UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ____ TO _______

Commission File Number: 000-54286

SURNA INC.

(Exact name of registrant as specified in its charter)

| Nevada | 27-3911608 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 1780 55th Street, Boulder, Colorado | 80301 | |

| (Address of principal executive offices) | (Zip code) |

(303) 993-5271

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class Registered

Common stock, par value $0.00001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X].

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X].

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. Yes [X] No [ ].

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer, “accelerated filer,” “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | [ ] | Accelerated Filer | [ ] |

| Non-accelerated Filer | [X] | Smaller Reporting Company | [X] |

| Emerging Growth Company | [ ] | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X].

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $7,090,000 based upon a closing price of $0.03 reported for such date on the OTCMarkets.

As of March 23, 2021, the number of outstanding shares of common stock of the registrant was 236,526,638.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Surna Inc.

Annual Report on Form 10-K

For Fiscal Year Ended December 31, 2020

Table of Contents

| 2 |

In this Annual Report, unless otherwise indicated, the “Company”, “we”, “us” or “our” refer to Surna Inc. and, where appropriate, its wholly-owned subsidiary.

Hemp and marijuana are technically both part of the “Cannabis sativa L.” plant. “Hemp” is a term used to classify varieties of cannabis that contain 0.3% or less tetrahydrocannabinol (“THC”) content (by dry weight), the principal psychoactive constituent of cannabis. Hemp and its derivatives were federally legalized in the United States as part the Agricultural Act of 2018. “Marijuana” is a term used to classify varieties of cannabis that contain more than 0.3% THC (by dry weight). Marijuana is not federally legal in the United States. Many states, however, have taken action to make marijuana legal for all purposes, made it available for medical uses, decriminalized it or a combination thereof. We currently provide nearly all of our products and services to customers that cultivate marijuana. In this Annual Report, unless otherwise indicated, “cannabis” refers to “marijuana.”

Although our customers do, we neither grow, manufacture, distribute nor sell cannabis (marijuana) and hemp or any of their related products.

CAUTIONARY STATEMENT

This Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7, contains forward-looking statements that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but are based on current management expectations that involve substantial risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed in, or implied by, these forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements including, but not limited to, any projections of revenue, gross profit, earnings or loss, tax provisions, cash flows or other financial items; any statements of the plans, strategies or objectives of management for future operations; any statements regarding current or future macroeconomic or industry-specific trends or events and the impact of those trends and events on us or our financial performance; any statements regarding pending investigations, legal claims or tax disputes; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing.

These forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause our actual results of operations, financial condition, liquidity, performance, prospects, opportunities, achievements or industry results, as well as those of the markets we serve or intend to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. These forward-looking statements are based on assumptions regarding our present and future business strategies and the environment in which we operate. Important factors that could cause those differences include, but are not limited to:

| ● | our business prospects and the prospects of our existing and prospective customers; |

| ● | the impact on our business and that of our customers of the current and future response by the government and business to the COVID-19 pandemic, including what is necessary to protect our staff and the staff of our customers in the conduct of our business; |

| ● | the overall impact of the COVID-19 pandemic on the business climate in our industry and the willingness of our customers to undertake projects in light of economic uncertainties; |

| ● | our overall financial condition, including our reduced revenue and business disruption, due to the COVID-19 pandemic business and economic response and its consequences; |

| ● | the inherent uncertainty of product development; |

| ● | regulatory, legislative and judicial developments, especially those related to changes in, and the enforcement of, cannabis laws; |

| ● | increasing competitive pressures in the CEA (Controlled Environment Agriculture) industry; |

| ● | the ability to effectively operate our business, including servicing our existing customers and obtaining new business; |

| ● | our relationships with our customers and suppliers; |

| 3 |

| ● | the continuation of normal payment terms and conditions with our customers and suppliers, including our ability to obtain advance payments from our customers; |

| ● | general economic conditions, our customers’ operations and access to capital, and market and business disruptions including severe weather conditions, natural disasters, health hazards, terrorist activities, financial crises, political crises or other major events, or the prospect of these events, adversely affecting demand for the products and services offered by us in the markets in which we operate; |

| ● | changes in our business strategy or development plans, including our expected level of capital expenses and working capital; |

| ● | our ability to attract and retain qualified personnel; |

| ● | our ability to raise equity and debt capital to fund our operations and growth strategy, including possible acquisitions; |

| ● | our ability to identify, complete and integrate potential strategic acquisitions; |

| ● | future revenue being lower than expected; |

| ● | our ability to convert our backlog into revenue in a timely manner, or at all; and |

| ● | our intention not to pay dividends. |

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this annual report on Form 10-K should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in “Risk Factors” in this Annual Report on Form 10-K. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Annual Report on Form 10-K. Except as required by the federal securities laws, we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, to reflect events or circumstances occurring after the date of this Annual Report on Form 10-K. The forward-looking statements and projections contained in this Annual Report on Form 10-K are excluded from the safe harbor protection provided by Section 27A of the Securities Act.

Non-GAAP Financial Measures

To supplement our financial results on U.S. generally accepted accounting principles (“GAAP”) basis, we use non-GAAP measures including net bookings, backlog, as well as adjusted net income (loss) which reflects adjustments for certain non-cash expenses such as stock-based compensation, certain debt-related items and depreciation expense. We believe these non-GAAP measures are helpful in understanding our past performance and are intended to aid in evaluating our potential future results. The presentation of these non-GAAP measures should be considered in addition to our GAAP results and are not intended to be considered in isolation or as a substitute for financial information prepared or presented in accordance with GAAP. We believe these non-GAAP financial measures reflect an additional way to view aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. For purposes of this Annual Report, (i) “adjusted net income (loss)” and “adjusted operating income (loss)” mean GAAP net income (loss) and operating income (loss), respectively, after adjustment for non-cash equity compensation expense, debt-related items and depreciation expense, and (ii) “net bookings” means new sales contracts executed during the quarter for which we received an initial deposit, net of any adjustments including cancellations and change orders during the quarter.

Our backlog, remaining performance obligations and net bookings may not be indicative of future operating results, and our customers may attempt to renegotiate or terminate their contracts for a number of reasons, including delays in or inability to obtain project financing or licensing or abandonment of the project entirely. Accordingly, there can be no assurance that contracts included in the backlog or remaining performance obligations will actually generate revenues or when the actual revenues will be generated.

| 4 |

Overview

We design, engineer and sell environmental control and other technologies for the Controlled Environment Agriculture (CEA) industry. The CEA industry is one of the fastest-growing sectors of the United States’ economy. From leafy greens (kale, Swiss chard, mustard, cress), microgreens (leafy greens harvested at the first true leaf stage), ethnic vegetables and small fruits (such as strawberries, blackberries and raspberries) to bell peppers, cucumbers, tomatoes and cannabis and hemp, some producers grow crops indoors in response to market dynamics or as part of their preferred farming practice. In service of the CEA, our principal technologies include: (i) liquid-based process cooling systems and other climate control systems, (ii) air handling equipment and systems, (iii) a full-service engineering package for designing and engineering commercial scale thermodynamic systems specific to cultivation facilities, and (iv) automation and control devices, systems and technologies used for environmental, lighting and climate control. Our customers include commercial, state- and provincial-regulated CEA growers in the U.S. and Canada as well as other international locations. Customers are those growers building new facilities and those expanding or retrofitting existing facilities. Currently, our revenue stream is derived primarily from supplying our products, services and technologies to commercial indoor facilities ranging from several thousand to more than 100,000 square feet.

Headquartered in Boulder, Colorado, we leverage our experience in this space to bring value-added climate control solutions to our customers that help improve their overall crop quality and yield, optimize energy and water efficiency, and satisfy the evolving state and local codes, permitting and regulatory requirements.

All CEA facility operators are facing multiple headwinds of high energy costs, issues about water usage and waste materials, and, in the case of cannabis growing, increasingly rigorous quality standards and declining cannabis prices. To be competitive, among other things, our customers must develop innovative ways to meet the demands of their business and reduce energy costs, 90% of which is typically related to their HVACD (50%) and lighting systems (40%). HVACD systems have historically been our focus. We often have the advantage of early engagement with our customers at the pre-build and construction phases and the corresponding opportunity to build longer-term relationships with our existing customers and their facilities. Going forward, our plan is to leverage our existing customer relationships and attempt to sell them additional products and services, thereby becoming “stickier” to our customers, in an effort to generate incremental revenue.

We have three core assets that we believe are important to our going-forward business strategy. First, we have multi-year relationships with customers and others in the CEA industry, notably in the cannabis segment. Second, we have specialized engineering know-how and experience gathered from designing environmental control systems for CEA cultivation facilities since 2016. Third, we have a line of proprietary environmental control products, which we are in the process of expanding.

We are an integrated provider of MEP (mechanical, electrical, plumbing) engineering design, proprietary environmental control equipment, and controls and automation offerings serving the CEA industry. Historically, nearly all of our customers have been in the cannabis cultivation business. We believe our employees have more experience than most other MEP firms serving this industry. Our customers engage us for their environmental and climate control systems because they want experts to design their facilities, and they come to us because of our reputation. We leverage our reputation and know-how against the many local contractors and MEP engineers who collectively constitute our largest competitors.

A number of recent events have had an adverse impact on our operations and financial condition, including constraints on capital availability for our customers and prospects who have commenced, or are contemplating, new and expanded CEA cultivation facilities and the recent outbreak of COVID-19, a novel strain of coronavirus first identified in China, which has spread across the globe including the U.S. Most recently, the response to this coronavirus by federal, state and local governments in the U.S. has resulted in significant market and business disruptions across many industries and affecting businesses of all sizes. This pandemic has also caused significant stock market volatility and further tightened capital access for most businesses.

Shares of our common stock are traded on The OTC Markets under the ticker symbol “SRNA.”

Impact of the COVID-19 Pandemic on Our Business

The impact of the government and the business economic response to the COVID-19 pandemic has affected demand across the majority of our markets and disrupted work on projects. The COVID-19 pandemic is expected to have continued adverse effects on our sales, project implementation, operating margins, and working capital. As of the date of this filing, uncertainty continues to exist concerning the magnitude and duration of the economic impact of the COVID-19 pandemic.

| 5 |

In response to the COVID-19 pandemic, in late March of 2020 the Company downsized operations to preserve cash resources, implementing workforce reductions, reductions of salaried employee compensation (including all executives and the CEO) and reduction of hours worked, cutting costs and focusing its operations on customer-centric sales and project management activities.

Following the receipt of loan funds in April 2020, the Company reinstated all staff who previously had been placed on furlough. Staff receiving salaries of $100,000 per year or less were restored to their full salaries. All executives, including the CEO, had their compensation reduced to the greater of $100,000 per year or 75% of their previous salary level. The Company re-engaged its staff so as to be able to fulfill its current customer contracts and any new sales orders and to continue its marketing and selling efforts. Over the course of the Summer 2020, the Company took further steps to adjust its work force by furloughing several employees, making temporary hourly and salary reduction adjustments, and then, in late September 2020, in light of our then sales efforts, reinstating continuing hourly employees to full-time status and restoring the salaries of continuing salaried employees.

Due to the speed with which the COVID-19 pandemic developed and the resulting uncertainties, including the depth and duration of the disruptions to customers and suppliers, its future effect on our business, on our results of operations, and on our financial condition, we cannot predict the overall effect on our business over the longer term. Despite this uncertainty, we have undertaken various plans to reduce costs so as to mitigate the impact of the COVID-19 pandemic to the best of our ability, although they may not be sufficient in the long-run for us to avoid reduced sales, increased losses and reduced operating cash flows.

Refer to Risk Factors, included in Part II, Item 1A of this Annual Report on Form 10-K below, for further discussion of the possible impact of the COVID-19 pandemic on our business.

Our Growth Strategy

We believe there are several ways to grow a business: (i) increase the number of customers, (ii) increase the average revenue per order, (iii) increase the frequency of orders, or (iv) expand the addressable market.

| 1. | Sell proverbial “Chevys.” In addition to “Cadillac” -level products, sell “Chevy” or equivalent products to satisfy a wider range of points along the demand curve. Anticipated result: Increase the number of customers. |

We have a sales and marketing program that generates many prospective customer relationships. However, our limited range of higher cost products, mostly chilled water systems, reduces the number of customer prospects who can afford to buy from us. In 2018 we started an aggressive effort to broaden our product and service offerings to provide a wider range of HVACD technical solutions (see chart below). In 2018 we began to offer stamped mechanical plan sets and our first 4-pipe chilled water systems. In 2019 we broadened our engineering services to include full MEP (mechanical, electrical, and plumbing) design services. We also began to offer our SentryIQ® Controls System. And in 2020 we added new products to include: split system DX (direct expansion) with integrated dehumidification, packaged DX systems with modulating hot gas reheat, heat recovery chiller/boiler for 4-pipe systems, and our StrataAir™ ™ racking airflow solution to address customer needs for multi-level cultivation facilities. These various systems provide solutions to answer a broader range of technical and cost constraints, and we will continue to develop and offer new solutions to our customers’ problems, so that a broader group of growers can take advantage of our engineering expertise and capabilities. We believe these new products and services will increase our addressable market and increase sales, further leveraging our investment in sales and marketing.

The success of our product development initiative can be seen in the following table, which documents the number of commercial-scale projects (over $100,000 sales) that have included one or more of our new products:

| Year | Percent using New Products | ||

| 2018 | 35% | ||

| 2019 | 76% | ||

| 2020 | 100% | ||

| 6 |

| 2. | Sell proverbial “steering wheels.” Sell our customers the automated facilities control systems they need—directly. Anticipated result: Increase average order size. |

Growing live plants indoors in a controlled environment is a technically demanding business, and a failed crop can cost a grower significant foregone revenue. We believe our licensed professional engineers are some of the industry’s leading experts in the design of such facilities, and we seek to extend that leadership into more advanced technology products.

In 2019 we introduced our SentryIQ® control system. If our climate control design and products are the proverbial car, then SentryIQ® is the proverbial steering wheel—one is needed to direct the car where to go. Before SentryIQ® we had to send our customers elsewhere for controls to regulate their cultivation environments, but we now have the ability to capture that revenue. To date, we have signed thirteen contracts for controls systems with an aggregate value of approximately $1,700,000.

Our next step down this technology and innovation road will be the eventual development of the equivalent of a self-driving car. Growers will tell the control system what they want to achieve, and the system will sense the environment and direct the climate control system to achieve the grower’s goals. These systems will be able to integrate data analytics—and eventually deploy artificial intelligence—to optimize multiple variables to maximize the grower’s profits. While we are in the early stages of development of these technology-driven systems, we believe it is important for us to become a player in this market because it expands our addressable market for both sensors and software while offering the possibility of higher margins and recurring revenue over time.

| 3. | Add more proverbial “dealers.” Engage in one or more strategic relationships with other technology leaders that serve our industry. Anticipated result: Increase the number of customers. |

Strategic relationships might include referral marketing agreements, selling through manufacturer’s representative organizations, co-development of unique integrated solutions with best-in-class partners, and acquisitions. To extend the automotive analogy, engaging in these types of relationships is like adding more dealers to sell our products, at little cost to us.

If some of these strategic alliances are successful in driving top-line revenue for us and our partners, over time these relationships could develop into more exclusive arrangements or evolve into possible acquisitions or a source of strategic capital for us. There can be no assurance that we will be able to successfully execute any of these strategic initiatives. Efforts will be primarily focused on working with new strategic partners to co-market each other’s products and services and possibly jointly develop new and improved products and services, as opposed to exclusively seeking acquisitions.

| 4. | Expand our addressable market |

Our sales and marketing efforts have historically been oriented towards the cannabis-cultivation segment of the CEA industry. The non-cannabis CEA industry is growing as well, and we believe our products and services can address that market either as currently engineered or with minimal modification.

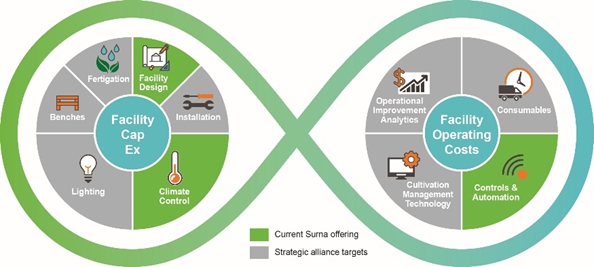

Surna’s core and historic expertise and products center on providing mechanical engineering for environmental controls for indoor growing facilities. We believe that our demonstrated expertise and experience positions us to expand our product and service offerings vertically, to include integrating many of the technologies and services required to build and operate a CEA cultivation facility, such as space programming and facility layout in addition to the MEP engineering we do today. In addition, we believe we can expand our product offerings to include the selection, integration, and provision of lighting, benching, irrigation and fertigation equipment and add-on maintenance and other recurring revenue services to operating facilities.

********

| 7 |

Our Key Initiatives

Our strategic business plan has four primary objectives:

| 1. | Achieve continued organic sales growth by broadening and vertically integrating our product and service offerings. | |

| 2. | Grow revenue and profitability by engaging in selective strategic relationships and acquisitions. | |

| 3. | Operate the business with disciplined financial management and become financially self-sustaining. | |

| 4. | Seek uplisting to a national securities exchange at a propitious moment. |

Our goal for the immediate future is to grow organically, strategically and profitably within the CEA industry. We will also consider acquisitions of complementary businesses both within and potentially outside of the CEA industry. We believe the worldwide CEA market will grow substantially for the foreseeable future, and that this will lead to more new build, retrofit and expansion projects to drive our continued growth. Here are some of the initiatives we pursued in 2020, and where more work is needed to progress each of them.

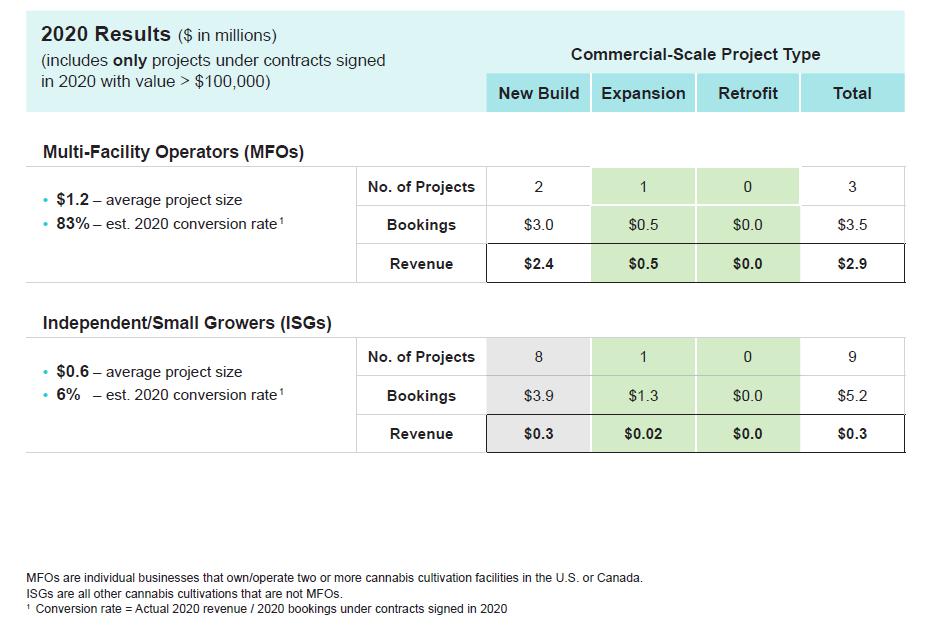

Focus on Multi-facility Operators. We actively pursue business from multi-facility operators (MFOs), which we define as businesses that own and operate two or more CEA cultivation facilities in either the U.S. or Canada. These MFOs are typically larger and have greater financial and organizational wherewithal to buy more and larger systems and are less prone to project delays and cancellations, compared to the smaller (and riskier) independent cultivators that had been our primary customers in the past. In 2020 we booked three projects totaling $3.5 million. We recorded $2.9 million in revenue from these projects, or 35% of our total 2020 revenue. Going forward, we will conduct our operations to seek a sales pipeline with MFO customers that we believe will result in more consistent and predictable revenue and cash flow. Because MFOs are typically more sophisticated and may, in many cases, have in-house engineering teams, such MFOs may not need the engineering expertise and experience we offer. This contrasts with the independent smaller grower market that places significant value in our overall expertise and experience, including our specific CEA related growing knowledge.

The table below shows our 2020 full year results for commercial-scale projects, which we define as contracts with a value over $100,000, by project and customer type.

| 8 |

To achieve profitability in the future, we must first be able to generate a more consistent and predictable revenue stream. To do so, we must: (i) maximize our new build facility projects, and (ii) supplement those projects with an increased number of retrofit and expansion projects—which typically have shorter completion cycles and fewer external contingencies that we do not control. Historically, whenever a new build project has been delayed or cancelled, which can occur often, our revenue and cash flow has taken a corresponding dramatic hit.

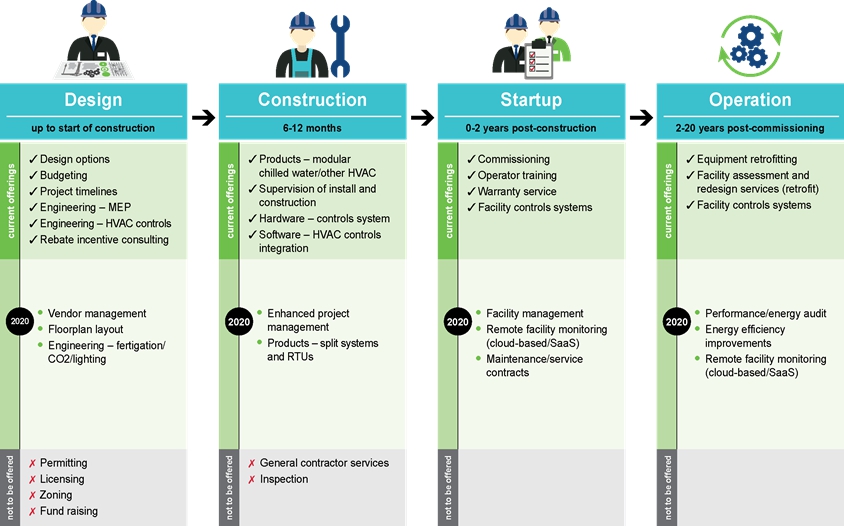

Offer a Broader Range of Products and Services Across the Cultivation Facility Lifecycle. During 2019, we fulfilled the first step of this goal with the introduction of our SentryIQ® controls package. We also began offering full mechanical, electrical, and plumbing engineering services, developed and sold a four-pipe, chilled water environmental control system with Surna branded fan coil units and custom air handlers, developed a proprietary destratification fan, and performed facility retrofit services. Our new custom air handlers alone generated $2.3 million in revenue in 2019, and another $516,000 in 2020. In 2020 we continued this effort by introducing several new DX-based packaged products (EnviroPro™) and our StrataAir™ air distribution product.

Following up on our product launch successes in 2019 and 2020, we plan to address facility lifecycle revenue opportunities by leveraging our strong brand name and positioning ourselves as the “trusted advisor” in environmental controls management. In addition, we will begin to offer recurring-revenue services for facility monitoring and preventive maintenance services. Our expanded product offering is illustrated by the following 4-phase matrix of product/service depth and facility lifecycle participation.

We attempt to become “stickier” to our customers by providing climate control products and services across the entire 4-phase facility lifecycle. Each phase of the facility lifecycle has many activities that present potential opportunities for us. We do not intend to offer products and services in all activities in each phase, but rather we will focus on technology and innovation that provide value-add to our customers as they attempt to seek out “best-in-class” partners to automate and control the indoor grow facilities of the future. We believe, if successful, this could possibly translate into greater demand for our proprietary, customized equipment, technology and software solutions.

Enter Strategic Alliances to Expand our Marketing and Sales Reach. We have identified several business verticals that we believe are logical and natural complements to our climate control business, such as: lighting, fertigation (automated process of delivering nutrients and water to plants), benches (customized systems to optimize use of the growing space), cultivation management technology (software), consumables (growing, packaging, facility and lab supplies), and operational improvement analytics (modeling, data aggregation and artificial intelligence). We will also consider strategic alliances, such as distribution, reseller, co-marketing or product development agreements, with select companies which are consistent with our strategic direction. Our strategic alliances will likely involve development of more comprehensive, end-to-end, integrated solutions for our customers, as well as specialized products and services that help cultivators compete in the market, whether through automation, software or operating efficiencies.

| 9 |

If some of these strategic alliances are successful in driving top-line revenue for us and our partners, over time these relationships could develop into more exclusive arrangements or evolve into possible acquisitions or a source of strategic capital for us. There can be no assurance that we will be able to successfully execute any of these strategic initiatives. Efforts will be primarily focused on working with new strategic partners to co-market each other’s products and services and possibly jointly develop new and improved products and services for the CEA industry.

Cash and Dilution. We started 2020 with just over $922,000 in cash but with a new discipline on cost control and increased bookings in the second half of the year we were able to increase our cash to $2,285,000 at the end of 2020. In 2019 and 2020 we used operating cash flows and loan proceeds to support our operations and did not engage in any dilutive financing. In 2020, we exercised strict financial discipline to weather a dramatic drop in new projects in the first half of the year, largely due to the Covid-19 pandemic response. We recovered in the second half. In the first two quarters of the year we had a major project cancellation and fewer new project bookings. Our adjusted net loss in 2020 was $1,239,000 compared to an adjusted net income in 2019 of $92,000. Our adjusted net income (loss) is our GAAP net income (loss) after addback for our non-cash equity compensation expenses, debt-related items and depreciation expense.

Our working capital remains negative, which is a constant impediment to the overall viability of our business as planned, so we must land more MFO and other contracts and we may have to raise capital again to fund our working capital needs and future growth.

Investor Relations. We previously had limited investor relations activities of any kind prior to 2019. In 2019 we began to attend investor conferences and we engaged an Investor Relations firm. Due to the financial impact of the pandemic we terminated these activities at the end of Q1 2020. Our goal remains to create an actively traded, widely held, and fully valued stock over time and in concert with our achievement of consistent financial goals. We intend to resume Investor Relations activities as our finances allow.

Products and Services

We now offer a broader range of products and services to the CEA market than the mechanical engineering and modular chilled water systems we historically offered. This includes products and services targeting smaller indoor grow facilities and commercial-scale facilities as well as sealed greenhouse, or hybrid, facilities.

Services: Engineering and Design. We offer licensed professional mechanical, electrical and plumbing design and engineering services to all customers, and those customers in the cannabis growing industry that are in cannabis-legal states and provinces. We believe we have leading edge, sophisticated engineering capabilities, which we attempt to leverage with independent small growers as well as MFOs that are building larger and more sophisticated commercial projects.

Going forward, we plan to: (i) emphasize our strong mechanical engineering team that includes an in-house staff of degreed engineers including an experienced licensed professional engineer (PE), (ii) offer pre-construction energy modeling to help our customers and enhance our sales closing rate, (iii) develop an engineering, design and audit services program for the expanding retrofit market, which remediates existing grow facilities that suffer from sub-optimal performance, and (iv) potentially offer other facility management programs.

Our technical experience and know-how in designing indoor cultivation facilities allow us to deliver to our customers practical solutions to complicated problems in four primary areas: (i) precision climate and environmental controls, (ii) energy and water efficiency, (iii) building code and permitting, and (iv) project management of construction of our products in the facility. Our engineering design typically includes all mechanical components of a climate control system: cooling and heating, dehumidification, ventilation, air sanitation and odor control. We provide load calculations, equipment specifications, and engineered systems drawings for both the cultivation and comfort cooling portions of our customers’ facilities. We also have experience in, or knowledge of, state and local permitting and code compliance for facilities in states and provinces where cannabis has been legalized for either recreational or medical use or is expected to be legalized, and we provide stamped, engineered drawings in all states and provinces where we operate.

| 10 |

Our competitive advantages are our experience and reputation. Since 2006 we have continuously improved our CEA facility design capabilities which we believe distinguishes us from our competition. Our primary competitors include local heating, ventilation and air conditioning (“HVAC”) contractors, traditional MEP engineering firms, and other CEA-focused design firms. CEA facilities present a very difficult mechanical engineering challenge, and traditional mechanical engineers, without our experience, are typically unfamiliar with the precise climate and air control requirements needed for such facilities. As important, they may be unable to effectively navigate the local code and permitting rules which did not contemplate the special requirements of CEA facilities when enacted. With our engineering design resources and experience, we are able to provide a code-compliant MEP plan set by collaborating with local regulators and our customers to engineer creative solutions that not only meet the intent of the local codes but also address concerns about the growing energy and resource usage of these facilities.

Energy use is, and will increasingly become, a primary concern for regulators and indoor cultivators. Two states, Massachusetts and Illinois, have already placed regulatory caps on energy density in indoor cultivation facilities and we expect this trend to continue. Energy costs are frequently the second largest operating expense for a cultivation facility, after labor, with HVACD and lighting comprising approximately 50% and 40%, respectively, of a facility’s energy use.

As a result, licensed producers are adopting practices to maximize energy efficiency and thereby reduce operating costs, which will become even more important as the industry matures and wholesale prices continue to decline. These practices include more efficient uses of water, more efficient lighting (typically LED lighting), and renewable energy alternatives. Sealed greenhouses, or hybrid facilities—which are insulated for energy efficiency and combine natural light with the use of artificial lights—also provide a more economical way to grow agricultural products compared to warehouse type indoor production. But regardless of whether an indoor or a hybrid facility is the grow venue, precise environmental controls are required to deliver consistent product quality and yield. We are evaluating possible strategic relationships with providers that are seeking an environmental controls partner for these specific facility applications.

We believe the right solution for our cultivation customers must include: (i) precise temperature/humidity control; (ii) reduced fungus, pollen, pesticide and insect contamination risk (“bio-security”); (iii) controlled regulatory compliance risk; (iv) lower maintenance complexity, costs and downtime; and (v) energy and resource efficiency.

Our bio-security program uses a combination of a sealed facility and customized approaches to air sterilization to maintain facility standards, while destroying harmful airborne microbes without the production of byproducts. Additionally, our ductless modular chilled water systems—using fan coil units within each grow room—isolate the air and potential contaminants within each room, while taking advantage of the energy efficiencies and redundancies offered by such systems. Our experience has shown that our precision environmental controls can reduce the reliance on the use of harmful pesticides and fungicides. We also believe our experience in the tightly regulated Canadian market where pharmaceutical-like standards (including Good Manufacturing Practice standards) exist for filtration, air quality and post-harvest plant quality gives us an advantage over our competitors, especially as product quality testing regulations continue to be enacted and made more stringent by state, provincial and local agencies.

The following perspectives explain and help conceptualize the complexity of the environmental controls systems that need to be deployed by indoor cultivators:

| ● | Lighting. Lighting demand is 70 times more energy intensive than commercial office buildings. This lighting intensity creates heat, which when combined with plant transpiration to create humidity, creates the need for dehumidification and corresponding additional energy demand. Further complicating matters, lighting schedules and density must be adjusted for the clone, vegetative and flowering stages of cultivation, and associated variances in watering rates and temperature and humidity targets. | |

| ● | HVACD. HVACD energy use is driven by the need to remove the heat emitted from lighting and the moisture released during the plant’s evapotranspiration process, coupled with air circulation and odor and contaminant filtration requirements. | |

| ● | Legacy Systems. Mechanical systems are often designed and/or installed poorly, which can increase energy consumption and inconsistencies in environmental conditions. Reasons include: (i) cultivators deploying HVACD systems without an understanding of how the HVACD system impacts the growing environment, (ii) cultivators failing to understand the criticality of proper installation, commissioning and servicing of the equipment, even if properly designed, (iii) HVACD systems selected without understanding the interrelationship between sensible (cooling) and latent (moisture) factors, and (iv) most HVACD systems are designed for human occupied spaces, not process loads to accommodate plants. |

| 11 |

New technologies and applications, coupled with emerging cultivation innovations, are providing opportunities for increased efficiency, which we are positioned to deliver to our customers. Our engineering and product development teams, which currently consist of seven people, are fully qualified and committed to delivering energy and resource efficient solutions to commercial cultivators. Leveraging their technical competence, and our customers’ increasing focus on energy efficiency, quality and yield, in the future we intend to offer retrofit/design, energy audit, energy efficiency improvement, performance audit, and preventive maintenance services.

Products: Environmental Control Systems. We offer, in addition to modular chilled water systems, other HVACD solutions, such as custom air handling units, split systems, packaged roof-top units, and self-contained and complex water chilled systems. During 2019, we launched upgraded equipment lines of fan coils and air handlers. In 2020 we introduced our first DX-based packaged systems. This expanded product line will allow us in the future to offer less expensive products that can help us serve customers who have tighter budget constraints.

We are now offering various configurations of our new Surna-branded fan coil units, which provide greater efficiency, design flexibility and control for growers using modular chilled water systems. We are capable of offering a utility rebate consulting service to help our new build customers obtain utility rebates. While this service is not expected to generate significant revenue, it should help us sell our environmental controls systems because our customers will be able to use these rebates to offset some of their capital costs.

There can be no assurance that we will be able to successfully execute any of these product initiatives, or identify, test and develop improved products or services, or that such products or services will generate revenue or profitability at the levels we expect. We also intend to work with select “best-in-class” vendors and partners that may be interested in jointly developing and marketing new and improved products and services.

Technology: Sensors, Controls and Automation Business. One of our key initiatives for 2019 was the development of a branded, proprietary controls and monitoring offering (consisting of sensors, controllers, software, monitoring and a user interface). We accomplished this and launched in April 2019 our SentryIQ® sensors, controls and automation (“SCA”) platform—a turnkey, single-vendor HVACD equipment and controls integration solution to new build projects as well as existing facilities in the startup and operation phases. We continued the rollout of SentryIQ® and to date we have entered into thirteen contracts with twelve different companies to implement our SentryIQ® SCA platform. This product line is important for tactical and strategic reasons, and we hope to offer this as a standalone offering in the future.

Cultivation facilities must have SCA to operate their HVACD equipment. In simple form, SCA is the thermostat in the room, with the occupant selecting the desired temperature set point, the wall thermostat (Sensor) detecting the actual temperature, and when the space temperature deviates from the desired set point the thermostat (Control) commands the furnace or air-conditioner to supply heated or cooled air to bring the room temperature back to the set point. In the case of the indoor cultivation facilities, there are more environmental conditions to monitor and control (such as temperature, relative humidity, CO2, lighting, vapor pressure deficit status, and more) than in a typical residential home.

Indoor CEA growers also need to vary and tightly control environmental conditions depending on the stage of plant growth (i.e., clone, vegetative and flowering stages), the time of day, and the plant genetics. In a cultivation facility the desired conditions change many times during the plant’s growth cycle and even within a day, and this is most easily accomplished with a programmable environmental control system (automation), not unlike a simple programmable thermostat in a home.

Our SentryIQ® SCA package includes precision sensors to measure temperature, humidity, and CO2 levels—more accurately than typical HVACD sensors and within tighter tolerance levels. Our controllers are purpose-built computers programmed by us to ensure our industrial environmental control equipment follows the engineered sequences of operation to obtain desired set-points. Our sensors connect to our branded controllers through wires installed in the facility, and similarly they are wired to our HVACD equipment (e.g., chillers, fan coils and dehumidifiers) to direct these pieces of equipment. The controllers also provide a user interface on a screen so they can be easily programmed and controlled to achieve the customer’s environmental objectives, and give the cultivator the ability to access this data and react to alerts remotely.

We have entered this business to satisfy our customer’s needs that we did not previously address and that historically was provided by third-party controls contractors. Our entry into the SCA market helps both our customers’ and our businesses. Our customers benefit because they are saved the extra work of finding and engaging a controls contractor, which allows them to get their facility up and running more quickly by taking one decision off the table and thereby establishing a single point of responsibility for controls implementation. We are also in a position to provide SCA because we know our proprietary equipment better than anyone, thereby ensuring smooth integration with our equipment with no work scope shortcomings, what we refer to as “scope gap.”

| 12 |

From a tactical perspective, with limited incremental selling costs, our current sales team can now offer our SCA package to nearly every prospect since every cultivation facility should have SCA technology. We believe this technology value-added solution gives us an opportunity to achieve incremental project revenue. Strategically, through our SCA package, we are also able to deepen our long-term customer relationship by tethering us to the customer through a controls interface (dashboard) to their facility. Future development will allow our customer to use artificial intelligence (AI) by aggregating environment and growing data to optimize energy use, operating efficiency, and product quality and yield. While there are several other total controls systems providers, we believe that our industry know-how, experience and reputation with climate control environments gives us a compelling and competitive SCA offering.

Sales and Marketing

Multi-Facility Operator (“MFO”) Focus

Our sales and marketing efforts will continue to focus on MFOs. However, we face multiple sources of competition in our attempt to penetrate the MFO market.

| ● | First, some companies with multiple CEA facilities have internal staffs with the requisite expertise to manage their environmental control needs, and who are able to access and engage vendors for both engineering services and equipment without external help. | |

| ● | Second, some large, multi-state and multi-national engineering and construction firms, which have deep engineering and construction management experience and expertise, have entered or are entering the CEA market. | |

| ● | Third, we compete with other CEA service providers, that like us promote their specific industry expertise and experience. | |

| ● | Fourth, several larger, brand name HVACD equipment manufacturers are now pursuing the CEA market directly through their own sales forces. |

We believe we can compete in the MFO market for the following reasons:

| ● | We believe that MFOs value the expertise we have gained from many years of designing environmental control systems for enclosed cultivation facilities since 2016 and our expansion into other engineered products and services. | |

| ● | Unlike the local and regional engineering firms operating in the market, we have the capability and experience to perform work across the U.S. and Canada, thereby matching the facilities footprint of our MFO prospects. | |

| ● | We believe that the MFOs value the range of experience and expertise that our personnel provide. Our professional staff has expertise covering the gamut, including commercial agriculture, engineering and facility design, HVACD technology, applications and controls, energy efficiency, and sustainability. | |

| ● | We have deep networks with CEA cultivators, HVACD technical experts, AgTech experts, sustainability leaders, and agricultural resources that we can easily access and bring to bear for the benefit of our customers. | |

| ● | And finally, during 2019 and 2020 we did business with five MFOs, covering a total of ten projects with an average contract value of $1.3 million, providing important validation and enhancing our credibility in the eyes of other MFOs we are pursuing. |

Our ability to develop relationships with, and obtain new business from, other MFOs will be critical to generating consistent revenues quarter-over-quarter. During the first half of 2020, we experienced project delays and cancellations due to the Covid pandemic. Fortunately, our bookings rebounded in the second half, and we finished the 2020 year with $8.4 million of backlogged projects. Notwithstanding our efforts, there is no assurance that we will be successful in growing and maintaining our business with these MFOs, especially in light of the uncertainty surrounding the potential impact of the coronavirus on our business and the business of our customers and customer prospects.

New Commercial-Scale Projects

The demand for our environmental control systems is driven primarily by the construction of new CEA facilities in the U.S. and Canada. As the CEA industry expands, the cannabis cultivation segment is, in turn, driven by changed legislation approving either medical or recreational use. Recent regulatory changes involving medical and/or recreational cannabis use in various jurisdictions, such as California, Michigan, Oklahoma, Utah, Missouri, Illinois and Canada, tend to be a leading indicator for the granting of licenses for new facility construction. As more new cultivation facilities become licensed, we in turn have an expanded set of potential customers that might buy our environmental control systems. However, since both medical and recreational cannabis use remains prohibited under U.S. federal law, uncertainty continues and tends to unfavorably impact the development and financing of new cultivation facilities in the U.S.

| 13 |

The following table sets forth our commercial-scale project bookings, which we define as contracts executed with a value over $100,000, for which we received an initial deposit for the years 2016 through 2020. Based on the current economic climate and our downsizing measures, there is no assurance that we will be able to continue to obtain the level of bookings that we had in the past.

| Number of New Commercial-Scale Project Bookings | ||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

| Total | 12 | 23 | 22 | 18 | 18 | |||||||||||||||

Our marketing efforts will be targeted at MFOs, smaller independent growers, design-build firms, architects working in the CEA industry, investors and consulting firms operating in that space. We believe these represent the largest markets, based on the state and local regulatory framework, for our products and services. We believe our marketing efforts will be curtailed for the foreseeable future due to our efforts to preserve our cash resources as we deal with the uncertainty surrounding the coronavirus.

Retrofit Market

Existing commercial retrofit projects also represent a business opportunity in the CEA industry. The estimated 3,000+ existing cannabis producing CEA facilities in North America are easier to identify than new build projects. We believe, based on evidence and our market knowledge, that some of these exiting facilities are operating sub-optimally and have environmental control problems that our products can help remediate. We also believe that the energy consumption of these facilities can be reduced, and we have commenced developing services and products to help them realize savings. We have a full product and service offering in mind, but we expect that the roll-out will take up to two years. To expedite this roll-out, we are evaluating possible strategic partners that could add products and services that are an immediate value-add to our customers. These CEA facilities retrofit projects do not typically carry the uncertainties associated with new build projects such as licensing, permitting and funding. In the future, we also will potentially launch an internally developed facility assessment and analysis tool to assist existing facilities in solving their environmental controls challenges.

New Build Facility Sales Cycle and Risks

The sales cycles for our new build commercial projects can vary significantly. From pre-sales and technical advisory meetings to sales contract execution, to engineering and design services and equipment delivery, and all the way through installation and commissioning of the installed system, the full cycle can range from six months to two years. Since we do not install the climate control systems, our customers are required to use third-party installation contractors, which adds to the variability of the sales cycle.

The length of our sales cycle for new facilities is driven by numerous factors including:

| ● | the large number of first-time participants interested in the CEA business; | |

| ● | the complexities and uncertainties involved in obtaining state and local licensure and permitting for certain types of CEA cultivation facilities, including relating to energy use, water use, and the environmental impacts of waste; | |

| ● | local and state government delays in approving licenses and permits due to lack of staff or the large number of pending applications, especially in states where there is no cap on the number of cultivators; | |

| ● | the customer’s need to obtain CEA cultivation facility financing and legal issues related to the crops sought to be grown; | |

| ● | the time needed, and coordination required, for our customers to acquire real estate and properly design and build the facility (to the stage where climate control systems can be installed); | |

| ● | the large price tag and technical complexities of the climate control and air sanitation system; | |

| ● | availability of power and the cost; and | |

| ● | delays that are typical in completing any commercial construction project. |

As a result of the foregoing, there are risks that we may not realize the full contract value of our backlog in a timely manner, or at all. The performance of our obligations under a sales contract, and the timing of our revenue recognition, is dependent upon our customers’ ability to secure funding and real estate, obtain a license and then build their cultivation facility so they can take possession of the equipment—each of which are outside of our control. More recently, as some of our new construction facility projects have become larger and more complex, the likelihood of delays—due to licensing and permitting, lack of or delay in funding, staged facility construction, and/or the shifting priorities of certain customers with multiple facility projects in progress at one time—has increased.

| 14 |

In order to address these risks, the obligations under our sales contracts are generally allocated into the following types of deliverables, and we typically require non-refundable payments from our customers in advance of our performance of services or delivery of equipment. However, in certain situations, especially as we expand our products and services offering for a customer’s entire facility lifecycle, we may extend credit to our customers in which case we are at risk for the collection of account receivables.

Engineering Services. We provide our customers with engineering and design services and drawings. In many cases, the engineering phase is done as part of the license application or building permit process and takes approximately six to eight weeks to complete. Our strategy is to secure the sales contract and commence the engineering and design portion of the project early in the customer’s planning phase of the project. This is important for a number of reasons: (i) we can assist our customers with their engineering and design plans as part of their licensing application process as well as better assure the customer has the right-sized equipment for their application, leading to a higher probability of a successful grow, (ii) we are better positioned to utilize our proprietary equipment for the project at an earlier stage, and (iii) we are able to help reduce a customer’s time to market. Before we commence the engineering phase of the project, we will generally require an advanced payment intended to cover the engineering value of the contract.

Surna Manufactured Equipment. Upon completion of the engineering and design phase, it may take our customer on average six to twelve months to complete the facility build-out, with possible delays due to financing or other aspects which are beyond our control as discussed above. Customer delays in obtaining financing and completing facility build-out make the completion timing of our sales contract unpredictable. For this reason, we require an additional advance payment before we begin manufacturing our proprietary equipment items.

Third-Party Manufactured Equipment. The final phase of our contract typically involves the delivery of third-party manufactured equipment items and other equipment to complete the project. We typically will not deliver until we receive a final advance payment for the remaining contract value. After the project is completed and the environmental control system has been fully installed by third-party installation contractors, we will deploy our technicians to the customer’s cultivation facility to support the start-up of the system. Start-up support involves testing that the equipment has been properly assembled and installed by the installation contractor and assuring the equipment is operating within the agreed specifications.

Given the timing of the deliverables of our sales contracts, we have often experienced large variances in quarterly revenue. Our revenue recognition is dependent upon shipment of the equipment portions of our sales contracts, which, in many cases, may be delayed while our customers complete permitting, prepare their facilities for equipment installation or obtain project financing.

Competition

Our environmental control systems and our related engineering and design services compete with various national and local HVACD contractors and traditional HVACD equipment suppliers who traditionally resell, design, and implement climate control systems for commercial and industrial facilities, most of whom do not have the specific knowledge that we have about the complexities and challenges of CEA facilities. We have positioned ourselves to differ from these competitors by providing engineering and design services and environmental control systems, across most major HVACD solutions, including modular chilled water systems, custom air handling units, split systems, packaged roof-top units, and self-contained and complex chilled-water systems, each tailored specifically for managing the distinct challenges involved in CEA facilities. We believe our industry-specific applications and experience in the CEA market allow us to deliver the right solution to our cultivation customers. Unlike many of our competitors, our solutions are designed specifically for cultivators to provide tight temperature/humidity control, reduce bio-security risk, reduce energy requirements, and minimize maintenance complexity, costs and downtime. However, we are seeing more competitors enter into the CEA market offering the same types and crop-specific climate control systems and engineering services that we offer. We believe this increased competition may adversely impact our ability to obtain new facility projects from both MFOs and independent smaller growers and could require us to accept lower gross margins on our projects.

As the cannabis segment of the CEA industry continues to mature and develop and legalization becomes more prevalent, we expect to see more competition from agricultural product and service providers who seek to expand into this niche of the CEA market. Going forward, we intend to expand our focus to include non-cannabis crops grown in controlled environments such as leafy greens (kale, Swiss chard, mustard, cress), microgreens (leafy greens harvested at the first true leaf stage), ethnic vegetables and small fruits (such as strawberries, blackberries and raspberries), bell peppers, cucumbers, and tomatoes. Companies already operating in the non-cannabis CEA industry may have longer operating histories, greater name recognition, larger client bases and significantly greater financial, technical, sales and marketing resources. These competitors may adopt more aggressive pricing policies and make more attractive offers to existing and potential clients, employees, strategic partners, distribution channels and advertisers. Increased competition is likely to result in price reductions, reduced gross margins and a potential loss of market share.

| 15 |

Intellectual Property

We rely on a combination of patent and trademark rights, licenses, trade secrets, and laws that protect intellectual property, confidentiality procedures, and contractual restrictions with our employees and others to establish and protect our intellectual property rights. We have several issued patents and pending patent applications; however, we do not believe that these issued and pending patents currently provide us with any competitive advantage. We have registered trademark registrations around our core Surna brand (“Surna”) in the United States and select foreign jurisdictions, as well as the Surna logo and the combined Surna logo and name in the United States. Our trademark is also registered in the European Union and Canada. Subject to ongoing use and renewal, trademark protection is potentially perpetual. We actively protect our inventions, new technologies, and product developments by maintaining trade secrets and, in limited circumstances, filing for patent protection.

Employees

We currently have 26 active full-time employees and two part-time employees. However, we may engage, and have in the past utilized, the services of consultants, independent contractors, and other non-employee professionals. Additional employees may be hired in the future depending on need, available resources, and our achieved growth.

Government Regulation

U.S. Regulations

While we do not generate any revenue from the direct sale of cannabis products, we have historically, and continue to, offer our services and engineering solutions to indoor cultivators that are engaged in various aspects of the cannabis industry. Marijuana is a Schedule I controlled substance and is illegal under federal law. Even in those states in which specific uses of marijuana has been legalized, such as medical marijuana or for adult recreational purpose, its use remains a violation of federal laws.

A Schedule I controlled substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety for use under medical supervision and a high potential for abuse. The Department of Justice defines Schedule I controlled substances as “the most dangerous drugs of all the drug schedules with potentially severe psychological or physical dependence.” If the federal government decides to enforce the Controlled Substances Act with respect to cannabis, persons that are charged with distributing, possessing with intent to distribute, or growing cannabis could be subject to fines and terms of imprisonment, the maximum being life imprisonment and a $50 million fine. Any such change in the federal government’s enforcement of current federal laws could cause significant financial damage to us. While we do not intend to harvest, manufacture, distribute or sell cannabis or cannabis products, we may be irreparably harmed by a change in enforcement by the federal or state governments.

Previously, the Obama administration took the position that it was not an efficient use of resources to direct federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical marijuana. The Trump administration revised this policy but made no major changes in enforcement through Attorney General Sessions rescinding the Cole Memorandum. The Department of Justice will continue to enforce the Controlled Substances Act with respect to cannabis under established principles in setting their law enforcement priorities to prevent:

| ● | the distribution of cannabis products, such as marijuana, to minors; | |

| ● | criminal enterprises, gangs and cartels receiving revenue from the sale of cannabis; | |

| ● | the diversion of cannabis products from states where it is legal under state law to other states; | |

| ● | state-authorized cannabis activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity; | |

| ● | violence and the use of firearms in the cultivation and distribution of cannabis products; | |

| ● | driving while impaired and the exacerbation of other adverse public health consequences associated with cannabis product usage; | |

| ● | the growing of cannabis on public lands; and | |

| ● | cannabis possession or use on federal property. |

Since the use of marijuana is illegal under federal law, most federally chartered banks will not accept deposit funds from businesses involved with marijuana. Consequently, businesses involved in the marijuana industry generally bank with state-chartered banks and credit unions to provide banking to the industry.

In 2014, Congress passed a spending bill containing a provision (the Rohrabacher-Farr amendment, now referred to as the Rohrabacher-Blumenauer Amendment) blocking federal funds and resources allocated under the 2015 appropriations bill from being used to “prevent such States from implementing their own State medical marijuana laws.” The Rohrabacher-Blumenauer Amendment, however, did not codify any federal protections for medical marijuana patients and producers operating within state law. The Justice Department maintains that it can still prosecute violations of the federal cannabis laws and continue cases already in the courts. The Rohrabacher-Blumenauer Amendment must be re-enacted every year, and it was continued for 2016, 2017, 2018, 2019 and 2020, and currently remains in effect. The continued re-authorization of the Rohrabacher-Blumenauer Amendment cannot be assured. If the Rohrabacher-Blumenauer Amendment is no longer in effect, the risk of federal enforcement and override of state marijuana use and cannabis related laws would increase. However, state laws do not supersede the prohibitions set forth in the federal drug laws.

| 16 |

In order to participate in either the medical or the adult use aspects of the cannabis industry, all businesses and employees must obtain licenses from the state and, for businesses, local jurisdictions as well. As an example, Colorado issues four types of business licenses including cultivation, manufacturing, dispensing, and testing. In addition, all owners and employees must obtain an occupational license to be permitted to own or work in a facility. All applicants for licenses undergo a background investigation, including a criminal record check for all owners and employees.

Colorado has also enacted stringent regulations governing the facilities and operations of cannabis businesses that are involved with the plant and its products. All facilities are required to be licensed by the state and local authorities and are subject to comprehensive security and surveillance requirements. In addition, each facility is subject to extensive regulations that govern its businesses practices, which includes mandatory seed-to-sale tracking and reporting, health and sanitary standards, packaging and labeling requirements, and product testing for potency and contaminants.

Laws and regulations affecting the medical marijuana industry are constantly changing, which could detrimentally affect our proposed operations. Local, state and federal medical marijuana laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter our business plan. In addition, violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our operations. It is also possible that regulations may be enacted in the future that will be directly applicable to our business. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

Canadian Regulations

Summary of the Cannabis Act

On October 17, 2018, the Cannabis Act came into force as law with the effect of legalizing adult recreational use of cannabis across Canada. The Cannabis Act replaced the Access to Cannabis for Medicinal Purposes Regulations (“ACMPR”) and the Industrial Hemp Regulations, both of which came into force under the Controlled Drugs and Substances Act (Canada) (the “CDSA”), which previously permitted access to cannabis for medical purposes for only those Canadians who had been authorized to use cannabis by their health care practitioner. The ACMPR replaced the Marihuana for Medical Purposes Regulations (Canada) (the “MMPR”), which was implemented in June 2013. The MMPR replaced the Marihuana Medical Access Regulations (Canada) (the “MMAR”) which was implemented in 2001. The MMPR and MMAR were initial steps in the Government of Canada’s legislative path towards the eventual legalization and regulating recreational and medical cannabis.

The Cannabis Act permits the recreational adult use of cannabis and regulates the production, distribution and sale of cannabis and related oil extracts in Canada, for both recreational and medical purposes. Under the Cannabis Act, Canadians who are authorized by their health care practitioner to use medical cannabis have the option of purchasing cannabis from one of the producers licensed by Health Canada and are also able to register with Health Canada to produce a limited amount of cannabis for their own medical purposes or to designate an individual who is registered with Health Canada to produce cannabis on their behalf for personal medical purposes.

Pursuant to the Cannabis Act, subject to provincial regulations, individuals over the age of 18 are able to purchase fresh cannabis, dried cannabis, cannabis oil, and cannabis plants or seeds and are able to legally possess up to 30 grams of dried cannabis, or the equivalent amount in fresh cannabis or cannabis oil. The Cannabis Act also permits households to grow a maximum of four cannabis plants. This limit applies regardless of the number of adults that reside in the household. In addition, the Cannabis Act provides provincial and municipal governments the authority to prescribe regulations regarding retail and distribution, as well as the ability to alter some of the existing baseline requirements of the Cannabis Act, such as increasing the minimum age for purchase and consumption.

Provincial and territorial governments in Canada have made varying announcements on the proposed regulatory regimes for the distribution and sale of cannabis for adult-use purposes. For example, Québec, New Brunswick, Nova Scotia, Prince Edward Island, Yukon and the Northwest Territories have chosen the government-regulated model for distribution, whereas Saskatchewan and Newfoundland & Labrador have opted for a private sector approach. Alberta, Ontario, Manitoba, Nunavut and British Columbia have announced plans to pursue a hybrid approach of public and private sale and distribution.

In connection with the new framework for regulating cannabis in Canada, the federal government has introduced new penalties under the Criminal Code (Canada), including penalties for the illegal sale of cannabis, possession of cannabis over the prescribed limit, production of cannabis beyond personal cultivation limits, taking cannabis across the Canadian border, giving or selling cannabis to a youth and involving a youth to commit a cannabis-related offence.

| 17 |

On July 11, 2018, the Canadian federal government published regulations in the Canada Gazette to support the Cannabis Act, including the Cannabis Regulations, the new Industrial Hemp Regulations, along with proposed amendments to the Narcotic Control Regulations and certain regulations under the Food and Drugs Act (Canada). The Industrial Hemp Regulations and the Cannabis Regulations, among other things, outline the rules for the legal cultivation, processing, research, analytical testing, distribution, sale, importation and exportation of cannabis and hemp in Canada, including the various classes of licenses that can be granted, and set standards for cannabis and hemp products. The Industrial Hemp Regulations and the Cannabis Regulations include strict specifications for the plain packaging and labelling and analytical testing of all cannabis products as well as stringent physical and personnel security requirements for all federally licensed production sites. The Industrial Hemp Regulations and the Cannabis Regulations also maintain a distinct system for access to cannabis. With the Cannabis Act now in force, cannabis has ceased to be regulated under the CDSA and is instead regulated under the Cannabis Act, and both the ACMPR and the Industrial Hemp Regulations have been repealed effective October 17, 2018.

Additional regulations were added in October 2019 governing the legal production and sale of three classes of cannabis, edibles, extracts and topicals. A processing license will be required in order to manufacture, package and label cannabis edibles, extracts and topicals to consumers. The licensing also has quality control and testing requirements for production to prevent contamination and address the risk of foodborne illness associated with cannabis. Cannabis products will have THC and cannabidiol limits per unit.

Security Clearances

The Cannabis Regulations require that certain people associated with cannabis licensees, including individuals occupying a “key position” directors, officers, large shareholders and individuals identified by the Minister of Health, must hold a valid security clearance issued by the Minister of Health. Officers and directors of a parent corporation must be security cleared.