accacr

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ |

|

|

|

|

Accelerated filer |

☐ |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

☐ |

|

|

|

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of a share of the registrant’s common stock on June 30, 2023 as reported by the New York Stock Exchange on such date was $

DOCUMENTS INCORPORATED BY REFERENCE

The information required to be furnished pursuant to Part III of this Form 10-K will be set forth in, and incorporated by reference from, the registrant’s definitive proxy statement for the annual meeting of stockholders (the “2023 Proxy Statement”), which will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year ended December 31, 2023.

TABLE OF CONTENTS

|

|

|

|

Page |

|

3 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

4 |

|

|

|

|

|

|

Item 1A. |

|

|

12 |

|

|

|

|

|

|

Item 1B. |

|

|

22 |

|

|

|

|

|

|

Item 1C. |

|

|

23 |

|

|

|

|

|

|

Item 2. |

|

|

24 |

|

|

|

|

|

|

Item 3. |

|

|

26 |

|

|

|

|

|

|

Item 4. |

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

27 |

|

|

|

|

|

|

Item 6. |

|

|

29 |

|

|

|

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

30 |

|

|

|

|

|

Item 7A. |

|

|

45 |

|

|

|

|

|

|

Item 8. |

|

|

46 |

|

|

|

|

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

89 |

|

|

|

|

|

Item 9A. |

|

|

89 |

|

|

|

|

|

|

Item 9B. |

|

|

89 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Item 10. |

|

|

90 |

|

|

|

|

|

|

Item 11. |

|

|

90 |

|

|

|

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

90 |

|

|

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

91 |

|

|

|

|

|

Item 14. |

|

|

91 |

|

|

|

|

|

|

PART IV |

|

|

||

|

|

|

|

|

Item 15. |

|

|

92 |

|

|

|

|

|

|

|

96 |

|||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements.” Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those anticipated or implied in the forward-looking statements as a result of various factors. Among the factors that significantly impact the metals distribution industry and our business are:

These risks and uncertainties could cause actual results to differ materially from those suggested by the forward-looking statements. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth in this Annual Report under “Risk Factors” and the caption “Industry and Operating Trends” included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report. Moreover, we caution you not to place undue reliance on these forward-looking statements, which speak only as of the date they were made. We do not undertake any obligation to revise or publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

3

PART I

ITEM 1. BUSINESS.

Ryerson Holding Corporation (“Ryerson Holding”), a Delaware corporation, is the parent company of Joseph T. Ryerson & Son, Inc. (“JT Ryerson”), a Delaware corporation. Affiliates of Platinum Equity, LLC (“Platinum”) own approximately 3,924,478 shares of our common stock, which is approximately 11.5% of our issued and outstanding common stock.

We are a leading value-added processor and distributor of industrial metals with operations in the United States ("U.S.") through JT Ryerson and other U.S. subsidiaries, in Canada through our indirect wholly-owned subsidiary Ryerson Canada, Inc., a Canadian corporation (“Ryerson Canada”), and in Mexico through our indirect wholly-owned subsidiary Ryerson Metals de Mexico, S. de R.L. de C.V., a Mexican corporation (“Ryerson Mexico”). In addition to our North American operations, we conduct metal processing and distribution operations in China through an indirect wholly-owned subsidiary, Ryerson China Limited, a Chinese limited liability company (“Ryerson China”). Unless the context indicates otherwise, Ryerson Holding, JT Ryerson, Ryerson Canada, Ryerson Mexico, and Ryerson China together with their subsidiaries, are collectively referred to herein as “Ryerson,” “we,” “us,” “our,” or the “Company.”

Our Company

We are one of the largest value-add processors and distributors of industrial metals in North America measured in terms of sales. We have approximately 4,600 employees across 110 facilities in North America and four facilities in China. Through this network we serve approximately 40,000 customers across a wide range of manufacturing end-markets. Our customers range from local, independently owned fabricators and machine shops to large, international original equipment manufacturers. We carry a full line of approximately 75,000 products in stainless steel, aluminum, carbon steel, and alloy steels and a limited line of nickel and red metals in various shapes and forms. In addition to our metals products, we offer numerous value-added processing and fabrication services, and nearly 80% of the products we sell are processed to meet customer requirements.

Our business strategy includes providing a superior level of customer service and responsiveness, technical services, and inventory management solutions while maintaining low operating costs in order to maximize financial results. Our growth strategy is based on increasing our operating results through organic growth activities and strategic acquisitions.

To that end, we continue to focus on our interconnected network, systems, and enhancing our value-added services and online presence to provide increased access, functionality, and flexibility to our customers. We are using advanced analytics to improve pricing and inventory utilization. Our service centers are strategically located near our customers, which permits us to quickly process and deliver our products and services, often the day after receiving an order. We own, lease, or contract a fleet of tractors and trailers, allowing us to efficiently meet our customers’ delivery demands. Our range of products together with our breadth of services allows us to service a diverse customer base and to create long-term partnerships with our customers and enhances our profitability.

We focus on strategic acquisitions that complement and enhance our product, customer, and geographic diversification. Ryerson’s M&A strategy includes both transformative turnaround acquisitions and value-add, bolt-on acquisitions. Recently, Ryerson has focused on bolt-on acquisitions. In 2023, Ryerson's acquisitions included BLP Holdings, LLC, Norlen Incorporated, TSA Processing, and Hudson Tool Steel Corporation. Please refer to the Section titled “Acquisitions” of Item 7, “Management’s Discussion and Analysis of Financial Conditions and Results of Operations,” and Note 2 — “Acquisitions” of Part II, Item 8 "Financial Statements and Supplementary Data" for further information regarding all acquisitions made in 2023.

Industry Overview

Metals service centers serve as key intermediaries between metal producers and end users of metal products. They purchase in scale and sell in smaller quantities. End-users often look for “one-stop” suppliers that offer lower order volumes, shorter lead times, more reliable delivery, and processing services. Metal producers mainly sell metals in the form of standard-sized coils, sheets, plates, structurals, bars, and tubes in large quantities, with longer lead times, and limited inventory. Metal service centers serve as key intermediaries closing the gap between metal producers’ supply and end-users’ demand.

By aggregating end-users’ demand and purchasing metal in bulk to take advantage of economies of scale, metals service centers may purchase, process, and deliver metal to end‑users in a more efficient and cost‑effective manner than the end‑user may achieve by dealing directly with the primary producer. Further, specialized metals processing equipment is costly and requires high‑volume production to be cost effective, and many customers are not able or willing to invest in the necessary technology, equipment, and warehousing of inventory to efficiently and effectively perform metal processing for their own operations. Due to this, many customers have reduced their in-house processing capabilities, opting to source processed metal from service centers like us. This

4

saves our customers time, labor, and expense, reducing their overall manufacturing costs, while permitting us to increasingly focus on value-added services and expanding our mix of fabrication products, which typically sell at higher margins. This supports our capital expenditures on processing equipment to grow annual gross profit margin.

Our industry is highly fragmented with the largest companies accounting for only a small percentage of total market share. The majority of metals services companies have limited product lines and inventories, with customers located in a specific geographic area. In general, competition is based on quality, service, price, and geographic proximity. We primarily compete with other metals service centers and to a lesser extent with metal producers.

The metals service center industry typically experiences cash flow trends that are counter-cyclical to the revenue and volume growth of the industry. During an industry downturn, companies generally reduce working capital assets and generate cash as inventory and accounts receivable balances decline, and as a result, operating cash flow and liquidity tend to increase during a downturn.

Competitive Strengths

Leading Market Position in North America.

Based on sales, we are one of the largest service center companies for carbon, stainless steel, and aluminum in the North American market where we have a broad geographic presence with 110 facilities.

Our service centers are located near our customer locations, enabling us to timely deliver to customers across numerous geographic markets. Additionally, our widespread network of locations in the U.S., Canada, and Mexico helps us to utilize our expertise to efficiently serve customers with complex supply chain requirements across multiple manufacturing locations. We believe this is a key differentiator for customers who need a supplier that can reliably and consistently support them. Our ability to transfer inventory among our facilities better enables us to timely and profitably source and process specialized items at regional locations throughout our network than if we were required to maintain inventory of all products and specialized equipment at each location.

Broad Geographic Reach Across Attractive End Markets.

Our operations serve a diverse range of industries including commercial ground transportation, metal fabrication and machine shops, industrial machinery and equipment manufacturing, consumer durable equipment, HVAC manufacturing, construction equipment manufacturing, food processing and agricultural equipment manufacturing, and oil and gas. We believe this broad range of industries in which we sell our products and services reduces our risk related to a downturn in a specific industry. We believe that our ability to quickly adjust our offerings based on regional and industry specific trends creates stability while also providing the opportunity to access specific growth markets. We are focused on expanding our presence within growing, secular markets, including electric vehicles and renewable energy.

Established Platform for Organic and Acquisition Growth.

Our growth strategy is based on increasing our operating results through organic growth activities and strategic acquisitions that enhance our service, product, customer, and geographic diversification. Our strategies include investing in value-added processing capabilities, analytically targeting attractive customers and end markets with our supply chain optimization service model, industry consolidation through targeted M&A, and providing customers faster and easier solutions to their metal needs, which we believe will provide us with growth opportunities.

Given the highly fragmented nature of the metals service center industry, we believe there are numerous additional opportunities to acquire businesses and incorporate them into our existing infrastructure. When integrating acquired businesses into our operational model, we may draw on our large scale and geographic reach to improve operational and financial performance through greater purchasing power, improved expense and working capital management, increased access to additional end markets, and broadening product mix.

Extensive Breadth of Products and Services for Diverse Customer Base.

We believe our broad product mix and marketing approach provides customers with a “one-stop shop” solution few other metals service center companies are able to offer. We provide a broad range of processing and fabrication services to meet the needs of our approximately 40,000 customers and typically fulfill approximately 1,000,000 orders per year. We provide supply chain solutions, including just-in-time delivery and value-added processing, to many original equipment manufacturing customers.

5

For the year ended December 31, 2023, no single customer, including their subcontractors, accounted for more than 8% of our sales, and our top 10 customers, including their subcontractors accounted for less than 16% of our sales.

Strong Relationships with Suppliers.

We are among the largest purchasers of metals in North America and have long-term relationships with many of our North American suppliers. We believe we are frequently one of the largest customers of our suppliers and that concentrating our orders among a core group of suppliers is effective for obtaining favorable pricing and service. We believe we have the opportunity to further leverage this strength through continued focus on price and volume using an analytics-driven approach to procurement. In addition, we view our strategic suppliers as supply chain partners. We focus on logistics, lead times, rolling schedules, and scrap return programs to drive value-based buying that is advantageous for us. Metals producers worldwide are consolidating, and large, geographically diversified customers, such as Ryerson, are desirable partners for these larger suppliers. Our relationships with suppliers often provide us with access to metals when supply is constrained. Through our knowledge of the global metals marketplace and capabilities of specific mills, we believe we have developed an advantageous global purchasing strategy.

Experienced Management Team with Deep Industry Knowledge.

Our senior management team has extensive industry and operational experience and has been instrumental in optimizing and implementing our strategy. Our senior management has an average of more than 30 years of experience in the metals or service center industries. Our Chief Executive Officer (“CEO”) and President, Mr. Edward Lehner, who joined the Company in August 2012 as Chief Financial Officer (“CFO”) and became CEO in June 2015, has 32 years of experience, predominantly in the metals industry. Mr. Mike Burbach, our Chief Operating Officer, has over 40 years of experience with the Company and previously served as the President of the North-West Region of the Company. Mr. Jim Claussen, Executive Vice President & CFO, has 29 years of industry experience.

Industry Outlook

The Institute for Supply Management’s Purchasing Managers’ Index (“PMI”) reported contracting factory activity throughout 2023 with readings consistently below the growth threshold of 50. The contractionary trend indicated by PMI began with readings dropping below 50 starting in November 2022 and continuing through December of 2023, marking 14 consecutive months, with the most recent reading of 47.4 for December 2023. The PMI measures the economic health of the manufacturing sector and is a composite index based on five indicators: new orders, inventory levels, production, supplier deliveries, and the employment environment. PMI readings can be a good indicator of industrial activity and general economic growth.

The Department of Commerce announced that real GDP increased 2.5 percent in 2023 and the Federal Reserve Bank of Philadelphia projected that the median growth rate in real GDP would be 1.7 percent, 1.8 percent, and 2.1 percent for 2024, 2025, and 2026, respectively.

Steel demand in North America is largely dependent on growth of the automotive, industrial equipment, consumer appliance, and construction end markets. Our end markets reflect the performance of the manufacturing economy, and according to the latest Livingston Survey, published by the Federal Reserve Bank of Philadelphia, U.S. industrial production is expected to have expanded by 0.3 percent in 2023 and is further expected to grow by 0.5 percent in 2024 and 1.4 percent in 2025.

Products and Services

We carry a full line of carbon steel, stainless steel, alloy steels, and aluminum, and a limited line of nickel and red metals. These materials are stocked in a number of shapes, including coils, sheets, rounds, hexagons, square and flat bars, plates, structurals, and tubing.

We also provide a wide variety of processing services to meet our customers’ needs. Most of the products that we carry require expensive specialized equipment for material handling and processing. We believe few of our customers have the capability to process metal into the desired sizes, forms, or finishes or they are unwilling to incur the significant capital expenditures to acquire the necessary equipment. We are growing and diversifying our product mix mainly as a result of our targeted growth strategy to provide increased levels of value-added processing services. We believe our enhanced processing capabilities will increase our ability to sell higher-margin metals processing services to a larger group of customers. We expect this, together with our focus on maintaining pricing discipline related to our processing services, will increase our gross profit margin.

We had capital expenditures of $358.1 million in the five-year period ended December 31, 2023. We are increasing our investments in processing equipment to offer more value-added processing to our customers in an effort to increase our margins and profitability. We currently perform processing services on nearly 80% of the materials sold by us.

6

The following pie charts show our percentage of sales by major product lines for 2023 and 2022:

We are not dependent on any particular customer group or industry because we process and distribute a variety of metals. This diversity of product type and material reduces our exposure to fluctuations or other weaknesses in the financial or economic stability of particular customers or industries. We are also less dependent on any particular suppliers as a result of our product diversification. See pie charts showing our sales by metal consuming industry within “Customers and Markets” discussion below.

Customers and Markets

Our customer base is diverse, numbering approximately 40,000 in a variety of industries, including metal fabrication and machine shops, industrial machinery and equipment, commercial ground transportation, consumer durable, food processing and agricultural equipment, construction equipment, HVAC, and oil & gas. Although we sell directly to many large original equipment manufacturers, the majority of our sales are to smaller customers, including small machine shops and fabricators, in small quantities with frequent deliveries, helping them manage their working capital and credit needs more efficiently.

For the year ended December 31, 2023, no single customer, including their subcontractors, accounted for more than 8% of our sales, and our top 10 customers, including their subcontractors, accounted for less than 16% of our sales. Substantially all of our sales are attributable to our U.S. operations and substantially all of our long-lived assets are located in the U.S.

7

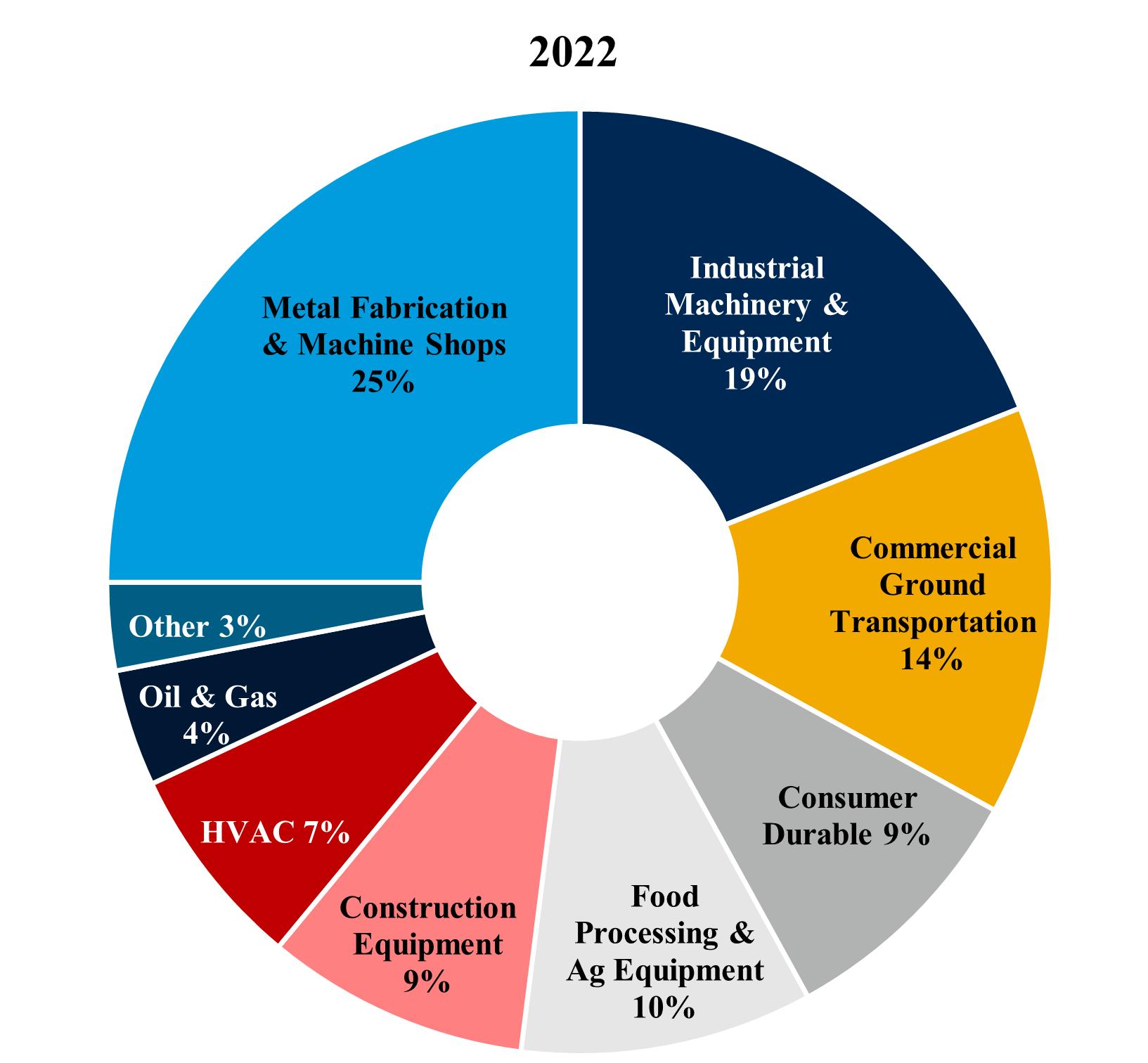

The following pie charts show the Company’s percentage of sales by metal consuming industry for 2023 and 2022:

Our customers are primarily located throughout the U.S., but we also have international customers. Our decentralized operating structure and facilities located near or close to most of our customers enable an efficient delivery system capable of handling a high frequency of short lead time orders. We transport our products directly to customers via our in-house and dedicated truck fleet, which further supports the just-in-time delivery requirements of our customers, and via third-party trucking firms.

We process our metals to specific customer orders as well as for stocking programs. Many of our larger customers commit to purchase on a regular basis at agreed upon or indexed prices for periods ranging from three to twelve months. To help mitigate price volatility risks, these price commitments are generally matched with corresponding supply arrangements, or to a lesser degree by commodity hedges. Customers notify us of specific release dates for processed products. Customers typically notify us of release dates anywhere from on a just-in-time basis to one month before the release date. Consequently, we are required to carry sufficient inventory to meet the short lead time and just-in-time delivery requirements of our customers.

We have international facilities located in Canada, Mexico, and China. Net sales of our international locations (based on where the shipments originated) accounted for 9.1% of our consolidated 2023 net sales, or $466.4 million. See Note 13 — “Segment information” of Part II, Item 8 “Financial Statements and Supplementary Data” for further information on U.S. and foreign revenues and assets.

Customer demand may change from time to time based on, among other things, general economic conditions and industry capacity. Many of the industries in which our customers compete are cyclical in nature. We believe that our various and diverse offerings, ways-to-market, and end markets reduce the volatility of our business in the aggregate, thus somewhat reducing earnings volatility. A portion of our customers experience seasonal slowdowns. Our sales, as measured in tonnage sold, in the months of July, November, and December traditionally have been lower than in other months because of a reduced number of shipping days and holiday or vacation closures for some customers. Consequently, our sales in the first two quarters of the year are usually higher than in the third and fourth quarters.

Suppliers

We purchase the majority of our inventories from key domestic metals suppliers. Because of our total volume of purchases and our long‑term relationships with our suppliers, we believe that we are generally able to purchase inventory at the best prices offered by our suppliers.

For the year ended December 31, 2023, our top 25 suppliers, including their subcontractors, accounted for approximately 78% of our purchase dollars. We are generally able to meet our materials requirements because we use many suppliers, there is a substantial overlap of product offerings from these suppliers, and there are several other suppliers able to provide identical or similar

8

products. While the metals producing supply base has experienced significant consolidation and supply interruptions in the past, we believe both our size and our long-term relationships with our suppliers has enabled us to meet our material requirements and will continue to allow us to do so in the future.

Sales and Marketing

We maintain our own professional sales force. In addition to our office sales staff, we market and sell our products through the use of our field sales force that we believe has extensive product and customer knowledge and offers a comprehensive catalog of our products. Our office and field sales staff, which together consist of approximately 850 employees, include technical personnel. Additionally, we offer our customers the ability to purchase our products through our e-commerce website.

Because much of our business is relationship-based, we operate under many different trade names. Businesses we acquire often have strong customer relationships and solid reputations, and we will often continue to use the acquired business name to maintain existing customer relationships.

Capital Expenditures

In 2023, we continued to focus on organic growth by expanding and modernizing existing facilities, adding new state-of -the-art facilities, and adding processing equipment to support value-added business. Investments by us in property, plant, and equipment, together with asset retirements for the five years ended December 31, 2023, excluding the initial purchase price of acquisitions are set forth below. The net capital change during such period aggregated to an increase of $223.2 million.

|

|

Additions |

|

|

Retirements |

|

|

Net |

|

|||

|

|

(In millions) |

|

|||||||||

2023 |

|

$ |

121.9 |

|

|

$ |

0.4 |

|

|

$ |

121.5 |

|

2022 |

|

|

105.1 |

|

|

|

8.3 |

|

|

|

96.8 |

|

2021 |

|

|

59.3 |

|

|

|

68.5 |

|

|

|

(9.2 |

) |

2020 |

|

|

26.0 |

|

|

|

0.2 |

|

|

|

25.8 |

|

2019 |

|

|

45.8 |

|

|

|

57.5 |

|

|

|

(11.7 |

) |

The net reductions in 2019 and 2021 are related to sale lease-back transactions. See Part II, Item 8, Note 5: Property, Plant, and Equipment for additional information on the 2021 sale-leaseback transactions. The lower amount of additions in 2020 was caused by capital expenditures deferred to 2021 and 2022 as spending was reduced due to uncertainties surrounding the COVID-19 pandemic. We currently anticipate capital expenditures, excluding acquisitions, of up to approximately $110 million for 2024, much of which is related to purchases geared towards highly accretive strategic initiatives, IT infrastructure investment, and growth, along with maintenance projects. We expect all of the 2024 capital expenditures to be funded using proceeds from the cash generated by operations. We will continue to evaluate and execute each growth project in light of the economic conditions and outlook at the time of investment and may significantly reduce our capital expenditures if economic conditions warrant a more conservative approach to capital allocation. For the long term, we expect capital expenditures to normalize to a rate that approximates depreciation.

Environmental, Health, and Safety Matters

Our facilities and operations are subject to many federal, state, local, and foreign laws and regulations relating to the protection of the environment and to health and safety. In particular, our operations are subject to requirements relating to waste disposal, recycling, air and water emissions, the handling of regulated materials, remediation, underground storage tanks, asbestos-containing building materials, workplace exposure, and other matters. We believe that our operations are currently in compliance with all such laws and do not presently anticipate substantial expenditures in the foreseeable future in order to meet environmental, workplace health or safety requirements, or to pay for any investigations, corrective action, or claims. However, claims, enforcement actions, or investigations regarding personal injury, property damage, or violation of environmental laws could result in substantial costs to us, divert our management’s attention, and result in significant liabilities, fines, or the suspension or interruption of our facilities.

We continue to analyze and implement safeguards to mitigate any environmental, health, and safety risks we may face. As a result, additional costs and liabilities may be incurred to comply with future requirements, including California and the proposed SEC climate disclosure requirements, or to address newly discovered conditions, and these costs and liabilities could have a material adverse effect on the results of operations, financial condition, or cash flows. While the costs of compliance could be significant, given the uncertain outcome and timing of future action by the U.S. federal government on this issue, we cannot accurately predict the full financial impact of current and future greenhouse gas regulations on our operations or our customers at this time. We do not currently anticipate any new programs disproportionately impacting us compared to our competitors.

9

Some of the properties currently or previously owned or leased by us are located in industrial areas or have a long history of heavy industrial use. We may incur environmental liabilities with respect to these properties in the future including costs of investigations, corrective action, claims for natural resource damages, claims by third parties relating to property damages, or claims relating to contamination at sites where we have sent waste for treatment or disposal. Based on currently available information we do not expect any investigation, remediation matters, or claims related to properties presently or formerly owned, operated, or to which we have sent waste for treatment or disposal would have a material adverse effect on our financial condition, results of operations, or cash flows.

In October 2011, the United States Environmental Protection Agency (the “EPA”) named JT Ryerson as one of more than 100 businesses that may be a potentially responsible party for the Portland Harbor Superfund Site. See Note 12: Commitments and Contingencies in the notes to the consolidated financial statements included in Part II, Item 8 of this Report on Form 10-K. As the EPA has not yet allocated responsibility for the contamination among the potentially responsible parties, including JT Ryerson, we do not currently have sufficient information available to us to determine whether the Record of Decision will be executed as currently stated, whether and to what extent JT Ryerson may be held responsible for any of the identified contamination, and how much (if any) of the final plan’s costs might ultimately be allocated to JT Ryerson. Therefore, management cannot predict the ultimate outcome of this matter or estimate a range of potential loss at this time.

There are various other claims and pending actions against the Company. The amount of liability, if any, for those claims and actions as of December 31, 2023 is not determinable but, in the opinion of management, such liability, if any, will not have a material adverse effect on the Company’s financial position, results of operations, or cash flows. We maintain liability insurance coverage to assist in protecting our assets from losses arising from or related to activities associated with business operations.

Our U.S. operations are also subject to the Department of Transportation Federal Motor Carrier Safety Regulations. We operate a private trucking motor fleet for making deliveries to some of our customers. Our drivers do not carry any material quantities of hazardous materials. Our foreign operations are subject to similar regulations. Future regulations could increase maintenance, replacement, and fuel costs for our fleet. These costs could have a material adverse effect on our results of operations, financial condition, or cash flows.

Intellectual Property

We own several U.S. and foreign trademarks, service marks, and copyrights. Certain of the trademarks are registered with the U.S. Patent and Trademark Office and, in certain circumstances, with the trademark offices of various foreign countries. We consider certain other information owned by us to be trade secrets. We protect our trade secrets by, among other things, entering into confidentiality agreements with our employees regarding such matters and implementing measures to restrict access to sensitive data and computer software source code on a need-to-know basis. We believe that these safeguards adequately protect our proprietary rights and we vigorously defend these rights. While we consider all our intellectual property rights as a whole to be important, we do not consider any single right to be essential to our operations as a whole.

Sustainability

In December 2023, Ryerson released its second Sustainability Report. The report builds on the Company’s inaugural 2022 report and provides an update on ongoing sustainability efforts, the investments being made in its people and service center network, and how it is serving its communities. Similar to the inaugural report, the 2023 edition illustrates the Company’s focus on energy and emissions reductions, sustainable products, data security, diversity, equity, and inclusion ("DEI"), and talent and future workforce while also providing updates on Ryerson’s advancement in these categories. A few achievements include Ryerson’s recognition by Forbes as one of America’s best mid-sized companies to work for, its launch of the award-winning Ryerson Illuminator app, and its continued role in the circular metals economy.

Additionally, the Sustainability Report includes important content on governance practices, including how we continuously monitor and analyze ourselves and our supply-chain relationships in order to operate with a high level of integrity and how we protect Company and stakeholder information through strong cybersecurity practices. We strive, and expect our suppliers, to comply with all applicable laws and regulations as well as Ryerson's Human Rights Policy, Conflict Minerals Policy, and Code of Ethics and Business Conduct.

Human Capital

In order to provide best in class customer experiences, it is crucial that we continue to work to attract and retain top talent. To facilitate talent attraction and retention, we strive to create a diverse, inclusive, and safe workplace, with opportunities for our

10

employees to grow and develop in their careers, supported by strong compensation, benefits, and wellness programs, and by programs that build connections between our employees and their communities.

Talent and Future Workforce. Our recruitment and talent management teams lead our mission to attract, retain and develop diverse talent. These teams are organized under our Talent Management Office ("TMO"), which includes our Chief Human Resources Officer, our Director of Talent Management, and other senior leaders. The TMO is responsible for our recruiting efforts, attracting the best talent, increasing diversity and hiring efficiencies, facilitating onboarding, and continuing education opportunities to engage employees as they join Ryerson and build their careers with us.

As part of retaining and developing talent, Ryerson offers employees competitive compensation, expanded benefits including a parental leave policy, career growth through its learning platform, mentorship and tuition reimbursement programs, and engagement through all-employee surveys conducted periodically.

Diversity and Inclusion. Ryerson is embracing diversity and inclusion via our Diversity, Equity, and Inclusion council ("DEI Council") that focuses on employee engagement, DEI training, and community outreach efforts with the mission of fostering an environment across the organization that values diversity of experiences and perspectives and encourages inclusivity in all aspects of the business.

In 2023, Ryerson’s DEI Council announced the establishment of three employee resource groups ("ERGs") to be available to employees in 2024: Women in Search of Excellence (WISE), Next Generation of Leaders (NextGen), and Leveraging All Diversity (LEAD). These ERGs are voluntary, employee-led groups that work to foster a more inclusive workplace by uniting people with common interests, identities, or backgrounds. Each of the three ERGs established is purposefully aligned with Ryerson’s DEI mission and strategic goals.

Further, Ryerson is invested in DEI training by providing employees with training on being inclusive, avoiding bias, and workplace intervention. Training is available at any time on the Company’s learning platform, where employees can select from a growing catalog of DEI courses.

Employee Health, Wellness, and Safety. Health, safety, and wellness are fundamental expectations of our Board, executives, employees, and our customers. Our safety standards, which go beyond industry standards and the minimum legal requirements, have helped protect the well-being of our people and prevent workplace injuries. Our commitment towards a zero-injury workplace is constant and driven by an Environmental, Health, and Safety policy that reinforces the goal. Our 2023 performance at our facilities, measured as the number of OSHA recordable injuries per 200,000 labor hours, was 2.26, which was better than the industry average as reported by the Bureau of Labor Statistics.

We provide our employees and their families with access to a variety of innovative, flexible, and convenient health and wellness programs, including benefits that provide protection and security so they can have peace of mind concerning events that may require time away from work or that impact their financial well-being; that support their physical and mental health by providing tools and resources to help them improve or maintain their health status, and encourage engagement in healthy behaviors; and that offer choice where possible so they can customize their benefits to meet their needs and the needs of their families.

Compensation and Benefits. We provide robust compensation and benefits programs to help meet the financial needs of our employees. In addition to salaries, we provide annual and quarterly sales incentive plans, healthcare and insurance benefits, health savings and flexible spending accounts, retirement savings contribution matching, paid time off, parental leave, employee assistance programs, and tuition assistance. Additionally, we have targeted equity-based grant programs with vesting conditions to facilitate retention of personnel, particularly those with critical skills and experience.

Employee Headcount and Unions. See Item 1A, Risks Related to Operating our Business, sub-section "Any significant work stoppages can harm our business", as well as Note 12: Commitments and Contingencies within Part II, Item 8 "Financial Statements and Supplementary Data" for further information.

Available Information

All periodic and current reports and other filings that we are required to file with the Securities and Exchange Commission (“SEC”), including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant Section 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge from the SEC’s website (www.sec.gov) or through our Investor Relations website at http://ir.ryerson.com. Such documents are available as soon as reasonably practicable after electronic filing of the material with the SEC. Copies of these reports (excluding

11

exhibits) may also be obtained free of charge, upon written request to: Investor Relations, Ryerson Holding Corporation, 227 W. Monroe St., 27th Floor, Chicago, Illinois 60606.

The Company also posts its Code of Ethics on its website. See Part III, Item 10 for more information regarding our Code of Ethics.

Our website address is included in this report for informational purposes only. Our website and the information contained therein or connected thereto are not incorporated into this annual report on Form 10-K.

ITEM 1A. RISK FACTORS.

Our business faces many risks. You should carefully consider the risks and uncertainties described below, together with the other information in this report, including the consolidated financial statements and notes to consolidated financial statements. We cannot assure you that any of the events discussed in the risk factors below will not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition, and cash flows.

RISKS RELATED TO OUR INDUSTRY

Weakness in the economy, market trends, and other conditions affecting the profitability and financial stability of our customers could negatively impact our sales growth and results of operations.

Economic and industry trends affect our business environments. We serve several metals-consuming industries in which the demand for our products and services is sensitive to the production activity, capital spending, and demand for products and services of our customers. Many of these customers operate in markets that are subject to highly cyclical fluctuations resulting from seasonality, market uncertainty, costs of goods sold, currency exchange rates, foreign competition, offshoring of production, oil and natural gas prices, geopolitical developments, and a variety of other factors beyond our control. Any of these factors could cause customers to idle or close facilities, delay purchases, reduce production levels, or experience reductions in the demand for their own products or services.

Any of these events could impair the ability of our customers to make full and timely payments or reduce the volume of products and services these customers purchase from us and could cause increased pressure on our selling prices and terms of sale.

We do not expect the cyclical nature of our industry to change and any downturn in our customers’ industries could reduce our revenues and profitability or a significant or prolonged slowdown in activity in the U.S., Canada, or any other major world economy, or a segment of any such economy, could negatively impact our sales growth and results of operations.

The metals services business is very competitive and increased competition could reduce our revenues and gross margins.

We face competition in all markets we serve, from metals producers that sell directly to certain customers or segments of the market, to other metal services companies. The metals services industry itself is highly fragmented and competitive. There are a few large competitors, but most of the market is served by small local and regional competitors. Competition is based principally on price, service, quality, production capabilities, inventory availability, and timely delivery.

We are experiencing increased pressure from online businesses that compete with price transparency. We expect technological advancements and the increased use of e-commerce solutions within the industry to continue to evolve at a rapid pace. As a result, our ability to effectively compete requires us to respond and adapt to new industry trends and developments, and implement new technology and innovations that may result in unexpected costs or may take longer than expected.

To remain competitive, we must be willing and able to respond to market pressures timely. These pressures, and the implementation, timing, and results of our strategic pricing and other responses, could have a material effect on our sales and profitability. If we are unable to grow sales or reduce costs, among other actions, to wholly or partially offset the effect on profitability of our pricing actions, our results of operations and financial condition may be adversely affected.

Changing metals prices may have a significant impact on our liquidity, net sales, gross margins, operating income, and net income.

The metals services industry as a whole is cyclical and, at times, pricing and availability of metal can be volatile due to numerous factors beyond our control, including, but not limited to, general domestic and international economic conditions, labor costs, sales levels, competition, levels of inventory held by other metals service centers, consolidation of metals producers, higher raw material costs for the producers of metals, import duties and tariffs, and currency exchange rates. This volatility can significantly

12

affect the availability and cost of materials for us. Our ability to pass on increases in costs in a timely manner depends on market conditions and may result in lower gross margins. In addition, higher prices could impact demand for our products, resulting in lower sales volumes. Moreover, we maintain substantial inventories of metal to accommodate the short lead times and just-in-time delivery requirements of our customers. Accordingly, we purchase metals in an effort to maintain inventory at levels that we believe to be appropriate to satisfy the anticipated needs of our customers based upon historic buying practices, contracts with customers, and market conditions. Commitments for metal purchases are generally at prevailing market prices in effect at the time orders are placed or at the time of shipment. During periods of rising metal prices, we may be negatively impacted by delays between the time of increases in the cost of metals to us and increases in the prices that we charge for our products if we are unable to pass these increased costs on to our customers. In addition, when metal prices decline, this could result in lower selling prices for our products and, as we use existing inventory that we purchased at higher metal prices, lower gross profit margins. Declines in prices or reductions in sales volumes could adversely impact our ability to maintain our liquidity and to remain in compliance with certain financial covenants under our $1.3 billion revolving credit facility (“the Ryerson Credit Facility”), as well as result in us incurring inventory or goodwill impairment charges. Consequently, changing metals prices could significantly impact our liquidity, net sales, gross margins, operating income, and net income.

Unexpected product shortages could negatively impact customer relationships, resulting in an adverse impact on results of operations.

Disruptions could occur due to factors beyond our control, including economic downturns, political unrest, port slowdowns, trade issues, including increased export or import duties or trade restrictions, health crises, climate related disruptions, and other factors. Recent unrest in the Red Sea has increased both shipping times and costs presenting new challenges to the metals industry. Any of the aforementioned items could adversely affect a supplier’s ability to manufacture or deliver products to us.

Any disruption resulting from these events could cause significant delays in shipments of products or difficulties in obtaining products, any of which may expose us to unanticipated liability or require us to change our business practices in a manner materially adverse to our business, results of operations, and financial condition. For our sources of lower cost products from Asia and other areas of the world, the effect of disruptions is typically increased due to the additional lead time required and distances involved. In addition, we have strategic relationships with a number of vendors. In the event we are unable to maintain those relations, there might be a loss of competitive pricing advantages which could, in turn, adversely affect results of operations.

Changes in customer or product mix could cause our gross margin percentage to decline.

From time to time, we experience changes in customer and product mix that affect gross margin. Changes in customer and product mix result primarily from business acquisitions, changes in customer demand, customer acquisitions, selling and marketing activities, and competition. If rapid growth with lower margin customers occurs, we will face pressure to maintain current gross margins, as these customers receive more discounted pricing due to their higher sales volume. There can be no assurance that we will be able to maintain historical gross margins in the future.

We may not be able to retain or expand our customer base if the North American manufacturing industry erodes through acquisition and merger or consolidation activity in our customers’ industries.

Our customer base primarily includes manufacturing and industrial firms. Some of our customers operate in industries that are undergoing consolidation through acquisition and merger activity and some customers have closed as they were unable to compete successfully with overseas competitors. Our facilities are predominately located in the U.S. and Canada. To the extent that our customers cease U.S. operations or relocate to regions in which we do not have a presence, we could lose their business. Acquirers of manufacturing and industrial firms may have suppliers of choice that do not include us, which could impact our customer base and market share.

Global metal overcapacity and imports of metal products into the United States have adversely affected, and may again adversely affect, United States metal prices, which could impact our sales and results of operations.

At times, global metal production capacity may exceed global consumption of metal products. Such excess capacity sometimes results in metal manufacturers in certain countries exporting steel at prices that are lower than prevailing domestic prices and sometimes at or below their cost of production. Excessive imports of metal into the U.S. have exerted and may exert in the future, downward pressure on U.S. steel prices which may negatively affect our results of operations.

13

Lead time and the cost of our products could increase if we were to lose one of our primary suppliers.

If, for any reason, our primary suppliers of aluminum, carbon steel, stainless steel, or other metals should curtail or discontinue their delivery of such metals in the quantities needed and at prices that are competitive, our business could suffer. The number of available suppliers could be reduced by factors such as industry consolidation and bankruptcies affecting steel and metal producers. For the year ended December 31, 2023, our top 25 suppliers represented approximately 78% of our purchases. We could be significantly and adversely affected if delivery were disrupted from a major supplier. If, in the future, we were unable to obtain sufficient amounts of the necessary metals at competitive prices and on a timely basis from our traditional suppliers, we may not be able to obtain such metals from alternative sources at competitive prices to meet our delivery schedules, which could have a material adverse effect on our sales and profitability.

RISKS RELATED TO MARKET AND ECONOMIC VOLATILITY

Changes in inflation may adversely affect financial performance.

Fluctuations in inflation could result in, and recent inflationary pressures have resulted in, lower revenues, higher costs, and decreased margins, profits, and earnings. Rapid or significant inflation could continue to increase the costs we incur to procure, process, package, and deliver our metal to customers and we may not be able to increase selling prices to customers at the same rate, resulting in decreased margins and operating profits. Prolonged periods of deflation could adversely affect the degree to which we are able to maintain or increase selling prices resulting in decreased revenues, margins, and operating profits. Additionally, prolonged deflation could impact our availability on the Ryerson Credit Facility as the value of our accounts receivable and inventory decreases.

In addition, we rely on arrangements with third-party shipping and freight companies for the delivery of our products. Freight and shipping costs may increase due to inflation, and any such increases could adversely affect our margins unless we are able to increase selling prices at the same rate.

We monitor the risk that the principal markets in which we operate could continue to experience increased inflationary conditions. The onset, duration, and severity of an inflationary period cannot be estimated with precision.

The volatility of the market could result in a material impairment of goodwill.

We evaluate goodwill annually on October 1 and whenever events or changes in circumstances indicate potential impairment. Events or changes in circumstances that could trigger an impairment review include significant underperformance relative to our historical or projected future operating results, significant changes in the manner or the use of our assets or the strategy for our overall business, and significant negative industry or economic trends. We test for impairment of goodwill by assessing various qualitative factors with respect to developments in our business and the overall economy and calculating the fair value of a reporting unit using a combination of an income approach based on discounted future cash flows and a market approach at the date of valuation, as necessary. Under the discounted cash flow method, the fair value of each reporting unit is estimated based on expected future economic benefits discounted to a present value at a rate of return commensurate with the risk associated with the investment. Projected cash flows are discounted to present value using an estimated weighted average cost of capital, which considers both returns to equity and debt investors. Please refer to the Section titled “Critical Accounting Estimates - Goodwill,” of Item 7, “Management’s Discussion and Analysis of Financial Conditions and Results of Operations,” and Note 1 — “Summary of Accounting and Financial Policies” of Part II, Item 8 "Financial Statements and Supplementary Data" for further information.

Poor investment performance or other factors could require us to make significant unplanned contributions to our pension plan and future funding for postretirement employee benefits other than pensions also may require substantial payments from current cash flow.

We provide defined benefit pension plans for certain eligible employees and retirees. The performance of the debt and equity markets affect the value of plan assets. A decline in the market value may increase the funding requirements for these plans. The cost of providing pension benefits is also affected by other factors, including interest rates used to measure the required minimum funding levels, the rate of return on plan assets, discount rates used in determining future benefit obligations, future government regulation, and prior contributions to the plans. Significant unanticipated changes in any of these factors may have an adverse effect on our financial condition, results of operations, liquidity, and cash flows.

14

RISKS RELATED TO EXPANSION AND INTERNATIONAL OPERATIONS

We may not be able to successfully consummate and complete the integration of future acquisitions, and if we are unable to do so, it could disrupt operations and cause unanticipated increases in costs and/or decreases in revenues and results of operations.

We have grown through a combination of internal expansion, acquisitions, and joint ventures. We intend to continue to grow through acquisitions, but we may not be able to identify appropriate acquisition candidates, obtain financing on satisfactory terms, consummate acquisitions, or integrate acquired businesses effectively and profitably into our existing operations. Restrictions contained in the agreements governing the Ryerson Credit Facility, or our other existing or future debt may also inhibit our ability to make certain investments, including acquisitions, and participations in joint ventures.

Acquisitions, partnerships, joint ventures, and other business combination transactions, both foreign and domestic, involve various inherent risks, such as uncertainties in assessing value, strengths, weaknesses, liabilities, and potential profitability. There is also risk relating to our ability to achieve identified operating and financial synergies anticipated to result from the transactions. Additionally, problems could arise from the integration of acquired businesses, including unanticipated changes in the business or industry or general economic conditions that affect the assumptions underlying the acquisition. Our future success will depend on our ability to complete the integration of these future acquisitions successfully into our operations. Specifically, after any acquisition, customers may choose to diversify their supply chains to reduce reliance on a single supplier for a portion of their metals needs. We may not be able to retain all of our and an acquisition’s customers, which may adversely affect our business and sales. Integrating acquisitions, particularly large acquisitions, requires us to enhance our operational and financial systems and employ additional qualified personnel, management, and financial resources, and may adversely affect our business by diverting management away from day-to-day operations. Further, failure to successfully integrate acquisitions may adversely affect our profitability by creating significant operating inefficiencies that could increase our operating expenses as a percentage of sales and reduce our operating income. In addition, we may not realize expected cost savings from acquisitions. Any one or more of these factors could cause us to not realize the benefits anticipated or have a negative impact on the fair value of the reporting units. Accordingly, goodwill and intangible assets recorded as a result of acquisitions could become impaired.

Certain of our operations are located outside of the United States, which subjects us to risks associated with international activities.

We have certain operations which are located outside of the U.S., in Canada, China, and Mexico. We are subject to the Foreign Corrupt Practices Act (“FCPA”), which generally prohibits U.S. companies and their intermediaries from making corrupt payments or otherwise corruptly giving anything of value to foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment, and requires companies to maintain adequate record-keeping and internal accounting practices. The FCPA applies to covered companies, individual directors, officers, employees, and agents. Under the FCPA, U.S. companies may be held liable for some actions taken by strategic or local partners or representatives. If we or our intermediaries fail to comply with the requirements of the FCPA, governmental authorities in the U.S. could seek to impose civil and/or criminal penalties.

Our international operations and potential joint ventures may cause us to incur costs and risks that may distract management from effectively operating our North American business, and such operations or joint ventures may not be profitable.

We maintain foreign operations in Canada, China, and Mexico. International operations are subject to certain risks inherent in conducting business in, and with, foreign countries, including price controls, exchange controls, export controls, economic sanctions, duties, tariffs, limitations on participation in local enterprises, nationalization, expropriation and other governmental action, and changes in currency exchange rates. While we believe that our current arrangements with local partners provide us with experienced business partners in foreign countries, events or issues, including disagreements with our partners, may occur that require attention of our senior executives and may result in expenses or losses that erode the profitability of our foreign operations or cause our capital investments abroad to be unprofitable.

We may be adversely affected by currency fluctuations in the U.S. dollar versus the Canadian dollar, the Chinese renminbi, the Hong Kong dollar, and the Mexican peso.

We have significant operations in Canada which incur the majority of their metal supply costs in U.S. dollars but earn the majority of their sales in Canadian dollars. Additionally, we have significant assets in China and conduct operations in Mexico. We may from time to time experience losses when the value of the U.S. dollar strengthens against the Canadian dollar, the Chinese renminbi, the Hong Kong dollar, or the Mexican peso, which could have a material adverse effect on our results of operations. In addition, we are subject to translation risk when we consolidate our Canadian, Chinese, and Mexican subsidiaries’ net assets into our balance sheet. Fluctuations in the value of the U.S. dollar versus the Canadian dollar, Chinese renminbi, the Hong Kong dollar, or the Mexican peso could reduce the value of these assets as reported in our financial statements, which could, as a result, reduce our stockholders’ equity.

15

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities, particularly with regards to the land our facilities are located on.

The Chinese government has exercised and continues to exercise substantial control over the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Moreover, the Chinese court system does not provide the same property and contract right guarantees as do courts in the U.S. and, accordingly, disputes may be protracted and resolution of claims may result in significant economic loss.

Additionally, there is no private ownership of land in China and all land ownership is held by the government of China, its agencies, and collectives, which issue land use rights that are generally renewable. We lease the land where our Chinese facilities are located from the Chinese government. If the Chinese government decided to terminate our land use rights agreements, our assets could become impaired and our ability to meet customer orders could be impacted.

RISKS RELATED TO CYBERSECURITY AND INFORMATION TECHNOLOGY

Damage to our information technology infrastructure could harm our business.

The unavailability of any of our computer-based systems for any significant period of time could have a material adverse effect on our operations. In particular, our ability to manage inventory levels successfully largely depends on the efficient operation of our computer hardware and software systems. We use management information systems to track inventory information at individual facilities, provide pricing recommendations for sales quotes, communicate customer information, and aggregate daily sales, margin, and promotional information. Difficulties associated with upgrades, installations of major software or hardware, and integration with new systems could have a material adverse effect on results of operations. We could be required to expend substantial resources to upgrade our information systems or integrate them with the systems of companies we have acquired. The upgrade or integration of these systems may disrupt our business or lead to operating inefficiencies. In addition, these systems are vulnerable to, among other things, damage or interruption from fire, flood, tornado, and other natural disasters, power loss, computer system and network failures, operator negligence, physical and electronic loss of data, or security breaches and computer viruses.

We are subject to cybersecurity risks and may incur increasing costs in an effort to minimize those risks.

We depend on the proper functioning and availability of our information technology platform, including communications and data processing systems, in operating our business. These systems include software programs that are integral to the efficient operation of our business. We have established security measures, controls, and procedures, including established recovery procedures for critical systems and business functions, to safeguard our information technology systems and to prevent unauthorized access to such systems and any data processed or stored in such systems, and we periodically evaluate and test the adequacy of such systems, measures, controls, and procedures; however, there can be no guarantee that such systems, measures, controls, and procedures will be effective. Security breaches could expose us to a risk of loss or misuse of our information, litigation, and potential liability. In addition, cyber incidents that impact the availability, reliability, speed, accuracy, or other proper functioning of these systems could have a significant impact on our operations, and potentially on our results. We may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyberattacks. A significant cyber incident, including system failure, security breach, disruption by malware, or other damage could interrupt or delay our operations, result in a violation of applicable privacy and other laws, damage our reputation, cause a loss of customers, or give rise to monetary fines and other penalties, which could be significant. Refer to Item 1C: "Cybersecurity" for further information on our Cybersecurity processes, policies, and programs.

RISKS RELATED TO OPERATING OUR BUSINESS

Any significant work stoppages can harm our business.

As of December 31, 2023, we employed approximately 4,300 persons in North America and 300 persons in China. Our North American workforce was comprised of approximately 1,900 office employees and approximately 2,400 plant employees. Sixteen percent of our plant employees were members of various unions, including the United Steel Workers and The International Brotherhood of Teamsters.

Eight renewal contracts covering 160 employees were successfully negotiated in 2023. Eight contracts covering 152 employees are currently scheduled to expire in 2024.

16

Certain employee retirement benefit plans are underfunded and the actual cost of those benefits could exceed current estimates, which would require us to fund the shortfall.

As of December 31, 2023, our pension plan had an unfunded liability of $63.9 million and our other postretirement benefits plan had an unfunded liability of $35.7 million. Our actual costs for benefits required to be paid may exceed those projected and future actuarial assessments. Under those circumstances, the adjustments required to be made to our recorded liability for these benefits could have a material adverse effect on our results of operations and financial condition and cash payments to fund these plans could have a material adverse effect on our cash flows. We may be required to make substantial future contributions to improve the plan’s funded status.

Any prolonged disruption of our processing centers could harm our business.

We have dedicated processing centers that permit us to produce standardized products in large volumes while maintaining low operating costs. We may suffer prolonged disruption in the operations of any of these facilities, whether due to labor or technical difficulties, destruction, or damage sustained as a result of natural disasters or climate-related events to any of the facilities or otherwise, which could adversely affect our operating results.

If we are unable to retain, attract, and motivate management and key personnel, it may adversely affect our business.

In order to compete and have continued growth, we must attract, retain, and motivate executives and other key employees, including those in managerial, technical, sales, marketing, and support positions. We believe that our success is due, in part, to our experienced management team. Losing the services of one or more members of our management team such as our CEO, Edward J. Lehner, could adversely affect our business and possibly prevent us from improving our operational, financial, and information management systems and controls. We compete to hire employees and then must train them and develop their skills and competencies. In the future, we may need to retain and hire additional qualified sales, marketing, administrative, operating, and technical personnel, and to train and manage new personnel. Our ability to implement our business plan is dependent on our ability to retain, hire, and train a large number of qualified employees each year. Our results of operations could be adversely affected by increased costs due to increased competition for employees, higher employee turnover, or increased employee benefit costs.

Our risk management strategies may result in losses.

From time to time, we may use fixed-price and/or fixed-volume supplier contracts to offset contracts with customers. Some of our existing supply agreements have required minimum purchase quantities. Under adverse economic conditions, those minimums may exceed our needs. Absent exceptions for force majeure and other circumstances affecting the legal enforceability of the agreements, these minimum purchase requirements may compel us to purchase quantities of raw materials that could significantly exceed our anticipated needs or pay damages to the supplier for shortfalls. In these circumstances, we would attempt to negotiate agreements for new purchase quantities. There is a risk, however, that we would not be successful in reducing purchase quantities, either through negotiation or litigation. If that occurred, we would likely be required to purchase more of a particular raw material in a particular year than we need, negatively affecting our results of operations and cash flows.

Additionally, we may use commodity contracts, foreign exchange contracts, and interest rate swaps to manage our exposure to commodity price risk, foreign currency exchange risk, and interest rate risk. These risk management strategies pose certain risks, including the risk that losses on a hedge position may exceed the amount invested in such instruments. Moreover, a party in a hedging transaction may be unavailable or unwilling to settle our obligations, which could cause us to suffer corresponding losses. A hedging instrument may not be effective in eliminating all of the risks inherent in any particular position. Our profitability may be adversely affected during any period as a result of the use of such instruments.

RISKS RELATED TO REGULATORY AND LEGAL MATTERS

We could incur substantial costs related to environmental, health, and safety laws.

Our operations are subject to increasingly stringent environmental, health, and safety laws. These include laws that impose limitations on the discharge of pollutants into the air and water and establish standards for the treatment, storage, and disposal of regulated materials, and the investigation and remediation of contaminated soil, surface water, and groundwater. Failure to maintain or achieve compliance with these laws or with the permits required for our operations could result in substantial increases in operating costs and capital expenditures. In addition, we may be subject to fines and civil or criminal sanctions, third party claims for property damage or personal injury, worker’s compensation or personal injury claims, cleanup costs, or temporary or permanent discontinuance of operations. Certain of our facilities are located in industrial areas, have a history of heavy industrial use, and have been in operation for many years and, over time, we and other predecessor operators of these facilities have generated, used, handled, and disposed of

17

hazardous and other regulated wastes. Environmental liabilities could exist, including cleanup obligations at these facilities or at off-site locations where materials from our operations were disposed of, which could result in future expenditures that cannot be currently quantified and which could have a material adverse effect on our financial position, results of operations, or cash flows. Such liabilities may be imposed without regard to fault or the legality of a party’s conduct and may, in certain circumstances, be joint and several. Future changes to environmental, health, and safety laws, including those related to climate change, could result in material liabilities and costs, constrain operations, or make such operations more costly for us, our suppliers, and our customers.