Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22375

PIMCO Equity Series

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive office)

Bradley Todd

Treasurer (Principal Financial & Accounting Officer)

PIMCO Equity Series

650 Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 877-4626

Date of fiscal year end: June 30

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Shareholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

| ● | PIMCO Equity Series Funds |

| ● | PIMCO Equity Series RAE Funds |

| ● | PIMCO Equity Series RealPath® Blend Funds |

| ● | PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF |

| ● | PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF |

| ● | PIMCO RAFI Dynamic Multi-Factor International Equity ETF |

| ● | PIMCO RAFI ESG U.S. ETF |

Table of Contents

PIMCO EQUITY SERIES®

Annual Report

June 30, 2020

PIMCO Dividend and Income Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website, pimco.com/literature, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by visiting pimco.com/edelivery or by contacting your financial intermediary, such as a broker-dealer or bank.

You may elect to receive all future reports in paper free of charge. If you own these shares through a financial intermediary, such as a broker-dealer or bank, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 888.87.PIMCO (888.877.4626). Your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Fund or to all funds held in your account if you invest through a financial intermediary, such as a broker-dealer or bank.

Table of Contents

| Page | ||||||||

| 2 | ||||||||

| Important Information About the PIMCO Dividend and Income Fund |

5 | |||||||

| 10 | ||||||||

| 13 | ||||||||

| 14 | ||||||||

| 16 | ||||||||

| 18 | ||||||||

| 19 | ||||||||

| 20 | ||||||||

| 57 | ||||||||

| 89 | ||||||||

| 90 | ||||||||

| 91 | ||||||||

| 92 | ||||||||

| 95 | ||||||||

| 97 | ||||||||

This material is authorized for use only when preceded or accompanied by the current PIMCO Equity Series prospectus. The Shareholder Reports for the other series of the PIMCO Equity Series are printed separately.

Table of Contents

Dear Shareholder,

We hope that you and your family are staying safe and healthy during these challenging times. We continue to work tirelessly to navigate markets and manage the assets that you have entrusted with us. Following this letter is the PIMCO Equity Series Annual Report, which covers the 12-month reporting period ended June 30, 2020. On the subsequent pages, you will find specific details regarding investment results and discussion of the factors that most affected performance during the reporting period.

For the 12-month reporting period ended June 30, 2020

The coronavirus took its toll on the U.S. economy, as it entered its first recession since the 2008 financial crisis. Looking back, U.S. gross domestic product (“GDP”) grew at a revised annual pace of 2.6% and 2.4% during the third and fourth quarters of 2019, respectively. The pandemic then caused the economy to significantly weaken, as annualized GDP growth in the first quarter of 2020 was -5.0%. The Commerce Department’s initial estimate for second quarter annualized GDP growth — released after the reporting period ended — was -32.9%. This represented the sharpest quarterly decline on record.

The Federal Reserve (the “Fed”) took unprecedented actions to support the economy and keep markets functioning properly. In early March 2020, the Fed lowered the federal funds rate to a range between 1.00% and 1.25%. Later in the month, the Fed lowered the rate to a range between 0.00% and 0.25%. On March 23, the Fed announced, “It has become clear that our economy will face severe disruptions. Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.” The Fed’s efforts included the ability to make unlimited purchases of Treasury and mortgage securities. It also announced that, for the first time, it would purchase existing corporate bonds on the open market. In addition, the U.S. government passed a $2 trillion fiscal stimulus bill to aid the economy in March.

In its June 2020 World Economic Outlook Update, the International Monetary Fund (“IMF”) stated that it expects the U.S. economy to contract 8.0% in 2020, compared to the 2.3% GDP expansion in 2019. Elsewhere, the IMF has also stated that it anticipates that 2020 GDP growth in the eurozone, U.K. and Japan will be -10.2%, -10.2% and -5.8%, respectively. For comparison purposes, the GDP of these economies expanded 1.3%, 1.4% and 0.7%, respectively, in 2019.

Against this backdrop, central banks around the world took a number of aggressive actions. In Europe, the European Central Bank (the “ECB”) unveiled a new €750 billion bond-buying program, which was subsequently expanded by another €600 billion in June 2020. Finally, in July – after the reporting period ended — the European Union agreed on a $2.06 trillion spending package to bolster its economy.

| 2 | PIMCO EQUITY SERIES |

Table of Contents

In March, the Bank of England reduced its key lending rate to 0.10% — a record low. Elsewhere, the Bank of Japan maintained its short-term interest rates at -0.1%, while increasing the target for its holdings of corporate bonds to ¥4.2 trillion from ¥3.2 trillion. Japan’s central bank also doubled its purchases of exchange-traded stock funds. Meanwhile, in May 2020, the Japanese government doubled its stimulus measures with a ¥117 trillion package.

Both short- and long-term U.S. Treasury yields fell sharply during the reporting period. In our view, this was due to a combination of declining global growth given the coronavirus, the Fed’s accommodative monetary policy and periods of extreme investor risk aversion. The yield on the benchmark 10-year U.S. Treasury note was 0.66% at the end of the reporting period, versus 2.00% on June 30, 2019. The Bloomberg Barclays Global Treasury Index (USD Hedged), which tracks fixed-rate, local currency government debt of investment grade countries, including both developed and emerging markets, returned 6.01%. Meanwhile, the Bloomberg Barclays Global Aggregate Credit Index (USD Hedged), a widely used index of global investment grade credit bonds, returned 6.90%. Riskier fixed income asset classes, including high yield corporate bonds and emerging market debt, generated weaker results. The ICE BofAML Developed Markets High Yield Constrained Index (USD Hedged), a widely used index of below investment grade bonds, returned -0.75%, whereas emerging market external debt, as represented by the JPMorgan Emerging Markets Bond Index (EMBI) Global (USD Hedged), returned 1.52%. Emerging market local bonds, as represented by the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (Unhedged), returned -2.82%.

After initially rising, global equities experienced a sharp decline in February and March 2020. We believe this was largely due to concerns over the impact of the coronavirus. In March 2020, the U.S. equity market ended its 11-year bull market run, and then posted the fastest fall on record from its all-time high to bear market territory. However, global equities rallied sharply in April, May and June 2020, in our view because investor sentiment improved given significant stimulus efforts from central banks around the world. All told, during the 12-months ended June 30, 2020, U.S. equities, as represented by the S&P 500 Index, returned 7.51% and global equities, as represented by the MSCI World Index, returned 2.84%. Meanwhile, Japanese equities, as represented by the Nikkei 225 Index (in JPY), returned 6.98% and European equities, as represented by the MSCI Europe Index (in EUR), returned -5.48%. Finally, emerging market equities, as measured by the MSCI Emerging Markets Index, returned -3.39%.

Commodity prices were extremely volatile and generated mixed results. When the reporting period began, Brent crude oil was approximately $67 a barrel. It ended the reporting period at roughly $41 a barrel after briefly trading below $15. Elsewhere, copper prices were relatively flat, whereas gold prices moved higher.

| ANNUAL REPORT | JUNE 30, 2020 | 3 |

Table of Contents

Chairman’s Letter (Cont.)

Finally, there were periods of volatility in the foreign exchange markets, due in part, in our view, to signs of moderating global growth, trade conflicts and changing central bank monetary policies, along with a number of geopolitical events. The U.S. dollar strengthened against a number of other major currencies. For example, the U.S. dollar returned 1.22%, 2.32% and 0.07% versus the euro, the British pound and the Japanese yen, respectively.

Thank you for the assets you have placed with us. We deeply value your trust, and we will continue to work diligently to meet your broad investment needs. For any questions regarding the funds, please contact your account manager or financial adviser, or call one of our shareholder associates at (888) 87-PIMCO. We also invite you to visit our website at www.pimco.com to learn more about our global viewpoints.

|

Sincerely,

Peter G. Strelow Chairman of the Board

|

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income distributions and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an unmanaged index.

| 4 | PIMCO EQUITY SERIES |

Table of Contents

Important Information About the PIMCO Dividend and Income Fund

PIMCO Equity Series (the “Trust”) is an open-end management investment company that includes PIMCO Dividend and Income Fund (the “Fund”).

We believe that equity funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that equity funds are subject to notable risks. Among other things, equity and equity-related securities may decline in value due to both real and perceived general market, economic, and industry conditions.

The values of equity securities, such as common stocks and preferred securities, have historically risen and fallen in periodic cycles and may decline due to general market conditions, which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Equity securities may also decline due to factors that affect a particular industry or industries, such as labor shortages, increased production costs and competitive conditions within an industry. In addition, the value of an equity security may decline for a number of reasons that directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets. Different types of equity securities may react differently to these developments and a change in the financial condition of a single issuer may affect securities markets as a whole.

During a general downturn in the securities markets, multiple asset classes, including equity securities, may decline in value simultaneously. The market price of equity securities owned by the Fund may go up or down, sometimes rapidly or unpredictably. Equity securities generally have greater price volatility than fixed income securities and common stocks generally have the greatest appreciation and depreciation potential of all equity securities.

The Fund may be subject to various risks as described in its prospectus and in the Principal Risks in the Notes to Financial Statements.

Classifications of the Fund’s portfolio holdings in this report are made according to financial reporting standards. The classification of a particular portfolio holding as shown in the Allocation Breakdown and Schedule of Investments sections of this report may differ from the classification used for the Fund’s compliance calculations, including those used in the Fund’s prospectus, investment objectives, regulatory, and other investment limitations and policies, which may be based on different asset class, sector or geographical classifications. The Fund is separately monitored for compliance with respect to prospectus and regulatory requirements.

The geographical classification of foreign (non-U.S.) securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

Beginning in January 2020, global financial markets have experienced and may continue to experience significant volatility resulting from the spread of a novel coronavirus known as COVID-19. The outbreak of COVID-19 has resulted in travel and border restrictions, quarantines, supply chain disruptions, lower consumer demand and general market uncertainty. The effects of COVID-19 have and may continue to adversely affect the global economy, the economies of certain nations and individual issuers, all of which may negatively impact the Fund’s performance. In addition, COVID-19

| ANNUAL REPORT | JUNE 30, 2020 | 5 |

Table of Contents

Important Information About the PIMCO Dividend and Income Fund (Cont.)

and governmental responses to COVID-19 may negatively impact the capabilities of the Fund’s service providers and disrupt the Fund’s operations.

The United States presidential administration’s enforcement of tariffs on goods from other countries, with a focus on China, has contributed to international trade tensions and may impact portfolio securities.

The United Kingdom’s withdrawal from the European Union may impact Fund returns. The withdrawal may cause substantial volatility in foreign exchange markets, lead to weakness in the exchange rate of the British pound, result in a sustained period of market uncertainty, and destabilize some or all of the other European Union member countries and/or the Eurozone.

The Fund may invest in certain instruments that rely in some fashion upon the London Interbank Offered Rate (“LIBOR”). LIBOR is an average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced plans to phase out the use of LIBOR by the end of 2021. The transition may result in a reduction in the value of certain instruments held by the Fund or a reduction in the effectiveness of related Fund transactions such as hedges. There remains uncertainty regarding future utilization of LIBOR and the nature of any replacement rate (e.g., the Secured Overnight Financing Rate, which is intended to replace U.S. dollar LIBOR and measures the cost of overnight borrowings through repurchase agreement transactions collateralized with U.S. Treasury securities), and any potential effects of the transition away from LIBOR on the Fund or on certain instruments in which the Fund invests are not known and could result in losses to the Fund.

Under the direction of the Federal Housing Finance Agency, the Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”) have entered into a joint initiative to develop a common securitization platform for the issuance of a uniform mortgage-backed security (the “Single Security Initiative”) that aligns the characteristics of FNMA and FHLMC certificates. The Single Security Initiative was implemented on June 3, 2019, and the effects it may have on the market for mortgage-backed securities are uncertain.

On the Fund Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the redemption of Fund shares. The Cumulative Returns chart and Average Annual Total Return table reflect any sales load that would have applied at the time of purchase or any Contingent Deferred Sales Charge (“CDSC”) that would have applied if a full redemption occurred on the last business day of the period shown in the Cumulative Returns chart. Class A shares are subject to an initial sales charge. A CDSC may be imposed in certain circumstances on Class A shares that are purchased without an initial sales charge and then redeemed during the first 12 months after purchase. Class C shares are subject to a 1% CDSC, which may apply in the first year. The Cumulative Returns chart reflects only Institutional Class performance. Performance may vary by share class based on each class’s expense ratios. Performance shown is net of fees and expenses. The minimum initial investment amount for Institutional Class, I-2 and I-3 shares is $1,000,000. The minimum initial investment amount for Class A and Class C shares is $1,000. The Fund measures its performance against at least one broad-based securities market index (“benchmark index”). The benchmark index does not take into account

| 6 | PIMCO EQUITY SERIES |

Table of Contents

fees, expenses, or taxes. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. There is no assurance that the Fund, even if the Fund has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. High performance is defined as a significant increase in either 1) the Fund’s total return in excess of that of the Fund’s benchmark between reporting periods or 2) the Fund’s total return in excess of the Fund’s historical returns between reporting periods. Unusual performance is defined as a significant change in the Fund’s performance as compared to one or more previous reporting periods. Historical performance for the Fund or share class may have been positively impacted by fee waivers or expense limitations in place during some or all of the periods shown, if applicable. Future performance (including total return or yield) and distributions may be negatively impacted by the expiration or reduction of any such fee waivers or expense limitations.

The following table discloses the inception dates of the Fund and its share classes along with the Fund’s diversification status as of period end:

| Fund Name | Fund Inception |

Institutional Class |

I-2 | I-3 | Class A | Class C | Diversification Status | |||||||||||||||||||||||

| PIMCO Dividend and Income Fund | 12/14/11 | 12/14/11 | 12/14/11 | — | 12/14/11 | 12/14/11 | Diversified | |||||||||||||||||||||||

An investment in the Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Fund.

The Trustees are responsible generally for overseeing the management of the Trust. The Trustees authorize the Trust to enter into service agreements with the Adviser, the Distributor, the Administrator and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Trust and the Fund. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither the Fund’s prospectus nor the Fund’s summary prospectus, the Trust’s Statement of Additional Information (“SAI”), any contracts filed as exhibits to the Trust’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Trust or the Fund creates a contract between or among any shareholder of the Fund, on the one hand, and the Trust, the Fund, a service provider to the Trust or the Fund, and/or the Trustees or officers of the Trust, on the other hand. The Trustees (or the Trust and its officers, service providers or other delegates acting under authority of the Trustees) may amend the most recent prospectus or use a new prospectus, summary prospectus or SAI with respect to the Fund or the Trust, and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which the Trust or the Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to the Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement is specifically disclosed in the Trust’s then-current prospectus or SAI.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on

| ANNUAL REPORT | JUNE 30, 2020 | 7 |

Table of Contents

Important Information About the PIMCO Dividend and Income Fund (Cont.)

behalf of the Fund. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of the Fund, and information about how the Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30th, are available without charge, upon request, by calling the Trust at (888) 87-PIMCO, on the Fund’s website at www.pimco.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Fund files portfolio holdings information with the SEC on Form N-PORT within 60 days of the end of each fiscal quarter. The Fund’s complete schedule of securities holdings as of the end of each fiscal quarter will be made available to the public on the SEC’s website at www.sec.gov and on PIMCO’s website at www.pimco.com, and will be made available, upon request, by calling PIMCO at (888) 87-PIMCO. Prior to its use of Form N-PORT, the Fund filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

The SEC adopted a rule that, beginning in 2021, generally will allow the Fund to fulfill its obligation to deliver shareholder reports to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Pursuant to the rule, investors may still elect to receive a complete shareholder report in the mail. Instructions for electing to receive paper copies of the Fund’s shareholder reports going forward may be found on the front cover of this report.

In November 2019, the SEC published a proposed rulemaking related to the use of derivatives and certain other transactions by registered investment companies. If the proposal is adopted in substantially the same form as it was proposed, these requirements could limit the ability of a Fund to use derivatives and reverse repurchase agreements and similar financing transactions as part of its investment strategies. Any new requirements, if adopted, may increase the cost of the Fund’s investments and cost of doing business, which could adversely affect investors.

In April 2020, the SEC issued a proposed rulemaking setting forth a proposed framework for fair valuation of fund investments. If the proposal is adopted in substantially the same form as it was proposed, the rule would set forth requirements for good faith determinations of fair value, establish conditions under which a market quotation is considered readily available for purposes of the definition of “value” under the Investment Company Act of 1940, and address the roles and responsibilities of a fund’s board of trustees and investment adviser with respect to fair valuation of fund investments. The impact that any such requirements may have on the Fund is uncertain.

On August 5, 2020, the SEC proposed changes to the mutual fund and ETF shareholder report and registration statement disclosure requirements and the registered fund advertising rules, which, if adopted, will change the disclosures provided to shareholders.

| 8 | PIMCO EQUITY SERIES |

Table of Contents

(THIS PAGE INTENTIONALLY LEFT BLANK)

| ANNUAL REPORT | JUNE 30, 2020 | 9 |

Table of Contents

PIMCO Dividend and Income Fund

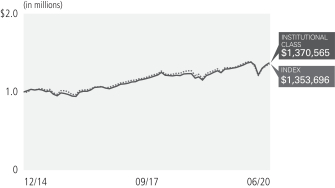

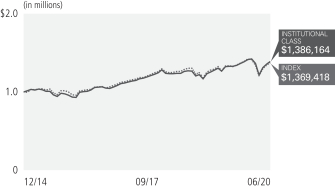

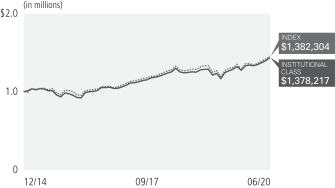

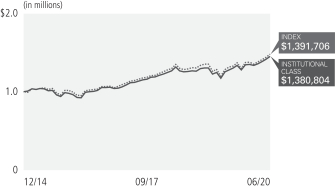

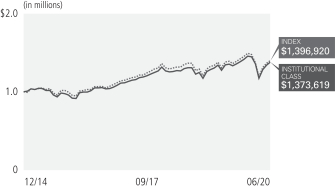

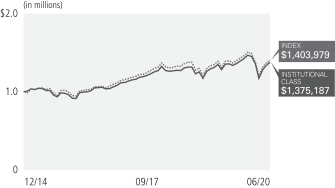

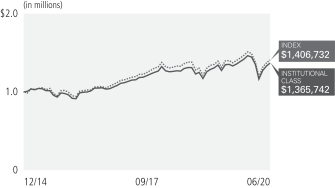

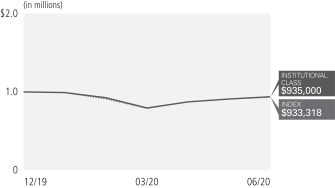

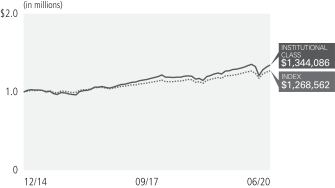

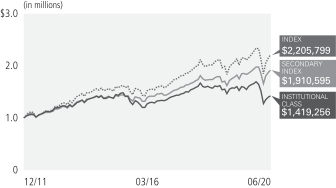

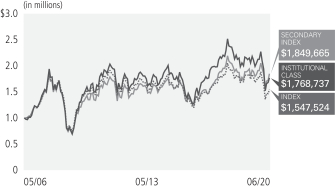

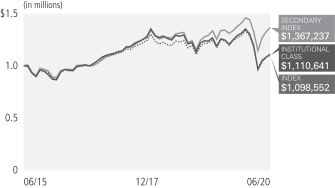

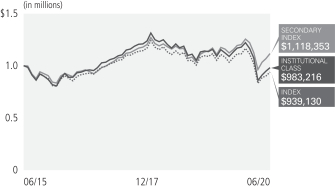

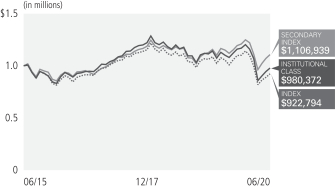

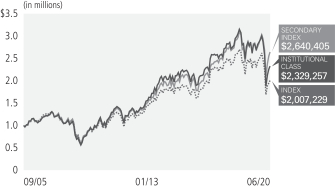

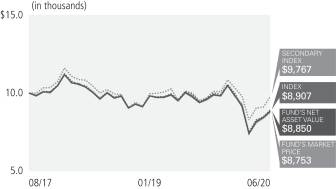

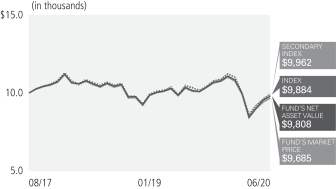

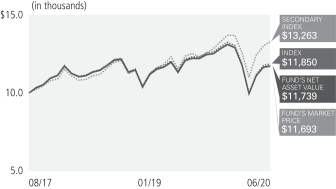

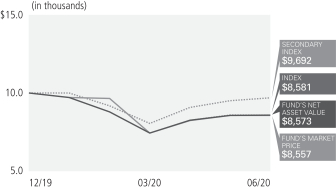

Cumulative Returns Through June 30, 2020

$1,000,000 invested at the end of the month when the Fund’s Institutional Class commenced operations.

| Average Annual Total Return for the period ended June 30, 2020 | ||||||||||||||

| 1 Year | 5 Years | Fund Inception (12/14/11) |

||||||||||||

|

PIMCO Dividend and Income Fund Institutional Class | (11.38)% | 0.04% | 4.44% | ||||||||||

| PIMCO Dividend and Income Fund I-2 | (11.43)% | (0.03)% | 4.35% | |||||||||||

| PIMCO Dividend and Income Fund Class A | (11.72)% | (0.32)% | 4.07% | |||||||||||

| PIMCO Dividend and Income Fund Class A (adjusted) | (16.60)% | (1.45)% | 3.38% | |||||||||||

| PIMCO Dividend and Income Fund Class C | (12.36)% | (1.08)% | 3.28% | |||||||||||

| PIMCO Dividend and Income Fund Class C (adjusted) | (13.22)% | (1.08)% | 3.28% | |||||||||||

|

MSCI World Index± | 2.84% | 6.90% | 10.18% | ||||||||||

|

75% MSCI World Index/25% Bloomberg Barclays Global Aggregate USD Unhedged±± | 3.55% | 6.26% | 8.26% | ||||||||||

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

± The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices.

±± The benchmark is a blend of 75% MSCI World Index/25% Bloomberg Barclays Global Aggregate USD Unhedged. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices. Bloomberg Barclays Global Aggregate (USD Unhedged) Index provides a broad-based measure of the global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian Government securities, and USD investment grade 144A securities.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Differences in the Fund’s performance versus the index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index. The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1.00% CDSC on Class C shares. For performance data current to the most recent month-end, visit www.pimco.com or via (888) 87-PIMCO.

The Fund’s total annual operating expense ratio in effect as of period end, were 0.96% for Institutional Class shares, 1.06% for I-2 shares, 1.31% for Class A shares, and 2.06% for Class C shares. Details regarding any changes to the Fund’s operating expenses, subsequent to period end, can be found in the Fund’s current prospectus, as supplemented.

| 10 | PIMCO EQUITY SERIES |

Table of Contents

| Institutional Class - PQIIX | I-2 - PQIPX | |

| Class A - PQIZX | Class C - PQICX |

| Geographic Breakdown as of June 30, 2020†§ | ||||

| United States | 53.9% | |||

| Japan | 10.7% | |||

| United Kingdom | 7.4% | |||

| France | 4.5% | |||

| Australia | 4.1% | |||

| Germany | 3.6% | |||

| Switzerland | 2.1% | |||

| Spain | 1.7% | |||

| Italy | 1.7% | |||

| Netherlands | 1.4% | |||

| Cayman Islands | 1.3% | |||

| Short- Term Instruments‡ | 1.0% | |||

| Other | 6.6% | |||

| Sector Breakdown as of June 30, 2020†§ | ||||

| Financials | 13.9% | |||

| U.S. Government Agencies | 9.5% | |||

| Industrials | 8.6% | |||

| Consumer Discretionary | 7.4% | |||

| Health Care | 6.6% | |||

| Communication Services | 6.5% | |||

| Energy | 6.3% | |||

| Consumer Staples | 6.2% | |||

| Utilities | 5.3% | |||

| Information Technology | 5.2% | |||

| Banking & Finance | 5.1% | |||

| Materials | 4.4% | |||

| Asset-Backed Securities | 3.7% | |||

| Non-Agency Mortgage-Backed Securities | 3.5% | |||

| U.S. Treasury Obligations | 2.6% | |||

| Real Estate | 1.6% | |||

| Sovereign Issues | 1.2% | |||

| Short- Term Instruments‡ | 1.0% | |||

| Other | 1.4% | |||

| † | % of Investments, at value. |

| § | Geographic and Sector Breakdown and % of Investments exclude securities sold short and financial derivative instruments, if any. |

| ‡ | Includes Central Funds Used for Cash Management Purposes. |

| ANNUAL REPORT | JUNE 30, 2020 | 11 |

Table of Contents

PIMCO Dividend and Income Fund (Cont.)

Investment Objective and Strategy Overview

PIMCO Dividend and Income Fund seeks to provide current income that exceeds the average yield on global stocks, and as a secondary objective, seeks to provide long-term capital appreciation, by investing under normal circumstances at least 80% of its assets in a diversified portfolio of income-producing investments, and will typically invest between 60-80% of its assets in equity and equity-related securities (such portion of the Fund’s portfolio, the “Equity Sleeve”) providing exposure to a portfolio of stocks (the “RAE Income Global Portfolio”) through investment in the securities that comprise the RAE Income Global Portfolio. Equity-related securities include securities having an equity component (e.g., hybrids, bank capital) and equity derivatives. With respect to investments in equity securities, there is no limitation on the market capitalization range of the issuers in which the Fund may invest. The stocks for the Equity Sleeve are selected by the Fund’s sub-adviser, Research Affiliates, LLC, from a broad universe of global equities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights

The following affected performance (on a gross basis) during the reporting period:

Equity Portfolio:

| » | Underweight exposure to the real estate sector contributed to relative returns, as the sector underperformed the benchmark index. |

| » | Underweight exposure to, and security selection in, the information technology sector detracted from relative returns, as the sector outperformed the benchmark index and the Fund’s holdings underperformed the benchmark index. |

| » | Overweight exposure to, and security selection in, the financials, communications services and energy sectors detracted from relative returns, as the sectors’ and the Fund’s holdings underperformed the benchmark index. |

| » | Security selection in consumer discretionary and industrials sectors detracted from relative returns, as the Fund’s holdings underperformed the benchmark index. |

Fixed Income Portfolio:

| » | Exposure to U.S. duration contributed to performance, as U.S. interest rates decreased. |

| » | Exposure to U.S. cash rate contributed to performance, as 3-month London Inter Bank Offering Rate was positive. |

| » | Exposure to non-Agency mortgage backed securities detracted from performance, as prices for these securities decreased. |

| » | Exposure to emerging market currencies detracted from performance, as these currencies depreciated relative to the U.S. dollar. |

| » | Select holdings of external emerging markets debt detracted from returns, as spreads widened. |

| 12 | PIMCO EQUITY SERIES |

Table of Contents

Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and exchange fees and (2) ongoing costs, including investment advisory fees, supervisory and administrative fees, distribution and/or service (12b-1) fees, and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which for all Funds and share classes is from January 1, 2020 to June 30, 2020 unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the appropriate row for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments and exchange fees. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense ratios may vary from period to period because of various factors such as an increase in expenses that are not covered by the investment advisory fees and supervisory and administrative fees, such as fees and expenses of the independent trustees and their counsel, extraordinary expenses and interest expense.

| Actual | Hypothetical (5% return before expenses) |

|||||||||||||||||||||||||||||||||||||||

| Beginning Account Value (01/01/20) |

Ending Account Value (06/30/20) |

Expenses Paid During Period* |

Beginning Account Value (01/01/20) |

Ending Account Value (06/30/20) |

Expenses Paid During Period* |

Net Annualized Expense Ratio** |

||||||||||||||||||||||||||||||||||

| Institutional Class |

$ | 1,000.00 | $ | 838.70 | $ | 3.77 | $ | 1,000.00 | $ | 1,020.62 | $ | 4.15 | 0.83 | % | ||||||||||||||||||||||||||

| I-2 |

1,000.00 | 838.00 | 4.23 | 1,000.00 | 1,020.13 | 4.65 | 0.93 | |||||||||||||||||||||||||||||||||

| Class A |

1,000.00 | 836.90 | 5.36 | 1,000.00 | 1,018.89 | 5.89 | 1.18 | |||||||||||||||||||||||||||||||||

| Class C |

1,000.00 | 833.30 | 8.75 | 1,000.00 | 1,015.18 | 9.62 | 1.93 | |||||||||||||||||||||||||||||||||

* Expenses Paid During Period are equal to the net annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/366 (to reflect the one-half year period).

** Net Annualized Expense Ratio is reflective of any applicable contractual fee waivers and/or expense reimbursements or voluntary fee waivers. Details regarding fee waivers, if any, can be found in Note 9, Fees and Expenses, in the Notes to Financial Statements.

| ANNUAL REPORT | JUNE 30, 2020 | 13 |

Table of Contents

Financial Highlights PIMCO Dividend and Income Fund

| Investment Operations | Less Distributions(c) | |||||||||||||||||||||||||||||||||||||||

| Selected Per Share Data for the Year^: |

Net Asset Beginning |

Net Investment Income |

Net Unrealized Gain (Loss) |

Total | From Net Investment Income |

From Net Realized Capital Gains |

Total | |||||||||||||||||||||||||||||||||

| Institutional Class |

||||||||||||||||||||||||||||||||||||||||

| 06/30/2020 |

$ | 11.27 | $ | 0.33 | $ | (1.57 | ) | $ | (1.24 | ) | $ | (0.32 | ) | $ | 0.00 | $ | (0.32 | ) | ||||||||||||||||||||||

| 06/30/2019 |

11.54 | 0.39 | (0.18 | ) | 0.21 | (0.48 | ) | 0.00 | (0.48 | ) | ||||||||||||||||||||||||||||||

| 06/30/2018 |

11.09 | 0.36 | 0.41 | 0.77 | (0.32 | ) | 0.00 | (0.32 | ) | |||||||||||||||||||||||||||||||

| 06/30/2017 |

9.94 | 0.30 | 1.08 | 1.38 | (0.23 | ) | 0.00 | (0.23 | ) | |||||||||||||||||||||||||||||||

| 06/30/2016 |

12.29 | 0.43 | (1.58 | ) | (1.15 | ) | (0.44 | ) | (0.76 | ) | (1.20 | ) | ||||||||||||||||||||||||||||

| I-2 |

||||||||||||||||||||||||||||||||||||||||

| 06/30/2020 |

11.29 | 0.32 | (1.58 | ) | (1.26 | ) | (0.31 | ) | 0.00 | (0.31 | ) | |||||||||||||||||||||||||||||

| 06/30/2019 |

11.56 | 0.38 | (0.19 | ) | 0.19 | (0.46 | ) | 0.00 | (0.46 | ) | ||||||||||||||||||||||||||||||

| 06/30/2018 |

11.11 | 0.34 | 0.42 | 0.76 | (0.31 | ) | 0.00 | (0.31 | ) | |||||||||||||||||||||||||||||||

| 06/30/2017 |

9.96 | 0.30 | 1.07 | 1.37 | (0.22 | ) | 0.00 | (0.22 | ) | |||||||||||||||||||||||||||||||

| 06/30/2016 |

12.30 | 0.39 | (1.54 | ) | (1.15 | ) | (0.43 | ) | (0.76 | ) | (1.19 | ) | ||||||||||||||||||||||||||||

| Class A |

||||||||||||||||||||||||||||||||||||||||

| 06/30/2020 |

11.27 | 0.29 | (1.57 | ) | (1.28 | ) | (0.29 | ) | 0.00 | (0.29 | ) | |||||||||||||||||||||||||||||

| 06/30/2019 |

11.53 | 0.35 | (0.19 | ) | 0.16 | (0.42 | ) | 0.00 | (0.42 | ) | ||||||||||||||||||||||||||||||

| 06/30/2018 |

11.08 | 0.31 | 0.42 | 0.73 | (0.28 | ) | 0.00 | (0.28 | ) | |||||||||||||||||||||||||||||||

| 06/30/2017 |

9.94 | 0.27 | 1.07 | 1.34 | (0.20 | ) | 0.00 | (0.20 | ) | |||||||||||||||||||||||||||||||

| 06/30/2016 |

12.29 | 0.39 | (1.57 | ) | (1.18 | ) | (0.41 | ) | (0.76 | ) | (1.17 | ) | ||||||||||||||||||||||||||||

| Class C |

||||||||||||||||||||||||||||||||||||||||

| 06/30/2020 |

11.29 | 0.21 | (1.57 | ) | (1.36 | ) | (0.23 | ) | 0.00 | (0.23 | ) | |||||||||||||||||||||||||||||

| 06/30/2019 |

11.48 | 0.26 | (0.18 | ) | 0.08 | (0.27 | ) | 0.00 | (0.27 | ) | ||||||||||||||||||||||||||||||

| 06/30/2018 |

11.06 | 0.22 | 0.42 | 0.64 | (0.22 | ) | 0.00 | (0.22 | ) | |||||||||||||||||||||||||||||||

| 06/30/2017 |

9.92 | 0.18 | 1.07 | 1.25 | (0.11 | ) | 0.00 | (0.11 | ) | |||||||||||||||||||||||||||||||

| 06/30/2016 |

12.27 | 0.31 | (1.57 | ) | (1.26 | ) | (0.33 | ) | (0.76 | ) | (1.09 | ) | ||||||||||||||||||||||||||||

| ^ | A zero balance may reflect actual amounts rounding to less than $0.01 or 0.01%. |

| (a) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Fund. |

| (b) | Per share amounts based on average number of shares outstanding during the year or period. |

| (c) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. See Note 2, Distributions to Shareholders, in the Notes to Financial Statements for more information. |

| (d) | Effective June 16, 2016, the Fund’s Investment advisory fee was decreased by 0.20% to an annual rate of 0.49%. |

| 14 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

| Ratios/Supplemental Data | |||||||||||||||||||||||||||||||||||||||||||

| Ratios to Average Net Assets | |||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value End of Year(a) |

Total Return(a) |

Net Assets End of Year |

Expenses | Expenses Excluding Waivers |

Expenses Excluding Interest Expense |

Expenses Excluding Interest Expense and Waivers |

Net Investment Income (Loss) |

Portfolio Turnover | |||||||||||||||||||||||||||||||||||

| $ | 9.71 | (11.38 | )% | $ | 16,438 | 0.83 | % | 0.84 | % | 0.80 | % | 0.81 | % | 3.05 | % | 158 | % | ||||||||||||||||||||||||||

| 11.27 | 2.06 | 20,685 | 0.95 | 0.96 | 0.80 | 0.81 | 3.48 | 108 | |||||||||||||||||||||||||||||||||||

| 11.54 | 6.89 | 23,027 | 0.85 | 0.86 | 0.80 | 0.81 | 3.04 | 80 | |||||||||||||||||||||||||||||||||||

| 11.09 | 14.01 | 23,087 | 0.80 | 0.81 | 0.79 | 0.80 | 2.88 | 93 | |||||||||||||||||||||||||||||||||||

| 9.94 | (9.06 | ) | 31,840 | 0.83 | (d) | 1.00 | (d) | 0.83 | (d) | 1.00 | (d) | 4.03 | 114 | ||||||||||||||||||||||||||||||

| 9.72 | (11.52 | ) | 19,236 | 0.93 | 0.94 | 0.90 | 0.91 | 2.95 | 158 | ||||||||||||||||||||||||||||||||||

| 11.29 | 1.91 | 25,573 | 1.05 | 1.06 | 0.90 | 0.91 | 3.40 | 108 | |||||||||||||||||||||||||||||||||||

| 11.56 | 6.80 | 27,286 | 0.95 | 0.96 | 0.90 | 0.91 | 2.94 | 80 | |||||||||||||||||||||||||||||||||||

| 11.11 | 13.86 | 24,731 | 0.90 | 0.91 | 0.89 | 0.90 | 2.79 | 93 | |||||||||||||||||||||||||||||||||||

| 9.96 | (9.05 | ) | 34,120 | 0.93 | (d) | 1.10 | (d) | 0.93 | (d) | 1.10 | (d) | 3.53 | 114 | ||||||||||||||||||||||||||||||

| 9.70 | (11.72 | ) | 96,148 | 1.18 | 1.19 | 1.15 | 1.16 | 2.70 | 158 | ||||||||||||||||||||||||||||||||||

| 11.27 | 1.61 | 122,533 | 1.30 | 1.31 | 1.15 | 1.16 | 3.13 | 108 | |||||||||||||||||||||||||||||||||||

| 11.53 | 6.60 | 138,561 | 1.20 | 1.21 | 1.15 | 1.16 | 2.70 | 80 | |||||||||||||||||||||||||||||||||||

| 11.08 | 13.54 | 144,912 | 1.15 | 1.16 | 1.14 | 1.15 | 2.53 | 93 | |||||||||||||||||||||||||||||||||||

| 9.94 | (9.38 | ) | 167,857 | 1.18 | (d) | 1.35 | (d) | 1.18 | (d) | 1.35 | (d) | 3.67 | 114 | ||||||||||||||||||||||||||||||

| 9.70 | (12.36 | ) | 46,644 | 1.93 | 1.94 | 1.90 | 1.91 | 1.92 | 158 | ||||||||||||||||||||||||||||||||||

| 11.29 | 0.87 | 83,059 | 2.05 | 2.06 | 1.90 | 1.91 | 2.34 | 108 | |||||||||||||||||||||||||||||||||||

| 11.48 | 5.72 | 115,183 | 1.95 | 1.96 | 1.90 | 1.91 | 1.91 | 80 | |||||||||||||||||||||||||||||||||||

| 11.06 | 12.70 | 140,710 | 1.90 | 1.91 | 1.89 | 1.90 | 1.75 | 93 | |||||||||||||||||||||||||||||||||||

| 9.92 | (10.07 | ) | 195,393 | 1.93 | (d) | 2.10 | (d) | 1.93 | (d) | 2.10 | (d) | 2.91 | 114 | ||||||||||||||||||||||||||||||

| ANNUAL REPORT | JUNE 30, 2020 | 15 |

Table of Contents

Statement of Assets and Liabilities PIMCO Dividend and Income Fund

| (Amounts in thousands†, except per share amounts) | ||||

| Assets: |

||||

| Investments, at value |

||||

| Investments in securities* |

$ | 198,745 | ||

| Investments in Affiliates |

539 | |||

| Financial Derivative Instruments |

||||

| Exchange-traded or centrally cleared |

63 | |||

| Over the counter |

85 | |||

| Cash |

1 | |||

| Deposits with counterparty |

867 | |||

| Foreign currency, at value |

591 | |||

| Receivable for investments sold |

22,380 | |||

| Receivable for TBA investments sold |

20,565 | |||

| Receivable for Fund shares sold |

971 | |||

| Interest and/or dividends receivable |

1,056 | |||

| Reimbursement receivable from PIMCO |

1 | |||

| Other assets |

1 | |||

| Total Assets |

245,865 | |||

| Liabilities: |

||||

| Borrowings & Other Financing Transactions |

||||

| Payable for reverse repurchase agreements |

$ | 6,199 | ||

| Payable for sale-buyback transactions |

560 | |||

| Financial Derivative Instruments |

||||

| Exchange-traded or centrally cleared |

35 | |||

| Over the counter |

254 | |||

| Payable for investments purchased |

22,570 | |||

| Payable for TBA investments purchased |

36,642 | |||

| Payable for unfunded loan commitments |

25 | |||

| Payable for Fund shares redeemed |

921 | |||

| Accrued investment advisory fees |

73 | |||

| Accrued supervisory and administrative fees |

59 | |||

| Accrued distribution fees |

30 | |||

| Accrued servicing fees |

30 | |||

| Accrued reimbursement to PIMCO |

1 | |||

| Total Liabilities |

67,399 | |||

| Net Assets |

$ | 178,466 | ||

| Net Assets Consist of: |

||||

| Paid in capital |

$ | 299,423 | ||

| Distributable earnings (accumulated loss) |

(120,957 | ) | ||

| Net Assets |

$ | 178,466 | ||

| Cost of investments in securities |

$ | 204,470 | ||

| Cost of investments in Affiliates |

$ | 538 | ||

| Cost of foreign currency held |

$ | 602 | ||

| Cost or premiums of financial derivative instruments, net |

$ | (91 | ) | |

| * Includes repurchase agreements of: |

$ | 1,101 | ||

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| 16 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| Net Assets: |

||||

| Institutional Class |

$ | 16,438 | ||

| I-2 |

19,236 | |||

| Class A |

96,148 | |||

| Class C |

46,644 | |||

| Shares Issued and Outstanding: |

||||

| Institutional Class |

1,694 | |||

| I-2 |

1,978 | |||

| Class A |

9,912 | |||

| Class C |

4,808 | |||

| Net Asset Value Per Share Outstanding(a): |

||||

| Institutional Class |

$ | 9.71 | ||

| I-2 |

9.72 | |||

| Class A |

9.70 | |||

| Class C |

9.70 | |||

| (a) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Fund. |

| ANNUAL REPORT | JUNE 30, 2020 | 17 |

Table of Contents

Statement of Operations PIMCO Dividend and Income Fund

| Year Ended June 30, 2020 | ||||

| (Amounts in thousands†) | ||||

| Investment Income: |

||||

| Interest |

$ | 2,716 | ||

| Dividends, net of foreign taxes* |

5,732 | |||

| Dividends from Investments in Affiliates |

21 | |||

| Total Income |

8,469 | |||

| Expenses: |

||||

| Investment advisory fees |

1,074 | |||

| Supervisory and administrative fees |

858 | |||

| Distribution fees - Class C |

483 | |||

| Servicing fees - Class A |

280 | |||

| Servicing fees - Class C |

161 | |||

| Trustee fees |

18 | |||

| Interest expense |

58 | |||

| Miscellaneous expense |

16 | |||

| Total Expenses |

2,948 | |||

| Waiver and/or Reimbursement by PIMCO |

(18 | ) | ||

| Net Expenses |

2,930 | |||

| Net Investment Income (Loss) |

5,539 | |||

| Net Realized Gain (Loss): |

||||

| Investments in securities |

(17,917 | ) | ||

| Exchange-traded or centrally cleared financial derivative instruments |

575 | |||

| Over the counter financial derivative instruments |

402 | |||

| Foreign currency |

(100 | ) | ||

| Net Realized Gain (Loss) |

(17,040 | ) | ||

| Net Change in Unrealized Appreciation (Depreciation): |

||||

| Investments in securities |

(14,182 | ) | ||

| Exchange-traded or centrally cleared financial derivative instruments |

(1,225 | ) | ||

| Over the counter financial derivative instruments |

(365 | ) | ||

| Foreign currency assets and liabilities |

1 | |||

| Net Change in Unrealized Appreciation (Depreciation) |

(15,771) | |||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | (27,272 | ) | |

| * Foreign tax withholdings - Dividends |

$ | 271 | ||

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| 18 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

Statements of Changes in Net Assets PIMCO Dividend and Income Fund

| (Amounts in thousands†) | Year Ended June 30, 2020 |

Year Ended June 30, 2019 |

||||||

| Increase (Decrease) in Net Assets from: |

||||||||

| Operations: |

||||||||

| Net investment income (loss) |

$ | 5,539 | $ | 7,923 | ||||

| Net realized gain (loss) |

(17,040 | ) | 6,596 | |||||

| Net change in unrealized appreciation (depreciation) |

(15,771 | ) | (11,287 | ) | ||||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

(27,272 | ) | 3,232 | |||||

| Distributions to Shareholders: |

||||||||

| From net investment income and/or net realized capital gains |

||||||||

| Institutional Class |

(569 | ) | (897 | ) | ||||

| I-2 |

(701 | ) | (1,066 | ) | ||||

| Class A |

(3,061 | ) | (4,742 | ) | ||||

| Class C |

(1,420 | ) | (2,395 | ) | ||||

| Total Distributions(a) |

(5,751 | ) | (9,100 | ) | ||||

| Fund Share Transactions: |

||||||||

| Net increase (decrease) resulting from Fund share transactions* |

(40,361 | ) | (46,339 | ) | ||||

| Total Increase (Decrease) in Net Assets |

(73,384 | ) | (52,207 | ) | ||||

| Net Assets: |

||||||||

| Beginning of year |

251,850 | 304,057 | ||||||

| End of year |

$ | 178,466 | $ | 251,850 | ||||

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| * | See Note 13, Shares of Beneficial Interest, in the Notes to Financial Statements. |

| (a) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. See Note 2, Distributions to Shareholders, in the Notes to Financial Statements for more information. |

| ANNUAL REPORT | JUNE 30, 2020 | 19 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund

(Amounts in thousands*, except number of shares, contracts and units, if any)

| 20 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 21 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 22 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 23 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 24 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 25 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 26 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 27 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 28 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 29 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 30 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 31 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 32 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 33 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 34 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 35 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 36 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 37 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 38 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 39 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

| 40 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 41 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

NOTES TO SCHEDULE OF INVESTMENTS:

| * | A zero balance may reflect actual amounts rounding to less than one thousand. |

| ^ | Security is in default. |

| « | Security valued using significant unobservable inputs (Level 3). |

| µ | All or a portion of this amount represents unfunded loan commitments. The interest rate for the unfunded portion will be determined at the time of funding. See Note 4, Securities and Other Investments, in the Notes to Financial Statements for more information regarding unfunded loan commitments. |

| ~ | Variable or Floating rate security. Rate shown is the rate in effect as of period end. Certain variable rate securities are not based on a published reference rate and spread, rather are determined by the issuer or agent and are based on current market conditions. Reference rate is as of reset date, which may vary by security. These securities may not indicate a reference rate and/or spread in their description. |

| • | Rate shown is the rate in effect as of period end. The rate may be based on a fixed rate, a capped rate or a floor rate and may convert to a variable or floating rate in the future. These securities do not indicate a reference rate and spread in their description. |

| þ | Coupon represents a rate which changes periodically based on a predetermined schedule or event. Rate shown is the rate in effect as of period end. |

| † | Forward Commitment Transaction. |

| (a) | Payment in-kind security. |

| (b) | Security is not accruing income as of the date of this report. |

| (c) | Security did not produce income within the last twelve months. |

| (d) | Coupon represents a weighted average yield to maturity. |

| (e) | Zero coupon security. |

| (f) | Principal amount of security is adjusted for inflation. |

| (g) | Perpetual maturity; date shown, if applicable, represents next contractual call date. |

| (h) | Security is subject to a forbearance agreement entered into by the Fund which forbears the Fund from taking action to, among other things, accelerate and collect payments on the subject note with respect to specified events of default. |

| (i) | Contingent convertible security. |

| 42 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

(j) RESTRICTED SECURITIES:

| Issuer Description | Acquisition Date |

Cost | Market Value |

Market Value as Percentage of Net Assets |

||||||||||||

| Dommo Energia S.A. |

12/26/2017 | $ | 1 | $ | 1 | 0.00 | % | |||||||||

| Dommo Energia S.A. |

12/03/2019 | 4 | 5 | 0.00 | ||||||||||||

| Eneva S.A. |

12/21/2017 - 12/03/2019 | 4 | 7 | 0.00 | ||||||||||||

| Uniti Group, Inc |

03/13/2020 | 0 | 0 | 0.00 | ||||||||||||

| Westmoreland Mining Holdings LLC |

03/26/2019 | 0 | 0 | 0.00 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| $ | 9 | $ | 13 | 0.00 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

BORROWINGS AND OTHER FINANCING TRANSACTIONS

(k) REPURCHASE AGREEMENTS:

| Counterparty | Lending Rate |

Settlement Date |

Maturity Date |

Principal Amount |

Collateralized By | Collateral (Received) |

Repurchase Agreements, at Value |

Repurchase Agreement Proceeds to be Received |

||||||||||||||||||||||

| FICC |

0.000 | % | 06/30/2020 | 07/01/2020 | $ | 1,101 | U.S. Treasury Inflation Protected Securities 0.125% due 04/15/2022 | $ | (1,123 | ) | $ | 1,101 | $ | 1,101 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total Repurchase Agreements |

|

$ | (1,123 | ) | $ | 1,101 | $ | 1,101 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||

REVERSE REPURCHASE AGREEMENTS:

| Counterparty | Borrowing Rate(1) |

Settlement Date |

Maturity Date |

Amount Borrowed(1) |

Payable for Reverse Repurchase Agreements |

|||||||||||||||

| BOS |

0.210 | % | 06/18/2020 | 07/02/2020 | $ | (685 | ) | $ | (685 | ) | ||||||||||

| BSN |

0.240 | 04/13/2020 | 07/13/2020 | (2,498 | ) | (2,500 | ) | |||||||||||||

| FOB |

0.600 | 05/05/2020 | TBD | (2) | (192 | ) | (192 | ) | ||||||||||||

| 0.900 | 05/05/2020 | TBD | (2) | (184 | ) | (185 | ) | |||||||||||||

| TDM |

0.500 | 06/12/2020 | TBD | (2) | (2,637 | ) | (2,637 | ) | ||||||||||||

|

|

|

|||||||||||||||||||

| Total Reverse Repurchase Agreements |

|

$ | (6,199 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||||

SALE-BUYBACK TRANSACTIONS:

| Counterparty | Borrowing Rate(1) |

Borrowing Date |

Maturity Date |

Amount Borrowed(1) |

Payable for Sale-Buyback Transactions |

|||||||||||||||

| TDM |

0.210 | % | 06/29/2020 | 07/02/2020 | $ | (560 | ) | $ | (560 | ) | ||||||||||

|

|

|

|||||||||||||||||||

| Total Sale-Buyback Transactions |

|

$ | (560 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||||

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 43 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

BORROWINGS AND OTHER FINANCING TRANSACTIONS SUMMARY

The following is a summary by counterparty of the market value of Borrowings and Other Financing Transactions and collateral pledged/(received) as of June 30, 2020:

| Counterparty | Repurchase Agreement Proceeds to be Received |

Payable for Reverse Repurchase Agreements |

Payable for Sale-Buyback Transactions |

Total Borrowings and Other Financing Transactions |

Collateral Pledged/ (Received) |

Net Exposure(3) | ||||||||||||||||||

| Global/Master Repurchase Agreement |

| |||||||||||||||||||||||

| BOS |

$ | 0 | $ | (685 | ) | $ | 0 | $ | (685 | ) | $ | 690 | $ | 5 | ||||||||||

| BSN |

0 | (2,500 | ) | 0 | (2,500 | ) | 2,484 | (16 | ) | |||||||||||||||

| FICC |

1,101 | 0 | 0 | 1,101 | (1,123 | ) | (22 | ) | ||||||||||||||||

| FOB |

0 | (377 | ) | 0 | (377 | ) | 428 | 51 | ||||||||||||||||

| TDM |

0 | (2,637 | ) | 0 | (2,637 | ) | 2,835 | 198 | ||||||||||||||||

| Master Securities Forward Transaction Agreement |

||||||||||||||||||||||||

| TDM |

0 | 0 | (560 | ) | (560 | ) | 552 | (8 | ) | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Borrowings and Other Financing Transactions |

$ | 1,101 | $ | (6,199 | ) | $ | (560 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

CERTAIN TRANSFERS ACCOUNTED FOR AS SECURED BORROWINGS

Remaining Contractual Maturity of the Agreements

| Overnight and Continuous |

Up to 30 days | 31-90 days | Greater Than 90 days | Total | ||||||||||||||||

| Reverse Repurchase Agreements |

| |||||||||||||||||||

| Corporate Bonds & Notes |

$ | 0 | $ | 0 | $ | 0 | $ | (3,014 | ) | $ | (3,014 | ) | ||||||||

| U.S. Treasury Obligations |

0 | (3,185 | ) | 0 | 0 | (3,185 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 0 | $ | (3,185 | ) | $ | 0 | $ | (3,014 | ) | $ | (6,199 | ) | |||||||

| Sale-Buyback Transactions |

| |||||||||||||||||||

| U.S. Treasury Obligations |

0 | (560 | ) | 0 | 0 | (560 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 0 | $ | (560 | ) | $ | 0 | $ | 0 | $ | (560 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Borrowings |

$ | 0 | $ | (3,745 | ) | $ | 0 | $ | (3,014 | ) | $ | (6,759 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Payable for reverse repurchase agreements and sale-buyback financing transactions |

|

$ | (6,759 | ) | ||||||||||||||||

|

|

|

|||||||||||||||||||

| (l) | Securities with an aggregate market value of $6,989 have been pledged as collateral under the terms of the above master agreements as of June 30, 2020. |

| (1) | The average amount of borrowings outstanding during the period ended June 30, 2020 was $(3,594) at a weighted average interest rate of 1.284%. Average borrowings may include reverse repurchase agreements and sale-buyback transactions, if held during the period. |

| (2) | Open maturity reverse repurchase agreement. |

| (3) | Net Exposure represents the net receivable/(payable) that would be due from/to the counterparty in the event of default. Exposure from borrowings and other financing transactions can only be netted across transactions governed under the same master agreement with the same legal entity. See Note 8, Master Netting Arrangements, in the Notes to Financial Statements for more information. |

| 44 | PIMCO EQUITY SERIES | See Accompanying Notes |

Table of Contents

June 30, 2020

(m) FINANCIAL DERIVATIVE INSTRUMENTS: EXCHANGE-TRADED OR CENTRALLY CLEARED

PURCHASED OPTIONS:

OPTIONS ON EXCHANGE-TRADED FUTURES CONTRACTS

| Description | Strike Price |

Expiration Date |

# of Contracts |

Notional Amount |

Cost | Market Value |

||||||||||||||||||

| Put - CBOT U.S. Treasury 10-Year Note September 2020 Futures |

$ | 95.000 | 08/21/2020 | 132 | $ | 132 | $ | 1 | $ | 0 | ||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Purchased Options |

|

$ | 1 | $ | 0 | |||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

FUTURES CONTRACTS:

LONG FUTURES CONTRACTS

| Description | Expiration Month |

# of Contracts |

Notional Amount |

Unrealized Appreciation/ (Depreciation) |

Variation Margin | |||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||

| U.S. Treasury 10-Year Note September Futures |

09/2020 | 132 | $ | 18,371 | $ | 51 | $ | 0 | $ | (21 | ) | |||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

SHORT FUTURES CONTRACTS

| Description | Expiration Month |

# of Contracts |

Notional Amount |

Unrealized Appreciation/ (Depreciation) |

Variation Margin | |||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||

| Australia Government 10-Year Bond September Futures |

09/2020 | 18 | $ | (1,848 | ) | $ | (30 | ) | $ | 3 | $ | (1 | ) | |||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Futures Contracts |

|

$ | 21 | $ | 3 | $ | (22 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

SWAP AGREEMENTS:

CREDIT DEFAULT SWAPS ON CREDIT INDICES - BUY PROTECTION(1)

| Index/Tranches | Fixed (Pay) Rate |

Payment Frequency |

Maturity Date |

Notional Amount(3) |

Premiums Paid/ (Received) |

Unrealized Appreciation/ (Depreciation) |

Market Value(4) |

Variation Margin | ||||||||||||||||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||||||||||||||||||

| CDX.HY-33 5-Year Index |

(5.000 | )% | Quarterly | 12/20/2024 | $ | 276 | $ | (18 | ) | $ | 19 | $ | 1 | $ | 0 | $ | (2 | ) | ||||||||||||||||||||||

| CDX.IG-31 5-Year Index |

(1.000 | ) | Quarterly | 12/20/2023 | 100 | (2 | ) | 1 | (1 | ) | 0 | 0 | ||||||||||||||||||||||||||||

| CDX.IG-33 5-Year Index |

(1.000 | ) | Quarterly | 12/20/2024 | 900 | 1 | (11 | ) | (10 | ) | 0 | (1 | ) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| $ | (19 | ) | $ | 9 | $ | (10 | ) | $ | 0 | $ | (3 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

CREDIT DEFAULT SWAPS ON CREDIT INDICES - SELL PROTECTION(2)

| Index/Tranches | Fixed Receive Rate |

Payment Frequency |

Maturity Date |

Notional Amount(3) |

Premiums Paid/ (Received) |

Unrealized Appreciation/ (Depreciation) |

Market Value(4) |

Variation Margin | ||||||||||||||||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||||||||||||||||||

| CDX.EM-33 5-Year Index |

1.000 | % | Quarterly | 06/20/2025 | $ 285 | $ | (32 | ) | $ | 19 | $ | (13 | ) | $ | 0 | $ | 0 | |||||||||||||||||||||||

| iTraxx Europe Main 33 5-Year Index |

1.000 | Quarterly | 06/20/2025 | EUR 800 | 12 | 3 | 15 | 3 | 0 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| $ | (20 | ) | $ | 22 | $ | 2 | $ | 3 | $ | 0 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| See Accompanying Notes | ANNUAL REPORT | JUNE 30, 2020 | 45 |

Table of Contents

Schedule of Investments PIMCO Dividend and Income Fund (Cont.)

INTEREST RATE SWAPS

| Pay/ Receive Floating Rate |

Floating Rate Index | Fixed Rate | Payment Frequency |

Maturity Date |

Notional Amount |

Premiums Paid/ (Received) |

Unrealized Appreciation/ (Depreciation) |

Market Value |

Variation Margin | |||||||||||||||||||||||||||

| Asset | Liability | |||||||||||||||||||||||||||||||||||

| Pay | 1-Year BRL-CDI | 5.830 | % | Maturity | 01/02/2023 | BRL | 800 | $ | 0 | $ | 7 | $ | 7 | $ | 0 | $ | 0 | |||||||||||||||||||

| Pay | 1-Year BRL-CDI | 5.836 | Maturity | 01/02/2023 | 600 | 0 | 5 | 5 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 1-Year BRL-CDI | 5.855 | Maturity | 01/02/2023 | 200 | 0 | 2 | 2 | 0 | 0 | ||||||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.500 | Semi-Annual | 12/18/2021 | $ | 100 | 0 | (2 | ) | (2 | ) | 0 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.000 | Semi-Annual | 06/17/2022 | 500 | 6 | (14 | ) | (8 | ) | 0 | 0 | ||||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.500 | Semi-Annual | 12/18/2024 | 3,100 | (157 | ) | (151 | ) | (308 | ) | 1 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 3.000 | Semi-Annual | 06/19/2026 | 2,300 | (84 | ) | (275 | ) | (359 | ) | 2 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.740 | Semi-Annual | 12/16/2026 | 100 | (1 | ) | (8 | ) | (9 | ) | 0 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.250 | Semi-Annual | 06/20/2028 | 4,900 | 108 | (778 | ) | (670 | ) | 7 | 0 | ||||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.000 | Semi-Annual | 12/10/2029 | 100 | 0 | (13 | ) | (13 | ) | 0 | 0 | ||||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.500 | Semi-Annual | 12/18/2029 | 200 | 6 | (23 | ) | (17 | ) | 0 | 0 | ||||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.750 | Semi-Annual | 01/15/2030 | 300 | (4 | ) | (30 | ) | (34 | ) | 1 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.000 | Semi-Annual | 02/12/2030 | 200 | (4 | ) | (24 | ) | (28 | ) | 1 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.000 | Semi-Annual | 03/10/2030 | 100 | 0 | (14 | ) | (14 | ) | 0 | 0 | ||||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.250 | Semi-Annual | 06/17/2030 | 2,400 | 114 | (259 | ) | (145 | ) | 5 | 0 | ||||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.910 | Semi-Annual | 10/17/2049 | 100 | (2 | ) | (25 | ) | (27 | ) | 1 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.895 | Semi-Annual | 10/18/2049 | 100 | (2 | ) | (24 | ) | (26 | ) | 1 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.250 | Semi-Annual | 12/11/2049 | 900 | (2 | ) | (320 | ) | (322 | ) | 9 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.000 | Semi-Annual | 01/15/2050 | 100 | (1 | ) | (29 | ) | (30 | ) | 1 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.625 | Semi-Annual | 01/16/2050 | 100 | (1 | ) | (18 | ) | (19 | ) | 1 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.750 | Semi-Annual | 01/22/2050 | 500 | (3 | ) | (111 | ) | (114 | ) | 5 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 1.625 | Semi-Annual | 02/03/2050 | 300 | (1 | ) | (57 | ) | (58 | ) | 3 | 0 | |||||||||||||||||||||||

| Receive | 3-Month USD-LIBOR | 2.250 | Semi-Annual | 03/12/2050 | 600 | (2 | ) | (218 | ) | (220 | ) | 6 | 0 | |||||||||||||||||||||||

| Pay | 3-Month ZAR-JIBAR | 7.250 | Quarterly | 09/19/2023 | ZAR | 900 | 0 | 5 | 5 | 0 | 0 | |||||||||||||||||||||||||

| Receive | 3-Month ZAR-JIBAR | 8.300 | Quarterly | 03/15/2027 | 600 | (2 | ) | (3 | ) | (5 | ) | 0 | 0 | |||||||||||||||||||||||

| Pay | 6-Month AUD-BBR-BBSW | 2.750 | Semi-Annual | 06/17/2026 | AUD | 5,080 | 175 | 294 | 469 | 2 | 0 | |||||||||||||||||||||||||

| Receive | 6-Month AUD-BBR-BBSW | 3.000 | Semi-Annual | 03/21/2027 | 80 | (1 | ) | (8 | ) | (9 | ) | 0 | 0 | |||||||||||||||||||||||

| Receive | 6-Month EUR-EURIBOR | 0.150 | Annual | 03/18/2030 | EUR | 800 | 15 | (21 | ) | (6 | ) | 0 | (2 | ) | ||||||||||||||||||||||

| Receive | 6-Month GBP-LIBOR | 0.750 | Semi-Annual | 03/18/2030 | GBP | 993 | 10 | (59 | ) | (49 | ) | 0 | (3 | ) | ||||||||||||||||||||||

| Receive | 6-Month JPY-LIBOR | 0.354 | Semi-Annual | 01/18/2028 | JPY | 20,000 | 0 | (5 | ) | (5 | ) | 0 | 0 | |||||||||||||||||||||||

| Receive | 6-Month JPY-LIBOR | 0.300 | Semi-Annual | 03/20/2028 | 85,000 | 6 | (25 | ) | (19 | ) | 1 | 0 | ||||||||||||||||||||||||

| Receive | 6-Month JPY-LIBOR | 0.450 | Semi-Annual | 03/20/2029 | 530,000 | (26 | ) | (166 | ) | (192 | ) | 6 | 0 | |||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.020 | Semi-Annual | 04/20/2029 | 10,000 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.002 | Semi-Annual | 04/22/2029 | 20,000 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.035 | Semi-Annual | 05/11/2029 | 10,000 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.024 | Semi-Annual | 05/12/2029 | 20,000 | 0 | (1 | ) | (1 | ) | 0 | 0 | ||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.011 | Semi-Annual | 05/13/2029 | 10,000 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.011 | Semi-Annual | 05/14/2029 | 10,000 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.036 | Semi-Annual | 05/20/2029 | 20,000 | 0 | (1 | ) | (1 | ) | 0 | 0 | ||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.021 | Semi-Annual | 05/21/2029 | 20,000 | 0 | (1 | ) | (1 | ) | 0 | 0 | ||||||||||||||||||||||||

| Pay | 6-Month JPY-LIBOR | 0.025 | Semi-Annual | 05/22/2029 | 1,000 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Receive | 28-Day MXN-TIIE | 6.950 | Lunar | 06/17/2022 | MXN | 32,100 | (5 | ) | (63 | ) | (68 | ) | 0 | (1 | ) | |||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 7.640 | Lunar | 01/03/2023 | 200 | 0 | 1 | 1 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 7.645 | Lunar | 01/03/2023 | 2,000 | 0 | 7 | 7 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 7.745 | Lunar | 01/05/2023 | 1,400 | 0 | 5 | 5 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 7.610 | Lunar | 01/23/2023 | 6,000 | (2 | ) | 23 | 21 | 0 | 0 | |||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 7.805 | Lunar | 02/06/2023 | 3,400 | 0 | 12 | 12 | 0 | 0 | ||||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 7.820 | Lunar | 02/06/2023 | 3,400 | (1 | ) | 13 | 12 | 0 | 0 | |||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 5.950 | Lunar | 01/30/2026 | 600 | (4 | ) | 5 | 1 | 0 | 0 | |||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 5.990 | Lunar | 01/30/2026 | 4,300 | (4 | ) | 14 | 10 | 0 | 0 | |||||||||||||||||||||||||

| Pay | 28-Day MXN-TIIE | 6.080 | Lunar | 03/10/2026 | 15,500 | (15 | ) | 53 | 38 | 1 | 0 | |||||||||||||||||||||||||