Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-36577

ContraFect Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 39-2072586 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

| 28 Wells Avenue, 3rd Floor Yonkers, NY |

10701 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(914) 207-2300

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class |

Name of Exchange on Which Registered | |

| Common Stock, Par Value $0.0001 per share Class A warrant, exercisable for one share of common stock |

NASDAQ Capital Market NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $120.0 million, based on the closing price of the registrant’s common stock on the NASDAQ Capital Market on June 30, 2015 of $5.25 per share.

As of March 9, 2016, there were 27,484,005 shares of Common Stock, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of Contents

| Page | ||||||

| PART I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

30 | |||||

| Item 1B. |

59 | |||||

| Item 2. |

59 | |||||

| Item 3. |

59 | |||||

| Item 4. |

59 | |||||

| PART II | ||||||

| Item 5. |

60 | |||||

| Item 6. |

61 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

61 | ||||

| Item 7A. |

71 | |||||

| Item 8. |

71 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

71 | ||||

| Item 9A. |

71 | |||||

| Item 9B. |

72 | |||||

| PART III | ||||||

| Item 10. |

73 | |||||

| Item 11. |

79 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

87 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

90 | ||||

| Item 14. |

92 | |||||

| PART IV | ||||||

| Item 15. |

93 | |||||

i

Table of Contents

References to ContraFect

Throughout this Annual Report on Form 10-K, the “Company,” “ContraFect,” “we,” “us,” and “our,” except where the context requires otherwise, refer to ContraFect Corporation, and “our board of directors” refers to the board of directors of ContraFect Corporation.

All brand names or trademarks appearing in this Annual Report on Form 10-K are the property of their respective holders.

Forward Looking Information

The information in this Annual Report on Form 10-K contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management. The words “anticipates”, “believes”, “estimates”, “expects”, “intends”, “targets”, “may”, “plans”, “projects”, “potential”, “will”, “would”, “could” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. All such forward-looking statements involve significant risks and uncertainties, including, but not limited to, statements regarding:

| • | the success, cost, timing and potential indications of our product development activities and clinical trials; |

| • | our ability to advance into and through clinical development and ultimately obtain FDA approval for our product candidates; |

| • | our future marketing and sales programs; |

| • | the rate and degree of market acceptance of our product candidates and our expectations regarding the size of the commercial markets for our product candidates; |

| • | our research and development plans and ability to bring forward additional product candidates into preclinical and clinical development; |

| • | the effect of competition and proprietary rights of third parties; |

| • | the availability of and our ability to obtain additional financing; |

| • | the effects of existing and future federal, state and foreign regulations; |

| • | the seeking of joint development, licensing or distribution and collaboration and marketing arrangements with third parties; and |

| • | the period of time for which our existing cash and cash equivalents will enable us to fund our operations. |

As more fully described under the heading “Risk Factors” contained elsewhere in this Annual Report on Form 10-K, many important factors affect our ability to achieve our stated objectives and to develop and commercialize any product candidates. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation, the risks and uncertainties set forth in our filings with the SEC. You should read this Annual Report on Form 10-K and the documents that we have filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

ii

Table of Contents

We are a clinical-stage biotechnology company focused on discovering and developing therapeutic protein and antibody products for the treatment of life-threatening infectious diseases, including those caused by drug-resistant pathogens, particularly those treated in hospital settings. Drug-resistant infections account for two million illnesses in the United States and 700,000 deaths worldwide each year. We intend to address drug-resistant infections using product candidates from our lysin and monoclonal antibody platforms that target conserved regions of either bacteria or viruses. Lysins are enzymes derived from naturally occurring bacteriophage which are viruses that infect bacteria. When recombinantly produced and then applied to bacteria, lysins cleave a key component of the target bacteria’s peptidoglycan cell wall, which results in rapid bacterial cell death. Lysins kill bacteria faster than conventional antibiotics, which typically require bacterial cell division and metabolism in order to kill or stop the growth of bacteria. We believe that the properties of our lysins will make them suitable for targeting antibiotic-resistant organisms, such as Staphylococcus aureus (“Staph aureus”) which causes serious infections such as bacteremia, pneumonia and osteomyelitis. In addition, our lysins have demonstrated the ability to clear biofilms in animal models, and we believe they may be useful for the treatment of biofilm-related infections in prosthetic joints, indwelling devices and catheters. Beyond our lysin programs, we are exploring therapies using monoclonal antibodies (“mAbs”) designed to bind to viral targets. Our approach to antibody therapy employs a combination of multiple mAbs to either achieve greater efficacy or provide broader coverage across pathogenic strains.

In August 2015, our most advanced lysin product candidate, CF-301, was granted fast track designation for the treatment of Staph aureus bacteremia, including endocarditis. CF-301 recently concluded a Phase 1 single ascending dose study in healthy volunteers. The study was designed as a randomized, double-blind, placebo-controlled trial in order to evaluate the safety, tolerability and pharmacokinetics of CF-301 alone, administered as a two hour IV infusion. As specified in the protocol, an independent data safety monitoring board (the “DSMB”) reviewed the safety, tolerability, and pharmacokinetic data from healthy volunteers dosed in all of the planned cohorts. The DSMB observed no clinical adverse safety signals associated with CF-301 in the study. We intend to pursue an initial indication for the treatment of Staph aureus bacteremia, including endocarditis, caused by methicillin-resistant (“MRSA”) or methicillin-susceptible (“MSSA”) Staph aureus. We believe CF-301 may also be developed for the treatment of Staph aureus pneumonia, osteomyelitis, and biofilm-related infections in prosthetic joints, indwelling devices and catheters. Our second product candidate, CF-404, is a combination of three human mAbs for the treatment of life-threatening human influenza, including all seasonal and most pandemic varieties. We are also advancing earlier stage programs that leverage the lysin and monoclonal antibody platforms.

Our Strategy

Our strategy is to use our therapeutic products to achieve a leading market position in the treatment of life-threatening infectious diseases, including those caused by drug-resistant pathogens. We plan to pursue commercialization of therapeutic products through discovery, acquisition and development as follows:

| • | Advance our lead product candidate, CF-301, through clinical trials and demonstrate superiority of our therapy combined with standard-of-care (“SOC”) drugs over SOC alone for the treatment of Staph aureus bacteremia; |

| • | Advance CF-404 through preclinical studies and clinical trials for the treatment of life-threatening complicated influenza; |

| • | Advance additional product candidates from our lysin portfolio, including lysins to gram-negative bacteria; |

| • | Acquire additional foundation technologies that enable the efficient discovery of anti-infective agents; and |

| • | Acquire clinical stage therapies that treat infectious diseases through unique mechanisms of action. |

1

Table of Contents

Our Indications

Staph aureus bacteremia

In the United States (“U.S.”) alone there are approximately 120,000 cases annually of Staph aureus bacteremia, a bloodstream infection, which causes approximately 30,000 deaths. Staph aureus bacteremia can be further complicated when the infection spreads into the heart muscle, heart valves or lining of the heart, causing endocarditis. Even with current SOC antibiotic therapy, the resulting damage to the heart muscle or heart valves could require surgery to prevent stroke, heart failure or severe organ damage. Of further concern, drug-resistant strains of Staph aureus are now evolving additional resistance against SOC antibiotics, which may ultimately result in an increase in the number of cases and in mortality from Staph aureus bacteremia, including endocarditis.

Influenza

On a global basis, approximately 20% of children and 5% of adults develop symptomatic influenza annually, resulting in approximately 4 million severe cases and 375,000 deaths each year. Of further concern, despite the widespread availability of annual vaccines in the U.S., approximately 30 million people will contract influenza, resulting in an average of over 200,000 hospitalizations and up to 49,000 influenza-associated deaths each year in the U.S. alone. Because of reduced vaccine effectiveness against the predominant circulating influenza virus in the 2014-2015 season, approximately 40 million people contracted influenza, resulting in over 970,000 flu-associated hospitalizations. As a result of genetic drift and genetic shift, mutations in influenza occur each year as it circulates through the population. These mutations may result in drug-resistance of the virus and ineffectiveness of the vaccine, which causes the need for annual reformulation of the vaccine. In addition, influenza has multiple chromosomes, and the virus can grow in a variety of species, such as human, swine, bird, etc., which may result in novel strains of influenza entering into human circulation, as did the “swine flu”. These new viruses have the potential to cause worldwide pandemics.

2

Table of Contents

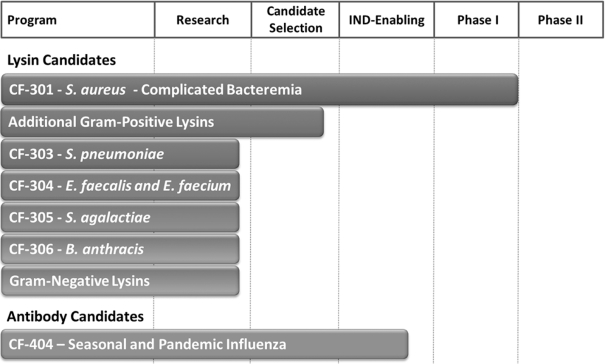

Our Pipeline

With our product candidates, we intend to treat life-threatening infections, including those caused by drug resistant pathogens. Our current pipeline of product candidates and advanced research programs is reflected in Figure 1:

Lysins

Bacteria can be divided into two groups based on structural differences of the bacteria’s outermost walls: (a) “gram-positive” and (b) “gram-negative”. Gram-positive bacteria have an outermost cell wall of peptidoglycan (a structure consisting of sugars and amino acids), which, when exposed to a dye known as the “Gram-stain,” absorb the dye and appear dark blue or violet when viewed under a microscope. Gram-negative bacteria have an additional outer membrane that prevents the Gram-stain from penetrating the peptidoglycan and, therefore, do not appear dark blue or violet when viewed microscopically. The additional outer membrane also makes gram-negative bacteria harder for lysins to penetrate. However, we have discovered and have multiple research programs on lysins that kill gram-positive and gram-negative bacteria.

Lysins are enzymes derived from naturally occurring bacteriophage, which are viruses that infect bacteria. When recombinantly produced and then applied to bacteria, lysins cleave a key component of the target bacteria’s peptidoglycan cell wall, resulting in rapid bacterial cell death. We believe lysins are unlike conventional antibiotics, especially regarding their mechanism and speed of action. Conventional antibiotics require bacterial cell division and metabolism to occur in order to exert their effect (i.e., cell death or cessation of growth). Based on in vitro tests, lysins, however, are fundamentally different in that they kill bacteria immediately upon contact, regardless of bacterial growth and cell division.

Our pipeline of lysins includes internally discovered lysins targeting gram-positive and gram-negative organisms, as well as lysins discovered at The Rockefeller University (“Rockefeller”) which are being developed by us. We were granted a world-wide, exclusive license under Rockefeller patent rights to discover, develop, make, have made, use, import, lease, sell and offer for sale lysin products. We acquired worldwide exclusive

3

Table of Contents

license rights to patents for composition of matter for nine lysins from Rockefeller. Each lysin targets a specific species of bacteria, including drug-sensitive and drug-resistant forms of Staph aureus, pneumococcus, group B streptococcus, enterococcus and anthrax. Significantly, our lysins kill only the specific species of bacteria they target, which we believe will avoid the damaging side effects that often occur when conventional antibiotic treatments kill the body’s healthy, desirable bacteria. Table 1 sets forth the lysins for which we have acquired licenses to patents from Rockefeller, the bacteria that each lysin targets and the diseases associated with such pathogenic bacteria.

Table 1: Lysins Licensed from The Rockefeller University

| Lysin |

Bacteria | Disease | ||

| CF-301, CF-302 |

Staphylococcus aureus | Bacteremia* | ||

| Abscesses* | ||||

| Endocarditis | ||||

| Meningitis | ||||

| Pneumonia | ||||

| CF-303, CF-309 |

Pneumococcus | Pneumonia* | ||

| Bacteremia* | ||||

| Endocarditis* | ||||

| Meningitis* | ||||

| Otitis Media* | ||||

| CF-304 |

Enterococcus | Serious Intestinal Infections | ||

| CF-305 |

Group B Strep | Neonatal Meningitis* | ||

|

CF-306, CF-307, CF-308 |

Bacillus Anthracis | Anthrax* | ||

| * | Indicates published data. |

Our Lead Lysin Program: CF-301

CF-301: Market Opportunity

We recently concluded a Phase 1 single ascending dose study in healthy volunteers with CF-301. CF-301 represents a first-in-class anti-bacterial therapeutic candidate. CF-301 has been granted fast track designation for the initial indication we intend to pursue for the treatment of Staph aureus bacteremia, including endocarditis, caused by MRSA or MSSA. If we are able to obtain regulatory approval of CF-301 for this initial indication, we believe CF-301 can be further developed for the treatment of Staph aureus pneumonia, osteomyelitis, and biofilm-related infections in prosthetic joints, indwelling devices and catheters.

The issue of antibiotic-resistant bacterial infections has been widely recognized as an increasingly urgent public health threat, including by the World Health Organization, the Centers for Disease Control and Prevention and the Infectious Disease Society of America. Antibiotic resistance has limited the effectiveness of many existing drugs, and the discovery of new antibiotics to address resistance has not kept pace with the increasing incidence of difficult-to-treat microbial infections. According to the Infectious Diseases Society of America, as of 2010 the estimated cost to the U.S. healthcare system of antibiotic-resistant infections was approximately $21 billion to $34 billion annually, a substantial portion of which is due to increased length of hospital stays.

Staph aureus bacteremia is a serious bacterial infection associated with high morbidity and mortality. In the U.S. alone, there were approximately 120,000 cases of Staph aureus bacteremia, of which over 80,000 were reported as invasive MRSA infections in 2011. Of further concern, the incidence of infective endocarditis is increasing, with over 47,000 cases in 2011, due to the growth of the at-risk populations, such as adults with heart disease and prosthetic device implants, especially cardiac devices.

4

Table of Contents

CF-301: Potential Advantages

Our preclinical studies to date have shown that CF-301 has the following attributes:

| • | Highly specific to, yet broadly active against Staph aureus bacteria. CF-301 exhibits broad activity against a wide spectrum of Staph aureus strains, including resistant strains such as MRSA, vancomycin-resistant Staph aureus (“VRSA”), and daptomycin-resistant Staph aureus (“DRSA”). Significantly, CF-301 specifically kills Staph aureus, which we believe will avoid the damaging side effects that often occur when conventional broad spectrum antibiotic treatments kill the body’s healthy, desirable bacteria. |

| • | Rapid bactericidal activity. In vitro, CF-301 kills Staph aureus bacteria within seconds after contact. Currently, mortality from Staph aureus bacteremia remains close to 30% with treatment on SOC drugs. The average length of hospitalization due to Staph aureus bacteremia is 21 days and the average total cost of hospitalization is $114,000. We expect CF-301, combined with SOC antibiotics, to have the potential to improve patient outcomes, shorten treatment times and reduce the length of hospital stays. |

| • | Synergy with standard-of-care antibiotics. We have discovered a strong synergy between CF-301 and several SOC antibiotics, including daptomycin, vancomycin and oxacillin. We intend to seek approval for CF-301 to be used in addition to these SOC antibiotics. We believe that the use of CF-301, if approved, in addition to, rather than as a replacement for, SOC antibiotics, may help speed adoption of our product by physicians and provide the best outcome for patients. |

| • | Clears biofilms. In in vitro studies, CF-301 clears biofilms that protect bacterial infections in the body, rendering infections up to 1,000-fold more resistant to antibiotics. Infected human tissues, such as a heart valve in endocarditis or bone in osteomyelitis, or indwelling medical devices, such as central venous catheters, prosthetic joints and pacemakers, are common sites for biofilm formation, providing an impediment to effective treatment using antibiotics alone. |

| • | Minimal resistance. To date, bacteria show minimal resistance to CF-301’s killing activity in vitro. |

| • | Minimal competition. There are only two FDA approved drugs for the treatment of MRSA bacteremia, vancomycin and daptomycin. MRSA bacteremia has shown resistance to both drugs. CF-301 works synergistically with both of these drugs and is intended to be used in addition to, not as a replacement for, SOC antibiotics. |

| • | Patent protection. Our issued composition of matter patent on CF-301 provides protection through 2032 and additional patents, if issued as we expect, could provide further protection beyond 2032. |

CF-301: Preclinical Data

A key feature of lysins is their ability to target pathogenic antibiotic-resistant bacteria, as well as those that are antibiotic-sensitive. Table 2 sets forth our findings of CF-301’s effect on Staph aureus isolates, showing that CF-301 killed all Staph aureus isolates tested, regardless of their antibiotic-resistance profile. In this experiment, we tested 250 different drug sensitive and resistant isolates of Staph aureus. The isolates (which are classified by the particular drugs they are sensitive or resistant too) tested included MSSA, MRSA, VRSA, linezolid-resistant (“LRSA”) and daptomycin-resistant (“DRSA”) Staph aureus. The isolates were all analyzed to determine their sensitivity to CF-301 and SOC antibiotics as measured by the Minimum Inhibitory Concentration (“MIC”) value. The MIC value is the minimum dose of drug that is required to kill a standard amount of bacteria over a 24-hour period. Based on demonstrated MIC values, CF-301 was shown to be active against all the strains tested (‘+’), while subsets of the Staph aureus strains were resistant to daptomycin, vancomycin or linezolid (‘–’).

5

Table of Contents

Table 2: In Vitro Sensitivity of Antibiotic-Sensitive and Antibiotic-Resistant Strains to CF-301

| Strain (n=250) |

CF-301 | Daptomycin | Vancomycin | Linezolid | ||||

| MRSA (120) |

+ | + | + | + | ||||

| MSSA (103) |

+ | + | + | + | ||||

| DRSA (8) |

+ | - | + | + | ||||

| VRSA (14) |

+ | + | - | + | ||||

| LRSA (5) |

+ | + | + | - | ||||

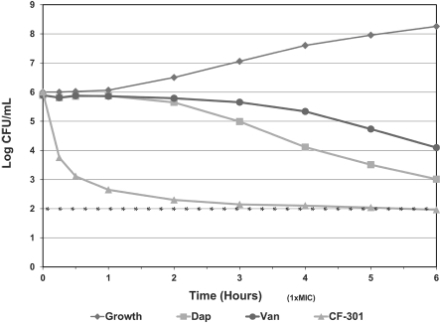

Lysins have been shown to kill bacteria upon contact and demonstrate bactericidal activity (defined as a 3-log drop in colony forming units (“CFU”) per mL) in minutes. The figure below compares the rate at which lysins kill bacteria to the rates at which SOC antibiotics kill bacteria (with all drugs being administered at 1X MIC). CF-301 reduced the number of Staph aureus bacteria in tests on 62 strains (20 MSSA; 42 MRSA) by 3-logs (99.9%) within 30 minutes. In contrast, daptomycin required six hours to achieve the same level of cell kill, while vancomycin failed to achieve a 2-log, or 99%, cell kill during the same six-hour test period. The rapid bactericidal activity of lysins is one of the primary reasons we believe they could be a highly desirable therapeutic option for the treatment of rapidly advancing bacterial infections.

Figure 2: CF 301’s Rapid Bactericidal Activity In Vitro

| * | The star symbols indicate the limit of detection in the plating assay. |

CF-301: Synergy with Standard-of-Care Antibiotics

Synergy is defined as the interaction of two or more agents so that their combined effect is greater than the sum of their individual effects. We discovered a strong synergy between lysins and several SOC antibiotics, including daptomycin, vancomycin and oxacillin through our in vitro testing (data not shown). In these

6

Table of Contents

preclinical tests, when used together, lysins and antibiotics offered a dual attack on pathogenic bacteria that was far greater than the sum of their individual contributions. The result was significantly improved killing of bacteria.

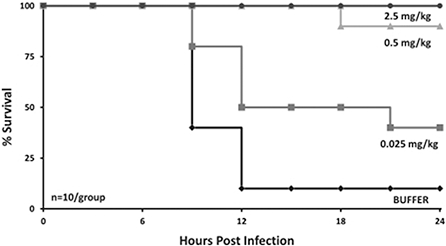

To demonstrate this synergy in vivo, we have developed animal models where CF-301 could be tested as single agent (monotherapy) or combined with a SOC antibiotic (combination therapy). Our Standard Bacteremia Model utilizes animals infected with 10 million CFU of MRSA and treated 3 hours later with various doses of therapy or buffer. When used alone, CF-301 has potent anti-Staph activity that demonstrates a dose/response effect. Figure 3 below presents the dose/response of animals treated with various doses of CF-301 in the Standard Bacteremia Model. As pictured on the graph below, all mice receiving at least 0.5 mg/kg of CF-301 demonstrated at least 90% survival, whereas doses below 0.5 mg/kg resulted in lower survival rates.

Figure 3: CF-301 Dose Response in Mice in the Standard Bacteremia Model

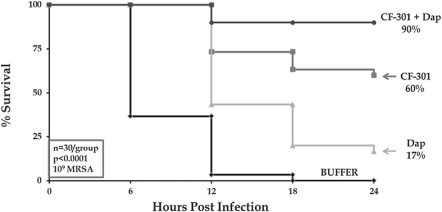

We also developed the Drug Failure Bacteremia Model, where the bacterial infection burden (one billion CFU) was so high that SOC antibiotics used at their human equivalent doses as monotherapies failed to have significant cure rates. We tested daptomycin, vancomycin and oxacillin in this model (data not shown for vancomycin and oxacillin). We then adjusted the dose of CF-301 so that CF-301 monotherapy would also fail to have significant cure rates under these intense infection conditions. To test whether the synergy that we had observed in vitro between CF-301 and SOC antibiotics would lead to improved efficacy in vivo, we then treated groups of animals in the Drug Failure Bacteremia Model with the drugs as monotherapies and also in combinations to evaluate if there was an improvement in efficacy.

Figure 4 below presents the results of the combination of CF-301 and daptomycin when used in the Drug Failure Bacteremia Model. All control mice treated with buffer (diamonds) succumbed to bacterial infection within 18 hours. Administration of a clinical dose of daptomycin as a single agent (triangles) resulted in clinical failure, as only 17% of mice survived. When CF-301 (squares) was dosed as a single agent at this chosen dose, only 60% of mice survived. In contrast, when mice received the combination of CF-301 plus daptomycin (circles), 90% survived the bacterial challenge, demonstrating superiority of the combination therapy over the single-drug regimens.

7

Table of Contents

Figure 4: Combination Therapy of CF-301 with Daptomycin in Drug Failure Bacteremia Model

We have tested the combination of CF-301 with daptomycin, vancomycin and oxacillin in 30 different experiments (including both the Standard and Drug Failure Bacteremia Models). In each experiment, the combination therapy was shown to be superior to monotherapy with a single drug alone. As a result, we believe this provides a strong foundation on which to pursue clinical development of the combination of CF-301 and SOC antibiotics for the treatment of Staph aureus bacteremia, as CF-301’s first indication.

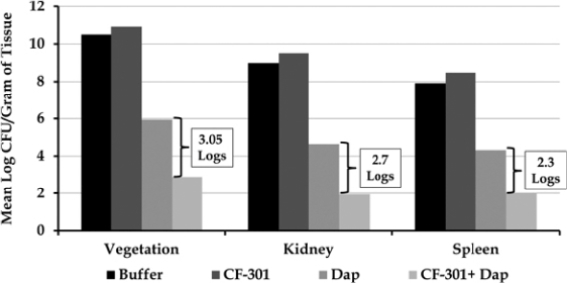

To further explore the activity of CF-301 in combination with SOC antibiotics for the treatment of life-threatening, drug-resistant infections, we engaged the LA Biomed Research Institute at Harbor-UCLA Medical Center (“UCLA”) to perform a study in their rat infective endocarditis model (“IE Model”). The IE Model has become a well-established experimental animal model and has been used for assessing possible efficacy of therapeutic agents in infective endocarditis. The primary endpoint of the IE Model is a reduction in the amount of bacteria (measured as CFUs) on the heart valve, in the kidney and in the spleen. Survival during the course of the treatment period was considered a secondary endpoint, as the study was not designed to see the long-term effects of the treatment on overall survival. Our study examined the activity of CF-301 alone and in combination with daptomycin, in UCLA’s prototypical high-burden biofilm-based IE Model. Prior to running the experiment, management and the investigator agreed that the achievement of a 2-log (or 99%) decrease in the CFU in the vegetation on the heart valve, spleen and kidney compared to daptomycin alone would be considered a good result and the achievement of a 3-log (or 99.9%) reduction would be considered impressive. We worked directly with UCLA to design the study, and the description of the methods and results follows below.

Figure 5 presents the results of the combination of CF-301 alone and in combination with daptomycin as compared to both buffer and daptomycin alone in the IE Model. In this study, a single dose of CF-301 significantly increased the activity of daptomycin. This study was designed to mimic the planned clinical approach (single dose of CF-301 on top of multiple days of SOC antibiotic therapy) in a difficult to treat biofilm-based infection. In this study, a single dose of CF-301, when combined with four days of daptomycin treatment, resulted in a 3-log drop in bacterial burden in the cardiac vegetations and >2-log drop in the kidney and spleen of infected animals relative to daptomycin treatment alone. Importantly, in the combination treatment groups 4 of 9 animals were determined to be culture negative, whereas no animals in any other treatment arms approached this level of disease eradication.

8

Table of Contents

Figure 5: Single Dose of CF-301 with Daptomycin in Rat Infective Endocarditis Model

As a result, we believe this additional data supports our human clinical study plan to evaluate the combination of CF-301 and SOC antibiotics for the treatment of patients with invasive Staph aureus infections, including endocarditis, caused by MSSA or MRSA.

CF-301: Impact on Antibiotic-Resistant Biofilms

Biofilm formation is a common protective mechanism for bacteria and a key feature associated with bacterial pathogenesis. Biofilms are characterized by densely packed bacterial cells that grow in communities and are enclosed within a complex matrix of dead bacteria and excess cell wall components. Biofilm bacteria exhibit significant tolerance of various antimicrobial agents, rendering biofilm cells up to 1,000-fold less susceptible than the same bacteria grown in a planktonic, or free-floating, non-biofilm culture. Infected human tissues, such as the heart valve in endocarditis or bone in osteomyelitis, or indwelling medical devices, such as central venous catheters, prosthetic joints and pacemakers, are common sites for biofilm formation, providing a hurdle for effective treatment with antibiotics alone. Biofilm coating of bacterial infections in human medicine is estimated to occur in more than 60% of bacterial infections, costing the healthcare system billions of dollars. For this reason, novel treatment strategies and antimicrobial agents with activity toward biofilms remain a serious unmet medical need as there is no product currently indicated for the treatment of biofilms.

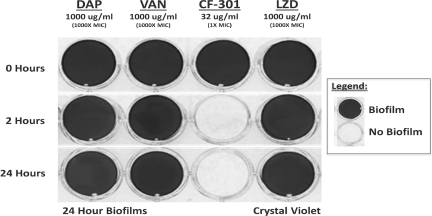

Since CF-301 disrupts the outer wall of Staph aureus by enzymatic lysis, we performed studies to determine if CF-301 would also disrupt biofilms. For this purpose, we cultured MRSA for 24 hours within wells of polystyrene dishes typically used for the culture of cells, at which point a dense biofilm formed on the dish surface. Dishes were incubated for up to 24 hours with high-dose (1,000x MIC) daptomycin, vancomycin or linezolid, or lower-dose (1xMIC) CF-301. After the four-hour treatment, dishes were washed and stained with a dye that stains the biomass of a biofilm a dark blue color. In dishes treated with CF-301, there was no visual biofilm present after two hours of treatment, whereas in dishes treated with antibiotics for up to 24 hours, the biofilm biomass remained intact (images shown in Figure 6 below). These findings are consistent with the inability of these antibiotics to penetrate and clear biofilm material. This demonstrated that CF-301 was at least 1,000-fold more potent than SOC antibiotics at destroying bacterial biofilms in vitro.

9

Table of Contents

Figure 6: Sensitivity of Staph Aureus (MRSA) Biofilms to CF-301 Versus SOC Antibiotics

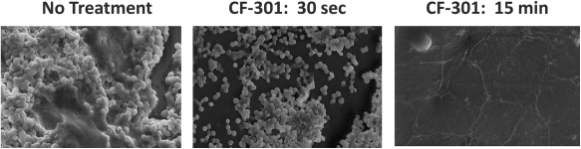

To microscopically visualize CF-301’s disruption of biofilms, we inoculated MRSA onto a medically relevant device (a catheter) where it attached to the wall of the plastic and formed a dense 3-dimensional structure. We then treated the interior of the catheter with CF-301 at 1x MIC. At various time intervals after treatment the interior of the catheter was sectioned and examined by scanning electron microscopy (“SEM”), select images shown below in Figure 7. In the untreated catheter (left panel) the majority of MRSA cells (little circles in the pictures below) were found within a biofilm. However, within 30 seconds of exposure to CF-301, the dense biofilm was largely removed and only single cells were observed (middle panel). Fifteen minutes following exposure to CF-301 (right panel), the biofilm was completely stripped and residual MRSA cells which had been beneath the biofilm were killed, in effect, sterilizing the catheter. These images emphasize the rapid and potent activity of CF-301 against bacterial biofilms. Taken together with the lack of efficacy that antibiotics display against biofilms, we believe CF-301 potentially represents a new therapeutic option against what were previously untreatable biofilms.

Figure 7: Sensitivity of Staph Aureus (MRSA) Biofilms Grown on Catheters to CF-301

CF-301: Product Development

Product development is generally accomplished in four steps, which may overlap: (1) preclinical activities to demonstrate consistent manufacturing, safety and efficacy in animals; (2) Phase 1 clinical trials, in healthy volunteers, to determine pharmacokinetics (“PK”), safety, tolerability, immunogenicity, dosing, effects in special populations, and other issues; (3) Phase 2 clinical trials in patients to determine dose, efficacy, safety, tolerability, PK and immunogenicity; and (4) Phase 3 clinical trials, the pivotal trials in patients to confirm efficacy and safety at the proposed commercial dose.

10

Table of Contents

Non-Clinical Activities

Chemistry, Manufacturing and Controls

Manufacturing of CF-301 utilizes a proprietary engineered E. coli strain that expresses the product in a recombinant manner during the fermentation process. This technology allows production of up to nine grams of CF-301 per liter of fermentation broth. After fermentation, the broth containing CF-301 is separated and purified through a process containing two chromatographic columns. The resulting product has greater than 99% purity. The CF-301 produced by this process has been used in animal studies submitted to the IND and may be used for our planned Phase 1 and Phase 2 clinical trials.

We intend to further optimize the manufacturing process for increased purity and yield. Once completed, we plan to begin a program to manufacture Phase 3 material. The process will then be scaled 35-fold from the current 100 liter fermentation to 5,000 liters. This process will then be validated in a series of manufacturing batches to demonstrate consistency. In parallel to the validation, we intend to conduct a comparability program that demonstrates comparability between the final product used in Phase 3 and commercial manufacturing. We intend to include the results in the biologics license application (“BLA”) that we expect to submit to the FDA. Following submission, the FDA will conduct pre-approval inspections of all manufacturing facilities and determine whether it agrees that our commercial material is sufficiently comparable to our Phase 3 material.

Safety Pharmacology and Toxicology

Preclinical safety pharmacology and toxicology studies have been completed in connection with our IND application for CF-301. In these studies CF-301 was well tolerated in rats for a single two-hour IV administration of doses up to 25mg/kg (determined by us to be the no observable adverse effect level, or “NOAEL”) and that a single dose of 2.5mg/kg was not associated with any effects, adverse or not, and was therefore determined to be the no observable effect level (“NOEL”). CF-301 was also well tolerated in these studies in both rats and dogs for seven consecutive days of once daily two-hour IV infusions of up to 2.5mg/kg. In a non-GLP pilot study in rats, 1.0 mg/kg/day was well tolerated for up to seven consecutive days of once daily two-hour IV infusions or IV boluses. We will need to conduct a definitive dose ranging, repeat dose study in rats prior to initiating any clinical trial with administration of CF-301 over consecutive days.

Dose dependent adverse tissue effects were seen in both species at doses above 25 mg/kg/day for 1 day in the rat and above 2.5 mg/kg/day for seven-consecutive days in both the rat and the dog. The dose limiting toxicity observed was a localized inflammation surrounding certain blood vessels. In accordance with industry practice, we intend to study CF-301 in clinical trials at doses much lower than those that caused adverse effects in animals, and we believe these doses to be within the efficacious range of the drug.

Upon first exposure to CF-301, no hypersensitivity reaction was observed in any of our animal studies. Upon administration of a second course of CF-301, given two weeks after completion of the first course, hypersensitivity or hypersensitivity-like findings were observed in mice, rats and dogs. In a dedicated hypersensitivity studies in rats, findings of Type III hypersensitivity were observed after a two week delayed re-challenge with a second course of CF-301 and were not dose dependent. In general, Type I hypersensitivity is an allergic anaphylaxis-like response (e.g., an immediate and potentially life-threatening allergic reaction) and Type III hypersensitivity is a serum sickness-like response (e.g., fever, joint pain, protein in urine, vascular changes). While the nature of hypersensitivity reactions in rats may not necessarily be predictive of hypersensitivity reactions that may occur in humans, we have also considered the risk of hypersensitivity occurring upon first administration of CF-301 due to potential prior exposure to the active protein component of CF-301 from the environment, as it is a naturally occurring protein. Testing for anti-CF-301 antibodies was performed in Phase I subjects. No clinical hypersensitivity related to CF-301 was observed in subjects dosed in our Phase 1 study.

11

Table of Contents

Clinical Activities

Phase 1. We recently concluded a Phase 1 single ascending dose study in healthy volunteers. This trial was a randomized, double-blind, placebo-controlled trial designed to evaluate the safety, tolerability and PK of four different intravenous doses of CF-301 alone. Subjects were randomized to receive a single IV dose of CF-301 or placebo, each administered as a two hour infusion. As specified in the protocol, an independent data safety monitoring board (DSMB) reviewed the safety, tolerability, and pharmacokinetic data from healthy volunteers dosed in all of the planned cohorts. The DSMB observed no clinical adverse safety signals associated with CF-301 in the study. No clinical hypersensitivity related to CF-301 was observed in subjects dosed in our Phase 1 study.

Phase 2. We expect to proceed into Phase 2 clinical trials to assess the safety, tolerability, PK, and efficacy of CF-301 plus standard-of-care (“SOC”) antibiotics. We expect any Phase 2 clinical trial to be a multicenter, double-blind, randomized study that evaluates the safety and efficacy of CF-301 plus SOC antibiotics and SOC antibiotics alone in patients with Staph bacteremia caused by MSSA or MRSA.

Phase 3. If the Phase 2 results are consistent with our expectations regarding the safety and efficacy profile of CF-301, we expect to enter into Phase 3 clinical trials. We expect any Phase 3 clinical trial to be a global, multicenter, double-blind, randomized study that evaluates the efficacy and safety of CF-301 plus SOC antibiotics compared to SOC antibiotics alone among patients with bacteremia caused by MSSA or MRSA. Specific parameters for Phase 3 trials will be based on the outcomes of previously completed clinical trials and relevant guidance and precedents from regulatory authorities.

Our Lysin Discovery Platform

We employ bioinformatics and a series of metagenomic-based techniques to clone bacteriophage lysins from bacterial, viral, and environmental sources. The field of metagenomics is based on the bulk extraction of DNA/RNA from environmental samples (e.g., soil, water, etc.) without prior isolation of individual microbial sources. This is useful when one considers that less than 1% of microbes are culturable under standard laboratory conditions. Once extracted, the metagenomic DNA can then be examined using sequence-based methods or by proprietary functional screens. These functional screens for bacteriophage lysin activity form the basis for our lysin discovery work.

For the functional metagenomic work that we perform, environmental genes are expressed in a recombinant format in a standard host organism (i.e., Escherichia coli) and cells are monitored for the acquisition of a desired phenotype. We can vary both the source of environmental DNA and the way we monitor for desired phenotypes to focus only on environmental populations enriched for bacteriophage lysins that can actively kill a pathogen of interest. We sample various DNA sources including viral, prophage, and pathogen-amplified viral metagenomics. Multiple methods for both DNA library construction and for functional screening are used in parallel in order to maximize lysin identification.

We have also established additional discovery methodologies, including bioinformatics analysis of the rapidly expanding databases of bacterial genomic sequences. The highly conserved modular structure of lysins, combined with sequence homologies amongst different lysin classes, enable the rapid analysis of putative lysins from DNA databases. Such sequences can be readily synthesized and screened for lytic activity against any pathogen of interest.

The application of these methods enables the large scale identification of lysins, enabling the production of lysin banks specific for any particular pathogen. We believe the ability to rapidly identify lysins specific for any pathogen of interest, either by in vitro or in silico methods, will provide a steady pipeline of novel lysins for consideration as potential antimicrobial therapeutic candidates.

12

Table of Contents

We intend to pursue preclinical and clinical development of additional lysins. In addition to the lysins we have licensed from Rockefeller and our in-house lysin discovery program, we have an active collaborative research agreement where we provide funding for the discovery of new lysins with Dr. Vincent Fischetti’s Laboratory of Bacterial Pathogenesis and Immunology at Rockefeller, where we have the first right to negotiate a license to all discoveries concerning lysins through October 2016. The primary focus of our in-house and sponsored research is the discovery of lysins to target gram-negative bacteria.

Monoclonal Antibodies

We are exploring combination therapy with mAbs that bind to target bacteria or viruses and block certain biological activities or recruit other parts of the immune system to destroy the pathogenic target. The strategies of our mAb program include: (1) targeting conserved regions of the virus or bacteria which are not prone to mutation and (b) targeting multiple proteins expressed from different genes within a bacteria or virus to prevent therapeutic escape and (c) combining mAbs to cover multiple strains for superior outcomes.

Our antibodies are generated by genetic engineering using phage display libraries, isolated directly from human blood samples or other available technologies, enabling the screening of billions of human mAbs with different binding sites. Once the best monoclonal antibodies are isolated, we use protein engineering techniques to optimize important antibody attributes such as pharmacokinetic profile, effector function engagement, antibody format (such as Fabs and bispecifics), and manufacturing efficiency. The common properties provide for a unique ability to create a therapeutic combination of mAbs.

Our Lead mAb Program: CF-404

We are developing a combination of three human mAbs against influenza as a treatment for life-threatening seasonal and pandemic influenza infections, a disease that kills as many as 49,000 people annually in the U.S. alone. We expect to complete the required manufacturing and preclinical studies to file an IND for CF-404 in 2016. Our preclinical studies to date have shown that CF-404 may have the following attributes:

| • | Broad activity against influenza in one combination drug. CF-404 exhibits broad activity against influenza strains, including the three principal strains (H1, H3 and B). By targeting a conserved region on the virus, we believe CF-404 bypasses the effects of seasonal change, which allows (1) our mAbs to cross-react and neutralize many different influenza strains; (2) for the production of a single therapeutic combination of only three mAbs covering all human seasonal and most pandemic influenza strains; and (3) for an immediate therapeutic effect that cannot be obtained by vaccination which typically requires weeks. |

| • | Minimal resistance potential. Our mAbs react with the principal protein, hemagglutinin, on the surface of influenza at a region referred to as the hemagglutinin stalk. Because the hemagglutinin stalk is genetically stable and therefore represents a conserved region of the virus, it does not vary from one season to another. |

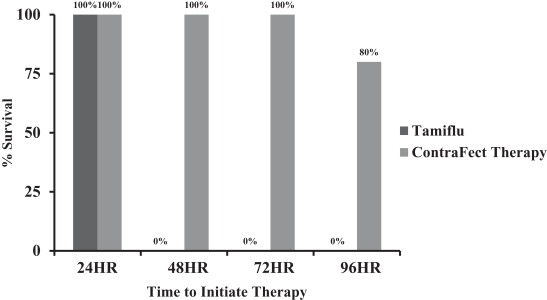

| • | Minimal competition. There are only four approved drugs for the treatment of influenza—Tamiflu, Relenza, Symmetrel and Flumadine—although only Tamiflu is widely used in practice. Influenza has demonstrated an increasing resistance to Tamiflu, and the clinical benefit of Tamiflu is greatest when antiviral treatment is administered early, especially within 48 hours of influenza illness onset. Based on preclinical data, we believe treatment with our mAbs may be effective even when given 96 hours after infection. |

Influenza Research

In preclinical studies, our combination of mAbs in CF-404 cross-reacts with all strains of influenza, including the three principal strains (H1, H3 and B). These mAbs react with the principal protein, hemagglutinin,

13

Table of Contents

on the surface of influenza at a region referred to as the hemagglutinin stalk which is genetically stable and does not vary from one season to another. We have produced mAbs that are reactive with the stalk region of hemagglutinin for the entire natural history of the H3 influenza (1968-present), H1 influenza (1918-present; seasonal and swine flu), other strains of type A influenza (including H5), and Type B influenza.

We have tested our mAbs in mouse models to evaluate protection against lethal infection with influenza in “proof-of-concept” experiments. These data demonstrated that our anti-H1 (CF-401), anti-H3 (CF-402) and anti-B mAbs (CF-403) were able to protect animals from lethal challenge. Importantly, our in vivo animal studies show that treatment with our mAbs appears to provide greatly enhanced potency compared to treatment with other mAbs.

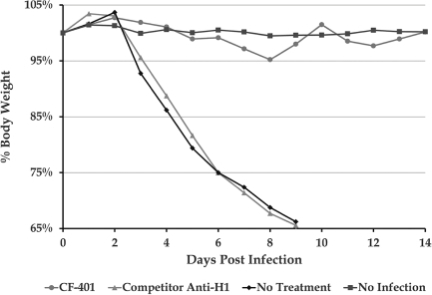

Figure 8 below shows the results of an experiment using CF-401 in a mouse model of HINI influenza infection, in which body weight loss is used as a proxy of disease progression (and ultimately, death). In this figure, we also demonstrate that at equivalent dosing of 1 mg/kg, CF-401 was far superior to a competitor’s mAb currently in clinical development. Control mice treated with buffer (diamonds) succumbed to viral infection within 9 days. Administration of a single treatment, 24 hours post-infection, of a competitor’s antibody (triangles) resulted in clinical failure at an identical rate as the no treatment group. When CF-401 (circles) was administered as a single treatment, 24 hours post-infection, the mice appeared perfectly healthy, with weight changes identical to animals that did not receive challenge with influenza (squares).

Figure 8: Effectiveness of CF-401 in Mouse Model of Influenza

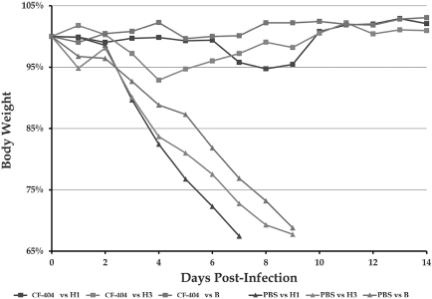

As the goal of our influenza program is to produce a combination of mAbs with efficacy against all human seasonal strains of influenza, we have formulated a combination of three mAbs (“CF-404”) and tested it in animal models of disease. Figure 9 below shows how CF-404 cured mice infected with three different strains of influenza, regardless of the strain (H1N1, H3N2 or B). Control mice treated with buffer (triangles) all succumbed to viral infection within 7-9 days. By contrast, when we administered a single treatment of our anti-Influenza combination CF-404 (squares) 24 hours post-infection, the infected mice appeared perfectly healthy, with weight changes comparable to healthy mice (not pictured).

14

Table of Contents

Figure 9: Effectiveness of CF-404 in Mouse Model

Currently, the SOC treatment for influenza is Tamiflu. Tamiflu, however, has several limitations, including emerging resistance. In 2009, just prior to the emergence of the pandemic H1N1 swine flu, the CDC cautioned against the use of Tamiflu for the treatment of H1N1 seasonal influenza due to nearly complete drug-resistance of the virus (in 2006 <1% of H1N1 were resistant, by 2009 that figure jumped to >98%). As previously discussed, due to the targeting of conserved regions on the hemagglutinin, we do not anticipate resistance will occur to our mAbs. The second major limitation of Tamiflu is its narrow time window to treat a patient and still be efficacious. The clinical benefit of Tamiflu is greatest when administered early in a patient’s infection, especially within 48 hours of illness onset. To compare the time-to-treat windows of our mAbs to Tamiflu, H1N1 influenza-infected mice were treated with either a single administration of CF-401or a 5 day course of Tamiflu beginning 24-96 hours post infection (“HPI”). Figure 10 below shows the findings of that study, including the finding that Tamiflu treatment had to have been initiated by 24 HPI to cure mice, while treatments beginning at 48, 72 or 96 HPI resulted in 100% death by day 14. In contrast, a single treatment with CF-401 resulted in 100% survival when given any time up to 72 HPI and in 80% survival when given 96 HPI. This result suggests that our mAb treatment may provide effective treatment to influenza patients at later times post-infection when Tamiflu is no longer effective.

15

Table of Contents

Figure 10: Our mAbs Provide Greater Therapeutic Window than Tamiflu® in Mouse Model

We believe our combination for the treatment of influenza is a novel approach addressing a high unmet medical need (influenza causes up to 49,000 deaths per year in U.S. alone) and would offer competitive advantages to the only product widely used on the market today if successfully developed and approved.

Intellectual Property

Our goal is to obtain, maintain and enforce patent protection for our products, formulations, processes, methods and other proprietary technologies, preserve our trade secrets, and operate without infringing on the proprietary rights of other parties, both in the United States and in other countries. Our policy is to actively seek to obtain, where appropriate, the broadest intellectual property protection possible for our product candidates, proprietary information and proprietary technology through a combination of contractual arrangements and patents, both in the United States and abroad. However, patent protection may not afford us with complete protection against competitors who seek to circumvent our patents.

We also depend upon the skills, knowledge, experience and know-how of our management and research and development personnel, as well as that of our advisors, consultants and other contractors. To help protect our proprietary know-how, which is not patentable, and for inventions for which patents may be difficult to enforce, we currently rely and will in the future rely on trade secret protection and confidentiality agreements to protect our interests. To this end, we will require all of our employees, consultants, and other contractors (including any consultants or contractors we may retain for purposes of any of our ad hoc Clinical Advisory Boards) to enter into confidentiality agreements that prohibit the disclosure of confidential information and, where applicable, require disclosure and assignment to us of the ideas, developments, discoveries and inventions important to our business.

Our lysin portfolio consists of eleven (11) U.S. patents, four (4) foreign patents and fifty-seven (57) U.S. and international patent applications that we have licensed from Rockefeller and/or developed in-house. The patents and patent applications are directed to compositions and methods for the treatment of infections caused by Group B Streptococci, Staphylococcus aureus, Streptococcus pneumonia, Bacillus anthracis (anthrax), Enterococcus faecalis and Enterococcus faecium. These patents will expire between 2023 and 2029. If patents are granted on our patent applications, which include the patent applications for CF-301, they would expire between 2032 and 2033.

16

Table of Contents

Our influenza patent portfolio consists of forty-one (41) U.S. and foreign patent applications, which we have licensed from Trellis and/or developed in-house. The patent applications are directed to compositions relating to influenza antibodies as well as to pharmaceutical compositions for administration to patients and to methods for their use in conferring passive immunity against various influenza strains and clades. If patents are granted on these patent applications they would expire between 2031 and 2036.

The U.S. patent system permits the filing of provisional and non-provisional patent applications. A non-provisional patent application is examined by the United States Patent and Trademark Office (“USPTO”), and can issue as a patent once the USPTO determines that the claimed invention meets the various standards for patentability. A provisional patent application is not examined or prosecuted, and automatically expires 12 months after its filing date if a non-provisional application is not filed based on the provisional application within that 12-month period. Provisional applications are often used, among other things, to establish a priority filing date for the subsequently filed non-provisional patent application. The term of individual patents depends upon the legal term for patents in the countries in which they are filed. In most countries in which we file, the patent term is 20 years from the earliest filing date of a non-provisional patent application. In the United States, a patent’s term may be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the USPTO in granting a patent. Alternatively, a patent’s term may be shortened if a patent is terminally disclaimed over another patent.

The term of a patent that covers an FDA-approved drug may also be eligible for patent term extension (“PTE”), which permits patent term restoration as compensation for the patent term lost during the FDA regulatory review process. The Drug Price Competition and Patent Term Restoration Act of 1984, or the Hatch-Waxman Amendments, permits a PTE of up to five years beyond the expiration of the patent. The length of the PTE is related to the length of time the drug is under regulatory review. Patent extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval and only one patent applicable to an approved drug may be extended. Similar provisions are available in Europe and certain other foreign jurisdictions to extend the term of a patent that covers an approved drug. In the future, if and when our pharmaceutical product candidates receive FDA or other regulatory approval, we may be able to apply for or receive the benefit of PTEs on patents covering those products.

License Agreements—The Rockefeller University

We have entered into the following license agreements with Rockefeller:

| • | On July 12, 2011, we entered into a license agreement for the worldwide, exclusive right to a provisional patent application, upon which a non-provisional patent application has since been filed, covering the composition of matter for the lysin PlySS2 for the treatment and prevention of diseases caused by gram-positive bacteria (the “CF-301 License”). We rebranded PlySS2 as CF-301. This license gives us the right to exclusively develop, make, have made, use, import, lease, sell and offer for sale products that would otherwise infringe a claim of this patent application or patent. |

| • | On June 1, 2011, we entered into a license agreement for the exclusive rights to Rockefeller’s interest in a joint patent application, which is presently pending, covering the method of delivering antibodies through the cell wall of a gram-positive bacteria to the periplasmic space. This intellectual property was developed as a result of the sponsored research agreement between us and Rockefeller, and was jointly discovered and filed by the two parties. |

| • | On September 23, 2010, we entered into a license agreement for the worldwide, exclusive right to develop, make, have made, use, import, lease and sell, and offer for sale products that would otherwise infringe a claim of the suite of patents and patent applications covering the composition of matter for eight individual lysin molecules for the treatment and prevention of diseases caused by gram-positive bacteria. The lysins in this suite have activity against Group B Streptococci, Staphylococcus aureus, Streptococcus pneumonia, Bacillus anthracis, Enterococcus faecalis and Enterococcus faecium. |

17

Table of Contents

In consideration for the licenses, we paid Rockefeller license initiation fees in cash and stock and may be required to pay an annual maintenance fee, milestone payments and royalties on net sales from products to Rockefeller. We are allowed to grant sublicenses to third parties without prior approval, subject to certain conditions and the payment of a certain percentage of all payments we receive from sublicensees.

Each license agreement terminates upon the later of (i) the expiration or abandonment of the last licensed patent under the license agreement to expire or become abandoned, or (ii) 10 years after the first commercial sale of the first licensed product. Rockefeller may terminate any license agreement in the event of a breach of such agreement by us or if we challenge the validity or enforceability of the underlying patent rights. We may terminate any license agreement at any time on 60 days’ notice.

License Agreement—Trellis Bioscience LLC

On January 29, 2014, we entered into a license agreement with Trellis that gives us exclusive rights to all Trellis mAbs in the field of influenza discovered from their CellSpot platform. Particularly, the license provides us with three fully human mAbs that bind, neutralize and protect animals from all strains of H1, H3 and B influenza, and that will also cross bind, neutralize and protect animals from other seasonal or pandemic influenza strains that may arise (including H5N1 and H7N9). We have selected our three lead mAbs for the H1, H3, and B influenzas and are currently producing these antibodies at scale using manufacturing-grade expression systems and performing IND-enabling studies.

In consideration for the license, we paid Trellis licensing fees in cash and stock and may be required to make specified development and regulatory milestone payments and make additional payments upon the achievement of future sales and a royalty on net sales from products to Trellis. We are allowed to grant sublicenses to third parties.

The license agreement terminates upon the earlier of (i) our decision to terminate the agreement at will or for safety reasons, (ii) material breach by either party that is not cured within ninety (90) days, or (iii) either party’s insolvency.

On August 14, 2014, we amended the license agreement to include research conducted pursuant to a government grant.

Collaborative Research Agreements—The Rockefeller University

Beginning in October 2009, we entered into a research agreement with Rockefeller where we provided funding for research focused on producing and testing monoclonal antibodies against proteins of Staph aureus. On October 24, 2011, we entered into a second research agreement with Rockefeller, where we provide funding for the research primarily to identify lysins, enzymes or small molecules that will kill gram-negative bacteria, and to identify and characterize lysins from Clostridia difficile to be engineered into gut commensal bacteria.

Our current agreement runs through October 31, 2016. Either party may terminate the agreement upon breach of the agreement, following 30 days written notice and failure to cure such breach. Following the expiration or termination of the agreement, each party will have a non-exclusive license to use for internal research purposes all research results, including joint intellectual property. If Rockefeller or joint intellectual property develops from these programs, we will have the right-of-first refusal to negotiate to acquire a royalty-bearing license to utilize such intellectual property for commercial purposes.

Competition

The pharmaceutical and biotechnology industries are intensely competitive. While we believe that our technology and scientific knowledge provide us with competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies and academic and research organizations in developing therapies to treat diseases.

18

Table of Contents

CF-301 is a first-in-class drug candidate and we believe will be among the first lysins to enter human clinical trials. We believe there is no clinical competitor to CF-301 as it was designed with at least six attributes that no single antibiotic possesses, including: (1) a novel mechanism of action, (2) specificity for a target bacteria (only Staph aureus), (3) rapid speed of action, (4) activity across all drug-sensitive and drug-resistant strains of the target bacteria (including MRSA, VRSA and DRSA), (5) the ability to eradicate biofilms, and (6) synergy with antibiotics. Staph aureus bacteremia is typically treated with oxacillin, or for MRSA strains, daptomycin and vancomycin. Vancomycin is currently a generic drug and we expect daptomycin to reach the end of its patent life by the time CF-301 comes to market, if approved. We do not see market competition with these drugs, as our strategy is to combine CF-301 with these drugs to aim for superiority over any one of those drugs alone. Additionally, we anticipate similar synergy and approach with identifiable clinical development molecules, such as Teflaro from Cerexa Inc.

Recently, iNtRon Biotechnology Inc., a biotechnology company located in South Korea, completed the first Phase I human clinical trial for SAL-200, an endolysin-based drug candidate for multidrug-resistant Staph aureus infections. We will continue to monitor the advancements of SAL-200 as data become available.

CF-404 is intended for the treatment of life-threatening seasonal and pandemic influenza infections. We believe CF-404 has competitive advantages in that it potentially addresses the short-comings of currently marketed products (Tamiflu, Relenza and Rapivab) and other products in development for the following reasons: (1) it may not be prone to drug-resistance due to targeting conserved regions of the influenza virus, (2) it may provide for an increased “time-to-treat” window compared to Tamiflu, Relenza and Rapivab, which are indicated to be used within 48 hours of symptom onset, and (3) it may provide complete coverage against all seasonal and most potential pandemic strains of human influenza without the need for annual reformulation, including influenza B.

CF-404 may directly or indirectly compete with other products already in development from F. Hoffmann-La Roche Ltd., Genentech, Inc., Crucell N.V, Vertex Pharmaceuticals Incorporated, Theraclone Sciences, Inc., Toyama Chemical Co., Ltd., Romark Laboratories, L.C., Biota Pharmaceuticals, Inc., Adamas Pharmaceuticals, Inc., Activaero GmbH, Far East Bio-Tec Co. Ltd, Visterra Inc., MedImmune LLC, Ansun Biopharma, Inc. and others with early stage product candidates.

Many of our competitors may have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved medicines than we do. We compete with companies that have products on the market or in development for the same indications as our product candidates. Mergers and acquisitions in the pharmaceutical, biotechnology and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

The key competitive factors affecting the success of all of our product candidates, if approved, are likely to be their efficacy, safety, convenience, price and the availability of reimbursement from government and other third-party payors. Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize medicines that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than any medicines that we may develop. Our competitors also may obtain FDA or other regulatory approval for their medicines more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

19

Table of Contents

Manufacturing

We do not own or operate, and currently have no plans to establish, any manufacturing facilities. We currently rely, and expect to continue to rely, on third parties for the manufacture of our product candidates for preclinical or clinical manufacturing, testing, as well as for commercial manufacture of any products that we may commercialize. We employ the services of Fujifilm UK to supply the drug substance for CF-301. We do not yet have contracts to produce a commercial supply of the drug substance for CF-301; however, we intend to pursue agreements with Fujifilm UK to do so. We employ the services of CanGene to produce CF-301 in its final vialed drug product form. We do not have contracts for the commercial supply of CF-301. We intend to pursue agreements with third party manufacturers regarding commercial supply of vialed drug product at an appropriate future time. We may choose to locate second fill finish third party manufacturers to supply other world regions such as the European Union or Asia.

Sales, Marketing and Distribution

We do not currently have an organization for the sales, marketing and distribution of pharmaceutical products. We may rely on licensing and co-promotion agreements with strategic partners for the commercialization of our products in the United States and other territories. If we choose to build a commercial infrastructure to support marketing in the United States, such commercial infrastructure could be expected to include a targeted sales force supported by sales management, internal sales support, an internal marketing group and distribution support. To develop the appropriate commercial infrastructure internally, we would have to invest financial and management resources, some of which would have to be deployed prior to any confirmation that any of our other products will be approved.

Research and Development Expenses

We have invested $15.0 million, $8.9 million and $9.1 million in research and development expenses for the years ended December 31, 2015, 2014 and 2013, respectively.

Government Regulation

The production, distribution, and marketing of products employing our research and intellectual property or that we may license from third parties are subject to extensive governmental regulation in the United States and in other countries. In the United States, our products will be regulated as biologics and subject to the Federal Food, Drug, and Cosmetic Act, as amended (the “FDC Act”), the Public Health Service Act, as amended (the “PHSA”) and the regulations of the FDA, as well as to other federal, state, and local statutes and regulations. These laws, and similar laws outside the United States, govern the research, development, clinical and preclinical testing, manufacture, safety, effectiveness, approval, labeling, distribution, sale, import, export, storage, record-keeping, reporting, advertising, and promotion and marketing of our products. Product development and approval within this regulatory framework, if successful, will require the expenditure of substantial resources and take years to achieve. Violations of regulatory requirements at any stage may result in various adverse consequences, including the FDA’s and other health authorities’ delay in approving or refusal to approve a product and may result in enforcement actions and administrative or judicial sanctions.

The following provides further information on certain legal and regulatory requirements that have the potential to affect our operations and the future marketing of our products.

FDA Approval Process

In the United States, pharmaceutical products are subject to extensive regulation by the FDA. The FDC Act and other federal and state statutes and regulations govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-

20

Table of Contents

approval monitoring and reporting, sampling, and import and export of pharmaceutical products. Biological products used for the prevention, treatment, or cure of a disease or condition of a human being are subject to regulation under the FDC Act, except the section of the FDC Act which governs the approval of new drug applications (“NDAs”). Biological products are approved for marketing under provisions of PHSA, via a BLA. However, the application process and requirements for approval of BLAs are very similar to those for NDAs, and biologics are associated with similar approval risks and costs as drugs. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending NDAs or BLAs, warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution.

Pharmaceutical product development for a new product or certain changes to an approved product in the United States typically involves preclinical laboratory and animal tests, the submission to the FDA of an IND, which must become effective before clinical testing may commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug for each indication for which FDA approval is sought. Satisfaction of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity, and novelty of the product or disease.

Preclinical tests include laboratory evaluation of product chemistry, formulation, and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the preclinical tests must comply with federal regulations and requirements, including good laboratory practices. The results of preclinical testing are submitted to the FDA as part of an IND along with other information, including information about product chemistry, manufacturing and controls, and a proposed clinical trial protocol. Long term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has neither commented on nor questioned the IND within this 30-day period, the clinical trial proposed in the IND may begin.

Clinical trials involve the administration of the investigational new drug or biologic to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted: (i) in compliance with federal regulations; (ii) in compliance with good clinical practice (“GCP”), an international standard meant to protect the rights and health of healthy volunteers or patients and to define the roles of clinical trial sponsors, administrators, and monitors; as well as (iii) under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety, and the effectiveness criteria to be evaluated. Each protocol involving testing on healthy volunteers or patients in the U.S. and subsequent protocol amendments must be submitted to the FDA as part of the IND.

The FDA may order the temporary, or permanent, discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial either is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. The study protocol and informed consent information for patients in clinical trials must also be submitted to an IRB for approval. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions.

Clinical trials to support NDAs or BLAs for marketing approval are typically conducted in three sequential phases, but the phases may overlap. In Phase 1, the initial introduction of the drug or biologic into healthy human subjects or patients, the product is tested to assess metabolism, pharmacokinetics, pharmacological actions, side effects associated with increasing doses, and, if possible, early evidence of effectiveness. Phase 2 usually involves trials in a limited patient population to determine the effectiveness of the drug or biologic for a particular indication, dosage tolerance, and optimum dosage, and to identify common adverse effects and safety risks. If a compound demonstrates evidence of effectiveness and an acceptable safety profile in Phase 2

21

Table of Contents