Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

As confidentially submitted with the Securities and Exchange Commission on May 15, 2019.

This draft registration statement has not been publicly filed with the Securities and

Exchange Commission and all information herein remains strictly confidential

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ANNOVIS BIO, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) 26-2540421 |

1055 Westlakes Drive, Suite 300

Berwyn, PA 19312

Attention:

(610) 727-3913

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Maria Maccecchini, Ph.D.

President and Chief Executive Officer

Annovis Bio, Inc.

1055 Westlakes Drive, Suite 300

Berwyn, PA 19312

(610) 727-3913

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Kathleen M. Shay, Esq. John W. Kauffman, Esq. Duane Morris LLP 30 South 17th Street Philadelphia, Pennsylvania 19103 (215) 979-1227 |

William N. Haddad, Esq. Carmen M. Fonda, Esq. Venable LLP Rockefeller Center 1270 Avenue of the Americas, 24th Floor New York, New York 10020 (917) 287-1580 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý |

Smaller reporting company ý Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ý

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) |

||

|---|---|---|---|---|

Common Stock, $0.0001 par value per share |

||||

Total |

||||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the "Securities

Act").

- (2)

- Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED [·], 2019 |

[ · ]Shares

Common Stock

ANNOVIS BIO, INC.

This is a firm commitment initial public offering of [ · ] shares of common stock of Annovis Bio, Inc. No public market currently exists for our shares. We anticipate that the initial public offering price of our shares will be between $[ · ] and $[ · ] and for calculation purposes herein, we assume a mid-point of $[ · ] per share.

We intend to apply to list our shares of common stock for trading on the Nasdaq Capital Market under the symbol "ANVS." No assurance can be given that our application will be approved.

We are an emerging growth company under the Jumpstart our Business Startups Act of 2012, or JOBS Act, and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our common stock is highly speculative and involves a high degree of risk. See "Risk Factors" beginning on page 12 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| |

Per Share |

Total |

||

|---|---|---|---|---|

| | | | | |

Initial public offering price |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds to us, before expenses |

$ | $ |

- (1)

- Underwriting discounts and commissions do not include a non-accountable expense allowance equal to [ · ]% of the public offering price payable to the underwriters. We refer you to "Underwriting" beginning on page [ · ] for additional information regarding underwriters' compensation.

We have granted the underwriters a 30-day over-allotment option to purchase up to [ · ] additional shares of common stock at the initial public offering price less underwriting discounts and commissions.

The underwriters expect to deliver our shares to purchasers in the offering on or about [ · ], 2019

ThinkEquity

a division of Fordham Financial Management, Inc.

The date of this prospectus is [ · ], 2019

We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes thereto and the information set forth in the sections titled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Unless the context otherwise requires, we use the terms "Annovis," "company," "we," "us" and "our" in this prospectus to refer to Annovis Bio, Inc.

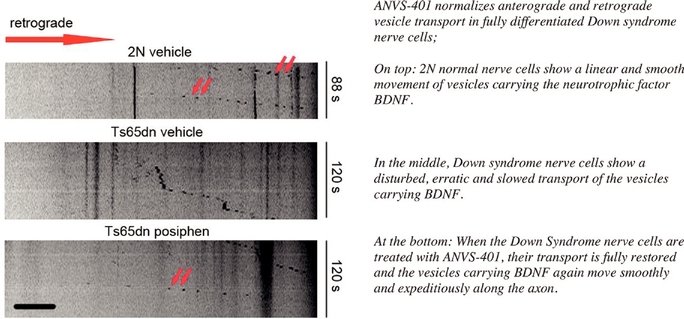

Our Company

Annovis is a clinical stage, drug platform company addressing neurodegeneration, such as Alzheimer's disease in Down syndrome (AD-DS), Alzheimer's disease (AD) and Parkinson's disease (PD). We have an ongoing Phase 2a proof-of-concept study in AD patients and a ready program to conduct a second Phase 2a study in PD patients. We expect our lead compound to be efficacious in AD-DS, AD and PD, because it inhibits the synthesis of neurotoxic proteins that are the main cause of neurodegeneration. Neurotoxic proteins—amyloid precursor protein APP/Ab (APP), tau/phospho-tau (tau) and a-Synuclein (aSYN)—inhibit axonal transport which is responsible for the communication between and within nerve cells. When that communication is impaired, nerve cells eventually die. Through our patented product platform, we normalize levels of neurotoxic proteins, which are the cause of neurodegeneration. We are focused on developing and commercializing innovative drugs for the treatment of AD-DS, AD and PD.

The industry has encountered challenges in targeting specifically one or the other neurotoxic protein, be it APP, tau or aSYN, indicating that targeting one neurotoxic protein alone does not change the course of neurodegeneration. Our goal is to develop a disease modifying drug (DMD) for patients with neurodegeneration by leveraging our clinical and animal evidence in inhibiting at least the three most relevant neurotoxic proteins.

We believe that we are the only company developing a clinical stage proof-of-concept drug for AD-DS, AD and PD that inhibits more than one neurotoxic protein and has a mechanism of action designed to restore nerve cell axonal and synaptic activity. By restoring axonal transport and homeostasis in the brain we expect to treat memory loss and dementia associated with AD-DS and AD as well as body and brain function in PD.

Since neurodegeneration starts with high levels of neurotoxic proteins impairing axonal transport and since, our lead compound, ANVS-401, lowers and normalizes the high levels of neurotoxic proteins and restores axonal transport, we believe that ANVS-401 has the potential to be the first drug to interfere with the underlying mechanism of neurodegeneration. ANVS-401 is a small, once a day, orally administered, brain penetrant inhibitor of neurotoxic proteins. The biological activity of ANVS-401 has been evaluated in 19 animal studies conducted in leading institutions such as the Karolinska Institute, Columbia University and Harvard University. We also conducted three clinical trials with 125 humans including two safety studies and a proof-of-concept study in AD patients by Parexel. In these studies, we showed that ANVS-401 was safe and we saw promising clinical signals in AD patients: ANVS-401 reduced and normalized the levels of APP, tau and aSYN back to the levels seen in healthy volunteers and statistically lowered inflammation.

We are presently conducting a Phase 2a study in AD patients in collaboration with the Alzheimer Disease Cooperative Study (ADCS) group and plan to initiate a second Phase 2a proof-of-concept study of ANVS-401 in the first quarter of 2020 with 50 PD patients. We have designed the study with Parexel by applying our understanding of the underlying disease states in neurodegeneration and by

1

measuring not just target, but also pathway validation in the spinal fluid of these patients. Successful termination of the AD and PD study will validate the target, the pathway and de-risk ANVS-401 for use in neurodegerative diseases.

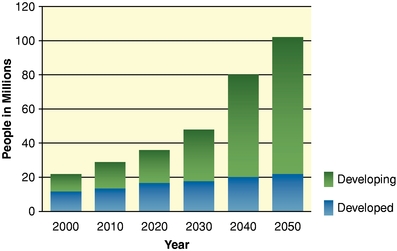

AD and PD are the two largest medical needs of the aging U.S. population, and the two potentially largest markets, once a disease modifying drug has been developed and approved. Therefore, we desire to demonstrate ANVS-401s efficacy in both indications. However, since AD studies are very large and time and capital consuming, we plan to focus on an orphan population that perfectly represents AD, but in a very controlled and limited setting. We intend to focus on AD in the DS population; in DS the APP gene is triplicated leading to early onset AD with the same pathology as sporadic AD. Lowering their high levels of APP will restore axonal transport and homeostasis in the brain of DS patients and normalize their memory loss and dementia. This will allow us to obtain human data for AD in an orphan subpopulation much faster than in the regular AD population. Concomitantly, our goal is to also conduct a Phase 3 pivotal study in early PD patients. In 2024 we expect to have conducted two pivotal studies, one in AD-DS and one in PD, obtain FDA approval and commence marketing ANVS-401.

Background—What is Neurodegeneration?

A normal nerve cell receives signals, processes them in the cell body and transports them through the axon, a long-arm nerve fiber that spans the distances in the body, connecting the cell body to the synapses, these fingers then touch the successive nerve cell(s), where the signals are relayed further.

Nerve Cell with Axon and Synapse

When brain cells become injured or stressed their first response is reduction and impairment of axonal transport. If the insult persists, axonal vesicle transport remains impaired resulting in decreased levels of neurotransmitters and leading to depression (serotonin), anxiety and insomnia (GABA), AD (acetylcholine) and PD (dopamine). It also results in lower levels of neurotrophic factors and in nerve

2

cells getting sick. When the immune system sees a sick cell, it proceeds to remove it, which leads to inflammation in the brain. Eventually, the sick cell is then killed by the immune system.

ANVS-401—Our Solution to Reverse Neurodegeneration

ANVS-401 is a small lipophilic molecule that is orally available and readily enters the brain, as demonstrated by pharmacokinetics analyses showing brain concentrations about 8 times higher than plasma concentrations. ANVS-401 has a unique mechanism of action, in that it inhibits the translation and, therefore, the levels of several key neurotoxic aggregating proteins both in vitro and in vivo including APP, tau and aSYN. ANVS-401's safety has been established in three Phase 1clinical studies that show that ANVS-401 is safe and normalized levels of APP, tau and aSYN in the cerebrospinal fluid (CSF) of mildly cognitively impaired (MCI) patients. Additionally, we now have preclinical data proving ANVS-401's efficacy in restoring memory and learning in two AD animal models—AD transgenic (tg) mice and DS trisomic mice. ANVS-401 also restores colonic motility in a human PD tg mouse model of PD.

By targeting multiple neurotoxic aggregating proteins, ANVS-401 resembles a combination therapy approach, with the added convenience of being a single drug with a single drug target. Therefore, we have worked to understand how ANVS-401 is able to inhibit the translation of more than one neurotoxic protein.

Novel Mechanism of Action and Target Engagement

We undertook an extensive exploration of the mechanism of action of ANVS-401 on APP and aSYN synthesis and determined that ANVS-401 specifically inhibits translation of mRNAs coding for neurotoxic proteins only. Using five different methods we came up with overlapping results. mRNAs of neurotoxic proteins have a conserved stem loop in the 5' untranslated region (5'UTR) called an iron-response element (IRE) type II stem loop. These IREs bind to an RNA binding protein, specifically to iron regulatory protein 1 (IRP1). When the mRNAs are bound, they are not translated. When the iron levels in the cytoplasm go up, IRP1 releases its mRNAs and they are translated.

Target Engagement ANVS-401 specifically binds to the IRE/IRP1 complex of mRNAs coding for neurotoxic proteins and stops the release of the mRNAs under high iron conditions. It does not bind to IRE/IRP1 complexes of mRNAs coding for iron carrying or shuttling proteins, such as ferritin, transferring or ferroportin.

Axonal Transport and Pathway Engagement

Interestingly, APP, tau, and aSYN display several similar features, including the fact that iron levels regulate their expression and the several ways they contribute to neurodegeneration by impairing axonal transport and synaptic transmission.

When axonal transport and synaptic transmission are impaired, the cell releases lower levels of neurotransmitters, leading to depression in the case of serotonin, sleep disorders in the case of GABA, movement disorders in the case of dopamine and cognitive problems in the case of acetylcholine. Abnormal axonal transport also lowers levels of neurotrophic factors, which are responsible for the health of nerve cells. When the immune system sees a sick nerve cell, it gets activated and attacks the nerve cell, eventually killing it. Therefore, impairment in axonal transport leads to inflammation and, finally, leads to nerve cell death. Through several studies, we have found that by reducing APP, tau and

3

aSYN levels, ANVS-401 treatment restores normal axonal transport and prevents or restores all those events all the way to preserving nerve cell health.

By normalizing axonal transport, ANVS-401 normalizes all the functions that are negatively affected by disturbances of the transport.

Pathway Engagement

- •

- ANVS-401 lowers and normalizes levels of neurotoxic proteins

- •

- AD tg mice—normal levels of APP and its fragments with full recovery of memory, learning and brain function

- •

- DS trisomic mice—normal levels of APP and full recovery of memory and learning

- •

- PD tg mice—normal levels of aSYN in brain and gut with full recovery of gut

motility

- •

- MCI patients—normal levels of APP, tau and aSYN

- •

- ANVS-401 normalizes anterograde and retrograde vesicle transport in

- •

- Fully differentiated DS nerve cells

- •

- ANVS-401 normalizes impaired synaptic transmission in

- •

- DS trisomic mice

- •

- Rat striatum, after traumatic brain injury (TBI)

- •

- Hippocampus of APP/PS1 tg mice.

- •

- ANVS-401 increases neurotransmitter release in

- •

- Rat dentate gyrus after TBI

- •

- ANVS-401 increases levels of neurogenesis and BDNF

- •

- Mice brains

- •

- ANVS-401 lowers inflammation in

4

- •

- Human CSF of MCI patients

- •

- Rat brain, after TBI.

- •

- ANVS-401 protects nerve cells in

- •

- Rat substantia nigra, after TBI;

- •

- Retina of rats with acute glaucoma

- •

- ANVS-401 restores normal brain function

- •

- By normalizing levels of neurotoxic proteins, ANVS-401 normalizes the affected function in all diseases we tested it

in:

- •

- AD mice: normal memory, learning, fear conditioning and long-term potentiation

- •

- PD mice: normal gut and gait function

- •

- TBI rats: normal memory and learning

- •

- Acute glaucoma rats: normal sight

Collectively, these effects make ANVS-401 a very promising drug for the treatment of memory loss and dementia in AD-DS and AD and bodily and brain functions in PD.

Impact: We expect that, in our Phase 2a studies in AD and PD patients, ANVS-401 will be well tolerated and will normalize the CSF levels of neurotoxic proteins (at least APP, tau, and aSYN) and inflammatory markers, as seen previously. In these studies, we are also planning to analyze the CSF levels of additional neurotoxic aggregating proteins, control proteins lacking the conserved mRNA sequence of neurotoxic aggregating proteins, as well as neurotransmitters, neurotrophic factors, degeneration markers, and cognitive outcomes. Thus, we will be able to identify potential biomarkers for use in later studies.

What are the plans for the two Phase 2 studies in AD and PD patients?

Our goal is to replicate the same target and pathway validation in our two Phase 2a studies in AD and PD patients. In the spinal fluid of AD and PD patients we plan to show a decrease in levels of neurotoxic proteins and show the reversal of the toxic cascade back to normal. Once these two studies are fully analyzed, we will be able to better understand the similarities and differences between early AD and PD patients, as well as the effect of ANVS-401 on all endpoints. The successful completion of the two studies will expand the clinical proof of mechanism of ANVS-401 in the case of AD and PD, thereby enabling the start of pivotal late phase clinical studies for these diseases.

To date, we have submitted all our animal and human data to the FDA as well as our plans for doing the two Phase 2a studies in AD and PD patients. The FDA has raised no objections to our plans and protocols.

Our Team

We have assembled a highly experienced management team, board of directors and scientific advisory board to execute on our mission to develop disease modifying therapies for the treatment of neurodegenerative disorders. Our Founder and Chief Executive Officer, Maria Maccecchini, Ph.D., is a business leader, drug developer and neuroscientist, with over 30 years of expertise in neurodegeneration. Our Chairman, Michael Hoffman, has extensive experience in investing in successful businesses as well as growing and leading companies. Our Chief Medical Officer, Jeffrey Cummings, M.D. is one of the most respected clinical Alzheimer scientists; he was Director of

5

Neurology at the Cleveland Clinic before becoming our CMO. Our Chief Financial Officer is Jeffrey McGroarty; he has extensive experience as CFO of public companies.

Our scientific advisory board is composed of world-renowned scientists in the area of neurodegeneration. We believe our team, with its deep scientific background, drug development experience and industry-leading business capabilities, positions us to become a leading company developing therapies for neurodegenerative disorders.

Our objectives are to develop and gain regulatory approval for ANVS-401 for the treatment of AD-DS, which is an orphan indication of Alzheimer's disease, AD and PD and leverage our discovery platform to treat other neurodegenerative disorders.

The key elements of our strategy are:

With the funds we are raising in this offering, we intend to:

- •

- Advance clinical development of ANVS-401 to two Phase 2a clinical studies—one in AD and one in

PD.

- •

- Accelerate recruitment of the ongoing Phase 2a study in AD patients run by ADCS to achieve full recruitment within one

year.

- •

- Start Phase 2a PD trial in the United States and, possibly, internationally, for the treatment of PD in the first quarter

of 2020.

- •

- Complete both studies by the end of 2020.

- •

- Prepare for a Phase 3 pivotal study in AD-DS

- •

- Commence the planning of the AD-DS phase 3 study in collaboration with Professor William Mobley.

- •

- Conduct chronic toxicology studies in rats and dogs—in order to test a drug in

humans for extended lengths of time, it has to first be tested for safety for 6 months in rats and 9 months in dogs

- •

- Manufacture adequate quantities of ANVS-401 to conduct the Phase 2a study in PD patients as well as Phase 3 studies in AD-DS and early PD patients.

Upon completion of a future subsequent financing, we intend to undertake the following:

At the end of the two Phase 2a studies, we will evaluate the data, discuss the animal toxicology and the two studies with the FDA and move to one Phase 3 in AD-DS and one in early PD patients.

- •

- Conduct a Phase 3 study in AD-DS, an orphan indication that fully follows the course of

AD, including memory loss and dementia, in a well characterized genetic predisposed group of people.

- •

- Conduct a Phase 3 study in early PD patients, who show symptoms of PD, but are not taking L-dopa or agonist.

Assuming the successful conduct of the two Phase 3 studies, we intend to:

- •

- Commercialize ANVS-401 in collaboration with one or more pharmaceutical companies. To commercialize ANVS-401, when approved, we intend to establish one or more marketing collaborations with pharmaceutical or biotechnology companies. We expect to seek separate development and commercialization collaborators in Japan and other parts of Asia.

6

- •

- Evaluate the development of ANVS-401 for other PD

populations. After our initial focus on early PD, we plan to test ANVS-401 in advanced PD as well as a prophylaxis for PD

- •

- Evaluate ANVS-401 for early AD

populations. Conduct a Phase 3 study in early AD.

- •

- Evaluate the development of ANVS-401 for other AD

populations. After our initial focus on early AD, we plan to test ANVS-401 in advanced AD as well as a prophylaxis for AD

- •

- Evaluate ANVS-401 in other neurodegenerative disorders.

Summary of Risks Associated with Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled "Risk Factors" immediately following this prospectus summary. Some of these risks are:

- •

- We have incurred significant net losses since inception and anticipate that we will continue to incur net losses for the foreseeable future and

may never achieve or maintain profitability.

- •

- Even if this offering is successful, we will require additional capital to fund our operations, and if we fail to obtain necessary funding, we

may not be able to complete the development and commercialization of ANVS-401.

- •

- Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

- •

- We are heavily dependent on the success of ANVS-401, our lead product candidate, which is still under clinical development, and if it does not

receive regulatory approval or is not successfully commercialized, our business may be harmed.

- •

- We have concentrated our research and development efforts on the treatment of AD in an orphan population and in the general population and in

PD, two diseases that have seen limited success in drug development.

- •

- Clinical trials are expensive, time-consuming, difficult to design and implement, and involve an uncertain outcome.

- •

- Results of preclinical studies, early clinical trials or analyses may not be indicative of results obtained in later trials.

- •

- If we are unable to obtain and maintain patent protection for our technology and products or if the scope of the patent protection obtained is not sufficiently broad, we may not be able to compete effectively in our target markets.

We were incorporated under the laws of the State of Delaware in 2008. Our principal executive offices are located at 1055 Westlakes Drive, Suite #300, Berwyn, PA 19312. Our telephone number is 610 727 3710.

Our website address is www.annovis.com. The information contained in, or accessible through, our website does not constitute a part of this prospectus.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An emerging growth company may take advantage of reduced reporting

7

requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

- •

- being permitted to present only two years of audited financial statements and only two years of related Management's Discussion and Analysis of

Financial Condition and Results of Operations in this prospectus;

- •

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended;

- •

- reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

- •

- exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of this offering. However, if certain events occur prior to the end of such five-year period, including if we become a large accelerated filer, our annual gross revenue exceeds $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

8

Common stock offered by us |

[·] shares | |

Common stock to be outstanding after this offering |

[·] shares (or [·] shares if the underwriters exercise their over-allotment option in full) |

|

Over-allotment option |

[·] shares |

|

Use of proceeds |

We intend to use the net proceeds of this offering to advance the preclinical and clinical development of ANVS-401 and for working capital and general corporate purposes. See "Use of Proceeds" in this prospectus for a more complete description of the intended use of proceeds from this offering. |

|

Risk factors |

See "Risk Factors" beginning on page [·] and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our common stock. |

|

Proposed Nasdaq Capital Market symbol |

"ANVS" |

The number of shares of our common stock to be outstanding after this offering is based on [ · ] shares of our common stock outstanding as of [ · ], 2019, which includes [ · ] shares of restricted stock subject to repurchase, and excludes:

- •

- 495,025 shares of common stock issuable upon exercise of stock options outstanding as of

[ · ], 2019, at a weighted-average exercise price of $0.13 per share; and

- •

- 533,746 shares of our common stock that are available for future issuance under our 2018 Incentive Award Plan, or shares that will become available under our 2019 Plan, which will become effective in connection with this offering.

Unless otherwise indicated, this prospectus reflects and assumes the following:

- •

- the automatic conversion of all outstanding shares of our preferred stock into an aggregate of 5,763,881 shares of our common stock upon the

closing of this offering;

- •

- the issuance of [ · ]

shares of our common stock upon conversion of the $530,000 principal amount of our convertible promissory notes upon the closing of this offering into shares of our common stock at a 20% discount to

the public offering price;

- •

- no exercise of outstanding options described above after December 31, 2018;

- •

- the filing of our restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur upon the closing

of this offering; and

- •

- no exercise by the underwriters of their over-allotment option or the warrants to purchase [ · ] shares of our common stock at an exercise price per share equal to [ · ]% of the initial public offering price per share or $[ · ], based on an assumed initial public offering price of $[ · ] per share, which is the midpoint of the price range set forth on the cover page of this prospectus, that may, under certain circumstances, be issued to the representatives of the underwriters in connection with this offering.

9

You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the "Selected Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of this prospectus. We have derived the statement of operations data for the years ended December 31, 2017 and December 31, 2018 and balance sheet data as of December 31, 2018 from our audited financial statements appearing at the end of this prospectus. Our historical results are not necessarily indicative of results that should be expected in any future period, and our results for any interim period are not necessarily indicative of results that should be expected for any full year.

| In thousands, except share and per share data |

2018 | 2017 | |||||

|---|---|---|---|---|---|---|---|

Statement of Operations Data: |

|||||||

Operating expenses: |

|||||||

Research and development |

$ | 324 | $ | 357 | |||

General and administrative |

390 | 325 | |||||

| | | | | | | | |

Total operating expenses |

714 | 682 | |||||

Loss from operations |

(714 |

) |

(682 |

) |

|||

Other income (expense): |

|||||||

Interest income, net |

— | — | |||||

Income tax expense (benefit) |

— | — | |||||

| | | | | | | | |

Net loss |

$ | (714 | ) | $ | (682 | ) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Net loss per common share—basic and diluted(1) |

$ | (1.84 | ) | $ | (1.90 | ) | |

Weighted average common shares outstanding—basic and diluted(1) |

388,612 | 358,599 | |||||

- (1)

Pro Forma(2)

|

Pro Forma As Adjusted(3) |

|

||||

|---|---|---|---|---|---|---|

| $ | (0.12) | $ | ||||

| 6,152,493 | ||||||

- (2)

- Reflects

the automatic conversion of all outstanding shares of our preferred stock into 5,763,881 shares of our common stock upon the closing of this offering.

- (3)

- Reflects the effect of our issuance and sale of [ · ] shares of our common stock in this offering at an assumed initial public offering price of $[ · ] share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us and the issuance of [ · ] shares of our common stock upon conversion of the $530,000 principal amount of our convertible promissory notes upon the closing of this offering into shares of our common stock at a 20% discount to the public offering price.

A $1.00 decrease in the assumed initial public offering price of $[ · ] per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would decrease the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $[ · ], assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. At an initial public offering price of $[ · ] per share, the pro forma as adjusted amount of each of cash and cash

10

equivalents, working capital, total assets and total stockholders' equity would increase by approximately $[ · ], assuming the number of shares offered by us, as set forth on the cover page of the prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. A $1.00 increase in the initial public offering price above $[ · ] per share would increase the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $[ · ], assuming the number of shares offered by us, as set forth on the cover of the prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offer expenses payable by us. A decrease of [ · ] shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would decrease the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $[ · ], assuming no change in the assumed initial public offering price per share and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. An increase of [ · ] shares in the number of shares offered by us, as set forth on the cover page of this prospectus, to [ · ] shares would increase the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $[ · ], after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and assuming the assumed initial public offering price stays the same. An increase in the number of shares offered by us, as set forth on the cover page of this prospectus, to [ · ] shares would increase the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $[ · ], after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and assuming the assumed initial public offering price stays the same. Each increase of [ · ] in the number of shares offered by us above [ · ] would increase the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $[ · ], after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us and assuming the initial public offering price stays the same.

11

You should carefully consider the risks and uncertainties described below and the other information in this prospectus before making an investment in our common stock. Our business, financial condition, results of operations or prospects could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred losses since inception and anticipate that we will continue to incur losses for the foreseeable future. We are not currently profitable, and we may never achieve or sustain profitability.

We are a clinical stage biopharmaceutical company with a limited operating history and have incurred losses since our formation. We had net losses of $0.7 million and $0.7 million for the years ended December 31, 2018 and 2017, respectively. As of December 31, 2018, we had an accumulated loss of $7.8 million. We have not commercialized any products and have never generated revenue from the commercialization of any product. To date, we have devoted most of our financial resources to research and development, including our preclinical and clinical work, and to intellectual property.

We expect to incur significant additional operating losses for the next several years, at least, as we advance ANVS-401 and any other product candidate through clinical development, complete clinical trials, seek regulatory approval and commercialize the drug or any other product candidate, if approved. The costs of advancing product candidates into each clinical phase tend to increase substantially over the duration of the clinical development process. Therefore, the total costs to advance any of our product candidates to marketing approval in even a single jurisdiction will be substantial. Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to begin generating revenue from the commercialization of any products or achieve or maintain profitability. Our expenses will also increase substantially if and as we:

- •

- commence our two Phase 3 trials in AD-DS and in early PD, or conduct clinical trials for any other product candidates;

- •

- are required by the U.S. Food and Drug Administration, or FDA, to complete two Phase 3 trials to support a New Drug Application, or NDA,

for ANVS-401 in AD-DS or in PD;

- •

- establish a sales, marketing and distribution infrastructure to commercialize our drug, if approved, and for any other product candidates for

which we may obtain marketing approval;

- •

- maintain, expand and protect our intellectual property portfolio;

- •

- hire additional clinical, scientific and commercial personnel;

- •

- add operational, financial and management information systems and personnel, including personnel to support our product development and planned

future commercialization efforts, as well as to support our transition to a public reporting company; and

- •

- acquire or in-license or invent other product candidates or technologies.

Furthermore, our ability to successfully develop, commercialize and license any product candidates and generate product revenue is subject to substantial additional risks and uncertainties, as described under "—Risks Related to Development, Clinical Testing, Manufacturing and Regulatory Approval" and "—Risks Related to Commercialization." As a result, we expect to continue to incur net losses and negative cash flows for the foreseeable future. These net losses and negative cash flows have had, and will continue to have, an adverse effect on our stockholders' equity and working capital. The amount of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability

12

to generate revenues. If we are unable to develop and commercialize one or more product candidates, either alone or through collaborations, or if revenues from any product that receives marketing approval are insufficient, we will not achieve profitability. Even if we do achieve profitability, we may not be able to sustain profitability or meet outside expectations for our profitability. If we are unable to achieve or sustain profitability or to meet outside expectations for our profitability, the value of our common stock will be materially and adversely affected.

Even if this offering is successful, we will require additional capital to fund our operations, and if we fail to obtain necessary financing, we may not be able to complete the development and commercialization of ANVS-401.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to advance the clinical development of ANVS-401 and launch and commercialize ANVS-401, if we receive regulatory approval. We will require additional capital for the further development and potential commercialization of ANVS-401 and may also need to raise additional funds sooner to pursue a more accelerated development of ANVS-401. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

We believe that the net proceeds from this offering together with our existing cash and cash equivalents as of December 31, 2018, will enable us to fund our operating expenses and capital expenditure requirements for at least the next 18 months. We have based this estimate on assumptions that may prove to be wrong, and we could deploy our available capital resources sooner than we currently expect. Our future funding requirements, both near and long-term, will depend on many factors, including, but not limited to the:

- •

- initiation, progress, timing, costs and results of preclinical studies and clinical trials, including patient enrollment in such trials, for

ANVS-401 or any other future product candidates;

- •

- clinical development plans we establish for ANVS-401 and any other future product candidates;

- •

- obligation to make royalty and non-royalty sublicense receipt payments to third-party licensors, if any, under our licensing agreements;

- •

- number and characteristics of product candidates that we discover or in-license and develop;

- •

- outcome, timing and cost of regulatory review by the FDA and comparable foreign regulatory authorities, including the potential for the FDA or

comparable foreign regulatory authorities to require that we perform more studies than those that we currently expect;

- •

- costs of filing, prosecuting, defending and enforcing any patent claims and maintaining and enforcing other intellectual property rights;

- •

- effects of competing technological and market developments;

- •

- costs and timing of the implementation of commercial-scale manufacturing activities; and

- •

- costs and timing of establishing sales, marketing and distribution capabilities for any product candidates for which we may receive regulatory approval.

If we are unable to expand our operations or otherwise capitalize on our business opportunities due to a lack of capital, our ability to become profitable will be compromised.

13

We, as well as our independent registered public accounting firm have expressed substantial doubt about our ability to continue as a going concern.

Our recurring losses from operations raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements for the year ended December 31, 2018 with respect to this uncertainty. Our ability to continue as a going concern will require us to obtain additional funding. We believe that the net proceeds from this offering and our existing cash and cash equivalents will be sufficient to fund our current operating plans through at least the next 18 months. We have based these estimates, however, on assumptions that may prove to be wrong, and we could spend our available financial resources much faster than we currently expect and need to raise additional funds sooner than we anticipate. If we are unable to raise capital when needed or on acceptable terms, we would be forced to delay, reduce or eliminate our research and development programs and commercialization efforts.

Raising additional capital may cause dilution to our stockholders, including purchasers of common stock in this offering, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial revenue, we may finance our cash needs through a combination of equity offerings, debt financings, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements or other sources. We do not currently have any committed external source of funds. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans.

To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a common stockholder. Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may be required to relinquish valuable rights to our technologies, intellectual property, future revenue streams or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate product candidate development or future commercialization efforts.

We have a limited operating history and no history of commercializing pharmaceutical products, which may make it difficult to evaluate the prospects for our future viability.

We were established and began operations in 2008. Our operations to date have been limited to financing and staffing our company, licensing product candidates, conducting preclinical studies of ANVS-401 for treatment of AD-DS, AD and PD and for understanding its mechanism of action and its capability of stopping the toxic cascade that leads to nerve cell death. We have further tested ANVS-401 in clinical trials for safety and proof-of-concept. We have not yet demonstrated the ability to successfully complete a large-scale, pivotal clinical trial, obtain marketing approval, manufacture a commercial scale product, or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. Consequently, predictions about our future success or viability may not be as accurate as they could be if we had a history of successfully developing and commercializing pharmaceutical products.

14

In addition, as a business with a limited operating history, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. We will eventually need to transition from a company with a research focus to a company capable of supporting commercial activities. We may not be successful in such a transition and, as a result, our business may be adversely affected.

As we continue to build our business, we expect our financial condition and operating results may fluctuate significantly from quarter to quarter and year to year due to a variety of factors, many of which are beyond our control. Accordingly, you should not rely upon the results of any particular quarterly or annual period as indications of future operating performance.

Our ability to use our net operating loss carryforwards to offset future taxable income may be subject to certain limitations.

As of December 31, 2018, we had net operating loss carryforwards, or NOLs, of $5.9 million for federal income tax purposes and $5.9 million for state income tax purposes, which may be available to offset our future taxable income, if any, and begin to expire in various amounts in 2028. NOLs of $0.6 million generated after December 31, 2017 are not subject to expiration but are limited to 80% of taxable income in future years. In general, under Sections 382 and 383 of the U.S. Internal Revenue Code of 1986, as amended, or the Code, a corporation that undergoes an "ownership change" is subject to limitations on its ability to use its pre-change NOLs to offset future taxable income. Due to previous ownership changes, or if we undergo an ownership change in connection with or after this offering, our ability to use our NOLs could be limited by Section 382 of the Code. Future changes in our stock ownership, some of which are outside of our control, could result in an ownership change under Sections 382 and 383 of the Code. Furthermore, our ability to use NOLs of companies that we may acquire in the future may be subject to limitations. For these reasons, we may not be able to use a material portion of the NOLs, even if we attain profitability.

Risks Related to Development, Clinical Testing, Manufacturing and Regulatory Approval

We are heavily dependent on the success of ANVS-401, our most advanced product candidate, which is still under clinical development, and if this drug does not receive regulatory approval or is not successfully commercialized, our business may be harmed.

We do not have any products that have gained regulatory approval. Currently, our only clinical stage product candidate is ANVS-401. As a result, our business is dependent on our ability to successfully complete clinical development of, obtain regulatory approval for, and, if approved, successfully commercialize ANVS-401 in a timely manner. We cannot commercialize ANVS-401 in the United States without first obtaining regulatory approval from the FDA; similarly, we cannot commercialize ANVS-401 outside of the United States without obtaining regulatory approval from comparable foreign regulatory authorities. Before obtaining regulatory approvals for the commercial sale of ANVS-401 for a target indication, we must demonstrate with substantial evidence gathered in preclinical studies and clinical trials, generally including two adequate and well-controlled clinical trials, and, with respect to approval in the United States, to the satisfaction of the FDA, that ANVS-401 is safe and effective for use for that target indication and that the manufacturing facilities, processes and controls are adequate. Even if ANVS-401 were to successfully obtain approval from the FDA and comparable foreign regulatory authorities, any approval might contain significant limitations related to use restrictions for specified age groups, warnings, precautions or contraindications, or may be subject to burdensome post-approval study or risk management requirements. If we are unable to obtain regulatory approval for ANVS-401 in one or more jurisdictions, or any approval contains significant limitations, we may not be able to obtain sufficient funding or generate sufficient revenue to continue the development of any other product candidate that we may in-license, develop or acquire in the future. Furthermore, even if we obtain regulatory approval for ANVS-401, we will still need to develop

15

a commercial organization, establish commercially viable pricing and obtain approval for adequate reimbursement from third-party and government payors. If we are unable to successfully commercialize ANVS-401, we may not be able to earn sufficient revenue to continue our business

Clinical trials are expensive, time-consuming and difficult to design and implement, and involve an uncertain outcome.

Clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during the clinical trial process. We may experience delays in initiating and completing any clinical trials that we intend to conduct, and we do not know whether planned clinical trials, including our Phase 2a trial for PD will begin on time, need to be redesigned, enroll patients on time or be completed on schedule, or at all. Clinical trials can be delayed for a variety of reasons, including delays related to:

- •

- the FDA or comparable foreign regulatory authorities disagreeing as to the design or implementation of our clinical studies;

- •

- obtaining regulatory approval to commence a trial;

- •

- reaching an agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites, the terms of

which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites;

- •

- obtaining Institutional Review Board, or IRB, approval at each site, or Independent Ethics Committee, or IEC, approval at sites outside the

United States;

- •

- recruiting suitable patients to participate in a trial in a timely manner and in sufficient numbers;

- •

- having patients complete a trial or return for post-treatment follow-up;

- •

- imposition of a clinical hold by regulatory authorities, including as a result of unforeseen safety issues or side effects or failure of trial

sites to adhere to regulatory requirements or follow trial protocols;

- •

- clinical sites deviating from trial protocol or dropping out of a trial;

- •

- addressing patient safety concerns that arise during the course of a trial;

- •

- adding a sufficient number of clinical trial sites; or

- •

- manufacturing sufficient quantities of product candidate for use in clinical trials.

We could also encounter delays if a clinical trial is suspended or terminated by us, the IRBs or IECs of the institutions in which such trials are being conducted, the Data Safety Monitoring Board, or DSMB, for such trial or the FDA or other regulatory authorities. Such authorities may impose such a suspension or termination due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial. Furthermore, we rely on CROs and clinical trial sites to ensure the proper and timely conduct of our clinical trials and, while we have agreements governing their committed activities, we have limited influence over their actual performance, as described in "—Risks Related to Our Dependence on Third Parties."

16

The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for ANVS-401 or any other product candidates, our business will be substantially harmed.

The time required to obtain approval by the FDA and comparable foreign authorities is unpredictable but typically takes many years following the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities. In addition, approval policies, regulations or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate's clinical development and may vary among jurisdictions. We have not obtained regulatory approval for any product candidate and it is possible that we will never obtain regulatory approval for ANVS-401 or any other product candidate. We are not permitted to market any of our product candidates in the United States until we receive regulatory approval of a New Drug Application (NDA) from the FDA.

- •

- we may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a product candidate is safe

and effective for its proposed indication;

- •

- serious and unexpected drug-related side effects experienced by participants in our clinical trials or by individuals using drugs similar to

our product candidates, or other products containing the active ingredient in our product candidates;

- •

- negative or ambiguous results from our clinical trials or results that may not meet the level of statistical significance required by the FDA

or comparable foreign regulatory authorities for approval;

- •

- we may be unable to demonstrate that a product candidate's clinical and other benefits outweigh its safety risks;

- •

- the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials;

- •

- the data collected from clinical trials of our product candidates may not be acceptable or sufficient to support the submission of an NDA or

other submission or to obtain regulatory approval in the United States or elsewhere, and we may be required to conduct additional clinical trials;

- •

- the FDA's or the applicable foreign regulatory agency's disagreement regarding the formulation, labeling and/or the specifications of our

product candidates;

- •

- the FDA or comparable foreign regulatory authorities may fail to approve or find deficiencies with the manufacturing processes or facilities of

third-party manufacturers with which we contract for clinical and commercial supplies; and

- •

- the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval.

Prior to obtaining approval to commercialize a product candidate in the United States or abroad, we must demonstrate with substantial evidence from well-controlled clinical trials, and to the satisfaction of the FDA or foreign regulatory agencies, that such product candidates are safe and effective for their intended uses. Results from preclinical studies and clinical trials can be interpreted in different ways. Even if we believe the preclinical or clinical data for our product candidates are promising, such data may not be sufficient to support approval by the FDA and other regulatory authorities. For diseases like PD and AD, the FDA has stated that one single Phase 3 trial is adequate for approval, if it demonstrates robust and unquestionable efficacy. However, the circumstances under which a single adequate and controlled study can be used as the sole basis of demonstrating efficacy of a drug are exceptional.

17

The FDA or any foreign regulatory bodies can delay, limit or deny approval of our product candidates or require us to conduct additional preclinical or clinical testing or abandon a program for many reasons, including:

- •

- the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of our clinical trials;

- •

- the FDA or comparable foreign regulatory authorities may disagree with our safety interpretation of our drug;

- •

- the FDA or comparable foreign regulatory authorities may disagree with our efficacy interpretation of our drug;

- •

- the FDA or comparable foreign regulatory authorities may regard our CMC package as inadequate.

Of the large number of drugs in development, only a small percentage successfully complete the regulatory approval processes and are commercialized. This lengthy approval process, as well as the unpredictability of future clinical trial results, may result in our failing to obtain regulatory approval to market ANVS-401 or another product candidate, which would significantly harm our business, results of operations and prospects.

In addition, the FDA or the applicable foreign regulatory agency also may approve a product candidate for a more limited indication or patient population than we originally requested, and the FDA or applicable foreign regulatory agency may approve a product candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that product candidate. Any of the foregoing scenarios could materially harm the commercial prospects for our product candidates.

We have concentrated our research and development efforts on the treatment of AD and PD, diseases that have seen limited success in drug development. Further, ANVS-401 is based on a new approach to treating AD and PD, which makes it difficult to predict the time and cost of development and subsequent obtaining of regulatory approval.

Efforts by biopharmaceutical and pharmaceutical companies in treating AD and PD have seen limited success in drug development, and there are no FDA-approved disease modifying therapeutic options available for patients with AD and PD. We cannot be certain that our approach will lead to the development of approvable or marketable products. The only drugs approved by the FDA to treat AD and PD to date address the disease's symptoms. As a result, the FDA has a limited set of products to rely on in evaluating ANVS-401. This could result in a longer than expected regulatory review process, increased expected development costs or the delay or prevention of commercialization of ANVS-401 for the treatment of AD and PD.

Enrollment and retention of patients in clinical trials is an expensive and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside our control.

The timely completion of clinical trials in accordance with their protocols depends, among other things, on our ability to enroll a sufficient number of patients who remain in the study until its conclusion. We may encounter delays in enrolling, or be unable to enroll, a sufficient number of patients to complete any of our clinical trials, and even once enrolled, we may be unable to retain a sufficient number of patients to complete any of our trials. Patient enrollment and retention in clinical trials depends on many factors, including:

- •

- the patient eligibility criteria defined in the protocol;

- •

- the size of the patient population required for analysis of the trial's primary endpoints;

18

- •

- the nature of the trial protocol;

- •

- the existing body of safety and efficacy data with respect to the product candidate;

- •

- the proximity of patients to clinical sites;

- •

- our ability to recruit clinical trial investigators with the appropriate competencies and experience;

- •

- clinicians' and patients' perceptions as to the potential advantages of the product candidate being studied in relation to other available

therapies, including any new drugs that may be approved for the indications we are investigating;

- •

- competing clinical trials being conducted by other companies or institutions;

- •

- our ability to maintain patient consents; and

- •

- the risk that patients enrolled in clinical trials will drop out of the trials before completion.

Results of preclinical studies, early clinical trials or analyses may not be indicative of results obtained in later trials.

The results of preclinical studies, early clinical trials or analyses of our product candidates may not be predictive of the results of later-stage clinical trials. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy traits despite having progressed through preclinical studies and initial clinical trials. A number of companies in the biopharmaceutical industry have suffered significant setbacks in advanced clinical trials due to lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier trials. In addition, conclusions based on promising data from analyses of clinical results may be shown to be incorrect when implemented in prospective clinical trials. Even if our clinical trials for ANVS-401 are completed as planned, we cannot be certain that their results will support the safety and efficacy sufficient to obtain regulatory approval.

Interim "top-line" and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data.

From time to time, we may publish interim "top-line" or preliminary data from our clinical studies. Interim data from clinical trials that we may complete are subject to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more patient data become available. Preliminary or "top-line" data also remain subject to audit and verification procedures that may result in the final data being materially different from the preliminary data we previously published. As a result, interim and preliminary data should be viewed with caution until the final data are available. Adverse differences between preliminary or interim data and final data could significantly harm our business prospects.

Our product candidates may cause serious adverse events or undesirable side effects, which may delay or prevent marketing approval, or, if approved, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales.

Serious adverse events or undesirable side effects caused by ANVS-401 or any other product candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the FDA or other comparable foreign authorities. Results of any clinical trial we conduct could reveal a high and unacceptable severity and prevalence of side effects or unexpected characteristics. Patients treated with ANVS-401 to date, have experienced adverse events that include nausea and vomiting.

19

If unacceptable side effects arise in the development of our product candidates, we, the FDA or the IRBs at the institutions in which our studies are conducted, or the DSMB, if constituted for our clinical trials, could recommend a suspension or termination of our clinical trials, or the FDA or comparable foreign regulatory authorities could order us to cease further development of or deny approval of a product candidate for any or all targeted indications. In addition, drug-related side effects could affect patient recruitment or the ability of enrolled patients to complete a trial or result in potential product liability claims. In addition, these side effects may not be appropriately recognized or managed by the treating medical staff. We expect to have to train medical personnel using our product candidates to understand the side effect profiles for our clinical trials and upon any commercialization of any of our product candidates. Inadequate training in recognizing or managing the potential side effects of our product candidates could result in patient injury or death. Any of these occurrences may harm our business, financial condition and prospects significantly.

Additionally, if one or more of our product candidates receives marketing approval, and we or others later identify undesirable side effects caused by such products, a number of potentially significant negative consequences could result, including:

- •

- regulatory authorities may withdraw approvals of such product;

- •

- regulatory authorities may require additional warnings on the label, such as a "black box" warning or contraindication;

- •

- additional restrictions may be imposed on the marketing of the particular product or the manufacturing processes for the product or any

component thereof;

- •

- we may be required to implement a Risk Evaluation and Mitigation Strategy, or REMS, or create a medication guide outlining the risks of such

side effects for distribution to patients;

- •

- we could be sued and held liable for harm caused to patients;

- •

- the product may become less competitive; and

- •

- our reputation may suffer.

Any of these events could prevent us from achieving or maintaining market acceptance of a product candidate, if approved, and could significantly harm our business, results of operations and prospects.

The market opportunities for ANVS-401, if approved, may be smaller than we anticipate.

We expect to initially seek approval for ANVS-401 for AD-DS, AD and PD in the US. Our estimates of market potential have been derived from a variety of sources, including scientific literature, patient foundations and market research, and may prove to be incorrect. Even if we obtain significant market share for any product candidate, if approved, if the potential target populations are small, we may never achieve profitability without obtaining marketing approval for additional indications.

We have never obtained marketing approval for a product candidate and we may be unable to obtain, or may be delayed in obtaining, marketing approval for any of our product candidates.

We have never obtained marketing approval for a product candidate. It is possible that the FDA may refuse to accept for substantive review any NDAs that we submit for our product candidates or may conclude after review of our data that our application is insufficient to obtain marketing approval of our product candidates. If the FDA does not accept or approve our NDAs for our product candidates, it may require that we conduct additional clinical, preclinical or manufacturing validation studies and submit that data before it will reconsider our applications. Depending on the extent of these or any other FDA-required studies, approval of any NDA that we submit may be delayed or may

20

require us to expend more resources than we have available. It is also possible that additional studies, if performed and completed, may not be considered sufficient by the FDA to approve our NDAs.

Any delay in obtaining, or an inability to obtain, marketing approvals would prevent us from commercializing our product candidates, generating revenues and achieving and sustaining profitability. If any of these outcomes occur, we may be forced to abandon our development efforts for our product candidates, which could significantly harm our business.

Even if we obtain FDA approval for ANVS-401 or any other product candidate in the United States, we may never obtain approval for or commercialize ANVS-401 or any other product candidate in any other jurisdiction, which would limit our ability to realize their full market potential.

In order to market any products in any particular jurisdiction, we must establish and comply with numerous and varying regulatory requirements on a country-by-country basis regarding safety and efficacy. Approval by the FDA in the United States does not ensure approval by regulatory authorities in other countries or jurisdictions. However, the failure to obtain approval in one jurisdiction may negatively impact our ability to obtain approval elsewhere. In addition, clinical trials conducted in one country may not be accepted by regulatory authorities in other countries, and regulatory approval in one country does not guarantee regulatory approval in any other country.

Approval processes vary among countries and can involve additional product testing and validation and additional administrative review periods. Seeking foreign regulatory approval could result in difficulties and increased costs for us and require additional preclinical studies or clinical trials which could be costly and time consuming. Regulatory requirements can vary widely from country to country and could delay or prevent the introduction of our products in those countries. We do not have any product candidates approved for sale in any jurisdiction, including in international markets, and we do not have experience in obtaining regulatory approval in international markets. If we fail to comply with regulatory requirements in international markets or to obtain and maintain required approvals, or if regulatory approvals in international markets are delayed, our target market will be reduced and our ability to realize the full market potential of any product we develop will be unrealized.

Even if we obtain regulatory approval for ANVS-401 or any product candidate, we will still face extensive and ongoing regulatory requirements and obligations and any product candidates, if approved, may face future development and regulatory difficulties.

Any product candidate for which we obtain marketing approval, along with the manufacturing processes, post-approval clinical data, labeling, packaging, distribution, adverse event reporting, storage, recordkeeping, export, import, advertising and promotional activities for such product, among other things, will be subject to extensive and ongoing requirements of and review by the FDA and other regulatory authorities. These requirements include submissions of safety and other post-marketing information and reports, establishment registration and drug listing requirements, continued compliance with current Good Manufacturing Practice, or cGMP, requirements relating to manufacturing, quality control, quality assurance and corresponding maintenance of records and documents, requirements regarding the distribution of samples to physicians and recordkeeping and Good Clinical Practice, or GCP, requirements for any clinical trials that we conduct post-approval.