UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22367

Cypress Creek Private Strategies Institutional Fund, L.P.

(Exact name of registrant as specified in charter)

712 W. 34th Street, Suite 201, Austin, TX 78705

(Address of principal executive offices) (Zip code)

| With a copy to: | ||

| William P. Prather III | George J. Zornada | |

| Cypress Creek Private Strategies Institutional | K & L Gates LLP | |

| Fund, L.P. | ||

| 712 W. 34th Street, Suite 201 | State Street Financial Center | |

| Austin, TX 78705 | One Lincoln St. | |

| (Name and address of agent for service) | Boston, MA 02111-2950 | |

| (617) 261-3231 |

Registrant’s telephone number, including area code: (512) 660-5146

Date of fiscal year end: 3/31/22

Date of reporting period: 3/31/22

Item 1. Reports to Stockholders.

(a)

TABLE OF CONTENTS

Cypress Creek Private Strategies Institutional Fund, L.P. |

|

Management Discussion of Fund Performance (Unaudited) |

1 |

Report of Independent Registered Public Accounting Firm |

13 |

Statement of Assets, Liabilities and Partners’ Capital |

14 |

Statement of Operations |

15 |

Statements of Changes in Partners’ Capital |

16 |

Statement of Cash Flows |

17 |

Notes to Financial Statements |

18 |

Supplemental Information (Unaudited) |

29 |

Privacy Policy (Unaudited) |

33 |

Cypress Creek Private Strategies Master Fund, L.P. |

|

Management Discussion of Fund Performance (Unaudited) |

37 |

Report of Independent Registered Public Accounting Firm |

50 |

Statement of Assets, Liabilities and Partners’ Capital |

51 |

Schedule of Investments |

52 |

Statement of Operations |

61 |

Statements of Changes in Partners’ Capital |

62 |

Statement of Cash Flows |

63 |

Notes to Financial Statements |

64 |

Supplemental Information (Unaudited) |

83 |

Privacy Policy (Unaudited) |

87 |

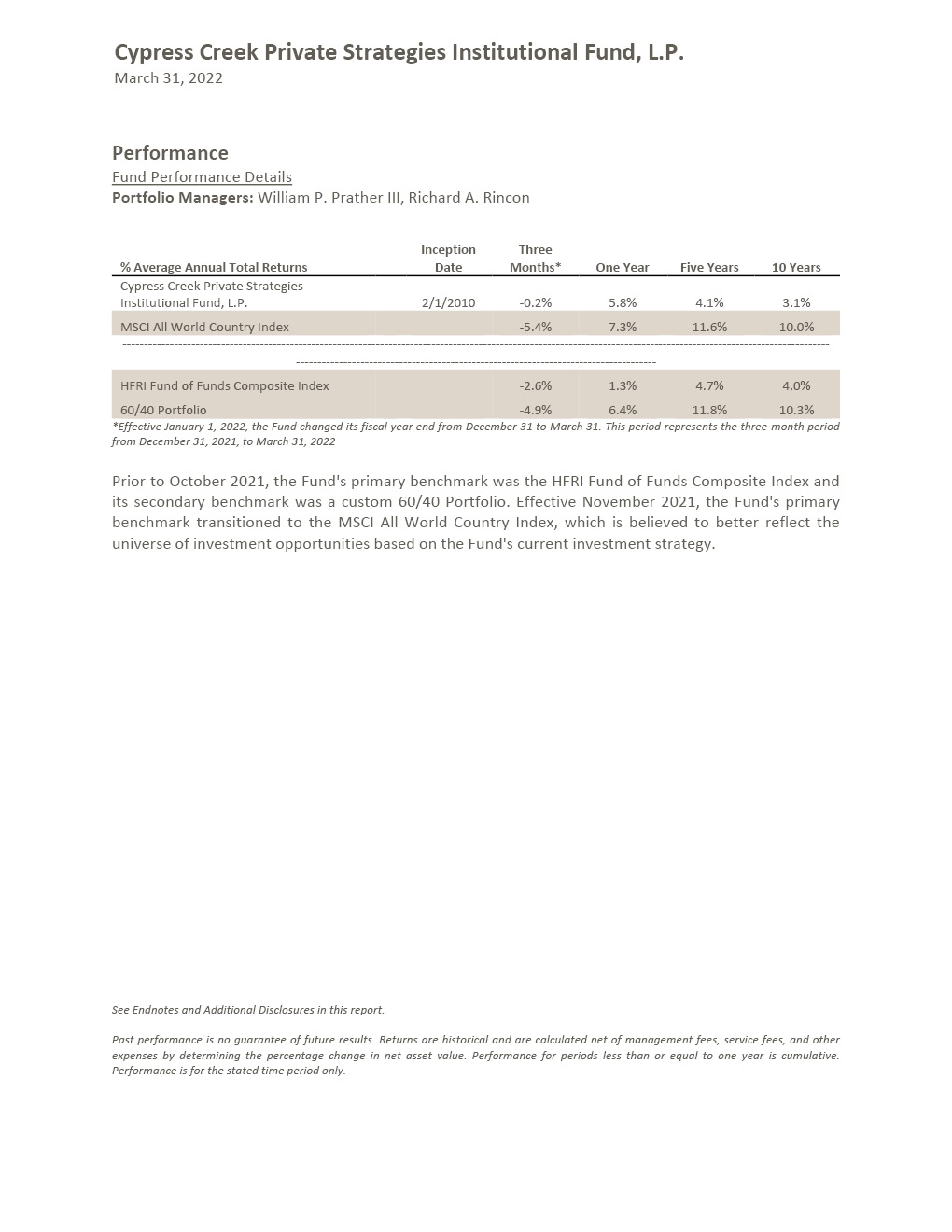

1

2

3

4

5

6

7

8

9

10

11

12

Report of Independent Registered Public Accounting Firm

To the Partners and the Board of Directors of

Cypress Creek Private Strategies Institutional Fund, L.P.

Opinion on the Financial Statements

We have audited the accompanying statement of assets, liabilities and partners’ capital of Cypress Creek Private Strategies Institutional Fund, L.P. (the Fund) as of March 31, 2022, the related statements of operations, changes in partners’ capital and cash flows for the period from January 1, 2022 to March 31, 2022 and for the year ended December 31, 2021, and the related notes to the financial statements (collectively, the financial statements), and the financial highlights for the period from January 1, 2022 to March 31, 2022 and for the year ended December 31, 2021. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2022, the results of its operations, changes in partners’ capital and its cash flows and financial highlights for the period from January 1, 2022 to March 31, 2022 and for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

The statement of changes in partners’ capital for the year ended December 31, 2020, and the financial highlights for the years ended December 31, 2020, December 31, 2019, December 31, 2018, and December 31, 2017, for the Fund were audited by other auditors. Those auditors expressed an unqualified opinion on those financial statements and financial highlights in their report dated February 26, 2021.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ RSM US LLP

We have served as the auditor of one or more Cypress Creek Partners investment companies since 2021.

Chicago, Illinois

May 30, 2022

13

Cypress Creek Private Strategies Institutional Fund, L.P.

(A Limited Partnership)

Statement of Assets, Liabilities and Partners’ Capital

March 31, 2022

Assets |

||||

Investment in the Master Fund, at fair value |

$ | 2,417,826 | ||

Receivable from the Master Fund |

92,823 | |||

Total assets |

2,510,649 | |||

Liabilities and Partners’ Capital |

||||

Withdrawals payable |

92,823 | |||

Servicing Fees payable |

717 | |||

Accounts payable and accrued expenses |

77,815 | |||

Total liabilities |

171,355 | |||

Partners’ capital |

2,339,294 | |||

Total liabilities and partners’ capital |

$ | 2,510,649 |

See accompanying notes to financial statements.

14

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Statement of Operations

Period Ended |

Year Ended |

|||||||

Net investment loss allocated from the Master Fund: |

||||||||

Dividend income (net of foreign tax withholding of $428 and $814, respectively) |

$ | 366 | $ | 12,778 | ||||

Interest income |

1,771 | 20,625 | ||||||

Expenses |

(10,054 | ) | (101,245 | ) | ||||

Net investment loss allocated from the Master Fund |

(7,917 | ) | (67,842 | ) | ||||

Expenses of the Institutional Fund: |

||||||||

Servicing Fees |

2,137 | 20,484 | ||||||

Professional fees |

12,574 | 50,488 | ||||||

Other expenses |

3,486 | 20,203 | ||||||

Total expenses of the Institutional Fund |

18,197 | 91,175 | ||||||

Net investment loss of the Institutional Fund |

(26,114 | ) | (159,017 | ) | ||||

Net realized and unrealized gain (loss) from investments allocated from the Master Fund: |

||||||||

Net realized gain (loss) from investments |

(34,678 | ) | 540,228 | |||||

Change in unrealized appreciation/depreciation from investments |

56,470 | 41,059 | ||||||

Net realized and unrealized gain (loss) from investments allocated from the Master Fund |

21,792 | 581,287 | ||||||

Net increase/(decrease) in partners’ capital resulting from operations |

$ | (4,322 | ) | $ | 422,270 | |||

|

* |

The Fund has changed its fiscal year end from December 31 to March 31. This period represents the three-month period from January 1, 2022 to March 31, 2022. |

See accompanying notes to financial statements.

15

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Statements of Changes in Partners’ Capital

Years Ended December 31, 2020, December 31, 2021 and Period Ended March 31, 2022*

Partners’ capital at December 31, 2019 |

$ | 6,813,699 | ||

Withdrawals |

(638,152 | ) | ||

Net increase in partners’ capital resulting from operations: |

||||

Net investment loss |

(172,912 | ) | ||

Net realized gain from investments |

249,331 | |||

Change in unrealized appreciation/depreciation from investments |

528,819 | |||

Net increase in partners’ capital resulting from operations |

605,238 | |||

Partners’ capital at December 31, 2020 |

$ | 6,780,785 | ||

Withdrawals |

(3,629,357 | ) | ||

Transfer of interests to Cypress Creek Private Strategies Offshore Fund, L.P. |

(301,146 | ) | ||

Transfer of interests to Cypress Creek Private Strategies Onshore Fund, L.P. |

(836,113 | ) | ||

Net increase in partners’ capital resulting from operations: |

||||

Net investment loss |

(159,017 | ) | ||

Net realized gain from investments |

540,228 | |||

Change in unrealized appreciation/depreciation from investments |

41,059 | |||

Net increase in partners’ capital resulting from operations |

422,270 | |||

Partners’ capital at December 31, 2021 |

$ | 2,436,439 | ||

Withdrawals |

(92,823 | ) | ||

Net decrease in partners’ capital resulting from operations: |

||||

Net investment loss |

(26,114 | ) | ||

Net realized loss from investments |

(34,678 | ) | ||

Change in unrealized appreciation/depreciation from investments |

56,470 | |||

Net decrease in partners’ capital resulting from operations |

(4,322 | ) | ||

Partners’ capital at March 31, 2022 |

$ | 2,339,294 |

|

* |

The Fund has changed its fiscal year end from December 31 to March 31. This period represents the three-month period from January 1, 2022 to March 31, 2022. |

See accompanying notes to financial statements.

16

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Statement of Cash Flows

Period Ended |

Year Ended |

|||||||

Cash flows from operating activities: |

||||||||

Net increase/(decrease) in partners’ capital resulting from operations |

$ | (4,322 | ) | $ | 422,270 | |||

Adjustments to reconcile net increase/(decrease) in partners’ capital resulting from operations to net cash provided by operating activities: |

||||||||

Net realized and unrealized gain from investments allocated from the Master Fund |

(21,792 | ) | (581,287 | ) | ||||

Net investment loss allocated from the Master Fund |

7,917 | 67,842 | ||||||

Withdrawals from the Master Fund |

98,860 | 3,719,774 | ||||||

Change in operating assets and liabilities: |

||||||||

Receivable from the Master Fund |

(92,823 | ) | 154,200 | |||||

Servicing Fees payable |

8 | (4,914 | ) | |||||

Accounts payable and accrued expenses |

12,152 | 5,848 | ||||||

Net cash provided by operating activities |

— | 3,783,733 | ||||||

Cash flows from financing activities: |

||||||||

Withdrawals, net of change in withdrawals payable |

— | (3,783,733 | ) | |||||

Net cash used in financing activities |

— | (3,783,733 | ) | |||||

Net change in cash and cash equivalents |

— | — | ||||||

Cash and cash equivalents at beginning of period |

— | — | ||||||

Cash and cash equivalents at end of period |

$ | — | $ | — | ||||

Supplemental schedule of noncash activity: |

||||||||

Transfer of interests to Cypress Creek Private Strategies Offshore Fund, L.P. |

$ | $ | (301,146 | ) | ||||

Transfer of interests to Cypress Creek Private Strategies Onshore Fund, L.P. |

(836,113 | ) | ||||||

|

* |

The Fund has changed its fiscal year end from December 31 to March 31. This period represents the three-month period from January 1, 2022 to March 31, 2022. |

See accompanying notes to financial statements.

17

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements

March 31, 2022

|

(1) |

ORGANIZATION |

The Cypress Creek Private Strategies Institutional Fund, L.P. (the “Institutional Fund”), formerly known as Salient Private Access Institutional Fund, L.P., a Delaware limited partnership registered under the Investment Company Act of 1940, as amended (the “1940 Act”), commenced operations on February 1, 2010, as a non-diversified, closed-end management investment company. The Institutional Fund was created to serve as a feeder fund for the Cypress Creek Private Strategies Master Fund, L.P. (the “Master Fund”), formerly known as Salient Private Access Master Fund, L.P.. For convenience, reference to the Institutional Fund may include the Master Fund, as the context requires.

The Institutional Fund’s investment objective is to preserve capital and to generate consistent long-term appreciation and returns across a market cycle (which is estimated to be five to seven years). The Institutional Fund pursues its investment objective by investing substantially all of its assets in the Master Fund, which invests its assets in primary and secondary subscriptions or commitments to private partnerships managed by Investment Managers as well as Direct Platforms (collectively, the “Investment Funds”), registered investment companies (including exchange-traded funds) and direct investments in marketable securities and derivative instruments. The Master Fund’s financial statements, Schedule of Investments and notes to financial statements, included elsewhere in this report, should be read in conjunction with this report. The percentage of the Master Fund’s partnership interests owned by the Institutional Fund on March 31, 2022, was 1.09%.

The Endowment Fund GP, L.P., a Delaware limited partnership, serves as the general partner of the Institutional Fund (the “General Partner”). To the fullest extent permitted by applicable law, the General Partner has irrevocably delegated to a board of directors (the “Board” and each member a “Director”) its rights and powers to monitor and oversee the business affairs of the Institutional Fund, including the complete and exclusive authority to oversee and establish policies regarding the management, conduct, and operation of the Institutional Fund’s business. A majority of the Directors are independent of the General Partner and its management. To the extent permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Institutional Fund, the Adviser (as hereinafter defined), or any committee of the Board.

The Board is authorized to engage an investment adviser and it has selected Endowment Advisers, L.P. d/b/a Cypress Creek Partners (the “Adviser”), to manage the Institutional Fund’s portfolio and operations, pursuant to an investment management agreement (the “Investment Management Agreement”). The Adviser is a Delaware limited partnership that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. Under the Investment Management Agreement, the Adviser is responsible for the establishment of an investment committee, which is responsible for developing, implementing, and supervising the Institutional Fund’s investment program subject to the ultimate supervision of the Board. In addition to investment advisory services, the Adviser also functions as the servicing agent of the Institutional Fund (the “Servicing Agent”) and as such provides or procures investor services and administrative assistance for the Institutional Fund. The Adviser can delegate all or a portion of its duties as Servicing Agent to other parties, who would in turn act as sub-servicing agents.

Under the Institutional Fund’s organizational documents, the Institutional Fund’s officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Institutional Fund. In the normal course of business, the Institutional Fund enters into contracts with service providers, which also provide for indemnifications by the Institutional Fund. The Institutional Fund’s maximum exposure under these arrangements is unknown, as this would involve any future potential claims that may be made against the Institutional Fund. However, based on experience, the General Partner expects that risk of loss to be remote.

Effective January 1, 2022, the fiscal year end for the Institutional Fund has been changed from December 31st to March 31st as approved by the Board by unanimous written consent in late-October 2021.

18

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

|

(2) |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES |

|

(a) |

BASIS OF ACCOUNTING |

The accounting and reporting policies of the Institutional Fund conform with U.S. generally accepted accounting principles (“U.S. GAAP”). The accompanying financial statements reflect the financial position of the Institutional Fund and the results of its operations. The Institutional Fund is an investment company and follows the investment company accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.”

|

(b) |

CASH EQUIVALENTS |

The Institutional Fund considers all unpledged temporary cash investments with a maturity date at the time of purchase of three months or less to be cash equivalents.

|

(c) |

INVESTMENT SECURITIES TRANSACTIONS |

The Institutional Fund records monthly, its pro-rata share of income, expenses, changes in unrealized appreciation and depreciation, and realized gains and losses derived from the Master Fund.

The Institutional Fund records investment transactions on a trade-date basis.

Investments that are held by the Institutional Fund are marked to fair value at the date of the financial statements, and the corresponding change in unrealized appreciation/depreciation is included in the Statement of Operations.

|

(d) |

INVESTMENT VALUATION |

The valuation of the Institutional Fund’s investments is determined as of the close of business at the end of each reporting period, generally monthly. The valuation of the Institutional Fund’s investments is calculated by UMB Fund Services, Inc., the Institutional Fund’s independent administrator (the “Administrator”).

The Board is responsible for overseeing the Institutional Fund’s valuation policies, making recommendations to the Board on valuation- related matters, and overseeing implementation by the Adviser of such valuation policies.

The Board has delegated day-to-day management of the valuation process to the Adviser, which has established a valuation committee (the “Adviser Valuation Committee”) to carry out this function. The Adviser Valuation Committee’s function, subject to the oversight of the Board, is generally to review valuation methodologies, valuation determinations, and any information provided to the Adviser Valuation Committee by the Adviser or the Administrator.

The Institutional Fund invests substantially all of its assets in the Master Fund. Investments in the Master Fund are recorded at fair value based on the Institutional Fund’s proportional share of the Master Fund’s partners’ capital. Valuation of the investments held by the Master Fund is discussed in the Master Fund’s notes to financial statements, included elsewhere in this report.

|

(e) |

INVESTMENT INCOME |

For investments in securities, dividend income is recorded on the ex-dividend date, net of withholding taxes. Interest income is recorded as earned on the accrual basis and includes amortization of premiums or accretion of discounts.

19

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

|

(f) |

FUND EXPENSES |

Unless otherwise voluntarily or contractually assumed by the Adviser or another party, the Institutional Fund bears all expenses incurred in its business, directly or indirectly through its investment in the Master Fund, including, but not limited to, the following: all costs and expenses related to investment transactions and positions for the Institutional Fund’s account; legal fees; compliance fees; accounting, auditing and tax preparation fees; recordkeeping and custodial fees; costs of computing the Institutional Fund’s net asset value; fees for data and software providers; research expenses; costs of insurance; registration expenses; offering costs; expenses of meetings of partners; directors fees; all costs with respect to communications to partners; transfer taxes; and other types of expenses as may be approved from time to time by the Board.

|

(g) |

INCOME TAXES |

The Institutional Fund is organized and operates as a limited partnership and is not subject to income taxes as a separate entity. Such taxes are the responsibility of the individual partners. Accordingly, no provision for income taxes has been made in the Institutional Fund’s financial statements. Investments in foreign securities may result in foreign taxes being withheld by the issuer of such securities.

For the current open tax years, and for all major jurisdictions, management of the Institutional Fund has evaluated the tax positions taken or expected to be taken in the course of preparing the Institutional Fund’s tax returns to determine whether the tax positions will “more-likely-than-not” be sustained by the Institutional Fund upon challenge by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold and that would result in a tax benefit or expense to the Institutional Fund would be recorded as a tax benefit or expense in the current period. For the period ended March 31, 2022, the Institutional Fund did not recognize any amounts for unrecognized tax benefit/expense. A reconciliation of unrecognized tax benefit/expense is not provided herein, as the beginning and ending amounts of unrecognized tax benefit/expense are zero, with no interim additions, reductions or settlements. Tax positions taken in tax years which remain open under the statute of limitations (generally three years for federal income tax purposes and four years for state income tax purposes) are subject to examination by federal and state tax jurisdictions.

|

(h) |

USE OF ESTIMATES |

The financial statements have been prepared in conformity with U.S. GAAP, which requires management to make estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results may differ from those estimates and such differences may be significant.

|

(3) |

FAIR VALUE MEASUREMENTS |

The Institutional Fund records its investment in the Master Fund at fair value. Investments of the Master Fund are recorded at fair value as more fully discussed in the Master Fund’s notes to financial statements, included elsewhere in this report.

20

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

|

(4) |

PARTNERS’ CAPITAL ACCOUNTS |

|

(a) |

ISSUANCE OF INTERESTS |

Upon receipt from an eligible investor of an initial or additional application for interests (the “Interests”), which will generally be accepted as of the first day of each month, the Institutional Fund will issue new Interests. The Interests have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state. The Institutional Fund issues Interests only in private placement transactions in accordance with Regulation D or other applicable exemptions under the Securities Act. No public market exists for the Interests, and none is expected to develop. The Institutional Fund is not required, and does not intend, to hold annual meetings of its partners. The Interests are subject to substantial restrictions on transferability and resale and may not be transferred or resold except as permitted under the Institutional Fund’s limited partnership agreement. The Institutional Fund reserves the right to reject any applications for subscription of Interests.

|

(b) |

ALLOCATION OF PROFITS AND LOSSES |

For each fiscal period, generally monthly, net profits or net losses of the Institutional Fund, including allocations from the Master Fund, are allocated among and credited to or debited against the capital accounts of all partners as of the last day of each fiscal period in accordance with the partners’ respective capital account ownership percentage for the fiscal period. Net profits or net losses are measured as the net change in the value of the partners’ capital of the Institutional Fund, including any change in unrealized appreciation or depreciation of investments and income, net of expenses, and realized gains or losses during a fiscal period. Net profits or net losses are allocated after giving effect for any initial or additional applications for Interests, which generally occur at the beginning of the month, or any repurchases of Interests.

|

(c) |

REPURCHASE OF INTERESTS |

A partner will not be eligible to have the Institutional Fund repurchase all or any portion of an Interest at the partner’s discretion at any time. The Adviser, which also serves as the investment adviser of the Master Fund, generally recommends to the Board that the Institutional Fund offer to repurchase such Interests during the period, pursuant to written tenders by partners.

During the year ended December 31, 2021, the Institutional Fund completed the following two tender offers to repurchase Interests in the Institutional Fund. The Board approved the tender offer to repurchase 2.5% of outstanding Interests in the Institutional Fund as recommended by the Adviser. This tender offer began on February 2, 2021, and was based on the estimated net asset value as of March 31, 2021. The Board approved the tender offer to repurchase Interests in the Institutional Fund as recommended by the Adviser. This tender offer began on August 13, 2021, and was to be executed at the same purchase price as was being offered by unaffiliated third parties (via multiple commingled investment vehicles) in connection with its proposed purchase of Master Fund interests from the Institutional Fund based on a discount to the estimated net asset value as of September 30, 2021. Following the completion of the tender offer, the general partner of the unaffiliated commingled investment vehicles resigned and the Adviser was named the new general partner for each of the entities.

The Board retains the sole discretion to accept or reject the recommendation of the Adviser and to determine the amount of Interests, if any, that will be purchased in any tender offer that it does approve. Since the Institutional Fund’s assets are invested in the Master Fund, the ability of the Institutional Fund to have its Interests in the Master Fund be repurchased would be subject to the Master Fund’s repurchase policy. The Master Fund’s repurchase policy is substantially similar to the Institutional Fund’s repurchase policy as any tender offer by the Master Fund is subject to the sole discretion of the Board. In addition, the Institutional Fund may determine not to conduct a repurchase

21

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

offer each time the Master Fund conducts a repurchase offer. In the event Interests are repurchased, there will be a substantial period of time between the date as of which partners must tender their Interests for repurchase and the date they can expect to receive payment for their Interests from the Institutional Fund.

At the February 3, 2022 Board Meeting, the Board approved the Institutional Fund’s ability to complete a mandatory repurchase of accounts of limited partners who will not meet the Institutional Fund’s eligibility requirements subsequent to April 1, 2022 (the “Mandatory Repurchase”). The Institutional Fund completed the Mandatory Repurchase to repurchase approximately 0.041% of outstanding Interests in the Institutional Fund as of March 31, 2022.

|

(5) |

INVESTMENTS IN PORTFOLIO SECURITIES |

As of March 31, 2022, all of the investments made by the Institutional Fund were in the Master Fund.

|

(6) |

FINANCIAL INSTRUMENTS WITH OFF-BALANCE SHEET RISK |

In the normal course of business, the Investment Funds in which the Institutional Fund may invest either directly or through the Master Fund may trade various derivative securities and other financial instruments, and enter into various investment activities with off-balance sheet risk both as an investor and as a principal. The Institutional Fund’s risk of loss in these Investment Funds is limited to the Institutional Fund’s pro rata share of the value of its investment in or commitment to such Investment Funds as held directly or through the Master Fund. In addition, the Master Fund may invest directly in derivative securities or other financial instruments to gain greater or lesser exposure to a particular asset class.

|

(7) |

ADMINISTRATION AGREEMENT |

In consideration for administrative, accounting, and recordkeeping services, the Master Fund pays the Administrator a monthly administration fee based on the month-end partners’ capital of the Master Fund. The Administrator also provides the Institutional Fund and the Master Fund with compliance, transfer agency, and other investor related services at an additional cost.

The fees for Institutional Fund administration are paid out of the Master Fund’s assets, which decreases the net profits or increases the net losses of the partners in the Institutional Fund.

22

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

|

(8) |

RELATED PARTY TRANSACTIONS |

|

(a) |

MANAGEMENT FEE |

In consideration of the advisory and other services provided by the Adviser to the Master Fund and the Institutional Fund, the Master Fund pays the Adviser a management fee (the “Management Fee”). The Management Fee is equal to the fee schedule shown below on an annualized basis of the Master Fund’s partners’ capital based on the Master Fund’s partners’ capital at the end of each month, payable quarterly in arrears:

Partners’ Capital: |

Management Fee |

First $150 million |

1.00% |

Next $250 million (up to $400 million) |

0.90% |

Next $300 million (up to $700 million) |

0.80% |

Next $300 million (up to $1,000 million) |

0.70% |

Next $250 million (up to $1,500 million) |

0.60% |

Amounts in excess of $1,500 million |

0.50% |

So long as the Institutional Fund invests all of its investable assets in the Master Fund, the Institutional Fund will not pay the Adviser directly any Management Fee; however, should the Institutional Fund not have all of its investments in the Master Fund, it may be charged the Management Fee directly. The Institutional Fund’s partners bear an indirect portion of the Management Fee paid by the Master Fund. The Management Fee decreases the net profits or increases the net losses of the Master Fund and indirectly the Institutional Fund as the fees reduce the capital accounts of the Master Fund’s partners.

|

(b) |

SERVICING FEE |

In consideration for providing or procuring investor services and administrative assistance to the Institutional Fund, the Adviser receives a servicing fee (the “Servicing Fee”) equal to 0.35% (on an annualized basis) of each partner’s capital account balance, calculated at the end of each month, payable quarterly in arrears.

The Adviser may engage one or more sub-servicing agents to provide some or all of the services. Compensation to any sub-servicing agent is paid by the Adviser. The Adviser or its affiliates also may pay a fee out of their own resources to sub-servicing agents.

For the period ended March 31, 2022, $2,137 was incurred for Servicing Fees, $717 was outstanding as a payable at March 31, 2022.

|

(c) |

PLACEMENT AGENTS |

The Institutional Fund may engage one or more placement agents (each, a “Placement Agent”) to solicit investments in the Institutional Fund. Foreside Financial Services, LLC, a broker-dealer, is engaged by the Institutional Fund to serve as a Placement Agent. A Placement Agent may engage one or more sub-placement agents. The Adviser or its affiliates may pay a fee out of their own resources to Placement Agents and sub-placement agents.

23

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

|

(9) |

FINANCIAL HIGHLIGHTS |

Period Ended |

Year |

Year |

Year |

Year |

Year |

|||||||||||||||||||

Net investment loss to average partners’ capital (1) |

(4.41 | )% | (2.93 | )% | (2.72 | )% | (2.19 | )% | (1.96 | )% | (2.62 | )% | ||||||||||||

Expenses to average partners’ capital (1) |

4.77 | % | 3.55 | % | 3.35 | % | 3.53 | % | 3.48 | % | 3.50 | % | ||||||||||||

Portfolio turnover (2) |

1.25 | % | 29.70 | % | 7.58 | % | 9.16 | % | 17.39 | % | 11.07 | % | ||||||||||||

Total return (3) |

(0.18 | )% | 6.02 | % | 9.90 | % | 1.90 | % | (0.55 | )% | 4.62 | % | ||||||||||||

Partners’ capital, end of period (000s) |

$ | 2,339 | $ | 2,436 | $ | 6,781 | $ | 6,814 | $ | 7,400 | $ | 8,237 | ||||||||||||

An investor’s return (and operating ratios) may vary from those reflected based on the timing of capital transactions.

|

* |

The Institutional Fund has changed its fiscal year end from December 31 to March 31. This period represents the 3-month period from January 1, 2022 to March 31, 2022. |

|

(1) |

Ratios are calculated by dividing the indicated amount by average partners’ capital measured at the end of each month during the period. Ratios include allocations of net investment loss and expenses from the Master Fund. Ratios are annualized for periods less than 12 months. |

|

(2) |

The Institutional Fund is invested exclusively in the Master Fund, therefore this ratio reflects the portfolio turnover of the Master Fund, which is for the period indicated. |

|

(3) |

The total return of the Institutional Fund is calculated as geometrically linked monthly returns for each month in the period, not annualized for periods less than 12 months. |

|

(10) |

INVESTMENT-RELATED RISKS |

All securities investing and trading activities risk the loss of capital. No assurance can be given that the Master Fund’s or any Investment Fund’s investment activities will be successful or that the Partners will not suffer losses.

In general, these principal risks exist whether the investment is made by an Investment Fund or held by the Master Fund directly and therefore for convenience purposes, the description of such risks in terms of an Investment Fund is intended to include the same risks for investments made directly by the Master Fund. It is possible that an Investment Fund (or the Master Fund) will make (or hold) an investment that is not described below, and any such investment will be subject to its own particular risks. For purposes of this discussion, references to the activities of the Investment Funds should generally be interpreted to include the activities of an Investment Manager. The risks and considerations described below are intended to reflect the Master Fund’s anticipated holdings.

|

(a) |

SECONDARY INVESTMENT RISK |

The overall performance of the Master Fund’s secondary investments will depend in large part on the acquisition price paid, which may be negotiated based on incomplete or imperfect information. Certain secondary investments may be purchased as a portfolio, and in such cases the Master Fund may not be able to exclude from such purchases those investments that the Adviser considers (for commercial, tax, legal or other reasons) less attractive. Where the Master Fund acquires an interest as a secondary investment, the Fund will generally not have the ability to modify or amend

24

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

such Investment’s constituent documents (e.g., limited partnership agreements) or otherwise negotiate the economic terms of the interests being acquired. In addition, the costs and resources required to investigate the commercial, tax and legal issues relating to secondary investments may be greater than those relating to primary investments.

|

(b) |

SECONDARY INVESTMENTS INVOLVING SYNDICATES RISK |

The Master Fund may acquire secondary investments as a member of a purchasing syndicate, in which case the Master Fund may be exposed to additional risks including (among other things): (i) counterparty risk or the risk that a syndicate member will not perform its contractual obligations, (ii) reputation risk or the risk that the Master Fund may suffer damage to its reputation), (iii) breach of confidentiality by a syndicate member and (iv) execution risk or the risk of financial loss if a transaction is not executed appropriately.

|

(c) |

HIGHLY VOLATILE MARKETS RISK |

The prices of an Investment Fund’s underlying investments, and therefore the (“NAV”) of the Fund’s interests, can be highly volatile. Price movements of forward contracts, futures contracts, and other derivative contracts in which an investment or the Master Fund may invest are influenced by, among other things, interest rates, changing supply and demand relationships, trade, fiscal, monetary and exchange control programs and policies of governments, and national and international political and economic events and policies. In addition, governments from time to time intervene, directly and by regulation, in certain markets, particularly those in currencies, financial instruments and interest rate-related futures and options. Such intervention often is intended directly to influence prices and may, together with other factors, cause all of such markets to move rapidly in the same direction because of, among other things, interest rate fluctuations. Moreover, since internationally there may be less government supervision and regulation of worldwide stock exchanges and clearinghouses than in the U.S., investments also are subject to the risk of the failure of the exchanges on which their positions trade or of their clearinghouses, and there may be a higher risk of financial irregularities and/or lack of appropriate risk monitoring and controls.

|

(d) |

PREPAYMENT AND EXTENSION RISK |

Due to a decline in interest rates or an excess in cash flow, borrowers may pay back principal before the market anticipates such payments. As a result, the Master Fund may have to reinvest the proceeds in an investment offering a lower yield, may not benefit from any increase in value that might otherwise result from declining interest rates and may lose any premium it paid to acquire the security. Higher interest rates generally result in slower payoffs, which effectively increase duration, heighten interest rate risk, and increase the Master Fund’s potential for price declines. The prices of variable and floating rate securities (including loans) can be less sensitive to prepayment risk.

|

(e) |

FIXED INCOME RISK |

The market value of fixed income investments changes in response to interest rate changes and other factors. During periods of rising interest rates, the values of outstanding fixed income securities generally decrease. Moreover, while securities with longer maturities tend to produce higher yields, the prices of longer maturity securities are also subject to greater market value fluctuations as a result of changes in interest rates. During periods of falling interest rates, certain debt obligations with high interest rates may be prepaid (or “called”) by the issuer prior to maturity. This may cause the weighted average weighted maturity of investments to fluctuate and may require investments to invest the resulting proceeds at lower interest rates. Income from the investment’s debt securities portfolio will decline if and when the investment invests the proceeds from matured, traded or called securities in securities with market interest rates that are below the current earnings rate of the investment’s portfolio. A rise in interest rates may also increase

25

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

volatility and reduce liquidity in the fixed income markets, and result in a decline in the value of the fixed income investments held by Investments. Reductions in dealer market-making capacity as a result of structural or regulatory changes could further decrease liquidity and/or increase volatility in the fixed income markets.

In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Master Fund invests, which in turn could negatively impact the Master Fund’s performance and cause losses on your investment in the Master Fund. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken worldwide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff. The impact of the COVID-19 pandemic may be short term or may last for an extended period of time, and in either case could result in a substantial economic downturn or recession. As a result of these market conditions, the Master Fund’s NAV may fluctuate. Fixed income securities may also be subject to credit risk, which is the possibility that an issuer will be unable or unwilling to make timely payments of either principal or interest. Changes in the actual or perceived creditworthiness of an issuer, factors affecting an issuer directly (such as management changes, labor relations, collapse of key suppliers or customers, or material changes in overhead), factors affecting the industry in which a particular issuer operates (such as competition or technological advances) and changes in general social, economic or political conditions can increase the risk of default by an issuer, which can affect a security’s credit quality or value. Since the Master Fund and investments may purchase securities backed by credit enhancements from banks and other financial institutions, changes in the credit ratings of these institutions could cause the Master Fund to lose money and may affect the Master Fund’s NAV. Moreover, in order to enforce its rights in the event of a default, bankruptcy or similar situation, the Master Fund may be required to retain legal or similar counsel, which may increase the Master Fund’s operating expenses and adversely affect the Master Fund’s NAV.

|

(f) |

FOREIGN CURRENCY TRANSACTIONS AND EXCHANGE RATE RISK |

Investments and the Master Fund may invest in equity and equity-related securities denominated in non-U.S. currencies and in other financial instruments, the price of which is determined with reference to such currencies. Investments may engage in foreign currency transactions for a variety of purposes, including to “lock in” the U.S. dollar price of the security, between the trade and the settlement dates, the value of a security an investment has agreed to buy or sell, or to hedge the U.S. dollar value of securities the investment already owns. The investments also may engage in foreign currency transactions for non-hedging purposes to generate returns. The Master Fund will, however, value its investments and other assets in U.S. dollars. To the extent unhedged, the value of the Master Fund’s net assets will fluctuate with U.S. dollar exchange rates as well as with price changes of an investment’s investments in the various local markets and currencies. Forward currency contracts and options may be utilized by investments to hedge against currency fluctuations, but the investments are not required to utilize such techniques, and there can be no assurance that such hedging transactions will be available or, even if undertaken, effective.

|

(g) |

CORPORATE EVENT RISK |

Substantial transaction failure risks are involved in companies that are the subject of publicly disclosed mergers, takeover bids, exchange offers, tender offers, spin-offs, liquidations, corporate restructuring, and other similar transactions. Similarly, substantial risks are involved in investments in companies facing negative publicity or uncertain litigation. Thus, there can be no assurance that any expected transaction will take place, that negative

26

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

publicity will not continue to affect a company or that litigation will be resolved in a company’s favor. Certain transactions are dependent on one or more factors to become effective, such as market conditions which may lead to unexpected positive or negative changes in a company profile, shareholder approval, regulatory and various other third party constraints, changes in earnings or business lines or shareholder activism as well as many other factors. No assurance can be given that the transactions entered into will result in a profitable investment for the investments or that the investments will not incur substantial losses.

|

(h) |

ISSUER RISK |

The issuers of securities acquired by investments sometimes involve a high degree of business and financial risk. These companies may be in an early stage of development, may not have a proven operating history, may be operating at a loss or have significant variations in operating results, may be engaged in a rapidly changing business with products subject to a substantial risk of obsolescence, may require substantial additional capital to support their operations, to finance expansion or to maintain their competitive position, or may otherwise have a weak financial condition.

Issuers of securities acquired by investments may be highly leveraged. Leverage may have important adverse consequences to these companies and an investment as an investor. These companies may be subject to restrictive financial and operating covenants. The leverage may impair these companies’ ability to finance their future operations and capital needs. As a result, these companies’ flexibility to respond to changing business and economic conditions and to business opportunities may be limited. A leveraged company’s income and net assets will tend to increase or decrease at a greater rate than if borrowed money were not used.

In addition, such companies may face intense competition, including competition from companies with greater financial resources, more extensive development, manufacturing, marketing, and other capabilities, and a larger number of qualified managerial and technical personnel.

|

(i) |

MODEL AND DATA RISK |

Some investments, and the Adviser with regard to certain investments, may rely on quantitative models (both proprietary models developed by the Adviser, and those supplied by third party vendors) and information and data supplied by third party vendors (“Models and Data”). Models and Data are used to construct sets of transactions and investments and to provide risk management insights.

When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon expose the Master Fund to potential risks. The success of relying on such models may depend on the accuracy and reliability of historical data supplied by third party vendors.

All models rely on correct market data inputs. If incorrect market data is entered into even a well-founded model, the resulting information will be incorrect. However, even if market data is input correctly, “model prices” will often differ substantially from market prices, especially for securities with complex characteristics, such as derivative securities.

|

(j) |

PROGRAMMING AND MODELING ERROR RISK |

The research and modeling process engaged in by some Investment Managers and in certain cases by the Adviser is extremely complex and involves financial, economic, econometric and statistical theories, research and modelling; the results of that process must then be translated into computer code. Although the Adviser seeks to hire individuals skilled in each of these functions and to provide appropriate levels of oversight, the complexity of the individual

27

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2022

tasks, the difficulty of integrating such tasks, and the limited ability to perform “real world” testing of the end product raises the chances that the finished model may contain an error; one or more of such errors could adversely affect the Master Fund’s performance.

|

(11) |

PANDEMICS AND ASSOCIATED ECONOMIC DISRUPTION |

An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in late 2019 and subsequently spread internationally. This coronavirus has resulted in closing borders, enhanced health screenings, changes to healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general concern and economic uncertainty. The impact of this coronavirus may be short-term or may last for an extended period of time and has resulted in substantial economic downturn. Health crises caused by outbreaks of disease, such as the coronavirus outbreak, may exacerbate other pre-existing political, social and economic risks. This outbreak, and other epidemics and pandemics that may arise in the future, could continue to negatively affect the global economy, as well as the economies of individual countries, individual companies and the market in general in significant and unforeseen ways. For example, a widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, and impact the Fund’s ability to complete repurchase requests. Any such impact could adversely affect the Master Fund’s performance, the performance of the securities in which the Master Fund invests, lines of credit available to the Master Fund and may lead to losses on your investment in the Master Fund. In addition, the increasing interconnectedness of markets around the world may result in many markets being affected by events or conditions in a single country or region or events affecting a single or small number of issuers.

|

(12) |

SUBSEQUENT EVENTS |

Management of the Institutional Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the financial statements as of March 31, 2022.

Beginning April 1, 2022, the Adviser is eligible to receive an incentive fee from the Master Fund representing 10% of the return of the Master Fund in excess of a 6% net return annually.

28

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Supplemental Information

March 31, 2022

(Unaudited)

Directors and Officers

The Institutional Fund’s operations are managed under the direction and oversight of the Board. Each Director serves for an indefinite term or until he or she reaches mandatory retirement, if any, as established by the Board. The Board appoints the officers of the Institutional Fund who are responsible for the Institutional Fund’s day-to-day business decisions based on policies set by the Board. The officers serve at the pleasure of the Board.

Compensation for Directors

The Cypress Creek Private Strategies Master Fund, L.P., the Cypress Creek Private Strategies Registered Fund, L.P., the Cypress Creek Private Strategies Institutional Fund, L.P, and the Cypress Creek Private Strategies TEI Fund, L.P., together pay each of the Directors who is not an “interested person” of the Adviser, as defined in the 1940 Act (the “Independent Directors”) an annual retainer of $35,000 paid quarterly. There are currently four Independent Directors. In the interest of retaining Independent Directors of the highest quality, the Board intends to periodically review such compensation and may modify it as the Board deems appropriate.

The table below shows, for each Director and executive officer, their full name, address and age, the position held with the Fund, the length of time served in that position, their principal occupation during the last five years, and other directorships held by such Director. The address of each Director and officer is c/o Cypress Creek Private Strategies Funds, 712 W. 34th Street, Suite 201, Austin, TX 78705.

Interested Directors

Name and Year of Birth |

Position(s) |

Principal |

Number of Portfolios |

Other Directorships |

William P. Prather, III |

Director, Principal Executive Officer (Since 2021) |

University of Texas / Texas A&M Investment Management Company (Endowment – Investment Management) – Head of Infrastructure and Natural Resources (2014-2019); Cypress Creek Partners (Investment Management) – Chief Investment Officer and Founding Partner (2019-Current) |

7 |

MTi Group Ltd (Director) from 2019 to Current |

|

(1) |

The ‘Fund Complex’ for the purpose of this table consists of The Endowment PMF Funds (three funds) and Cypress Creek Private Strategies Funds (four funds) with all funds in the Fund Complex being advised by the Adviser. |

29

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2022

(Unaudited)

Independent Directors

Name and Year of Birth |

Position(s) |

Principal |

Number of |

Other Directorships |

Graeme Gunn |

Director (Since 2021) |

SL Capital Partners LLP; Partner |

7 |

3 Bridges Capital; Director; Sport Maison Limited; Director |

Victor L. Maruri |

Director (Since 2021) |

Managing Partner, HCP Management Co., LLC (investment company) |

7 |

Career Training Academy (trade school) (2011-2020 Taylor College Inc. (trade school) (2013-2021) MIAT College, Inc. (2014-2021) (trade school) HPE II (investment company) (since 2008), HCP ED Holdings) holding company) (since 2010) |

David Munoz |

Director (Since 2021) |

President and CEO of financial services company. Advisor to multiple financial services companies. |

7 |

Deltec International Group; Deltec Bank & Trust Limited; International Financial Services Group Limited; International Financial Services Group SA/CV; Deltec Investment Advisers Limited; Deltec Fund Services; Deltec U.S. Holdings Inc.; Deltec Wealth Management LLC; Deltec Securities Ltd.; Deltec Capital Limited; Long Cay Captive Insurance Management; Halcyon Life Insurance Limited.; Access Personal Finance LLC; Global Clearing & Settlement Assurance LLC |

30

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2022

(Unaudited)

Name and Year of Birth |

Position(s) |

Principal |

Number of |

Other Directorships |

Carl Weatherley-White |

Director (Since 2021) |

Managing Director, Advantage Capital (investment company) (since 2019); Chief Executive, Hoosier Solar Holdings, LLC (solar development company) (Since 2020); Chief Executive, VivoPower Holdings (solar development company) (from 2016 to 2019). |

7 |

VivoPower International, October 4, 2017 to December 28, 2017 |

|

(1) |

The ‘Fund Complex’ for the purpose of this table consists of The Endowment PMF Funds (three funds) and Cypress Creek Private Strategies (four funds) with all funds in the Fund Complex being advised by the Adviser. |

Officers of the Fund Who Are Not Directors *

Name and Year of Birth |

Position(s) Held with the Fund |

Principal Occupation(s) During the Past 5 Years |

Benjamin Murray |

Principal Financial Officer & Chief Compliance Officer (Since 2021) |

Director/Head of Operational Due Diligence – University of Texas/Texas A&M Investment Management Company (2016-2020); Chief Operating Officer – Cypress Creek Partners (2020-2021) |

Richard Rincon |

Vice President, Secretary, and Treasurer (Since 2021) |

Senior Director – University of Texas/Texas A&M Investment Management Company (2014-2020); Founding Partner – Cypress Creek Partners (2020-2021) |

31

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2022

(Unaudited)

Allocation of Investments

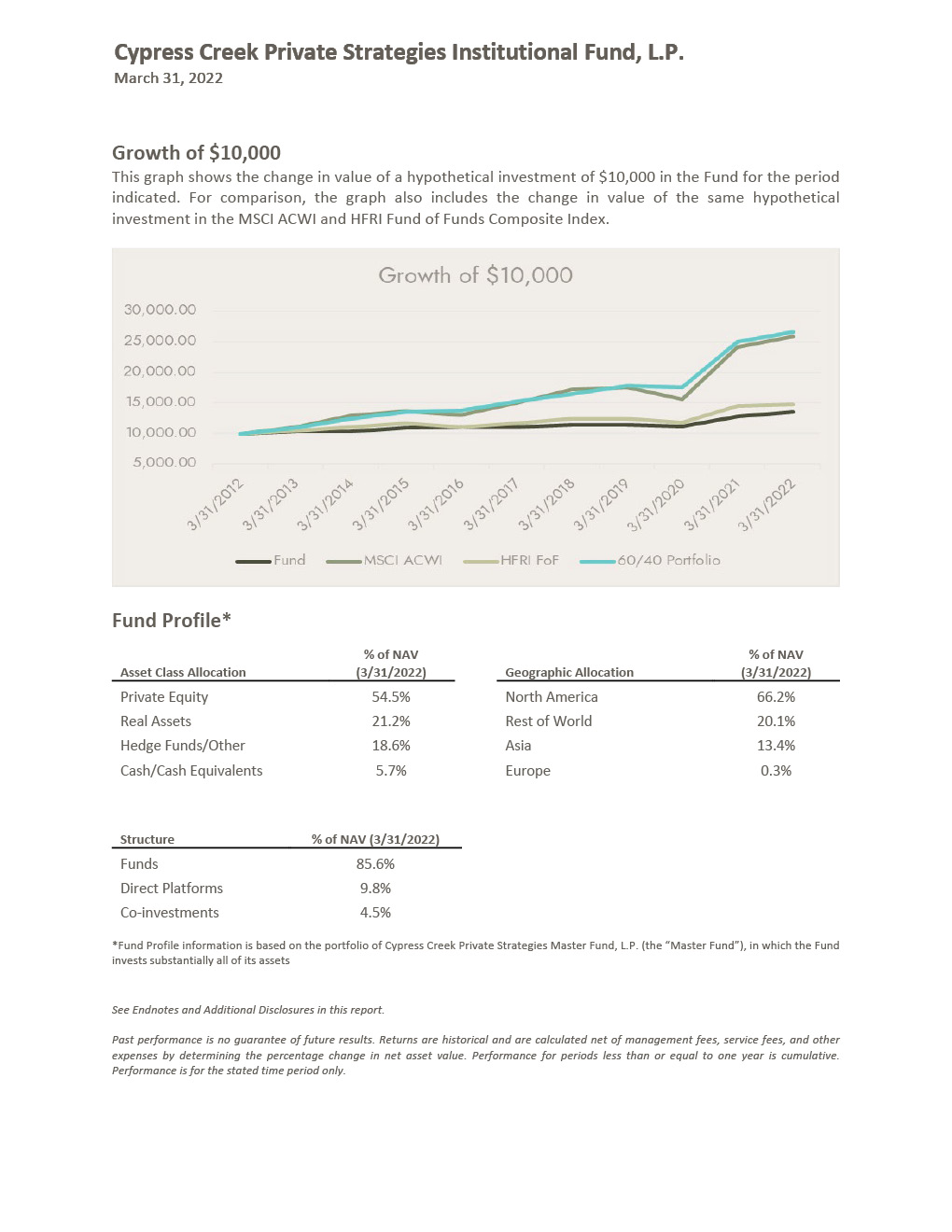

The following chart indicates the allocation of investments among the asset classes in the Master Fund as of March 31, 2022.

Asset Class(1) |

Fair Value |

% |

||||||

Buyout |

$ | 29,480,744 | 13.99 | |||||

Event Driven |

1,135,102 | 0.54 | ||||||

Global Macro |

5,885,130 | 2.79 | ||||||

Growth Equity |

39,634,508 | 18.81 | ||||||

Infrastructure |

14,041,287 | 6.66 | ||||||

Natural Resources |

20,286,034 | 9.63 | ||||||

Private Debt |

22,586,879 | 10.72 | ||||||

Real Estate |

13,033,588 | 6.19 | ||||||

Relative Value |

32,364,842 | 15.36 | ||||||

Securities |

29,480,744 | 1.04 | ||||||

Total Investments |

210,708,183 | 100 | ||||||

|

(1) |

The complete list of investments included in the following asset class categories is included in the Schedule of Investments of the Master Fund. |

Form N-PORT Filings

The Institutional Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Institutional Fund’s Form N-PORT’s are available on the SEC’s website at http://www.sec.gov.

Proxy Voting Policies

A description of the policies and procedures that the Institutional Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-725-9456; and (ii) on the Securities and Exchange Commission website at http://www.sec.gov.

Information regarding how the Institutional Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (i) without charge, upon request, by calling 1-800-725-9456; and (ii) on the Securities and Exchange Commission website at http://www.sec.gov.

Additional Information

The Institutional Fund’s private placement memorandum (the “PPM”) includes additional information about Directors of the Institutional Fund. The PPM is available, without charge, upon request by calling 1-800-725-9456.

32

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Privacy Policy

(Unaudited)

FACTS |

WHAT DOES CYPRESS CREEK PARTNERS1 (“CCP”) DO WITH YOUR PERSONAL INFORMATION? |

||

WHY? |

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

||

WHAT? |

The types of personal information we collect and share depend on the product or service you have with us. This information can include: ● Social security number ● Income ● Assets ● Account balances ● Wire transfer instructions ● Transaction history When you are no longer our customer, we continue to share information about you as described in this notice. |

||

HOW? |

All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons CCP chooses to share; and whether you can limit this sharing. |

||

Reasons we can share your personal information |

Does CCP Share? |

Can you limit this sharing? |

|

For our everyday business purposes - |

Yes |

No |

|

For our marketing purposes - |

Yes |

No |

|

For joint marketing with other financial companies |

No |

We do not share |

|

For our affiliates’ everyday business purposes - |

No |

We do not share |

|

For our affiliates’ everyday business purposes – |

No |

We do not share |

|

For non-affiliates to market to you |

No |

We do not share |

|

Questions? |

Call CCP at (512) 660-5146 |

||

|

1 |

Endowment Advisers, L.P., d/b/a Cypress Creek Partners |

33

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Privacy Policy, continued

(Unaudited)

Page 2 |

|

Who we are |

|

Who is providing this notice? |

This notice pertains to CCP, the registered and private funds it manages (as follows), and each funds’ general partner. ● The Endowment PMF Master Fund, L.P. ● The PMF Fund, L.P. ● PMF TEI Fund, L.P. ● PMF Offshore TEI Fund, Ltd. ● Cypress Creek Private Strategies Master Fund, L.P. ● Cypress Creek Private Strategies Registered Fund, L.P. ● Cypress Creek Private Strategies TEI Fund, L.P. ● Cypress Creek Private Strategies Institutional Fund, L.P. ● Cypress Creek Private Strategies Domestic Fund, L.P. ● Cypress Creek Private Strategies Domestic QP Fund, L.P. ● Cypress Creek Private Strategies International Fund, Ltd. ● Cypress Creek Private Strategies Offshore TEI Fund, Ltd. ● Cypress Creek Private Strategies Onshore Fund, L.P. ● Cypress Creek Private Strategies Offshore Fund, L.P. ● Cypress Creek Private Strategies Offshore Blocker Fund, LLC ● CCP Coastal Redwood Fund, L.P. ● CCP Sierra Redwood Fund, L.P. ● Marinas I SPV LLC |

What we do |

|

How does CCP protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

How does CCP collect my personal information? |

We collect your personal information, for example, when you ● Open an account ● Enter into an investment advisory contract ● Seek financial advice ● Make deposits or withdrawals from your account ● Provide account information |

Why can’t I limit all sharing? |

Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes—information about your creditworthiness ● affiliates from using your information to market to you ● sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

34

CYPRESS CREEK PRIVATE STRATEGIES INSTITUTIONAL FUND, L.P.

(A Limited Partnership)

Privacy Policy, continued

(Unaudited)

Page 3 |

|

Definitions |

|

Affiliates |

Companies related by common ownership or control. They can be financial and nonfinancial companies. ● CCP does not share with our affiliates. |

Non-affiliates |

Companies not related by common ownership or control. They can be financial and non-financial companies. ● CCP does not share with non-affiliates so they can market to you. |

Joint Marketing |

A formal agreement between non-affiliated financial companies that together market financial products or services to you. ● CCP does not jointly market. |

Other important information |

|

n/a |

|

35

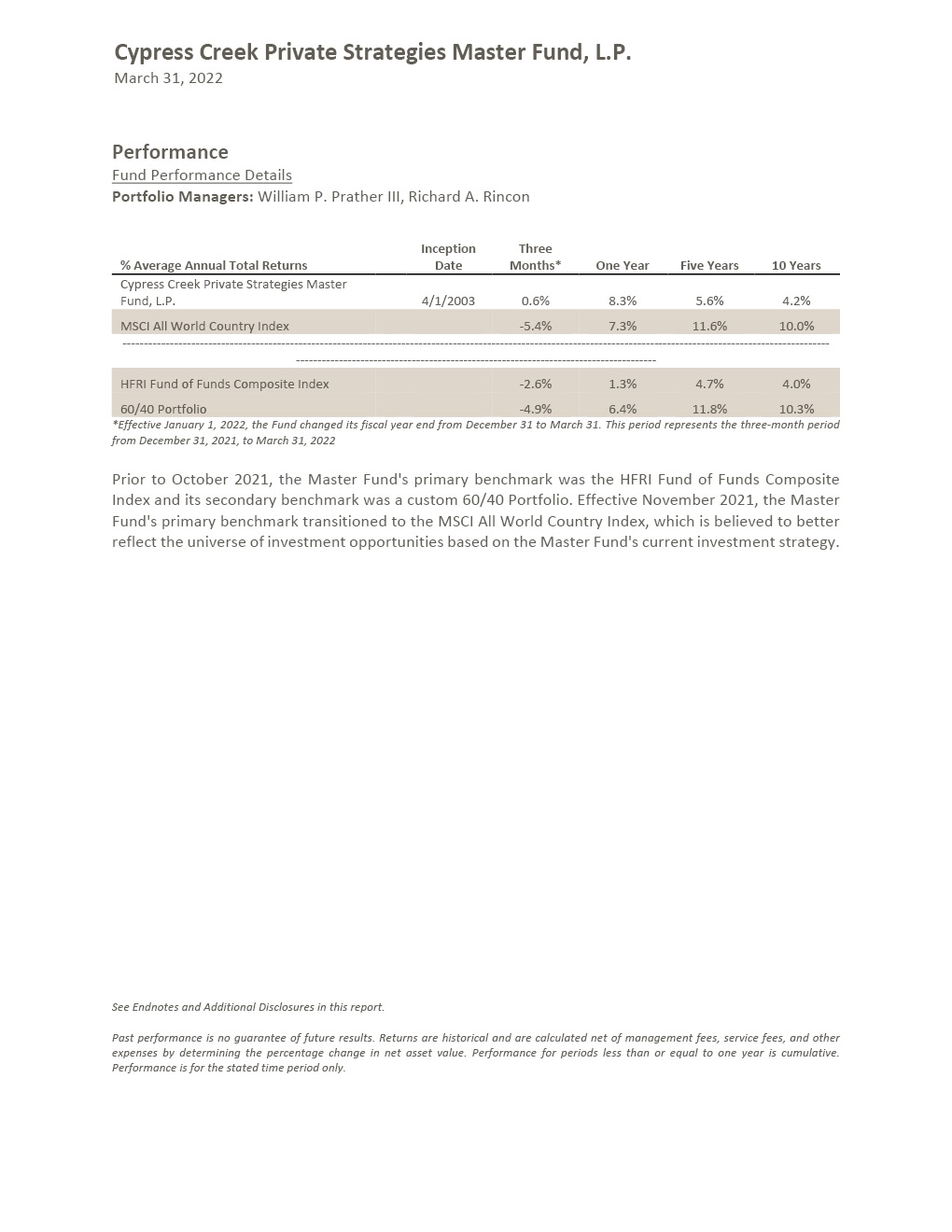

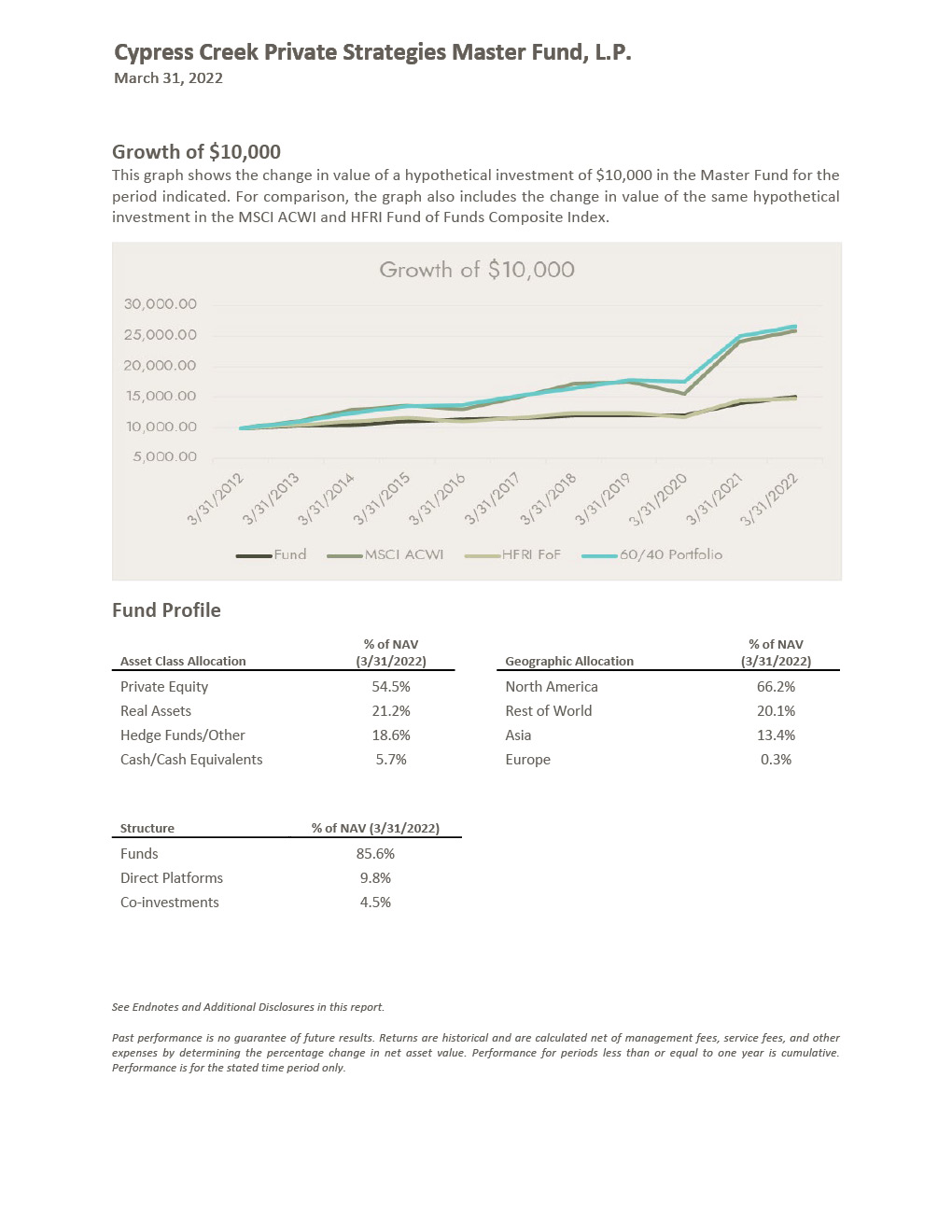

37

38

39

40

41

42

43

44

45

46

47

48

49

Report of Independent Registered Public Accounting Firm

To the Partners and the Board of Directors of

Cypress Creek Private Strategies Master Fund, L.P.

Opinion on the Financial Statements

We have audited the accompanying statement of assets, liabilities and partners’ capital of Cypress Creek Private Strategies Master Fund, L.P. (the Fund), including the schedule of investments, as of March 31, 2022, the related statements of operations, changes in partners’ capital and cash flows for the period from January 1, 2022 to March 31, 2022 and for the year ended December 31, 2021, and the related notes to the financial statements (collectively, the financial statements), and the financial highlights for the period from January 1, 2022 to March 31, 2022 and for the year ended December 31, 2021. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2022, the results of its operations, changes in partners’ capital and its cash flows and financial highlights for the period from January 1, 2022 to March 31, 2022 and for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

The statement of changes in partners’ capital for the year ended December 31, 2020, and the financial highlights for the years ended December 31, 2020, December 31, 2019, December 31, 2018, and December 31, 2017, for the Fund were audited by other auditors. Those auditors expressed an unqualified opinion on those financial statements and financial highlights in their report dated February 26, 2021.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of March 31, 2022, by correspondence with the custodians, underlying fund advisors or by other appropriate audit procedures where replies were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ RSM US LLP

We have served as the auditor of one or more Cypress Creek Partners investment companies since 2021.

Chicago, Illinois

May 30, 2022

50

CYPRESS CREEK PRIVATE STRATEGIES MASTER FUND, L.P.

(A Limited Partnership)

Statement of Assets, Liabilities and Partners’ Capital

March 31, 2022

Assets |

||||

Investments in Investment Funds, at fair value (cost $161,892,402) |

$ | 185,350,083 | ||

Investments in affiliated investments for which ownership exceeds 5% of the investment’s capital, at fair value (cost $20,791,505) |

13,255,228 | |||

Investments in affiliated investments for which ownership exceeds 25% of the investment’s capital, at fair value (cost $10,053,118) |

9,918,443 | |||

Investments in securities and CLO Equity, at fair value (cost $3,979,585) |

2,184,429 | |||

Total investments (cost $196,716,610) |

210,708,183 | |||

Cash and cash equivalents |

13,133,675 | |||

Receivable from investments sold |

405,235 | |||

Prepaids and other assets |

34,931 | |||

Total assets |

224,282,024 | |||

Liabilities and Partners’ Capital |

||||

Withdrawals payable |

1,350,660 | |||

Credit facility |

9,149 | |||

Investment Management fees payable |

181,784 | |||

Administration fees payable |

14,297 | |||

Payable to Directors |

74,083 | |||

Accounts payable and accrued expenses |

549,597 | |||

Total liabilities |

2,179,570 | |||

Commitments and contingencies (see Note 3) |

||||

Partners’ capital |

222,102,454 | |||

Total liabilities and partners’ capital |

$ | 224,282,024 |

See accompanying notes to financial statements.

51

CYPRESS CREEK PRIVATE STRATEGIES MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments

March 31, 2022

Geographic |

Initial |

Shares |

Cost |

Fair |

% of |

|||||||||||||||||||

Private Investments Portfolio |

||||||||||||||||||||||||

Operating Companies |

||||||||||||||||||||||||

Buyout (0.27% of Partners’ Capital) |

|

|||||||||||||||||||||||

Milton ZXP LLC - Class A Units (2)(4)(6) |

North America | February, 2018 |

6,029 | $ | 602,900 | $ | 602,900 | |||||||||||||||||

Growth Equity (0.28% of Partners’ Capital) |

|

|||||||||||||||||||||||

Clovis Point II RIVS Investment, LLC (4)(6) |

North America | March, 2019 |

650,000 | 618,200 | ||||||||||||||||||||

Venture Capital (0.00% of Partners’ Capital) |

|

|||||||||||||||||||||||

TasteMade, Inc. (4) |

North America | April, 2016 |

2,582 | 100,000 | — | |||||||||||||||||||

Total Operating Companies |

|

1,352,900 | 1,221,100 | 0.55 | % | |||||||||||||||||||

Private Investment Funds |

||||||||||||||||||||||||

Private Equity |

||||||||||||||||||||||||

Buyout (13.01% of Partners’ Capital) |

||||||||||||||||||||||||

Advent Latin American Private Equity Fund IV-F L.P. |

Rest of the World | August, 2007 |

201,046 | 104,061 | ||||||||||||||||||||

Advent Latin American Private Equity Fund V-F L.P. |

Rest of the World | May, 2010 |

1,409,392 | 1,426,782 | ||||||||||||||||||||

Darwin Private Equity I L.P. |

Europe | September, 2007 |

1,306,831 | 205,533 | ||||||||||||||||||||

Intervale Capital Fund, L.P. |

North America | May, 2008 |

1,150,435 | 1,156,153 | ||||||||||||||||||||

J.C. Flowers III L.P. |

Global | October, 2009 |

1,169,801 | 280,062 | ||||||||||||||||||||

KF Partner Investments Fund III LP (1)(2) |

North America | June, 2020 |

1,866,323 | 1,950,363 | ||||||||||||||||||||

Mid Europa Fund III LP |

Europe | November, 2007 |

280,414 | 1,015 | ||||||||||||||||||||

Monomoy Capital Partners II, L.P. (1) |

North America | May, 2011 |

1,090,211 | 1,724,757 | ||||||||||||||||||||

Monomoy Capital Partners III, L.P. (1) |

North America | December, 2017 |

2,755,571 | 5,376,073 | ||||||||||||||||||||

Reservoir Capital Partners (Cayman), L.P. |

North America | June, 2009 |

303,800 | 521,769 | ||||||||||||||||||||

Sovereign Capital Limited Partnership III (1) |

Europe | March, 2010 |

— | 153,736 | ||||||||||||||||||||

See accompanying notes to financial statements.

52

CYPRESS CREEK PRIVATE STRATEGIES MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

March 31, 2022

Geographic |

Initial |

Shares |

Cost |

Fair |

% of |

|||||||||||||||||||

Private Investment Funds (continued) |

||||||||||||||||||||||||

Private Equity (continued) |

||||||||||||||||||||||||

Buyout (13.01% of Partners’ Capital) (continued) |

||||||||||||||||||||||||

Sterling Capital Partners II, L.P. |

North America | August, 2005 |

$ | 190,740 | $ | 20,155 | ||||||||||||||||||

Sterling Group Partners III, L.P. |

North America | April, 2010 |

1,086,398 | 11,008 | ||||||||||||||||||||

Strattam Capital Investment Fund, L.P. (1) |

North America | December, 2015 |

3,192,683 | 3,747,115 | ||||||||||||||||||||

Strattam Capital Investment Fund II, L.P. (1) |

North America | February, 2018 |

2,521,360 | 3,598,402 | ||||||||||||||||||||

Strattam Capital Investment Fund III, L.P. (2) |

North America | March, 2022 |

18,898 | — | ||||||||||||||||||||

Strattam Co-Invest Fund V, L.P. |

North America | December, 2018 |

453,214 | 1,369,164 | ||||||||||||||||||||

Strattam Co-Invest Fund VI, L.P. |

North America | December, 2018 |

532,232 | 690,946 | ||||||||||||||||||||

Strattam Co-Invest Fund VII, L.P. |

North America | September, 2019 |

413,727 | 666,459 | ||||||||||||||||||||

Trivest Fund IV, L.P.(1) |

North America | November, 2007 |

12,230 | 7,608 | ||||||||||||||||||||

VCFA Private Equity Partners IV, L.P. |

North America | March, 2005 |

5,030 | 14,257 | ||||||||||||||||||||

Viburnum Equity 4, LP (2) |

Global | January, 2022 |

5,530,305 | 5,852,426 | ||||||||||||||||||||

Growth Equity (17.57% of Partners’ Capital) |

||||||||||||||||||||||||

Catterton Growth Partners, L.P. |

North America | March, 2008 |

1,929,339 | 539,497 | ||||||||||||||||||||

Chicago Pacific Founders Fund II, LP |

North America | January, 2020 |

3,309,426 | 7,127,225 | ||||||||||||||||||||

Clovis Point II, LP |

North America | February, 2020 |

2,140,195 | 2,070,860 | ||||||||||||||||||||

Crosslink Crossover Fund V, L.P. |

North America | May, 2007 |

316,468 | 100,089 | ||||||||||||||||||||

Crosslink Crossover Fund VI, L.P. |

North America | March, 2007 |

— | 3,391,342 | ||||||||||||||||||||

CX Partners Fund Ltd. (1) |

Asia | April, 2009 |

1,648,913 | 1,174,968 | ||||||||||||||||||||

Gavea Investment Fund II A, L.P. |

Rest of the World | May, 2007 |

— | 7,418 | ||||||||||||||||||||

Gavea Investment Fund III A, L.P. |

Rest of the World | September, 2008 |

— | 37,775 | ||||||||||||||||||||

HealthCor Partners Fund, L.P. |

North America | August, 2007 |

266,750 | 965,631 | ||||||||||||||||||||

See accompanying notes to financial statements.

53

CYPRESS CREEK PRIVATE STRATEGIES MASTER FUND, L.P.

(A Limited Partnership)

Schedule of Investments, continued

March 31, 2022

Geographic |

Initial |

Shares |

Cost |

Fair |

% of |

|||||||||||||||||||

Private Investment Funds (continued) |

||||||||||||||||||||||||

Private Equity (continued) |

||||||||||||||||||||||||

Growth Equity (17.58% of Partners’ Capital) (continued) |

||||||||||||||||||||||||

New Horizon Capital III, L.P. (1) |

Asia | March, 2009 |

$ | 430,085 | $ | 555,490 | ||||||||||||||||||