The New M&A Rule also established additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex, including requirements in some instances that the MOC be notified in advance of any change of control transaction in which a foreign investor takes control of a PRC domestic enterprise.

On July 30, 2017, for the purpose of promoting the reform of the foreign investment administrative system and simplifying the administrative procedures, the MOC amended the which was promulgated in October 2016 and amended in June 2018. According to the amended interim measures, a record-filing administration system shall apply to foreign investors’ mergers and acquisitions of domestic

Interim

Measures for the Record-filing

Administration of the Incorporation and Change of Foreign-invested Enterprises

non-foreign-invested

enterprises and strategic investments in listed companies, provided that they do not involve the implementation of special access administrative measures prescribed by the state or involve the mergers and acquisitions of affiliates.On December 30, 2019, for the purpose of further promoting the foreign investment administration and simplifying the administrative procedures, the MOC and the SAMR promulgated the which became effective on January 1, 2020 and suspended the on the same date. Under this regulation, an information reporting system shall apply to foreign investors’ mergers and acquisitions of domestic

Measures on Reporting of Foreign Investment Information,

Interim Measures for the Record-filing

Administration of the Incorporation and Change of Foreign-invested Enterprises

non-foreign-invested

enterprises and strategic investments in listed companies, provided that they comply with the implementation of special access administrative measures prescribed by the state and do not involve the mergers and acquisitions of affiliates. To be specific, under the information reporting system, where a new foreign-invested enterprise is incorporated or a non-foreign

invested enterprise changes to a foreign-invested enterprise through acquisition, merger or other means, such incorporation or change no longer requires approval or record-filing of MOC, but should report online on an Enterprise Registration System and the National Enterprise Credit Information Publicity System, together with the registration with the relevant department of the SAMR through the same systems.Regulation on Security Review

In August 2011, the MOC promulgated the , or the MOC Security Review Rule, which came into effect on September 1, 2011, to implement the promulgated on February 3, 2011. Under these regulations, a security review is required for foreign investors’ mergers and acquisitions having “national defense and security” implications and mergers and acquisitions by which foreign investors may acquire “de facto control” of domestic enterprises having “national security” implications. In addition, when deciding whether a specific merger or acquisition of a domestic enterprise by foreign investors is subject to a security review, the MOC will look into the substance and actual impact of the transaction. The MOC Security Review Rule further prohibits foreign investors from bypassing the security review requirement by structuring transactions through proxies, trusts, indirect investments, leases, loans, control through contractual arrangements or offshore transactions.

Rules of Ministry of Commerce on Implementation of Security Review System of Mergers and Acquisitions of Domestic Enterprises by Foreign Investors

Notice of the General Office of the State Council on Establishing the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors

Regulations on Labor Contracts

The that became effective on January 1, 2008, as amended on December 28, 2012, seeks to clarify the responsibilities of both employers and employees and codifies certain basic rights and protections of employees. Among others, the provides that after completing two fixed-term employment contracts, an employee that desires to continue working for an employer is entitled to require a also requires that the employees dispatched from human resources outsourcing firms or labor agencies be limited to temporary, auxiliary or substitute positions. Furthermore, an employer may be held jointly liable for any damages to its dispatched employees caused by its human resources outsourcing firm or labor agency if it hired such employees through these entities. According to the , which was promulgated in December 2013 to implement the provisions of the regarding labor dispatch, a company is permitted to use dispatched employees for up to 10% of its labor force and the companies currently using dispatched employees are given a

Labor Contract Law

Labor Contract Law

non-fixed-term

employment contract. In addition, employees who have been employed for more than ten years by the same employer are entitled to require a non-fixed-term

contract. The Labor Contract Law

Interim Provisions on Labor Dispatch

Labor Contract Law

two-year

grace period after March 1, 2014 to comply with this limit.51

Considering the PRC governmental authorities have continued to introduce various new labor-related regulations since the effectiveness of the labor contract law, and the interpretation and implementation of these regulations are still evolving, we cannot assure you that our employment practice will at all times be deemed in compliance with the new regulations. If we are subject to severe penalties or incur significant liabilities in connection with labor disputes or investigations, our business and results of operations may be adversely affected. See “Item 3. Key Information — D. Risk Factors — Risks Related to Our Business — Our current employment practices may be adversely impacted under the labor contract law of the PRC.”

Regulation on Information Protection on Networks

On December 28, 2012, SCNPC issued , pursuant to which network service providers and other enterprises and institutions shall, when gathering and using electronic personal information of citizens in business activities, publish their collection and use rules and adhere to the principles of legality, rationality and necessarily, explicitly state the purposes, manners and scopes of collecting and using information, and obtain the consent of those from whom information is collected, and shall not collect and use information in violation of laws and regulations and the agreement between both sides; and the network service providers and other enterprises and institutions and their personnel must strictly keep such information confidential and may not divulge, alter, damage, sell, or illegally provide others with such information.

Decision of the Standing Committee of the National People’s Congress on Strengthening Information Protection on Networks

On July 16, 2013, the Ministry of Industry and Information Technology, or the MIIT, issued the. The requirements under this order are stricter and wider compared to the above decision issued by the National People’s Congress. According to this order, if a network service provider wishes to collect or use personal information, it may do so only if such collection is necessary for the services it provides. Furthermore, it must disclose to its users the purpose, method and scope of any such collection or usage, and must obtain consent from the users whose information is being collected or used. Network service providers are also required to establish and publish their protocols relating to personal information collection or usage, keep any collected information strictly confidential and take technological and other measures to maintain the security of such information. Network service providers are required to cease any collection or usage of the relevant personal information, and provide services for the users to

Order for the Protection of Telecommunication and Internet User Personal Information

de-register

the relevant user account, when a user stops using the relevant Internet service. Network service providers are further prohibited from divulging, distorting or destroying any such personal information, or selling or providing such personal information unlawfully to other parties. In addition, if a network service provider appoints an agent to undertake any marketing or technical services that involve the collection or usage of personal information, the network service provider is required to supervise and manage the protection of the information. The order states, in broad terms, that violators may face warnings, fines, public exposure and, criminal liability whereas the case constitutes a crime.On June 1, 2017, the promulgated in November, 2016 by SCNPC became effective. This law also absorbed and restated the principles and requirements mentioned in the aforesaid decision and order, and further provides that, where an individual finds any network operator collects or uses his or her personal information in violation of the provisions of any law, regulation or the agreement of both parties, the individual shall be entitled to request the network operator to delete his or her personal information; if the individual finds that his or her personal information collected or stored by the network operator has any error, he or she shall be entitled to request the network operator to make corrections, and the network operator shall take measures to do so. Pursuant to this law, the violators may be subject to: (i) warning; (ii) confiscation of illegal gains and fines equal to 100% to 1000% of the illegal gains; or if without illegal gains, fines up to RMB1,000,000; or (iii) an order to shut down the website, suspend the business operation for rectification, or revoke business license. Besides, responsible persons may be subject to fines between RMB10,000 and RMB100,000.

Cybersecurity Law of the People’s Republic of China

52

The Regulation (EU) 2016/679 of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data, and repealing Directive 95/46/EC GDPR, imposes certain requirements on the processing of personal data relating to natural persons. GDPR requirements will apply both to companies established in the EU and to companies, such as us, that are not established in the EU but process personal data of individuals who are in the EU (and in the EEA subject to the enactment of implementation procedures), where the processing activities relate to: (a) the offering of goods or services, irrespective of whether a payment of the data subject is required, to such data subjects in the EU; or (b) the monitoring of their behavior as far as their behavior takes place within the EU. Therefore, the GDPR applies to our EU entities as well as the offering of services by our

non-EU

entities when EU guests are targeted. The GDPR imposes on concerned companies a large number of obligations, which relate for example, but are not limited, to (i) the principles applying to the processing of personal data: e.g. lawfulness, fairness, transparency, purpose limitation, data minimization and “privacy by design”, accuracy, storage limitations to process and store personal data only as long as necessary, access restrictions on a “need to know basis”, and ensuring security and confidentiality of personal data by technical and organizational measures; (ii) the ability of the controller to demonstrate compliance with such principles (accountability); (iii) the obligation to identify a legal basis before the processing (special requirements apply to certain specific categories of data such as sensitive data); and (iv) data subjects rights (e.g. transparency, right of information about personal data processed, right of access/receive copies, right to rectification, right to erasure, right to restrict processing, right to data portability, right to object to a processing under certain circumstances). This leads to companies being under the obligation to implement a number of formal processes and policies reviewing and documenting the privacy implications of the development, acquisition, or use of all new products and services, technologies, or types of data. The GDPR provides for substantial fines for breaches of data protection requirements, which, depending on the infringed provisions of the GDPR, can go up to either (thresholds depending on the obligations which have been breached): (i) 2% of the annual worldwide turnover of the preceding financial year or EUR10 million, whichever is greater, or (ii) 4% of the annual worldwide turnover of the preceding financial year or EUR20 million, whichever is greater. The fine may be imposed instead of, or in addition to, measures that may be ordered by supervisory authorities (e.g. request to cease the processing). The GDPR and EU Member States law also provide for private enforcement mechanisms and, in the most severe cases, criminal liability.The Directive (EC) 2002/58 of 12 July 2002 concerning the processing of personal data and the protection of privacy in the electronic communications sector imposes restrictions on the use of cookies and similar means as well as on website tracking, including the requirement to obtain informed consent for storage or access to information stored on a user’s terminal equipment in the EU in certain cases (in particular for cookies which track for marketing purposes). The forthcoming Regulation on privacy and electronic communications, aiming at repealing the Directive 2002/58, will update the current rules (not yet known when it will be enacted). Sanctions may be imposed on companies not fully compliant with all practices in relation to the implementation of the regulation on

e-privacy;

the relation to the GDPR is not fully clear, but in the worst case, the same sanctions as which under the GDPR may apply.53

4.C. Organizational Structure

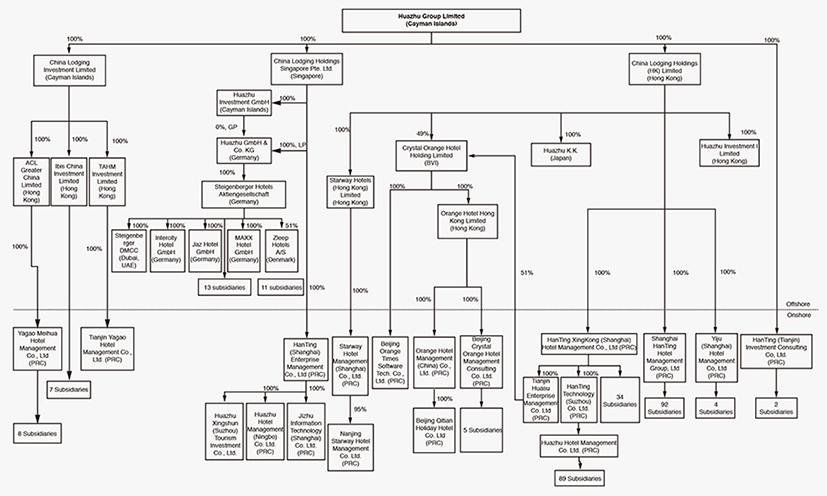

The following diagram illustrates our corporate and ownership structure, the place of formation and the ownership interests of our subsidiaries as of March 31, 2020.

The following table sets forth summary information for our significant subsidiaries as of March 31, 2020.

| Major Subsidiaries |

Percentage of Ownership |

Date of Incorporation/Acquisition |

Place of Incorporation |

|||||||||

| China Lodging Holdings (HK) Limited |

100 |

% | October 22, 2008 |

Hong Kong |

||||||||

| China Lodging Holdings Singapore Pte. Ltd. |

100 |

% | April 14, 2010 |

Singapore |

||||||||

| Shanghai HanTing Hotel Management Group, Ltd. |

100 |

% | November 17, 2004 |

PRC |

||||||||

| HanTing Xingkong (Shanghai) Hotel Management Co., Ltd. |

100 |

% | March 3, 2006 |

PRC |

||||||||

| HanTing (Tianjin) Investment Consulting Co., Ltd |

100 |

% | January 16, 2008 |

PRC |

||||||||

| Yiju (Shanghai) Hotel Management Co., Ltd. |

100 |

% | April 12, 2007 |

PRC |

||||||||

| HanTing Technology (Suzhou) Co., Ltd. |

100 |

% | December 3, 2008 |

PRC |

||||||||

| HanTing (Shanghai) Enterprise Management Co., Ltd. |

100 |

% | December 14, 2010 |

PRC |

||||||||

| Starway Hotels (Hong Kong) Limited |

100 |

% | May 1, 2012 |

Hong Kong |

||||||||

| Starway Hotel Management (Shanghai) Co., Ltd. |

100 |

% | May 1, 2012 |

PRC |

||||||||

| HuaZhu Hotel Management Co., Ltd. |

100 |

% | August 16, 2012 |

PRC |

||||||||

| Jizhu Information Technology (Shanghai) Co., Ltd. |

100 |

% | February 26, 2014 |

PRC |

||||||||

| ACL Greater China Limited |

100 |

% | May 9, 2016 |

Hong Kong |

||||||||

| Ibis China Investment Limited |

100 |

% | April 22, 2016 |

Hong Kong |

||||||||

| TAHM Investment Limited |

100 |

% | August 4, 2016 |

Hong Kong |

||||||||

54

| Huazhu Investment I Limited |

100 |

% | November 10, 2017 |

Hong Kong |

||||||||

| Yagao Meihua Hotel Management Co., Ltd. |

100 |

% | February 16, 2015 |

PRC |

||||||||

| Crystal Orange Hotel Holdings Limited |

100 |

% | May 25, 2017 |

BVI |

||||||||

| Orange Hotel Hong Kong Limited |

100 |

% | May 25, 2017 |

Hong Kong |

||||||||

| Orange Hotel Management (China) Co., Ltd. |

100 |

% | May 25, 2017 |

PRC |

||||||||

| Beijing Crystal Orange Hotel Management Consulting Co., Ltd. |

100 |

% | May 25, 2017 |

PRC |

||||||||

| Huazhu Hotel Management (Ningbo) Co., Ltd. |

100 |

% | July 20, 2018 |

PRC |

||||||||

| Steigenberger Hotels Aktiengesellschaft |

100 |

% | January 2, 2020 |

Germany |

4.D. Property, Plants and Equipment

Our headquarters are located in Shanghai, China and occupy nearly 20,000 square meters of office space, about 1,500 square meters of which is owned by us and the rest is leased. As of December 31, 2019, we leased 681 out of our 5,618 hotel facilities with an aggregate size of approximately 4.0 million square meters, including approximately 124,100 square meters subleased to third parties. As of December 31, 2019, we owned seven out of our 5,618 hotel facilities with an aggregate size of approximately 53,900 square meters. For detailed information about the locations of our hotels, see “Item 4. Information on the Company — B. Business Overview — Our Hotel Network.”

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

Not applicable.

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

5.A. Operating Results

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our consolidated financial statements and the related notes included elsewhere in this annual report on Form 20-F. This discussion may contain forward-looking statements based upon current expectations that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Item 3. Key Information

D. Risk Factors” or in other parts of this annual report on Form 20-F.

Overview

We are a leading and fast-growing multi-brand hotel group in China with an international coverage. We operate under leased and owned, manachised and franchised models. Under the lease and ownership model, we directly operate hotels located primarily on leased properties. Under the manachise model, we manage manachised hotels through the

on-site

hotel managers we appoint and collect fees from franchisees. Under the franchise model, we provide training, reservation and support services to the franchised hotels and collect fees from franchisees but do not appoint on-site

hotel managers. We apply a consistent standard and platform across all of our hotels. As of December 31, 2019, we had 688 leased and owned, 4,519 manachised and 411 franchised hotels in operation and 43 leased and owned hotels and 2,219 manachised and franchised hotels under development.As of the date of this annual report, we operate the following hotel brands that are designed to target distinct segments of customers:

| • | Economy hotel brands: HanTing Hotel Hi Inn Elan Hotel Zleep Hotels Ibis |

| • | Midscale hotel brands: Starway Hotel JI Hotel Orange Hotel Ibis Styles Mercure |

| • | Upper midscale hotel brands: Manxin Hotel Crystal Orange Hotel IntercityHotel Novotel |

55