As filed with the Securities and Exchange Commission on March 13, 2024

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BRT APARTMENTS CORP.

(Exact name of registrant as specified in its charter)

| Maryland | 13-2755856 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

60 Cutter Mill Road, Suite 303

Great Neck, NY 11021

(516) 466-3100

(Address, including zip code, telephone number, including

area code, of registrant’s principal executive offices)

S. Asher Gaffney, Esq.

Vice President and Corporate Secretary

BRT Apartments Corp.

60 Cutter Mill Road, Suite 303

Great Neck, NY 11021

(516) 466-3100

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Jeffrey A. Baumel, Esq.

Brian Lee, Esq.

Dentons US LLP

1221 Avenue of the Americas

New York, New York 10020

(212) 768-6700

Approximate date the registrant proposes to begin selling securities to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☒

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered in connection with dividend or interest reinvestment plans, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a small reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “small reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company ☒ | |

| Non-accelerated filer ☒ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

PROSPECTUS

BRT APARTMENTS CORP.

DIVIDEND REINVESTMENT PLAN

700,000 shares of Common Stock

This prospectus relates to 700,000 shares of common stock, $0.01 par value per share, of BRT Apartments Corp. registered for purchase under the BRT Apartments Corp. Dividend Reinvestment Plan, which we refer to as the “Plan.” This prospectus describes the Plan.

The Plan provides an economical and convenient way for our stockholders to invest in our common stock. Through participation in the Plan, you will have the opportunity to reinvest cash dividends paid on your shares of common stock in additional shares of common stock, at a discount ranging from 0% to 5%, as we may determine from time to time in our sole discretion. As of the date of this prospectus, we are offering a discount of 3% on the price of shares of common stock purchased directly from us through the reinvestment of dividends pursuant to the Plan. We reserve the right to change or eliminate the discount at any time. (See Question 12 for more detailed information regarding the calculation of the price at which dividends are reinvested).

Our shares of common stock are traded on the New York Stock Exchange under the symbol “BRT.” On March 12, 2024, the closing price of our common stock as reported on the New York Stock Exchange was $16.06 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 4 of this prospectus for a description of certain factors you should consider before investing in our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is March 13, 2024.

TABLE OF CONTENTS

Please read this prospectus carefully. If you own our common stock now, or if you decide to buy it in the future, then please keep this prospectus with your permanent investment records, since it contains important information about the Plan.

You should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus may only be used where it is legal to sell these securities. You should not assume that the information contained in this prospectus is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

In this prospectus, the words “we,” “us” and “our” refer to BRT Apartments Corp. and its subsidiaries.

The following summary of the Plan omits certain information that may be important to you. You should carefully read the entire text of the Plan contained in this prospectus before you decide to participate in the Plan.

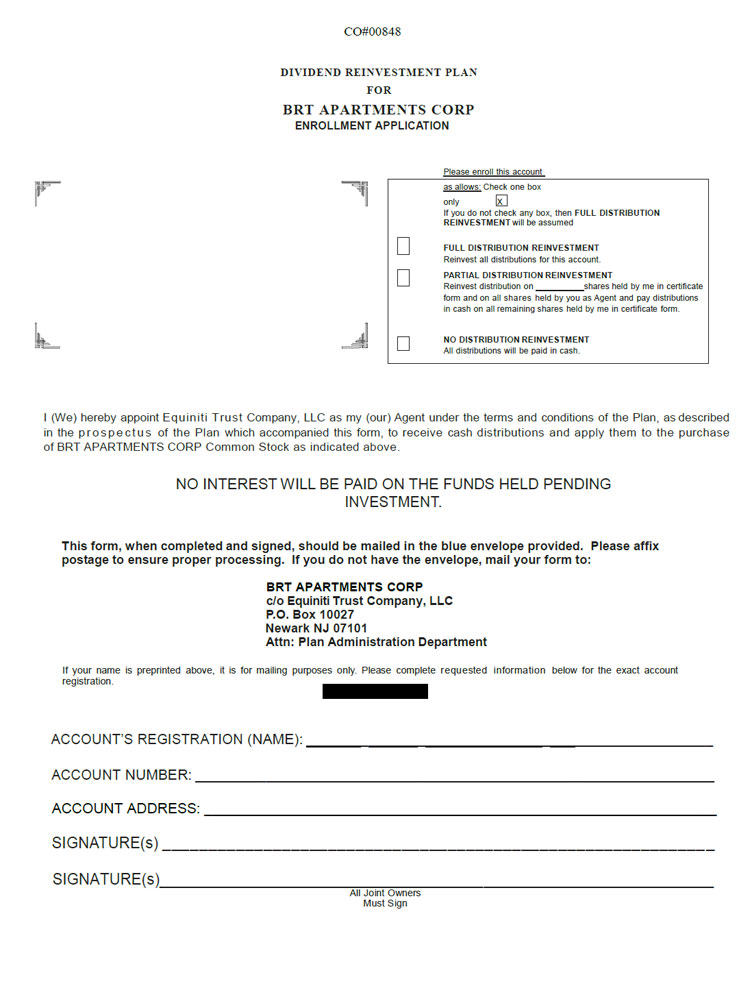

Enrollment

You can participate in the Plan by completing and submitting the enclosed Enrollment Form. You may also obtain an Enrollment Form from the Plan Administrator, Equiniti Trust Company, LLC, (formerly known as American Stock Transfer & Trust Company LLC), by accessing its website at www.equiniti.com/us/. Please see Question 8 for more detailed information.

Reinvestment of Dividends

If you are a stockholder of record, you can reinvest any cash dividends paid on all or a portion of your shares of common stock. You will be able to purchase shares of common stock by reinvesting your dividends without paying any brokerage commissions or other fees on stock purchased directly from us. Except for the restrictions contained in our articles of incorporation, which we refer to as the “Charter”, with respect to the ownership and transfer of our shares, the reinvestment of any cash dividends paid on your common stock is not subject to a maximum limit. Please see “Sources of Shares of Common Stock” and Questions 7 and 9 for more detailed information.

Administration

Equiniti Trust Company, LLC, the transfer agent for our common stock, will serve as the plan administrator of the plan (the “Plan Administrator” or “Equiniti”). All general correspondence (i.e., other than inquiries with respect to a specific transaction) to the Plan Administrator should be sent to: Equiniti Trust Company, LLC, 55 Challenger Road, Ridgefield Park, NJ 07660, Attention: Shareholder Relations. All correspondence with respect to specific transaction(s) should be sent as follows: (i) if the correspondence will be received by Equiniti by March 31, 2024, it should be sent to: Plan Administrator, Equiniti Trust Company, LLC, Box 922, Wall Street Station, New York, NY 10269-0560 and (ii) if the correspondence will be received by Equiniti after March 31, 2024, it should be sent to: Plan Administrator, Equiniti Trust Company, LLC, P.O. Box 10027, Newark, NJ 07101. You may also call the Plan Administrator at 1-888-888-0144. If you are inquiring about enrollments, termination, sale of shares or if you desire to view your account balance, you may log onto the Plan Administrator’s website at www.equiniti.com/us. Please see Question 5 for more detailed information.

Source of Shares of Common Stock

Generally, common stock purchased by the Plan Administrator under the Plan will come from our legally authorized but unissued shares of common stock. However, we may, in our sole discretion, direct the Plan Administrator to purchase shares of common stock in the open market or in privately negotiated transactions with third parties. If shares of common stock are purchased for you in the open market or in privately negotiated transactions, you will not receive any discount. Please see Question 4 for more detailed information.

Purchase Price

Purchases from Us

The purchase price for shares of common stock that the Plan Administrator purchases directly from us for dividend reinvestments under the Plan will be equal to the higher of:

| ● | 97% (or such other discount as may then be in effect) of the average of the high and low sales prices of a share of our common stock during the five days on which the NYSE is open and for which trades in shares of common stock are reported immediately preceding the relevant purchase date, or, if no trading occurs in the shares of common stock on one or more of such days, for the five days immediately preceding the purchase date for which trades are reported; and |

| ● | 97% (or such other discount as may then be in effect) of the average of the high and low sales prices of a share of our common stock on the purchase date. |

The share prices to be used in the calculation will be the prices reported on the NYSE Composite Transactions Tape and all price calculations will be computed to four decimal places. The discount is subject to change from time to time, in our sole discretion, but will be between 0% to 5%. We will advise participants through a press release of any change in the applicable discount at least five days prior to the effective date of the change. Please see Question 12 for more detailed information.

Purchases on the Open Market

The purchase price for shares of common stock purchased in the open market or in privately negotiated transactions with third parties will equal the weighted average of the purchase prices paid for the shares, as computed to four decimal places by the Plan Administrator. Please see Question 12 for more detailed information.

Tracking Your Investment

You will receive periodic statements of the transactions made in your Plan account. These statements will provide you with details of the transactions and will indicate the share balance in your Plan account. Please see Question 20 for information on your transaction statements.

We are an internally managed real estate investment trust, also known as a REIT, that is focused on the ownership, operation and, to a lesser extent, development of multi-family properties. These properties may be wholly owned or owned by unconsolidated joint ventures in which we generally contribute a significant portion of the equity. At December 31, 2023, we: (i) wholly-own 21 multi-family properties with an aggregate of 5,420 units with a carrying value of $634.0 million; (ii) have ownership interests, through unconsolidated entities, in seven multi-family properties with an aggregate of 2,287 units for which the carrying value of our net equity investment therein is $30.4 million; and (iii) own other assets, through consolidated and unconsolidated subsidiaries, with a carrying value of $5.6 million. The 28 multi-family properties are located in 11 states; primarily in the Southeast United States and Texas.

Our corporate office is located at 60 Cutter Mill Road, Suite 303, Great Neck, N.Y. 11021 and we can be contacted at 516-466-3100. We maintain a website at www.brtapartments.com. The information contained on or connected to our website is not incorporated by reference into this prospectus, and you must not consider the information on our website to be a part of this prospectus.

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend such forward-looking statements to be covered by the safe harbor provision for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “could,” “likely,” “should,” “plan,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “predict,” “project,” or similar expressions or variations thereof. You should not place undo reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could materially affect actual results, performance or achievements.

The following factors could cause our actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking statements:

| • | inability to generate sufficient cash flows due to unfavorable economic and market conditions (e.g., inflation, volatile interest rates and the possibility of a recession), changes in supply and/or demand, competition, uninsured losses, changes in tax and housing laws or other factors; |

| • | adverse changes in real estate markets, including, but not limited to, the extent of future demand for multifamily units in our significant markets, barriers of entry into new markets which we may seek to enter in the future, limitations on our ability to increase or collect rental rates, competition, our ability to identify and consummate attractive acquisitions and dispositions on favorable terms, and our ability to reinvest sale proceeds in a manner that generates favorable returns; |

| • | general and local real estate conditions, including any changes in the value of our real estate; |

| • | decreasing rental rates or increasing vacancy rates; |

| • | challenges in acquiring properties (including challenges in buying properties directly without the participation of joint venture partners and the limited number of multi-family property acquisition opportunities available to us), which acquisitions may not be completed or may not produce the cash flows or income expected; |

| • | the competitive environment in which we operate, including competition that could adversely affect our ability to acquire properties and/or limit our ability to lease apartments or increase or maintain rental rates; |

| • | exposure to risks inherent in investments in a single industry and sector; |

| • | the concentration of our multi-family properties in the Southeastern United States and Texas, which makes us more susceptible to adverse developments in those markets; |

| • | increases in expenses over which we have limited control, such as real estate taxes, insurance costs and utilities, due to inflation and other factors; |

| • | impairment in the value of real estate we own; |

| • | failure of property managers to properly manage properties; |

| • | accessibility of debt and equity capital markets; |

| • | disagreements with, or misconduct by, joint venture partners; |

| • | inability to obtain financing at favorable rates, if at all, or refinance existing debt as it matures; |

| • | level and volatility of interest or capitalization rates or capital market conditions; |

| • | extreme weather and natural disasters such as hurricanes, tornadoes and floods; |

| • | lack of or insufficient amounts of insurance to cover, among other things, losses from catastrophes; |

| • | risks associated with acquiring value-add multi-family properties, which involves greater risks than more conservative approaches; |

| • | the condition of Fannie Mae or Freddie Mac, which could adversely impact us; |

| • | changes in Federal, state and local governmental laws and regulations, including laws and regulations relating to taxes and real estate and related investments; |

| • | our failure to comply with laws, including those requiring access to our properties by disabled persons, which could result in substantial costs; |

| • | board determinations as to timing and payment of dividends, if any, and our ability or willingness to pay future dividends; |

| • | our ability to satisfy the complex rules required to maintain our qualification as a REIT for federal income tax purposes; |

| • | possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently owned or previously owned by us or a subsidiary owned by us or acquired by us; |

| • | our dependence on information systems and risks associated with breaches of such systems; |

| • | disease outbreaks and other public health events, and measures that are taken by federal, state, and local governmental authorities in response to such outbreaks and events; |

| • | impact of climate change on our properties or operations; |

| • | risks associated with the stock ownership restrictions of the Internal Revenue Code of 1986, as amended (the "Code") for REITs and the stock ownership limit imposed by our charter; and |

| • | other risks detailed from time-to-time in our reports filed with the Securities and Exchange Commission(the “SEC”). |

Any forward-looking statement we make in this prospectus or elsewhere speaks only as of the date on which we make it. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the forward-looking statements we make in this prospectus (including any information incorporated by reference into this prospectus) whether as a result of new information, future events or otherwise, except as required by law. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider such disclosures to be a complete discussion of all potential risks or uncertainties.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with SEC. The SEC maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information that we file electronically with the SEC. You may also secure a copy of this information (including the documents identified below under “Incorporation of Certain Information by Reference”) without charge on the Investor Relations page on our website: www.brtapartments.com, or upon written or telephonic request to: BRT Apartments Corp., 60 Cutter Mill Road, Suite 303, Great Neck, New York 11021, (516) 466-3100, Attention: Investor Relations.

We have filed with the SEC a “shelf” registration statement on Form S-3 under the Securities Act of 1933, as amended, relating to the securities that may be offered by this prospectus. This prospectus is a part of that registration statement, but does not contain all of the information in the registration statement. We have omitted parts of the registration statement in accordance with the rules and regulations of the SEC. For more details about us and any securities that may be offered by this prospectus, you may examine the registration statement on Form S-3 and the exhibits filed with it as noted in the previous paragraph.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We incorporate information into this prospectus by reference, which means that we disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except to the extent superseded by information contained herein or by information contained in documents filed with or furnished to the SEC after the date of this prospectus. This prospectus incorporates by reference the documents set forth below that have been previously filed with the SEC:

| ● | our Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 15, 2023 (the “Annual Report”); |

| ● | the information specifically incorporated by reference into the Annual Report from our proxy statement filed on April 21, 2023; |

| ● | our Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30, 2023, and September 30, 2023, filed on May 8, 2023, August 7, 2023 and November 6, 2023, respectively; |

| ● | our Current Reports on Form 8-K (including amendments thereto) filed on May 12, 2023, May 15, 2023, June 15, 2023, August 15, 2023, August 30, 2023, December 4, 2023 and December 26, 2023; |

| ● | the description of our shares of common stock included as Exhibit 4.2 (the “Exhibit”) to our Annual Report filed on March 15, 2021; and |

| ● | all other reports filed by us pursuant to Section 13(a) or 15(d) of the Exchange Act since December 31, 2022. |

All documents and reports filed by us with the SEC (other than Current Reports on Form 8-K furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K, unless otherwise indicated therein) pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date that the registration statement of which this prospectus is a part is first filed with the SEC and prior to the termination of this offering shall be deemed incorporated by reference in this prospectus and shall be deemed to be a part of this prospectus from the date of filing of such documents and reports.

Any statement in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement in this prospectus or in any subsequently filed document or report incorporated or deemed to be incorporated by reference in this prospectus modifies or supersedes such statement. Any such statement so modified or superseded shall only be deemed to constitute a part of this prospectus as it is so modified or superseded.

Investing in our securities involves significant risks. Please see the risk factors under the heading “Risk Factors” in our periodic reports filed with the SEC under the Exchange Act, which are incorporated by reference in this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this Prospectus and any prospectus supplement. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations.

In addition to the risk factors incorporated by reference into this Prospectus, below is a description of certain risks that you may face by virtue of your participation in the Plan. There may be additional risks that are not listed below or in the referenced documents, and you should consult your financial, tax, legal and other advisors prior to determining whether to participate in the Plan.

There is no price protection for your shares of common stock in the Plan. Your investment in the shares of common stock held in the Plan will be exposed to changes in market conditions and changes in the market value of shares of common stock. Your ability to liquidate or otherwise dispose of shares of common stock in the Plan is subject to the terms of the Plan and the withdrawal procedures under the Plan. You may not be able to withdraw or sell your shares of common stock in the Plan in time to react to market conditions.

The purchase price for shares of common stock purchased or sold under the Plan will vary. The purchase price for any shares of common stock that you purchase or sell under the Plan will vary and cannot be predicted. You may purchase or sell shares of common stock at a purchase price that is different from (more or less than) the price that you would face if you acquired or sold shares on the open market on the related dividend payment date, purchase date or sale date, as appropriate.

Because our common stock may not be actively traded and the market price for our common stock varies, you should purchase shares of common stock for long-term investment only. Although our common stock is listed on the NYSE, our common stock may not be actively traded. We cannot assure you that there will, at any time in the future, be an active trading market for our common stock. Even if there is an active trading market for our common stock, we cannot assure you that you will be able to sell all of your shares of common stock at one time or at a favorable price, if at all. As a result, you should participate in the Plan only if you are capable of, and seeking, to make a long-term investment in shares of common stock.

We may reduce or eliminate the discount for shares purchased pursuant to the Plan. A benefit of participating in the Plan is that you may be able to reinvest your dividends and acquire our shares at a discount to the then trading price. (See Questions 3, 4 and 12 for further information). While the discount is currently 3% (although we can increase it up to 5%), we reserve the right, without notice to you (to the extent permitted by law, we will announce the change in the discount by issuing a press release and not by a notice sent to participants in the Plan) to reduce or eliminate the discount. Further, if we elect to have the Plan Administrator purchase the shares in the open market or privately negotiated transactions (See Question 12 for further information), which election may be made without notice to you, there will be no discount with respect to such purchase, and you will be responsible for your pro rata share of fees and commissions, including brokerage fees, incurred in connection therewith. We reserve the right to reduce or eliminate the discount at any time for any reason whatsoever and the reduction or elimination of the discount, which you may not be aware of, may make participation in the Plan of less benefit to you.

We may not be able to pay dividends. Our board of directors has the discretion to authorize dividends, subject to certain limitations imposed under Maryland law and our Charter and by-laws. If we are unable to maintain profitability or if the Board does not authorize dividends, we may not be able to make distributions to our stockholders.

You will not earn any interest on your dividends or cash pending investment. No interest will be paid on dividends, cash or other funds pending investment or disbursement.

You may incur tax obligations without receiving cash with which to pay those obligations. If you acquire shares by reinvesting dividends under the Plan, you will be treated for U.S. federal income tax purposes as if you received a cash dividend on the date the shares are acquired in an amount equal to the fair market value of the shares acquired under the Plan (including the shares you acquired as a result of the Plan discount) on that date. Any income tax obligation you incur will be the same as if you received such dividend in cash but you will have to pay that obligation using funds from other sources. Certain participants may also be subject to an additional non-deductible 3.8% tax on “net investment income.” See Question 23 for a description of certain U.S. federal income tax consequences of participating in the Plan.

TERMS AND CONDITIONS OF THE PLAN

The following constitutes our Dividend Reinvestment Plan, effective as of the date the Registration Statement on Form S-3 relating to the Plan is filed with the SEC. All references in this prospectus to “common stock” refer to our shares of common stock, par value $0.01 per share.

Purpose

| 1. | What is the purpose of the Plan? |

The purpose of the Plan is to provide our stockholders with a simple, convenient and cost effective way to reinvest, all or a portion of their cash dividends in additional shares of our common stock. To the extent that shares of common stock are purchased directly from us, we will receive additional funds to repay debt, make investments in real estate and for other purposes. See Question 12 and “Use of Proceeds.”

Participation Options

| 2. | What are my investment options under the Plan? |

Once enrolled in the Plan, you may buy shares of common stock through the following investment options:

| ● | Full Dividend Reinvestment. You may have cash dividends paid on all of your shares of common stock automatically reinvested in additional shares of common stock. | |

| ● | Partial Dividend Reinvestment. You may have cash dividends paid on a specified number of your shares of common stock held by you automatically reinvested in additional shares of common stock. We will continue to pay you cash dividends on your remaining shares of common stock. |

Advantages

| 3. | What are the advantages of the Plan? |

The advantages of the Plan are as follows:

| ● | Reinvestment of Dividends. Participants may purchase additional shares of common stock automatically by reinvesting all or a portion of their cash dividends. Dividend payments not reinvested will be paid by check or electronic fund transfer. |

| ● | Fractional Shares. All cash dividends paid on a participant’s shares of common stock are fully invested in additional shares of common stock because the Plan permits fractional share interests to be credited to Plan accounts. In addition, dividends will be paid on, and may be reinvested with respect to, such fractional share interests. | |

| ● | Discount. We may offer a discount of up to 5% of the market price on purchases of shares of common stock under the Plan for stock purchased directly from us. Currently, we offer a discount of 3.0% for reinvested dividends. We will advise participants through a press release of any change in the applicable discount at least five days prior to the effective date of the change. | |

| ● | Sale or Transfer of Shares: Participants may request that the Plan Administrator effect the sale of a portion or all of their Plan shares. Please see Question 22 for additional information. | |

| ● | Reduced Fees. No brokerage commissions or fees are charged with respect to shares of common stock acquired directly from us with reinvested dividends. With respect to shares of common stock purchased with reinvested dividends on the open market or in privately negotiated transactions, you will pay your pro rata share of the brokerage commissions incurred by the Plan Administrator with respect to such purchase. With respect to shares of common stock you sell through the Plan Administrator, you will pay the Plan Administrator $15.00 for each transaction and $0.12 per share sold. The Plan Administrator believes that these fees are generally less than the fees that would have been paid if the stockholder purchased or sold shares directly through a broker. Please see Question 22 for more information. | |

| ● | Simplified Recordkeeping. Participants are furnished periodic statements which show the detail of each transaction and indicate the share balance of the Plan account, providing a simplified method of recordkeeping. |

Disadvantages

| 4. | What are the disadvantages of the Plan? |

The disadvantages of the Plan are as follows:

| ● | No interest paid on funds pending investment. No interest is paid on dividends held by the Plan Administrator pending reinvestment. | |

| ● | Purchase/sale price determination. Participants have no control over the share price or the timing of the purchase or sale of Plan shares. Participants cannot designate a specific price or a specific date at which to purchase or sell shares of common stock or the selection of a broker/dealer through or from whom purchases or sales are made. In addition, participants will not know the exact number of shares purchased until after the investment date. | |

| ● | Reinvested dividends will be treated as dividends for tax purposes. Participants who reinvest dividends paid on shares of common stock will be treated for U.S. federal income tax purposes as if they received a cash dividend equal to the fair market value of the shares acquired through the Plan (including the shares acquired as a result of the Plan discount) but will not receive cash to pay any tax payment that may be owed on that dividend. Regardless of any Plan discount, the amount of such dividend will equal the fair market value of the shares as of the date the shares are acquired under the Plan. Please see Question 23 for more detailed information. | |

| ● | No discount for open market or privately negotiated transactions. If we direct the Plan Administrator to purchase shares of common stock in the open market or in privately negotiated transactions with third parties (as we may do in our sole discretion without notice to you), you will not receive any discount on the purchase. At the present, we do not contemplate the purchase of shares of common stock in the open market or in privately negotiated transactions for dividend reinvestments. | |

| ● | The purchase price used in calculating the number of shares to be issued to you may not be as favorable as the purchase price you may have obtained had you purchased the shares on the open market. The number of shares of common stock purchased directly from us under the Plan is based on the share price that is determined by a formula described under Question 12. As a result of this formula, the purchase price under the Plan may not be as favorable to you, even after giving effect to the discount, as you would have obtained had you purchased the shares without participating in the Plan. Additionally, without giving you prior notice, we may direct the Plan Administrator to buy shares of common stock under the Plan either in the open market or in privately negotiated transactions with third parties. The purchase price for shares of common stock purchased in the open market or in privately negotiated transactions with third parties will equal the weighted average of the purchase prices paid by the Plan Administrator for the shares, you will not receive the benefit of any discount, and you will pay your pro rata share of the brokerage and similar fees incurred by the Plan Administrator in effecting such purchases. Please see Question 22 for more detailed information. | |

| ● | Delay of sales. Sales of shares held in the Plan may not take place promptly upon your request because the Plan Administrator will generally not sell shares more than once per day. Accordingly, sales of shares of common stock held in your Plan account may be delayed. (See Question 16 for more detailed information). | |

|

●

|

Plan shares may not be pledged. You may not pledge shares of common stock deposited in your Plan account unless you withdraw those shares from the Plan. |

Administration

| 5. | Who will administer the Plan? |

Equiniti Trust Company, LLC has been appointed as administrator of the Plan. Enrollment, sale of share requests and other transactions or services offered under the Plan should be directed to the Plan Administrator through use of any of the following:

Telephone

Customer Service Representatives are available 8:00 a.m. to 8:00 p.m., New York City, Monday through Friday (except holidays) at 1-888-888-0144.

In Writing

You may also write to the Plan Administrator at the following addresses:

| For transactions: | For inquiries: |

|

Until March 31, 2024: Equiniti Trust Company, LLC P.O. Box 922, Wall Street Station, New York, NY 10269-0560 |

Equiniti Trust Company, LLC 55 Challenger Road Ridgefield Park, New Jersey 07660 Attention: Shareholder Relations |

|

After March 31, 2024: |

|

|

Equiniti Trust Company, LLC P.O. Box 10027 Newark, New Jersey 07101 |

Be sure to include your name, address, daytime phone number, social security or tax I.D. number and a reference to BRT Apartments Corp. on all correspondence.

Internet

For terminations, sale of shares or to view account balances or history, you may visit the Plan Administrator’s website at www.equiniti.com/us. In order to use the website, you must be enrolled in the Plan and have available your social security number and ten digit account number. Once you have gained access, you should follow the instructions on the menu.

Employees of the Plan Administrator are not permitted to give any opinions on the merits of any security or class of securities. Securities held by the Plan Administrator in your Plan account are not subject to protection under the Securities Investor Protection Act of 1970. The Plan Administrator may use, and commissions may be paid to, a broker-dealer that is affiliated with the Plan Administrator. Investors must make independent investment decisions based upon their own judgment and research.

We may replace the Plan Administrator at any time upon written notice to the Plan Administrator, and the Plan Administrator may resign as the Plan Administrator. If we replace the Plan Administrator or the Plan Administrator resigns, we may designate another qualified administrator as successor to the Plan Administrator for all or a part of the Plan Administrator’s functions under the Plan. All participants will be notified of any such change. If we change the Plan Administrator, references in this prospectus to the Plan Administrator shall be deemed to be references to the successor Plan Administrator, unless the context requires otherwise.

Participation

| 6. | Who is eligible to participate in the Plan? |

Record Owners. You are a record owner if you own shares of common stock that are registered in your name with our transfer agent. If you are a record owner, you may participate directly in any or all of the features of the Plan.

Beneficial Owners. You are a beneficial owner if you own shares of common stock that are registered in the name of a broker, bank or other nominee. If you are a beneficial owner, you must (a) become a record owner by having one or more shares transferred into your own name, or (b) coordinate your participation in the Plan through the broker, bank or other nominee in whose name your shares of common stock are held.

Plan Restrictions

| 7. | What are these restrictions on participation in the Plan other than those described under Question 6? |

Legality. You may not participate in the Plan if it would be unlawful for you to do so in the jurisdiction where you are a citizen or reside. If you live outside the U.S. and you are a qualified U.S. person, you should first determine if there are any laws or governmental regulations that would prohibit your participation in the Plan. We reserve the right to terminate participation of any participant if we deem it advisable under any foreign laws or regulations.

REIT Status. Our common stock is subject to certain restrictions on ownership and transfer designed, among other things, to preserve our qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes. In furtherance thereof, our Charter restricts any person, with certain exceptions, from owning, or being deemed to own by virtue of the attribution provisions of the Internal Revenue Code of 1986, as amended, which we refer to as the Code, more than 6.0%, in number of shares or value, of the issued and outstanding shares of our common stock. Our Charter provides that we have various rights to enforce this limitation, including the transfer of such shares of capital stock to a trust. This summary of the ownership limitation is qualified in its entirety by reference to our Charter. We reserve the right to invalidate any purchases made under the Plan that we determine, in our sole discretion, may violate the ownership limitation set forth in our Charter or any REIT provision in the Code.

Our Discretion. We reserve the right to modify, suspend or terminate the Plan. Additionally, we may modify, suspend or terminate the participation in the Plan by any participant in order to eliminate practices which are, in our sole discretion, not consistent with the purpose or operation of the Plan or which adversely affect the price of our shares of common stock.

Enrollment

| 8. | How do I enroll in the Plan? |

If you are eligible to participate in the Plan, you may join the Plan at any time. Once you enroll in the Plan, you will remain enrolled until you withdraw from the Plan or we terminate the Plan or your participation in the Plan.

Enrollment Form. To enroll and participate in the Plan, you must complete the enclosed Enrollment Form and mail it to the Plan Administrator at Equiniti Trust Company, LLC. If your send the Enrollment Form so that it is received:

| ● | by March 31, 2024, please send it to: P.O. Box 922, Wall Street Station, New York, NY 10269-0560, and |

| ● | after March 31, 2024, please send it to: P.O. Box 10027, Newark, NJ 07101. |

You may also enroll by accessing the Plan Administrator’s website at www.equiniti.com/us. If your shares of common stock are registered in more than one name (such as joint tenants or trustees), all such registered holders must sign the Enrollment Form. If you are eligible to participate in the Plan, you may sign and return the Enrollment Form to participate in the Plan at any time. The Plan Administrator must receive a properly executed Enrollment Form by the dividend record date for the relevant dividend payment.

Record Holders. If you own shares of common stock that are registered in your name (not the name of a broker, bank or other nominee), you can enroll in the Plan by completing an Enrollment Form and submitting it to the Plan Administrator. As a record holder, you may participate in any of the services of the Plan.

Beneficial Holders. If you are a beneficial holder, you may arrange to have your broker or bank participate in the Plan on your behalf. The Plan Administrator will not have a record of your transactions or your account since they will remain under the name of your broker or bank.

Dividend Reinvestment Options

| 9. | How do I reinvest dividends? |

Choosing Your Investment Options. If you elect to reinvest your dividends, you must choose one of the following when completing the Dividend Reinvestment section of the Enrollment Form:

| ● | Full Dividend Reinvestment: This option directs the Plan Administrator to reinvest the cash dividends paid on all of the shares of common stock owned by you then or in the future in additional shares. | |

| ● | Partial Dividend Reinvestment: This option allows you to specify a fixed number of full shares held by you on which you would like to receive a cash dividend payment and directs the Plan Administrator to reinvest the cash dividends paid on all remaining shares of common stock owned by you then or in the future. We will continue to pay you cash dividends, when, as and if declared by our board of directors, on the specified number of shares, unless you designate those shares for reinvestment pursuant to the Plan. |

You should choose your investment option by checking the appropriate option(s) on the Enrollment Form, a copy of which is enclosed. If you sign and return an Enrollment Form without checking an option, the Plan Administrator will choose the “Full Dividend Reinvestment” option and will reinvest all cash dividends on all shares of common stock registered in your name. If you select both Full and Partial Dividend Reinvestment, the Plan Administrator will choose the “Full Dividend Reinvestment.”

The Plan Administrator must receive a properly executed Enrollment Form by the dividend record date for the relevant dividend payment.

Changing Your Investment Option. You may change your investment option by contacting the Plan Administrator. The Plan Administrator must receive any change with regard to your participation in the Plan by the record date for a dividend payment in order for the change to be effective for that dividend payment. You may, of course, choose not to reinvest any of your dividends, in which case the Plan Administrator will remit any dividends to you.

Timing of Dividend Reinvestments

| 10. | When are dividends reinvested? |

The Plan Administrator will invest dividends in additional shares of common stock that are purchased directly from us on the dividend payment date, unless the dividend payment date is not a day on which the NYSE is open for trading, in which case the dividends will be invested on the next trading day. In the case of purchases on the open market or in privately negotiated transactions with third parties, the Plan Administrator will make such purchases as soon as practicable on or after the dividend payment date.

We generally have paid dividends during the first two weeks of each January, April, July and October. In the past, the dividend record dates have preceded the dividend payment dates by ten to twenty days. We cannot assure you that we will continue to pay dividends according to this schedule, and nothing contained in the Plan obligates us to do so. Neither we nor the Plan Administrator will be liable when conditions, including compliance with the provisions of our Charter and rules and regulations of the SEC or the NYSE, prevent the Plan Administrator from buying shares of common stock or interfere with the timing of such purchases.

For purposes of the Plan, we may aggregate all dividend reinvestments for participants with more than one account using the same social security or taxpayer identification number. For participants unable to supply a social security or taxpayer identification number, we may limit their participation to only one Plan account. In addition, all Plan accounts that we believe to be under common control or management or to have common ultimate beneficial ownership may be aggregated. Unless we have determined that reinvestment of dividends for each such account would be consistent with the purposes of the Plan, we have the right to aggregate all such accounts and to return, without interest, within 30 days any amounts in excess of the investment limitations applicable to a single account received in respect of all such accounts.

We pay dividends as and when authorized and declared by our board of directors. We cannot assure you that we will declare or pay a dividend in the future, and nothing contained in the Plan obligates us to do so. The Plan does not represent a guarantee of future dividends.

Common Stock Purchases

| 11. | What is the source of shares to be purchased under the Plan? |

All dividends reinvested through the Plan will be used to purchase either newly issued shares directly from us, or shares on the open market or in privately negotiated transactions with third parties, at our discretion. Shares purchased directly from us will consist of authorized but unissued shares of common stock.

Price of Shares Purchased

| 12. | At what price will shares be purchased? |

The purchase price for shares under the Plan depends on whether the Plan Administrator obtains shares in the open market or in privately negotiated transactions with third parties or by purchasing them directly from us. Specifically:

| ● | the purchase price for shares of common stock purchased in the open market or in privately negotiated transactions will equal the weighted average price of all the shares purchased by the Plan Administrator for all participating participants on the applicable purchase date. | ||

| ● | the purchase price for shares of common stock that the Plan Administrator purchases directly from us will be equal to the higher of: | ||

| - | 97% (or such other discount as may then be in effect), of the average of the daily high and low sales prices of our common stock on the NYSE for the five trading days in which are shares are traded immediately preceding the purchase date, or if no trading occurs in the shares of common stock on one or more of such days, for the five days immediately preceding the purchase date for which trades are reported; and | ||

| - | 97% (or such other discount as may then be in effect) of the average of the high and low sales of our common stock on the purchase date. | ||

The high and low sales prices will be the prices as reported on the NYSE Composite Transaction Tape. All price calculations will be made to four decimal places. Currently, we offer a discount of 3.0% on shares purchased by dividend reinvestment directly from us. We may change the discount at any time, in our sole discretion, but the discount shall always be between 0% - 5%. In the event there is no trading in the common stock, or if for any reason we and the Plan Administrator have difficulty in determining the price of shares to be purchased under the Plan, then we, in consultation with the Plan Administrator, will use such other public report or sources as we deems appropriate to determine the market price and the appropriate discount.

Stock Certificates and Safekeeping

| 13. | Will I receive certificates for shares purchased through the Plan? |

No. Plan account shares are held in your name in non-certificated, “book-entry” form. This feature protects against the loss, theft or destruction of certificates evidencing your shares of common stock.

| 14. | Can I get certificates if I want them? |

No.

| 15. | May I deposit stock certificates I currently hold into my Plan account? |

If you own shares of common stock in certificated form, you may deposit all or a portion of the certificates in your possession with the Plan Administrator for safekeeping. To deposit your stock certificates, you should send the certificates to the Plan Administrator by registered or certified mail, return receipt requested (or some other form of traceable mail), and properly insured. The insured amount represents the approximate cost to you of replacing the certificates if they are lost in transit to the Plan Administrator. The Plan Administrator will promptly send you a statement confirming each stock certificate deposited. The Plan Administrator will credit the shares of common stock represented by the certificates to your account in book-entry form and will combine the shares with any whole and fractional shares then held in your Plan account.

In addition to protecting against the loss, theft or destruction of your certificates, this service also is convenient if you sell shares of common stock through the services of the Plan Administrator. See Question 16 for more information on how to sell your shares of common stock under the Plan.

The Plan Administrator charges a $7.50 per transaction fee for stock certificates deposited with it for “safekeeping”, which fee is waived if the shares deposited are to be sold at or about the same time as the stock certificates are deposited.

Sale and Transfer of Shares

| 16. | How can I sell shares in my Plan account? |

You can sell any number of shares held in your Plan account at any time by contacting the Plan Administrator. After receipt of your sale request, the Plan Administrator will sell such shares through a designated broker or dealer. The Plan Administrator will mail to you a check for the proceeds of such sale, less applicable fees described in Question 22 and any taxes. The Plan Administrator generally intends to sell shares of common stock at least once per day at the then current market prices through one or more brokerage firms.

Cost of Selling Shares. Please see Question 22 for a description of such fees and costs.

Termination of Your Account Upon Sale of All Shares. If you no longer hold any shares in your Plan account, the Plan Administrator may close your Plan account. Similarly, if you hold less than one share in your Plan account, the Plan Administrator may liquidate the fractional share and remit the proceeds to you, less any applicable fees, and close your Plan account.

Timing and Control. If the Plan Administrator sells your shares, we do not have the authority or power to control the timing or pricing of shares sold or the selection of the broker making the sales. Therefore, you will not be able to precisely time your sales through the Plan, and will bear the market risk associated with fluctuations in the price of shares of common stock. That is, if you request the Plan Administrator to sell your shares, it is possible that the market price of shares of common stock could go down or up before your shares are sold and the per share sales price you receive will be the average price of all common stock shares sold through the Plan Administrator with respect to that sale date. In addition, you will not earn interest on a sales transaction.

| 17. | How can I transfer or give gifts of shares? |

You may transfer or give gifts of shares of common stock to anyone you choose (subject to the restrictions set forth in our Charter, and as may be amended from time to time), by sending the Plan Administrator, (a) an Enrollment Form executed by you, (b) a stock assignment properly executed by you, (c) a letter from you setting forth a detailed description of the transfer and (d) a Form W-9 (Certificate of Taxpayer Identification Number) completed and executed by the person to whom you are transferring your shares. These materials, if sent so that they are received:

| ● | by March 31, 2024, should be sent to Equiniti Trust Company, LLC, Plan Administrator, P.O. Box 922, Wall Street Station, New York, NY 10269-0560, and |

| ● | after March 31, 2024, should be sent to Equiniti Trust Company, LLC, Plan Administrator, P.O. Box 10027, Newark, New Jersey 07101. |

Absent any instructions by you, if you are enrolled in the Plan, any transferee of your shares will also automatically be enrolled in the Plan as well.

| 18. | Can I transfer my right to participate in the Plan to another person? |

You may not transfer your right to participate in the Plan to another person. However, you may change ownership of all or part of your Plan shares through a gift, sale or otherwise at any time.

Termination of Participation

| 19. | How would I terminate my participation? |

You may withdraw from the Plan at any time. To do so, you must provide notice to the Plan Administrator instructing it to terminate your Plan participation. Notice may be provided by mail, telephone or through the Plan Administrator’s website. To be effective for any given dividend payment, the Plan Administrator must receive notice at least three days prior to the next purchase date. If your Plan withdrawal notice is received less than three days before the next purchase date, the dividend will be applied in accordance with the Plan, but subsequent dividends will be paid to you in cash. Upon termination of your Plan account, you will receive a certificate for the whole shares you held under the Plan, and a check for any fractional shares held in your account at the time of termination based on the current market value less any applicable service fees. After the Plan Administrator terminates your account, future dividends will be sent directly to you by check. Alternatively, if you so direct, the Plan Administrator will sell all whole and fractional shares in your Plan account and send you a check for the proceeds less any applicable fees.

Rejoining the Plan After Withdrawal. After you withdraw from the Plan, you may rejoin the Plan at any time by delivering a new Enrollment Form to the Plan Administrator. However, the Plan Administrator has the right to reject your Enrollment Form if you repeatedly join and withdraw from the Plan, or for any other reason. The Plan Administrator’s exercise of this right is intended to minimize unnecessary administrative expenses and to encourage use of the Plan as a long-term stockholder investment service.

Reports and Notices to Participants

| 20. | How will I keep track of my investments? |

The Plan Administrator will send you a transaction notice confirming the details of each transaction you make. If you continue to participate in the Plan but have no transactions, the Plan Administrator will send you an annual statement after the end of the year detailing the status of your holdings of shares of common stock in your Plan account. Participants who have elected to have their dividends reinvested will receive a quarterly Plan account statement in addition to the transaction notices.

| 21. | Where will notices be sent? |

The Plan Administrator will address all of its notices to you at your last known address. You should notify the Plan Administrator promptly, in writing, of any change of address.

Fees and Commissions

| 22. | What are the costs of participating in the Plan? |

If the Plan acquires shares directly from us, you will not pay any fees or brokerage commissions for shares of common stock purchased with your reinvested dividends. (We have agreed to pay the Plan Administrator’s fees (i.e., 5% of the amount reinvested, up to a maximum fee of $5.00 per reinvesting account) in connection with reinvested dividends. If the Plan purchases shares in the open market or in privately negotiated transactions, you will be responsible for your pro rata shares of fees and commissions, including brokerage fees, incurred in connection therewith. As of the date of this prospectus, the Plan does not intend to acquire shares in the open market or through privately negotiated transactions.

If you request that the Plan Administrator sell your shares, you will pay a fee of $15.00 per transaction and $0.12 for each share sold.

See also Question 15 for information regarding the fees imposed in connection with depositing all or a portion of your certificates for safekeeping.

Federal Tax Consequences

| 23. | What are the federal income tax consequences of participating in the Plan? |

The following is a brief summary of the U.S. federal income tax consequences of participation in the Plan as of the date of this prospectus. However, this summary does not reflect every situation that could result from participation in the Plan, and we advise you to consult your own tax and other advisors for information about your specific situation, including any applicable state, local or foreign income and other tax consequences that may result from your participation in the Plan. Any state tax consequences will vary from state to state, and any tax consequences to you if you reside outside of the U.S. will vary from jurisdiction to jurisdiction. This summary does not address all of the tax implications of your ownership of shares of the common stock of a REIT, including the effect of distributions made in respect of such shares.

Under Internal Revenue Service rulings in connection with similar plans, the fair market value of the shares acquired through the Plan (including the shares acquired as a result of any Plan discount) will be taxable as dividends to the extent of our current or accumulated earnings and profits notwithstanding that such dividends are in stock. The amount of such dividends will equal the fair market value of the stock acquired with the reinvested dividends as of the date the stock is acquired under the Plan, regardless of any Plan discount.

Distributions with respect to our shares that are not designated as capital gain dividends, will generally be taxable as ordinary income, and generally will not constitute “qualified dividend income” eligible to be taxed at capital gains rates for U.S. federal income tax purposes to the extent made out of our current or accumulated earnings and profits. Dividends paid to individual stockholders generally will not qualify for the "qualified dividend income" tax rate. Qualified dividend income generally includes dividends paid to most individual taxpayers by domestic C corporations and certain qualified foreign corporations. Because we are generally not subject to U.S. federal income tax on the portion of our REIT taxable income distributed to our stockholders, our dividends generally will not be eligible for the 20% tax rate on qualified dividend income. As a result, our ordinary REIT dividends will be subject to taxation at the highest marginal tax rate applicable to ordinary income, currently 37%. However, for taxable years prior to 2026, individual stockholders are generally allowed to deduct 20% of the aggregate amount of their “qualified REIT dividends,” subject to certain limitations, which would reduce the maximum marginal effective tax rate for individuals on the receipt of such ordinary dividends to 29.6%. Qualified REIT dividends generally include any dividend from a REIT received during the taxable year which is not a capital gain dividend or qualified dividend income. Notwithstanding the foregoing, the 20% tax rate for qualified dividend income will apply to our ordinary REIT dividends (i) attributable to dividends received by us from taxable corporations, including any taxable REIT subsidiary, and (ii) to the extent attributable to taxable REIT income upon which we have paid corporate income tax (e.g., to the extent that we distribute less than 100% of our taxable income). In general, to qualify for the 20% tax rate on qualified dividend income, a stockholder must hold our shares for more than 60 days during the 121-day period beginning on the date that is 60 days before the date on which such shares become ex-dividend. Dividends paid to a corporate stockholder will not be eligible for the dividends received deduction generally available for corporations and such dividends will be subject to taxation at the regular corporate tax rate of 21%. Distributions in excess of our current or accumulated earnings and profits will be treated for U.S. federal income tax purposes as a return of capital. The amount of a return of capital would first reduce the adjusted tax basis of the shares to which the distribution is attributable, with any excess treated as a return of capital and would be taxable as a gain on sale from the disposition of such shares.

In the event that we designate a part or the entire amount distributed as a capital gain dividend, the amount so designated should be treated as a long-term capital gain to the extent that such distribution does not exceed our actual net capital gain for the taxable year, without regard to the period for which a stockholder has held its shares. Corporate stockholders may be required to treat up to 20% of some capital gain dividends as ordinary income. Long-term capital gains are generally taxable at maximum U.S. federal rates of 20% in the case of stockholders who are individuals, and 21% for corporations. Capital gains dividends attributable to the sale of depreciable real property held for more than 12 months are subject to a 25% tax rate for individual stockholders, to the extent of previously claimed depreciation deductions.

Your tax basis in shares of common stock acquired under the Plan (including the shares acquired as a result of any Plan discount) will be equal to the fair market value of such shares as of the date the shares were acquired. Your holding period for shares of common stock acquired under the Plan generally will commence on the day following the date on which the common stock is credited to your Plan account or, if the shares are purchased in the open market, the holding period will commence on the day following the date of purchase.

You will not recognize gain or loss for U.S. federal income tax purposes upon your receipt of certificates for shares previously credited to your Plan account. However, you will generally recognize gain or loss (which for most participants, will be capital gain or loss) when you sell or exchange shares received from the Plan or when a fractional share interest is liquidated. Such gain or loss will equal the difference between the amount that you receive for such fractional share interest or such shares and your adjusted tax basis in such fractional share interest or shares. If you hold the shares as a capital asset for greater than one year, such gain or loss derived from a sale or exchange of such shares will be characterized as long-term capital gain or loss. The maximum tax rate on long-term capital gains applicable to individuals is 20%. Corporate stockholders will be subject to taxation on their net capital gain at the regular corporate tax rate of 21%.

Certain Plan participants, including individuals, estates and trusts, may also be subject to a nondeductible 3.8% tax on the lesser of (i) “net investment income,” for the taxable year, which includes, among other things, dividends on and gains from the sale or other disposition of stock or (ii) the amount by which such participant’s modified adjusted gross income for the taxable year exceeds a certain threshold amount depending on the participant’s U.S. federal income tax filing status. Participants should consult with their own tax advisers regarding this tax.

In the case of foreign participants who elect to have their dividends reinvested and whose dividends are subject to United States income tax withholding, an amount equal to the dividends payable to such participants who elect to reinvest dividends, less the amount of tax required to be withheld, will be applied by the Plan Administrator to the purchase of shares of Common Stock. A Form 1042S, mailed to each foreign participant after the final purchase of the calendar year, will show the amount of tax withheld in that year. A Form 1099 will be mailed to domestic participants in the event that Federal income tax withholding is imposed in the future on dividends to domestic participants.

The foregoing is intended only as a general discussion of the current federal income tax consequences of participation in the Plan, and may not be applicable to certain participants, such as tax-exempt entities. You should consult your own tax and other professional advisors regarding the foreign, federal, state and local income tax consequences (including the effects of any changes in applicable law or interpretations thereof) of your participation in the Plan or the disposal of shares acquired pursuant to the Plan.

Other Information

| 24. | How can I vote my shares? |

You will receive proxy material for all shares in your Plan account. You may vote your shares of common stock either by designating the vote of the shares by proxy or by voting the shares in person at the meeting of stockholders. The proxy will be voted in accordance with your direction. If you do not return the proxy card or if you return it unsigned, none of your shares will be voted.

| 25. | Can the Plan be amended, modified, suspended or terminated? |

We reserve the right to amend, modify, suspend or terminate the Plan at any time. You will receive written notice of any material amendment, modification, suspension or termination. We and the Plan Administrator also reserve the right to change any administrative procedures of the Plan.

If we terminate the Plan, you will receive a certificate for all whole shares held in your Plan account and a check representing the value of any fractional shares based on the then current market price. We also will return to you any uninvested dividends held in your account.

| 26. | How will a stock split or a rights offering affect my Plan account? |

Stock Split. We will adjust your account to reflect any stock split or dividend payable in shares of common stock. In such event, the Plan Administrator will receive and credit to your Plan account the applicable number of whole and/or fractional shares of common stock.

Rights Offering. If we have a rights offering in which we issue separately tradable and exercisable rights to registered holders of shares of common stock, we will transfer the rights attributable to whole shares of common stock held in your Plan account to you as soon as practicable after we issue such rights. The Plan Administrator will sell for your account any rights attributable to fractional shares.

The Plan Administrator, at its sole discretion, may curtail or suspend transactions pending under the Plan until completion of any stock split or dividend, rights offering or other corporate action.

| 27. | Are there any risks associated with the Plan? |

Your investment in shares of common stock purchased under the Plan is no different from any investment in shares of common stock that you hold directly. Neither we nor the Plan Administrator can assure you a profit or protect you against a loss on shares that you purchase. You bear the risk of loss and enjoy the benefits of any gain from market price changes with respect to shares purchased under the Plan. We encourage you to carefully consider the various risk factors associated with an investment in our shares of common stock set forth in the “Risk Factors” section of this prospectus.

| 28. | What are the responsibilities of you and the Plan Administrator? |

Neither we nor the Plan Administrator will be liable for any act done in good faith or for any good faith failure to act, including, without limitation, any claim of liability (a) arising from the failure to terminate your account upon your death or judgment of incompetence prior to the Plan Administrator’s receipt of notice in writing of the death or incompetence, (b) relating to the prices and times at which the Plan Administrator buys or sells shares for your account, or (c) relating to any fluctuation in the market value of the shares of common stock.

We, the Plan Administrator and each of our respective agents will not have any duties, responsibilities or liabilities other than those expressly set forth in the Plan or as imposed by applicable law, including Federal securities laws. Since we have delegated all responsibility for administering the Plan to the Plan Administrator, we specifically disclaim any responsibility for any of the Plan Administrator’s actions or inactions in connection with the administration of the Plan. None of our directors, officers or stockholders will have any personal liability under the Plan.

The payment of dividends is at the discretion of our board of directors and will depend upon future earnings, our financial condition and other factors. The board of directors may change the amount and timing of dividends at any time without notice.

| 29. | How will you interpret and regulate the Plan? |

We may interpret, regulate and take any other action in connection with the Plan that we deem reasonably necessary in our sole discretion to carry out the Plan. As a participant in the Plan, you will be bound by any actions taken by us or the Plan Administrator.

| 30. | What law governs the Plan? |

The laws of the State of Maryland govern the Plan.

We will receive the proceeds from the sale of shares of our common stock that the Plan Administrator purchases directly from us. We will not receive proceeds from the sale of shares of common stock that the Plan Administrator purchases in the open market or in negotiated transactions. We intend to use the net proceeds of the sale of any newly issued shares of common stock issued under the Plan for (i) the acquisition of additional multi-family properties (including equity investments in joint ventures that acquire such properties and/or the acquisition of the interest of our joint venture partners in one or more joint ventures), (ii) other direct or indirect acquisitions of, or investments in, real estate and related assets, and (iii) general corporate purposes. General corporate purposes may include, among other things, the purchase of our common stock, repayment of debt and capital expenditures.

We will have significant discretion in the use of any net proceeds. Investors will be relying on the judgment of our management regarding the application of the proceeds from any sale of the securities. We may invest the net proceeds temporarily until we use them for their stated purpose. We consider the Plan to be a cost-effective means of expanding our equity capital base and furthering our investment objectives while at the same time benefiting our stockholders.

Except to the extent the Plan Administrator purchases shares of common stock in the open market or in negotiated transactions, we will sell directly to you through the Plan Administrator the shares of common stock acquired under the Plan. The shares of common stock may be resold in market transactions on any national securities exchange on which shares of our common stock trade or in privately negotiated transactions. Our shares of common stock are currently listed on the New York Stock Exchange.

Persons who acquire shares of common stock through the Plan and resell them shortly after acquiring them, including coverage of short positions, under certain circumstances, may be participating in a distribution of securities that would require compliance with Regulation M under the Exchange Act, and may be considered to be underwriters within the meaning of the Securities Act of 1933, as amended. We will not extend to any such person any rights or privileges other than those to which it would be entitled as a participant under the Plan, nor will we enter into any agreement with any such person regarding such person’s purchase of such shares or any resale or distribution thereof.

Subject to the restrictions contained in our Charter, our bylaws, and the availability of shares of common stock registered for issuance under the Plan, there is no maximum number of shares of common stock that can be purchased by a stockholder pursuant to the reinvestment of dividends. In connection with any reinvestment of dividends in which the Plan Administrator purchases shares of common stock in the open market or negotiated transactions, you will pay your pro rata share of any trading fees. You also will have to pay any fees and commissions set forth in Question 22 of the Plan.

DISCLOSURE OF SEC’s POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILIITIES

Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended, may be permitted to directors, officers or persons controlling us, we have been informed that, in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

The validity of the securities offered hereby and certain U.S. federal income tax matters will be passed upon for us by Dentons US LLP, New York, New York.

The consolidated financial statements of BRT Apartments Corp. and Subsidiaries appearing in BRT Apartments Corp. Annual Report (Form 10-K) for the year ended December 31, 2022, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the report of Ernst & Young LLP pertaining to such financial statements (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

BRT APARTMENTS CORP.

DIVIDEND REINVESTMENT PLAN

700,000 shares of Common Stock

PROSPECTUS

March 13, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 14. | Other Expenses of Issuance and Distribution |

The following table sets forth the costs and expenses, other than underwriting discounts and commissions, payable by us in connection with the sale and distribution of the securities being registered. All amounts except the SEC registration fee are estimated.

| SEC Registration Fee | $ | 1,611 | ||

| Accounting Fees and Expenses | 5,000 | |||

| Legal Fees and Expenses | 10,000 | |||

| Printing Expenses | 3,000 | |||

| Miscellaneous | 15,389 | |||

| Total | $ | 35,000 |

| Item 15. | Indemnification of Directors and Officers |

Limitation of Liability

The Maryland General Corporation Law (the “MGCL”) permits the charter of a Maryland corporation to include a provision limiting the liability of its directors and officers to the corporation and its stockholders for money damages, except to the extent that (1) it is proved that the person actually received an improper benefit or profit in money, property or services, or (2) a judgment or other final adjudication is entered in a proceeding based on a finding that the person’s action, or failure to act, was the result of active and deliberate dishonesty and was material to the cause of action adjudicated in the proceeding. Our articles of incorporation, which we refer to as our “Charter,” provides for the elimination of the liability of our directors and officers to us or our stockholders for money damages to the maximum extent permitted by Maryland law from time to time.

Indemnification