As filed with the Securities and Exchange Commission September __, 2016

Registration No.______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BMC CAPITAL, INC. |

Nevada |

| 5094 |

| 90-0712962 |

(State or Other Jurisdiction of Organization) |

| (Primary Standard Industrial Classification Code) |

| (IRS Employer Identification Number) |

3267 Bee Caves Road

Suite 107-122

Austin, Texas 78746

(512) 553-6785

(Address, including zip code, and telephone number, including area code, of

Registrant’s principal executive offices)

Christian Briggs

3267 Bee Caves Road

Suite 107-122

Austin, Texas 78746

(310)279-9400

c@bmchas.com

(Name, address, including zip code, and telephone number, including area

code, of agent for service)

Copies of all communications to:

Thomas E. Stepp, Jr.

Stepp Law Corporation

15707 Rockfield Boulevard, Suite 101

Irvine, California 92618

Telephone: 949.660.9700

Fax: 949.660.9010

Email: tes@stepplawgroup.com

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. T

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer”, a “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

Non-accelerated Filer | ¨ | Smaller Reporting Company | x |

CALCULATION OF REGISTRATION FEE

Title of Each Class Of Securities To Be Registered |

| Number of Shares To Be Registered |

|

| Proposed Maximum Offering Price Per Share |

| Proposed Maximum Aggregate Offering Price |

| Registration Fee (1) | ||

Common Stock, $.001 par value(1) |

|

| 1,348,354 |

|

| $.30 |

| $404,506.20 |

| $40.73 | |

(1) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and, in accordance with Rule 457, the offering price was determined by the price shares were sold to our shareholders in private placement transactions. The selling shareholders may sell shares of our common stock at a fixed price of $.30 per share until the prices of our common stock are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $.30 has been determined as the selling price based upon what we believe will be the market value of our common stock after the registration statement of which this prospectus is a part is declared effective by the SEC. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTC Bulletin Board, nor can there be any assurance that an application for quotation will be approved.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON DATES AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING UNDER SAID SECTION 8(a), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING SHAREHOLDERS MAY NOT SELL THEIR SECURITIES UNTIL THE REGISTRATION STATEMENT OF WHICH THIS PROSPECTUS IS A PART AND FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE OF THESE SECURITIES IS NOT PERMITTED.

| 2 |

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION,

DATED September ____, 2016

BMC CAPITAL, INC.

Up to 1,348,354 Shares of Common Stock

Offering Price: $.30 per share

This is a resale prospectus for the resale of up to 1,348,354 shares of our common stock by the selling stockholders specified herein. We will not receive any proceeds from the sale of those shares.

Our common stock is not traded on any public market and, although we intend to apply to have the prices of our common stock quoted on the Over-The-Counter Bulletin Board (“OTCBB”) maintained by the Financial Industry Regulatory Authority (“FINRA”) concurrently with the filing of the registration statement of which this prospectus is a part, there can be no assurance that a market maker will agree to file the necessary documents with FINRA to enable us to participate on the OTCBB, nor can there be any assurance that any application filed by any such market maker for quotation on the OTCBB will be approved.

Selling stockholders will sell at a fixed price of $.30 per share until the prices of our common stock are quoted on the OTCBB and thereafter at prevailing market prices or privately negotiated prices.

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April, 2012 and will be subject to reduced public company reporting requirements. See “Jumpstart Our Business Startups Act” specified herein.

Investing in our common stock involves very significant risks. See “RISK FACTORS” beginning on Page 11 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commissioner has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is September __, 2016.

You should rely only on the information specified in this prospectus. We have not authorized anyone to provide you with information different from that specified in this prospectus. The selling shareholders are offering to sell, and seeking offers to buy, their common shares only in jurisdictions where offers and sales are permitted. The information specified in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common shares.

| 3 |

|

| 5 |

| |

|

| 5 |

| |

|

| 5 |

| |

|

| 7 |

| |

|

| 11 |

| |

|

| 25 |

| |

|

| 25 |

| |

|

| 26 |

| |

|

| 26 |

| |

|

| 26 |

| |

|

| 28 |

| |

|

| 31 |

| |

|

| 31 |

| |

|

| 33 |

| |

|

| 33 |

| |

|

| 42 |

| |

|

| 42 |

| |

|

| 42 |

| |

|

| 42 |

| |

|

| 43 |

| |

|

| 43 |

| |

|

| 44 |

| |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL POSITION AND |

|

| 44 |

|

|

| 44 |

| |

|

| 51 |

| |

|

| 54 |

| |

SUMMARY OWNERSHIP OF MANAGEMENT & CERTAIN BENEFICIAL SECURITY HOLDERS |

|

| 57 |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

| 60 |

|

|

| 60 |

| |

|

| 61 |

| |

|

| 61 |

| |

AUDITED FINANCIAL STATEMENTS FOR YEARS ENDED DECEMBER 31, 2015, AND DECEMBER 31, 2014 |

|

| 63 |

|

UNAUDITED FINANCIAL STATEMENTS FOR THE 6 MONTHS ENDED JUNE 30, 2016 AND JUNE 30, 2015 |

|

| 72 |

|

|

| 80 |

| |

|

| 80 |

| |

|

| 81 |

|

| 4 |

| Table of Contents |

Except where the context otherwise requires and for purposes of this prospectus only:

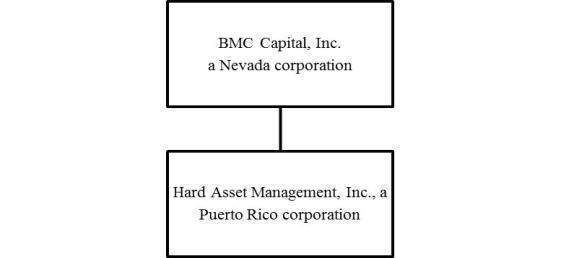

| · | the terms “we,” “us,” “our,” “the Company,” “our Company” refer to BMC Capital Inc., a Nevada corporation | |

| · | the terms “our Subsidiary,” “the Subsidiary,” “HAM” refer to Hard Asset Management, Inc., a Puerto Rico corporation. |

THIS PROSPECTUS INCLUDES FORWARD-LOOKING STATEMENTS. TO THE EXTENT THAT ANY STATEMENTS MADE IN THIS PROSPECTUS CONTAIN INFORMATION THAT IS NOT HISTORICAL, SUCH AS FINANCIAL PROJECTIONS, INFORMATION OR EXPECTATIONS ABOUT OUR BUSINESS PLANS, RESULTS OF OPERATIONS, PRODUCTS OR MARKETS, OR FUTURE EVENTS, SUCH STATEMENTS ARE FORWARD-LOOKING. FORWARD-LOOKING STATEMENTS CAN BE IDENTIFIED BY THE USE OF WORDS SUCH AS “INTENDS”, “ANTICIPATES”, “BELIEVES”, “ESTIMATES”, “PROJECTS”, “FORECASTS”, “EXPECTS”, “PLANS” AND “PROPOSES”. ALTHOUGH WE BELIEVE THAT THE EXPECTATIONS SPECIFIED IN THOSE FORWARD-LOOKING STATEMENTS ARE BASED ON REASONABLE ASSUMPTIONS, THERE ARE A NUMBER OF RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE FORWARD-LOOKING STATEMENTS. THESE INCLUDE, AMONG OTHERS, THE CAUTIONARY STATEMENTS IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 11 OF THIS PROSPECTUS AND THE “MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL POSITION AND RESULTS OF OPERATIONS” SECTION ELSEWHERE IN THIS PROSPECTUS. WE DO NOT UNDERTAKE ANY OBLIGATION TO UPDATE PUBLICLY ANY FORWARD-LOOKING STATEMENTS.

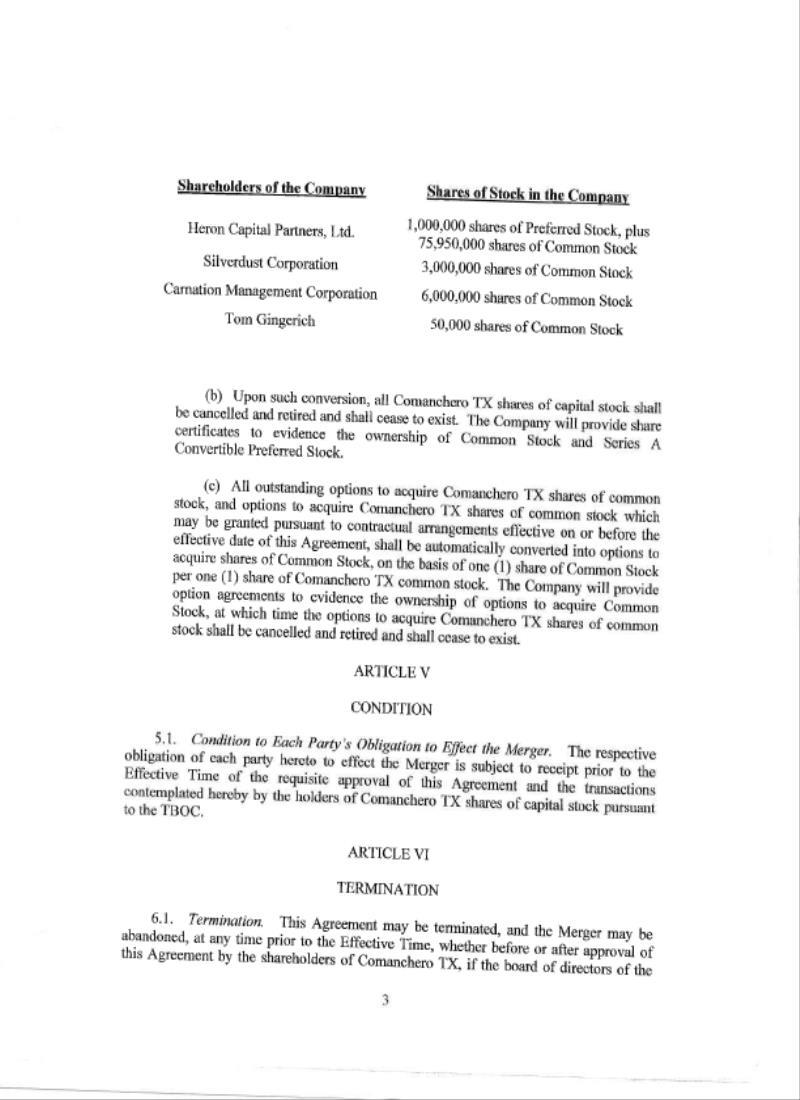

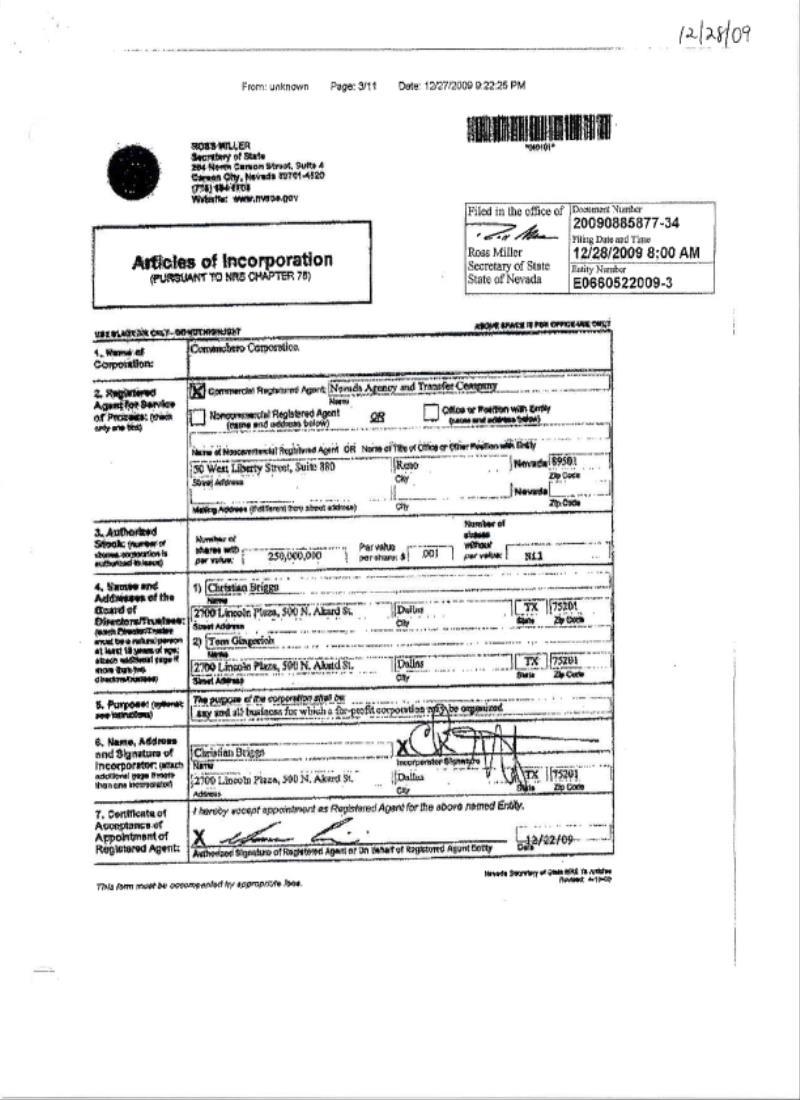

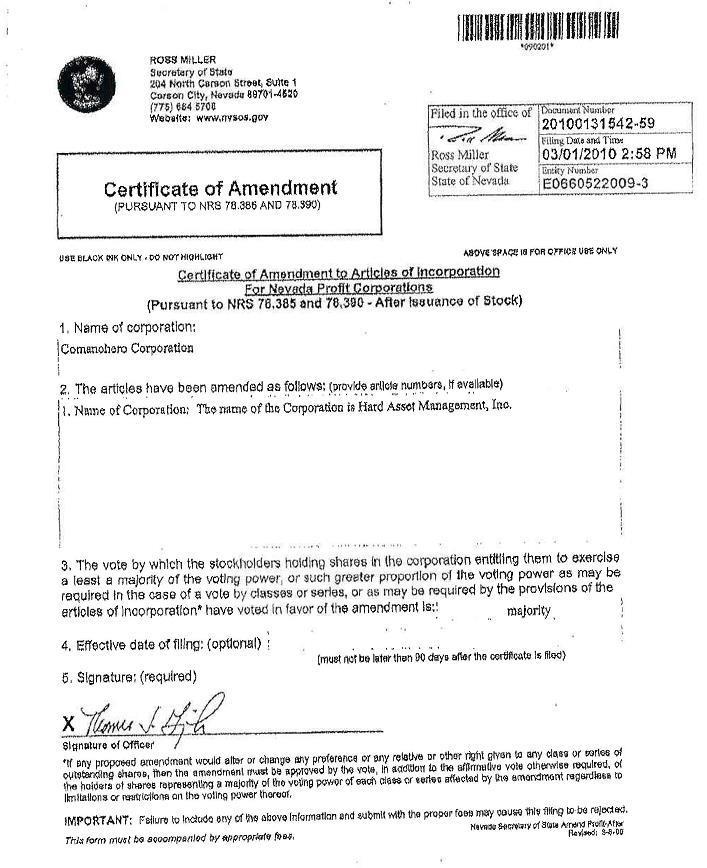

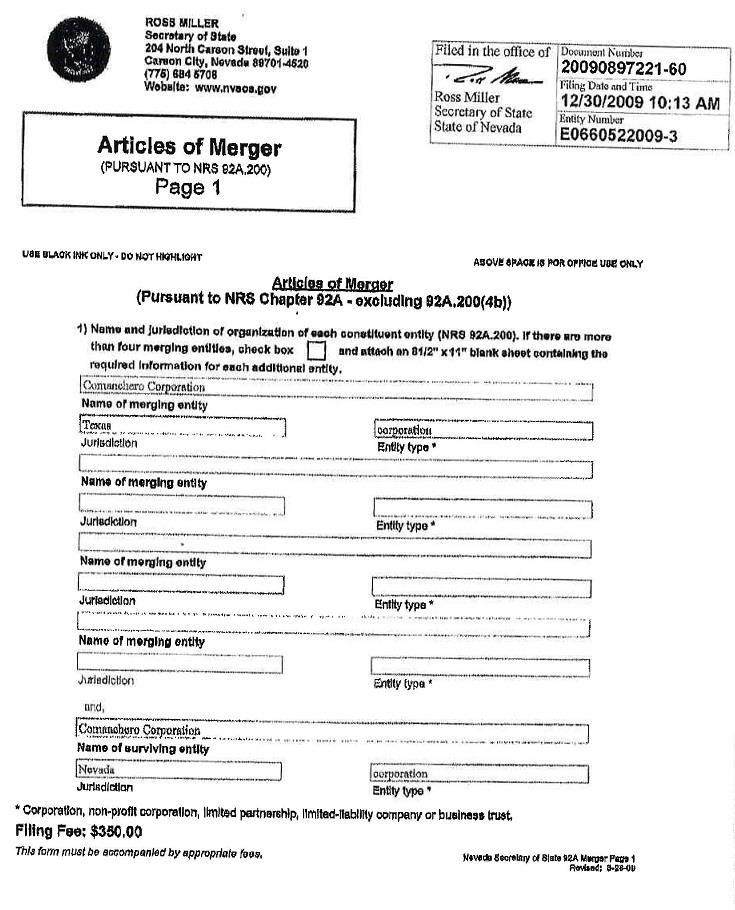

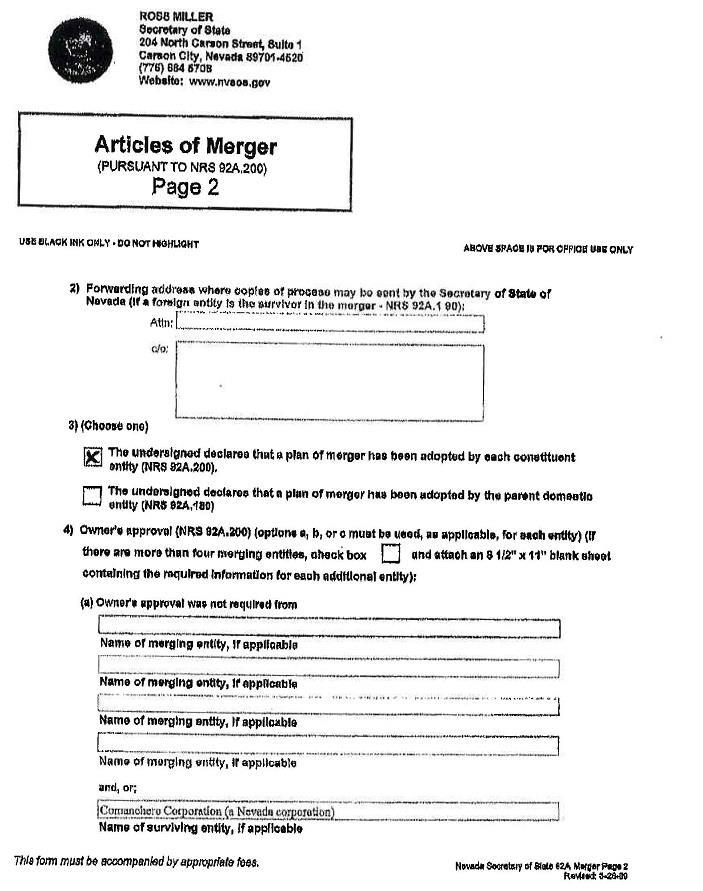

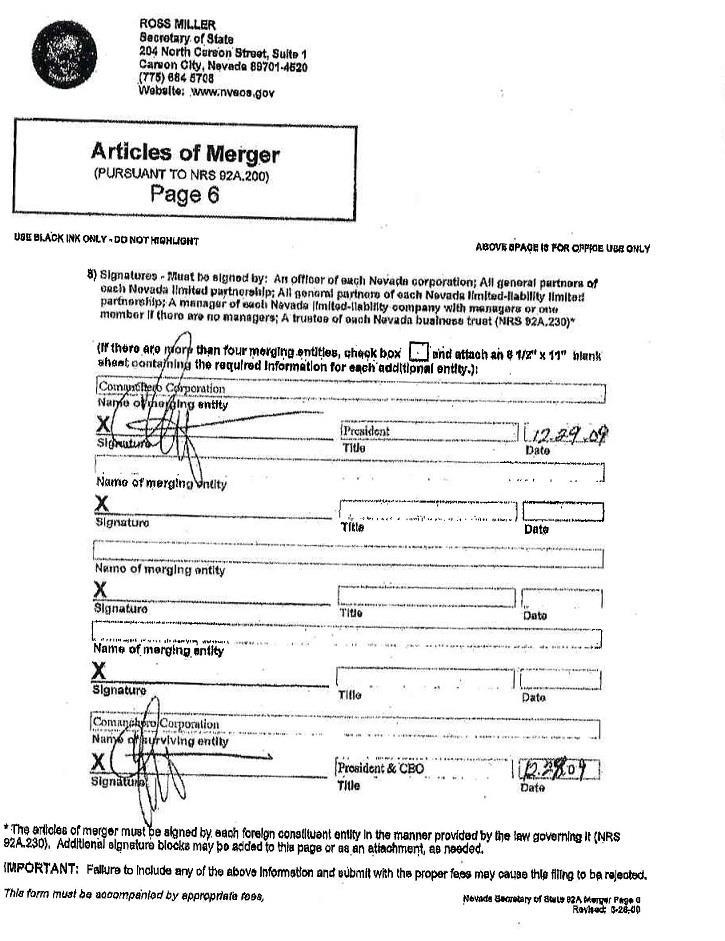

BMC Capital, Inc. (“we”, “our”, “us” or the “Company”) was formed as a Nevada corporation on December 28, 2009, with the name Comanchero Corporation to engage in the business of marketing and selling coins, metals, automobiles, and other assets. A copy of our Articles of Incorporation is attached as Exhibit 3.1 to the registration statement to which this prospectus is a part. On December 30, 2009, we merged with a Texas corporation entitled Comanchero Corporation. Pursuant to that merger, the Texas corporation was merged with and into Comanchero Corporation, a Nevada corporation, and, accordingly, we are the surviving corporation. A copy of the Agreement and Plan of Merger which specifies the terms and conditions of that merger is attached as Exhibit 2.1 to the registration statement of which this prospectus is a part. A copy of the Articles of Merger filed with the Nevada Secretary of State and the Certificate of Merger filed with the Texas Secretary of State is attached as Exhibit 3.6 to the registration statement of which this prospectus is a part.

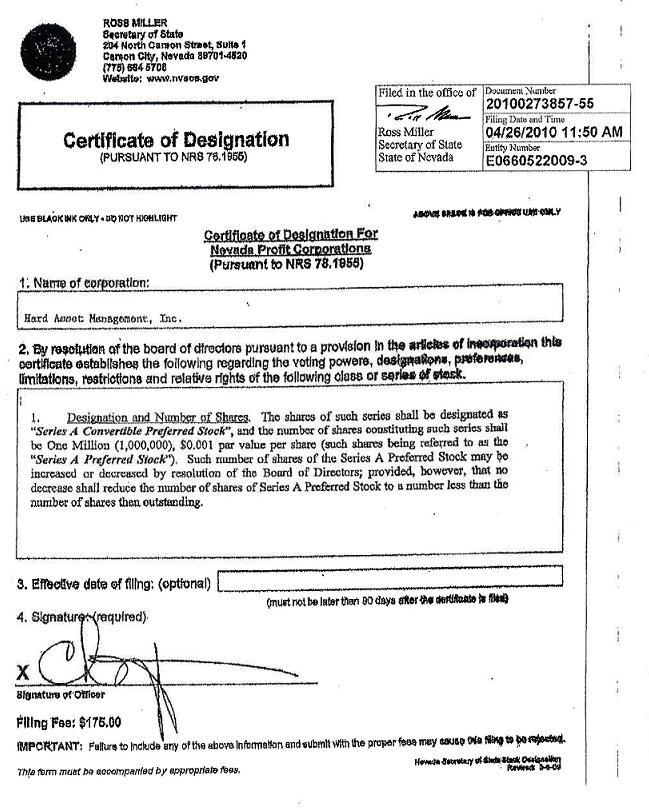

On March 1, 2010, we changed our name to Hard Asset Management, Inc. We changed our name to Hard Asset Management, Inc. to better associate us with the rare coin and metals industries. A copy of the Certificate of Amendment which changed our name to Hard Asset Management, Inc. is attached as Exhibit 3.2 to the registration statement of which this prospectus is a part.

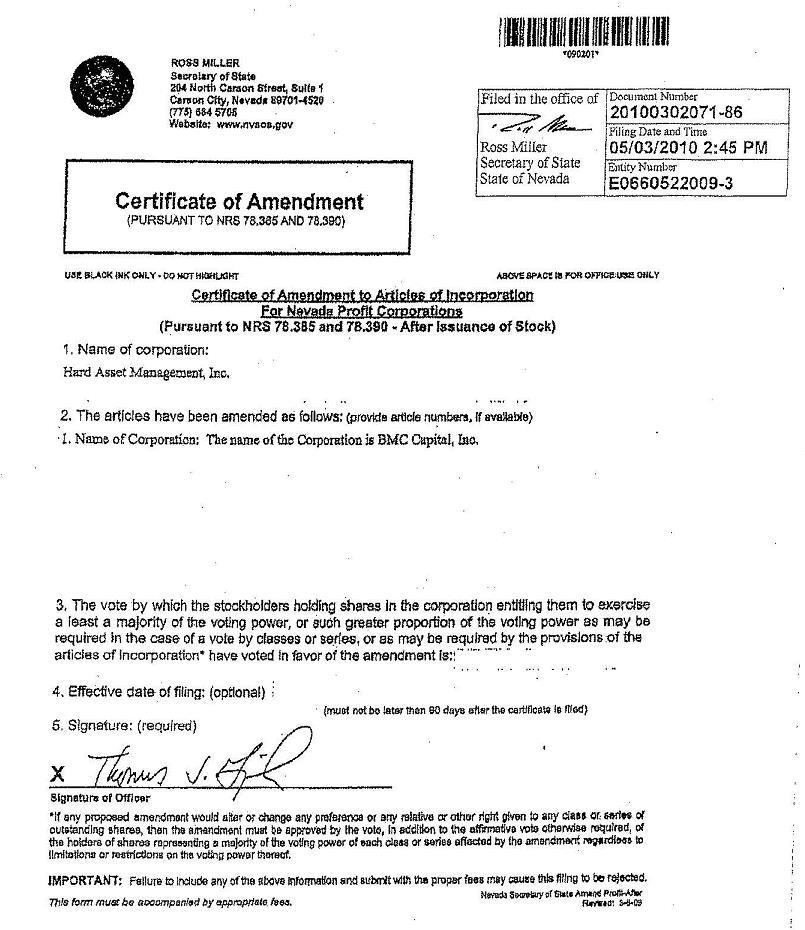

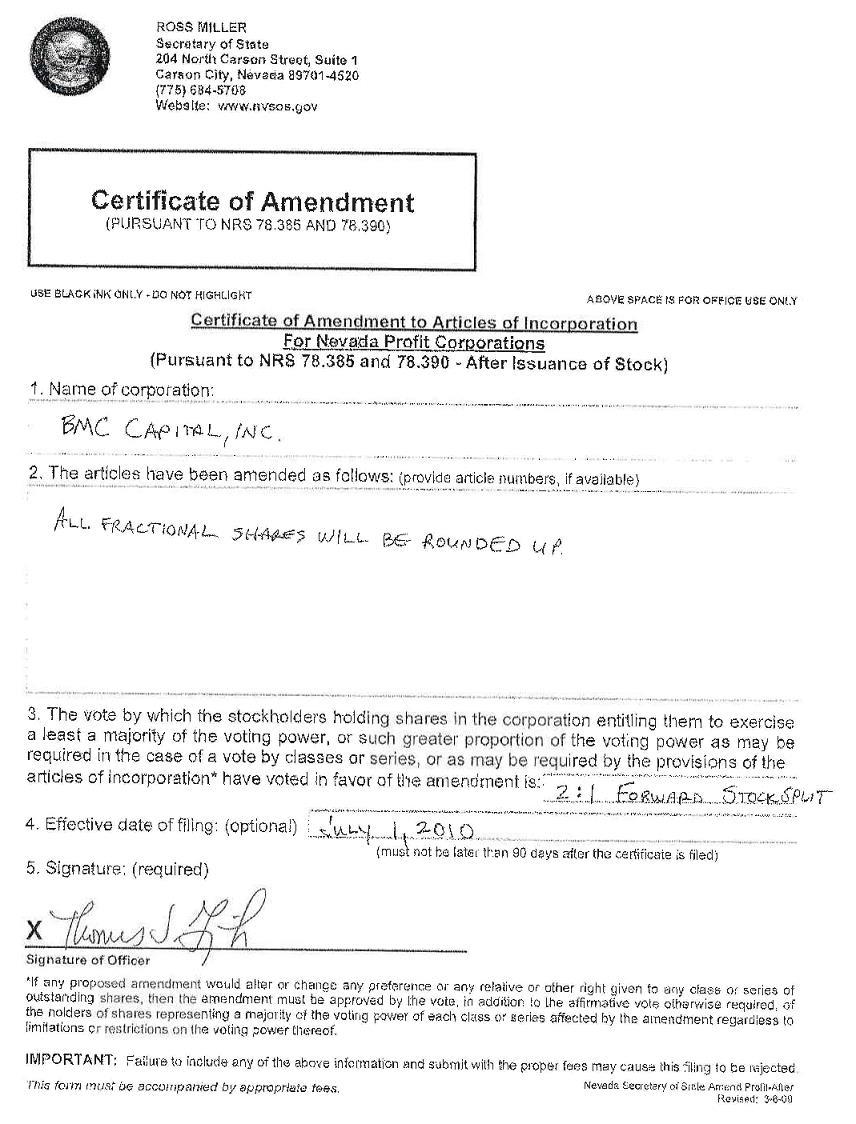

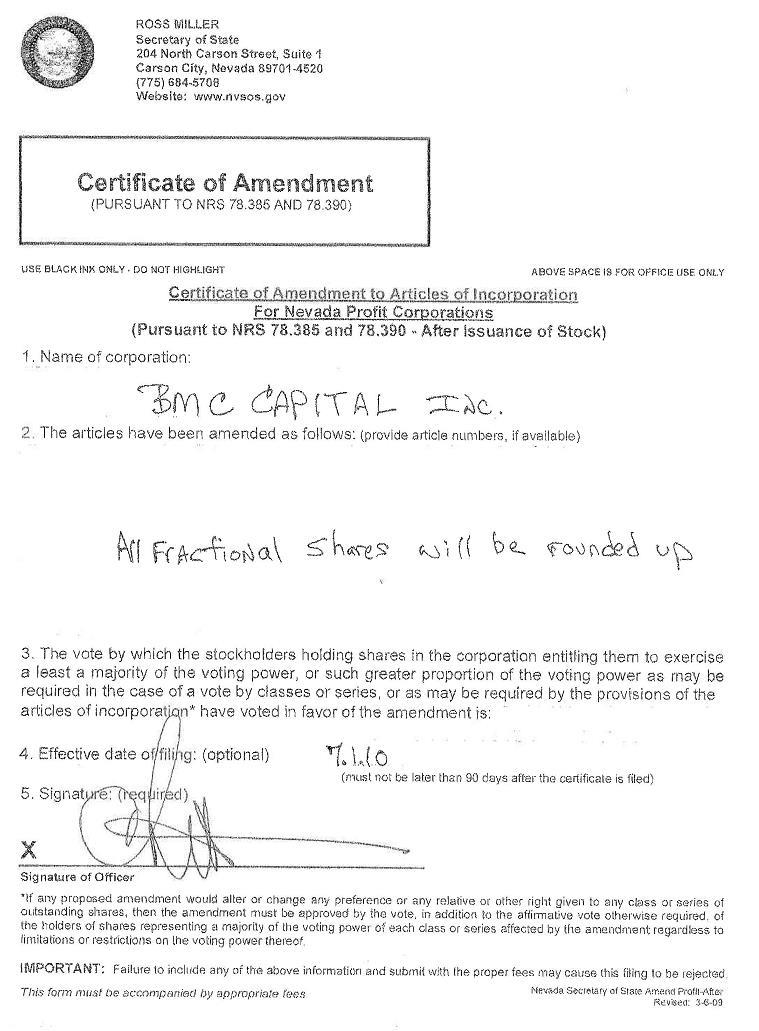

On May 3, 2010, we changed our name to BMC Capital, Inc. We changed our name to BMC Capital, Inc., as an acronym for “Bring Me Coins”. A copy of the Certificate of Amendment which changed our name to BMC Capital, Inc. is attached as Exhibit 3.3 to the registration statement of which this prospectus is a part. Subsequently, we were notified by BMC Capital, LP, a Texas company, that it had a perfected interest in the name BMC Capital and, accordingly, we could not operate in Texas using “BMC Capital” as part of our name. Accordingly, on September 20, 2012, we registered the trade name BMC Hard Assets, Inc., and we operate using that name in our business of purchasing and selling rare coins, precious metals and antiquities.

| 5 |

| Table of Contents |

We are a developmental stage company with a principal business of purchasing hard assets, as well as providing a platform for collectors to sell their hard assets, which assets include rare coins, precious metals and other antiquities (the “Hard Assets”). Our business is primarily conducted through our wholly-owned subsidiary, Hard Asset Management, Inc., a corporation formed under the laws of the Commonwealth of Puerto Rico (“HAM”). Accordingly, HAM will be subject to the tax laws of the Commonwealth of Puerto Rico, including Puerto Rico’s Act 20, which provides tax incentives for companies that establish and expand their export services businesses in Puerto Rico.

Corporate Structure

HAM was formed on July 14, 2016, pursuant to the laws of Puerto Rico. On August 25, 2016, the Company entered into a Stock Purchase Agreement with HAM, whereby the Company purchased and acquired 100% of the issued and outstanding shares of common stock of HAM. As a result, HAM became a wholly-owned subsidiary of the Company. A copy of that Stock Purchase Agreement is attached as Exhibit 2.2 to that registration statement of which this prospectus is a part. HAM, whose operations are based in Puerto Rico, will purchase, store, sell and ship the Hard Assets.

We desire to become one of the leading companies in managing and selling rare coins, precious metals and other antiquities within the hard asset industry. Accordingly, we will offer an alternative to auction houses and wholesalers, thereby allowing collectors to purchase and sell such hard assets through our online marketplace created through our website bmchardassets.com, which was completed in August 2016. The base content of our website will remain the same, but the inventory section will be constantly updated with new items. Through our website, we intend to sell to, and act as a selling agent for, collectors who desire to sell antiquities, rare coins and precious metals. We have three Acquisition and Management programs, which will allow collectors to choose their purchase amounts, the Silver Account ($50,000-$250,000); the Gold Account ($250,000 - $1,000,000) and the Platinum Account (more than $1,000,000).

Our operations to date have been devoted primarily to start-up business development activities. While our President, Chief Executive Officer and Chief Creative Officer have performed start-up activities such as acquiring our Subsidiary and creating our website, our Subsidiary has commenced operations, which include the following:

| · | Research antiquities, rare coins and precious metals for purchase and resale | |

| · | Research trends in the antiquities, rare coins and the precious metals industries | |

| · | Research and develop our online market place through our website bmchardassets.com | |

| · | Identify office space and storage facilities to lease in Puerto Rico |

We anticipate that we will receive revenue from the sale of Hard Assets. Additionally, we intend to charge a commission for transfers that occur through our website, which we anticipate will be a percentage of gross sales proceeds.

| 6 |

| Table of Contents |

Our principal executive office is located at 700 Lavaca Street, Suite 1419, Austin, Texas 78701, however all notices and correspondence is sent to 3267 Bee Caves Road, Suite 107-122, Austin, Texas 78746. Our telephone number is (512) 553-6785.

The principal executive office for our Subsidiary is located at 332 Dorado Beach East, Dorado, Puerto Rico 00646. Our Subsidiary’s telephone number is (787) 948-0072.

Our fiscal year ends on December 31.

As of the date of this prospectus, we have not sold any of the Hard Assets nor have any transfers of the Hard Assets been made through our website. Our net losses for the period ending December 31, 2015, and June 30, 2016, were ($12,291) and ($131,113), respectively.

As of the date of this prospectus, we have 178,011,826 shares of our $.001 par value common stock issued and outstanding and held by 50 shareholders. 263,158 shares of that common stock were offered and sold to Leslie Ball, a member of our board of directors, at a purchase price of $.19 per share and an additional 263,158 shares of that common stock were issued to Leslie Ball for marketing and consulting services rendered to the Company. 152,900,000 shares of that common stock were issued to Heron Capital Partners Ltd. (“Heron”) for sales, marketing, purchasing and administrative services rendered to the Company by Christian Briggs, our President, Chief Executive Officer and chairman of our board of directors. Heron intends to transfer those shares to Peach Management, LLC, a Puerto Rico limited liability company (“Peach”). The membership units of Peach are held by Christian Briggs and his wife, Julie Briggs, equally. 100,000 shares of that common stock were issued to Thomas Gingerich, our Chief Financial Officer and a member of our board of directors, for accounting, sales and administration services rendered to the Company. 10,000 shares of that common stock were issued to Delfino Galindo, our Chief Creative Officer, for creating our website and consulting services rendered to the Company. The remaining 24,475,510 shares of that common stock were offered and sold at purchase prices of $.01 to .30 per share.

We are registering 1,348,354 shares of our common stock held by 47 shareholders pursuant to the Securities Act of 1933 for sale by those shareholders, which are named later in this prospectus. Our officers and directors hold 153,536,316 shares of our common stock, and 127,040 of those shares are being registered.

As of June 30, 2016, we had $300 in current assets and $676,689 in liabilities. Accordingly, our working deficit position as of June 30, 2016, was $676,389.

As of December 31, 2015, we had $492 in current assets and $545,768 in liabilities. Accordingly, our working deficit position as of December 31, 2015, was $545,276.

As of August 31, 2016, our cash on hand was $5,206. Currently, we do not have enough cash to finance our operations. We have incurred operating losses since our formation and expect to incur losses for the foreseeable future, and we may not achieve profitability. We expect to incur negative cash flows as we increase our inventory and incur operating losses. Because of the operating losses and negative cash flows, there is substantial doubt as to our ability to continue as a going concern. We will need to generate revenues in excess of the current amounts to achieve profitability and positive cash flows necessary to continue operating our business.

| 7 |

| Table of Contents |

Yuma Properties, LP., which is beneficially owned by Christian Briggs, our Chief Executive Officer, President and member of our Board of Directors (“Yuma”), lends us the funds necessary to operate our business. In that regard, we have a written Senior Secured Line of Credit with Yuma pursuant to which we can borrow from Yuma the principal amount of $250,000, which accrues at an interest rate of 10% per annum, commencing on the dates the funds are borrowed. We can provide no guarantee or assurance that we can pay the amount lent, or any other amount, on the date the borrowed funds are to be repaid, May 31, 2017. A copy of that Senior Secured Line of Credit is attached as Exhibit 99.1 to that registration statement of which this prospectus is a part. As of August 31, 2016, Yuma has lent us $155,000. Funds lent pursuant to that Senior Secured Line of Credit are due and payable on May 31, 2017; provided, however, accrued interest on the outstanding balance of advances is required to be paid monthly. To date, we have not made any payments of such interest. The transaction contemplated by that Senior Secured Line of Credit does not contemplate a revolving line of credit, and amounts we pay to Yuma for advances made pursuant to that Senior Secured Line of Credit may not be borrowed by us again. Our operating expenses are approximately $64,000 each month.

We anticipate to fund our operations for the next 12 months we will require approximately (i) $1,800,000.00 for inventory, which we anticipate that we will acquire during the first 3 months after we have sufficient funding; (ii) $64,000 each month for operating expenses ($768,000); and (iii) $200,000 for working capital, for a total of $2,768,000. We anticipate that we should be able to generate cash in excess of $50,000 from the sale of our current inventory. That inventory is fully paid, and the proceeds from the sale of that inventory will be used to purchase additional inventory, pay our general and administrative expenses, and additional working capital necessary to conduct our business. Additionally, we have commenced the offer and sale of up to 6,666,666 shares of our common stock at $0.30 per share in a private placement transaction pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506(b) of Regulation D (the “Offering”). As of the date of this prospectus, no capital has been raised pursuant to the Offering.

To the extent we are not able to raise any capital pursuant to the Offering or sell our inventory or the sale of our inventory does not provide sufficient proceeds to fund our operations, we will continue to borrow money from Yuma. In the event Yuma cannot lend us funds necessary to support our operations during the next 12 months, we plan to obtain additional funds through revenue from operations, private placements of our capital stock and/or loans from sources other than Yuma.

Employees of the Company

Presently, we have 4 employees.

Thomas Gingerich is our Chief Financial Officer.

Delfino Galindo is our Chief Creative Officer.

Josh Gottesgen and Patrick Kliesch are full-time employees of the Company that assist us in our website development, video production and live show on our website.

We anticipate that on or about November 1, 2016, Mr. Gingerich, Mr. Galindo, Mr. Gottesgen and Mr. Kliesch will cease being employees of the Company and will become employees of the Subsidiary in similar capacities.

Currently, we have no written employment agreements with our employees.

| 8 |

| Table of Contents |

Our officers and directors are responsible for all planning, development and operational duties and will continue to do so throughout the early stages of our growth. Human resource planning will be a part of an ongoing process that will include regular evaluation of our operations. We intend to hire additional employees at such time as we determine it is appropriate. We can provide no assurance or guarantee on the date on which we will hire employees.

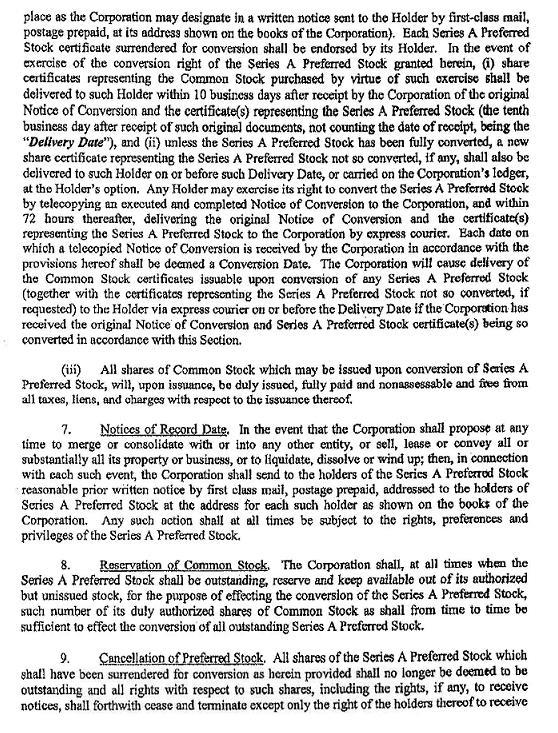

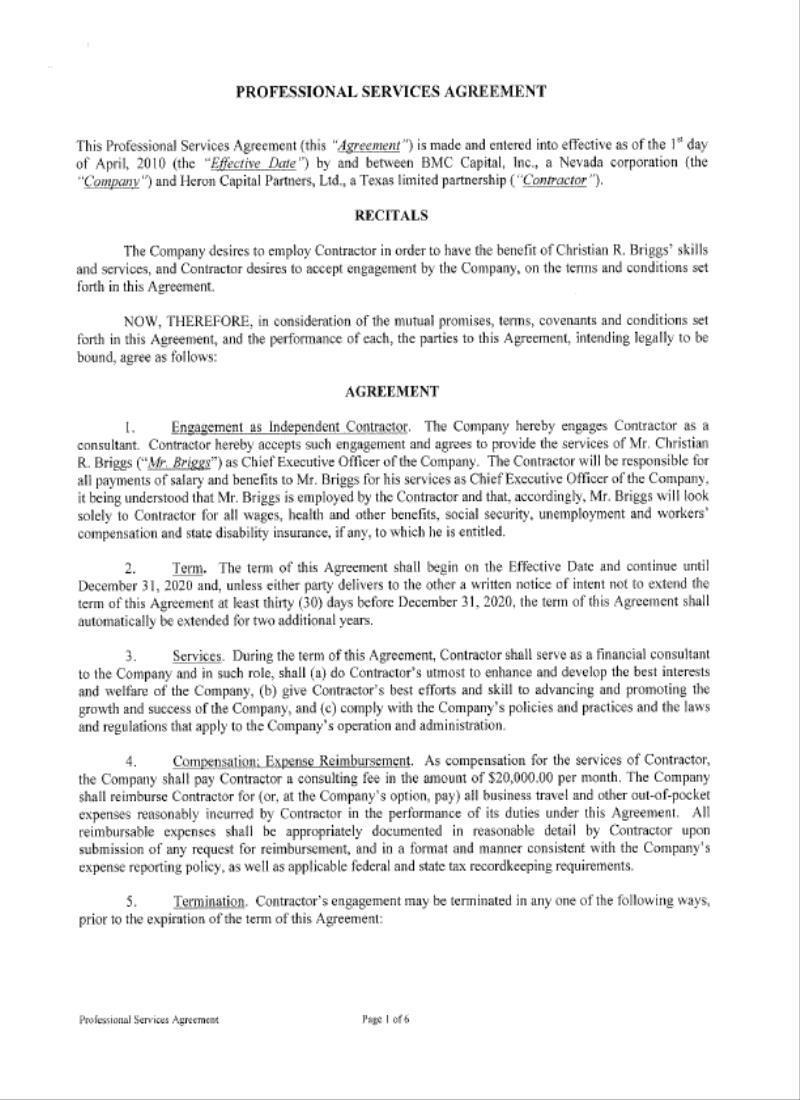

Christian R. Briggs is our Chief Executive Officer, President and chairman of our board of directors. He is not an employee of the Company; rather, he provides his services to the Company pursuant to a Professional Services Agreement between the Company, on the one hand, and Heron, on the other hand. It is anticipated that on or about November 1, 2016, that agreement will terminate and Mr. Briggs will become an employee of the Subsidiary in similar capacities.

Employees of our Subsidiary

Our Subsidiary, currently, has no employees.

We have no present plans to be acquired or to merge with another company, nor do our directors or shareholders have plans to enter into a change of control or similar transaction.

Jumpstart Our Business Startups Act (the “JOBS Act”)

We have elected to not opt out of the JOBS Act extended accounting transition period. This may make our financial statements more difficult to compare to other companies.

Pursuant to the JOBS Act, as an emerging growth company, we can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the standard for the private company. This may make comparison of our financial statements with any other public company which is not either an emerging growth company or an emerging growth company which has opted out of using the extended transition period difficult or impossible, as possible different or revised standards may be used.

Emerging Growth Company:

The JOBS Act is intended to reduce the regulatory burden on emerging growth companies. We meet the definition of an emerging growth company and as long as we qualify as an “emerging growth company,” we will, among other things:

| · | be temporarily exempted from the internal control audit requirements Section 404(b) of the Sarbanes-Oxley Act; | |

|

| |

| · | be temporarily exempted from various existing and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for- performance”, and “CEO pay ratio”; | |

|

| |

| · | be temporarily exempted from any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting; | |

|

| |

| · | be temporarily exempted from having to solicit advisory say-on-pay, say- on-frequency and say-on-golden-parachute shareholder votes regarding executive compensation pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); | |

|

| |

| · | be permitted to comply with the SEC’s detailed executive compensation disclosure requirements on the same basis as a smaller reporting company; and | |

|

| |

| · | be permitted to adopt any new or revised accounting standards using the same timeframe as private companies (if the standard applies to private companies). |

| 9 |

| Table of Contents |

We will continue to be an emerging growth company until the earliest of:

· the last day of the fiscal year during which we have annual total gross revenues of $1 billion or more; · the last day of the fiscal year following the fifth anniversary of the first sale of our common equity securities in an offering registered pursuant to the Securities Act of 1933, as amended; · the date on which we issue more than $1 billion in non-convertible debt securities during a previous three-year period; or · the date on which we become a large accelerated filer, which generally is a company with a public float of at least $700 million (Exchange Act Rule 12b-2).

The offering

Securities being offered: | Up to 1,348,354 shares of our common stock, $.001 par value by the selling stockholders. |

Offering price per share: | $.30 |

Offering period: | The shares will be offered on a time-to-time basis by the selling stockholders. |

Net proceed: | We will not receive any proceeds from the sale of the shares. |

Use of proceed: | We will not receive any proceeds from the sale of the shares. |

Number of Shares of Common Stock Authorized and Outstanding: | 178,011,826 shares of common stock issued and outstanding, 249,000,000 shares of $.001 par value common stock authorized. |

The number of shares of our common stock outstanding excludes:

| · | A total of 20,000,000 shares of common stock reserved for future issuance pursuant to our 2016 Equity Incentive Plan, which we refer to as the “Plan”; | |

|

| |

| · | A total of 1,000,000 shares of common stock issuable upon the conversion of shares of our preferred stock; and | |

|

| |

| · | Those shares of our common stock issuable upon the conversion of a Convertible Demand Promissory Note dated June 16, 2011, in the principal amount of $47,125. |

There is no trading market for our common stock. We intend to apply for participation on the Over-the-Counter Bulletin Board (“OTCBB”), and we hope that thereafter such trading market will develop. The selling stockholders will sell at a fixed price of $.30 per share until prices of our common stock are quoted on the OTCBB and thereafter at prevailing market prices or privately negotiated prices.

We intend to enter into an agreement with a broker-dealer registered with the Securities and Exchange Commission (the “SEC”) and a member in good standing of FINRA to assist us in connection with causing the prices of our common stock to be quoted on the OTCBB. There can be no assurance that any application filed by any sponsoring market maker for such quotation on the OTCBB will be approved.

| 10 |

| Table of Contents |

Selected Financial Information

|

| For the year ended December 31, 2015 |

|

| For the year ended December 31, 2014 |

|

| For the 6 months ended June 30, 2016 (unaudited) |

| |||

|

|

|

|

|

|

|

|

| ||||

BALANCE SHEET DATA: |

|

|

|

|

|

|

|

|

| |||

Current Assets: |

| $ | 492 |

|

| $ | 302 |

|

| $ | 300 |

|

Total Assets: |

| $ | 492 |

|

| $ | 302 |

|

| $ | 300 |

|

Total Liabilities: |

| $ | 545,768 |

|

| $ | 533,287 |

|

| $ | 676,689 |

|

Stockholders’ Deficit |

| $ | (545,276 | ) |

| $ | (532,985 | ) |

| $ | (676,389 | ) |

| For the year ended December 31, 2015 |

|

| For the year ended December 31, 2014 |

|

| For the 6 months ended June 30, 2016 (unaudited) |

| ||||

STATEMENT OF OPERATIONS DATA: |

|

|

|

|

|

|

|

| ||||

Revenue: |

| $ | 0 |

|

| $ | 0 |

|

| $ | 0 |

|

Gross Profit: |

| $ | 0 |

|

| $ | 0 |

|

| $ | 0 |

|

Operating Expenses: |

| $ | 5 |

|

| $ | 75 |

|

| $ | 121,656 |

|

Other Expenses (Interest): |

| $ | 12,286 |

|

| $ | 12,286 |

|

| $ | 9,457 |

|

Net (Loss): |

| $ | (12,291 | ) |

| $ | (12,361 | ) |

| $ | (131,113 | ) |

The foregoing summary information is qualified by and should be read in conjunction with our financial statements and accompanying footnotes, appearing elsewhere in the registration statement of which this prospectus is a part.

This prospectus contains forward-looking statements, which relate to future events or our future financial performance. In some cases, those forward-looking statements can be identified by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks specified below that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

| 11 |

| Table of Contents |

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Investors should carefully consider the following factors in evaluation our business, operations and financial condition. Additional risks and uncertainties not presently known to us, that we currently deem immaterial, or that are similar to those faced by other companies in our industry or business in general, such as competitive conditions, may also impair our business operations. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Business

Our limited operating history makes it difficult to evaluate our business and future prospects. There is no assurance our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease operations.

Our limited operating history makes it difficult to evaluate our business and future prospects. We were formed in 2009, but have a minimal operating history. Our operations have consisted mainly of identifying sources of antiquities, rare coins and precious metals, developing our website and otherwise organizing and planning our operations. Currently, we are minimally capitalized and have limited operations and no revenue.

Our net losses for the period ending December 31, 2015, and June 30, 2016, were ($12,291) and ($131,113), respectively. As of August 31, 2016, our cash on hand was $5,206. Currently, we do not have enough cash to finance our operations.

Any purchaser of our common stock should consider our business and prospects in light of the risks and difficulties we will encounter as an early stage business. These risks include:

| · | our ability to identify and acquire antiquities, investment quality antiquities, rare coins and precious metals at prices that are advantageous to us; | |

|

| |

| · | our ability to effectively and efficiently market and distribute our products; | |

|

| |

| · | our ability to obtain market acceptance of our current and future products; | |

|

| |

| · | our ability to sell our products at competitive prices, which exceed our per unit costs; and | |

|

| |

| · | our ability to maximize the profitability of our business operations. |

| 12 |

| Table of Contents |

We may not be able to resolve these risks and difficulties, which could materially and adversely affect our revenue, operating results and our ability to continue to operate our business.

We can provide no assurance that we will be successful in generating sufficient revenues to support our operations in the future. Our ability to generate future revenues will be dependent on a number of factors, most of which are beyond our control, including demand for rare coins, precious metals and antiquities, market competition and government regulation. Failure to generate sufficient revenues may force us to cease operations and you could lose all or part of your investment. As with any investment in a company with a limited operating history, ownership of our securities may involve significant risks and is not recommended if an investor cannot reasonably accommodate the risk of a total loss of his or her investment.

We require additional funding to continue our operations. If we do not secure additional funding, we may not be able to continue as a going concern.

We incurred a net loss of ($131,113) for the six months ended June 30, 2016. We incurred a net loss of ($12,291) for the year ended December 31, 2015. We anticipate these losses will continue for the foreseeable future.

On June 30, 2016, we had cash reserves of $0 and negative retained earnings of ($2,830,517). On December 31, 2015, we had cash reserves of $192 and negative retained earnings of ($2,699,404). We estimate that such cash reserves are not sufficient to fund our daily operations. To fund our daily operations we must raise additional capital. No guarantee or assurance can be given that we will receive additional funds required to fund our daily operations. In addition, in the absence of the receipt of additional funding, we may be required to scale back our operations. Currently, we do not have enough cash to finance our operations for even one month. We have secured from Yuma, and an affiliate of Christian Briggs, our President and Chief Executive Officer, a Senior Secured Line of Credit in the principal amount of $250,000. Currently, Yuma has advanced to us the principal amount of $155,000. Accordingly, there remains available to us the principal amount of $95,000 of that line of credit.

We anticipate to fund our operations for the next 12 months we will require approximately (i) $1,800,000 for inventory, which we anticipate that we will acquire during the first 3 months after we have sufficient funding; (ii) $64,000 each month for operating expenses ($768,000); and (iii) $200,000 for working capital, for a total of $2,768,000. We plan to meet any shortfall of cash necessary to fund our operations through revenue from operations, private placements of our capital stock and/or loans from sources other than Yuma.

A copy of the Senior Secured Line of Credit is attached as Exhibit 99.1 to that registration statement to which this prospectus is a part.

Because of the lingering effects of the recession and the lack of available credit for businesses such as ours, we may be hampered in our ability to raise the necessary working capital. We cannot provide any assurance that any additional funding will be available to us, or if available, will be on terms favorable to us. If we do not raise the necessary working capital and or increase our revenue, we will not be able to remain operational.

Our failure to raise additional capital or generate the cash necessary to finance our business could force us to limit or cease our operations. Accordingly, we will need to raise additional funds, and we may not be able to obtain additional funds on favorable terms, if at all. If we raise additional funds by the sale of our common stock, our stockholders may experience significant dilution of their ownership interests, and the per-share value of our common stock could decline.

Because we are currently considered a “shell company” within the meaning of Rule 12b-2 pursuant to the Securities Exchange Act of 1934, the ability of holders of our common stock to sell their shares may be limited by applicable regulations.

We are, currently, considered a “shell company” within the meaning of Rule 12b-2 pursuant to the Securities Exchange Act of 1934 and pursuant to Rule 405 of the Securities Act of 1933, in that we currently have (i) nominal assets and operations; and (ii) our assets consist solely of cash and cash equivalents. Accordingly, the ability of holders of our common stock to sell their shares may be limited by applicable regulations.

| 13 |

| Table of Contents |

As a result of our classification as a “shell company”, our investors are not allowed to rely on the “safe harbor” provisions of Rule 144 promulgated pursuant to the Securities Act of 1933 so as not to be considered underwriters in connection with the sale of our securities until one year from the date that we cease to be a “shell company.” Additionally, as a result of our classification as a shell company:

| · | investors should consider shares of our common stock to be significantly risky and illiquid investments; | |

|

| |

| · | we may not register our securities on Form S-8 (an abbreviated form of registration statement); and | |

|

| |

| · | our ability to attract additional funding to sustain our operations may be limited significantly. |

We can provide no assurance or guarantee that we will cease to be a “shell company” and, accordingly, we can provide no assurance or guarantee that there will be a liquid market for our shares. Accordingly, investors may not be able to sell our shares and lose their investments in the Company.

Our auditor has expressed substantial doubt about our ability to continue as a going concern.

We may not be able to generate profitable operations in the future or obtain the necessary financing to meet our obligations and repay liabilities arising from normal business operations when they come due. The outcome of these matters cannot be predicted with any certainty at this time. These factors raise substantial doubt that we will be able to continue as a going concern. We plan to continue to provide for our capital needs through related party advances. Our financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern.

Material weaknesses in our internal controls and financial reporting may limit our ability to prevent or detect financial misstatements or omissions. As a result, our financial reports may not be in compliance with U.S. GAAP. Any material weakness, misstatement or omission in our financial statements will negatively affect the market and the price of our stock, which could result in significant losses to our investors.

Our current management does not possess recent experience managing and operating a public company. We rely in many instances on the professional experience and advice of third parties. Therefore, we may, in turn, experience “weakness” and potential problems in implementing and maintaining adequate internal controls as required under Section 404 of the “Sarbanes-Oxley” Act of 2002. This “weakness” also includes a deficiency, or combination of deficiencies, in internal controls over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. If we fail to achieve and maintain the adequacy of our internal controls, as such requirements are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

| 14 |

| Table of Contents |

Pursuant to Section 404 of the Sarbanes-Oxley Act, we are required to include in our annual reports our assessment of the effectiveness of our internal control over financial reporting as of the end of our fiscal years. We have not yet completed any assessment of the effectiveness of our internal control over financial reporting. We expect to incur additional expenses and diversion of management’s time as a result of performing the system and process evaluation, testing, and remediation required in order to comply with the management certification.

As we are an emerging growth company and have elected not to opt out of the extended transition period created by the provisions of the JOBS Act, during that transition period, our independent auditor shall not attest to, and report on, the assessment made by our management regarding the effectiveness of our internal control structure and procedures for financial reporting.

As we have elected to use the extended transition period for complying with new or revised accounting standards pursuant to the JOBS Act, our financial statements may not be comparable to public companies that are not emerging growth companies.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933 for complying with new or revised accounting standards. An emerging growth company can, therefore, delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may, therefore, not be comparable to those public companies that comply with such new or revised accounting standards.

Our officers and directors control approximately 86% of the Company, giving them significant voting power, which allows them to take action that may not be in the best interest of all other shareholders.

Christian Briggs, our Chief Executive Officer, President and chairman of our board of directors; Delfino Galindo, our Chief Creative Officer; Thomas Gingerich, our Chief Financial Officer and a member of our board of directors, and Leslie Ball, a member of our board of directors, beneficially own approximately 86% of our outstanding shares of common stock as of the date of this prospectus. As a result, they have control of most matters requiring approval by our stockholders, without the approval of our minority stockholders. They will, also, be able to affect most corporate matters requiring stockholder approval by written consent, without the need for a duly noticed and duly held meeting of our stockholders. Accordingly, our other shareholders will be limited in their ability to affect change in how we conduct our business. Mr. Briggs, Mr. Galindo, Mr. Gingerich, and Mr. Ball have significant influence in determining the outcome of any corporate transaction or other matters submitted to our shareholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets, the election of directors and other significant corporate actions. In addition to their stock ownership, they are key to our operations and have significant influence over our key decisions. This concentration of ownership and influence over our decision-making may also discourage, delay or prevent a change in control of the Company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of the Company and might reduce the price of our common stock. These actions may be taken even if they are opposed by our other shareholders.

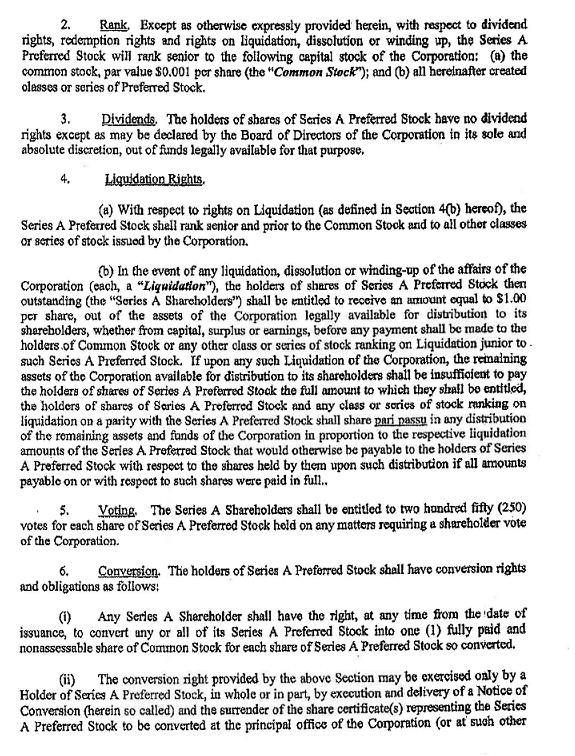

Additionally, we are authorized to issue 1,000,000 shares of preferred stock. All of those shares of preferred stock are convertible into shares of our common stock on a 1 share per 1 share basis. Additionally, each share of our preferred stock is entitled to 250 votes per share on all matters submitted to our stockholders for a vote. Those 1,000,000 shares of our preferred stock were issued to Heron. Heron intends to transfer those shares to Peach. The membership units of Peach are held by Christian Briggs, our President and Chief Executive Officer, and his wife, Julie Briggs, equally. Accordingly, in addition to those shares of common stock currently held by Heron, Mr. Briggs is in a position to influence the vote of those 1,000,000 shares of our preferred stock.

| 15 |

| Table of Contents |

Our officers and directors are aware of their fiduciary duties to the Company and its shareholders and will make every effort to consider the best interests of the Company and its shareholders in connection with the relationship between the Company and our Subsidiary. We cannot provide any assurance, however, that our officers and directors will not engage in conduct or make decisions which are not in the best interest in the Company. Such decisions could harm our operations, business plans and cash flows.

We have not formulated a plan to resolve any possible conflict of interest with our directors’ and officers’ other business activities. In the event they are unable to fulfill any aspect of their duties to the Company, we may experience little or no profits and eventual closure of business.

Because Christian Briggs, Delfino Galindo, Thomas Gingerich, and Leslie Ball (our officers and directors) have other outside business activities and will have limited time to spend on our business, our operations may be sporadic, which may result in periodic interruptions or suspensions of operations.

In addition to having other outside business activities, our officers and directors who are also officers and directors of our Subsidiary, which conducts the majority of our operations, will only be devoting approximately 5 hours per week to the Company and between 10-40 hours per week to our Subsidiary. Accordingly, our operations may be sporadic and occur at times which are convenient to Mr. Briggs, Mr. Galindo, Mr. Gingerich, and Mr. Ball. Christian Briggs will devote up to 5 hours to the Company and 40 hours to our Subsidiary per week; Delfino Galindo will devote 0 hours to the Company and up to 40 hours per week to our Subsidiary; Thomas Gingerich, will devote up to 5 hours per week to the Company and approximately 40 hours per week to our Subsidiary; and Leslie Ball will devote up to 5 hours per week to the Company and approximately 10 hours per week to our Subsidiary. In the event they are unable to fulfill any aspect of their duties to the Company, we may experience a shortfall or complete lack of sales resulting in little or no profits and eventual closure of the business.

We are dependent upon our current officers and directors, and the loss of one or more of our executive officers or directors or an inability to attract and retain highly skilled employees could compromise our ability to pursue our growth strategy and grow our business.

Our success depends in large part on the continued service and efforts of our key management personnel. We are currently managed by 3 officers (Christian Briggs, Delfino Galindo, and Thomas Gingerich) and 3 directors (Christian Briggs, Leslie Ball and Thomas Gingerich) and we are entirely dependent upon them to conduct our operations. If they should resign or die, there could be no one to operate the Company. If our current officers and directors are no longer able to serve as such and we are unable to find other persons to replace them, it will have a negative effect on our ability to continue active business operations and could result in investors losing some or all of their investment in the Company. Additionally, competition for qualified management in our industry is intense. Many of the companies with which we compete for management personnel have greater financial and other resources than we do. As a result, we may experience difficulty hiring and retaining qualified personnel.

To grow our business, we will need the assistance of additional sales representatives knowledgeable in the industry. There is no guarantee we can add such sales representatives to assist in future growth.

Our officers and directors have limited experience in the rare coin, precious metals and antiquities business, and we may have to hire qualified consultants to assist us in our operations. If we cannot locate qualified consultants, we may have to suspend or cease operations which will result in the loss of your investment.

Christian Briggs, our Chief Executive Officer and a member of our Board of Directors, has experience in our industry, but due to his lack of recent experience in the rare coin, precious metals and antiquities business, he and our other officers (who have no such experience) may make decisions and choices that negatively impact our operations, including marketing and sales. Consequently, our operations, earnings and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry. As a result, we may have to suspend or cease operations which will result in the loss of our shareholders’ investments. We may decide to hire independent consultants to assist us in sales and marketing. As independent consultants, with no fiduciary responsibility to our shareholders, their expertise and sales ability may fall short of our expectations and not assist in our growth, but cause us to incur additional expense for their services. Without name recognition, we will have a definite marketing challenge, and our competitors will have advantages in attracting customers.

| 16 |

| Table of Contents |

If we are unable to retain key personnel, it will have an adverse effect on our business. We do not maintain “key man” life insurance policies on our key personnel.

The conduct of our business is dependent on retaining the services of qualified personnel. The loss of key management, the inability to secure or retain such key personnel with unique knowledge of our business or our inability to attract and retain sufficient numbers of other qualified personnel would adversely affect our business and could have a material adverse effect on our business, operating results, and financial condition.

We do not have “key man” life insurance policies for any of our key personnel. If we were to obtain “key man” insurance for our key personnel, of which there can be no assurance, the amounts of such policies may not be sufficient to pay losses experienced by us as a result of the loss of any of those personnel.

We may not maintain sufficient insurance coverage for the risks associated with our business operations.

Risks associated with our business operations include, but are not limited to, claims for wrongful acts committed by our officers, directors, and other representatives, the loss of intellectual property rights, the loss of key personnel and risks posed by natural disasters. Any of these risks may result in significant losses. We do not carry business interruption insurance. In addition, we cannot provide any assurance that our insurance coverage is sufficient to cover any losses that we may sustain, or that we will be able to successfully claim our losses under our insurance policies on a timely basis or at all. If we incur any loss not covered by our insurance policies, or the compensated amount is significantly less than our actual loss or is not timely paid, our business, financial condition and results of operations could be materially and adversely affected.

We intend to become subject to the periodic reporting requirements of the Securities Exchange Act of 1934, which will require us to incur audit fees and legal fees in connection with preparation of reports. These additional costs could reduce or eliminate our ability to operate profitability.

Following the effective date of this registration statement of which this prospectus is a part, we will be required to file periodic reports with the SEC pursuant to the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. The costs charged by these professionals for such services cannot be accurately predicted at this time, because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined and such factors will have a major effect on the amount of time to be spent by our auditors and attorneys. These costs will be expenses of our operations and, therefore, have a negative effect on our ability to pay our other costs and expenses and earn a profit.

Conversion of our preferred stock to common stock could result in dilution to our shareholders.

Heron, currently, holds 1,000,000 shares of our preferred stock. Those shares of our preferred stock are convertible, on a one share for one share basis, into shares of our common stock. Heron is beneficially owned by Christian Briggs, our Chief Executive Officer, President and Chairman of our board of directors. If Mr. Briggs converts shares of our preferred stock to shares of our common stock, our other stockholders may experience dilution of their ownership interests, and the per share value of our common stock could decline. There are no restrictions regarding the conversion of that preferred stock by Mr. Briggs.

| 17 |

| Table of Contents |

Our information systems and website may be susceptible to cybersecurity breaches and other risks.

We anticipate that we will receive revenue from the sale of Hard Assets through our website, bmchardassets.com. We also intend to charge a commission for transfers that occur through that website. Additionally, we have information systems that support our business, including service development, marketing, sales, and intracompany communications. Our website and systems may be susceptible to outages due to fire, floods, power loss, telecommunication failures, break-in and other events. Additionally, our website and systems may be vulnerable to cybersecurity breaches such as computer viruses, break-in and similar disruptions from unauthorized tampering. The occurrence of these or other events could disrupt or damage our information systems and adversely affect our business and results of operations.

Our growth strategy contemplated by our business plan may not be achievable or may not result in profitability.

We may not be able to implement the growth strategy contemplated in our business plan fast enough for us to achieve profitability. Our growth strategy is dependent on a number of factors, including market acceptance of our products. We can provide no assurance that potential customers will purchase our products or that those customers will purchase our products at the cost and on the terms assumed in our business plan. Among other things, implementation of our growth strategy would be adversely affected if:

· | we are not able to attract sufficient customers to the products we offer, considering the price and other terms required in order for us to attain the level of profitability that will enable us to continue to pursue our growth strategy; |

·

| adequate penetration of new markets at a reasonable cost becomes impossible, in turn limiting the future demand for our products below the level assumed by our business plan; |

· | we are forced to significantly adapt our business plan to meet changes in our markets; and |

· | for any reason, we are not able to attract, hire, retain and motivate qualified personnel. |

If we cannot manage our growth effectively, we may not become profitable.

Businesses which grow rapidly often have difficulty managing their growth. If we grow as rapidly as we anticipate, we will need to expand our management by recruiting and employing experienced executives and key employees capable of providing the necessary support. We can provide no assurance that our management will be able to manage our growth effectively or successfully. Our failure to meet these challenges could cause us to lose money and our shareholders’ investments in us could be lost.

Among other things, implementation of our growth strategy would be adversely affected if we were not able to attract sufficient customers for the products we offer or plan to offer considering the price and other terms required for us to attain the necessary profitability.

| 18 |

| Table of Contents |

Risks Related to our Common Stock

We are an “emerging growth company,” and any decision on our part to comply with certain reduced disclosure requirements applicable to emerging growth companies could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act enacted in April 2012, and, for as long as we continue to be an emerging growth company, we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote regarding executive compensation, and stockholder approval of any golden parachute payments not previously approved. We could be an emerging growth company for up to five years, although, if the market value of our common stock that is held by non-affiliates exceeds $700 million during that five-year period or we issue more than $1 billion of non-convertible debt during a 3 year period, we would cease to be an “emerging growth company”. We cannot predict if investors will determine that our common stock is less desirable, if we choose to rely on those exemptions. If some investors determine that our common stock is less desirable, as a result of any choices to reduce future disclosure, there may be a less active trading market for our common stock and our stock price may be more volatile.

Currently, there is no public market for our common stock, and there can be no assurance that any public market will ever develop or that our common stock will be quoted for trading and, even if quoted, it will probably be subject to significant price fluctuations. We anticipate our common stock may be quoted on the OTCBB, which may result in limited liquidity and the inability of our stockholders to maintain accurate price quotations for our common stock.

Prior to the date of this prospectus, there was not an established trading market for our common stock, and there is currently no public market whatsoever for our common stock. We intend to retain a broker-dealer registered with the SEC and a member in good standing of FINRA to file an application with FINRA, so as to enable the quotation for the prices of our common stock on the OTCBB. There can be no assurance as to whether any market maker will file that application or if that application will be accepted by FINRA. We are not permitted to file such application on our own behalf. If that application is accepted, there can be no assurance as to whether any market for our common stock will develop or the prices at which our common stock will trade. If that application is accepted, we cannot predict the extent to which investor interest in us will result in the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors.

In addition, it is probable that our common stock will not be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until an orderly market develops in our common stock, if ever, the price at which it trades will probably fluctuate significantly. Prices for our common stock will be determined in the market and may be influenced by many factors, including the depth and liquidity of the market for our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these RISK FACTORS, investor perception, and general economic and market conditions. No assurance can be given that an orderly or liquid market will develop for our common stock. Because of the anticipated low price of our common stock, many brokerage firms may not be willing to effect transactions in our common stock.

| 19 |

| Table of Contents |

Upon our liquidation, holders of our preferred stock are entitled to receive the first proceeds from the liquidation of our assets.

In the event of any liquidation, dissolution or winding up of our affairs, the holders of the shares of our preferred stock then outstanding are entitled to receive an amount equal to $1 per share from our assets legally available for distribution to our shareholders, whether from capital, surplus or earnings, and before any payment shall be made to the holders of our common stock. In the event of any such liquidation, dissolution or winding up, there may not be sufficient proceeds from such liquidation, dissolution or winding up after the payment to the holders of our preferred stock of funds sufficient to return to the holders of our common stock the amounts of their investments, or any amount whatsoever.

The market price, if any, for our common stock may be volatile.

If a market price for our common stock should develop, that market price for our common stock may be volatile and subject to significant fluctuations in response to factors including the following:

| · | liquidity of the market for our shares of common stock; | |

| · | actual or anticipated fluctuations in our operating results; | |

| · | sales of substantial amounts of our common stock, or the perception that such sales might occur; | |

| · | changes in financial estimates by securities research analysts; | |

| · | changes in the economic performance or market valuations of other companies in our industry; | |

| · | announcements by us or our competitors of acquisitions, strategic partnerships, joint ventures or capital commitments; | |

| · | addition or departure of key personnel; | |

| · | fluctuations of exchange rates between foreign currencies and the U.S. dollar; | |

| · | our dividend policy; and | |

| · | general economic or political conditions. |

Our operating results may decline below the expectations of our investors. In that event, the market price of our common stock, if any, would likely be materially adversely affected, and the value of our common stock may decline. In addition, the securities market has, from time to time, experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may, also, materially and adversely affect the market price of our common stock, if any.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock, if one develops, may be characterized by significant price volatility, and we expect that our share price may be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert our management's attention and resources.

Certain provisions of Nevada law provide for indemnification of our officers and directors at our expense and limit their liability, which may result in a major cost to us and damage the interests of our shareholders, because our resources may be expended for the benefit of our officers and/or directors.

Applicable Nevada law provides for the indemnification of our directors, officers, employees, and agents, under certain circumstances, for attorney’s fees and other expenses incurred by them in any litigation to which they become a party resulting from their association with us or activities on our behalf. We will also pay the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s promise to repay us, if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us, which we will be unable to recover.

| 20 |

| Table of Contents |

We have been advised that, in the opinion of the SEC, indemnification for liabilities occurring pursuant to federal securities laws is against public policy as expressed in the Securities Act of 1933 and, therefore, unenforceable. In the event that a claim for indemnification against these types of liabilities, other than the payment by us of expenses incurred or paid by a director, officer, or controlling person in the successful defense of any action, lawsuit, or proceeding, is asserted by a director, officer, or controlling person in connection with our securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the issue of whether such indemnification by us is against public policy as expressed in the Securities Act of 1933, and we will be governed by the final adjudication of such issue. The legal process relating to this matter, if it were to occur, probably will be very costly and may result in us receiving negative publicity, either of which factors would probably materially reduce the market and price for our common stock, if such a market ever develops.

Any market that develops for our common stock will be subject to the penny stock restrictions, which will create a lack of liquidity and make trading difficult or impossible.

SEC Rule 15g-9 establishes the definition of a “penny stock,” for purposes relevant to us, as an equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions. It is probable that our common stock will be considered to be a penny stock for the immediately foreseeable future. This classification severely and adversely affects the market liquidity for our common stock. For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker-dealer approve a person’s account for transactions in penny stocks, and the broker-dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased.

To approve a person’s account for transactions in penny stocks, the broker-dealer must obtain financial information, investment experience and objectives of that person and make a reasonable determination that transactions in penny stocks are suitable for that person and that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker-dealer must, also, deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

· | the basis on which the broker-dealer made the suitability determination, and | |

· | that the broker-dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure, also, has to be made about the risks of investing in penny stock in both public offerings and in secondary trading and commissions payable to, both, the broker-dealer and the registered representative, current quotations for the securities, and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of these regulations, broker-dealers may desire to not engage in the necessary paperwork and disclosures and encounter difficulties in their attempt to sell our common stock, which may affect the ability of the selling shareholders or other holders to sell our common stock in the secondary market and have the effect of reducing trading activity in the secondary market of our common stock. These additional sales practice and disclosure requirements could impede the sale of our common stock, if and when our common stock becomes publicly traded. In addition, the liquidity of our common stock may decrease, with a corresponding decrease in the price of our common stock. Our common stock, in all probability, will be subject to such penny stock rules for the foreseeable future and our shareholders will, quite probably, have difficulty selling our common stock.

| 21 |

| Table of Contents |

We do not intend to pay dividends on our common stock.

We have not paid any dividends on our common stock, and we have no plans to pay dividends on our common stock in the foreseeable future.

We intend to retain earnings, if any, to provide funds for the operation of our business. Therefore, there can be no assurance that holders of our common stock will receive any additional cash, stock or other dividends on their shares of our common stock until we have funds which our Board of Directors determines can be allocated to dividends. Investors that require liquidity should also not invest in our common stock. There is no established trading market for our common stock and should one develop, it will likely be volatile and subject to minimal trading volumes.

Because we can issue additional shares of common stock, purchasers of our common stock may experience dilution.

We are authorized to issue up to 249,000,000 shares of $.001 par value common stock. At present, there are 178,011,826 shares of our common stock issued and outstanding. Our board of directors has the authority to cause us to issue additional shares of common stock without consent of any of our stockholders. We anticipate that we will be required to raise additional capital to finance our operations, and that capital may be raised by the sale of additional shares of our common stock. Consequently, upon the sale of additional shares of our common stock, our stockholders will experience dilution in the ownership of our common stock.

One of the effects of the existence of unissued and unreserved common stock may be to enable our board of directors to issue shares of our common stock to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of our Board of Directors by merger, tender offer, proxy contests, or otherwise, and thereby protect the continuity of our management and possibly deprive our stockholders of opportunities to sell their shares of our common stock at prices higher than prevailing market prices.

If a market develops for our common stock, sales of our common stock in reliance on Rule 144 may reduce prices in that market by a material amount.

All of the outstanding shares of our common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933. As restricted securities, those shares may be resold only pursuant to an effective registration statement or pursuant to the requirements of Rule 144 or other applicable exemptions from registration under that act and as required under applicable state securities laws. Rule 144 provides in essence that an affiliate (i.e., an officer, director, or control person) who has held restricted securities for a prescribed period may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed 1.0% of the issuer’s outstanding common stock. The alternative average weekly trading volume during the four calendar weeks prior to the sale is not available to our shareholders, as the OTCBB (if and when the prices of our common stock are quoted thereon) is not an “automated quotation system” and, accordingly, market based volume limitations are not available for securities quoted only on the OTCBB.

Pursuant to the provisions of Rule 144, there is no limit on the number of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days before the date of the proposed sale) after the restricted securities have been held by the owner for a prescribed period. A sale under Rule 144 or under any other exemption from the Securities Act of 1933, if available, or pursuant to registration of shares of our common stock held by our stockholders, may reduce the price of our common stock in any market that may develop.

Any trading market that may develop for our common stock may be restricted, because of state securities “Blue Sky” laws which prohibit trading absent compliance with individual state laws.

Transfers of our common stock may, also, be restricted under the securities laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such laws, our common stock may not be traded in such jurisdictions. Because the shares of our common stock registered hereunder have not been registered for resale under the “Blue Sky” laws of any state, the holders of such shares and persons who desire to purchase such shares in any trading market that might develop in the future, should be aware that there may be significant state “Blue Sky” law restrictions upon the ability of investors to sell and purchasers to purchase such shares. These restrictions prohibit the secondary trading our common stock. We, currently, do not intend and may not be able to qualify securities for resale in those states which do not offer manual exemptions and require securities to be qualified before they can be resold by our shareholders. Accordingly, investors should consider the secondary market for our securities to be limited.

| 22 |

| Table of Contents |

Risks Related to our Industry

Competitors with more resources may force us out of business.