UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Not Applicable

(Translation of Registrant’s Name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Executive Officer

Silence Therapeutics plc

Tel:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary shares, nominal value £0.05 per share:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

|

|

Page |

|

4 |

|

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

|

4 |

|

4 |

|

|

4 |

|

|

43 |

|

|

73 |

|

|

74 |

|

|

89 |

|

|

105 |

|

|

107 |

|

|

107 |

|

|

108 |

|

ITEM 11: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

116 |

ITEM 12: DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

|

117 |

|

119 |

|

|

119 |

|

ITEM 14: MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

|

119 |

|

119 |

|

|

120 |

|

|

120 |

|

|

120 |

|

ITEM 16D: EXEMPTIONS FORM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

|

121 |

ITEM 16E: PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

|

121 |

|

121 |

|

|

121 |

|

|

122 |

|

ITEM 16I: DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

|

122 |

|

123 |

|

|

123 |

|

|

123 |

|

|

123 |

|

|

125 |

|

|

F-1 |

i

GENERAL INFORMATION

Unless otherwise indicated or the context otherwise requires, all references in this report to the terms “Silence,” “Silence Therapeutics,” “Silence Therapeutics plc,” “the company,” “we,” “us” and “our” refer to Silence Therapeutics plc together with its subsidiaries. In this Annual Report, the U.S. Securities and Exchange Commission is referred to as the “SEC”, the Securities Act of 1933, as amended, is referred to as the “Securities Act” and the Securities Exchange Act of 1934, as amended, is referred to as the “Exchange Act.”

PRESENTATION OF FINANCIAL AND OTHER DATA

We maintain our books and records in pounds sterling and report under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. None of the financial statements included in this report were prepared in accordance with generally accepted accounting principles in the United States. All references in this report to “$” are to U.S. dollars and all references to “£” are to pounds sterling. Except with respect to U.S. dollar amounts presented as contractual terms or otherwise indicated, all amounts presented in this report in U.S. dollars have been translated from pounds sterling solely for convenience at an assumed exchange rate of $1.21 per £1.00, based on the noon buying rate of the Federal Reserve Bank of New York on December 31, 2022. We make no representation that any pounds sterling or U.S. dollar amounts referred to in this Annual Report could have been, or could be, converted into U.S. dollars or pounds sterling, as the case may be, at any particular rate, or at all. These translations should not be considered representations that any such amounts have been, could have been or could be converted from pounds sterling into U.S. dollars at that or any other exchange rate as of that or any other date.

We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them. Additionally, numerical figures under £100,000 have been rounded to the nearest thousand in this Annual Report.

All references to “shares” or “ordinary shares” in this Annual Report refer to ordinary shares of Silence Therapeutics plc with a nominal value of £0.05 per share. All references to ADSs refer to American Depositary Shares, each representing three ordinary shares of Silence Therapeutics plc, which are denominated in U.S. dollars and listed on Nasdaq.

TRADEMARKS, TRADENAMES AND SERVICE MARKS

This Annual Report includes trademarks, tradenames and service marks, certain of which belong to us and others that are the property of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this report appear without the ®, ™ and SM symbols, but the absence of those symbols is not intended to indicate, in any way, that we will not assert our rights or that the applicable owner will not assert its rights to these trademarks, tradenames and service marks to the fullest extent under applicable law. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that involve substantial risks and uncertainties. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements and opinions contained in this Annual Report are based upon information available to us as of the date of this Annual Report and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Forward-looking statements include statements about:

You should refer to the section of this Annual Report titled “Risk Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in

2

any specified time frame, or at all. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

You should read this Annual Report and the documents that we reference in this Annual Report and have filed as exhibits to the Annual Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

3

PART I

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3: KEY INFORMATION

A. [Reserved.]

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. Risk Factors.

Investing in American Depositary Shares representing our ordinary shares, or ADSs, involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this Annual Report, including our consolidated financial statements and the related notes, before investing in the ADSs. The risks and uncertainties described below are those significant risk factors, currently known and specific to us, that we believe are relevant to an investment in the ADSs. If any of these risks materialize, our business, results of operations or financial condition could suffer, the price of the ADSs could decline and you could lose part or all of your investment. Additional risks and uncertainties not currently known to us or that we now deem immaterial may also harm us and adversely affect your investment in the ADSs.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. You should carefully consider all of the information set forth in this report and, in particular, should evaluate the specific factors set forth in the section titled “Risk Factors” before deciding whether to invest in our ADSs. Among these important risks are, but not limited to, the following:

4

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we may take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include:

5

We will remain an emerging growth company until the earliest of: (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion; (2) the last day of 2025; (3) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur on the last day of any fiscal year that the aggregate worldwide market value of our common equity held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter; or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during any three-year period.

Foreign Private Issuer

We report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

Foreign private issuers are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

Risks Related to Our Financial Condition and Need for Additional Capital

We have a history of net losses and we anticipate that we will continue to incur significant losses for the foreseeable future.

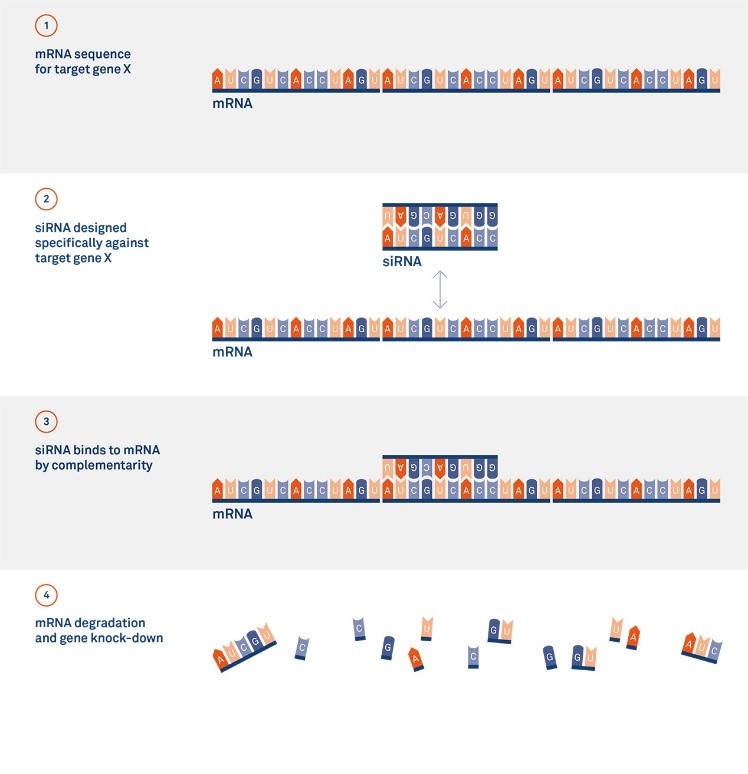

We are a clinical-stage biopharmaceutical company. As of the date hereof, our operations have been primarily limited to developing our siRNA product platform, undertaking basic research around siRNA targets, conducting preclinical and clinical studies and out-licensing some of our intellectual property rights. We have not yet obtained marketing approval for any product candidates and may not for the foreseeable future, if ever. Consequently, any predictions about our future success or viability, or any evaluation of our business and prospects, may not be accurate.

We have incurred net losses in each year since our inception. Our net losses were £40.5 million for the year ended December 31, 2022, £39.4 million for the year ended December 31, 2021, and £32.5 million for the year ended December 31, 2020. As of December 31, 2022, we had an accumulated loss of £263.3 million. Our losses have resulted from costs incurred to research and development, including our preclinical and clinical development activities.

6

We expect to continue to incur significant expenses and increasing operating losses for the foreseeable future, although these losses may fluctuate significantly between periods. We anticipate that our expenses will increase substantially as we continue the research, preclinical and clinical development of our product candidates, both independently and under our collaboration agreements with third parties. We would also incur additional expenses in connection with seeking marketing approvals for any product candidates that successfully complete clinical trials, if any, and establishing a sales, marketing and distribution infrastructure to commercialize any products for which we may obtain marketing approval. We will also need to maintain, expand and protect our intellectual property portfolio, hire additional personnel, and create additional infrastructure to support our operations and our product development efforts. We expect that all of these additional expenses will cause our total expenses to substantially exceed our revenue over the near term, resulting in continuing operating losses and increasing accumulated deficits.

We have never generated any revenue from product sales and may never be profitable.

Our ability to generate revenue and achieve profitability depends on our ability, alone or with collaboration partners, to successfully complete the development of, obtain the necessary regulatory approvals for and commercialize our product candidates. We do not anticipate generating revenues from sales of products for the foreseeable future, if ever. Our ability to generate future revenues from product sales will depend heavily on our success in:

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to predict the timing or amount of increased expenses and when we will be able to achieve or maintain profitability, if ever. In addition, our expenses could increase if we were required by the U.S. Food and Drug Administration, or FDA, the European Medicines Agency, or EMA, the U.K. Medicines and Healthcare products Regulatory Agency, or MHRA, or other regulatory agencies to perform studies and trials in addition to those that we currently anticipate.

Even if one or more of our product candidates is approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved product on our own. Even if we were able to generate revenues from the sale of any approved products, we may not become profitable and may need to obtain additional funding to continue operations.

We will require additional financial resources to continue as a going concern and to continue ongoing development of our product candidates and pursue our business objectives; if we are unable to obtain these additional resources when needed or on acceptable terms, we may be forced to delay or discontinue our planned operations, including clinical testing of our product candidates.

7

We have used substantial funds to develop our RNAi technologies and will require substantial funds to conduct further research and development, including preclinical testing and clinical trials of our product candidates, and to manufacture, market and sell any of our products that may be approved for commercial sale. Because the length of time or activities associated with successful development of our product candidates may be greater than we anticipate, we are unable to estimate the actual funds we will require to develop and commercialize them. As of December 31, 2022, our accumulated losses since inception were £263.3 million. We expect our operating expenditures and net losses to increase significantly in connection with our ongoing clinical trials and our internal research and development capabilities.

Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. We expect our research and development expenses to substantially increase in connection with our ongoing activities, particularly as we advance our product candidates towards or through clinical trials. We will need additional capital to fund our operations and such funding may not be available to us on acceptable terms, or at all. We may need additional capital or to otherwise obtain funding through additional strategic collaborations if we choose to initiate clinical trials for product candidates other than those which are funded by our collaboration partners. In any event, we will require additional capital to obtain regulatory approval for, and to commercialize, future product candidates.

For the foreseeable future, we expect to rely primarily on additional non-dilutive collaboration arrangements, as well as equity and/or debt financings, to fund our operations. Raising additional capital through the sale of securities could cause significant dilution to our shareholders. Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates. Our ability to raise additional funds will depend, in part, on the success of our preclinical studies and clinical trials and other product development activities, regulatory events, our ability to identify and enter into licensing or other strategic arrangements, and other events or conditions that may affect our value or prospects, as well as factors related to financial, economic and market conditions, many of which are beyond our control. There can be no assurances that sufficient funds will be available to us when required or on acceptable terms, if at all. If we are unable to raise additional capital when required or on acceptable terms, we may be required to:

Any of these events would have a material adverse effect on our business, operating results and prospects and could significantly impair the value of your investment in our ADSs.

The Company has incurred recurring losses since inception, including net losses of £40.5 million for the year ended December 31, 2022. As of December 31, 2022, the Company had accumulated losses of £263.3 million and cash outflows from operating activities for the year ended 31 December 2022 of £45.5 million. The Company expects to incur operating losses for the foreseeable future as it continues its research and development efforts, seeks to obtain regulatory approval of its product candidates and pursues any future product candidates the Company may develop.

To-date, the Company has funded its operations through upfront payments and milestones from collaboration agreements, equity offerings and proceeds from private placements, as well as management of expenses and other financing options to support its continued operations. During 2021, the Company received $40.0 million (£30.8 million) of the upfront payments in respect of the AstraZeneca collaboration, $45 million from a private placement of ADSs (approximately $42.0 million / £30.8 million, net of expenses) and approximately $16.0 million (£10.7 million)

8

of the upfront payment, (net of taxes withheld, based on the exchange rate at the payment date), related to the Hansoh Pharmaceutical Group Company Limited or Hansoh, collaboration executed on October 14, 2021. In August 2022 the Company raised additional funds through a registered direct offering with aggregate gross proceeds of $56.5 million (approximately £46.4 million) before deducting $4.1 million (approximately £3.3 million) in underwriting discounts, commissions and estimated offering expenses. As of December 31, 2022, the Company had cash and cash equivalents and U.S Treasury Bills of £71.1 million ($86.0 million).

The Company has the responsibility to evaluate whether conditions and/or events raise material uncertainty about its ability to meet its future financial obligations as they become due within one year after the date that the financial statements are issued. The forecast for evaluating the going concern basis of the Company includes continued investment in our technology platform and product pipeline. The forecast does not include collaboration milestones which have not been fully achieved or other assumptions for potential future non-dilutive or dilutive funding sources. Based on this evaluation, the Company believes that its current cash and cash equivalents are only sufficient to fund its operating expenses through the first quarter of 2024. This indicates that a material uncertainty exists that may cast significant doubt (or raise substantial doubt as contemplated by Public Company Accounting Oversight Board (“PCAOB”) standards) on the Company’s ability to continue as a going concern and therefore the Company may be unable to realize assets and discharge liabilities in the normal course of business.

The Company will need to raise additional funding to fund its operation expenses and capital expenditure requirements in relation to its clinical development activities. The Company may seek additional funding through public or private financings, debt financing or collaboration agreements. Specifically, the Company may receive future milestone payments of up to $14 million from existing collaboration agreements in the next 12 months which will extend the ability to fund operations beyond the first quarter of 2024. However, these future milestone payments are dependent on achievement of certain development or regulatory objectives that may not occur. The Company has an authorized open market sale agreement and can potentially raise funds through the sale of ADSs. However, there is no assurance that we will be successful in obtaining sufficient funding on terms acceptable to us, or if at all. The inability to obtain future funding could impact; the Company’s financial condition and ability to pursue its business strategies, including being required to delay, reduce or eliminate some of its research and development programs, or being unable to continue operations or unable to continue as a going concern.

These consolidated financial statements have been prepared assuming that the Company will continue as a going concern which contemplates the continuity of operations, realization of assets and the satisfaction of liabilities in the ordinary course of business and do not include adjustments that would result if the Company were unable to continue as a going concern.

The forecast of cash resources is forward-looking information that involves risks and uncertainties, and our actual cash requirements may vary materially from our current expectations for a number of other factors that may include, but are not limited to, changes in the focus and direction of our development programs, slower and/or faster than expected progress of our research and development efforts, changes in governmental regulation, competitive and technical advances, rising costs associated with the development of our product candidates, our ability to secure partnering arrangements, and costs of filing, prosecuting, defending and enforcing our intellectual property rights. Global political and economic events, including the COVID-19 pandemic and increased inflation, have already resulted in a significant disruption of global financial markets. If the disruption persists and deepens, we could experience an inability to access additional capital or make the terms of any available financing less attractive, which could in the future negatively affect our operations. If we exhaust our capital reserves more quickly than anticipated, regardless of the reason, and we are unable to obtain additional financing on terms acceptable to us or at all, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Raising additional capital may cause dilution to our holders, including holders of our ADSs, restrict our operations or require us to relinquish rights to our technologies or product candidates.

We expect that additional capital will be needed in the future to continue our planned operations, including expanded research and development activities and potential commercialization efforts. Until such time, if ever, as we

9

can generate substantial product revenues, we expect to finance our cash needs through any or a combination of securities offerings, debt financings, license and collaboration agreements and research grants and tax credits.

To the extent that we raise additional capital through the sale of equity or convertible debt securities, including in any at-the-market offering through our open market sale agreement, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a shareholder. Debt financing and preferred equity financing, if available, could result in fixed payment obligations, and we may be required to accept terms that restrict our ability to incur additional indebtedness, force us to maintain specified liquidity or other ratios or restrict our ability to pay dividends or make acquisitions. If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may be required to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us. In addition, we could also be required to seek funds through arrangements with collaborators or others at an earlier stage than otherwise would be desirable.

If we raise funds through research grants or take advantage of research and development tax credits, we may be subject to certain requirements, which may limit our ability to use the funds or require us to share information from our research and development. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to a third party to develop and market product candidates that we would otherwise prefer to develop and market ourselves. Raising additional capital through any of these or other means could adversely affect our business and the holdings or rights of our shareholders, and may cause the market price of our ADSs to decline.

Risks Related to the Discovery, Development, Regulatory Approval and Potential Commercialization of Our Product Candidates

The approach we are taking to discover and develop drugs is novel and may never lead to marketable products.

We have concentrated our therapeutic product research and development efforts on siRNA technology, and our future success depends on the successful development of this technology and products based on our siRNA product platform. Although the FDA has approved five siRNA treatments for marketing in the United States since 2018, no assurance can be given that the FDA will approve any other siRNA treatments such as ours.

The scientific discoveries that form the basis for our efforts to discover and develop product candidates based on siRNA technology are relatively new. The scientific evidence to support the feasibility of developing product candidates based on these discoveries is both preliminary and limited. If we do not successfully develop and commercialize product candidates based upon our technological approach, we may not become profitable and the value of our ordinary shares may decline.

Further, our focus solely on siRNA technology for developing drugs as opposed to multiple, more proven technologies for drug development increases the risks associated with the ownership of our ordinary shares. If we are not successful in developing any product candidates using siRNA technology, we may be required to change the scope and direction of our product development activities. In that case, we may not be able to identify and successfully implement an alternative product development strategy.

We may not be successful in our efforts to identify or discover potential product candidates.

The success of our business depends primarily upon our ability to identify, develop and commercialize siRNA therapeutics. Our research programs may show initial promise in identifying potential product candidates, yet fail to yield product candidates for clinical development for a number of reasons, including:

10

If any of these events occur, we may be forced to abandon our development efforts for a program or programs, which would have a material adverse effect on our business and could potentially cause us to cease operations. Research programs to identify new product candidates require substantial technical, financial and human resources. We may focus our efforts and resources on potential programs or product candidates that ultimately prove to be unsuccessful.

We may not be successful in our efforts to increase our pipeline, including by pursuing additional indications for our current product candidates, identifying additional indications for our proprietary platform technology or in-licensing or acquiring additional product candidates for other indications.

We may not be able to develop or identify product candidates that are safe, tolerable and effective. Even if we are successful in continuing to build our pipeline, the potential product candidates that we identify, in-license or acquire may not be suitable for clinical development, including as a result of being shown to have harmful side effects or other characteristics that indicate that they are unlikely to be products that will receive marketing approval and achieve market acceptance.

Preclinical studies and clinical trials of our product candidates may not be successful. If we are unable to generate successful results from these studies and trials, or experience significant delays in doing so, our business may be materially harmed.

We have invested a significant portion of our efforts and financial resources in the identification and development of siRNA-based product candidates. Our ability to generate product revenues, which we do not expect will occur for many years, if ever, will depend heavily on the successful development and eventual commercialization of our product candidates.

The success of our product candidates will depend on several factors, including, inter alia, the following:

If we do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully complete the development of, or commercialize, our product candidates, which would materially harm our business.

If clinical trials of our product candidates fail to commence or, once commenced fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities, or do not otherwise produce positive results, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates.

11

In clinical development, the risk of failure for product candidates is high. It is impossible to predict when or if any of our product candidates will prove effective or safe in humans or will receive regulatory approval. We are the sponsor of Investigational Medicinal Product Dossiers in multiple jurisdictions and must achieve and maintain compliance with the requirements of various regulatory authorities. Before obtaining marketing approval from regulatory authorities for the sale of product candidates, we or a strategic collaborator must conduct extensive clinical trials to demonstrate the safety and efficacy of the product candidates in humans. As of the date hereof, we have three product candidates in clinical development, and our other product candidates are preclinical. Clinical trials are expensive, difficult to design and implement, can take many years to complete and are uncertain as to outcome. A failure of one or more clinical trials can occur at any stage of testing. The outcome of early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. A number of companies in the biopharmaceutical industry have suffered significant setbacks in advanced clinical trials due to lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier trials. Moreover, clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their product candidates performed satisfactorily in clinical trials have nonetheless failed to obtain marketing approval for their products.

Events which may result in a delay or unsuccessful completion of clinical development include, among other things:

12

If we or our current or future strategic collaborators are required to conduct additional clinical trials or other testing of any product candidates beyond those that are currently contemplated, are unable to successfully complete clinical trials of any such product candidates or other testing, or if the results of these trials or tests are not positive or are only moderately positive, or if there are safety concerns, we and they may:

Many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates. In addition, our product development costs will also increase if we experience delays in testing or marketing approvals. We do not know whether any clinical trials will begin as planned, will need to be restructured or will be completed on schedule, or at all. Significant clinical trial delays also could shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do, which would impair our ability to successfully commercialize our product candidates and may harm our business and results of operations. Any inability to successfully complete clinical development, whether independently or with a strategic collaborator, could result in additional costs to us or impair our ability to generate revenues from product sales, regulatory and commercialization milestone payments and royalties.

Conducting successful clinical trials requires the enrollment of large numbers of patients, and suitable patients may be difficult to identify and recruit.

Patient enrollment in clinical trials and completion of patient participation and follow-up depends on many factors, including the size of the patient population; the nature of the trial protocol; the attractiveness of, or the discomforts and risks associated with, the treatments received by enrolled subjects; the availability of appropriate clinical trial investigators; support staff; the number of ongoing clinical trials in the same indication that compete for the same patients; proximity of patients to clinical sites and ability to comply with the eligibility and exclusion criteria for participation in the clinical trial and patient compliance. For example, patients may be discouraged from enrolling in our clinical trials if the trial protocol requires them to undergo extensive post-treatment procedures or follow-up to assess the safety and effectiveness of our products or if they determine that the treatments received under the trial protocols are not attractive or involve unacceptable risks or discomforts. Patients may also not participate in our clinical trials if they choose to participate in contemporaneous clinical trials of competitive products.

We rely on third parties to conduct some aspects of our manufacturing, research and development activities, and those third parties may not perform satisfactorily, including failing to meet deadlines for the completion of research or clinical testing, or may terminate our agreements.

We do not expect to independently conduct all aspects of our manufacturing and drug discovery activities, research or preclinical and clinical studies of product candidates. We currently rely and expect to continue to rely on third parties to conduct some aspects of our drug development studies and chemical syntheses. Any of these third parties may terminate their engagements with us at any time. If we need to enter into alternative arrangements, it would delay our product development activities. Our reliance on these third parties for research and development activities will reduce our control over these activities but will not relieve us of our responsibilities. If these third parties do not successfully carry out their contractual duties, meet expected deadlines or conduct our studies in accordance with regulatory requirements or our stated study plans and protocols, we will not be able to complete, or may be delayed in completing, the necessary preclinical studies to enable us to progress viable product candidates for

13

investigational new drug, or IND, submissions and will not be able to, or may be delayed in our efforts to, successfully develop and commercialize such product candidates.

Although our research and development services can only be performed by us or at our discretion, we rely on third party clinical investigators, CROs, clinical data management organizations, medical institutions and consultants to design, conduct, supervise and monitor preclinical studies and clinical trials in relation to our product candidates. Because we rely on third parties and do not have the ability to conduct clinical trials independently, we have less control over the timing, quality and other aspects of clinical trials than we would if we conducted them on our own. These investigators, CROs and consultants are not our employees and we have limited control over the amount of time and resources that they dedicate to our programs. These third parties may have contractual relationships with other entities, some of which may be our competitors, which may draw time and resources from our programs. If we cannot contract with acceptable third parties on commercially reasonable terms, or at all, or if these third parties do not carry out their contractual duties, satisfy legal and regulatory requirements for the conduct of clinical trials or meet expected deadlines, our clinical development program could be delayed or otherwise adversely affected. In all events, we are responsible for ensuring that each of our clinical trials is conducted in accordance with the general investigational plan and protocols for the trial. The FDA and comparable foreign regulatory agencies require us to comply with GCP for conducting, recording and reporting the results of clinical trials to assure that data and reported results are credible, accurate and complete and that the rights, integrity and confidentiality of trial participants are protected. We rely, for example, on third parties for aspects of quality control which are especially important in monitoring compliance with GCP requirements and avoiding any investigator fraud or misconduct in clinical research, such as practices including adherence to an investigational plan; accurate recordkeeping; drug accountability; obtaining completed informed consent forms; timely reporting of any adverse drug reactions; notifying appropriate IRBs and Ethics Committees of progress reports and any significant changes; and obtaining documented IRB approvals. Our reliance on third parties that we do not control does not relieve us of these responsibilities and requirements. The third parties with which we contract might not be diligent, careful or timely in conducting our clinical trials, as a result of which we could experience one or more lapses in quality controls or other aspects of clinical trial management, and the clinical trials could be delayed or unsuccessful. Any such event could have a material adverse effect on our business, financial condition, results of operations and prospects.

Our dependence on collaborators for capabilities and funding means that our business could be adversely affected if any collaborator materially amends or terminates its collaboration agreement with us or fails to perform its obligations under that agreement. Our current or future collaborations, if any, may not be scientifically or commercially successful. Disputes may arise in the future with respect to the ownership of rights to technology or products developed with collaborators, which could have an adverse effect on our ability to develop and commercialize any affected product candidate. Our current collaborations allow, and we expect that any future collaborations will allow, either party to terminate the collaboration for a material breach by the other party. In addition, our collaborators may have additional termination rights for convenience with respect to the collaboration or a particular program under the collaboration, under certain circumstances. For example, our collaboration agreement with Mallinckrodt plc, or Mallinckrodt, for an exclusive worldwide license for SLN501 (SLN500 program candidate) and additional complement-target products, our collaboration agreement with AstraZeneca PLC, or AstraZeneca, to discover, develop and commercialize siRNA therapeutics for the treatment of cardiovascular, renal, metabolic and respiratory diseases, and our collaboration agreement with Hansoh Pharmaceutical Group Company Limited, or Hansoh, to develop siRNAs for three undisclosed targets, may be terminated by Mallinckrodt, AstraZeneca and Hansoh, respectively, at any time upon prior written notice to us. If we were to lose a collaborator, we would have to attract a new collaborator or develop expanded R&D, sales, distribution and marketing capabilities internally, which would require us to invest significant amounts of financial and management resources.

We rely on third-party manufacturers to produce our preclinical, clinical product candidates and certain starting material components, and we intend to rely on third parties to produce future clinical supplies of product candidates that we advance into clinical trials and commercial supplies of any approved product candidates.

Reliance on third-party manufacturers entails risks, including risks that we would not be subject to if we manufactured the product candidates ourselves, including:

14

We face risks inherent in relying on contract manufacturing organizations, or CMOs, as any disruption, such as a fire, natural hazards, pandemic, epidemic, war or outbreak of an infectious disease at a CMO could significantly interrupt our manufacturing capability. If necessary to avoid future disruption, we may have to establish alternative manufacturing sources. This would require substantial capital on our part, which we may not be able to obtain on commercially acceptable terms or at all. Additionally, we may experience manufacturing delays as we build or locate replacement facilities and seek and obtain necessary regulatory approvals. If this occurs, we will be unable to satisfy manufacturing needs on a timely basis, if at all. Also, operating any new facilities may be more expensive than operating our current facility. Further, business interruption insurance may not adequately compensate us for any losses that may occur and we would have to bear the additional cost of any disruption. For these reasons, a significant disruptive event affecting the manufacturing facility could have drastic consequences, including placing our financial stability at risk.

Even if we complete the necessary preclinical studies and clinical trials, we cannot predict whether or when we will obtain regulatory approval to commercialize a product candidate and we cannot, therefore, predict the timing of any revenue from a future product.

Neither we nor any strategic collaborator can commercialize a product until the appropriate regulatory authorities, such as the FDA, EMA or MHRA, have reviewed and approved the product candidate. The regulatory agencies may not complete their review processes in a timely manner, or we may not be able to obtain regulatory approval. Additional delays may result if an FDA Advisory Committee, or similar foreign governmental institution, recommends restrictions or conditions on approval or recommends non-approval. In addition, we or a strategic collaborator may experience delays or rejections based upon additional government regulation from future legislation or administrative action, or changes in regulatory agency policy during the period of product development, clinical trials and the review process.

Even if we obtain regulatory approval for a product candidate, we will still face extensive regulatory requirements and our products may face future development and regulatory difficulties.

Even if we obtain regulatory approval in the United States and the European Union, the FDA and the EMA may still impose significant restrictions on the indicated uses or marketing of our product candidates or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. The holder of an approved new drug application, or NDA, in the United States, or a marketing authorization, or MA, in the European Union is obligated to monitor and report adverse events, or AEs, or adverse reactions and any failure of a product to meet the

15

specifications in the NDA, or MA. The holder of an approved NDA or MA must also submit new or supplemental applications and obtain regulatory approval in order to make certain changes to the approved product, product labeling or manufacturing process. Advertising and promotional materials must comply with the relevant regulatory rules and, in the United States and in some EU Member States, are subject to FDA review or national regulatory review, in addition to other potentially applicable federal and state laws.

In addition, drug product manufacturers and their facilities are subject to payment of user fees or may require manufacturing and import authorizations, or MIAs in the European Union, and continual review and periodic inspections by regulatory authorities for compliance with current good manufacturing practices, or cGMP, including quality control, quality assurance, and the maintenance of records and documentation to ensure that approved products are safe and consistently meet applicable requirements, and adherence to commitments made in the NDA or MA. While we have not yet, and may not ever, obtain marketing approval for any of our products, when we do, we or any third party manufacturers we engage may be unable to comply with these cGMP and with other regulatory authority requirements. These requirements are enforced by regulatory authorities through periodic inspections of manufacturing facilities. If we or a regulatory agency discovers previously unknown problems with a product such as AEs of unanticipated severity or frequency, adverse reactions, or product quality issues, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions relative to that product or the manufacturing facility. A negative outcome from such inspection or a failure to provide adequate and timely corrective actions in response to deficiencies identified could result in enforcement action, including warning letters, fines and civil penalties, suspension of production, suspension or delay in product approval, product seizure or recall, plant shutdown, or the delay, withholding, or withdrawal of product approval. If the safety of any product is compromised due to a manufacturer’s failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval for or successfully commercialize our products, which would seriously harm our business.

If there are changes in the application of legislation or regulatory policies, or if problems are discovered with a product or our manufacture of a product, or if we or one of our distributors, licensees or co-marketers fails to comply with regulatory requirements, the regulators could take various actions such as:

Any government investigation of alleged violations of law could require us to expend significant time and resources in response and could generate negative publicity. The occurrence of any event or penalty described above may inhibit our ability to commercialize our future products and generate revenues.

Even if we obtain and maintain approval for our product candidates in one jurisdiction, we may never obtain approval for our product candidates with other regulatory authorities in other jurisdictions. Sales of our product candidates outside of the United States and the European Union will be subject to foreign regulatory requirements governing clinical trials and marketing approval and continual regulatory review. We will be subject to ongoing obligations and oversight by regulatory authorities, including adverse event reporting requirements, marketing restrictions and, potentially, other post-marketing obligations, all of which may result in significant expense and limit our ability to commercialize such products.

16

We may not be able to obtain or maintain orphan drug designations for any of our product candidates, and we may be unable to maintain the benefits associated with orphan drug designation, including the potential for market exclusivity.

Regulatory authorities in some jurisdictions, including the United States and Europe, may designate drugs or biologics for relatively small patient populations as orphan drugs. In the United States, under the Orphan Drug Act, the FDA may grant orphan designation to a drug or biological product intended to treat a rare disease or condition. Such diseases and conditions are those that affect fewer than 200,000 individuals in the United States, or if they affect more than 200,000 individuals in the United States, there is no reasonable expectation that the cost of developing and making a drug available in the United States for these types of diseases or conditions will be recovered from sales of the drug. However, orphan drug designation must be requested before submitting an NDA and there can be no assurance that any such designation will be granted. If the FDA grants orphan drug designation, the identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. Orphan drug designation does not convey any advantage in or shorten the duration of the regulatory review and approval process.

In the United States, orphan drug designation recipients can take advantage of special incentives provided by the FDA such as (i) potential market exclusivity of the product for seven years as the first sponsor (ii) tax credits for qualified clinical research for a designated orphan product and (iii) waiver of associated fees when submitting a marketing application to the FDA.

Similarly, in the European Union, orphan designation is intended to promote the development of medicinal products that are intended for (i) the diagnosis, prevention or treatment of life-threatening or chronically debilitating conditions affecting not more than five in 10,000 persons in the European Union, or that are intended for the diagnosis, prevention, or treatment of a life-threatening, seriously debilitating or serious and chronic condition when, without incentives, it is unlikely that sales in Europe would be sufficient to justify the necessary investment, and (ii) there exists no satisfactory method of diagnosis, prevention or treatment of the condition that has been authorized in Europe or, if such method exists, that the medicinal product will be of significant benefit to those affected. In Europe, orphan designation entitles a party to a number of incentives, such as protocol assistance and scientific advice specifically for designated orphan medicines, and potential fee reductions depending on the status of the sponsor. European orphan medicines also benefit from ten years of market exclusivity, which precludes the EMA from approving another marketing application during this time period for a similar drug and for the same indication. This marketing exclusivity period can however, be reduced to six years if, at the time the marketing authorization is renewed after five years, a drug no longer meets the criteria for orphan designation or if the drug is sufficiently profitable, such that market exclusivity is no longer justified.

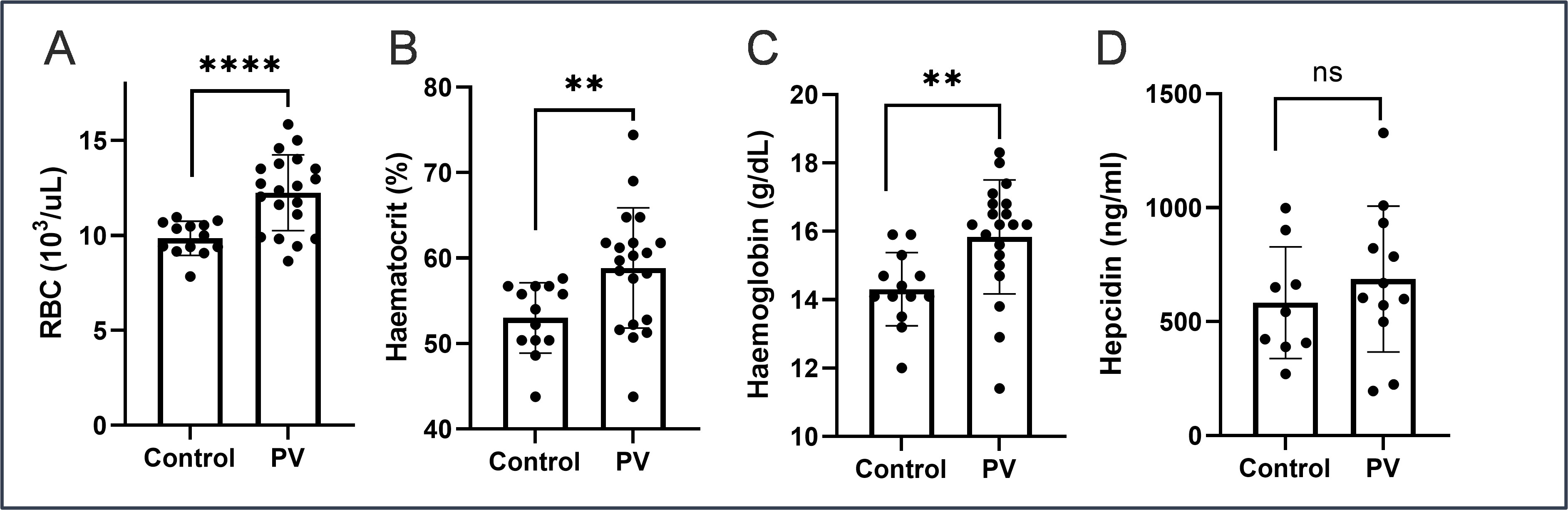

Our product candidate SLN124 has received orphan drug designation from the EMA for the treatment of beta-thalassemia and from the FDA for the treatment of beta-thalassemia, myelodysplastic syndrome, or MDS, and polycythemia vera, or PV. Our drug candidate SLN501 (collaboration with Mallinckrodt) has received orphan drug designation from the FDA for complement 3 glomerulopathy, or C3G. The EMA will reassess eligibility for SLN124 orphan exclusivity at the time of MA review and can remove orphan status if the drug no longer meets the eligibility criteria, including offering a significant benefit to those affected, at that time. Moreover, even if we obtain orphan drug exclusivity in the future for a product candidate for these or other indications, such exclusivity may not effectively protect the product candidate from competition because different therapies can be approved for the same condition and the same therapies can be approved for different conditions but used off-label. Even after an orphan drug is approved, the FDA or EMA can subsequently approve a different or a similar drug for the same condition if such regulatory authority concludes that the later drug is clinically superior because it is shown to be safer, more effective or makes a major contribution to patient care. Orphan drug exclusivity may also be lost if the regulatory authority later determines that the initial request for designation was materially defective. In addition, orphan drug exclusivity does not prevent the regulatory authority from approving competing drugs for the same disease or condition containing a different active ingredient. In addition, if a subsequent drug is approved for marketing for the same disease or condition as any of our product candidates that receive marketing approval, we may face increased competition and lose market share regardless of orphan drug exclusivity.

17

Although we have obtained Rare Pediatric Disease Designation for SLN124 for the treatment of beta-thalassemia, we may not realize the expected benefits of this designation.

In 2012, Congress authorized the FDA to award priority review vouchers to sponsors of certain rare pediatric disease product applications. This provision is designed to encourage development of new drug and biological products for prevention and treatment of certain rare pediatric diseases. Specifically, under this program, a sponsor who receives an approval for a drug or biologic for a “rare pediatric disease” may qualify for a voucher that can be redeemed to receive a priority review of a subsequent marketing application for a different product. The sponsor of a rare pediatric disease drug product receiving a priority review voucher may transfer (including by sale) the voucher to another sponsor. The voucher may be further transferred any number of times before the voucher is used, as long as the sponsor making the transfer has not yet submitted the application. The FDA may also revoke any priority review voucher if the rare pediatric disease drug for which the voucher was awarded is not marketed in the U.S. within one year following the date of approval.

SLN124 has been granted rare pediatric disease designation, but designation of a drug for a rare pediatric disease does not guarantee that an NDA will meet the eligibility criteria for a rare pediatric disease priority review voucher at the time the application is approved. Specifically, on December 27, 2020, the Rare Pediatric Disease Priority Review Voucher Program was extended by Congress; under the current statutory sunset provisions, after September 30, 2024, FDA may only award a voucher for an approved rare pediatric disease product application if the sponsor has rare pediatric disease designation for the drug, and that designation was granted by September 30, 2024. After September 30, 2026, FDA may not award any rare pediatric disease priority review vouchers. Furthermore, a Rare Pediatric Disease Designation does not lead to faster development or regulatory review of the product, or increase the likelihood that it will receive marketing approval. We may or may not realize any benefit from receiving a voucher.

We may use our financial and human resources to pursue a particular research program or product candidate and fail to capitalize on programs or product candidates that may be more profitable or for which there is a greater likelihood of success.

Because we have limited financial and human resources, we intend to leverage our existing licensing and collaboration agreements and may enter into new strategic collaboration agreements for the development and commercialization of our programs and potential product candidates in indications with potentially large commercial markets while focusing our internal development resources, and any future internal sales and marketing organization that we may establish, on research programs and product candidates intended for selected markets or patient populations, such as rare diseases. As a result, and even as we prioritize rare indications with expansion opportunities to large populations, we may forego or delay pursuit of other programs or product candidates or other indications that later prove to have greater commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable commercial products or profitable market opportunities. Our spending on research and development programs and product candidates for specific indications may not yield any commercially viable products. If we do not accurately evaluate the commercial potential or target market for a particular product candidate, we may relinquish valuable rights to that product candidate through strategic collaboration, licensing or other royalty arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to such product candidate, or we may allocate internal resources to a product candidate in a therapeutic area in which it would have been more advantageous to enter into a collaboration arrangement.

Any of our product candidates may cause adverse effects or have other properties that could delay or prevent their regulatory approval or limit the scope of any approved label or market acceptance.

AEs caused by our product candidates could cause us, other reviewing entities, clinical trial sites or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval. Certain oligonucleotide therapeutics have been observed to result in injection site reactions and pro-inflammatory effects and may also lead to impairment of kidney or liver function. There is a risk that our future product candidates may induce similar AEs.

18

If AEs are observed in any clinical trials of our product candidates, including those that a strategic collaborator may develop under an agreement with us, our or our collaborators’ ability to obtain regulatory approval for product candidates may be negatively impacted.

Further, if any of our future products, if and when approved for commercial sale, cause serious or unexpected side effects, a number of potentially significant negative consequences could result, including:

Any of these events could prevent us or our collaborators from achieving or maintaining market acceptance of the affected product and could substantially increase the costs of commercializing our future products and impair our ability to generate revenues from the commercialization of these products either on our own or with the collaborator.

Even if any of our product candidates receive marketing approval, they may fail to achieve the degree of market acceptance by physicians, patients, third party payers and others in the medical community necessary for commercial success.

The product candidates that we are developing are based upon new technologies or therapeutic approaches. Key participants in pharmaceutical marketplaces, such as physicians, third-party payers and consumers, may not accept a product intended to improve therapeutic results based on RNAi technology. As a result, it may be more difficult for us to convince the medical community and third-party payers to accept and use our product, or to provide favorable reimbursement and market access. The degree of market acceptance of our product candidates, if approved for commercial sale, will depend on a number of factors, including:

19

Risks Related to Our Business Operations and Compliance with Government Regulations

We face competition from other companies that are working to develop novel drugs and technology platforms using technologies similar to ours. If these companies develop drugs more rapidly than we do or their technologies, including delivery technologies, are more effective, our ability to successfully commercialize drugs may be adversely affected.

We face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions, governmental agencies and public and private research institutions. Many of our competitors may have greater experience in research and development, manufacturing, managing clinical trials and/or regulatory compliance than we do, and may be better resourced financially. Any product candidates that we successfully develop and commercialize will compete with existing products and new products that may become available in the future. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and recruiting lead clinical trial investigators and establishing clinical study sites and patient registration for clinical studies, as well as in acquiring technologies complementary to, or necessary for, our programs.

Companies that complete clinical trials, obtain required regulatory authority approvals and commence commercial sale of their drugs before we do may achieve a significant competitive advantage, and our commercial opportunity could be reduced or eliminated if competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than any products that we may develop and commercialize. Because our products and many potential competing products are in various stages of preclinical and clinical development, and given the inherent unpredictability of drug development, it is difficult to predict which third parties may provide the most competition, and on what specific basis.

In addition to the competition we face from competing drugs in general, we also face competition from other companies working to develop novel drugs using technology that competes more directly with our own. We are aware of several other companies that are working to develop RNAi therapeutic products and other companies may develop alternative treatments for the diseases we have identified as being potentially treated with our siRNA molecules. To the extent those alternative treatments are more efficacious, less expensive, more convenient or produce fewer side effects, our market opportunity would be reduced.

Our future success depends on our ability to retain key executives and to attract, retain and motivate qualified personnel.

We are highly dependent on principal members of our executive team, the loss of whose services may adversely impact the achievement of our objectives. Certain of our executive officers are “at will” employees and may terminate their employment with us at any time upon prior written notice. Recruiting and retaining other qualified employees for our business, including scientific and technical personnel, will also be critical to our success. There is currently a shortage of skilled executives in our industry, which is likely to continue. As a result, competition for skilled personnel is intense and the turnover rate can be high. We may not be able to attract and retain personnel on acceptable terms given the competition among numerous life sciences companies for individuals with similar skill sets. In addition, failure to succeed in preclinical studies and clinical trials may make it more challenging to recruit and retain qualified personnel.

The inability to recruit or loss of the services of any executive or key employee might impede the progress of our research, development and commercialization objectives.

We may need to expand our organization and may experience difficulties in managing this growth, which could disrupt our operations.

As of December 31, 2022 we had 122 employees. In the future we may expand our employee base to increase our managerial, scientific, operational, commercial, financial and other resources and to hire more consultants and contractors. Future growth would impose significant additional responsibilities on our management, including the need to identify, recruit, maintain, motivate and integrate additional employees, consultants and contractors. Also, our

20

management may need to divert a disproportionate amount of its attention away from its day-to-day activities and devote a substantial amount of time to managing these growth activities. We may not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, give rise to operational mistakes, loss of business opportunities, loss of employees and reduced productivity among remaining employees. Our expected growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of additional product candidates. Moreover, if our management is unable to effectively manage our growth, our expenses may increase more than expected, our ability to generate and/or grow revenues could be reduced, and we may not be able to implement our business strategy. Our future financial performance and our ability to commercialize product candidates and compete effectively will depend, in part, on our ability to effectively manage any future growth.

If we fail to introduce new products or keep pace with advances in technology, our business, financial condition and results of operations could be adversely affected.

We spend a relatively low amount on technological innovation compared to our larger competitors. There is a risk that competitors will be quicker to develop new technologies, new products for the same gene targets or new delivery methods of nucleic acids into novel cell types, particularly once competitors learn about new gene targets that we or our collaborators have selected for development of siRNA molecules. We will need to successfully introduce new products to achieve our strategic business objectives. Our successful product development will depend on many factors, including our ability to attract strong talent to lead our research and development efforts, adapt to new technologies, obtain regulatory approvals on a timely basis, demonstrate satisfactory clinical results, manufacture products in an economical and timely manner, obtain appropriate intellectual property protection for our products, gain and maintain market acceptance of our products, and differentiate our products from those of our competitors. In addition, patents attained by others may preclude or delay our commercialization of a product. There can be no assurance that any products now in development or that we may seek to develop in the future will achieve technological feasibility, obtain regulatory approval or gain market acceptance. If we cannot successfully introduce new products or adapt to changing technologies, our products may become obsolete and our revenue and profitability could suffer.

We face potential product liability and other claims, and, if successful claims are brought against us, we may incur substantial liability and costs.

The use of our product candidates in clinical trials and the sale of any products for which we obtain marketing approval exposes us to the risk of product liability claims, including claims related to impurities in our products or potential product recalls. Certain single-stranded oligonucleotide therapeutics have led to injection site reactions and pro-inflammatory effects and may also lead to impairment of kidney or liver function. There is a risk that our current and future product candidates, although double-stranded, may induce similar or other adverse events. Product liability claims might be brought against us by consumers, healthcare providers, life sciences companies or others selling or otherwise coming into contact with our products; other claims may be brought against us by third parties with whom we contract, or by current or former employees or consultants, including claims of wrongful terminations, discrimination, other violations of labor law or other alleged conduct. If we cannot successfully defend against such claims, we could incur substantial liability and costs. In addition, regardless of merit or eventual outcome, such claims may result in, among other things:

21

We maintain product liability insurance relating to the use of our therapeutics in clinical trials. However, such insurance coverage may not be sufficient to reimburse us for any expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive and in the future we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses due to liability. If and when we obtain marketing approval for product candidates, we intend to expand our insurance coverage to include the sale of commercial products; however, we may be unable to obtain product liability insurance on commercially reasonable terms or in adequate amounts. On occasion, large judgments have been awarded in class action lawsuits based on drugs that had unanticipated adverse effects. A successful product liability claim or series of claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could adversely affect our results of operations and business.

Cybersecurity risks and the failure to maintain the confidentiality, integrity, and availability of our computer hardware, software, and internet applications and related tools and functions could result in damage to our reputation and/or subject us to costs, fines or lawsuits.

Our business requires manipulating, analyzing and storing large amounts of data. We also maintain personally identifiable information about our employees. Our business therefore depends on the continuous, effective, reliable, and secure operation of our computer hardware, software, networks, internet servers, third party technology service providers and related infrastructure. To the extent that our hardware or software malfunctions or access to our data by internal research personnel is interrupted, our business could suffer. The integrity and protection of our employee and company data is critical to our business and employees have a high expectation that we will adequately protect their personal information. The regulatory environment governing information, security and privacy laws is increasingly demanding and continues to evolve, as further described below. Maintaining compliance with applicable security and privacy regulations may increase our operating costs. Although our computer and communications hardware are protected through physical and software safeguards, we are still vulnerable to fire, storm, flood, power loss, earthquakes, telecommunications failures, physical or software break-ins, software viruses, accidental or malicious insider-action and similar events. These events could lead to the unauthorized access, disclosure and use of non-public information. The techniques used by criminal elements to attack computer systems are sophisticated, change frequently and may originate from less regulated and remote areas of the world and increasingly involve highly resourced threat actors such as organized criminals and nation states. As a result, we cannot provide assurance that our efforts to address these techniques proactively or implement adequate preventative measures will always be successful. If our computer systems are compromised, we could be subject to fines, damages, litigation and enforcement actions, and we could lose trade secrets, the occurrence of which could harm our business. In addition, any sustained disruption in internet systems or network access provided by other companies could harm our business.

The collection, processing and cross-border transfer of personal information is subject to restrictive laws and regulations.