Exhibit (a)(1)(A)

OFFER TO EXCHANGE

SHARES OF SERIES B CONVERTIBLE CUMULATIVE PERPETUAL PREFERRED STOCK

FOR

OUTSTANDING SHARES OF COMMON STOCK

OF

PERFORMANCE SHIPPING INC.

THE EXCHANGE OFFER PERIOD AND YOUR RIGHT TO WITHDRAW COMMON SHARES THAT YOU TENDER WILL EXPIRE AT 5:00 P.M.,

NEW YORK CITY TIME, ON FRIDAY, JANUARY 21, 2022 UNLESS THE EXCHANGE OFFER PERIOD IS EXTENDED OR EARLIER TERMINATED. PERFORMANCE SHIPPING INC. MAY EXTEND THE EXCHANGE OFFER PERIOD AT ANY TIME.

|

Performance Shipping Inc., a Marshall Islands corporation (the “Company”, “our”, “we”, “us” or “Performance Shipping”), is offering to

exchange up to 4,066,181 of the currently issued and outstanding common shares of the Company, par value $0.01 per share (Nasdaq: PSHG) (the “Common Shares”), for newly issued shares of the Company’s Series B Convertible Cumulative Perpetual

Preferred Stock, par value $0.01 and liquidation preference $25.00 (the “Series B Preferred Shares”), on the terms and subject to the conditions set forth in this offer to exchange (this “Offer to Exchange”) and in the accompanying letter of

transmittal (the “Letter of Transmittal”), each as may be amended or supplemented from time to time. For each Common Share, we are offering to exchange 0.28 Series B Preferred Shares. We refer to this offer, on the terms and subject to the conditions

set forth in this Offer to Exchange, as the “Exchange Offer.”

The “Exchange Offer Period” is the period commencing on Monday, December 20, 2021 and ending at 5:00 p.m., New York City Time, on Friday,

January 21, 2022, or such later date to which the Company may extend the Exchange Offer (the “Expiration Date”). The Exchange Offer is subject to the conditions discussed under “The Exchange Offer — Conditions to the Exchange Offer.” If any of the

offer conditions are not met, we may amend, terminate or extend the Exchange Offer.

Each Series B Preferred Share has a liquidation preference of $25.00 per share and will be entitled to receive a dividend per share equal

to 4.00% per annum of the $25.00 per share liquidation preference, payable quarterly in arrears in cash or, at the Company’s election, in Common Shares valued at the volume-weighted average price of the Common

Shares for the 10 trading days prior to the applicable Dividend Payment Date (as defined below) (the “Series B Preferred Dividend”).

The Series B Preferred Dividend is cumulative from the date of original issuance (the “Original Issue Date”) and will be payable out of

amounts legally available for such purpose (when, as, and if declared by our Board of Directors, and accrued, if not declared) quarterly in arrears, on each March 15, June 15, September 15, and December 15 (each, a “Dividend Payment Date”),

commencing with June 15, 2022 on the Series B Preferred Shares issued in connection with this Exchange Offer.

The Series B Preferred Shares will be redeemable at the Company’s option, at any time after the one year anniversary of the Original Issue

Date at $25.00 per share, plus any accumulated and unpaid dividends thereon to and including the date of redemption.

The Series B Preferred Shares will have no voting rights, subject to certain exceptions described under “Description of Series B

Convertible Cumulative Perpetual Preferred Stock—Voting Rights.” A copy of the Certificate of Designation for the Series B Preferred Shares, which includes all of the terms of the Series B Preferred Shares, is included as Annex A to this Offer to

Exchange. Please see the section entitled “Material Differences Between Common Shares and Series B Preferred Shares” for a more complete description of the differences between the Company’s Common Shares and Series B Preferred Shares.

Each Series B Preferred Share is convertible, at the option of the holder and for additional cash consideration of $7.50 per converted

Series B Preferred Share, into two shares of the Company’s Series C Convertible Cumulative Perpetual Preferred Stock (the “Series C Preferred Shares”), par value $0.01 per share and liquidation preference of $25.00 (the “Series B Conversion Right”).

Please see the section entitled “Description of Series B Convertible Cumulative Perpetual Preferred Stock—Conversion to Series C Convertible Cumulative Perpetual Preferred Stock” in this Offer to Exchange for a description of the rights, privileges

and preferences of our Series C Preferred Shares. The Series B Conversion Right may only be exercised during a 30-day period, such period commencing on the date that is the later of (i) the 31st calendar day following the Original Issue

Date and (ii) the date on which the Company notifies the holders of Series B Preferred Shares that the issuance of Series C Preferred Shares upon exercise of the Series B Conversion Right is covered under an effective registration statement that is

filed with the SEC under the Securities Act or the date that the Company notifies the holders of Series B Preferred Shares that it has determined, in its sole discretion, that the issuance of such Series C Preferred Shares is exempt from the

registration requirements of the Securities Act (the “Conversion Period”).

We are authorized to issue 500,000,000 Common Shares, of which 5,082,726 shares were issued and outstanding as of December 20, 2021, and

25,000,000 preferred shares, par value $0.01 per share, of which no shares were issued and outstanding as of December 20, 2021.

Our Common Shares are listed on the Nasdaq Stock Market under the symbol “PSHG.” Our Series B Preferred Shares and, if issued, our Series C

Preferred Shares, will not be listed for trading on any nationally recognized stock exchange.

You should consider carefully the “Risk Factors” in this Offer to Exchange and the other information included herein

before you decide whether to participate in the Exchange Offer. Our Board of Directors has authorized us to make the Exchange Offer. Our Board of Directors is not making any recommendation as to whether or not to tender their Common Shares for

exchange in the Exchange Offer, and has not made any specific determination as to the value of the consideration to be received by tendering shareholders. Accordingly, you must make your own decision as to whether to tender Common Shares in the

Exchange Offer in light of your own particular circumstances, taking into account your determination as to the value of the consideration to be received.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR

DISAPPROVED OF THE SERIES B PREFERRED SHARES OR DETERMINED IF THIS OFFER TO EXCHANGE IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THE EXCHANGE OFFER, PASSED UPON THE

MERITS OR FAIRNESS OF THE EXCHANGE OFFER OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURES IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Exchange Offer is conditioned on, among other things, the Minimum Tender Condition (as such term is defined herein), as described

herein.

You may tender some or all of your Common Shares on these terms. If you elect to tender Common Shares in response to the Exchange Offer,

please follow the instructions in this Offer to Exchange and the related documents, including the Letter of Transmittal.

If you tender Common Shares, you may withdraw your tendered Common Shares before the Expiration Date and retain them on their terms by

following the instructions herein.

Investing in the Series B Preferred Shares involves a high degree of risk. Please see the section entitled “Risk

Factors” of this Offer to Exchange for a discussion of information that you should consider before tendering Common Shares in the Exchange Offer.

The Exchange Offer will commence on Monday, December 20, 2021 (the date the materials relating to the Exchange Offer are first sent to the

Common Shareholders) and will end on the Expiration Date. The Company is offering to exchange up to 4,066,181 of its currently issued and outstanding Common Shares. If more than 4,066,181 Common Shares are validly tendered and not properly withdrawn

prior to the Expiration Date, the Company will exchange Series B Preferred Shares for Common Shares, subject to the terms of the Exchange Offer, of all shareholders on a pro-rata basis from all Common Shares tendered for exchange.

A detailed discussion of the Exchange Offer is contained in this Offer to Exchange. Holders of Common Shares are strongly encouraged to

read this entire package of materials, and the publicly-filed information about the Company referenced herein, before making a decision regarding the Exchange Offer.

December 20, 2021

IMPORTANT PROCEDURES

If you want to tender some or all of your Common Shares for the Company’s Series B Preferred Shares, you must do one of the following

before the Expiration Date:

|

• |

if your Common Shares are registered in the name of a broker, dealer, commercial bank, trust company, or other nominee, contact the nominee and have the nominee tender your Common Shares for

you, which typically can be done electronically;

|

|

• |

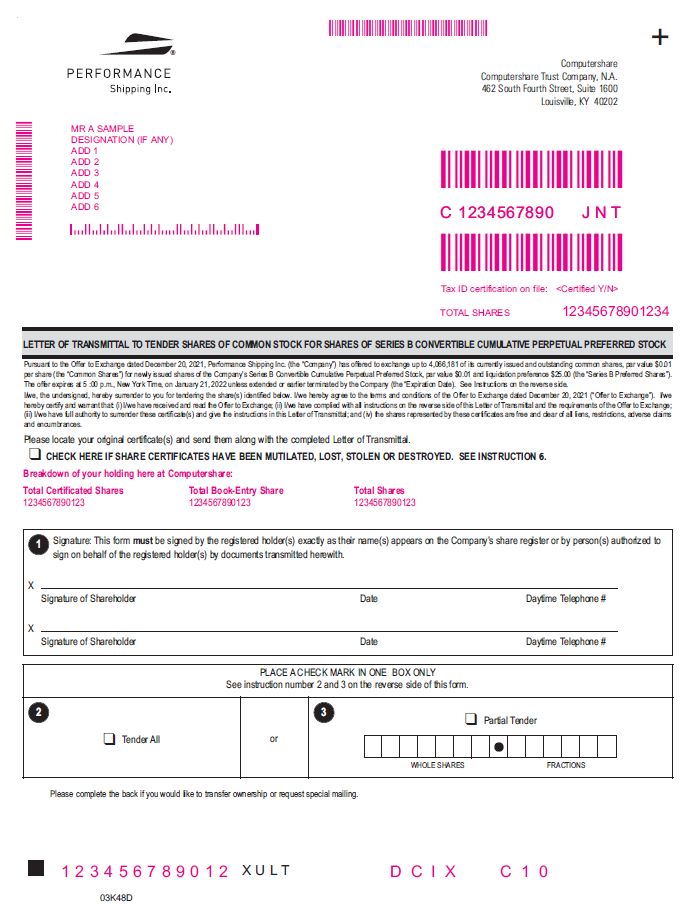

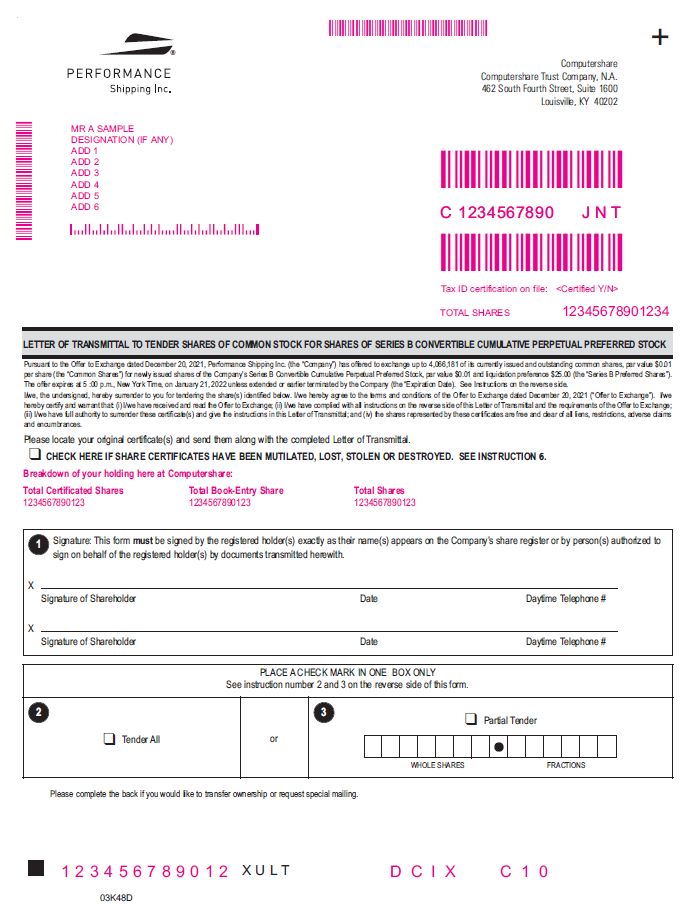

if you hold Common Share certificates in your own name, complete and sign the appropriate enclosed Letter of Transmittal according to its instructions, and deliver it, together

with any required signature guarantees, the certificates for your Common Shares, and any other documents required by the Letter of Transmittal, to the Exchange Agent; or

|

|

• |

if you are an institution participating in The Depository Trust Company (“DTC”), you must tender your Common Shares according to the procedure for book-entry transfer described

in “The Exchange Offer – Procedures for Tendering Common Shares” of this Offer to Exchange.

|

To validly tender Common Shares pursuant to the Exchange Offer, other than Common Shares registered in the name of a broker, dealer,

commercial bank, trust company or other nominee, you must properly complete and duly execute the Letter of Transmittal and deliver it to us in accordance with the procedures described in this Offer to Exchange.

No fractional Series B Preferred Shares will be issued. Common Shares may only be exchanged for whole Series B Preferred Shares. In lieu

of issuing fractional Series B Preferred Shares to which any holder of Common Shares would otherwise be entitled, we will round down the number of Series B Preferred Shares to which such holder is entitled, after aggregating all fractions, to the

nearest whole number of Series B Preferred Shares.

We are not making the Exchange Offer to, and will not accept any tendered Common Shares from, shareholders in any jurisdiction where it

would be illegal to do so. However, we may, at our discretion, take any actions necessary for us to comply with the applicable laws and regulations to make the Exchange Offer to shareholders in any such jurisdiction.

We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your

Common Shares pursuant to the Exchange Offer. You should rely only on the information contained in this Offer to Exchange and in the related Letter of Transmittal or to which we have referred you. We have not authorized anyone to provide you with

information or to make any representation in connection with the Exchange Offer other than those contained in this Offer to Exchange or in the related Letter of Transmittal. If anyone makes any recommendation or gives any information or

representation regarding the Exchange Offer, you must not rely upon that recommendation, information or representation as having been authorized by us or our Board of Directors for the Exchange Offer. You should not assume that the information

provided in this Offer to Exchange is accurate as of any date other than the date as of which it is shown, or if no date is otherwise indicated, the date of this Offer to Exchange.

We are relying on Section 3(a)(9) of the Securities Act to exempt the Exchange Offer from the registration requirements of the Securities

Act. We are also relying on Section 18(b)(4)(c) of the Securities Act to exempt the exchange offer from state securities law requirements. We have no contract, arrangement, or understanding relating to the

payment of, and will not, directly or indirectly, pay, any commission or other remuneration to any broker, dealer, salesperson, agent, or any other person for soliciting tenders in the Exchange Offer. In addition, none of the Exchange Agent,

Information Agent, or any broker, dealer, salesperson, agent, or any other person, is engaged or authorized to express any statement, opinion, recommendation, or judgment with respect to the relative merits and risks of the Exchange Offer. Our

officers, directors, and regular employees may solicit tenders from shareholders and will answer inquiries concerning the terms of the Exchange Offer, but they will not receive additional compensation for soliciting tenders or answering any such

inquiries.

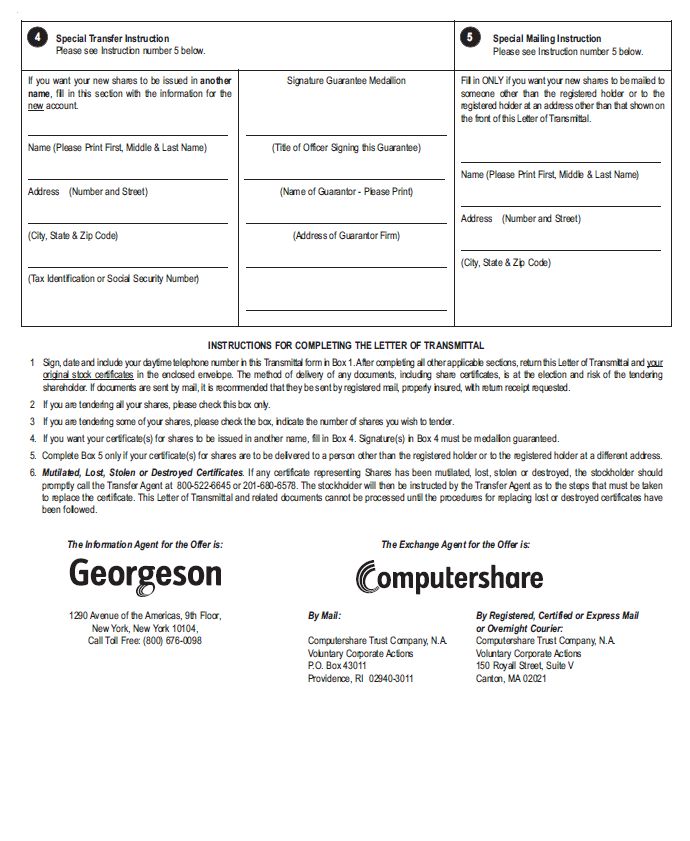

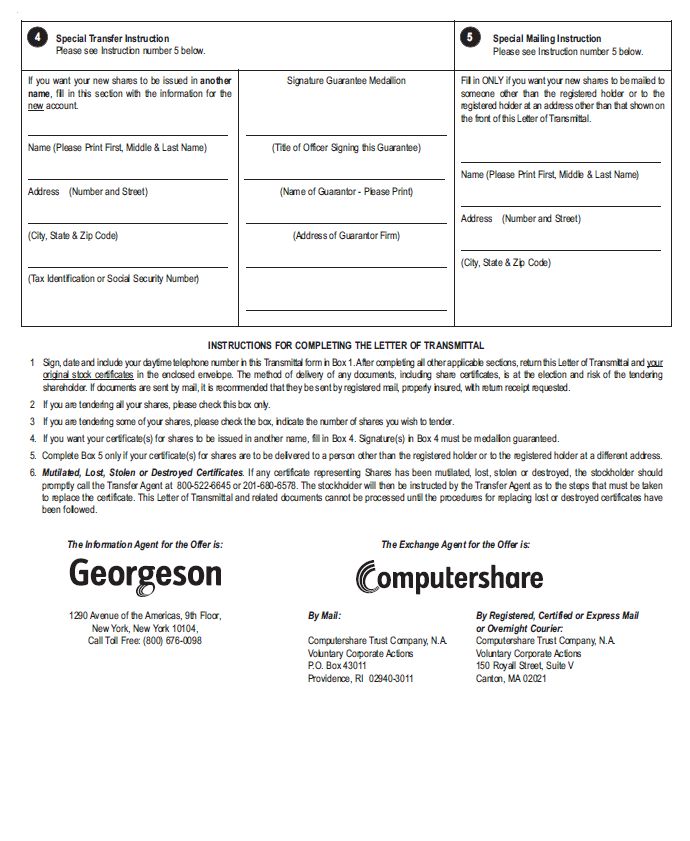

All inquiries relating to this Offer to Exchange should be directed to Georgeson LLC, the Information Agent for the exchange offer, at one

of the telephone numbers or the address listed on the back cover page of Offer to Exchange. Questions regarding the procedures for tendering in the Exchange Offer and requests for assistance in tendering your old securities should be directed to

Computershare, the Exchange Agent, at the telephone number or the address listed on the back cover page of this offering. Requests for additional copies of this Offer to Exchange, any documents incorporated by reference into this Offer to Exchange or

the Letter of Transmittal may be directed to the Information Agent at the telephone number and address listed on the back cover page of this Offer to Exchange.

TABLE OF CONTENTS

|

IMPORTANT PROCEDURES

|

iv

|

| |

|

|

SUMMARY

|

1

|

| |

|

|

CERTAIN QUESTIONS AND ANSWERS ABOUT THE EXCHANGE OFFER

|

4

|

| |

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

8

|

| |

|

|

RISK FACTORS

|

10

|

| |

|

|

THE EXCHANGE OFFER

|

14

|

| |

|

|

DESCRIPTION OF SERIES B CONVERTIBLE CUMULATIVE PERPETUAL PREFERRED STOCK

|

23

|

| |

|

|

COMPARISON OF RIGHTS BETWEEN THE COMMON STOCK AND SERIES B CONVERTIBLE CUMULATIVE PERPETUAL PREFERRED STOCK

|

30

|

| |

|

|

MARKET PRICE INFORMATION

|

32

|

| |

|

|

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

|

33

|

| |

|

|

CERTAIN SECURITIES LAWS CONSIDERATIONS

|

38

|

| |

|

|

ABOUT THE COMPANY

|

39

|

| |

|

|

AVAILABLE INFORMATION

|

39

|

| |

|

|

INCORPORATION OF DOCUMENTS BY REFERENCE

|

39

|

SUMMARY

The following is a summary of the terms of the Exchange Offer being provided for your convenience. It highlights certain material

information in this Offer to Exchange, but before you make any decision with respect to the Exchange Offer, we urge you to read carefully this entire Offer to Exchange, including the section entitled “Risk Factors,” the related Letter of

Transmittal, the descriptions of Common Shares and Series B Preferred Shares and the documents incorporated by reference into this Offer to Exchange. Our Annual Report on Form 20-F for the year ended December 31, 2020 (the “Annual Report”) is

available online at the SEC website (www.sec.gov), and is also available from us upon request. See “Where You Can Find More Information.” The following summary is qualified in its entirety by the more detailed information appearing elsewhere in

this Offer to Exchange and the related Letter of Transmittal.

|

The Company

|

|

Performance Shipping Inc., a Marshall Islands corporation.

|

|

The Exchange Offer

|

|

We are offering to acquire Common Shares for Series B Preferred Shares. For each Common Share validly tendered and

not properly withdrawn, we will issue 0.28 Series B Preferred Shares. If all conditions to the Exchange Offer are satisfied or waived, we will acquire up to 4,066,181 outstanding Common Shares

from all tendering holders. However, only whole Series B Preferred Shares will be delivered.

A holder may tender as few or as many Common Shares as the holder elects. If more than 4,066,181 Common

Shares and validly tendered and not properly withdrawn prior to the Expiration Date, the Company will exchange Series B Preferred Shares for Common Shares, subject to the terms of the Exchange Offer, of all shareholders on a pro-rata

basis from all Common Shares tendered for exchange.

Common Shares may only be exchanged for whole Series B Preferred Shares. In lieu of issuing fractional Series B Preferred Shares

to which any holder of Common Shares would otherwise have been entitled, the Company will round down the number of Series B Preferred Shares to which such holder is entitled, after aggregating all fractions, to the nearest whole number

of Series B Preferred Shares.

The Exchange Offer is being made exclusively to existing holders of Common Shares.

Please see “The Exchange Offer” for additional information.

If you have questions, please call the Information Agent at the telephone number below. See “The Exchange Offer—Procedure for

Tendering.”

|

|

The Common Shares

|

|

As of December 20, 2021, we had 5,082,726 common shares issued and

outstanding. Our Common Shares are listed on Nasdaq under the symbol “PSHG”.

The last reported closing sale price of our Common Shares as reported by the Nasdaq on December 17, 2021, the last trading day

before the date of this Offer to Exchange, was $4.73 per share.

|

|

The Series B Preferred Shares

|

|

As of December 20, 2021, we had no Series B Preferred Shares outstanding.

Our Series B Preferred Shares are not listed on any nationally recognized stock exchange and we do not intend to seek a listing

for our Series B Preferred Shares or the Series C Preferred Shares into which they may be converted.

Each Series B Preferred Share has a liquidation preference of $25.00 per share (the “Liquidation Preference”) and will be entitled to receive

(when, as, and if declared by our Board of Directors, will accrue, if not declared), a dividend per share equal to 4.00% per annum of the $25.00 per share liquidation preference, payable quarterly in arrears, in cash, or, at the

Company’s election, in additional Common Shares valued at the volume-weighted average price of the Common Shares for the 10 trading days prior to the applicable Dividend Payment Date (the “Series B Preferred Dividend”).

The Series B Preferred Dividend is cumulative from the Original Issue Date and will be payable out of amounts legally available for such

purpose, when, as, and if declared by our Board of Directors, quarterly in arrears, on each June 15, September 15, December 15, March 15, commencing with June 15, 2022 on the Series B Preferred Shares issued in connection with this

Exchange Offer.

The Series B Preferred Shares will be redeemable at the Company’s option, at any time after the one-year anniversary of the Original Issue Date

at $25.00 per share plus any accumulated and unpaid dividends thereon to and including the date of redemption.

The Series B Preferred Shares will have no voting rights, subject to certain exceptions described under “Description of Series B Convertible

Cumulative Perpetual Preferred Stock – Voting Rights.”

Each Series B Preferred Share is convertible, at the option of the holder and for additional cash consideration of $7.50 per converted Series B Preferred Share, into

two Series C Preferred Shares (the “Series B Conversion Right”). The Series B Conversion Right may only be exercised during a 30-day period, such period commencing on the date that is the later of (i) the 31st calendar day

following the Original Issue Date and (ii) the date on which the Company notifies the holders of Series B Preferred Shares that the issuance of Series C Preferred Shares upon exercise of the Series B Conversion Right is covered under an

effective registration statement that is filed with the SEC under the Securities Act or the date that the Company notifies the holders of Series B Preferred Shares that it has determined, in its sole discretion, that the issuance of

such Series C Preferred Shares is exempt from the registration requirements of the Securities Act (the “Conversion Period”).

Please see the section entitled “Description of Series B Convertible Cumulative Perpetual Preferred Stock—Conversion to Series C Convertible Cumulative Perpetual

Preferred Stock” in this Offer to Exchange for a description of the rights, privileges and preferences of our Series C Preferred Shares.

|

| |

|

|

|

No Recommendation

|

|

Neither we, our Board of Directors, the Exchange Agent, the Information Agent, nor any affiliate of any of the foregoing or any

other person is making any recommendation as to whether or not you should tender your Common Shares in the Exchange Offer. We have not authorized any person to make such a recommendation. You must make your own investment decision

regarding the Exchange Offer based upon your own assessment of the market value of the Common Shares and the Series B Preferred Shares, your liquidity needs, your investment objectives and any other factors you deem relevant.

|

|

Conditions to the Consummation of the Exchange Offer

|

|

A detailed discussion of the general conditions to the consummation of the Exchange Offer is contained in “The Exchange Offer — Conditions to the

Exchange Offer.”

|

| |

|

|

|

Expiration Date of Offer

|

|

5:00 p.m., New York City Time, on Friday, January 21, 2022, or such later date to which we may extend the Exchange

Offer. All Common Shares and related paperwork must be received by the Exchange Agent by this time, as instructed herein. See “The Exchange Offer —Expiration; Extensions; Termination; Amendment.”

|

| |

|

|

|

Withdrawal Rights

|

|

If you tender your Common Shares and change your mind, you may withdraw your tendered Common Shares at any time until the Expiration Date, as

described in greater detail in “The Exchange Offer—Withdrawal Rights.”

|

| |

|

|

|

Participation by Directors and Major Shareholders

|

|

Certain of the Company’s directors and major shareholders beneficially own Common Shares and will be entitled to participate in the Exchange

Offer with respect to such Common Shares on the same terms and conditions as the other shareholders.

Mango Shipping Corp. (“Mango”), an entity controlled by Aliki Paliou, one of the Company’s directors, beneficially owns 2,352,047 Common Shares,

representing approximately 46.3% of the Common Shares outstanding as of December 20, 2021. Mango has indicated to the Company that it intends to exchange all such Common Shares beneficially owned by it pursuant to this Exchange Offer

for Series B Preferred Shares, and then exercise its Series B Conversion Right to acquire Series C Preferred Shares. Ms. Paliou is also the daughter of the Chairman of the Board and spouse of Mr. Michalopoulos, the Company’s Chief

Executive Officer and a Director.

None of the Company’s other executive officers, directors and significant shareholders have entered into any agreement or other

commitment or otherwise indicated whether or not they intend to participate in the Exchange Offer.

|

| |

|

|

|

Appraisal Rights

|

|

Holders of Common Shares are not entitled to appraisal rights in connection with the Exchange Offer.

|

| |

|

|

|

Information Agent

|

|

Georgeson LLC

|

| |

|

|

|

Exchange Agent

|

|

Computershare Trust Company, N.A.

|

CERTAIN QUESTIONS AND ANSWERS ABOUT THE EXCHANGE OFFER

The following questions and answers are for your convenience only, and briefly address some commonly asked

questions about the Exchange Offer. We urge you to read carefully this entire Exchange Offer, including the section entitled “Risk Factors,” the section entitled “Comparison of Rights Between the Common Shares and Series B Preferred Shares,”

the related Letter of Transmittal, and the other documents incorporated by reference into this Offer to Exchange.

|

Q:

|

Why am I receiving these materials?

|

| |

|

|

A:

|

We are providing these materials to provide you with information regarding our offer to exchange outstanding Common Shares that you currently hold for our Series B

Preferred Shares.

|

| |

|

|

Q:

|

How many Common Shares are sought to be tendered in the Exchange Offer? Is it a condition to the Exchange Offer?

|

| |

|

|

A:

|

We are offering to exchange up to 4,066,181 Common Shares, representing approximately 80% of our outstanding Common Shares.

There are no conditions to the consummation of the Exchange Offer based upon any minimum number of Common Shares tendered.

|

| |

|

|

Q.

|

Under what circumstances may the Exchange Offer be terminated, and what happens to my tendered Common Shares if that occurs?

|

| |

|

| |

The Exchange Offer may be terminated if the conditions, such as the Minimum Tender Condition, to the Exchange Offer discussed in this Offer to Exchange are not

satisfied or waived. If the Exchange Offer is terminated and you previously have tendered Common Shares, such tendered Common Shares will be credited back to an appropriate account promptly following the termination of the Exchange

Offer without expense to you. See “The Exchange Offer.”

|

| |

|

|

Q:

|

What are the effects of the Exchange Offer on the ownership structure of Performance Shipping Inc.?

|

| |

|

|

A:

|

The main effect that the Exchange Offer could have is that holders of Common Shares who do not exchange their shares will see their percentage ownership of our

outstanding common shares increase, and those interests will be subordinated to the Series B Preferred Shares in respect of dividends and rights upon liquidation. Series C Preferred Shares acquired upon exercise of the Series B

Conversion Right will convey voting rights superior to those of the Common Shares. In addition, depending on the number of shareholders that elect to tender some or all of their Common Shares in the Exchange Offer, there may be fewer

Common Shares held by non-affiliated shareholders, and there will therefore likely be fewer transactions in the Common Shares resulting in lower liquidity than currently, which could result in decreased prices of the Common Shares.

While we expect the Common Shares to meet the Nasdaq continued listing requirements following consummation of the Exchange Offer, there is a possibility that it may fail to meet those requirements and, if so, the Common Shares could be

de-listed from the Nasdaq, and the Common Shares may not satisfy the listing requirements of any other national securities exchange.

|

| |

|

|

Q:

|

What is the effect of the Company’s Stockholders’ Rights Agreement on the shareholders tendering in the Exchange Offer?

|

| |

|

|

A:

|

The Company adopted a Stockholders’ Rights Agreement on December 20, 2021 (the “Stockholders’ Rights Agreement”). For a summary of the terms of this agreement, see

the Company’s Report on Form 6-K filed on December 20, 2021. In general terms and with certain exceptions, the Stockholders’ Rights Agreement imposes a significant penalty on any person or group that acquires “beneficial ownership” (as

defined in the Stockholders’ Rights Agreement) of more than 10% of the Common Shares without the approval of the

|

| |

Company’s Board of Directors. For the purposes of the Stockholders’ Rights Agreement, to the extent that your Common Shares tendered in the Exchange Offer are

accepted by the Company for exchange, you will be deemed the “beneficial owner” of the total number of Common Shares issuable on conversion of the Series C Preferred Shares into which the Series B Preferred Shares acquired by you upon

consummation of the Exchange Offer may be converted.

|

| |

|

|

Q.

|

How will I be notified if the Exchange Offer is extended, amended or terminated?

|

| |

|

|

A.

|

We, in our sole discretion, may extend the Expiration Date for any reason. If the Exchange Offer is extended, amended or terminated, we will promptly make a public

announcement by issuing a press release. In the case of an extension, the announcement will be issued no later than 9:00 a.m., New York City Time, on the next business day after the previously scheduled expiration date of the Exchange

Offer. See “The Exchange Offer—Expiration; Extension, Termination; Amendment.”

|

| |

|

|

Q:

|

What will I receive in the Exchange Offer if I tender my Common Shares and they are accepted?

|

| |

|

|

A:

|

You will receive 0.28 Series B Preferred Shares for each Common Share tendered, unless more than 4,066,181 of the Common Shares

are tendered, in which case the Series B Preferred Shares will be allocated on a pro rata basis.

|

| |

|

|

Q:

|

What happens if stockholders tender more than 4,066,181 Common Shares?

|

| |

|

|

A:

|

If stockholders tender more than 4,066,181 Common Shares, we will exchange shares on a pro rata basis. This means that we will exchange from you a number of shares

calculated by multiplying the number of shares you properly tendered by a proration factor. The proration factor will equal 4,066,181 divided by the total number of shares properly tendered and not withdrawn. We will make adjustments to

avoid exchanges of fractional shares. For information about the proration procedures of the Exchange Offer, see “The Exchange Offer.”

|

| |

|

|

Q:

|

If you prorate, when will I know how many Common Shares will actually be exchanged?

|

| |

|

|

A:

|

If proration of the tendered Common Shares is required, we do not expect to announce the final results of proration or exchange for any shares until approximately

five trading days after the expiration of the Exchange Offer. This is because we will not know the precise number of Common Shares properly tendered (and not withdrawn) until all supporting documentation for those tenders are reviewed.

Preliminary results of proration will be announced by press release promptly following the expiration of the Exchange Offer. For information about the proration procedures of the Exchange Offer, see “The Exchange Offer.”

|

| |

|

|

Q:

|

What are the terms of the Series B Preferred Shares?

|

| |

|

|

A:

|

The Series B Preferred Shares have a liquidation preference of $25.00 per share, will be entitled to receive the Series B Preferred Dividend, and have no voting

rights, subject to certain exceptions as described under “Description of Series B Convertible Cumulative Perpetual Preferred Stock—Voting Rights.” In addition, pursuant to the Series B Conversion Right, each Series B Preferred Share is

convertible, at the option of the holder and for additional cash consideration of $7.50 per converted Series B Preferred Share, into two Series C Preferred Shares during the Conversion Period. Please see the section entitled

“Description of Series B Convertible Cumulative Perpetual Preferred Stock—Conversion to Series C Convertible Cumulative Perpetual Preferred Stock” in this Offer to Exchange for a description of the

rights, privileges and preferences of our Series C Preferred Shares.

|

| |

|

| |

The Series B Conversion Right may only be exercised during a 30-day period, such period commencing on the date that is the later of (i) the 31st calendar

day following the Original Issue Date and (ii) the date on which the Company notifies the holders of Series B Preferred Shares that the issuance of Series C Preferred

|

| |

Shares upon exercise of the Series B Conversion Right is covered under an effective registration statement that is filed with the SEC under the Securities Act or the

date that the Company notifies the holders of Series B Preferred Shares that it has determined, in its sole discretion, that the issuance of such Series C Preferred Shares is exempt from the registration requirements of the Securities

Act (the “Conversion Period”).

|

| |

|

| |

The Series B Preferred Shares will be redeemable at the Company’s option, at any time after the one-year anniversary of the Original Issue Date at $25.00 per share

plus any accumulated and unpaid dividends thereon to and including the date of redemption.

|

| |

|

|

Q:

|

What protections will I have if I decide I do not want to tender my shares?

|

| |

|

|

A:

|

None. If you do not tender your Common Shares in the Exchange Offer, you will continue to hold such shares. Our Common Shares are subordinate to the Series B

Preferred Shares in respect of dividends and rights upon liquidation.

|

| |

|

|

Q:

|

Do I have a choice in whether to tender my shares?

|

| |

|

|

A:

|

Yes. Holders of Common Shares are not required to tender their shares pursuant to the Exchange Offer.

|

| |

|

|

Q:

|

How long do I have to decide if I want to tender my shares, or withdraw previously tendered shares?

|

| |

|

|

A:

|

Unless extended or earlier terminated, the Exchange Offer and withdrawal rights expire at 5:00 p.m., New York City time, on Friday, January 21, 2022. If you hold

your shares in street name (i.e., through a broker, dealer or other nominee), you should consult with that firm to see if they have an earlier deadline.

|

| |

|

|

Q:

|

How do I tender my Common Shares?

|

| |

|

|

A:

|

To tender Common Shares, you must deliver a completed Letter of Transmittal and any other documents required by the Letter of Transmittal, together, in the case of

certificated shares, with the certificates representing your shares, to the Exchange Agent for the Exchange Offer, not later than the time the Exchange Offer expires. The Letter of Transmittal is enclosed with this Offer to Exchange. If

your shares are held in street name (i.e., through a broker, dealer or other nominee), your shares can be tendered by your nominee by book-entry transfer through The Depository Trust Company, or “DTC”. In all cases, tendered Common

Shares will be exchanged for Series B Preferred Shares only after timely receipt by the Exchange Agent of such shares (or of a confirmation of a book-entry transfer of such shares as described in “The Exchange Offer — Procedures for

Tendering Common Shares” and a properly completed and duly executed Letter of Transmittal and any other required documents for such shares.

|

| |

|

|

Q:

|

How do I withdraw previously tendered Common Shares?

|

| |

|

|

A:

|

A stockholder may withdraw Common Shares tendered pursuant to the Exchange Offer at any time prior to the Expiration Date. For a withdrawal of Common Shares to be

effective, a written or facsimile transmission notice of withdrawal must be timely received by the Exchange Agent at its address set forth on the back cover of this Offer to Exchange. See “The Exchange Offer — Withdrawal Rights.”

|

| |

|

|

Q:

|

How soon after the Expiration Date will the exchange take place?

|

| |

|

|

A:

|

The exchange is expected to occur promptly following the Expiration Date, but we may announce the final results of proration or exchange of Common Shares until

approximately five trading days after the Expiration Date, at which time we will issue 0.28 Series B Preferred Shares in consideration for each Common Share accepted for exchange in the Exchange Offer.

|

|

Q.

|

Whom do I call if I have any questions on how to tender my Common Shares or any other questions relating to the Exchange Offer?

|

| |

|

|

A.

|

Questions related to the terms of the Exchange Offer and requests for assistance, as well as for additional copies of this Offer to Exchange or any other documents,

may be directed to the Information Agent using the contact information set forth on the back cover of this Offer to Exchange.

|

| |

|

|

Q.

|

Where can I find more information about the Company?

|

| |

|

|

A.

|

For more information, see our Annual Report on Form 20-F for the fiscal year ended December 31, 2020 and the other reports and documents we file with the SEC, which

are available online at the SEC website (www.sec.gov) and our website (www.pshipping.com), and are also available from us upon request.

|

| |

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Matters discussed herein, and the documents incorporated by reference may constitute forward-looking statements. The

Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include, but are

not limited to, statements concerning plans, objectives, goals, strategies, future events or performance, underlying assumptions and other statements, which are other than statements of historical facts.

The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of

1995 and is including this cautionary statement in connection with this safe harbor legislation. This document and any other written or oral statements made by the Company or on its behalf may include forward-looking statements, which reflect its

current views with respect to future events and financial performance, and are not intended to give any assurance as to future results. When used in this document, the words “believe,” “anticipate,” “intends,” “estimate,” “forecast,” “project,”

“plan,” “potential,” “will,” “may,” “should,” “expect” “targets,” “likely,” “would,” “could,” “seeks,” “continue,” “possible,” “might,” “pending” and similar expressions, terms or phrases may identify forward-looking statements.

Please note in this Exchange Offer “we,” “us,” “our” and “the Company” all refer to Performance Shipping Inc. and its

subsidiaries, unless the context requires otherwise.

The forward-looking statements in this document are based upon various assumptions, many of which are based, in turn,

upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in its records and other data available from third parties. Although the Company believes that these assumptions were

reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control, the Company cannot assure you that it will achieve or

accomplish these expectations, beliefs or projections.

Such statements reflect the Company’s current views with respect to future events and are subject to certain risks,

uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated,

expected or intended. The Company is making investors aware that such forward-looking statements, because they relate to future events, are by their very nature subject to many important factors that could cause actual results to differ materially

from those contemplated.

In addition to these important factors and matters discussed elsewhere herein, including under the heading “Risk

Factors,” and in the documents incorporated by reference herein, important factors that, in its view, could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to: the

strength of world economies, fluctuations in currencies and interest rates, general market conditions, including fluctuations in charter rates and vessel values, changes in demand in the tanker shipping industry, changes in the supply of vessels,

changes in worldwide oil production and consumption and storage, changes in the Company’s operating expenses, including bunker prices, crew costs, drydocking and insurance costs, the Company’s future operating or financial results, availability of

financing and refinancing and changes to the Company’s financial condition and liquidity, including the Company’s ability to pay amounts that it owes and obtain additional financing to fund capital expenditures, acquisitions and other general

corporate activities and the Company’s ability to obtain financing and comply with the restrictions and other covenants in the Company’s financing arrangements, the Company’s ability to continue as a going concern, potential liability from pending

or future litigation and potential costs due to environmental damage and vessel collisions, the market for the Company's vessels, availability of skilled workers and the related labor costs, compliance with governmental, tax, environmental and

safety regulation, any non-compliance with the U.S. Foreign Corrupt Practices Act of 1977 (FCPA) or other applicable regulations relating to bribery, the impact of the discontinuance of LIBOR after 2021 on interest rates of the Company’s debt that

reference LIBOR, general economic conditions and conditions in the oil industry, effects of new products and new technology in the Company’s industry, the failure of counter parties to fully perform their contracts with us, the Company’s dependence

on key personnel, adequacy of insurance coverage, the Company’s ability to obtain indemnities from customers, changes in laws, treaties or regulations, the volatility of the price of the Company’s common shares, the Company’s incorporation under

the laws of the Marshall Islands and the different rights to relief that may be available compared to other countries, including the United States, changes in governmental rules and regulations or actions

taken by regulatory authorities, general domestic and international political conditions or events, including “trade wars”, acts by

terrorists or acts of piracy on ocean-going vessels, the length and severity of epidemics and pandemics, including the ongoing outbreak of the novel coronavirus (COVID-19) and its impact on the demand for seaborne transportation of petroleum and

other types of products, potential disruption of shipping routes due to accidents, labor disputes or political events, vessel breakdowns and instances of off-hires and other important factors described from time to time in the reports filed by the

Company with the Securities and Exchange Commission, or the SEC.

This Exchange Offer may contain assumptions, expectations, projections, intentions and beliefs about future events. These

statements are intended as forward-looking statements. The Company may also, from time to time, make forward-looking statements in other documents and reports that are filed with or submitted to the SEC, in other information sent to the Company’s

security holders, and in other written materials. The Company also cautions that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be material. The

Company undertakes no obligation to publicly update or revise any forward-looking statement contained in herein, whether as a result of new information, future events or otherwise, except as required by law.

RISK FACTORS

Risks Related to our Business

For a discussion of the risks associated with our business, please see the discussion of risks related to our business under the heading

“Risk Factors” in our Annual Report.

Risks Related to the Series B Preferred Shares

There is no established trading market for the Series B Preferred Shares, which may negatively affect the market value

of the Series B Preferred Shares and your ability to transfer or sell them.

The Series B Preferred Shares will be a new issue of securities with no established trading market. We do not intend to apply to list the

Series B Preferred Shares on any stock exchange or in any trading market.

Since the Series B Preferred Shares will have no stated maturity date, you may be forced to hold your Series B Preferred Shares

indefinitely, with no guarantee as to ever receiving the liquidation preference. No trading market for the Series B Preferred Shares is expected to develop, and holders of Series B Preferred Shares may not be able to transfer or sell their Series B

Preferred Shares, and, if they do, the price received may be substantially less than the stated liquidation preference.

We may not have sufficient cash from our operations to enable us to pay dividends on or to redeem our Series B

Preferred Shares following the payment of expenses and the establishment of any reserves.

We will pay quarterly dividends on the Series B Preferred Shares only from funds legally available for such purpose when, as, and if

declared by our Board of Directors, or, at our option, through the issuance of additional Common Shares, valued at the volume-weighted average price of the common stock for the 10 trading days prior to the Dividend Payment Date. We may not have

sufficient cash available each quarter to pay dividends.

In addition, we may have insufficient cash available to redeem the Series B Preferred Shares. The amount of cash we can use to pay

dividends or redeem our Series B Preferred Shares depends upon the amount of cash we generate from our operations, which may fluctuate significantly, and other factors, including the following:

|

• |

changes in our operating cash flow, capital expenditure requirements, working capital requirements and other cash needs;

|

|

• |

the amount of any cash reserves established by our Board of Directors;

|

|

• |

restrictions under Marshall Islands law;

|

|

• |

restrictions under our credit facilities and other instruments and agreements governing our existing and future indebtedness; and

|

|

• |

our overall financial and operating performance, which, in turn, is subject to prevailing economic and competitive conditions and to the risks associated with the shipping industry and the

other factors, many of which are beyond our control.

|

The amount of cash we generate from our operations may differ materially from our net income or loss for the period, and our Board of

Directors, at its discretion, may elect not to declare any dividends. We may incur other expenses or liabilities that could reduce or eliminate the cash available for distribution as dividends. As a result of these and the other factors mentioned

above, we may pay dividends during periods when we record losses and may not pay dividends during periods when we record net income.

Our ability to pay dividends on and to redeem our Series B Preferred Shares, and therefore your ability to receive

payments on the Series B Preferred Shares, is limited by the requirements of Marshall Islands law and by our contractual obligations.

Marshall Islands law provides that we may pay dividends on and redeem the Series B Preferred Shares only to the extent that assets are

legally available for such purposes. Legally available assets generally are limited to our surplus, which essentially represents our retained earnings and the excess of consideration received by us for the sale of shares above the par value of the

shares. In addition, under Marshall Islands law, we may not pay dividends on or redeem Series B Preferred Shares if we are insolvent or would be rendered insolvent by the payment of such a dividend or the making of such redemption.

Further, the terms of some of our outstanding credit facilities may prohibit us from declaring or paying any dividends or distributions on

preferred stock, including the Series B Preferred Shares, or redeeming, purchasing, acquiring or making a liquidation payment on preferred stock in certain circumstances.

Our Series B Preferred Shares are subordinated to our debt obligations, and your interests could be diluted by the

issuance of additional shares, including additional Series B Preferred Shares, the Series C Preferred Shares that are issuable upon conversion of the Series B Preferred Shares, and by other transactions.

Our Series B Preferred Shares are subordinated to all of our existing and future indebtedness. We may incur additional indebtedness under

our existing or future credit facilities or other debt agreements. The payment of principal and interest on our debt reduces cash available for distribution to us and on our shares, including the Series B Preferred Shares.

The issuance of additional preferred shares on a parity with or senior to our Series B Preferred Shares, such as the Series C Preferred

Shares that are issuable upon conversion of the Series B Preferred Shares, would dilute the interests of the holders of our Series B Preferred Shares, and any issuance of Senior Securities or Parity Securities or additional indebtedness could affect

our ability to pay dividends on, redeem or pay the liquidation preference on our Series B Preferred Shares.

Our Series B Preferred Shares will rank pari passu with any Parity Securities as to the payment of

dividends and amounts payable upon liquidation or reorganization. If less than all dividends payable with respect to the Series B Preferred Shares and any Parity Securities are paid, any partial payment shall be made pro rata with respect to the

Series B Preferred Shares and any Parity Securities entitled to a dividend payment at such time in proportion to the aggregate amounts remaining due in respect of such shares at such time.

The Series B Preferred Shares represent perpetual equity interests in us.

The Series B Preferred Shares represent perpetual equity interests in us and, unlike our indebtedness, will not give rise to a claim for

payment of a principal amount at a particular date. As a result, holders of the Series B Preferred Shares may be required to bear the financial risks of an investment in the Series B Preferred Shares for an indefinite period of time. In addition, the

Series B Preferred Shares will rank junior to all of our indebtedness and other liabilities, and any other senior securities we may issue in the future with respect to assets available to satisfy claims against us.

As a holder of Series B Preferred Shares, you have extremely limited voting rights and may encounter difficulties in

exercising some of your rights.

Your voting rights as a holder of Series B Preferred Shares will be extremely limited. The Common Shares and Series C Preferred Shares are

the only classes of stock carrying full voting rights. No Series C Preferred Shares are presently outstanding, but any Series C Preferred Shares issued upon exercise of the Series B Conversion Right will convey voting rights superior to those of the

Common Shares. Holders of the Series B Preferred Shares generally have no voting rights, except as provided under Marshall Islands law. In addition, unless we have received the affirmative vote or consent of the holders of at least two-thirds of the

outstanding Series B Preferred Shares, voting as a single class, we may not adopt any amendment to our Amended and Restated Articles of Incorporation that materially and adversely alters the preferences, powers or rights of the Series B Preferred

Shares.

The Series B Preferred Shares are only redeemable at our option and investors should not expect us to redeem the Series

B Preferred Shares in the future.

We may redeem, at our option, all or from time to time part of, the Series B Preferred Shares at any time after the one year anniversary of

the Original Issue Date, subject to any applicable restrictions in agreements governing our current or future indebtedness and Marshall Islands law. If we redeem the Series B Preferred Shares, holders of the Series B Preferred Shares will be entitled

to receive a redemption price equal to $25.00 plus any accumulated and unpaid dividends thereon to and including the date of redemption. Any decision we may make at any time to propose a redemption of the Series

B Preferred Shares will depend upon, among other things, our evaluation of our capital position, the composition of our shareholders’ equity and general market conditions at that time, and investors should not expect us to redeem the Series B

Preferred Shares on any particular date in the future, or at all. If the Series B Preferred Shares are redeemed, it may be a taxable event to you. In addition, you might not be able to reinvest the money you receive upon redemption of the Series B

Preferred Shares in a similar security or at similar rates. We may elect to exercise our redemption right on multiple occasions. Any such optional redemption would be effected only out of funds legally available for such purpose.

Risks Related to the Exchange Offer

We have not obtained a third-party determination that the Exchange Offer is fair to holders of Common Shares.

Neither we, nor our Board of Directors, nor any other person is making any recommendation as to whether or not you should tender your

Series B Preferred Shares in the Exchange Offer. We have not authorized any person to make such a recommendation. You must make your own independent decision regarding your participation in the Exchange Offer.

There can be no assurance that any trading market for the Common Shares will be maintained.

There can be no assurance that the current market for the Common Shares will be maintained. If an active market for the Common Shares fails

to be sustained, the trading price of the Common Shares could be materially adversely affected. Following the completion of the Exchange Offer, it may be harder for you to monetize your investment in our Common Shares and the value of your investment

may decline. Additionally, the lack of liquidity may result in wide bid-ask spreads, contribute to significant fluctuations in the market price of the Common Shares and limit the number of investors who are able to buy the Common Shares.

The successful completion of the Exchange Offer will result in a diminished public float for our Common Shares, which

could adversely affect the liquidity and market value of our Common Shares and create uncertainty as to whether our Common Shares would remain eligible for listing on the Nasdaq or any other national securities exchange.

Upon the consummation of the Exchange Offer, there will be fewer Common Shares held by our unaffiliated stockholders, and there will

therefore likely be fewer transactions in Common Shares. If the Common Shares do not meet the Nasdaq’s continued listing requirements, our common stock may be de-listed, and the Common Shares may not satisfy the listing requirements of any other

national securities exchange. We will use our reasonable best efforts to maintain the listing of our Common Shares on the Nasdaq; if our Common Shares are de-listed from the Nasdaq, we will use our reasonable best efforts to have our Common Shares

listed on another national securities exchange; and, in the event we are unable using our reasonable best efforts to cause the Common Shares to be listed on another national securities exchange after it is de-listed from the Nasdaq, we will use our

reasonable best efforts to cause a market to be made for the Common Shares. A lack of an active trading market may have an adverse effect on the trading price of our Common Shares.

The Series B Preferred Shares, and any other Senior Securities that we may issue, will have priority over our Common

Shares with respect to payment in the event of a voluntary or involuntary liquidation, dissolution or winding up.

In any voluntary or involuntary liquidation, dissolution or winding up of the Company, our Common Shares would rank below all of our shares

of preferred stock, including the Series B Preferred Shares and, if issued, the Series C Preferred Shares. As a result, holders of our Common Shares will not be entitled to receive any payment or other

distribution of assets upon such liquidation, dissolution or winding up until our obligations to the holders of preferred stock, including the Series B

Preferred Shares and, if issued, the Series C Preferred Shares, have been satisfied.

To the extent issued, the superior voting rights of our Series C Preferred Shares may limit the ability of our common

shareholders to control or influence corporate matters, could have anti-takeover effects, and the interests of the holder of such shares could conflict with the interests of common shareholders.

While our common shares have one vote per share, each Series C Preferred Share shall be entitled to a number of votes equal to the number

of Common Shares into which the share is then convertible multiplied by 10. Holders of the Series C Preferred Shares shall be entitled to vote with holders of Common Shares, voting together as a single class (with certain exceptions), with respect to

all matters presented to the stockholders.

The superior voting rights of our Series C Preferred Shares, if issued, may limit our common shareholders’ ability to influence corporate

matters.

The issuance of Series C Preferred Shares could have anti-takeover effects and substantially impede the ability of public shareholders to

benefit from a change in control and, as a result, may adversely affect the market price of our common shares and our shareholders' ability to realize any potential change of control premium.

The interests of the holder of the Series C Preferred Shares may conflict with the interests of our common shareholders, and as a result,

the holders of our capital stock may approve actions that our common shareholders do not view as beneficial. Any such conflicts of interest could adversely affect our business, financial condition and results of operations, and the trading price of

our common shares.

Interests of directors and executive officers in the Exchange Offer.

Certain of our executive officers and directors have interests in the Exchange Offer that may be different from the interests of our

stockholders generally. Our Board of Directors was aware of these interests and considered them, among other matters, in approving the Exchange Offer.

Mango Shipping Corp., an entity controlled by Aliki Paliou, one of the Company’s directors, beneficially owns 2,352,047

Common Shares, representing approximately 46.3% of the Common Shares outstanding as of December 20, 2021. Mango has indicated to the Company that it intends to exchange all such Common Shares beneficially owned by it pursuant to this Exchange Offer

for Series B Preferred Shares, and then exercise its Series B Conversion Right to acquire Series C Preferred Shares. Ms. Paliou is also the daughter of the Chairman of the Board and spouse of Mr. Michalopoulos, the Company’s Chief Executive Officer

and a Director.

The Exchange Offer may not be consummated if the Minimum Tender Condition is not satisfied or waived.

If the Minimum Tender Condition is not satisfied or waived, we will not accept any Common Shares tendered in the Exchange

Offer. See “The Exchange Offer — Conditions to the Exchange Offer” for a list of the conditions to the consummation of the Exchange Offer.

The tax consequences of the Exchange Offer are complex and will vary depending on your particular facts and

circumstances.

The U.S. federal income tax consequences to you of participating in the Exchange Offer are complex and will vary depending on certain facts

and circumstances. You generally will be treated as having exchanged your Common Shares for Series B Preferred Shares pursuant to a “recapitalization” and you generally will not recognize gain or loss for U.S. federal income tax purposes. Please see

“Certain U.S. Federal Income Tax Considerations” in this Offer to Exchange. Because the U.S. federal income tax consequences of the Exchange Offer are complex, you are urged to consult with your own tax advisor.

THE EXCHANGE OFFER

General

We are making the Exchange Offer for 4,066,181 outstanding Common Shares. Upon the terms and subject to the conditions set forth in this

Offer to Exchange and in the Letter of Transmittal, we will accept for exchange any Common Shares that are properly tendered and are not withdrawn prior to the expiration of the Exchange Offer. The Exchange Offer will expire at 5:00 p.m., New York

City time, on Friday, January 21, 2022, unless extended or earlier terminated by us.

We will issue 0.28 Series B Preferred Shares in exchange for each validly tendered Common Share promptly after the Expiration Date. Common Shares may only be exchanged for whole Series B Preferred Shares. In lieu of issuing fractional Series B Preferred Shares to which any holder of Common Shares would otherwise have been entitled, we will round down the

number of Series B Preferred Shares to which such holder is entitled, after aggregating all fractions, to the nearest whole number of Series B Preferred Shares.

A holder may tender as few or as many Common Shares as the holder elects. If more than 4,066,181

Common Shares are validly tendered prior to the Expiration Date, and not properly withdrawn, we will, upon the terms and subject to the conditions of the Offer to Exchange, exchange 4,066,181 shares on a pro rata basis (with adjustments to avoid

exchanges of fractional shares) based upon the number of Common Shares validly tendered by the expiration date and not properly withdrawn. If proration of tendered shares is required, because of the difficulty of determining the precise number of

Common Shares properly tendered and not withdrawn, we do not expect to announce the final results of proration or exchange any shares until approximately five trading days after the Expiration Date. Preliminary results of proration will be announced

by press release promptly following the Expiration Date. All Common Shares not accepted for exchange will be returned to the stockholder or, in the case of tendered Common Shares delivered by book-entry transfer, credited to the account at the

book-entry transfer facility from which the transfer had previously been made, promptly after the expiration or termination of the Exchange Offer in each case, in accordance with the procedure described in the section entitled “Acceptance of Common

Shares for Exchange and Delivery of Series B Preferred Shares.”

This Offer to Exchange is being sent to all beneficial holders of Common Shares. Common Shares tendered but not accepted because they were

not validly tendered will remain outstanding upon completion of the Exchange Offer. Any tendered Common Shares not accepted for exchange because of an invalid tender, the occurrence of other events set forth in this Offer to Exchange or otherwise,

will promptly be returned, without expense, to the tendering stockholder after the Expiration Date. Our obligation to accept Common Shares tendered pursuant to the Exchange Offer is limited by the conditions listed below under “— Conditions to the Exchange Offer.” Common Shares that are not exchanged in the Exchange Offer will remain outstanding and will be entitled to all rights and benefits their holders have under our certificate of incorporation and

bylaws and applicable law.

Purpose

The purpose of this Exchange Offer is to provide our shareholders with the opportunity to exchange their Common Shares for Series B

Preferred Shares. The Series B Preferred Shares are designed to appeal to investors who prefer receiving regular dividends and having seniority on liquidation. This Exchange Offer is to provide assurance that all stockholders have a meaningful

opportunity, in light of all factors and developments, to determine whether to exchange their Common Shares for Series B Preferred Shares.

We believe that the Series B Preferred Shares may serve as a vehicle for raising equity through the Series B Conversion Right, which

provides holders with the option to convert, during the Conversion Period, their shares into two Series C Preferred Shares for additional cash consideration of $7.50 per converted Series B Preferred Share.

Except as described herein, we have no definitive plans for utilizing the Series B Preferred Shares in the manner outlined above or for any

future issuance of Series B Preferred Shares or other securities, and we cannot assure anyone that any such plans will be developed or consummated or on what terms. For a detailed description of

differences between the Common Shares and the Series B Preferred Shares, please see “Material Differences Between Common Shares and Series B Preferred Shares”

below.

Exchange Offer Consideration

We are offering to exchange for each Common Share, 0.28 Series B Preferred Shares. For a description of the Series B Preferred Shares and a

summary of the material differences between the Common Shares and the Series B Preferred Shares, please see “Description of Series B Convertible Cumulative Perpetual Preferred Stock” and “Material Differences Between Common Shares and Series B

Preferred Shares.”

Procedures for Tendering Common Shares

General

In order to receive Series B Preferred Shares in exchange for your Common Shares, you must validly tender your Common Shares, and not

withdraw them, prior to the expiration date.

You are likely to hold your Common Shares in the name of a bank, broker, custodian or other nominee as a beneficial owner. Therefore, as a

beneficial owner, in order to validly tender your Common Shares in the Exchange Offer, you must follow the instructions provided by your bank, broker, custodian or other nominee with regard to procedures for tendering your shares.

Should you have any questions as to the procedures for tendering your shares, please call your bank, broker, custodian or other nominee; or

call our Information Agent at its telephone number set forth on the back cover of this Offer to Exchange.

In order for a bank, broker, custodian or other nominee to validly tender your Common Shares in the Exchange Offer, a bank, broker,

custodian or other nominee must deliver to the Exchange Agent:

|

• |

a message in which you acknowledge and agree to, and agree to be bound by, the terms of the Letter of Transmittal and that we may enforce such agreement against you; and

|

|

• |

a timely confirmation of book-entry transfer of your Common Shares into the Exchange Agent’s account, by which transfer you will be deemed to have given the applicable messages above.

|

You are urged to instruct your bank, broker, custodian or other nominee at least five business days prior to the expiration date in order

to allow adequate processing time for your instruction. For further information, contact the Information Agent at its telephone number and address set forth on the back cover page of this document or consult your bank, broker, custodian or other

nominee for assistance.

We are not providing for guaranteed delivery procedures and therefore you must allow sufficient time for the necessary tender procedures to

be completed during normal business hours of DTC prior to the expiration date. Tenders not received by the Exchange Agent on or prior to the expiration date will be disregarded and of no effect.

Delivery of Common Shares and the method of delivery of all other required documents is at your election and risk and, except as otherwise

provided in the Letter of Transmittal, delivery will be deemed made only when actually received by the Exchange Agent. If delivery of any document is by mail, we suggest that you use properly insured, registered mail, with a return receipt requested,

and that the mailing be made sufficiently in advance of the expiration date to permit delivery to the Exchange Agent prior to the expiration date.

Tendering of Common Shares Through DTC

Common Shares in book-entry form must be tendered through DTC. The Exchange Agent, promptly after the date of this Offer to Exchange (to

the extent such arrangements have not been previously made), will establish and maintain an account with respect to Common Shares at DTC, and any financial institution that is a DTC participant

and whose name appears on a security position listing as the owner of Common Shares may make book-entry delivery of such Common Shares by causing DTC to

transfer such Common Shares into the Exchange Agent’s account in accordance with DTC’s procedures for such transfer.

To participate in the Exchange Offer, a DTC participant must:

|

• |

comply with the automated tender offer program procedures of DTC described below; or

|

|

• |

(1) complete and sign and date the Letter of Transmittal, or a facsimile of the Letter of Transmittal; (2) have the signature on the Letter of Transmittal guaranteed if the Letter of

Transmittal so requires; and (3) mail or deliver the Letter of Transmittal or facsimile to the Exchange Agent prior to the expiration date

|

In addition, for the tender of Common Shares to be valid, either:

|

• |

the Exchange Agent must receive, prior to the expiration date, a properly transmitted Agent’s Message (as defined below); or

|

|

• |

the Exchange Agent must receive, prior to the expiration date, a timely confirmation of book-entry transfer of tendered Common Shares into the Exchange Agent's account at DTC according to

DTC’s procedure for book-entry transfer and the Letter of Transmittal and other documents required by the Letter of Transmittal.

|

If Common Shares are tendered by delivery of a Letter of Transmittal, to be validly tendered, the Exchange Agent must receive any physical

delivery of the Letter of Transmittal and other required documents at its address indicated on the back cover of this Offer to Exchange and the front cover of the Letter of Transmittal prior to the expiration date.

Subject to and effective upon the acceptance for exchange of, and issuance of Series B Preferred Shares for, Common Shares tendered

thereby, by executing and delivering the Letter of Transmittal, or being deemed to have done so as part of your electronic submission of your tender through DTC, you agree to be bound by the terms of the Letter of Transmittal, by which, among other

things, you (1) irrevocably tender, sell, assign and transfer to or upon our order all right, title and interest in and to all the Common Shares tendered thereby and (2) irrevocably appoint the Company as your true and lawful agent and

attorney-in-fact, with full power coupled with an interest, to:

|

• |

transfer ownership of the Common Shares on the account books maintained by DTC, together with all accompanying evidences of transfer and authenticity, to or upon our order;

|

|

• |

present the Common Shares for transfer on the relevant security register; and

|

|

• |

receive all benefits or otherwise exercise all rights of beneficial ownership of the Common Shares, all in accordance with the terms of the Exchange Offer.

|

The method of delivery of the Letter of Transmittal and all other required documents to the Exchange Agent is at your election and risk.

Rather than mail these items, if you desire to tender Common Shares, we recommend that you use an overnight delivery service. In all cases where you desire to tender Common Shares, you should allow sufficient time to assure delivery to the Exchange

Agent before the expiration date. You should not send any Letter of Transmittal to us.

Tendering through DTC’s ATOP

The Exchange Agent and DTC have confirmed that any financial institution that is a participant in DTC’s system may use DTC’s automated

tender offer program (“ATOP”) to tender Common Shares in the Exchange Offer. DTC participants may, instead of physically completing and signing the Letter of Transmittal and delivering it to the Exchange Agent, transmit an acceptance of the Exchange

Offer electronically. DTC participants may do so by causing DTC to transfer the Common Shares to the Exchange Agent in accordance with its procedures for transfer. DTC will then send an Agent’s Message to the Exchange Agent.

The term “Agent’s Message” means a message transmitted by DTC, received by the Exchange Agent and forming part of the book-entry

confirmation, to the effect that:

|

• |

DTC has received an express acknowledgment from a DTC participant that it is tendering Common Shares that are the subject of such book-entry confirmation;

|

|

• |

such DTC participant has received and agrees to be bound by the terms of the Letter of Transmittal; and

|

|

• |

the Letter of Transmittal may be enforced against such DTC participant.

|

Delivery of the Agent’s Message by DTC will satisfy the terms of the Exchange Offer in lieu of execution and delivery of the Letter of

Transmittal by the DTC participant identified in the Agent’s Message. Accordingly, the Letter of Transmittal need not be completed by a holder tendering through ATOP.

Signature Guarantees

Signatures on the Letter of Transmittal must be guaranteed by a firm that is a participant in the Security Transfer Agents Medallion

Program or the Stock Exchange Medallion Program or is otherwise an “eligible guarantor institution” as that term is defined in Rule 17Ad-15 under the Exchange Act (generally a member of a registered national securities exchange, a member of the

Financial Industry Regulatory Authority, Inc. (“FINRA”) or a commercial bank or trust company having an office in the United States) (an “Eligible Institution”), unless (i) such Letter of Transmittal is signed by the registered holder of the Common

Shares tendered therewith and the Series B Preferred Shares issued in exchange for Common Shares are to be issued in the name of and delivered to, or if any Common Shares not accepted for exchange are to be returned to, such holder, or (ii) such

Common Shares are tendered for the account of an Eligible Institution.

Determination of Validity

All questions as to the validity, form, eligibility (including time of receipt) and acceptance for exchange of any tendered Common Shares

pursuant to any of the procedures described above, and the form and validity (including time of receipt of notices of withdrawal) of all documents will be determined by us in our sole discretion, which determination will be final and binding.

Alternative, conditional or contingent tenders will not be considered valid. We reserve the absolute right to reject any or all tenders of any Common Shares we determine not to be in proper form, or if the acceptance of, or exchange of, such Common

Shares may, in the opinion of our counsel, be unlawful. We also reserve the right to waive any conditions to the Exchange Offer that we are legally permitted to waive. A waiver of any defect or irregularity with respect to one tender of Common Shares

shall not constitute a waiver of the same or any other defect or irregularity with respect to any other tender of Common Shares except to the extent we may otherwise provide. Our interpretation of the terms and conditions of the Exchange Offer will

be final and binding.

Your tender will not be deemed to have been validly made until all defects or irregularities in your tender have been cured or waived. None