UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 10-Q

_____________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-35870

_____________________________________

CHARTER FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

_____________________________________

Maryland | 90-0947148 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1233 O.G. Skinner Drive, West Point, Georgia | 31833 |

(Address of Principal Executive Offices) | (Zip Code) |

(706) 645-1391

(Registrant’s telephone number)

N/A

(Former name or former address, if changed since last report)

_____________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such requirements for the past 90 days. YES x NO o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer | o | Accelerated filer | x |

Non-accelerated filer | o (Do not check if smaller reporting company) | Smaller reporting company | o |

Emerging growth company | o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

The number of shares of the registrant’s common stock outstanding as of August 2, 2018 was 15,262,472.

CHARTER FINANCIAL CORPORATION

TABLE OF CONTENTS

Page No. | ||

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

June 30, 2018 | September 30, 2017 (1) | ||||||

Assets | |||||||

Cash and amounts due from depository institutions | $ | 20,328,705 | $ | 25,455,465 | |||

Interest-earning deposits in other financial institutions | 150,570,173 | 126,882,924 | |||||

Cash and cash equivalents | 170,898,878 | 152,338,389 | |||||

Loans held for sale, fair value of $1,998,594 and $1,998,988 | 1,965,657 | 1,961,185 | |||||

Certificates of deposit held at other financial institutions | 4,027,270 | 7,514,630 | |||||

Investment securities available for sale | 157,232,405 | 183,789,821 | |||||

Federal Home Loan Bank stock | 4,075,200 | 4,054,400 | |||||

Restricted securities, at cost | 279,000 | 279,000 | |||||

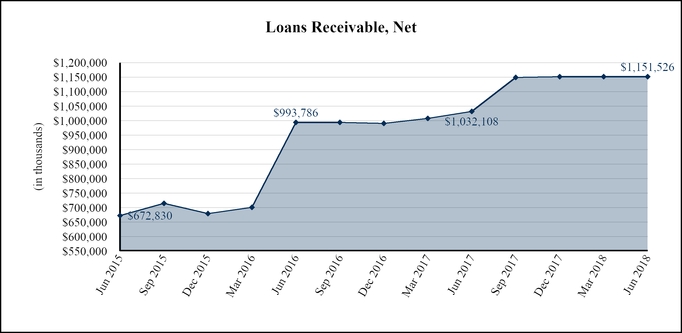

Loans receivable | 1,164,306,803 | 1,161,519,752 | |||||

Unamortized loan origination fees, net | (1,284,342 | ) | (1,165,148 | ) | |||

Allowance for loan losses | (11,496,661 | ) | (11,078,422 | ) | |||

Loans receivable, net | 1,151,525,800 | 1,149,276,182 | |||||

Other real estate owned | 227,531 | 1,437,345 | |||||

Accrued interest and dividends receivable | 4,354,702 | 4,197,708 | |||||

Premises and equipment, net | 28,857,528 | 29,578,513 | |||||

Goodwill | 39,347,378 | 39,347,378 | |||||

Other intangible assets, net of amortization | 3,064,830 | 3,614,833 | |||||

Cash surrender value of life insurance | 54,546,197 | 53,516,317 | |||||

Deferred income taxes | 3,876,928 | 5,970,282 | |||||

Other assets | 1,555,998 | 3,282,577 | |||||

Total assets | $ | 1,625,835,302 | $ | 1,640,158,560 | |||

Liabilities and Stockholders’ Equity | |||||||

Liabilities: | |||||||

Deposits | $ | 1,317,738,045 | $ | 1,339,143,287 | |||

Short-term borrowings | 5,010,175 | — | |||||

Long-term borrowings | 55,000,925 | 60,023,100 | |||||

Floating rate junior subordinated debt | 6,827,470 | 6,724,646 | |||||

Advance payments by borrowers for taxes and insurance | 2,366,262 | 2,956,441 | |||||

Other liabilities | 14,485,773 | 17,112,581 | |||||

Total liabilities | 1,401,428,650 | 1,425,960,055 | |||||

Stockholders’ equity: | |||||||

Common stock, $0.01 par value; 15,262,472 shares issued and outstanding at June 30, 2018 and 15,115,883 shares issued and outstanding at September 30, 2017 | 152,625 | 151,159 | |||||

Preferred stock, $0.01 par value; 50,000,000 shares authorized at June 30, 2018 and September 30, 2017 | — | — | |||||

Additional paid-in capital | 86,569,306 | 85,651,391 | |||||

Unearned compensation – ESOP | (4,192,308 | ) | (4,673,761 | ) | |||

Retained earnings | 145,268,886 | 134,207,368 | |||||

Accumulated other comprehensive loss | (3,391,857 | ) | (1,137,652 | ) | |||

Total stockholders’ equity | 224,406,652 | 214,198,505 | |||||

Total liabilities and stockholders’ equity | $ | 1,625,835,302 | $ | 1,640,158,560 | |||

__________________________________

(1) | Financial information at September 30, 2017 has been derived from audited financial statements. |

See accompanying notes to unaudited condensed consolidated financial statements.

1

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

Three Months Ended June 30, | Nine Months Ended June 30, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Interest income: | |||||||||||||||

Loans receivable | $ | 15,168,739 | $ | 12,276,095 | $ | 45,043,315 | $ | 36,749,414 | |||||||

Taxable investment securities | 1,021,648 | 1,036,572 | 3,081,621 | 3,236,212 | |||||||||||

Nontaxable investment securities | 3,274 | 4,571 | 9,822 | 13,714 | |||||||||||

Federal Home Loan Bank stock | 57,813 | 39,913 | 161,744 | 119,432 | |||||||||||

Interest-earning deposits in other financial institutions | 612,023 | 235,928 | 1,459,216 | 560,055 | |||||||||||

Certificates of deposit held at other financial institutions | 17,079 | 30,953 | 62,714 | 112,357 | |||||||||||

Restricted securities | 3,481 | 2,855 | 9,779 | 8,107 | |||||||||||

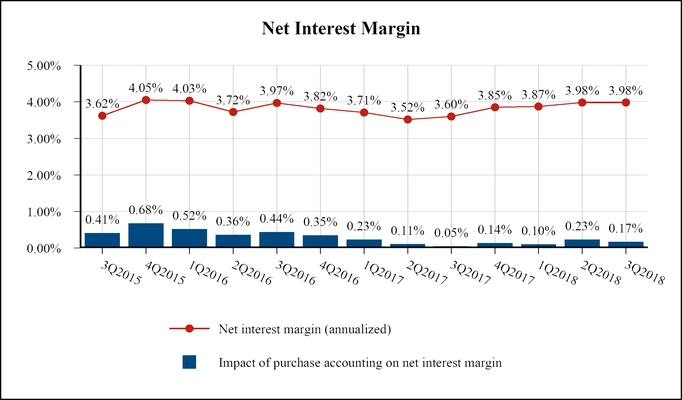

Total interest income | 16,884,057 | 13,626,887 | 49,828,211 | 40,799,291 | |||||||||||

Interest expense: | |||||||||||||||

Deposits | 1,596,469 | 1,182,649 | 4,534,057 | 3,506,425 | |||||||||||

Borrowings | 367,493 | 327,790 | 1,102,532 | 1,077,644 | |||||||||||

Floating rate junior subordinated debt | 149,807 | 129,051 | 427,674 | 373,473 | |||||||||||

Total interest expense | 2,113,769 | 1,639,490 | 6,064,263 | 4,957,542 | |||||||||||

Net interest income | 14,770,288 | 11,987,397 | 43,763,948 | 35,841,749 | |||||||||||

Provision for loan losses | — | — | (350,000 | ) | (900,000 | ) | |||||||||

Net interest income after provision for loan losses | 14,770,288 | 11,987,397 | 44,113,948 | 36,741,749 | |||||||||||

Noninterest income: | |||||||||||||||

Service charges on deposit accounts | 2,097,870 | 1,972,205 | 6,194,239 | 5,560,729 | |||||||||||

Bankcard fees | 1,690,450 | 1,443,151 | 4,692,182 | 4,092,195 | |||||||||||

Gain on investment securities available for sale | — | — | 1,074 | 247,780 | |||||||||||

Gain (loss) on sale of other assets held for sale | — | — | 265,806 | (38,528 | ) | ||||||||||

Bank owned life insurance | 338,992 | 305,709 | 1,029,880 | 884,976 | |||||||||||

Gain on sale of loans | 563,567 | 542,762 | 1,640,090 | 1,816,848 | |||||||||||

Brokerage commissions | 216,770 | 185,674 | 552,308 | 576,237 | |||||||||||

Recoveries on acquired loans previously covered under FDIC-assisted acquisitions | — | — | — | 250,000 | |||||||||||

Other | 316,557 | 189,996 | 1,203,168 | 778,261 | |||||||||||

Total noninterest income | 5,224,206 | 4,639,497 | 15,578,747 | 14,168,498 | |||||||||||

Noninterest expenses: | |||||||||||||||

Salaries and employee benefits | 7,049,321 | 6,530,408 | 20,429,841 | 18,742,656 | |||||||||||

Occupancy | 1,549,444 | 1,156,618 | 4,580,138 | 3,699,807 | |||||||||||

Data processing | 1,279,244 | 1,091,208 | 3,681,398 | 3,004,137 | |||||||||||

Legal and professional | 293,820 | 384,240 | 834,637 | 1,055,985 | |||||||||||

Marketing | 437,717 | 383,890 | 1,245,999 | 1,152,357 | |||||||||||

Federal insurance premiums and other regulatory fees | 203,648 | 198,350 | 699,604 | 561,106 | |||||||||||

Net cost (benefit) of operations of real estate owned | 8,307 | 18,079 | (40,667 | ) | (327,365 | ) | |||||||||

Furniture and equipment | 242,536 | 202,259 | 787,919 | 604,696 | |||||||||||

Postage, office supplies and printing | 201,526 | 224,073 | 646,850 | 717,775 | |||||||||||

Core deposit intangible amortization expense | 168,501 | 117,806 | 550,003 | 420,902 | |||||||||||

Merger-related expenses | 843,887 | 131 | 1,770,517 | 131 | |||||||||||

Other | 989,002 | 790,073 | 2,687,898 | 2,504,167 | |||||||||||

Total noninterest expenses | 13,266,953 | 11,097,135 | 37,874,137 | 32,136,354 | |||||||||||

Income before income taxes | 6,727,541 | 5,529,759 | 21,818,558 | 18,773,893 | |||||||||||

Income tax expense | 2,081,428 | 2,015,909 | 7,525,933 | 6,897,581 | |||||||||||

Net income | $ | 4,646,113 | $ | 3,513,850 | $ | 14,292,625 | $ | 11,876,312 | |||||||

Basic net income per share | $ | 0.32 | $ | 0.24 | $ | 0.99 | $ | 0.83 | |||||||

Diluted net income per share | $ | 0.30 | $ | 0.23 | $ | 0.94 | $ | 0.78 | |||||||

Weighted average number of common shares outstanding | 14,544,417 | 14,353,082 | 14,490,993 | 14,293,859 | |||||||||||

Weighted average number of common and potential common shares outstanding | 15,413,155 | 15,256,623 | 15,263,528 | 15,197,400 | |||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

2

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

Three Months Ended June 30, | Nine Months Ended June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Net income | $ | 4,646,113 | $ | 3,513,850 | $ | 14,292,625 | $ | 11,876,312 | ||||||||

Reclassification adjustment for net gains realized in net income, net of taxes of $0, $0, $312 and $95,643, respectively | — | — | (762 | ) | (152,137 | ) | ||||||||||

Net unrealized holding (losses) gains on investment and mortgage securities available for sale arising during the period, net of taxes of $(155,602), $223,156, $(921,762) and $(1,472,726), respectively | (380,402 | ) | 354,968 | (2,253,442 | ) | (2,342,626 | ) | |||||||||

Comprehensive income | $ | 4,265,711 | $ | 3,868,818 | $ | 12,038,421 | $ | 9,381,549 | ||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

3

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY (UNAUDITED)

Common stock | Additional paid-in capital | Unearned compensation ESOP | Retained earnings | Accumulated other comprehensive loss | Total stockholders' equity | |||||||||||||||||||||

Number of shares | Amount | |||||||||||||||||||||||||

Balance at September 30, 2017 (1) | 15,115,883 | $ | 151,159 | $ | 85,651,391 | $ | (4,673,761 | ) | $ | 134,207,368 | $ | (1,137,652 | ) | $ | 214,198,505 | |||||||||||

Net income | — | — | — | — | 14,292,625 | — | 14,292,625 | |||||||||||||||||||

Dividends paid, $0.24 per share | — | — | — | — | (3,475,648 | ) | — | (3,475,648 | ) | |||||||||||||||||

Change in other comprehensive loss | — | — | — | — | — | (2,009,664 | ) | (2,009,664 | ) | |||||||||||||||||

Reclassification of tax effects in AOCI resulting from the new federal corporate income tax rate | — | — | — | — | 244,541 | (244,541 | ) | — | ||||||||||||||||||

Allocation of ESOP common stock | — | — | 540,210 | 481,453 | — | — | 1,021,663 | |||||||||||||||||||

Effect of restricted stock awards | — | — | 621,149 | — | — | — | 621,149 | |||||||||||||||||||

Stock option expense | — | — | 240,655 | — | — | — | 240,655 | |||||||||||||||||||

Issuance of common stock, stock option exercises | 258,840 | 2,589 | 505,964 | — | — | — | 508,553 | |||||||||||||||||||

Issuance of common stock, restricted stock | 22,500 | 225 | (225 | ) | — | — | — | — | ||||||||||||||||||

Cancellation of restricted stock | (15,000 | ) | (150 | ) | 150 | — | — | — | — | |||||||||||||||||

Shares of common stock withheld in net settlement upon exercise of stock options | (105,387 | ) | (1,054 | ) | (727,127 | ) | — | — | — | (728,181 | ) | |||||||||||||||

Repurchase of shares | (14,364 | ) | (144 | ) | (262,861 | ) | — | — | — | (263,005 | ) | |||||||||||||||

Balance at June 30, 2018 | 15,262,472 | $ | 152,625 | $ | 86,569,306 | $ | (4,192,308 | ) | $ | 145,268,886 | $ | (3,391,857 | ) | $ | 224,406,652 | |||||||||||

__________________________________

(1) | Financial information at September 30, 2017 has been derived from audited financial statements. |

See accompanying notes to unaudited condensed consolidated financial statements.

4

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Nine Months Ended June 30, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 14,292,625 | $ | 11,876,312 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Provision for loan losses | (350,000 | ) | (900,000 | ) | |||

Depreciation and amortization | 1,594,476 | 1,305,818 | |||||

Deferred income tax expense | 2,915,402 | — | |||||

Accretion and amortization of premiums and discounts, net | 625,330 | 767,008 | |||||

Accretion of fair value discounts related to acquired loans | (1,710,274 | ) | (1,255,154 | ) | |||

Gain on sale of loans | (1,640,090 | ) | (1,816,848 | ) | |||

Proceeds from sale of loans | 58,927,681 | 73,225,998 | |||||

Originations and purchases of loans held for sale | (57,519,717 | ) | (70,907,065 | ) | |||

Gain on sale of mortgage-backed securities, collateralized mortgage obligations and other investments | (1,074 | ) | (247,780 | ) | |||

Write down of real estate owned | 88,674 | 19,784 | |||||

Gain on sale of real estate owned | (191,202 | ) | (509,129 | ) | |||

(Gain) loss on sale of fixed assets | (265,806 | ) | 46,556 | ||||

Restricted stock award expense | 621,149 | 596,036 | |||||

Stock option expense | 240,655 | 248,337 | |||||

Increase in cash surrender value of bank owned life insurance | (1,029,880 | ) | (884,976 | ) | |||

Changes in assets and liabilities: | |||||||

Increase in accrued interest and dividends receivable | (156,994 | ) | (132,394 | ) | |||

Decrease (increase) in other assets | 1,314,233 | (24,152 | ) | ||||

(Decrease) increase in other liabilities | (1,605,145 | ) | 878,811 | ||||

Net cash provided by operating activities | 16,150,043 | 12,287,162 | |||||

Cash flows from investing activities: | |||||||

Proceeds from sales of investment securities available for sale | 13,336 | 2,078,436 | |||||

Principal collections on investment securities available for sale | 25,570,967 | 13,525,105 | |||||

Purchase of investment securities available for sale | (14,874,249 | ) | (20,335,542 | ) | |||

Proceeds from maturities or calls of investment securities available for sale | 12,290,000 | 19,157,491 | |||||

Purchase of Federal Home Loan Bank stock | (20,800 | ) | (122,800 | ) | |||

Net decrease in certificates of deposit held at other financial institutions | 3,473,000 | 6,718,000 | |||||

Net increase in loans receivable | (467,634 | ) | (37,318,650 | ) | |||

Proceeds from sale of real estate owned | 1,545,302 | 2,485,558 | |||||

Proceeds from sale of premises and equipment | 905,806 | 221,483 | |||||

Purchases of premises and equipment, net of dispositions | (323,488 | ) | (1,188,434 | ) | |||

Net cash provided by (used in) investing activities | 28,112,240 | (14,779,353 | ) | ||||

Cash flows from financing activities: | |||||||

Repurchase of shares | (263,005 | ) | (1,881 | ) | |||

Issuance of common stock | 508,553 | 594,494 | |||||

Dividends paid | (3,475,648 | ) | (2,571,839 | ) | |||

Taxes paid in net settlement of tax obligation upon exercise of stock options | (728,181 | ) | — | ||||

Net (decrease) increase in deposits | (21,153,334 | ) | 32,671,884 | ||||

Proceeds from Federal Home Loan Bank advances | 1,000,000 | 26,000,000 | |||||

Principal payments on Federal Home Loan Bank advances | (1,000,000 | ) | (26,000,000 | ) | |||

See accompanying notes to unaudited condensed consolidated financial statements.

5

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) continued | |||||||

Nine Months Ended June 30, | |||||||

2018 | 2017 | ||||||

Net (decrease) increase in advance payments by borrowers for taxes and insurance | (590,179 | ) | 94,048 | ||||

Net cash (used in) provided by financing activities | (25,701,794 | ) | 30,786,706 | ||||

Net increase in cash and cash equivalents | 18,560,489 | 28,294,515 | |||||

Cash and cash equivalents at beginning of period | 152,338,389 | 91,849,499 | |||||

Cash and cash equivalents at end of period | $ | 170,898,878 | $ | 120,144,014 | |||

Supplemental disclosures of cash flow information: | |||||||

Interest paid | $ | 6,196,430 | $ | 5,158,767 | |||

Income taxes paid | 3,463,059 | 5,483,170 | |||||

Supplemental disclosure of noncash activities: | |||||||

Real estate acquired through foreclosure of collateral on loans receivable | $ | 232,960 | $ | 1,227,365 | |||

Issuance of common stock under stock benefit plan | 1,021,663 | 684,018 | |||||

Unrealized loss on investment securities available for sale, net | (2,009,664 | ) | (2,494,764 | ) | |||

See accompanying notes to unaudited condensed consolidated financial statements.

6

CHARTER FINANCIAL CORPORATION AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Note 1: Nature of Operations

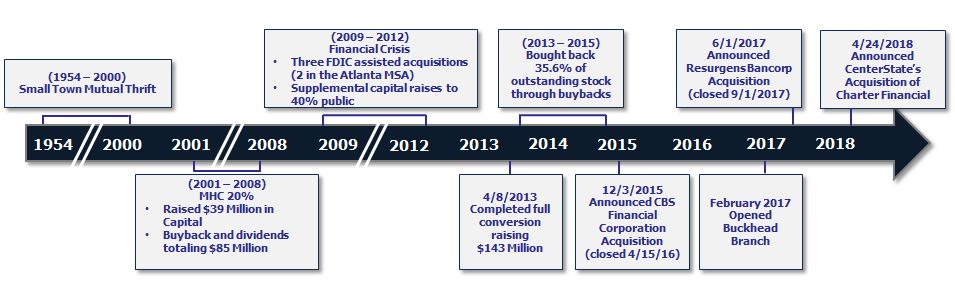

Charter Financial Corporation (“Charter Financial” or the “Company”) is a savings and loan holding company that was incorporated under the laws of the State of Maryland in April 2013 to serve as the holding company for CharterBank (“CharterBank” or “the Bank”). The Bank is a federally-chartered savings bank that was originally founded in 1954 as a federally-chartered mutual savings and loan association.

On April 8, 2013, the Company completed its conversion and reorganization pursuant to which it converted from the mutual holding company form of organization to the stock holding company form of organization. The Company sold 14.3 million shares of common stock for gross offering proceeds of $142.9 million in the offering. Following the conversion and reorganization, the Bank became 100% owned by Charter Financial and Charter Financial became 100% owned by public shareholders.

As of June 30, 2018, the Company operated 22 branch offices in the metropolitan Atlanta area (“Metro Atlanta” or the “MSA”), including one cashless branch office in Norcross, Georgia, the I-85 corridor south to Auburn, Alabama, and the Florida Gulf Coast.

On April 24, 2018, the Company and CenterState Bank Corporation, a Florida corporation (“CenterState”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) whereby the Company will be merged with and into CenterState (the “Merger”). Pursuant to and simultaneously with entering into the Merger Agreement, CharterBank and CenterState's wholly owned subsidiary bank, CenterState Bank, N.A. (“CenterState Bank”), entered into a Plan of Merger and Merger Agreement whereby CharterBank will be merged with and into CenterState Bank immediately following the Merger (the “Bank Merger”). See Note 4: Business Combinations for further information on the proposed Merger.

Note 2: Basis of Presentation

The accompanying unaudited interim consolidated financial statements of Charter Financial and the Bank include the accounts of the Company and the Bank as of June 30, 2018 and September 30, 2017 (derived from audited financial statements), and for the three and nine-month periods ended June 30, 2018 and 2017. All intercompany accounts and transactions have been eliminated in consolidation. The unaudited interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the unaudited interim condensed consolidated financial statements include all necessary adjustments, consisting of normal recurring accruals, necessary for a fair presentation for the periods presented. The results of operations for the three and nine-month period ended June 30, 2018, are not necessarily indicative of the results that may be expected for the entire year or any other interim period.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change in the near term relate to the determination of the allowance for loan losses, the valuation of real estate acquired in connection with foreclosures or in satisfaction of loans, the estimates used for fair value acquisition accounting, the estimate of expected cash flows on purchased impaired and other acquired loans, and the assessment for other-than-temporary impairment of investment securities, mortgage-backed securities, collateralized mortgage-backed securities and collateralized mortgage obligations. Certain reclassifications of prior fiscal year balances have been made to conform to classifications used in the current fiscal year. These reclassifications did not change net income or stockholders' equity.

Note 3: Recent Accounting Pronouncements

In June 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Non-Employee Share-Based Payment Accounting (“ASU 2018-07”). The amendments in this update are part of the FASB's Simplification Initiative, and expand the scope of Topic 718, Compensation - Stock Compensation, which currently only includes share-based payments issued to employees, to also include share-based payments issued to nonemployees for goods and services. As a result, the accounting for share-based payments to nonemployees and employees will be substantially aligned. The ASU supersedes Subtopic 505-50, Equity - Equity-Based Payments to Non-Employees. The amendments specify that Topic 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed in a grantor's own operations by issuing share-based payment awards except when they are used to effectively provide (1) financing to the issuer or (2) awards granted in conjunction with selling goods or

7

services to customers as part of a contract accounted for under Topic 606, Revenue from Contracts with Customers. The amendments change numerous current GAAP practices for share-based payments to nonemployees, including the overall measurement objective, measurement date, awards with performance conditions, and classification reassessment of certain equity-classified awards. The amendments in this ASU affect all companies that enter into share-based payment transactions for acquiring goods or services from nonemployees, and are effective for public companies for fiscal years beginning after December 15, 2018, including interim periods within that fiscal year. Early adoption is permitted, but no earlier than a company's adoption date of Topic 606. The Company does not anticipate a material effect from adoption of this standard on its consolidated financial statements.

In May 2018, the FASB issued ASU 2018-06, Codification Improvements to Topic 942, Financial Services - Depository and Lending. The amendments in this update are intended to supersede outdated guidance related to the Office of the Comptroller of the Currency's (“OCC”) Banking Circular 202, Accounting for Net Deferred Tax Charges (Circular 202). The guidance has been rescinded by the OCC and is no longer relevant. Prior guidance from the OCC limited the net deferred tax debits that can be carried on a bank's statement of condition for regulatory purposes to the amount that would be recoverable by carryback of net operating losses. With the guidance now rescinded, that limitation for regulatory purposes is no longer applicable. The amendment is effective upon issuance. The guidance does not impact the Company's consolidated statements of financial condition.

In March 2018, the FASB issued ASU 2018-05, Income Taxes (Topic 740): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118. The amendments in this update address certain accounting items for current and deferred income taxes related to the Tax Cuts and Jobs Act (“the Tax Act”). Under these amendments, a Company is expected to record any income tax effects that can be reasonably estimated from the Tax Act in its financial statements, while allowing for those items which cannot be reasonably estimated to remain unrecorded. The amendments are effective immediately. The Company recorded additions to income tax expense in its consolidated statements of income that could reasonably be estimated in the amount of $40,000 and $1.5 million during the three and nine months ended June 30, 2018, respectively.

In February 2018, the FASB issued ASU 2018-02, Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. The amendments in this update allow for a reclassification of stranded tax effects resulting from the Tax Act from accumulated other comprehensive income to retained earnings. The amendments in this update are effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted and the Company elected to early adopt this guidance effective March 31, 2018. The adoption resulted in a reclassification of stranded tax effects of $245,000 from accumulated other comprehensive loss to retained earnings in the Company's consolidated statements of financial condition and stockholders' equity at June 30, 2018.

In August 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which is intended to better align hedge accounting with an organization's risk management activities in the financial statements. The ASU also simplifies the application of hedge accounting guidance in areas where practice issues exist. The amendments in this ASU are intended to address financial statement user concerns over hedge accounting through changes to the guidance that will accomplish the following: (1) expand hedge accounting for nonfinancial and financial risk components and amend measurement methodologies to more closely align hedge accounting with a company's risk management activities; (2) decrease the complexity of preparing and understanding hedge results through eliminating the separate measurement and reporting of hedge ineffectiveness; (3) enhance transparency, comparability, and understandability of hedge results through enhanced disclosures and changing the presentation of hedge results to align the effects of the hedging instrument and the hedged item; and (4) reduce the cost and complexity of applying hedge accounting by simplifying the manner in which assessments of hedge effectiveness may be performed. The standard applies broadly to any company that elects to apply hedge accounting in accordance with current accounting principles generally accepted in the United States of America (“GAAP”), and will be effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. The Company does not currently apply hedge accounting but may do so in the future, and is in the process of determining the impact this standard would have on its consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which sets forth a "current expected credit loss" (“CECL”) model requiring the Company to measure all expected credit losses for financial instruments held at the reporting date based on historical experience, current conditions and reasonable supportable forecasts. This replaces the existing incurred loss model and is applicable to the measurement of credit losses on financial assets measured at amortized cost and applies to some off-balance sheet credit exposures. For public business entities that are U.S. Securities and Exchange Commission filers, the amendments in this update are effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. The Company has assembled a transition team to assess the adoption of this ASU, which is in the process of developing a project plan regarding implementation and has contracted with a third-party provider to implement enhanced modeling techniques and a more automated database solution. The team is currently evaluating data and software requirements for implementation, and plans to run parallel models for a year prior to implementation. The Company is currently in the process of determining the impact of adopting this standard.

8

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The FASB issued this ASU to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet by lessees for those leases classified as operating leases under current U.S. GAAP and disclosing key information about leasing arrangements. The amendments in this ASU are effective for public business entities for annual periods, and interim periods within those annual periods, beginning after December 15, 2018. Early application of this ASU is permitted for all entities. The Company is in the process of evaluating its current inventory of leases to determine the impact of adoption of this standard.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments-Recognition and Measurement of Financial Assets and Liabilities, which is intended to improve the recognition and measurement of financial instruments by requiring: equity investments (other than equity method or consolidation) to be measured at fair value with changes in fair value recognized in net income; public business entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes; separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (i.e., securities or loans and receivables) on the balance sheet or the accompanying notes to the financial statements; eliminating the requirement to disclose the fair value of financial instruments measured at amortized cost for organizations that are not public business entities; eliminating the requirement for public business entities to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost on the balance sheet; and requiring a reporting organization to present separately in other comprehensive income the portion of the total change in the fair value of a liability resulting from a change in the instrument-specific credit risk (also referred to as “own credit”) when the organization has elected to measure the liability at fair value in accordance with the fair value option for financial instruments. This ASU is effective for public companies for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. This ASU permits early adoption of the instrument-specific credit risk provision. The adoption of ASU 2016-01 on October 1, 2018, is not expected to have a material impact on the Company's consolidated financial position, results of operations or cash flows.

In May 2014, the FASB issued ASU 2014-09, Revenue From Contracts With Customers. This standard outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry specific guidance. The core principle of the revenue model is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard was to be effective for annual reporting periods beginning after December 15, 2016. In August 2015, the FASB issued ASU 2015-14, deferring the effective date for the standard to reporting periods beginning after December 15, 2017. As a financial institution, the Company's revenue is more significantly weighted towards net interest income on its financial assets and liabilities, which is explicitly excluded from the scope of the new standard. The Company continues to assess its revenue streams and review its contracts with customers that are potentially affected by the new guidance, such as fees on deposits, gains and losses on the sale of other real estate owned, bankcard fees and brokerage commissions, to determine the potential impact the new guidance is expected to have on the Company's consolidated financial statements. The Company's revenue recognition pattern for these revenue streams, however, is not expected to change materially from current practice. The Company also continues to follow implementation issues specific to financial institutions which are still under discussion by the FASB's Transition Resource Group. The Company plans to adopt the ASU on October 1, 2018, most likely under the modified retrospective approach.

Note 4: Business Combinations

Pending acquisition by CenterState Bank Corporation

On April 24, 2018, the Company and CenterState entered into the Merger Agreement whereby the Company will be merged with and into CenterState. Pursuant to and simultaneously with entering into the Merger Agreement, CharterBank and CenterState Bank entered into a Plan of Merger and Merger Agreement whereby CharterBank will be merged with and into CenterState Bank immediately following the Merger.

Pursuant to the Merger Agreement, each outstanding share of Charter common stock issued and outstanding immediately prior to the effective time of the Merger will be converted into the right to receive 0.738 shares of CenterState common stock and a cash amount equal to $2.30, provided that cash in lieu of any fractional shares of CenterState common stock will be paid. Each outstanding share of CenterState stock shall remain outstanding and unaffected by the Merger. Each option to purchase shares of Charter common stock will be converted into the right to receive a cash payment equal to the product (i) of the number of shares of Charter common stock underlying such option and (ii) $23.00 minus the exercise price per share under such option. Immediately prior to the effective time of the Merger, all shares of Charter restricted stock shall vest in full and shall be treated like all other issued and outstanding shares of Charter common stock. As of the announcement date on April 24, 2018, based on CenterState's closing stock price of $27.72, the total merger consideration amounted to $360.1 million, or approximately $22.76 per share.

9

The Merger Agreement has been unanimously approved by the boards of directors of the Company and CenterState, and is expected to close in the third or fourth quarter of calendar 2018 subject to customary conditions, including receipt of all applicable regulatory approvals and the approval of the stockholders of the Company.

During the three and nine months ended June 30, 2018, the Company recorded $844,000 of merger related costs from the proposed CenterState acquisition.

Acquisition of Resurgens Bancorp

On September 1, 2017, the Company completed its acquisition of Resurgens Bancorp (“Resurgens”) and its wholly-owned subsidiary, Resurgens Bank, for cash consideration of $25.8 million. Upon completion of the acquisition, Resurgens merged into Charter Financial, and Resurgens Bank merged into CharterBank. The acquisition expanded the bank's presence in the Atlanta market with two branches in DeKalb County.

The following table provides a summary of the assets acquired and liabilities assumed of Resurgens as recorded by the Company. As provided for under GAAP, management has up to one year following the date of acquisition to finalize the fair values of the acquired assets and assumed liabilities. The fair values shown in the following table have been determined by management to be the Day 1 Fair Values.

Purchase Price: | |||||||

Cash paid to Resurgens shareholders | $ | 25,775,313 | |||||

Fair value of assets acquired: | |||||||

Cash and cash equivalents | $ | 31,196,692 | |||||

Loans receivable, net | 128,756,348 | ||||||

Federal Home Loan Bank stock | 569,800 | ||||||

Premises and equipment | 1,507,309 | ||||||

Accrued interest and dividends receivable | 468,900 | ||||||

Core deposit intangible | 1,536,000 | ||||||

Bank owned life insurance | 3,051,900 | ||||||

Deferred tax assets | 393,195 | ||||||

Other assets | 476,458 | ||||||

Total assets acquired | 167,956,602 | ||||||

Fair value of liabilities assumed: | |||||||

Deposits | 138,031,166 | ||||||

Federal Home Loan Bank advances | 10,024,100 | ||||||

Other borrowings | 3,250,000 | ||||||

Advance payments by borrowers for taxes and insurance | 47,592 | ||||||

Other liabilities | 382,053 | ||||||

Total liabilities assumed | $ | 151,734,911 | |||||

Fair value of net assets acquired | 16,221,691 | ||||||

Goodwill recognized for Resurgens | $ | 9,553,622 | |||||

Goodwill of $9.6 million, which is the excess of merger consideration over the estimated fair value of net assets acquired, was recorded and is the result of expected operational synergies and other factors. This goodwill is not expected to be deductible for tax purposes.

No loans were recognized as credit impaired in the acquisition.

The Company recorded no merger expenses related to the Resurgens acquisition during the three months ended June 30, 2018, and $927,000 of such expenses during the nine months ended June 30, 2018, and $131 for the three and nine months ended June 30, 2017. The Company recorded a total of $1.9 million of such expenses during the year ended September 30, 2017. Full conversion of the acquisition was completed in mid-February of 2018, and no further costs related to the Resurgens acquisition are expected. The Company also assumed a $3.3 million borrowing that was paid off immediately following closing of the acquisition.

10

Acquisition of CBS Financial Corporation

On April 15, 2016, the Company completed its acquisition of CBS Financial Corporation (“CBS”) and its wholly-owned subsidiary, Community Bank of the South, for cash consideration of $55.9 million. In addition to the cash paid by Charter Financial, CBS paid approximately $2.9 million in Stock Appreciation Rights and Stock Options payouts to its holders for a total transaction value of $58.8 million. Upon completion of the acquisition, CBS merged into Charter Financial, and Community Bank of the South merged into CharterBank. The acquisition expanded the bank's presence in the Atlanta market with four branches in Cobb County.

The Company acquired $300.8 million of net loans receivable, and assumed $333.7 million of deposits. Goodwill of $25.5 million, which is the excess of the merger consideration over the estimated fair value of net assets acquired, was recorded in the CBS acquisition and is the result of expected operational synergies and other factors. A portion of this goodwill is expected to be deductible for tax purposes.

No loans were recognized as credit impaired in the acquisition.

Note 5: Investment Securities

Investment securities available for sale are summarized as follows:

June 30, 2018 | |||||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

Other investment securities: | |||||||||||||||

State and municipal securities | $ | 1,569,292 | $ | — | $ | (12,479 | ) | $ | 1,556,813 | ||||||

Collateralized loan obligations | 43,803,295 | 41,725 | (120,258 | ) | 43,724,762 | ||||||||||

Mortgage-backed securities: | |||||||||||||||

FHLMC certificates | 18,171,186 | — | (442,800 | ) | 17,728,386 | ||||||||||

FNMA certificates | 94,749,446 | 25,971 | (3,926,177 | ) | 90,849,240 | ||||||||||

GNMA certificates | 1,026,048 | — | (37,304 | ) | 988,744 | ||||||||||

Private-label mortgage securities: (1) | |||||||||||||||

Investment grade | 371,308 | 1,016 | — | 372,324 | |||||||||||

Split rating (2) | 1,559,834 | — | (73,150 | ) | 1,486,684 | ||||||||||

Non-investment grade | 537,422 | — | (11,970 | ) | 525,452 | ||||||||||

Total | $ | 161,787,831 | $ | 68,712 | $ | (4,624,138 | ) | $ | 157,232,405 | ||||||

________________________________

(1) | Credit ratings are current as of June 30, 2018. |

(2) | Bonds with split ratings represent securities with both investment and non-investment grades. |

September 30, 2017 | |||||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||

Other investment securities: | |||||||||||||||

State and municipal securities | $ | 2,238,758 | $ | 13,177 | $ | (120 | ) | $ | 2,251,815 | ||||||

Collateralized loan obligations | 40,629,368 | 92,000 | (43,692 | ) | 40,677,676 | ||||||||||

Mortgage-backed securities: | |||||||||||||||

FHLMC certificates | 21,657,987 | 220,228 | (123,093 | ) | 21,755,122 | ||||||||||

FNMA certificates | 114,740,214 | 177,495 | (1,926,890 | ) | 112,990,819 | ||||||||||

GNMA certificates | 2,504,334 | 2,645 | (916 | ) | 2,506,063 | ||||||||||

Private-label mortgage securities: | |||||||||||||||

Investment grade | 614,679 | — | (23,236 | ) | 591,443 | ||||||||||

Split rating (1) | 2,337,239 | — | (87,569 | ) | 2,249,670 | ||||||||||

Non-investment grade | 790,956 | — | (23,743 | ) | 767,213 | ||||||||||

Total | $ | 185,513,535 | $ | 505,545 | $ | (2,229,259 | ) | $ | 183,789,821 | ||||||

______________________________

11

(1) | Bonds with split ratings represent securities with both investment and non-investment grades. |

The amortized cost and estimated fair value of investment securities available for sale as of June 30, 2018, by contractual maturity, are shown below. Expected maturities may differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

Amortized Cost | Estimated Fair Value | ||||||

Due within one year | $ | 500,751 | $ | 500,595 | |||

Due from one year to five years | 1,068,541 | 1,056,218 | |||||

Due after five years | 43,803,295 | 43,724,762 | |||||

Mortgage-backed securities | 116,415,244 | 111,950,830 | |||||

Total | $ | 161,787,831 | $ | 157,232,405 | |||

During the nine months ended June 30, 2018 and 2017, $12.3 million and $19.2 million in investment securities available for sale were called or matured, respectively. Proceeds from sales of investment securities available for sale were $13,336 and $2.1 million during the nine months ended June 30, 2018 and 2017. Gross realized gains on the sale of these securities were $1,074 for the nine months ended June 30, 2018, and $247,780 for the same period in 2017. No gross realized losses were recognized for the nine months ended June 30, 2018 or 2017.

Investment securities available for sale with an aggregate carrying value of $37.7 million and $89.6 million at June 30, 2018 and September 30, 2017, respectively, were available to be pledged to secure Federal Home Loan Bank (“FHLB”) advances. However, no securities were pledged at either period end to secure FHLB advances.

Investment securities available for sale that had been in a continuous unrealized loss position for less than 12 months at June 30, 2018 and September 30, 2017 are as follows:

June 30, 2018 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Other investment securities: | |||||||||||

State and municipal securities | $ | 1,569,292 | $ | (12,479 | ) | $ | 1,556,813 | ||||

Collateralized loan obligations | 27,994,494 | (120,259 | ) | 27,874,235 | |||||||

Mortgage-backed securities: | |||||||||||

FHLMC certificates | 9,123,630 | (65,326 | ) | 9,058,304 | |||||||

FNMA certificates | 19,911,981 | (701,169 | ) | 19,210,812 | |||||||

GNMA certificates | 1,026,049 | (37,304 | ) | 988,745 | |||||||

Total | $ | 59,625,446 | $ | (936,537 | ) | $ | 58,688,909 | ||||

September 30, 2017 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Other investment securities: | |||||||||||

State and municipal securities | $ | 556,675 | $ | (120 | ) | $ | 556,555 | ||||

Collateralized loan obligations | 9,173,224 | (43,692 | ) | 9,129,532 | |||||||

Mortgage-backed securities: | |||||||||||

FHLMC certificates | 10,721,484 | (123,093 | ) | 10,598,391 | |||||||

FNMA certificates | 46,902,868 | (270,060 | ) | 46,632,808 | |||||||

GNMA certificates | 1,042,769 | (916 | ) | 1,041,853 | |||||||

Private-label mortgage securities | 107,879 | (211 | ) | 107,668 | |||||||

Total | $ | 68,504,899 | $ | (438,092 | ) | $ | 68,066,807 | ||||

12

Investment securities available for sale that had been in a continuous unrealized loss position for greater than 12 months at June 30, 2018 and September 30, 2017 are as follows:

June 30, 2018 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Mortgage-backed securities: | |||||||||||

FHLMC certificates | $ | 9,047,555 | $ | (377,474 | ) | $ | 8,670,081 | ||||

FNMA certificates | 70,810,929 | (3,225,008 | ) | 67,585,921 | |||||||

Private-label mortgage securities | 2,097,256 | (85,120 | ) | 2,012,136 | |||||||

Total | $ | 81,955,740 | $ | (3,687,602 | ) | $ | 78,268,138 | ||||

September 30, 2017 | |||||||||||

Amortized Cost | Gross Unrealized Losses | Estimated Fair Value | |||||||||

Mortgage-backed securities: | |||||||||||

FNMA certificates | $ | 59,666,482 | $ | (1,656,829 | ) | $ | 58,009,653 | ||||

Private-label mortgage securities | 3,634,997 | (134,338 | ) | 3,500,659 | |||||||

Total | $ | 63,301,479 | $ | (1,791,167 | ) | $ | 61,510,312 | ||||

At June 30, 2018 the Company had approximately $85,000 of gross unrealized losses on private-label mortgage securities with aggregate amortized cost of approximately $2.1 million. As of June 30, 2018, the Company has no other-than-temporary impairment losses in its portfolio of investment securities available for sale.

Regularly, the Company performs an assessment to determine whether there have been any events or economic circumstances to indicate that a security on which there is an unrealized loss is impaired other-than-temporarily. The assessment considers many factors including the severity and duration of the impairment, the Company’s intent and ability to hold the security for a period of time sufficient for recovery in value, recent events specific to the industry, and current characteristics of each security such as delinquency and foreclosure levels, credit enhancements, and projected losses and loss coverage ratios. It is possible that the underlying collateral of these securities will perform worse than current expectations, which may lead to adverse changes in cash flows on these securities and potential future other-than-temporary impairment losses. Events that may trigger material declines in fair values for these securities in the future include but are not limited to, deterioration of credit metrics, significantly higher levels of default and severity of loss on the underlying collateral, deteriorating credit enhancement and loss coverage ratios, or further illiquidity. All of these securities were evaluated for other-than-temporary impairment based on an analysis of the factors and characteristics of each security as previously enumerated. The Company considers these unrealized losses to be temporary impairment losses primarily because of continued sufficient levels of credit enhancements and credit coverage levels of less senior tranches to tranches held by the Company.

13

Note 6: Loans Receivable

Loans outstanding, by portfolio segment, are summarized in the following table:

June 30, 2018 | September 30, 2017 | ||||||

1-4 family residential real estate | $ | 246,591,057 | $ | 232,040,341 | |||

Commercial real estate | 676,399,345 | 697,070,779 | |||||

Commercial | 102,936,278 | 103,673,447 | |||||

Real estate construction | 101,570,279 | 88,791,799 | |||||

Consumer and other | 36,809,844 | 39,943,386 | |||||

Total loans, net of acquisition fair value adjustments | 1,164,306,803 | 1,161,519,752 | |||||

Unamortized loan origination fees, net | (1,284,342 | ) | (1,165,148 | ) | |||

Allowance for loan losses | (11,496,661 | ) | (11,078,422 | ) | |||

Total loans, net | $ | 1,151,525,800 | $ | 1,149,276,182 | |||

Loan Origination and Risk Management. The Company has certain lending policies and procedures in place that are designed to maximize loan income within an acceptable level of risk. Management reviews and approves these policies and procedures on a regular basis. A reporting system supplements the review process by providing management with frequent reports related to loan production, loan quality, concentrations of credit, loan delinquencies and nonperforming and potential problem loans. Diversification in the loan portfolio is a means of managing risk associated with fluctuations in economic conditions.

Commercial real estate loans are generally made by the Company to entities in Georgia, Alabama, Florida and adjoining states and are secured by properties in these states. Commercial real estate lending involves different risks compared to one- to four-family residential lending. Repayment of commercial real estate loans often depends on the successful operations and income stream of the borrowers, and commercial real estate loans typically involve larger loan balances to single borrowers or groups of related borrowers compared to residential real estate loans. The Company’s underwriting criteria for commercial real estate loans include maximum loan-to-value ratios, debt coverage ratios, secondary sources of repayment, guarantor requirements, net worth requirements and quality of cash flow. As part of the loan approval and underwriting of commercial real estate loans, management undertakes a cash flow analysis, and generally requires a debt-service coverage ratio of at least 1.15 times. In addition, management tracks the level of owner-occupied commercial real estate loans versus non-owner occupied loans. At June 30, 2018, approximately 32.1% of the outstanding principal balance of the Company’s commercial real estate loans was secured by owner-occupied properties.

The Company makes construction and land development loans primarily for the construction of one- to four-family residences but also for multi-family and nonresidential real estate projects on a select basis. The Company offers construction loans to builders including both speculative (unsold) and pre-sold loans to pre-approved local builders. The number of speculative loans that management will extend to a builder at one time depends upon the financial strength and credit history of the builder. The Company’s construction loan program is expected to remain a modest portion of the loan volume, and management generally limits the number of outstanding loans on unsold homes under construction within a specific area.

The Company also originates first and second mortgage loans and home equity lines of credit secured by one- to four-family residential properties within Georgia, Alabama and the Florida panhandle. Management currently originates mortgages at all branch locations, but utilizes a centralized underwriting location to reduce risk. The Company originates both fixed rate and adjustable rate one- to four-family residential mortgage loans. Fixed rate 30-year conforming loans are generally originated for sale into the primary or secondary markets and loans that are non-conforming due to property exceptions and that have adjustable rates are generally retained in the Company’s portfolio. The non-conforming loans originated are not considered to be subprime loans and the amount of subprime and low documentation loans held by the Company is not material. The Company also offers home equity lines of credit as a complement to one- to four-family residential mortgage lending. The underwriting standards applicable to home equity credit lines are similar to those for one- to four-family residential mortgage loans, except for slightly more stringent credit-to-income and credit score requirements. Home equity loans are generally limited to 90% of the value of the underlying property unless the loan is covered by private mortgage insurance. At June 30, 2018, the Company had $44.8 million of home equity lines of credit and second mortgage loans.

The Company originates consumer loans that consist of loans on deposits, auto loans, purchased mobile home loans, and various other installment loans. The Company primarily offers consumer loans as an accommodation to customers. Consumer loans tend to have a higher credit risk than residential mortgage loans because they may be secured by rapidly depreciable assets, or may be unsecured. The Company’s consumer lending generally follows accepted industry standards for non-subprime lending, including credit scores and debt to income ratios.

14

The Company’s commercial business loans are generally limited to terms of ten years or less. While management typically collateralizes these loans with a lien on commercial real estate or, much less frequently, with a lien on business assets and equipment, the primary underwriting consideration is the business cash flow. Management also generally requires the personal guarantee of the business owner. Interest rates on commercial business loans are generally higher than interest rates on residential or commercial real estate loans due to the risk inherent in this type of loan. Commercial business loans are generally considered to have more risk than residential mortgage loans or commercial real estate loans because the collateral may be in the form of intangible assets and/or readily depreciable inventory. Commercial business loans may also involve relatively large loan balances to single borrowers or groups of related borrowers, with the repayment of such loans typically dependent on the successful operation and income stream of the borrower. Such risks can be significantly affected by economic conditions. In addition, commercial business lending generally requires substantially greater supervision efforts by management compared to residential mortgage or commercial real estate lending.

The Company also has a portfolio of Small Business Administration (“SBA”) loans, which are generally related to commercial lending. Each loan has either a portion guaranteed by the SBA or other credit enhancements provided by the government.

The Company maintains an internal loan review function that reviews and validates the credit risk program on a periodic basis. Results of these reviews are presented to management. The loan review process complements and reinforces the risk identification and assessment decisions made by lenders and credit personnel, as well as the Company’s policies and procedures.

Nonaccrual and Past Due Loans. An aging analysis of past due loans, segregated by portfolio segment, at June 30, 2018 and September 30, 2017 was as follows:

June 30, 2018 | September 30, 2017 | ||||||

Current | $ | 1,157,740,999 | $ | 1,155,094,965 | |||

Accruing past due loans: | |||||||

30-89 days past due | |||||||

1-4 family residential real estate | 2,476,122 | 1,567,688 | |||||

Commercial real estate | 1,265,449 | 1,490,424 | |||||

Commercial | 113,257 | 1,000,840 | |||||

Real estate construction | 324,924 | — | |||||

Consumer and other | 777,656 | 659,174 | |||||

Total 30-89 days past due | 4,957,408 | 4,718,126 | |||||

90 days or greater past due (1) | |||||||

1-4 family residential real estate | 154,659 | 46,223 | |||||

Commercial real estate | — | — | |||||

Commercial | — | — | |||||

Real estate construction | — | — | |||||

Consumer and other | 86,983 | — | |||||

Total 90 days or greater past due | 241,642 | 46,223 | |||||

Total accruing past due loans | 5,199,050 | 4,764,349 | |||||

Nonaccruing loans: (2) | |||||||

1-4 family residential real estate | 348,150 | 293,224 | |||||

Commercial real estate | 771,901 | 1,327,037 | |||||

Commercial | 224,157 | 40,177 | |||||

Real estate construction | — | — | |||||

Consumer and other | 22,546 | — | |||||

Nonaccruing loans | 1,366,754 | 1,660,438 | |||||

Total loans | $ | 1,164,306,803 | $ | 1,161,519,752 | |||

(1) | No acquired loans are regarded as accruing loans and included in this section at June 30, 2018 or September 30, 2017. These loans which are accounted for under ASC 310-30 are reported as accruing loans because of the ongoing recognition of accretion income established at the time of acquisition. |

(2) | Acquired loans in the amount of $0 and $888,000 at June 30, 2018 and September 30, 2017, respectively, are regarded as accruing loans and excluded from the nonaccrual section due to the ongoing recognition of accretion income established at the time of acquisition. |

15

Impaired Loans. The Company evaluates “impaired” loans, which include nonperforming loans and accruing troubled debt restructured loans having risk characteristics that are unique to an individual borrower, on a loan-by-loan basis with balances above a specified level. For smaller loans, the allowance is calculated based on the credit grade utilizing historical loss experience and other qualitative factors.

Impaired loans for the periods ended June 30, 2018 and September 30, 2017, segregated by portfolio segment, are presented below. There were $1,251,449 and $48,733 of recorded allowances for loan losses on impaired loans at June 30, 2018 and September 30, 2017, respectively.

Three Months Ended June 30, 2018 | Nine Months Ended June 30, 2018 | ||||||||||||||||||||||||||

Recorded Investment | Unpaid Principal Balance | Related Allowance | Average Investment in Impaired Loans | Interest Income Recognized | Average Investment in Impaired Loans | Interest Income Recognized | |||||||||||||||||||||

1-4 family residential real estate (1) | $ | 1,051,428 | $ | 1,208,242 | $ | 8,020 | $ | 1,056,993 | $ | 8,254 | $ | 1,114,914 | $ | 42,079 | |||||||||||||

Commercial real estate (2) | 8,558,786 | 9,774,957 | 1,199,353 | 8,614,619 | 97,047 | 8,878,239 | 299,275 | ||||||||||||||||||||

Commercial | 224,157 | 48,343 | — | 228,730 | — | 226,492 | 2,386 | ||||||||||||||||||||

Real estate construction | — | — | — | — | — | — | — | ||||||||||||||||||||

Consumer and other (3) | 135,920 | 138,799 | 44,076 | 137,053 | 2,407 | 138,976 | 7,297 | ||||||||||||||||||||

Total impaired loans | $ | 9,970,291 | $ | 11,170,341 | $ | 1,251,449 | $ | 10,037,395 | $ | 107,708 | $ | 10,358,621 | $ | 351,037 | |||||||||||||

________________________________

(1) | 1-4 family residential real estate loans with related allowances totaling $8,020 had a recorded investment of $29,999 and unpaid principal balance of $33,905 at June 30, 2018. During the three and nine months ended June 30, 2018, the Company had an average investment in such loans of $30,360 and $31,050, respectively, and recorded no interest income on the loans. |

(2) | Commercial real estate loans with related allowances totaling $1,199,353 had a recorded investment of $4,487,205 and unpaid principal balance of $4,807,777 at June 30, 2018. During the three and nine months ended June 30, 2018, the Company had an average investment in such loans of $4,508,128 and $4,710,529, respectively, and recorded $50,716 and $158,980 of interest income, respectively, on the loans. |

(3) | Consumer and other loans with related allowances totaling $44,076 had a recorded investment of $48,937 and unpaid principal balance of $51,817 at June 30, 2018. During the three and nine months ended June 30, 2018, the Company had an average investment in such loans of $49,969 and $51,360, respectively, and recorded $437 and $1,349 of interest income, respectively, on the loans. |

The recorded investment in accruing troubled debt restructured loans (“TDRs”) at June 30, 2018 totaled $3.9 million and is included in the impaired loan table above.

Year Ended September 30, 2017 | |||||||||||||||||||

Recorded Investment | Unpaid Principal Balance | Related Allowance | Average Investment in Impaired Loans | Interest Income Recognized | |||||||||||||||

1-4 family residential real estate (1) | $ | 955,522 | $ | 1,143,831 | $ | 24,434 | $ | 975,317 | $ | 33,166 | |||||||||

Commercial real estate (2) | 5,960,208 | 6,970,943 | 24,299 | 6,131,422 | 259,651 | ||||||||||||||

Commercial | 140,012 | 363,382 | — | 161,068 | — | ||||||||||||||

Real estate construction | — | — | — | — | — | ||||||||||||||

Consumer and Other | 28,806 | 30,125 | — | 30,394 | 1,976 | ||||||||||||||

Total impaired loans | $ | 7,084,548 | $ | 8,508,281 | $ | 48,733 | $ | 7,298,201 | $ | 294,793 | |||||||||

________________________________

(1) | 1-4 family residential real estate loans with related allowances totaling $24,434 had a recorded investment of $24,434 and unpaid principal balance of $25,131 at September 30, 2017. During the year ended September 30, 2017, the Company had an average investment in such loans of $24,858 and recorded $90 of interest income on the loans. |

(2) | Commercial real estate loans with related allowances totaling $24,299 had a recorded investment of $686,520 and unpaid principal balance of $695,762 at September 30, 2017. During the year ended September 30, 2017, the Company had an average investment in such loans of $717,892 and recorded $39,825 of interest income on the loans. |

16

The recorded investment in accruing TDRs at September 30, 2017 totaled $5.0 million and is included in the impaired loan table above.

Loans are classified as restructured by the Company when certain modifications are made to the loan terms and concessions are granted to the borrowers due to financial difficulty experienced by those borrowers. The Company only restructures loans for borrowers in financial difficulty that have presented a viable business plan to fully pay off all obligations, including outstanding debt, interest, and fees, either by generating additional income from the business or through liquidation of assets. Generally, these loans are restructured to provide the borrower additional time to execute upon their plans. The concessions granted on TDRs generally include terms to reduce the interest rate or extend the term of the debt obligation.

Loans on nonaccrual status at the date of modification are initially classified as nonaccrual TDRs. Loans on accruing status at the date of concession are initially classified as accruing TDRs if the loan is reasonably assured of repayment and performance is expected in accordance with its modified terms. Such loans may be designated as nonaccrual loans subsequent to the concession date if reasonable doubt exists as to the collection of interest or principal under the restructuring agreement. TDRs are returned to accruing status when there is economic substance to the restructuring, there is documented credit evaluation of the borrower’s financial condition, the remaining balance is reasonably assured of repayment in accordance with its modified terms, and the borrower has demonstrated sustained repayment performance in accordance with the modified terms for a reasonable period of time (generally a minimum of six months).

For the nine month periods ended June 30, 2018 and 2017, the following table presents a breakdown of the types of concessions determined to be TDRs during the period by loan class.

Accruing Loans | Nonaccrual Loans | ||||||||||||||||||

Nine Months Ended June 30, 2018 | Nine Months Ended June 30, 2018 | ||||||||||||||||||

Number of Loans | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Number of Loans | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | ||||||||||||||

Payment structure modification: | |||||||||||||||||||

1-4 family residential real estate | 4 | $ | 195,854 | $ | 195,854 | — | $ | — | $ | — | |||||||||

Commercial real estate | 1 | 94,337 | 94,337 | 2 | 186,813 | 186,813 | |||||||||||||

Commercial | — | — | — | 2 | 199,467 | 199,467 | |||||||||||||

Total | 5 | $ | 290,191 | $ | 290,191 | 4 | $ | 386,280 | $ | 386,280 | |||||||||

Accruing Loans | Nonaccrual Loans | ||||||||||||||||||

Nine Months Ended June 30, 2017 | Nine Months Ended June 30, 2017 | ||||||||||||||||||

Number of Loans | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Number of Loans | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | ||||||||||||||

Payment structure modification: | |||||||||||||||||||

1-4 family residential real estate | 7 | $ | 441,756 | $ | 441,756 | — | $ | — | $ | — | |||||||||

Commercial real estate | 2 | 515,639 | 515,639 | — | — | — | |||||||||||||

Consumer and other | — | — | — | 1 | 32,138 | 32,138 | |||||||||||||

Total | 9 | $ | 957,395 | $ | 957,395 | 1 | $ | 32,138 | $ | 32,138 | |||||||||

At June 30, 2018, restructured loans with a modified balance of $3.9 million were accruing and $373,576 were nonaccruing, while restructured loans with a modified balance of $5.0 million were accruing and $106,739 were nonaccruing at June 30, 2017. There were no loans that were restructured within the past twelve months and subsequently defaulted at June 30, 2018 or June 30, 2017.

17

Acquired Impaired Loans. The following table documents changes in the accretable discount on acquired credit impaired loans during the nine months ended June 30, 2018 and 2017:

Nine Months Ended June 30, 2018 | Nine Months Ended June 30, 2017 | ||||||

Balance, beginning of period | $ | — | $ | 462,071 | |||

Loan accretion | — | (397,685 | ) | ||||

Balance, end of period | $ | — | $ | 64,386 | |||

The following table presents the outstanding balances and related carrying amounts for all purchase credit impaired loans at the periods ended June 30, 2018 and September 30, 2017:

June 30, 2018 | September 30, 2017 | ||||||

Unpaid principal balance | $ | 16,911,270 | $ | 18,327,905 | |||

Carrying amount | 15,819,914 | 16,974,607 | |||||

Acquired Performing Loans. Included within total loans are acquired performing loans shown net of fair value discounts in the amount of $260.0 million and $333.5 million at June 30, 2018 and September 30, 2017, respectively. These fair value discounts are being amortized over the remaining lives of the respective loans and totaled $2.3 million and $4.1 million at June 30, 2018 and September 30, 2017, respectively.

Credit Quality Indicators. As part of the ongoing monitoring of the credit quality of the Company’s loan portfolio, management tracks certain credit quality indicators including the level of classified loans, net charge-offs, nonperforming loans (see details above) and the general economic conditions in its market areas.

The Company utilizes a risk rating system to assign a risk grade to each of its loans. Loans are graded on a scale of 1 to 8. The risk grade for each individual loan is determined by the loan officer and other approving officers at the time of loan origination and is adjusted from time to time to reflect an ongoing assessment of loan risk. Risk grades are reviewed quarterly for all substandard, nonaccrual and TDR loans, and annually as part of the Company's internal loan review process. In addition, individual loan risk grades are reviewed in connection with all renewals, extensions and modifications.

The following table presents the risk grades of the loan portfolio, segregated by class of loans:

June 30, 2018

1-4 family residential real estate | Commercial real estate | Commercial | Real estate construction | Consumer and other | Total | ||||||||||||||||||

Pass (1-4) | $ | 243,081,293 | $ | 644,337,423 | $ | 101,393,896 | $ | 101,570,279 | $ | 36,760,496 | $ | 1,127,143,387 | |||||||||||

Special Mention (5) | 788,521 | 13,380,351 | 1,088,534 | — | — | 15,257,406 | |||||||||||||||||

Substandard (6) | 2,721,243 | 18,681,571 | 453,848 | — | 49,348 | 21,906,010 | |||||||||||||||||

Doubtful (7) | — | — | — | — | — | — | |||||||||||||||||

Loss (8) | — | — | — | — | — | — | |||||||||||||||||

Total loans | $ | 246,591,057 | $ | 676,399,345 | $ | 102,936,278 | $ | 101,570,279 | $ | 36,809,844 | $ | 1,164,306,803 | |||||||||||

September 30, 2017

1-4 family residential real estate | Commercial real estate | Commercial | Real estate construction | Consumer and other | Total | ||||||||||||||||||

Pass (1-4) | $ | 230,417,503 | $ | 654,217,207 | $ | 102,690,306 | $ | 88,551,410 | $ | 39,914,580 | $ | 1,115,791,006 | |||||||||||

Special Mention (5) | — | 14,318,249 | 494,241 | 240,389 | — | 15,052,879 | |||||||||||||||||

Substandard (6) | 1,622,838 | 28,535,323 | 488,900 | — | 28,806 | 30,675,867 | |||||||||||||||||

Doubtful (7) | — | — | — | — | — | — | |||||||||||||||||

Loss (8) | — | — | — | — | — | — | |||||||||||||||||

Total loans | $ | 232,040,341 | $ | 697,070,779 | $ | 103,673,447 | $ | 88,791,799 | $ | 39,943,386 | $ | 1,161,519,752 | |||||||||||

18

Allowance for Loan Losses. The allowance for loan losses is established through a provision for loan losses charged to expense and is an amount that management believes will be adequate to absorb losses on existing loans that become uncollectible, based on evaluations of the collectability of loans. The evaluations take into consideration such factors as changes in the nature and volume of the loan portfolio, historical loss rates, overall portfolio quality, review of specific problem loans, and current economic conditions and trends that may affect a borrower’s ability to repay. Loans are charged against the allowance for loan losses when management believes that the collectability of the principal is unlikely. Subsequent recoveries are added to the allowance.

Management’s allowance for loan losses methodology is a loan classification-based system. Management bases the required reserve on a percentage of the loan balance for each type of loan and classification level. Loans may be classified manually and are automatically classified if they are not previously classified when they reach certain levels of delinquency. Unclassified loans are reserved at different percentages based on the loan loss history of the last seven years. Reserve percentages are also adjusted based upon our estimate of the effect that the current economic environment will have on each type of loan.

Management segments its allowance for loan losses into the following four major categories: (1) specific reserves; (2) general allowances for Classified/Watch loans; (3) general allowances for loans with satisfactory ratings; and (4) an unallocated amount. Risk ratings are initially assigned in accordance with CharterBank’s loan and collection policy. An organizationally independent department reviews risk grade assignments on an ongoing basis. Management reviews current information and events regarding a borrowers’ financial condition and strengths, cash flows available for debt repayment, the related collateral supporting the loan and the effects of known and expected economic conditions. When the evaluation reflects a greater than normal risk associated with the individual loan, management classifies the loan accordingly. If the loan is determined to be impaired, management allocates a portion of the allowance for loan losses for that loan based on the fair value of the collateral, if the loan is considered collateral-dependent, as the measure for the amount of the impairment. Impaired and Classified/Watch loans are aggressively monitored.

The allowances for loans by credit grade are further subdivided by loan type. Charter Financial has developed specific quantitative allowance factors to apply to each loan which considers loan charge-off experience over the most recent seven years by loan type. In addition, loss estimates are applied for certain qualitative allowance factors that are subjective in nature and require considerable judgment on the part of management. Such qualitative factors include economic and business conditions, the volume of past due loans, changes in the value of collateral of collateral-dependent loans, and other economic uncertainties. An unallocated component of the allowance is also established for potential losses that exist in the remainder of the portfolio, but have yet to be identified.

The Company incorporates certain refinements and improvements to its allowance for loan losses methodology from time to time. During the current quarter and the prior fiscal year, the Company made minor refinements to the qualitative risk factors but no significant changes to its allowance methodology. The adjustments in the Company's methodology were not material to the overall allowance or provision for the three and nine months ended June 30, 2018 or for the fiscal year ended September 30, 2017.

An unallocated allowance is generally maintained in a range of 4% to 12% of the total allowance in recognition of the imprecision of the estimates and other factors. In times of greater economic downturn and uncertainty, the higher end of this range is provided.

The Company recorded net recoveries of $768,239 during the nine months ended June 30, 2018. With asset quality remaining strong, and the continued trend of net recoveries, the Company recorded negative provision for loan losses of $350,000 and $900,000 during the nine months ended June 30, 2018 and 2017. No provision for loan losses was recorded for the three months ended June 30, 2018 or 2017. A negative provision of $900,000 was recorded during the fiscal year ended September 30, 2017.

The following tables present an analysis of the allowance for loan losses by portfolio segment and changes in the allowance for loan losses for the three and nine months ended June 30, 2018 and 2017. The total allowance for loan losses is disaggregated into those amounts associated with loans individually evaluated and those associated with loans collectively evaluated, as well as loans acquired with deteriorated credit quality.

Three Months Ended June 30, 2018 | |||||||||||||||||||||||||||

1-4 family real estate | Commercial real estate | Commercial | Real estate construction | Consumer and other | Unallocated | Total | |||||||||||||||||||||

Allowance for loan losses: | |||||||||||||||||||||||||||

Beginning balance | $ | 777,284 | $ | 7,612,059 | $ | 864,346 | $ | 549,349 | $ | 187,326 | $ | 1,120,539 | $ | 11,110,903 | |||||||||||||

Charge-offs | (23,928 | ) | — | — | — | (3,969 | ) | — | (27,897 | ) | |||||||||||||||||

Recoveries | 17,532 | 186,104 | 114,973 | — | 95,046 | — | 413,655 | ||||||||||||||||||||

Provision | (69,026 | ) | 340,210 | (332,132 | ) | 105,444 | (75,083 | ) | 30,587 | — | |||||||||||||||||