expr-2020080100014835102020Q2FALSE--01-30us-gaap:AccountingStandardsUpdate201602Member00014835102020-02-022020-08-010001483510us-gaap:CommonStockMember2020-02-022020-08-010001483510expr:PreferredStockPurchaseRightsMember2020-02-022020-08-01xbrli:shares00014835102020-08-29iso4217:USD00014835102020-08-0100014835102020-02-01iso4217:USDxbrli:shares00014835102020-05-032020-08-0100014835102019-05-052019-08-0300014835102019-02-032019-08-030001483510us-gaap:CommonStockMember2020-02-010001483510us-gaap:AdditionalPaidInCapitalMember2020-02-010001483510us-gaap:RetainedEarningsMember2020-02-010001483510us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-02-010001483510us-gaap:TreasuryStockMember2020-02-010001483510us-gaap:RetainedEarningsMember2020-02-022020-05-0200014835102020-02-022020-05-020001483510us-gaap:CommonStockMember2020-02-022020-05-020001483510us-gaap:AdditionalPaidInCapitalMember2020-02-022020-05-020001483510us-gaap:TreasuryStockMember2020-02-022020-05-020001483510us-gaap:CommonStockMember2020-05-020001483510us-gaap:AdditionalPaidInCapitalMember2020-05-020001483510us-gaap:RetainedEarningsMember2020-05-020001483510us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-05-020001483510us-gaap:TreasuryStockMember2020-05-0200014835102020-05-020001483510us-gaap:RetainedEarningsMember2020-05-032020-08-010001483510us-gaap:CommonStockMember2020-05-032020-08-010001483510us-gaap:AdditionalPaidInCapitalMember2020-05-032020-08-010001483510us-gaap:TreasuryStockMember2020-05-032020-08-010001483510us-gaap:CommonStockMember2020-08-010001483510us-gaap:AdditionalPaidInCapitalMember2020-08-010001483510us-gaap:RetainedEarningsMember2020-08-010001483510us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-08-010001483510us-gaap:TreasuryStockMember2020-08-010001483510us-gaap:CommonStockMember2019-02-020001483510us-gaap:AdditionalPaidInCapitalMember2019-02-020001483510us-gaap:RetainedEarningsMember2019-02-020001483510us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-02-020001483510us-gaap:TreasuryStockMember2019-02-0200014835102019-02-0200014835102018-02-042019-02-020001483510srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-02-020001483510srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-02-020001483510us-gaap:RetainedEarningsMember2019-02-032019-05-0400014835102019-02-032019-05-040001483510us-gaap:CommonStockMember2019-02-032019-05-040001483510us-gaap:AdditionalPaidInCapitalMember2019-02-032019-05-040001483510us-gaap:TreasuryStockMember2019-02-032019-05-040001483510us-gaap:CommonStockMember2019-05-040001483510us-gaap:AdditionalPaidInCapitalMember2019-05-040001483510us-gaap:RetainedEarningsMember2019-05-040001483510us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-05-040001483510us-gaap:TreasuryStockMember2019-05-0400014835102019-05-040001483510us-gaap:RetainedEarningsMember2019-05-052019-08-030001483510us-gaap:CommonStockMember2019-05-052019-08-030001483510us-gaap:AdditionalPaidInCapitalMember2019-05-052019-08-030001483510us-gaap:TreasuryStockMember2019-05-052019-08-030001483510us-gaap:CommonStockMember2019-08-030001483510us-gaap:AdditionalPaidInCapitalMember2019-08-030001483510us-gaap:RetainedEarningsMember2019-08-030001483510us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-08-030001483510us-gaap:TreasuryStockMember2019-08-0300014835102019-08-03expr:store0001483510us-gaap:RetailMember2020-08-010001483510expr:OutletMember2020-08-01expr:segmentxbrli:pure0001483510expr:ApparelMember2020-05-032020-08-010001483510expr:ApparelMember2019-05-052019-08-030001483510expr:ApparelMember2020-02-022020-08-010001483510expr:ApparelMember2019-02-032019-08-030001483510expr:AccessoriesAndOtherMember2020-05-032020-08-010001483510expr:AccessoriesAndOtherMember2019-05-052019-08-030001483510expr:AccessoriesAndOtherMember2020-02-022020-08-010001483510expr:AccessoriesAndOtherMember2019-02-032019-08-030001483510expr:OtherRevenueMember2020-05-032020-08-010001483510expr:OtherRevenueMember2019-05-052019-08-030001483510expr:OtherRevenueMember2020-02-022020-08-010001483510expr:OtherRevenueMember2019-02-032019-08-030001483510us-gaap:RetailMember2020-05-032020-08-010001483510us-gaap:RetailMember2019-05-052019-08-030001483510us-gaap:RetailMember2020-02-022020-08-010001483510us-gaap:RetailMember2019-02-032019-08-030001483510expr:OutletMember2020-05-032020-08-010001483510expr:OutletMember2019-05-052019-08-030001483510expr:OutletMember2020-02-022020-08-010001483510expr:OutletMember2019-02-032019-08-030001483510expr:LoyaltyProgramMember2020-05-020001483510expr:LoyaltyProgramMember2019-05-040001483510expr:LoyaltyProgramMember2020-02-010001483510expr:LoyaltyProgramMember2019-02-020001483510expr:LoyaltyProgramMember2020-05-032020-08-010001483510expr:LoyaltyProgramMember2019-05-052019-08-030001483510expr:LoyaltyProgramMember2020-02-022020-08-010001483510expr:LoyaltyProgramMember2019-02-032019-08-030001483510expr:LoyaltyProgramMember2020-08-010001483510expr:LoyaltyProgramMember2019-08-030001483510expr:GiftCardLiabilityMember2020-08-010001483510expr:GiftCardLiabilityMember2020-02-010001483510expr:GiftCardLiabilityMember2020-05-020001483510expr:GiftCardLiabilityMember2019-05-040001483510expr:GiftCardLiabilityMember2019-02-020001483510expr:GiftCardIssuancesMember2020-05-032020-08-010001483510expr:GiftCardIssuancesMember2019-05-052019-08-030001483510expr:GiftCardIssuancesMember2020-02-022020-08-010001483510expr:GiftCardIssuancesMember2019-02-032019-08-030001483510expr:GiftCardRedemptionsMember2020-05-032020-08-010001483510expr:GiftCardRedemptionsMember2019-05-052019-08-030001483510expr:GiftCardRedemptionsMember2020-02-022020-08-010001483510expr:GiftCardRedemptionsMember2019-02-032019-08-030001483510expr:GiftCardBreakageMember2020-05-032020-08-010001483510expr:GiftCardBreakageMember2019-05-052019-08-030001483510expr:GiftCardBreakageMember2020-02-022020-08-010001483510expr:GiftCardBreakageMember2019-02-032019-08-030001483510expr:GiftCardLiabilityMember2019-08-030001483510us-gaap:CreditCardMemberexpr:ComenityBankMember2017-08-280001483510us-gaap:CreditCardMemberexpr:ComenityBankMember2020-08-010001483510expr:ComenityBankMember2020-05-020001483510expr:ComenityBankMember2019-05-040001483510expr:ComenityBankMember2020-02-010001483510expr:ComenityBankMember2019-02-020001483510expr:ComenityBankMember2020-05-032020-08-010001483510expr:ComenityBankMember2019-05-052019-08-030001483510expr:ComenityBankMember2020-02-022020-08-010001483510expr:ComenityBankMember2019-02-032019-08-030001483510expr:ComenityBankMember2020-08-010001483510expr:ComenityBankMember2019-08-030001483510us-gaap:PerformanceSharesMember2020-05-032020-08-010001483510us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-08-010001483510us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-08-010001483510us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-08-010001483510us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-02-010001483510us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-02-010001483510us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-02-010001483510expr:PreviouslyRecognizedDeferredTaxAssetsMember2020-02-022020-08-010001483510expr:FederalStateAndLocalIncomeTaxesAndOtherTaxCreditsMember2020-02-022020-08-010001483510expr:StoresMembersrt:MinimumMember2020-08-010001483510expr:StoresMembersrt:MaximumMember2020-08-01expr:renewal_option0001483510srt:OfficeBuildingMember2020-02-022020-08-010001483510srt:OfficeBuildingMember2020-08-010001483510expr:EquipmentAndOtherAssetsMembersrt:MinimumMember2020-08-010001483510expr:EquipmentAndOtherAssetsMembersrt:MaximumMember2020-08-010001483510us-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2019-05-240001483510us-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2020-03-172020-03-170001483510us-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2020-08-010001483510us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMember2020-08-010001483510us-gaap:EurodollarMemberus-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2019-05-242019-05-240001483510us-gaap:PrimeRateMemberus-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2019-05-242019-05-240001483510us-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2019-05-242019-05-240001483510us-gaap:FederalFundsEffectiveSwapRateMemberus-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2019-05-242019-05-240001483510us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberexpr:FirstAmendmentToTheSecondAmendedAndRestatedAssetBasedLoanCreditAgreementMember2020-02-0100014835102018-06-132018-06-1300014835102020-03-172020-03-170001483510us-gaap:RestrictedStockUnitsRSUMember2020-05-032020-08-010001483510us-gaap:RestrictedStockUnitsRSUMember2019-05-052019-08-030001483510us-gaap:RestrictedStockUnitsRSUMember2020-02-022020-08-010001483510us-gaap:RestrictedStockUnitsRSUMember2019-02-032019-08-030001483510us-gaap:EmployeeStockOptionMember2020-05-032020-08-010001483510us-gaap:EmployeeStockOptionMember2019-05-052019-08-030001483510us-gaap:EmployeeStockOptionMember2020-02-022020-08-010001483510us-gaap:EmployeeStockOptionMember2019-02-032019-08-030001483510expr:PerformanceSharesRestrictedStockUnitsMember2020-05-032020-08-010001483510expr:PerformanceSharesRestrictedStockUnitsMember2019-05-052019-08-030001483510expr:PerformanceSharesRestrictedStockUnitsMember2020-02-022020-08-010001483510expr:PerformanceSharesRestrictedStockUnitsMember2019-02-032019-08-030001483510us-gaap:RestrictedStockUnitsRSUMember2020-02-010001483510us-gaap:RestrictedStockUnitsRSUMember2020-08-010001483510expr:PerformanceSharesRestrictedStockUnitsMembersrt:MinimumMember2020-02-022020-08-010001483510expr:PerformanceSharesRestrictedStockUnitsMembersrt:MaximumMember2020-02-022020-08-010001483510expr:PerformanceSharesRestrictedStockUnitsMember2020-08-010001483510expr:TimeBasedCashSettledAwardsMember2020-02-022020-08-010001483510expr:TimeBasedCashSettledAwardsMember2020-08-010001483510expr:PerformanceBasedCashSettledAwardsMembersrt:MinimumMember2020-02-022020-08-010001483510expr:PerformanceBasedCashSettledAwardsMembersrt:MaximumMember2020-02-022020-08-010001483510expr:PerformanceBasedCashSettledAwardsMember2020-02-022020-08-010001483510expr:PerformanceBasedCashSettledAwardsMember2020-08-0100014835102017-01-2800014835102017-11-280001483510expr:ShareRepurchaseProgram2017Member2019-05-052019-08-030001483510expr:ShareRepurchaseProgram2017Member2019-02-032019-08-0300014835102020-04-20expr:right00014835102020-04-202020-04-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended August 1, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM ______ TO ______

Commission File Number 001-34742

EXPRESS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 26-2828128 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

1 Express Drive Columbus, Ohio | | 43230 |

| (Address of principal executive offices) | | (Zip Code) |

Telephone: (614) 474-4001

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | EXPR | | The New York Stock Exchange |

| Preferred Stock Purchase Rights | | EXPR | | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of outstanding shares of the registrant’s common stock was 64,837,737 as of August 29, 2020.

EXPRESS, INC. | Q2 2020 Form 10-Q | 1

EXPRESS, INC.

INDEX TO FORM 10-Q

EXPRESS, INC. | Q2 2020 Form 10-Q | 2

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Quarterly Report”) contains forward-looking statements within the “safe harbor” provisions of the Private Securities Reform Act of 1995 that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Quarterly Report are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance, and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “potential,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, and financial results, our plans and objectives for future operations, growth, initiatives, or strategies, plans to repurchase shares of our common stock, or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

•changes in consumer spending and general economic conditions;

•customer traffic at malls, shopping centers, and at our stores;

•the novel coronavirus outbreak, declared a pandemic by the World Health Organization, is adversely affecting and may continue to adversely affect our business operations, store traffic, employee availability, financial condition, liquidity and cash flow;

•competition from other retailers;

•our dependence upon independent third parties to manufacture all of our merchandise;

•changes in the cost of raw materials, labor, and freight;

•supply chain disruption and increased tariffs;

•difficulties associated with our distribution facilities;

•natural disasters, extreme weather, public health issues, including pandemics, fire, and other events that cause business interruption; and

•our reliance on third parties to provide us with certain key services for our business.

•our ability to identify and respond to new and changing fashion trends, customer preferences, and other related factors;

•fluctuations in our sales, results of operations, and cash levels on a seasonal basis and due to a variety of other factors, including our product offerings relative to customer demand, the mix of merchandise we sell, promotions, inventory levels, and sales mix between stores and eCommerce;

•our dependence on a strong brand image;

•our ability to adapt to changes in consumer behavior and develop and maintain a relevant and reliable omnichannel experience for our customers;

•our dependence upon key executive management; and

•our ability to execute our growth strategy, including but not limited to, engaging our customers and acquiring new ones, executing with precision to accelerate sales and profitability, putting product first, and reinvigorating our brand.

| | | | | | | | | | | | | | |

Information Technology Risks such as: | | | | |

| | | | |

•the failure or breach of information systems upon which we rely;

•the increase of our employees working remotely and use of technology for work functions; and

•our ability to protect our customer data from fraud and theft.

•our substantial lease obligations;

•restrictions imposed on us under the terms of our asset-based loan facility, including restrictions on our ability to repurchase shares of our common stock; and

•impairment charges on long-lived assets and our lease assets.

EXPRESS, INC. | Q2 2020 Form 10-Q | 3

| | | | | | | | | | | | | | |

Legal, Regulatory and Compliance Risks such as: | | | | |

| | | | |

•claims made against us resulting in litigation or changes in laws and regulations applicable to our business;

•our inability to protect our trademarks or other intellectual property rights that may preclude the use of our trademarks or other intellectual property around the world;

•changes in tax requirements, results of tax audits, and other factors that may cause fluctuations in our effective tax rate; and

•our failure to maintain adequate internal controls.

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. For a discussion of these risks and other risks and uncertainties that could cause actual results to differ materially from those contained in our forward-looking statements, please refer to “Item 1A. Risk Factors” included elsewhere in this Quarterly Report and in our Annual Report on Form 10-K for the year ended February 1, 2020 (“Annual Report”), filed with the Securities and Exchange Commission (“SEC”) on March 17, 2020. The forward-looking statements included in this Quarterly Report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

EXPRESS, INC. | Q2 2020 Form 10-Q | 4

PART I – FINANCIAL INFORMATION

ITEM 1.FINANCIAL STATEMENTS.

EXPRESS, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | | | | | | | | | |

| | August 1, 2020 | | February 1, 2020 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 192,894 | | | $ | 207,139 | |

| Receivables, net | 18,806 | | | 10,824 | |

| Income tax receivable | 88,724 | | | 3,000 | |

| Inventories | 232,302 | | | 220,303 | |

| Prepaid rent | 6,829 | | | 6,850 | |

| Other | 26,337 | | | 22,573 | |

| Total current assets | 565,892 | | | 470,689 | |

| | | |

| | | |

| | | |

| RIGHT OF USE ASSET, NET | 902,211 | | | 1,010,216 | |

| | | |

| PROPERTY AND EQUIPMENT | 989,589 | | | 979,639 | |

| Less: accumulated depreciation | (773,972) | | | (731,309) | |

| Property and equipment, net | 215,617 | | | 248,330 | |

| | | |

| | | |

| DEFERRED TAX ASSETS | — | | | 54,973 | |

| OTHER ASSETS | 3,724 | | | 6,531 | |

| Total assets | $ | 1,687,444 | | | $ | 1,790,739 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Short-term lease liability | $ | 207,672 | | | $ | 226,174 | |

| Accounts payable | 143,491 | | | 126,863 | |

| Deferred revenue | 30,932 | | | 38,227 | |

| | | |

| Accrued expenses | 145,999 | | | 76,211 | |

| Total current liabilities | 528,094 | | | 467,475 | |

| | | |

| LONG-TERM LEASE LIABILITY | 816,877 | | | 897,304 | |

| LONG-TERM DEBT | 165,000 | | | — | |

| | | |

| OTHER LONG-TERM LIABILITIES | 28,597 | | | 19,658 | |

| Total liabilities | 1,538,568 | | | 1,384,437 | |

| | | |

COMMITMENTS AND CONTINGENCIES (Note 9) | | | |

| | | |

| STOCKHOLDERS’ EQUITY: | | | |

Preferred stock – $0.01 par value; 10,000 shares authorized; no shares issued or outstanding | — | | | — | |

Common stock – $0.01 par value; 500,000 shares authorized; 93,632 shares and 93,632 shares issued at August 1, 2020 and February 1, 2020, respectively, and 64,830 shares and 63,922 shares outstanding at August 1, 2020 and February 1, 2020, respectively | 936 | | | 936 | |

| Additional paid-in capital | 217,828 | | | 215,207 | |

| | | |

| Retained earnings | 260,529 | | | 533,690 | |

Treasury stock – at average cost; 28,802 shares and 29,710 shares at August 1, 2020 and February 1, 2020, respectively | (330,417) | | | (343,531) | |

| Total stockholders’ equity | 148,876 | | | 406,302 | |

| Total liabilities and stockholders’ equity | $ | 1,687,444 | | | $ | 1,790,739 | |

See Notes to Unaudited Consolidated Financial Statements. EXPRESS, INC. | Q2 2020 Form 10-Q | 5

EXPRESS, INC.

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

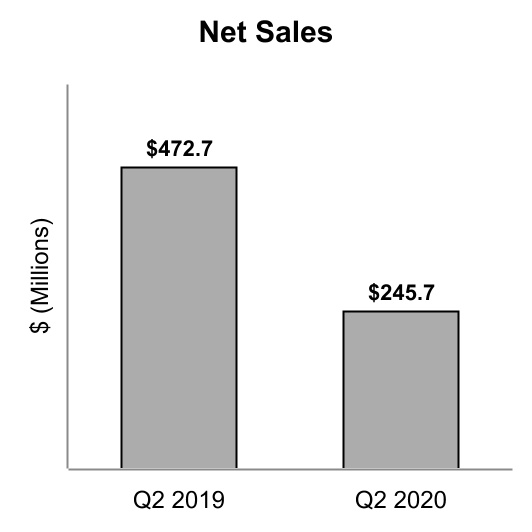

| NET SALES | | | | $ | 245,703 | | | $ | 472,715 | | | $ | 455,978 | | | $ | 923,986 | |

| COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS | | | | 289,760 | | | 346,217 | | | 546,242 | | | 674,985 | |

| Gross (loss)/profit | | | | (44,057) | | | 126,498 | | | (90,264) | | | 249,001 | |

| OPERATING EXPENSES: | | | | | | | | | | |

| Selling, general, and administrative expenses | | | | 92,805 | | | 135,723 | | | 191,970 | | | 271,090 | |

| | | | | | | | | | |

| Other operating (income)/expense, net | | | | (568) | | | 535 | | | (661) | | | (775) | |

| Total operating expenses | | | | 92,237 | | | 136,258 | | | 191,309 | | | 270,315 | |

| | | | | | | | | | |

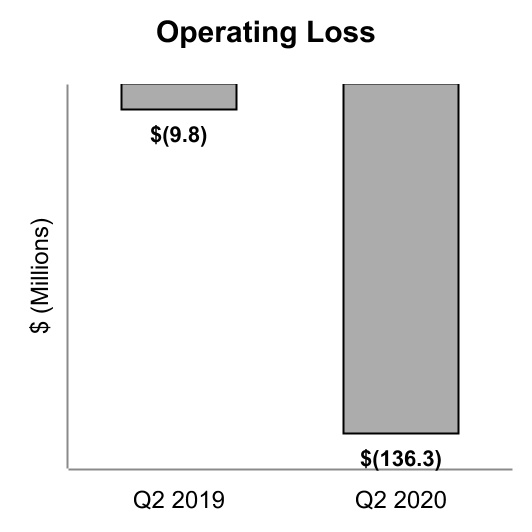

| OPERATING LOSS | | | | (136,294) | | | (9,760) | | | (281,573) | | | (21,314) | |

| | | | | | | | | | |

| INTEREST EXPENSE/(INCOME), NET | | | | 1,023 | | | (783) | | | 1,079 | | | (1,495) | |

| OTHER EXPENSE, NET | | | | — | | | — | | | 2,733 | | | — | |

| LOSS BEFORE INCOME TAXES | | | | (137,317) | | | (8,977) | | | (285,385) | | | (19,819) | |

| INCOME TAX (BENEFIT)/EXPENSE | | | | (29,547) | | | 726 | | | (23,565) | | | (182) | |

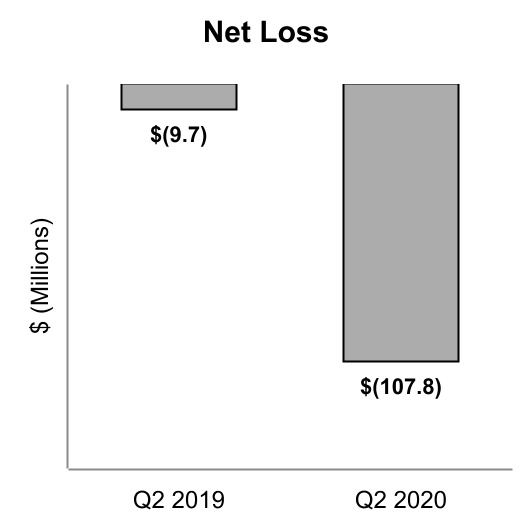

| NET LOSS | | | | $ | (107,770) | | | $ | (9,703) | | | $ | (261,820) | | | $ | (19,637) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMPREHENSIVE LOSS | | | | $ | (107,770) | | | $ | (9,703) | | | $ | (261,820) | | | $ | (19,637) | |

| | | | | | | | | | |

| EARNINGS PER SHARE: | | | | | | | | | | |

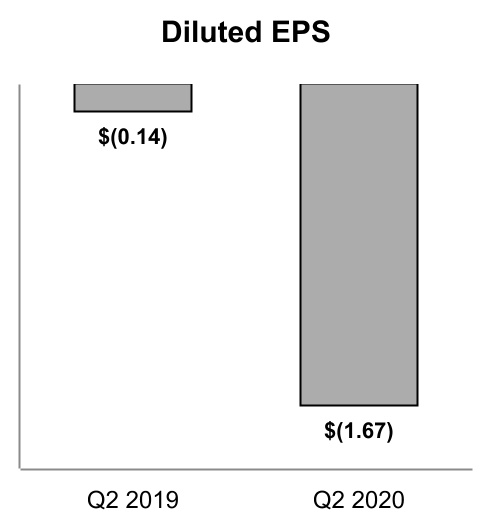

| Basic | | | | $ | (1.67) | | | $ | (0.14) | | | $ | (4.07) | | | $ | (0.29) | |

| Diluted | | | | $ | (1.67) | | | $ | (0.14) | | | $ | (4.07) | | | $ | (0.29) | |

| | | | | | | | | | |

| WEIGHTED AVERAGE SHARES OUTSTANDING: | | | | | | | | | | |

| Basic | | | | 64,645 | | | 67,253 | | | 64,338 | | | 67,049 | |

| Diluted | | | | 64,645 | | | 67,253 | | | 64,338 | | | 67,049 | |

See Notes to Unaudited Consolidated Financial Statements. EXPRESS, INC. | Q2 2020 Form 10-Q | 6

EXPRESS, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Amounts in Thousands) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Common Stock | | | | | Treasury Stock | | |

| | Shares Outstanding | Par Value | Additional

Paid-in

Capital | Retained

Earnings | Accumulated Other Comprehensive Loss | Shares | At Average Cost | Total |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

BALANCE, February 1, 2020 | 63,922 | | $ | 936 | | $ | 215,207 | | $ | 533,690 | | $ | — | | 29,710 | | $ | (343,531) | | $ | 406,302 | |

| Net loss | — | | — | | — | | (154,050) | | — | | — | | — | | (154,050) | |

| Exercise of stock options and restricted stock | 802 | | — | | (1,609) | | (7,659) | | — | | (802) | | 9,268 | | — | |

| Share-based compensation | — | | — | | 2,502 | | — | | — | | — | | — | | 2,502 | |

| Repurchase of common stock | (268) | | — | | — | | — | | — | | 268 | | (540) | | (540) | |

| BALANCE, May 2, 2020 | 64,456 | | $ | 936 | | $ | 216,100 | | $ | 371,981 | | $ | — | | 29,176 | | $ | (334,803) | | $ | 254,214 | |

| Net loss | — | | — | | — | | (107,770) | | — | | — | | — | | (107,770) | |

| Exercise of stock options and restricted stock | 386 | | — | | (732) | | (3,682) | | — | | (386) | | 4,414 | | — | |

| Share-based compensation | — | | — | | 2,460 | | — | | — | | — | | — | | 2,460 | |

| Repurchase of common stock | (12) | | — | | — | | — | | — | | 12 | | (28) | | (28) | |

BALANCE, August 1, 2020 | 64,830 | | $ | 936 | | $ | 217,828 | | $ | 260,529 | | $ | — | | 28,802 | | $ | (330,417) | | $ | 148,876 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | Treasury Stock | | | |

| | Shares Outstanding | Par Value | Additional

Paid-in

Capital | Retained

Earnings | Accumulated Other Comprehensive Loss | Shares | At Average Cost | | Total |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| BALANCE, February 2, 2019 | 67,424 | | $ | 936 | | $ | 211,981 | | $ | 713,864 | | $ | — | | 26,208 | | $ | (341,603) | | | $ | 585,178 | |

Adoption of ASC Topic 842 | — | | — | | — | | (5,482) | | — | | — | | — | | | (5,482) | |

| Net loss | — | | — | | — | | (9,934) | | — | | — | | — | | | (9,934) | |

| Exercise of stock options and restricted stock | 1,024 | | — | | (4,316) | | (8,735) | | — | | (1,024) | | 13,051 | | | — | |

| Share-based compensation | — | | — | | 2,372 | | — | | — | | — | | — | | | 2,372 | |

| Repurchase of common stock | (1,273) | | — | | — | | — | | — | | 1,273 | | (6,387) | | | (6,387) | |

| BALANCE, May 4, 2019 | 67,175 | | $ | 936 | | $ | 210,037 | | $ | 689,713 | | $ | — | | 26,457 | | $ | (334,939) | | | $ | 565,747 | |

| Net loss | — | | — | | — | | (9,703) | | — | | — | | — | | | (9,703) | |

| Exercise of stock options and restricted stock | 93 | | — | | (311) | | (867) | | — | | (93) | | 1,178 | | | — | |

| Share-based compensation | — | | — | | 2,424 | | — | | — | | — | | — | | | 2,424 | |

| Repurchase of common stock | (1) | | — | | — | | — | | — | | 1 | | (4) | | | (4) | |

| BALANCE, August 3, 2019 | 67,267 | | $ | 936 | | $ | 212,150 | | $ | 679,143 | | $ | — | | 26,365 | | $ | (333,765) | | | $ | 558,464 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

See Notes to Unaudited Consolidated Financial Statements.

EXPRESS, INC. | Q2 2020 Form 10-Q | 7

EXPRESS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in Thousands) (Unaudited)

| | | | | | | | | | | |

| Twenty-Six Weeks Ended | | |

| | August 1, 2020 | | August 3, 2019 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (261,820) | | | $ | (19,637) | |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 37,323 | | | 43,243 | |

| Loss on disposal of property and equipment | 1 | | | 860 | |

| Impairment of property, equipment and lease assets | 21,483 | | | 2,281 | |

| Equity method investment impairment | 3,233 | | | 500 | |

| | | |

| | | |

| Share-based compensation | 4,962 | | | 4,796 | |

| | | |

| Deferred taxes | 63,621 | | | 164 | |

| Landlord allowance amortization | (208) | | | (1,181) | |

| | | |

| Other non-cash adjustments | (500) | | | (500) | |

| Changes in operating assets and liabilities: | | | |

| Receivables, net | (7,982) | | | 4,841 | |

| Income tax receivable | (85,724) | | | (1,136) | |

| Inventories | (11,999) | | | (1,039) | |

| Accounts payable, deferred revenue, and accrued expenses | 75,588 | | | (22,655) | |

| Other assets and liabilities | (8,361) | | | (8,809) | |

Net cash (used in) provided by operating activities | (170,383) | | | 1,728 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Capital expenditures | (10,130) | | | (12,145) | |

| | | |

| | | |

| | | |

Net cash used in investing activities | (10,130) | | | (12,145) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| Costs incurred in connection with debt arrangements | — | | | (849) | |

| Proceeds from financing arrangements | 167,548 | | | — | |

| Payments on lease financing obligations | — | | | (54) | |

| Repayments of financing arrangements | (712) | | | — | |

| | | |

| | | |

| Repurchase of common stock under share repurchase program | — | | | (4,889) | |

| Repurchase of common stock for tax withholding obligations | (568) | | | (1,502) | |

Net cash provided by (used in) financing activities | 166,268 | | | (7,294) | |

| | | |

| | | |

| | | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (14,245) | | | (17,711) | |

| CASH AND CASH EQUIVALENTS, Beginning of period | 207,139 | | | 171,670 | |

| CASH AND CASH EQUIVALENTS, End of period | $ | 192,894 | | | $ | 153,959 | |

See Notes to Unaudited Consolidated Financial Statements. EXPRESS, INC. | Q2 2020 Form 10-Q | 8

| | | | | | | | | | | | | | |

| EXPRESS, INC. | | | | |

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS | | | | |

| | | | |

EXPRESS, INC. | Q2 2020 Form 10-Q | 9

| | | | | | | | | | | | | | |

NOTE 1 | DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION | | | | |

| | | | |

Business Description

Express, Inc., together with its subsidiaries (“Express” or the “Company”), is a modern, versatile, dual gender apparel and accessories brand that helps people get dressed for every day and any occasion. Launched in 1980 with the idea that style, quality and value should all be found in one place, Express has been a brand of the now, offering some of the most important and enduring fashion trends. Express aims to Create Confidence & Inspire Self-Expression through a design & merchandising view that brings forward The Best of Now for Real Life Versatility. The Company operates 593 retail and factory outlet stores in the United States and Puerto Rico, as well as an online destination.

As of August 1, 2020, Express operated 378 primarily mall-based retail stores in the United States and Puerto Rico as well as 215 factory outlet stores. Additionally, as of August 1, 2020, the Company earned revenue from 7 franchise stores in Latin America. These franchise stores are operated by franchisees pursuant to franchise agreements. Under the franchise agreements, the franchisees operate stand-alone Express stores that sell Express-branded apparel and accessories purchased directly from the Company.

Fiscal Year

The Company’s fiscal year ends on the Saturday closest to January 31. Fiscal years are referred to by the calendar year in which the fiscal year commences. References herein to “2020” and “2019” represent the 52-week period ended January 30, 2021 and the 52-week period ended February 1, 2020, respectively. All references herein to “the second quarter of 2020” and “the second quarter of 2019” represent the thirteen weeks ended August 1, 2020 and August 3, 2019, respectively.

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and the U.S. Securities and Exchange Commission’s Article 10, Regulation S-X and therefore do not include all of the information or footnotes required for complete financial statements. In the opinion of management, the accompanying unaudited Consolidated Financial Statements reflect all adjustments (which are of a normal recurring nature) necessary to state fairly the financial position, results of operations, and cash flows for the interim periods, but are not necessarily indicative of the results of operations to be anticipated for 2020. Therefore, these statements should be read in conjunction with the Consolidated Financial Statements and Notes thereto for the year ended February 1, 2020, included in the Company’s Annual Report on Form 10-K, filed with the SEC on March 17, 2020.

Principles of Consolidation

The unaudited Consolidated Financial Statements include the accounts of Express, Inc. and its wholly-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation.

Segment Reporting

The Company defines an operating segment on the same basis that it uses to evaluate performance internally. The Company has determined that, together, its Chief Executive Officer and its President and Chief Operating Officer are the Chief Operating Decision Maker, and that there is one operating segment. Therefore, the Company reports results as a single segment, which includes the operation of its Express brick-and-mortar retail and outlet stores, eCommerce operations, and franchise operations.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the unaudited Consolidated Financial Statements and the reported amounts of revenue and expense during the reporting period, as well as the related disclosure of contingent assets and liabilities as of the date of the unaudited Consolidated Financial Statements. Actual results may differ from those estimates. The Company revises its estimates and assumptions as new information becomes available.

EXPRESS, INC. | Q2 2020 Form 10-Q | 10

Impact of the COVID-19 Pandemic

In March 2020, the World Health Organization declared the outbreak of the novel strain of coronavirus ("COVID-19") a global pandemic and recommended containment and mitigation measures. Since then, extraordinary actions have been taken by international, federal, state, and local public health and governmental authorities to contain and combat the outbreak and spread of COVID-19. The pandemic has significantly impacted global economies, resulting in workforce and travel restrictions, supply chain and production disruptions and reduced demand and spending across many industries.

During March 2020, in response to the COVID-19 outbreak and business disruption resulting from quarantines, stay-at-home orders, and similar mandates, Express temporarily closed all its Company stores and offices, and as a result, all store associates and a number of home office employees were furloughed. For the remainder of the home office employees, remote work arrangements were put in place and were designed to allow for continued operation of the business, including financial reporting systems and internal controls. Express continued to be materially impacted by COVID-19 in the second quarter, as over 30% of Express stores were closed for more than half of the second quarter, and some stores in California and New York remained closed as of August 26, 2020. These continued closures and the potential that additional stores could be closed for a significant amount of time in the future could lead results and cash flows to be significantly different than the Company's forecasts.

The Company's website, www.express.com, remained open, supported by third-party logistics providers, and Company employees working remotely.

The Company has considered the impact of COVID-19 on our unaudited Consolidated Financial Statements and expects it to have future impacts, the extent of which is uncertain and largely subject to whether the severity of the pandemic worsens and/or its duration lengthens. These impacts could include but may not be limited to risks and uncertainty in the near to medium term related to federal, state, and local store closure requirements, customer demand, worker availability, the Company's ability to procure inventory, distribution facility closures, shifts in demand between sales channels, and market volatility in supply chain and store rents. Consequently, this may subject the Company to future risk of long-lived asset and lease right of use asset impairments, increased reserves for uncollectible accounts, and adjustments for inventory, including the lower of cost or net realizable value adjustment. The Company writes down inventory, the impact of which is reflected in cost of goods sold, buying and occupancy costs in the unaudited Consolidated Statements of Income and Comprehensive Income, if the cost of specific inventory items on hand exceeds the amount the Company expects to realize from the ultimate sale or disposal of the inventory. These estimates are based on management's judgment regarding future demand and market conditions and analysis of historical experience. The lower of cost or net realizable value adjustment to inventory as of August 1, 2020 and February 1, 2020 was $20.2 million and $10.4 million, respectively.

| | | | | | | | | | | | | | |

NOTE 2 | REVENUE RECOGNITION | | | | |

| | | | |

The following is information regarding the Company’s major product categories and sales channels:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

| | | | (in thousands) | | | | | | |

| Apparel | | | | $ | 207,421 | | | $ | 408,305 | | | $ | 387,004 | | | $ | 797,195 | |

| Accessories and other | | | | 25,888 | | | 50,596 | | | 47,268 | | | 96,456 | |

| Other revenue | | | | 12,394 | | | 13,814 | | | 21,706 | | | 30,335 | |

| Total net sales | | | | $ | 245,703 | | | $ | 472,715 | | | $ | 455,978 | | | $ | 923,986 | |

EXPRESS, INC. | Q2 2020 Form 10-Q | 11

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

| | | | (in thousands) | | | | | | |

| Retail | | | | $ | 164,745 | | | $ | 337,606 | | | $ | 324,282 | | | $ | 665,945 | |

| Outlet | | | | 68,564 | | | 121,295 | | | 109,990 | | | 227,706 | |

| Other revenue | | | | 12,394 | | | 13,814 | | | 21,706 | | | 30,335 | |

| Total net sales | | | | $ | 245,703 | | | $ | 472,715 | | | $ | 455,978 | | | $ | 923,986 | |

Other revenue consists primarily of revenue earned from our private label credit card agreement, shipping and handling revenue related to eCommerce activity, revenue from gift card breakage, sell-off revenue related to marked-out-of-stock inventory sales to third parties, and revenue from franchise agreements.

Revenue related to the Company’s international franchise operations was not material for any period presented and, therefore, are not reported separately from domestic revenue.

Revenue Recognition Policies

Merchandise Sales

The Company recognizes sales for in-store purchases at the point-of-sale. Revenue related to eCommerce transactions is recognized upon shipment based on the fact that control transfers to the customer at that time. The Company has made a policy election to treat shipping and handling as costs to fulfill the contract and as a result any amounts received from customers are included in the transaction price allocated to the performance obligation of providing goods with a corresponding amount accrued within cost of goods sold, buying and occupancy costs in the unaudited Consolidated Statements of Income and Comprehensive Income for amounts paid to applicable carriers. Associate discounts on merchandise purchases are classified as a reduction of net sales. Net sales excludes sales tax collected from customers and remitted to governmental authorities.

Loyalty Program

The Company maintains a customer loyalty program in which customers earn points toward rewards for qualifying purchases and other marketing activities. Upon reaching specified point values, customers are issued a reward, which they may redeem on merchandise purchases at the Company’s stores or on its website. Generally, rewards earned must be redeemed within 60 days from the date of issuance. The Company defers a portion of merchandise sales based on the estimated standalone selling price of the points earned. This deferred revenue is recognized as certificates that are redeemed or expire. To calculate this deferral, the Company makes assumptions related to card holder redemption rates based on historical experience. The loyalty liability is included in deferred revenue on the unaudited Consolidated Balance Sheets.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

| | (in thousands) | | | | | | |

| Beginning balance loyalty deferred revenue | | $ | 9,585 | | | $ | 14,716 | | | $ | 14,063 | | | $ | 15,319 | |

| Reduction in revenue/(revenue recognized) | | 284 | | | 50 | | | (4,194) | | | (553) | |

| Ending balance loyalty deferred revenue | | $ | 9,869 | | | $ | 14,766 | | | $ | 9,869 | | | $ | 14,766 | |

Sales Returns Reserve

The Company reduces net sales and provides a reserve for projected merchandise returns based on prior experience. Merchandise returns are often resalable merchandise and are refunded by issuing the same payment tender as the original purchase. The sales returns reserve was $7.8 million and $9.1 million as of August 1, 2020 and February 1, 2020, respectively, and is included in accrued expenses on the unaudited Consolidated Balance Sheets. The asset related to projected returned merchandise is included in other assets on the unaudited Consolidated Balance Sheets.

EXPRESS, INC. | Q2 2020 Form 10-Q | 12

Gift Cards

The Company sells gift cards in its stores, on its eCommerce website, and through third parties. These gift cards do not expire or lose value over periods of inactivity. The Company accounts for gift cards by recognizing a liability at the time a gift card is sold. The gift card liability balance was $20.9 million and $24.1 million, as of August 1, 2020 and February 1, 2020, respectively, and is included in deferred revenue on the unaudited Consolidated Balance Sheets. The Company recognizes revenue from gift cards when they are redeemed by the customer. The Company also recognizes income on unredeemed gift cards, referred to as “gift card breakage.” Gift card breakage is recognized proportionately using a time-based attribution method from issuance of the gift card to the time when it can be determined that the likelihood of the gift card being redeemed is remote and that there is no legal obligation to remit unredeemed gift cards to relevant jurisdictions. The gift card breakage rate is based on historical redemption patterns. Gift card breakage is included in net sales in the unaudited Consolidated Statements of Income and Comprehensive Income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

| | | | (in thousands) | | | | | | |

| Beginning gift card liability | | | | $ | 21,728 | | | $ | 21,576 | | | $ | 24,142 | | | $ | 25,133 | |

| Issuances | | | | 4,353 | | | 7,956 | | | 8,393 | | | 15,669 | |

| Redemptions | | | | (4,728) | | | (8,799) | | | (10,146) | | | (18,918) | |

| Gift card breakage | | | | (488) | | | (767) | | | (1,524) | | | (1,918) | |

| Ending gift card liability | | | | $ | 20,865 | | | $ | 19,966 | | | $ | 20,865 | | | $ | 19,966 | |

Private Label Credit Card

The Company has an agreement with Comenity Bank (the “Bank”) to provide customers with private label credit cards (the “Card Agreement”) which was amended on August 28, 2017 to extend the term of the arrangement through December 31, 2024. Each private label credit card bears the logo of the Express brand and can only be used at the Company’s store locations and eCommerce channel. The Bank is the sole owner of the accounts issued under the private label credit card program and absorbs the losses associated with non-payment by the private label card holders and a portion of any fraudulent usage of the accounts.

Pursuant to the Card Agreement, the Company receives amounts from the Bank during the term based on a percentage of private label credit card sales and is also eligible to receive incentive payments for the achievement of certain performance targets. These funds are recorded as net sales in the unaudited Consolidated Statements of Income and Comprehensive Income. The Company also receives reimbursement funds from the Bank for certain expenses the Company incurs. These reimbursement funds are used by the Company to fund marketing and other programs associated with the private label credit card. The reimbursement funds received related to private label credit cards are recorded as net sales in the unaudited Consolidated Statements of Income and Comprehensive Income.

In connection with the Card Agreement, the Bank agreed to pay the Company a $20.0 million refundable payment which the Company recognized upon receipt as deferred revenue within other long-term liabilities in the Consolidated Balance Sheets and began to recognize into income on a straight-line basis commencing January of 2018. As of August 1, 2020, the deferred revenue balance of $12.7 million will be recognized over the remaining term of the amended Card Agreement within the other revenue component of net sales.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

| | | | (in thousands) | | | | | | |

| Beginning balance refundable payment liability | | | | $ | 13,431 | | | $ | 16,309 | | | $ | 14,150 | | | $ | 17,028 | |

| | | | | | | | | | |

| Recognized in revenue | | | | (720) | | | (720) | | | (1,439) | | | (1,439) | |

| Ending balance refundable payment liability | | | | $ | 12,711 | | | $ | 15,589 | | | $ | 12,711 | | | $ | 15,589 | |

EXPRESS, INC. | Q2 2020 Form 10-Q | 13

| | | | | | | | | | | | | | |

NOTE 3 | EARNINGS PER SHARE | | | | |

| | | | |

The following table provides a reconciliation between basic and diluted weighted-average shares used to calculate basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

| | | | (in thousands) | | | | | | |

| Weighted-average shares - basic | | | | 64,645 | | | 67,253 | | | 64,338 | | | 67,049 | |

| Dilutive effect of stock options and restricted stock units | | | | — | | | — | | | — | | | — | |

| Weighted-average shares - diluted | | | | 64,645 | | | 67,253 | | | 64,338 | | | 67,049 | |

Equity awards representing 11.3 million and 10.4 million shares of common stock were excluded from the computation of diluted earnings per share for the thirteen and twenty-six weeks, ended August 1, 2020, respectively, as the inclusion of these awards would have been anti-dilutive. Equity awards representing 6.6 million and 6.3 million shares of common stock were excluded from the computation of diluted earnings per share for the thirteen and twenty-six weeks ended August 3, 2019, respectively, as the inclusion of these awards would have been anti-dilutive.

Additionally, for the thirteen weeks ended August 1, 2020, approximately 0.2 million shares were excluded from the computation of diluted weighted average shares because the number of shares that will ultimately be issued is contingent on the Company’s performance compared to pre-established performance goals which have not been achieved as of August 1, 2020.

| | | | | | | | | | | | | | |

NOTE 4 | FAIR VALUE MEASUREMENTS | | | | |

| | | | |

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities measured at fair value are classified using the following hierarchy, which is based upon the transparency of inputs to the valuation as of the measurement date.

■Level 1 - Valuation is based upon quoted prices (unadjusted) for identical assets or liabilities in active markets.

■Level 2 - Valuation is based upon quoted prices for similar assets and liabilities in active markets or other inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

■Level 3 - Valuation is based upon other unobservable inputs that are significant to the fair value measurement.

Financial Assets

The following table presents the Company’s financial assets, recorded in cash and cash equivalents on the unaudited Consolidated Balance Sheets, measured at fair value on a recurring basis as of August 1, 2020 and February 1, 2020, aggregated by the level in the fair value hierarchy within which those measurements fall.

EXPRESS, INC. | Q2 2020 Form 10-Q | 14

| | | | | | | | | | | | | | | | | |

| August 1, 2020 | | | | |

| Level 1 | | Level 2 | | Level 3 |

| (in thousands) | | | | |

| Money market funds | $ | 173,071 | | | $ | — | | | $ | — | |

| | | | | |

| | | | | |

| | | | | |

| February 1, 2020 | | | | |

| Level 1 | | Level 2 | | Level 3 |

| (in thousands) | | | | |

| Money market funds | $ | 188,182 | | | $ | — | | | $ | — | |

The money market funds are valued using quoted market prices in active markets.

The carrying amounts reflected on the unaudited Consolidated Balance Sheets for the remaining cash and cash equivalents, receivables, prepaid expenses, and payables as of August 1, 2020 and February 1, 2020 approximated their fair values.

Non-Financial Assets

The Company’s non-financial assets, which include fixtures, equipment, improvements, and right of use assets are not required to be measured at fair value on a recurring basis. However, if certain triggering events occur indicating the carrying value of these assets may not be recoverable, an impairment test is required. For stores that trigger, a recovery test is performed first comparing the undiscounted cash flows to the net assets of the store. The second step impairment test requires the Company to estimate the fair value of the assets and compare this to the carrying value of the assets. If the fair value of the asset is less than the carrying value, then an impairment charge is recognized, and the non-financial assets are recorded at fair value. The Company estimates the fair value using a discounted cash flow model or other fair value models as appropriate. Factors used in the evaluation include, but are not limited to, management’s plans for future operations, recent operating results, projected cash flows, and overall economic factors, including the current global outbreak of COVID-19. As a result of the COVID-19 pandemic, including temporary store closures and the related decline in sales beginning in March 2020 and continuing through the second quarter, the Company concluded that a triggering event had occurred. Consequently, the Company performed interim impairment testing. As a result of this testing, during the thirteen and twenty-six weeks ended August 1, 2020, the Company recognized impairment charges of approximately $6.8 million and $21.5 million, respectively, related to store-level property and equipment and right of use assets. During the thirteen and twenty-six weeks ended August 3, 2019, the Company recognized impairment charges of approximately $2.3 million. Impairment charges are recorded in cost of goods sold, buying and occupancy costs in the unaudited Consolidated Statements of Income and Comprehensive Income.

The provision for income taxes is based on a current estimate of the annual effective tax rate, adjusted to reflect the effect of discrete items. The Company’s effective income tax rate may fluctuate from quarter to quarter as a result of a variety of factors, including the estimate of annual pre-tax income, the related changes in the estimate, and the effect of discrete items. The impact of these items on the effective tax rate will be greater at lower levels of pre-tax earnings.

On March 27, 2020, the Coronavirus Aid Relief and Economic Security (“CARES”) Act was enacted into law. The CARES Act provides several provisions that impact the Company including the establishment of a five-year carryback of net operating losses originating in the tax years 2018, 2019, and 2020, temporarily suspending the 80% limitation on the use of net operating losses, relaxing limitation rules on business interest deductions, and retroactively clarifying that businesses may immediately write-off certain qualified leasehold improvement property dating back to January 1, 2018.

The Company’s effective tax rate was 21.5% and (8.1)% for the thirteen weeks ended August 1, 2020 and August 3, 2019, respectively. The effective tax rate for the thirteen weeks ended August 1, 2020 reflects the impact of recording an additional valuation allowance of $16.2 million against estimated 2020 U.S. federal and state deferred tax assets and other tax credits of which a portion relates to 2020 U.S. federal net operating losses that could not be carried back to offset taxable income in the five-year carryback period as part of the CARES Act. This was partially

EXPRESS, INC. | Q2 2020 Form 10-Q | 15

offset by $9.1 million of tax benefit related to the portion of the estimated 2020 U.S. federal net operating losses that are able to be carried back to years with a higher federal statutory tax rate than is currently enacted. The effective tax rate for the thirteen weeks ended August 3, 2019 reflects a tax benefit from a pre-tax loss offset by $1.1 million of discrete tax expense related to a tax shortfall for share-based compensation.

The Company’s effective tax rate was 8.3% and 0.9% for the twenty-six weeks ended August 1, 2020 and August 3, 2019, respectively. The effective tax rate for the twenty-six weeks ended August 1, 2020 was less than the statutory rate due to the impact of establishing a valuation allowance against the Company’s net deferred tax assets, which includes $55.0 million of discrete tax expense from a valuation allowance against previously recognized deferred tax assets and a $22.3 million valuation allowance against estimated 2020 U.S. federal and state deferred tax assets and other tax credits of which a portion relates to 2020 U.S. federal net operating losses that could not be carried back to offset taxable income in the five-year carryback period as part of the CARES Act. This was partially offset by a $28.6 million tax benefit related to the portion of the estimated 2019 and 2020 U.S. federal net operating losses that are able to be carried back to years with a higher federal statutory tax rate than is currently enacted. The effective tax rate for the twenty-six weeks ended August 3, 2019 reflects a tax benefit from a pre-tax loss offset by $2.5 million of discrete tax expense related to a tax shortfall for share-based compensation.

Due to the ongoing impact of the COVID-19 pandemic, the Company no longer believes it is able to objectively forecast taxable income in future years, which provides significant negative evidence when assessing whether the Company will more likely than not realize the full amount of the U.S. net deferred tax assets. As such, the Company recorded a valuation allowance against the full amount of the U.S. net deferred tax assets that are not forecasted to be utilized with the 2020 net operating loss carryback. We will continue to evaluate the Company’s ability to realize the deferred tax assets on a quarterly basis.

The Company leases all of its store locations and its corporate headquarters, which also includes its distribution center, under operating leases. The store leases typically have initial terms of 5 to 10 years. The current lease term for the corporate headquarters expires in 2026, with one optional five-year extension period. The Company also leases certain equipment and other assets under operating leases, typically with initial terms of 3 to 5 years. The lease term includes the initial contractual term as well as any options to extend the lease when it is reasonably certain that the Company will exercise that option. Leases with an initial term of 12 months or less (short-term leases) are not recorded on the balance sheet. The Company does not currently have any material short-term leases. The Company is generally obligated for the cost of property taxes, insurance and other landlord costs, including common area maintenance charges, relating to its leases. If these charges are fixed, they are combined with lease payments in determining the lease liability; however, if such charges are not fixed, they are considered variable lease costs and are expensed as incurred. The variable payments are not included in the measurement of the lease liability or asset. The Company’s finance leases are immaterial.

Certain lease agreements include rental payments based on a percentage of retail sales over contractual levels and others include rental payments adjusted periodically for inflation. The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.

The Company’s lease agreements do not provide an implicit rate, so the Company uses an estimated incremental borrowing rate, which is derived from third-party information available at the lease commencement date, in determining the present value of lease payments. The rate used is for a secured borrowing of a similar term as the lease.

As a result of the impact of the COVID-19 pandemic, the Company did not initially make its store rent payments for certain stores in the first and second quarter of 2020. The Company established an accrual for rent payments that were not made and has continued to recognize accrued rent expense. As a result of negotiations with certain landlords, the Company has since made rent payments for certain stores and some landlords have agreed to abate certain rent payments. The appropriate adjustments were made to accrued rent. The Accrued rent is within accrued expenses on the unaudited Consolidated Balance Sheets. Accrued minimum rent as of August 1, 2020 and February 1, 2020, was $73.7 million and $3.2 million, respectively.

EXPRESS, INC. | Q2 2020 Form 10-Q | 16

Supplemental cash flow information related to leases is as follows:

| | | | | | | | |

| Twenty-Six Weeks Ended | |

| August 1, 2020 | August 3, 2019 |

| (in thousands) | |

| Cash paid for amounts included in the measurement of lease liabilities: | | |

Operating cash flows for operating leases | $ | 70,707 | | $ | 142,530 | |

| Right-of-use assets obtained in exchange for operating lease liabilities | $ | 17,893 | | $ | 8,448 | |

A summary of the Company’s financing activities is as follows:

Revolving Credit Facility

On May 24, 2019, Express Holding, LLC, a wholly-owned subsidiary of the Company (“Express Holding”), and its subsidiaries entered into a First Amendment to the Second Amended and Restated $250.0 million Asset-Based Loan Credit Agreement (“Revolving Credit Facility”). The expiration date of the Revolving Credit Facility is May 24, 2024.

On March 17, 2020, the Company provided notice to the lenders under the Revolving Credit Facility of a request to borrow $165.0 million. The Company borrowed under the Revolving Credit Facility in order to strengthen its liquidity position and preserve financial flexibility in response to the COVID-19 pandemic and the related temporary store closures. As of August 1, 2020, the Company had $165.0 million in borrowings outstanding and approximately $51.5 million remained available for borrowing under the Revolving Credit Facility after $18.8 million of letters of credit outstanding and subject to certain borrowing base limitations as further discussed below.

Under the Revolving Credit Facility, revolving loans may be borrowed, repaid, and reborrowed until May 24, 2024, at which time all amounts borrowed must be repaid. Borrowings under the Revolving Credit Facility bear interest at a rate equal to either the rate published by ICE Benchmark Administration Limited (with a floor of 0%) (the “Eurodollar Rate”) plus an applicable margin rate or the highest of (1) Wells Fargo Bank, National Association’s prime lending rate (with a floor of 0%), (2) 0.50% per annum above the federal funds rate (with a floor of 0%) or (3) 1% above the Eurodollar Rate (the “Base Rate”), in each case plus an applicable margin rate. The applicable margin rate is determined based on excess availability as determined by reference to the borrowing base. The applicable margin rate for Eurodollar Rate-based advances is 1.25% or 1.50% and the applicable margin rate for Base Rate-based advances is 0.25% or 0.50%, in each case, based on the borrowing base. Under certain circumstances, a default interest rate will apply on any overdue amount payable under the Revolving Credit Facility during the existence of an event of default at a per annum rate equal to 2.0% above the applicable interest rate for any overdue principal and 2.0% above the rate applicable for Base Rate-based advances for any other overdue interest. As of August 1, 2020 the interest rate on the outstanding borrowings was approximately 2.4%.

The Revolving Credit Facility requires Express Holding and its subsidiaries to maintain a fixed charge coverage ratio of at least 1.0:1.0 if excess availability plus eligible cash collateral is less than 10.0% of the borrowing base for 15 consecutive days. Since our excess availability was above 10% as of August 1, 2020, the fixed charge coverage ratio covenant was not applicable. In addition, the Revolving Credit Facility contains customary covenants and restrictions on Express Holding’s and its subsidiaries’ activities, including, but not limited to, limitations on the incurrence of additional indebtedness, liens, negative pledges, guarantees, investments, loans, asset sales, mergers, acquisitions, prepayment of other debt, distributions, dividends, the repurchase of capital stock, transactions with affiliates, the ability to change the nature of its business or fiscal year, and permitted business activities. All obligations under the Revolving Credit Facility are guaranteed by Express Holding and its domestic subsidiaries (that are not borrowers) and secured by a lien on, among other assets, substantially all working capital assets including cash, accounts receivable, and inventory of Express Holding and its domestic subsidiaries.

EXPRESS, INC. | Q2 2020 Form 10-Q | 17

Letters of Credit

The Company may enter into stand-by letters of credit (“stand-by LCs”) on an as-needed basis to secure payment obligations for third party logistic services, merchandise purchases, and other general and administrative expenses. As of August 1, 2020 and February 1, 2020, outstanding stand-by LCs totaled $18.8 million and $12.7 million, respectively.

| | | | | | | | | | | | | | |

NOTE 8 | SHARE-BASED COMPENSATION | | | | |

| | | | |

The Company records the fair value of share-based payments to employees in the unaudited Consolidated Statements of Income and Comprehensive Income within selling, general, and administrative expenses as compensation expense, net of forfeitures, over the requisite service period. The Company issues shares of common stock from treasury stock, at average cost, upon exercise of stock options and vesting of restricted stock units, including those with performance conditions.

Share-Based Compensation Plans

In 2010, the Board approved, and the Company implemented, the Express, Inc. 2010 Incentive Compensation Plan (as amended, the "2010 Plan"). The 2010 Plan authorized the Compensation Committee (the "Committee") of the Board and its designees to offer eligible employees and directors cash and stock-based incentives as deemed appropriate in order to attract, retain, and reward such individuals.

On April 30, 2018, upon the recommendation of the Committee, the Board unanimously approved and adopted, subject to stockholder approval, the Express, Inc. 2018 Incentive Compensation Plan (the “2018 Plan”) to replace the 2010 Plan. On June 13, 2018, stockholders of the Company approved the 2018 Plan and all grants made subsequent to that approval will be made under the 2018 Plan. The primary change made by the 2018 Plan was to increase the number of shares of common stock available for equity-based awards by 2.4 million shares. In addition to increasing the number of shares, the Company also made several enhancements to the 2010 Plan to reflect best practices in corporate governance. The 2018 Plan incorporates these concepts and also includes several other enhancements which were practices the Company already followed but were not explicitly stated in the 2010 Plan. None of these changes will have a significant impact on the accounting for awards made under the 2018 Plan.

In the third quarter of 2019, in connection with updates made by the Company to its policy regarding the clawback of incentive compensation awarded to associates, the Board approved an amendment to the 2018 Plan, solely for the purpose of updating the language regarding the recoupment of awards granted under the 2018 Plan.

On March 17, 2020, upon the recommendation of the Committee, the Board unanimously approved and adopted, subject to stockholder approval, a second amendment to the 2018 Plan, which increased the number of shares of common stock available under the 2018 Plan by 2.5 million shares. On June 10, 2020, stockholders of the Company approved this plan amendment.

The following summarizes share-based compensation expense:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | | | Twenty-Six Weeks Ended | | |

| | | | August 1, 2020 | | August 3, 2019 | | August 1, 2020 | | August 3, 2019 |

| | | | (in thousands) | | | | | | |

| Restricted stock units | | | | $ | 2,143 | | | $ | 2,119 | | | $ | 4,327 | | | $ | 4,329 | |

| Stock options | | | | 317 | | | 126 | | | 635 | | | 164 | |

| Performance-based restricted stock units | | | | — | | | 179 | | | — | | | 303 | |

| Total share-based compensation | | | | $ | 2,460 | | | $ | 2,424 | | | $ | 4,962 | | | $ | 4,796 | |

The stock compensation related income tax benefit recognized by the Company during the thirteen and twenty-six weeks ended August 1, 2020 was $0.2 million and $0.7 million, respectively. The stock compensation related income tax benefit recognized by the Company during the thirteen and twenty-six weeks ended August 3, 2019 was $0.1 million and $1.6 million, respectively.

EXPRESS, INC. | Q2 2020 Form 10-Q | 18

Restricted Stock Units

During the twenty-six weeks ended August 1, 2020, the Company granted restricted stock units (“RSUs”) under the 2018 Plan. The fair value of RSUs is determined based on the Company’s closing stock price on the day prior to the grant date in accordance with the 2018 Plan. The RSUs granted in 2020 vest ratably over three years and the expense related to these RSUs will be recognized using the straight-line attribution method over this vesting period.

The Company’s activity with respect to RSUs, including awards with performance conditions granted prior to 2018, for the twenty-six weeks ended August 1, 2020 was as follows:

| | | | | | | | |

| Number of Shares | Grant Date

Weighted Average

Fair Value Per Share |

| (in thousands, except per share amounts) | |

Unvested - February 1, 2020 | 4,260 | | $ | 4.78 | |

| Granted | 5,086 | | $ | 1.74 | |

| | |

| Vested | (1,187) | | $ | 5.59 | |

| Forfeited | (491) | | $ | 4.05 | |

Unvested - August 1, 2020 | 7,668 | | $ | 2.69 | |

The total fair value of RSUs that vested during the twenty-six weeks ended August 1, 2020 and August 3, 2019 was $6.6 million and $11.5 million, respectively. As of August 1, 2020, there was approximately $15.8 million of total unrecognized compensation expense related to unvested RSUs, which is expected to be recognized over a weighted-average period of approximately 1.6 years.

Stock Options

The Company’s activity with respect to stock options during the twenty-six weeks ended August 1, 2020 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of Shares | | Grant Date

Weighted Average

Exercise Price Per Share | | Weighted-Average Remaining Contractual Life (in years) | | Aggregate Intrinsic Value |

| (in thousands, except per share amounts and years) | | | | | | |

Outstanding - February 1, 2020 | 3,650 | | | $ | 7.67 | | | | | |

| Granted | — | | | $ | — | | | | | |

| Exercised | — | | | $ | — | | | | | |

| Forfeited or expired | (263) | | | $ | 18.04 | | | | | |

Outstanding - August 1, 2020 | 3,387 | | | $ | 6.87 | | | 7.4 | | $ | — | |

Expected to vest at August 1, 2020 | 2,009 | | | $ | 2.70 | | | 8.9 | | $ | — | |

Exercisable at August 1, 2020 | 1,313 | | | $ | 13.45 | | | 4.9 | | $ | — | |

As of August 1, 2020, there was approximately $1.8 million of total unrecognized compensation expense related to stock options, which is expected to be recognized over a weighted average period of approximately 1.5 years.

EXPRESS, INC. | Q2 2020 Form 10-Q | 19

Performance-based Restricted Stock Units

In the first quarter of 2018, the Company granted performance shares to a limited number of senior executive-level employees, which entitle these employees to receive a specified number of shares of the Company’s common stock upon vesting. The number of shares earned could range between 0% and 200% of the target amount depending upon performance achieved over a three-year vesting period. The performance conditions of the award include adjusted diluted earnings per share ("EPS") targets and total shareholder return ("TSR") of the Company’s common stock relative to a select group of peer companies. A Monte Carlo valuation model was used to determine the fair value of the awards. The TSR performance metric is a market condition. Therefore, fair value of the awards is fixed at the measurement date and is not revised based on actual performance. The number of shares that will ultimately vest will change based on estimates of the Company’s adjusted EPS performance in relation to the pre-established targets. As of August 1, 2020, it is estimated that none of the shares granted in 2018 will vest based on the performance against predefined financial targets to date.

Time-based Cash-Settled Awards

During the twenty-six weeks ended August 1, 2020, the Company granted time-based cash-settled awards to employees that vest ratably over three years. These awards are classified as liabilities, are valued based on the fair value of the award at the grant date and do not vary based on changes in the Company's stock price. The expense related to these awards will be recognized using the straight-line attribution method over this vesting period. As of August 1, 2020, $3.8 million of total unrecognized compensation cost is expected to be recognized on cash-settled awards over a weighted-average period of 1.8 years.

Performance-based Cash-Settled Awards

In 2019, the Company granted cash-settled awards to a limited number of senior executive-level employees. These awards are classified as liabilities, are valued based on the fair value of the award at the grant date and are remeasured at each reporting date until settlement with compensation expense being recognized in proportion to the completed requisite period up until date of settlement. The amount of cash earned could range between 0% and 200% of the target amount depending upon performance achieved over the three-year vesting period. The performance conditions of the award include EPS targets and TSR of the Company’s common stock relative to a select group of peer companies. A Monte Carlo valuation model was used to determine the fair value of the awards. As of August 1, 2020, it is estimated that none of the shares granted in 2019 will vest based on the performance against predefined financial targets to date.

| | | | | | | | | | | | | | |

NOTE 9 | COMMITMENTS AND CONTINGENCIES | | | | |

| | | | |

In a complaint filed in January 2017 by Mr. Jorge Chacon in the Superior Court for the State of California for the County of Orange, certain subsidiaries of the Company were named as defendants in a representative action alleging violations of California state wage and hour statutes and other labor standards. The lawsuit seeks unspecified monetary damages and attorneys’ fees. In July 2018, former associate Ms. Christie Carr filed suit in Alameda County Superior Court for the State of California naming certain subsidiaries of the Company in a representative action alleging violations of California State wage and hour statutes and other labor standard violations. The lawsuit seeks unspecified monetary damages and attorneys’ fees. On January 28, 2019, Mr. Jorge Chacon filed a second representative action in the Superior Court for the State of California for the County of Orange alleging violations of California state wages and hour statutes and other labor standard violations. The lawsuit seeks unspecified monetary damages and attorneys' fees. The Company is vigorously defending itself against these claims and, as of August 1, 2020, has established an estimated liability based on its best estimate of the outcome of the matters. The Company is subject to various other claims and contingencies arising out of the normal course of business. Management believes that the ultimate liability arising from such claims and contingencies, if any, is not likely to have a material adverse effect on the Company’s results of operations, financial condition, or cash flows.

| | | | | | | | | | | | | | |

NOTE 10 | INVESTMENT IN EQUITY INTERESTS | | | | |

| | | | |

In 2016, the Company made a $10.1 million investment in Homage, LLC, a privately held retail company based in Columbus, Ohio. The non-controlling investment in the entity is being accounted for under the equity method. Under

EXPRESS, INC. | Q2 2020 Form 10-Q | 20