UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23013

Goldman Sachs ETF Trust

(Exact name of registrant as specified in charter)

200 West Street, New York, New York 10282

(Address of principal executive offices) (Zip code)

| Caroline Kraus, Esq. | Copies to: | |

| Goldman Sachs & Co. LLC | Geoffrey R.T. Kenyon, Esq. | |

| 200 West Street | Dechert LLP | |

| New York, New York 10282 | 100 Oliver Street | |

| 40th Floor | ||

| Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: August 31, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Annual Report | August 31, 2018 | |||

| Access Fixed Income ETFs | ||||

| Access High Yield Corporate Bond ETF | ||||

| Access Investment Grade Corporate Bond ETF | ||||

| Access Treasury 0-1 Year ETF | ||||

Goldman Sachs Access Fixed Income ETFs

| ∎ | ACCESS HIGH YIELD CORPORATE BOND ETF |

| ∎ | ACCESS INVESTMENT GRADE CORPORATE BOND ETF |

| ∎ | ACCESS TREASURY 0-1 YEAR ETF |

| 1 | ||||

| 4 | ||||

| 22 | ||||

| 44 | ||||

| 48 | ||||

| 51 | ||||

| 61 | ||||

| 62 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

Goldman Sachs Access Fixed Income ETFs

Principal Investment Strategies

GOLDMAN SACHS ACCESS HIGH YIELD CORPORATE BOND ETF

The Goldman Sachs Access High Yield Corporate Bond ETF (the “Fund”) seeks to achieve its investment objective by investing at least 80% of its assets (exclusive of collateral held from securities lending) in securities included in its underlying index.

The FTSE Goldman Sachs High Yield Corporate Bond Index (the “Index”) is a rules-based index that is designed to measure the performance of high yield corporate bonds denominated in U.S. dollars (“USD”) that meet certain liquidity and fundamental screening criteria. “High yield” bonds are bonds that are rated below investment grade and are commonly referred to as “junk bonds.” As of October 31, 2017, there were 673 constituents in the Index and the Index had a weighted average maturity of 5.81 years. The Index is a custom index that is owned and calculated by FTSE Fixed Income LLC (“FTSE”), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group” or the “Index Provider”) . The Index is based on the FTSE US High-Yield Market Index (the “Reference Index”) using concepts developed with Goldman Sachs Asset Management, L.P. (“GSAM”).

Given the Fund’s investment objective of attempting to track the Index, the Fund does not follow traditional methods of active investment management, which may involve buying and selling securities based upon analysis of economic and market factors.

The Index Provider constructs the Index in accordance with a rules-based methodology that involves two steps.

Step 1 - In the first step, the Index Provider defines a universe of potential index constituents (the “Universe”) by applying specified criteria to the constituents of the Reference Index. The Reference Index includes high yield corporate bonds issued by companies domiciled in the United States or Canada that have a minimum of one year to maturity and are rated a maximum of BB+ by Standard & Poor’s Ratings Services (“S&P”) and Ba1 by Moody’s Investors Service, Inc. (“Moody’s”) and a minimum of C by S&P and Ca by Moody’s. Only constituents of the Reference Index that (i) have a minimum of $400 million outstanding, a minimum issuer size of $1 billion and a maximum final maturity of 15 years and (ii) are rated at least CCC+ by S&P or Caa1 by Moody’s are included in the Universe. A maturity bucketing process is used to approximate the average effective duration of the Reference Index.

Step 2 - In the second step, the Index Provider applies a fundamental screen to the Universe. Issuers are first grouped into three broad industry groups: financials, industrials and utilities. Within each industry group, issuers are measured by two fundamental factors, debt service and leverage. The Index Provider ranks each issuer based on the two fundamental factors, equally weighted. The Index is constructed by including the highest ranking eligible securities in each industry group, screening out lowest ranking eligible securities.

GOLDMAN SACHS ACCESS INVESTMENT GRADE CORPORATE BOND ETF

The Goldman Sachs Access Investment Grade Corporate Bond ETF (the “Fund”) seeks to achieve its investment objective by investing at least 80% of its assets (exclusive of collateral held from securities lending) in securities included in its underlying index.

The FTSE Goldman Sachs Investment Grade Corporate Bond Index (the “Index”) is a rules-based index that is designed to measure the performance of investment grade, corporate bonds denominated in U.S. dollars (“USD”) that meet certain liquidity and fundamental screening

1

INVESTMENT PROCESS

criteria. As of October 31, 2017, there were 1,948 constituents in the Index and the Index had a weighted average maturity of 10.59 years. The Index is a custom index that is owned and calculated by FTSE Fixed Income LLC (“FTSE”), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group” or the “Index Provider”). The Index is based on the FTSE US Broad Investment-Grade (USBIG®) Corporate Index (the “Reference Index”) using concepts developed with Goldman Sachs Asset Management, L.P. (“GSAM”).

Given the Fund’s investment objective of attempting to track the Index, the Fund does not follow traditional methods of active investment management, which may involve buying and selling securities based upon analysis of economic and market factors.

The Index Provider constructs the Index in accordance with a rules-based methodology that involves two steps.

Step 1 - In the first step, the Index Provider defines a universe of potential index constituents (the “Universe”) by applying specified criteria to the constituents of the Reference Index. The Reference Index includes investment grade corporate bonds that have a minimum of one year to maturity and are rated at least BBB- by Standard & Poor’s Ratings Services (“S&P”) or Baa3 by Moody’s Investors’ Services, Inc. (“Moody’s”). Only corporate bond constituents of the Reference Index that have a minimum of $750 million outstanding and a minimum issuer size of $2 billion are included in the Universe. A maturity bucketing process is used to approximate the average effective duration of the Reference Index.

Step 2 - In the second step, the Index Provider applies a fundamental screen to the Universe. Issuers are first grouped into three broad industry groups: financials, industrials and utilities. Within each industry group, issuers are measured by two fundamental factors, operating margin and leverage. The Index Provider ranks each issuer based on the two fundamental factors, equally weighted. The Index is constructed by including the highest ranking eligible securities in each industry group, screening out lowest ranking eligible securities.

GOLDMAN SACHS ACCESS TREASURY 0-1 YEAR ETF (formerly Goldman Sachs TreasuryAccess 0-1 Year ETF)

Effective August 7, 2018, the Goldman Sachs TreasuryAccess 0-1 Year ETF was re-named Goldman Sachs Access Treasury 0-1 Year ETF (the “Fund”). The Fund seeks to achieve its investment objective by investing at least 80% of its assets (exclusive of collateral held from securities lending) in securities included in its underlying index.

The FTSE US Treasury 0-1 Year Composite Select Index (the “Index”) is designed to measure the performance of U.S. Treasury Obligations with a maximum remaining maturity of 12 months. “U.S. Treasury Obligations” refer to securities issued or guaranteed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government. U.S. Treasury Obligations include U.S. Treasury notes, U.S. Treasury bills and U.S. Treasury floating rate bonds. As of October 31, 2017, there were 73 issues in the Index and the Index had a weighted average maturity of 0.38 years. The Index includes publicly-issued U.S. Treasury Obligations that have a minimum remaining maturity of 1 month and a maximum remaining maturity of 12 months at the time of rebalance and that have a minimum issue size of $5 billion. In addition, the securities in the Index must be non-convertible and denominated in U.S. dollars. The Index excludes certain special issues, such as targeted investor notes, state and local government series bonds and coupon issues that have been stripped from bonds. 10-year and 30-year U.S. Treasury bonds are not eligible for inclusion in the Index.

2

INVESTMENT PROCESS

The Index is sponsored by FTSE Fixed Income LLC (“FTSE”), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group or the “Index Provider”), which is not affiliated with the Fund or the Investment Adviser. The Index is market capitalization-weighted and the securities in the Index are updated on the last business day of each month. Given the Fund’s investment objective of attempting to track the Index, the Fund does not follow traditional methods of active investment management, which may involve buying and selling securities based upon analysis of economic and market factors.

THE FUND IS NOT A MONEY MARKET FUND AND DOES NOT ATTEMPT TO MAINTAIN A STABLE NET ASSET VALUE.

ALL FUNDS

Each of the FTSE Goldman Sachs High Yield Corporate Bond Index and FTSE Goldman Sachs Investment Grade Corporate Bond Index is rebalanced (i) monthly on the last business day of each month, to account for changes in maturities, duration, corporate actions or ratings migration, and (ii) quarterly, to account for updates to the constituents on the basis of the fundamental factors (as described above). The FTSE US Treasury 0-1 Year Composite Select Index is rebalanced monthly on the last day of the month.

The Investment Adviser uses a representative sampling strategy to manage each Fund. “Representative sampling” is an indexing strategy in which a Fund invests in a representative sample of constituent securities that has a collective investment profile similar to that of its Index. The securities selected for investment by a Fund are expected to have, in the aggregate, investment characteristics, fundamental characteristics and liquidity measures similar to those of its Index. A Fund may or may not hold all of the securities in its Index.

Each of the Goldman Sachs Access High Yield Corporate Bond ETF and Goldman Sachs Investment Grade Corporate Bond ETF may concentrate its investments (i.e. hold more than 25% of its total assets) in a particular industry or group of industries to the extent that its Index is concentrated. The degree to which components of its Index represent certain sectors or industries may change over time. The Goldman Sachs Access Treasury 0-1 Year ETF may concentrate its investments (i.e., hold more than 25% of its total assets) in a particular industry or group of industries to the extent that the Index is concentrated. The U.S. government, state and municipal governments and their agencies, authorities and instrumentalities are not deemed to be industries for this purpose.

3

Goldman Sachs Access High Yield Corporate Bond ETF

Investment Objective

The Goldman Sachs Access High Yield Corporate Bond ETF (the “Fund”) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Goldman Sachs High Yield Corporate Bond Index (the “Index”).

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Fixed Income and Liquidity Solution Team discusses the Fund’s performance and positioning for the period since it commenced operations on September 5, 2017 through August 31, 2018 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund returned 2.58% based on net asset value (“NAV”) and 2.41% based on market price. The Index returned 2.98% during the same period. |

| The Fund had an NAV of $49.92 per share on the date of inception and ended the Reporting Period with an NAV of $48.86 per share. The Fund’s market price on August 31, 2018 was $48.82 per share. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Index. The Fund’s performance reflects Fund expenses, including management fees and brokerage expenses. The Fund’s relative performance also reflects the impact of any cash held in the Fund as well as any other differences between the Fund’s holdings and the constituents of the Index. The Index is unmanaged, and Index returns do not reflect fees and expenses, which would reduce returns. |

| The Index is designed to measure the performance of high yield corporate bonds denominated in U.S. dollars that meet certain liquidity and fundamental screening criteria. “High yield” bonds are bonds that are rated below investment grade and are commonly referred to as “junk bonds.” The Index is a custom index that is owned and calculated by FTSE Fixed Income LLC (“FTSE”), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group” or the “Index Provider”). The Index is based on the FTSE US High-Yield Market Index (the “Reference Index”) using concepts developed with Goldman Sachs Asset Management, L.P. (“GSAM”). The Index is rules-based and the securities in the Index are updated on the last business day of each month. |

| Given the Fund’s investment objective of attempting to track the Index, the Fund does not follow traditional methods of active investment management, which may involve buying and selling securities based upon analysis of economic and market factors. |

| During the Reporting Period, the Fund posted positive absolute returns that modestly lagged those of the Index, as measured by NAV. The Fund is passively managed to the Index and aims to minimize tracking error to the Index. |

| Overall, high yield corporate bond returns are driven by three primary factors — yield, duration (whether interest rates are rising or falling) and spreads (or a widening or tightening of the yield differential to U.S. Treasuries). During the Reporting Period, interest rates increased. The yield on the 10-year U.S. Treasury increased by approximately 81 basis points during the Reporting Period. (A basis point is 1/100th of a percentage point.) The U.S. Federal Reserve (the “Fed”) raised interest rates three times during the Reporting Period — in December 2017, March 2018 and June 2018, and expectations for additional interest rate hikes in 2018 and 2019, coupled with rising inflation, contributed to U.S. Treasuries’ rising yields. |

| High yield corporate spreads tightened by approximately 44 basis points during the Reporting Period. Despite heightened market volatility, as seen primarily in equity markets, high yield corporate bonds exhibited resilience on the back of strong corporate earnings, a significant decline in new issue supply and prospects for ongoing U.S. economic growth with added fiscal stimulus. |

| All told, then, the high yield corporate bond sector posted positive returns during the Reporting Period, with coupon income and low default rates offsetting rising interest rates. |

4

PORTFOLIO RESULTS

| At the end of the Reporting Period, we believed it likely the Fed would hike interest rates next in September 2018 for a total of two more times in 2018 and then three times in 2019 in increments of 25 basis points each. We believed the U.S. economy would continue to grow in the months ahead and corporate earnings remain strong during the next couple of quarters. Further, we expected default rates within the high yield corporate bond market to remain low. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | The Fund does not employ derivatives. |

| Q | What was the Fund’s weighted average duration, weighted average maturity, weighted average coupon and 30-day standardized yield at the end of the Reporting Period?1 |

| A | The Fund had a weighted average duration of 3.73 years, a weighted average maturity of 5.62 years and a weighted average coupon of 6.13% as of August 31, 2018. The 30-day standardized yield of the Fund at the end of the Reporting Period was 5.50%. |

| Q | What was the Fund’s credit allocation at the end of the Reporting Period?2 |

| A |

| BB |

51.3 | % | ||||

| B | 37.4 | % | ||||

| CCC | 8.5 | % | ||||

| Not Rated | 0.2 | % | ||||

| Cash | 2.7 | % |

| Q | What was the Fund’s industry allocation at the end of the Reporting Period? |

| A | Of the approximately 96.22% of the Fund’s assets invested in high yield corporate bonds at the end of the Reporting Period, approximately 82.42% was in industrials, 6.55% in financials and 7.25% in utilities. |

| Q | What was the Fund’s sector positioning relative to the Index at the end of the Reporting Period?3 |

| A | While the Index was 99.34% allocated to high yield corporate bonds and 0.66% allocated to emerging market corporate bonds, the Fund was 96.22% invested in high yield corporate bonds, 1.10% in emerging market corporate bonds and 2.67% in cash at the end of the Reporting Period. |

| 1 | Duration is a time measure of a bond’s interest-rate sensitivity, based on the weighted average of the time periods over which a bond’s cash flows accrue to the bondholder. Time periods are weighted by multiplying by the present value of its cash flow divided by the bond’s price. (A bond’s cash flows consist of coupon payments and repayment of capital.) |

| A bond’s duration will almost always be shorter than its maturity, with the exception of zero-coupon bonds, for which maturity and duration are equal. Weighted average duration is a measure of the duration for the securities in the portfolio overall. Weighted average maturity (“WAM”) is the weighted average amount of time until the debt securities in a portfolio mature, or the weighted average of the remaining terms to maturity of the debt securities within a portfolio. The higher the WAM, the longer it takes for all of the bonds in the portfolio to mature, and WAM is used to manage debt portfolios and to assess the performance of debt portfolio managers. Coupons are fixed percentages paid out on a fixed income security on an annual basis. Weighted average coupon is calculated by weighting the coupon of each debt security by its relative size in the portfolio. The 30-day standardized yield calculation is based on a 30-day period ending on the last day of the Reporting Period. It is computed by dividing the net investment income per share earned during the period by the maximum offering price per share on the last day of the period. |

| 2 | This Fund and the Index have not been rated by an independent rating agency. The credit allocation provided refers to the Fund’s underlying portfolio securities. For the purpose of determining compliance with any credit rating requirement, the Fund assigns a security, at the time of purchase, the highest rating by a Nationally Recognized Statistical Rating Organization (“NRSRO”) if the security is rated by more than one NRSRO. For this purpose, the Fund relies only on the ratings of the following NRSROs: S&P, Moody’s and Fitch, Inc. This method may differ from the method independently used by the Index Provider. GSAM will use a single rating if that is the only one available. Securities that are not rated by all three agencies are reflected as such in the breakdown. Unrated securities may be purchased by the Fund if they are determined by the Investment Adviser to be of a credit quality consistent with the Fund’s credit rating requirements. Unrated securities do not necessarily indicate low quality, and for such securities the Investment Adviser will evaluate the credit quality. GSAM converts all ratings to the equivalent S&P major rating category when illustrating credit rating breakdowns. Ratings and fund/index credit quality may change over time. |

| 3 | The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Goldman Sachs High Yield Corporate Bond Index. |

5

FUND BASICS

Access High Yield Corporate Bond ETF

as of August 31, 2018

| FUND SNAPSHOT |

| |||||

| As of August 31, 2018 | ||||||

| Market Price1 | $ | 48.82 | ||||

| Net Asset Value (NAV)1 | $ | 48.86 | ||||

| 1 | The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com. |

| PERFORMANCE REVIEW |

| |||||||||||

| September 5, 2017– August 31, 2018 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

FTSE Goldman Sachs High Yield Corporate Bond Index3 |

|||||||||

| Shares | 2.58% | 2.41 | % | 2.98 | % | |||||||

| 2 | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculations assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00 pm EST and do not reflect the returns you would receive if you traded shares at other times. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the Market Price returns. Total returns for periods less than one full year are not annualized. |

| 3 | The Index was developed and is calculated and maintained by FTSE Fixed Income LLC (“FTSE”), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group” or the “Index Provider”). FTSE is not affiliated with the Fund or GSAM. The Fund is not sponsored, endorsed, sold or promoted by FTSE or any of its affiliates and FTSE makes no representation to any owner or prospective owner of the Fund regarding the advisability of investing in securities generally or in the Fund particularly, or the ability of the Fund to track the price and yield performance of the Index or the ability of the Index to track general bond market performance. FTSE’s only relationship to GSAM (“Licensee”) is the licensing of certain information, data, trademarks and trade names of FTSE or its affiliates. The Index is determined, composed and calculated by FTSE without regard to the Fund. FTSE has no obligation to take the needs of the owners or prospective owners of the Fund into consideration in determining, composing or calculating the Index. FTSE is not responsible for and has not participated in the determination of the prices and amount of the shares to be issued by the Fund or the timing of the issuance or sale of the shares to be issued by the Fund or in the determination or calculation of the equation by which the shares to be issued by the Fund are to be converted into cash. FTSE has no obligation or liability in connection with the administration, marketing or trading of the Fund. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale or redemption of Fund shares.

6

FUND BASICS

| 30-DAY STANDARDIZED YIELD4 | ||||

| 30-Day Standardized Yield4 | ||||

| Shares | 5.50% | |||

| 4 | The method of calculation of the 30-Day Standardized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the 30-day period ending on the last day of the Reporting Period by the maximum public offering price per share on the last day of the period. This number is then annualized. |

| EXPENSE RATIO5 | ||||

| Expense Ratio | ||||

| Shares | 0.34% | |||

| 5 | The expense ratio of the Fund is as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratio disclosed on the Financial Highlights in this report. |

| TOP TEN HOLDINGS AS OF 8/31/186 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| First Data Corp., 7.00%, 12/01/23 |

0.9 | % | Information Technology | |||||

| MGM Resorts International, 6.63%, 12/15/21 |

0.8 | Consumer, Cyclical | ||||||

| Bausch Health Cos, Inc., 7.00%, 03/15/24 |

0.8 | Consumer, Non-cyclical | ||||||

| CCO Holdings LLC / CCO Holdings Capital Corp., 5.13%, 05/01/27 |

0.8 | Telecommunication Services | ||||||

| CSC Holdings LLC, 10.88%, 10/15/25 |

0.8 | Telecommunication Services | ||||||

| Sirius XM Radio, Inc., 6.00%, 07/15/24 |

0.7 | Telecommunication Services | ||||||

| Prime Security Services Borrower LLC / Prime Finance, Inc., 9.25%, 05/15/23 |

0.7 | Consumer, Non-cyclical | ||||||

| Bausch Health Cos, Inc., 6.13%, 04/15/25 |

0.7 | Consumer, Non-cyclical | ||||||

| First Data Corp., 5.75%, 01/15/24 |

0.7 | Information Technology | ||||||

| DISH DBS Corp., 5.88%, 11/15/24 |

0.7 | Telecommunication Services | ||||||

| 6 | The top 10 holdings may not be representative of the Fund’s future investments. |

7

FUND BASICS

| INDUSTRY ALLOCATION AS OF 8/31/187 |

| |||||

| Industry | % of Net Assets | |||||

| Telecommunication Services |

22.1 | % | ||||

| Consumer, Non-cyclical |

17.5 | |||||

| Energy |

14.8 | |||||

| Consumer, Cyclical |

11.1 | |||||

| Financials |

8.1 | |||||

| Industrials |

7.4 | |||||

| Information Technology |

6.2 | |||||

| Materials |

5.1 | |||||

| Utilities |

3.4 | |||||

| Other |

1.9 | |||||

| 7 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. The “Other” category represents the Fund’s investments in other investment companies. Figures in the table may not sum to 100% due to the exclusion of other assets and liabilities. |

8

GOLDMAN SACHS ACCESS HIGH YIELD CORPORATE BOND ETF

Performance Summary

August 31, 2018

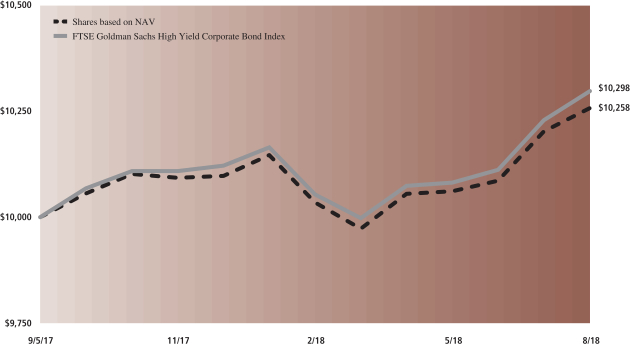

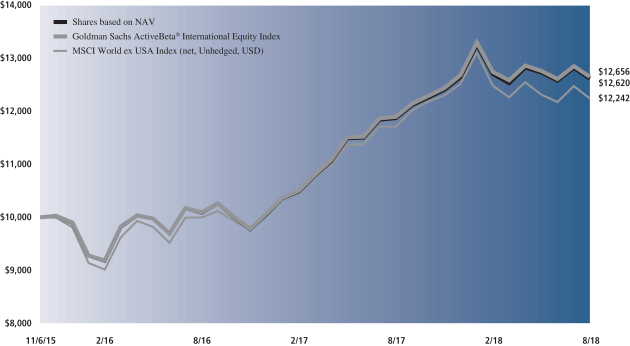

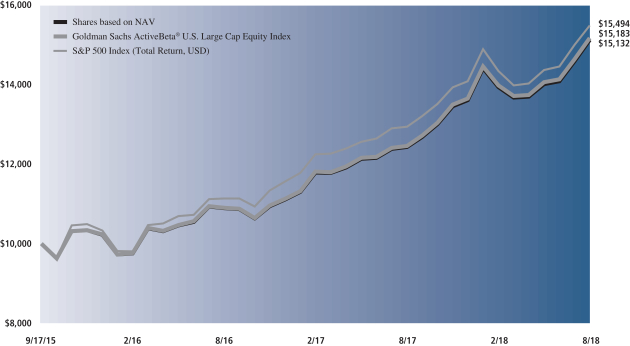

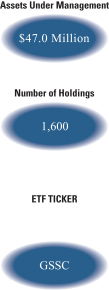

The following graph shows the value, as of August 31, 2018, of a $10,000 investment made on September 5, 2017 (commencement of operations) in Shares at NAV. For comparative purposes, the performance of the Fund’s underlying index, the FTSE Goldman Sachs High Yield Corporate Bond Index is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. In addition to the performance of constituents of the underlying index, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and creation and redemption in-kind transactions.

| Goldman Sachs Access High Yield Corporate Bond ETF’s Lifetime Performance |

Performance of a $10,000 Investment, with distributions reinvested, from September 5, 2017 through August 31, 2018.

| Average Annual Total Return through August 31, 2018 | Since Inception | |||||||

|

|

||||||||

| Shares based on NAV (Commenced September 5, 2017 ) |

2.58%* | |||||||

|

|

||||||||

| * | Total return for periods of less than one year represents cumulative total return. |

9

PORTFOLIO RESULTS

Goldman Sachs Access Investment Grade Corporate Bond ETF

Investment Objective

The Goldman Sachs Access Investment Grade Corporate Bond ETF (the “Fund”) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Goldman Sachs Investment Grade Corporate Bond Index (the “Index”).

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Fixed Income and Liquidity Solution Team discusses the Fund’s performance and positioning for the 12-month period ended August 31, 2018 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund returned -1.04% based on net asset value (“NAV”) and -1.05% based on market price. The Index returned -0.84% during the same period. |

| The Fund had an NAV of $50.28 per share on August 31, 2017 and ended the Reporting Period with an NAV of $48.31 per share. The Fund’s market price on August 31, 2018 was $48.28 per share. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Index. The Fund’s performance reflects Fund expenses, including management fees and brokerage expenses. The Fund’s relative performance also reflects the impact of any cash held in the Fund as well as any other differences between the Fund’s holdings and the constituents of the Index. The Index is unmanaged, and Index returns do not reflect fees and expenses, which would reduce returns. |

| The Index is designed to measure the performance of investment grade corporate bonds denominated in U.S. dollars that meet certain liquidity and fundamental screening criteria. The Index is a custom index that is owned and calculated by FTSE Fixed Income LLC (“FTSE”), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group” or the “Index Provider”). The Index is based on the FTSE US Broad Investment Grade (USBIG®) Corporate Index (the “Reference Index”) using concepts developed with Goldman Sachs Asset Management, L.P. (“GSAM”). The Index is rules-based and the securities in the Index are updated on the last business day of each month. |

| Given the Fund’s investment objective of attempting to track the Index, the Fund does not follow traditional methods of active investment management, which may involve buying and selling securities based upon analysis of economic and market factors. |

| During the Reporting Period, the Fund posted negative absolute returns that modestly lagged those of the Index, as measured by NAV. The Fund is passively managed to the Index and aims to minimize tracking error to the Index. |

| Overall, investment grade corporate bond returns are driven by three primary factors — yield, duration (whether interest rates are rising or falling) and spreads (or a widening or tightening of the yield differential to U.S. Treasuries). During the Reporting Period, interest rates increased. The yield on the 10-year U.S. Treasury increased by approximately 69 basis points during the Reporting Period. (A basis point is 1/100th of a percentage point.) The U.S. Federal Reserve (the “Fed”) raised interest rates three times during the Reporting Period — in December 2017, March 2018 and June 2018, and expectations for additional interest rate hikes in 2018 and 2019, coupled with rising inflation, contributed to U.S. Treasuries’ rising yields. |

| Investment grade corporate spreads widened by approximately five basis points during the Reporting Period. Investment grade corporate bond markets also saw significant new issue supply on the back of tax reform and repatriation of U.S. dollar-based investments, which further drove the sector’s negative returns. |

| At the end of the Reporting Period, we believed it likely the Fed would hike interest rates next in September 2018 for a total of two more times in 2018 and then three times in 2019 in increments of 25 basis points each. We believed the U.S. economy would continue to grow in the months ahead and corporate earnings remain strong during the next couple of |

10

PORTFOLIO RESULTS

| quarters. Further, we expected new issue supply within the investment grade corporate bond market to moderate and demand for long-term corporate credit to sustain, likely contributing to a flatter investment grade corporate bond yield curve. (A flatter yield curve is one wherein the differential between yields on longer-term and shorter-term maturities narrows.) |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | The Fund does not employ derivatives. |

| Q | What was the Fund’s weighted average duration, weighted average maturity, weighted average coupon and 30-day standardized yield at the end of the Reporting Period?1 |

| A | The Fund had a weighted average duration of 7.22 years, a weighted average maturity of 10.77 years and a weighted average coupon of 3.91% as of August 31, 2018. The 30-day standardized yield of the Fund at the end of the Reporting Period was 3.78%. |

| Q | What was the Fund’s credit allocation at the end of the Reporting Period? |

| A |

| AAA |

2.9 | % | ||||

| AA |

12.7 | % | ||||

| A |

40.6 | % | ||||

| BBB |

42.7 | % | ||||

| BB |

0.4 | % | ||||

| Cash |

0.7 | % |

| Q | What was the Fund’s industry allocation at the end of the Reporting Period?2 |

| A | Of the approximately 97% of the Fund’s assets invested in investment grade corporate bonds at the end of the Reporting Period, approximately 30.24% was in financials, 65.17% in industrials and 1.59% in utilities. |

| Q | What was the Fund’s sector positioning relative to the Index at the end of the Reporting Period?3 |

| A | While the Index was 97.60% allocated to investment grade corporate bonds, 0.43% in high yield corporate bonds and 1.97% in emerging market corporate bonds, the Fund was approximately 97% invested in investment grade corporate bonds, 0.41% in high yield corporate bonds, 1.90% in emerging market corporate bonds and 0.68% in cash at the end of the Reporting Period. |

| 1 | Duration is a time measure of a bond’s interest-rate sensitivity, based on the weighted average of the time periods over which a bond’s cash flows accrue to the bondholder. Time periods are weighted by multiplying by the present value of its cash flow divided by the bond’s price. (A bond’s cash flows consist of coupon payments and repayment of capital.) |

| A bond’s duration will almost always be shorter than its maturity, with the exception of zero-coupon bonds, for which maturity and duration are equal. Weighted average duration is a measure of the duration for the securities in the portfolio overall. Weighted average maturity (“WAM”) is the weighted average amount of time until the debt securities in a portfolio mature, or the weighted average of the remaining terms to maturity of the debt securities within a portfolio. The higher the WAM, the longer it takes for all of the bonds in the portfolio to mature, and WAM is used to manage debt portfolios and to assess the performance of debt portfolio managers. Coupons are fixed percentages paid out on a fixed income security on an annual basis. Weighted average coupon is calculated by weighting the coupon of each debt security by its relative size in the portfolio. The 30-day standardized yield calculation is based on a 30-day period ending on the last day of the Reporting Period. It is computed by dividing the net investment income per share earned during the period by the maximum offering price per share on the last day of the period. |

| 2 | This Fund and the Index have not been rated by an independent rating agency. The credit allocation provided refers to the Fund’s underlying portfolio securities. For the purpose of determining compliance with any credit rating requirement, the Fund assigns a security, at the time of purchase, the highest rating by a Nationally Recognized Statistical Rating Organization (“NRSRO”) if the security is rated by more than one NRSRO. For this purpose, the Fund relies only on the ratings of the following NRSROs: S&P, Moody’s and Fitch, Inc. This method may differ from the method independently used by the Index Provider. GSAM will use a single rating if that is the only one available. Securities that are not rated by all three agencies are reflected as such in the breakdown. Unrated securities may be purchased by the Fund if they are determined by the Investment Adviser to be of a credit quality consistent with the Fund’s credit rating requirements. Unrated securities do not necessarily indicate low quality, and for such securities the Investment Adviser will evaluate the credit quality. GSAM converts all ratings to the equivalent S&P major rating category when illustrating credit rating breakdowns. Ratings and fund/index credit quality may change over time. |

| 3 | The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Goldman Sachs Investment Grade Corporate Bond Index. |

11

FUND BASICS

Access Investment Grade Corporate Bond ETF

as of August 31, 2018

| FUND SNAPSHOT |

| |||||

| As of August 31, 2018 | ||||||

| Market Price1 | $ | 48.28 | ||||

| Net Asset Value (NAV)1 | $ | 48.31 | ||||

| 1 | The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com. |

| PERFORMANCE REVIEW |

| |||||||||||

| September 1, 2017– August 31, 2018 | Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

FTSE Goldman Sachs Investment Grade Corporate Bond Index3 |

|||||||||

| Shares | -1.04% | -1.05 | % | -0.84 | % | |||||||

| 2 | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculations assumes all management fees incurred by the Fund. Market Price returns are based upon the based upon the last trade as of 4:00 pm EST and do not reflect the returns you would receive if you traded shares at other times. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the Market Price returns. Total returns for periods less than one full year are not annualized. |

| 3 | The Index was developed and is calculated and maintained by FTSE Fixed Income LLC (“FTSE”), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group” or the “Index Provider”). FTSE is not affiliated with the Fund or GSAM. The Fund is not sponsored, endorsed, sold or promoted by FTSE or any of its affiliates and FTSE makes no representation to any owner or prospective owner of the Fund regarding the advisability of investing in securities generally or in the Fund particularly, or the ability of the Fund to track the price and yield performance of the Index or the ability of the Index to track general bond market performance. FTSE’s only relationship to GSAM (“Licensee”) is the licensing of certain information, data, trademarks and trade names of FTSE or its affiliates. The Index is determined, composed and calculated by FTSE without regard to the Fund. FTSE has no obligation to take the needs of the owners or prospective owners of the Fund into consideration in determining, composing or calculating the Index. FTSE is not responsible for and has not participated in the determination of the prices and amount of the shares to be issued by the Fund or the timing of the issuance or sale of the shares to be issued by the Fund or in the determination or calculation of the equation by which the shares to be issued by the Fund are to be converted into cash. FTSE has no obligation or liability in connection with the administration, marketing or trading of the Fund. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale or redemption of Fund shares.

12

FUND BASICS

| STANDARDIZED TOTAL RETURNS4 |

| |||||||||||||

| For period ended June 30, 2018 | One Year | Since Inception | Inception Date | |||||||||||

| Shares (based on NAV | -1.16 | % | -1.15 | % | 6/6/17 | |||||||||

| Shares (based on Market Price) |

-1.31 | -1.17 | 6/6/17 | |||||||||||

| 4 | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the Market Price returns. |

| 30-DAY STANDARDIZED YIELD5 | ||||

| 30-Day Standardized Yield5 | ||||

| Shares | 3.78% | |||

| 5 | The method of calculation of the 30-Day Standardized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the 30-day period ending on the last day of the Reporting Period by the maximum public offering price per share on the last day of the period. This number is then annualized. |

| EXPENSE RATIO6 | ||||

| Expense Ratio | ||||

| Shares | 0.14% | |||

| 6 | The expense ratio of the Fund is as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratio disclosed on the Financial Highlights in this report. |

| TOP TEN HOLDINGS AS OF 8/31/187 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| BP Capital Markets PLC, 3.56%, 11/01/21 |

0.9 | % | Energy | |||||

| Anheuser-Busch InBev Finance, Inc., 2.63%, 01/17/23 |

0.7 | Consumer, Non-cyclical | ||||||

| Alibaba Group Holding Ltd., 3.13%, 11/28/21 |

0.6 | Telecommunication Services | ||||||

| JPMorgan Chase & Co., 2.55%, 03/01/21 |

0.5 | Financials | ||||||

| Dell International LLC / EMC Corp., 4.42%, 06/15/21 |

0.5 | Information Technology | ||||||

| JPMorgan Chase & Co., 2.97%, 01/15/23 |

0.5 | Financials | ||||||

| Apple, Inc., 2.25%, 02/23/21 |

0.5 | Information Technology | ||||||

| Morgan Stanley, Series GMTN, 4.35%, 09/08/26 |

0.4 | Financials | ||||||

| Royal Bank of Canada, Series MTN, 2.35%, 10/30/20 |

0.4 | Financials | ||||||

| Anheuser-Busch InBev Finance, Inc., 3.65%, 02/01/26 |

0.4 | Consumer, Non-cyclical | ||||||

| 7 | The top 10 holdings may not be representative of the Fund’s future investments. |

13

FUND BASICS

| INDUSTRY ALLOCATION AS OF 8/31/188 |

| |||||

| Industry | % of Net Assets | |||||

| Financials |

31.1 | % | ||||

| Consumer, Non-cyclical |

18.4 | |||||

| Telecommunication Services |

13.6 | |||||

| Information Technology |

10.9 | |||||

| Energy |

9.9 | |||||

| Consumer, Cyclical |

6.2 | |||||

| Industrials |

4.7 | |||||

| Materials |

2.1 | |||||

| Utilities |

1.6 | |||||

| Other |

0.6 | |||||

| 8 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. The “Other” category represents the Fund’s investments in other investment companies. Figures in the table may not sum to 100% due to the exclusion of other assets and liabilities. |

14

GOLDMAN SACHS ACCESS INVESTMENT GRADE CORPORATE BOND ETF

Performance Summary

August 31, 2018

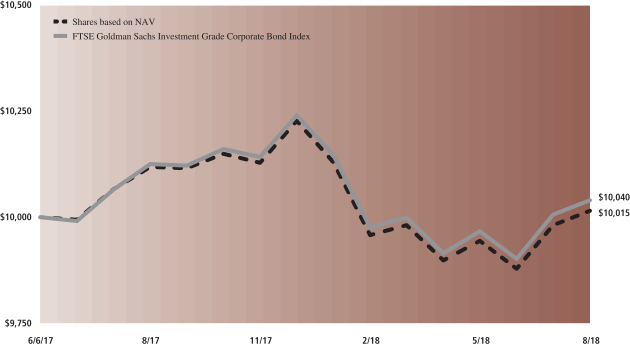

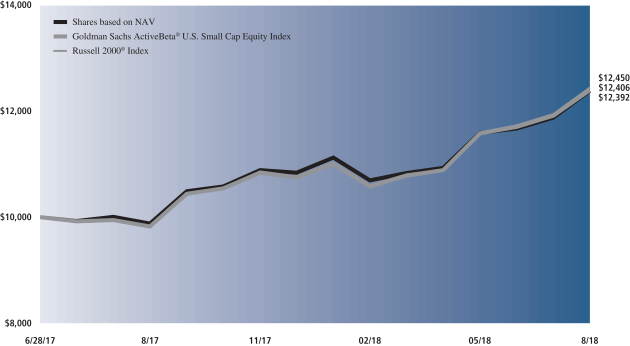

The following graph shows the value, as of August 31, 2018, of a $10,000 investment made on June 6, 2017 (commencement of operations) in Shares at NAV. For comparative purposes, the performance of the Fund’s underlying index, the FTSE Goldman Sachs Investment Grade Corporate Bond Index is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. In addition to the performance of constituents of the underlying index, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and creation and redemption in-kind transactions.

| Goldman Sachs Access Investment Grade Corporate Bond ETF’s Lifetime Performance |

Performance of a $10,000 Investment, with distributions reinvested, from June 6, 2017 through August 31, 2018.

| Average Annual Total Return through August 31, 2018 | 1 Year Return | Since Inception | ||||||

|

|

||||||||

| Shares based on NAV (Commenced June 6, 2017) |

-1.04% | 0.12% | ||||||

|

|

||||||||

15

PORTFOLIO RESULTS

Goldman Sachs Access Treasury 0-1 Year ETF

(formerly Goldman Sachs TreasuryAccess 0-1 Year ETF)

Investment Objective

The Goldman Sachs Access Treasury 0-1 Year ETF (the “Fund”) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE US Treasury 0-1 Year Composite Select Index (the “Index”).

Portfolio Management Discussion and Analysis

Effective August 7, 2018, the Goldman Sachs TreasuryAccess 0-1 Year ETF was re-named Goldman Sachs Access Treasury 0-1 Year ETF, and its benchmark index, the Citi US Treasury 0-1 Year Composite Select Index was re-named the FTSE US Treasury 0-1 Year Composite Select Index. Below, the Goldman Sachs Global Fixed Income and Liquidity Solutions Team discusses the Fund’s performance and positioning for the 12-month period ended August 31, 2018 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund returned 1.37% based on net asset value (“NAV”) and 1.38% based on market price. The Index returned 1.47% during the same period. |

| The Fund had an NAV of $100.10 on August 31, 2017 and ended the Reporting Period with an NAV of $100.16 per share. The Fund’s market price on August 31, 2018 was $100.18 per share. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Index. The Fund’s performance reflects Fund expenses, including management fees and brokerage expenses. The Fund’s relative performance also reflects the impact of any cash held in the Fund as well as any other differences between the Fund’s holdings and the constituents of the Index. The Index is unmanaged, and Index returns do not reflect fees and expenses, which would reduce returns. |

| The Index is designed to measure the performance of U.S. Treasury Obligations with a maximum remaining maturity of 12 months. “U.S. Treasury Obligations” refer to securities issued or guaranteed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government. U.S. Treasury Obligations include U.S. Treasury notes, U.S. Treasury bills and U.S. Treasury floating rate bonds. The Index is sponsored by FTSE Fixed Income LLC (“FTSE” ), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group or the “Index Provider”), which is not affiliated with the Fund or the Investment Adviser. The Index is market capitalization-weighted and the securities in the Index are updated on the last business day of each month. |

| Given the Fund’s investment objective of attempting to track the Index, the Fund does not follow traditional methods of active investment management, which may involve buying and selling securities based upon analysis of economic and market factors. |

| During the Reporting Period, the Fund posted positive absolute returns that closely tracked those of the Index, as measured by NAV. The Fund is passively managed to the Index and aims to minimize tracking error to the Index. |

| Three primary factors affected the short-term U.S. Treasury market during the Reporting Period — increased new issue supply, higher interest rates and heightened market volatility. |

| First, on the back of tax reform signed into law in December 2017, new issue supply increased. The increased supply, in turn, drove the yields on short-term U.S. Treasuries higher. Second, the U.S. Federal Reserve (the “Fed”) hiked interest rates three times during the Reporting Period — in December 2017 and in March and June 2018 — by 25 basis points each time, bringing the targeted federal funds rate to a range of 1.75% to 2.00%. (A basis point is 1/100th of a percentage point.) While the value of U.S. Treasuries traded down during the first half of the Reporting Period as Fed policy became priced into short-term rates, increasing yields helped offset negative price action during the second half of the Reporting Period. Third, amid a pick-up in anti-trade rhetoric from the U.S. Administration and the re-negotiation of several trade partnerships, volatility in markets across fixed income and equities heightened. In |

16

PORTFOLIO RESULTS

| addition, several specific political and economic events in emerging markets, including Venezuela, Argentina, Turkey, Brazil and South Africa, contributed to an investor preference for U.S. assets. This investor sentiment, in turn, tended to increase the value of U.S. Treasuries. |

| At the end of the Reporting Period, we believed each of these factors would continue to be important to the performance of the short-term U.S. Treasury market in the months ahead. We believed it likely the Fed would hike interest rates next in September 2018 for a total of two more times in 2018 and then three times in 2019 in increments of 25 basis points each, in line with the Fed’s median projections. At the end of the Reporting Period, it did not appear that the market had priced in the Fed’s forward guidance and a risk to valuations of short-term U.S. Treasuries could be a sharp market repricing to consider the median rate path provided by the Fed. A hawkish surprise to Fed policy, meaning a bias to a more aggressive path of interest rate hikes, could also be a risk to valuations. As for supply, at the end of the Reporting Period, we expected supply of U.S. Treasury bills to continue to increase, which, as a result, may well contribute to rising yields of short-term U.S. Treasuries going forward. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | The Fund does not employ derivatives. |

| Q | What was the Fund’s weighted average duration, weighted average maturity, weighted average coupon and 30-day standardized yield at the end of the Reporting Period?1 |

| A | The Fund had a weighted average duration of 0.36 years, a weighted average maturity of 0.36 years and a weighted average coupon of 0.40% as of August 31, 2018. The 30-day standardized yield of the Fund at the end of the Reporting Period was 1.96% (subsidized) and 1.94% (unsubsidized). |

| Q | What was the Fund’s sector positioning relative to the Index at the end of the Reporting Period?2 |

| A | While the Index was 100% allocated to U.S. Treasury bills as the end of the Reporting Period, the Fund was approximately 99.97% invested in U.S. Treasury bills and 0.03% in cash at the end of the Reporting Period. |

| 1Duration | is a time measure of a bond’s interest-rate sensitivity, based on the weighted average of the time periods over which a bond’s cash flows accrue to the bondholder. Time periods are weighted by multiplying by the present value of its cash flow divided by the bond’s price. (A bond’s cash flows consist of coupon payments and repayment of capital.) |

| A bond’s duration will almost always be shorter than its maturity, with the exception of zero-coupon bonds, for which maturity and duration are equal. Weighted average duration is a measure of the duration for the securities in the portfolio overall. Weighted average maturity (“WAM”) is the weighted average amount of time until the debt securities in a portfolio mature, or the weighted average of the remaining terms to maturity of the debt securities within a portfolio. The higher the WAM, the longer it takes for all of the bonds in the portfolio to mature, and WAM is used to manage debt portfolios and to assess the performance of debt portfolio managers. Coupons are fixed percentages paid out on a fixed income security on an annual basis. Weighted average coupon is calculated by weighting the coupon of each debt security by its relative size in the portfolio. The 30-day standardized yield calculation is based on a 30-day period ending on the last day of the Reporting Period. It is computed by dividing the net investment income per share earned during the period by the maximum offering price per share on the last day of the period. |

| 2The | Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE US Treasury 0-1 Year Composite Select Index. |

17

FUND BASICS

Access Treasury 0-1 Year ETF

as of August 31, 2018

| FUND SNAPSHOT |

| |||||

| As of August 31, 2018 | ||||||

| Market Price1 | $100.18 | |||||

| Net Asset Value (NAV)1 | $100.16 | |||||

| 1 | The Market Price is the price at which the Fund’s shares are trading on the NYSE Arca, Inc. The Market Price of the Fund’s shares will fluctuate and, at the time of sale, shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus other assets, less any liabilities, by the number of Fund shares outstanding. Fund shares are not individually redeemable and are issued and redeemed by the Fund at their NAV only in large, specified blocks of shares called creation units. Shares otherwise can be bought and sold only through exchange trading at market price (not NAV). Shares may trade at a premium or discount to their NAV in the secondary market. Information regarding how often shares of the Fund traded on NYSE Arca at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at www.GSAMFUNDS.com. |

| PERFORMANCE REVIEW |

| |||||||||||||

| September 1, 2017– August 31, 2018 |

Fund Total Return (based on NAV)2 |

Fund Total Return (based on Market Price)2 |

FTSE US Treasury 0-1 Year Composite Select Index3 |

|||||||||||

| Shares | 1.37 | % | 1.38 | % | 1.47 | % | ||||||||

| 2 | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. The Total Returns based on NAV and Market Price assume the reinvestment of dividends and do not reflect brokerage commissions in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculations assumes all management fees incurred by the Fund. Market Price returns are based upon the last trade as of 4:00 pm EST and do not reflect the returns you would receive if you traded shares at other times. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the Market Price returns. Total returns for periods less than one full year are not annualized. |

| 3 | The Index is designed to measure the performance of U.S. Treasury Obligations with a maximum remaining maturity of 12 months. “U.S. Treasury Obligations” refer to securities issued or guaranteed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government. U.S. Treasury Obligations include U.S. Treasury notes, U.S. Treasury bills and U.S. Treasury floating rate bonds. The Index is sponsored by FTSE Fixed Income LLC (“FTSE” ), a trading name of the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group” or the “Index Provider”), which is not affiliated with the Fund or GSAM. The Index is determined, composed and calculated by FTSE without regard to the Fund. It is not possible to invest directly in an unmanaged index. |

18

FUND BASICS

| STANDARDIZED TOTAL RETURNS4 | ||||||||||||

| For period ended June 30, 2018 | One Year | Since Inception | Inception Date | |||||||||

| Shares (based on NAV) | 1.22 | % | 0.86 | % | 9/6/16 | |||||||

| Shares (based on Market Price) | 1.19 | 0.87 | 9/6/16 | |||||||||

| 4 | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the Market Price returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale or redemption of Fund shares.

| 30-DAY STANDARDIZED YIELD5 |

| |||||||||

| 30-Day Subsized Yield5 | 30-Day Unsubsized Yield5 | |||||||||

| Shares | 1.96 | % | 1.94 | % | ||||||

| 5 | The method of calculation of the 30-Day Standardized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price per share on the last day of the period. This number is then annualized. The 30-Day Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Subsidized Yield and 30-Day Unsubsidized Yield will be identical. |

| EXPENSE RATIO6 |

| |||||||||

| Net Expense Ratio (Current)7 | Gross Expense Ratio (Before Waivers) | |||||||||

| Shares | 0.12 | % | 0.14 | % | ||||||

| 6 | The expense ratio of the Fund is as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed on the Financial Highlights in this report. |

| 7 | The Investment Adviser has agreed to waive a portion of its management fee in order to achieve an effective net management fee rate of 0.12% as an annual percentage rate of average daily net assets of the Fund. This arrangement will remain in effect through at least December 29, 2018, and prior to such date the Investment Adviser may not terminate the arrangement without the approval of the Board of Trustees. |

19

FUND BASICS

| TOP HOLDINGS AS OF 8/31/188 |

| |||||||

| Holding | Maturity Date | % of Net Assets | ||||||

| U.S. Treasury Note, 0.88% |

10/15/18 | 11.2 | % | |||||

| U.S. Treasury Bills, 1.98% |

10/25/18 | 7.4 | ||||||

| U.S. Treasury Bills, 2.01% |

10/25/18 | 6.8 | ||||||

| U.S. Treasury Note, 1.25% |

04/30/19 | 6.4 | ||||||

| U.S. Treasury Bills, 2.19% |

01/24/19 | 5.9 | ||||||

| U.S. Treasury Bills, 2.04% |

11/23/18 | 5.4 | ||||||

| U.S. Treasury Note, 1.00% |

03/15/19 | 5.2 | ||||||

| U.S. Treasury Note, 1.00% |

06/30/19 | 5.1 | ||||||

| U.S. Treasury Bills, 2.21% |

01/24/19 | 4.6 | ||||||

| U.S. Treasury Note, 0.75% |

02/15/19 | 4.4 | ||||||

| Other |

N/A | 37.6 | ||||||

| 8 | The top 10 holdings may not be representative of the Fund’s future investments. |

20

GOLDMAN SACHS ACCESS TREASURY 0-1 YEAR ETF

Performance Summary

August 31, 2018

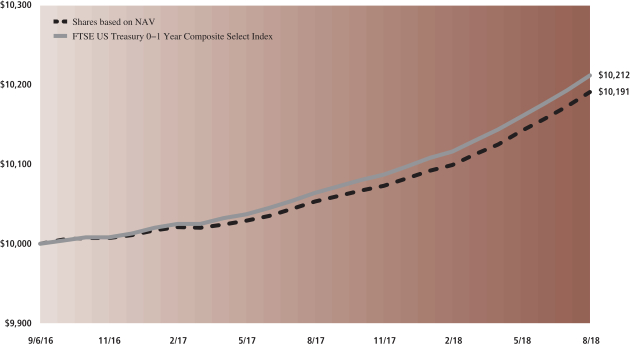

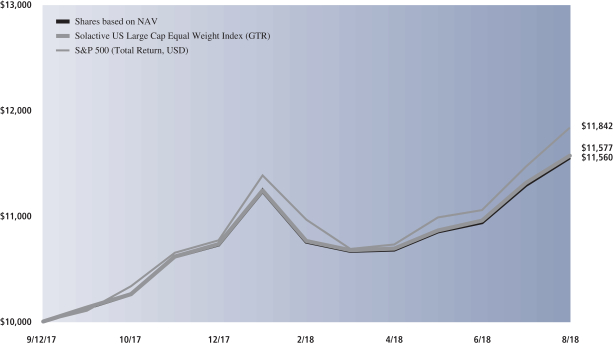

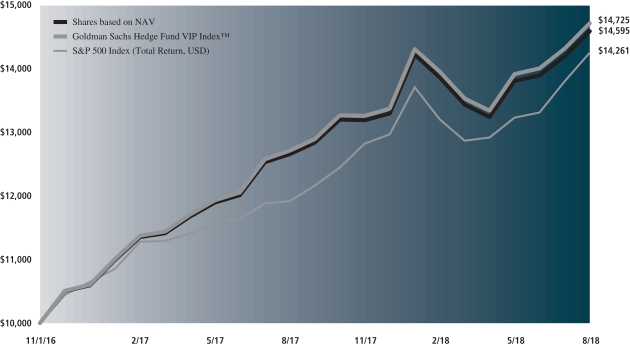

The following graph shows the value, as of August 31, 2018, of a $10,000 investment made on September 6, 2016 (commencement of operations) in Shares at NAV. For comparative purposes, the performance of the Fund’s underlying index, the FTSE US Treasury 0-1 Year Composite Select Index is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. In addition to the performance of constituents of the underlying index, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and creation and redemption in-kind transactions.

| Goldman Sachs Access Treasury 0-1 Year ETF’s Lifetime Performance |

Performance of a $10,000 Investment, with distributions reinvested, from September 6, 2016 through August 31, 2018.

| Average Annual Total Return through August 31, 2018 | 1 Year Return | Since Inception | ||||||

|

|

||||||||

| Shares based on NAV (Commenced September 6, 2016) |

1.37% | 0.96% | ||||||

|

|

||||||||

21

GOLDMAN SACHS ACCESS HIGH YIELD CORPORATE BOND ETF

August 31, 2018

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – 89.8% | ||||||||||||||

| Aerospace & Defense – 1.0% | ||||||||||||||

| TransDigm, Inc. |

||||||||||||||

| $ | 186,000 | 5.500 | % | 10/15/20 | $ | 186,930 | ||||||||

| 79,000 | 6.000 | 07/15/22 | 80,185 | |||||||||||

| 60,000 | 6.500 | 07/15/24 | 61,500 | |||||||||||

| 45,000 | 6.500 | 05/15/25 | 46,013 | |||||||||||

| 70,000 | 6.375 | 06/15/26 | 71,050 | |||||||||||

|

|

|

|||||||||||||

| 445,678 | ||||||||||||||

|

|

|

|||||||||||||

| Agriculture – 0.3% | ||||||||||||||

| JBS USA LUX SA / JBS USA Finance, Inc. |

||||||||||||||

| 30,000 | 5.875 | (a) | 07/15/24 | 28,950 | ||||||||||

| 100,000 | 5.750 | (a) | 06/15/25 | 94,875 | ||||||||||

|

|

|

|||||||||||||

| 123,825 | ||||||||||||||

|

|

|

|||||||||||||

| Air Freight & Logistics – 0.2% | ||||||||||||||

| XPO Logistics, Inc. |

||||||||||||||

| 6,000 | 6.500 | (a) | 06/15/22 | 6,218 | ||||||||||

| 107,000 | 6.125 | (a) | 09/01/23 | 110,745 | ||||||||||

|

|

|

|||||||||||||

| 116,963 | ||||||||||||||

|

|

|

|||||||||||||

| Automobiles – 0.4% | ||||||||||||||

| Tesla, Inc. |

||||||||||||||

| 193,000 | 5.300 | (a) | 08/15/25 | 168,151 | ||||||||||

|

|

|

|||||||||||||

| Banks – 1.1% | ||||||||||||||

| CIT Group, Inc. |

||||||||||||||

| 160,000 | 4.125 | 03/09/21 | 160,600 | |||||||||||

| 110,000 | 5.000 | 08/15/22 | 112,612 | |||||||||||

| 108,000 | 5.250 | 03/07/25 | 110,430 | |||||||||||

| Freedom Mortgage Corp. |

||||||||||||||

| 125,000 | 8.250 | (a) | 04/15/25 | 121,563 | ||||||||||

|

|

|

|||||||||||||

| 505,205 | ||||||||||||||

|

|

|

|||||||||||||

| Basic Industry – 0.4% | ||||||||||||||

| Blue Cube Spinco LLC |

||||||||||||||

| 10,000 | 9.750 | 10/15/23 | 11,350 | |||||||||||

| Hexion, Inc. |

||||||||||||||

| 45,000 | 6.625 | 04/15/20 | 42,750 | |||||||||||

| 81,000 | 10.375 | (a) | 02/01/22 | 80,190 | ||||||||||

| Novelis Corp. |

||||||||||||||

| 50,000 | 6.250 | (a) | 08/15/24 | 51,125 | ||||||||||

|

|

|

|||||||||||||

| 185,415 | ||||||||||||||

|

|

|

|||||||||||||

| Broadcasting – 3.1% | ||||||||||||||

| Clear Channel Worldwide Holdings, Inc., Series A |

||||||||||||||

| 150,000 | 6.500 | 11/15/22 | 153,188 | |||||||||||

| Clear Channel Worldwide Holdings, Inc., Series B |

||||||||||||||

| 274,000 | 7.625 | 03/15/20 | 275,712 | |||||||||||

| Nexstar Broadcasting, Inc. |

||||||||||||||

| 145,000 | 5.625 | (a) | 08/01/24 | 142,825 | ||||||||||

| Sinclair Television Group, Inc. |

||||||||||||||

| 80,000 | 5.375 | 04/01/21 | 80,700 | |||||||||||

| Sirius XM Radio, Inc. |

||||||||||||||

| 30,000 | 3.875 | (a) | 08/01/22 | 29,513 | ||||||||||

| 305,000 | 6.000 | (a) | 07/15/24 | 317,581 | ||||||||||

| 47,000 | 5.375 | (a) | 04/15/25 | 47,822 | ||||||||||

| 124,000 | 5.375 | (a) | 07/15/26 | 124,000 | ||||||||||

| 50,000 | 5.000 | (a) | 08/01/27 | 48,563 | ||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Broadcasting – (continued) | ||||||||||||||

| Univision Communications, Inc. |

||||||||||||||

| 70,000 | 5.125 | (a) | 05/15/23 | 66,675 | ||||||||||

| 147,000 | 5.125 | (a) | 02/15/25 | 135,791 | ||||||||||

|

|

|

|||||||||||||

| 1,422,370 | ||||||||||||||

|

|

|

|||||||||||||

| Capital Goods – 2.5% | ||||||||||||||

| Berry Global, Inc. |

||||||||||||||

| 70,000 | 5.500 | 05/15/22 | 71,488 | |||||||||||

| 88,000 | 4.500 | (a) | 02/15/26 | 82,940 | ||||||||||

| Brand Industrial Services, Inc. |

||||||||||||||

| 50,000 | 8.500 | (a) | 07/15/25 | 51,375 | ||||||||||

| BWAY Holding Co. |

||||||||||||||

| 179,000 | 5.500 | (a) | 04/15/24 | 178,105 | ||||||||||

| 100,000 | 7.250 | (a) | 04/15/25 | 98,250 | ||||||||||

| Flex Acquisition Co., Inc. |

||||||||||||||

| 100,000 | 6.875 | (a) | 01/15/25 | 96,750 | ||||||||||

| |

Reynolds Group Issuer, Inc. / Reynolds Group Issuer LLC / |

| ||||||||||||

| 247,000 | 5.125 | (a) | 07/15/23 | 246,691 | ||||||||||

| 64,000 | 7.000 | (a) | 07/15/24 | 65,360 | ||||||||||

| Sensata Technologies BV |

||||||||||||||

| 25,000 | 4.875 | (a) | 10/15/23 | 25,094 | ||||||||||

| 121,000 | 5.000 | (a) | 10/01/25 | 122,361 | ||||||||||

| Vertiv Group Corp. |

||||||||||||||

| 120,000 | 9.250 | (a) | 10/15/24 | 123,600 | ||||||||||

|

|

|

|||||||||||||

| 1,162,014 | ||||||||||||||

|

|

|

|||||||||||||

| Capital Markets – 0.4% | ||||||||||||||

| MSCI, Inc. |

||||||||||||||

| 160,000 | 5.250 | (a) | 11/15/24 | 165,000 | ||||||||||

| 5,000 | 4.750 | (a) | 08/01/26 | 4,987 | ||||||||||

|

|

|

|||||||||||||

| 169,987 | ||||||||||||||

|

|

|

|||||||||||||

| Chemicals – 0.9% | ||||||||||||||

| Chemours Co. (The) |

||||||||||||||

| 100,000 | 7.000 | 05/15/25 | 107,250 | |||||||||||

| 75,000 | 5.375 | 05/15/27 | 73,875 | |||||||||||

| Olin Corp. |

||||||||||||||

| 97,000 | 5.125 | 09/15/27 | 96,272 | |||||||||||

| 97,000 | 5.000 | 02/01/30 | 93,120 | |||||||||||

| Platform Specialty Products Corp. |

||||||||||||||

| 30,000 | 6.500 | (a) | 02/01/22 | 30,788 | ||||||||||

| 25,000 | 5.875 | (a) | 12/01/25 | 24,875 | ||||||||||

|

|

|

|||||||||||||

| 426,180 | ||||||||||||||

|

|

|

|||||||||||||

| Commercial Services & Supplies – 0.7% | ||||||||||||||

| ADT Corp. (The) |

||||||||||||||

| 60,000 | 6.250 | 10/15/21 | 63,750 | |||||||||||

| 60,000 | 4.125 | 06/15/23 | 57,300 | |||||||||||

| 60,000 | 4.875 | (a) | 07/15/32 | 48,750 | ||||||||||

| Covanta Holding Corp. |

||||||||||||||

| 60,000 | 6.375 | 10/01/22 | 61,725 | |||||||||||

| 25,000 | 5.875 | 07/01/25 | 25,031 | |||||||||||

| West Corp. |

||||||||||||||

| 80,000 | 8.500 | (a) | 10/15/25 | 73,100 | ||||||||||

|

|

|

|||||||||||||

| 329,656 | ||||||||||||||

|

|

|

|||||||||||||

| 22 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS ACCESS HIGH YIELD CORPORATE BOND ETF

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Communications – 6.7% | ||||||||||||||

| CCO Holdings LLC / CCO Holdings Capital Corp. |

||||||||||||||

| $ | 60,000 | 5.250 | % | 03/15/21 | $ | 60,750 | ||||||||

| 154,000 | 5.250 | 09/30/22 | 155,540 | |||||||||||

| 145,000 | 5.125 | (a) | 05/01/23 | 145,544 | ||||||||||

| 8,000 | 5.750 | 09/01/23 | 8,180 | |||||||||||

| 47,000 | 5.750 | 01/15/24 | 48,057 | |||||||||||

| 201,000 | 5.875 | (a) | 04/01/24 | 205,523 | ||||||||||

| 110,000 | 5.750 | (a) | 02/15/26 | 110,412 | ||||||||||

| 159,000 | 5.500 | (a) | 05/01/26 | 157,609 | ||||||||||

| 369,000 | 5.125 | (a) | 05/01/27 | 352,856 | ||||||||||

| 67,000 | 5.875 | (a) | 05/01/27 | 66,665 | ||||||||||

| 191,000 | 5.000 | (a) | 02/01/28 | 180,018 | ||||||||||

| Cequel Communications Holdings I LLC / Cequel Capital Corp. |

||||||||||||||

| 259,000 | 5.125 | (a) | 12/15/21 | 259,971 | ||||||||||

| CSC Holdings LLC |

||||||||||||||

| 212,000 | 6.750 | 11/15/21 | 225,250 | |||||||||||

| 60,000 | 5.250 | 06/01/24 | 58,650 | |||||||||||

| 300,000 | 10.875 | (a) | 10/15/25 | 351,750 | ||||||||||

| 200,000 | 5.500 | (a) | 04/15/27 | 195,750 | ||||||||||

| DISH DBS Corp. |

||||||||||||||

| 62,000 | 5.875 | 07/15/22 | 59,985 | |||||||||||

| 350,000 | 5.875 | 11/15/24 | 306,250 | |||||||||||

| 199,000 | 7.750 | 07/01/26 | 180,592 | |||||||||||

|

|

|

|||||||||||||

| 3,129,352 | ||||||||||||||

|

|

|

|||||||||||||

| Construction & Engineering – 0.3% | ||||||||||||||

| AECOM |

||||||||||||||

| 30,000 | 5.875 | 10/15/24 | 32,025 | |||||||||||

| 98,000 | 5.125 | 03/15/27 | 96,285 | |||||||||||

|

|

|

|||||||||||||

| 128,310 | ||||||||||||||

|

|

|

|||||||||||||

| Consumer Cyclical – 6.1% | ||||||||||||||

| Allison Transmission, Inc. |

||||||||||||||

| 177,000 | 5.000 | (a) | 10/01/24 | 176,336 | ||||||||||

| 20,000 | 4.750 | (a) | 10/01/27 | 18,875 | ||||||||||

| American Axle & Manufacturing, Inc. |

||||||||||||||

| 151,000 | 6.250 | 04/01/25 | 151,000 | |||||||||||

| APX Group, Inc. |

||||||||||||||

| 153,000 | 7.875 | 12/01/22 | 156,825 | |||||||||||

| Caesars Resort Collection LLC / CRC Finco, Inc. |

||||||||||||||

| 151,000 | 5.250 | (a) | 10/15/25 | 144,771 | ||||||||||

| Cinemark USA, Inc. |

||||||||||||||

| 60,000 | 5.125 | 12/15/22 | 60,525 | |||||||||||

| 100,000 | 4.875 | 06/01/23 | 99,250 | |||||||||||

| CyrusOne LP / CyrusOne Finance Corp. |

||||||||||||||

| 161,000 | 5.000 | 03/15/24 | 163,817 | |||||||||||

| ESH Hospitality, Inc. |

||||||||||||||

| 119,000 | 5.250 | (a) | 05/01/25 | 115,728 | ||||||||||

| Hilton Domestic Operating Co., Inc. |

||||||||||||||

| 74,000 | 4.250 | 09/01/24 | 72,243 | |||||||||||

| 100,000 | 5.125 | (a) | 05/01/26 | 100,375 | ||||||||||

| |

Hilton Worldwide Finance LLC / Hilton Worldwide |

| ||||||||||||

| 77,000 | 4.625 | 04/01/25 | 76,230 | |||||||||||

| 154,000 | 4.875 | 04/01/27 | 152,075 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Consumer Cyclical – (continued) | ||||||||||||||

| JC Penney Corp., Inc. |

||||||||||||||

| 80,000 | 5.875 | (a) | 07/01/23 | 71,600 | ||||||||||

| 60,000 | 8.625 | (a) | 03/15/25 | 44,700 | ||||||||||

| |