UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22358

City National Rochdale Structured Claims Fixed Income Fund

(Exact name of registrant as specified in charter)

400 Park Avenue

New York, NY 10022-4406

(Address of principal executive offices) (Zip code)

Michael Lukaj

400 Park Avenue

New York, NY 10022-4406

(Name and address of agent for service)

(800) 245-9888

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2018

City National Rochdale Structured Claims Fixed Income Fund (CNRSCFIF)

Semi-Annual Report

March 31, 2018

Dear Fellow Shareholders,

The City National Rochdale Structured Claims Fixed Income Fund ("CNRSCFIF" or the "Fund") offers an opportunity for portfolio diversification through an investment in a pool of structured legal settlements with an investment objective that seeks safety of principal and above average current income. The Fund is collateralized by a note secured by cash flows from a diversified pool of annuities, purchased to cover structured legal settlements that have been acquired through a formal legal process from the claimants. Investment returns are generated by the interest income of cash flow payments received from each underlying annuity.

Major developed equity markets broke their winning streak in the first quarter of 2018 as volatility returned vigorously. Everything from worries about inflation, the threat of a trade war with China, and the prospect of new regulations on tech firms drove the market. With that said, economic data remained upbeat, and the Fed, under new Chair Jerome Powell, moved to raise rates again. With equity markets finding themselves slightly negative to end Q1 - bond markets were also quite volatile with the yield on the 10-year Treasury moving from 2.41% at the start of the quarter to a peak of 2.95%, before ending at 2.74% (as of 3/31/2018).

Performance in the fixed-income markets has been decidedly negative across the board in the first quarter of 2018 as the impact from rising interest rates and widening credit spreads have taken their toll. Market rates rose in the first part of the quarter due to the tax cuts, rising optimism by businesses and consumers, and a commensurate increase in inflation expectations. As the quarter wound down, this optimism faded as consumption remained weak, policy uncertainty increased, and stock market volatility returned.

The Fed, led by new chairman Jerome Powell, has played a large and visible role in market sentiment as the FOMC progresses further down its well-broadcast path of gradual rate hikes. The increase in the federal-funds rate following the March FOMC meeting was well-telegraphed, but the markets were shaken by the increase to the Fed’s projections for further rate increases over the next two years. In response to stronger fundamental factors and more hawkish voters joining the FOMC, City National Rochdale has increased its expectations from three to four hikes this year (one more than Fed projections). With more rate rises by the US Federal Reserve, we do expect volatility to rise in the markets. The alternative continues to require taking more credit risk at a time when economic growth, while improving, remains uncertain.

In light of this, we believe the expected stability and known values of CNRSCFIF’s cash flows make the Fund an ideal fixed income investment for such uncertain times. Compared to equivalent fixed income securities, the yield from CNRSCFIF provides above average levels of current income with low volatility and strong credit quality. In addition, although we do not see inflation as being a significant risk over the next 12 months, should it occur, a solid income producing investment like CNRSCFIF is likely to generate a relatively good yield, even after inflation. The strategy continues to collect cash flows as expected from the launch of the vehicle, and underlying market values of asset pool are adjusted for the current interest rate environment.

Overall, the advantage of CNRSCFIF lies in preservation of principal, reliability of cash flows, and the high yield it brings to a portfolio. The Fund is backed by well-diversified, investment grade insurance companies, which are, in our view, highly secured. Furthermore, we believe during volatile equity market periods, such as we are currently experiencing, the addition of non-equity, non-traditional investments has the added benefit of providing significant diversification value to a portfolio.

Sincerely,

Garrett R. D’Alessandro, CFA, CAIA, AIF

Chief Executive Officer & President

City National Rochdale LLC

Important Disclosures

Performance quoted represents past performance and is unaudited. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. The most recent month-end performance can be obtained by calling 800-245-9800.

An investor should consider carefully the Fund’s investment objectives, risks, charges, and expenses. The Private Offering Memorandum contains this and other important information about the investment company, and it may be obtained by calling 800-245-9800. Please read it carefully before investing. RIM Securities LLC is an affiliated broker dealer for City National Rochdale LLC and the Distributor of the Fund, 400 Park Avenue, New York, NY 10022.

The views expressed herein represent the opinions of City National Rochdale LLC and are subject to change without notice at any time. This information should not in any way be construed to be investment, financial, tax, or legal advice or other professional advice or service, and should not be relied on in making any investment or other decisions. As with all investment strategies, there are risks associated with its implementation. Applicable risks include, but are not limited to, market risk, inflation risk, credit risk, and government policy risk. There is no guarantee that investment objectives will be met and the entire investment may be lost.

City National Rochdale Structured Claims Fixed Income Fund is considered a long term investment with limited liquidity and should not be invested in by investors whose objectives conflict with these characteristics. The limited liquidity of the Fund, due to the absence of a public market and a current investor’s limited transfer options to other investors, results in the lack of available market prices during the life of the Fund. Valuation will be provided as detailed in the Private Offering Memorandum and may be inaccurate and may also affect the value and expenses of the Fund. The Fund invests in a single issuer note, making it a non-diversified fund and more susceptible than a diversified fund to any single economic, financial, insurance industry, political or regulatory occurrence that may affect annuities, insurance companies or the Special Purpose Entity (“SPE”) structure. Performance and likelihood of future payments depend on factors such as the business standing of the SPE and its affiliates, the insurance companies, ratings of the insurer, federal and state regulation as well as human error during the transfer process.

City National Rochdale Structured Claims

Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

City National Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

|

TABLE OF CONTENTS

|

Page |

|

Financial Statements

|

|

| |

Statement of Net Assets

|

2

|

| |

Statement of Operations

|

3

|

| |

Statement of Changes in Members' Capital

|

4

|

| |

Statement of Cash Flows

|

5

|

| |

Notes to Financial Statements

|

6 - 12

|

| |

Financial Highlights

|

13

|

| |

Investment Breakdown

|

14

|

| |

|

|

|

Additional Information

|

|

|

City National Rochdale Structured Claims Fixed Income Fund, LLC

|

|

| |

|

|

|

|

STATEMENT OF NET ASSETS

|

|

| |

|

|

|

|

March 31, 2018 (Unaudited)

|

|

| |

|

|

|

| |

|

|

|

|

ASSETS:

|

|

|

|

| |

|

|

|

|

Investments in Securities: 103.1%

|

|

|

|

| |

|

|

|

|

Promissory Note: 99.4%

|

|

|

|

|

Crescit Eundo Finance I, LLC Note, 8.10%, Series 2009-A,

|

|

$

|

22,492,461

|

|

|

due February 15, 2040; (1) (2) at fair value (cost $21,664,407)

|

|

|

|

|

| |

|

|

|

|

|

Short-Term Investments: 3.7%

|

|

|

|

|

|

First American Government Obligations Fund Cl. Z, 1.50% (3) (cost $841,763)

|

|

|

841,763

|

|

| |

|

|

|

|

|

Total Investments in Securities (cost $22,506,170) (4)

|

|

|

23,334,224

|

|

| |

|

|

|

|

|

Interest receivable

|

|

|

78,760

|

|

|

Prepaid expenses

|

|

|

2,024

|

|

|

Total assets

|

|

|

23,415,008

|

|

| |

|

|

|

|

|

LIABILITIES:

|

|

|

|

|

| |

|

|

|

|

|

Distribution payable

|

|

|

691,451

|

|

|

Payable to Adviser

|

|

|

9,704

|

|

|

Payable to directors

|

|

|

1,602

|

|

|

Accrued expenses and other liabilities

|

|

|

84,605

|

|

|

Total liabilities

|

|

|

787,362

|

|

| |

|

|

|

|

|

NET ASSETS

|

|

$

|

22,627,646

|

|

| |

|

|

|

|

| |

|

|

|

|

|

ANALYSIS OF NET ASSETS

|

|

|

|

|

| |

|

|

|

|

|

Paid in Capital

|

|

|

21,799,592

|

|

|

Unrealized Appreciation

|

|

|

828,054

|

|

| |

|

|

|

|

|

TOTAL MEMBERS' CAPITAL

|

|

$

|

22,627,646

|

|

| |

|

|

|

|

|

Capital Units outstanding

|

|

|

|

|

|

(Unlimited number of Units authorized, no par value)

|

|

|

39,004

|

|

| |

|

|

|

|

|

Net asset value price per Unit (net assets/Units outstanding)

|

|

$

|

580.13

|

|

| |

|

|

|

|

| |

(1)

|

Illiquid restricted security.

|

|

|

|

| |

(2)

|

Fair valued by Valuation Committee as delegated by the Fund's Board of Managers.

|

|

|

| |

(3)

|

7-day yield.

|

|

|

|

| |

(4)

|

Tax cost of investments is the same.

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

The accompanying notes are an integral part of these financial statements.

|

|

|

|

|

City National Rochdale Structured Claims Fixed Income Fund, LLC

|

|

| |

|

|

|

|

STATEMENT OF OPERATIONS

|

|

| |

|

|

|

|

For the Six Months Ended March 31, 2018 (Unaudited)

|

|

| |

|

|

|

| |

|

|

|

|

INVESTMENT INCOME:

|

|

|

|

| |

|

|

|

|

Interest Income

|

|

$

|

916,514

|

|

| |

|

|

|

|

|

EXPENSES:

|

|

|

|

|

| |

|

|

|

|

|

Legal fees

|

|

|

30,240

|

|

|

Advisory fees

|

|

|

29,697

|

|

|

Affiliated service fees

|

|

|

29,697

|

|

|

Fund accounting and fund administration fees

|

|

|

28,541

|

|

|

Audit and tax fees

|

|

|

26,120

|

|

|

Custody fees

|

|

|

3,107

|

|

|

Board of managers fees

|

|

|

2,310

|

|

|

Insurance expense

|

|

|

894

|

|

|

Other

|

|

|

2,712

|

|

| |

|

|

|

|

|

Total Expenses

|

|

|

153,318

|

|

| |

|

|

|

|

|

Net Investment Income

|

|

|

763,196

|

|

| |

|

|

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

|

|

|

|

|

| |

|

|

|

|

|

Net change to fair value of promissory note

|

|

|

(120,471

|

)

|

| |

|

|

|

|

|

Net Increase in Members' Capital Resulting From Operations

|

|

$

|

642,725

|

|

| |

|

|

|

|

| |

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

|

|

City National Rochdale Structured Claims Fixed Income Fund, LLC

|

|

| |

|

|

|

|

|

|

|

STATEMENT OF CHANGES IN MEMBERS' CAPITAL

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Six Months Ended

|

|

|

|

|

| |

|

March 31, 2018

|

|

|

Year Ended

|

|

| |

|

(Unaudited)

|

|

|

September 30, 2017

|

|

| |

|

|

|

|

|

|

|

FROM OPERATIONS

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Net investment income

|

|

$

|

763,196

|

|

|

$

|

1,641,020

|

|

| |

|

|

|

|

|

|

|

|

|

Net change in fair value of promissory note

|

|

|

(120,471

|

)

|

|

|

(97,742

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net Increase in Members' Capital Resulting From Operations

|

|

|

642,725

|

|

|

|

1,543,278

|

|

| |

|

|

|

|

|

|

|

|

|

DISTRIBUTIONS TO SHAREHOLDERS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

From net investment income

|

|

|

(769,765

|

)

|

|

|

(1,635,787

|

)

|

| |

|

|

|

|

|

|

|

|

|

From return of capital

|

|

|

(1,366,571

|

)

|

|

|

(2,288,417

|

)

|

| |

|

|

|

|

|

|

|

|

|

Total Distributions to Members

|

|

|

(2,136,336

|

)

|

|

|

(3,924,204

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net Decrease in Members' Capital

|

|

|

(1,493,611

|

)

|

|

|

(2,380,926

|

)

|

| |

|

|

|

|

|

|

|

|

|

MEMBERS' CAPITAL

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

24,121,257

|

|

|

|

26,502,183

|

|

| |

|

|

|

|

|

|

|

|

|

End of period/year

|

|

$

|

22,627,646

|

|

|

$

|

24,121,257

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

|

|

City National Rochdale Structured Claims Fixed Income Fund, LLC

|

| |

|

|

|

|

STATEMENT OF CASH FLOWS

|

| |

|

|

|

|

For the Six Months Ended March 31, 2018 (Unaudited)

|

| |

|

|

|

| |

|

|

|

|

CASH FLOW FROM OPERATING ACTIVITIES

|

|

|

|

| |

|

|

|

|

Net increase in members' capital resulting from operations

|

|

$

|

642,725

|

|

| |

|

|

|

|

|

Adjustments to reconcile net increase in members' capital resulting

|

|

|

|

|

|

from operations to net cash provided by operating activities:

|

|

|

|

|

| |

|

|

|

|

|

Net change in fair value of promissory note

|

|

|

120,471

|

|

|

Principal repayment of note receivable

|

|

|

1,366,572

|

|

|

Purchases of money market investments

|

|

|

(2,530,374

|

)

|

|

Redemptions of money market investments

|

|

|

2,067,247

|

|

| |

|

|

|

|

|

Change in operating assets and liabilities:

|

|

|

|

|

| |

|

|

|

|

|

Interest receivable

|

|

|

4,471

|

|

|

Prepaid expenses

|

|

|

835

|

|

|

Payable to Adviser

|

|

|

(398

|

)

|

|

Payable to directors

|

|

|

1,255

|

|

|

Accrued expenses and other liabilities

|

|

|

11,360

|

|

| |

|

|

|

|

|

Net cash provided by operating activities

|

|

|

1,684,164

|

|

| |

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

| |

|

|

|

|

|

Distributions

|

|

|

(1,684,164

|

)

|

| |

|

|

|

|

|

Net cash used in financing activities

|

|

|

(1,684,164

|

)

|

| |

|

|

|

|

|

Net change in cash and cash equivalents

|

|

|

-

|

|

| |

|

|

|

|

|

CASH AND CASH EQUIVALENTS

|

|

|

|

|

| |

|

|

|

|

|

Beginning of year

|

|

|

-

|

|

| |

|

|

|

|

|

End of year

|

|

$

|

-

|

|

| |

|

|

|

|

|

Supplemental disclosure of non cash financing activities:

|

|

|

|

|

| |

|

|

|

|

|

Increase in distributions payable

|

|

$ |

452,172

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

City National Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

City National Rochdale Structured Claims Fixed Income Fund, LLC (the "Fund") is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified, management investment company. The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The Fund’s investment objective is to seek a steady level of current income with low volatility through investment in promissory notes secured by interests in receivables from insurance companies related to structured settlements.

The Fund’s Board of Managers (the “Board”) is responsible for the Fund’s management, including supervision of the duties performed by City National Rochdale LLC, which serves as investment adviser (the “Adviser” of the Fund).

Each Shareholder (“Member”) must certify that they are a qualified investor or “accredited investor” under Federal securities law and subscribe for a minimum initial investment in the Fund of $25,000. Brokers selling units may establish higher minimum investment requirements than the Fund and may independently charge transaction fees and additional amounts in return for their services in addition to receiving a portion of the sales charge. The Fund is an illiquid investment, and no Member will have the right to require the Fund to redeem its units. The Fund commenced operations on February 24, 2010. The existence of the Fund is not expected to be perpetual, but will instead be self-liquidating over time or sold, with an expected life of between seven and fifteen years from inception.

| 2. |

Significant Accounting Policies

|

The following accounting policies are in accordance with accounting principles generally accepted in the United States and are consistently followed by the Fund as an investment company.

Security Valuation

All investments are carried at fair value. The Fund invested substantially all of its investable assets in the 8.10% Fixed Rate Note, Series 2009-A, which is represented by one certificate (“Note”) issued by Crescit Eundo Finance I, LLC (“Special Purpose Entity”). The equity in Crescit Eundo Finance I, LLC is held by a non-affiliated party. The Board has delegated fair value determinations to the Adviser. The Adviser has formed an internal Fair Value Committee (the “Committee”) to monitor and implement the fair valuation process with respect to the Fund.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

Market quotations are not readily available for the Note. The Note is issued by a Special Purpose Entity, which holds interests in a trust that owns a pool of receivables from various insurance companies (the “Annuity Providers”). The receivables are based on and secured by rights to payments pursuant to underlying settlement agreements of legal claims. Except in certain instances of misrepresentations and warranties by the seller of the underlying settlement agreements, the Fund’s right to payment of the Note is secured by the Fund’s interests in the trust and right to receivable payments.

A discounted cash flow analysis is used to determine the fair value of the Note on a monthly basis. All future cash inflows are estimated and discounted to arrive at the Note’s fair value. The inputs into the discounted cash flow model are discussed below.

The cash flow to the Fund generated by the Note is estimated based on the cash flows projected by the Annuity Providers at the time the Notes were purchased by the Fund. The Committee will adjust such estimated cash flows, if necessary, based on the following types of information obtained by the Adviser:

- Information relating to the financial position of the Special Purpose Entity, the trust, and their affiliates.

- Information regarding the Annuity Providers (including the credit ratings of the Annuity Providers).

- Information regarding the cash flows underlying the settlement receivables from the Annuity Providers.

- The occurrence of any significant market or company specific event that may affect any of the foregoing or the structured settlement industry.

The discount rate used in the analysis is computed as the total of (i) the current Barclays Capital US Investment Grade Credit Insurance Index (yield-to-worst) (the “Barclays Index”), plus (ii) a liquidity premium adjustment, plus (iii) a credit adjustment.

The liquidity premium adjustment is a factor meant to reflect the discount from the Barclays Index rate that would be used by the market in determining the value of the receivable payments from the Annuity Providers in connection with the sale or liquidation of the receivable payments. Based on historical experience, this factor will normally range from 2% to 4%. Upon acquisition of the Note, the initial liquidity premium adjustment was established at 2.25%. The 2.25% factor is adjusted monthly in the same proportion as the current level of the Barclays Index varies from 5.5%, which is the long-term average of the Barclays Index. As of March 31, 2018, the liquidity premium adjustment was 3.50%.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

The credit adjustment is a factor meant to reflect the discount that would be used by the market in determining the value of the receivable payments that the Fund is entitled to receive based on the nature and structure of the underlying legal claim settlement agreements. As of March 31, 2018, the Committee has established the adjustment as 0.50%.

To the extent the receivables are not collected in a timely basis, or to the extent the trust is unable to secure collection, the Fund is exposed to credit risk from both the underlying insurance companies and the trust.

Cash and Cash Equivalents

Cash and cash equivalents are stated at face value and comprise cash on hand, deposits held on call with banks, and other short-term highly liquid investments that are readily convertible to cash and subject to an insignificant risk of change in value.

The fair value of the money market fund is the net asset value of the mutual fund investment which is calculated on a daily basis. The money market fund is registered and regulated by the SEC. The money market fund invests in government obligations, exclusively in short term U.S. government securities. The money market fund provides for daily liquidity.

Fair Value Measurements

The Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources, and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities.

The following is a summary of the inputs used to value the Fund’s investments at March 31, 2018:

|

Investment

|

|

Quoted Prices in

Active Markets for Identical Assets

|

|

|

Significant Other Observable

Inputs

|

|

|

Significant

Unobservable

Inputs

|

|

|

|

|

|

Description

|

|

(Level 1)

|

|

|

(Level 2)

|

|

|

(Level 3)

|

|

|

Total

|

|

|

Note

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

22,492,461

|

|

|

$

|

22,492,461

|

|

|

Money Market Fund

|

|

|

841,763

|

|

|

|

-

|

|

|

|

-

|

|

|

|

841,763

|

|

| |

|

$

|

841,763

|

|

|

$

|

-

|

|

|

$

|

22,492,461

|

|

|

$

|

23,334,224

|

|

The Fund’s policy is to recognize transfers in and transfers out of each level as of the beginning of the year. There were no transfers in or out of Level 1, Level 2 or Level 3 of the fair value hierarchy during the reporting period, as compared to their classification from the most recent annual report.

The following is a reconciliation of the beginning and ending balances for assets and liabilities measured at fair value using significant unobservable inputs (Level 3) during the six months ended March 31, 2018:

| |

|

Investment in Note

|

|

|

Balance, September 30, 2017:

|

|

$

|

23,979,504

|

|

| |

|

|

|

|

|

Realized gain/(loss)

|

|

|

-

|

|

|

Change in unrealized fair value

|

|

|

(120,471

|

)

|

|

Purchases

|

|

|

-

|

|

|

Principal paydowns

|

|

|

(1,366,572

|

)

|

| |

|

|

|

|

|

Balance, March 31, 2018

|

|

$

|

22,492,461

|

|

Quantitative Information about Level 3 Fair Value Measurements held in the Fund:

|

Investment Description

|

|

Fair Value at

March 31, 2018

|

|

Valuation Technique

|

|

Unobservable Input

|

|

Value

|

|

Promissory Note

|

|

$22,492,461

|

|

Discounted Cash Flow

|

|

Discount Rate

|

|

7.59%

|

An increase in the discount rate used would result in a lower fair value measurement.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

Restricted securities include securities that have not been registered under the Securities Act of 1933, as amended, and securities that are subject to restrictions on resale. The Fund may invest in restricted securities that are consistent with the Fund’s investment objective and investment strategies. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Investments in restricted securities are reported at fair value as determined in good faith in accordance with procedures adopted by the Board. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material. At March 31, 2018, the Fund was invested in one restricted security: Crescit Eundo Finance I, LLC Note fair valued at $22,492,461 constituting 99.4% of the Fund’s net assets, with a cost basis as of March 31, 2018 of $21,664,407. The Note was acquired on February 24, 2010.

Investment Risk Factors

Credit Risk: Credit risk is the risk an issuer will be unable to make principal and interest payments when due, or will default on its obligations.

Interest Rate Risk: Interest risk refers to the fluctuations in value of fixed-income securities resulting from the relationship between market price and yield. An increase in interest rates will tend to reduce the market value of previously issued fixed income investments.

Liquidity Risk: Liquidity risk refers to the risk that an investment cannot be bought or sold quickly enough to prevent or minimize loss to the Fund due to the lack of an active market.

Investment Income Recognition

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Realized and unrealized gains and losses are included in the determination of income.

Fund Expenses

The Fund bears expenses incurred in its business. The expenses of the Fund include, but are not limited to, the following: management fees; legal fees; accounting and auditing fees; custody fees; costs of computing the Fund’s net asset value; expenses of preparing, printing, and filing reports and other documents with government agencies; expenses of Members’ and Board meetings; Member record keeping and Member account services, fees, and disbursements; insurance premiums; fees for investor services; and other types of expenses as may be approved from time to time by the Board.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Notes to Financial Statements

March 31, 2018 (Unaudited)

Federal Income Taxes

The Fund’s tax year end is December 31. The Fund intends to be treated as a partnership for U.S. Federal income tax purposes. Each Member is responsible for the tax liability or benefit relating to such Member’s distributive share of taxable income or loss. Therefore, no federal income tax provision is reflected in the accompanying financial statements.

The Fund has adopted accounting standards regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The Fund recognizes the effect of tax positions when they are more likely than not of being sustained. The Fund has concluded that there is no impact on the Fund’s net assets or results of operations and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on its tax returns. These standards require the Fund to analyze all open tax years, as defined by the statute of limitations, for all major jurisdictions. During the six months ended March 31, 2018, distributions in the amount of $769,765 and $1,366,571 were, for tax purposes, ordinary income and return of capital, respectively.

Subsequent Events

The Fund has adopted financial reporting rules regarding subsequent events which require an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the statement of net assets. The Fund made distributions of $122,494 and $124,451 of ordinary income and return of capital, respectively, effective April 30, 2018 and payable May 15, 2018. Management has evaluated subsequent events from the statement of net assets date through the date at which the financial statements were available to be issued and determined that there are no other items to disclose.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

The Fund has an investment management agreement with the Adviser. The Adviser is responsible for providing investment advisory management, certain administrative services, and conducts relations with the service providers to the Fund.

The Fund will pay the Adviser an investment management fee at an annual rate equal to 0.25% of the Fund’s month-end net assets. The investment management fee is accrued and paid monthly.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Semi-Annual Report

March 31, 2018 (Unaudited)

The Adviser has contractually agreed to waive and/or reimburse the Fund’s expenses to the extent needed to limit the Fund’s annual operating expenses to 1.40% of net assets. To the extent that the Adviser reimburses or absorbs fees and expenses, it may seek payment of such amounts for the rolling 36 months after the actual month in which the expenses were reimbursed or absorbed. The Fund will make no such payment, however, if its total annual operating expenses exceed the expense limit in effect at the time the expenses were reimbursed or at the time these payments are proposed. During the six months ended March 31, 2018, there were no waivers made nor any outstanding amounts subject to recoupment by the Advisor.

|

5.

|

Shareholder Servicing Arrangement

|

The Fund pays a shareholder servicing fee to the Adviser (or its affiliates) at an annual rate of 0.25% of the Fund’s month-end net assets, including assets attributable to the Adviser (or its affiliates). Services provided include, but are not limited to, handling Member inquiries regarding the Fund (e.g., responding to questions concerning investments in the Fund, reports, and tax information provided by the Fund); assisting in the enhancement of relations and communications between Members and the Fund; assisting in the establishment and maintenance of Member accounts with the Fund; and assisting in the maintenance of Fund records containing Member information.

|

6.

|

Distribution to Members

|

The Fund intends to make distributions to Members on a monthly basis in aggregate amounts representing substantially all of its net investment income, if any, during the year. The Fund also intends to distribute monthly proceeds from any principal paydowns on the Note, which will be designated as a return of capital to Members. Although the Fund does not expect to realize long-term capital gains except under extraordinary circumstances (such as the sale of all or a substantial portion of the Note), if it does earn such gains, they will be paid out once each year (unless otherwise permitted by the 1940 Act). The Fund will make distributions only if authorized by the Board and declared by the Fund out of assets legally available for these distributions.

|

7.

|

Investment Transactions

|

For the six months ended March 31, 2018, excluding short-term securities and U.S. Government securities, the principal repayments on note were $1,366,572. There were no purchases or sales of U.S. Government securities during the six months ended March 31, 2018.

|

City National Rochdale Structured Claims Fixed Income Fund, LLC

|

| |

|

|

Financial Highlights

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 31, 2018

|

|

|

|

Year Ended

|

|

|

|

Year Ended

|

|

|

Year Ended

|

|

|

Year Ended

|

|

|

Year Ended

|

|

| |

|

(Unaudited)

|

|

|

|

September 30, 2017

|

|

|

|

September 30, 2016

|

|

|

September 30, 2015

|

|

|

September 30, 2014

|

|

|

September 30, 2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Asset Value, beginning of year

|

|

$

|

618.43

|

|

|

|

$

|

679.47

|

|

|

|

$

|

765.56

|

|

|

$

|

827.20

|

|

|

$

|

908.08

|

|

|

$

|

945.63

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from investment operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

19.57

|

|

|

|

|

42.07

|

|

|

|

|

45.85

|

|

|

|

51.50

|

|

|

|

57.18

|

|

|

|

62.98

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized gain/(loss) on

|

|

|

(3.09

|

)

|

|

|

|

(2.50

|

)

|

|

|

|

(5.35

|

)

|

|

|

(4.13

|

)

|

|

|

(4.47

|

)

|

|

|

(7.29

|

)

|

|

promissory note

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from investment operations

|

|

|

16.48

|

|

|

|

|

39.57

|

|

|

|

|

40.50

|

|

|

|

47.37

|

|

|

|

52.71

|

|

|

|

55.69

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less Distributions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From net investment income

|

|

|

(19.74

|

)

|

|

|

|

(41.94

|

)

|

|

|

|

(47.18

|

)

|

|

|

(51.42

|

)

|

|

|

(56.16

|

)

|

|

|

(59.86

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From return on capital

|

|

|

(35.04

|

)

|

|

|

|

(58.67

|

)

|

|

|

|

(79.41

|

)

|

|

|

(57.59

|

)

|

|

|

(77.43

|

)

|

|

|

(33.38

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total distributions

|

|

|

(54.78

|

)

|

|

|

|

(100.61

|

)

|

|

|

|

(126.59

|

)

|

|

|

(109.01

|

)

|

|

|

(133.59

|

)

|

|

|

(93.24

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of period/year

|

|

$

|

580.13

|

|

|

|

$

|

618.43

|

|

|

|

$

|

679.47

|

|

|

$

|

765.56

|

|

|

$

|

827.20

|

|

|

$

|

908.08

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL RETURN - NET

|

|

|

2.73

|

%

|

(1) |

|

|

6.30

|

%

|

|

|

|

5.69

|

%

|

|

|

6.12

|

%

|

|

|

6.23

|

%

|

|

|

6.20

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RATIOS/SUPPLEMENTAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Members' Capital, end of period ($000's)

|

|

$

|

22,628

|

|

|

|

$

|

24,121

|

|

|

|

$

|

26,502

|

|

|

$

|

29,605

|

|

|

$

|

32,264

|

|

|

$

|

35,419

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio Turnover

|

|

|

0.00

|

%

|

|

|

|

0.00

|

%

|

|

|

|

0.00

|

%

|

|

|

0.00

|

%

|

|

|

0.00

|

%

|

|

|

0.00

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of Net Investment Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to Average Net Assets:

|

|

|

6.39

|

%

|

(2) |

|

|

6.50

|

%

|

|

|

|

6.29

|

%

|

|

|

6.40

|

%

|

|

|

6.60

|

%

|

|

|

6.81

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of Gross Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to Average Net Assets:

|

|

|

1.28

|

%

|

(2) |

|

|

1.18

|

%

|

|

|

|

1.43

|

%

|

|

|

1.20

|

%

|

|

|

1.11

|

%

|

|

|

0.90

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of Net Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to Average Net Assets:

|

|

|

1.28

|

%

|

(2) |

|

|

1.21

|

%

|

(3)

|

|

|

1.40

|

%

|

|

|

1.20

|

%

|

|

|

1.11

|

%

|

|

|

0.90

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1) Not annualized.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(2) Annualized.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(3) Rate was determined after taking into account recoupments of expenses previously waived and reimbursed by the adviser (see note 4).

|

|

|

|

| |

(4) Rate was determined after taking into account expenses waived and reimbursed by the adviser (see note 4).

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return is calculated for all Members taken as a whole.

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The expense ratios are calculated for all Members taken as a whole.

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City National Rochdale Structured Claims Fixed Income Fund, LLC

|

| |

|

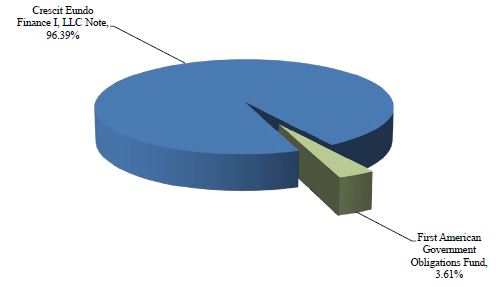

Investment Breakdown

|

|

(as a % of Total Investments)

|

| |

|

March 31, 2018 (Unaudited)

|

The accompanying notes are an integral part of these financial statements.

City National Rochdale Structured Claims Fixed Income Fund, LLC

Additional Information

Proxy Voting Policies and Procedures

You may obtain a description of the Fund’s proxy voting policies and procedures and information regarding how the Fund voted proxies relating to portfolio securities without charge, upon request, by contacting the Fund directly at 1-800-245-9888; or on the EDGAR Database on the SEC’s website at www.sec.gov.

Portfolio Holdings Disclosure

The Fund will file its complete schedule of portfolio holdings with the SEC at the end of the first and third fiscal quarters on Form N-Q within sixty days of the end of the quarter to which it relates. The Fund’s Forms N-Q will be available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-202-942-8090.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable for semi-annual reports.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable for semi-annual reports.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant’s nominating committee charter does not contain any procedures by which shareholders may recommend nominees to the registrant’s board of managers.

Item 11. Controls and Procedures.

| (a) |

The registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the registrant and by the registrant’s service provider.

|

| (b) |

There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

|

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable.

Item 13. Exhibits.

| (a) |

(1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable.

|

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable during this period.

(4) Change in the registrant's independent public accountant. There was no change in the registrant's independent public accountatn for the period covered by this report.

|

(b)

|

Certifications pursuant to Section 906 of the Sarbanes‑Oxley Act of 2002. Furnished herewith.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) City National Rochdale Structured Claims Fixed Income Fund LLC

By (Signature and Title) /s/ Garrett R. D’Alessandro, President

Garrett R. D’Alessandro, President

Date June 7, 2018

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title) /s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro, President

Date June 7, 2018

By (Signature and Title) /s/ Mitchell Cepler

Mitchell Cepler, Treasurer

Date June 7, 2018