Offers to Purchase

EX-99.2

Exhibit 99.2

Offer to

Purchase

THE ENDOWMENT INSTITUTIONAL FUND, L.P.

P.O. Box 182663

Columbus, Ohio

43218-2663

Offer to Purchase Up to $300,000 of Outstanding

Limited Partnership Interests at Net Asset Value

Dated October 22, 2014

The Offer and Withdrawal Rights Will Expire at

Midnight, Central Standard Time, on November 20, 2014,

Unless the Offer is Extended

To the

Investors of The Endowment Institutional Fund, L.P.:

The Endowment Institutional Fund, L.P., a closed-end, non-diversified, management

investment company organized as a Delaware limited partnership (the “Fund”), is offering to purchase on the terms and conditions set forth in this offer to purchase (“Offer to Purchase”) and the related Letter of Transmittal

(which together with the Offer to Purchase constitutes the “Offer”) up to $300,000 of interests (the “Offer Amount”) in the Fund or portions thereof pursuant to tenders by investors at a price equal to their estimated net asset

value as of December 31, 2014 (the “Valuation Date”). This Offer is currently scheduled to expire at midnight, Central Standard Time, on November 20, 2014 (the “Expiration Date”), but the Fund may extend this date. (As

used in this Offer, the term “Interest,” or “Interests,” as the context requires, shall refer to the interests in the Fund and portions thereof representing limited partnership interests in the Fund and those interests and

portions thereof that have been tendered for repurchase. This Offer is being made to all investors of the Fund and is not conditioned on any minimum amount of Interests being tendered, but is subject to certain conditions described below. Interests

are not traded on any established trading market and are subject to strict restrictions on transferability pursuant to the Fund’s Limited Partnership dated as of December 8, 2009 (the “LP Agreement”).

The Fund is one of several “feeder” funds into The Endowment Master Fund, L.P. (the “Master Fund”), which then invests its

capital in Investment Funds. The Board of the Master Fund has approved a tender offer for up to $9,700,000 of capital of its investors (“Master Offer Amount”), including the Fund. The Board of the Fund has approved a tender offer of up to

the Offer Amount.

Investors should realize that the value of the Interests tendered in this Offer will likely change between the most

recent time net asset value was calculated and communicated to them and the Valuation Date, when the value of the Interests tendered to the Fund will be determined for purposes of calculating the purchase price of such Interests, and such change

could be material. The Fund determines the estimated net asset value monthly based on the information it receives from the managers of the Investment Funds in which it invests. Any tendering investors that wish to obtain the estimated net asset

value of their interests on this basis should contact the Support Desk of Endowment Advisers, L.P. at (800) 725-9456 Monday through Friday, except holidays, during normal business hours of 9:00 a.m. to 5:00 p.m. (Central Standard Time).

Investors desiring to tender all or any portion of their Interest in the Fund in accordance with the terms of the Offer should complete and

sign the appropriate forms in accordance with the procedures in the Offer to Purchase.

IMPORTANT

NEITHER THE FUND NOR THE INVESTMENT ADVISER NOR ANY OF THE MANAGERS OR DIRECTORS OF THE FUND MAKE ANY RECOMMENDATION TO ANY INVESTOR AS TO

WHETHER TO TENDER OR REFRAIN FROM TENDERING INTERESTS. INVESTORS MUST MAKE THEIR OWN DECISIONS WHETHER TO TENDER INTERESTS, AND, IF SO, THE PORTION OF THEIR INTERESTS TO TENDER.

BECAUSE EACH INVESTOR’S INVESTMENT DECISION IS A PERSONAL ONE, BASED ON ITS FINANCIAL

CIRCUMSTANCES, NO PERSON HAS BEEN AUTHORIZED TO MAKE ANY RECOMMENDATION ON BEHALF OF THE FUND AS TO WHETHER INVESTORS SHOULD TENDER INTERESTS PURSUANT TO THE OFFER. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS

IN CONNECTION WITH THE OFFER OTHER THAN THOSE CONTAINED HEREIN OR IN THE LETTER OF TRANSMITTAL. IF GIVEN OR MADE, SUCH RECOMMENDATION AND SUCH INFORMATION AND REPRESENTATIONS MUST NOT BE RELIED ON AS HAVING BEEN AUTHORIZED BY THE FUND.

THIS TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION

OR ANY STATE SECURITIES COMMISSION PASSED ON THE FAIRNESS OR MERITS OF SUCH TRANSACTION OR ON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Questions and requests for assistance and requests for additional copies of the Offer may be directed to the Fund’s Investment Adviser.

|

| Endowment Advisers, L.P. |

| P.O. Box 182663 |

| Columbus, Ohio 43218-2663 |

| Phone: (800) 725-9456 |

TABLE OF CONTENTS

|

|

|

|

|

| SUMMARY TERM SHEET |

|

|

1 |

|

|

|

| 1. Background and Purpose of the Offer |

|

|

1 |

|

|

|

| 2. Offer to Purchase and Price |

|

|

2 |

|

|

|

| 3. Amount of Tender |

|

|

2 |

|

|

|

| 4. Procedure for Tenders |

|

|

2 |

|

|

|

| 5. Withdrawal Rights |

|

|

3 |

|

|

|

| 6. Purchases and Payment |

|

|

3 |

|

|

|

| 7. Certain Conditions of the Offer |

|

|

5 |

|

|

|

| 8. Certain Information About the Fund |

|

|

5 |

|

|

|

| 9. Certain Federal Income Tax Consequences |

|

|

6 |

|

|

|

| 10. Miscellaneous |

|

|

7 |

|

|

|

| Financial Statements (incorporated by reference) |

|

|

7 |

|

SUMMARY TERM SHEET

| |

• |

|

As we disclosed in your Fund’s private placement memorandum dated January 1, 2014, as may be amended and supplemented from time to time (the “PPM”), the Adviser intends to recommend to the Board and

the Board is expected to approve offers to buy your limited partnership interests at their estimated net asset value (that is, the estimated value of the Fund’s assets minus its liabilities, multiplied by the proportionate interest in the Fund

you desire to sell via a tender offer process. The current offer will remain open until midnight, Central Standard Time, on November 20, 2014 (the “Expiration Date”) with the estimated net asset value calculated for this purpose as of

December 31, 2014 (the “Valuation Date”). Capitalized terms used in this tender offer filing but not otherwise defined shall have the meanings ascribed to them in the PPM. |

| |

• |

|

Following this summary is a formal notice of the offer to repurchase your limited partnership interests. The offer remains open until the Expiration Date, unless extended. You have the right to withdraw your tendered

Interests any time until the earlier to occur of the date such tendered Interests are accepted by the Fund or the Valuation Date. If you would like to tender your Interests, you should complete a Letter of Transmittal (the two page Tender Offer Form

will suffice), enclosed with the Offer to Purchase, and contact your financial advisor for specific return instructions. Allow for additional processing time by your financial intermediary if necessary as the form must ultimately be submitted to

Endowment Advisers, L.P. (the “Investment Adviser”), at P.O. Box 182663, Columbus, Ohio 43218-2663, Attention: The Endowment Fund or faxed to Endowment Advisers, L.P. at (866) 624-0077, Attention: The Endowment Fund. If you choose to

fax the Letter of Transmittal, you should mail the original Tender Offer Form promptly after you fax it. Properly completed mailed tender forms or the faxed form must be received prior to the Expiration Date. The value of your limited partnership

interests will likely change between the most recent time the net asset value was calculated and communicated to you and the Valuation Date, when the value of your investment will be determined for purposes of calculating your purchase price.

|

| |

• |

|

If you would like to obtain the estimated net asset value of your limited partnership interests, which the Fund’s administrator calculates monthly based on the information the Fund receives from the managers of the

Investment Funds in which the Fund invests, you may contact the Support Desk of the Investment Adviser at (800) 725-9456, Monday through Friday, except holidays, during normal business hours of 9:00 a.m. to 5:00 p.m. (Central Standard Time).

Please note that although you have the opportunity to have your limited partnership interests repurchased, we have the right to cancel, amend or postpone this offer prior to the earlier to occur of the Valuation Date (as such may be extended if the

Expiration Date is extended) or when the tendered Interests have been accepted by the Fund. |

1. Background and Purpose of

the Offer. The purpose of the Offer is to provide liquidity to investors who hold Interests as contemplated by and in accordance with the procedures set forth in the Fund’s LP Agreement. The LP Agreement, which was provided to each investor

in advance of subscribing for Interests, provides that the Board has the discretion to determine whether the Fund will purchase limited partnership interests from investors from time to time pursuant to written tenders. Because there is no secondary

trading market for Interests and transfers of Interests are prohibited without prior approval of the Fund, the Board has determined, after consideration of various matters, that the Offer is in the best interests of investors of the Fund to provide

liquidity for Interests as contemplated in the LP Agreement. The Board intends to consider the continued desirability of the Fund making an offer to purchase Interests four times each year, but the Fund is not required to make any such offer.

The purchase of Interests pursuant to the Offer will have the effect of increasing the proportionate interest in the Fund of investors who do

not tender Interests. Investors who retain their Interests may be subject to increased risks that may possibly result from the reduction in the Fund’s aggregate assets resulting from payment for the Interests tendered as well as potentially

increased illiquidity of the Master Fund’s portfolio. Additionally, a reduction in the aggregate assets of the Fund may result in investors who do not tender Interests bearing higher costs to the extent that certain expenses borne by the Fund

are relatively fixed and may not decrease if assets decline. These effects may be reduced or eliminated to the extent that additional subscriptions for Interests are made by new and existing investors from time to time, although there can be no

assurances that such new or additional subscriptions will occur.

1

Interests that are tendered to the Fund in connection with the Offer to Purchase, if accepted for

repurchase, will be repurchased, resulting in an increase in the Sharing Ratios of remaining Partners in the Fund (assuming no further issuances of Interests).

2. Offer to Purchase and Price. The Fund will purchase, upon the terms and subject to the conditions of the Offer, up to the Offer

Amount of those outstanding Interests that are properly tendered by and not withdrawn before the Expiration Date based on the value as of the Valuation Date.

The Fund is one of several “feeder” funds that invests all of its capital into The Endowment Master Fund, L.P. (the “Master

Fund”), which then invests its capital in Investment Funds. The Board of the Master Fund has approved the Master Offer Amount, which includes the Fund and the other “feeder funds”. The Board of the Institutional Fund has approved the

Offer Amount.

If the Fund elects to extend the tender period, for the purpose of determining the purchase price for tendered Interests,

the estimated net asset value of such Interests will be determined approximately one month after the tender offer actually expires. The later of the initial Expiration Date or the latest time and date to which the Offer is extended hereinafter is

called the “Expiration Date.” The Fund reserves the right to extend, amend or cancel the Offer as described herein. The purchase price of an Interest tendered will be its estimated net asset value as of the close of business on the

Valuation Date.

As of the close of business on August 31, 2014, there was approximately $9,989,094 outstanding in capital of the

Fund held in Interests (based on the estimated net asset value of such Interests). The Fund’s administrator determines its estimated net asset value monthly based on information it receives from the managers of the Investment Funds in which it

invests. Investors may obtain this information by contacting the Support Desk of Endowment Advisers, L.P. at (800) 725-9456, Monday through Friday, except holidays, during normal business hours of 9:00 a.m. to 5:00 p.m. (Central Standard Time).

Of course, the value of the Interests tendered by the investors likely will change between the most recent time net asset value was calculated and communicated to you and the Valuation Date.

3. Amount of Tender. Subject to the limitations set forth below, investors may tender their entire Interest or a portion of their

Interest. The Offer is being made to all investors of the Fund and is not conditioned on any minimum amount of Interests being tendered.

If the amount of the Interests that are properly tendered pursuant to the Offer and not withdrawn is less than or equal to the Offer Amount,

as adjusted, the Fund will, on the terms and subject to the conditions of the Offer, purchase all of the Interests so tendered unless the Fund elects to cancel or amend the Offer, or postpone acceptance of tenders made pursuant to the Offer. If more

than the Offer Amount is duly tendered to the Fund before the expiration of the Offer and not withdrawn, the Fund will, in its sole discretion, either (a) accept the additional Interests permitted to be accepted pursuant to Rule 13e-4(f)(1)(ii)

under the Securities Exchange Act of 1934, as amended; (b) extend the Offer, if necessary, and increase the amount of Interests that the Fund is offering to purchase to an amount it believes sufficient to accommodate the excess Interests

tendered as well as any Interests tendered during the extended Offer; or (c) accept Interests tendered on or before the Expiration Date for payment on a pro rata basis based on the aggregate estimated net asset value of tendered Interests. The

Fund does not presently expect any increase in the amount of Interests offered for repurchase in the event of an oversubscription. At the present time, the Fund is not aware of any intentions of any of the Managers or Directors to have their

Interests acquired in this tender offer.

4. Procedure for Tenders. Investors wishing to tender Interests pursuant to the Offer

should complete and execute the Letter of Transmittal (the two page Tender Offer Form will suffice) and contact their financial advisor as the financial intermediary may have specific instructions that need to be followed. Please allow for

additional processing time by your financial intermediary if necessary as the form must ultimately be received by the Investment Adviser, either by mail, to the attention of The Endowment Fund, at P.O. Box 182663, Columbus, Ohio 43218-2663, or by

fax, also to the attention of The Endowment Fund, at (866) 624-0077, prior to the Expiration Date. The Fund recommends that all documents be submitted by certified mail, return receipt requested, or by facsimile transmission. An investor

choosing to fax a Letter of Transmittal should also send the original completed and executed Letter of Transmittal (the two page Tender Offer Form will suffice) promptly thereafter.

2

Investors wishing to confirm receipt of a Letter of Transmittal may contact the Investment

Adviser at (800) 725-9456. The method of delivery of any documents is at the election and complete risk of the investor tendering an Interest, including, but not limited to, the failure of the Investment Adviser to receive any Letter of

Transmittal or other document submitted by facsimile transmission. All questions as to the validity, form, eligibility (including time of receipt) and acceptance of tenders will be determined by the Fund, in its sole discretion, and such

determination shall be final and binding. The Fund reserves the absolute right to reject any or all tenders determined by it not to be in appropriate form or the acceptance of or payment for which would, in the opinion of counsel for the Fund, be

unlawful. The Fund also reserves the absolute right to waive any of the conditions of the Offer or any defect in any tender with respect to any particular Interest or any particular investor, and the Fund’s interpretation of the terms and

conditions of the Offer will be final and binding. Unless waived, any defects or irregularities in connection with tenders must be cured within such time as the Fund shall determine. Tenders will not be deemed to have been made until the defects or

irregularities have been cured or waived. Neither the Fund nor the Investment Adviser nor any of the Managers or Directors of the Fund shall be obligated to give notice of any defects or irregularities in tenders, nor shall any of them incur any

liability for failure to give such notice.

5. Withdrawal Rights. Any investor tendering an Interest pursuant to this Offer may

withdraw its Interest at any time until the earlier to occur of the date such tendered Interests are accepted by the Fund or the Valuation Date. To be effective, any notice of withdrawal must be timely received by the Investment Adviser by mail or

fax. A form to use to give notice of withdrawal is available by calling the Support Desk of the Investment Adviser at (800) 725-9456. All questions as to the form and validity (including time of receipt) of notices of withdrawal will be

determined by the Fund, in its sole discretion, and such determination shall be final and binding. Interests properly withdrawn shall not thereafter be deemed to be tendered for purposes of the Offer. However, withdrawn Interests may be re-tendered

prior to the Expiration Date by following the procedures for tenders described above.

6. Purchases and Payment. For purposes of

the Offer, the Fund will be deemed to have accepted Interests that are tendered when it gives written notice to the tendering investor of its election to purchase such Interest. The purchase price of an Interest tendered by any investor will be the

estimated net asset value thereof as of the close of business on the Valuation Date. If the Fund elects to extend the tender period, the estimated net asset value of tendered Interests will be determined approximately one month after the tender

offer actually expires. The estimated net asset value will be determined after all allocations to capital accounts of the investors required to be made by the LP Agreement have been made.

| |

• |

|

The initial payment (the “Initial Payment”) will be made in an amount equal to at least 95% of the estimated value of the repurchased Interest (or portion thereof), determined as of the Valuation Date. The

Initial Payment will be made as of the later of (1) the 30th day after the Valuation Date, or (2) in the sole discretion of the Investment Adviser, if the Fund has requested withdrawals of its capital from any Investment Funds in order to

fund the repurchase of Interests, within ten business days after the Fund has received at least 95% of the aggregate amount so requested to be withdrawn by the Fund from the Investment Funds (the “Investment Fund Payment Date”).

|

| |

• |

|

The second and final payment (the “Final Payment”) is expected to be in an amount equal to the excess, if any, of (1) the value of the repurchased Interest (or portion thereof), determined as of the

Valuation Date based upon the results of the annual audit of the Fund’s financial statements for the fiscal year in which the Valuation Date of such repurchase occurred, over (2) the Initial Payment. The Investment Adviser anticipates that

the annual audit of the Fund’s financial statements will be completed within 60 days after the end of each fiscal year of the Fund and that the Final Payment will be made as promptly as practicable after the completion of such audit.

|

| |

• |

|

Although the amounts required to be paid by the Fund will generally be paid in cash, the Fund may under certain limited circumstances pay all or a portion of the amounts due by an in-kind distribution of securities.

|

| |

• |

|

Notwithstanding anything in the foregoing to the contrary, in the event that a Partner has requested the repurchase of a portion of its Interest which

would result in such Partner continuing to hold at least 10% of the value of its Interest as of December 31 of the fiscal year ending immediately prior to the fiscal year in which such request was made, the Final Payment in respect of such

repurchase |

3

| |

shall be made on or before the 60th day after the Valuation Date, provided that if the Fund, in the sole discretion of the Investment Adviser, has requested withdrawals of its capital from any

Investment Funds in order to fund the repurchase of Interests, such payment may be postponed until 10 business days after the applicable Investment Fund Payment Date. Such payment shall be in an amount equal to the excess, if any, of (1) the

value of the repurchased Interest (or portion thereof), determined as of the Valuation Date, based upon information known to the Fund as of the date of the Final Payment, over (2) the Initial Payment. If, based upon the results of the annual

audit of the Fund’s financial statements for the fiscal year in which the Valuation Date of such repurchase occurred, it is determined that the value at which the Interest was repurchased was incorrect, the Fund shall, as promptly as

practicable after the completion of such audit, decrease such Partner’s capital account balance by the amount of any overpayment, or increase such Partner’s capital account balance by the amount of any underpayment, as applicable.

|

The repurchase of Interests is subject to regulatory requirements imposed by the Securities and Exchange Commission

(“SEC”). The Fund’s repurchase procedures are intended to comply with such requirements. However, in the event that the Board determines that modification of the repurchase procedures described above is required or appropriate, the

Board will adopt revised repurchase procedures as necessary to ensure the Fund’s compliance with applicable regulations or as the Board in its sole discretion deems appropriate. Following the commencement of an offer to repurchase Interests,

the Fund may suspend, postpone or terminate such offer in certain circumstances upon the determination of a majority of the Board, including a majority of the Independent Directors, that such suspension, postponement or termination is advisable for

the Fund and its Partners, including, without limitation, circumstances as a result of which it is not reasonably practicable for the Fund to dispose of its investments or to determine the value of its net assets, and other unusual circumstances.

Each Partner whose Interest (or portion thereof) has been accepted for repurchase will continue to be a Partner of the Fund until the

Valuation Date (and thereafter if its Interest is repurchased in part) and may exercise its voting rights with respect to the repurchased Interest (or portion thereof) until the Valuation Date. Moreover, the capital account maintained in respect of

a Partner whose Interest (or portion thereof) has been accepted for repurchase will be adjusted for the net profits or net losses of the Fund through the Valuation Date, and such Partner’s capital account shall not be adjusted for the amount

withdrawn, as a result of the repurchase, prior to the Valuation Date.

Upon its acceptance of tendered Interests or portions of Interests

for repurchase, the Fund will maintain on its books (1) cash, (2) liquid securities or (3) interests in Investment Funds that the Fund has requested be withdrawn (or any combination of them), in an amount equal to the amount of

accepted tendered Interests.

Payments for repurchased Interests may require the Fund to liquidate portfolio holdings in Investment Funds

earlier than the Investment Adviser otherwise would liquidate such holdings, potentially resulting in losses, reduced tax efficiency and may increase the Fund’s portfolio turnover. The Investment Adviser intends to take measures to attempt to

avoid or minimize such potential losses and turnover. The Fund may, but need not, maintain cash or the Master Fund may borrow money to meet repurchase requests. Such a practice could increase the Fund’s operating expenses and impact the ability

of the Fund to achieve its investment objective.

As approved by the Board, in certain instances, a 2% Early Repurchase Fee will be

charged by the Fund (and inure to the benefit of the remaining Partners) with respect to any repurchase of an Interest (or portion thereof) from a Partner at any time prior to the business day immediately preceding the one-year anniversary of the

Partner’s purchase of such Interest (or portion thereof). Partial Interests tendered for repurchase will be treated as having been repurchased on a “first in—first out” basis. Therefore, the portion of an Interest repurchased

will be deemed to have been taken from the earliest capital contribution made by such Partner (adjusted for subsequent net profits and net losses) until that capital contribution is decreased to zero, and then from each subsequent capital

contribution made by such Partner (adjusted for subsequent net profits and net losses) until such capital contribution is decreased to zero.

Other than the Early Repurchase Fee, the Fund does not presently intend to impose any charges (other than direct costs and expenses, such as

wiring fees) on the repurchase of Interests, although it may allocate to Partners whose Interests are repurchased withdrawal or similar charges imposed by Investment Funds if the Investment Adviser determines to withdraw from one or more Investment

Funds as a result of Partner repurchase tenders and such charges are imposed on the Fund.

4

A Partner who tenders some but not all of the Partner’s Interest for repurchase will be

required to maintain a minimum capital account balance of $100,000. Such minimum capital account balance requirement may be waived by the Fund, in its sole discretion. The Fund reserves the right to reduce the amount to be repurchased from a Partner

so that the required capital account balance is maintained.

The Fund expects that the purchase price for Interests acquired pursuant to

the Offer to Purchase, which will not exceed the Offer Amount (unless the Fund elects to purchase a greater amount), will be derived from: (1) cash on hand; (2) the proceeds of the sale of and/or delivery of securities and portfolio assets

held by the Fund; and/or (3) possibly borrowings, as described below.

There are no material conditions to the financing of the repurchase

of Interests discussed above. None of the Fund, the Master Fund, the Investment Adviser or any of the Managers or Directors of the Fund have determined at this time to borrow funds to purchase tendered Interests in connection with the Offer to

Purchase. However, depending on the dollar amount of Interests tendered and prevailing general economic and market conditions, the Master Fund, in its sole discretion, may decide to seek to borrow money to fund all or a portion of any repurchase.

7. Certain Conditions of the Offer. The Fund reserves the right, at any time and from time to time, to extend the period of time

during which the Offer is pending by notifying investors of such extension. If the Fund elects to extend the tender period, for the purpose of determining the purchase price for tendered Interests, the estimated net asset value of such Interests

will be determined approximately one month after the tender offer actually expires. During any such extension, all Interests previously tendered and not withdrawn will remain subject to the Offer. The Fund also reserves the right, at any time and

from time to time, up to and including acceptance of tenders pursuant to the Offer, to: (a) cancel the Offer and in the event of such cancellation, not to purchase or pay for any Interests tendered pursuant to the Offer; (b) amend the

Offer; or (c) postpone the acceptance of Interests tendered. If the Fund determines to amend the Offer or to postpone the acceptance of Interests tendered, it will, to the extent necessary, extend the period of time during which the Offer is

open as provided above and will promptly notify investors.

Please note that just as you have the opportunity to have your Interests

repurchased in the Offer and the right to withdraw your tender on or before the Expiration Date, the Fund has the right to cancel, amend or postpone this offer at any time prior to the earlier to occur of the Valuation Date (as such may be extended

if the Expiration Date is extended) or when the tendered Interests have been accepted by the Fund. The Fund may cancel the Offer, amend the Offer or postpone the acceptance of tenders made pursuant to the Offer if: (a) the Fund would not be

able to liquidate portfolio securities in a manner that is orderly and consistent with the Fund’s investment objectives and policies in order to purchase Interests tendered pursuant to the Offer; (b) there is, in the Directors’

judgment, any (i) legal action or proceeding instituted or threatened challenging the Offer or that otherwise would have a material adverse effect on the Fund, (ii) declaration of a banking moratorium by Federal or state authorities or any

suspension of payment by banks in the United States or New York State that is material to the Fund, (iii) limitation imposed by Federal or state authorities on the extension of credit by lending institutions, (iv) suspension of trading on

any organized exchange or over-the-counter market where the Fund has a material investment, (v) commencement of war, armed hostilities or other international or national calamity directly or indirectly involving the United States that is

material to the Fund, (vi) material decrease in the estimated net asset value of the Fund from the estimated net asset value of the Fund as of the commencement of the Offer, or (vii) other event or condition that would have a material

adverse effect on the Fund or its investors if Interests tendered pursuant to the Offer were purchased; or (c) the Independent Directors of the Fund determine that it is not in the best interest of the Fund to purchase Interests pursuant to the

Offer. However, there can be no assurance that the Fund will exercise its right to extend, amend or cancel the Offer or to postpone acceptance of tenders pursuant to the Offer.

8. Certain Information About the Fund. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940

Act”), as a closed-end, non-diversified, management investment company and is organized as a Delaware limited partnership. The principal executive office of the Fund is located at 4265 San Felipe, 8th Floor, Houston, Texas 77027 and the

telephone number is (713) 993-4675. Interests are not traded on any established trading market and are subject to strict restrictions on transferability pursuant to the LP Agreement. The Investment Adviser’s investment committee

(“Investment Committee”) members are Messrs. Lee G. Partridge, Jeremy L. Radcliffe, William K. Enszer, William B. Hunt and William R. Guinn (the “Managers”). Their address is c/o Endowment Advisers, L.P. at 4265 San Felipe, 8th

Floor, Houston, Texas 77027 and the telephone number is (713) 993-4675.

5

Based on August 31, 2014 estimated values, Mr. John A. Blaisdell, Manager,

Director and Co-Principal Executive Officer of the Fund, beneficially owns $797,530 of Interests in the Fund and an aggregate of $1,061,718 of the Interests in the fund complex.

Based on August 31, 2014 estimated values, Mr. Andrew B. Linbeck, Manager, Director and Co-Principal Executive Officer of the

Fund, beneficially owns $1,129,685 of Interests in the Fund and an aggregate of $1,416,947 of the Interests in the fund complex.

Based on

August 31, 2014 estimated values, Mr. John E. Price, Principal Financial Officer of the Fund, does not have any beneficial ownership in the Fund.

Based on August 31, 2014 estimated values, Mr. A. Haag Sherman, Director of the Fund, does not have any beneficial ownership in the

Fund.

Based on August 31, 2014 estimated values, Mr. Lee G. Partridge, Manager and Chief Investment Officer of the

Investment Adviser, does not have any beneficial ownership in the Fund.

Based on August 31, 2014 estimated values,

Mr. Jeremy L. Radcliffe, Secretary of the Fund, beneficially owns $544,958 of Interests in the Fund and an aggregate of $544,958 of the Interests in the fund complex.

Based on August 31, 2014 estimated values, Mr. Scott E. Schwinger, Independent Director of the Fund, does not have any

beneficial ownership in the Fund, but beneficially owns an aggregate of $235,565 of the Interests in the fund complex.

Based on

August 31, 2014 estimated values, Mr. William K. Enszer, portfolio manager of the Fund, does not have any beneficial ownership in the Fund.

None of the other directors of the Fund have any beneficial ownership in the Fund or the fund complex.

The Fund does not have any plans or proposals that relate to or would result in: (a) the acquisition by any person of additional

Interests (other than the Fund’s intention to accept subscriptions for Interests from time to time in the discretion of the Fund) or the disposition of Interests (except for periodic discretionary solicitations of tender offers); (b) an

extraordinary transaction, such as a merger, reorganization or liquidation, involving the Fund; (c) any material change in the present distribution policy or indebtedness or capitalization of the Fund; (d) any change in the identity of the

Investment Adviser or the Managers or Directors of the Fund, or in the management of the Fund including, but not limited to, any plans or proposals to change the number or the term of the Managers or Directors of the Fund, to fill any existing

vacancy for a Manager or to change any material term of the investment advisory arrangements with the Investment Adviser; (e) a sale or transfer of a material amount of assets of the Fund (other than as the Directors determine may be necessary

or appropriate to fund any portion of the purchase price for Interests acquired pursuant to this Offer to Purchase or in connection with the ordinary portfolio transactions of the Fund); (f) any other material change in the Fund’s

structure or business, including any plans or proposals to make any changes in its fundamental investment policy for which a vote would be required by Section 13 of the 1940 Act; or (g) any changes in the LP Agreement or other actions that

may impede the acquisition of control of the Fund by any person.

9. Certain Federal Income Tax Consequences. The following

discussion is a general summary of the federal income tax consequences of the purchase of Interests by the Fund from investors pursuant to the Offer. Investors should consult their own tax advisers for a complete description of the tax consequences

to them of a purchase of their Interests by the Fund pursuant to the Offer.

An investor who tenders its entire Interest to the Fund for

repurchase generally will recognize capital gain or loss to the extent of the difference between the proceeds received by such investor and such investor’s adjusted tax basis in its Interest. The amount realized will include the investor’s

allocable share of the Fund’s nonrecourse borrowings (as defined for Federal income tax purposes) from the Master Fund, if any. Gain, if any, will be

6

recognized by a tendering investor only as and after the total proceeds received by such investor exceed the investor’s adjusted tax basis in its Interest. An investor’s basis in its

Interest generally will be adjusted for Fund income, gain, deduction or loss allocated, for tax purposes, to the investor for periods prior to the purchase of the Interest by the Fund. A loss, if any, will be recognized only after the tendering

investor has received full payment. This capital gain or loss will be short-term or long-term depending upon the investor’s holding period for its Interest at the time the gain or loss is recognized. United States Treasury Regulations provide

that an investor may have a fragmented holding period for its Interest if the investor has made contributions to the Fund at different times. However, a tendering investor will recognize ordinary income to the extent such investor’s allocable

share of the Fund’s “unrealized receivables” or items of Fund inventory exceeds the investor’s basis in such unrealized receivables or items of Fund inventory, as determined pursuant to the Treasury Regulations. For these

purposes, accrued but untaxed market discount, if any, on securities held by the Fund will be treated as an unrealized receivable with respect to the tendering investor. An investor who tenders less than its entire Interest to the Fund for

repurchase will recognize gain (but not loss) in a similar manner only to the extent that the amount of the proceeds received exceeds such investor’s adjusted tax basis in its Interest.

Pursuant to the authority granted to it under the LP Agreement, the Investment Adviser intends to specially allocate items of Fund capital

gain, including short-term capital gain, to a withdrawing investor to the extent its liquidating distribution would otherwise exceed its adjusted tax basis in its Interest. Such a special allocation may result in the withdrawing investor recognizing

capital gain, which may include short-term gain, in the investor’s last taxable year in the Fund, thereby reducing the amount of any long-term capital gain recognized during the tax year in which it receives its liquidating distribution upon

withdrawal.

10. Miscellaneous. The Offer is not being made to, nor will tenders be accepted from, investors in any jurisdiction in

which the Offer or its acceptance would not comply with the securities or Blue Sky laws of such jurisdiction. The Fund is not aware of any jurisdiction in which the Offer or tenders pursuant thereto would not be in compliance with the laws of such

jurisdiction. However, the Fund reserves the right to exclude investors from the Offer in any jurisdiction in which it is asserted that the Offer cannot lawfully be made. The Fund believes such exclusion is permissible under applicable laws and

regulations, provided the Fund makes a good faith effort to comply with any state law deemed applicable to the Offer.

The Fund has filed

an Issuer Tender Offer Statement on Schedule TO with the SEC, which includes certain information relating to the Offer summarized herein. A free copy of such statement may be obtained from the Fund by contacting the Investment Adviser

(800) 725-9456 or from the SEC’s internet web site, http://www.sec.gov. For a fee, a copy may be obtained from the Public Reference Room of the SEC at 100 F Street, N.E., Washington, DC 20549. (For more information about its operation call

(202) 551-8090.

Financial Statements

The audited financial statements of the Fund for the fiscal year ended December 31, 2013, and the schedule of investments dated

December 31, 2013, both filed with the SEC on EDGAR on Form N-CSR on March 11, 2014, are hereby incorporated by reference. The semi-annual, unaudited financial statements for the six month period ended June 30, 2014, filed with the

SEC on EDGAR on Form N-CSRS on September 5, 2014, are hereby incorporated by reference.

7

Offer to Purchase

Clients of Merrill Lynch Financial Advisors or U.S. Trust Portfolio Managers

THE ENDOWMENT INSTITUTIONAL FUND, L.P.

P.O. Box 182663

Columbus, Ohio

43218-2663

Offer to Purchase Up to $300,000 of Outstanding

Limited Partnership Interests at Net Asset Value

Dated October 22, 2014

The Offer and Withdrawal Rights Will Expire at

Midnight, Central Standard Time, on November 20, 2014,

Unless the Offer is Extended

To the

Investors of The Endowment Institutional Fund, L.P.:

The Endowment Institutional Fund, L.P., a closed-end, non-diversified, management

investment company organized as a Delaware limited partnership (the “Fund”), is offering to purchase on the terms and conditions set forth in this offer to purchase (“Offer to Purchase”) and the related Letter of Transmittal

(which together with the Offer to Purchase constitutes the “Offer”) up to $300,000 of interests (the “Offer Amount”) in the Fund or portions thereof pursuant to tenders by investors at a price equal to their estimated net asset

value as of December 31, 2014 (the “Valuation Date”). This Offer is currently scheduled to expire at midnight, Central Standard Time, on November 20, 2014 (the “Expiration Date”), but the Fund may extend this date. (As

used in this Offer, the term “Interest,” or “Interests,” as the context requires, shall refer to the interests in the Fund and portions thereof representing limited partnership interests in the Fund and those interests and

portions thereof that have been tendered for repurchase.) This Offer is being made to all investors of the Fund and is not conditioned on any minimum amount of Interests being tendered, but is subject to certain conditions described below. Interests

are not traded on any established trading market and are subject to strict restrictions on transferability pursuant to the Fund’s Agreement of Limited Partnership dated as of December 8, 2009 (the “LP Agreement”).

The Fund is one of several “feeder” funds into The Endowment Master Fund, L.P. (the “Master Fund”), which then invests its

capital in Investment Funds. The Board of the Master Fund has approved a tender offer for up to $9,700,000 of capital of its investors (“Master Offer Amount”), including the Fund. The Board of the Fund has approved a tender offer of up to

the Offer Amount.

Investors should realize that the value of the Interests tendered in this Offer will likely change between the most

recent time net asset value was calculated and communicated to them and the Valuation Date, when the value of the Interests tendered to the Fund will be determined for purposes of calculating the purchase price of such Interests, and such change

could be material. The Fund determines the estimated net asset value monthly based on the information it receives from the managers of the Investment Funds in which it invests. Any tendering investors that wish to obtain the estimated net asset

value of their interests on this basis should contact the Support Desk of Endowment Advisers, L.P. at (800) 725-9456 Monday through Friday, except holidays, during normal business hours of 9:00 a.m. to 5:00 p.m. (Central Standard Time).

Investors desiring to tender all or any portion of their Interest in the Fund in accordance with the terms of the Offer should complete and

sign the appropriate forms in accordance with the procedures in the Offer to Purchase.

IMPORTANT

NEITHER THE FUND NOR THE INVESTMENT ADVISER NOR ANY OF THE MANAGERS OR DIRECTORS OF THE FUND MAKE ANY RECOMMENDATION TO ANY INVESTOR AS TO

WHETHER TO TENDER OR REFRAIN FROM TENDERING INTERESTS. INVESTORS MUST MAKE THEIR OWN DECISIONS WHETHER TO TENDER INTERESTS, AND, IF SO, THE PORTION OF THEIR INTERESTS TO TENDER.

8

BECAUSE EACH INVESTOR’S INVESTMENT DECISION IS A PERSONAL ONE, BASED ON ITS FINANCIAL

CIRCUMSTANCES, NO PERSON HAS BEEN AUTHORIZED TO MAKE ANY RECOMMENDATION ON BEHALF OF THE FUND AS TO WHETHER INVESTORS SHOULD TENDER INTERESTS PURSUANT TO THE OFFER. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS

IN CONNECTION WITH THE OFFER OTHER THAN THOSE CONTAINED HEREIN OR IN THE LETTER OF TRANSMITTAL. IF GIVEN OR MADE, SUCH RECOMMENDATION AND SUCH INFORMATION AND REPRESENTATIONS MUST NOT BE RELIED ON AS HAVING BEEN AUTHORIZED BY THE FUND.

THIS TRANSACTION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION

OR ANY STATE SECURITIES COMMISSION PASSED ON THE FAIRNESS OR MERITS OF SUCH TRANSACTION OR ON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Questions and requests for assistance and requests for additional copies of the Offer may be directed to your Financial Advisor or Portfolio

Manager.

|

| Endowment Advisers, L.P. |

| P.O. Box 182663 |

| Columbus, Ohio 43218-2663 |

| Phone: (800) 725-9456 |

TABLE OF CONTENTS

|

|

|

|

|

| SUMMARY TERM SHEET |

|

|

1 |

|

|

|

| 1. Background and Purpose of the Offer |

|

|

1 |

|

|

|

| 2. Offer to Purchase and Price |

|

|

2 |

|

|

|

| 3. Amount of Tender |

|

|

2 |

|

|

|

| 4. Procedure for Tenders |

|

|

2 |

|

|

|

| 5. Withdrawal Rights |

|

|

3 |

|

|

|

| 6. Purchases and Payment |

|

|

3 |

|

|

|

| 7. Certain Conditions of the Offer |

|

|

5 |

|

|

|

| 8. Certain Information About the Fund |

|

|

5 |

|

|

|

| 9. Certain Federal Income Tax Consequences |

|

|

6 |

|

|

|

| 10. Miscellaneous |

|

|

7 |

|

|

|

| Financial Statements (incorporated by reference) |

|

|

7 |

|

SUMMARY TERM SHEET

| |

• |

|

As we disclosed in your Fund’s private placement memorandum dated January 1, 2014, as may be amended and supplemented from time to time (the “PPM”), the Adviser intends to recommend to the Board and

the Board is expected to approve offers to buy your limited partnership interests at their estimated net asset value (that is, the estimated value of the Fund’s assets minus its liabilities, multiplied by the proportionate interest in the Fund

you desire to sell) via a tender offer process. The current offer will remain open until midnight, Central Standard Time, on November 20, 2014 (the “Expiration Date”) with the estimated net asset value calculated for this purpose as

of December 31, 2014 (the “Valuation Date”). Capitalized terms used in this tender offer filing but not otherwise defined shall have the meanings ascribed to them in the PPM. |

| |

• |

|

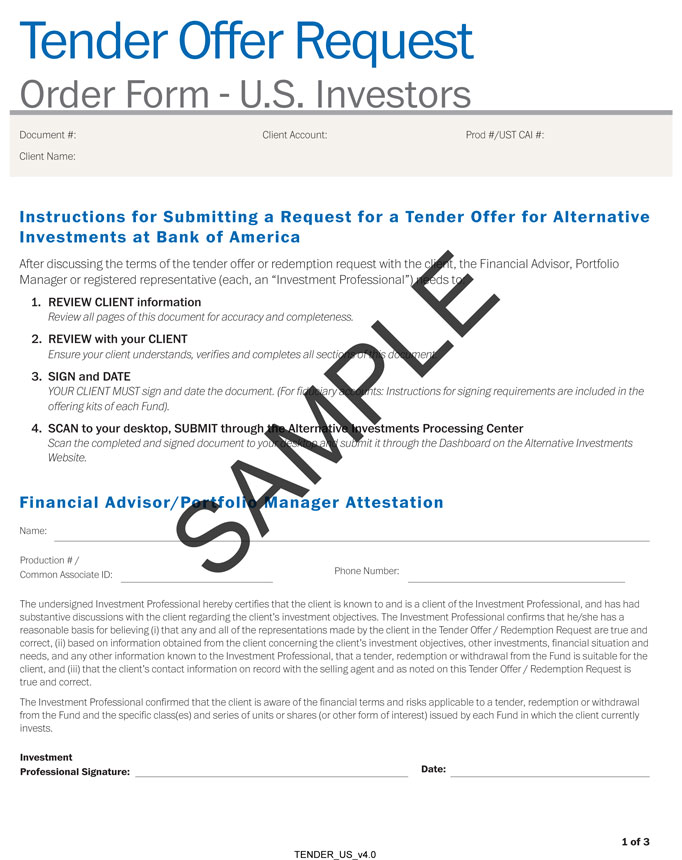

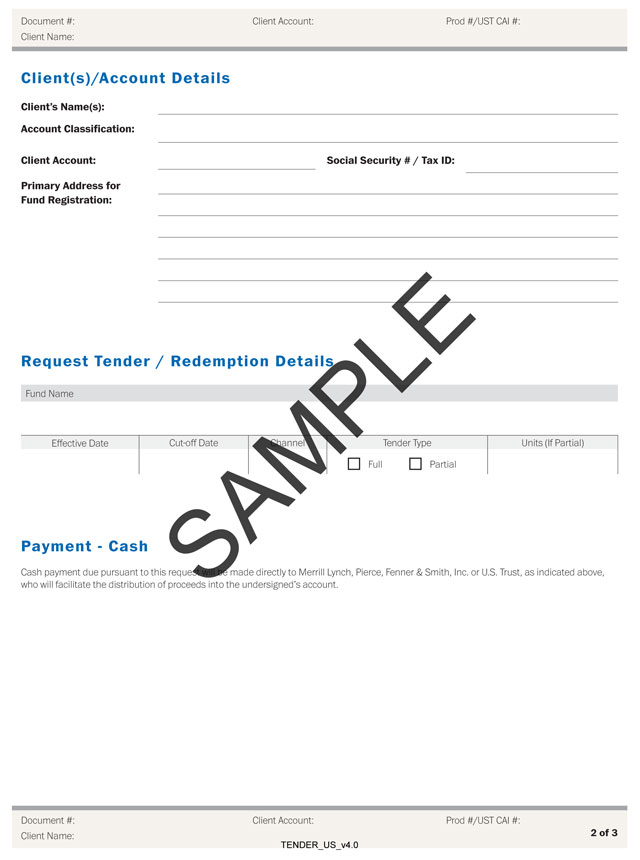

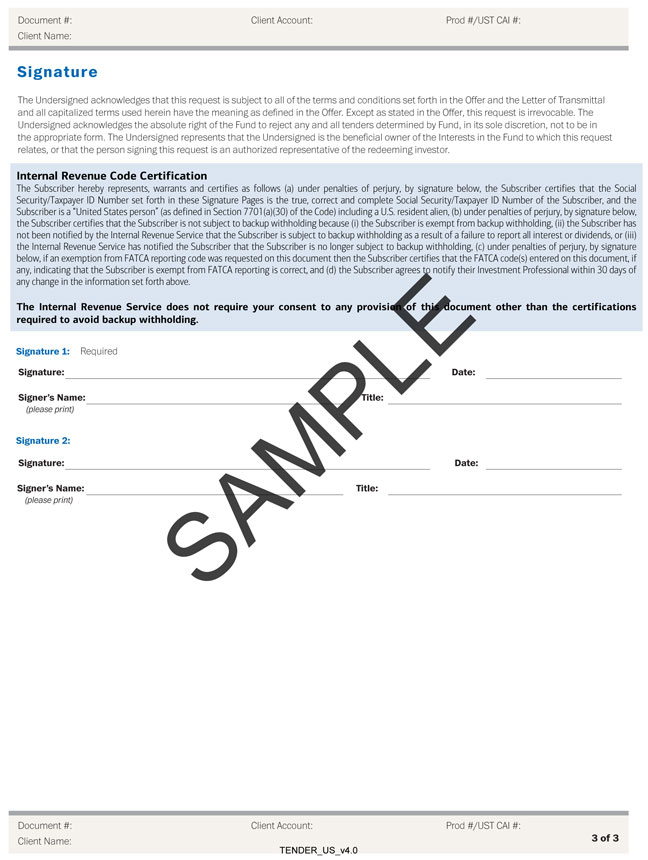

Following this summary is a formal notice of the offer to repurchase your limited partnership interests. The offer remains open until the Expiration Date, unless extended. You have the right to withdraw your tendered

Interests any time until the earlier to occur of the date such tendered Interests are accepted by the Fund or the Valuation Date. If you would like to tender your Interests, you should contact your Financial Advisor or Portfolio Manager who will

provide you with a customized Tender Offer Form for you to sign and return. The Letter of Transmittal contained in this Offer to Purchase includes a sample Tender Offer Form for your reference only. The Tender Offer Form generated for your account

will need to be signed and returned to your Financial Advisor or Portfolio Manager. Upon receiving the signed Tender Offer Form, your Financial Advisor or Portfolio Manager will need to submit the order with the properly completed tender form prior

to the Expiration Date. The value of your limited partnership interests will likely change between the most recent time the net asset value was calculated and communicated to you and the Valuation Date, when the value of your investment will be

determined for purposes of calculating your purchase price. |

| |

• |

|

If you would like to obtain the estimated net asset value of your limited partnership interests, which the Fund’s administrator calculates monthly based on the information the Fund receives from the managers of the

Investment Funds in which the Fund invests, you may contact the Support Desk of the Investment Adviser at (800) 725-9456 Monday through Friday, except holidays, during normal business hours of 9:00 a.m. to 5:00 p.m. (Central Standard Time).

Please note that although you have the opportunity to have your limited partnership interests repurchased, we have the right to cancel, amend or postpone this offer at any time prior to the earlier to occur of the Valuation Date (as such may be

extended if the Expiration Date is extended) or when the tendered Interests have been accepted by the Fund. |

1.

Background and Purpose of the Offer. The purpose of the Offer is to provide liquidity to investors who hold Interests as contemplated by and in accordance with the procedures set forth in the Fund’s LP Agreement. The LP Agreement, which was

provided to each investor in advance of subscribing for Interests, provides that the Board has the discretion to determine whether the Fund will purchase limited partnership interests from investors from time to time pursuant to written tenders.

Because there is no secondary trading market for Interests and transfers of Interests are prohibited without prior approval of the Fund, the Board has determined, after consideration of various matters, that the Offer is in the best interests of

investors of the Fund to provide liquidity for Interests as contemplated in the LP Agreement. The Board intends to consider the continued desirability of the Fund making an offer to purchase Interests four times each year, but the Fund is not

required to make any such offer.

The purchase of Interests pursuant to the Offer will have the effect of increasing the proportionate

interest in the Fund of investors who do not tender Interests. Investors who retain their Interests may be subject to increased risks that may possibly result from the reduction in the Fund’s aggregate assets resulting from payment for the

Interests tendered as well as potentially increased illiquidity of the Master Fund’s portfolio. Additionally, a reduction in the aggregate assets of the Fund may result in investors who do not tender Interests bearing higher costs to the extent

that certain expenses borne by the Fund are relatively fixed and may not decrease if assets decline. These effects may be reduced or eliminated to the extent that additional subscriptions for Interests are made by new and existing investors from

time to time, although there can be no assurances that such new or additional subscriptions will occur.

Interests that are tendered to

the Fund in connection with the Offer to Purchase, if accepted for repurchase, will be repurchased, resulting in an increase in the Sharing Ratios of remaining Partners in the Fund (assuming no further issuances of Interests).

1

2. Offer to Purchase and Price. The Fund will purchase, upon the terms and subject to the

conditions of the Offer, up to the Offer Amount of those outstanding Interests that are properly tendered by and not withdrawn before the Expiration Date based on the value as of the Valuation Date.

The Fund is one of several “feeder” funds that invests all of its capital into The Endowment Master Fund, L.P. (the “Master

Fund”), which then invests its capital in Investment Funds. The Board of the Master Fund has approved the Master Offer Amount, which includes the Fund and the other “feeder funds”. The Board of the Institutional Fund has approved the

Offer Amount.

If the Fund elects to extend the tender period, for the purpose of determining the purchase price for tendered Interests,

the estimated net asset value of such Interests will be determined approximately one month after the tender offer actually expires. The later of the initial Expiration Date or the latest time and date to which the Offer is extended hereinafter is

called the “Expiration Date.” The Fund reserves the right to extend, amend or cancel the Offer as described herein. The purchase price of an Interest tendered will be its estimated net asset value as of the close of business on the

Valuation Date.

As of the close of business on August 31, 2014, there was approximately $9,989,094 outstanding in capital of the

Fund held in Interests (based on the estimated net asset value of such Interests). The Fund’s administrator determines its estimated net asset value monthly based on information it receives from the managers of the Investment Funds in which it

invests. Investors may obtain this information by contacting the Support Desk of Endowment Advisers, L.P. at (800) 725-9456, Monday through Friday, except holidays, during normal business hours of 9:00 a.m. to 5:00 p.m. (Central Standard Time).

Of course, the value of the Interests tendered by the investors likely will change between the most recent time net asset value was calculated and communicated to you and the Valuation Date.

3. Amount of Tender. Subject to the limitations set forth below, investors may tender their entire Interest or a portion of their

Interest. The Offer is being made to all investors of the Fund and is not conditioned on any minimum amount of Interests being tendered.

If the amount of the Interests that are properly tendered pursuant to the Offer and not withdrawn is less than or equal to the Offer Amount,

as adjusted, the Fund will, on the terms and subject to the conditions of the Offer, purchase all of the Interests so tendered unless the Fund elects to cancel or amend the Offer, or postpone acceptance of tenders made pursuant to the Offer. If more

than the Offer Amount is duly tendered to the Fund before the expiration of the Offer and not withdrawn, the Fund will, in its sole discretion, either (a) accept the additional Interests permitted to be accepted pursuant to Rule 13e-4(f)(1)(ii)

under the Securities Exchange Act of 1934, as amended; (b) extend the Offer, if necessary, and increase the amount of Interests that the Fund is offering to purchase to an amount it believes sufficient to accommodate the excess Interests

tendered as well as any Interests tendered during the extended Offer; or (c) accept Interests tendered on or before the Expiration Date for payment on a pro rata basis based on the aggregate estimated net asset value of tendered Interests. The

Fund does not presently expect any increase in the amount of Interests offered for repurchase in the event of an oversubscription. At the present time, the Fund is not aware of any intentions of any of the Managers or Directors to have their

Interests acquired in this tender offer.

4. Procedure for Tenders. Investors wishing to tender Interests pursuant to the Offer

should contact their Financial Advisor or Portfolio Manager who will provide a customized Tender Offer Form to be signed and returned. The completed and executed Tender Offer Form must be submitted by the Financial Advisor or Portfolio Manager prior

to the Expiration Date. The Fund recommends that all documents be submitted by certified mail, return receipt requested, or by facsimile transmission. An investor choosing to fax a Letter of Transmittal should also send the original completed and

executed Letter of Transmittal (the Tender Offer Form will suffice) promptly thereafter.

Investors wishing to confirm receipt of a Letter

of Transmittal may contact their Financial Advisor or Portfolio Manager. The method of delivery of any documents is at the election and complete risk of the investor tendering an Interest, including, but not limited to, the failure of the Placement

Agent to receive any Letter of Transmittal or other document submitted by facsimile transmission. All questions as to the validity, form, eligibility (including time of receipt) and acceptance of tenders will be determined by the Fund, in its sole

discretion, and such determination shall be final and binding. The Fund reserves the absolute right to reject any or all tenders determined

2

by it not to be in appropriate form or the acceptance of or payment for which would, in the opinion of counsel for the Fund, be unlawful. The Fund also reserves the absolute right to waive any of

the conditions of the Offer or any defect in any tender with respect to any particular Interest or any particular investor, and the Fund’s interpretation of the terms and conditions of the Offer will be final and binding. Unless waived, any

defects or irregularities in connection with tenders must be cured within such time as the Fund shall determine. Tenders will not be deemed to have been made until the defects or irregularities have been cured or waived. Neither the Fund nor the

Placement Agent nor the Investment Adviser nor any of the Managers or Directors of the Fund shall be obligated to give notice of any defects or irregularities in tenders, nor shall any of them incur any liability for failure to give such notice.

5. Withdrawal Rights. Any investor tendering an Interest pursuant to this Offer may withdraw its Interest at any time until the

earlier to occur of the date such tendered Interests are accepted by the Fund or the Valuation Date. To be effective, any notice of withdrawal must be timely received by the Placement Agent. A form to use to give notice of withdrawal is available by

calling the Support Desk of the Investment Adviser at (800) 725-9456. All questions as to the form and validity (including time of receipt) of notices of withdrawal will be determined by the Fund, in its sole discretion, and such determination

shall be final and binding. Interests properly withdrawn shall not thereafter be deemed to be tendered for purposes of the Offer. However, withdrawn Interests may be re-tendered prior to the Expiration Date by following the procedures for tenders

described above.

6. Purchases and Payment. For purposes of the Offer, the Fund will be deemed to have accepted Interests that are

tendered when it gives written notice to the tendering investor of its election to purchase such Interest. The purchase price of an Interest tendered by any investor will be the estimated net asset value thereof as of the close of business on the

Valuation Date. If the Fund elects to extend the tender period, the estimated net asset value of tendered Interests will be determined approximately one month after the tender offer actually expires. The estimated net asset value will be determined

after all allocations to capital accounts of the investors required to be made by the LP Agreement have been made.

| |

• |

|

The initial payment (the “Initial Payment”) will be made in an amount equal to at least 95% of the estimated value of the repurchased Interest (or portion thereof), determined as of the Valuation Date. The

Initial Payment will be made as of the later of (1) the 30th day after the Valuation Date, or (2) in the sole discretion of the Investment Adviser, if the Fund has requested withdrawals of its capital from any Investment Funds in order to

fund the repurchase of Interests, within ten business days after the Fund has received at least 95% of the aggregate amount so requested to be withdrawn by the Fund from the Investment Funds (the “Investment Fund Payment Date”).

|

| |

• |

|

The second and final payment (the “Final Payment”) is expected to be in an amount equal to the excess, if any, of (1) the value of the repurchased Interest (or portion thereof), determined as of the

Valuation Date based upon the results of the annual audit of the Fund’s financial statements for the fiscal year in which the Valuation Date of such repurchase occurred, over (2) the Initial Payment. The Investment Adviser anticipates that

the annual audit of the Fund’s financial statements will be completed within 60 days after the end of each fiscal year of the Fund and that the Final Payment will be made as promptly as practicable after the completion of such audit.

|

| |

• |

|

Although the amounts required to be paid by the Fund will generally be paid in cash, the Fund may under certain limited circumstances pay all or a portion of the amounts due by an in-kind distribution of securities.

|

| |

• |

|

Notwithstanding anything in the foregoing to the contrary, in the event that a Partner has requested the repurchase of a portion of its Interest which

would result in such Partner continuing to hold at least 10% of the value of its Interest as of December 31 of the fiscal year ending immediately prior to the fiscal year in which such request was made, the Final Payment in respect of such

repurchase shall be made on or before the 60th day after the Valuation Date, provided that if the Fund, in the sole discretion of the Investment Adviser, has requested withdrawals of its capital from any Investment Funds in order to fund the

repurchase of Interests, such payment may be postponed until 10 business days after the applicable Investment Fund Payment Date. Such payment shall be in an amount equal to the excess, if any, of (1) the value of the repurchased Interest (or

portion thereof), determined as of the Valuation Date, based upon information known to the Fund as of the |

3

| |

date of the Final Payment, over (2) the Initial Payment. If, based upon the results of the annual audit of the Fund’s financial statements for the fiscal year in which the Valuation

Date of such repurchase occurred, it is determined that the value at which the Interest was repurchased was incorrect, the Fund shall, as promptly as practicable after the completion of such audit, decrease such Partner’s capital account

balance by the amount of any overpayment, or increase such Partner’s capital account balance by the amount of any underpayment, as applicable. |

The repurchase of Interests is subject to regulatory requirements imposed by the Securities and Exchange Commission (“SEC”). The

Fund’s repurchase procedures are intended to comply with such requirements. However, in the event that the Board determines that modification of the repurchase procedures described above is required or appropriate, the Board will adopt revised

repurchase procedures as necessary to ensure the Fund’s compliance with applicable regulations or as the Board in its sole discretion deems appropriate. Following the commencement of an offer to repurchase Interests, the Fund may suspend,

postpone or terminate such offer in certain circumstances upon the determination of a majority of the Board, including a majority of the Independent Directors, that such suspension, postponement or termination is advisable for the Fund and its

Partners, including, without limitation, circumstances as a result of which it is not reasonably practicable for the Fund to dispose of its investments or to determine the value of its net assets, and other unusual circumstances.

Each Partner whose Interest (or portion thereof) has been accepted for repurchase will continue to be a Partner of the Fund until the

Valuation Date (and thereafter if its Interest is repurchased in part) and may exercise its voting rights with respect to the repurchased Interest (or portion thereof) until the Valuation Date. Moreover, the capital account maintained in respect of

a Partner whose Interest (or portion thereof) has been accepted for repurchase will be adjusted for the net profits or net losses of the Fund through the Valuation Date, and such Partner’s capital account shall not be adjusted for the amount

withdrawn, as a result of the repurchase, prior to the Valuation Date.

Upon its acceptance of tendered Interests or portions of Interests

for repurchase, the Fund will maintain on its books (1) cash, (2) liquid securities or (3) interests in Investment Funds that the Fund has requested be withdrawn (or any combination of them), in an amount equal to the amount of

accepted tendered Interests.

Payments for repurchased Interests may require the Fund to liquidate portfolio holdings in Investment Funds

earlier than the Investment Adviser otherwise would liquidate such holdings, potentially resulting in losses, reduced tax efficiency and may increase the Fund’s portfolio turnover. The Investment Adviser intends to take measures to attempt to

avoid or minimize such potential losses and turnover. The Fund may, but need not, maintain cash or the Master Fund may borrow money to meet repurchase requests. Such a practice could increase the Fund’s operating expenses and impact the ability

of the Fund to achieve its investment objective.

As approved by the Board, in certain instances, a 2% Early Repurchase Fee will be

charged by the Fund (and inure to the benefit of the remaining Partners) with respect to any repurchase of an Interest (or portion thereof) from a Partner at any time prior to the business day immediately preceding the one-year anniversary of the

Partner’s purchase of such Interest (or portion thereof). Partial Interests tendered for repurchase will be treated as having been repurchased on a “first in-first out” basis. Therefore, the portion of an Interest repurchased will

be deemed to have been taken from the earliest capital contribution made by such Partner (adjusted for subsequent net profits and net losses) until that capital contribution is decreased to zero, and then from each subsequent capital contribution

made by such Partner (adjusted for subsequent net profits and net losses) until such capital contribution is decreased to zero.

Other

than the Early Repurchase Fee, the Fund does not presently intend to impose any charges (other than direct costs and expenses, such as wiring fees) on the repurchase of Interests, although it may allocate to Partners whose Interests are repurchased

withdrawal or similar charges imposed by Investment Funds if the Investment Adviser determines to withdraw from one or more Investment Funds as a result of Partner repurchase tenders and such charges are imposed on the Fund.

A Partner who tenders some but not all of the Partner’s Interest for repurchase will be required to maintain a minimum capital account

balance of $100,000. Such minimum capital account balance requirement may be waived by the Fund, in its sole discretion. The Fund reserves the right to reduce the amount to be repurchased from a Partner so that the required capital account balance

is maintained.

4

The Fund expects that the purchase price for Interests acquired pursuant to the Offer to

Purchase, which will not exceed the Offer Amount (unless the Fund elects to purchase a greater amount), will be derived from: (1) cash on hand; (2) the proceeds of the sale of and/or delivery of securities and portfolio assets held by the

Fund; and/or (3) possibly borrowings, as described below.

There are no material conditions to the financing of the repurchase of

Interests discussed above. None of the Fund, the Master Fund, the Investment Adviser or any of the Managers or Directors of the Fund have determined at this time to borrow funds to purchase tendered Interests in connection with the Offer to

Purchase. However, depending on the dollar amount of Interests tendered and prevailing general economic and market conditions, the Master Fund, in its sole discretion, may decide to seek to borrow money to fund all or a portion of any repurchase.

7. Certain Conditions of the Offer. The Fund reserves the right, at any time and from time to time, to extend the period of time

during which the Offer is pending by notifying investors of such extension. If the Fund elects to extend the tender period, for the purpose of determining the purchase price for tendered Interests, the estimated net asset value of such Interests

will be determined approximately one month after the tender offer actually expires. During any such extension, all Interests previously tendered and not withdrawn will remain subject to the Offer. The Fund also reserves the right, at any time and

from time to time, up to and including acceptance of tenders pursuant to the Offer, to: (a) cancel the Offer and in the event of such cancellation, not to purchase or pay for any Interests tendered pursuant to the Offer; (b) amend the

Offer; or (c) postpone the acceptance of Interests tendered. If the Fund determines to amend the Offer or to postpone the acceptance of Interests tendered, it will, to the extent necessary, extend the period of time during which the Offer is

open as provided above and will promptly notify investors.

Please note that just as you have the opportunity to have your Interests

repurchased in the Offer and the right to withdraw your tender on or before the Expiration Date, the Fund has the right to cancel, amend or postpone this offer at any time prior to the earlier to occur of the Valuation Date (as such may be extended

if the Expiration Date is extended) or when the tendered Interests have been accepted by the Fund. The Fund may cancel the Offer, amend the Offer or postpone the acceptance of tenders made pursuant to the Offer if: (a) the Fund would not be

able to liquidate portfolio securities in a manner that is orderly and consistent with the Fund’s investment objectives and policies in order to purchase Interests tendered pursuant to the Offer; (b) there is, in the Directors’

judgment, any (i) legal action or proceeding instituted or threatened challenging the Offer or that otherwise would have a material adverse effect on the Fund, (ii) declaration of a banking moratorium by Federal or state authorities or any

suspension of payment by banks in the United States or New York State that is material to the Fund, (iii) limitation imposed by Federal or state authorities on the extension of credit by lending institutions, (iv) suspension of trading on

any organized exchange or over-the-counter market where the Fund has a material investment, (v) commencement of war, armed hostilities or other international or national calamity directly or indirectly involving the United States that is

material to the Fund, (vi) material decrease in the estimated net asset value of the Fund from the estimated net asset value of the Fund as of the commencement of the Offer, or (vii) other event or condition that would have a material

adverse effect on the Fund or its investors if Interests tendered pursuant to the Offer were purchased; or (c) the Independent Directors of the Fund determine that it is not in the best interest of the Fund to purchase Interests pursuant to the

Offer. However, there can be no assurance that the Fund will exercise its right to extend, amend or cancel the Offer or to postpone acceptance of tenders pursuant to the Offer.

8. Certain Information About the Fund. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940

Act”), as a closed-end, non-diversified, management investment company and is organized as a Delaware limited partnership. The principal executive office of the Fund is located at 4265 San Felipe, 8th Floor, Houston, Texas 77027 and the

telephone number is (713) 993-4675. Interests are not traded on any established trading market and are subject to strict restrictions on transferability pursuant to the LP Agreement. The Investment Adviser’s investment committee

(“Investment Committee”) members are Messrs. Lee G. Partridge, Jeremy L. Radcliffe, William K. Enszer, William B. Hunt and William R. Guinn (the “Managers”). Their address is c/o Endowment Advisers, L.P. at 4265 San Felipe, 8th

Floor, Houston, Texas 77027 and the telephone number is (713) 993-4675.

5

Based on August 31, 2014 estimated values, Mr. John A. Blaisdell , Manager,

Director and Co-Principal Executive Officer of the Fund, beneficially owns $797,530 of Interests in the Fund and an aggregate of $1,061,718 of the Interests in the fund complex.

Based on August 31, 2014 estimated values, Mr. Andrew B. Linbeck, Manager, Director and Co-Principal Executive Officer of the

Fund, beneficially owns $1,129,685 of Interests in the Fund and an aggregate of $1,416,947 of the Interests in the fund complex.

Based on

August 31, 2014 estimated values, Mr. John E. Price, Principal Financial Officer of the Fund, does not have any beneficial ownership in the Fund.

Based on August 31, 2014 estimated values, Mr. A. Haag Sherman, Director of the Fund, does not have any beneficial ownership in the

Fund.

Based on August 31, 2014 estimated values, Mr. Lee G. Partridge, Manager and Chief Investment Officer of the

Investment Adviser, does not have any beneficial ownership in the Fund.

Based on August 31, 2014 estimated values,

Mr. Jeremy L. Radcliffe, Secretary of the Fund, beneficially owns $544,958 on Interests in the Fund and an aggregate of $544,958 of the Interests in the fund complex.

Based on August 31, 2014 estimated values, Mr. Scott E. Schwinger, Independent Director of the Fund, does not have any

beneficial ownership in the Fund, but beneficially owns an aggregate of $235,565 of the Interests in the fund complex.

Based on

August 31, 2014 estimated values, Mr. William K. Enszer, portfolio manager of the Fund, does not have any beneficial ownership in the Fund.

None of the other directors of the Fund have any beneficial ownership in the Fund or the fund complex.

The Fund does not have any plans or proposals that relate to or would result in: (a) the acquisition by any person of additional

Interests (other than the Fund’s intention to accept subscriptions for Interests from time to time in the discretion of the Fund) or the disposition of Interests (except for periodic discretionary solicitations of tender offers); (b) an

extraordinary transaction, such as a merger, reorganization or liquidation, involving the Fund; (c) any material change in the present distribution policy or indebtedness or capitalization of the Fund; (d) any change in the identity of the

Investment Adviser or the Managers or Directors of the Fund, or in the management of the Fund including, but not limited to, any plans or proposals to change the number or the term of the Managers or Directors of the Fund, to fill any existing

vacancy for a Manager or to change any material term of the investment advisory arrangements with the Investment Adviser; (e) a sale or transfer of a material amount of assets of the Fund (other than as the Directors determine may be necessary

or appropriate to fund any portion of the purchase price for Interests acquired pursuant to this Offer to Purchase or in connection with the ordinary portfolio transactions of the Fund); (f) any other material change in the Fund’s

structure or business, including any plans or proposals to make any changes in its fundamental investment policy for which a vote would be required by Section 13 of the 1940 Act; or (g) any changes in the LP Agreement or other actions that

may impede the acquisition of control of the Fund by any person.

9. Certain Federal Income Tax Consequences. The following

discussion is a general summary of the federal income tax consequences of the purchase of Interests by the Fund from investors pursuant to the Offer. Investors should consult their own tax advisers for a complete description of the tax consequences

to them of a purchase of their Interests by the Fund pursuant to the Offer.

An investor who tenders its entire Interest to the Fund for

repurchase generally will recognize capital gain or loss to the extent of the difference between the proceeds received by such investor and such investor’s adjusted tax basis in its Interest. The amount realized will include the investor’s

allocable share of the Fund’s nonrecourse borrowings (as defined for Federal income tax purposes) from the Master Fund, if any. Gain, if any, will be recognized by a tendering investor only as and after the total proceeds received by such

investor exceed the investor’s adjusted tax basis in its Interest. An investor’s basis in its Interest generally will be adjusted for Fund income, gain, deduction or loss allocated, for tax purposes, to the investor for periods prior to

the purchase of the

6

Interest by the Fund. A loss, if any, will be recognized only after the tendering investor has received full payment. This capital gain or loss will be short-term or long-term depending upon the

investor’s holding period for its Interest at the time the gain or loss is recognized. United States Treasury Regulations provide that an investor may have a fragmented holding period for its Interest if the investor has made contributions to