Exhibit 99.3

FELDMAN FINANCIAL ADVISORS, INC.

1001 CONNECTICUT AVENUE NW, SUITE 840

WASHINGTON, DC 20036

202-467-6862

(FAX) 202-467-6963

FULLERTON FEDERAL SAVINGS ASSOCIATION

Baltimore, Maryland

Conversion Valuation Appraisal Report

Valued as of May 27, 2011

Prepared in Conjunction with the

Conversion Merger with

Fairmount Bank

Baltimore, Maryland

Prepared By

Feldman Financial Advisors, Inc.

Washington, DC

FELDMAN FINANCIAL ADVISORS, INC.

1001 CONNECTICUT AVENUE, NW, SUITE 840

WASHINGTON, DC 20036

202-467-6862

(FAX) 202-467-6963

May 27, 2011

Board of Directors

Fullerton Federal Savings Association

7527 Belair Road

Baltimore, MD 21236

Members of the Board:

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of Fullerton Federal Savings Association (“Fullerton” or the “Association”) on a fully converted basis, as of May 27, 2011, in conjunction with the merger into Fairmount Bank, a Maryland-chartered stock savings bank headquartered in Baltimore, Maryland. Fairmount Bancorp, Inc. (“Fairmount”) is the parent for Fairmount Bank. As a result of the merger, Fullerton depositors will become depositors of Fairmount Bank. The Appraisal is furnished pursuant to the filing of the Agreement and Plan of Conversion Merger by and among Fairmount Bancorp, Inc., Fairmount Bank and Fullerton Federal Savings Association with the Office of Thrift Supervision (“OTS”).

Feldman Financial Advisors, Inc. (“Feldman Financial”) is a financial consulting and economic research firm that specializes in financial valuations and analyses of business enterprises and securities in the thrift, banking, and mortgage industries. The background of Feldman Financial is presented in Exhibit I. In preparing the Appraisal, we conducted an analysis of the Association that included discussions with the Association’s management and the Association’s legal counsel, Elias, Matz, Tiernan & Herrick L.L.P. In addition, where appropriate, we considered information based on other available published sources that we believe are reliable; however, we cannot guarantee the accuracy and completeness of such information.

We also reviewed, among other factors, the economy in the Association’s primary market area and compared the Association’s financial condition and operating performance with that of selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and in the market for thrift institution common stocks in particular.

The Appraisal is based on the Association’s representation that the information contained in the Application and additional evidence furnished to us by the Association is truthful, accurate, and complete. We did not independently verify the financial statements and other information provided by the Association, nor did we independently value the assets or liabilities of the Association. The Appraisal considers the Association only as a going concern and should not be considered as an indication of the liquidation value of the Association.

FELDMAN FINANCIAL ADVISORS, INC.

Board of Directors

Fullerton Federal Savings Association

May 27, 2011

Page Two

It is our opinion that, as of May 27, 2011, the estimated pro forma market value of the Association on a fully converted basis was within a range (the “Valuation Range”) of $510,000 to $690,000 with a midpoint of $600,000. The Valuation Range was based upon a 15% decrease from the midpoint to determine the minimum and a 15% increase from the midpoint to establish the maximum. Assuming an additional 15% increase above the maximum value would result in an adjusted maximum of $793,500.

Our Appraisal is intended only to be used in the context of determining the value of Fullerton Federal Savings Association in conjunction with the proposed merger with Fairmount Bancorp, Inc. through a pro forma stock offering and is not to be used for any other purpose. Feldman Financial is not a seller of securities within the meaning of any federal or state securities laws and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

The valuation reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Association’s operating performance, financial condition, or management policies, and current conditions in the securities markets for thrift institution common stocks. Should any such new developments or changes be material, in our opinion, to the valuation of the Association, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

| Respectfully submitted, |

| Feldman Financial Advisors, Inc. |

|

|

| Trent R. Feldman |

| President |

|

|

| Greg Izydorczyk |

| Senior Vice President |

FELDMAN FINANCIAL ADVISORS, INC.

TABLE OF CONTENTS

| TAB |

PAGE | |||||||

| INTRODUCTION | 1 | |||||||

| I. |

Chapter One – BUSINESS OF FULLERTON FEDERAL SAVINGS ACCOCIATION | |||||||

| General Overview | 3 | |||||||

| Financial Condition | 6 | |||||||

| Income and Expense Trends | 15 | |||||||

| Interest Rate Risk Management | 21 | |||||||

| Asset Quality | 24 | |||||||

| Market Area | 26 | |||||||

| Summary Outlook | 30 | |||||||

| II. |

Chapter Two – COMPARISONS WITH PUBLICLY HELD THRIFTS | |||||||

| General Overview | 31 | |||||||

| Selection Criteria | 32 | |||||||

| Recent Financial Comparisons | 35 | |||||||

| III. |

Chapter Three – MARKET VALUE ADJUSTMENTS | |||||||

| General Overview | 46 | |||||||

| Earnings Prospects | 47 | |||||||

| Financial Condition | 48 | |||||||

| Market Area | 50 | |||||||

| Management | 50 | |||||||

| Dividend Policy | 51 | |||||||

| Liquidity of the Issue | 51 | |||||||

| Subscription Interest | 52 | |||||||

| Stock Market Conditions | 53 | |||||||

| Recent Acquisition Activity | 54 | |||||||

| New Issue Discount | 55 | |||||||

| Effect of Government Regulations and Regulatory Reform | 56 | |||||||

| Adjustments Conclusion | 57 | |||||||

| Valuation Approach | 57 | |||||||

| Valuation Conclusion | 63 | |||||||

| IV. |

Appendix – EXHIBITS | |||||||

| I | Background of Feldman Financial Advisors, Inc. | I-1 | ||||||

| II-1 | Statement of Financial Condition | II-1 | ||||||

| II-2 | Statement of Operations | II-2 | ||||||

| II-3 | Loan Portfolio Composition | II-3 | ||||||

| II-4 | Deposit Account Distribution | II-4 | ||||||

| III | Financial and Market Data for All Public Thrifts | III-1 | ||||||

| IV-1 | Pro Forma Assumptions for Full Conversion Valuation | IV-1 | ||||||

| IV-2 | Pro Forma Conversion Valuation Range | IV-2 | ||||||

| IV-3 | Pro Forma Conversion Analysis at Midpoint | IV-3 | ||||||

| IV-4 | Comparative Discount and Premium Analysis | IV-4 | ||||||

i

FELDMAN FINANCIAL ADVISORS, INC.

LIST OF TABLES

| TAB |

PAGE | |||||||

| I. | Chapter One – BUSINESS OF FULLERTON FEDERAL SAVINGS ACCOCIATION | |||||||

| Table 1 | Selected Financial Condition and Performance Data | 6 | ||||||

| Table 2 | Selected Financial and Performance Ratios | 7 | ||||||

| Table 3 | Loan Portfolio | 10 | ||||||

| Table 4 | Deposit Portfolio | 13 | ||||||

| Table 5 | Summary Income Statement Data | 15 | ||||||

| Table 6 | Average Balances and Yields | 16 | ||||||

| Table 7 | Interest Rate Sensitivity and Net Portfolio Value | 23 | ||||||

| Table 8 | Non-performing Asset and Loan Loss Reserve Summary | 24 | ||||||

| Table 9 | Selected Demographic Data | 28 | ||||||

| Table 10 | Deposit Market Share for Baltimore County | 29 | ||||||

| II. | Chapter Two – COMPARISONS WITH PUBLICLY HELD THRIFTS | |||||||

| Table 11 | Comparative Group Operating Summary | 34 | ||||||

| Table 12 | Key Financial Comparisons | 37 | ||||||

| Table 13 | General Financial Performance Ratios | 41 | ||||||

| Table 14 | Income and Expense Analysis | 42 | ||||||

| Table 15 | Yield-Cost Structure and Growth Rates | 43 | ||||||

| Table 16 | Balance Sheet Composition | 44 | ||||||

| Table 17 | Regulatory Capital, Credit Risk, and Loan Composition | 45 | ||||||

| III. | Chapter Three – MARKET VALUE ADJUSTMENTS | |||||||

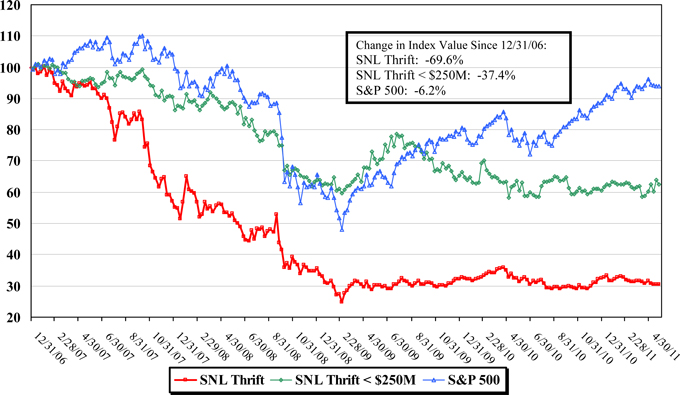

| Table 18 | Comparative Stock Index Performance | 59 | ||||||

| Table 19 | Summary of Recent Maryland Acquisition Activity | 60 | ||||||

| Table 20 | Summary of Recent Full Conversion Stock Offerings | 61 | ||||||

| Table 21 | Pro Forma Market Valuation Analysis | 64 | ||||||

ii

FELDMAN FINANCIAL ADVISORS, INC.

INTRODUCTION

As requested, Feldman Financial Advisors, Inc. (“Feldman Financial”) has prepared an independent appraisal (the “Appraisal”) of the estimated pro forma market value of Fullerton Federal Savings Association (“Fullerton” or the “Association”) on a fully converted basis, as of May 27, 2011, pursuant to a merger agreement (the “Merger”) in which Fullerton will merge with and into Fairmount Bank, a federally-chartered stock savings bank headquartered in Baltimore, Maryland. The Appraisal is furnished pursuant to the filing of the Agreement and Plan of Conversion Merger (the “Agreement”) with the Office of Thrift Supervision (“OTS”).

In the course of preparing the Appraisal, we reviewed and discussed with the Association’s management the financial statements of the Association’s operations for the years ended December 31, 2009 and 2010 and for the three months ended March 31, 2011. All financials reviewed are unaudited as the Association does not have audited financial statements. We also discussed with management other financial matters of the Association.

Where appropriate, we considered information based upon other available public sources, which we believe to be reliable; however, we cannot guarantee the accuracy or completeness of such information. We visited the Association’s primary market area and examined the prevailing economic conditions. We also examined the competitive environment within which the Association operates and assessed the Association’s relative strengths and weaknesses.

We examined and compared the Association’s financial performance with selected segments of the thrift industry and selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and the market for thrift institution common stocks in particular. We included in our analysis an examination of the potential effects of a pro forma

1

FELDMAN FINANCIAL ADVISORS, INC.

stock offering on the Association’s operating characteristics and financial performance as they relate to the estimated pro forma market value of the Association.

In preparing the Appraisal, we have relied upon and assumed the accuracy and completeness of financial and statistical information provided by the Association. We did not independently verify the financial statements and other information provided by the Association, nor did we independently value the assets or liabilities of the Association. The Appraisal considers the Association only as a going concern and should not be considered as an indication of the liquidation value of the Association.

Our Appraisal is intended only to be used in the context of determining the value of Fullerton Federal Savings Association in conjunction with the proposed merger with Fairmount Bancorp, Inc. through a pro forma stock offering and is not to be used for any other purpose. Feldman Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

The valuation reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Association’s financial performance or management policies, and current conditions in the securities market for thrift institution common stocks. Should any such developments or changes be material, in our opinion, to the valuation of the Association, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

2

FELDMAN FINANCIAL ADVISORS, INC.

I. BUSINESS OF FULLERTON FEDERAL SAVINGS ASSOCIATION

General Overview

Fullerton Federal Savings Association is a federally chartered mutual savings association founded in 1888 and provides financing primarily for home ownership and traditional savings opportunities for customers in the Overlea-Fullerton section of Baltimore County. The Association operates one banking office located in Baltimore, Maryland. Deposits are insured by the Federal Deposit Insurance Corporation (“FDIC”) and the Association is regulated by the OTS. Fullerton also is a member of the FHLB System. As of March 31, 2011, Fullerton had total assets of $9.0 million, total deposits of $7.8 million, and total equity of $1.2 million, 12.75% of total assets. The Association has only one full-time employee, an Executive Vice-President, and two part-time tellers.

Fullerton has entered into an Agreement and Plan of Conversion Merger (the “Agreement”) with Fairmount Bancorp, Inc., (“Fairmount”) and Fairmount Bank, a wholly owned subsidiary of Fairmount on May 12, 2011. Pursuant to the Agreement, Fullerton will convert from a federally chartered mutual savings association to a federally chartered stock savings association. Immediately following Fullerton’s mutual-to-stock conversion, Fairmount will acquire 1,000 shares of common stock of Fullerton issued in the conversion for $1.00 in cash, without interest, per share. The 1,000 shares of Fullerton common stock will constitute all of Fullerton’s issued and outstanding shares of common stock. Immediately following the acquisition of Fullerton, Fullerton will merge with and into Fairmount Bank, with the Fairmount Bank as the resulting institution. In connection with the acquisition and pursuant to the terms of the Agreement, Fairmount will offer shares of its common stock on a priority basis first to eligible members of Fullerton and then to Fairmount’s Employee Stock Ownership Plan

3

FELDMAN FINANCIAL ADVISORS, INC.

(“ESOP”) in a subscription offering. The amount of Fairmount common stock to be offered in the subscription offering will be based on the independent valuation of Fullerton. Any Fairmount common stock not purchased by eligible members of Fullerton or Fairmount’s ESOP in the subscription offering will be offered to certain members of Fullerton’s community and the general public. Fairmount reserves the right to accept or reject any orders in part or in whole in the community offering. Following the closing of the offering pursuant to the Agreement, Fullerton will merge with and into Fairmount Bank, with Fairmount Bank as the surviving institution.

Fairmount Bank believes that the Conversion Merger is consistent with its growth goals. Fullerton will enhance Fairmount Bank’s retail network in Baltimore County and will give Fairmount Bank three offices in Baltimore County. The proposed transaction will provide Fullerton with Fairmount’s community banking expertise in retail lending and retail deposit products, and customers of Fullerton are expected to benefit from a broader range of products and services including enhanced lending capabilities. Fairmount Bank by virtue of its size and greater variety of deposit and loan products, trust, investment and brokerage services, will be able to increase services currently offered by Fullerton.

Fullerton has historically faced significant challenges with respect to generating sufficient earnings from its operations and expects to continue to face significant earnings challenges in the future, absent a transaction such as the conversion merger. Since Fullerton does not have the size and financial resources to compete and operate profitably, Fullerton’s board of directors explored various options for Fullerton that it believed were in the best interests of Fullerton and its members.

4

FELDMAN FINANCIAL ADVISORS, INC.

Specifically, Fullerton’s board of directors determined that Fullerton would not be able to convert to stock form on a stand-alone basis due to the small size of Fullerton, lack of profitability and the local market conditions. As a result, Fullerton’s board determined to pursue a strategic alliance and believed that an in-market partner would be the best fit. Due to the presence of a Fairmount Bank branch in the Rosedale area of Baltimore County and the Fairmount’s operating culture, Fullerton contacted Fairmount to gauge Fairmount’s interest in a merger transaction. Based upon favorable discussions between Fullerton and Fairmount, the parties pursued the permissibility of such a transaction with the Office of Thrift Supervision.

The Conversion Merger is subject to approval by the members depositors of Fullerton.

Fullerton’s primary reasons for proposing the Conversion Merger are as follows:

| • | limited options continuing as a stand-alone entity; |

| • | eliminate growth and earnings pressure; |

| • | high operating expenses as a stand-alone entity due to its small size and limited earning capacity resulting there from; |

| • | expanded services offered by Fairmount Bank; and |

| • | the opportunity for Fullerton’s customers to purchase Fairmount’s common stock below market price. |

The remainder of Chapter I examines in more detail the operations of the Association as well as its competitive environment. The discussion is supplemented by the exhibits in the Appendix. Exhibit II-1 summarizes the Association’s consolidated balance sheets as of the years ended December 31, 2009 and 2010 and for the three months ended March 31, 2011. Exhibit II-2 presents the Association’s consolidated income statements for the years ended December 31, 2009 and 2010 and for the three months ended March 31, 2010 and 2011.

5

FELDMAN FINANCIAL ADVISORS, INC.

Financial Condition

Table 1 presents selected data concerning the Association’s financial position as of December 31, 2008, 2009 and 2010 and March 31, 2011 and financial performance for the fiscal years ended December 31, 2008, 2009 and 2010 and the three-month period ended March 31, 2010 and 2011. Table 2 displays relative financial and performance ratios for the Association for the fiscal years ended December 31, 2008, 2009 and 2010 and the three-month period ended March 31, 2010 and 2011. All figures are unaudited as the Association does not have audited financials.

Table 1

Selected Financial Condition and Performance Data

As of or For the Years Ended December 31, 2008, 2009 and 2010

and the Three Months Ended March 31, 2010 and 2011

| At March 31, | At December 31, | |||||||||||||||

| 2011 | 2010 | 2009 | 2008 | |||||||||||||

| (In thousands) | ||||||||||||||||

| Selected Financial Condition Data: |

||||||||||||||||

| Total assets |

$ | 8,975 | $ | 8,980 | $ | 9,042 | $ | 9,404 | ||||||||

| Cash and cash equivalents |

4,275 | 3,892 | 2,952 | 2,399 | ||||||||||||

| Investment securities |

198 | 200 | 198 | |||||||||||||

| Mortgage-backed securities held to maturity |

903 | 1,035 | 2,090 | 2,299 | ||||||||||||

| Loans receivable, net |

2,693 | 2,843 | 2,957 | 3,700 | ||||||||||||

| Total Repossessed Assets |

0 | 0 | 0 | 0 | ||||||||||||

| Total Real Estate Held for Investment |

395 | 482 | 501 | 514 | ||||||||||||

| Deposits |

7,757 | 7,770 | 7,667 | 7,881 | ||||||||||||

| Borrowings |

0 | 0 | 0 | 0 | ||||||||||||

| Equity |

1,144 | 1,142 | 1,315 | 1,463 | ||||||||||||

| Three Months Ended March 31, |

for the Year Ended December 31, |

|||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Total interest income |

$ | 51 | $ | 75 | $ | 242 | $ | 304 | $ | 357 | ||||||||||

| Total interest expense |

22 | 31 | 112 | 154 | 209 | |||||||||||||||

| Net interest income |

29 | 44 | 130 | 150 | 148 | |||||||||||||||

| Provision for loan losses |

0 | 0 | 0 | 0 | 0 | |||||||||||||||

| Net interest income after provision for loan losses |

29 | 44 | 130 | 150 | 148 | |||||||||||||||

| Total non-interest income |

69 | 49 | 62 | 38 | 165 | |||||||||||||||

| Total non-interest expense |

96 | 88 | 355 | 340 | 328 | |||||||||||||||

| Income (loss) before income tax expense (benefit) |

2 | 5 | (163) | (152) | (15) | |||||||||||||||

| Income tax expense (benefit) |

0 | (2) | (2) | (4) | (3) | |||||||||||||||

| Net income (loss) |

$ | 2 | $ | 7 | ($ | 161 | ) | ($ | 148 | ) | ($ | 12 | ) | |||||||

Source: Fullerton, SNL Financial LC

6

FELDMAN FINANCIAL ADVISORS, INC.

Table 2

Selected Financial and Performance Ratios

As of or For the Years Ended December 31, 2008, 2009 and 2010

And for the Three Months Ended March 31, 2010 and 2011

| At or for the Three Months Ended March 31, |

At or for the Year Ended December 31, |

|||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| Selected Financial Ratios and Other Data: |

||||||||||||||||||||

| Performance ratios: |

||||||||||||||||||||

| Return on assets (ratio of net income to average total assets) |

0.09 | % | 0.30 | % | -1.75 | % | -1.60 | % | -0.13 | % | ||||||||||

| Return on equity (ratio of net income to average equity) |

0.70 | % | 2.12 | % | -12.82 | % | -10.62 | % | -0.82 | % | ||||||||||

| Interest rate spread |

1.69 | % | 2.43 | % | 1.79 | % | 1.97 | % | 1.82 | % | ||||||||||

| Net interest margin |

1.60 | % | 2.35 | % | 1.73 | % | 1.95 | % | 1.83 | % | ||||||||||

| Interest income to average assets |

2.27 | % | 3.26 | % | 2.63 | % | 3.29 | % | 3.73 | % | ||||||||||

| Interest expense to average assets |

0.98 | % | 1.35 | % | 1.22 | % | 1.67 | % | 2.18 | % | ||||||||||

| Net interest income to average assets |

1.29 | % | 1.91 | % | 1.41 | % | 1.62 | % | 1.55 | % | ||||||||||

| Noninterest income to average total assets |

3.07 | % | 2.13 | % | 0.67 | % | 0.41 | % | 1.72 | % | ||||||||||

| Operating expense to average total assets |

4.28 | % | 3.82 | % | 3.85 | % | 3.68 | % | 3.43 | % | ||||||||||

| Efficiency ratio |

97.96 | % | 94.62 | % | 184.90 | % | 180.85 | % | 104.79 | % | ||||||||||

| Asset quality ratios: |

||||||||||||||||||||

| Nonperforming assets to total assets at end of period |

1.64 | % | 1.73 | % | 1.69 | % | 1.91 | % | 1.87 | % | ||||||||||

| Nonperforming loans to total loans |

5.39 | % | 4.95 | % | 5.28 | % | 5.77 | % | 4.71 | % | ||||||||||

| Allowance for loan losses to non-performing assets |

34.01 | % | 30.86 | % | 32.89 | % | 28.90 | % | 28.41 | % | ||||||||||

| Allowance for loan losses to loans receivable, net |

1.83 | % | 1.53 | % | 1.74 | % | 1.67 | % | 1.34 | % | ||||||||||

| Net charge-offs to average loans outstanding |

0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | ||||||||||

| Capital Ratios: |

||||||||||||||||||||

| Equity to total assets at end of period |

12.75 | % | 14.12 | % | 12.72 | % | 14.54 | % | 15.56 | % | ||||||||||

| Leverage ratio at end of period |

8.53 | % | 9.08 | % | 7.63 | % | 9.30 | % | 10.33 | % | ||||||||||

| Tier 1 Risk Based Ratio (%) |

21.42 | % | 21.88 | % | 18.29 | % | 22.40 | % | 24.08 | % | ||||||||||

| Risk Based Capital Ratio (%) |

22.68 | % | 23.13 | % | 19.53 | % | 23.65 | % | 25.32 | % | ||||||||||

| Other data: |

||||||||||||||||||||

| Number of full service offices |

1 | 1 | 1 | 1 | 1 | |||||||||||||||

Source: Fullerton, SNL Financial LC

Balance Sheet Composition

Total assets have remained relatively constant at $9.0 million as of March 31, 2011 as compared with December 31, 2010. Total assets declined $62,000, or 0.7%, between December 31, 2009 and December 31, 2010. As the balance sheet has been shrinking overall, the level of cash and investment securities has increased. Cash and investment securities grew from $3.0 million at December 31, 2009 to $4.1 million at December 31, 2010, an increase of $1.1 million, or 38.6%. Cash and investments increased $381,000, or 9.3%, to $4.5 million at March 31,

7

FELDMAN FINANCIAL ADVISORS, INC.

2011. Unlike most traditional financial institutions, the Association’s assets are primarily invested in cash and securities, which comprise approximately 50% of the balance sheet as of March 31, 2011.

Offsetting a portion of this increase in cash and securities has been a decline in mortgage-backed securities. Mortgage-backed securities decreased from $2.1 million at December 31, 2009 to $1.0 million at December 31, 2010, a decrease of $1.1 million or 50.5%. Mortgage-backed securities declined $132,000, or 12.8%, to $900,000 at March 31, 2011.

Loans. The loan portfolio has declined over the past few years, as the Association has not been writing new loans. The last new loan originated by the Association was in February 2010. The gross loan portfolio declined $150,000, or 5.2%, from $2.8 million at December 31, 2010 to $2.7 million at March 31, 2011 due to the repayment of existing loans. All loans on the books of the Association are one-to-four family real estate mortgage loans. The gross loan portfolio had a decrease of $114,000, or 3.8%, to $2.8 million at December 31, 2010 from $2.8 million at December 31, 2009.

Allowance for Loan Losses. The allowance for loan losses at March 31, 2011 was $50,000 or 1.82% of gross loans receivable. This reserve amount has remained constant over the past few years as it totaled $50,000 at both December 31, 2010 and 2009. The Association had $147,000 of non-performing loans at March 31, 2011, compared to $152,000 at December 31, 2010 and $173,000 at December 31, 2009. The Association has not had any foreclosed real estate over the past few years.

Deposits. Total deposits remained relatively flat at $7.8 million at March 31, 2011 and December 31, 2010. Total deposits increased $103,000, or 1.3%, to $7.8 million at December 31, 2010 from $7.7 million at December 31, 2009.

8

FELDMAN FINANCIAL ADVISORS, INC.

Equity. Total equity remained relatively flat at $1.1 million, or 12.8% of total assets, at March 31, 2011 from $1.2 million, or 12.7% of total assets, at December 31, 2010.

Total equity decreased $161,000 to $1.2 million at December 31, 2010 or 12.7% of total assets, from $1.3 million, or 14.5% of total assets at December 31, 2009. This decrease was primarily due to losses incurred by the Association.

Lending Operations

Table 3 and Exhibit II-3 present information concerning the composition of the Association’s loan portfolio in dollar amounts and in percentages (before deductions for loans in process, deferred fees and discounts and allowances for losses) at the dates indicated. As noted earlier, the Association has not made a new loan in an extended period of time.

Loan Approval Procedures and Authority. The Association’s lending policies and loan approval limits are approved by the Board of Directors. The Executive Vice President/Managing Officer is responsible for developing, implementing and administering the formal lending guidelines as well as monitoring the portfolio and providing the board with monthly and quarterly updates.

Loan Products Offered. Fullerton offers mortgage loans secured by the following property types:

| (1) | Single family residential |

| (2) | Land – Residential development |

| (3) | Residential commercial |

9

FELDMAN FINANCIAL ADVISORS, INC.

The Association will originate loans on single-family residences in amounts up to $150,000 with a maximum term of 30 years. Loans for residential development are offered up to $125,000 and loans on residential commercial property are offered up to $125,000 and a maximum term of 15 years.

Table 3

Loan Portfolio

As of December 31, 2009 and 2010

And March 31, 2011

| At March 31, | At December 31, | |||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (in thousands) | ||||||||||||

| Mortgage Loans |

||||||||||||

| 1-4 family dwellings |

$ | 2,743.0 | $ | 2,893.0 | $ | 3,007.0 | ||||||

| Construction |

0.0 | 0.0 | 0.0 | |||||||||

| Multifamily |

0.0 | 0.0 | 0.0 | |||||||||

| Commercial |

0.0 | 0.0 | 0.0 | |||||||||

| 2,743.0 | 2,893.0 | 3,007.0 | ||||||||||

| Consumer |

0.0 | 0.0 | 0.0 | |||||||||

| Less: |

||||||||||||

| Net deferred loan fees |

0.0 | 0.0 | 0.0 | |||||||||

| Allowance for loan losses |

50.0 | 50.0 | 50.0 | |||||||||

| Total loans, net |

$ | 2,693.0 | $ | 2,843.0 | $ | 2,957.0 | ||||||

Source: Fullerton, SNL Financial LC

The residential mortgage loans are written using generally accepted underwriting guidelines, and are readily saleable to Freddie Mac, Fannie Mae, or other private investors.

Property appraisals on real estate loans are made by state certified independent appraisers approved by the Board of Directors. Appraisals are performed in accordance with applicable regulations and policies.

10

FELDMAN FINANCIAL ADVISORS, INC.

Real Estate Held For Investment

The Association currently holds three homes near its branch that are currently being marketed by the Association. Management believes the three properties have a collective gain on sale of approximately $100,000. The book value of these properties as of March 31, 2011 was $395,000.

Investment Portfolio

Fullerton’s investment portfolio historically has been a significant portion of its assets as the Association has originated limited numbers of loans over the past few years. The Association’s investment portfolio as of March 31, 2011 consisted primarily of mortgage-backed securities issued by Fannie Mae and Freddie Mac, bonds issued by Federal Farms Credit Bank and certificates of deposit. The general objective of the investment portfolio is to provide liquidity and generate an acceptable level of return consistent with the principles of safety, soundness and liquidity. Investment quality emphasizes safer investments with the yield on those investments secondary to not taking unnecessary risk with the available funds of Fullerton.

The Association does not currently participate in hedging programs, interest rate caps, floors or swaps, or other activities involving the use of off-balance sheet derivative financial instruments. Further, it does not invest in securities which are not rated investment grade.

At March 31, 2011, the Association’s investment portfolio included $903,000 of mortgage-backed securities, $198,000 in government agency bonds, $919,000 of federal funds sold, $295,000 of Federal Home Loan Bank (“FHLB”) deposits and $2.2 million of certificates of deposit. The Association also had $864,000 of cash as of March 31, 2011.

11

FELDMAN FINANCIAL ADVISORS, INC.

Deposit Portfolio

Deposits are the Association’s source of funds for lending and investment purposes. Exhibit II-4 and Table 4 present a summary of the Association’s deposit composition as of December 31, 2009 and 2010 and March 31, 2011. Total deposits amounted to $7.8 million at March 31, 2011.

Current deposit products include free share accounts, money market, checking accounts, and certificates of deposit accounts. Deposit account terms vary, primarily as to the required minimum balance amount, the amount of time that the funds must remain on deposit and the applicable interest rate. The Association solicits deposits in its market areas. At March 31, 2011, the Association had no brokered, Internet or wholesale deposits. Fullerton primarily relies on competitive pricing policies, marketing and customer service to attract and retain these deposits. As of March 31, 2011, core deposits, which are defined as non-certificate or non-time deposit accounts, represented approximately 49.8% of total deposits.

Approximately 12%, or about $900,000, of the Association’s total deposits consist of funeral home deposits, or Pre-Need Funding, in which an individual prepays their funeral costs and the funeral home deposits the money in an account until the time of death of the depositor or until the individual withdraws the funds. These accounts are governed by the State of Maryland.

The flow of deposits is influenced significantly by general economic conditions, changes in money market and prevailing interest rates and competition. Fullerton tries to manage the pricing of deposits in keeping with the asset/liability management, liquidity and profitability objectives, subject to competitive factors. Based on experience, the Association believes that its deposit portfolio is a relatively stable source of funds. Despite this stability, the ability to attract

12

FELDMAN FINANCIAL ADVISORS, INC.

and maintain these deposits and the rates paid on them has been and will continue to be significantly affected by market conditions.

Table 4

Deposit Portfolio Distribution

As of December 31, 2009 to 2010 and March 31, 2011

(Dollars in Thousands)

| at March 31, | at December 31, | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| Amount | Percent of total |

Amount | Percent of total |

Amount | Percent of total |

|||||||||||||||||||

| Checking accounts |

$ | 106 | 1.4 | % | $ | 113 | 1.5 | % | $ | 127 | 1.7 | % | ||||||||||||

| Free Share accounts |

$ | 3,302 | 42.6 | $ | 3,342 | 43.0 | $ | 3,246 | 42.3 | |||||||||||||||

| MMDA accounts |

454 | 5.9 | 464 | 6.0 | 190 | 2.5 | ||||||||||||||||||

| Total non-certificates |

3,862 | 49.8 | 3,919 | 50.4 | 3,563 | 46.5 | ||||||||||||||||||

| Certificates of deposit |

3,895 | 50.2 | 3,852 | 49.6 | 4,106 | 53.5 | ||||||||||||||||||

| Total deposits |

$ | 7,757 | 100.0 | % | $ | 7,771 | 100.0 | % | $ | 7,669 | 100.0 | % | ||||||||||||

Source: Fullerton, SNL Financial LC

A large percentage of deposits are in certificates of deposit. Liquidity could be reduced if a significant amount of certificates of deposit, maturing within a short period of time, were not renewed. Historically, a significant portion of the certificates of deposit remain after they mature and management believes that this will continue. However, in a rising rate environment, the need to retain these time deposits could result in an increase in the cost of funds.

Borrowings

Due to limited lending demand, the Association has not had to utilize borrowings over the past few years to meet liquidity requirements and does not foresee the need to utilize borrowings in the future.

At March 31, 2011, the Association had no FHLB advances outstanding. The Association has not utilized borrowings in over twenty-five years.

13

FELDMAN FINANCIAL ADVISORS, INC.

Equity Capital

At March 31, 2011, total equity was $1.1 million. The small increase from December 31, 2010 reflected the small profit reported by the Association in the March 2011 quarter. As of March 31, 2011, the Association exceeded all applicable regulatory capital requirements and was well capitalized.

The Association’s Tier 1 capital amounted to $730,000 or 8.53% of adjusted total assets at March 31, 2011. The Association’s regulatory capital ratios of Tier 1 risk-based capital and total risk-based capital were 21.42% and 22.68%, respectively, as of March 31, 2011. In comparison, regulatory requirements for “adequately-capitalized” were 4.00%, 4.00%, and 8.00%, and the threshold requirements for regulatory “well-capitalized” levels were 5.00%, 6.00%, and 10.00%, respectively.

14

FELDMAN FINANCIAL ADVISORS, INC.

Income and Expense Trends

Table 5 displays the main components of the Association’s earnings performance over the three months ended March 31, 2010 and 2011 and the fiscal years ended December 31, 2009 to 2010. Table 6 displays sets forth certain information relating yields and costs for the periods indicated. The average yields and costs are derived by dividing income or expense by the average balance of assets or liabilities, respectively, for the periods presented.

Table 5

Summary Income Statement Data

For Years Ended December 31, 2009 to 2010

And the Three Month Periods Ending March 31, 2010 and 2011

| Three Months Ended March 31, |

For the Year Ended December 31, |

|||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||

| (In thousands) | ||||||||||||||||

| Summary Income Statement: |

||||||||||||||||

| Total interest income |

$ | 51 | $ | 75 | $ | 242 | $ | 304 | ||||||||

| Total interest expense |

22 | 31 | 112 | 154 | ||||||||||||

| Net interest income |

29 | 44 | 130 | 150 | ||||||||||||

| Provision for loan losses |

0 | 0 | 0 | 0 | ||||||||||||

| Net interest income after provision for loan losses |

29 | 44 | 130 | 150 | ||||||||||||

| Total non-interest income |

69 | 49 | 62 | 38 | ||||||||||||

| Total non-interest expense |

96 | 88 | 355 | 340 | ||||||||||||

| Income (loss) before income tax expense (benefit) |

2 | 5 | (163 | ) | (152 | ) | ||||||||||

| Income tax expense (benefit) |

0 | (2 | ) | (2 | ) | (4 | ) | |||||||||

| Net income (loss) |

$ | 2 | $ | 7 | ($ | 161 | ) | ($ | 148 | ) | ||||||

Source: Fullerton, SNL Financial LC.

15

FELDMAN FINANCIAL ADVISORS, INC.

Table 6

Average Balances and Yields

For the Years Ended December 31, 2009 and 2010

and the Three Months Ended March 31, 2010 and 2011

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | |||||||||||||||||||||||||||||

| Average Outstanding Balance |

Yield/ Rate |

Average Outstanding Balance |

Yield/ Rate |

Average Outstanding Balance |

Yield/ Rate |

Average Outstanding Balance |

Yield/ Rate |

|||||||||||||||||||||||||

| Interest-Earning Assets: |

||||||||||||||||||||||||||||||||

| Loans receivable |

$ | 2,804 | 5.28 | % | $ | 3,136 | 6.63 | % | $ | 3,087 | 5.28 | % | $ | 3,300 | 5.77 | % | ||||||||||||||||

| Investments |

3,465 | 1.15 | 3,010 | 1.06 | 3,404 | 1.29 | 1,806 | 1.05 | ||||||||||||||||||||||||

| Mortgage Backed securities |

965 | 1.78 | 1,334 | 4.51 | 1,041 | 3.30 | 2,584 | 3.68 | ||||||||||||||||||||||||

| Other interest-earning assets |

0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | ||||||||||||||||||||||||

| Total interest-earning assets |

7,234 | 2.83 | 7,480 | 4.01 | 7,532 | 3.20 | 7,690 | 3.96 | ||||||||||||||||||||||||

| Interest-Bearing Liabilities: |

||||||||||||||||||||||||||||||||

| Deposits |

7,763 | 1.13 | 7,826 | 1.58 | 7,898 | 1.42 | 7,778 | 1.98 | ||||||||||||||||||||||||

| Total interest-bearing liabilities |

$ | 7,763 | 1.13 | $ | 7,826 | 1.58 | $ | 7,898 | 1.42 | $ | 7,778 | 1.98 | ||||||||||||||||||||

| Interest rate spread |

1.70 | % | 2.43 | % | 1.78 | % | 1.98 | % | ||||||||||||||||||||||||

| Net earning assets |

($ | 529 | ) | ($ | 346 | ) | ($ | 366 | ) | ($ | 88 | ) | ||||||||||||||||||||

| Net interest margin |

1.60 | % | 2.35 | % | 1.73 | % | 1.95 | % | ||||||||||||||||||||||||

| Ratio of average interest-earning assets to average interest-bearing liabilities |

93.19 | % | 95.58 | % | 95.37 | % | 98.87 | % | ||||||||||||||||||||||||

Source: Fullerton, SNL Financial LC

16

FELDMAN FINANCIAL ADVISORS, INC.

As noted in the tables above, the Association has struggled to report profitable operations over the past few years. Net income was a negative $148,000 for the year ended December 31, 2009 and a negative $161,000 for the year ended December 31, 2010. For the three months ended March 31, 2011, the Association reported a meager profit of $2,000 compared to $7,000 for the same period in 2010. The March 2011 quarter profit reflected a gain on real estate held for investment.

Management believes the primary factor for the poor performance is related to its inability to generate any meaningful operations due to its limited size and competition in its market area. Also, as existing loans repay, the Associations margins continue to deteriorate. The interest rate spread, which is the difference between the average yield earned on interest-earning assets and the average rate paid on interest-bearing liabilities, declined from 1.97% in fiscal 2009 to 1.79% in fiscal 2010 and then to 1.69% during the three months ended March 31, 2011. Also due to the small size of the Association’s loan portfolio, net interest income only covers a small portion of operating expenses.

Comparison of Operating Results for the Three Months Ended March 31, 2011 and March 31, 2010

Net income for the three months ended March 31, 2011 was $2,000 compared to net income of $7,000 for the three months ended March 31, 2010. The earnings represent an annualized return on average assets of 0.09% for the three-month period in 2011 and 0.30% for the same period in 2010.

The decrease in net income was due primarily to a decrease in the interest rate spread and net interest income. For the three months ended March 31, 2011, the Association reported a yield/cost spread of 1.69% compared to 2.43% for the same period in 2010. The average yield

17

FELDMAN FINANCIAL ADVISORS, INC.

on assets decreased to 2.83% for the three months ended March 31, 2010 from 4.01% for the same period in 2010. The average cost of liabilities decreased to 1.13% for the three months ended March 31, 2011 from 1.58% for the three months ended March 31, 2010. This decline in net interest spread resulted in a decline in net interest income to $29,000 for the three months ended March 31, 2011 from $44,000 for the three months ended March 31, 2010.

The average net interest margin declined to 1.60% for the three-month period ended March 31, 2011 from 2.35% for the same period in 2010. The ratio of average interest earning assets to average interest bearing liabilities fell to 93.2% for the March 2011 quarter compared to 95.6% for the March 2010 quarter.

Interest income dropped to $51,000 for the three-month period ended March 31, 2011 from $77,000 for the three-month period ended March 31, 2010, a decline of $24,000, or 32.0%. This was the result of the decline in yields on earning assets plus the slight decrease in earning assets over these periods.

Interest expense for the three-month period ended March 31, 2011 was $22,000 compared to $31,000 for the same period in 2010, a decrease of $9,000 or 29.0%. The decrease was primarily the result of a decrease in average cost of liabilities.

The Association did not record any provisions in either three-month period ended March 31, 2011 or 2010. The allowance for loan losses to net loans receivable was 1.83% at March 31, 2011 compared to 1.53% at March 31, 2010.

Non-interest income for the three months ended March 31, 2011 increased $20,000, or 40.8%, to $69,000. This increase was due to a gain on real estate held for investment recorded in

18

FELDMAN FINANCIAL ADVISORS, INC.

the March 2011 quarter. Non-interest expense for the three months ended March 31, 2011 was $96,000, $8,000 or 9.1% more than the $88,000 for the same period in 2010.

Comparison of Operating Results for the Years Ended December 31, 2010 and December 31, 2009

Net income for the year ended December 31, 2010 was a loss of $161,000 compared to a net loss of $148,000 for the year ended December 31, 2009. The earnings represent a return on average assets of a negative 1.79% for fiscal year 2010 and a negative 1.60% for fiscal year 2009.

The decrease in net income was due primarily to a decrease in the interest rate spread, combined with an increase in non-interest expense, which offset the increase in non-interest income. The average yield on assets decreased to 3.20% for the year ended December 31, 2010 from 3.96% for the year ended December 31, 2009. As a result of this decline, the net interest rate spread fell from 1.98% for fiscal 2009 to 1.78% for fiscal 2010.

Net interest income decreased $20,000, or 13.3%, to $130,000 in 2010 from $150,000 in 2009 as yields on earning assets declined. The average net interest margin declined to 1.73% for fiscal 2010 from 1.95% for fiscal 2009. The ratio of average interest earning assets to average interest bearing liabilities declined slightly from 98.9% during fiscal 2009 to 95.4% in fiscal 2010.

Interest income fell sharply between fiscal 2009 and 2010, totaling $242,000 in fiscal 2010 compared to $304,000 in fiscal 2009, a decline of $62,000 or 20.4%. Both the yield on earning assets and the level of earning assets decreased over this period.

Interest expense for fiscal 2010 was $112,000 compared to $154,000 for 2009, a decrease of $42,000 or 27.3%. The decrease was primarily the result of a decrease in the average cost of deposit accounts offsetting a slight increase in average balances. Average deposit accounts

19

FELDMAN FINANCIAL ADVISORS, INC.

increased to $7.9 million for 2010 from $7.8 million for 2009 while the average rate paid on deposits decreased to 1.42% for 2010 from 1.98% for 2009.

The Association did not record any provisions in either fiscal 2010 or 2009. The allowance for loan losses to net loans receivable was 1.74% at December 31, 2010 compared to 1.67% at December 31, 2009.

Non-interest income for 2010 increased $24,000, or 63.2%, to $62,000. The increase was due primarily to a gain of $40,000 recorded in fiscal 2010 on securities held to maturity. Non-interest expense for 2010 was $355,000, $11,000 or 7.2% more than the $340,000 for 2009. The primary component of non-interest expense is compensation and benefits, which increased $12,000 to 207,000 in fiscal 2010. The Association had one full-time employee at December 31, 2009 and 2010.

20

FELDMAN FINANCIAL ADVISORS, INC.

Interest Rate Risk Management

The rates of interest earned on assets and paid on liabilities generally are established contractually for a period of time. Market interest rates change over time. Loans generally have longer maturities than deposits. Accordingly, the results of operations, like those of other financial institutions, are impacted by changes in interest rates and the interest rate sensitivity of our assets and liabilities. The risk associated with changes in interest rates and the ability to adapt to these changes is known as interest rate risk and is the Association’s most significant market risk.

As part of the Association’s attempt to manage its exposure to changes in interest rates and comply with applicable regulations, the Association monitors its interest rate risk. In monitoring interest rate risk, it continually analyzes and manages assets and liabilities based on their payment streams and interest rates, the timing of their maturities, and their sensitivity to actual or potential changes in market interest rates. The Association manages its interest rate risk in a conservative manner, consistent with its general operating philosophy.

The Association’s investment policy guides the Association to buy short-term assets during periods of rising rates and longer-term assets during periods of declining rates. It is the Association’s intent to hold investments until maturity. As such, the Association does utilize a trading account.

When purchasing securities, the Association considers the following factors:

| A) | Current market conditions; |

| B) | The forecast for how long current conditions may last; |

| C) | Strategies of the Association; |

| D) | Availability of securities that as closely match the Association’s strategies; |

21

FELDMAN FINANCIAL ADVISORS, INC.

| E) | The ability to dispose of such securities if conditions change; and, |

| F) | The ability of the Association to carry such securities to maturity. |

Except for short-term deposits in certificates of deposit, all loan originations purchases of investments and securities need to be approved by either the Board of Directors or the Executive Committee as appointed by the Board.

To manage risk, the Association measures its interest rate sensitivity based on the net portfolio value (“NPV”) of market equity. NPV reflects the simulated equity of the Association as obtained by estimating the economic present value of its assets, liabilities, and off-balance sheet items under different interest rate scenarios. Table 7 presents (as of December 31, 2010, the most current table available) forward-looking information about sensitivity to changes in interest rates. Interest rate risk is measured by changes in NPV for instantaneous parallel shifts in the yield curve. As illustrated in Table 7, Fullerton does not benefit more from either a decrease in market rates or an increase. Only under a rising interest rate scenario of 100 basis points would the Association not have a negative change in NPV. Under this scenario, NPV would remain relatively flat with resulting NPV ratio of 15.50% of assets. All other scenarios result in a decline in the Association’s NPV ratio. In the event of a 200 basis point increase in interest rates, NPV would experience a 2.0% decrease with a resulting NPV ratio of 15.32%. A downward movement in market rates by 100 basis points would result in a negative impact on NPV of 1.0% as the NPV ratio measures 15.25% under this declining rate scenario.

22

FELDMAN FINANCIAL ADVISORS, INC.

Table 7

Interest Rate Sensitivity of Net Portfolio Value

| As of December 31, 2010 | ||||||||||

| Changes in Interest Rates |

Net Portfolio Value |

NPV as a % of Portfolio Value of Assets | ||||||||

| Amount |

$ Change |

% Change |

NPV Ratio |

Change (bp) | ||||||

| (Basis Points) | ||||||||||

| +300 |

$1,381 | ($61) | (4.00) | 15.04% | (38) | |||||

| +200 |

1,417 | (25) | (2.00) | 15.32% | (11) | |||||

| +100 |

1,443 | 1 | 0.00 | 15.50% | 7 | |||||

| +50 |

1,436 | (6) | 0.00 | 15.40% | (2) | |||||

| 0 |

1,442 | — | — | 15.43% | — | |||||

| -50 |

1,407 | (35) | (2.00) | 15.08% | (34) | |||||

| -100 |

1,427 | (15) | (1.00) | 15.25% | (18) | |||||

Source: Fullerton

23

FELDMAN FINANCIAL ADVISORS, INC.

Asset Quality

Table 8 provides information regarding the Association’s non-performing loans and other non-performing assets and allowance for loan loss reserves for the period indicated. At March 31, 2011, the allowance for loan losses totaled $50,000, non-performing loans totaled $147,000, and the ratio of allowance for loan losses to gross loans was 1.82%.

Table 8

Non-performing Asset and Loan Loss Reserve Summary

As of December 31, 2009 to 2010 and March 31, 2011

| March 31, 2011 |

At December 31, | |||||||||||

| 2010 | 2009 | |||||||||||

| (Dollars in thousands) | ||||||||||||

| Nonaccruing loans |

||||||||||||

| One- to four-family |

$ | 147 | $ | 152 | $ | 173 | ||||||

| All Other |

— | — | — | |||||||||

| Total |

147 | 152 | 173 | |||||||||

| Foreclosed assets: |

||||||||||||

| One- to four-family |

— | — | — | |||||||||

| All Other |

— | — | — | |||||||||

| Total |

— | — | — | |||||||||

| Total nonperforming assets |

$ | 147 | $ | 152 | $ | 173 | ||||||

| Total as a percentage of total assets |

1.64 | % | 1.69 | % | 1.91 | % | ||||||

| Loan loss reserves, beginning of period |

$ | 50 | $ | 50 | $ | 50 | ||||||

| Less: Charge-offs |

— | — | — | |||||||||

| Plus: Recoveries |

— | — | — | |||||||||

| Additions charged to operations |

— | — | — | |||||||||

| Loan loss reserves, end of period |

$ | 50 | $ | 50 | $ | 50 | ||||||

| Loan loss reserves as a percentage of total loans |

1.82 | % | 1.73 | % | 1.66 | % | ||||||

| Loan loss reserves as a percentage of total non-performing loans |

34.01 | % | 32.89 | % | 28.90 | % | ||||||

Source: Fullerton, SNL Financial LC.

Management, in compliance with federal guidelines, has instituted an internal loan review program, whereby non-performing loans are classified as special mention, substandard, doubtful or loss. It is the Association’s policy to review the loan portfolio, in accordance with regulatory

24

FELDMAN FINANCIAL ADVISORS, INC.

classification procedures, on at least a quarterly basis. When a loan is classified as substandard or doubtful, management is required to evaluate the loan for impairment. When management classifies a portion of a loan as loss, a reserve equal to 100% of the loss amount is required to be established or the loan is to be charged-off.

An asset that does not currently expose the Association to a sufficient degree of risk to warrant an adverse classification, but which possesses credit deficiencies or potential weaknesses that deserve management’s close attention is classified as “special mention.”

An asset classified as “substandard” is inadequately protected by the current net worth and paying capacity of the obligor or the collateral pledged, if any. Assets so classified have well-defined weaknesses and are characterized by the distinct possibility that the Association will sustain some loss if the deficiencies are not corrected.

An asset classified as “doubtful” has all the weaknesses inherent in a “substandard” asset with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently existing facts, conditions, and values, highly questionable and improbable. The possibility of a loss on a doubtful asset is high.

That portion of an asset classified as “loss” is considered uncollectible and of such little value that it’s continuance as an asset, without establishment of a specific valuation or charge-off, is not warranted. This classification does not necessarily mean that an asset has absolutely no recovery or salvage value; but rather, it is not practical or desirable to defer writing off a basically worthless asset even though partial recovery may be effected in the future.

The Association regularly reviews the problem assets in portfolio to determine whether any assets require classification in accordance with applicable regulations.

25

FELDMAN FINANCIAL ADVISORS, INC.

Market Area

The Association is headquartered in Baltimore. Maryland, and operates one retail banking office in the Overlea-Fullerton section of Baltimore County. Baltimore County is located in the northern part of the state of Maryland. Baltimore County does not actually include the city of Baltimore, which left the county to become an independent city in 1851.

The economy of Baltimore County represents a cross section of employment sectors, with a mix of services, manufacturing, wholesale/retail trade, federal and local government, health care facilities, defense contractors and finance related employment. Black and Decker, McCormick, Severstal Steel, Lockheed Martin, and T. Rowe Price all have major operations or headquarters in Baltimore County. The largest employers in the Baltimore County include the Social Security Administration/Centers for Medicare & Medicaid Services (CMS), Franklin Square Hospital Center, Greater Baltimore Medical Center, T. Rowe Price and McCormick & Company, Inc.

The Association faces substantial competition in attracting deposits and in originating loans. The Association operates in a market area with a high concentration of banking and financial institutions. A number of competitors are significantly larger institutions with greater financial and managerial resources and lending limits. The Association’s ability to compete successfully is a significant factor affecting growth potential and profitability.

Table 9 displays selected demographic data for the United States, the state of Maryland, Baltimore County and zip code 21236. Population growth in the Association’s market is projected to decline over the next few years. Projected population growth for zip code 21236 is a negative 1.2% while Baltimore County’s population is projected to increase only 0.5% over the

26

FELDMAN FINANCIAL ADVISORS, INC.

period 2010-2015. This contrasts with projected population growth for both the state of Maryland at 1.9% and the United States as a whole at 3.9%.

The median household income level for Baltimore County was below comparable demographic data for Maryland but higher than the United States. The median household income for Baltimore County was estimated at $63,355 in 2010, as compared to the state median household income level of $66,983 and the national median household income level of $54,442. The median household income for zip code 21236 was similar to the Baltimore County number at $61,192. With a median age of 40.2 years, Baltimore County has an older population than either the state at 38.3 years or the United States at 37.0 years. The average age for zip code 21236 is 40.8 years.

Table 10 summarizes deposit market data for all commercial banks and thrift institutions with offices in Baltimore County, Maryland. Based on deposit data as of May 270, 201 and adjusted for any subsequent merger transactions, the Association ranked 41st in deposit market share among the financial institutions operating in the county. As of such date, the Association had total deposits of $8.1 million in the county, which reflected a 0.05% market share based on the county’s total deposits of $15.4 billion. Three large regional commercial banks occupied the top market share rankings of deposits in Baltimore County. M&T Bank Corp., Bank of America Corp. and Well Fargo & Co. held market shares of 18.5%, 16.6% and 11.6%, respectively.

27

FELDMAN FINANCIAL ADVISORS, INC.

Table 9

Selected Demographic Data

United States, Maryland, Baltimore County and Zip Code 21236

| United States |

State of Maryland |

Baltimore County |

Zip Code 21236 |

|||||||||||||

| Total Population |

||||||||||||||||

| 2010 - Current |

311,212,863 | 5,730,892 | 791,426 | 39,480 | ||||||||||||

| % Change 2000-10 |

10.6 | % | 8.2 | % | 4.9 | % | -0.6 | % | ||||||||

| % Change 2010-15 |

3.9 | % | 1.9 | % | 0.5 | % | -1.2 | % | ||||||||

| Age Distribution, 2008 |

||||||||||||||||

| 0 - 14 Age Group |

20.1 | % | 19.7 | % | 17.6 | % | 16.7 | % | ||||||||

| 15 -34 Age Group |

27.2 | % | 25.9 | % | 26.1 | % | 25.1 | % | ||||||||

| 35 -54 Age Group |

28.0 | % | 29.7 | % | 28.4 | % | 29.2 | % | ||||||||

| 55+ Age Group |

24.7 | % | 24.8 | % | 28.0 | % | 29.1 | % | ||||||||

| Median Age (years) |

37.0 | 38.3 | 40.2 | 40.8 | ||||||||||||

| Total Households |

||||||||||||||||

| 2010 - Current |

116,761,140 | 2,138,493 | 314,631 | 16,531 | ||||||||||||

| % Change 2000-10 |

10.7 | % | 8.0 | % | 4.9 | % | -0.5 | % | ||||||||

| % Change 2010-15 |

3.9 | % | 2.0 | % | 0.5 | % | -1.2 | % | ||||||||

| Total Household Income |

||||||||||||||||

| $0-25K Households (%) |

20.8 | % | 15.2 | % | 14.6 | % | 13.8 | % | ||||||||

| $25-50K Households (%) |

24.7 | % | 20.2 | % | 22.6 | % | 23.3 | % | ||||||||

| $50-100K Households (%) |

35.7 | % | 38.0 | % | 43.1 | % | 46.7 | % | ||||||||

| $100K+ Households (%) |

18.8 | % | 26.6 | % | 19.7 | % | 16.3 | % | ||||||||

| Median Household Net Worth |

$ | 93,084 | $ | 135,762 | $ | 120,262 | $ | 110,120 | ||||||||

| Average Household Income |

||||||||||||||||

| 2010 - Current |

$ | 70,173 | $ | 83,182 | $ | 76,039 | $ | 68,925 | ||||||||

| % Change 2000-10 |

23.9 | % | 23.3 | % | 16.9 | % | 13.1 | % | ||||||||

| % Change 2010-15 |

13.1 | % | 14.1 | % | 13.7 | % | 12.1 | % | ||||||||

| Median Household Income |

||||||||||||||||

| 2010 - Current |

$ | 54,442 | $ | 66,983 | $ | 63,355 | $ | 61,192 | ||||||||

| % Change 2000-10 |

29.1 | % | 26.4 | % | 25.0 | % | 18.1 | % | ||||||||

| % Change 2010-15 |

12.4 | % | 13.7 | % | 10.9 | % | 6.6 | % | ||||||||

| Per Capita Income |

||||||||||||||||

| 2010 - Current |

$ | 26,739 | $ | 31,494 | $ | 30,669 | $ | 29,038 | ||||||||

| % Change 2000-10 |

23.9 | % | 23.0 | % | 17.2 | % | 12.4 | % | ||||||||

| % Change 2010-15 |

13.1 | % | 14.1 | % | 13.8 | % | 12.1 | % | ||||||||

| Unemployment Rate (%) |

||||||||||||||||

| March 2011 |

8.8 | % | 7.0 | % | 7.6 | % | NA | |||||||||

| December 2010 |

9.4 | % | 7.1 | % | 7.8 | % | NA | |||||||||

| December 2009 |

10.0 | % | 7.2 | % | 7.6 | % | NA | |||||||||

Source: SNL Financial and ESRI.

28

FELDMAN FINANCIAL ADVISORS, INC.

Table 10

Deposit Market Share

Baltimore County, Maryland

Data as of May 270, 2009 and 2010

(adjusted for completed and announced mergers)

| Baltimore, MD |

||||||||||||||||||||||||||||

| 2010 | 2009 | |||||||||||||||||||||||||||

|

Rank |

Total Branches |

Total Deposits |

Market Share |

Total Deposits |

Market Share |

|||||||||||||||||||||||

| 2010 |

2009 |

Institution (ST) |

Type | |||||||||||||||||||||||||

| 1 | 1 | M&T Bank Corp. (NY) | Bank | 51 | 2,862,292 | 18.53 | 2,945,036 | 19.06 | ||||||||||||||||||||

| 2 | 2 | Bank of America Corp. (NC) | Bank | 38 | 2,559,802 | 16.57 | 2,809,127 | 18.18 | ||||||||||||||||||||

| 3 | 3 | Wells Fargo & Co. (CA) | Bank | 21 | 1,787,965 | 11.58 | 1,805,123 | 11.68 | ||||||||||||||||||||

| 4 | 4 | PNC Financial Services Group (PA) | Bank | 33 | 1,459,763 | 9.45 | 1,396,161 | 9.03 | ||||||||||||||||||||

| 5 | 5 | SunTrust Banks Inc. (GA) | Bank | 19 | 939,185 | 6.08 | 879,703 | 5.69 | ||||||||||||||||||||

| 6 | 6 | Eastern SB FSB (MD) | Savings Inst | 4 | 700,331 | 4.53 | 753,039 | 4.87 | ||||||||||||||||||||

| 7 | 7 | Susquehanna Bancshares Inc. (PA) | Bank | 11 | 591,075 | 3.83 | 622,030 | 4.02 | ||||||||||||||||||||

| 8 | 11 | Rosedale FS&LA (MD) | Savings Inst | 5 | 437,880 | 2.84 | 392,450 | 2.54 | ||||||||||||||||||||

| 9 | 8 | BB&T Corp. (NC) | Bank | 9 | 427,248 | 2.77 | 488,552 | 3.16 | ||||||||||||||||||||

| 10 | 10 | BCSB Bancorp Inc. (MD) | Thrift | 12 | 425,171 | 2.75 | 393,177 | 2.54 | ||||||||||||||||||||

| 11 | 9 | First Mariner Bancorp (MD) | Bank | 12 | 400,761 | 2.59 | 432,417 | 2.80 | ||||||||||||||||||||

| 12 | 21 | Capital Funding Bancorp LLC (MD) | Bank HC | 1 | 296,137 | 1.92 | 101,405 | 0.66 | ||||||||||||||||||||

| 13 | 14 | Hopkins Bancorp Inc. (MD) | Thrift HC | 1 | 242,105 | 1.57 | 217,206 | 1.41 | ||||||||||||||||||||

| 14 | 13 | Northwest Bancshares, Inc. (PA) | Thrift | 2 | 241,396 | 1.56 | 253,637 | 1.64 | ||||||||||||||||||||

| 15 | 15 | Patapsco Bancorp Inc. (MD) | Bank | 3 | 219,930 | 1.42 | 198,757 | 1.29 | ||||||||||||||||||||

| 41 | 40 | Fullerton FSA (MD) | Savings Inst | 1 | 8,059 | 0.05 | 7,949 | 0.05 | ||||||||||||||||||||

| All Other Institutions | 48 | 1,846,315 | 11.95 | 1,759,628 | 11.39 | |||||||||||||||||||||||

| Total For Institutions In Market | 271 | 15,445,415 | 100.00 | 15,455,397 | 100.00 | |||||||||||||||||||||||

Source: SNL Financial.

29

FELDMAN FINANCIAL ADVISORS, INC.

Summary Outlook

The overall earnings outlook of the Association (without the benefit of the Conversion Merger) remains unfavorable due to high levels of securities as a percentage of total assets and the Association’s limited lending operations which has not originated a new loan in over one year, combined with a declining net interest margin.

Management of the Association feels the Association is constrained due to its size and resources and is not able to effectively compete with competitors in the market.

30

FELDMAN FINANCIAL ADVISORS, INC.

II. COMPARISONS WITH PUBLICLY HELD THRIFTS

General Overview

The comparative market approach provides a sound basis for determining estimates of going-concern valuations where a regular and active market exists for the stocks of peer institutions. The comparative market approach was utilized in determining the estimated pro forma market value of the Association because: (i) reliable market and financial data are readily available for comparable institutions; (ii) the comparative market method is required by the applicable regulatory guidelines; and (iii) other alternative valuation methods (such as income capitalization, liquidation analysis, or discounted cash flow) are unlikely to produce a valuation relevant to the future trading patterns of the related equity interest. The generally employed valuation method in initial public offerings, where possible, is the comparative market approach, which also can be relied upon to determine pro forma market value in a thrift stock conversion.

The comparative market approach derives valuation benchmarks from the trading patterns of selected peer institutions which, due to certain factors such as financial performance and operating strategies, enable the appraiser to estimate the potential value of the subject institution in a stock conversion offering. The pricing and trading history of recent initial public offerings of thrifts are also examined to provide evidence of the “new issue discount” that must be considered. In Chapter II, our valuation analysis focuses on the selection and comparison of the Association with a comparable group of publicly traded thrift institutions (the “Comparative Group”). Chapter III will detail any additional discounts or premiums that we believe are appropriate to the Association’s pro forma market value.

31

FELDMAN FINANCIAL ADVISORS, INC.

Selection Criteria

Selected market price and financial performance data for all public thrifts listed on major stock exchanges are shown in Exhibit III. The list excludes companies that are subject to being acquired under a pending transaction and companies that have a majority ownership interest controlled by a mutual holding company (“MHC”). Several criteria, discussed below, were used to select the individual members of the Comparative Group from the overall universe of publicly held thrifts.

| • | Operating characteristics – An institution’s operating characteristics are the most important factors because they affect investors’ expected rates of return on a company’s stock under various business/economic scenarios, and they influence the market’s general perception of the quality and attractiveness of a given company. Operating characteristics, which may vary in importance during the business cycle, include financial variables such as profitability, balance sheet growth, capitalization, asset quality, and other factors such as lines of business and management strategies. |

| • | Degree of marketability and liquidity – Marketability of a stock reflects the relative ease and promptness with which a security may be sold when desired, at a representative current price, without material concession in price merely because of the necessity of sale. Marketability also connotes the existence of buying interest as well as selling interest and is usually indicated by trading volumes and the spread between the bid and asked price for a security. Liquidity of the stock issue refers to the organized market exchange process whereby the security can be converted into cash. We attempted to limit our selection to companies that have access to a regular trading market or price quotations. We eliminated from the comparative group companies with market prices that were materially influenced by publicly announced or widely rumored acquisitions. However, the expectation of continued industry consolidation is currently embedded in thrift equity valuations. |

| • | Geographic Location – The region of the country where a company operates is also of importance in selecting the comparative group. The operating environment for thrift institutions varies from region to region with respect to business and economic environments, real estate market conditions, speculative takeover activity, and investment climates. Economic and investor climates can also vary greatly within a region, particularly due to takeover activity. |

32

FELDMAN FINANCIAL ADVISORS, INC.

In determining the Comparative Group composition, we focused on the Association’s corporate structure, asset size, equity level and profitability. As with any composition of a group of comparable companies, the selection criteria were broadened sufficiently to assemble a meaningful number of members for inclusion. Specifically, we first applied the following selection criteria:

| • | Publicly traded thrift – stock-form thrift whose shares are traded on the New York or NYSE Amex stock exchanges or listed on the NASDAQ market. |

| • | Non-acquisition target – company is not subject to a pending acquisition. |

| • | Mutual holding company – majority ownership not held by an MHC. |

| • | Seasoned trading issue – company completed its initial public offering (“IPO”) over one year ago. |

| • | Current financial data – publicly reported financial data available for the most recent last twelve months (“LTM”) ending March 31, 2011. |

| • | Asset size – total assets less than $500 million. |

| • | Capitalization – equity to assets ratio greater than or equal to 6.0%. |

| • | Profitability measure – LTM Core ROA <= 0.35%. |

As a result of applying the above criteria, the screening process produced a group of nine publicly traded thrifts with operations comparable to those of the Association. In addition, we have also selected BCSB Bancorp, Inc. due to its location (headquartered in the same state as the Association) and its earning profile. A general operating summary of these ten members selected for the Comparative Group is presented in Table 11.

The asset sizes of the selected companies range from $204.2 million at First Bancshares, Inc. to $624.8 million at BCSB Bancorp, Inc. The median asset size of the Comparative Group was $301.7 million, significantly larger than the Association’s asset size of $9.0 million.

33

FELDMAN FINANCIAL ADVISORS, INC.

In comparison to recent performance trends of the aggregate public thrift industry, the Comparative Group companies generally exhibited below-average profitability ratios, slightly lower net interest margins, lower capital ratios, higher efficiency ratios and higher levels of problem assets combined with lower levels of reserves related to those problem assets. While some differences inevitably may exist between the Association and the individual companies, we believe that the chosen Comparative Group, overall, provides a meaningful basis of financial comparison for valuation purposes.

Table 11

Comparative Group Operating Summary

As of March 31, 2011

| Company |

City |

State | No. of Offices |

Initial Conversion Date |

Total Assets ($000s) |

Equity/ Assets (%) |

||||||||||||||||

| Fullerton FSA |

Baltimore | MD | 1 | NA | 8,975 | 12.75 | ||||||||||||||||

| BCSB Bancorp, Inc. |

Baltimore | MD | 17 | 04/11/08 | 624,764 | 8.08 | ||||||||||||||||

| OBA Financial Services, Inc. |

Germantown | MD | 5 | 01/22/10 | 355,971 | 22.72 | ||||||||||||||||

| Broadway Financial Corporation |

Los Angeles | CA | 5 | 01/09/96 | 476,734 | 6.83 | ||||||||||||||||

| CMS Bancorp, Inc. |

White Plains | NY | 6 | 04/04/07 | 246,348 | 8.77 | ||||||||||||||||

| First Federal of Northern Michigan Bancorp, Inc. |

Alpena | MI | 8 | 04/04/05 | 215,445 | 10.91 | ||||||||||||||||

| WSB Holdings, Inc. |

Bowie | MD | 5 | 08/03/88 | 409,352 | 12.79 | ||||||||||||||||

| First Bancshares, Inc. |

Mountain Grove | MO | 13 | 12/22/93 | 204,185 | 9.56 | ||||||||||||||||

| Park Bancorp, Inc. |

Chicago | IL | 4 | 08/12/96 | 207,665 | 8.11 | ||||||||||||||||

| WVS Financial Corp. |

Pittsburgh | PA | 6 | 11/29/93 | 247,419 | 11.46 | ||||||||||||||||

| Central Bancorp, Inc. |

Somerville | MA | 11 | 10/24/86 | 487,625 | 9.66 | ||||||||||||||||

Source: Fullerton FSA; SNL Financial; Feldman Financial.

34

FELDMAN FINANCIAL ADVISORS, INC.

Recent Financial Comparisons

Table 12 summarizes certain key financial comparisons between the Association and the Comparative Group. Tables 13 through 17 contain the detailed financial comparisons of the Association with the individual Comparative Group companies based on measures of profitability, income and expense components, yield-cost structure, capital levels, credit risk, balance sheet composition, and growth rates. Financial data for the Association, the Comparative Group, and All Public Thrift aggregate were utilized as of or for the most recent available LTM period ending March 31, 2011.

The Association’s LTM return on average assets was a negative 1.81%, reflecting a profitability measure below the Comparative Group median of 0.13% and well below the All Public Thrift median of 0.45%. The Association’s comparatively weaker earnings level was attributable mainly to its considerably lower net interest margin and higher level of non-interest expense. The Association’s LTM return on average equity at a negative 13.70% was also below the Comparative Group median of 1.05% and the All Public Thrift median of 3.55%.

The Association’s net interest income level of 1.26% relative to average assets was positioned well below the Comparative Group median of 3.13% and the All Public Thrift median of 3.14%. The Association’s lower level of net interest income production was attributable to its significantly lower level of interest income during the period as compared to the Comparative Group and All Public Thrift Group medians.

The Association’s earning asset yield measured 2.92% and trailed the Comparative Group median of 4.82% and the All Public Thrift median of 4.93%. The Association’s lower asset yield resulted from having a small concentration of loans as a percentage of total assets, which carry a

35

FELDMAN FINANCIAL ADVISORS, INC.

higher yield than investment securities, which comprise the majority of the Association’s earning assets, as compared to the Comparative Group and the All Public Thrift Group. The Association’s ratio of loans to total assets measured 30.0% compared to the Comparative Group median of 68.0% and the All Public Thrift Group median of 68.3%. Conversely, cash and investment securities comprise 59.9% of the Association’s assets as compared to a median of 25.1% for both the Comparative Group and the All Public Thrift Group. Slightly offsetting the Association’s lower yield on earning assets as compared to both the Comparative Group and the All Public Thrift Group, its cost of interest-bearing liabilities at 1.31% was below the Comparative Group median of 1.83% and the All Public Thrift median of 1.68%. The Association’s liability costs reflect its significant level of deposits, 86.4% of total assets, as a source of funds as opposed to the Comparative Group, 71.6% of total assets, and All Public Thrifts, 72.9% of total assets, combined with the Comparative Group’s and All Public Thrift Group’s higher reliance upon borrowings as deposits generally bear lower rates than borrowings. The Association’s level of borrowed funds was well below the Comparative Group and All Public Group’s median debt utilization. Borrowings measured 0.0% of the Association’s assets and 16.0% for the Comparative Group median and 13.2% for the All Public Thrift median.

The Association’s non-interest operating income, exclusive of any gains, totaled 0.21% of average assets, underperforming the Comparative Group and All Public Thrift medians of 0.36% and 0.52%, respectively.

36

FELDMAN FINANCIAL ADVISORS, INC.

Table 12

Key Financial Comparisons

Fullerton and the Comparative Group

As of or for the Last Twelve Months Ended March 31, 2011

| Fullerton Federal Savings Association |

Comp. Group Median |

All Public Thrift Median |

||||||||||

| Profitability |

||||||||||||

| LTM Return on Average Assets |

(1.81 | )% | 0.13 | % | 0.45 | % | ||||||

| LTM Return on Average Equity |

(13.70 | ) | 1.05 | 3.55 | ||||||||

| Core Return on Average Assets |

(2.49 | ) | 0.09 | 0.46 | ||||||||

| Core Return on Average Equity |

(18.85 | ) | 0.63 | 3.87 | ||||||||

| Income and Expense (% of avg. assets) |

||||||||||||

| Total Interest Income |

2.38 | 4.60 | 4.52 | |||||||||

| Total Interest Expense |

1.12 | 1.53 | 1.44 | |||||||||

| Net Interest Income |

1.26 | 3.13 | 3.14 | |||||||||

| Provision for Loan Losses |

0.00 | 0.41 | 0.43 | |||||||||

| Other Operating Income |

0.21 | 0.36 | 0.52 | |||||||||

| Net Gains and Nonrecurring Income |

0.69 | 0.06 | 0.10 | |||||||||

| General and Administrative Expense |

3.96 | 3.16 | 2.91 | |||||||||