Exhibit 10.1

Execution Version

SECURITIES PURCHASE

AGREEMENT

This Securities Purchase Agreement (this

“Agreement”) is made and entered into as of June 26, 2024 (the “Effective Date”)

by and among KALA BIO, Inc., a Delaware corporation (the “Company”), and the purchasers listed on the

signature pages hereto (each a “Purchaser” and together the “Purchasers”). Certain

terms used and not otherwise defined in the text of this Agreement are defined in Section 11 hereof.

RECITALS

WHEREAS, the Company and the Purchasers

are executing and delivering this Agreement in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of

the Securities Act of 1933, as amended (the “1933 Act”), and/or Rule 506 of Regulation D promulgated by

the United States Securities and Exchange Commission (the “Commission”) under the 1933 Act; and

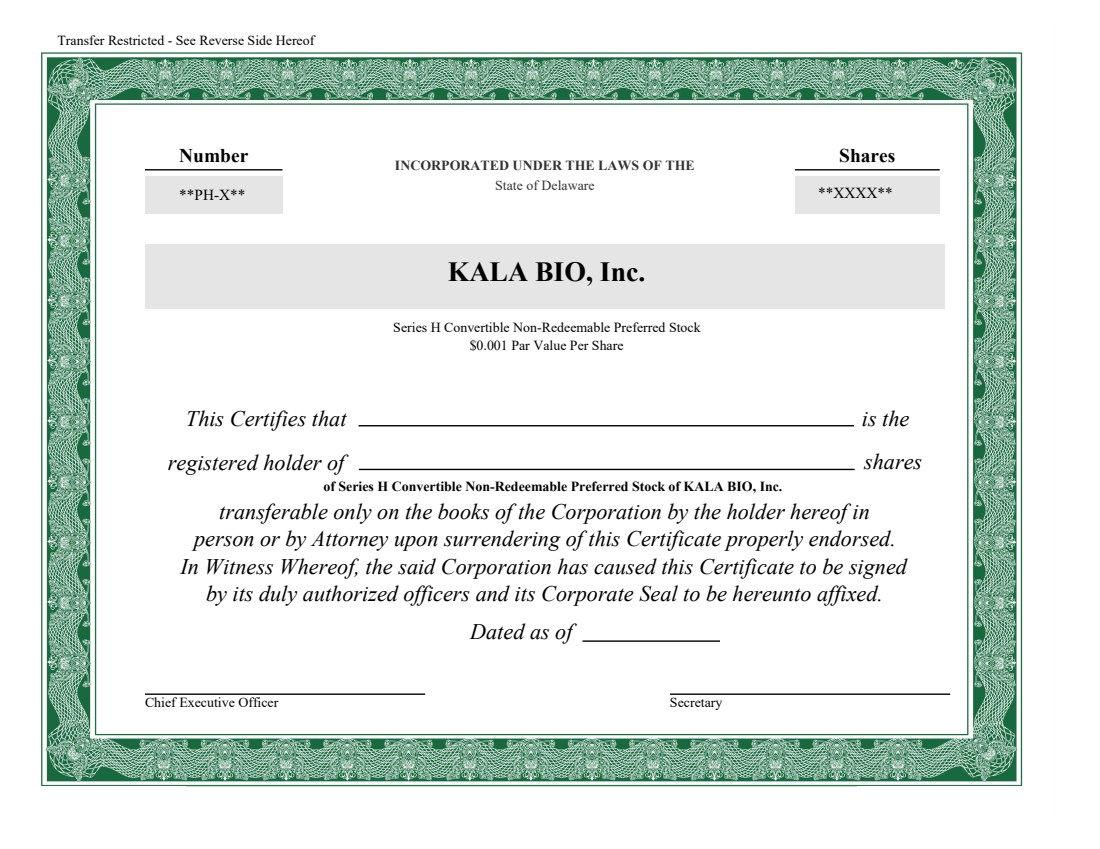

WHEREAS, the Company desires to sell

to the Purchasers, and the Purchasers desire to purchase from the Company, an aggregate of (i) 9,393 shares of Series H Convertible

Non-Redeemable Preferred Stock, par value $0.001 per share (the “Series H Preferred Stock”), having the

relative rights, preferences, limitations and powers set forth in the Certificate of Designations, Preferences and Rights of Series H

Convertible Non-Redeemable Preferred Stock of KALA BIO, Inc. in the form attached hereto as Exhibit A (the “Certificate

of Designations”), and (ii) 1,197,314 shares (the “Shares”) of the Company’s common

stock, par value $0.001 per share (the “Common Stock”), in accordance with the terms and provisions of this

Agreement.

NOW, THEREFORE, in consideration of

the foregoing and the mutual representations, warranties and covenants herein contained, the parties hereto hereby agree as follows:

SECTION 1. Authorization of

Securities.

1.01 The

Company has authorized the sale and issuance of the Series H Preferred Stock and the Shares on the terms and subject to the conditions

set forth in this Agreement. The shares of Series H Preferred Stock and the Shares sold hereunder at the Closing (as defined below)

shall be referred to as the “Securities.”

SECTION 2. Sale and Purchase

of the Securities.

2.01 Upon

the terms and subject to the conditions herein contained, the Company agrees to sell to each Purchaser, and each Purchaser agrees to

purchase from the Company, that number of shares of Series H Preferred Stock and Common Stock set forth opposite such Purchaser’s

name on the Schedule of Purchasers for the purchase price to be paid by each Purchaser set forth opposite such Purchaser’s name

on the Schedule of Purchasers, for aggregate gross proceeds of $12,499,191.90, each share of Series H Preferred Stock being issued

and sold for a purchase price of $585.00 per share and each share of Common Stock being issued and sold for a purchase price of $5.85

per share.

2.02 At

or prior to the Closing, each Purchaser will pay the applicable purchase price set forth opposite such Purchaser’s name on the

Schedule of Purchasers by wire transfer of immediately available funds in accordance with wire instructions provided by the Company to

the Purchasers prior to the Closing.

2.03 If

any Purchaser fails to purchase all of the Securities set forth opposite such Purchaser’s name on the Schedule of Purchasers at

the Closing (such Purchaser, a “Failing Purchaser”), then, effective immediately upon the Closing, such Failing

Purchaser’s rights under Section 6.06 shall terminate and be of no further effect.

SECTION 3. Closing.

3.01 Subject

to the satisfaction of the closing conditions set forth in Section 7, the closing with respect to the transactions contemplated

in Section 2.01 hereof (the “Closing”), shall take place remotely via exchange of executed documents

and funds on the second Business Day (as defined below) after the date hereof (the “Closing Date”), or at such

other time and place as the Company may designate by notice to the Purchasers.

SECTION 4. Representations and

Warranties of the Purchasers. Each Purchaser, severally and not jointly, represents and warrants to the Company that the statements

contained in this Section 4 are true and correct as of the Effective Date, and will be true and correct as of the Closing

Date:

4.01 Validity.

The execution, delivery and performance of each of the Transaction Documents (as defined below) to which the Purchaser is a party and

the consummation by the Purchaser of the transactions contemplated by each Transaction Document have been duly authorized by all necessary

corporate, partnership, limited liability or similar actions, as applicable, on the part of such Purchaser. Each of the Transaction Documents

to which the Purchaser is a party has been duly executed and delivered by the Purchaser and constitute valid and binding obligations

of the Purchaser, enforceable against it in accordance with their terms, except as limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance, and any other laws of general application affecting enforcement of creditors’ rights generally,

and as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

4.02 Brokers.

There is no broker, investment banker, financial advisor, finder or other person which has been retained by or is authorized to act on

behalf of the Purchaser who might be entitled to any fee or commission for which the Company will be liable in connection with the execution

of this Agreement and the consummation of the transactions contemplated hereby.

4.03 Investment

Representations and Warranties. The Purchaser understands and agrees that the offering and sale of the Securities has not been registered

under the 1933 Act or any applicable state securities laws and is being made in reliance upon federal and state exemptions for transactions

not involving a public offering which depend upon, among other things, the bona fide nature of the investment intent and the accuracy

of the Purchaser’s representations as expressed herein.

4.04 Acquisition

for Own Account; No Control Intent. The Purchaser is acquiring the Securities for its own account for investment and not with a view

towards distribution in a manner which would violate the 1933 Act or any applicable state or other securities laws. The Purchaser is

not party to any agreement providing for or contemplating the distribution of any of the Securities. The Purchaser has no present intent

to effect a “change of control” of the Company as such term is understood under the rules promulgated pursuant to Section 13(d) of

the 1934 Act (as defined below).

4.05 No

General Solicitation. The Purchaser is not purchasing the Securities as a result of any advertisement, article, notice or other communication

regarding the Securities published in any newspaper, magazine or similar media or broadcast over television, radio or the internet or

presented at any seminar or any other general solicitation or general advertisement. The purchase of the Securities has not been solicited

by or through anyone other than the Company.

4.06 Ability

to Protect Its Own Interests and Bear Economic Risks. The Purchaser has the capacity to protect its own interests in connection with

the transactions contemplated by this Agreement and is capable of evaluating the merits and risks of the investment in the Securities.

The Purchaser is able to bear the economic risk of an investment in the Securities and is able to sustain a loss of all of its investment

in the Securities without economic hardship, if such a loss should occur. Such Purchaser further acknowledges that there is no trading

market for the Series H Preferred Stock.

4.07 Accredited

Investor; No Bad Actor. The Purchaser is an “accredited investor” as that term is defined in Rule 501(a) under

the 1933 Act. To the extent the Purchaser is one of the covered persons identified in Rule 506(d)(1), such Purchaser has not taken

any of the actions set forth in, and is not subject to, the disqualification provisions of Rule 506(d)(1) of the 1933 Act.

4.08 Access

to Information. The Purchaser has been given access to Company documents, records, and other information, and has had adequate opportunity

to ask questions of, and receive answers from, the Company’s officers, employees, agents, accountants and representatives concerning

the Company’s business, operations, financial condition, assets, liabilities and all other matters relevant to its investment in

the Securities. The Purchaser understands that an investment in the Securities bears significant risk and represents that it has reviewed

the SEC Reports (as defined below), which serve to qualify certain of the Company representations set forth below.

4.09 Restricted

Securities. The Purchaser understands that the Securities will be characterized as “restricted securities” under the

federal securities laws inasmuch as they are being acquired from the Company in a private placement under Section 4(a)(2) of

the 1933 Act and/or Rule 506 of Regulation D promulgated thereunder and that under such laws and applicable regulations such Securities

may be resold without registration under the 1933 Act only in certain limited circumstances. Each Purchaser understands that the Securities,

and any securities issued in respect of or exchange for the Securities, may be notated with one or more legends required by the federal

securities laws or the securities laws of any state, in each case, to the extent such laws are applicable to the Securities represented

by the certificate, instrument or book-entry so legended, including as provided in Section 9.01.

4.10 Short

Sales. Between the time the Purchaser learned about the offering contemplated by this Agreement and the public announcement of the

offering, the Purchaser has not engaged in any short sales (as defined in Rule 200 of Regulation SHO under the 1934 Act (“Short

Sales”)) or similar transactions with respect to the Common Stock or any securities exchangeable or convertible for Common

Stock, nor has the Purchaser, directly or indirectly, caused any person to engage in any Short Sales or similar transactions with respect

to the Common Stock.

4.11 Tax

Advisors. The Purchaser has had the opportunity to review with the Purchaser’s own tax advisors the federal, state and local

tax consequences of its purchase of the Securities set forth opposite such Purchaser’s name on the Schedule of Purchasers, where

applicable, and the transactions contemplated by this Agreement. The Purchaser is relying solely on the Purchaser’s own determination

as to tax consequences or the advice of such tax advisors and not on any statements or representations of the Company or any of its agents

and understands that the Purchaser (and not the Company) shall be responsible for the Purchaser’s own tax liability that may arise

as a result of the transactions contemplated by this Agreement.

4.12 Beneficial

Ownership. The purchase by such Purchaser of the Securities issuable to it pursuant to this Agreement will not result in such Purchaser

(individually or together with any other Person (as defined below) with whom such Purchaser has identified, or will have identified,

itself as part of a “group” in a public filing made with the Commission involving the Company’s securities) acquiring,

or obtaining the right to acquire, beneficial ownership in excess of 19.99% of the outstanding shares of Common Stock or the voting power

of the Company on a post transaction basis that assumes that the Closing shall have occurred. Such Purchaser does not presently intend

to, alone or together with others, make a public filing with the Commission to disclose that it has (or that it together with such other

Persons have) acquired, or obtained the right to acquire, as a result of the Closing (when added to any other securities of the Company

that it or they then own or have the right to acquire), beneficial ownership in excess of 19.99% of the outstanding shares of Common

Stock or the voting power of the Company on a post transaction basis that assumes that the Closing shall have occurred.

4.13 CFIUS

Foreign Person Status. Such Purchaser is not a “foreign person” within the meaning of the Defense Production Act of 1950,

as amended, including all implementing regulations thereof.

SECTION 5. Representations and

Warranties by the Company. Assuming the accuracy of the representations and warranties of the Purchasers set forth in Section 4

and except as set forth in the reports, schedules, forms, statements and other documents filed by the Company with the Commission

pursuant to the 1934 Act (collectively, the “SEC Reports”), which disclosures serve to qualify these representations

and warranties in their entirety, the Company represents and warrants to the Purchasers that the statements contained in this Section 5

are true and correct as of the Effective Date and will be true and correct as of the Closing Date:

5.01 SEC

Reports. The Company has timely filed all of the reports, schedules, forms, statements and other documents required to be filed by

the Company with the Commission pursuant to the reporting requirements of the 1934 Act since January 1, 2024. The SEC Reports, at

the time they were filed with the Commission, (i) complied as to form in all material respects with the requirements of the 1934

Act and the 1934 Act Regulations (as defined below) and (ii) did not include an untrue statement of a material fact or omit to state

a material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under which

they were made, not misleading.

5.02 Independent

Accountants. The accountants who certified the audited consolidated financial statements of the Company included in the SEC Reports

are independent public accountants as required by the 1933 Act, the 1933 Act Regulations (as defined below), the 1934 Act and the 1934

Act Regulations, and the Public Company Accounting Oversight Board.

5.03 Financial

Statements; Non-GAAP Financial Measures. The consolidated financial statements included or incorporated by reference in the SEC Reports

since January 1, 2024, together with the related notes, present fairly, in all material respects, the financial position of the

Company and its consolidated subsidiaries at the dates indicated and the results of its operations and the changes in its cash flows

of the Company and its consolidated subsidiaries for the periods specified; said financial statements have been prepared in conformity

with U.S. generally accepted accounting principles (“GAAP”) applied on a consistent basis throughout the periods

involved, except in the case of unaudited, interim financial statements, subject to normal year-end audit adjustments and the exclusion

of certain footnotes.

5.04 No

Material Adverse Change in Business. Since the date of the most recent financial statements of the Company included or incorporated

by reference in the SEC Reports, (a) there has been no material adverse change in the condition, financial or otherwise, or in the

results of operations, business affairs or business prospects of the Company and its subsidiaries considered as one enterprise, whether

or not arising in the ordinary course of business (a “Material Adverse Effect”), (b) there have been no

transactions entered into by the Company or any of its subsidiaries, other than those in the ordinary course of business except as contemplated

in this Agreement, which are material with respect to the Company and its subsidiaries considered as one enterprise and (c) there

has been no dividend or distribution of any kind declared, paid or made by the Company on any class of its capital stock.

5.05 Good

Standing of the Company. The Company has been duly incorporated and is validly existing as a corporation in good standing under the

laws of the State of Delaware and has corporate power and authority to own, lease and operate its properties and to conduct its business

as disclosed in the SEC Reports and to enter into and perform its obligations under this Agreement, except where the failure to be so

qualified or in good standing or have such power or authority would not result in a Material Adverse Effect; and the Company is duly

qualified as a foreign corporation to transact business and is in good standing in each other jurisdiction in which such qualification

is required, whether by reason of the ownership or leasing of property or the conduct of business, except where the failure so to qualify

or to be in good standing would not result in a Material Adverse Effect.

5.06 Good

Standing of Subsidiaries. Each subsidiary of the Company has been duly incorporated or organized and is validly existing in good

standing under the laws of the jurisdiction of its incorporation or organization, has corporate or similar power and authority to own,

lease and operate its properties and to conduct its business as described in the SEC Reports and is duly qualified to transact business

and is in good standing in each jurisdiction in which such qualification is required, whether by reason of the ownership or leasing of

property or the conduct of business, except where the failure to so qualify or to be in good standing would not result in a Material

Adverse Effect. All of the issued and outstanding capital stock of each subsidiary of the Company has been duly authorized and validly

issued, is fully paid and non-assessable and is owned by the Company, directly or through subsidiaries, free and clear of any security

interest, mortgage, pledge, lien, encumbrance, claim or equity. None of the outstanding shares of capital stock of any subsidiary of

the Company were issued in violation of the preemptive or similar rights of any securityholder of such subsidiary.

5.07 Capitalization.

The outstanding shares of capital stock of the Company have been duly authorized and validly issued and are fully paid and non-assessable.

None of the outstanding shares of capital stock of the Company were issued in violation of the preemptive or other similar rights of

any securityholder of the Company which have not been waived.

5.08 Validity.

Each of the Transaction Documents has been duly authorized, executed and delivered by the Company and constitutes a valid and binding

obligation of the Company, enforceable against it in accordance with its terms, except as limited by applicable bankruptcy, insolvency,

reorganization, moratorium, fraudulent conveyance, and any other laws of general application affecting enforcement of creditors’

rights generally, and as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable

remedies.

5.09 Authorization

and Description of Securities. Upon the filing of the Certificate of Designations with the Secretary of State of the State of Delaware,

the Series H Preferred Stock will have been duly and validly authorized and, when issued and paid for pursuant to this Agreement,

will be validly issued, fully paid and nonassessable, and shall be free and clear of all encumbrances and restrictions, except for restrictions

on transfer set forth in this Agreement or imposed by applicable securities laws, and shall not be subject to preemptive or similar rights

of stockholders. The Conversion Shares (as defined below) have been duly authorized and, upon the due conversion of the Series H

Preferred Stock, will be validly issued, fully paid and non-assessable free and clear of all encumbrances and restrictions, except for

restrictions on transfer set forth in this Agreement or imposed by applicable securities laws, and shall not be subject to preemptive

or similar rights of stockholders. The Shares have been duly authorized and, when, issued and paid for pursuant to this Agreement, will

be validly issued, fully paid and nonassessable, and shall be free and clear of all encumbrances and restrictions, except for restrictions

on transfer set forth in this Agreement or imposed by applicable securities laws, and shall not be subject to preemptive or similar rights

of stockholders.

5.10 Absence

of Violations, Defaults and Conflicts. Neither the Company nor any of its subsidiaries is (A) in violation of its charter, bylaws

or similar organizational document, except, in the case of the Company’s subsidiaries, for such violations that would not, singly

or in the aggregate, result in a Material Adverse Effect, (B) in default in the performance or observance of any obligation, agreement,

covenant or condition contained in any contract, indenture, mortgage, deed of trust, loan or credit agreement, note, lease or other agreement

or instrument to which the Company or any of its subsidiaries is a party or by which it or any of them may be bound or to which any of

the properties or assets of the Company or any subsidiary is subject (collectively, “Agreements and Instruments”),

except for such defaults that would not, singly or in the aggregate, result in a Material Adverse Effect, or (C) in violation of

any law, statute, rule, regulation, judgment, order, writ or decree of any arbitrator, court, governmental body, regulatory body, administrative

agency or other authority, body or agency having jurisdiction over the Company or any of its subsidiaries or any of their respective

properties, assets or operations (each, a “Governmental Entity”), except for such violations that would not,

singly or in the aggregate, result in a Material Adverse Effect. The execution, delivery and performance of each of the Transaction Documents

and the consummation of the transactions contemplated by the Transaction Documents (including the issuance and sale of the Securities

and the Conversion Shares) and compliance by the Company with its obligations hereunder do not and will not, whether with or without

the giving of notice or passage of time or both, conflict with or constitute a breach of, or default or Repayment Event (as defined below)

under, or result in the creation or imposition of any lien, charge or encumbrance upon any properties or assets of the Company or any

subsidiary pursuant to, the Agreements and Instruments (except for such conflicts, breaches, defaults or Repayment Events or liens, charges

or encumbrances that would not, singly or in the aggregate, result in a Material Adverse Effect), nor will such action result in any

violation of (i) the provisions of the certificate of incorporation, by-laws or similar organizational document of the Company or

any of its subsidiaries or (ii) any applicable law, statute, rule, regulation, judgment, order, writ or decree of any Governmental

Entity, except in the case of clause (ii) for such violations as would not, singly or in the aggregate, result in a Material Adverse

Effect. As used herein, a “Repayment Event” means any event or condition which gives the holder of any note,

debenture or other evidence of indebtedness (or any person acting on such holder’s behalf) the right to require the repurchase,

redemption or repayment of all or a portion of such indebtedness by the Company or any of its subsidiaries.

5.11 Absence

of Labor Dispute. No labor dispute with the employees of the Company or any of its subsidiaries exists or, to the knowledge of the

Company, is imminent, and the Company is not aware of any existing or imminent labor disturbance by the employees of any of its or any

subsidiary’s principal suppliers, manufacturers, customers or contractors, which, in either case, would result in a Material Adverse

Effect.

5.12 Absence

of Proceedings. There is no action, suit, proceeding, inquiry or investigation before or brought by any Governmental Entity now pending

or, to the knowledge of the Company, threatened, against or affecting the Company or any of its subsidiaries, which would reasonably

be expected to result in a Material Adverse Effect, or which would reasonably be expected to materially and adversely affect the consummation

of the transactions contemplated in this Agreement or the performance by the Company of its obligations hereunder.

5.13 Absence

of Further Requirements. No filing with, or authorization, approval, consent, license, order, registration, qualification or decree

of, any Governmental Entity is necessary or required for the performance by the Company of its obligations hereunder, in connection with

the offering, issuance, or sale of the Securities hereunder or the consummation of the transactions contemplated by this Agreement, except

the filing of the Certificate of Designations, filings required by Nasdaq or under federal and state securities laws, filings required

pursuant to this Agreement and filings as have been already obtained.

5.14 Possession

of Licenses and Permits. The Company and its subsidiaries possess such permits, licenses, approvals, consents and other authorizations

(collectively, “Governmental Licenses”) issued by the appropriate Governmental Entities necessary to conduct

the business now operated by them, except where the failure so to possess would not, singly or in the aggregate, result in a Material

Adverse Effect. The Company and its subsidiaries are in compliance with the terms and conditions of all Governmental Licenses, except

where the failure so to comply would not, singly or in the aggregate, result in a Material Adverse Effect. All of the Governmental Licenses

are valid and in full force and effect, except when the invalidity of such Governmental Licenses or the failure of such Governmental

Licenses to be in full force and effect would not, singly or in the aggregate, result in a Material Adverse Effect. Neither the Company

nor any of its subsidiaries has received any notice of proceedings relating to the revocation or modification of any Governmental Licenses

which, singly or in the aggregate, if the subject of an unfavorable decision, ruling or finding, would result in a Material Adverse Effect.

5.15 Title

to Property. The Company and its subsidiaries do not own any real property. The Company and its subsidiaries have title to all tangible

personal property owned by them, in each case, free and clear of all mortgages, pledges, liens, security interests, claims, restrictions

or encumbrances of any kind except such as (A) are described in the SEC Reports or (B) do not, singly or in the aggregate,

materially affect the value of such property and do not materially interfere with the use made and proposed to be made of such property

by the Company or any of its subsidiaries; and all of the leases and subleases material to the business of the Company and its subsidiaries,

considered as one enterprise, and under which the Company or any of its subsidiaries holds properties described in the SEC Reports, are

in full force and effect, and neither the Company nor any such subsidiary has any notice of any material claim of any sort that has been

asserted by anyone adverse to the rights of the Company or any subsidiary under any of the leases or subleases mentioned above, or affecting

or questioning the rights of the Company or such subsidiary to the continued possession of the leased or subleased premises under any

such lease or sublease.

5.16 Intellectual

Property. The Company and its subsidiaries own or possess the right to use all patents, patent applications, inventions, licenses,

know-how (including trade secrets and other unpatented and/or unpatentable proprietary or confidential information or procedures), trademarks,

service marks, trade names, domain names, copyrights, and other intellectual property, and registrations and applications for registration

of any of the foregoing (collectively, “Intellectual Property”) necessary to conduct their business as presently

conducted and currently contemplated to be conducted in the future as described in the SEC Reports and, to the knowledge of the Company,

neither the Company nor any of its subsidiaries, whether through their respective products and services or the conduct of their respective

businesses, has in any material respect infringed, misappropriated, conflicted with or otherwise violated, or is currently infringing,

misappropriating, conflicting with or otherwise violating, and none of the Company or its subsidiaries have received any heretofore unresolved

communication or notice of infringement of, misappropriation of, conflict with or violation of, any Intellectual Property of any other

person or entity, other than as described in the SEC Reports and except as would not, singly or in the aggregate have a Material Adverse

Effect. As of the Effective Date, neither the Company nor any of its subsidiaries has received any written communication or notice (in

each case that has not been resolved) alleging that by conducting their business as described in the SEC Reports, such parties would

infringe, misappropriate, conflict with, or violate, any of the Intellectual Property of any other person or entity, except as would

not, singly or in the aggregate have a Material Adverse Effect. The Company knows of no infringement, misappropriation or violation by

others of Intellectual Property owned by or licensed to the Company or its subsidiaries which would reasonably be expected to result

in a Material Adverse Effect. The Company and its subsidiaries have taken reasonable steps necessary to secure their interests in such

material Intellectual Property from their employees and contractors and to protect the confidentiality of all of their confidential information

and trade secrets. None of the Intellectual Property employed by the Company or its subsidiaries has been obtained or is being used by

the Company or its subsidiaries in violation of any contractual obligation binding on the Company or any of its subsidiaries or, to the

knowledge of the Company, any of their respective officers, directors or employees, except as would not reasonably be expected, singly

or in the aggregate, to have a Material Adverse Effect. Except as disclosed in the SEC Reports, all Intellectual Property owned or exclusively

licensed by the Company or its subsidiaries is free and clear of all liens, encumbrances, defects or other restrictions (other than non-exclusive

licenses granted in the ordinary course of business), except those that would not reasonably be expected, singly or in the aggregate,

to have a Material Adverse Effect. The Company and its subsidiaries are not subject to any judgment, order, writ, injunction or decree

of any court or any Governmental Entity, nor has the Company or any of its subsidiaries entered into or become a party to any agreement

made in settlement of any pending or threatened litigation, which materially restricts or impairs their use of any Intellectual Property.

5.17 Company

IT Systems. The Company and its subsidiaries own or have a valid right to access and use all computer systems, networks, hardware,

software, databases, websites, and equipment used to process, store, maintain and operate data, information, and functions used in connection

with the business of the Company and its subsidiaries (the “Company IT Systems”), except as would not, singly

or in the aggregate, have a Material Adverse Effect. The Company IT Systems are adequate for, and operate and perform in all material

respects as required in connection with, the operation of the business of the Company and its subsidiaries as currently conducted, except

as would not, singly or in the aggregate, have a Material Adverse Effect. The Company and its subsidiaries have implemented commercially

reasonable backup, security and disaster recovery technology consistent in all material respects with applicable regulatory standards

and customary industry practices.

5.18 Cybersecurity.

Except as would not, singly or in the aggregate, reasonably be expected to have a Material Adverse Effect, (A) there has been no

security breach or other compromise of or relating to the Company IT Systems; (B) the Company has not been notified of, and has

no knowledge of any event or condition that would reasonably be expected to result in, any such security breach or other compromise of

the Company IT Systems; (C) the Company and its subsidiaries have implemented policies and procedures with respect to the Company

IT Systems that are reasonably consistent with industry standards and practices, or as required by applicable regulatory standards; and

(D) the Company and its subsidiaries are presently in material compliance with all applicable laws or statutes, judgments, orders,

rules and regulations of any court or arbitrator or governmental or regulatory authority and contractual obligations relating to

the privacy and security of the Company IT Systems and to the protection of the Company IT Systems from unauthorized use, access, misappropriation

or modification.

5.19 Compliance

with Data Privacy Laws. The Company and its subsidiaries are, and at all prior times were, in material compliance with all applicable

state and federal data privacy and security laws and regulations, including without limitation the Health Insurance Portability and Accountability

Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act (“HIPAA”),

and the Company and its subsidiaries have taken commercially reasonable actions to prepare to comply with, and since May 25, 2018,

have been and currently are in compliance with, the European Union General Data Protection Regulation (“GDPR”)

(EU 2016/679) (collectively, the “Privacy Laws”). To ensure compliance with the Privacy Laws, the Company and

its subsidiaries have in place, comply with, and take appropriate steps reasonably designed to ensure compliance in all material respects

with their policies and procedures relating to data privacy and security and the collection, storage, use, disclosure, handling, and

analysis of Personal Data (as defined below) (the “Policies”). The Company and its subsidiaries have at all

times made all disclosures to users or customers required by applicable laws and regulatory rules or requirements, and none of such

disclosures made or contained in any Policy have, to the knowledge of the Company, been inaccurate or in violation of any applicable

laws and regulatory rules or requirements in any material respect. The Company further certifies that neither it nor any subsidiary:

(i) has received notice of any actual or potential liability under or relating to, or actual or potential violation of, any of the

Privacy Laws, and has knowledge of any event or condition that would reasonably be expected to result in any such notice; (ii) is

currently conducting or paying for, in whole or in part, any investigation, remediation, or other corrective action pursuant to any Privacy

Law; or (iii) is a party to any order, decree, or agreement that imposes any obligation or liability under any Privacy Law. “Personal

Data” means (i) a natural person’s name, street address, telephone number, e-mail address, photograph, social

security number or tax identification number, driver’s license number, passport number, credit card number, bank information, or

customer or account number; (ii) any information which would qualify as “personally identifying information” under the

Federal Trade Commission Act, as amended; (iii) “personal data” as defined by GDPR; (iv) any information which

would qualify as “protected health information” under HIPAA; and (v) any other piece of information that allows the

identification of such natural person, or his or her family, or permits the collection or analysis of any data related to an identified

person’s health or sexual orientation.

5.20 Environmental

Laws. Except as would not, singly or in the aggregate, result in a Material Adverse Effect, (A) neither the Company nor any

of its subsidiaries is in violation of any applicable federal, state, local or foreign statute, law, rule, regulation, ordinance, code,

policy or rule of common law or any judicial or administrative interpretation thereof, including any judicial or administrative

order, consent, decree or judgment, relating to pollution or protection of human health, the environment (including, without limitation,

ambient air, surface water, groundwater, land surface or subsurface strata) or wildlife, including, without limitation, laws and regulations

relating to the release or threatened release of chemicals, pollutants, contaminants, wastes, toxic substances, hazardous substances,

petroleum or petroleum products, asbestos-containing materials or mold (collectively, “Hazardous Materials”)

or to the manufacture, processing, distribution, use, treatment, storage, disposal, transport or handling of Hazardous Materials (collectively,

“Environmental Laws”), (B) the Company and its subsidiaries have all permits, authorizations and approvals

required for their operations under any applicable Environmental Laws and are each in compliance with their requirements, (C) there

are no pending or, to the knowledge of the Company, threatened administrative, regulatory or judicial actions, suits, demands, demand

letters, claims, liens, notices of noncompliance or violation, investigations or proceedings relating to any Environmental Law against

the Company or any of its subsidiaries and (D) to the knowledge of the Company, there are no events or circumstances existing as

of the date hereof that would reasonably be expected to form the basis of an order for clean-up or remediation, or an action, suit or

proceeding by any private party or Governmental Entity, against or affecting the Company or any of its subsidiaries relating to Hazardous

Materials or any Environmental Laws.

5.21 Accounting

Controls and Disclosure Controls. The Company and its subsidiaries have established systems of “internal control over financial

reporting” (as defined under Rule 13a-15 and 15d-15 under the 1934 Act Regulations) sufficient to provide reasonable assurances

that (A) transactions are executed in accordance with management’s general or specific authorization; (B) transactions

are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain accountability for assets;

(C) access to assets is permitted only in accordance with management’s general or specific authorization; and (D) the

recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with

respect to any differences. Since the end of the Company’s most recent audited fiscal year, there has been (1) no material

weakness in the Company’s internal control over financial reporting (whether or not remediated) and (2) no change in the Company’s

internal control over financial reporting that has materially adversely affected, or is reasonably likely to materially adversely affect,

the Company’s internal control over financial reporting.

5.22 Compliance

with the Sarbanes-Oxley Act. The Company is in compliance in all material respects with all provisions of the Sarbanes-Oxley Act

of 2002 and all rules and regulations promulgated thereunder or implementing the provisions thereof that are in effect and with

which the Company is required to comply.

5.23 Payment

of Taxes. The Company and its subsidiaries have filed all United States federal income tax returns required by law to be filed (taking

into account any timely requested extensions thereof) through the Effective Date and all other material state, local and foreign tax

returns required by law to be filed (taking into account any timely requested extensions thereof) through the Effective Date. The Company

has paid all federal, state, local and foreign taxes due, except for taxes being contested in good faith and for which adequate reserves

have been taken, and except as would not, singly or in the aggregate, result in a Material Adverse Effect. Except as otherwise disclosed

in the SEC Reports, there is no tax deficiency that has been, or would reasonably be expected to be, asserted against the Company or

any of its subsidiaries or any of its respective properties or assets, in each case, except as would not have a Material Adverse Effect.

5.24 ERISA.

(i) Each employee benefit plan, within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974,

as amended (“ERISA”), for which the Company or any member of its “Controlled Group” (defined as

any organization which is a member of a controlled group of corporations within the meaning of Section 414 of the Code) would have

any liability (each, a “Plan”) has been maintained in compliance with its terms and the requirements of any

applicable statutes, orders, rules and regulations, including but not limited to ERISA and the Internal Revenue Code of 1986, as

amended (the “Code”), except for noncompliance that would not reasonably be expected to result in material

liability to the Company; (ii) no prohibited transaction, within the meaning of Section 406 of ERISA or Section 4975 of

the Code, has occurred with respect to any Plan excluding transactions effected pursuant to a statutory or administrative exemption that

would reasonably be expected to result in a material liability to the Company; (iii) for each Plan that is subject to the funding

rules of Section 412 of the Code or Section 302 of ERISA, the minimum funding standard of Section 412 of the Code

or Section 302 of ERISA, as applicable, has been satisfied (without taking into account any waiver thereof or extension of any amortization

period) and is reasonably expected to be satisfied in the future (without taking into account any waiver thereof or extension of any

amortization period); (iv) the fair market value of the assets of each Plan that is required to be funded exceeds the present value

of all benefits accrued under such Plan (determined based on those assumptions used to fund such Plan); (v) no “reportable

event” (within the meaning of Section 4043(c) of ERISA) has occurred or is reasonably expected to occur that either has

resulted, or would reasonably be expected to result, in material liability to the Company; (vi) neither the Company nor any member

of the Controlled Group has incurred, nor reasonably expects to incur, any liability under Title IV of ERISA (other than contributions

to the Plan or premiums to the Pension Benefit Guaranty Corporation (“PBGC”), in the ordinary course and without

default) in respect of a Plan (including a “multiemployer plan”, within the meaning of Section 4001(a)(3) of ERISA);

and (vii) there is no pending audit or investigation by the Internal Revenue Service, the U.S. Department of Labor, the PBGC or

any other governmental agency or any foreign regulatory agency with respect to any Plan that would reasonably be expected to result in

material liability to the Company. None of the following events has occurred or is reasonably likely to occur: (x) a material increase

in the aggregate amount of contributions required to be made to all Plans by the Company in the current fiscal year of the Company compared

to the amount of such contributions made in the Company’s most recently completed fiscal year; other than an increase solely attributable

to (A) an increase in the number of employees covered by such Plans or (B) an increase arising from the renewal in the ordinary

course of business of contracts with vendors, insurers, plan administrators or other similar service providers under which the benefits

of such Plans are provided; or (y) a material increase in the Company’s “accumulated post-retirement benefit obligations”

(within the meaning of Statement of Financial Accounting Standards 106) compared to the amount of such obligations in the Company’s

most recently completed fiscal year.

5.25 Insurance.

The Company and the subsidiaries carry or are entitled to the benefits of insurance, with what the Company reasonably believes to be

financially sound and reputable insurers, in such amounts and covering such risks as is adequate for the conduct of their respective

businesses and the value of their respective properties and assets, and all such insurance is in full force and effect. The Company has

no reason to believe that it or any of the subsidiaries will not be able (A) to renew its existing insurance coverage as and when

such policies expire or (B) to obtain comparable coverage from similar institutions as may be necessary or appropriate to conduct

its business as now conducted and at a cost that would not result in a Material Adverse Effect.

5.26 Investment

Company Act. The Company is not and, immediately after giving effect to the issuance and sale of the Securities, will not be required,

to register as an “investment company” under the Investment Company Act of 1940, as amended.

5.27 No

Unlawful Payments. Neither the Company nor any of its subsidiaries nor, to the knowledge of the Company, any director, officer, employee,

agent, affiliate or other person acting on behalf of the Company or any of its subsidiaries has (i) used any corporate funds for

any unlawful contribution, gift, entertainment or other unlawful expense relating to political activity; (ii) made or taken an act

in furtherance of an offer, promise or authorization of any direct or indirect unlawful payment or benefit to any foreign or domestic

government official or employee, including of any government-owned or controlled entity or of a public international organization, or

any person acting in an official capacity for or on behalf of any of the foregoing, or any political party or party official or candidate

for political office; (iii) violated or is in violation of any provision of the Foreign Corrupt Practices Act of 1977, as amended,

or any applicable law or regulation implementing the OECD Convention on Combating Bribery of Foreign Public Officials in International

Business Transactions, or committed an offence under the Bribery Act 2010 of the United Kingdom or any other applicable anti-bribery

or anti-corruption law; or (iv) made, offered, agreed, requested or taken an act in furtherance of any unlawful bribe or other unlawful

benefit, including, without limitation, any unlawful rebate, payoff, influence payment, kickback or other unlawful or improper payment

or benefit. The Company and its subsidiaries have instituted, maintain and enforce, and will continue to maintain and enforce policies

and procedures designed to promote and ensure compliance with all applicable anti-bribery and anti-corruption laws.

5.28 Compliance

with Anti-Money Laundering Laws. The operations of the Company and its subsidiaries are and have been conducted at all times in compliance

in all material respects with applicable financial recordkeeping and reporting requirements, including those of the Currency and Foreign

Transactions Reporting Act of 1970, as amended, the money laundering statutes of all applicable jurisdictions, the rules and regulations

thereunder and any related or similar rules or regulations issued, administered or enforced by any Governmental Entity (collectively,

the “Anti-Money Laundering Laws”) and no action, suit or proceeding by or before any Governmental Entity involving

the Company or any of its subsidiaries with respect to the Anti-Money Laundering Laws is pending or, to the knowledge of the Company,

threatened. The Company and its subsidiaries have instituted, maintain and enforce, and will continue to maintain and enforce policies

and procedures designed to promote and ensure compliance with all applicable anti-bribery and anti-money laundering laws.

5.29 No

Conflicts with Sanctions Laws. Neither the Company nor any of its subsidiaries nor, to the knowledge of the Company, any director,

officer, employee, agent, affiliate or other person acting on behalf of the Company or any of its subsidiaries is currently the subject

or the target of any sanctions administered or enforced by the U.S. government, (including, without limitation, the Office of Foreign

Assets Control of the U.S. Department of the Treasury or the U.S. Department of State and including, without limitation, the designation

as a “specially designated national” or “blocked person”), the United Nations Security Council, the European

Union or His Majesty’s Treasury (collectively, “Sanctions”), nor is the Company or any of its subsidiaries

located, organized or resident in a country or territory that is the subject of Sanctions; and the Company will not knowingly directly

or indirectly use the proceeds of the sale of the Securities, or lend, contribute or otherwise make available such proceeds to any subsidiaries,

joint venture partners or other Person (as defined below), to fund any activities of or the business with any Person, or in any country

or territory, that, at the time of such funding, is the subject of Sanctions or in any other manner that will result in violation by

any Person of Sanctions.

5.30 Regulatory

Matters. Except as described in the SEC Reports, the Company and its subsidiaries (i) are, and at all times has been, in compliance

with all statutes, rules and regulations of the U.S. Food and Drug Administration (the “FDA”) and other

comparable federal, state, local or foreign governmental and regulatory authorities (collectively the “Regulatory Authorities”)

applicable to the ownership, testing, development, manufacture, packaging, processing, use, distribution, storage, import, export or

disposal of any product manufactured or distributed by the Company (“Applicable Laws”), except where such noncompliance

would not, singly or in the aggregate, have a Material Adverse Effect; and (ii) have not received any FDA Form 483, written

notice of adverse finding, warning letter, untitled letter or other correspondence or written notice from any court or arbitrator or

Regulatory Authority alleging or asserting non-compliance with (x) any Applicable Laws or (y) any licenses, exemptions, certificates,

approvals, clearances, authorizations, permits and supplements or amendments thereto required by any such Applicable Laws (the “Authorizations”).

Neither the Company nor any of its subsidiaries has failed to file with the Regulatory Authorities any required filing, declaration,

listing, registration, report or submission with respect to the Company’s product candidates that are described or referred to

in the SEC Reports, except where such failure to file would not, singly or in the aggregate, have a Material Adverse Effect; all such

filings, declarations, listings, registrations, reports or submissions were in material compliance with applicable laws when filed; and

no material deficiencies regarding compliance with applicable law have been asserted by any applicable Regulatory Authority with respect

to any such filings, declarations, listings, registrations, reports or submissions.

5.31 Research,

Studies and Tests. The research, nonclinical and clinical studies and tests conducted by, or to the knowledge of the Company, or

on behalf of the Company and its subsidiaries have been and, if still pending, are being conducted with reasonable care and in all material

respects in accordance with experimental protocols, procedures and controls pursuant to all Applicable Laws and Authorizations; the descriptions

of the results of such research, nonclinical and clinical studies and tests contained in the SEC Reports are accurate in all material

respects and fairly present the data derived from such research, nonclinical and clinical studies and tests; the Company is not aware

of any research, nonclinical or clinical studies or tests, the results of which the Company believes reasonably call into question the

research, nonclinical or clinical study or test results described or referred to in the SEC Reports when viewed in the context in which

such results are described; and neither the Company nor, to the knowledge of the Company, any of its subsidiaries has received any notices

or correspondence from any Governmental Entity that will require the termination, suspension or material modification of any research,

nonclinical or clinical study or test conducted by or on behalf of the Company or its subsidiaries, as applicable.

5.32 Private

Placement. Neither the Company nor its subsidiaries, nor any person acting on its or their behalf, has, directly or indirectly, made

any offers or sales of any security or solicited any offers to buy any security under any circumstances that would require registration

under the 1933 Act of the Securities being sold pursuant to this Agreement. Assuming the accuracy of the representations and warranties

of the Purchasers contained in Section 4 hereof, the issuance of the Securities, including the issuance of the Conversion

Shares, is exempt from registration under the 1933 Act.

5.33 No

Disqualification Events. With respect to the Securities to be offered and sold hereunder in reliance on Regulation D under the 1933

Act, none of the Company, any of its predecessors, any affiliated issuer, any director, executive officer, other officer of the Company

participating in the offering hereunder, any beneficial owner of 20% or more of the Company’s outstanding voting equity securities,

calculated on the basis of voting power, nor any promoter (as that term is defined in Rule 405 under the 1933 Act) connected with

the Company in any capacity at the time of sale is subject to any of the “Bad Actor” disqualifications described in Rule 506(d)(1)(i) to

(viii) under the 1933 Act (a “Disqualification Event”), except for a Disqualification Event covered by

Rule 506(d)(2) or (d)(3). The Company has complied, to the extent applicable, with its disclosure obligations under Rule 506(e) and

has furnished to the Purchasers a copy of any disclosures provided thereunder.

5.34 Registration

Rights. Except as required by (a) the Registration Rights Agreement (as defined below), (b) that certain Third Amended

and Restated Registration Rights Agreement, dated April 6, 2016, by and among the Company and the parties thereto and (c) that

certain Registration Rights Agreement, dated March 2, 2023, by and among the Company and the parties thereto (the “Baker

Registration Rights Agreement”), the Company is presently not under any obligation, and has not granted any rights, to

register under the 1933 Act any of the Company’s presently outstanding securities or any of its securities that may hereafter be

issued that have not expired or been satisfied.

5.35 No

Additional Agreements. The Company has no other agreements or understandings (including, without limitations, side letters) with

any Purchaser to purchase Securities on terms more favorable to such Purchaser than as set forth herein.

5.36 Shell

Company Status. The Company is not, and has never been, an issuer identified in Rule 144(i)(1).

SECTION 6. Covenants.

6.01 Reasonable

Best Efforts. Each party hereto shall use its reasonable best efforts to timely satisfy each of the conditions to be satisfied by

it as provided in Section 7 of this Agreement.

6.02 Disclosure

of Transactions and Other Material Information. No later than 9:30 a.m. (Eastern Time) on the Business Day immediately following

the date of this Agreement, the Company shall issue a press release (the “Press Release”) and/or a Current

Report on Form 8-K disclosing all material terms of the transactions contemplated by this Agreement. Within the applicable period

of time required by the 1934 Act, the Company shall file a Current Report on Form 8-K describing the terms and conditions of the

transactions contemplated by this Agreement in the form required by the 1934 Act and attaching the Agreement, the Registration Rights

Agreement and the Certificate of Designations as exhibits to such filing (including all attachments, the “8-K Filing”).

Following the issuance of the Press Release, no Purchaser shall be in possession of any material non-public information received from

the Company, its subsidiaries or any of their respective officers, directors, employees or agents. The Company shall provide the Purchasers

with a reasonable opportunity to review and provide comments on the draft of such Press Release and 8-K Filing describing the terms and

conditions of the transactions contemplated by this Agreement.

6.03 Expenses.

The Company and each Purchaser is liable for, and will pay, its own expenses incurred in connection with the negotiation, preparation,

execution and delivery of this Agreement, including, without limitation, attorneys’ and consultants’ fees and expenses, except

that the Company has agreed to (a) reimburse the Baker Brothers Purchasers (as defined below) in an amount of up to $100,000 in

the aggregate and (b) reimburse the SR One Purchaser (as defined below) in an amount of up to $35,000 in the aggregate, in each

case, for such purchasers’ reasonable and documented legal fees at the time of the Closing.

6.04 Listing.

The Company shall use its best efforts to take all steps necessary to (i) cause all of the Conversion Shares and the Shares to be

listed on the Nasdaq Stock Market and (ii) maintain the listing of its Common Stock on the Nasdaq Stock Market.

6.05 Reservation

of Common Stock. The Company has reserved, and the Company shall continue to reserve and keep available at all times, a sufficient

number of shares of Common Stock for the purpose of enabling the Company to issue the Shares pursuant to this Agreement and the Conversion

Shares pursuant to any conversion of the Series H Preferred Stock.

6.06 Negative

Covenants. Until the earlier of (i) the date on which less than 5.0% of the shares of the Series H Preferred Stock issued

pursuant to this Agreement are outstanding or (ii) the occurrence of a Change of Control (as defined below) of the Company, the

Company shall not, without the prior approval of Purchasers holding two-thirds of the shares of Series H Preferred Stock held by

all Purchasers, issue or authorize the issuance of any equity security that is senior or pari passu to the Series H Preferred

Stock with respect to liquidation preference as provided in the Certificate of Designations; provided that if the Company seeks approval

from the Purchasers for the foregoing and any Purchaser does not respond to such request within five (5) Business Days or any Purchaser

elects not to receive the information required to consider such requested approval, the requirement for that Purchasers’ approval

shall be deemed waived by such Purchaser solely with respect to the applicable approval being sought.

SECTION 7. Conditions of Parties’

Obligations.

7.01 Conditions

of the Purchasers’ Obligations at the Closing. The obligations of the Purchasers under Section 2 hereof are subject

to the fulfillment, at or prior to the Closing, of all of the following conditions, any of which may be waived in whole or in part by

the Purchasers holding a majority of the shares of Common Stock issued pursuant to this Agreement (including shares of Common Stock issued

or issuable upon conversion of Series H Preferred Stock without regard to the Beneficial Ownership Limitation) (the “Requisite

Purchasers”) in their absolute discretion (except for Section 7.01(i) which may be waived solely by the

Other Purchasers (as defined below) holding a majority of the shares of Common Stock issued pursuant to this Agreement (including shares

of Common Stock issued or issuable upon conversion of Series H Preferred Stock without regard to the Beneficial Ownership Limitation).

(a) Representations

and Warranties. The representations and warranties of the Company contained in this Agreement shall be true and correct on and as

of the Closing Date with the same effect as though such representations and warranties had been made on and as of the Closing Date (except

to the extent expressly made as of an earlier date in which case as of such earlier date).

(b) Performance.

The Company shall have performed and complied with all covenants, agreements, obligations and conditions contained in this Agreement

that are required to be performed or complied with by it on or prior to the Closing Date.

(c) Opinion

of Company Counsel. The Company shall have caused to be delivered to the Purchasers the opinion of Wilmer Cutler Pickering Hale and

Dorr LLP, counsel for the Company, dated as of the Closing Date, in form and substance satisfactory to the Purchasers.

(d) Compliance

Certificate. The Chief Executive Officer of the Company shall have delivered to the Purchasers at the Closing Date a certificate

certifying that the conditions specified in Sections 7.01(a) and 7.01(b) of this Agreement have been fulfilled.

(e) Secretary’s

Certificate. The Secretary of the Company shall have delivered to the Purchasers at the Closing Date a certificate certifying (i) the

Certificate of Incorporation, as amended, including the Certificate of Designations, of the Company; (ii) the Bylaws of the Company;

and (iii) resolutions of the Board of Directors of the Company (the “Board”) (or an authorized committee

thereof) approving the Transaction Documents and the transactions contemplated by the Transaction Documents.

(f) Good

Standing. The Company shall have delivered to the Purchasers (i) a certificate evidencing the Company’s valid existence

and good standing in the State of Delaware issued by the Secretary of State of the State of Delaware and (ii) a certificate evidencing

the Company’s due qualification and good standing as a foreign corporation in the Commonwealth of Massachusetts issued by the Secretary

of the Commonwealth of the Commonwealth of Massachusetts, in each case dated as of a date within three (3) Business Days of the

Closing Date.

(g) Listing

Requirements. The Common Stock (i) shall be listed on the Nasdaq Stock Market and (ii) shall not have been suspended, as

of the Closing Date, by the Commission or the Nasdaq Stock Market from trading on the Nasdaq Stock Market.

(h) Qualification

under State Securities Laws. All registrations, qualifications, permits and approvals, if any, required under applicable state securities

laws shall have been obtained for the lawful execution, delivery and performance of this Agreement.

(i) Registration

Rights Agreement. The Company shall have executed and delivered to the Other Purchasers the Registration Rights Agreement (as defined

below).

7.02 Conditions

of the Company’s Obligations at the Closing. The obligations of the Company under Section 2 hereof are subject

to the fulfillment, at or prior to the Closing, of all of the following conditions, any of which may be waived in whole or in part by

the Company in its absolute discretion.

(a) Representations

and Warranties. The representations and warranties of the Purchasers contained in this Agreement shall be true and correct on and

as of the Closing Date with the same effect as though such representations and warranties had been made on and as of the Closing Date

(except to the extent expressly made as of an earlier date in which case as of such earlier date).

(b) Registration

Rights Agreement. The Other Purchasers shall have executed and delivered to the Company the Registration Rights Agreement.

(c) Performance.

Each Purchaser shall have performed and complied with all covenants, agreements, obligations and conditions contained in this Agreement

that are required to be performed or complied with by it on or prior to the Closing Date.

SECTION 8. Registration Rights.

8.01 Baker

Brothers Purchasers. Under the Baker Registration Rights Agreement, the Shares and Conversion Shares issuable to the Baker Brothers

Purchasers shall be deemed “Registrable Securities” (as such term is defined in the Baker Registration Rights Agreement).

8.02 Other

Purchasers. Contemporaneously with the sale of the Shares and the Series H Preferred Stock, the Company and the Other Purchasers

shall execute and deliver a Registration Rights Agreement, in the form attached hereto as Exhibit B (the “Registration

Rights Agreement”), pursuant to which the Company shall agree to provide certain registration rights under the 1933 Act

and applicable state securities laws in respect of the Shares and the Conversion Shares issued and/or issuable to the Other Purchasers.

SECTION 9. Transfer Restrictions;

Restrictive Legend.

9.01 Transfer

Restrictions. The Purchasers understand that the Company may, as a condition to the transfer of any of the Securities or Conversion

Shares, require that the request for transfer be accompanied by an opinion of counsel reasonably satisfactory to the Company, to the

effect that the proposed transfer does not result in a violation of the 1933 Act, unless such transfer is covered by an effective registration

statement or by Rule 144 (as defined below) or Rule 144A under the 1933 Act. It is understood that the book-entry shares or

certificates, as the case may be, evidencing the Securities and Conversion Shares may bear substantially the following legend:

“THE SECURITIES REPRESENTED

BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF ANY STATE OF THE

UNITED STATES. THE SECURITIES MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED, HYPOTHECATED, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF

AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER APPLICABLE SECURITIES LAWS, OR UNLESS OFFERED, SOLD, PLEDGED, HYPOTHECATED

OR TRANSFERRED PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THOSE LAWS. THE COMPANY AND ITS TRANSFER AGENT

SHALL BE ENTITLED TO REQUIRE AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY AND THE TRANSFER AGENT THAT SUCH REGISTRATION IS NOT REQUIRED.”

9.02 Legend

Removal. Upon request of any Purchaser, and if such legend is no longer required under the 1933 Act and applicable state securities

laws, the Company shall promptly cause the legend to be removed from any certificate for any Conversion Shares or Shares in accordance

with the terms of this Agreement and deliver, or cause to be delivered, to any Purchaser new certificate(s) representing such Conversion

Shares or Shares that are free from all restrictive and other legends or, at the request of such Purchaser, via DWAC transfer to such

Purchaser’s account. A Purchaser may request that the Company remove, and the Company agrees to authorize the removal of, any legend

from the Conversion Shares or the Shares, upon the earliest of (x) such time as the Conversion Shares or the Shares, as applicable,

are subject to an effective registration statement covering the resale of such Conversion Shares or Shares and (y) following the

delivery by a Purchaser to the Company or the Company’s transfer agent of a legended certificate representing such Conversion Shares

or Shares: (i) following any sale of such Conversion Shares or Shares pursuant to Rule 144, (ii) if such Conversion Shares

or Shares are eligible for sale under Rule 144(b)(1) without the requirement for the Company to be in compliance with the current

public information requirements under Rule 144(c)(1) (or any successor thereto), or (iii) following the time a legend

is no longer required with respect to such Conversion Shares or Shares. Certificates for Conversion Shares or Shares free from all restrictive

legends may be transmitted by the Company’s transfer agent to the Purchasers by crediting the account of the Purchaser’s

prime broker with the Depository Trust Company (“DTC”) as directed by such Purchaser. If a Purchaser effects

a transfer of the Conversion Shares or Shares in accordance with this Section 9.02, the Company shall permit the transfer

and shall promptly instruct its transfer agent to issue one or more certificates or credit shares to the applicable balance accounts

at DTC in such name and in such denominations as specified by such Purchaser to effect such transfer. Additionally, if a Purchaser effects

a conversion of the Series H Preferred Stock into Conversion Shares at a time when a legend is not required with respect to the

Conversion Shares, such Conversion Shares shall be issued without the restrictive legends set forth in Section 9.01. Each

Purchaser hereby agrees that the removal of the restrictive legend pursuant to this Section 9.02 is predicated upon the Company’s

reliance that such Purchaser will sell any such Conversion Shares or Shares pursuant to either the registration requirements of the Securities

Act, including any applicable prospectus delivery requirements, or an exemption therefrom.

SECTION 10. Registration, Transfer

and Substitution of Certificates for Securities.

10.01 Stock

Register; Ownership of Securities. The Company will keep at its principal office, or will cause its transfer agent to keep, a register

in which the Company will provide for the registration of transfers of the Securities and Conversion Shares. The Company may treat the

person in whose name any of the Securities or Conversion Shares are registered on such register as the owner thereof and the Company

shall not be affected by any notice to the contrary. All references in this Agreement to a “holder” of any Securities or

Conversion Shares shall mean the person in whose name such shares are at the time registered on such register.

10.02 Replacement

of Certificates. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of

any certificate representing shares of Series H Preferred Stock, if any, and, in the case of any such loss, theft or destruction,

upon delivery of an indemnity agreement and surety bond reasonably satisfactory to the Company or, in the case of any such mutilation,

upon surrender of such certificate for cancellation at the office of the Company maintained pursuant to Section 10.01, the

Company at its expense will execute and deliver, in lieu thereof, a new certificate representing such shares of Series H Preferred

Stock, of like tenor.

SECTION 11. Definitions.

Unless the context otherwise requires, the terms defined in this Section 11 shall have the meanings specified for all purposes

of this Agreement.

“1933 Act Regulations”

means the rules and regulations promulgated under the 1933 Act.

“1934 Act”

means the Securities Exchange Act of 1934, as amended.

“1934 Act Regulations”

means the rules and regulations promulgated under the 1934 Act.

“Affiliate”

shall have the meaning ascribed to such term in Rule 12b-2 of the General Rules and Regulations under the 1934 Act.

“Baker Brothers Purchasers”

means 667, L.P. and Baker Brothers Life Sciences, L.P.

“Beneficial Ownership Limitation”

shall have the meaning ascribed to such term in the Certificate of Designations.

“Business Day”

means any day other than Saturday, Sunday or other day on which commercial banks in the City of New York are authorized or required by

law to remain closed.

“Change of Control”

means (i) any merger or consolidation of the Company with or into another Person, in which the Company is not the surviving entity

and in which the stockholders of the Company immediately prior to such merger or consolidation do not own, directly or indirectly, at

least 50% of the voting power of the surviving entity immediately after such merger or consolidation, (ii) the Company effects any

sale to another Person of all or substantially all of its assets in one transaction or a series of related transactions, (iii) pursuant

to any tender offer or exchange offer (whether by the Company or another Person), holders of capital stock tender shares representing

more than 50% of the voting power of the capital stock of the Company and the Company or such other Person, as applicable, accepts such

tender for payment or (iv) the Company consummates a stock purchase agreement or other business combination (including, without

limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person whereby such other Person acquires

more than the 50% of the voting power of the capital stock of the Company (except for any such transaction in which the stockholders

of the Company immediately prior to such transaction maintain, in substantially the same proportions, the voting power of such Person

immediately after the transaction).

“Conversion Shares”

means the shares of Common Stock issuable upon conversion of the Series H Preferred Stock.

“Other Purchasers”

means the Purchasers other than the Baker Brothers Purchasers.

“Person” means

any individual, corporation, partnership, limited liability company, trust, unincorporated association, governmental entity or other

legal entity.

“Rule 144”

means Rule 144 promulgated by the Commission pursuant to the 1933 Act, as such Rule may be amended from time to time, or any

similar rule or regulation hereafter adopted by the Commission having substantially the same effect as such Rule.

“SR One Purchaser”

means SR One Capital Fund II Aggregator, LP.

“Transaction Documents”

means this Agreement and the Registration Rights Agreement.

SECTION 12. Approvals, Waivers

and Acknowledgments.

12.01 (i) Pursuant

to and in accordance with Section 6.09 of the Securities Purchase Agreement, dated November 28, 2022, by and between the Company

and the Baker Brothers Purchasers (the “2022 Securities Purchase Agreement”), the undersigned Baker Brothers

Purchasers hereby consent to and approve the authorization and issuance of shares of Series H Preferred Stock under this Agreement,

(ii) pursuant to and in accordance with Section 12.01 of the 2022 Securities Purchase Agreement, the undersigned Baker Brothers

Purchasers hereby waive the rights of the Baker Brothers Purchasers under Section 6.06(a) of the 2022 Securities Purchase Agreement,

including, without limitation, any rights to notice, with respect to the issuance under this Agreement of the Shares, the shares of Series H

Preferred Stock and any Conversion Shares, (iii) pursuant to and in accordance with Section 6.06 of the Securities Purchase

Agreement, dated December 21, 2023, by and between the Company and the Baker Brothers Purchasers (the “2023 Securities

Purchase Agreement”), the undersigned Baker Brothers Purchasers hereby consent to and approve the authorization and issuance

of shares of Series H Preferred Stock under this Agreement, and (iv) pursuant to and in accordance with Section 6.06 of

the Securities Purchase Agreement, dated March 25, 2024, by and between the Company and the Baker Brothers Purchasers (the “2024

Securities Purchase Agreement”), the undersigned Baker Brothers Purchasers hereby consent to and approve the authorization

and issuance of shares of Series H Preferred Stock under this Agreement. For the avoidance of doubt, the participation rights of

the Baker Brothers Purchasers set forth in Section 6.06 of the 2022 Securities Purchase Agreement shall survive the Closing.

12.02 Except

as set forth herein with respect to the additional rights to dividends, rank, and liquidation, the Series H Preferred Stock is intended

to provide the same economic rights as the Common Stock. Accordingly, the Company shall not treat the Series H Preferred Stock as

“preferred stock” within the meaning of Sections 351(g)(3)(A) or 356(e) of the Code and the U.S. Treasury Regulations

thereunder, unless an alternative treatment is required as a result of a “final determination” within the meaning of Section 1313(a) of

the Code.

SECTION 13. Miscellaneous.

13.01 Waivers

and Amendments. Upon the approval of the Company and the written consent of the Requisite Purchasers, the obligations of the Company

and the rights of the Purchasers under this Agreement may be waived (either generally or in a particular instance, either retroactively