PIMCO Equity Series

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT

COMPANIES

Investment Company Act file number:

811-22375

PIMCO Equity Series

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal

executive offices)

Trent W. Walker

Treasurer and Principal Financial Officer

PIMCO Equity Series

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1900 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (888) 877-4626

Date of fiscal year end: June 30

Date of reporting period: December 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be

transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure

review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and

the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control

number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The

OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

| |

• |

|

PIMCO Equity Series—Institutional, P, Administrative, D, A, C and R Classes |

Your Global Investment

Authority

PIMCO Equity

Series®

Semiannual Report

December 31, 2013

PIMCO Dividend and Income

Builder Fund

PIMCO EqS® Dividend Fund

PIMCO

EqS® Emerging Markets Fund

PIMCO

EqS® Long/Short Fund

PIMCO Emerging Multi-Asset Fund

PIMCO EqS Pathfinder

Fund®

Share Classes

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Insights from the

Portfolio Managers |

|

|

Fund

Summary |

|

|

Schedule of

Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PIMCO Dividend and Income Builder Fund |

|

|

6 |

|

|

|

9 |

|

|

|

45 |

|

| PIMCO EqS® Dividend

Fund |

|

|

10 |

|

|

|

12 |

|

|

|

54 |

|

| PIMCO EqS® Emerging Markets

Fund |

|

|

13 |

|

|

|

16 |

|

|

|

59 |

|

| PIMCO EqS® Long/Short

Fund |

|

|

17 |

|

|

|

19 |

|

|

|

69 |

|

| PIMCO Emerging Multi-Asset Fund |

|

|

20 |

|

|

|

22 |

|

|

|

75 |

|

| PIMCO EqS Pathfinder

Fund® |

|

|

23 |

|

|

|

25 |

|

|

|

80 |

|

This material is authorized for use only when preceded or accompanied by the current PIMCO Equity Series prospectus.

Chairman’s Letter

Dear Shareholder,

Please find enclosed the Semiannual Report for the PIMCO Equity

Series covering the six-month reporting period ended December 31, 2013. On the following pages are specific details about the investment performance of each fund and a discussion of the factors that influenced performance during the reporting

period. In addition, the letters from the portfolio managers provide a further review of such factors as well as an overview of each fund’s investment strategy.

The last six months of 2013 were marked by continued periods of

heightened bond market volatility brought on by uncertainty around central bank monetary and fiscal policy, geopolitical concerns, and a slower than hoped for rebound in the global economy. Following a particularly bumpy third quarter, however, all

financial markets completed the year along a relatively smoother path. Federal Reserve (“Fed”) Chairman Ben Bernanke laid the groundwork in September, when he clarified the Fed’s commitment to maintain its quantitative easing

(“QE”) bond purchase program of U.S. Treasuries and mortgages, while maintaining the Federal Funds Rate within a zero-bound range. The nomination of Janet Yellen to the Chairmanship further helped to reassure investors that the Fed would

be committed to the continuation of their accommodative policies.

Towards the latter part of December, the Fed announced that beginning in January 2014 it intends to gradually exit its bond-buying program, by reducing it from $85 billion to $75 billion

spread equally across mortgage and U.S. Treasury purchases. As expected, in order to anchor the front-end of the yield curve, the Federal Open Market Committee (“FOMC”) provided even greater assurances that the policy rate would remain

near a zero-bound range until signs of sustainable growth are more broadly evident in the U.S. economy. While the markets had months to prepare for the announcement, equities and other risk assets soared in reaction to the news while bond markets

saw yields drift higher.

Highlights of the

financial markets during our six-month reporting period include:

| |

n |

|

Developed market equities continued to post strong performance in the last six months of 2013, despite a period marked by considerable

volatility and uncertainty around central bank policy and geopolitical risks. U.S. equities, as measured by the S&P 500 Index, returned 16.31%. Global equities, as represented by the MSCI All Country World Index Net USD and MSCI World Index,

returned 15.79% and 16.83%, respectively. Emerging market (“EM”) equities, as represented by the MSCI Emerging Markets Index (Net Dividends in USD), returned 7.70%. EM equities underperformed developed market equities due to declining

earnings growth and rising interest rates in the U.S. which placed pressure on local EM currencies. |

| |

n |

|

U.S. Treasuries underperformed most other developed sovereign bond markets on a hedged basis as investors reacted to the various Fed

announcements regarding the tapering of their QE bond purchase program. In particular, U.S. Treasury yields rose to their highest level in late December as investors reacted to the Fed’s announcement that it would begin the reduction of its

asset purchases starting in January 2014. This decision was made on the back of improving economic data, which included a lower unemployment rate, respectable monthly job reports, and improving housing fundamentals. The benchmark ten-year U.S.

Treasury note yielded 3.03% at the end of the reporting period, as compared to 2.49% on June 30, 2013. The Barclays U.S. Aggregate Index, a widely used index of U.S. investment-grade bonds, returned 0.43% for the period.

|

All of our active equity

strategies are global, high-conviction portfolios that are unconstrained by geography, benchmark or market capitalization and incorporate downside risk management. Each strategy is managed by experienced equity investors who benefit from

PIMCO’s global investment resources and macroeconomic insights. We believe the long-term potential of equities to grow earnings and dividends is an important component of an investor’s overall portfolio.

If you have any questions regarding the PIMCO Equity Series,

please contact your account manager or financial adviser, or call one of our shareholder associates at 888.87.PIMCO (888.877.4626). We also invite you to visit our website at www.pimco.com/investments to learn more about our views and global thought

leadership.

Thank you again for the trust you have placed in us. We value your commitment and will continue

to work diligently to meet your broad investment needs.

|

|

|

|

|

Sincerely,

Brent R. Harris

Chairman of the Board,

PIMCO Equity Series

January 24, 2014 |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2013 |

|

3 |

Important Information About the Funds

PIMCO Equity Series (the “Trust”) is an open-end management investment company

currently consisting of six separate investment portfolios (the “Funds”). Each Fund is an actively managed equity strategy. While we believe that equity funds have an important role to play in a well diversified investment portfolio, they

are subject to notable risks. Among other things, equity and equity-related securities may decline in value due to both real and perceived general market, economic, and industry conditions.

As of the date of this report, interest rates in the U.S. are at or near historically low levels. As such, funds

that invest in fixed income securities may currently face an increased exposure to the risks associated with a rising interest rate environment. This is especially true since the Federal Reserve Board has begun tapering its quantitative easing

program. Further, while the U.S. bond market has steadily grown over the past three decades, dealer inventories of corporate bonds have remained relatively stagnant. As a result, there has been a significant reduction in the ability of dealers

to “make markets.” All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets, which could result in losses to a Fund. If the performance of a

Fund were to be negatively impacted by rising interest rates, the Fund could face increased redemptions by its shareholders, which could further reduce the value of the Fund.

The Funds may be subject to various risks as described in the

Funds’ prospectus. Some of these risks may include, but are not limited to, the following: allocation risk, Acquired Fund risk, equity risk, dividend-oriented stocks risk, value investing risk, foreign (non-U.S.) investment risk, emerging

markets risk, market risk, issuer risk, interest rate risk, credit risk, high yield and distressed company risk, cash holdings risk, currency risk, real estate risk, liquidity risk, leveraging risk, management risk,

small-cap and mid-cap company risk, arbitrage risk, derivatives risk, mortgage-related and other asset-backed risk, short sale risk, commodity risk, convertible

securities risk, tax risk, subsidiary risk, operational risk and issuer non-diversification risk. A complete description of these risks and other risks is contained in the Funds’ prospectus. The Funds may

use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, leverage risk,

mispricing or improper valuation risk and the risk that the Funds could not close out a position when it would be most advantageous to do so. Certain derivative transactions may have a leveraging effect on a Fund. For example, a small investment in

a derivative instrument may have a significant impact on a Fund’s exposure to interest rates, currency exchange rates or other investments. As a result, a relatively small price

movement in a derivative instrument may cause an immediate and substantial loss or gain. A Fund may engage in such transactions regardless of whether the Fund owns the asset, instrument or

components of the index underlying the derivative instrument. A Fund may invest a significant portion of its assets in these types of instruments. If it does, the Fund’s investment exposure could far exceed the value of its portfolio securities

and its investment performance could be primarily dependent upon securities it does not own. Investing in non-U.S. securities may entail risk due to non-U.S. economic and political developments; this risk may be increased when investing in emerging

markets.

High-yield bonds typically have a lower

credit rating than other bonds. Lower-rated bonds generally involve a greater risk to principal than higher-rated bonds. Further, markets for lower-rated bonds are typically less liquid than for higher-rated bonds, and public information is usually

less abundant in such markets. Thus, high yield investments increase the chance that the Fund will lose money. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio.

Mortgage- and Asset-Backed Securities represent ownership interests in “pools” of mortgages or other assets such as consumer loans or receivables. As a general matter, Mortgage- and Asset-Backed Securities are subject to interest rate

risk, extension risk, prepayment risk, and credit risk. These risks largely stem from the fact that returns on Mortgage- and Asset-Backed Securities depend on the ability of the underlying assets to generate cash flow.

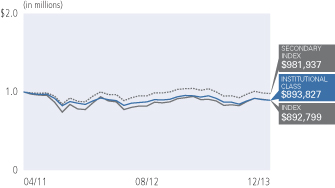

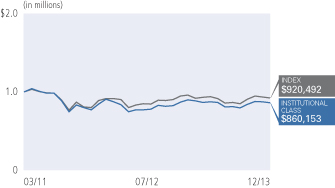

On each individual Fund Summary page in this Shareholder Report,

the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Class A shares are subject to an initial sales charge. A Contingent Deferred Sales

Charge (“CDSC”) may be imposed in certain circumstances on Class A shares that are purchased without an initial sales charge and then redeemed during the first 18 months after purchase. The Cumulative Returns chart reflects only

Institutional Class performance. Performance for Class P, Administrative Class, Class D, Class A, Class C and Class R shares is typically lower than Institutional Class performance due to the lower expenses paid by Institutional Class shares.

Performance shown is net of fees and expenses. A Fund’s total annual operating expense ratios on each individual Fund summary page are as of the currently effective prospectus, as supplemented to date. The Cumulative Returns chart assumes the

initial investment of $1,000,000 was made at the end of the month that the Institutional Class of the relevant Fund commenced operations. The minimum initial investment amount for Institutional Class, Class P or Administrative Class shares is

$1,000,000. The

minimum initial investment amount for Class A, Class C and Class D shares is $1,000. There is no minimum initial investment for Class R shares. Each Fund measures its performance against a

broad-based securities market index (benchmark index). The benchmark index does

not take into account fees, expenses, or taxes. A Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The following

table discloses the inception dates of each Fund and its respective share classes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund Name |

|

|

|

Fund

Inception |

|

|

Institutional

Class |

|

|

Class P |

|

|

Administrative

Class |

|

|

Class D |

|

|

Class A |

|

|

Class C |

|

|

Class R |

|

| PIMCO Dividend and Income Builder Fund |

|

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

— |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

| PIMCO EqS® Dividend Fund |

|

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

— |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

|

|

12/14/11 |

|

| PIMCO EqS® Emerging Markets Fund |

|

|

|

|

03/22/11 |

|

|

|

03/22/11 |

|

|

|

03/22/11 |

|

|

|

04/19/11 |

|

|

|

03/22/11 |

|

|

|

03/22/11 |

|

|

|

03/22/11 |

|

|

|

03/22/11 |

|

| PIMCO EqS® Long/Short Fund |

|

|

|

|

04/20/12 |

|

|

|

04/20/12 |

|

|

|

04/30/12 |

|

|

|

— |

|

|

|

04/30/12 |

|

|

|

04/30/12 |

|

|

|

04/30/12 |

|

|

|

— |

|

| PIMCO Emerging Multi-Asset Fund |

|

|

|

|

04/12/11 |

|

|

|

04/12/11 |

|

|

|

04/12/11 |

|

|

|

04/19/11 |

|

|

|

04/12/11 |

|

|

|

04/12/11 |

|

|

|

04/12/11 |

|

|

|

04/12/11 |

|

| PIMCO EqS Pathfinder

Fund® |

|

|

|

|

04/14/10 |

|

|

|

04/14/10 |

|

|

|

04/14/10 |

|

|

|

— |

|

|

|

04/14/10 |

|

|

|

04/14/10 |

|

|

|

04/14/10 |

|

|

|

04/14/10 |

|

For periods prior to the inception date of the Class P, Administrative Class, Class D, Class

A, Class C and Class R shares (if applicable), performance information shown is based on the performance of the Fund’s Institutional Class shares. The prior Institutional Class performance has been adjusted to reflect the distribution and/or

service fees and other expenses paid by the Class P, Administrative Class, Class D, Class A, Class C and Class R shares, respectively.

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation

(“FDIC”) or any other government agency. It is possible to lose money on investments in a Fund.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers

Act of 1940, as amended. The Proxy Policy has been adopted by PIMCO Equity Series as the policies and procedures that PIMCO will use when voting proxies on behalf of a Fund. A description of the

policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of a Fund, and information about how the Fund voted proxies relating to portfolio securities held during

the most recent twelve-month period ended June 30th, are available without charge, upon request, by calling the Trust at (888) 87-PIMCO, on the Fund’s website at

http://www.pimco.com/investments, and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

PIMCO Equity Series files a complete schedule of each Fund’s portfolio holdings with the SEC for the first and third quarters of each

fiscal year on Form N-Q. A copy of a Fund’s Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s

Public Reference Room in Washington, D.C. A Fund’s Form N-Q will also be available without charge, upon request, by calling the Trust

at (888) 87-PIMCO and on the Fund’s website at http://www.pimco.com/investments. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2013 |

|

5 |

Insights from the Portfolio Managers PIMCO Dividend and Income Builder Fund

Dear Shareholder,

We appreciate your investment in the PIMCO Dividend and Income

Builder Fund (the “Fund”). In the following letter, please find a discussion of the recent market environment and a review of portfolio performance.

Market Overview

During the six-month reporting period ended December 31, 2013, the MSCI All Country World Index Net USD (the “Index”), which tracks

the performance of stocks in developed and emerging markets countries, returned 15.79%. Performance was strongest in the information technology, industrials, and consumer discretionary sectors. Utilities, consumer staples, and energy were the

poorest performing sectors.

Equities rallied early

in the period as Federal Reserve (“Fed”) Chairman Ben Bernanke continued to communicate that highly accommodative monetary policy would remain necessary for the foreseeable future, though markets declined in August as headline comments on

the Fed’s tapering program created uncertainty. Markets climbed again in September as the situation in Syria continued to play out through diplomatic channels. Stock prices continued to rise until the Fed announced its decision to keep its $85

billion bond-buying program in place. Equities then sold off towards the end of September as investors shifted their macro concerns to the U.S. budget and debt ceiling debates in Washington.

Stocks took off in October as U.S. politicians were finally able to pass legislation that reopened the government

and raised the country’s debt ceiling. Also in October, Janet Yellen was nominated to replace Ben Bernanke as the Chairman of the Federal Reserve, allaying investor concerns about rising interest rates. U.S. equities rose even higher in late

December after the Fed strengthened its pledge to maintain very low interest rates. While the Fed did announce a December taper (i.e. reduced asset purchases), investors were anticipating this possibility and were heartened by the

accompanying positive economic data.

During the

reporting period, performance was particularly strong in Europe, as economic reports continued to suggest that the region was exiting its recession, albeit at a slow pace. In November, the European Central Bank (“ECB”) cut interest rates,

though the ECB president hinted that other, more aggressive stimulus actions were not under consideration. Given the disinflation facing the region, these comments were viewed by many as far too timid.

Among developed markets, Japan was the worst performing region.

While Japanese equities were strong in local terms, especially after the country announced Gross Domestic Product (“GDP”) numbers that were ahead of expectations, the devaluation of the yen caused Japanese equities to be relatively weak in

U.S. dollar terms.

Emerging markets continued to underperform developed markets during the reporting period

Concerns about a slowdown in China and widening current account deficits in the “fragile five” countries (Turkey, South Africa, India, Indonesia, and Brazil) weighed on returns. Political unrest in Turkey and Vietnam only exacerbated

capital outflows from the region.

Fund Review

We seek to provide attractive current yield,

growing dividends over time, and capital appreciation. During the six-month reporting period ended December 31, 2013, the Fund paid ordinary quarterly dividends of 18.8 cents per share and a one-time supplemental dividend of 1 cent per share on

its Institutional Class shares. The dividend per share was slightly lower for the other share classes, to account for varying class specific expenses. The Fund’s net asset value increased by $1.06 per share (from $11.60 to $12.66) over the

reporting period, bringing the six-month total return to 10.88% (net of fees). On a relative basis, the Fund underperformed its benchmark (a blend of 75% MSCI All Country World Index Net USD/25% Barclays Global Aggregate (USD Unhedged) Index), which

returned 12.32%. Both security selection and sector allocation decisions within equities detracted from relative performance.

At the security level, the Fund’s position in Walgreens was the largest contributor to relative performance. The U.S. retail drugstore

operator outperformed as year-over-year sales, especially in the front end of the store, improved. The company also raised its quarterly dividend.

Marathon Petroleum was another top contributor to performance. The U.S. oil refining and distribution company outperformed as crack spreads

continued to widen, and after the company announced a $2 billion increase to its share buyback program. Furthermore, Marathon Petroleum’s stock rallied after the Environmental Protection Agency indicated that it was open to adjusting a

renewable fuel mandate that had caused Marathon’s input costs to increase during the first half of 2013.

The largest detractor from performance for the reporting period was the Fund’s holding of Cisco Systems. The U.S. communications equipment company underperformed after stating that it

planned to lay off approximately 5% of its workforce in an effort to rationalize headcount gained in recent strategic acquisitions. While the market viewed this news as negative, management indicated that it remained committed to returning capital

to shareholders. Cisco’s stock price declined again when the company’s management announced disappointing short-term earnings guidance due to weak revenues from the emerging markets. We continue to think that Cisco is an

attractively-valued market leader with a solid balance sheet, and we added to our position.

The Fund’s holding of ProSafe was another detractor from performance. Following strong

performance early in the third quarter, the Norwegian owner and operator of accommodation rigs underperformed after it announced a weakening in forward contracting, though quarterly earnings results hit a record high. We continue to believe that

ProSafe’s leading position in a niche market makes it an attractive investment.

The Fund’s fixed income allocation performed positively, driven mainly by security selection, primarily within the securitized sector.

Conclusion

Over the reporting period, we “derisked” the

portfolio by decreasing our allocation to “Consistent Earners” (i.e. stable, blue-chip companies) that had appreciated in value during the market rally. At the same time, we increased our allocations to “Basic Value”

(i.e. more cyclical) companies and “Emerging Franchises” (i.e. growth companies) as the market volatility provided opportunities to initiate positions in some very compelling investments. We also increased our allocations to

European stocks and to financials.

Going forward, we

maintain our long-term view that dividend-paying equities have the potential to be an attractive long-term investment solution, especially given a secular outlook for lower returns across asset classes. As always, however, we continue to emphasize

valuation in a market that has recently been characterized by overreactions to both positive and negative news.

Thank you for your investment in the Fund.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brad Kinkelaar |

|

Dan Ivascyn |

| Portfolio Manager |

|

Fixed Income Co-Portfolio Manager |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Alfred Murata |

|

|

| Fixed Income Co-Portfolio Manager |

|

|

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2013 |

|

7 |

Insights from the Portfolio Managers PIMCO Dividend and Income Builder Fund (Cont.)

Top 10 Holdings1

|

|

|

|

|

|

|

| Cisco Systems, Inc. |

|

|

|

|

3.6% |

|

| HSBC Holdings PLC |

|

|

|

|

3.6% |

|

| Roche Holding AG |

|

|

|

|

3.2% |

|

| Qualcomm, Inc. |

|

|

|

|

3.1% |

|

| Nippon Telegraph & Telephone Corp. |

|

|

|

|

3.0% |

|

| Enagas S.A. |

|

|

|

|

2.9% |

|

| Standard Chartered PLC |

|

|

|

|

2.7% |

|

| JPMorgan Chase & Co. |

|

|

|

|

2.7% |

|

| Total S.A. |

|

|

|

|

2.7% |

|

| Cia de Saneamento Basico do Estado de Sao Paulo SP—ADR |

|

|

|

|

2.6% |

|

Geographic

Breakdown1

|

|

|

|

|

|

|

| United States |

|

|

|

|

48.6% |

|

| United Kingdom |

|

|

|

|

11.6% |

|

| Brazil |

|

|

|

|

5.3% |

|

| France |

|

|

|

|

4.0% |

|

| South Africa |

|

|

|

|

3.7% |

|

| Netherlands |

|

|

|

|

3.5% |

|

| Spain |

|

|

|

|

3.2% |

|

| Switzerland |

|

|

|

|

3.2% |

|

| Japan |

|

|

|

|

3.1% |

|

| Cyprus |

|

|

|

|

2.5% |

|

| Other |

|

|

|

|

8.9% |

|

Sector Breakdown1

|

|

|

|

|

|

|

| Financials |

|

|

|

|

26.4% |

|

| Consumer Discretionary |

|

|

|

|

12.1% |

|

| Information Technology |

|

|

|

|

11.8% |

|

| Energy |

|

|

|

|

9.7% |

|

| Health Care |

|

|

|

|

7.8% |

|

| Industrials |

|

|

|

|

6.9% |

|

| Utilities |

|

|

|

|

6.3% |

|

| Consumer Staples |

|

|

|

|

5.4% |

|

| Telecommunication Services |

|

|

|

|

4.9% |

|

| Mortgage-Backed Securities |

|

|

|

|

2.3% |

|

| Materials |

|

|

|

|

1.8% |

|

| Other |

|

|

|

|

1.8% |

|

| 1

|

% of Total Investments as of 12/31/2013. Top Holdings, Geographic and Sector Breakdown solely reflect long positions. Securities sold

short, financial derivative instruments and short-term instruments are not taken into consideration. |

PIMCO Dividend and Income Builder Fund

|

|

|

| Institutional Class -

PQIIX |

|

Class A - PQIZX |

| Class P -

PQIPX |

|

Class C - PQICX |

| Class D - PQIDX |

|

Class R - PQIBX |

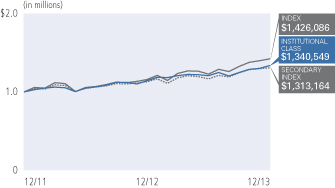

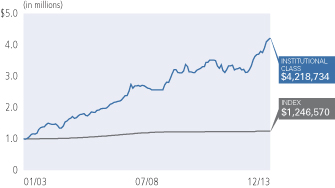

Cumulative Returns Through December 31, 2013

All Fund returns are net of

fees and expenses.

* Cumulative return.

± The MSCI All Country World Index Net USD is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of

developed and emerging markets. The Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. It is not possible to invest directly in an unmanaged index.

±± The benchmark is a blend of 75% MSCI All Country World Index Net USD/25% Barclays Global Aggregate USD Unhedged. The MSCI All Country World Index Net USD is a

free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index consists of 45 country indices comprising 24 developed and 21 emerging market country

indices. Barclays Global Aggregate (USD Unhedged) Index provides a broad-based measure of the global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the

Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian Government securities, and USD investment grade 144A securities. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past

performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less

than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into account the maximum sales charge of 5.50% on

Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 1.20% for the Institutional Class shares, 1.30% for the Class P

shares, 1.55% for the Class D shares, 1.55% for the Class A shares, 2.30% for the Class C shares and 1.80% for the Class R shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. For performance

current to the most recent month-end, visit www.pimco.com/investments.

Portfolio Insights

| » |

|

The PIMCO Dividend and Income Builder Fund seeks to provide current income that exceeds the average yield on global stocks, and to provide a growing

stream of income per share over time, with a secondary objective to seek to provide long-term capital appreciation, by investing under normal circumstances at least 80% of its assets in a diversified portfolio of income-producing investments, and

will typically invest at least 50% of its assets in equity and equity-related securities. The Fund’s investments in equity and equity-related securities include common and preferred stock (and securities convertible into, or that PIMCO expects

to be exchanged for, common or preferred stock), as well as securities issued by real estate investment trusts, master limited partnerships and other equity trusts and depositary receipts. |

| » |

|

The Fund’s Institutional Class shares returned 10.88% after fees, and the Fund’s benchmark index, a blend of 75% MSCI All Country World Index

Net USD/25% Barclays Global Aggregate (USD Unhedged) Index, returned 12.32% during the reporting period. |

| » |

|

During the reporting period, the Fund paid ordinary quarterly dividends of 18.8 cents per share and a one-time supplemental dividend of 1 cent per share

on its Institutional Class shares. The dividend per share was slightly lower for the other share classes, to account for varying class specific expenses. The net asset value of the Fund’s Institutional Class shares increased by $1.06

per share (from $11.60 to $12.66) over the reporting period, bringing the six-month total return to 10.88%. |

| » |

|

Security selection detracted from performance. The largest single detractor from relative performance was the Fund’s holding of Cisco Systems,

the U.S.-based communications equipment company. |

| » |

|

The largest single contributor to relative performance was the Fund’s holding of Walgreens, the U.S.-based retail drugstore operator.

|

| » |

|

The Fund’s weight in cash detracted from relative performance during a period in which the Fund’s blended benchmark index

returned 12.32%. |

| » |

|

The Fund’s fixed income allocation performed positively, driven mainly by security selection, primarily within the securitized sector.

|

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2013 |

|

9 |

Insights from the Portfolio Managers PIMCO

EqS® Dividend Fund

Dear Shareholder,

We appreciate your investment in the PIMCO

EqS® Dividend Fund (the “Fund”). In the following

letter, please find a discussion of the recent market environment and a review of portfolio performance.

Market Overview

During the six-month reporting period ended December 31, 2013, the MSCI All Country World Index Net USD (the “Index”), which tracks the performance of stocks in developed and

emerging markets countries, returned 15.79%. Performance was strongest in the information technology, industrials, and consumer discretionary sectors. Utilities, consumer staples, and energy were the poorest performing sectors.

Equities rallied early in the period as Federal Reserve

(“Fed”) Chairman Ben Bernanke continued to communicate that highly accommodative monetary policy would remain necessary for the foreseeable future, though markets declined in August as headline comments on the Fed’s tapering program

created uncertainty. Markets climbed again in September as the situation in Syria continued to play out through diplomatic channels. Stock prices continued to rise until the Fed announced its decision to keep its $85 billion bond-buying program in

place. Equities then sold off towards the end of September as investors shifted their macro concerns to the U.S. budget and debt ceiling debates in Washington.

Stocks took off in October as U.S. politicians were finally able to pass legislation that reopened the government and raised the

country’s debt ceiling. Also in October, Janet Yellen was nominated to replace Ben Bernanke as the Chairman of the Federal Reserve, allaying investor concerns about rising interest rates. U.S. equities rose even higher in late December after

the Fed strengthened its pledge to maintain very low interest rates. While the Fed did announce a December taper (i.e. reduced asset purchases), investors were anticipating this possibility and were heartened by the accompanying positive

economic data.

During the reporting period,

performance was particularly strong in Europe, as economic reports continued to suggest that the region was exiting its recession, albeit at a slow pace. In November, the European Central Bank (“ECB”) cut interest rates, though the ECB

president hinted that other, more aggressive stimulus actions were not under consideration. Given the disinflation facing the region, these comments were viewed by many as far too timid.

Among developed markets, Japan was the worst performing region. While Japanese equities were strong in local

terms, especially after the country announced Gross Domestic Product numbers that were ahead of expectations, the devaluation of the yen caused Japanese equities to be relatively weak in U.S. dollar terms.

Emerging markets continued to underperform developed markets during the period. Concerns

about a slowdown in China and widening current account deficits in the “fragile five” countries (Turkey, South Africa, India, Indonesia, and Brazil) weighed on returns. Political unrest in Turkey and Vietnam only exacerbated capital

outflows from the region.

Fund Review

We seek to provide attractive current yield, growing dividends

over time, and capital appreciation. During the six-month reporting period ended December 31, 2013, the Fund paid ordinary quarterly dividends of 18.9 cents per share and a one-time supplemental dividend of 7 cents per share on its Institutional

Class shares. The dividend per share was slightly lower for the other share classes, to account for varying class specific expenses. The Fund’s net asset value increased by $0.42 per share (from $11.87 to $12.29) over the reporting period,

bringing the six-month total return to 11.21% (net of fees). On a relative basis, the Fund underperformed the MSCI All Country World Index Net USD, which returned 15.79%. Both security selection and sector allocation decisions detracted from

relative performance.

At the security level, the

Fund’s position in Walgreens was the largest contributor to relative performance. The U.S. retail drugstore operator outperformed as year-over-year sales, especially in the front end of the store, improved. The company also raised its quarterly

dividend.

Marathon Petroleum was another top

contributor to performance. The U.S. oil refining and distribution company outperformed as crack spreads continued to widen, and after the company announced a $2 billion increase to its share buyback program. Furthermore, Marathon Petroleum’s

stock rallied after the Environmental Protection Agency indicated that it was open to adjusting a renewable fuel mandate that had caused Marathon’s input costs to increase during the first half of 2013.

The largest detractor from performance for the reporting period

was the Fund’s holding of Cisco Systems. The U.S. communications equipment company underperformed after stating that it planned to lay off approximately 5% of its workforce in an effort to rationalize headcount gained in recent strategic

acquisitions. While the market viewed this news as negative, management indicated that it remained committed to returning capital to shareholders. Cisco’s stock price declined again when the company’s management announced disappointing

short-term earnings guidance due to weak revenues from the emerging markets. We continue to think that Cisco is an attractively-valued market leader with a solid balance sheet, and we added to our position.

The Fund’s holding of ProSafe was another detractor from

performance. Following strong performance early in the third quarter,

the Norwegian owner and operator of accommodation rigs underperformed after it announced a weakening in forward contracting, though quarterly earnings results hit a record high. We continue to

believe that ProSafe’s leading position in a niche market makes it an attractive investment.

Conclusion

Over the reporting period, we “derisked” the portfolio by decreasing our allocation to “Consistent Earners” (i.e. stable, blue-chip companies) that had appreciated

in value during the market rally. At the same time, we increased our allocations to “Basic Value” (i.e. more cyclical) companies and “Emerging Franchises” (i.e. growth companies) as the market volatility provided

opportunities to initiate positions in some very compelling investments. We also increased our allocations to European stocks and to financials.

Going forward, we maintain our long-term view that dividend-paying equities have the potential to be an attractive long-term investment

solution, especially given a secular outlook for lower returns across asset classes. As always, however, we continue to emphasize valuation in a market that has recently been characterized by overreactions to both positive and negative news.

Thank you for your investment in the Fund.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brad Kinkelaar Portfolio Manager |

|

|

Top 10 Holdings1

|

|

|

|

|

|

|

| HSBC Holdings PLC |

|

|

|

|

4.3% |

|

| Cisco Systems, Inc. |

|

|

|

|

4.1% |

|

| Roche Holding AG |

|

|

|

|

3.9% |

|

| Qualcomm, Inc. |

|

|

|

|

3.4% |

|

| Nippon Telegraph & Telephone Corp. |

|

|

|

|

3.3% |

|

| Standard Chartered PLC |

|

|

|

|

3.3% |

|

| Enagas S.A. |

|

|

|

|

3.1% |

|

| Total S.A. |

|

|

|

|

3.0% |

|

| JPMorgan Chase & Co. |

|

|

|

|

3.0% |

|

| ProSafe SE |

|

|

|

|

2.8% |

|

Geographic

Breakdown1

|

|

|

|

|

|

|

| United States |

|

|

|

|

48.0% |

|

| United Kingdom |

|

|

|

|

12.9% |

|

| Brazil |

|

|

|

|

5.6% |

|

| France |

|

|

|

|

4.3% |

|

| South Africa |

|

|

|

|

4.0% |

|

| Switzerland |

|

|

|

|

3.9% |

|

| Japan |

|

|

|

|

3.3% |

|

| Spain |

|

|

|

|

3.1% |

|

| Cyprus |

|

|

|

|

2.8% |

|

| Netherlands |

|

|

|

|

2.6% |

|

| Other |

|

|

|

|

8.5% |

|

Sector

Breakdown1

|

|

|

|

|

|

|

| Financials |

|

|

|

|

28.0% |

|

| Consumer Discretionary |

|

|

|

|

13.1% |

|

| Information Technology |

|

|

|

|

13.0% |

|

| Energy |

|

|

|

|

9.9% |

|

| Health Care |

|

|

|

|

9.3% |

|

| Utilities |

|

|

|

|

6.2% |

|

| Consumer Staples |

|

|

|

|

6.1% |

|

| Industrials |

|

|

|

|

6.0% |

|

| Telecommunication Services |

|

|

|

|

5.5% |

|

| Materials |

|

|

|

|

1.9% |

|

| 1

|

% of Total Investments as of 12/31/2013. Top Holdings, Geographic and Sector Breakdown solely reflect long positions. Securities sold

short, financial derivative instruments and short-term instruments are not taken into consideration. |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2013 |

|

11 |

PIMCO EqS® Dividend Fund

|

|

|

| Institutional Class -

PQDIX |

|

Class A -

PQDAX |

| Class P -

PQDPX |

|

Class C -

PQDCX |

| Class D -

PQDDX |

|

Class R - PQDRX |

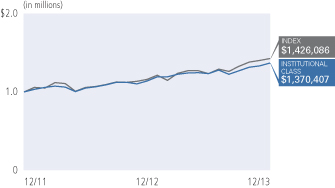

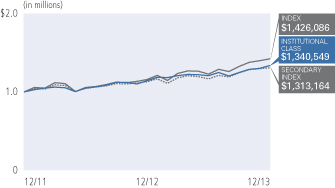

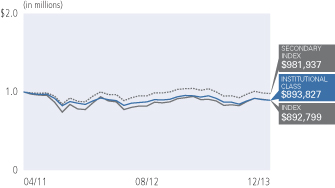

Cumulative Returns Through December 31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2013 |

|

| |

|

|

|

6 Months* |

|

|

1 Year |

|

|

Fund Inception

(12/14/11) |

|

|

|

PIMCO EqS® Dividend Fund Institutional Class |

|

|

11.21% |

|

|

|

20.33% |

|

|

|

17.68% |

|

|

|

PIMCO EqS® Dividend Fund Class P |

|

|

11.15% |

|

|

|

20.21% |

|

|

|

17.61% |

|

|

|

PIMCO EqS® Dividend Fund Class D |

|

|

11.10% |

|

|

|

19.93% |

|

|

|

17.35% |

|

|

|

PIMCO EqS® Dividend Fund Class A |

|

|

11.01% |

|

|

|

19.93% |

|

|

|

17.35% |

|

|

|

PIMCO EqS® Dividend Fund Class A (adjusted) |

|

|

4.91% |

|

|

|

13.33% |

|

|

|

14.15% |

|

|

|

PIMCO EqS® Dividend Fund Class C |

|

|

10.64% |

|

|

|

19.05% |

|

|

|

16.40% |

|

|

|

PIMCO EqS® Dividend Fund Class C (adjusted) |

|

|

9.64% |

|

|

|

18.05% |

|

|

|

16.40% |

|

|

|

PIMCO EqS® Dividend Fund Class R |

|

|

10.88% |

|

|

|

19.66% |

|

|

|

17.04% |

|

|

|

MSCI All Country World Index Net USD± |

|

|

15.79% |

|

|

|

22.80% |

|

|

|

20.96% |

|

All Fund returns are net of

fees and expenses.

* Cumulative return.

± The MSCI All Country World Index Net USD is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of

developed and emerging markets. The Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past

performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less

than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The adjusted returns take into account the maximum sales charge of 5.50% on

Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual operating expense ratio as stated in the Fund’s current prospectus, as supplemented to date, is 1.18% for the Institutional Class shares, 1.28% for the Class P

shares, 1.53% for the Class D shares, 1.53% for the Class A shares, 2.28% for the Class C shares and 1.78% for the Class R shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. For performance

current to the most recent month-end, visit www.pimco.com/investments.

Portfolio Insights

| » |

|

The PIMCO EqS® Dividend Fund seeks

to provide current income that exceeds the average yield on global stocks, and as a secondary objective, seeks to provide long-term capital appreciation, by investing under normal circumstances at least 75% of its assets in equity and equity-related

securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock), as well as securities issued by real estate investment trusts, master limited partnerships and

other equity trusts and depositary receipts. |

| » |

|

The Fund’s Institutional Class shares returned 11.21% after fees, and the Fund’s benchmark index, the MSCI All Country World Index Net USD,

returned 15.79% during the reporting period. |

| » |

|

During the reporting period, the Fund paid ordinary quarterly dividends of 18.9 cents per share and a one-time supplemental dividend of 7 cents per share

on its Institutional Class shares. The dividend per share was slightly lower for the other share classes to account for varying class specific expenses. The net asset value of the Fund’s Institutional Class shares increased by $0.42

per share (from $11.87 to $12.29) over the reporting period, bringing the six-month total return to 11.21%. |

| » |

|

Security selection detracted from performance. The largest single detractor from relative performance was the Fund’s holding of Cisco Systems,

the U.S.-based communications equipment company. |

| » |

|

The largest single contributor to relative performance was the Fund’s holding of Walgreens, the U.S.-based retail drugstore operator.

|

| » |

|

The Fund’s holdings in cash detracted from relative performance during a period in which the Fund’s benchmark index returned 15.79%.

|

Insights from the Portfolio Managers PIMCO

EqS® Emerging Markets Fund

Dear Shareholder,

We appreciate your investment in the PIMCO

EqS® Emerging Markets Fund (the “Fund”). In the

following letter, please find a discussion of the recent market environment and a review of portfolio performance.

Market Overview

While emerging market (“EM”) equities rebounded in the second half of the year following May’s “taper tantrum,” developed market (“DM”) equities rallied

even stronger. The MSCI Emerging Markets Index delivered 7.70%, underperforming its developed market counterpart, the MSCI World Index, which returned 16.83%.

Second half performance was nevertheless stronger than the first half of the year, in which EM equities underperformed DM equities. Much of

the underperformance can be explained by weakening fundamentals in the EM corporate sector. Whereas developed market firms have grown earnings, EM firms have experienced significant earnings deterioration, in part due to on-going structural

challenges, such as overcapacity and rising wage costs. Compounding the problem has been the influence of developed market monetary policy. When Federal Reserve (“Fed”) Chairman Ben Bernanke first publicly indicated that scaling back

monetary stimulus was a near-term possibility, investors opted to redeploy capital away from the emerging world and into the developed world, driving a market sell-off in May and June 2013.

The strong rebound in the second half of 2013 was driven by both mean reversion from the summer sell-off, and

policy influence moving in the opposite direction, as the Fed announced a delay in tapering its stimulus program. In addition, stronger Chinese manufacturing data helped generate more positive sentiment. These factors helped EM equities begin the

fourth quarter of 2013 on a strong note. However, by the end of the reporting period concerns over a slowdown in China and widening current account deficits in the “fragile five” countries (Turkey, South Africa, India, Indonesia, and

Brazil) weighed on returns. Political unrest, as seen in Turkey and Vietnam, only exacerbated capital outflows.

Looking ahead to 2014, we believe that EM equities remain attractively valued. However, we continue to be mindful of the risks, and will be observing closely how the asset class reacts to

reduced Fed purchases and whether the Chinese government can grow its economy back to pre-crisis levels, while simultaneously delivering on its promises of financial and social reform. In addition, upcoming EM political elections may serve as

another source of volatility, in our view. While they serve as an opportunity for elected officials to introduce substantial policy shifts, we believe it is likely that unpopular structural reforms may be delayed. In this environment we believe

differentiation between both countries and companies will remain critical.

Fund Review

Over the six-month reporting period, the Fund’s

Institutional Class shares returned 6.54% net of fees, underperforming its benchmark index, the MSCI Emerging Markets Index, which returned 7.70%. Though the Fund lagged its benchmark index over the six-month reporting period ended December 31,

2013, the Fund outperformed its benchmark index for the full 2013 calendar year.

The Fund’s underperformance over the six-month reporting period was driven by stock-specific events, as well as the general market environment of the third quarter of 2013. As the market

re-bounded from its summer lows in September, more cyclical, lower quality sectors rallied. The Fund’s bias towards firms with higher operating margins and returns on equity, which helped it perform well in the first six months of 2013, caused

the Fund to lag during the EM equity market rebound in the second half of 2013.

In addition, holdings in KIA Motors, a Korean car manufacturer, and Iluka Resources, an Australian mining company, impacted performance as the stock prices of these companies struggled over

the reporting period. Japan’s bond buying program has been successful in weakening the yen, boosting country exports and improved earnings for Japanese industries, particularly carmakers. While this has been positive for our holdings in

Japanese industrials, it has come at the expense of competing firms in the Asia-Pacific region, such as KIA Motors. KIA suffered slightly over the reporting period as revenue was challenged by lower-priced Japanese car models. Although we recognize

the competition from Japan, we believe that KIA retains a strong market position and is one of the most attractively valued global auto manufacturers.

Concern over whether Chinese growth was cooling also resurfaced in the second half of 2013, and with it concerns of a slowdown among its

largest commodity trading partners, such as Australia. This weighed on Australian materials company Iluka Resources as demand for its building materials, which are used heavily in Chinese real estate construction, cooled. Although Chinese growth is

likely to slow over the cyclical timeframe, we think that Iluka will benefit from long-term demand for building materials.

Areas that performed well during the reporting period included our holdings in Russian energy companies, a good example of our focus on

investing in strong free cash flow generating companies with increasing dividend payouts. From a valuation perspective, Russia is the cheapest market in the developing world, and the energy sector makes up close to 60% of the equity market. We are

vigilant of typical investing traps in Russia, such as high cyclicality and poor corporate governance, and we believe investing in businesses with high dividend yields or at low valuations may help mitigate these issues. Over the

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2013 |

|

13 |

Insights from the Portfolio Managers PIMCO

EqS® Emerging Markets Fund (Cont.)

reporting period, Russian energy companies performed extremely well, helped by news that the government is considering opening up the state-run liquefied natural gas market by granting operating

licenses to independent producers as early as 2014.

Other areas that performed well included our long-standing positions in the Asian gaming industry. The Chinese region of Macau offers

investors the chance to benefit from rising consumer demand and middle-class consumption on the back of improving infrastructure to access hotels and casinos from the Chinese mainland. Wynn Macau and Melco Crown are businesses that continue to

experience double-digit revenue growth from a combination of expanding demand and a constrained supply of table licenses, which is limited by regulation.

Conclusion

Looking ahead, we believe that EM equities remain attractively valued on a historical basis and that real wage growth and an emerging

consuming class should drive equity returns over the secular horizon. However, we retain a cautious eye in the near term and believe the asset class remains susceptible to currency volatility and negative shocks. As EM corporate earnings remain

highly levered to Gross Domestic Product growth, we believe sustained outperformance likely rests on a turn in the earnings cycle and improving manufacturing data.

To navigate this environment we continue to believe in an

active, fundamental approach, investing in both EM equities and DM equities with EM growth drivers, and fully incorporating macroeconomic views. With the near-term headwinds facing EM, we believe that differentiation is critical. We continue to

favor companies commanding premium profitability and benefiting from healthy long-run consumer dynamics. From a country perspective we are cautious on countries with large current account deficits, preferring those with strong balance sheets and a

high degree of policy flexibility. From a sector perspective, we see value in higher quality cyclicals and may look to add to select consumer staples on any market pull-back.

Again, we thank you for your continued investment in the Fund

and look forward to serving your investment needs.

Sincerely,

|

|

|

Maria (Masha)

Gordon Portfolio Manager |

Top 10

Holdings1

|

|

|

|

|

|

|

| Samsung Electronics Co. Ltd. |

|

|

|

|

5.8% |

|

| Kia Motors Corp. |

|

|

|

|

3.0% |

|

| MegaFon OAO—GDR |

|

|

|

|

2.6% |

|

| China Shenhua Energy Co. Ltd. ‘H’ |

|

|

|

|

2.4% |

|

| AIA Group Ltd. |

|

|

|

|

2.3% |

|

| Industrial & Commercial Bank of China Ltd. ‘H’ |

|

|

|

|

2.3% |

|

| Credicorp Ltd. |

|

|

|

|

2.2% |

|

| JPMorgan Chase & Co., Chinese Exchange

Basket—Exp. 01/08/2014 |

|

|

|

|

2.1% |

|

| MediaTek, Inc. |

|

|

|

|

2.0% |

|

| Prada SpA |

|

|

|

|

2.0% |

|

Geographic

Breakdown1

|

|

|

|

|

|

|

| Brazil |

|

|

|

|

10.9% |

|

| China |

|

|

|

|

10.6% |

|

| South Korea |

|

|

|

|

10.6% |

|

| India |

|

|

|

|

5.8% |

|

| Hong Kong |

|

|

|

|

5.7% |

|

| United Kingdom |

|

|

|

|

3.9% |

|

| Japan |

|

|

|

|

3.7% |

|

| Peru |

|

|

|

|

3.3% |

|

| Taiwan |

|

|

|

|

3.0% |

|

| Russia |

|

|

|

|

2.6% |

|

| Cyprus |

|

|

|

|

2.3% |

|

| Italy |

|

|

|

|

2.0% |

|

| Israel |

|

|

|

|

2.0% |

|

Geographic Breakdown1 (Cont.)

|

|

|

|

|

|

|

| South Africa |

|

|

|

|

2.0% |

|

| Mexico |

|

|

|

|

1.9% |

|

| Cambodia |

|

|

|

|

1.9% |

|

| Denmark |

|

|

|

|

1.8% |

|

| Australia |

|

|

|

|

1.6% |

|

| Other |

|

|

|

|

11.5% |

|

Sector

Breakdown1

|

|

|

|

|

|

|

| Financials |

|

|

|

|

21.8% |

|

| Consumer Discretionary |

|

|

|

|

15.7% |

|

| Consumer Staples |

|

|

|

|

12.3% |

|

| Information Technology |

|

|

|

|

9.6% |

|

| Materials |

|

|

|

|

8.6% |

|

| Industrials |

|

|

|

|

6.1% |

|

| Energy |

|

|

|

|

5.4% |

|

| Telecommunication Services |

|

|

|

|

3.5% |

|

| Utilities |

|

|

|

|

2.7% |

|

| Other |

|

|

|

|

1.4% |

|

| 1

|

% of Total Investments as of 12/31/2013. Top Holdings, Geographic and Sector Breakdown solely reflect long positions. Securities sold

short, financial derivative instruments and short-term instruments are not taken into consideration. |

|

|

|

|

|

|

|

|

|

SEMIANNUAL REPORT |

|

DECEMBER 31, 2013 |

|

15 |

PIMCO EqS® Emerging Markets Fund

|

|

|

| Institutional Class -

PEQWX |

|

Class A -

PEQAX |

| Class P -

PEQQX |

|

Class C -

PEQEX |

| Administrative Class -

PEQTX |

|

Class R - PEQHX |

| Class D -

PEQDX |

|

|

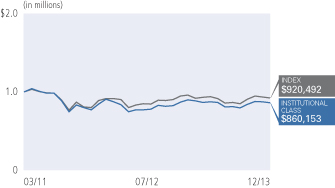

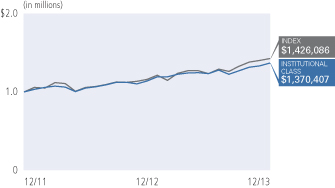

Cumulative Returns Through December 31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Return for the period ended December 31, 2013 |

|

| |

|

|

|

6 Months* |

|

|

1 Year |

|

|

Fund Inception

(03/22/11) |

|

|

|

PIMCO EqS® Emerging

Markets Fund Institutional Class |

|

|

6.54% |

|

|

|

-0.79% |

|

|

|

-4.03% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Class P |

|

|

6.67% |

|

|

|

-0.79% |

|

|

|

-4.06% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Administrative Class |

|

|

6.44% |

|

|

|

-1.02% |

|

|

|

-4.30% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Class D |

|

|

6.46% |

|

|

|

-1.02% |

|

|

|

-4.35% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Class A |

|

|

6.46% |

|

|

|

-1.13% |

|

|

|

-4.41% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Class A (adjusted) |

|

|

0.58% |

|

|

|

-6.53% |

|

|

|

-6.33% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Class C |

|

|

5.92% |

|

|

|

-1.94% |

|

|

|

-5.08% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Class C (adjusted) |

|

|

4.92% |

|

|

|

-2.92% |

|

|

|

-5.08% |

|

|

|

PIMCO EqS® Emerging

Markets Fund Class R |

|

|

6.23% |

|

|

|

-1.36% |

|

|

|

-4.60% |

|

|

|

MSCI Emerging Markets Index (Net Dividends in USD)± |

|

|

7.70% |

|

|

|

-2.60% |

|

|

|

-1.36% |

|

All Fund returns are net of

fees and expenses.

* Cumulative return.

± The MSCI Emerging Markets Index (Net Dividends in USD) is a free float-adjusted market capitalization index that is designed to measure equity market performance of

emerging markets. It is not possible to invest directly in an unmanaged index.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance

shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund

distributions or the redemption of fund shares. The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1.00% CDSC on Class C shares. The Fund’s total annual operating expense ratio as stated in the

Fund’s current prospectus, as supplemented to date, is 1.45% for the Institutional Class shares, 1.55% for the Class P shares, 1.70% for the Administrative Class shares, 1.80% for the Class D shares, 1.80% for the Class A shares, 2.55% for

the Class C shares and 2.05% for the Class R shares. Details regarding any Fund’s operating expenses can be found in the Fund’s prospectus. For performance current to the most recent month-end, visit www.pimco.com/investments.

Portfolio Insights

| » |

|

The PIMCO EqS® Emerging Markets

Fund seeks capital appreciation by investing under normal circumstances at least 80% of its assets in a diversified portfolio of investments economically tied to emerging market countries. The Fund will invest a substantial portion of its assets in

equity and equity-related securities, including common and preferred stock (and securities convertible into, or that PIMCO expects to be exchanged for, common or preferred stock). The Fund may also invest in fixed income securities, including debt

securities issued by both corporate and government issuers. The Fund may invest in commodity related instruments, including exchange-traded funds, futures and other investment companies. The Fund may also invest in derivative instruments, such as

options, futures contracts or swap agreements. |

| » |

|

The Fund’s Institutional Class shares returned 6.54% after fees, and the Fund’s benchmark index, the MSCI Emerging Markets Index, returned 7.70%

during the reporting period. |

| » |

|

From a sector perspective, stock selection in the energy and industrials sectors contributed to relative performance. Positions in Russian energy

companies were the top contributors. A focus on Japanese industrials with higher dividend yield and earnings forecasts was also additive to returns. |

| » |

|

On the downside, an overweight to the materials sector detracted from returns. Stock selection in Australian and Israeli materials companies detracted

from performance. |

| » |

|

From a country perspective, an overweight to Russia and an underweight to Indonesia were positive for performance. Security selection within Russian

energy contributed to performance. An underweight to Indonesia was positive for performance. |

| » |

|

On the downside, stock selection in Korea and off-benchmark allocations to Israel and Australia were negative for relative performance. In

Korea, stock selection within the consumer discretionary and information technology sectors, coupled with an underweight to the financials and materials sectors, detracted from returns. An allocation to the Israeli and Australian materials sector

was negative on concerns over Chinese demand. |

| » |

|

Currency positioning and cash holdings were negative contributors over the reporting period. |

Insights from the Portfolio Managers PIMCO

EqS® Long/Short Fund

Dear Shareholder,

We appreciate your investment in the PIMCO

EqS® Long/Short Fund (the “Fund”). In the

following letter, please find a discussion of the recent market environment and a review of recent portfolio performance.

Market Overview

Following the pull back in equity markets during June 2013 as investors began to speculate as to the speed and magnitude of the Federal

Reserve’s (“Fed”) eventual exit of its supportive monetary policies, investors began to accept that “tapering” was not necessarily “tightening.” Macroeconomic fears continued to recede as economic results for both

the U.S. and Europe indicated stronger than anticipated growth. While the Fed did somewhat surprise the markets with their announcement of a December tapering, their strengthened pledge towards a zero interest rate policy largely offset investor

concerns of tightening monetary policy.

Fund Review

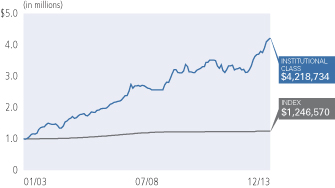

Over the six-month reporting period, the

Fund’s Institutional Class shares returned 13.78% net of fees, outperforming its benchmark, 3-Month USD LIBOR Index, by 13.65% on an after fees basis. The performance over this time period contributed to

a strong 2013. For the 2013 calendar year, the Fund returned 34.52% net of fees, outperforming both its benchmark index by 34.24% and the broader U.S. equity market return of 32.39%, as represented by the S&P 500 Index.

As a reminder, the Fund is a concentrated, long-biased equity

fund that integrates bottom-up research and macroeconomic insights. With the flexibility to increase or decrease equity market exposure, the Fund has the potential to participate in market upside while also seeking to mitigate losses during

extended market declines. The Fund’s ability to take sizeable positions in its highest conviction stock ideas enhances the potential for returns. In 2013, our performance was driven by strong stock selection, particularly among our

long positions.

During the six-month reporting

period, the Fund’s position in DST Systems was the top contributor to performance. DST is a conglomerate business, built as the company’s former CEO used DST’s strong free cash flow to make investments in other public companies,

private equity, and real estate to amass a substantial portfolio of non-core assets. Last year, the company’s shareholders appointed a new chairman and CEO to improve the company’s overall capital allocation, and this management team is

now monetizing these investments and redeploying the capital into share repurchases and debt reduction. We believed that the stock had significant upside with means to unlock shareholder value or the potential to be considered a favorable takeover

target for private equity investors.

The Fund’s investment in Genworth Financial was another contributor to returns over the

reporting period. Genworth is a combination of two businesses that are a bit of an odd couple: 1) a life insurance operation with a long-term care business, and 2) a U.S. mortgage insurance business that had been driving a sub-par return on equity

(“ROE”). As half of the competitors have left the long-term care business over the past two years due to low interest rates and poor ROEs, the industry right now is an oligopoly with just four players. We viewed the company as being in an

attractive position to benefit from a rising rate environment along with an improvement in the housing market to improve the headwinds from their mortgage insurance business. Combined with the potential to spin off other businesses and initiate a

dividend next year, we viewed that there was substantial upside and the thesis played out favorably over the reporting period.

These positive results were partially offset by the Fund’s position in Penn West Petroleum, which detracted from returns. The company

traded sharply lower on announcing that it would be targeting as much as $2 billion Canadian dollars of asset sales before 2015 as a strategic review, which was a sharply negative surprise for investors and extended the timing of the company’s

transition plan. Given this new information, we revisited our original investment thesis and decided to exit the position.

In addition, our short positions detracted from performance in aggregate due to the strong equity market rally. Our approach to shorting is

primarily to generate alpha as opposed to simply hedging market risk. While detracting from performance over the six-month period, these positions have historically served to reduce the overall volatility of the portfolio in periods when the equity

market pulled back, and we believe can still generate alpha over the full market cycle.

Conclusion

We reflect on 2013 as a year in which U.S. equities surged to record highs on signs of economic recovery and continued aggressive monetary policy. In addition, we have observed that equities