UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22363

SteelPath MLP Funds Trust

(Exact name of registrant as specified in charter)

6803 S. Tucson Way

Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip Code)

Arthur S. Gabinet

OFI SteelPath, Inc.

Two World Financial Center

New York, New York 10281-1008

(Name and address of agent for service)

Registrant's telephone number, including area code: (303) 768-3200

Date of fiscal year end: November 30, 2012

Date of reporting period: November 30, 2012

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

TABLE OF CONTENTS

Oppenheimer SteelPath MLP Funds

|

|

Page

|

|

Letter to Shareholders

|

2

|

|

Growth of a $10,000 Investment and Performance

|

|

|

Select 40 Fund

|

5

|

|

Alpha Fund.

|

6

|

|

Income Fund

|

7

|

|

Alpha Plus Fund

|

8

|

|

Schedules of Investments

|

|

|

Select 40 Fund

|

9

|

|

Alpha Fund.

|

10

|

|

Income Fund

|

11

|

|

Alpha Plus Fund

|

12

|

|

Statements of Assets and Liabilities

|

13

|

|

Statements of Operations

|

14

|

|

Statements of Changes in Net Assets

|

15

|

|

Statements of Cash Flows

|

19

|

|

Financial Highlights

|

|

|

Select 40 Fund

|

20

|

|

Alpha Fund

|

20

|

|

Income Fund

|

22

|

|

Alpha Plus Fund

|

22

|

|

Notes to Financial Statements

|

24

|

|

Report of Independent Registered Public Accounting Firm

|

32

|

|

Expense Example

|

33

|

|

Special Shareholder Meeting

|

35

|

|

Other Information

|

39

|

|

Trustees and Officers

|

40

|

|

Approval of Investment Advisory Agreement

|

44

|

LETTER TO SHAREHOLDERS

To Our Shareholders:

We thank you for investing with Oppenheimer SteelPath MLP Funds. Our fiscal year ended on November 30, 2012 and we would like to share our thoughts on the latest annual period.

The Master Limited Partnership (“MLP”) sector lagged the broader market for the year resulting in the worst period of underperformance since 1999. In part, underperformance appeared to result from March to May commodity price volatility. Though the majority of energy infrastructure focused MLPs have only minimal margin exposure to commodity pricing, MLP equities can exhibit correlation to the broader energy markets, particularly during periods of volatility. Further, over the year, a record $30.3 billion in equity supply, coming from both secondary and initial public offerings, weighed on the sector. While fund flows into closed-end, open-end, and index-based products approximated $8.4 billion, suggesting investor demand remains healthy, we believe this level of supply simply overwhelmed demand.

MLPs, as measured by the Alerian MLP Index (AMZ)1, provided a simple return2 of 7.8% for the period ended November 30, 2012 versus the 13.6% simple return provided by the S&P 500 Index3. Highlighting one of the sector’s attributes, the performance comparison is improved on a total return basis, after distributions or dividends paid are included. Over the same period, MLPs provided a 14.4% total return versus the 16.1% total return provided by the S&P 500 Index.

Macro Review

Over the year, price performance dispersion within the MLP sector appeared to in part reflect heightened investor risk aversion. On average, petroleum transportation focused names performed very well, with an average price return of 17% and a number of individual names soaring 30% or more. However, names with margin exposure to natural gas liquids (NGLs) pricing generally did much worse, with most of those names experiencing a modest to significant correction over the year. More broadly, names that were able to offer very visible paths to robust distribution growth performed extremely well, while those that were not able to provide such visibility, due to commodity price exposure or company specific issues, performed poorly. Importantly, we think such performance bifurcation can often lead to opportunity as market behavior in such times can exhibit exaggerated price performance relative to underlying fundamentals, both on the upside and the downside.

Fund Review

Please refer to pages 5 - 8 of this annual report for the Oppenheimer SteelPath MLP Funds performance covering the results for the 12-month period ending November 30, 2012.

Key contributors to the Oppenheimer SteelPath MLP Alpha and Alpha Plus Funds were Plains All American Pipeline, L.P. (PAA) and Sunoco Logistics Partners, LP (SXL).

PAA continued to benefit from its diverse crude oil handling asset footprint and from strategic acquisition spending. The partnership maintains a highly visible path to future distribution growth and appears on track to meet the higher end of its 7%-9% distribution growth guidance for the year and 7%-8% 2013 guidance.

SXL has benefited from one of the most advantageous crude oil handling asset footprints in the energy infrastructure universe over the last couple of years. As a result, the partnership was able to raise its distribution by 10% in each of the past two quarters resulting in 25% year-over-year growth. Though the historically wide basis differentials that have benefited the partnership may begin to diminish with additional infrastructure, the partnership’s healthy distribution growth has been achieved while maintaining 2.5x distribution coverage providing a prudent cushion for such a shift.

Key detractors to the Oppenheimer SteelPath MLP Alpha and Alpha Plus Funds were Buckeye Partners, L.P. (BPL) and NuStar Energy, L.P. (NS).

BPL suffered from uncertainty related to a Federal Energy Regulatory Commission (FERC) review of certain of its pipeline rate setting methodologies and disappointing first and second quarter earnings reports. However, positive third quarter results, the closing of a key acquisition, and improving clarity related to the company’s Bahamas Oil Refining Company (BORCO) storage facility growth plans began to aid relative unit performance toward the end of the period.

| 2 |

Oppenheimer SteelPath MLP Funds Annual Report

|

NS repeatedly reported disappointing results during the year due to poor hedging and poor asphalt fundamentals, exhausting market patience and creating distribution growth uncertainty. However, the partnership subsequently divested 50% of its asphalt assets and divested a small fuels refinery, the primary contributors to recent earnings volatility. Proceeds from these asset sales as well as an equity offering were used to dramatically increase the partnership’s Eagle Ford liquids handling assets through an acquisition which also added significantly to the partnership’s backlog of organic growth opportunities.

Key contributors to the Oppenheimer SteelPath MLP Income Fund were Inergy Midstream, LP (NRGM) and Holly Energy Partners, LP (HEP).

NRGM completed its IPO in December 2011 and has already been able to provide distribution growth from its stable of quality fee-based assets. The general partner’s sponsor of NRGM, Inergy LP (NRGY), also divested its retail propane assets. While the asset sale did not directly impact NRGM, the transaction improved NRGY’s credit metrics thereby creating a more stable sponsor.

HEP owns and operates well positioned crude oil handling assets and completed the purchase of a 75% stake in the UNEV Pipeline, a refined products pipeline, from its general partner, HollyFrontier Corp. (HFC), during the third quarter. The transaction is expected to provide additional distribution growth and further demonstrates the benefit of the partnership’s relationship with its general partner.

Key detractors to the Oppenheimer SteelPath MLP Income Fund were Buckeye Partners, L.P. (BPL) and Copano Energy, LLC (CPNO).

BPL suffered from uncertainty related to a Federal Energy Regulatory Commission (FERC) review of certain of its pipeline rate setting methodologies and disappointing first and second quarter earnings reporting. However, positive third quarter results, the closing of a key acquisition, and improving clarity related to the company’s Bahamas Oil Refining Company (BORCO) storage facility growth plans began to aid relative unit performance toward the end of the period.

CPNO encountered operating issues as it brought online a new facility to process Eagle Ford gas earlier in the year. These operational missteps as well as commodity price volatility, which was particularly acute for NGLs, created investor uncertainty about the company’s distribution growth capabilities. The partnership appears to have corrected these operational issues and despite continued NGL price weakness was able to report normal distribution coverage metrics in the last period. The Fund sold its position in this investment during the year.

Key contributors to the Oppenheimer SteelPath MLP Select 40 Fund were Plains All American Pipeline, LP (PAA) and Magellan Midstream Partners, LP (MMP).

PAA continued to benefit from its diverse crude oil handling asset footprint and from strategic acquisition spending. The partnership maintains a highly visible path to future distribution growth and appears on track to meet the higher end of its 7%-9% distribution growth guidance for the year and 7%-8% 2013 guidance.

MMP’s advantageous petroleum products pipeline footprint and burgeoning crude oil logistics footprint allowed the partnership to deliver significant distribution growth during the year; the partnership’s third quarter distribution was 21% higher on a year-over-year basis. The partnership also provided 2013 distribution growth guidance of 10%.

Key detractors to the Oppenheimer SteelPath MLP Select 40 Fund were Buckeye Partners, L.P. (BPL) and NuStar Energy, L.P. (NS).

BPL suffered from uncertainty related to a Federal Energy Regulatory Commission (FERC) review of certain of its pipeline rate setting methodologies and disappointing first and second quarter earnings reports. However, positive third quarter results, the closing of a key acquisition, and improving clarity related to the company’s Bahamas Oil Refining Company (BORCO) storage facility growth plans began to aid relative unit performance toward the end of the period.

NS repeatedly reported disappointing results during the year due to poor hedging and poor asphalt fundamentals, exhausting market patience and creating distribution growth uncertainty. However, the partnership subsequently divested 50% of its asphalt assets and divested a small fuels refinery, the primary contributors to recent earnings

| November 30, 2012 |

3

|

volatility. Proceeds from these asset sales as well as an equity offering were used to dramatically increase the partnership’s Eagle Ford liquids handling assets through an acquisition which also added significantly to the partnership’s backlog of organic growth opportunities.

Outlook

Though crude oil and NGL prices may disappoint the market in 2013, as production success could continue to outpace the logistical and industrial changes needed to spur demand, we remain optimistic on midstream MLPs. We note both crude oil and NGL pricing could fall substantially while still supporting robust producer activity and volume growth to the benefit of energy infrastructure operators.

The opportunity set created by the macro trend of dramatic growth in domestic crude oil, natural gas, and NGL production volumes is widespread, robust and long-term in nature. We prefer to seek exposure to these dynamics through names with fee or fee-like exposure to this volume growth versus commodity price exposure as we believe such entities offer the most attractive risk-to-reward opportunity within the sector.

Sincerely,

The OFI SteelPath Investment Committee

This material is not authorized for use unless accompanied or preceded by a prospectus.

Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Total returns of the Funds current to the most recent month-end can be obtained by visiting our website at www.steelpath.com.

|

1

|

The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (AMZ). It is not possible to invest directly in an index. Performance information provided for the Alerian MLP Index is not indicative of the performance of the Oppenheimer SteelPath MLP Funds.

|

|

2

|

Simple return reflects Index performance without including the impact of distributions/dividends. A simple return is also referred to as price return or price appreciation. Total return reflects Index performance including the impact of distributions/dividends.

|

|

3

|

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance and typically does not include fees and expenses. It is not possible to invest directly in an index.

|

| 4 |

Oppenheimer SteelPath MLP Funds Annual Report

|

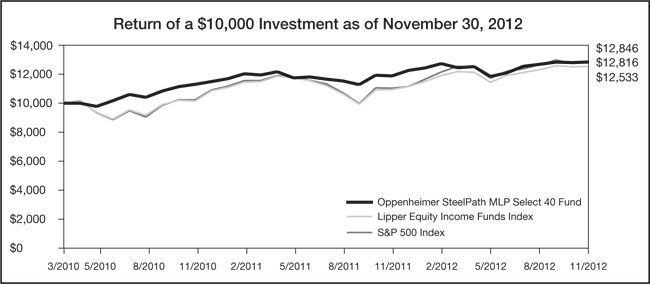

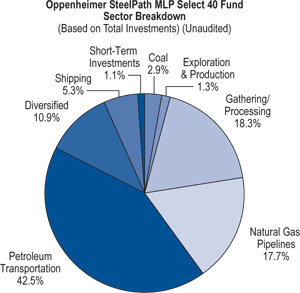

OPPENHEIMER STEELPATH MLP SELECT 40 FUND—GROWTH OF A $10,000 INVESTMENT AND PERFORMANCE

(Unaudited)

The above graph assumes an initial investment of $10,000 in the Class I Shares made at the close of business March 31, 2010 (Commencement of the Fund’s Operations). Performance for the Class A Shares, Class C Shares and Class Y Shares will vary from the performance of the Class I Shares for the Fund due to differences in charges and expenses. Sales load applicable to the Class A Shares or contingent deferred sales charge applicable to Class C Shares would reduce the performance shown above.

|

Annualized

|

|||

|

Total Returns as of November 30, 2012

|

1 Year

|

Since Inception*

|

|

|

Oppenheimer SteelPath MLP Select 40 Fund

|

|||

|

Class I Shares

|

8.11%

|

9.84%

|

|

|

Class A Shares (1)

|

1.70%

|

7.09%

|

|

|

Class C Shares (2)

|

6.36%

|

7.71%

|

|

|

Class Y Shares

|

8.21%

|

9.84%

|

|

|

Lipper Equity Income Funds Index (3)

|

14.51%

|

8.83%

|

|

|

S&P 500 Index (4)

|

16.13%

|

9.74%

|

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. To obtain performance information current to the most recent month-end, please call 1-888-614-6614, or go to www.steelpath.com.

|

*

|

For the period close of business March 31, 2010 (commencement of operations) through November 30, 2012.

|

|

(1)

|

Reflects maximum sales charge of 5.75%.

|

|

(2)

|

Class C Shares commenced operations at the close of business July 14, 2011. 1-Year return reflects contingent deferred sales charge of 1%.

|

|

(3)

|

The Lipper Equity Income Funds Index includes the 30 largest equity income mutual funds tracked by Lipper, Inc. Returns include the reinvestment of distributions but do not consider sales charges. Performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

|

|

(4)

|

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance and typically does not include fees and expenses.

|

The above referenced Indices do not reflect the deduction of fees and taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in their underlying securities.

| November 30, 2012 |

5

|

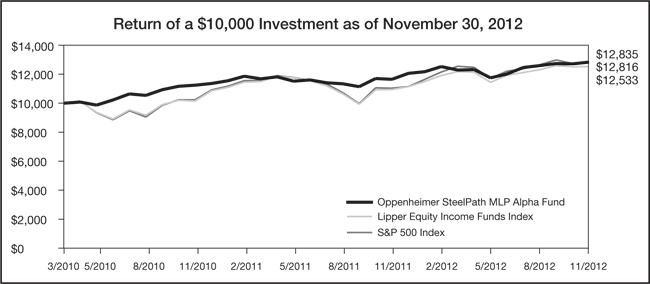

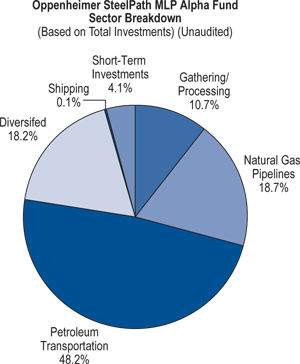

OPPENHEIMER STEELPATH MLP ALPHA FUND—GROWTH OF A $10,000 INVESTMENT AND PERFORMANCE

(Unaudited)

The above graph assumes an initial investment of $10,000 in the Class I Shares made at the close of business March 31, 2010 (Commencement of the Fund’s Operations). Performance for the Class A Shares and Class C Shares will vary from the performance of the Class I Shares for the Fund due to differences in charges and expenses. Sales load applicable to the Class A Shares or contigent deferred sales charge applicable to Class C Shares would reduce the performance shown above.

|

Annualized

|

|||

|

Total Returns as of November 30, 2012

|

1 Year

|

Since Inception*

|

|

|

Oppenheimer SteelPath MLP Alpha Fund

|

|||

|

Class I Shares

|

10.18%

|

9.80%

|

|

|

Class A Shares (1)

|

3.64%

|

7.13%

|

|

|

Class C Shares (2)

|

8.12%

|

14.78%

|

|

|

Lipper Equity Income Funds Index (3)

|

14.51%

|

8.83%

|

|

|

S&P 500 Index (4)

|

16.13%

|

9.74%

|

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. To obtain performance information current to the most recent month-end, please call 1-888-614-6614, or go to www.steelpath.com.

|

*

|

For the period close of business March 31, 2010 (commencement of operations) through November 30, 2012.

|

|

(1)

|

Reflects maximum sales charge of 5.75%.

|

|

(2)

|

Class C Shares commenced operations at the close of business August 25, 2011. 1-Year return reflects contigent deferred sales charge of 1%.

|

|

(3)

|

The Lipper Equity Income Funds Index includes the 30 largest equity income mutual funds tracked by Lipper, Inc. Returns include the reinvestment of distributions but do not consider sales charges. Performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

|

|

(4)

|

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance and typically does not include fees and expenses.

|

The above referenced Indices do not reflect the deduction of fees and taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in their underlying securities.

| 6 |

Oppenheimer SteelPath MLP Funds Annual Report

|

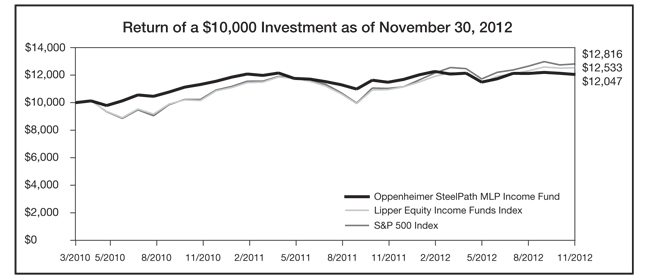

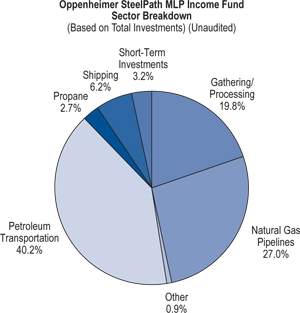

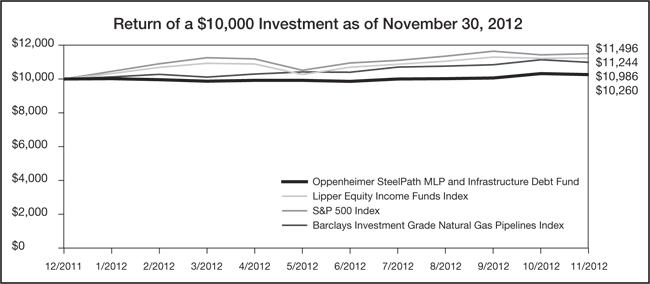

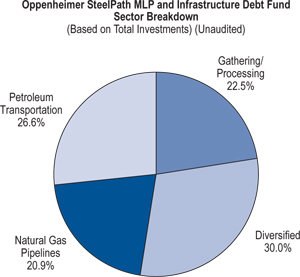

OPPENHEIMER STEELPATH MLP INCOME FUND—GROWTH OF A $10,000 INVESTMENT AND PERFORMANCE

(Unaudited)

The above graph assumes an initial investment of $10,000 in the Class I Shares made at the close of business March 31, 2010 (Commencement of the Fund’s Operations). Performance for the Class A Shares and Class C Shares will vary from the performance of the Class I Shares for the Fund due to differences in charges and expenses. Sales load applicable to the Class A Shares or contigent deferred sales charge applicable to Class C Shares would reduce the performance shown above.

|

Annualized

|

|||

|

Total Returns as of November 30, 2012

|

1 Year

|

Since Inception*

|

|

|

Oppenheimer SteelPath MLP Income Fund

|

|||

|

Class I Shares

|

4.89%

|

7.23%

|

|

|

Class A Shares (1)

|

-1.42%

|

4.66%

|

|

|

Class C Shares (2)

|

2.89%

|

2.53%

|

|

|

Lipper Equity Income Funds Index (3)

|

14.51%

|

8.83%

|

|

|

S&P 500 Index (4)

|

16.13%

|

9.74%

|

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. To obtain performance information current to the most recent month-end, please call 1-888-614-6614, or go to www.steelpath.com.

|

*

|

For the period close of business March 31, 2010 (commencement of operations) through November 30, 2012.

|

|

(1)

|

Reflects maximum sales charge of 5.75%.

|

|

(2)

|

Class C Shares commenced operations at the close of business June 12, 2011. 1-Year return reflects contigent deferred sales charge of 1%.

|

|

(3)

|

The Lipper Equity Income Funds Index includes the 30 largest equity income mutual funds tracked by Lipper, Inc. Returns include the reinvestment of distributions but do not consider sales charges. Performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

|

|

(4)

|

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance and typically does not include fees and expenses.

|

The above referenced Indices do not reflect the deduction of fees and taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in their underlying securities.

| November 30, 2012 |

7

|

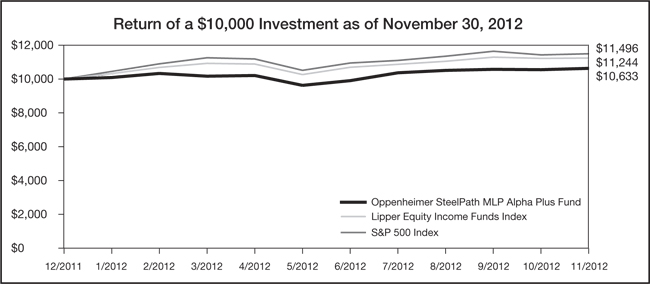

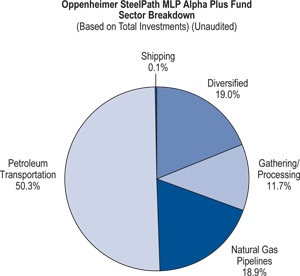

OPPENHEIMER STEELPATH MLP ALPHA PLUS FUND—GROWTH OF A $10,000 INVESTMENT AND PERFORMANCE

(Unaudited)

The above graph assumes an initial investment of $10,000 in the Class I Shares made at the close of business December 30, 2011 (Commencement of the Fund’s Operations). Performance for the Class A Shares and Class C Shares will vary from the performance of the Class I Shares for the Fund due to differences in charges and expenses. Sales load applicable to the Class A Shares or contigent deferred sales charge applicable to Class C Shares would reduce the performance shown above.

|

Total Returns as of November 30, 2012

|

Since Inception*

|

|

Oppenheimer SteelPath MLP Alpha Plus Fund

|

|

|

Class I Shares

|

6.33%

|

|

Class A Shares (1)(2)

|

-1.47%

|

|

Class C Shares (3)

|

7.39%

|

|

Lipper Equity Income Funds Index (4)

|

12.44%

|

|

S&P 500 Index (5)

|

14.96%

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. To obtain performance information current to the most recent month-end, please call 1-888-614-6614, or go to www.steelpath.com.

|

*

|

For the period close of business December 30, 2011 (commencement of operations) through November 30, 2012.

|

|

(1)

|

Class A Shares commenced operations at the close of business February 6, 2012.

|

|

(2)

|

Reflects maximum sales charge of 5.75%.

|

|

(3)

|

Class C Shares commenced operations at the close of business May 22, 2012. Since inception return reflects contingent deferred sales charge of 1%.

|

|

(4)

|

The Lipper Equity Income Funds Index includes the 30 largest equity income mutual funds tracked by Lipper, Inc. Returns include the reinvestment of distributions but do not consider sales charges. Performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

|

|

(5)

|

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance and typically does not include fees and expenses.

|

The above referenced Indices do not reflect the deduction of fees and taxes associated with a mutual fund, such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in their underlying securities.

| 8 |

Oppenheimer SteelPath MLP Funds Annual Report

|

SCHEDULE OF INVESTMENTS

November 30, 2012

Oppenheimer SteelPath MLP Select 40 Fund

|

Description

|

Shares

|

Fair Value

|

||||||

|

Master Limited Partnership Shares — 104.9%

|

||||||||

|

Coal — 3.1%

|

||||||||

|

Alliance Holdings GP LP

|

284,275 | $ | 13,045,380 | |||||

|

Alliance Resource Partners LP

|

277,788 | 15,797,803 | ||||||

|

PVR, Partners LP

|

105,929 | 2,551,830 | ||||||

|

Total Coal

|

31,395,013 | |||||||

|

Diversified — 11.5%

|

||||||||

|

Enterprise Products Partners LP

|

968,125 | 50,177,919 | ||||||

|

ONEOK Partners LP

|

590,536 | 34,398,722 | ||||||

|

Williams Partners LP

|

668,899 | 34,053,648 | ||||||

|

Total Diversified

|

118,630,289 | |||||||

|

Exploration & Production — 1.4%

|

||||||||

|

EV Energy Partners LP

|

144,543 | 8,773,760 | ||||||

|

Linn Energy LLC

|

141,897 | 5,623,378 | ||||||

|

Total Exploration & Production

|

14,397,138 | |||||||

|

Gathering/Processing — 19.4%

|

||||||||

|

Access Midstream Partners LP

|

962,048 | 33,662,059 | ||||||

|

Compressco Partners LP

|

375,880 | 6,502,724 | ||||||

|

Crosstex Energy LP

|

380,724 | 5,741,318 | ||||||

|

DCP Midstream Partners LP

|

571,382 | 23,929,478 | ||||||

|

Exterran Partners LP

|

803,648 | 17,495,417 | ||||||

|

MarkWest Energy Partners LP

|

486,131 | 25,123,250 | ||||||

|

Regency Energy Partners LP

|

1,224,378 | 27,389,336 | ||||||

|

Summit Midstream Partners LP (1)

|

496,316 | 9,807,204 | ||||||

|

Targa Resources Partners LP

|

381,230 | 14,360,934 | ||||||

|

Western Gas Partners LP

|

713,611 | 34,938,395 | ||||||

|

Total Gathering/Processing

|

198,950,115 | |||||||

|

Natural Gas Pipelines — 18.8%

|

||||||||

|

Boardwalk Pipeline Partners LP

|

996,370 | 25,696,382 | ||||||

|

El Paso Pipeline Partners LP

|

1,080,287 | 40,327,114 | ||||||

|

Energy Transfer Equity LP

|

876,564 | 39,857,365 | ||||||

|

Energy Transfer Partners LP

|

659,551 | 28,947,693 | ||||||

|

EQT Midstream Partners LP

|

130,532 | 4,009,943 | ||||||

|

Inergy Midstream LP

|

123,047 | 2,894,065 | ||||||

|

Spectra Energy Partners LP

|

950,178 | 28,305,803 | ||||||

|

TC Pipelines LP

|

542,505 | 22,617,034 | ||||||

|

Total Natural Gas Pipelines

|

192,655,399 | |||||||

|

Petroleum Transportation — 45.1%

|

||||||||

|

Buckeye Partners LP

|

795,343 | 39,973,939 | ||||||

|

Delek Logistics Partners LP (1)

|

152,679 | 3,427,643 | ||||||

|

Enbridge Energy Partners LP

|

1,545,615 | 44,853,747 | ||||||

|

Genesis Energy LP

|

1,301,647 | 46,690,078 | ||||||

|

Global Partners LP

|

911,620 | 22,699,338 | ||||||

|

Holly Energy Partners LP

|

701,289 | 47,091,556 | ||||||

|

Magellan Midstream Partners LP

|

1,070,303 | 47,607,078 | ||||||

|

Martin Midstream Partners LP

|

217,392 | 6,700,022 | ||||||

|

MPLX LP (1)

|

135,059 | 3,897,803 | ||||||

|

NuStar Energy LP

|

821,918 | 37,676,721 | ||||||

|

NuStar GP Holdings LLC

|

828,671 | 23,186,215 | ||||||

|

Oiltanking Partners LP

|

449,737 | 16,667,253 | ||||||

|

Plains All American Pipeline LP

|

1,188,121 | 55,342,676 | ||||||

|

Sunoco Logistics Partners LP

|

905,738 | $ | 46,029,605 | |||||

|

Tesoro Logistics LP

|

318,200 | 14,669,020 | ||||||

|

TransMontaigne Partners LP

|

190,120 | 6,602,868 | ||||||

|

Total Petroleum Transportation

|

463,115,562 | |||||||

|

Shipping — 5.6%

|

||||||||

|

Golar LNG Partners LP

|

768,823 | 22,987,808 | ||||||

|

Seadrill Partners LLC (1)

|

28,252 | 742,180 | ||||||

|

Teekay LNG Partners LP

|

892,246 | 33,762,588 | ||||||

|

Total Shipping

|

57,492,576 | |||||||

|

Total Master Limited Partnership Shares

|

||||||||

|

(identified cost $875,061,557)

|

1,076,636,092 | |||||||

|

Short-Term Investments — 1.2%

|

||||||||

|

Money Market — 1.2%

|

||||||||

|

Fidelity Treasury Portfolio, 0.010% (2)

|

11,983,180 | 11,983,180 | ||||||

|

Total Short-Term Investments

|

||||||||

|

(identified cost $11,983,180)

|

11,983,180 | |||||||

|

Total Investments — 106.1%

|

||||||||

|

(identified cost $887,044,737)

|

1,088,619,272 | |||||||

|

Liabilities In Excess of Other Assets — (6.1)%

|

(62,658,863 | ) | ||||||

|

Net Assets — 100.0%

|

$ | 1,025,960,409 | ||||||

LLC — Limited Liability Company

LP — Limited Partnership

|

(1)

|

Non-income producing security.

|

|

(2)

|

Variable rate security; the coupon rate represents the rate at November 30, 2012.

|

See accompanying Notes to Financial Statements.

| November 30, 2012 |

9

|

SCHEDULE OF INVESTMENTS

November 30, 2012

Oppenheimer SteelPath MLP Alpha Fund

|

Description

|

Shares

|

Fair Value

|

||||||

|

Master Limited Partnership Shares — 104.5%

|

||||||||

|

Diversified — 19.9%

|

||||||||

|

Enterprise Products Partners LP

|

1,342,632 | $ | 69,588,616 | |||||

|

ONEOK Partners LP

|

839,928 | 48,925,806 | ||||||

|

Williams Partners LP

|

880,735 | 44,838,219 | ||||||

|

Total Diversified

|

163,352,641 | |||||||

|

Gathering/Processing — 11.7%

|

||||||||

|

MarkWest Energy Partners LP

|

809,648 | 41,842,609 | ||||||

|

Regency Energy Partners LP

|

1,660,293 | 37,140,754 | ||||||

|

Western Gas Partners LP

|

349,152 | 17,094,482 | ||||||

|

Total Gathering/Processing

|

96,077,845 | |||||||

|

Natural Gas Pipelines — 20.3%

|

||||||||

|

El Paso Pipeline Partners LP

|

1,520,181 | 56,748,357 | ||||||

|

Energy Transfer Equity LP

|

1,031,041 | 46,881,434 | ||||||

|

EQT Midstream Partners LP

|

104,830 | 3,220,378 | ||||||

|

Spectra Energy Partners LP

|

868,400 | 25,869,636 | ||||||

|

TC Pipelines LP

|

820,381 | 34,201,684 | ||||||

|

Total Natural Gas Pipelines

|

166,921,489 | |||||||

|

Petroleum Transportation — 52.5%

|

||||||||

|

Buckeye Partners LP

|

586,557 | 29,480,355 | ||||||

|

Enbridge Energy Partners LP

|

1,458,593 | 42,328,369 | ||||||

|

Genesis Energy LP

|

1,481,330 | 53,135,307 | ||||||

|

Holly Energy Partners LP

|

783,312 | 52,599,401 | ||||||

|

Magellan Midstream Partners LP

|

1,016,609 | 45,218,768 | ||||||

|

MPLX LP (1)

|

236,238 | 6,817,829 | ||||||

|

NuStar Energy LP

|

885,523 | 40,592,374 | ||||||

|

Oiltanking Partners LP

|

115,614 | 4,284,655 | ||||||

|

Plains All American Pipeline LP

|

1,500,294 | 69,883,694 | ||||||

|

Sunoco Logistics Partners LP

|

990,851 | 50,355,048 | ||||||

|

Tesoro Logistics LP

|

484,848 | 22,351,493 | ||||||

|

TransMontaigne Partners LP

|

437,889 | 15,207,885 | ||||||

|

Total Petroleum Transportation

|

432,255,178 | |||||||

|

Shipping — 0.1%

|

||||||||

|

Seadrill Partners LLC (1)

|

39,743 | 1,044,049 | ||||||

|

Total Master Limited Partnership Shares

|

||||||||

|

(identified cost $693,957,005)

|

859,651,202 | |||||||

|

Short-Term Investments — 4.5%

|

||||||||

|

Money Market — 4.5%

|

||||||||

|

Fidelity Treasury Portfolio, 0.010% (2)

|

36,591,989 | $ | 36,591,989 | |||||

|

Total Short-Term Investments

|

||||||||

|

(identified cost $36,591,989)

|

36,591,989 | |||||||

|

Total Investments — 109.0%

|

||||||||

|

(identified cost $730,548,994)

|

896,243,191 | |||||||

|

Liabilities In Excess of Other Assets — (9.0)%

|

(73,971,489 | ) | ||||||

|

Net Assets — 100.0%

|

$ | 822,271,702 | ||||||

LLC — Limited Liability Company

LP — Limited Partnership

|

(1)

|

Non-income producing security.

|

|

(2)

|

Variable rate security; the coupon rate represents the rate at November 30, 2012.

|

See accompanying Notes to Financial Statements.

| 10 |

Oppenheimer SteelPath MLP Funds Annual Report

|

SCHEDULE OF INVESTMENTS

November 30, 2012

Oppenheimer SteelPath MLP Income Fund

|

Description

|

Shares

|

Fair Value

|

||||||

|

Master Limited Partnership Shares — 99.7%

|

||||||||

|

Gathering/Processing — 20.4%

|

||||||||

|

American Midstream Partners LP (1)

|

394,713 | $ | 6,414,086 | |||||

|

Compressco Partners LP

|

404,997 | 7,006,448 | ||||||

|

Crosstex Energy LP

|

530,379 | 7,998,115 | ||||||

|

Exterran Partners LP

|

1,082,252 | 23,560,626 | ||||||

|

Regency Energy Partners LP

|

1,276,308 | 28,551,010 | ||||||

|

Southcross Energy Partners LP (1)

|

306,702 | 7,201,363 | ||||||

|

Summit Midstream Partners LP (1)

|

695,905 | 13,751,083 | ||||||

|

Targa Resources Partners LP

|

223,873 | 8,433,296 | ||||||

|

Total Gathering/Processing

|

102,916,027 | |||||||

|

Natural Gas Pipelines — 27.7%

|

||||||||

|

Boardwalk Pipeline Partners LP

|

1,137,081 | 29,325,319 | ||||||

|

Energy Transfer Equity LP

|

419,281 | 19,064,707 | ||||||

|

Energy Transfer Partners LP

|

855,629 | 37,553,557 | ||||||

|

Inergy Midstream LP

|

1,423,398 | 33,478,321 | ||||||

|

TC Pipelines LP

|

495,302 | 20,649,140 | ||||||

|

Total Natural Gas Pipelines

|

140,071,044 | |||||||

|

Other — 1.0%

|

||||||||

|

Hi-Crush Partners LP (1)

|

314,943 | 4,869,019 | ||||||

|

Petroleum Transportation — 41.4%

|

||||||||

|

Buckeye Partners LP

|

617,464 | 31,033,741 | ||||||

|

Delek Logistics Partners LP (1)

|

52,142 | 1,170,588 | ||||||

|

Enbridge Energy Partners LP

|

1,172,605 | 34,028,997 | ||||||

|

Global Partners LP

|

1,041,706 | 25,938,479 | ||||||

|

Holly Energy Partners LP

|

463,786 | 31,143,230 | ||||||

|

Martin Midstream Partners LP

|

680,512 | 20,973,380 | ||||||

|

NuStar Energy LP

|

683,149 | 31,315,550 | ||||||

|

Plains All American Pipeline LP

|

356,876 | 16,623,284 | ||||||

|

TransMontaigne Partners LP

|

481,962 | 16,738,540 | ||||||

|

Total Petroleum Transportation

|

208,965,789 | |||||||

|

Propane — 2.8%

|

||||||||

|

Amerigas Partners LP

|

122,190 | 4,971,911 | ||||||

|

Ferrellgas Partners LP

|

209,532 | 3,911,963 | ||||||

|

Suburban Propane Partners LP

|

131,839 | 5,193,138 | ||||||

|

Total Propane

|

14,077,012 | |||||||

|

Shipping — 6.4%

|

||||||||

|

Seadrill Partners LLC (1)

|

22,248 | 584,455 | ||||||

|

Teekay LNG Partners LP

|

839,659 | 31,772,697 | ||||||

|

Total Shipping

|

32,357,152 | |||||||

|

Total Master Limited Partnership Shares

|

||||||||

|

(identified cost $468,004,465)

|

503,256,043 | |||||||

|

Short-Term Investments — 3.2%

|

||||||||

|

Money Market — 3.2%

|

||||||||

|

Fidelity Treasury Portfolio, 0.010% (2)

|

16,391,469 | $ | 16,391,469 | |||||

|

Total Short-Term Investments

|

||||||||

|

(identified cost $16,391,469)

|

16,391,469 | |||||||

|

Total Investments — 102.9%

|

||||||||

|

(identified cost $484,395,934)

|

519,647,512 | |||||||

|

Liabilities In Excess of Other Assets — (2.9)%

|

(14,858,395 | ) | ||||||

|

Net Assets — 100.0%

|

$ | 504,789,117 | ||||||

LLC — Limited Liability Company

LP — Limited Partnership

|

(1)

|

Non-income producing security.

|

|

(2)

|

Variable rate security; the coupon rate represents the rate at November 30, 2012.

|

See accompanying Notes to Financial Statements.

| November 30, 2012 |

11

|

SCHEDULE OF INVESTMENTS

November 30, 2012

Oppenheimer SteelPath MLP Alpha Plus Fund

|

Description

|

Shares

|

Fair Value

|

||||||

|

Master Limited Partnership Shares — 135.7%

|

||||||||

|

Diversified — 25.8%

|

||||||||

|

Enterprise Products Partners LP (1)

|

19,434 | $ | 1,007,264 | |||||

|

ONEOK Partners LP (1)

|

12,151 | 707,796 | ||||||

|

Williams Partners LP (1)

|

12,572 | 640,041 | ||||||

|

Total Diversified

|

2,355,101 | |||||||

|

Gathering/Processing — 15.8%

|

||||||||

|

MarkWest Energy Partners LP (1)

|

12,863 | 664,760 | ||||||

|

Regency Energy Partners LP (1)

|

23,938 | 535,493 | ||||||

|

Western Gas Partners LP (1)

|

4,887 | 239,267 | ||||||

|

Total Gathering/Processing

|

1,439,520 | |||||||

|

Natural Gas Pipelines — 25.7%

|

||||||||

|

El Paso Pipeline Partners LP (1)

|

21,447 | 800,616 | ||||||

|

Energy Transfer Equity LP (1)

|

14,912 | 678,049 | ||||||

|

EQT Midstream Partners LP (1)

|

1,534 | 47,124 | ||||||

|

Spectra Energy Partners LP (1)

|

10,845 | 323,073 | ||||||

|

TC Pipelines LP (1)

|

11,858 | 494,360 | ||||||

|

Total Natural Gas Pipelines

|

2,343,222 | |||||||

|

Petroleum Transportation — 68.3%

|

||||||||

|

Buckeye Partners LP (1)

|

8,470 | 425,702 | ||||||

|

Enbridge Energy Partners LP (1)

|

21,055 | 611,016 | ||||||

|

Genesis Energy LP (1)

|

21,400 | 767,618 | ||||||

|

Holly Energy Partners LP (1)

|

11,187 | 751,207 | ||||||

|

Magellan Midstream Partners LP (1)

|

14,619 | 650,253 | ||||||

|

MPLX LP (2)

|

3,415 | 98,557 | ||||||

|

NuStar Energy LP (1)

|

12,833 | 588,265 | ||||||

|

Oiltanking Partners LP (1)

|

1,680 | 62,261 | ||||||

|

Plains All American Pipeline LP (1)

|

21,637 | 1,007,852 | ||||||

|

Sunoco Logistics Partners LP (1)

|

14,223 | 722,813 | ||||||

|

Tesoro Logistics LP

|

7,010 | 323,161 | ||||||

|

TransMontaigne Partners LP (1)

|

6,358 | 220,813 | ||||||

|

Total Petroleum Transportation

|

6,229,518 | |||||||

|

Shipping — 0.1%

|

||||||||

|

Seadrill Partners LLC (2)

|

589 | $ | 15,473 | |||||

|

Total Master Limited Partnership Shares

|

||||||||

|

(identified cost $12,109,836)

|

12,382,834 | |||||||

|

Total Investments — 135.7%

|

||||||||

|

(identified cost $12,109,836)

|

12,382,834 | |||||||

|

Liabilities In Excess of

Other Assets — (35.7)%

|

(3,260,211 | ) | ||||||

|

Net Assets — 100.0%

|

$ | 9,122,623 | ||||||

LLC — Limited Liability Company

LP — Limited Partnership

|

(1)

|

As of November 30, 2012, all or a portion of the security has been pledged as collateral for a Fund loan. The market value of the securities in the pledged account totaled $8,222,472 as of November 30, 2012. The loan agreement requires continuous collateral whether the loan has a balance or not. See Note 6 to the financial statements.

|

|

(2)

|

Non-income producing security.

|

See accompanying Notes to Financial Statements.

| 12 |

Oppenheimer SteelPath MLP Funds Annual Report

|

STATEMENTS OF ASSETS AND LIABILITIES

November 30, 2012

Oppenheimer SteelPath MLP Funds

|

|

Oppenheimer

SteelPath MLP

Select 40 Fund

|

Oppenheimer

SteelPath MLP

Alpha Fund

|

Oppenheimer

SteelPath MLP

Income Fund

|

Oppenheimer

SteelPath MLP

Alpha Plus Fund*

|

||||||||||||

|

Assets:

|

||||||||||||||||

|

Investment securities:

|

||||||||||||||||

|

At acquisition cost

|

$ | 887,044,737 | $ | 730,548,994 | $ | 484,395,934 | $ | 12,109,836 | ||||||||

|

At fair value

|

$ | 1,088,619,272 | $ | 896,243,191 | $ | 519,647,512 | $ | 12,382,834 | ||||||||

|

Cash

|

— | — | — | 193,999 | ||||||||||||

|

Deferred tax asset

|

25,631,073 | 22,193,371 | 4,536,061 | 42,528 | ||||||||||||

|

Dividends receivable

|

123 | 263 | 109 | — | ||||||||||||

|

Receivable for investments sold

|

— | — | — | 185,071 | ||||||||||||

|

Receivable for capital stock sold

|

3,095,297 | 1,281,017 | 1,817,085 | — | ||||||||||||

|

Prepaid expenses

|

241,771 | 181,006 | 101,335 | 23,253 | ||||||||||||

|

Total assets

|

1,117,587,536 | 919,898,848 | 526,102,102 | 12,827,685 | ||||||||||||

|

Liabilities:

|

||||||||||||||||

|

Interest expense payable

|

— | — | — | 528 | ||||||||||||

|

Payable for capital stock redeemed

|

606,165 | 11,622,314 | 2,644,625 | 4,764 | ||||||||||||

|

Payable for investments purchased

|

2,159,265 | 11,520,412 | — | 358,217 | ||||||||||||

|

Deferred tax liability

|

88,188,477 | 73,690,328 | 18,172,144 | 92,130 | ||||||||||||

|

Payable to Advisor

|

390,227 | 559,042 | 193,928 | 15,908 | ||||||||||||

|

Payable for 12b-1 fees, Class A

|

36,907 | 32,973 | 93,073 | 1,444 | ||||||||||||

|

Payable for 12b-1 fees, Class C

|

1,441 | 970 | 2,367 | 37 | ||||||||||||

|

Line of Credit

|

— | — | — | 3,161,204 | ||||||||||||

|

Other liabilities

|

244,645 | 201,107 | 206,848 | 70,830 | ||||||||||||

|

Total liabilities

|

91,627,127 | 97,627,146 | 21,312,985 | 3,705,062 | ||||||||||||

|

Total Net Assets

|

$ | 1,025,960,409 | $ | 822,271,702 | $ | 504,789,117 | $ | 9,122,623 | ||||||||

|

Net Assets Consist of:

|

||||||||||||||||

|

Paid-in capital

|

$ | 919,443,746 | $ | 734,587,692 | $ | 484,433,045 | $ | 9,038,886 | ||||||||

|

Undistributed net investment loss, net of deferred taxes

|

(8,084,610 | ) | (9,446,628 | ) | (5,301,455 | ) | (42,206 | ) | ||||||||

|

Accumulated undistributed net realized gains/(losses) on investments, net of deferred taxes

|

(12,302,264 | ) | (7,163,324 | ) | 3,413,480 | (45,500 | ) | |||||||||

|

Net unrealized appreciation on investments, net of

deferred taxes

|

126,903,537 | 104,293,962 | 22,244,047 | 171,443 | ||||||||||||

|

Total Net Assets

|

$ | 1,025,960,409 | $ | 822,271,702 | $ | 504,789,117 | $ | 9,122,623 | ||||||||

|

Net Asset Value, Offering Price and Redemption Proceeds Per Share ($0.001 Par Value, Unlimited Shares Authorized)

|

||||||||||||||||

|

Class A Shares:

|

||||||||||||||||

|

Net asset value and redemption proceeds per share

|

$ | 10.67 | $ | 10.70 | $ | 9.83 | $ | 9.93 | ||||||||

|

Offering price per share**

|

$ | 11.32 | $ | 11.35 | $ | 10.43 | $ | 10.54 | ||||||||

|

Class C Shares:

|

||||||||||||||||

|

Net asset value, offering price and redemption proceeds per share

|

$ | 10.64 | $ | 10.64 | $ | 9.75 | $ | 9.91 | ||||||||

|

Class I Shares:

|

||||||||||||||||

|

Net asset value, offering price and redemption proceeds per share

|

$ | 10.77 | $ | 10.78 | $ | 9.89 | $ | 9.96 | ||||||||

|

Class Y Shares:

|

||||||||||||||||

|

Net asset value, offering price and redemption proceeds per share

|

$ | 10.77 | $ | — | $ | — | $ | — | ||||||||

|

Net Assets:

|

||||||||||||||||

|

Class A shares

|

$ | 207,630,613 | $ | 193,974,153 | $ | 333,543,569 | $ | 6,915,159 | ||||||||

|

Class C shares

|

23,371,841 | 14,593,091 | 36,764,228 | 603,908 | ||||||||||||

|

Class I shares

|

733,081,962 | 613,704,458 | 134,481,320 | 1,603,556 | ||||||||||||

|

Class Y shares

|

61,875,993 | — | — | — | ||||||||||||

|

Total Net Assets

|

$ | 1,025,960,409 | $ | 822,271,702 | $ | 504,789,117 | $ | 9,122,623 | ||||||||

|

Shares Outstanding:

|

||||||||||||||||

|

Class A shares

|

19,454,313 | 18,132,280 | 33,937,701 | 696,209 | ||||||||||||

|

Class C shares

|

2,196,608 | 1,371,249 | 3,771,306 | 60,966 | ||||||||||||

|

Class I shares

|

68,048,119 | 56,918,796 | 13,592,888 | 160,991 | ||||||||||||

|

Class Y shares

|

5,743,729 | — | — | — | ||||||||||||

|

Total Shares Outstanding

|

95,442,769 | 76,422,325 | 51,301,895 | 918,166 | ||||||||||||

|

*

|

Fund commenced operations on the close of business on December 30, 2011.

|

|

**

|

Computation of offering price per share 100/94.25 of net asset value.

|

See accompanying Notes to Financial Statements.

| November 30, 2012 |

13

|

STATEMENTS OF OPERATIONS

For the Year/Period Ended November 30, 2012

Oppenheimer SteelPath MLP Funds

|

|

Oppenheimer

SteelPath MLP

Select 40 Fund

|

Oppenheimer

SteelPath MLP

Alpha Fund

|

Oppenheimer

SteelPath MLP

Income Fund

|

Oppenheimer

SteelPath MLP

Alpha Plus Fund*

|

||||||||||||

|

Investment Income:

|

||||||||||||||||

|

Distributions from Master Limited Partnerships

|

$ | 56,796,079 | $ | 41,779,645 | $ | 30,456,837 | $ | 235,815 | ||||||||

|

Less: return of capital on distributions

|

(56,796,079 | ) | (41,779,645 | ) | (30,456,837 | ) | (235,815 | ) | ||||||||

|

Dividend income

|

622,584 | 4,087 | 2,187 | — | ||||||||||||

|

Total investment income

|

622,584 | 4,087 | 2,187 | — | ||||||||||||

|

Expenses:

|

||||||||||||||||

|

Investment advisory fee

|

6,232,786 | 7,696,799 | 3,859,246 | 33,580 | ||||||||||||

|

Administrative fees

|

722,132 | 630,882 | 485,359 | 54,664 | ||||||||||||

|

12b-1 fees, Class A

|

448,493 | 395,394 | 668,935 | 4,068 | ||||||||||||

|

Transfer agent fees

|

246,658 | 171,426 | 288,270 | 51,250 | ||||||||||||

|

Legal, auditing, and other professional fees

|

237,379 | 224,266 | 183,465 | 51,120 | ||||||||||||

|

Registration fees

|

187,419 | 160,333 | 137,325 | 71,611 | ||||||||||||

|

12b-1 fees, Class C

|

116,240 | 52,578 | 161,070 | 2,029 | ||||||||||||

|

Custody fees

|

69,684 | 57,218 | 43,345 | 14,500 | ||||||||||||

|

Trustees' fees

|

60,700 | 60,700 | 60,700 | 45,450 | ||||||||||||

|

Printing and postage

|

60,064 | 60,083 | 50,406 | 21,250 | ||||||||||||

|

Insurance premiums

|

37,650 | 27,078 | 15,920 | 56 | ||||||||||||

|

CCO fees

|

16,889 | 16,889 | 16,889 | 14,667 | ||||||||||||

|

Miscellaneous

|

19,741 | 15,649 | 11,220 | 5,076 | ||||||||||||

|

Total expenses, before waivers

|

8,455,835 | 9,569,295 | 5,982,150 | 369,321 | ||||||||||||

|

Less expense waivers

|

(322,719 | ) | (374,961 | ) | (683,544 | ) | (316,212 | ) | ||||||||

|

Net expenses, before interest on Line of Credit and deferred taxes

|

8,133,116 | 9,194,334 | 5,298,606 | 53,109 | ||||||||||||

|

Interest expense on Line of Credit

|

— | — | — | 14,098 | ||||||||||||

|

Net expenses, before deferred taxes

|

8,133,116 | 9,194,334 | 5,298,606 | 67,207 | ||||||||||||

|

Net investment loss, before deferred taxes

|

(7,510,532 | ) | (9,190,247 | ) | (5,296,419 | ) | (67,207 | ) | ||||||||

|

Deferred tax benefit

|

2,537,665 | 3,231,882 | 1,837,141 | 25,001 | ||||||||||||

|

Net investment loss, net of deferred taxes

|

(4,972,867 | ) | (5,958,365 | ) | (3,459,278 | ) | (42,206 | ) | ||||||||

|

Net Realized and Unrealized Gains/(Losses) on Investments:

|

||||||||||||||||

|

Net Realized Gains/(Losses)

|

||||||||||||||||

|

Investments

|

(17,899,447 | ) | (13,630,283 | ) | 10,668,530 | (72,452 | ) | |||||||||

|

Deferred tax benefit/(expense)

|

6,829,277 | 5,193,992 | (3,835,564 | ) | 26,952 | |||||||||||

|

Net realized gains/(losses), net of deferred taxes

|

(11,070,170 | ) | (8,436,291 | ) | 6,832,966 | (45,500 | ) | |||||||||

|

Net Change in Unrealized Appreciation/(Depreciation)

|

||||||||||||||||

|

Investments

|

126,988,664 | 128,914,908 | 17,439,666 | 272,998 | ||||||||||||

|

Deferred tax expense

|

(46,613,578 | ) | (47,515,360 | ) | (6,258,750 | ) | (101,555 | ) | ||||||||

|

Net change in unrealized appreciation, net of

deferred taxes

|

80,375,086 | 81,399,548 | 11,180,916 | 171,443 | ||||||||||||

|

Net realized and unrealized gains on investments,

net of deferred taxes

|

69,304,916 | 72,963,257 | 18,013,882 | 125,943 | ||||||||||||

|

Change in net assets resulting from operations

|

$ | 64,332,049 | $ | 67,004,892 | $ | 14,554,604 | $ | 83,737 | ||||||||

|

*

|

Fund commenced operations on the close of business on December 30, 2011.

|

See accompanying Notes to Financial Statements.

| 14 |

Oppenheimer SteelPath MLP Funds Annual Report

|

STATEMENTS OF CHANGES IN NET ASSETS

Oppenheimer SteelPath MLP Funds

|

Oppenheimer SteelPath

MLP Select 40 Fund

|

Oppenheimer SteelPath

MLP Alpha Fund

|

|||||||||||||||

|

|

For the

Year Ended

November 30, 2012

|

For the

Year Ended

November 30, 2011

|

For the

Year Ended

November 30, 2012

|

For the

Year Ended

November 30, 2011

|

||||||||||||

|

Increase (Decrease) in Net Assets

|

||||||||||||||||

|

Operations:

|

||||||||||||||||

|

Net investment loss, net of deferred taxes

|

$ | (4,972,867 | ) | $ | (2,802,108 | ) | $ | (5,958,365 | ) | $ | (3,101,216 | ) | ||||

|

Net realized gains/(losses) on investments, net of

deferred taxes

|

(11,070,170 | ) | (1,359,063 | ) | (8,436,291 | ) | 1,416,368 | |||||||||

|

Net change in unrealized appreciation on investments, net of deferred taxes

|

80,375,086 | 24,191,728 | 81,399,548 | 8,895,045 | ||||||||||||

|

Change in net assets resulting from operations

|

64,332,049 | 20,030,557 | 67,004,892 | 7,210,197 | ||||||||||||

|

Distributions to Shareholders:

|

||||||||||||||||

|

Distributions to shareholders from return of capital:

|

||||||||||||||||

|

Class A shares

|

(12,188,081 | ) | (5,094,158 | ) | (10,633,996 | ) | (3,992,751 | ) | ||||||||

|

Class C shares

|

(829,755 | ) | (31,821 | ) | (395,950 | ) | (3,466 | ) | ||||||||

|

Class I shares

|

(41,805,855 | ) | (22,839,711 | ) | (34,503,821 | ) | (22,703,858 | ) | ||||||||

|

Class Y shares

|

(4,411,514 | ) | (5,455,860 | ) | — | — | ||||||||||

|

Change in net assets resulting from distributions to shareholders

|

(59,235,205 | ) | (33,421,550 | ) | (45,533,767 | ) | (26,700,075 | ) | ||||||||

|

Capital Share Transactions:

|

||||||||||||||||

|

Class A

|

||||||||||||||||

|

Shares sold

|

154,256,008 | 88,843,761 | 135,025,877 | 102,233,663 | ||||||||||||

|

Shares issued for reinvestment of distributions

|

11,308,597 | 4,784,179 | 9,364,190 | 3,399,959 | ||||||||||||

|

Shares redeemed

|

(72,254,604 | ) | (21,890,675 | ) | (63,074,653 | ) | (27,710,127 | ) | ||||||||

|

Net increase

|

93,310,001 | 71,737,265 | 81,315,414 | 77,923,495 | ||||||||||||

|

Class C

|

||||||||||||||||

|

Shares sold

|

22,034,118 | 2,861,390 | 14,178,221 | 311,945 | ||||||||||||

|

Shares issued for reinvestment of distributions

|

593,520 | 16,178 | 316,251 | 1,676 | ||||||||||||

|

Shares redeemed

|

(1,991,350 | ) | (17,352 | ) | (245,331 | ) | — | |||||||||

|

Net increase

|

20,636,288 | 2,860,216 | 14,249,141 | 313,621 | ||||||||||||

|

Class I

|

||||||||||||||||

|

Shares sold

|

372,088,606 | 324,932,937 | 250,145,996 | 367,669,736 | ||||||||||||

|

Shares issued for reinvestment of distributions

|

37,790,243 | 18,189,109 | 30,276,817 | 21,187,525 | ||||||||||||

|

Shares redeemed

|

(136,231,551 | ) | (63,879,658 | ) | (136,078,328 | ) | (86,890,001 | ) | ||||||||

|

Net increase

|

273,647,298 | 279,242,388 | 144,344,485 | 301,967,260 | ||||||||||||

|

Class Y

|

||||||||||||||||

|

Shares sold

|

14,126,950 | 18,414,339 | — | — | ||||||||||||

|

Shares issued for reinvestment of distributions

|

3,879,652 | 5,286,443 | — | — | ||||||||||||

|

Shares redeemed

|

(47,126,254 | ) | (29,625,086 | ) | — | — | ||||||||||

|

Net decrease

|

(29,119,652 | ) | (5,924,304 | ) | — | — | ||||||||||

|

Change in net assets resulting from capital share transactions

|

358,473,935 | 347,915,565 | 239,909,040 | 380,204,376 | ||||||||||||

|

Change in net assets

|

363,570,779 | 334,524,572 | 261,380,165 | 360,714,498 | ||||||||||||

|

Net Assets:

|

||||||||||||||||

|

Beginning of year

|

662,389,630 | 327,865,058 | 560,891,537 | 200,177,039 | ||||||||||||

|

End of year

|

$ | 1,025,960,409 | $ | 662,389,630 | $ | 822,271,702 | $ | 560,891,537 | ||||||||

|

Undistributed net investment loss, net of deferred taxes

|

$ | (8,084,610 | ) | $ | (3,335,528 | ) | $ | (9,446,628 | ) | $ | (3,634,763 | ) | ||||

See accompanying Notes to Financial Statements.

| November 30, 2012 |

15

|

STATEMENTS OF CHANGES IN NET ASSETS (Continued)

Oppenheimer SteelPath MLP Funds

|

Oppenheimer SteelPath

MLP Select 40 Fund

|

Oppenheimer SteelPath

MLP Alpha Fund

|

|||||||||||||||

|

|

For the

Year Ended

November 30, 2012

|

For the

Year Ended

November 30, 2011

|

For the

Year Ended

November 30, 2012

|

For the

Year Ended

November 30, 2011

|

||||||||||||

|

Transactions in Shares:

|

||||||||||||||||

|

Class A

|

||||||||||||||||

|

Shares sold

|

14,257,403 | 8,249,610 | 12,749,078 | 9,809,925 | ||||||||||||

|

Shares reinvested

|

1,056,178 | 450,461 | 881,562 | 325,145 | ||||||||||||

|

Shares redeemed

|

(6,744,059 | ) | (2,056,342 | ) | (5,948,491 | ) | (2,629,370 | ) | ||||||||

|

Net increase

|

8,569,522 | 6,643,729 | 7,682,149 | 7,505,700 | ||||||||||||

|

Class C

|

||||||||||||||||

|

Shares sold

|

2,050,660 | 273,663 | 1,334,147 | 30,209 | ||||||||||||

|

Shares reinvested

|

55,707 | 1,526 | 29,918 | 161 | ||||||||||||

|

Shares redeemed

|

(183,301 | ) | (1,647 | ) | (23,186 | ) | — | |||||||||

|

Net Increase

|

1,923,066 | 273,542 | 1,340,879 | 30,370 | ||||||||||||

|

Class I

|

||||||||||||||||

|

Shares sold

|

34,325,767 | 29,909,699 | 23,419,979 | 34,004,107 | ||||||||||||

|

Shares reinvested

|

3,502,960 | 1,700,149 | 2,829,783 | 2,017,337 | ||||||||||||

|

Shares redeemed

|

(12,632,031 | ) | (6,034,881 | ) | (12,695,143 | ) | (8,374,618 | ) | ||||||||

|

Net increase

|

25,196,696 | 25,574,967 | 13,554,619 | 27,646,826 | ||||||||||||

|

Class Y

|

||||||||||||||||

|

Shares sold

|

1,297,061 | 1,711,481 | — | — | ||||||||||||

|

Shares reinvested

|

358,295 | 492,370 | — | — | ||||||||||||

|

Shares redeemed

|

(4,311,082 | ) | (2,711,194 | ) | — | — | ||||||||||

|

Net decrease

|

(2,655,726 | ) | (507,343 | ) | — | — | ||||||||||

|

Net increase from transactions in shares

|

33,033,558 | 31,984,895 | 22,577,647 | 35,182,896 | ||||||||||||

See accompanying Notes to Financial Statements.

| 16 |

Oppenheimer SteelPath MLP Funds Annual Report

|

STATEMENTS OF CHANGES IN NET ASSETS (Continued)

Oppenheimer SteelPath MLP Funds

|

Oppenheimer SteelPath

MLP Income Fund

|

Oppenheimer SteelPath MLP Alpha Plus Fund

|

|||||||||||

|

|

For the

Year Ended

November 30, 2012

|

For the

Year Ended

November 30, 2011

|

For the

Period Ended

November 30, 2012*

|

|||||||||

|

Increase (Decrease) in Net Assets

|

||||||||||||

|

Operations:

|

||||||||||||

|

Net investment loss, net of deferred taxes

|

$ | (3,459,278 | ) | $ | (1,643,402 | ) | $ | (42,206 | ) | |||

|

Net realized gains/(losses) on investments, net of deferred taxes

|

6,832,966 | (514,420 | ) | (45,500 | ) | |||||||

|

Net change in unrealized appreciation on investments, net of deferred taxes

|

11,180,916 | 786,203 | 171,443 | |||||||||

|

Change in net assets resulting from operations

|

14,554,604 | (1,371,619 | ) | 83,737 | ||||||||

|

Distributions to Shareholders:

|

||||||||||||

|

Distributions to shareholders from return of capital:

|

||||||||||||

|

Class A shares

|

(18,950,153 | ) | (9,881,870 | ) | (118,634 | ) | ||||||

|

Class C shares

|

(1,256,275 | ) | (39,741 | ) | (15,486 | ) | ||||||

|

Class I shares

|

(8,487,035 | ) | (6,593,570 | ) | (59,951 | ) | ||||||

|

Distributions to shareholders from return of capital

|

(28,693,463 | ) | (16,515,181 | ) | (194,071 | ) | ||||||

|

Distributions to shareholders from income:

|

||||||||||||

|

Class A shares

|

(2,089,209 | ) | — | — | ||||||||

|

Class C shares

|

(138,501 | ) | — | — | ||||||||

|

Class I shares

|

(935,675 | ) | — | — | ||||||||

|

Distributions to shareholders from income

|

(3,163,385 | ) | — | — | ||||||||

|

Change in net assets resulting from distributions to shareholders

|

(31,856,848 | ) | (16,515,181 | ) | (194,071 | ) | ||||||

|

Capital Share Transactions:

|

||||||||||||

|

Class A

|

||||||||||||

|

Shares sold

|

273,658,796 | 169,059,992 | 7,634,170 | |||||||||

|

Shares issued for reinvestment of distributions

|

15,375,061 | 7,320,977 | 115,630 | |||||||||

|

Shares redeemed

|

(115,908,389 | ) | (51,378,677 | ) | (791,773 | ) | ||||||

|

Net increase

|

173,125,468 | 125,002,292 | 6,958,027 | |||||||||

|

Class C

|

||||||||||||

|

Shares sold

|

35,251,238 | 2,808,325 | 580,917 | |||||||||

|

Shares issued for reinvestment of distributions

|

888,711 | 27,791 | 15,321 | |||||||||

|

Shares redeemed

|

(843,880 | ) | — | (6,672 | ) | |||||||

|

Net increase

|

35,296,069 | 2,836,116 | 589,566 | |||||||||

|

Class I

|

||||||||||||

|

Shares sold

|

105,610,038 | 54,673,813 | 2,866,970 | |||||||||

|

Shares issued for reinvestment of distributions

|

8,372,978 | 5,490,034 | 59,951 | |||||||||

|

Shares redeemed

|

(59,701,957 | ) | (37,558,617 | ) | (1,241,557 | ) | ||||||

|

Net increase

|

54,281,059 | 22,605,230 | 1,685,364 | |||||||||

|

Change in net assets resulting from capital share transactions

|

262,702,596 | 150,443,638 | 9,232,957 | |||||||||

|

Change in net assets

|

245,400,352 | 132,556,838 | 9,122,623 | |||||||||

|

Net Assets:

|

||||||||||||

|

Beginning of year

|

259,388,765 | 126,831,927 | — | |||||||||

|

End of year

|

$ | 504,789,117 | $ | 259,388,765 | $ | 9,122,623 | ||||||

|

Undistributed net investment loss, net of deferred taxes

|

$ | (5,301,455 | ) | $ | (1,936,598 | ) | $ | (42,206 | ) | |||

|

*

|

Fund commenced operations on the close of business on December 30, 2011.

|

See accompanying Notes to Financial Statements.

| November 30, 2012 |

17

|

STATEMENTS OF CHANGES IN NET ASSETS (Continued)

Oppenheimer SteelPath MLP Funds

|

Oppenheimer SteelPath

MLP Income Fund

|

Oppenheimer SteelPath MLP Alpha Plus Fund

|

|||||||||||

|

|

For the

Year Ended

November 30, 2012

|

For the

Year Ended

November 30, 2011

|

For the

Period Ended

November 30, 2012*

|

|||||||||

|

Transactions in Shares:

|

||||||||||||

|

Class A

|

||||||||||||

|

Shares sold

|

26,838,018 | 15,824,526 | 763,735 | |||||||||

|

Shares reinvested

|

1,518,859 | 699,339 | 11,706 | |||||||||

|

Shares redeemed

|

(11,394,240 | ) | (4,948,478 | ) | (79,232 | ) | ||||||

|

Net increase

|

16,962,637 | 11,575,387 | 696,209 | |||||||||

|

Class C

|

||||||||||||

|

Shares sold

|

3,488,506 | 276,187 | 60,112 | |||||||||

|

Shares reinvested

|

88,955 | 2,751 | 1,554 | |||||||||

|

Shares redeemed

|

(85,093 | ) | — | (700 | ) | |||||||

|

Net Increase

|

3,492,368 | 278,938 | 60,966 | |||||||||

|

Class I

|

||||||||||||

|

Shares sold

|

10,275,296 | 5,071,966 | 283,356 | |||||||||

|

Shares reinvested

|

821,796 | 518,056 | 6,079 | |||||||||

|

Shares redeemed

|

(5,810,968 | ) | (3,591,120 | ) | (128,444 | ) | ||||||

|

Net increase

|

5,286,124 | 1,998,902 | 160,991 | |||||||||

|

Net increase from transactions in shares

|

25,741,129 | 13,853,227 | 918,166 | |||||||||

|

*

|

Fund commenced operations on the close of business on December 30, 2011.

|

See accompanying Notes to Financial Statements.

| 18 |

Oppenheimer SteelPath MLP Funds Annual Report

|

STATEMENT OF CASH FLOWS

For the Period Ended November 30, 2012*

Oppenheimer SteelPath MLP Alpha Plus Fund

|

Cash flows from operating activities

|

|

|||

|

Net increase in net assets resulting from operations

|

$ | 83,737 | ||

|

Non cash items included in operations:

|

||||

|

Deferred income taxes

|

49,602 | |||

|

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities:

|

||||

|

Purchases of long-term portfolio investments

|

(15,470,692 | ) | ||

|

Sales of long-term portfolio investments

|

3,052,589 | |||

|

Return of capital on distributions from Master Limited Partnerships

|

235,815 | |||

|

Increase in receivable for investments sold

|

(185,071 | ) | ||

|

Increase in prepaid expenses

|

(23,253 | ) | ||

|

Increase in payable to Advisor

|

15,908 | |||

|

Increase in payable for capital stock redeemed

|

4,764 | |||

|

Increase in payable for investments purchased

|

358,217 | |||

|

Increase in other liabilities

|

70,830 | |||

|

Increase in payable for 12b-1 fees, Class A

|

1,444 | |||

|

Increase in payable for 12b-1 fees, Class C

|

37 | |||

|

Increase in interest expense payable

|

528 | |||

|

Net realized loss on investments

|

72,452 | |||

|

Net change in accumulated unrealized appreciation on investments

|

(272,998 | ) | ||

|

|

||||

|

Net cash used in operating activities

|

(12,006,091 | ) | ||

|

|

||||

|

Cash flows from financing activities

|

||||

|

Proceeds from shares sold

|

11,082,057 | |||

|

Payment of shares redeemed

|

(2,040,002 | ) | ||

|

Distributions paid to shareholders, net of reinvestments

|

(3,169 | ) | ||

|

Net increase in line of credit

|

3,161,204 | |||

|

|

||||

|

Net cash provided by financing activities

|

12,200,090 | |||

|

Net change in cash

|

193,999 | |||

|

|

||||

|

Cash at beginning of period

|

— | |||

|

Cash at end of period

|

$ | 193,999 | ||

Supplemental disclosure of cash flow information:

Cash paid on interest of $13,570

Non-cash financing activities not included consist of reinvestment of dividends and distributions of $190,902.

|

*

|

Fund commenced operations on the close of business on December 30, 2011.

|

See accompanying Notes to Financial Statements.

| November 30, 2012 |

19

|

Selected data for a share outstanding throughout the period indicated.

Oppenheimer SteelPath MLP Funds

|

Income From Operations:

|

Distributions From:

|

|||||||||||||||||||||||||||||||||||

|

Net Asset Value, Beginning of Year/Period

|

Net investment income/(loss)(1)

|

Return of Capital(1)

|

Net Realized and Unrealized Gains (losses)(2)

|

Increase (Decrease) from Operations

|

Return of Capital

|

Total Distributions

|

Net Asset Value, End of Year

|

Total

Return(3)(10)

|

||||||||||||||||||||||||||||

|

Oppenheimer SteelPath Select 40 Fund

|

||||||||||||||||||||||||||||||||||||

|

Class A Shares

|

||||||||||||||||||||||||||||||||||||

|

For the year ended

|

||||||||||||||||||||||||||||||||||||

|

11/30/2012

|

$ | 10.56 | (0.07 | ) | 0.43 | 0.46 | 0.82 | (0.71 | ) | (0.71 | ) | $ | 10.67 | 7.87 | % | |||||||||||||||||||||

|

11/30/2011

|

$ | 10.74 | (0.07 | ) | 0.44 | 0.14 | 0.51 | (0.69 | ) | (0.69 | ) | $ | 10.56 | 4.85 | % | |||||||||||||||||||||

|

For the period from

|

||||||||||||||||||||||||||||||||||||

|

3/31/2010 - 11/30/2010 (6)

|

$ | 10.00 | (0.03 | ) | 0.30 | 0.96 | 1.23 | (0.49 | ) | (0.49 | ) | $ | 10.74 | 12.63 | % | |||||||||||||||||||||

|

Class C Shares

|

||||||||||||||||||||||||||||||||||||

|

For the year ended

|

||||||||||||||||||||||||||||||||||||

|

11/30/2012

|

$ | 10.58 | (0.12 | ) | 0.46 | 0.43 | 0.77 | (0.71 | ) | (0.71 | ) | $ | 10.64 | 7.36 | % | |||||||||||||||||||||

|

For the period from

|

||||||||||||||||||||||||||||||||||||

|

7/14/2011 - 11/30/2011 (7)

|

$ | 10.90 | (0.05 | ) | 0.22 | (0.14 | ) | 0.03 | (0.35 | ) | (0.35 | ) | $ | 10.58 | 0.33 | % | ||||||||||||||||||||

|

Class I Shares

|

||||||||||||||||||||||||||||||||||||

|

For the year ended

|

||||||||||||||||||||||||||||||||||||

|

11/30/2012

|

$ | 10.63 | (0.06 | ) | 0.44 | 0.47 | 0.85 | (0.71 | ) | (0.71 | ) | $ | 10.77 | 8.11 | % | |||||||||||||||||||||

|

11/30/2011

|

$ | 10.78 | (0.06 | ) | 0.43 | 0.17 | 0.54 | (0.69 | ) | (0.69 | ) | $ | 10.63 | 5.12 | % | |||||||||||||||||||||

|

For the period from

|

||||||||||||||||||||||||||||||||||||

|

3/31/2010 - 11/30/2010 (6)

|

$ | 10.00 | (0.02 | ) | 0.30 | 0.99 | 1.27 | (0.49 | ) | (0.49 | ) | $ | 10.78 | 13.04 | % | |||||||||||||||||||||

|

Class Y Shares

|

||||||||||||||||||||||||||||||||||||

|

For the year ended

|

||||||||||||||||||||||||||||||||||||

|

11/30/2012

|

$ | 10.62 | (0.05 | ) | 0.41 | 0.50 | 0.86 | (0.71 | ) | (0.71 | ) | $ | 10.77 | 8.21 | % | |||||||||||||||||||||

|

11/30/2011

|

$ | 10.78 | (0.06 | ) | 0.41 | 0.18 | 0.53 | (0.69 | ) | (0.69 | ) | $ | 10.62 | 5.02 | % | |||||||||||||||||||||

|

For the period from

|

||||||||||||||||||||||||||||||||||||

|

3/31/2010 - 11/30/2010 (6)

|

$ | 10.00 | (0.02 | ) | 0.27 | 1.02 | 1.27 | (0.49 | ) | (0.49 | ) | $ | 10.78 | 13.04 | % | |||||||||||||||||||||

|

Oppenheimer SteelPath Alpha Fund

|

||||||||||||||||||||||||||||||||||||

|

Class A Shares

|

||||||||||||||||||||||||||||||||||||

|

For the year ended

|

||||||||||||||||||||||||||||||||||||

|

11/30/2012

|

$ | 10.38 | (0.10 | ) | 0.41 | 0.70 | 1.01 | (0.69 | ) | (0.69 | ) | $ | 10.70 | 9.93 | % | |||||||||||||||||||||

|

11/30/2011

|

$ | 10.71 | (0.10 | ) | 0.43 | 0.02 | 0.35 | (0.68 | ) | (0.68 | ) | $ | 10.38 | 3.32 | % | |||||||||||||||||||||

|

For the period from

|

||||||||||||||||||||||||||||||||||||

|

3/31/2010 - 11/30/2010 (6)

|