As confidentially submitted to the U.S. Securities and Exchange Commission on July 16, 2021.

This draft registration statement has not been filed publicly with the Securities and Exchange Commission, and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

All Market Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2000 | 11-3713156 | ||

| (State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

250 Park Avenue South

Seventh Floor

New York, NY 10003

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant’s Principal Executive Offices)

Michael Kirban, Co-Founder and Co-Chief Executive Officer

Martin Roper, Co-Chief Executive Officer

All Market Inc.

250 Park Avenue South, 7th Floor

New York, NY 10003

(212) 206-0763

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Ian D. Schuman Stelios G. Saffos Latham & Watkins LLP 1271 Avenue of the Americas New York, New York 10020 (212) 906-1200 |

Alexander D. Lynch Barbra J. Broudy Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee(3) | ||

| Common stock, $0.01 par value per share |

$ | $ | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional shares that the underwriters have the option to purchase. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

Pursuant to the applicable provisions of the Fixing America’s Surface Transportation Act, we are omitting our unaudited financial statements as of and for the three months ended March 31, 2020 and 2021 because they relate to historical periods that we believe will not be required to be included in the prospectus at the time of the contemplated offering. We intend to amend the registration statement to include all financial information required by Regulation S-X at the date of such amendment before distributing a preliminary prospectus to investors.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated , 2021

Shares of Common Stock

This is an initial public offering of shares of common stock of All Market Inc. (d/b/a “The Vita Coco Company”). We are offering shares of our common stock.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price will be between $ and $ per share. We intend to apply to list our common stock on the under the symbol “ .”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, may elect to comply with certain reduced public company reporting requirements for this registration statement and in future reports after the completion of this offering.

We elected in April 2021 to be treated as a public benefit corporation under Delaware law. As a public benefit corporation, we are required to balance the financial interests of our stockholders with the best interests of those stakeholders materially affected by our conduct, including particularly those affected by the specific benefit purposes set forth in our certificate of incorporation. Accordingly, our duty to balance a variety of interests may result in actions that do not maximize stockholder value.

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page 31 to read about factors you should consider before buying shares of our common stock.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(¹) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| ¹ | See the section titled “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted to the underwriters the option for a period of up to 30 days to purchase up to an additional shares of common stock from us at the initial public offering price, less the underwriting discounts and commissions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2021.

| Goldman Sachs & Co. LLC | Credit Suisse | Evercore ISI | ||

| Wells Fargo Securities | ||||

Prospectus dated , 2021.

TABLE OF CONTENTS

| Page | ||||

| i | ||||

| Letter From Michael Kirban, Co-Founder and Co-Chief Executive Officer |

iii | |||

| 1 | ||||

| 31 | ||||

| 74 | ||||

| 76 | ||||

| 77 | ||||

| 78 | ||||

| 80 | ||||

| 83 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

85 | |||

| 108 | ||||

| 137 | ||||

| 145 | ||||

| 157 | ||||

| 159 | ||||

| 160 | ||||

| 166 | ||||

| 168 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Our Common Stock |

170 | |||

| 174 | ||||

| 180 | ||||

| 180 | ||||

| 180 | ||||

| F-1 | ||||

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission, or the SEC. Neither we nor any of the underwriters have authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus we have prepared. Neither we nor the underwriters take responsibility for, and can provide assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of common stock offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, results of operations, financial condition, and prospects may have changed since such date.

For investors outside of the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus and any free writing prospectus must inform themselves about and observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

This prospectus contains estimates, projections and other information concerning our industry and our business, including data regarding the estimated size of the market, projected growth rates and perceptions and preferences of customers, that we have prepared based on industry publications, reports and other independent sources, each of which is either publicly available without charge or available on a subscription fee basis. None of such information was prepared specifically for us in connection with this offering. Some data also is based on our good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. Market and industry data is subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Although we are responsible for all of the disclosures contained in this prospectus and we believe the industry and market data included in this prospectus is reliable, we have not independently verified any of the data from third party sources nor have we ascertained the underlying economic assumptions on which such data is based. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources. The industry and market data included in this prospectus involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such information.

Unless otherwise expressly stated, we obtained industry, business, market and other data from the reports, publications and other materials and sources listed below. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise expressly stated or the context otherwise requires.

| • | SPINS MultiOutlet + Convenience Channel (powered by IRI), for the 52 weeks ended May 16, 2021, or SPINS; |

| • | Information Resources Inc. Custom Research, MULO + Convenience channels, for the periods ended, June 13, 2021, or IRI; IRI Total Chilled Coconut Water Category, Value Sales, 52 Weeks to 19th June 2021, Total UK; |

| • | Euromonitor International Limited; Coconut and other plant waters category, Combined On-Trade & Off-Trade Value Sales for 2020 as per Passport Soft Drinks 2021 edition, or Euromonitor; and |

| • | Numerator, 6 months ended, May 14, 2021, or Numerator. |

i

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We have proprietary rights to trademarks, trade names and service marks appearing in this prospectus that are important to our business. Solely for convenience, the trademarks, trade names and service marks may appear in this prospectus without the ® and TM symbols, but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

NON-GAAP FINANCIAL MEASURES

This prospectus contains “non-GAAP financial measures” that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with accounting principles generally accepted in the United States, or GAAP. Specifically, we make use of the non-GAAP financial measures “EBITDA” and “Adjusted EBITDA.”

EBITDA and Adjusted EBITDA have been presented in this prospectus as supplemental measures of financial performance that are not required by, or presented in accordance with, GAAP, because we believe they assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance and because we believe it is useful for investors to see the measures that management uses to evaluate the Company. Management uses EBITDA and Adjusted EBITDA to supplement GAAP measures of performance in the evaluation of the effectiveness of our business strategies, to make budgeting decisions, to establish discretionary annual incentive compensation and to compare our performance against that of other peer companies using similar measures. Management supplements GAAP results with non-GAAP financial measures to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone.

EBITDA and Adjusted EBITDA are not recognized terms under GAAP and should not be considered as an alternative to net income as a measure of financial performance or cash flows from operations as a measure of liquidity, or any other performance measure derived in accordance with GAAP and should not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring items. The presentations of these measures have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company. For a discussion of the use of these measures and a reconciliation of the most directly comparable GAAP measures, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures.”

ii

LETTER FROM MICHAEL KIRBAN, CO-FOUNDER AND CO-CHIEF EXECUTIVE OFFICER

I have always been non-traditional, leading with my heart, trusting my instincts and always true to my values. Growing up dyslexic, I had a hard time connecting with books, but an easy time connecting with people and the outdoors. I came from a family of entrepreneurs who embraced my differences and inspired me to pursue my passions. Starting even as a kindergartener selling tomatoes at my grandmother’s card games, my entrepreneurial spirit has always propelled me to embrace the combination of business with the fruits of nature. Experiences like that have helped to form my passion of living every day to the fullest while bringing joy to those around me, and thus starting me down the path that would ultimately lead to the creation of Vita Coco.

The Adventure of a Lifetime

Vita Coco, like many great adventures, began in a bar. On a cold winter evening in 2003, my best friend, Ira, and I met two Brazilian women at a Manhattan bar and this encounter changed our lives forever, particularly for Ira who sold everything he had, married one of the women and moved to Brazil. It was on my first visit to Brazil that Ira introduced me to coconut water straight from a coconut. In the midst of a hot, active day, the drink was incredibly refreshing and hydrating. Surprisingly, packaged coconut water filled the shelves of Brazilian grocery stores. As I traveled through Brazil, I noticed that packaged coconut water was as prevalent as bottled water, and I started opting for coconut water because it made me feel great. Back in the United States, pure coconut water didn’t exist. This we knew was a white space we could fill.

We took the next four months and created our brand Vita Coco, found a local co-manufacturer and started selling our product. We found a small distributor in Brooklyn and lower Manhattan, and I rollerbladed from store to store sampling and selling Vita Coco. In Latino and Southeast Asian grocery stores, people would literally hug me with joy and tell me that the product reminded them of their childhoods. In natural food stores and yoga studios people told me how excited they were to have found a natural alternative to artificial sport drinks. We knew early on we had a winner. Today, our products are sold in 24 countries around the world with hundreds of thousands of points of distribution. We are the number one coconut water brand with a significant relative market share advantage. We quickly became one of the largest independently owned and fastest growing healthy beverage brands globally.

Our success did not go unnoticed! In 2009, Coca Cola and PepsiCo entered our category through acquisitions. Some feared that the strength of their distribution networks would lead to our demise. In fact, the opposite happened. We did what we have always done best: we out-hustled, out-innovated, and out-maneuvered the competition. We battled with everything we had. And we won what has been dubbed, “The Coconut Water Wars”! Most importantly, we won because consumers loved our brand and stayed loyal to it.

As the brand grew, we needed more and more coconuts. From Brazil, we expanded our supply chain into Southeast Asia where we partnered with the largest producers of food grade coconut products in the Philippines. When we asked if we could purchase their coconut water, they literally laughed at us because to them, the water was a by-product. After laughing with them out of courtesy, we offered to invest capital and help them procure the right equipment in exchange for a long-term, exclusive supply agreement. They thought we were crazy, but agreed and soon we were up and running. We replicated this same exact model with many of the world’s other large coconut product manufacturers in Sri Lanka, Indonesia, Malaysia and Thailand. Our supply chain has proven to be incredibly robust, globally diversified, protected, and scalable. We were upcycling even before it became culturally relevant.

iii

We have developed a symbiotic relationship with our global suppliers: we have become invaluable to each other, and we take this responsibility very seriously. As our supply chain scaled, we came across an entirely different and unexpected opportunity: we realized we could positively impact the communities from which we source our coconuts, and that we could magnify our impact even more. Our coconuts are mostly grown and harvested by thousands of small family farmers. Many of our farming partners and the people in their communities live in poverty. For generations, they’ve supported themselves by selling coconuts and fishing for food. While visiting these farming communities in Southeast Asia, we saw things that were completely foreign to us, such as young children attending school while huddled in the mud under a tarp to protect them from the rain. We also heard stories of farmers cutting down their coconut palms for lumber because the trees were producing only 1/3 of the coconuts that the same trees had produced for their parents and grandparents. We quickly understood that if we were going to be successful in the long term, these farming communities needed to grow with us. Helping them was the right thing to do, not only for the business but for humanity. That’s when we created the Vita Coco Project based on a simple philosophy of Give, Grow and Guide, with the goal to build thriving communities and impact the lives of over one million people.

Over the past seven years, we’ve built nearly 30 schools, offered dozens of college scholarships and have trained hundreds of local farmers at our model farms to be more productive and efficient. By teaching simple farming practices like intercropping, planting new seedlings and better harvesting techniques, we have helped these families increase their yield, income and livelihoods. This has been one of the most rewarding parts of the journey for me. This has led us to evolve our corporate structure to a Public Benefit Corporation. The specific benefit and purpose of The Vita Coco Company is harnessing, while protecting, nature’s resources for the betterment of the world and its inhabitants, by creating ethical, sustainable, better-for-you beverages and consumer products that not only uplift our communities, but that do right by our planet.

We are committed to using our business as a force for good. During the pandemic, we saw our sales surge by over 100%, which prompted us to donate $1 million of our profits to No Kid Hungry and Feeding America and we challenged our much larger competitors on Twitter to do the same. Many of them did! We’re looking forward to continuing our efforts to deliver better products that are indeed, better for the world.

The Next Chapter of Our Journey

Now we are planning our next adventure, and we believe the best place for us to advance on this journey is in the public markets. We believe that being public will give us the currency to further accelerate our growth and offer us a platform to have a greater impact. Most healthy hydration companies are small, private and just don’t have the scale to achieve their true potential. We, on the other hand, have spent seventeen years building one of the largest independently owned healthy hydration companies, and I believe it has all led up to this moment; the beginning of something much larger and much more impactful.

Today’s global beverage market is controlled mainly by behemoths who generate most of their profits from products that are not necessarily healthy for people or the planet. 21st century consumers seek products and brands that are not only good for their bodies but better for society. Our values of aligning profit with purpose really resonates with our consumers. We are humbled by their trust and loyalty, and they motivate us to do better every day.

The white space we see ahead remains enormous. Significant growth opportunities exist for our core brand, Vita Coco, through greater household penetration, distribution gains and innovation. We

iv

also plan to create new healthy, functional beverages and to acquire brands that fit with our values. Our goal is to be the fastest growing and most impactful healthy hydration company in the world. And when we win, so will our partners—whether consumers, retailers, employees, growers or investors.

A teacher once told me “If you can’t read, you’ll never be able to get a job!”. And to this day, I’ve never held a job or even been on a job interview. Instead, I have been able to spend every day with my best friends (otherwise known as my co-workers), create amazing products that people love and have the privilege to positively impact millions of people’s lives. If only my teachers could see me now!

I hope you will join us on this journey and help us continue to grow and redefine the meaning of good for you—for your body, for your communities, for your planet.

Thank you,

Mike

v

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “Vita Coco,” the “company,” “we,” “us,” and “our” in this prospectus refer to All Market Inc. (d/b/a “The Vita Coco Company”) and its consolidated subsidiaries.

The Leader of a Healthy Beverage Revolution Through the Power of Plants

The Vita Coco Company is a leading fast-growing, plant-based functional hydration platform, which pioneered packaged coconut water in 2004, and recently began extending into other healthy hydration categories. We are on a mission to reimagine what is possible when brands deliver great tasting, natural, and nutritious products that are better for consumers and better for the world. At the Vita Coco Company, we strongly believe that we have a nearly two-decade head start on building a modern, healthy beverage company providing products that consumers demand. We observed early on the shift toward healthier and more functional beverage and food products led by the next generation of consumers. As a result, we believe our platform is tethered to the future and not anchored to the past. Our portfolio is led by Vita Coco, which is the leader in the global coconut water category, and includes Runa, a leading plant-based energy drink inspired from a plant native to Ecuador, and Ever & Ever, a sustainably packaged water.

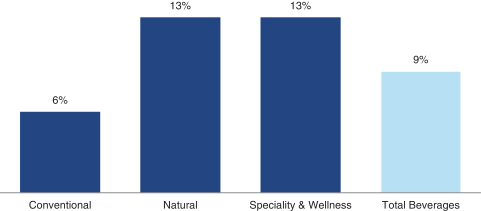

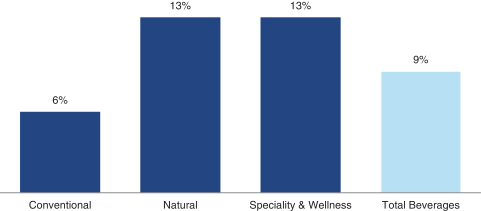

Since our inception, we have been boldly re-defining healthy hydration to truly be good for your body rather than “less bad for you” as defined by the old guards of the beverage industry. We have embraced the power of plants from around the globe by turning them into conveniently packaged beverages that our consumers can enjoy across need-states and beverage occasions throughout the day—as a replacement to orange juice in the morning, as a natural sports drink invented by Mother Nature, as a refreshing alternative to both regular or plant-based milk in a smoothie, or simply on its own as a great-tasting functional hydrator. Together, our brands help our consumers satiate their large and growing thirst for healthy and functional hydration, which fuels well-being from the inside out. This enables us to serve a U.S. beverage market of over $119 billion, providing a long runway for growth, and within which the $13 billion natural segment is currently growing at twice the pace of the conventional brands, according to SPINS.

We do all of this as a responsible global citizen with a consistent appreciation of our impact on the environment and social wellbeing of the communities in which we operate. We are a Public Benefit Corporation focused on harnessing, while protecting, nature’s resources for the betterment of the world and its habitants by creating ethical, sustainable, better-for-you beverages and consumer products that not only uplift our communities, but that do right by our planet. That is why we bring our products to market through a responsibly designed supply chain, and provide our farmers and producers the partnership, investment, and training they need to not only reduce waste and environmental impact, but bring income and opportunity to local communities. Ultimately, we believe it is our unique, inclusive, and entrepreneurial culture rooted in being kind to our bodies, our environment, and to each other, that enables us to win in the marketplace and ride the healthy hydration wave of the future. Our journey is still young, and we believe that we are well-positioned to continue to deliver exceptional growth and profitability as we continue to grow our consumer reach in existing and new markets around the globe. We are laser focused on owning as many healthy hydration occasions as possible.

1

We have undertaken numerous initiatives to turn our ideals into action. In 2014, we created the Vita Coco Project to support and empower our coconut farming communities through innovative farming practices, improving education resources, and scaling our business to promote economic prosperity—through all of which we hope to positively impact the lives of over one million people. Additionally, we seek to partner with other third party organizations that share and advance our ideals including fair trade, accessible nutrition and wellness, and environmental responsibility.

Vita Coco: The Global Leader in Coconut Water

We pioneered the North American and European packaged coconut water market and made coconut water a mainstream beverage loved by consumers who were seeking healthier alternatives. Today we are the largest brand globally (in retail sales) in the coconut and other plant waters category, according to Euromonitor. Our visionary co-founder and co-CEO, Mike Kirban, discovered coconut water on an adventure in Brazil with his best friend. In many tropical countries, coconut water is viewed as a gift from Mother Nature and has been consumed for centuries as a substitute for water given its hydrating and functional properties from electrolytes. Since the beginning, our goal has been to bring high quality yet affordably priced and sustainably sourced coconut water to the masses.

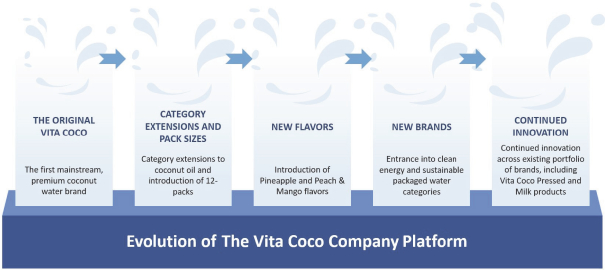

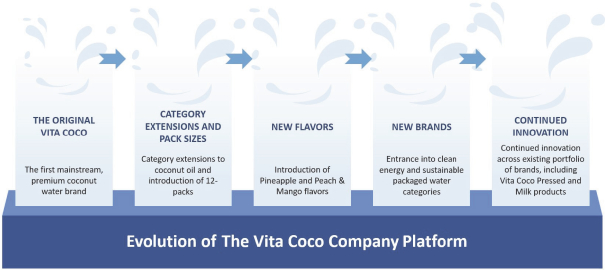

When Vita Coco launched in New York City in 2004, we established the coconut water category as a premium lifestyle drink, and we have been on the forefront of natural and functional beverages ever since. We believe the ongoing adoption of Vita Coco is largely attributable to its taste qualities and nutrients, and the fact that it is an alternative to sugar-packed sports drinks and other less healthy hydration alternatives. Vita Coco has evolved from a single pure coconut water SKU, to a full portfolio of coconut water flavors and enhanced coconut waters, as well as other plant based offerings such as coconut oil and coconut milk, all of which have been commercially successful and loved by consumers. With market share leadership, the Vita Coco brand is synonymous with coconut water and healthy hydration. Vita Coco is truly the brand that helps you “drink a little better, eat a little better, and live a little better.” We have leveraged the strength of our category leading Vita Coco brand and our innovation capabilities to broaden our portfolio.

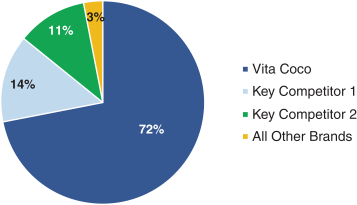

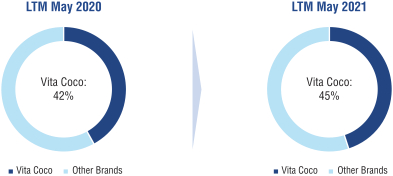

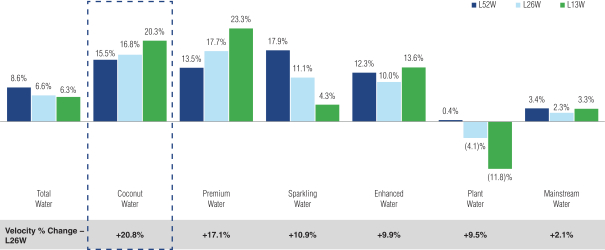

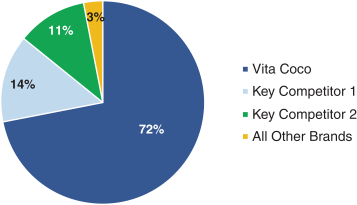

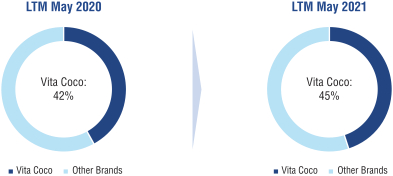

Today, Vita Coco is the coconut water category leader with 45% market share in the United States, a 34% relative market share advantage over the next leading competitor, according to SPINS. Vita Coco is driving growth in the overall category as well as growing its share. The brand competes in the $2 billion global coconut and plant waters category, according to Euromonitor, and is only being sold in 24 countries with low household penetration in most of them. We believe that Vita Coco has had the biggest influence in making coconut water a mainstream beverage choice in the United States, and driving the category to its 24% year-over-year growth, which is outpacing the growth in enhanced waters and sparkling waters, with 20% and 8% year-over-year growth, respectively, for the 13 weeks ended, June 16, 2021, according to IRI Custom Research. The category and the brand are sought after by consumers of all ages, but according to Numerator, does skew to younger and more multicultural shoppers, supporting the exciting growth prospects we have.

Internationally, our business is anchored by Vita Coco’s footprint in the United Kingdom, where it is the coconut water category leader with over 70% market share, according to IRI. Our U.K. footprint and operational base in Asia, has allowed us to start selling into other European and Asian countries, where our brand while still nascent, has been well received. In collaboration with our key retail partners in the United Kingdom, we have innovated beyond our current portfolio by extending the brand into natural personal care products that have been very well received by our loyal consumer base. We have established solid foundations in key markets such as China, France, Spain, the Nordic Region and the Middle East from which to build our brand.

2

Available Where Our Consumer Wants Us to Be

As we build and expand our business, we strive to democratize health and wellness by making our high-quality products accessible to mainstream consumers through broad distribution and price points. Our products are distributed through club, food, drug, mass, convenience, e-commerce, and foodservice channels across North America, Europe, and Asia. In the United States, we are available from up and down the street in bodegas where we got our start to natural food and big box stores all over the country. We can also be found in a variety of on-premise locations such as yoga studios, corporate offices and even music festivals and sports arenas.

We go to market in North America through a versatile and tailored approach that varies depending on a given product’s lifecycle stage, and the needs of our retail partners as brands evolve and mature. This practice will continue as we expand our platform through innovation and acquisitions, and we utilize our insights and experience across various distribution channels, including direct-store-delivery, or DSD, direct-to-retailer warehousing, or DTW, broadline distribution partners (e.g, UNFI, KeHE), and our own direct-to-consumer, or DTC, channel through our online operations. We are in the advantageous situation where without owning any of the assets needed for distribution, we can match the right retailer needs with the right route to market. For example, where club and e-commerce retailers prefer to receive full truckloads of our products directly delivered to the limited number of warehouses they deploy, in most instances the convenience retailers, with over 100,000 doors in the channel, prefer to have smaller deliveries directly to their stores through our distributor network that provides national coverage.

In addition to the strength of our brand, we believe our strong relationships across retailers is further aided by our highly-engaged sales and marketing teams who continually raise the bar for retail execution in the industry. Their proven track record of creating consumer excitement at the point of purchase has helped ensure that our products continue to fly off the shelves, while getting continuously restocked. We believe our marketing team has written the playbook on authentic grassroots brand building and influencer marketing, which draws highly coveted consumers into our retail partners in search of our products. Our in-the-field marketing efforts couple well with our superstar investors to tout the quality of our products and authenticity of the brand to further support ongoing purchasing.

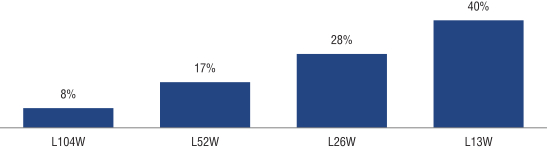

Vita Coco – Year-Over-Year Retail Sales Growth

Source: Retail sales of Vita Coco per IRI for the periods ended June 13, 2021 (MULO + Convenience).

3

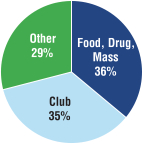

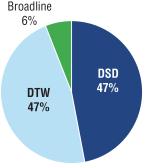

| 2020 AMERICAS SALES BY CHANNEL | 2020 AMERICAS SALES BY ROUTE TO MARKET | |

|

| |

Source: Management estimates based on gross sales and IRI Custom Research.

Notes: “Other” includes e-commerce, convenience and food service.

Unique Global Supply Chain Anchored in Upcycling and Supporting Growth Prospects

We have set up an asset-lite business model. We believe we have unique expertise sourcing and overseeing the packaging of coconut water from the tropical belt, and delivering our high quality, branded packaged coconut water to consumers worldwide. Through our direct access to coconut farmers globally and our relationships with processors in many countries, including the Philippines, Indonesia, and Brazil, we have built up a unique body of knowledge and relationships which we believe creates a competitive advantage unrivaled in the industry. We believe this is an important differentiator for our business and difficult to replicate.

As the pioneer of branded coconut water in the United States, we sourced our first coconut water in the early 2000s in Brazil, and helped local producers set up the infrastructure needed to supply and grow a high quality coconut water business. Over time, we took this capability to other parts of the world and also started giving back to the local communities in which we operate.

We have carefully cultivated a coconut water supply chain of scale, which enables coconut processing facilities to monetize their coconut water. Prior to our involvement, many facilities had solely focused on desiccated coconut, coconut cream, and other coconut products, and were discarding the coconut water as an un-needed byproduct of their coconut processing. Thus, we saw an opportunity for upcycling the coconut water.

Unlike other packaged beverages that can be produced or co-packed anywhere, coconut water needs to be transferred from the coconut into an aseptic package within hours of the coconut being cut from the tree. This means that we had to set up our production process as close to the coconut farms as possible to keep quality at the highest level. This was often in remote, less developed tropical areas with unsophisticated infrastructure and antiquated farming practices. In the areas we source from, we have established model farms to emulate, and we work closely with our manufacturing partners to assist the local farmers with best practices on how to grow and process coconuts in a sustainable and efficient manner. We believe the work we are doing with our manufacturing partners has set the gold standard for coconut water processing.

In exchange for sharing the technical resources and expert know-how that we developed over time, we receive long-term contracts, typically with exclusivity provisions. We helped in creating an

4

invaluable, loyal farming community around our manufacturing partners through our agricultural education programs and investments in schooling. This has strengthened our long-term manufacturing relationships and enables the scale and capacity needed for future growth.

Today, our supply chain reaches far beyond Brazil, and includes tropical countries around the world including the Philippines, Thailand and Sri Lanka. Our thousands of farming partners presently organize the cracking of approximately 2.5 million coconuts each day at the highest quality standards to meet our demand for just that, and we believe we are the largest purchaser of coconut water in the world. We source approximately two-thirds of our coconut water from Asia, and one-third from Latin America. Our well-diversified global network spans across 10 countries and 15 coconut water factories, which together are able to seamlessly service our commercial markets with delicious coconut water. We believe this network, and the relationships within it, are truly valuable, unique, and hard to replicate at scale.

Our business model is asset-lite as we do not own any of the coconut water factories that we work with, and we use co-packers for local production when needed in our major markets. This provides us with enormous flexibility as we can move production from one facility or country to another quickly. We are able to rapidly adjust our sourcing and production on a global scale, which not only de-risks our exposure to political, weather and macro-economic risks, but also ensures a constant, reliable and high quality supply of coconut water while keeping operations nimble and capital efficient.

Additionally, all of our manufacturing partners operate under the highest quality standards, and collectively provide a range of Tetra, PET and canning capabilities. This not only supports our existing offerings, but also allows us to be more expansive with our approach to innovation and product releases, such that we are not constrained due to any one packaging type.

Our supply chain scale, diversification, and flexibility also create leverage with manufacturers, warehouses, and logistics providers to reduce waste and operating and transportation costs, and helps us reduce our total costs while maintaining reliable supply. This scale also supports our position as one of the largest and highest quality coconut water producers in the world and should allow us to continue to manage our supply and growth prospects for many years to come.

Leveraging Our Success and Scale into a Multi-Brand Platform

Over the past nearly two decades, we have built the scale to service our retailers and consumers around the globe. While we are now a big organization with a strong back office team, our entrepreneurial spirit stays central to everything we do. Our sales team seeks to set the bar for retail execution in the industry, and has a proven track record of creating consumer excitement at the point of purchase. They are complemented by our marketing team who effectively employs authentic grassroots brand building and influencer marketing campaigns to aid brand awareness. We have leveraged our scale and entrepreneurial spirit to expand into other categories both organically and through acquisitions. We are constantly looking to expand our demographic reach and the beverage occasions that our products serve. We remain very focused on growing our share of the beverage market that sits at the intersection of functional and natural through a wide variety of clean, responsible, good for you products.

We expanded into private label coconut water in 2016 as a way to develop stronger ties with select, strategic retail partners and improve our operating scale. This strategic move has enabled us to grow our branded share in the category as well as improve our gross margins across the total portfolio. We leverage private label as a way to manage the overall coconut water category at retail, enabling us

5

to be better stewards of the category and influence the look and feel at retail shelves and more of the overall consumer experience with coconut water. Our private label offering strategically increases the scale and efficiency of our coconut water supply chain, and also proactively provides us with improved revenue management. Through this offering, we are able to better manage our products and capture the value segment without diluting our own brand, while concurrently supporting more family farms in the regions that we operate in. While our private label business has aided our growth historically, we expect our brands to be the primary drivers of top-line growth going forward.

After building the scale and infrastructure to support our beloved Vita Coco brand, we realized that we were well positioned to support our platform with other brands that could leverage our strong capabilities in sales, marketing, and distribution. In recent years, we have added two other, complementary brands to our portfolio that align with our values and allow us to expand our reach and consumer base, and increase the number of occasions where we can play a role in our consumers’ lives: Runa and Ever & Ever.

Runa: As part of our ongoing evaluation of the broader beverage industry, we saw an opportunity to leverage our success and learning in building Vita Coco and apply it to a clean, plant-based energy drink, with an aim to disrupt the very large and fast growing energy drinks category with a plant-based and fully natural alternative for consumers. This led us to acquire Runa in 2018 given its distinct plant-based and natural energy positioning, and our proven ability to source products from emerging markets. Runa’s clean energy drinks provide consumers a refreshing energy boost without the jolts and jitters, and with less sugar than traditional energy beverages. Our clean taste and smooth energy lift comes from Guayusa, an Amazonian jungle super-leaf containing theobromine and L-theanine, which has been shown to boost energy levels, alertness, and improve consumers’ moods and concentration.

Ever & Ever: Launched in 2019, Ever & Ever is a purified water brand packaged solely in aluminum bottles with a pH balance of 7.4. We saw an opportunity to quickly create a brand that responded to the need for a sustainably packaged water product given the reusable nature of the bottles and its infinite recyclability, and transformed our concept into reality in under three months. Ever & Ever was launched with a focus on the foodservice and office channels, as top Fortune 500 companies and large corporations continue to make a conscious effort to participate in the sustainability movement with a focus on reducing plastic waste. Ever& Ever is also available in our DTC channels.

Track Record of Industry Leading Financial Performance

We exercise strong financial discipline when managing our business and executing on our growth strategies, and our financial performance reflects that. While many companies at our stage and with our growth profile adopt a “growth-at-all-cost” mindset, we have always been focused on profitable, responsible, and sustainable growth. We believe this strategy is the most prudent and value-maximizing for all of our stakeholders, including investors, consumers, customers, employees, and global citizens, over the long-term horizon.

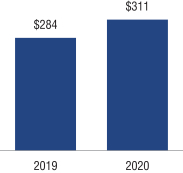

Our historical financial performance reflects the tremendous strides we have made to scale and grow our business. For the year ended December 31, 2020, we reported net sales of $310.6 million, a 9% increase from $284 million for the year ended December 31, 2019. For the year ended December 31, 2020, we generated gross profit of $105 million representing a margin of 34%, a 13% increase from $93 million for the year ended December 31, 2019 and a 100 basis point gross margin improvement. Our net income for the year ended December 21, 2020 was $33 million, representing a

6

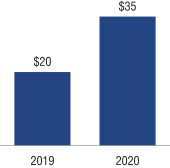

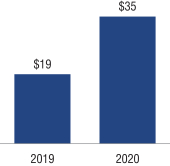

margin of 11%, an increase of 250% and approximately 800 basis points higher than our net income of $9 million and 3% margin for the year ended December 31, 2019. Our adjusted EBITDA for the year ended December 31, 2020 was $35 million representing a margin of 11%, an increase of 75% and approximately 400 basis points higher than our adjusted EBITDA of $20 million and 7% margin for the year ended December 31, 2019. This improved margin is a result of our gross profit margin expansion and right-sized marketing investments. We have traditionally experienced minimal capital expenditures given our asset-lite model, which allows us to generate high cash flow conversion, which we calculated as adjusted EBITDA less capital expenditures, divided by adjusted EBITDA, and provides sufficient operating capital to support future growth and initiatives.

| Net Sales ($m) |

Adjusted EBITDA ($m) | Adj. EBITDA – CapEX ($m) | ||

|

|

| ||

Our Competitive Strengths

A Pure-Play Healthy Hydration Platform Disrupting a Massive Category

Ever since his first encounter with a coconut straight from a tree on a sunny beach in Brazil, our co-founder Mike Kirban has been on a mission to bring the benefits of the coconut to the western world. Vita Coco has evolved from one pure coconut water SKU, to an award-winning portfolio of coconut water flavors, enhanced coconut water, coconut oil, and coconut milk, all the while retaining its #1 market share of 45%, which is bigger than the next ten brands combined, according to SPINS. In fact, all of our brands are rooted in clean, natural ingredients that deliver tangible and functional benefits to our consumers and address different need-states across all dayparts. Whether it is the electrolytes, nutrients, and vitamins in Vita Coco, Runa’s organic, plant-based and natural caffeine with a lower calorie count and sugar content than traditional energy drinks, or Ever & Ever’s aluminum packaging that is infinitely recyclable, our brands embody what we stand for as a company and resonate across consumers. We believe our platform has served as a leader in disrupting and transforming the healthy and functional beverage landscape.

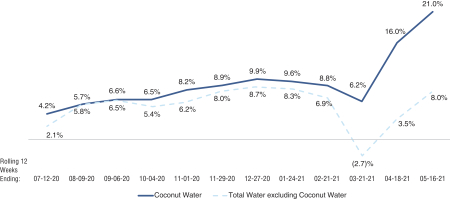

Today, Vita Coco is a top ten refreshment brand (non-alcoholic beverages excluding milk) within the broader $13 billion U.S. natural beverage category, according to SPINS data. Vita Coco continues to be the main driver of the coconut water category’s growth while simultaneously increasing our share and outpacing all other branded coconut water competitors. In the last twelve months, our retail sales in the coconut water category grew 15% compared to the 8% and 13% growth in the coconut water and natural beverage categories, respectively, according to SPINS.

7

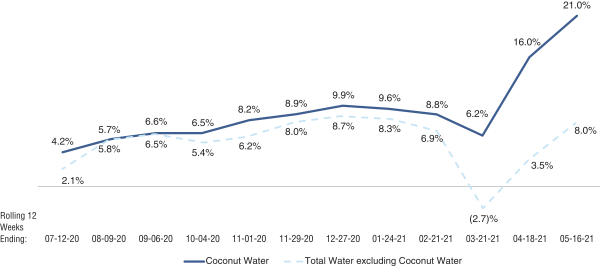

Coconut Water versus Total Water Year-Over-Year 12-Weekly Retail Sales Growth

Source: Retail sales per IRI Custom Research (MULO + Convenience).

Authentic Brands Appealing to A Loyal and Attractive Base of Consumers Who Are Coveted by Retailers

Our consistent quality and accessibility has helped establish Vita Coco as synonymous with the coconut water category. According to Numerator, 54% of consumers report Vita Coco as the only brand they consider within the category. As the most trusted brand in the category, according to BrandSpark, Vita Coco tends to be a planned purchase by 70% of brand shoppers, while also driving incremental consumers into the coconut water category. Of the last six months’ growth, 90% was incremental to the category, with 66% attributable to new coconut water category consumers.

Our brand resonates with the fastest growing demographic groups in the United States. We over-index to multi-cultural and younger consumers, and families, which we believe allows us to capture a broader array of the population, and creates early adoption allowing for long-term brand loyalists. According to Numerator, almost 60% of our consumers are non-white, with a large portion identifying as Asian or Hispanic, 41% of our shoppers are Generation Z or Millennials, and 40% of our consumers have children at home. These are valuable shoppers who are more likely to seek natural and organic foods, prioritize healthy eating, stay up to date on health trends, care about the environment, and engage in an active lifestyle – all of which align with The Vita Coco Company’s core purpose. We always strive to satisfy the functional hydration needs of the emerging generations that are leaving their mark on popular culture.

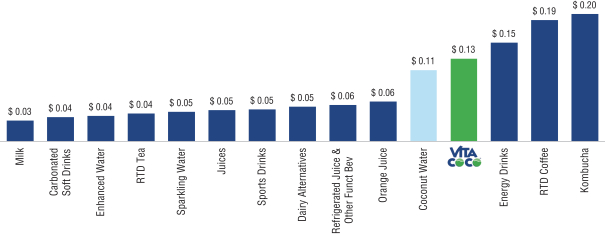

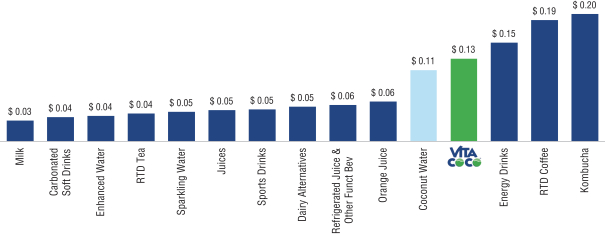

We believe retailers favor our brands because of the high quality shoppers we attract, alongside the premium products we offer. Our brands are able to attract new shoppers and encourage store traffic, with 400,000+ new households estimated to have been added to our customer base over the 12 months ended April 30, 2021, according to Numerator, and shopper baskets with Vita Coco products worth 15% more than the average water shopper’s basket over the six month period ended May 14, 2021, according to Numerator. Coconut water offers consumers an affordable health and wellness choice, priced more premium than traditional juices and carbonated soft drinks, while still more affordable than energy drinks and ready-to-drink coffee, enabling us to democratize healthy eating and natural products and drive strong shopper metrics for retailers.

8

Select Beverage $/EQ Units

Source: Retail and equivalent volume sales per SPINS for the 52 weeks ended May 16, 2021 (MULO + Convenience).

Vita Coco Shopper Characteristics

Source: Per Numerator for the six months ended May 14, 2021.

Note: Index represents the relative concentration of Vita Coco shoppers as compared to average of the total U.S. population (represented by an index of 100).

9

Agile Innovator with a Proven Track Record

Since day one, we have been category innovators, as proven by our decision to initially launch Vita Coco and pioneer packaged coconut water in the United States. As first-movers and leaders in a major beverage category, we understand the key components to ensuring the lasting success of a product or brand. When we first started Vita Coco, the coconut water category barely existed in the United States and was mostly sold in ethnic grocery stores. We estimate that the coconut water category in the United States was under $10 million when we launched Vita Coco in 2004. Today, this category has grown to $658 million in the United States alone, based on Euromonitor data.

We are consistently innovating our existing portfolio range to drive wider adoption of our brands, increase consumption occasions, and take market share across the natural beverage category. Our company culture empowers our entire team such that our field salespeople and marketers are able to interact with our consumers and incorporate real-time consumer and retailer feedback to identify gaps in our portfolio and find new innovations. For example, inspired by coconut water consumers who sometimes mixed coconut water with other flavored beverages, we created one of the first premium flavored coconut waters in the United States. We develop and release new products where we believe we can differentiate ourselves in a way that is consistent with long-term consumer trends and can leverage our supply chain and distribution capabilities.

More recently, we launched Vita Coco Pressed, a drink that packs more coconutty flavor into every sip. Today, Pressed alone makes up 7% of the coconut water category and as a standalone brand would be the fastest growing coconut water brand in the category relative to competing brands, according to IRI Custom Research. We also recently successfully launched a shelf stable coconut milk under the Vita Coco brand to enter the large and growing plant-based dairy alternatives segment, while also increasing Vita Coco’s ability to participate in additional use occasions such as coffee and cereal.

Additionally, we are constantly evaluating our product formats to ensure we are delivering consumers what they want in the best possible format. We have released new package types, multi-packs, and larger formats, all of which have supported category growth, and aided in increasing shoppers’ basket sizes by 12%, according to Numerator.

10

Hybrid Go-to-Market Strategy Enabling Us to Win at Retail

Our entire route to market is designed to maximize efficiency, reliability, flexibility, and profitability: from the way we source our coconut water all the way to how our products are delivered to retailers and consumers. We have refined our distribution model over the past two decades, which has enabled us to deliberately tailor our production and go-to-market capabilities to better serve our diverse customers.

With our unique product portfolio, sophisticated and experienced team, and differentiated supply chain, we believe we are able to outperform smaller competitors with our scale and global reach, while distinguishing ourselves from larger beverage players through our nimbler, hybrid platform. Our distribution capabilities ensure our go-to- market path is efficient and effective for each channel we participate in, as well as each product in its respective lifecycle. For example, when a product is in its early stage of development, we might select a broadline distribution partner for going to market, and as scale increases we could decide to enter it into the DSD system or go DTW if the retailers prefer to do so. Having access to the full range of distribution options, while not being restricted or forced to use only one of them, maximizes our execution speed and impact.

11

We employ a passionate and highly energetic sales force that is either on the ground talking to consumers and store managers, or in regular dialogue with retailers to ensure we are securing the best possible shelf locations and displays, and executing programs to benefit our retailers’ business – all as a means to grow our business. This insatiable appetite for expansion is key to our growth and continued market position as retailers look to Vita Coco not only as the brand to stock within the coconut water category, but also as a must-have brand within the natural beverages category. As a sign of our ongoing brand and execution strength, we have been able to capture 72% of the growth in the coconut water category in the current year to date, according to IRI Custom Research.

Year-to-Date Share of Retail Sales Growth in Coconut Water Category

Source: Retail sales per IRI for the year-to-date period ended June 13, 2021 (MULO + Convenience).

In addition to our strong sales force and route to market, we have further entrenched our relationship as a value-add supplier to select retailers through servicing their private label needs. Our private label business strengthens our relationships with retailers that are committed to their own private label products, allows us to ensure the integrity and quality of the category and also allows us to enhance the relationships we have forged with coconut water manufacturers globally. This offering supports our leadership position within the coconut water category, and while we believe our branded offering will drive future growth, our private label offering ensures we are continuing to support both retailers and suppliers.

A Unique, Asset-Lite Supply Chain That Starts Close to the Coconut Tree and Is Difficult to Replicate

As pioneers of the coconut water industry, and thought leaders in upcycling coconut water, we have spent the last 17 years developing a global, asset-lite operating model of scale that starts in the tropical belt around the world and is able to seamlessly service our markets with the highest quality packaged coconut water. Our growing body of knowledge on efficient manufacturing and sourcing processes from farm to facility for coconut water has created a competitive advantage that is unrivaled in the industry today.

We believe we are the largest branded coconut water producer in the world, and to date, no competitor has been able to achieve what we do at the same scale and efficiency. We also believe that replicating our current supply chain set-up would be challenging and time consuming.

12

Our well-diversified global network of thousands of coconut farmers and 15 factories across 10 countries is able to seamlessly service our end markets with the highest quality, delicious coconut water. As we do not own any of the coconut water factories that we work with, our supply chain is asset-lite, which combined with our scale, enables us to be flexible and move production from one facility or country to another as needed. We are able to quickly adapt to changes in the market or consumer preferences while also efficiently introduce new products across our platform.

Our manufacturing partners arrange the cracking of approximately 2.5 million coconuts each day at the highest quality standard for our coconut water needs, which requires supply from thousands of individual coconut farmers spread across the world and manufacturing operations located as closely as practical to the farms. This makes our supply chain truly valuable and unique, and sets us apart from other beverage companies. Our deep, long-standing relationships with our farming community have helped us scale to where we are today and will continue to support our high-growth business model in the future, while allowing for ongoing profitability.

Finally, we believe our purchasing power is supported by our leading market position through Vita Coco and our private label offering, which provide significant scale-based cost advantages versus competitors and any potential new entrants across sourcing, shipping, and other logistics.

Social Responsibility Commitment That Permeates Through Our Products and Organization

The Vita Coco Company’s purpose is simple: we believe in harnessing, while protecting, nature’s resources for the betterment of the world and its inhabitants by delivering ethical, responsible, and better-for-you hydrating products, that not only taste delicious, but also uplift our communities and do right by our planet. We believe these ideals have had a direct effect on our growth, and cause increased consumer adoption and spend on our products.

Our operational decision-making goes beyond solely maximizing shareholder value. We have sought out and achieved Certified B-Corporation status within parts of our organization, and our parent company, The Vita Coco Company, operates as a Delaware Public Benefit Corporation. Our commitment to social responsibility has three primary areas of focus:

| • | promoting healthy lifestyles; |

| • | cultivating communities and culture; and |

| • | protecting natural resources. |

In addition to our responsible consumer-facing and organizational initiatives, our business’ growth and scale have aided communities where our manufacturing relationships are located. Many of these regions have limited modern infrastructure, and we created the Vita Coco Project to help these coconut farmers increase their annual yield, diversify their crops, and grow sustainably. With our “Give, Grow, Guide” philosophy we remain committed and focused on the future, and seek to contribute to educational programs and facilities through efforts such as building new classrooms and funding scholarships; all to impact the lives of over 1 million people in these communities. We believe this purpose-driven approach has aided our growth as it is strategically aligned with the beliefs of our global consumer base.

Entrepreneurial, Inclusive, and Mission-Driven Culture Led by an Experienced Leadership Team

We have built a high-energy, entrepreneurial, and mission-driven management team. This group is comprised of experienced executives with a track record of success in growing better-for-you hydration and nutritious, healthy brands, developing large scale beverage platforms, and aiding our communities.

13

Our co-CEO, Michael Kirban, is the visionary co-founder who pioneered the coconut water category in the United States before healthy, functional beverages were top-of-mind for mainstream consumers. He partners closely with our other co-CEO, Martin Roper, who joined the team in 2019 after having been the CEO of The Boston Beer Company for nearly two decades. Mr. Roper was instrumental in transforming The Boston Beer Company from a regional, disruptive, single-branded craft beer company to an international beverage powerhouse with a portfolio of multiple mainstream brands. Mr. Roper’s experience in achieving diversified growth across multiple brands and channels through in-house innovation, strategic M&A and a keen sense for where consumer appetite is have already proven immensely valuable at The Vita Coco Company.

The passion and focus of our leadership permeate throughout our organization. As such, we have been able to attract diverse and highly engaged employees and directors who share our belief in our mission and have further promoted our inclusive company culture.

Our people are at the heart of everything we do, and we pride ourselves on living our values. We are human beings first, we operate with a culture of inclusivity, transparency, and optimism, and we treat our people and our communities with humility and respect, all of the time. Our openness, diverse backgrounds and bottomless curiosity allow us to learn from one another and we are all better for it.

Every employee of The Vita Coco Company understands the value we place on providing “better” for our consumers and our planet. Our full team is bought into utilizing our products to simultaneously help consumers in our served markets achieve their health goals and bring significant economic value to developing countries. We have an ongoing emphasis on how we can further enhance initiatives such as the Vita Coco Project, or improve our sustainability—whether it be through our packaging, analyzing and reducing our carbon footprint, or new ideas that we hear within our collaborative culture. The importance we place on these ideals have resulted in us gaining Certified B-Corporation status for Runa and our European business, and we are proud to have earned this.

Our Growth Strategies

Drive Further Brand Awareness and Customer Acquisition

We believe our ongoing growth is largely attributable to our effectiveness in authentically connecting with a loyal and broad consumer base through bold, dynamic, and disruptive marketing initiatives, and with a brand tone that is honest and true to ourselves. According to BrandSpark, this has translated into Vita Coco becoming the most trusted coconut water brand in the United States and a firm market leader with a size larger than the next ten brands combined, according to SPINS. Our consumer base over indexes relative to peers with the fastest growing demographic trends in the country: our drinkers are younger, more culturally diverse and spend more per shopping trip than the average shopper, according to Numerator.

Our strong position with younger and multicultural consumers in the United States provides an organic consumer growth engine as we believe the demographics in the country are shifting towards a more diverse population and as Generation Z and Millennials will make up the majority of the purchasing power in the country. We are relentless on our mission to offer healthier products and promote an active lifestyle, while taking care of our communities and our planet, and as our consumers actively seek out brands that uphold these values.

14

|

|

| ||

| Asian American 201 index |

Hispanic 177 index |

Millennials 135 index |

Consumer Index

Source: Per Numerator for the six months ended May 14, 2021.

Note: Index represents the relative concentration of Vita Coco shoppers as compared to average of the total U.S. population (represented by an index of 100).

Despite our 45% market share within the coconut water category in the United States according to SPINS, Vita Coco’s household penetration in the 12 months ended May 31, 2021 is only 9%, according to Numerator. We have a proven track record of highlighting our taste, quality and functional attributes, whether it be through celebrity endorsement, our own social media campaigns, or in-the-field consumer sampling and education.

We believe we have the potential to substantially increase our household penetration in coming years by (1) benefitting from the growth in our core consumer base as the multi-cultural and younger cohorts make up an increasingly larger share of shoppers, (2) raising awareness by leveraging our earned media and increasing our digital media investments, (3) gaining share of coconut water shoppers through our increased pack and flavor offerings, (4) using our sales and promotional teams to increase visibility and trial at retail, and (5) continuing to invest in e-commerce channels to drive

15

higher consumption rates and loyalty. Meanwhile we see additional volume growth opportunities through increasing the frequency of consumption through (1) increasing pantry loading with multi-packs, (2) winning in key occasions such as smoothies, and (3) entering new occasions through functional benefit led innovations such as Vita Coco Boosted with added medium-chain triglyceride, or MCT, and natural caffeine, through additional formats such as Vita Coco in cans and through our Vita Coco coconut milk products.

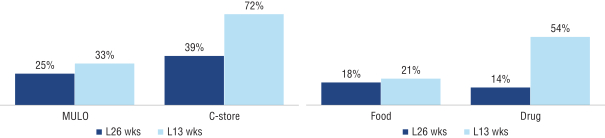

Increase Penetration and Distribution Across Channels

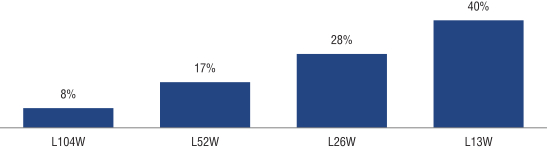

We believe there are significant opportunities across channels to gain distribution, and we plan to leverage our existing relationships to increase penetration and broaden our footprint across the Americas. Despite achieving over $200 million in retail sales for the 52 weeks ended June 13, 2021, as reported by IRI, we are continuing to experience 40% retail dollar sales growth across the United States for the 13 weeks ended June 13, 2021, according to IRI, and our growth is strong across all channels, mainly driven by velocity increases.

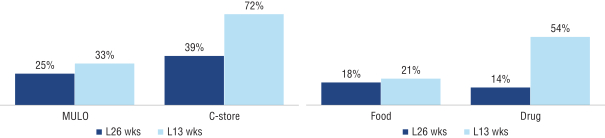

Vita Coco YoY Retail Sales Growth

Source: Retail sales per IRI for the 13 and 26 weeks ended June 13, 2021 (MULO + Convenience).

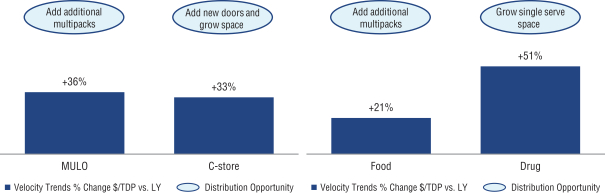

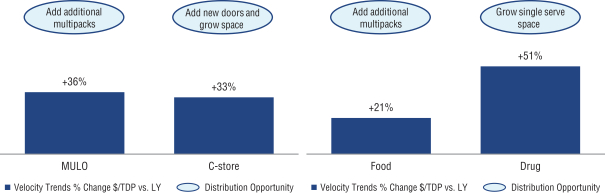

We see opportunities to translate this consumption growth into further distribution gains across channels, leveraging our strong share position, retail management team and best-in-class category management capabilities, with a focus on increasing space through the addition of multi-packs in food, mass and club channels, and via increasing space for single serve products in drug and convenience stores. In addition, we see a large opportunity to increase the number of doors in the convenience channel, where Vita Coco remains under distributed with only 54% of all-commodities-value weighted distribution, or ACV distribution, according to IRI, while our velocity is even with, or outperforming, a large portion of enhanced water, juice and sport drink brands, all of whom have higher ACV distribution.

16

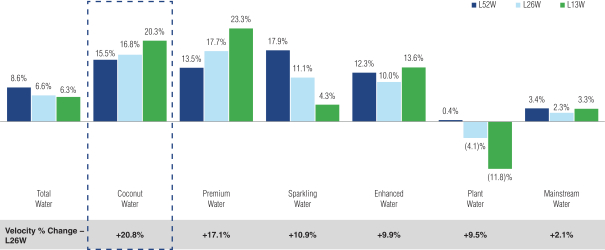

Vita Coco Velocity Growth

Source: Retail sales per IRI for the 13 weeks ended June 13, 2021 (MULO + Convenience). Velocity is defined as % change in $ per total distribution points, or TDP.

We also believe the foodservice channel contains massive whitespace for us and as the channel where Vita Coco originally found its roots, we are confident in our ability to capture it. In partnership with strong route to market partners specialized in the foodservice channel, we are especially focused on gyms, travel, office delivery, vending, healthcare, and education segments with a longer-term focus on casual dining opportunities. Lastly, we see a large opportunity to expand our e-commerce business, where we are market share leader on Amazon, Instacart, and on various other e-commerce platforms such as Walmart.com and Ready Refresh, and are in the process of building in-house DTC capabilities.

Continue Investing in Innovation Initiatives

As the market leader in the coconut water category, we have led the way in innovation. We continue to seek ways to leverage our expertise in product development to innovate within our portfolio and be ahead of the ever-changing consumer demands and preferences. We set a high bar for product extensions and new brands when developing potential additions to our portfolio and we demand superior quality products, healthier attributes and clean labels. We extensively test our products with consumers in-market as well as in test environments.

As an example, in 2021 we identified the growing consumer need for functional beverages that provide sustained energy all day, but without the high caffeine and coffee after taste, and we launched Vita Coco Boosted, a coconut water product with a blend of coconut MCT oil, coconut cream, B-vitamins, and tea extract, with no added sugar. With geographically focused distribution across key retailers, the product is proving to be highly incremental to the brand and the category.

We intend to focus on introducing products that are aligned with our mission and consumer base, and to expand in categories where we believe we can compete and win.

17

Broaden Our Geographic Reach

Today, 15% of our net sales are international and we see an opportunity to grow further within existing and new geographies over the coming years. We pioneered the coconut water category in Europe and were early entrants into China in 2014. The success of our coconut water products demonstrates both our ability to win in new markets, and the international appeal of our brands. Our international business is anchored by Vita Coco’s footprint in the United Kingdom, where it is the coconut water category leader with over 70% market share, according to IRI. Our scale and nimble route to market which combines direct to retail, wholesalers and ecommerce in the United Kingdom, and a local sales and marketing team directing promotions and investments against market opportunities, allows us to be impactful and reactive to changes in the beverage market. While our primary focus is on beverages, we have innovated in collaboration with key retail partners, by extending the brand into natural personal care products that have been very well received by our loyal consumer base and is allowing us to test which broader consumer needs our brand can expand to meet.

We entered China, France and Spain early in our international journey, and learned from these investments some of the keys to success in different export markets. We adjusted our approach in 2019 to focus on key markets and retailers to build a stronger base business, and now have healthy profitable stable businesses that we can build from. Our U.K. team runs market development activities in Europe and the Middle East. In the China market, we have a commercial team focused on local execution for which costs are shared with our local distribution partner. We have differing route to market models for each country and these varied approaches minimize the financial risks in these markets while allowing us to establish our brands and invest in these markets for long term growth in a prudent financial way, and to evolve our approach in each market as our brand develops.

We believe we are uniquely positioned to take greater share of the large and growing global natural beverages market based on the functional benefits that our Vita Coco brand offers consumers interested in health and wellness and our company’s mission and responsible sourcing that should appeal to consumers’ interest in purpose driven brands. Leveraging our global capabilities, we believe we can continue to grow existing markets and broaden our global reach through the addition of new markets. For each country we customize our product offering and packaging, initially focus on marketing and sales activation in key cities to establish the brand, and look for potential innovation opportunities unique to that culture that would boost our brand’s probability of success.

We plan to prioritize regions where we believe the most attractive opportunities are available to us based on product fit with consumer demographics and interest in health, wellness and purpose, and market opportunity. We are currently focused on regions such as Western Europe and China, where we believe the interest in health and wellness is growing and the markets are sizable and expected to grow significantly.

Leverage Growth, Continuous Improvement, and Scale for Margin Expansion

Since our founding, we have exercised healthy financial discipline when managing our business and executing on our growth strategies. While many companies at our stage and with our growth profile employ a “growth-at-all-cost” mindset, we have always been focused on profitable, responsible, and sustainable growth. We view this strategy to be most prudent and value-maximizing for all of our stakeholders, including investors, consumers, customers, employees, and global citizens, over the long-term horizon.

Our financial discipline was a primary motivator to build out an asset-lite model that provides us strong gross margins and high free cash flow generation, which together provides us financial

18

flexibility. Our investment in engineering resources to support our suppliers has identified a consistent flow of operational improvement projects that we and the suppliers have benefited from, and while slightly paused during COVID-19, we anticipate this continuing on an ongoing basis. As we continue to grow our top-line, both organically and through opportunistic M&A, we expect to also benefit from economies of scale and operating leverage, thus expanding our margins and mitigating inflationary pressures in the longer-term.

We have recently made investments in our supply chain capacity, information systems, and other infrastructure to better position our organization for long-term growth. To date, those actions have helped us manage our business and cost structure in a more efficient way and ultimately yielded margin expansion as evidenced by our year-over-year gross margin and EBITDA margin improvements. We anticipate the impact of the COVID-19 pandemic, which has created near-term inflationary pressures on supply chain costs, to start normalizing in the mid-term horizon. As such, we expect further margin expansion in the future as we continue to scale our portfolio of brands and gain increased operating leverage once these impacts dissipate.

Execute Strategic M&A to Enhance Our Portfolio