contents

support our protocol design for our Phase 3 clinical trials and our proposed mechanism of action, retrospective analyses performed after unmasking trial results can result in the introduction of bias, may not be predictive of future study results and are given less weight by regulatory authorities than pre-specified analyses.

We may fail to achieve success in our pivotal Phase 3 clinical program evaluating EBI-005 for the treatment of moderate to severe dry eye disease for a variety of potential reasons.

| • | The efficacy endpoints in our Phase 1b/2a trial were measured six weeks after the first dose of EBI-005. The co-primary efficacy endpoints in our pivotal Phase 3 clinical program will be measured 12 weeks after the first dose of EBI-005. We have no clinical efficacy data on EBI-005 in any clinical trial longer than six weeks. |

| • | We have made changes to the vehicle we use to formulate EBI-005 for topical, ophthalmic delivery in our Phase 3 clinical trials from the vehicle used in our Phase 1b/2a trial. The most significant change to the vehicle is the removal of carboxymethyl cellulose, or CMC. CMC is a common ingredient in artificial tears. We used our new formulation in our completed Phase 2 clinical trial of EBI-005 in patients with allergic conjunctivitis. |

| • | We will restrict the use of rescue artificial tears by patients in our Phase 3 clinical trials. If the restriction on the use of artificial tears causes discomfort to patients and results in patients’ discontinuing their participation in our Phase 3 clinical trials, such discontinuations would harm our ability to complete our Phase 3 clinical trials on a timely basis. |

| • | We changed the eligibility criteria in our Phase 3 clinical trials from the criteria we used in our Phase 1b/2a trial with regard to patient scores on the OSDI. We cannot predict the impact these changes will have on the rate at which patients will be enrolled or randomized in our Phase 3 clinical trials. If these changes slow the rate at which patients are enrolled or randomized compared to the rate we anticipate, the availability of top-line clinical data from our first Phase 3 clinical trial and our completion of our pivotal Phase 3 clinical program will be delayed. |

| • | We plan to conduct our Phase 3 clinical trials at many clinical centers that were not included in our Phase 1b/2a trial. The introduction of new centers, and the resulting involvement of new treating physicians, can introduce additional variability into the conduct of the trials in accordance with their protocols and may result in greater variability of patient outcomes, which could adversely affect our ability to detect statistically significant differences between patients treated with EBI-005 and vehicle control. |

If, in our first Phase 3 clinical trial, we do not demonstrate a statistically significant improvement from baseline in the EBI-005 treatment group on a pre-specified co-primary endpoint, but we do demonstrate a statistically significant improvement from baseline in the EBI-005 treatment group on one of our secondary endpoints, we may decide to substitute that secondary endpoint for the co-primary endpoint in our second Phase 3 clinical trial prior to initiation of our second Phase 3 clinical trial. Whether this substitution and combination of results would be an acceptable means of meeting the FDA’s requirement that we duplicate in two adequate and well controlled clinical trials a statistically significant improvement on a clinically relevant sign and symptom would be a review issue at the time of our application for marketing approval. If the FDA does not find this to be an acceptable means of meeting the requirements for marketing approval, we will not receive marketing approval for EBI-005, and we will have to conduct another Phase 3 clinical trial if we wish to seek marketing approval for EBI-005 in the future.

The protocols for our pivotal Phase 3 clinical program and other supporting information are subject to review by the FDA and regulatory authorities outside the United States. The FDA or other regulatory authorities may request additional information, require us to conduct additional non-clinical trials or require us to modify our pivotal Phase 3 clinical program, including its endpoints or patient enrollment criteria, to receive clearance to initiate such program or to continue such program once initiated.

- 17 -

Table of Contents

In November 2013, we submitted to the FDA the protocol for our first pivotal Phase 3 clinical trial of EBI-005 and data supporting our change to a larger-scale manufacturing process for the production of EBI-005 to be used in this Phase 3 clinical trial. We submitted the protocol for our separate safety study to the FDA and intend to submit the protocol for our second pivotal Phase 3 clinical trial to the FDA prior to initiation of that trial. The FDA is not obligated to comment on our submissions within any specified time period or at all or to affirmatively clear or approve any clinical trial, and we are not obligated to wait for clearance or approval of the FDA to commence any clinical trial. We initiated our first pivotal Phase 3 clinical trial in the United States in January 2014 without waiting for comments from the FDA. On March 24, 2014, we received a letter from the FDA requesting additional information regarding the characterization of EBI-005 produced using our larger-scale manufacturing process based on the FDA’s product quality review of our November 2013 submission. We have responded to the FDA with the information the FDA requested. If the FDA is not satisfied with our responses, the FDA may delay our continuing our first Phase 3 clinical trial or our initiating our second Phase 3 clinical trial. If our Phase 3 program is placed on clinical hold by the FDA, we may be significantly delayed and incur significantly greater expense in our proposed development program. For example, our Phase 1b/2a trial of EBI-005 was placed on clinical hold between September 6, 2012 and October 29, 2012 until we provided particular manufacturing stability information regarding the drug product lots intended to be used in our clinical studies.

We submitted to the EMA a draft protocol for our Phase 3 clinical program of EBI-005 for the treatment of moderate to severe dry eye disease and sought and received scientific advice from the CHMP regarding European registration requirements for EBI-005. The scientific advice received indicates that the requirements for European registration in dry eye disease will differ from the requirements for registration in the United States and our pivotal Phase 3 clinical program is not consistent with the advice of the CHMP. We plan to further discuss with the EMA a registration plan for EBI-005 in moderate to severe dry eye disease for the European Union. The EMA may require us to conduct other clinical trials, in addition to those included in our Phase 3 clinical program, in order to support an application for marketing approval of EBI-005.

We also are required to submit our plans for clinical trials to each national regulatory authority in the European Union having jurisdiction over a country in which we wish to conduct these clinical trials. These national regulatory authorities are not obligated to follow the scientific advice of the EMA and may impose additional requirements on our conduct of clinical trials of EBI-005 in order to initiate clinical trials and support our application for marketing approval of EBI-005. If we are required by the EMA or a national regulatory authority in the European Union to conduct other clinical trials, in addition to those included in our Phase 3 clinical program, our expenses will increase substantially, and we may experience delays in completing the development and commercialization of EBI-005 in the European Union.

We have not received guidance from other regulatory authorities outside the United States regarding the design of our pivotal Phase 3 clinical program. We may not receive clearance from the EMA or other national regulatory authorities in the European Union or other regulatory authorities outside the European Union to initiate our pivotal Phase 3 clinical trials on a timely basis, if at all. Our Phase 2 trial of EBI-005 for the treatment of allergic conjunctivitis was conducted in Canada. We have not submitted an investigational new drug application, or IND, to the FDA for the purpose of conducting clinical trials of EBI-005 for the treatment of allergic conjunctivitis. We must submit an IND to the FDA before commencing clinical trials of EBI-005 for the treatment of allergic conjunctivitis in the United States. Submission of the IND may not result in the FDA allowing clinical trials to commence.

In our Phase 2 clinical trial of EBI-005 in patients with allergic conjunctivitis, we designed the Phase 2 study to evaluate the safety and efficacy of EBI-005 compared to vehicle-control in two models of allergen challenge adapted to evaluate the late phase response of allergy. The two models were a modified environmental exposure chamber model, or EEC, and a modified direct conjunctival allergen challenge model, or CAPT. Neither the modified CAPT nor the modified EEC has been used as the basis for approval by the FDA of any other treatment for allergic conjunctivitis. We met with the FDA’s Division of Transplant and Ophthalmology Products in February 2015 to discuss these results and our plans for a pivotal Phase 3 clinical program. Based in part on the discussions at that meeting and the scientific advice we received from the European Medicine Agency’s, or EMA, Committee for Medicinal Products for Human Use, or CHMP, we now believe that the CAPT model alone is not an appropriate model for the conduct of our pivotal clinical trials. We intend to use a natural environmental study design for further clinical development of EBI-005 for the treatment of allergic conjunctivitis. We have no clinical efficacy data on EBI-005 in a natural environmental study.

- 18 -

Table of Contents

We believe that our pivotal Phase 3 clinical program in allergic conjunctivitis will consist of two Phase 3 clinical trials evaluating EBI-005 for the treatment of moderate to severe allergic conjunctivitis and a separate clinical trial evaluating the safety of treatment with EBI-005. If we cannot use the results of our separate safety study of EBI-005 in our Phase 3 clinical program in dry eye disease to satisfy the requirement for a separate safety study of EBI-005 in allergic conjunctivitis, we could experience a delay in completing our Phase 3 clinical program in allergic conjunctivitis and we would incur additional costs to complete this Phase 3 clinical program.

If we experience any of a number of possible unforeseen events in connection with our clinical trials, potential marketing approval or commercialization of our product candidates could be delayed or prevented.

We may experience numerous unforeseen events during, or as a result of, clinical trials that could delay or prevent our ability to receive marketing approval or commercialize EBI-005 or any other product candidates that we may develop, including:

| • | clinical trials of our product candidates may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials or abandon product development programs; |

| • | the number of patients required for clinical trials of our product candidates may be larger than we anticipate, enrollment in these clinical trials may be slower than we anticipate or participants may drop out of these clinical trials at a higher rate than we anticipate; |

| • | our third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all; |

| • | regulators or institutional review boards may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; |

| • | we may experience delays in reaching, or fail to reach, agreement on acceptable clinical trial contracts or clinical trial protocols with prospective trial sites; |

| • | we may decide, or regulators or institutional review boards may require us, to suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements or a finding that the participants are being exposed to unacceptable health risks; |

| • | the cost of clinical trials of our product candidates may be greater than we anticipate; |

| • | the supply or quality of our product candidates or other materials necessary to conduct clinical trials of our product candidates may be insufficient or inadequate; and |

| • | our product candidates may have undesirable side effects or other unexpected characteristics, causing us or our investigators, regulators or institutional review boards to suspend or terminate the trials. |

If we are required to conduct additional clinical trials or other testing of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete clinical trials of our product candidates or other testing, if the results of these trials or tests are not favorable or are only modestly favorable or if there are safety concerns, we may:

| • | be delayed in obtaining marketing approval for our product candidates; |

| • | not obtain marketing approval at all; |

- 19 -

Table of Contents

| • | obtain approval for indications or patient populations that are not as broad as intended or desired; |

| • | obtain approval with labeling that includes significant use or distribution restrictions or safety warnings; |

| • | be subject to additional post-marketing testing requirements; or |

| • | have the product removed from the market after obtaining marketing approval. |

Our product development costs will also increase if we experience delays in testing or marketing approvals. We do not know whether any of our preclinical studies or clinical trials will begin as planned, will need to be restructured or will be completed on schedule, or at all. Significant preclinical or clinical trial delays also could shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do and impair our ability to successfully commercialize our product candidates.

If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented.