PIMCO Equity Series

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22375

PIMCO Equity Series

(Exact name of registrant as specified in charter)

650 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive office)

Trent W. Walker

Treasurer (Principal Financial & Accounting Officer)

PIMCO Equity Series

650

Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s

telephone number, including area code: (888) 877-4626

Date of fiscal year end: June 30

Date of reporting period: December 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission

to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory,

disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and

the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control

number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The

OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507

| Item 1. |

Reports to Shareholders. |

The following is a copy of the report transmitted to

shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

• PIMCO Equity Series—Institutional, P, Administrative, D, A, C and R Classes

• PIMCO Equity Series RAE Fundamental Funds—Institutional, P, A and C Classes

• PIMCO Equity Series RealPathTM Blend Funds—Institutional, Administrative and A

Classes

PIMCO

Equity Series®

Semiannual Report

December 31, 2015

PIMCO Balanced Income Fund

PIMCO Dividend and Income Builder Fund

PIMCO EqS® Long/Short Fund

PIMCO Global Dividend Fund

PIMCO International Dividend Fund

PIMCO U.S. Dividend Fund

Share Classes

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO Equity Series prospectus. The Shareholder Reports for the other series of the PIMCO Equity Series

are printed separately.

Chairman’s Letter

Dear Shareholder,

Please find enclosed the Semiannual Report for the PIMCO Equity Series covering

the six-month reporting period ended December 31, 2015. The following pages contain specific details about the investment performance of each fund and a discussion of the factors that most affected performance during the reporting period.

Highlights of the financial markets during the six-month reporting

period include:

| |

n

|

|

Heightened market volatility throughout the reporting period was sparked by a mix of investor concerns including geopolitical developments, monetary

policy and the potential for slowing global economic growth, which generally contributed to dampened investor sentiment. In particular, increasing concern over the outlook for Chinese growth sent commodity prices and inflation expectations lower,

while also negatively impacting prices of emerging market (“EM”) debt and equities. In addition, the Chinese equity market began a strong decline in June 2015, which prompted the Chinese government to prop-up equity share prices and

devalue the Chinese yuan. Volatility in Chinese equity markets continued into January 2016 on renewed concern over slowing Chinese economic growth. Furthermore, rising tension in the Middle East and the continued debt crisis in Greece also

contributed to investor unease throughout the reporting period. |

| |

n

|

|

Economic data in the U.S. continued to confirm a healthy economy, particularly labor market indicators such as employment and wages. Still, signs of

caution remained, particularly as U.S. consumers appeared to be more selective in their spending and chose to save rather than spend their windfall from lower gas prices. Additionally, consumer sentiment and certain housing indicators softened

towards the end of the reporting period, and December 2015 U.S. manufacturing data indicated the fastest contraction in six years. Within the Eurozone, volatility increased despite gradual improvement in the underlying economies. Eurozone economic

data also showed generally positive signs of an early recovery but were tempered slightly by sluggish inflation. |

| |

n

|

|

The theme of divergent global central bank monetary policy continued throughout the reporting period. The European Central Bank (“ECB”)

expressed its commitment to increase quantitative easing (or large-scale asset purchases), along with the Bank of Japan and the People’s Bank of China who also indicated their intent to accelerate such measures. The Federal Reserve

(“Fed”), on the other hand, moved on December 16 to raise the Federal Funds Rate by 0.25% to a new range of 0.25% – 0.50%, marking its first rate hike in nine years. However, the Fed noted that future increases in its target rate

would be “gradual” and in-line with their previous projections, which helped to ease investor concerns. Outside of the reporting period on January 27, the Fed opted to leave the Federal Funds Rate unchanged, noting their intent to closely

monitor how the global economy and markets influence the U.S. economic outlook. |

| |

n

|

|

U.S. equities, as represented by the S&P 500 Index, returned 0.15% due to an improving economic outlook and stronger jobs growth. Internationally,

equity markets experienced weak performance, as the MSCI EAFE Net Dividend Index (USD Hedged) declined 3.13% and the MSCI EAFE Net Dividend Index (USD Unhedged) declined 6.01% over the reporting period. During the first half of the reporting period,

declining commodities prices and China’s economic deceleration drove concerns of slowing global growth, which weighed on equities. However, in the last half of the reporting period, developed market equities rebounded from lows reached in the

first half as the theme of diverging monetary policy came into focus with the Federal Reserve raising interest rates for the first time in nearly a decade, while central banks around the world continued to implement accommodative monetary policies.

|

| |

n

|

|

Emerging market (“EM”) equities, as represented by the MSCI Emerging Markets Index (Net Dividends in USD), declined 17.36% over the reporting

period. Concerns over China’s struggling economy continued as weak data and several attempts to support the Chinese equity market by the People’s Bank of China added to fears of slowing global growth. In addition, Brazil’s economic

and political woes continued over the reporting period as the country’s credit rating was downgraded by S&P and Fitch to sub-investment grade, while President Dilma Rousseff faced increased scrutiny over her ability to revive the

country’s economy. |

| |

n

|

|

Style-wise, growth equities outperformed value equities globally as the MSCI All Country World Growth Index (Net Dividends in USD) declined 3.13% and the

MSCI All Country World Value Index (Net Dividends in USD) declined 6.68%. In general, the consumer staples and information technology sectors were the top performing equity sectors, while the energy and materials sectors were the worst performing

equity sectors over the reporting period. |

| |

n

|

|

U.S. Treasuries, as represented by the Barclays U.S. Treasury Index, returned 0.81% for the reporting period. Longer-maturity yields (i.e., ten to thirty

year yields) declined, with prices therefore higher, while shorter-maturity yields (i.e., six month to seven year yields) rose. The benchmark ten-year U.S. Treasury note yielded 2.27% at the end of the reporting period, down from 2.35% on June 30,

2015. The Barclays U.S. Aggregate Index, a widely used index of U.S. investment-grade bonds, returned 0.65% for the reporting period. |

If you have any questions regarding the PIMCO Equity Series, please contact your account manager or financial adviser, or call one of our shareholder

associates at 888.87.PIMCO (888.877.4626). We also invite you to visit our website at www.pimco.com to learn more about our views and global thought leadership.

Thank you again for the trust you have placed in us. We value your commitment

and will continue to work diligently to meet your broad investment needs.

|

|

|

|

|

Sincerely,

Brent R. Harris

Chairman of the Board,

PIMCO Equity Series

February 22, 2016 |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2015 |

|

3 |

Important Information About the Funds

We believe that equity funds have an important role to play in a well diversified investment

portfolio. It is important to note, however, that equity funds are subject to notable risks. Among other things, equity and equity-related securities may decline in value due to both real and perceived general market, economic, and industry

conditions.

The values of equity securities, such as

common stocks and preferred stocks, have historically risen and fallen in periodic cycles and may decline due to general market conditions, which are not specifically related to a particular company, such as real or perceived adverse economic

conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Equity securities may also decline due to factors that affect a particular industry or industries, such

as labor shortages, increased production costs and competitive conditions within an industry. In addition, the value of an equity security may decline for a number of reasons that directly relate to the issuer, such as management performance,

financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets. Different types of equity securities may react differently to these

developments and a change in the financial condition of a single issuer may affect securities markets as a whole.

During a general downturn in the securities markets, multiple asset classes, including equity securities, may decline in value simultaneously. The market price of equity securities owned by a

Fund may go up or down, sometimes rapidly or unpredictably. Equity securities generally have greater price volatility than fixed income securities and common stocks generally have the greatest appreciation and depreciation potential of all equity

securities.

The Funds may be subject to various

risks as described in the Funds’ prospectus. Some of these risks may include, but are not limited to, the following: new/small fund risk, equity risk, dividend-oriented stocks risk, value investing risk, foreign (non-U.S.) investment risk,

emerging markets risk, sovereign debt risk, market risk, issuer risk, interest rate risk, call risk, credit risk, high yield and distressed company risk, cash holdings risk, currency risk, real estate risk, liquidity risk, leveraging risk, issuer

non-diversification risk, management risk, small-cap and mid-cap company risk, derivatives risk, mortgage-related and other asset-backed securities risk, short sale risk

and convertible securities risk. A complete description of these and other risks is contained in the Funds’ prospectus.

The Funds may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve

certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, leverage risk, management risk and the risk that a Fund

may not be able to close out a position when it would be most advantageous to do so. Certain derivative transactions may have a leveraging effect on a Fund. For example, a small investment in a

derivative instrument may have a significant impact on a Fund’s exposure to interest rates, currency exchange rates or other investments. As a result, a relatively small price movement in an asset, instrument or component of the index

underlying a derivative instrument may cause an immediate and substantial loss or gain, which translates into heightened volatility for the Funds. A Fund may engage in such transactions regardless of whether the Fund owns the asset, instrument or

components of the index underlying the derivative instrument. A Fund may invest a significant portion of its assets in these types of instruments. If it does, the Fund’s investment exposure could far exceed the value of its portfolio securities

and its investment performance could be primarily dependent upon securities it does not own. Investing in foreign (non-U.S.) securities may entail risk due to foreign (non-U.S.) economic and political developments; this risk may be

increased when investing in emerging markets.

The

value of an equity security of an issuer that has paid dividends in the past may decrease if the issuer reduces or eliminates future payments to its shareholders. If the dividends or distributions received by a Fund decrease, the Fund may have less

income to distribute to the Fund’s shareholders. In addition, during certain market conditions, the equity securities of issuers that have paid regular dividends or distributions may not be widely available or may be highly concentrated in

particular sectors of the market. A Fund may invest a significant portion of its assets in value stocks. Value stocks may perform differently from other types of stocks and the market as a whole. A value stock may decrease in price or may not

increase in price as anticipated by PIMCO if it continues to be undervalued by the market or the factors that the portfolio manager believes will cause the stock price to increase do not occur.

The geographical classification of foreign (non-U.S.) securities

in this report are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

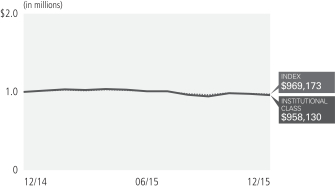

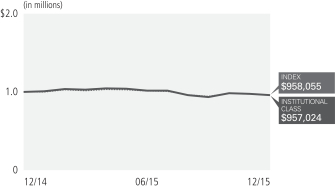

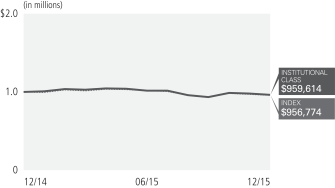

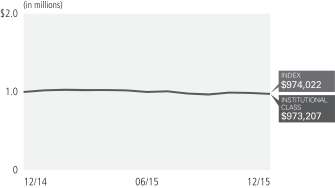

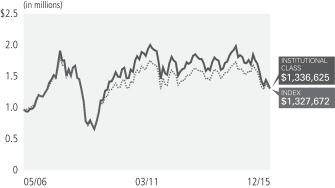

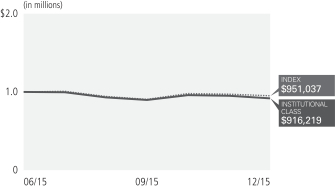

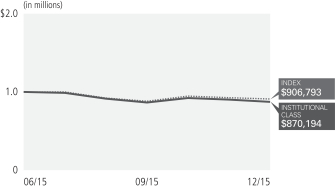

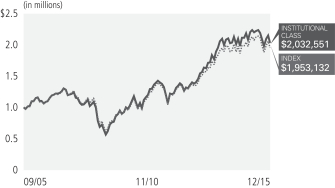

On each individual Fund Summary page in this Shareholder Report,

the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Class A shares are subject to an initial sales charge. A Contingent Deferred Sales

Charge (“CDSC”) may be imposed in certain circumstances on Class A shares that are purchased without an initial sales charge and then redeemed during the first (i) 18 months after purchase for purchases made prior to

August 10, 2015 and (ii) 12 months after purchase for purchases made on or after August 10, 2015. The Cumulative Returns chart reflects only Institutional Class performance.

Performance for Class P, Administrative Class, Class D, Class A, Class C and Class R shares, if applicable, are typically lower than Institutional Class performance due

to the lower expenses paid by Institutional Class shares. Performance shown is net of fees and expenses. A Fund’s total annual operating expense ratios on each individual Fund Summary page are as of the currently effective prospectus, as

supplemented to date. The Cumulative Returns chart assumes the initial investment of $1,000,000 was made at the end of the month that the Institutional Class of the relevant Fund commenced operations. The minimum initial investment

amount for Institutional Class, Class P and Administrative Class shares is $1,000,000. The minimum initial investment amount for Class A, Class C and Class D shares is $1,000.

There is no minimum initial investment for Class R shares. Each Fund measures its performance against a broad-based securities market index (“benchmark index”). The benchmark index does not take into account fees, expenses, or taxes. A

Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The following

table discloses the inception dates of each Fund and its respective share classes along with each Fund’s diversification status as of period end:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund Name |

|

|

|

Fund

Inception |

|

|

Institutional

Class |

|

|

Class P |

|

|

Class D |

|

|

Class A |

|

|

Class C |

|

|

Class R |

|

|

Diversification

Status |

| PIMCO Balanced Income Fund |

|

|

|

|

03/31/14 |

|

|

|

03/31/14 |

|

|

|

03/31/14 |

|

|

|

03/31/14 |

|

|

|

03/31/14 |

|

|

|

03/31/14 |

|

|

|

— |

|

|

Diversified |

| PIMCO Dividend and Income Builder Fund |

|

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

Diversified |

| PIMCO EqS® Long/Short Fund |

|

|

|

|

04/20/12 |

|

|

|

04/20/12 |

|

|

|

04/30/12 |

|

|

|

04/30/12 |

|

|

|

04/30/12 |

|

|

|

04/30/12 |

|

|

|

— |

|

|

Non-diversified |

| PIMCO Global Dividend Fund |

|

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

Diversified |

| PIMCO International Dividend Fund |

|

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

— |

|

|

Diversified |

| PIMCO U.S. Dividend Fund |

|

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

12/15/14 |

|

|

|

— |

|

|

Diversified |

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal

Deposit Insurance Corporation (“FDIC”) or any other government agency. It is possible to lose money on investments in a Fund.

The Trustees are responsible generally for overseeing the management of the Trust. The Trustees authorize the Trust to enter into service

agreements with the Adviser, the Distributor, the Administrator and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Trust

and the Funds. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither a Fund’s prospectus nor a Fund’s summary prospectus, the Trust’s Statement of Additional Information (“SAI”),

any contracts filed as exhibits to the Trust’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Trust or a Fund creates a contract between or among

any shareholder of a Fund, on the one hand, and the Trust, a Fund, a service provider to the Trust or a Fund, and/or the Trustees or officers of the Trust, on the other hand. The Trustees (or the Trust and its officers, service providers or other

delegates acting under authority of the Trustees) may amend the most recent prospectus or use a new prospectus, summary prospectus or SAI with respect to a Fund or the Trust, and/or amend, file and/or issue any other communications, disclosure

documents or regulatory filings, and may amend or enter into any contracts to which the Trust or a Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to any Fund, without

shareholder

input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval

requirement is specifically disclosed in the Trust’s then-current prospectus or SAI.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers

Act of 1940, as amended. The Proxy Policy has been adopted by PIMCO Equity Series as the policies and procedures that PIMCO will use when voting proxies on behalf of a Fund. A description of the policies and procedures that PIMCO uses to vote

proxies relating to portfolio securities of a Fund, and information about how the Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30th, are available without charge, upon request,

by calling the Trust at (888) 87-PIMCO, on the Fund’s website at www.pimco.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

PIMCO Equity Series files a complete schedule of

each Fund’s portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of a Fund’s Form N-Q is available on the

SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. A Fund’s Form N-Q will also be available without charge, upon request,

by calling the Trust at (888) 87-PIMCO and on the Fund’s website at www.pimco.com. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2015 |

|

5 |

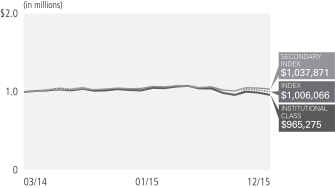

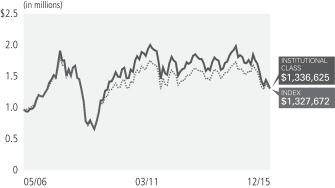

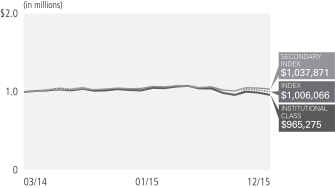

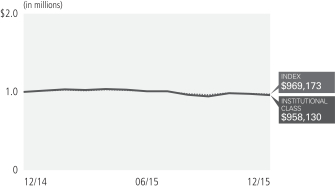

PIMCO Balanced Income Fund

Cumulative Returns Through December 31, 2015

Investment Objective and Strategy Overview

| |

» |

|

The PIMCO Balanced Income Fund seeks to maximize current income while providing long-term capital appreciation by investing under normal circumstances in

a diversified portfolio of income-producing equity and fixed income securities, each of which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. The Fund will typically invest at least 25% of its

net assets in equity and equity related securities and at least 25% of its net assets in fixed income securities. The Fund’s investments in equity and equity-related securities include common and preferred stock (and securities convertible

into, or that PIMCO expects to be exchanged for, common or preferred stock), as well as securities issued by real estate investment trusts, master limited partnerships and other equity trusts and depositary receipts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2015 |

|

| |

|

|

|

6 Months* |

|

|

1 Year |

|

|

Fund Inception

(03/31/14) |

|

|

|

PIMCO Balanced Income Fund Institutional Class |

|

|

(7.71)% |

|

|

|

(5.96)% |

|

|

|

(2.00)% |

|

|

|

PIMCO Balanced Income Fund Class P |

|

|

(7.76)% |

|

|

|

(6.06)% |

|

|

|

(2.10)% |

|

|

|

PIMCO Balanced Income Fund Class D |

|

|

(7.88)% |

|

|

|

(6.39)% |

|

|

|

(2.34)% |

|

|

|

PIMCO Balanced Income Fund Class A |

|

|

(7.88)% |

|

|

|

(6.39)% |

|

|

|

(2.34)% |

|

|

|

PIMCO Balanced Income Fund Class A (adjusted) |

|

|

(12.91)% |

|

|

|

(11.52)% |

|

|

|

(5.43)% |

|

|

|

PIMCO Balanced Income Fund Class C |

|

|

(8.26)% |

|

|

|

(7.12)% |

|

|

|

(3.09)% |

|

|

|

PIMCO Balanced Income Fund Class C (adjusted) |

|

|

(9.14)% |

|

|

|

(8.01)% |

|

|

|

(3.09)% |

|

|

|

MSCI All Country World Index± |

|

|

(4.90)% |

|

|

|

(2.36)% |

|

|

|

0.35% |

|

|

|

50% MSCI ACWI/50% Barclays Global Aggregate Index hedged USD±± |

|

|

(1.64)% |

|

|

|

(0.46)% |

|

|

|

2.14% |

|

All Fund returns are net of

fees and expenses.

* Cumulative return.

± The MSCI All Country World Index is

a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index consists of 46 country indices comprising 23 developed and 23 emerging market

country indices.

±± The benchmark is a blend of

50% MSCI All Country World Index/50% Barclays Global Aggregate USD Hedged. The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and

emerging markets. The Index consists of 46 country indices comprising 23 developed and 23 emerging market country indices. Barclays Global Aggregate (USD Hedged) Index provides a broad-based measure of the global investment-grade fixed income

markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian Government securities, and USD

investment grade 144A securities.

It is not

possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current

performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of

taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual

operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 1.03% for the Institutional Class shares, 1.13% for the Class P shares, 1.38% for the Class D shares, 1.38% for the Class A shares, and 2.13%

for the Class C shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. For performance current to the most recent month-end, visit www.pimco.com.

|

|

|

|

|

|

|

|

|

| Institutional Class - PBITX |

|

Class P - PBIEX |

|

Class D - PBIDX |

|

Class A - PBIAX |

|

Class C - PBICX |

Top 10 Holdings1

|

|

|

|

|

|

|

| U.S. Treasury Bonds |

|

|

|

|

2.9% |

|

| QUALCOMM, Inc. |

|

|

|

|

2.5% |

|

| PG&E Corp. |

|

|

|

|

2.5% |

|

| Vodafone Group PLC |

|

|

|

|

2.4% |

|

| AT&T, Inc. |

|

|

|

|

2.2% |

|

| HSBC Holdings PLC |

|

|

|

|

2.1% |

|

| Colony Capital, Inc. ‘A’ |

|

|

|

|

2.1% |

|

| AbbVie, Inc. |

|

|

|

|

1.9% |

|

| Pfizer, Inc. |

|

|

|

|

1.9% |

|

| Roche Holding AG |

|

|

|

|

1.8% |

|

Geographic Breakdown1

|

|

|

|

|

|

|

| United States |

|

|

|

|

54.4% |

|

| United Kingdom |

|

|

|

|

8.8% |

|

| Netherlands |

|

|

|

|

3.4% |

|

| Australia |

|

|

|

|

3.2% |

|

| Brazil |

|

|

|

|

2.6% |

|

| Italy |

|

|

|

|

2.3% |

|

| France |

|

|

|

|

2.2% |

|

| Hong Kong |

|

|

|

|

1.9% |

|

| Switzerland |

|

|

|

|

1.9% |

|

| Taiwan |

|

|

|

|

1.2% |

|

| Greece |

|

|

|

|

1.2% |

|

| Canada |

|

|

|

|

1.1% |

|

| Cayman Islands |

|

|

|

|

1.0% |

|

| Other |

|

|

|

|

3.4% |

|

Sector Breakdown1

|

|

|

|

|

|

|

| Financials |

|

|

|

|

16.3% |

|

| Asset-Backed Securities |

|

|

|

|

10.8% |

|

| Health Care |

|

|

|

|

8.0% |

|

| Telecommunication Services |

|

|

|

|

8.0% |

|

| Information Technology |

|

|

|

|

7.5% |

|

| Consumer Discretionary |

|

|

|

|

7.0% |

|

| Utilities |

|

|

|

|

5.7% |

|

| Industrials |

|

|

|

|

5.4% |

|

| Non-Agency Mortgage-Backed Securities |

|

|

|

|

5.1% |

|

| U.S. Treasury Obligations |

|

|

|

|

4.4% |

|

| Consumer Staples |

|

|

|

|

3.0% |

|

| Materials |

|

|

|

|

2.1% |

|

| Bank Loan Obligations |

|

|

|

|

2.0% |

|

| Energy |

|

|

|

|

1.8% |

|

| Sovereign Issues |

|

|

|

|

1.5% |

|

1 % of Investments, at value as of 12/31/2015. Top 10 Holdings, Geographic and Sector Breakdowns solely reflect long positions. Securities sold short, financial derivative instruments and

short-term instruments are not taken into consideration.

Fund Insights

| » |

|

During the reporting period, the Fund paid ordinary quarterly dividends totaling 24 cents per share on its Institutional class shares. The dividend per

share was slightly lower for the other share classes to account for varying class-specific expenses. |

| » |

|

Stock selection within the commercial services & supplies industry detracted from relative returns, as the Fund’s overweight position in Spotless

Group Holdings within this industry significantly underperformed the MSCI All Country World Index over the reporting period. |

| » |

|

An overweight exposure to small-cap companies detracted from relative performance, as small-cap stocks underperformed the MSCI All Country World Index

over the reporting period. |

| » |

|

Over the reporting period, the top three equity contributors were NN Group NV, Ameren Corporation and Imperial Tobacco Group PLC. The top three equity

detractors were Spotless Group Holdings Ltd, Golar LNG Partners LP and Targa Resources Corp. |

| » |

|

The Fund’s fixed income allocation underperformed its fixed income benchmark, Barclays Global Aggregate USD Unhedged, primarily driven by exposure to

Brazilian 30-year duration as Brazilian 30-year yields generally rose over the reporting period. |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2015 |

|

7 |

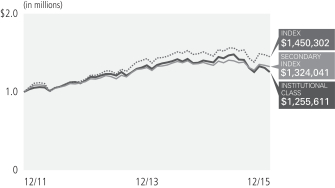

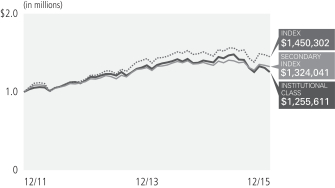

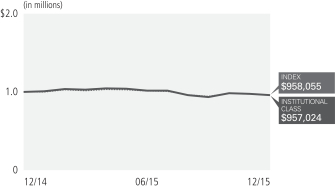

PIMCO Dividend and Income Builder Fund

Cumulative Returns Through December 31, 2015

Investment Objective and Strategy Overview

| |

» |

|

The PIMCO Dividend and Income Builder Fund seeks to provide current income that exceeds the average yield on global stocks, and to provide a growing

stream of income per share over time, with a secondary objective to seek to provide long-term capital appreciation, by investing under normal circumstances at least 80% of its assets in a diversified portfolio of income-producing investments, and

will typically invest at least 50% of its assets in equity and equity-related securities. The Fund’s investments in equity and equity-related securities include common and preferred stock (and securities convertible into, or that PIMCO expects

to be exchanged for, common or preferred stock), as well as securities issued by real estate investment trusts, master limited partnerships and other equity trusts and depositary receipts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2015 |

|

| |

|

|

|

6 Months* |

|

|

1 Year |

|

|

Fund Inception

(12/14/11) |

|

|

|

PIMCO Dividend and Income Builder Fund Institutional Class |

|

|

(11.30)% |

|

|

|

(9.70)% |

|

|

|

6.33% |

|

|

|

PIMCO Dividend and Income Builder Fund Class P |

|

|

(11.42)% |

|

|

|

(9.80)% |

|

|

|

6.23% |

|

|

|

PIMCO Dividend and Income Builder Fund Class D |

|

|

(11.56)% |

|

|

|

(10.04)% |

|

|

|

5.95% |

|

|

|

PIMCO Dividend and Income Builder Fund Class A |

|

|

(11.47)% |

|

|

|

(9.96)% |

|

|

|

5.98% |

|

|

|

PIMCO Dividend and Income Builder Fund Class A (adjusted) |

|

|

(16.37)% |

|

|

|

(14.93)% |

|

|

|

4.51% |

|

|

|

PIMCO Dividend and Income Builder Fund Class C |

|

|

(11.85)% |

|

|

|

(10.68)% |

|

|

|

5.17% |

|

|

|

PIMCO Dividend and Income Builder Fund Class C (adjusted) |

|

|

(12.66)% |

|

|

|

(11.49)% |

|

|

|

5.17% |

|

|

|

PIMCO Dividend and Income Builder Fund Class R |

|

|

(11.59)% |

|

|

|

(10.26)% |

|

|

|

5.73% |

|

|

|

MSCI All Country World Index± |

|

|

(4.90)% |

|

|

|

(2.36)% |

|

|

|

10.58% |

|

|

|

75% MSCI All Country World Index/25% Barclays Global Aggregate USD Unhedged±± |

|

|

(3.60)% |

|

|

|

(2.40)% |

|

|

|

7.95% |

|

All Fund returns are net of

fees and expenses.

* Cumulative return.

± The MSCI All Country World Index is

a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index consists of 46 country indices comprising 23 developed and 23 emerging market

country indices.

±± The benchmark is a blend of

75% MSCI All Country World Index/25% Barclays Global Aggregate USD Unhedged. The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and

emerging markets. The Index consists of 46 country indices comprising 23 developed and 23 emerging market country indices. Barclays Global Aggregate (USD Unhedged) Index provides a broad-based measure of the global investment-grade fixed income

markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian Government securities, and USD

investment grade 144A securities.

It is not

possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current

performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of

taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual

operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 1.20% for the Institutional Class shares, 1.30% for the Class P shares, 1.55% for the Class D shares, 1.55% for the Class A shares, 2.30% for

the Class C shares, and 1.80% for Class R shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. For performance current to the most recent month-end, visit www.pimco.com.

|

|

|

|

|

|

|

|

|

|

|

| Institutional Class - PQIIX |

|

Class P - PQIPX |

|

Class D - PQIDX |

|

Class A - PQIZX |

|

Class C - PQICX |

|

Class R - PQIBX |

Top 10 Holdings1

|

|

|

|

|

|

|

| PG&E Corp. |

|

|

|

|

3.7% |

|

| QUALCOMM, Inc. |

|

|

|

|

3.7% |

|

| AT&T, Inc. |

|

|

|

|

3.6% |

|

| Vodafone Group PLC |

|

|

|

|

3.6% |

|

| HSBC Holdings PLC |

|

|

|

|

3.2% |

|

| Colony Capital, Inc. ‘A’ |

|

|

|

|

3.2% |

|

| AbbVie, Inc. |

|

|

|

|

2.8% |

|

| Pfizer, Inc. |

|

|

|

|

2.8% |

|

| Roche Holding AG |

|

|

|

|

2.8% |

|

| Lloyds Banking Group PLC |

|

|

|

|

2.8% |

|

Geographic Breakdown1

|

|

|

|

|

|

|

| United States |

|

|

|

|

50.3% |

|

| United Kingdom |

|

|

|

|

13.5% |

|

| Australia |

|

|

|

|

5.1% |

|

| Netherlands |

|

|

|

|

4.2% |

|

| Italy |

|

|

|

|

3.8% |

|

| France |

|

|

|

|

3.3% |

|

| Hong Kong |

|

|

|

|

2.8% |

|

| Switzerland |

|

|

|

|

2.8% |

|

| Brazil |

|

|

|

|

2.2% |

|

| Taiwan |

|

|

|

|

1.8% |

|

| Canada |

|

|

|

|

1.6% |

|

| Japan |

|

|

|

|

1.4% |

|

| Spain |

|

|

|

|

1.4% |

|

| Greece |

|

|

|

|

1.3% |

|

| Germany |

|

|

|

|

1.0% |

|

| Other |

|

|

|

|

2.3% |

|

Sector Breakdown1

|

|

|

|

|

|

|

| Financials |

|

|

|

|

22.4% |

|

| Telecommunication Services |

|

|

|

|

12.2% |

|

| Health Care |

|

|

|

|

12.1% |

|

| Information Technology |

|

|

|

|

11.1% |

|

| Consumer Discretionary |

|

|

|

|

10.7% |

|

| Utilities |

|

|

|

|

8.4% |

|

| Industrials |

|

|

|

|

6.4% |

|

| Consumer Staples |

|

|

|

|

4.5% |

|

| Materials |

|

|

|

|

3.3% |

|

| Energy |

|

|

|

|

2.9% |

|

| Non-Agency Mortgage-Backed Securities |

|

|

|

|

2.1% |

|

| Asset-Backed Securities |

|

|

|

|

2.0% |

|

| Other |

|

|

|

|

0.7% |

|

1 % of Investments, at value as of 12/31/2015. Top 10 Holdings, Geographic and Sector Breakdowns solely reflect long positions. Securities sold short, financial derivative instruments and

short-term instruments are not taken into consideration.

Fund Insights

| » |

|

During the reporting period, the Fund paid ordinary quarterly dividends totaling 20 cents per share on its Institutional class shares. The dividend per

share was slightly lower for the other share classes to account for varying class-specific expenses. |

| » |

|

Stock selection within the commercial services & supplies industry detracted from relative returns, as the Fund’s overweight to Spotless Group

Holdings within this industry significantly underperformed the MSCI All Country World Index over the reporting period. |

| » |

|

An overweight exposure to small-cap companies detracted from relative performance, as small-cap stocks underperformed the MSCI All Country World Index

over the reporting period. |

| » |

|

Over the reporting period, the top three equity contributors were NN Group NV, Imperial Tobacco Group PLC and Ameren Corporation. The top three equity

detractors were Spotless Group Holdings Ltd, Targa Resources Corp. and Golar LNG Partners LP. |

| » |

|

The Fund’s fixed income allocation outperformed its fixed income benchmark, Barclays Global Aggregate USD Unhedged, primarily driven by select

currency underweights specifically to the euro and the British pound, as these currencies underperformed versus the U.S. dollar over the reporting period. |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2015 |

|

9 |

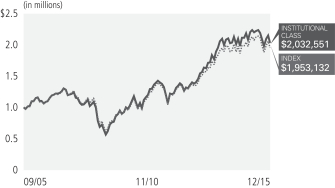

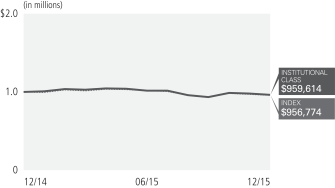

PIMCO EqS® Long/Short Fund

Cumulative Returns Through December 31, 2015*

Investment Objective and Strategy Overview

| |

» |

|

The PIMCO EqS® Long/Short Fund seeks long-term capital appreciation by investing under normal circumstances in long and short positions of equity and equity-related securities, including common and preferred

stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock), utilizing a fundamental investing style that integrates bottom-up and top-down research. The Fund will normally invest a substantial

portion of its assets in equity and equity-related securities. The Fund may also invest in fixed income securities of varying maturities, cash and cash equivalents. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2015* |

|

| |

|

|

|

6 Months** |

|

|

1 Year |

|

|

5 Year |

|

|

10 Year |

|

|

Fund Inception

(01/01/03) |

|

|

|

|

PIMCO EqS®

Long/Short Fund Institutional Class |

|

|

(2.27)% |

|

|

|

0.82% |

|

|

|

4.79% |

|

|

|

8.86% |

|

|

|

11.75% |

|

|

|

PIMCO EqS®

Long/Short Fund Class P |

|

|

(2.28)% |

|

|

|

0.74% |

|

|

|

4.74% |

|

|

|

8.84% |

|

|

|

11.73% |

|

|

|

PIMCO EqS®

Long/Short Fund Class D |

|

|

(2.46)% |

|

|

|

0.49% |

|

|

|

4.51% |

|

|

|

8.72% |

|

|

|

11.64% |

|

|

|

PIMCO EqS®

Long/Short Fund Class A |

|

|

(2.46)% |

|

|

|

0.49% |

|

|

|

4.51% |

|

|

|

8.72% |

|

|

|

11.64% |

|

|

|

PIMCO EqS®

Long/Short Fund Class A (adjusted) |

|

|

(7.79)% |

|

|

|

(5.01)% |

|

|

|

3.34% |

|

|

|

8.11% |

|

|

|

11.15% |

|

|

|

PIMCO EqS®

Long/Short Fund Class C |

|

|

(2.86)% |

|

|

|

(0.30)% |

|

|

|

3.93% |

|

|

|

8.41% |

|

|

|

11.40% |

|

|

|

PIMCO EqS®

Long/Short Fund Class C (adjusted) |

|

|

(3.82)% |

|

|

|

(1.28)% |

|

|

|

3.93% |

|

|

|

8.41% |

|

|

|

11.40% |

|

|

|

|

3 Month USD LIBOR

Index± |

|

|

0.15% |

|

|

|

0.29% |

|

|

|

0.32% |

|

|

|

1.68% |

|

|

|

1.76% |

|

All Fund returns are net of

fees and expenses.

** Cumulative return.

± The 3 Month USD LIBOR (London

Interbank Offered Rate) Index is an average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money (3 months) in England’s Eurodollar market. It is not possible to invest in

an unmanaged index.

It is not possible to invest

directly in an unmanaged index.

Performance

quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will

fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into

account the maximum sales charge of 5.50% on Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 1.91% for the

Institutional Class shares, 2.01% for the Class P shares, 2.26% for the Class D shares, 2.26% for the Class A shares, and 3.01% for the Class C shares. Details regarding any Fund’s operating expenses can be found in the Fund’s

prospectus. For performance current to the most recent month-end, visit www.pimco.com.

* For periods prior to April 20, 2012, the Fund’s performance reflects the performance when the Fund was a partnership, net of actual fees and expenses charged to individual

partnership accounts in the aggregate. If the performance had been restated to reflect the applicable fees and expenses of each share class, the performance may have been higher or lower. The Fund began operations as a partnership on January 1,

2003 and, on April 20, 2012, was reorganized into a newly-formed fund that was registered as an investment company under the Investment Company Act of 1940. Prior to the reorganization, the Fund had an investment objective, investment

strategies, investment guidelines, and restrictions that were substantially similar to those currently applicable to the Fund; however, the Fund was not registered as an investment company under the Investment Company Act of 1940 and was not subject

to its requirements or requirements imposed by the Internal Revenue Code of 1986 which, if applicable, may have adversely affected its performance. The performance of Class P, D, A and C shares for the period from April 20, 2012 to

April 30, 2012 is based on the performance of the Institutional Class shares of the Fund adjusted to reflect the fees and expenses of Class P, D, A and C shares (as applicable). The performance of each class of shares will differ as a result of

the different levels of fees and expenses applicable to each class of shares.

|

|

|

|

|

|

|

|

|

| Institutional Class - PMHIX |

|

Class P - PMHBX |

|

Class D - PMHDX |

|

Class A - PMHAX |

|

Class C - PMHCX |

Top 10 Holdings1

|

|

|

|

|

|

|

| First Data Corp. ‘A’ |

|

|

|

|

5.7% |

|

| Iron Mountain, Inc. |

|

|

|

|

5.3% |

|

| Laboratory Corp. of America Holdings |

|

|

|

|

4.8% |

|

| KAR Auction Services, Inc. |

|

|

|

|

4.2% |

|

| DST Systems, Inc. |

|

|

|

|

3.8% |

|

| Live Nation Entertainment, Inc. |

|

|

|

|

2.9% |

|

| Nordstrom, Inc. |

|

|

|

|

2.6% |

|

| Level 3 Communications, Inc. |

|

|

|

|

2.5% |

|

| Bank of New York Mellon Corp. |

|

|

|

|

2.3% |

|

| Alphabet, Inc. ‘C’ |

|

|

|

|

2.3% |

|

Sector Breakdown2

|

|

|

|

|

|

|

| Information Technology |

|

|

|

|

13.3% |

|

| Financials |

|

|

|

|

7.5% |

|

| Health Care |

|

|

|

|

5.3% |

|

| Telecommunication Services |

|

|

|

|

2.5% |

|

1 % of Investments, at value as of 12/31/2015. Top 10 Holdings solely reflect long positions. Securities sold short, derivatives, and short-term instruments are not taken into consideration.

2 % of net exposure (Investments, at value

less Securities Sold Short) as of 12/31/2015. Financial derivative instruments and short-term instruments are not taken into consideration.

Fund Insights

| » |

|

The Fund’s long equity positions detracted from absolute returns, as prices of these securities generally declined during the reporting period.

|

| » |

|

The Fund’s short equity positions within the materials sector contributed to absolute returns, as this sector declined over the reporting period.

|

| » |

|

The Fund’s short equity positions within the energy sector contributed to absolute returns, as this sector declined over the reporting period.

|

| » |

|

Over the reporting period, the Fund increased its gross short exposure from 22.6% to 37.2% and decreased its gross long exposure from 78.3% to 56.8%,

reducing the overall net equity exposure from 55.7% to 19.6% of net assets. |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2015 |

|

11 |

PIMCO Global Dividend Fund

Cumulative Returns Through December 31, 2015

Investment Objective and Strategy Overview

| |

» |

|

The PIMCO Global Dividend Fund seeks to provide current income that exceeds the average yield on global stocks, and as a secondary objective, seeks to

provide long-term capital appreciation, by investing under normal circumstances at least 75% of its assets in equity and equity-related securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be

exchanged for, common or preferred stock), as well as securities issued by real estate investment trusts, master limited partnerships and other equity trusts and depositary receipts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2015 |

|

| |

|

|

|

6 Months* |

|

|

1 Year |

|

|

Fund Inception

(12/14/11) |

|

|

|

PIMCO Global Dividend Fund Institutional Class |

|

|

(12.86)% |

|

|

|

(10.99)% |

|

|

|

6.37% |

|

|

|

PIMCO Global Dividend Fund Class P |

|

|

(12.87)% |

|

|

|

(10.92)% |

|

|

|

6.32% |

|

|

|

PIMCO Global Dividend Fund Class D |

|

|

(12.99)% |

|

|

|

(11.15)% |

|

|

|

6.06% |

|

|

|

PIMCO Global Dividend Fund Class A |

|

|

(12.99)% |

|

|

|

(11.15)% |

|

|

|

6.06% |

|

|

|

PIMCO Global Dividend Fund Class A (adjusted) |

|

|

(17.78)% |

|

|

|

(16.04)% |

|

|

|

4.59% |

|

|

|

PIMCO Global Dividend Fund Class C |

|

|

(13.45)% |

|

|

|

(11.94)% |

|

|

|

5.19% |

|

|

|

PIMCO Global Dividend Fund Class C (adjusted) |

|

|

(14.20)% |

|

|

|

(12.70)% |

|

|

|

5.19% |

|

|

|

PIMCO Global Dividend Fund Class R |

|

|

(13.15)% |

|

|

|

(11.43)% |

|

|

|

5.77% |

|

|

|

MSCI All Country World Index± |

|

|

(4.90)% |

|

|

|

(2.36)% |

|

|

|

10.58% |

|

All Fund returns are net of

fees and expenses.

* Cumulative return.

± The MSCI All Country World Index is

a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index consists of 46 country indices comprising 23 developed and 23 emerging market

country indices.

It is not possible to invest

directly in an unmanaged index.

Performance

quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will

fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into

account the maximum sales charge of 5.50% on Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 1.07% for the

Institutional Class shares, 1.17% for the Class P shares, 1.42% for the Class D shares, 1.42% for the Class A shares, 2.17% for the Class C shares and 1.67% for the Class R shares. Details regarding any Fund’s operating expenses can be

found in the Fund’s prospectus. For performance current to the most recent month-end, visit www.pimco.com.

|

|

|

|

|

|

|

|

|

|

|

| Institutional Class - PQDIX |

|

Class P - PQDPX |

|

Class D - PQDDX |

|

Class A - PQDAX |

|

Class C - PQDCX |

|

Class R - PQDRX |

Top 10 Holdings1

|

|

|

|

|

|

|

| Vodafone Group PLC |

|

|

|

|

3.5% |

|

| QUALCOMM, Inc. |

|

|

|

|

3.0% |

|

| AT&T, Inc. |

|

|

|

|

3.0% |

|

| PG&E Corp. |

|

|

|

|

3.0% |

|

| Lloyds Banking Group PLC |

|

|

|

|

3.0% |

|

| Western Digital Corp. |

|

|

|

|

2.9% |

|

| Aegon NV |

|

|

|

|

2.9% |

|

| Pfizer, Inc. |

|

|

|

|

2.7% |

|

| HSBC Holdings PLC |

|

|

|

|

2.7% |

|

| Intesa Sanpaolo SpA |

|

|

|

|

2.6% |

|

Geographic Breakdown1

|

|

|

|

|

|

|

| United States |

|

|

|

|

51.6% |

|

| United Kingdom |

|

|

|

|

13.0% |

|

| Netherlands |

|

|

|

|

3.9% |

|

| Italy |

|

|

|

|

3.9% |

|

| Australia |

|

|

|

|

3.5% |

|

| Japan |

|

|

|

|

3.5% |

|

| France |

|

|

|

|

3.4% |

|

| Hong Kong |

|

|

|

|

2.5% |

|

| Switzerland |

|

|

|

|

2.2% |

|

| Brazil |

|

|

|

|

2.1% |

|

| Taiwan |

|

|

|

|

1.7% |

|

| Canada |

|

|

|

|

1.6% |

|

| Spain |

|

|

|

|

1.5% |

|

| Greece |

|

|

|

|

1.3% |

|

| Germany |

|

|

|

|

1.0% |

|

| Other |

|

|

|

|

0.9% |

|

1 % of Investments, at value as of 12/31/2015. Top 10 Holdings and Geographic Breakdown solely reflect long positions. Securities sold short, financial derivative instruments and short-term

instruments are not taken into consideration.

Fund

Insights

| » |

|

During the reporting period, the Fund paid ordinary quarterly dividends totaling 10 cents per share on its Institutional class shares. The dividend per

share was slightly lower for the other share classes to account for varying class-specific expenses. |

| » |

|

Stock selection within the oil, gas & consumable fuels industry detracted from relative returns, as the Fund’s holdings within this industry

significantly underperformed the MSCI All Country World Index over the reporting period. |

| » |

|

An overweight exposure to small-cap companies detracted from relative performance, as small-cap stocks underperformed the MSCI All Country World Index

over the reporting period. |

| » |

|

Over the reporting period, the top three equity contributors were NN Group NV, PG&E Corporation and Imperial Tobacco Group PLC. The top three equity

detractors were Targa Resources Corp., Golar LNG Partners LP and Spotless Group Holdings Ltd. |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2015 |

|

13 |

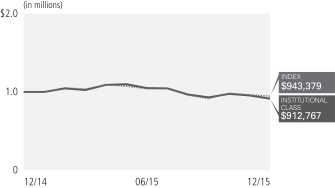

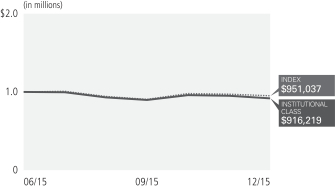

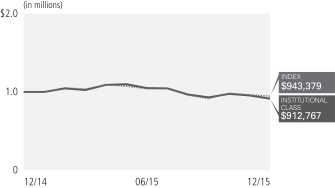

PIMCO International Dividend Fund

Cumulative Returns Through December 31, 2015

Investment Objective and Strategy Overview

| |

» |

|

The PIMCO International Dividend Fund seeks to provide current income that exceeds the average yield on international stocks, while providing long-term

capital appreciation, by investing in an international-focused diversified portfolio of dividend-paying stocks that have an attractive yield, a growing dividend, and long-term capital appreciation. The Fund will invest primarily in equity and

equity-related securities that are economically tied to developed and emerging markets outside the United States, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred

stock), as well as securities issued by real estate investment trusts, master limited partnerships and other equity trusts and depositary receipts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2015 |

|

| |

|

|

|

6 Months* |

|

|

1 Year |

|

|

Fund Inception

(12/15/14) |

|

|

|

PIMCO International Dividend Fund Institutional Class |

|

|

(12.88)% |

|

|

|

(8.63)% |

|

|

|

(6.90)% |

|

|

|

PIMCO International Dividend Fund Class P |

|

|

(12.93)% |

|

|

|

(8.73)% |

|

|

|

(6.99)% |

|

|

|

PIMCO International Dividend Fund Class D |

|

|

(13.04)% |

|

|

|

(8.96)% |

|

|

|

(7.23)% |

|

|

|

PIMCO International Dividend Fund Class A |

|

|

(13.03)% |

|

|

|

(8.86)% |

|

|

|

(7.14)% |

|

|

|

PIMCO International Dividend Fund Class A (Adjusted) |

|

|

(17.81)% |

|

|

|

(13.87)% |

|

|

|

(12.02)% |

|

|

|

PIMCO International Dividend Fund Class C |

|

|

(13.40)% |

|

|

|

(9.67)% |

|

|

|

(7.95)% |

|

|

|

PIMCO International Dividend Fund Class C (Adjusted) |

|

|

(14.24)% |

|

|

|

(10.54)% |

|

|

|

(7.95)% |

|

|

|

MSCI All Country World ex US Index± |

|

|

(9.32)% |

|

|

|

(5.66)% |

|

|

|

(2.51)% |

|

All Fund returns are net of

fees and expenses.

* Cumulative return.

± The MSCI All Country World ex US

Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index consists of 45 country indices comprising 22 developed and 23 emerging market

country indices.

It is not possible to invest

directly in an unmanaged index.

Performance

quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will

fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into

account the maximum sales charge of 5.50% on Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.99% for the

Institutional Class shares, 1.09% for the Class P shares, 1.34% for the Class D shares, 1.34% for the Class A shares, and 2.09% for the Class C shares. Details regarding any Fund’s operating expenses can be found in the Fund’s

prospectus. For performance current to the most recent month-end, visit www.pimco.com.

|

|

|

|

|

|

|

|

|

| Institutional Class - PVIIX |

|

Class P - PVIPX |

|

Class D - PVIDX |

|

Class A - PVIAX |

|

Class C - PVICX |

Top 10 Holdings1

|

|

|

|

|

|

|

| Vodafone Group PLC |

|

|

|

|

4.4% |

|

| Roche Holding AG |

|

|

|

|

4.1% |

|

| Aegon NV |

|

|

|

|

4.0% |

|

| Bridgestone Corp. |

|

|

|

|

4.0% |

|

| Lloyds Banking Group PLC |

|

|

|

|

4.0% |

|

| HSBC Holdings PLC |

|

|

|

|

4.0% |

|

| Intesa Sanpaolo SpA |

|

|

|

|

4.0% |

|

| Engie S.A. |

|

|

|

|

3.5% |

|

| China Mobile Ltd. |

|

|

|

|

3.4% |

|

| Taiwan Semiconductor Manufacturing Co. Ltd. |

|

|

|

|

3.2% |

|

Geographic Breakdown1

|

|

|

|

|

|

|

| United Kingdom |

|

|

|

|

17.0% |

|

| United States |

|

|

|

|

14.4% |

|

| Japan |

|

|

|

|

9.5% |

|

| Australia |

|

|

|

|

8.2% |

|

| Netherlands |

|

|

|

|

7.1% |

|

| France |

|

|

|

|

6.4% |

|

| Hong Kong |

|

|

|

|

5.8% |

|

| Italy |

|

|

|

|

5.6% |

|

| Switzerland |

|

|

|

|

4.1% |

|

| Taiwan |

|

|

|

|

3.2% |

|

| Brazil |

|

|

|

|

3.1% |

|

| Canada |

|

|

|

|

2.3% |

|

| Ireland |

|

|

|

|

2.3% |

|

| Israel |

|

|

|

|

2.0% |

|

| Spain |

|

|

|

|

1.7% |

|

| China |

|

|

|

|

1.4% |

|

| Mexico |

|

|

|

|

1.4% |

|

| Germany |

|

|

|

|

1.3% |

|

| Greece |

|

|

|

|

1.3% |

|

| Other |

|

|

|

|

1.7% |

|

1 % of Investments, at value as of 12/31/2015. Top 10 Holdings and Geographic Breakdown solely reflect long positions. Securities sold short, financial derivative instruments and short-term

instruments are not taken into consideration.

Fund

Insights

| » |

|

During the reporting period, the Fund paid ordinary quarterly dividends totaling 15 cents per share on its Institutional class shares. The dividend per

share was slightly lower for the other share classes to account for varying class-specific expenses. |

| » |

|

Stock selection within the electric utilities industry detracted from relative returns, as the Fund’s holdings within this industry significantly

underperformed the MSCI All Country World ex-US Index over the reporting period. |

| » |

|

Stock selection within the oil, gas & consumable fuels industry detracted from relative returns, as the Fund’s holdings within this industry

significantly underperformed the MSCI All Country World ex-US Index over the reporting period. |

| » |

|

Over the reporting period, the top three equity contributors were NN Group NV, Imperial Tobacco Group PLC and Lawson Inc. The top three equity detractors

were Spotless Group Holdings Ltd., Golar LNG Partners LP and Total Access Communication Public Co., Ltd. |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2015 |

|

15 |

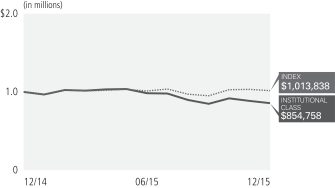

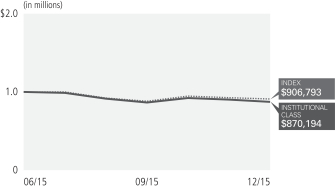

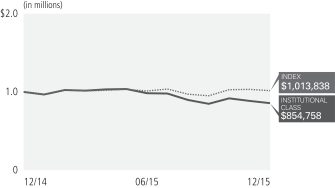

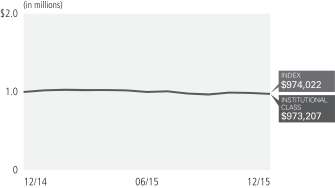

PIMCO U.S. Dividend Fund

Cumulative Returns Through December 31, 2015

Investment Objective and Strategy Overview

| |

» |

|

The PIMCO U.S. Dividend Fund seeks to provide current income that exceeds the average yield on U.S. stocks, while providing long-term capital

appreciation, by investing in a U.S.-focused diversified portfolio of dividend-paying stocks that have an attractive yield, a growing dividend, and long-term capital appreciation. The Fund will invest primarily in equity and equity-related

securities that are economically tied to the United States, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock), as well as securities issued by real estate

investment trusts, master limited partnerships and other equity trusts and depositary receipts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2015 |

|

| |

|

|

|

6 Months* |

|

|

1 Year |

|

|

Fund Inception

(12/15/14) |

|

|

|

PIMCO U.S. Dividend Fund Institutional Class |

|

|

(12.98)% |

|

|

|

(14.44)% |

|

|

|

(10.41)% |

|

|

|

PIMCO U.S. Dividend Fund Class P |

|

|

(12.94)%

|

|

|

|

(14.53)% |

|

|

|

(10.51)% |

|

|

|

PIMCO U.S. Dividend Fund Class D |

|

|

(13.06)%

|

|

|

|

(14.76)% |

|

|

|

(10.74)% |

|

|

|

PIMCO U.S. Dividend Fund Class A |

|

|

(13.13)% |

|

|

|

(14.66)% |

|

|

|

(10.64)% |

|

|

|

PIMCO U.S. Dividend Fund Class A (Adjusted) |

|

|

(17.92)% |

|

|

|

(19.39)% |

|

|

|

(15.34)% |

|

|

|

PIMCO U.S. Dividend Fund Class C |

|

|

(13.40)% |

|

|

|

(15.33)% |

|

|

|

(11.34)% |

|

|

|

PIMCO U.S. Dividend Fund Class C (Adjusted) |

|

|

(14.24)% |

|

|

|

(16.15)% |

|

|

|

(11.34)% |

|

|

|

S&P 500

Index± |

|

|

0.15% |

|

|

|

1.38% |

|

|

|

4.78% |

|

All Fund returns are net of

fees and expenses.

* Cumulative return.

± S&P 500 Index is an unmanaged

market index generally considered representative of the stock market as a whole. The Index focuses on the large-cap segment of the U.S. equities market.

It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past

performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less

than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into account the maximum sales charge of 5.50% on

Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 0.90% for the Institutional Class shares, 1.00% for the Class P

shares, 1.25% for the Class D shares, 1.25% for the Class A shares, and 2.00% for the Class C shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. For performance current to the most recent

month-end, visit www.pimco.com.

|

|

|

|

|

|

|

|

|

| Institutional Class - PVDIX |

|

Class P - PVDPX |

|

Class D - PVDDX |

|

Class A - PVDAX |

|

Class C - PVDCX |

Top 10 Holdings1

|

|

|

|

|

|

|

| AT&T, Inc. |

|

|

|

|

5.5% |

|

| QUALCOMM, Inc. |

|

|

|

|

5.1% |

|

| Pfizer, Inc. |

|

|

|

|

5.0% |

|

| Comcast Corp. ‘A’ |

|

|

|

|

5.0% |

|

| PG&E Corp. |

|

|

|

|

5.0% |

|

| Neilsen Holdings PLC |

|

|

|

|

5.0% |

|

| AbbVie, Inc. |

|

|

|

|

4.6% |

|

| Apple, Inc. |

|

|

|

|

4.4% |

|

| Merck & Co., Inc. |

|

|

|

|

4.2% |

|

| Roche Holding AG |

|

|

|

|

4.0% |

|

Sector Breakdown1

|

|

|

|

|

|

|

| Health Care |

|

|

|

|

17.8% |

|

| Consumer Discretionary |

|

|

|

|

16.4% |

|