UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended

or

For the transition period from to .

Commission File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ |

|

Accelerated filer |

☐ |

|

Emerging growth company |

||

|

|

|

|

|

|

|

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of July 26, 2024, there were

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

INDEX

|

|

|

PAGE NO. |

|

|||

|

|

|

|

|

Item 1. |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows (Unaudited)—Six Months Ended June 30, 2024 and 2023 |

4 |

|

|

|

|

|

|

Condensed Consolidated Balance Sheets—June 30, 2024 (Unaudited) and December 31, 2023 |

5 |

|

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements (Unaudited) |

6 |

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

|

|

|

|

Item 3. |

30 |

|

|

|

|

|

|

Item 4. |

31 |

|

|

|

|

|

|

|||

|

|

|

|

|

Item 1. |

32 |

|

|

|

|

|

|

Item 1A. |

32 |

|

|

|

|

|

|

Item 2. |

32 |

|

|

|

|

|

|

Item 3. |

32 |

|

|

|

|

|

|

Item 4. |

32 |

|

|

|

|

|

|

Item 5. |

32 |

|

|

|

|

|

|

Item 6. |

33 |

|

|

|

|

|

34 |

|||

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Statements of Comprehensive Income (Unaudited)

(In millions, except per share data)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Net sales |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Cost of materials sold |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Warehousing, delivery, selling, general, and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Restructuring and other charges |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Operating profit |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other income and (expense), net |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Interest and other expense on debt |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Income before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Less: Net income attributable to noncontrolling interest |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Net income attributable to Ryerson Holding Corporation |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Comprehensive income (loss) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

Less: Comprehensive income attributable to noncontrolling interest |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Comprehensive income (loss) attributable to Ryerson Holding Corporation |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

Basic earnings per share |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Diluted earnings per share |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Dividends declared per share |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

See Notes to Condensed Consolidated Financial Statements.

3

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In millions)

|

|

Six Months Ended |

|

|||||

|

|

June 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Operating activities: |

|

|

|

|

|

|

||

Net income |

|

$ |

|

|

$ |

|

||

Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

|

|

||

Stock-based compensation |

|

|

|

|

|

|

||

Deferred income taxes |

|

|

|

|

|

|

||

Provision for allowances, claims, and doubtful accounts |

|

|

|

|

|

|

||

Restructuring and other charges |

|

|

|

|

|

— |

|

|

Pension and other postretirement benefits curtailment gain |

|

|

( |

) |

|

|

— |

|

Pension settlement charge |

|

|

|

|

|

— |

|

|

Non-cash gain from derivatives |

|

|

( |

) |

|

|

( |

) |

Other items |

|

|

|

|

|

( |

) |

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

||

Receivables |

|

|

( |

) |

|

|

( |

) |

Inventories |

|

|

|

|

|

|

||

Other assets and liabilities |

|

|

|

|

|

( |

) |

|

Accounts payable |

|

|

( |

) |

|

|

|

|

Accrued liabilities |

|

|

( |

) |

|

|

( |

) |

Accrued taxes payable/receivable |

|

|

( |

) |

|

|

|

|

Deferred employee benefit costs |

|

|

( |

) |

|

|

( |

) |

Net adjustments |

|

|

( |

) |

|

|

|

|

Net cash provided by (used in) operating activities |

|

|

( |

) |

|

|

|

|

Investing activities: |

|

|

|

|

|

|

||

Acquisitions, net of cash acquired |

|

|

— |

|

|

|

( |

) |

Capital expenditures |

|

|

( |

) |

|

|

( |

) |

Proceeds from sale of property, plant, and equipment |

|

|

|

|

|

|

||

Other items |

|

|

( |

) |

|

|

— |

|

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Financing activities: |

|

|

|

|

|

|

||

Repayment of debt |

|

|

( |

) |

|

|

( |

) |

Net proceeds of short-term borrowings |

|

|

|

|

|

|

||

Net increase (decrease) in book overdrafts |

|

|

( |

) |

|

|

|

|

Principal payments on finance lease obligations |

|

|

( |

) |

|

|

( |

) |

Dividends paid to shareholders |

|

|

( |

) |

|

|

( |

) |

Share repurchases |

|

|

( |

) |

|

|

( |

) |

Proceeds from exercise common stock options |

|

|

|

|

|

— |

|

|

Contingent payment related to acquisitions |

|

|

( |

) |

|

|

— |

|

Tax withholdings on stock-based compensation awards |

|

|

( |

) |

|

|

( |

) |

Net cash provided by (used in) financing activities |

|

|

|

|

|

( |

) |

|

Net decrease in cash, cash equivalents, and restricted cash |

|

|

( |

) |

|

|

( |

) |

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

|

( |

) |

|

|

( |

) |

Net change in cash, cash equivalents, and restricted cash |

|

|

( |

) |

|

|

( |

) |

Cash, cash equivalents, and restricted cash—beginning of period |

|

|

|

|

|

|

||

Cash, cash equivalents, and restricted cash—end of period |

|

$ |

|

|

$ |

|

||

Supplemental disclosures: |

|

|

|

|

|

|

||

Cash paid during the period for: |

|

|

|

|

|

|

||

Interest paid to third parties, net |

|

$ |

|

|

$ |

|

||

Income taxes, net |

|

|

|

|

|

|

||

Noncash investing activities: |

|

|

|

|

|

|

||

Asset additions under operating leases |

|

|

|

|

|

|

||

Asset additions under finance leases |

|

|

|

|

|

|

||

See Notes to Condensed Consolidated Financial Statements.

4

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Balance Sheets

(In millions, except shares and per share data)

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

|

|

(unaudited) |

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Restricted cash |

|

|

|

|

|

|

||

Receivables less provisions of $ |

|

|

|

|

|

|

||

Inventories |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Property, plant, and equipment, at cost |

|

|

|

|

|

|

||

Less: Accumulated depreciation |

|

|

|

|

|

|

||

Property, plant, and equipment, net |

|

|

|

|

|

|

||

Operating lease assets |

|

|

|

|

|

|

||

Other intangible assets |

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

||

Deferred charges and other assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Salaries, wages, and commissions |

|

|

|

|

|

|

||

Other accrued liabilities |

|

|

|

|

|

|

||

Short-term debt |

|

|

|

|

|

|

||

Current portion of operating lease liabilities |

|

|

|

|

|

|

||

Current portion of deferred employee benefits |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Long-term debt |

|

|

|

|

|

|

||

Deferred employee benefits |

|

|

|

|

|

|

||

Noncurrent operating lease liabilities |

|

|

|

|

|

|

||

Deferred income taxes |

|

|

|

|

|

|

||

Other noncurrent liabilities |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Equity |

|

|

|

|

|

|

||

Ryerson Holding Corporation stockholders’ equity: |

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Capital in excess of par value |

|

|

|

|

|

|

||

Retained earnings |

|

|

|

|

|

|

||

Treasury stock at cost – Common stock of |

|

|

( |

) |

|

|

( |

) |

Accumulated other comprehensive loss |

|

|

( |

) |

|

|

( |

) |

Total Ryerson Holding Corporation stockholders’ equity |

|

|

|

|

|

|

||

Noncontrolling interest |

|

|

|

|

|

|

||

Total equity |

|

|

|

|

|

|

||

Total liabilities and equity |

|

$ |

|

|

$ |

|

||

See Notes to Condensed Consolidated Financial Statements.

5

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

NOTE 1: FINANCIAL STATEMENTS

Ryerson Holding Corporation (“Ryerson Holding”), a Delaware corporation, is the parent company of Joseph T. Ryerson & Son, Inc. (“JT Ryerson”), a Delaware corporation. Affiliates of Platinum Equity, LLC (“Platinum”) own approximately

We are a leading value-added processor and distributor of industrial metals with operations in the U.S. through JT Ryerson and other U.S. subsidiaries, in Canada through our indirect wholly-owned subsidiary Ryerson Canada, Inc., a Canadian corporation (“Ryerson Canada”), and in Mexico through our indirect wholly-owned subsidiary Ryerson Metals de Mexico, S. de R.L. de C.V., a Mexican corporation (“Ryerson Mexico”). In addition to our North American operations, we conduct materials processing and distribution operations in China through an indirect wholly-owned subsidiary, Ryerson China Limited (“Ryerson China”), a Chinese limited liability company. Unless the context indicates otherwise, Ryerson Holding, JT Ryerson, Ryerson Canada, Ryerson China, and Ryerson Mexico, together with their subsidiaries, are collectively referred to herein as “Ryerson,” “we,” “us,” “our,” or the “Company.”

Results of operations for any interim period are not necessarily indicative of results of any future periods or for the year. The condensed consolidated financial statements as of June 30, 2024 and for the three-month and six-month periods ended June 30, 2024 and 2023 are unaudited, but in the opinion of management, include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of results for such periods. The year-end condensed consolidated balance sheet data contained in this report was derived from audited financial statements, but does not include all disclosures required by U.S. generally accepted accounting principles (“GAAP”). These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

NOTE 2: RECENT ACCOUNTING PRONOUNCEMENTS

Impact of Recently Issued Accounting Standards—Adopted

No accounting pronouncements have been issued that impact our financial statements.

Impact of Recently Issued Accounting Standards—Not Yet Adopted

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standard Update (“ASU”) 2023-07, “Segment Reporting (Topic 280)”. The amendments in this update require public entities to enhance segment disclosures on both an interim and annual basis. These disclosures include, among others, significant segment expenses regularly reviewed by the chief operating decision maker (CODM), an amount for other segment items, the title and position of the CODM, and how the CODM uses this information in assessing performance. Full segment disclosures will be required of entities that have a operating segment. The ASU is effective for fiscal years beginning after December 15, 2023 and interim periods of fiscal years beginning after December 15, 2024 and should be adopted retrospectively to all prior periods presented in the financial statements. We do not expect this guidance to materially impact the consolidated financial statements.

In December 2023, FASB issued ASU 2023-09, “Income Taxes (Topic 740)”. The amendments in this update require public businesses to disclose specific categories in the rate reconciliation and further information for reconciling items that meet a quantitative threshold. This update also requires further disclosures of income taxes paid disaggregated by federal, state, and foreign jurisdictions as well as by the individual jurisdiction in which income taxes are paid if the amount paid is equal to or greater than five percent of total income taxes paid. Further, this update requires a disclosure of income or loss from continuing operations before income tax expense disaggregated between domestic and foreign and income tax expense or benefit disaggregated by federal, state, and foreign. This update is effective for annual periods beginning after December 15, 2024 and early adoption is permitted. We will adopt this ASU as of January 1, 2025. We do not expect this guidance to materially impact the consolidated financial statements.

6

NOTE 3: CASH, CASH EQUIVALENTS, AND RESTRICTED CASH

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the Condensed Consolidated Balance Sheets that sum to the total of the beginning and ending cash balances shown in the Condensed Consolidated Statements of Cash Flows:

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

|

|

(In millions) |

|

|||||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Restricted cash |

|

|

|

|

|

|

||

Total cash, cash equivalents, and restricted cash |

|

$ |

|

|

$ |

|

||

We had cash restricted for the purpose of covering letters of credit that can be presented for potential insurance claims.

NOTE 4: INVENTORIES

The Company primarily uses the last-in, first-out (LIFO) method of valuing inventory.

Inventories, at stated LIFO value, were classified at June 30, 2024 and December 31, 2023 as follows:

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

|

|

(In millions) |

|

|||||

In process and finished products |

|

$ |

|

|

$ |

|

||

If current cost had been used to value inventories, such inventories would have been $

The Company has consignment inventory at certain customer locations, which totaled $

NOTE 5: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill, which represents the excess of cost over the fair value of net assets acquired, amounted to $

Pursuant to FASB ASC 350, “Intangibles – Goodwill and Other,” we review the recoverability of goodwill annually as of October 1 or whenever significant events or changes occur which might impair the recovery of recorded amounts. The most recently completed impairment test of goodwill was performed as of

Other intangible assets with finite useful lives continue to be amortized over their useful lives. We did not record any additional intangible assets during the first six months of 2024. We review the recoverability of our long-lived assets whenever events or changes in circumstances indicate the carrying amount of such assets may not be recoverable.

7

NOTE 6: ACQUISITIONS

2023 Acquisitions

On March 1, 2023, JT Ryerson acquired BLP Holdings, LLC ("BLP"). Based out of Houston, Texas, BLP is comprised of three divisions: Absolute Metal Products, Metal Cutting Specialists, and Houston Water Jet, serving various industries such as oil & gas, aerospace, telecommunications, and structural fabrication. BLP provides complex fabrication services in addition to toll processing, including saw cutting, machining, and water jet cutting.

On October 2, 2023, JT Ryerson acquired Norlen Incorporated ("Norlen"). Based out of Schofield, Wisconsin, Norlen is a full-service metal fabricator, providing stamping, machining, painting, and additional value-added fabrication services to industries including agriculture, HVAC, and defense.

On November 1, 2023, JT Ryerson acquired TSA Processing ("TSA"). Headquartered in Houston, Texas, with five other locations across the Midwest and Southern United States, TSA is a stainless steel and aluminum coil and sheet processor.

On December 1, 2023, JT Ryerson acquired Hudson Tool Steel Corporation ("Hudson"). Hudson is headquartered in Cerritos, California, with two facilities located in the Midwest and Northeast. Hudson is a supplier of tool steels and high-speed, carbon, and alloy steels.

The 2023 acquisitions will strengthen and expand JT Ryerson's valued-add services within our industry-leading stainless and aluminum franchises as well as our tool steel capabilities which will allow us to increase our offerings to better serve our diverse customer base across our entire network. In 2023, we paid a total of $

We deemed the 2023 acquisitions individually immaterial, yet significant in the aggregate to the Condensed Consolidated Balance Sheets.

Included in the financial results for the three-month periods ended June 30, 2024 and June 30, 2023 was $

The allocations of the total purchase price from our combined 2023 acquisitions to the fair values of the assets acquired and liabilities assumed were as follows:

|

|

(In millions) |

|

|

Cash and cash equivalents |

|

$ |

|

|

Receivables, less provisions |

|

|

|

|

Inventories |

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

Property, plant, and equipment |

|

|

|

|

Operating lease assets |

|

|

|

|

Other intangible assets |

|

|

|

|

Goodwill |

|

|

|

|

Other noncurrent assets |

|

|

|

|

Total identifiable assets acquired |

|

|

|

|

Accounts payable |

|

|

( |

) |

Salaries, wages, and commissions |

|

|

( |

) |

Other accrued liabilities |

|

|

( |

) |

Operating lease liabilities |

|

|

( |

) |

Deferred income taxes |

|

|

( |

) |

Total liabilities assumed |

|

|

( |

) |

Net identifiable assets acquired |

|

$ |

|

|

8

The 2023 acquisitions discussed above were all accounted for under the acquisition method of accounting and, accordingly, the purchase price for each transaction has been allocated to the assets acquired and liabilities assumed based on the estimated fair values at the date of each acquisition. As needed, for each transaction the Company used a third-party valuation firm to estimate the fair values of property, plant, and equipment, leases, earn-outs, and intangible assets. Inventory was valued by the Company using acquisition date fair values of the metals. The Condensed Consolidated Balance Sheets reflect the allocations of each acquisition's purchase price as of June 30, 2024 and December 31, 2023. The measurement period for purchase price allocations will end 12 months after each acquisition date. The purchase price allocations for BLP and TSA are complete. The purchase price allocations for Hudson and Norlen are pending the completion of purchase price adjustments.

Included in the total purchase price is $

As part of the purchase price allocations for the 2023 acquisitions, we allocated $

2023 Asset Acquisition

During the first six months of 2023, JT Ryerson completed the purchase of certain assets from ExOne Operating, LLC. The total amount paid by JT Ryerson for the acquired assets was $

2022 Acquisition Activity

On August 31, 2022, JT Ryerson acquired Howard Precision Metals, Inc. ("Howard"). In the first three months of 2024, JT Ryerson paid $

On November 1, 2022, JT Ryerson acquired Excelsior, Inc. ("Excelsior"). In the six months ended June 30, 2024, JT Ryerson paid $

NOTE 7: LONG-TERM DEBT

Long-term debt consisted of the following at June 30, 2024 and December 31, 2023:

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2024 |

|

|

2023 |

|

||

|

|

(In millions) |

|

|||||

Ryerson Credit Facility |

|

$ |

|

|

$ |

|

||

Foreign debt |

|

|

|

|

|

|

||

Other debt |

|

|

— |

|

|

|

|

|

Unamortized debt issuance costs and discounts |

|

|

( |

) |

|

|

( |

) |

Total debt |

|

|

|

|

|

|

||

Less: Short-term foreign debt |

|

|

|

|

|

|

||

Less: Other short-term debt |

|

|

— |

|

|

|

|

|

Total long-term debt |

|

$ |

|

|

$ |

|

||

Ryerson Credit Facility

On June 29, 2022, Ryerson entered into a fifth amendment of its revolving credit facility to among other things, increase the facility size from $

9

At June 30, 2024, Ryerson had $

Amounts outstanding under the Ryerson Credit Facility bear interest at (i) a rate determined by reference to (A) the base rate (the highest of the Federal Funds Rate plus

The spread over the base rate is between

Borrowings under the Ryerson Credit Facility are secured by first-priority liens on all of the inventory, accounts receivables, lockbox accounts, and related assets of the borrowers and the guarantors.

The Ryerson Credit Facility also contains covenants that, among other things, restrict Ryerson Holding and its restricted subsidiaries with respect to the incurrence of debt, the creation of liens, transactions with affiliates, mergers and consolidations, sales of assets, and acquisitions. The Ryerson Credit Facility also requires that, if availability under the Ryerson Credit Facility declines to a certain level, Ryerson maintain a minimum fixed charge coverage ratio as of the end of each fiscal quarter.

The Ryerson Credit Facility contains events of default with respect to, among other things, default in the payment of principal when due or the payment of interest, fees, and other amounts due thereunder after a specified grace period, material misrepresentations, failure to perform certain specified covenants, certain bankruptcy events, the invalidity of certain security agreements or guarantees, material judgments, the occurrence of a change of control of Ryerson, and a cross-default to other financing arrangements. If such an event of default occurs, the lenders under the Ryerson Credit Facility will be entitled to various remedies, including acceleration of amounts outstanding under the Ryerson Credit Facility and all other actions permitted to be taken by secured creditors.

The lenders under the Ryerson Credit Facility could reject a borrowing request if any event, circumstance, or development has occurred that has had or could reasonably be expected to have a material adverse effect on the Company. If Ryerson Holding, JT Ryerson, any of the other borrowers, or any restricted subsidiaries of JT Ryerson becomes insolvent or commences bankruptcy proceedings, all amounts borrowed under the Ryerson Credit Facility will become immediately due and payable.

Net proceeds of short-term borrowings that are reflected in the Condensed Consolidated Statements of Cash Flows represent borrowings under the Ryerson Credit Facility with original maturities of three months or less.

Foreign Debt

At June 30, 2024, Ryerson China's foreign borrowings were $

10

Availability under the foreign credit lines was $

NOTE 8: EMPLOYEE BENEFITS

The following tables summarize the components of net periodic benefit cost (credit) for the Ryerson pension plans and postretirement benefit plans other than pension:

|

|

Three Months Ended June 30, |

|

|||||||||||||

|

|

Pension Benefits |

|

|

Other Benefits |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

|

|

(In millions) |

|

|||||||||||||

Components of net periodic benefit cost (credit) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Service cost |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

|||

Interest cost |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expected return on assets |

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

Settlement gain |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Recognized actuarial (gain) loss |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net periodic benefit cost (credit) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

||

|

|

Six Months Ended June 30, |

|

|||||||||||||

|

|

Pension Benefits |

|

|

Other Benefits |

|

||||||||||

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

|

|

(In millions) |

|

|||||||||||||

Components of net periodic benefit cost (credit) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Service cost |

|

$ |

|

|

$ |

|

|

|

|

|

$ |

|

||||

Interest cost |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expected return on assets |

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

Settlement expense |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Curtailment gain |

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

Recognized actuarial (gain) loss |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net periodic benefit cost (credit) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

||

Components of net periodic benefit cost (credit), excluding service cost, are included in Other income and (expense), net in our Condensed Consolidated Statement of Comprehensive Income.

Due to the closure of Central Steel & Wire's ("CSW") headquarters in Chicago, IL and move to University Park, IL, a significant reduction in the service years of employees occurred between the fourth quarter of 2023 and first quarter of 2024, triggering curtailment accounting. The CSW Pension and Postretirement Benefits plans were remeasured as of February 29, 2024, resulting in a curtailment gain. As the curtailment was a net gain, the gain is required to be reflected in the periods in which the terminations occur, resulting in a curtailment gain of $

In the first quarter of 2024, the Ryerson Canada Bargaining Unit Pension Plan made $

The net pension settlement loss and the curtailment gain were recorded within Other income and (expense), net within the Condensed Consolidated Statement of Comprehensive Income for the six months ended June 30, 2024.

The Company contributed $

11

NOTE 9: COMMITMENTS AND CONTINGENCIES

There have been no material changes to the contingencies and legal matters from those disclosed in Part I, Item 1: Business - Environment, Health, and Safety Matters and in Note 12 of the Notes to the Consolidated Financial Statements, in Part II, Item 8: Financial Statements in the Company's 2023 Form 10-K.

NOTE 10: DERIVATIVES AND FAIR VALUE MEASUREMENTS

Derivatives

The Company may use derivatives to partially offset its business exposure to commodity price, foreign currency, and interest rate fluctuations and their related impact on expected future cash flows and certain existing assets and liabilities. However, the Company may choose not to hedge certain exposures for a variety of reasons including, but not limited to, Company policy, accounting considerations, or the prohibitive economic cost of hedging particular exposures. There can be no assurance the hedges will offset more than a portion of the financial impact resulting from movements in commodity pricing, foreign currency exchange, or interest rates. Interest rate swaps may be entered into to manage interest rate risk associated with the Company’s floating-rate borrowings. We use foreign currency exchange contracts to hedge variability in cash flows in our Canada, Mexico, and China operations when a payment currency is different from our functional currency. From time to time, we may enter into fixed price sales contracts with our customers for certain of our inventory components. We may enter into metal commodity futures and options contracts to reduce volatility in the price of these metals. We may also enter into fixed price natural gas contracts to manage the price risk of forecasted purchases of natural gas.

The Company currently does not account for its commodity contracts and foreign exchange derivative contracts as hedges but rather marks them to market with a corresponding offset to current earnings.

The Company regularly reviews the creditworthiness of its derivative counterparties and does not expect to incur a significant loss from the failure of any counterparties to perform under any agreements.

The following table summarizes the location and fair value amount of our derivative instruments reported in our Condensed Consolidated Balance Sheets as of June 30, 2024 and December 31, 2023. As of June 30, 2024 and December 31, 2023, all derivative instruments held by the Company were subject to master netting arrangements with various financial institutions. The Company’s accounting policy is to not offset these positions in its Condensed Consolidated Balance Sheets. The gross derivative assets and liabilities presented in the Condensed Consolidated Balance Sheets offset to a net asset of $

|

|

Asset Derivatives |

|

|

Liability Derivatives |

|

||||||||||||||

|

|

Balance Sheet Location |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

Balance Sheet Location |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

||||

Derivatives not designated as hedging instruments under ASC 815 |

|

(In millions) |

|

|||||||||||||||||

Metal commodity contracts |

|

|

$ |

|

|

$ |

|

|

Other accrued |

|

$ |

|

|

$ |

|

|||||

The following table presents the volume of the Company’s activity in derivative instruments as of June 30, 2024 and December 31, 2023:

|

|

Notional Amount |

|

|

|

|||||

Derivative Instruments |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

Unit of Measurement |

||

Hot roll coil swap contracts |

|

|

|

|

|

|

|

Tons |

||

Aluminum swap contracts |

|

|

|

|

|

|

|

Tons |

||

Nickel swap contracts |

|

|

|

|

|

|

|

Tons |

||

Foreign currency exchange contracts |

|

|

|

|

|

U.S. dollars |

||||

12

The following table summarizes the location and amount of gains and losses on derivatives not designated as hedging instruments reported in our Condensed Consolidated Statements of Comprehensive Income for the three and six months ended June 30, 2024 and 2023:

Derivatives not designated as hedging |

|

Location of Gain/(Loss) |

|

Amount of Gain/(Loss) Recognized in Income on Derivatives |

|

|||||||||||||

instruments under ASC 815 |

|

Recognized in Income |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

on Derivatives |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Metal commodity contracts |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||

Foreign exchange contracts |

|

|

|

— |

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Total |

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|||

Fair Value Measurements

The Company has various commodity derivatives to lock in hot roll coil, nickel, and aluminum prices for varying time periods. The fair value of hot roll coil, nickel, and aluminum derivatives is determined based on the spot price each individual contract was purchased at and compared with the one-month daily average actual spot price on the Chicago Mercantile Exchange (hot roll coil) and the London Metals Exchange (nickel and aluminum), respectively, for the commodity on the valuation date. In addition, the Company has numerous foreign exchange contracts to hedge variability in cash flows when a payment currency is different from our functional currency. The Company defines the fair value of foreign exchange contracts as the amount of the difference between the contracted and current market value at the end of the period. The Company estimates the current market value of foreign exchange contracts by obtaining month-end market quotes of foreign exchange rates and forward rates for contracts with similar terms. The Company uses the exchange rates provided by Reuters. Each commodity and foreign exchange contract term varies in the number of months, but in general, contracts are between

The estimated fair value of the Company’s cash and cash equivalents, restricted cash, receivables less provisions, and accounts payable approximate their carrying amounts due to the short-term nature of these financial instruments. The estimated fair value of the Company's long-term debt and the current portions thereof equal the carrying amounts due to the short-term nature of the underlying borrowings on the Ryerson Credit Facility which are typically

13

NOTE 11: STOCKHOLDERS’ EQUITY, ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS), AND NONCONTROLLING INTEREST

On February 28, 2023, Platinum closed on an underwritten secondary offering of

The following table details changes in Ryerson Holding Corporation Stockholders’ Equity accounts for the three-month and six-month periods ended June 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated Other |

|

|

|

|

|

|||||||||||||||

|

|

Common |

|

|

Treasury |

|

|

Capital in |

|

|

Retained Earnings |

|

|

Foreign |

|

|

Benefit Plan |

|

|

Non-controlling |

|

|

Total |

|

||||||||||||||||

|

|

Shares |

|

|

Dollars |

|

|

Shares |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

||||||||||

|

|

(In millions, except shares in thousands) |

|

|||||||||||||||||||||||||||||||||||||

Balance at January 1, 2024 |

|

|

|

|

$ |

|

|

|

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

Net income (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

|

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Changes in defined benefit pension and other post-retirement benefit plans, net of tax of $ |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Share repurchases, net of tax of |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Stock-based compensation expense, net |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

||

Cash dividends and dividend equivalents |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Balance at March 31, 2024 |

|

|

|

|

$ |

|

|

|

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Changes in defined benefit pension and other post-retirement benefit plans, net of tax of $ |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Share repurchases, net of tax $ |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Stock-based compensation expense, net |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Issuance of common stock |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Dividends declared to non-controlling interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||||||||

Cash dividends and dividend equivalents |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Balance at June 30, 2024 |

|

|

|

|

$ |

|

|

|

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

14

The following table details changes in Ryerson Holding Corporation Stockholders’ Equity accounts for the three-month and six-month periods ended June 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated Other |

|

|

|

|

|

|||||||||||||||

|

|

Common |

|

|

Treasury |

|

|

Capital in |

|

|

Retained Earnings |

|

|

Foreign |

|

|

Benefit Plan |

|

|

Non-controlling |

|

|

Total |

|

||||||||||||||||

|

|

Shares |

|

|

Dollars |

|

|

Shares |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

||||||||||

|

|

(In millions, except shares in thousands) |

|

|||||||||||||||||||||||||||||||||||||

Balance at January 1, 2023 |

|

|

|

|

$ |

|

|

|

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

|

||

Changes in defined benefit pension and other post-retirement benefit plans, net of tax of $ |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Share repurchases, net of tax of $ |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Stock-based compensation expense, net |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

||

Cash dividends and dividend equivalents |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Balance at March 31, 2023 |

|

|

|

|

$ |

|

|

|

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Changes in defined benefit pension and other post-retirement benefit plans, net of tax of $ |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Share repurchases, net of tax $ |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Stock-based compensation expense, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Issuance of common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Cash dividends and dividend equivalents |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Balance at June 30, 2023 |

|

|

|

|

$ |

|

|

|

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

|

$ |

|

||||||

The following table details changes in accumulated other comprehensive income (loss), net of tax, for the six months ended June 30, 2024:

|

|

Changes in Accumulated Other Comprehensive |

|||||||

|

|

Foreign |

|

|

Benefit |

|

|

||

|

|

(In millions) |

|||||||

Balance at January 1, 2024 |

|

$ |

( |

) |

|

$ |

( |

) |

|

Other comprehensive income (loss) before reclassifications |

|

|

( |

) |

|

|

|

|

|

Amounts reclassified from accumulated other comprehensive income into net income |

|

|

— |

|

|

|

( |

) |

|

Net current-period other comprehensive income (loss) |

|

|

( |

) |

|

|

|

|

|

Balance at June 30, 2024 |

|

$ |

( |

) |

|

$ |

( |

) |

|

15

The following table details the reclassifications out of accumulated other comprehensive income (loss) for the three-month and six-month periods ended June 30, 2024:

|

|

Reclassifications Out of Accumulated Other Comprehensive Income (Loss) |

|||||||

|

|

Amount reclassified from Accumulated Other Comprehensive Income (Loss) |

|

|

|||||

|

|

|

|

|

|||||

|

|

Three Months Ended |

|

|

Six Months Ended |

|

Affected line item in the Condensed Consolidated Statements of Comprehensive Income (Loss) |

||

Details about Accumulated Other |

|

June 30, 2024 |

|

|

|||||

Comprehensive Income (Loss) Components |

|

(In millions) |

|

|

|||||

Amortization of defined benefit pension and other post-retirement benefit plan items |

|

|

|

|

|

|

|

||

Actuarial gain |

|

$ |

( |

) |

|

$ |

( |

) |

Other income and (expense), net |

Pension settlement loss (gain) |

|

|

( |

) |

|

|

|

Other income and (expense), net |

|

Curtailment gain |

|

|

— |

|

|

|

( |

) |

Other income and (expense), net |

Total before tax |

|

|

( |

) |

|

|

( |

) |

|

Tax expense |

|

|

|

|

|

— |

|

|

|

Net of tax |

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

|

|

|

|

|

|

||

|

|

Reclassifications Out of Accumulated Other Comprehensive Income (Loss) |

|||||||

|

|

Amount reclassified from Accumulated Other Comprehensive Income (Loss) |

|

|

|||||

|

|

|

|

|

|||||

|

|

Three Months Ended |

|

|

Six Months Ended |

|

Affected line item in the Condensed Consolidated Statements of Comprehensive Income |

||

Details about Accumulated Other |

|

June 30, 2023 |

|

|

|||||

Comprehensive Income (Loss) Components |

|

(In millions) |

|

|

|||||

Amortization of defined benefit pension and other post-retirement benefit plan items |

|

|

|

|

|

|

|

||

Actuarial gain |

|

$ |

( |

) |

|

$ |

( |

) |

Other income and (expense), net |

Total before tax |

|

|

( |

) |

|

|

( |

) |

|

Tax expense |

|

|

|

|

|

|

|

||

Net of tax |

|

$ |

( |

) |

|

$ |

( |

) |

|

NOTE 12: REVENUE RECOGNITION

Net sales include product revenue and shipping and handling charges, net of estimated sales returns and any related sales incentives. Revenue is measured as the amount of consideration the Company expects to receive in exchange for transferring products.

We have

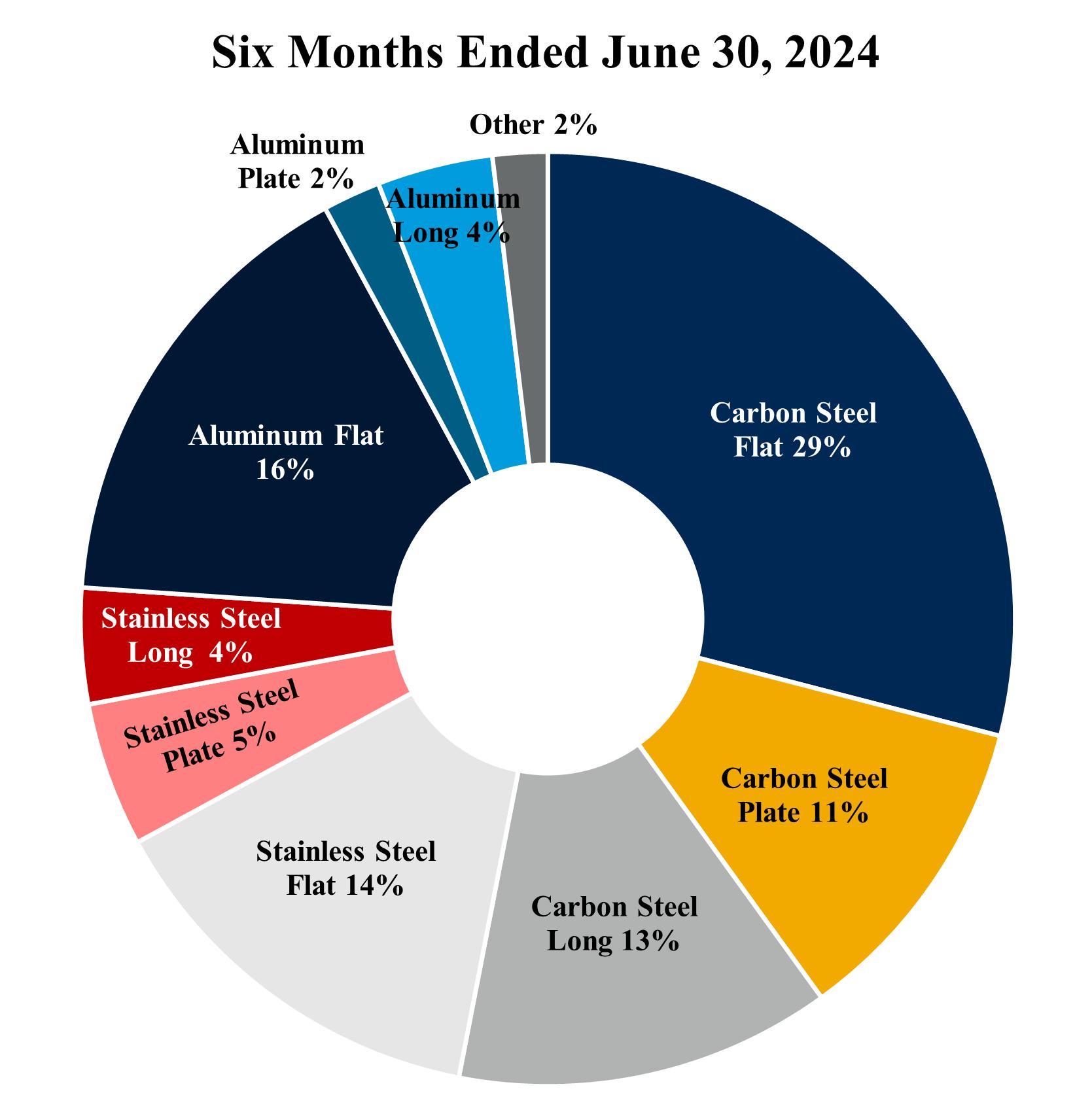

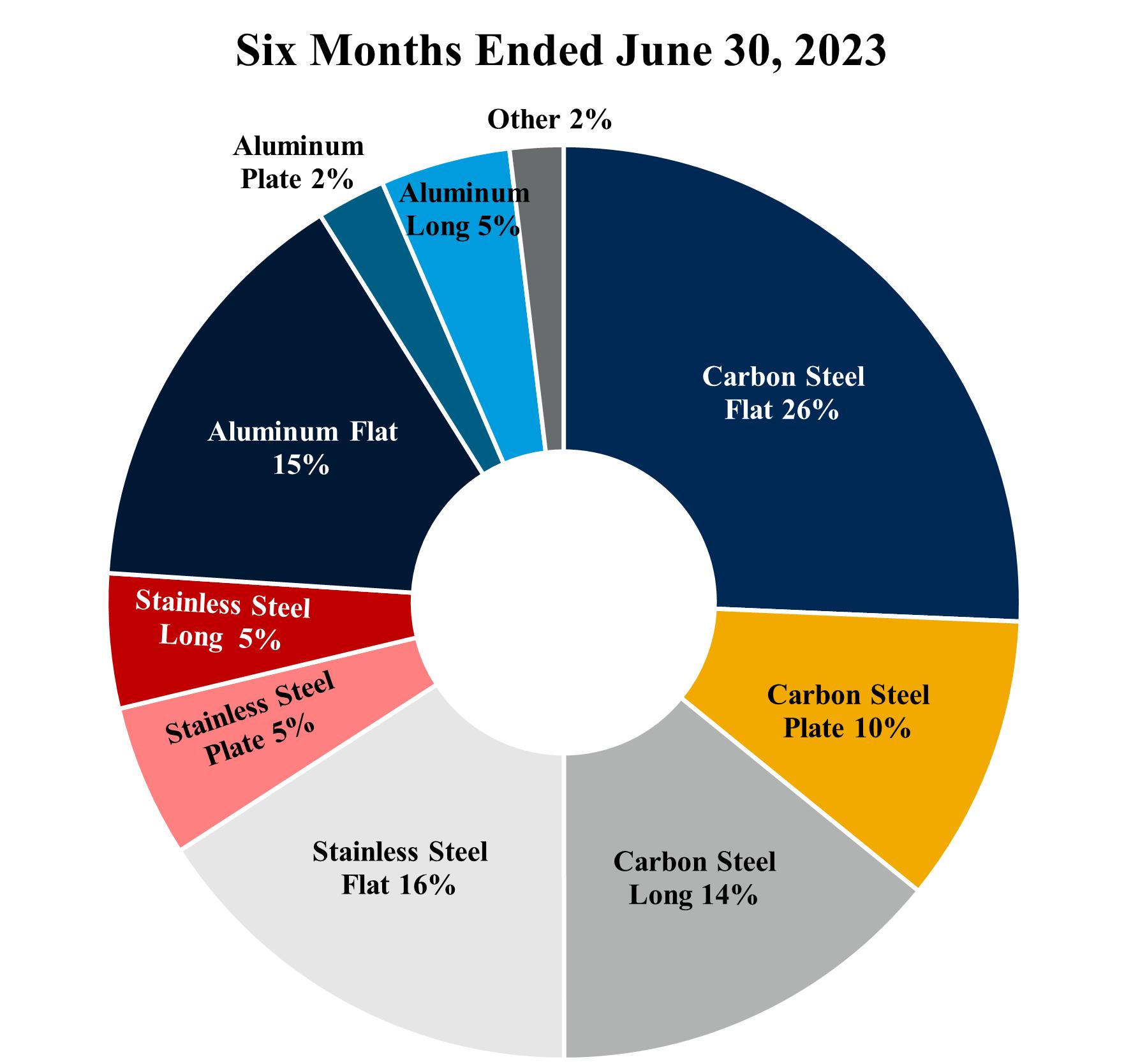

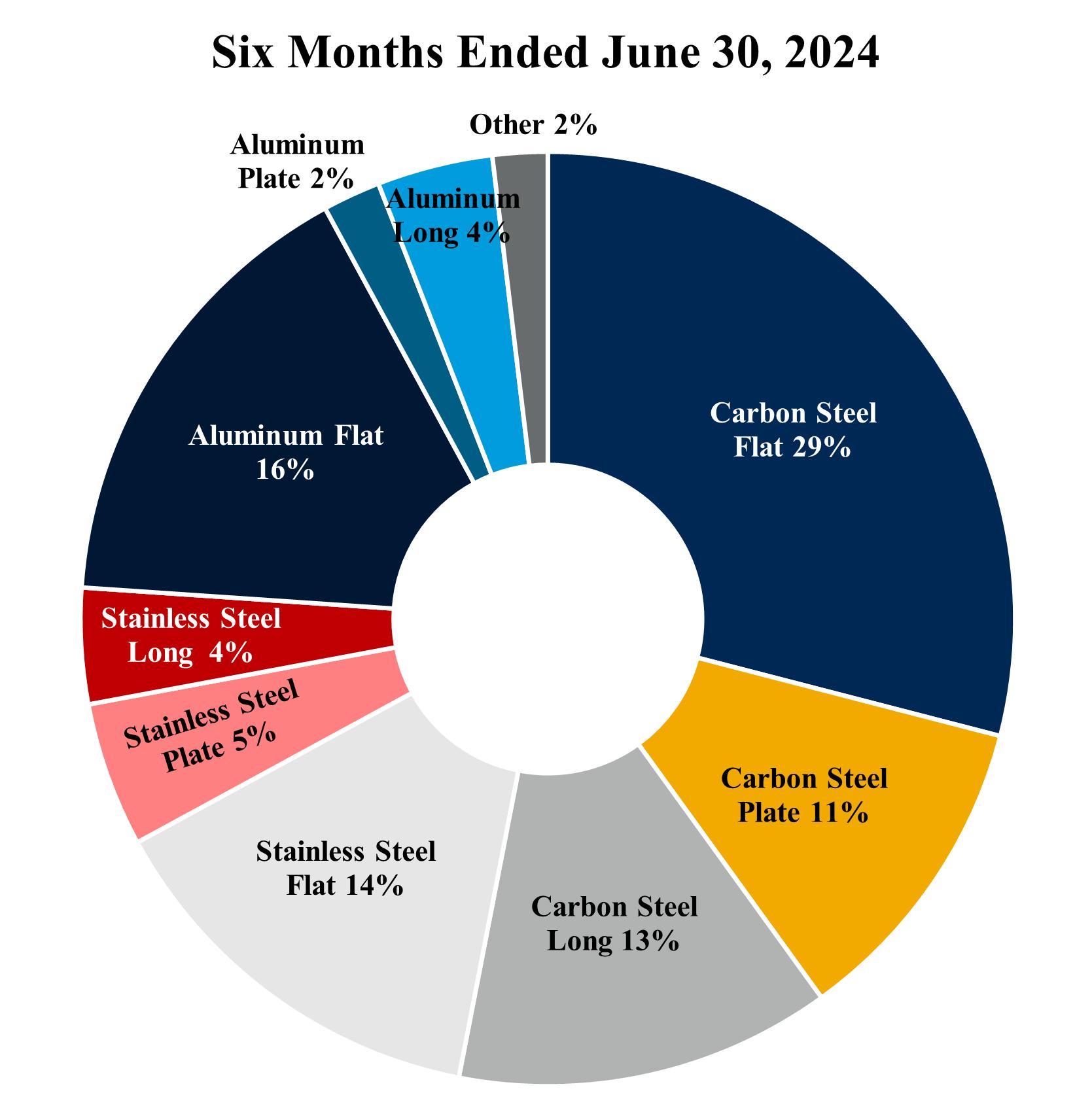

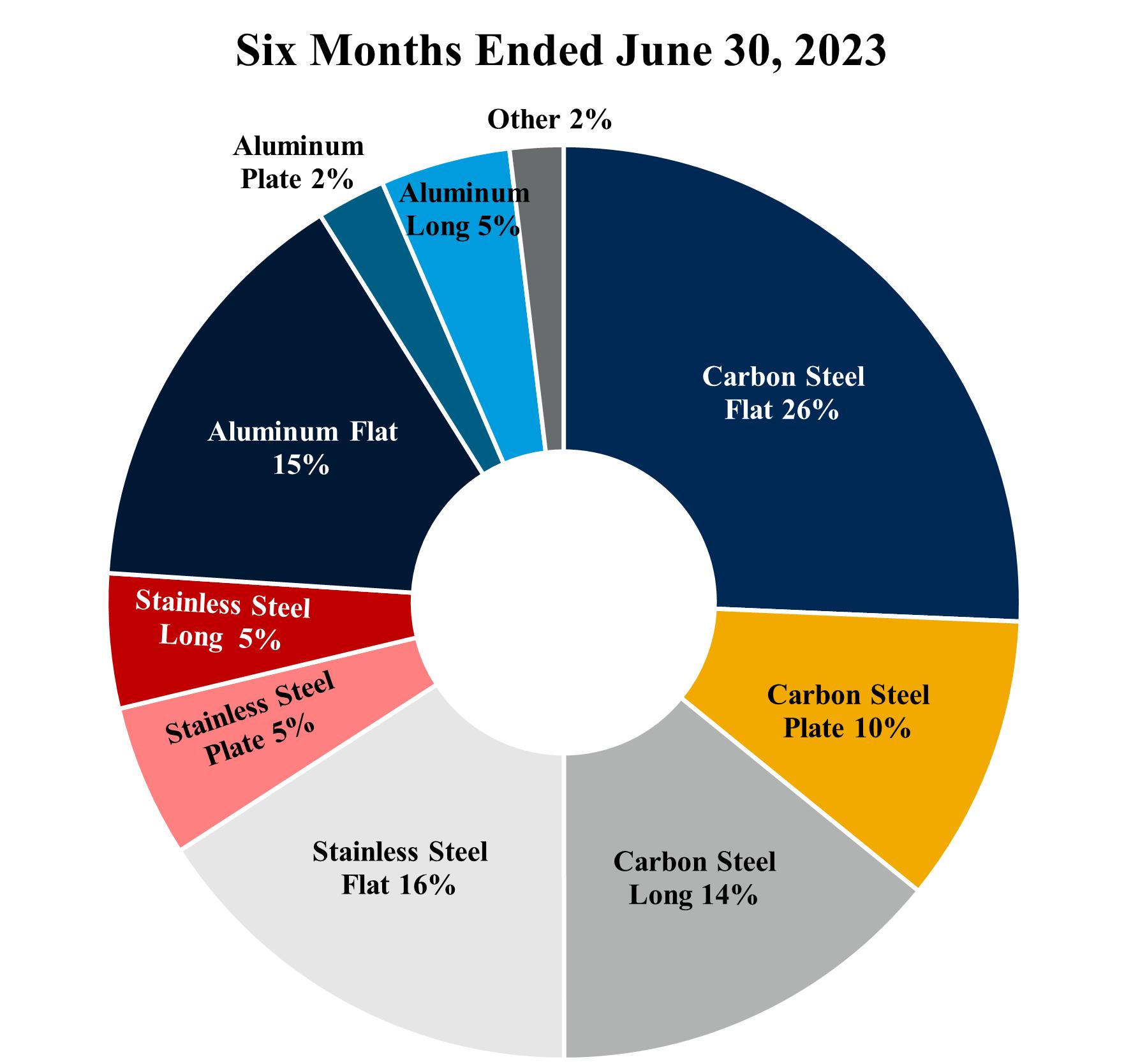

The Company derives substantially all of its revenue from the distribution of metals. The following table shows the Company’s percentage of sales disaggregated by major product line:

|

|

Three Months Ended |

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

June 30, |

|

||||||||||

Product Line |

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

|

||||

Carbon Steel Flat |

|

|

% |

|

|

% |

|

% |

|

|

% |

||||

Carbon Steel Plate |

|

|

|

|

|

|

|

|

|

|

|

||||

Carbon Steel Long |

|

|

|

|

|

|

|

|

|

|

|

||||

Stainless Steel Flat |

|

|

|

|

|

|

|

|

|

|

|

||||

Stainless Steel Plate |

|

|

|

|

|

|

|

|

|

|

|

||||

Stainless Steel Long |

|

|

|

|

|

|

|

|

|

|

|

||||

Aluminum Flat |

|

|

|

|

|

|

|

|

|

|

|

||||

Aluminum Plate |

|

|

|

|

|

|

|

|

|

|

|

||||

Aluminum Long |

|

|

|

|

|

|

|

|

|

|

|

||||

Other |

|

|

|

|

|

|

|

|

|

|

|

||||

Total |

|

|

% |

|

|

% |

|

% |

|

|

% |

||||

16

A significant majority of the Company’s sales are attributable to its U.S. operations. The only sales attributed to foreign countries relate to the Company’s subsidiaries in Canada, China, and Mexico. The following table summarizes consolidated financial information of our operations by geographic location based on where sales originated:

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Net Sales |

(In millions) |

|

|

(In millions) |

|

||||||||||

United States |

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Foreign countries |

|

|

|

|

|

|

|

|

|

|

|

||||

Total |

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Revenue is recognized either at a point in time or over time based on if the contract has an enforceable right to payment and the type of product that is being sold to the customer, with products that are determined to have no alternative use being recognized over time. The following table summarizes revenues by the type of item sold:

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

Timing of Revenue Recognition |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Revenue on products with an alternative use |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

Revenue on products with no alternative use |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

Contract Balances

A receivable is recognized in the period in which an invoice is issued, which is generally when the product is delivered to the customer. Payment terms on invoiced amounts are typically

Receivables, which are included in accounts receivables within the Condensed Consolidated Balance Sheet, from contracts with customers were $

Contract assets, which consist primarily of revenues recognized over time that have not yet been invoiced and the value of inventory, as estimated, that will be received in conjunction with product returns, are reported in prepaid expenses and other current assets within the Condensed Consolidated Balance Sheets. Contract liabilities, which consist primarily of accruals associated with amounts that will be paid to customers for volume rebates, cash discounts, sales returns and allowances, estimates of shipping and handling costs associated with performance obligations recorded over time, customer prepayments, and bill and hold transactions are reported in other accrued liabilities within the Condensed Consolidated Balance Sheets. Contract assets amounted to $

The Company’s performance obligations are typically short-term in nature. As a result, the Company has elected the practical expedient that provides an exemption of the disclosure requirements regarding information about remaining performance obligations on contracts that have original expected durations of

NOTE 13: PROVISION FOR CREDIT LOSSES

Provisions for allowances and claims on accounts receivables and contract assets are based upon historical rates, expected trends, and estimates of potential returns, allowances, customer discounts, and incentives. The Company considers all available information when assessing the adequacy of the provision for allowances, claims, and doubtful accounts.

The Company performs ongoing credit evaluations of customers and sets credit limits based upon review of the customers’ current credit information, payment history, and the current economic and industry environments. The Company’s credit loss reserve consists of two parts: a) a provision for estimated credit losses based on historical experience and b) a reserve for specific customer collection issues that the Company has identified. Estimation of credit losses requires adjusting historical loss experience for current economic conditions and judgments about the probable effects of economic conditions on certain customers.

17

The following table provides a reconciliation of the provision for credit losses reported within the Condensed Consolidated Balance Sheets as of June 30, 2024:

|

Changes in Provision for Expected Credit Losses |

|

|

|

(In millions) |

|

|

Balance at January 1, 2024 |

$ |

|

|

Current period provision |

|

|

|

Write-offs charged against allowance |

|

( |

) |

Translation |

|

|

|

Balance at June 30, 2024 |

$ |

|

|

NOTE 14: INCOME TAXES

For the three months ended June 30, 2024, the Company recorded income tax expense of $

As required by ASC 740, the Company assesses the realizability of its deferred tax assets. The Company records a valuation allowance when, based upon the evaluation of all available evidence, it is more-likely-than-not that all or a portion of the deferred tax assets will not be realized. In making this determination, we analyze, among other things, our recent history of earnings, the nature and timing of reversing book-tax temporary differences, tax planning strategies, and future income. The Company maintains a valuation allowance on certain foreign and U.S. federal deferred tax assets until such time as in management’s judgment, considering all available positive and negative evidence, the Company determines that these deferred tax assets are more likely than not realizable. The valuation allowance is reviewed quarterly and will be maintained until sufficient positive evidence exists to support the reversal of some or all of the valuation allowance. The valuation allowance was $

The Company accounts for uncertain income tax positions in accordance with ASC 740. We anticipate that certain statutes of limitation will close within the next twelve months resulting in the immaterial reduction of the reserve for uncertain tax benefits related to various intercompany transactions. The reserve for uncertain tax benefits increased from $

18

NOTE 15: EARNINGS PER SHARE

Basic earnings per share attributable to Ryerson Holding’s common stock is determined based on earnings for the period divided by the weighted average number of common shares outstanding during the period. Diluted earnings per share attributable to Ryerson Holding’s common stock considers the effect of potential common shares, unless inclusion of the potential common shares would have an antidilutive effect. The weighted average number of shares excluded, as they would have had an antidilutive effect, were

The following table sets forth the calculation of basic and diluted earnings per share:

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

Basic and diluted earnings per share |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

|

|

(In millions, except number of shares which are reflected in thousands and per share data) |

|

|||||||||||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net income attributable to Ryerson Holding Corporation |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Dilutive effect of stock-based awards |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average shares outstanding adjusted for dilutive securities |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

|

|

$ |

|

|

$ |

|