DEF 14A0001481792false00014817922023-01-012023-12-31iso4217:USD00014817922022-01-012022-12-3100014817922021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardsReportedValueMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardAdjustmentsMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardsReportedValueMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardAdjustmentsMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardsReportedValueMember2021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardAdjustmentsMember2021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedDuringTheYearVestedMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2023-01-012023-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-01-012022-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001481792ecd:PeoMemberquad:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsReportedValueMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardAdjustmentsMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsReportedValueMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardAdjustmentsMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsReportedValueMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardAdjustmentsMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedDuringTheYearVestedMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2023-01-012023-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-01-012022-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001481792ecd:NonPeoNeoMemberquad:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

ý No fee required

¨ Fee paid previously with preliminary materials

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

QUAD/GRAPHICS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Time and Date:

Wednesday, May 22, 2024 at 9:00 a.m. Central Time

Virtual Meeting:

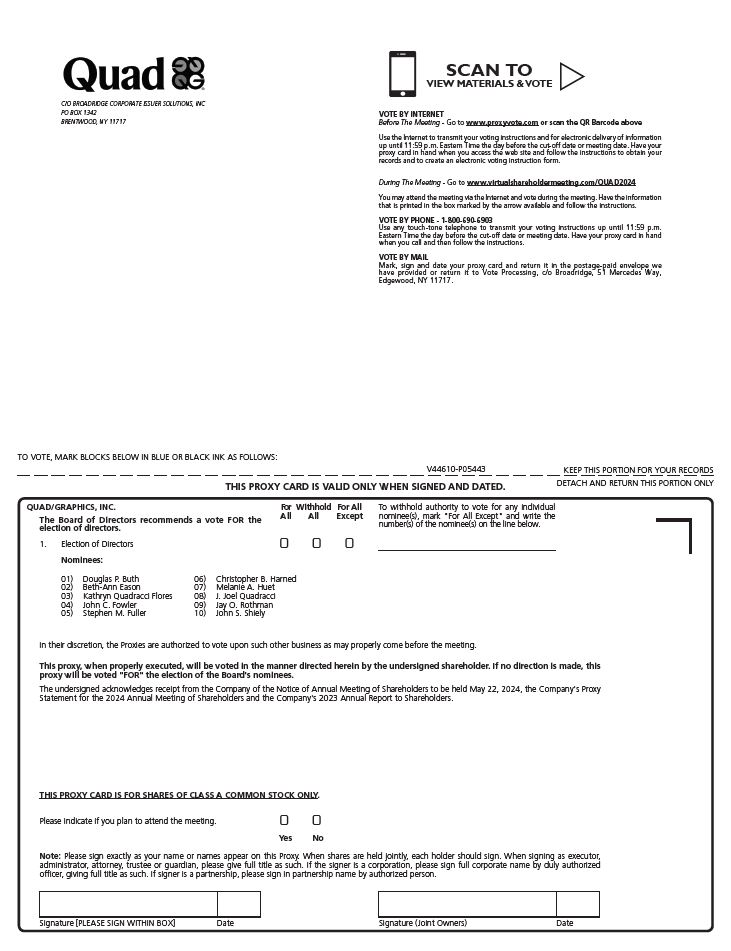

We are holding the 2024 Annual Meeting online at www.virtualshareholdermeeting.com/QUAD2024. You will not be able to attend the 2024 Annual Meeting physically. You or your proxyholder can participate, vote, and examine our shareholder list at the 2024 Annual Meeting by visiting www.virtualshareholdermeeting.com/QUAD2024 and using your control number found on your proxy card.

Matters to be Voted On:

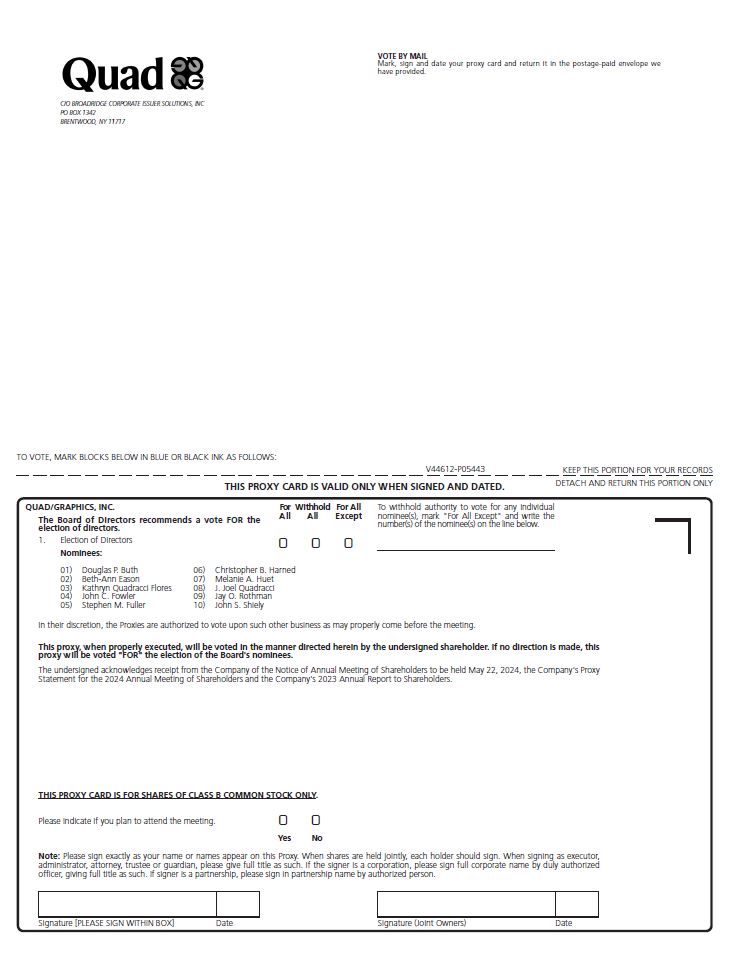

1.To elect all ten director nominees to serve for a one-year term and until their successors are duly elected and qualified; and

2.To consider and act upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

Who Can Vote:

Holders of Quad/Graphics, Inc. class A and class B common stock at the close of business on March 21, 2024.

We are pleased to take advantage of Securities and Exchange Commission rules that allow companies to furnish their proxy materials (i.e., proxy statement, 2023 annual report to shareholders and proxy card) over the internet. On or about April 12, 2024, we will commence mailing to the holders of our class A common stock entitled to vote at the Annual Meeting a Notice of Internet Availability of Proxy Materials (the “Notice”). We believe this process expedites the receipt of proxy materials by our shareholders, ensures that proxy materials remain easily accessible to our shareholders, lowers costs and reduces the environmental impact of our Annual Meeting.

The Notice contains clear instructions on how holders of our class A common stock can access our proxy materials and how such holders can vote at our 2024 Annual Meeting of Shareholders. In addition, the Notice contains instructions on how to obtain printed proxy materials.

Holders of our class B common stock will continue to receive hard copies of our proxy materials, and we will commence mailing on or about April 12, 2024.

Your vote is very important to us, regardless of how many shares you own. Even if you plan to attend the virtual meeting online, to ensure that every vote is counted at the 2024 Annual Meeting, we encourage you to vote as instructed in the Notice and/or proxy card, via the internet, by telephone or by mailing back the proxy card received from us or from your broker, bank or other provider. You may revoke your previously submitted proxy and vote your shares at the virtual meeting online. Please note, however, that if your shares are held by a broker, bank or other nominee and you wish to vote at the 2024 Annual Meeting online, you must obtain from the record holder of those shares (i.e., your broker, bank or other nominee) a legal proxy issued in your name.

By Order of the Board of Directors

Dana B. Gruen

General Counsel, Corporate Secretary and Chief Risk & Compliance Officer

April 12, 2024

Important notice regarding the availability of proxy materials for the shareholders’ meeting to be held on May 22, 2024: The proxy statement and 2023 Annual Report to Shareholders are available at: www.proxyvote.com and http://quad.com/investor-relations.

TABLE OF CONTENTS

QUAD/GRAPHICS, INC.

N61 W23044 Harry’s Way

Sussex, Wisconsin 53089

SUMMARY

of

PROXY STATEMENT

This summary highlights certain information that is described in more detail elsewhere in this proxy statement. This summary does not contain all the information you should consider before voting on the matters at the Annual Meeting of Shareholders of Quad/Graphics, Inc. (the “Company”, “Quad”, “we”, “our”, “us”, or similar terms) to be held on Wednesday, May 22, 2024 at 9:00 a.m. Central Time, and all adjournments or postponements thereof (the “Annual Meeting”), so we ask that you read the entire proxy statement carefully. Page references are provided to help you quickly find further information.

2024 Annual Meeting of Shareholders

| | | | | |

| Date and Time: | May 22, 2024 at 9:00 a.m. Central Time |

| |

| Virtual Meeting Site: | www.virtualshareholdermeeting.com/QUAD2024 |

| |

Eligibility to Vote

You can vote at the Annual Meeting if you were a holder of record of our class A common stock or class B common stock at the close of business on March 21, 2024 (the “Record Date”).

Governance Highlights

We are dedicated to high standards of corporate governance. Our Board of Directors (the “Board”) is committed to acting in the long-term best interests of our shareholders and continually reviews our policies with those interests in mind, as well as in light of recent trends in corporate governance.

Below is a summary of our corporate governance highlights with respect to our Board.

•Six out of our ten current directors are independent.

•We maintain a fully independent Audit Committee.

•Our Board meets at regularly scheduled executive sessions, both without members of management present and also without non-independent directors present.

•Our Board and executive officers are prohibited from hedging our stock, and are required to obtain prior approval of any pledge of our stock.

•Our Board and executive officers are subject to stock ownership guidelines.

•We hold annual board and committee evaluations.

•We require approval of certain related party transactions.

•We are committed to proactively addressing environmental, social and governance matters.

Additional information about our corporate governance policies and practices, including our efforts to drive positive, sustainable change in our business and in the world, can be found at pages 10 - 15 of this proxy statement.

Voting Matters

| | | | | | | | | | | |

| Proposal | The Board’s Voting Recommendations | Voting Standard to Approve Proposal (assuming a quorum is present) | Treatment of Abstentions and

Broker Non-Votes |

| 1. Election of Directors | “FOR” each nominee | Plurality of

Votes Cast | Not counted as votes cast and therefore have no effect |

| | | |

| | | |

| | | |

| | | |

| | | |

Election of Directors

We elect our directors on an annual basis.

| | | | | | | | | | | |

| Director Nominees | Age | Director Since | Independent |

| J. Joel Quadracci | 55 | 2003 | |

| Kathryn Quadracci Flores | 56 | 2013 | |

| Douglas P. Buth | 69 | 2005 | X |

| Beth-Ann Eason | 57 | 2023 | X |

| John C. Fowler | 73 | 2016 | |

| Stephen M. Fuller | 63 | 2016 | X |

| Christopher B. Harned | 61 | 2005 | |

| Melanie A. Huet | 48 | 2023 | X |

| Jay O. Rothman | 64 | 2017 | X |

| John S. Shiely | 71 | 1996 | X |

Director Tenure

We have added five new directors since 2016, four of whom are independent.

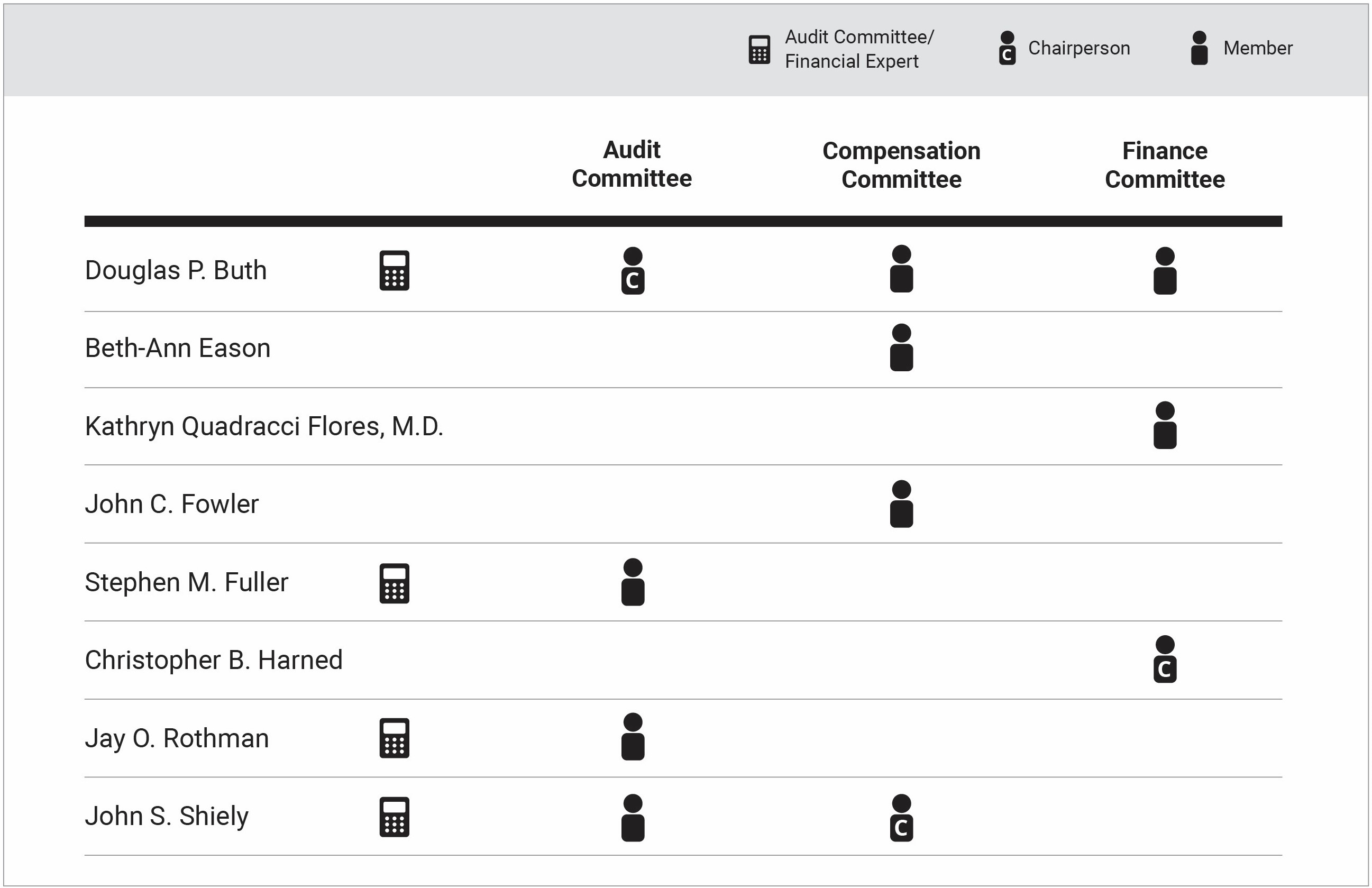

Committee Membership

There are three standing committees of the Board — the Audit Committee, the Compensation Committee and the Finance Committee. Current members of the committees are listed in the table below.

Additional information about our director nominees can be found at pages 6 - 9 of this proxy statement.

Compensation Highlights

We periodically review best practices in the area of executive compensation and update our compensation policies and practices to reflect those that we believe are appropriate for our Company, including the following:

•Pay for performance—A substantial fraction of total compensation for our named executive officers is tied to the operating performance of our Company. Our performance measures under our incentive compensation program are also aligned with our business objectives.

•Alignment with shareholder interests—Our core executive compensation principles are designed to promote alignment of our named executive officers’ interests with the interests of shareholders.

•Salary increases, bonuses and equity awards must be earned—We do not guarantee salary increases, bonuses or equity awards for our executive officers.

•No option repricing—Our equity compensation plan does not permit repricing of stock options.

•Compensation risk management—We periodically review our pay practices to ensure that they do not encourage excessive risk taking and to confirm that our governance practices are designed to prevent excessive compensation that would not be consistent with our philosophy and business objectives.

•Stock ownership—We maintain stock ownership guidelines for our directors and executive officers, including our named executive officers.

•No evergreen provision in equity plan—Our equity incentive plan does not include automatic annual increases in the share reserve such that shareholders generally must approve any increase in the share reserve.

•Independent compensation consultant—The compensation committee retains an independent compensation consultant to provide advice and recommendations concerning the compensation of our named executive officers.

PROXY STATEMENT

For

ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 22, 2024

This proxy statement is being furnished to shareholders by the Board, beginning on or about April 12, 2024. This proxy statement is being furnished in connection with a solicitation of proxies by the Board for use at the Annual Meeting for the purposes set forth in the attached Notice of Annual Meeting of Shareholders.

The Annual Meeting is a virtual only meeting, accessible online at www.virtualshareholdermeeting.com/QUAD2024. We have worked to offer the similar participation opportunities as would be provided at an in person annual meeting.

Only holders of record of the Company’s class A common stock and class B common stock (collectively the “common stock”) at the close of business on the Record Date are entitled to vote at the Annual Meeting. On that date, the Company had outstanding and entitled to vote: (a) 37,841,559 shares of class A common stock, each of which is entitled to one vote per share, with an aggregate of 37,841,559 votes; and (b) 13,261,983 shares of class B common stock, each of which is entitled to ten votes per share, with an aggregate of 132,619,830 votes. The presence of a majority of the votes entitled to be cast shall constitute a quorum for the purpose of transacting business at the Annual Meeting. Abstentions and broker non-votes will be considered present for purposes of determining whether a quorum exists.

To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Annual Meeting by virtual presence online. Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a shareholder of record, you have the option to vote by mail using your proxy card or electronically via either the internet or telephone pursuant to instructions provided on the Notice or on the proxy card sent to you. A shareholder of record may access and complete the proxy card online at www.proxyvote.com or vote by telephone (1-800-690-6903), in each case by using the control number provided on your proxy card or in the Notice. If a bank, broker or other nominee holds your Company common stock for your benefit but not in your own name, such shares are in “street name.” In that case, your bank, broker or other nominee will send you a voting instruction form to use for your shares. The availability of internet voting instruction depends on the voting procedures of your bank, broker or other nominee. Please follow the instructions on the voting instruction form they send you. Even if you vote via the internet, by telephone, or complete and mail your proxy card, you may nevertheless revoke your proxy at any time prior to the Annual Meeting by sending us written notice, voting your shares online at the Annual Meeting or submitting a later-dated proxy.

If you attend the Annual Meeting online, you may also vote your shares at www.virtualshareholdermeeting.com/QUAD2024 during the meeting, and any previous votes that you submitted will be superseded by the vote that you cast at the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain from the record holder of those shares a legal proxy issued in your name.

A proxy which is properly executed, duly returned to the Company and not revoked, or a valid vote via the internet or by telephone, will be voted in accordance with the instructions contained in it. The shares represented by executed but unmarked proxies will be voted as follows:

•FOR all ten persons nominated for election as directors referred to in this proxy statement;

•on such other business or matters that may properly come before the Annual Meeting in accordance with the best judgment of the persons named as proxies in the form of proxy.

Other than the election of ten directors, the Board has no knowledge of any matters to be presented for action by the shareholders at the Annual Meeting. An inspector of elections appointed by the Board will tabulate all votes at the Annual Meeting.

You may attend and participate in the Annual Meeting by virtual presences online if you were a shareholder or joint holder as of the close of business on the Record Date, or you hold a valid proxy for the Annual Meeting. To attend the Annual Meeting by virtual presence online, go to www.virtualshareholdermeeting.com/QUAD2024. If you are a shareholder of record, you will also need to provide your control number found on your proxy card. If you are not a shareholder of record, but hold shares through a bank, broker or other nominee, you will also need to obtain a legal proxy from the bank, broker or other nominee that holds your shares, have a copy of the voting instruction card provided by your bank, broker or other nominee, and provide your control number found on the voting instruction card provided by such bank, broker or other nominee.

The virtual Annual Meeting will begin promptly at 9:00 a.m. Central Time. Online check-in will begin at 8:45 a.m. Central Time, and you should allow ample time for the online check-in procedures. If you have difficulty accessing the Annual Meeting, please call the telephone number provided on the login page at www.virtualshareholdermeeting.com/QUAD2024. We will have technicians available to assist you.

In order to answer shareholder questions as completely as possible during the question and answer session at the Annual Meeting, please submit any questions by the end of the day on Monday, May 20, 2024. You may submit a question by such time at www.proxyvote.com after logging in with the control number provided on your proxy card.

ELECTION OF DIRECTORS

The Board currently consists of ten directors. At the Annual Meeting, the shareholders will elect all ten directors to one-year terms—to hold office until the 2025 Annual Meeting of Shareholders and until their successors are duly elected and qualified. Unless shareholders otherwise specify, the shares represented by the proxies received will be voted in favor of the election as directors of the ten persons named as nominees in this proxy statement. The Board has no reason to believe that the listed nominees will be unable or unwilling to serve as directors if elected. However, in the event that any nominee should be unable to serve or for good cause will not serve, the shares represented by proxies received will be voted for another nominee selected by the Board.

Each director will be elected by a plurality of the votes cast at the Annual Meeting, assuming a quorum is present. For this purpose, “plurality” means that the nominees receiving the largest number of votes will be elected as directors. Any shares not voted at the Annual Meeting, whether due to abstentions, broker non-votes or otherwise, will have no impact on the election of the directors. Shares of the Company’s class A common stock and class B common stock vote together as a single class on the election of directors.

The following sets forth certain information, as of the date of mailing of the proxy materials, about the Board’s nominees for election at the Annual Meeting.

J. Joel Quadracci, 55, has been a director of Quad since 2003, its President since January 2005, its President and Chief Executive Officer since July 2006 and its Chairman, President and Chief Executive Officer since January 2010. Mr. Quadracci joined Quad in 1991 and, prior to becoming President and Chief Executive Officer, served in various capacities, including Sales Manager, Regional Sales Strategy Director, Vice President of Print Sales, Senior Vice President of Sales and Administration, and President and Chief Operating Officer. He serves on the board of directors for Plexus Corp., Pixability, Inc., Road America, Inc., the National Association of Manufacturers, and the Metropolitan Milwaukee Association of Commerce. He also serves on the advisory council of the Smithsonian National Postal Museum. Mr. Quadracci received a B.A. in Philosophy from Skidmore College in 1991. Mr. Quadracci is the brother of Kathryn Quadracci Flores, M.D., a director of Quad and Chief Executive Officer of QuadMed, the brother-in-law of Christopher B. Harned, a director of Quad, and the first cousin of Robert Quadracci, Chief Human Resources Officer. Quad believes that Mr. Quadracci’s experience in both the commercial printing and advertising and marketing services industries, as well as his leadership positions within Quad, qualify him for service as a director of Quad.

Kathryn Quadracci Flores, M.D., 56, has been a director of Quad since 2013 and is a member of the Finance Committee. Dr. Flores joined QuadMed, LLC, a subsidiary of the Company in 2021 and serves as the Chief Executive Officer of QuadMed. Dr. Flores serves as President and Director of the Windhover Foundation, a large multi-generational family foundation and is a co-chair of the President’s Leadership Council of Brown University. Dr. Flores previously served as Vice President and Secretary of the board of trustees for the Collegiate School of New York, on the Board of Directors for the Brown University Sports Foundation, on the Board of Trustees for the Marymount School of New York and as Commodore of the Pine Lake Yacht Club. Dr. Flores received her B.A. and B.S. from Brown University in 1990 and her M.D. from Columbia University in 1995. Dr. Flores is the sister of J. Joel Quadracci, Quad’s Chairman, President and Chief Executive Officer, the sister-in-law of Christopher B. Harned, a director of Quad, and the first cousin of Robert Quadracci, Chief Human Resources Officer. Quad believes that Dr. Flores’ knowledge of Quad, her education, and her board and business experience qualify her to serve as a director of Quad.

Douglas P. Buth, 69, has been a director of Quad since 2005 and is the Chair of the Audit Committee and also is a member of the Compensation and Finance Committees. Mr. Buth retired as Chairman and Chief Executive Officer of Appvion, Inc., formerly known as Appleton Papers, Inc., a producer of carbonless, thermal, security paper and performance packaging products, and as Chief Executive Officer and President of Paperweight Development Corp., the parent company of Appvion, Inc., in 2005. Prior to becoming Chief Executive Officer, Mr. Buth had served in a variety of roles at Appvion, Inc., including positions in strategic planning, marketing and sales and as General Manager and Executive Vice President. Mr. Buth is currently a member of the board of directors for Trek Bicycle Corporation, where he serves as chairman of the Audit Committee and a member of the Compensation Committee. He retired from the board of Grange Mutual Insurance Company in 2021, where he chaired the Compensation Committee and served as a member of the Investment Committee and the Audit Committee. Mr. Buth received a Bachelor of Business Administration in Accounting from the University of Notre Dame in 1977. He qualified as a C.P.A. with PricewaterhouseCoopers LLP in 1979 and thereafter held a number of financial positions with Saks Fifth Avenue and BATUS, Inc. Quad believes that Mr. Buth’s financial background as a C.P.A. and his experience as a leader of a publicly-traded company and member of several boards of directors qualify him for service as a director of Quad.

Beth-Ann Eason, 57, has been a director of Quad since 2023 and is a member of the Compensation Committee. In 2023, Ms. Eason also received her NACD board certification. Ms. Eason was the Managing Director, Senior Digital Transformation Executive for Accenture Interactive from January 2020 to December 2022, working with chief marketing officers on digital transformation. Prior to joining Accenture Interactive, Ms. Eason served from May 2015 to January 2020 as President of Innovid, the world’s largest independent Connected TV and video advertising software platform. Ms. Eason was at Conde Nast from April 2011 to May 2015, serving as Senior Vice President and General Manager of Conde Nast’s Epicurious from April 2011 to July 2013. Ms. Eason was also Vice President of Category Development for Yahoo! from 2001 to 2006 and DoubleClick from 1996 to 2001 where she was promoted in to a General Manager role. She holds a Bachelor’s degree from Lehigh University. Quad believes that Ms. Eason’s experience as an industry leader in digital transformation, marketing and advertising qualifies her for service as a director of Quad.

John C. Fowler, 73, has been a director of Quad since 2016 and is a member of the Compensation Committee. Mr. Fowler served as Quad’s Vice Chairman and Executive Vice President of Global Strategy and Corporate Development from March 2014 until December 2017. Prior thereto, he served as Quad’s Executive Vice President and Chief Financial Officer from July 2010 to March 2014, as Senior Vice President and Chief Financial Officer from May 2005 to July 2010, and as Vice President and Controller from when he joined Quad in 1980 (which at the time was the Company’s top financial position) until May 2005. Prior to joining Quad, Mr. Fowler worked for Arthur Andersen LLP for six years. In November 2018, Mr. Fowler was elected as a director of Mandel Group, Inc. He also serves on the board of directors of Manipal Technologies Ltd., the L’Eft Bank Wine Company, and is a past board member of several private and venture capital companies that were successfully sold. Mr. Fowler attended Tufts University and Iowa State University, graduating summa cum laude with Bachelor’s degrees in both economics and accounting. Quad believes that Mr. Fowler’s experience in the printing industry and in leadership positions with Quad and on several boards of directors qualify him for service as a director of Quad.

Stephen M. Fuller, 63, has been a director of Quad since 2016 and is a member of the Audit Committee. Mr. Fuller served as Senior Vice President and Chief Marketing Officer for L.L. Bean, Inc. of Freeport, Maine from 2001 until his retirement in 2016. In this former role, he led all marketing functions for L.L. Bean, including branding, advertising, customer satisfaction, e-commerce, partnerships, database analytics and marketing operations. In addition to his CMO role, Mr. Fuller had full P&L responsibility for L.L. Bean’s international efforts since 2008. Currently, he is a member of the board of directors of Boyne Resorts and K2-MDV Holdings, LP; a former trustee at Bates College; and is a frequent speaker at Dartmouth College’s Tuck School of Business. Mr. Fuller is a former member of L.L. Bean’s board of directors. He also has been on the boards of several environmental and outdoor organizations. Mr. Fuller received his Bachelor’s degree from Bates College in Lewiston, Maine, and his MBA from Boston College. He also attended Harvard Business School’s Advanced Management Program. Quad believes that Mr. Fuller’s leadership in marketing and board experience qualify him to serve as a director of Quad.

Christopher B. Harned, 61, has been a director of Quad since 2005 and is the Chair of the Finance Committee. Mr. Harned is the Co-Founder and Managing Partner of Windhover Capital, a private equity firm focused on the food and consumer sector. From September 2016 to October 2020, Mr. Harned was a Partner and Head of the New York office for Arbor Investments. Prior to joining Arbor Investments, he was a Managing Director and Head of Consumer Products-Americas for Nomura Securities International, Inc. Starting in January 2012, he served as a Managing Director of the Investment Banking Group M&A team at Robert W. Baird & Co., Inc. He previously served as a Partner, Managing Director and Head of the Consumer Products Group of The Cypress Group LLC, a New York City-based private equity firm. Prior to joining The Cypress Group LLC in 2001, Mr. Harned was a Managing Director and Global Head of Consumer Products M&A with Lehman Brothers, where he worked for over 16 years. Mr. Harned is a member of the board of directors of Titan Frozen Fruit, Lakeview Farms, Inc. and Southeastern Meats, Inc. He is a former member of the board of directors of FreshPet, Inc., a pet food company, where he served on the Audit and Compensation committees. Mr. Harned is also a former member of the board of directors of Red Collar Pet Foods, bswift, Danka Business Systems PLC, The Meow Mix Company, Stone Canyon Entertainment, Brand Connections LLC and Philadelphia Media Network. Mr. Harned earned a Bachelor’s degree from Williams College in 1985. Mr. Harned is the brother-in-law of J. Joel Quadracci, Quad’s Chairman, President and Chief Executive Officer, the brother-in-law of Kathryn Quadracci Flores, M.D., a director of Quad and Chief Executive Officer of QuadMed, and the husband of Elizabeth Quadracci Harned, a Trustee of the Quad Voting Trust (as defined below). Quad believes that Mr. Harned’s experience in the financial services industry and his leadership at several companies in various industries qualify him to serve as a director of Quad.

Melanie A. Huet, 48, has been a director of Quad since 2023. Ms. Huet is President of Brand Management & Innovation at Newell Brands, a consumer products company, and has global responsibility for brand management, innovation, insights, media, design and packaging. Prior to joining Newell Brands in 2023, Ms. Huet led the transformation of Serta Simmons Bedding from a sales-led to a consumer-led organization as its first Chief Marketing Officer from 2019 to 2021, and then Executive Vice President and Chief Commerce Officer from 2021 to 2022. Serta Simmons Bedding LLC filed for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code in January 2023. Ms. Huet also previously served as Vice President Marketing at KraftHeinz from 2017 to 2018; in various marketing roles at Kimberly-Clark from 2011 to 2016; and in marketing and sales roles at Unilever from 2005 to 2011. She holds an MBA from the University of Rochester in New York and a bachelor's degree from the University of St. Thomas, Minnesota. Quad believes that Ms. Huet's experience as an industry leader in brand management, consumer engagement and innovation qualify her to serve as a director of Quad.

Jay O. Rothman, 64, has been a director of Quad since 2017 and is a member of the Audit Committee. Mr. Rothman has served as President of the Universities of Wisconsin since June 2022. He previously served as the Chairman and Chief Executive Officer of Foley & Lardner LLP, a national law firm, from June 2011 until his retirement from the firm in May 2022. At Foley & Lardner LLP, Mr. Rothman also had been a member of the firm’s Management Committee since February 2002, and a partner since February 1994. He joined Foley & Lardner LLP in 1986. Mr. Rothman serves on the board of directors of Mayville Engineering Company, Inc. Mr. Rothman received a Bachelor of Arts degree from Marquette University in 1982 and a Juris Doctor from Harvard Law School in 1985. Quad believes that Mr. Rothman’s career as an executive and as a business attorney qualify him to serve as a director of Quad.

John S. Shiely, 71, has been a director of Quad since 1996 and is the Chair of the Compensation Committee and also is a member of the Audit Committee. Mr. Shiely is the retired Chairman and Chief Executive Officer of Briggs & Stratton Corporation, a producer of air-cooled gasoline engines for outdoor power equipment. Prior to becoming Chief Executive Officer in 2001 and Chairman in 2003, Mr. Shiely had worked for Briggs & Stratton Corporate since 1986 in various capacities, including as Vice President and General Counsel, Executive Vice President – Administration and President. Mr. Shiely served on the board of directors of Oshkosh Corporation from 2012 to 2024 and as a director of Scotts Miracle-Gro Company from 2007 to 2013, BMO Financial Corporation from 2011 to 2023, BMO Harris Bank N.A. from 2012 to 2023, and Marshall & Ilsley Corporation from 1999 until its sale in 2011. Mr. Shiely received a Bachelor of Business Administration in Accounting from the University of Notre Dame, a Juris Doctor from Marquette University Law School, a Master of Management from the J. L. Kellogg Graduate School of Management at Northwestern University, and in 2010 studied corporate governance as a visiting scholar in the graduate program at Harvard Law School. Quad believes that Mr. Shiely’s career as an executive of a publicly-traded company, his experience as a director of various publicly traded companies, and his education in accounting and law qualify him to serve as a director of Quad.

THE BOARD RECOMMENDS THE FOREGOING NOMINEES FOR ELECTION AS DIRECTORS AND URGES EACH SHAREHOLDER TO VOTE “FOR” SUCH NOMINEES. SHARES OF COMMON STOCK REPRESENTED AT THE ANNUAL MEETING BY EXECUTED, OR OTHERWISE VALIDLY VOTED, BUT UNMARKED PROXIES, WILL BE VOTED “FOR” SUCH NOMINEES.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board has adopted corporate governance guidelines that, in conjunction with the Board committee charters, establish processes and procedures to help ensure effective and responsive governance by the Board. The corporate governance guidelines also establish the Company’s policies on director orientation and continuing education, which include a mandatory orientation program for new directors and provide that the Board will be assessed on an annual basis to determine whether it and its committees are functioning effectively. In addition, the Company’s corporate governance guidelines provide that the Board have regularly scheduled meetings at which the non-management directors meet in executive session without the Company’s executive officers being present. The non-management directors may also meet without the Company’s executive officers present at such other times as they determine appropriate. The corporate governance guidelines also provide that the Company’s executive officers and other members of senior management who are not members of the Board will participate in Board meetings to present information, make recommendations and be available for direct interaction with members of the Board. The corporate governance guidelines are available, free of charge, on the Company’s website, www.QUAD.com. The information contained on the Company’s website is not incorporated into, and does not form a part of, this proxy statement or any other Company report or document on file with or furnished to the Securities and Exchange Commission (“SEC”).

Independence; NYSE Controlled Company Exemptions; Board Leadership Structure

The Board has adopted director independence standards to assist it in making determinations regarding whether the Company’s directors are independent as that term is defined in the listing standards of the New York Stock Exchange (“NYSE”). These standards are available, free of charge, on the Company’s website, www.QUAD.com. Based on these standards, the Board determined that Messrs. Buth, Fuller, Rothman and Shiely and Mses. Eason and Huet are independent as that term is defined in the listing standards of the NYSE and the director independence standards adopted by the Board, while Dr. Flores and Messrs. Quadracci, Fowler and Harned are not deemed to be independent.

Since the Quad/Graphics, Inc. Amended and Restated Voting Trust Agreement (“Quad Voting Trust”) (see “Stock Ownership of Management and Others—Quad Voting Trust” later in this proxy statement) owns more than 50% of the total voting power of the Company’s stock, the Company is considered a “controlled company” under the corporate governance listing standards of the NYSE. As a controlled company, the Company is eligible for the NYSE’s exemption of controlled companies from the obligation to comply with certain of the NYSE’s corporate governance requirements, including the requirements:

•that a majority of the Board consist of independent directors, as defined under the rules of the NYSE (although a majority of the members of the Company’s Board are independent under the listing standards of the NYSE and the director independence standards adopted by the Board);

•that the Company have a corporate governance and nominating committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and

•that the Company have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

The Company’s bylaws and corporate governance guidelines provide the Board with the discretion to determine whether to combine or separate the positions of chairman of the board and chief executive officer. The Board currently believes it is in the best interests of the Company and its shareholders to combine these two roles because this provides the Company with unified leadership and direction and Mr. Quadracci is the person best qualified to serve as chairman given his history with the Company and his skills and knowledge within the industry in which the Company operates.

Based on the fact that the Company is controlled by the Quadracci family through the Quad Voting Trust, the Board does not believe it is necessary to have an independent lead director.

Board’s Role in the Oversight of Risk

The full Board is responsible for the oversight of the Company’s operational and strategic risk management process. The Board oversees a company-wide approach to risk management, carried out by management. The full Board determines the appropriate risk for the Company generally, assesses the specific risks the Company faces and reviews the steps taken by management to manage those risks. With regard to cybersecurity risk, the Board (through the audit committee) periodically reviews information on management’s policies and processes related to the Company’s cybersecurity and data-protection, and the entire Board receives periodic updates on the Company’s cybersecurity risk management progress through the Company’s general enterprise risk management program described in the foregoing sentence.

While the full Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, the Board relies on its audit committee to address significant financial risk exposures (including cybersecurity risk) facing the Company and the steps management has taken to monitor, control and report such exposures, with appropriate reporting of these risks to be made to the full Board. The Board relies on its compensation committee to address significant risk exposures facing the Company with respect to compensation and with appropriate reporting of these risks to be made to the full Board. The Board’s role in the Company’s risk oversight has not affected the Board’s leadership structure.

Board Meetings

The Board held five meetings in 2023. During the period of the directors’ service in 2023, each of the directors attended at least 75% of the aggregate of the total number of meetings of the Board and those committees of the Board on which such director served.

At each regularly-scheduled Board meeting, the directors also met in executive session without the Company’s executive officers present. In addition, the non-management directors met separately in executive session and the independent directors also met separately in executive session. No presiding director was chosen for these sessions in 2023. An independent director presides over each executive session of the independent directors. The independent director who presides may differ from meeting to meeting, which is dependent on the subject matter of the agenda of the executive session.

Directors are expected to attend the Company’s Annual Meeting of Shareholders each year. At the 2023 Annual Meeting, eight of the nine directors then serving were in attendance (in-person, via webcast or by telephone).

Communications with the Board

Shareholders and other interested parties may communicate with the Board by writing to Quad/Graphics, Inc., Board of Directors (or, at the writer’s option, to a specific director or to the non-management directors as a group), c/o Dana B. Gruen, General Counsel, Corporate Secretary and Chief Risk & Compliance Officer, Quad/Graphics, Inc., N61 W23044 Harry’s Way, Sussex, Wisconsin 53089-3995. Ms. Gruen will ensure that the communication is delivered to the Board, the specified director or the specified group of directors, as the case may be.

Board Committees

The Board currently has standing audit, compensation and finance committees. Each committee is appointed by and reports to the Board. The Board has adopted, and may amend from time to time, a written charter for each of the audit, finance and compensation committees, which, among other things, sets forth the committee’s responsibilities. The Company makes available on its website, www.QUAD.com, copies of each of these charters free of charge. As a controlled company under the corporate governance listing standards of the NYSE, the Board is not required to, and does not have, a nominating committee.

Audit Committee

The audit committee of the Board currently consists of Messrs. Buth (chairperson), Fuller, Rothman and Shiely, each of whom is independent as defined by the rules of the SEC and the listing standards of the NYSE, as well as the director independence standards adopted by the Board. In addition, the Board has determined that each current member of the audit committee qualifies as an “audit committee financial expert” as defined by the rules of the SEC and meets the expertise requirements for audit committee members under the listing standards of the NYSE. Each member of the audit committee has served in senior positions with their respective organizations or have served as directors of public and private companies, which has afforded the member the opportunity to gain familiarity with financial matters relevant to Quad.

The principal functions performed by the audit committee include assisting and discharging certain responsibilities of the Board in overseeing the reliability of financial reporting, the effectiveness of internal control over financial reporting, the process for monitoring compliance with corporate codes of conduct, the internal auditors and audit functions and the independence of the independent external auditors and audit functions. In addition, the audit committee’s duties also include direct responsibility for the appointment, compensation, retention and oversight of the independent external auditors; review and discussion with the independent external auditors of the scope of their audit; review and discussion of the financial statements, management’s discussion and analysis of financial condition and results of operations included in the Company’s periodic filings; review of any reports to shareholders containing financial information, quarterly earnings press releases and other financial information and earnings guidance; discussion with the Company’s internal auditors about the audit plan, and results of internal audits; review of such accounting principles, policies and practices, reporting policies and practices as it may deem necessary or proper; review and discussion of compliance matters and compliance program, including policies and procedures for reporting compliance matters; review and discussion of cybersecurity matters and cybersecurity program; and establishment of policies concerning the provision of non-audit services by the independent external auditors. The audit committee held five meetings in 2023. The audit committee members were offered an opportunity at each audit committee meeting to meet with only the Company’s independent external auditors present and did so regularly.

Compensation Committee

The compensation committee of the Board currently consists of Messrs. Shiely (chairperson), Buth and Fowler and Ms. Eason. Messrs. Shiely and Buth and Ms. Eason are independent as defined by the listing standards of the NYSE and the director independence standards adopted by the Board. The compensation committee held six meetings in 2023.

The principal functions of the compensation committee are to review and approve the annual salary, bonuses, equity-based incentives and other benefits, direct and indirect, of the Company’s executive officers; review and report on the compensation and human resources policies, programs and plans of the Company; administer the Company’s stock option and other compensation plans; review and recommend to the Board chief executive officer compensation; and review and recommend to the Board director compensation to align directors’ interests with the long-term interest of the Company’s shareholders. In addition, the compensation committee’s duties also include determining and approving the Company’s compensation philosophy; determining stock ownership guidelines for the Company’s executive officers and directors and monitoring compliance with any such guidelines; on an annual basis, preparing a report regarding executive officer compensation for inclusion in the Company’s annual proxy statement; and reviewing and evaluating the Company’s policies and practices in compensating employees, including non-executive officers, as they relate to risk management practices and risk-taking incentives.

The compensation committee also has authority to establish subcommittees and delegate authority to such subcommittees to accomplish the duties and responsibilities of the committee. The compensation committee has established a subcommittee consisting of Messrs. Shiely and Buth and Ms. Eason and delegated to it certain responsibilities of the Board and the compensation committee with respect to compensation intended to satisfy certain regulatory requirements, including equity-based awards to and transactions with officers of the Company intended to be exempt from Section 16(b) of the Securities Exchange Act of 1934, as amended, and to perform other duties delegated from time to time by the Board or the compensation committee. Each of Messrs. Shiely and Buth and Ms. Eason meets the requirements to be considered a “non-employee director” within the meaning of Section 16.

The executive officers’ role in determining the amount or form of executive officer compensation is limited to assisting the compensation committee with its reviews of the Company’s compensation and benefit arrangements and making recommendations to the compensation committee regarding the compensation of the executive officers (other than their own). Certain of our executive officers may attend meetings (other than executive sessions) of the compensation committee at which the committee considers the compensation of other executive officers.

The compensation committee engaged FW Cook & Co., Inc. (“FW Cook”) in 2023 to serve as the compensation committee’s independent compensation consultant and provide recommendations and advice on the Company’s executive and director compensation programs. Pursuant to its engagement in 2023, FW Cook advised the compensation committee on general trends in public company compensation arrangements and provided benchmarking data with respect to 2023 executive officer compensation. FW Cook did not provide any services to the Company other than pursuant to such engagement by the committee during 2023. For more information regarding the role of the compensation consultant, please see the disclosure later in this proxy statement under the section titled “Compensation of Executive Officers—Compensation Discussion and Analysis.”

Finance Committee

The finance committee of the Board presently consists of Mr. Harned (chairperson), Mr. Buth and Dr. Flores. The principal functions performed by the finance committee are to provide assistance to, and discharge certain responsibilities of, the Board relating to the capital structure, means of financing, selection of lenders, cash flow modeling, interest rate sensitivity and similar matters so as to achieve the Company’s long-term plans. The finance committee held two meetings in 2023.

Compensation Committee Interlocks and Insider Participation

Elizabeth Prahl, Mr. Fowler’s daughter, is employed by the Company as a product development & innovation director. Her total compensation for 2023 was $256,115, consisting of base salary, bonus, a 401(k) matching contribution and the aggregate grant date fair value of equity awards granted to her in 2023.

Nominations of Directors

Pursuant to the direction of the Quad Voting Trust, the Board will select nominees to become directors to fill vacancies or newly created directorships and nominate directors for election by the Company’s shareholders at annual meetings of the shareholders. The Quad Voting Trust will consider candidates recommended by the Company’s shareholders to become nominees for election as directors. Shareholders who wish to propose nominees for election as directors must follow certain procedures contained in the Company’s bylaws. In the case of nominees for election at an annual meeting, shareholders must send notice to the Secretary of the Company at the Company’s principal offices on or before December 31 of the year immediately preceding such annual meeting (provided that if the date of the annual meeting is on or after May 1 in any year, notice must be received not later than the close of business on the day which is determined by adding to December 31 of the immediately preceding year the number of days on or after May 1 that the annual meeting takes place). The notice must contain certain information specified in the Company’s bylaws, including certain information about the shareholder or shareholders bringing the nomination (including, among other things, the number and class of shares held by such shareholder(s)) as well as certain information about the nominee (including, among other things, a description of all arrangements or understandings between such shareholder and each nominee and any other person pursuant to which the nomination is to be made, and other information that would be required to be disclosed in solicitations of proxies for elections of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended).

In identifying and evaluating nominees for director, the Company seeks to ensure that the Board possesses, as a whole, certain core competencies. Each director candidate will be reviewed based upon the Board’s current capabilities, any needs therein and the capabilities of the candidate. The selection process takes into account all appropriate factors, which may include, among other things, diversity, experience, personal integrity, skill set, the ability to act on behalf of shareholders and the candidate’s personal and professional ethics, integrity, values and business judgment.

Policies and Procedures Governing Related Person Transactions

The Board has adopted written policies and procedures regarding related person transactions. For purposes of these policies and procedures:

•A “related person” means any of the Company’s directors, executive officers, nominees for director, any holder of 5% or more of any class of the Company’s common stock or any of their immediate family members; and

•A “related person transaction” generally is a transaction (including any indebtedness or a guarantee of indebtedness) in which the Company was or is to be a participant and the amount involved exceeds $120,000, and in which a related person had or will have a direct or indirect material interest.

Each executive officer, director or nominee for director is required to disclose to the full Board certain information relating to related person transactions for review, approval or, if necessary, ratification by the independent directors. Disclosure to the Board should occur before the related person transaction is effected or, if prior disclosure is not reasonably possible, as soon as practicable after the related person transaction is effected, but in any event as soon as practicable after the executive officer, director or nominee for director becomes aware of the related person transaction. The decision whether or not to approve or, if necessary, ratify a related person transaction is to be made in light of the determination by the independent directors as to whether the relationship is believed by the independent directors to serve the best interests of the Company and its shareholders and whether the relationship should be continued or eliminated. The Board may delegate some or all of its authority relating to related person transactions to the audit committee.

Certain Relationships and Related Person Transactions

In addition to the related person transactions described under “Board Committees—Compensation Committee Interlocks and Insider Participation” above, the following is a description of transactions since January 1, 2023 to which the Company has been a party, in which the amount involved in the transaction exceeded or will exceed $120,000, and in which any of the Company’s directors, nominees for director, executive officers or beneficial holders of more than 5% of the common stock had or will have a direct or indirect material interest.

Kathryn Quadracci Flores, a director of the Company, is Chief Executive Officer of QuadMed, LLC, a subsidiary of the Company. In this role, Dr. Flores received compensation for 2023 of $720,396, consisting of base salary, bonus and the grant date fair value of equity awards granted to her in 2023.

Sustainable Impact

For more than 52 years, Quad has focused on “creating a better way,” believing it can do good in the world while doing well as a business. This focus reflects its “maker” culture where employees not only envision solutions, but actually create and execute them, all of which has inspired creativity in how Quad addresses environmental issues, social issues and corporate governance, and contributes to good corporate citizenship. The Company details its progress on driving positive, sustainable impact in its Environmental, Social and Governance (ESG) report. Additional information is available in our Annual Report on Form 10-K and on our website at https://www.quad.com/about/esg.

AUDIT COMMITTEE REPORT

In accordance with its written charter adopted by the Board, the audit committee assists the Board in fulfilling its oversight responsibilities with respect to the reliability of financial reporting, the effectiveness of internal control over financial reporting, the process for monitoring compliance with corporate codes of conduct, control of the internal auditors and audit functions and control over the independence and qualifications of the independent external auditors and audit functions.

In fulfilling its responsibilities, the audit committee:

•Reviewed and discussed the audited financial statements for the year ended December 31, 2023 with the Company’s management and Ernst & Young LLP, the independent registered public accounting firm for Quad;

•Reviewed and discussed with management and Ernst & Young LLP the assessment and audit of the Company’s internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act;

•Discussed with Ernst & Young LLP the matters required to be discussed by the Public Company Accounting Oversight Board’s (“PCAOB”) Auditing Standard No. 1301, Communications With Audit Committees, and Rule 2-07 of Regulation S-X; and

•Received from Ernst & Young LLP the written disclosures and letter required by the PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, and discussed with Ernst & Young LLP its independence.

The audit committee also approved the Company’s internal auditors’ overall scope and plan for its audits. The audit committee met periodically with the internal auditors to discuss the results of their examinations and their evaluation of the Company’s internal controls. The audit committee also periodically met and discussed with management and Ernst & Young LLP, with and without management present, such other matters as it deemed appropriate.

Based on the foregoing review and discussions, and relying thereon, the audit committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 to be filed with the SEC.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such Acts.

AUDIT COMMITTEE

Douglas P. Buth, Chairperson

Stephen M. Fuller

Jay O. Rothman

John S. Shiely

STOCK OWNERSHIP OF MANAGEMENT AND OTHERS

The following table sets forth certain information regarding the beneficial ownership of the Company’s class A common stock and class B common stock as of the Record Date by: (1) each director and director nominee; (2) each of the executive officers named in the Summary Compensation Table; (3) all of the directors, director nominees and executive officers (including the executive officers named in the Summary Compensation Table) as a group; and (4) each person or entity known to us to be the beneficial owner of more than 5% of any class of the common stock. Except as otherwise indicated in the footnotes, each of the holders listed below has sole voting and investment power over the shares beneficially owned. The footnotes also indicate instances in which the same shares are reported as held by two or more holders. As of the Record Date, there were 37,841,559 shares of class A common stock and 13,261,983 shares of class B common stock outstanding. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares Beneficially Owned | | |

| | Class A

Common Stock | | Class B

Common Stock(1) | | |

| Name of Beneficial Owners | | Shares | | % | | Shares | | % | | |

| Directors and Executive Officers | | | | | | | | | | |

J. Joel Quadracci(2) | | 2,148,166 | | | 5.68 | % | | 358,789 | | | 2.71 | % | | |

| Anthony C. Staniak | | 253,250 | | | * | | — | | | — | % | | |

David J. Honan(3) | | 636,223 | | | 1.68 | % | | 8,608 | | | * | | |

| Eric N. Ashworth | | 222,190 | | | * | | — | | | — | % | | |

| Kelly A. Vanderboom | | 265,274 | | | * | | — | | | — | % | | |

Douglas P. Buth(4) | | 144,633 | | | * | | — | | | — | % | | |

Beth-Ann Eason(5) | | 45,509 | | | * | | — | | | — | % | | |

Kathryn Quadracci Flores, M.D.(6) | | 138,653 | | | * | | 23,523 | | | * | | |

John C. Fowler(7) | | 185,572 | | | * | | 21,416 | | | * | | |

Stephen M. Fuller(8) | | 142,855 | | | * | | — | | | — | % | | |

Christopher B. Harned(9) | | 544,692 | | | 1.44 | % | | 236,900 | | | 1.79 | % | | |

Melanie A. Huet(10) | | 15,869 | | | * | | — | | | — | % | | |

Jay O. Rothman(11) | | 136,204 | | | * | | — | | | — | % | | |

John S. Shiely(12) | | 257,404 | | | * | | — | | | — | % | | |

All current directors, nominees and executive officers as a group (21 persons)(13) | | 5,971,528 | | | 15.43 | % | | 649,236 | | | 4.90 | % | | |

| | | | | | | | | | |

| Other Holders | | | | | | | | | | |

Quad Voting Trust(14) | | 7,534 | | | * | | 12,279,380 | | | 92.59 | % | | |

Quad ESOP(15) | | 2,907,421 | | | 7.68 | % | | — | | | — | % | | |

| | | | | | | | | | |

BlackRock, Inc.(16) | | 2,177,890 | | | 5.76 | % | | — | | | — | % | | |

Dimensional Fund Advisors LP(17) | | 2,260,524 | | | 5.97 | % | | — | | | — | % | | |

William H. Miller III Living Trust (18) | | 2,311,000 | | | 6.11 | % | | — | | | — | % | | |

| | | | | | | | | | |

______________________________

* Denotes less than 1%

(1)Each share of class B common stock is convertible at any time into one share of class A common stock.

(2)Includes 129,425 shares of class B common stock held by trusts of which Mr. Quadracci is the trustee or co-trustee and/or a potential beneficiary. Does not include shares that are held by various trusts, including the Quad Voting Trust, (a) for the benefit or potential benefit of Mr. Quadracci, over which Mr. Quadracci has no investment or voting control and no right to obtain such control within 60 days of the Record Date and (b) of which Mr. Quadracci is one of three or more trustees since, as one of multiple trustees who must act by majority vote, Mr. Quadracci does not have voting or investment control over such shares.

(3)Includes 12,201 shares of class A common stock and 8,608 shares of class B common stock held by trusts of which Mr. Honan is trustee.

(4)Includes 60,651 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date.

(5)Includes 45,509 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date.

(6)Includes 12,201 shares of class A common stock and 23,523 shares of class B common stock held by trusts of which Dr. Flores is trustee. Also includes 78,417 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date. Does not include shares that are held by various trusts, including the Quad Voting Trust, (a) for the benefit or potential benefit of Dr. Flores, over which Dr. Flores has no investment or voting control and no right to obtain such control within 60 days of the Record Date and (b) of which Dr. Flores is one of three or more trustees since, as one of multiple trustees who must act by majority vote, Dr. Flores does not have voting or investment control over such shares.

(7)Includes 132,504 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date. Includes 21,416 shares of class B common stock held by trusts of which Mr. Fowler is a trustee, but not a beneficiary. Does not include shares that are held by trusts of which Mr. Fowler is one of three or more trustees since, as one of multiple trustees who must act by majority vote, Mr. Fowler does not have voting or investment control over such shares.

(8)Includes 132,504 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date.

(9)Includes 50,205 shares of class A common stock and 2,888 shares of class B common stock held by a trust to which Mr. Harned is a trustee; 60,651 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date; and 265,271 shares of class A common stock and 234,012 shares of class B common stock held by Elizabeth Quadracci Harned. Does not include shares that are held by trusts of which Mr. Harned is one of three or more trustees since, as one of multiple trustees who must act by majority vote, Mr. Harned does not have voting or investment control over such shares.

(10)Includes 15,869 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date.

(11)Includes 132,504 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date.

(12)Includes 196,904 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date.

(13)Includes 855,513 shares of class A common stock attributable to deferred stock units that could be received within 60 days of the Record Date.

(14)Some of the shares of class A common stock and class B common stock owned by the Quadracci family members have been deposited into the Quad Voting Trust, pursuant to which the three trustees thereof (currently J. Joel Quadracci, Kathryn Quadracci Flores, M.D. and Elizabeth Quadracci Harned), acting by majority action, have shared voting power and shared investment power over all such shares. The terms of the Quad Voting Trust are more particularly described below under “— Quad Voting Trust.” The address of the Quad Voting Trust is N61 W23044 Harry’s Way, Sussex, Wisconsin 53089.

(15)The directed trustee of the Quad/Graphics, Inc. Employee Stock Ownership Plan (the “ESOP”) is Delaware Charter Guarantee & Trust Company dba Principal Trust Company and its address is 1013 Centre Road, Suite 300, Wilmington, Delaware 19805-1265.

(16)The number of shares owned set forth in the table is as of or about December 31, 2023 as reported by BlackRock, Inc. (“BlackRock”), in its Schedule 13G/A filed with the SEC. The address for this shareholder is 50 Hudson Yards, New York, New York 10001. BlackRock reports sole voting power with respect to 2,137,499 of these shares and sole dispositive power with respect to all of the shares.

(17)The number of shares owned set forth in the table is as of or about December 31, 2023 as reported by Dimensional Fund Advisors LP (“Dimensional Fund”), in its Schedule 13G/A filed with the SEC. The address for this shareholder is 6300 Bee Cave Road, Building One, Austin, Texas 78746. Dimensional Fund reports sole voting power with respect to 2,213,124 of these shares and sole dispositive power with respect to all of the shares.

(18)The number of shares owned set forth in the table is as of or about December 31, 2022 as reported by the William H. Miller III Living Trust (the “Trust”), in its Schedule 13G/A filed with the SEC. The address for this shareholder is One South Street, Suite 2550, Baltimore, Maryland 21202. The Trust reports sole voting and dispositive power with respect to 961,000 of these shares and shared voting and dispositive power with respect to 1,350,000 of the shares (which are owned by clients of Miller Value Partners, LLC, a registered investment advisor).

Quad Voting Trust

To help ensure the continuity and stability of the management of Quad, various members of the Quadracci family, including certain affiliated entities, entered into a voting trust agreement in September 1982, which has been subsequently amended. Pursuant to the Quad Voting Trust, certain shares of Quad common stock held by such individuals and entities are held by the Quad Voting Trust.

Under the Quad Voting Trust, the three trustees (currently J. Joel Quadracci, Kathryn Quadracci Flores, M.D., and Elizabeth Quadracci Harned) are vested with the full legal title to all common stock and any other securities of the Company that are held by the Quad Voting Trust, with all rights and power of the owner and holder of the stock of whatever nature necessary to enable the trustees to exercise the powers vested in them under the agreement. The rights held by the trustees under the Quad Voting Trust include the shared right to vote the shares (subject to certain exceptions noted below), the right to become parties to or prosecute or intervene in any legal or administrative proceedings affecting the stock, the Company or the powers, duties and obligations of the trustee, the right to transfer the stock into their names as trustee or into the name of other nominees, the right to enter into shareholder agreements and the right to exercise all rights and preferences of the stock. Except as otherwise provided in the voting trust agreement, the trustees act by majority vote (or unanimous vote if there are only two trustees).

The Quad Voting Trust provides that the trustees shall exercise their judgment to select suitable directors of the Company and to vote on such other matters that may come before them at shareholder meetings. Without approval of the beneficiaries holding trust certificates representing two-thirds of the stock held under the Quad Voting Trust, however, the trustees do not have the power to vote the stock in favor of the merger or consolidation of the Company, the sale or exchange of all, or substantially all, of the voting securities of the Company, the sale, lease or exchange of all, or substantially all, of the property and assets of the Company, the total or partial liquidation of the Company, the dissolution of the Company, any act that is likely to lead to a public offering, any issuance of Company securities if it would result in the stock held by the trustees not having the power to elect a majority of the Company’s board of directors or any amendment to the Company’s amended and restated articles of incorporation that would diminish the rights reserved to the trust beneficiaries.

The shares held by the Quad Voting Trust may be withdrawn by a beneficiary prior to the expiration or termination of the Quad Voting Trust only if there is an amendment to the voting trust agreement that is determined to materially adversely affect that particular beneficiary or a group of beneficiaries and if the trustees allow such withdrawal. Notwithstanding the foregoing, certain de minimis withdrawals from the Quad Voting Trust are permitted and the trustees may, by unanimous vote, permit stock to be withdrawn, but, subject to certain exceptions, the withdrawn stock will be converted into, or exchanged for, class A common stock.

The Quad Voting Trust is perpetual. Notwithstanding the foregoing, the voting trust agreement may be terminated by the unanimous vote of the trustees and a two-thirds vote of beneficiaries. The voting trust agreement automatically terminates when none of the stock held by the trustees under the agreement possess voting rights, upon the sale, dissolution or liquidation of the Company, upon the sale of substantially all of its assets, or upon a merger, reorganization, combination or exchange of stock involving the Company that results in the securities under the voting trust agreement constituting less than ten percent of the votes entitled to be cast in an election of directors of the surviving or successor entity.

COMPENSATION OF EXECUTIVE OFFICERS

Compensation Discussion and Analysis

This Compensation Discussion and Analysis relates to the material elements of compensation awarded to, earned by, or paid to the individuals listed in the Summary Compensation Table (“NEOs”) for 2023. This Compensation Discussion and Analysis also discusses events that took place prior or subsequent to 2023 to the extent they are material to understanding 2023 compensation.

We are currently a “smaller reporting company” as defined under SEC rules and, as a result, we are not required to include in this proxy statement a Compensation Discussion and Analysis section and certain other disclosures relating to executive compensation. However, we are voluntarily providing certain information that would be required if we were not a smaller reporting company for purposes of maintaining transparency concerning executive compensation and consistency with our disclosure in prior years when we were not a smaller reporting company.

2023 Executive Compensation Highlights

In 2023, our compensation committee continued its focus on structuring our compensation arrangements in keeping with our compensation philosophy, which is described below under “Overview of our Executive Compensation Philosophy and Design.” Actions taken or approved by our compensation committee or our Board relative to the compensation programs for our executive officers for 2023 included the following:

•The compensation committee approved an annual cash incentive program for 2023 that used two primary financial measures (net earnings (loss) excluding interest expense, income tax expense, depreciation and amortization and restructuring, impairment and transaction-related charges (“Adjusted EBITDA”); and free cash flow). The compensation committee also developed performance and payout scales to quantitatively measure performance and define payouts at each level of performance.

•The compensation committee approved a performance-based component to our NEO’s long-term incentive compensation program for 2023, granting long-term incentive awards in the form of 67% performance-based cash and 33% restricted stock or restricted stock units. The compensation committee decided to use this structure because it believes the structure provides performance incentives that are effective in motivating our executives to execute on our long-term strategic plan and to drive exceptional shareholder value creation over the three-year period to which the awards relate.

•The compensation committee approved adjustments to the compensation of certain of our NEOs for 2023, as described further below.

•The Board reviewed the performance of our Chairman, President and Chief Executive Officer and determined his total compensation.

Compensation Practices and Governance Highlights

We periodically review best practices in the area of executive compensation and update our compensation policies and practices to reflect those that we believe are appropriate for our Company, including the following:

•Pay for performance—A substantial fraction of NEO total compensation is tied to the operating performance of our Company and the achievement of our business objectives. Our performance measures under our incentive compensation program are also aligned with our business objectives.

•Alignment with shareholder interests—Our core executive compensation principles are designed to promote alignment of our named executive officers’ interests with the interests of shareholders.

•Salary increases, bonuses and equity awards must be earned—We do not guarantee salary increases, bonuses or equity awards for our executive officers.

•No option repricing—Our equity compensation plan does not permit repricing of stock options.

•Compensation risk management—We periodically review our pay practices to ensure that they do not encourage excessive risk taking and to confirm that our governance practices are designed to prevent excessive compensation that would not be consistent with our philosophy and business objectives.

•Prohibition on hedging and limitation on pledging—We prohibit our executive officers and directors from hedging our securities and from pledging our securities without prior approval.

•Stock ownership—We maintain stock ownership guidelines for our directors and executive officers, including our NEOs.

•Independent compensation consultant—The compensation committee retains an independent compensation consultant to provide advice and recommendations concerning the compensation of the NEOs.

Say on Pay Vote

Our shareholders are provided with an opportunity to cast a non-binding, advisory vote every three years on our executive compensation program. Our most recent advisory say on pay vote was held at our May 2023 annual shareholders’ meeting, at which more than 97% of votes cast were in favor of our say on pay proposal. Our compensation committee considered these voting results in the context of our overall compensation philosophy, as well as our compensation policies, decisions and performance. The compensation committee believes that the strong vote of shareholder approval generally endorsed our compensation decisions and, after reflecting on this vote, the compensation committee elected not to undertake any material changes to our executive compensation programs. At our 2023 annual shareholders’ meeting, our shareholders expressed a preference that future advisory shareholder votes on the compensation of our NEOs be held on a triennial basis. Accordingly, the next say on pay vote is expected at the 2026 Annual Meeting.

Overview of our Executive Compensation Philosophy and Design

We believe that a skilled, experienced and dedicated senior management team is essential to our future success as a Company and to building shareholder value. There are three principal objectives that our executive compensation programs are designed to achieve: