UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For transition period from to

Commission File Number 001-41043

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

Telephone: ( | ||||||||

| (Address of registrant’s principal executive offices) | (Zip code) | |||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |||||||

Smaller reporting company | ||||||||

Emerging growth company | ||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

The registrant was not a public company as of June 30, 2021, the last business day of its most recently completed second fiscal quarter, and therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-

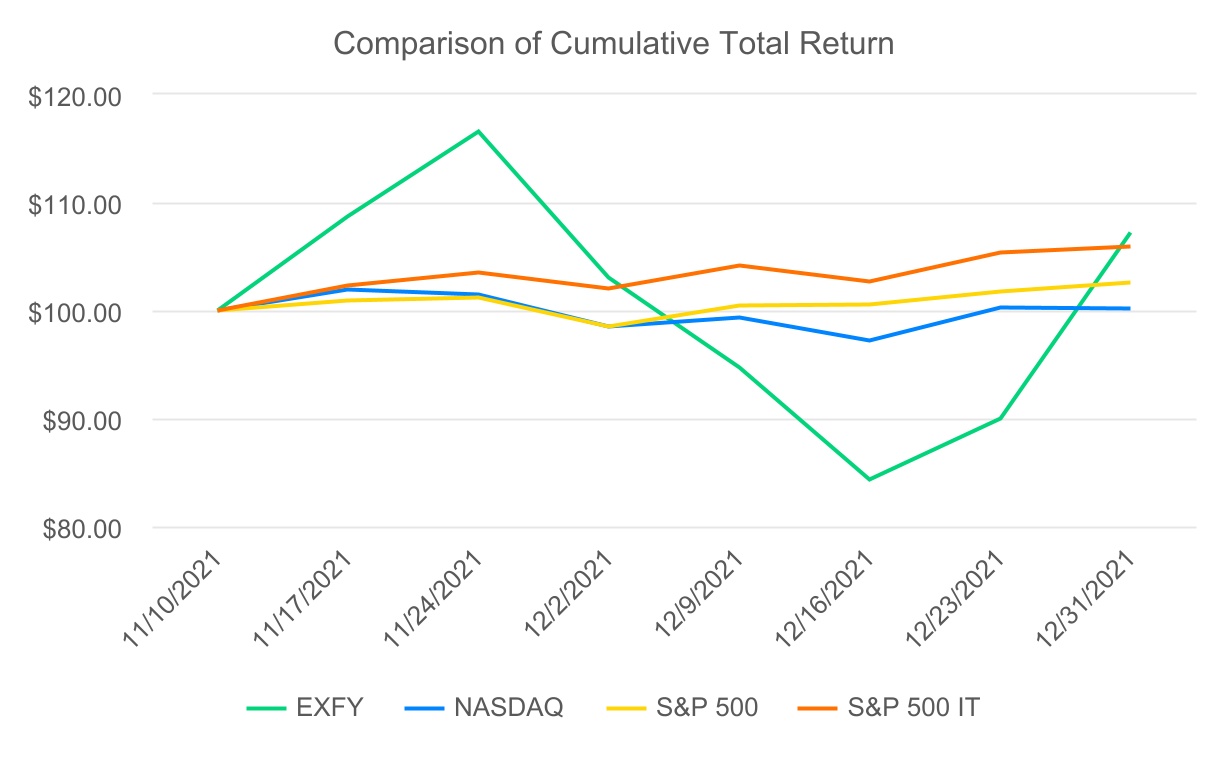

affiliates as of such date. The registrant’s Class A common stock began trading on the Nasdaq Global Select Market on November 10, 2021.

As of March 25, 2022, there were approximately 68,027,354 shares of the registrant's Class A common stock outstanding, 7,332,640 shares of the registrant's LT10 common stock outstanding, and 6,224,160 shares of the registrant's LT50 Common stock outstanding..

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

| Page | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8 | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14 | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

1

Special Note Regarding Forward Looking Statements

This Annual Report on Form 10-K contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements regarding our strategy, future financial condition, future operations, projected costs, prospects, plans, objectives of management and expected market growth, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “goal,” “objective,” “seeks,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

•the economic, political and social impact of, and uncertainty relating to, the COVID-19 pandemic;

•the war in Ukraine and escalating geopolitical tensions as a result of Russia's invasion of Ukraine;

•our expectations regarding our financial performance and future operating performance;

•our ability to attract and retain members, expand usage of our platform, sell subscriptions to our platform and convert individuals and organizations into paying customers;

•the timing and success of new features, integrations, capabilities and enhancements by us, or by competitors to their products, or any other changes in the competitive landscape of our market;

•the amount and timing of operating expenses and capital expenditures that we may incur to maintain and expand our business and operations to remain competitive;

•the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs;

•our ability to make required payments under and to comply with the various requirements of our current and future indebtedness;

•our ability to effectively manage our exposure to fluctuations in foreign currency exchange rates;

•the increased expenses associated with being a public company;

•the size of our addressable markets, market share and market trends;

•anticipated trends, developments and challenges in our industry, business and the highly competitive markets in which we operate;

•our expectations regarding our income tax liabilities and the adequacy of our reserves;

•our ability to effectively manage our growth and expand our infrastructure and maintain our corporate culture;

•our ability to identify, recruit and retain skilled personnel, including key members of senior management;

•the safety, affordability and convenience of our platform and our offerings;

•our ability to successfully defend litigation brought against us;

•our ability to successfully identify, manage and integrate any existing and potential acquisitions of businesses, talent, technologies or intellectual property;

•general economic conditions in either domestic or international markets, including the societal and economic impact of the COVID-19 pandemic, and geopolitical uncertainty and instability;

1

•our protections against security breaches, technical difficulties, or interruptions to our platform; and

•our ability to maintain, protect and enhance our intellectual property.

We caution you that the foregoing list does not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations, estimates, forecasts and projections about future events and trends that we believe may affect our business, results of operations, financial condition and prospects. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report on Form 10-K, we cannot guarantee that the future results, levels of activity, performance, or events and circumstances reflected in the forward-looking statements will be achieved or occur at all. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and you are cautioned not to unduly rely upon these statements. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “Expensify,” the “Company,” “we,” “us,” “our” or similar references are to Expensify, Inc. Capitalized terms used and not defined above are defined elsewhere within this Annual Report on Form 10-K.

2

Risk Factor Summary

Our business is subject to a number of risks and uncertainties of which you should be aware. These risks are more fully described in the section titled “Risk Factors”. These risks include, among others, the following:

•Our quarterly and annual results of operations have fluctuated in the past and may fluctuate significantly in the future and may not meet our expectations or those of investors or securities analysts.

•We experienced rapid growth in recent periods prior to the COVID-19 pandemic, and those growth rates may not be indicative of our future growth, and we may not be able to maintain profitability.

•The COVID 19 pandemic has materially adversely affected, and may continue to materially adversely affect, our business and our ability to grow. Whether or not a result of the COVID-19 pandemic, a sustained general economic downturn, an uneven recovery, or continued instability could materially and adversely affect our business, results of operations and financial condition and growth prospects.

•Our expense management feature drives the majority of our subscriptions, and any failure of this feature to satisfy customer demands or to achieve increased market acceptance could adversely affect our business, results of operations, financial condition and growth prospects.

•If we fail to adapt and respond effectively to rapidly changing technology, evolving industry standards and changing customer needs or preferences, our platform may become less competitive.

•If we are unable to attract new customers on a cost-effective basis, convert individuals and organizations using our free basic expense management feature and trial subscriptions into paying customers, retain existing customers and expand usage within organizations, our revenue growth will be harmed.

•We may fail to accurately predict the optimal pricing strategies necessary to attract new customers, retain existing customers and respond to changing market conditions.

•We may not successfully develop or introduce new features, enhancements, integrations, capabilities and versions of our existing features that achieve market acceptance, and our business could be harmed and our revenue could suffer as a result.

•We face significant competition, the market in which we operate is rapidly evolving, and if we do not compete effectively, our results of operations and financial condition could be harmed.

•The estimates of market opportunity and forecasts of market growth included in this prospectus may prove to be inaccurate. Even if the market in which we compete achieves the forecasted growth, our business could fail to grow at similar rates, if at all.

•We depend on our senior management team, as well as a single professional services firm for a significant portion of our finance function, and the loss of any key employees or our outsourced finance team could adversely affect our business.

•Our failure to protect our sites, networks and systems against security breaches, or otherwise to protect our confidential information or the confidential information of our members, customers, or other third parties, would damage our reputation and brand, and substantially harm our business and results of operations.

•Our business depends on a strong brand, and if we are not able to maintain and enhance our brand, our ability to expand our base of customers may be impaired, and our business and results of operations will be harmed.

3

•Our culture has contributed to our success, and if we cannot maintain this culture as we grow, we could lose the high employee engagement fostered by our culture, which could harm our business.

•We may be adversely affected by global economic and political instability, including the war in Ukraine and escalating geopolitical tensions as a result of Russia’s invasion of Ukraine.

•Sales to customers outside the United States and our international operations expose us to risks inherent in international sales and operations.

•We receive, process, store and use business and personal information, which subjects us to governmental regulation and other legal obligations related to data protection and security, and our actual or perceived failure to comply with such obligations could harm our business and expose us to liability.

•If we fail to manage our technical operations infrastructure, or experience service outages, interruptions, or delays in the deployment of our platform, our results of operations may be harmed.

•The multiple class structure of our common stock and the ownership of substantially all of our LT10 and LT50 common stock by holders through a trust agreement (the "Voting Trust") have the effect of concentrating voting control with the Voting Trust for the foreseeable future, which will limit your ability to influence corporate matters, including a change in control. We are controlled by the Voting Trust, whose interests may differ from those of our public stockholders. Our amended and restated certificate of incorporation also delegates significant authority to our Executive Committee.

4

Part I.

Item 1. Business

OVERVIEW

Expensify is a cloud-based expense management software platform that helps the smallest to the largest businesses simplify the way they manage money. Every day, people from all walks of life in organizations around the world use Expensify to scan and reimburse receipts from flights, hotels, coffee shops, office supplies and ride shares. Since our founding in 2008, we have added over 11 million members to our community, and processed and automated over 1.2 billion expense transactions on our platform, freeing people to spend less time managing expenses and more time doing the things they love. For the quarter ended December 31, 2021, an average of 711,000 paid members across 53,000 companies and over 200 countries and territories used Expensify to make money easy.

Small and medium businesses (“SMBs”) are the cornerstone of the global economy, making up almost all businesses and the majority of employment in OECD countries. Despite their significance, the vast majority of SMBs still rely on manual, inefficient processes to manage the critical back office functions that power their businesses every day. Expense management, which refers to the collection, processing, auditing and reimbursement of employee expenses, is one of the last great holdouts of paper-based back office processes, with employees stuffing actual physical receipts into an envelope and handing it to their accountant. As SMBs seek to modernize back office functions like expense management to better compete in today’s digital economy, we believe they will look for comprehensive technologies that are easy to discover, implement, purchase, manage and use. At the same time, individual employees are becoming a powerful source of change as they increasingly expect to bring their own choice of technology into the workplace.

Since the beginning of Expensify, our North Star has been improving the experience of the actual end users of expense management software: everyday employees. We designed Expensify to be easy to set up, integrate, configure and use from any device, which has enabled us to serve employees of all types and organizations of all sizes, industries and geographies. Our first breakthrough was revolutionizing receipt tracking with our patented scanning technology, SmartScan, which allows anyone to simply take a photo of any receipt – no matter the currency or quality of handwriting – for fast, automatic and accurate transcription of a receipt with just one tap. After removing the need for people to keep a pocket full of crumbled receipts and spend hours manually tracking expenses, we moved on to automating the entire expense journey, from the initial receipt scan all the way through to categorization, expense approval, reconciliation and next-day reimbursement. Since then, we have expanded our platform to include features that help businesses manage corporate credit cards, generate and send invoices, pay bills and book travel, all from our single, easy-to-use mobile application. We intend to continue adding complementary features to retain and add value to existing customers and attract new members.

Our intense focus on improving the everyday experience of regular employees with an easy-to-use but powerful platform has enabled a viral, “bottom-up” business model that is capital efficient and extremely scalable. By allowing people to spend less time managing receipts and more time pursuing their real goals, our members have adopted, championed and spread Expensify to their colleagues, managers and friends. We believe our happy members are the best form of marketing, and our self-service, bottom-up approach takes advantage of strong, organic word-of-mouth adoption.

Behind our platform is a company with passionate people and a unique culture that guides everything we do. Our company operates with a flat, generalist organizational structure united by a robust set of common values that foster the long-term happiness and retention of our employees. The efficiency of our business model allows us to prioritize attracting, retaining and inspiring talented, ambitious and humble people committed to a long-term vision. We are a team that likes to solve real problems, and

5

though expense reports are problematic for most people, there are other pressing problems facing our world that we want to also help solve.

OUR INDUSTRY

Given their size, SMBs typically have one person overseeing the discovery and implementation of new systems, a responsibility that is often in addition to their core job function. As a result, SMBs have specific requirements when adopting new technologies:

•Easy to discover. With job responsibilities spanning multiple functions, SMBs do not have the bandwidth and expertise to discover, meet with and evaluate several technology vendors. As such, SMBs increasingly rely on online channels for finding new technologies and heavily consider recommendations from experts, friends and colleagues.

•Easy to implement. IT departments within SMBs are often one person or the business owner themselves, and are incapable of taking time away from their business to support cumbersome implementation, maintenance and training requirements. As a result, SMBs prefer solutions that are easy to implement, onboard and integrate and that require little ongoing maintenance.

•Easy to purchase. With no procurement department and limited resources, the individuals making the purchasing decision at SMBs often prefer vendors with transparent, self-service monthly subscription plans that can be paid by credit card.

•Easy to manage. Unlike large enterprises, which often require multiple, customized point solutions for specialized business processes, SMBs prefer a single, comprehensive platform from one provider that can solve multiple pain points.

•Easy to use. Many SMBs prioritize ease of use and convenience over cost and seek solutions with elegant, intuitive user experiences that require no training or expertise to operate.

In short, SMBs look for “easy money” management.

OUR APPROACH

Since our founding, we have taken a unique approach to expense management built on key, complementary elements:

•Platform strategy hyper-focused on the employee. We designed Expensify to be easily configured and used by every single employee within an organization, not just decision makers or managers. Expensify is a highly integrated mobile platform with many features designed to make our members’ lives easier, simple enough for freelancers and small businesses, and powerful enough for large enterprises with tens of thousands of employees. Our product development is compounding and driven by member feedback, with every new feature making every past feature a little bit better, as well as methodically laying a strategic foundation for features yet to come.

•Viral, bottom-up business model driven by the employee. Our employee-focused platform strategy enables a viral, “bottom-up” adoption cycle that starts with an individual employee. After signing up for free on the website or downloading our free app to submit expenses and realizing the benefits of using Expensify, our enthusiastic members champion our platform internally, spreading it via word-of-mouth to other employees and convincing decision makers to adopt Expensify company-wide. This enables us to focus our time and resources on making our features better for our members, and avoid the reliance on a costly, traditional top-down sales and marketing approach to attract and retain customers.

•Word-of-mouth adoption supported by a market consensus approach. We believe that our happy members are the best form of marketing. We strive to build a superior platform that makes the lives of employees and admins easier so that they become our champions and promote us to other individuals and organizations. We deploy large scale brand advertising to build on this

6

platform superiority and help create market consensus that Expensify is the category leader for expense management software. We believe this enables us to focus on creating great features for our members rather than rely on the expensive and ineffective activities of traditional sales and marketing to drive customer acquisition.

•Unique company culture and long-term vision. Our platform strategy and business model are complemented by our unique company culture and intense focus on the long-term happiness of our employees. Our organization is flat, generalist, transparent and inclusive, and we value ideas from every corner of our company, no matter who or where it comes from. We believe our special culture and the long-term commitment from our employees are key drivers to our success.

We believe that these elements of our approach are hard to replicate, self-reinforcing and work together to drive a powerful competitive advantage.

Our Platform Strategy

Expensify is a leading cloud-based expense management platform that allows any business to simplify how it manages expenses. We built our platform to be intuitive and easy to deploy, with powerful features that increase our network effect inside and between companies. This helps us reach more potential members and expand our value by solving more pain points for our customers. While our core features enable businesses to easily manage expenses, our platform includes features for managing corporate cards, paying bills, generating invoices, collecting payments and booking travel. Our platform strategy centers around the following key concepts:

•Built for everyone. We designed our platform to be used by everyone in an organization, from employees to managers to the finance department. We offer an intuitive, elegant user interface that everyday employees can easily understand and operate from any device. We deliver guided workflows for administrators to accurately and quickly approve expenses in accordance with their unique company policies. Our platform is simple enough for SMBs, but powerful features can be enabled for use across enterprises with tens of thousands of employees. We believe that the more intuitive and simple Expensify is, the more employees and administrators will want to use it.

•Easy to set up. We designed our platform to be easily implemented and configured without the need to speak with a sales person. Any employee can download our free application from mobile app stores or sign up on the website, create an account and start submitting expenses within minutes. When an expense report is submitted, the manager who receives it also automatically becomes a member. Concierge, our AI-powered customer support engine, helps new members set up an account, connect teammates, assign company policies and immediately sync Expensify with existing accounting, HR and travel systems. We believe that by making our platform easily accessible, simple to set up and easily configurable attracts more members to download and try Expensify.

•Designed to improve experiences for all members. We designed our platform to leverage leading technology, such as our patented SmartScan and our proprietary AI-powered customer support engine, Concierge, to automate and reduce errors from the cumbersome, manual tasks associated with managing expenses. By doing so, we give employees, contractors and administrators in businesses of all shapes and sizes more time to spend on things they care about, leading to improved costs, enhanced productivity and higher job satisfaction. We believe that always having the pain points of our members at the center of every technology decision and feature we develop enables us to consistently deliver an improved experience for every employee in an organization.

•One platform, many features. Expensify is one platform, with one price that unlocks access to every feature on the platform, from expense management to bill payment. Our features are just different configurations of the same underlying tool, and are not different products in some kind of combined suite. We develop our features in a compounding manner, which means that everything we build improves everything we've already built, and lays a foundation for what we will build next.

7

This enables increasingly rapid deployment of new features that solve other problems for our members and allows us to extend the network effect of our platform.

•Highly integrated. We designed our platform to easily integrate with other business and consumer applications. We offer over 40 pre-built integrations, allowing Expensify to seamlessly connect with HR, payroll and accounting systems, travel management software, business and employee bank accounts and credit cards. These integrations enable our members to synchronize data in real-time across their technology ecosystem and automate expense management with the applications and tools they use every day.

We believe that elements of our platform strategy are a critical driver of the viral, widespread adoption of Expensify across and between any type of organization.

Our Business Model

Our platform strategy enables a viral “bottom-up” business model that is capital efficient and extremely scalable. Anyone can easily download our mobile application or go to our website to sign up for free on their own, and later upgrade to a paid subscription for advanced features. The adoption of Expensify within an organization often starts with the individual employee, who downloads our mobile application or signs up on our website for free and uses it to easily submit expenses to their manager with a few taps. After the employee realizes the benefits of our platform, they become a champion of Expensify and often spread it internally to other employees. With multiple employees using Expensify and valuable features simplifying the manager’s job, the decision maker purchases a subscription to Expensify and becomes a paying customer with a few members. Our usage within an organization expands further as the company adds members and adopts new features such as the Expensify Card or Bill Pay.

We offer simple, transparent and flexible subscription plans for both individuals and businesses that are completely self-service and payable by credit card. Rather than the traditional software sales model of complex pricing, user thresholds and inconsistent fees, we designed our pricing plans to facilitate the easy adoption of our platform by the smallest mom-and-pop stores to the largest and most complex organizations. Purchasers can select a transparent plan with features that best suit their specific needs, all without interacting with a sales representative or paying hidden costs for implementation, maintenance, or support.

Our individual subscriptions include our Track and Submit plans, which include an optional paid monthly upgrade for anyone wishing to SmartScan more than 25 receipts in a given month:

•Free Plans (Optional upgrade for unlimited SmartScan)

◦Track. Our free Track plan comes with our SmartScan receipt scanning functionality and is used primarily by individuals and sole proprietors to streamline their receipt and mileage tracking.

◦Submit. Our free Submit plan includes the same functionality in Track, and also adds the ability to automatically submit expense reports to anyone for reimbursement.

Our business subscriptions can be used by teams, organizations, and companies for free or upgraded to one of our paid plans, which include our Collect and Control plans, following a free trial. We bill customers on Collect and Control plans at the start of each month based on the number of policy members who were active in the previous month. Each customer has either a "pay per use" plan in which they are billed a flat rate or each active member, or an "annual" plan where they commit to a

8

minimum number of monthly seats in exchange for a discount. Collect and Control customers can access additional discounts if they spend on the Expensify Card:

•Free Plans

◦Free. Our Free plan enables our members to roll out a corporate card program with the Expensify Card, reimburse cash expenses for employees, send invoices to clients and set up bill payment for their team.

•Paid Plans

◦Collect. Our Collect plan enables our members to integrate with popular small business accounting systems, configure simple expense report approval workflows, as well as pay employees, contractors and volunteers via Direct Deposit ACH.

◦Control. Our Control plan, which is by far our most popular plan, includes everything in Collect and adds the ability to configure rules-based approval workflows and integrate with financial, travel, HR, as well as other internal systems commonly used by mid-market and enterprise companies.

We also leverage partnerships with accounting and bookkeeping firms, who provide validation of our platform and refer customers to us. We partner with strategic accounting software partners such as Intuit, NetSuite, Xero and Intacct to integrate our software in their clients’ back offices, and recognize us as a top expense tool when their clients are browsing and selecting integrated solutions. Additionally, our ExpensifyApproved! Partner Program trains and supports accountants to use our platform and encourages their customers to use Expensify. We work hard to maintain top expense partner status with all partners to support our market consensus strategy. The strength of our alliances is highlighted by frequent distinction by our partners, including being named NetSuite’s Innovation Partner of the Year, Xero’s App Partner of the Year and one of the most reviewed “Popular Apps” on the Intuit Quickbooks platform.

Our Growth Strategies

We intend to drive the growth of our business by executing on the following strategies:

•Build new features that create additional value for existing members. Our word-of-mouth model works well because people genuinely enjoy using Expensify. We intend to continue to invest in building features that increase the value our software delivers to our existing members. Our flat, generalist and democratic structure cultivates a diversity of ideas from every single one of our employees, which enables an efficient, scalable and rigorous product development process. By efficiently investing in new features that prioritize the needs of our members, we can continue to retain existing members and attract new members via word-of-mouth;

•Build new features that attract new members beyond employees who submit expenses. We have and will continue to invest in developing features complementary and adjacent to expense management. At most companies, not every employee generates expenses that would be submitted via an expense report. As we add additional features that can be used by all employees rather than just those that submit expense reports, we have the potential to monetize the segment of our customers’ employees that are not submitting expense reports on a monthly basis, and increase revenue without adding more customers or raising prices. These features will enable easy financial collaboration within communities and between friends and family;

•Build viral loops into our member experience that increase adoption by new customers. We design our expense management platform and every new feature with the aim of frictionless adoption. Individual employees download the Expensify mobile app or sign up on our website, for free, and use it to submit their expenses to their bosses – turning every expense report into a highly targeted marketing message, straight to a decision maker. Outside of expense management, we

9

have expanded our platform and built invoicing and bill payment features with the goal of replicating the frictionless adoption of our expense management feature. By sending an invoice using Expensify, accounts receivable departments naturally promote Expensify to their clients. A company that adopts Expensify bill payment tacitly promotes Expensify to all of their vendors: any one vendor that sends a manual invoice receives an email notifying them that their invoice was converted into an Expensify invoice, and they should sign in to collect payment online. We will continue to focus on the maintaining and extending the virality of our features to support our viral, bottom-up business model;

•Expand and monetize transaction volume from existing and new customers. We fully launched the Expensify Card in 2020 and, despite pullback in corporate expenses with the COVID-19 pandemic, customers began adopting the card. We expect its adoption to continue to grow, especially as business travel is expected to return from the challenges caused by the COVID-19 pandemic. Going forward, we intend to increase the promotion of the Expensify Card to both new and existing customers to drive growth in adoption;

•Promote Expensify’s culture and values. We believe that consumers are more likely to both use and recommend products from brands they admire. By consistently acting on and vocally promoting our values, we have the ability to both drive positive change and create brand awareness that can add to the virality of our platform. Our culture and values, including our adherence to Environmental, Social, and Governance (ESG) principles, will be shared in our company code of ethics and conduct and in future sustainability reporting;

•Continue to strengthen our market consensus. We have worked hard to establish and maintain Expensify as the dominant expense management platform for SMBs. We leverage a variety of targeted marketing strategies that involve industry conferences, industry influencers, partner marketing, our own conference and more to achieve market consensus that Expensify is the premier, industry standard expense management platform. This is essential to our viral and word-of-mouth business model. We plan to reinforce the market consensus surrounding our platform, as well as expand on these strategies across new feature verticals and markets;

•Create physical spaces to attract new members and promote our brand. Before the COVID-19 pandemic we began transition our office spaces into co-working spaces, which we call lounges. These spaces are uniquely designed to be extensions of our culture and brand, and we intend to open these spaces to certain members in addition to Expensify employees. These spaces are designed to showcase how we work and have built our company, which we hope will encourage current members to adopt our culture for their companies and invite their friends to join, adding new members;

•Expand integrations and strengthen partnerships. Expense management touches many functions across a company. To provide a seamless experience for our customers, we integrate with the accounting, ERP and travel software used by SMBs and their employees every day. We also have frictionless integrations with many of the technology providers that generate the most receipts for our members, such as Uber and Lyft. Through our ExpensifyApproved! Partner Program, we train and support accountants who then encourage their customers to use Expensify. We intend to continue to invest in both integrations and partnerships as they are critical to delivering best-in-class user experiences and ensuring that Expensify is deeply embedded within our customer base; and

•Expand internationally. We see significant opportunity to acquire new customers internationally. Because word-of-mouth drives significant adoption, we have experienced member growth outside of our core geographies without investment in marketing or regional sales forces. We have the opportunity to accelerate international growth by investing in marketing, developing a localized platform experience and expanding international partnership and integrations.

10

We believe that the combination of the strength of our platform, our scalable business model and our special company culture has us well-positioned to achieve these growth strategies.

Our Platform

Expensify makes money easy for SMBs by enabling them to collaborate and complete financial tasks more efficiently. Our AI-driven, mobile-first, cloud-based platform offers a best-in-class experience for companies looking to modernize their financial processes away from paper and excel spreadsheets for the first time.

We define preaccounting as the systemized set of processes through which employees, or non-accountants, gather, code, aggregate and normalize financial data. While other financial processes have seen vast efficiency improvements with the widespread adoption of cloud-based ecosystems, company-focused preaccounting tasks such as expense management have largely remained unchanged, and therefore are still overwhelmingly inefficient, unscalable and time-consuming. Our comprehensive financial platform offers a wide range of easy-to-use but powerful features that automate the preaccounting processes for businesses of all sizes – including managing expenses, capturing and managing spend via the Expensify Card and more recently, paying bills and sending invoices, all included in the Expensify platform.

Expense Management

Expenses are among the most complicated preaccounting workflow, no matter the size of a company. Expenses touch every employee, span every layer of the organization and require interaction with a host of internal and external business systems. While the expense management process is incredibly complex, it largely occurs in three distinct, sequential phases: Capture > Approve > Pay.

CAPTURE

Most of today’s financial data still exists on paper. Expensify streamlines the capture and normalization of disparate financial data in the following ways:

•SmartScan. Snap a photo of your receipt, forward receipts from email, or upload attachments directly in the application. SmartScan optimizes for high-accuracy data extraction to support our “fire and forget” receipt capture.

•Credit card matching. Receipts and emails are automatically matched to incoming credit card transactions in real-time, preventing duplicates and reducing the need to manually reconcile credit card statements at month end.

•Mobile expense capture. With mobile apps for Android and iOS, it’s possible to capture receipts, mileage expenses and per diems while in the office or anywhere else in the world – online or offline. In addition, members can automatically import receipts from their favorite travel tools, including Uber, Lyft, Grab, Hotel Tonight, among others.

APPROVE

Once financial transactions are captured, we deliver AI-driven insights into the nature of company spend, as well as adherence to company-specific rules and guidelines. Expensify’s robust approval functionality can be scaled up and down in the following ways:

•Multi-level approval workflows. Customizable approval workflows help companies of all sizes tailor their approval hierarchies, route specific expenses to budget or project owners and approve expenses through an intuitive “Guided Review” that highlights specific items requiring review.

11

•Intelligent auditing. Process data automatically or configure which types of transactions require review. Expensify detects receipt duplicates by default and automatically verifies that any manually-entered expenses match attached receipts.

•Powerful integrations. Connect directly with leading cloud accounting and finance platforms such as QuickBooks, Xero, Oracle NetSuite, Sage Intacct and FinancialForce, among others. A continuous real-time sync means that information is dynamically updated across all connected platforms. Expensify connects directly with the top banks in the U.S., as well as leading human resource, practice management, tax reclamation, recruiting and travel management systems. A self-service API is available to anyone who wants to integrate Expensify into their technology ecosystem on their own without additional cost.

•Comprehensive visibility. Whether companies require visibility into transaction approvals, help with corporate credit card reconciliation and remittance, or insights into travel spend, financial data is visible throughout the platform.

PAY

After capturing and approving relevant company spend, businesses require an easy and fast method for disbursing funds to employees and vendors. Expensify’s payments platform streamlines how modern payments are made and reconciled in the following ways:

•Next day ACH direct deposit. For companies that enable automatic processing and reimbursement, employees receive expense reimbursements in their bank account the following business day.

•Centralized travel procurement. Manage and centrally pay for travel bookings made with any Expensify Card, all while ensuring compliance with company travel policies.

•Corporate card remittance. Streamline the process of managing and remitting corporate card payments.

Expensify Card

The Expensify Card is a natural extension of our expense management platform, and is powered by the Visa network. Companies can use the Expensify Card in conjunction with existing expense policies at no additional cost, or independently as a separate corporate card program through our platform.

The Expensify Card leverages our wealth of experience acquired by working directly with finance administrators. The feature is designed to fix the common pain points seen with traditional corporate cards, namely the lack of real-time receipt capture and transaction visibility, enhanced access to credit for small businesses and streamlined setup of corporate card programs.

Key capabilities of the Expensify Card include:

•Streamlined card application/setup. Companies receive an automated approval decision in seconds, and card provisioning for an entire organization is possible in a few minutes. Every member receives a virtual card for immediate use.

•Continuous automatic reconciliation. Card transactions are synchronized in real-time between Expensify and a company’s accounting systems. This removes the need for an arduous once-a-month statement reconciliation.

•Real-time compliance. Cardholders receive an immediate push notification when their card is charged, which helps protect against fraud. In addition, eReceipts mean that no receipt capture is required for nearly all purchases, though companies can stipulate their own receipt policy where preferred.

12

•Spend control with Smart Limits. Companies control the maximum exposure they will accept for each employee by stipulating their individual unapproved spend, which is another cash control feature. If a cardholder fails to submit their expenses in a timely fashion, card activity is suspended until historical card spend is approved.

•Cash back. Companies receive up to 4% cash back in their first 3 months, and up to 2% with no limits for all spend on their Expensify Cards afterwards. Companies receive 1% cash back when they spend over $25,000 summed across all of their Expensify Cards, or 2% cash back when they spend over $250,000 summed across all of their Expensify Cards.

•Karma Points. Every time a cardholder makes a purchase, Expensify donates 10% of our interchange amount to Expensify.org for use in one of its five funds – Hunger, Climate, Homes, Youth, Reentry.

•Daily settlement. Ensure that employees never overspend what a company is able to pay. Daily settlement also helps smooth cash flows throughout the month, as opposed to one large, uncertain lump sum at month’s end.

•Integrated travel booking. Offered at no additional cost for all cardholders, administrators can set flight class, hotel ratings and other travel preferences to ensure that bookings comply with company policy. Reporting tools give admins full visibility into trip costs, and currently every booking comes with emergency transportation services in partnership with Global Rescue at no additional cost, as well as health and security assessments applicable for their destination.

We believe we have growth in many areas in regards to the Expensify card. Our goal is to to continue increasing the amount of companies that have adopted the Expensify card and the number of members that have a card provisioned per company both of which would increase the amount of total spend converted to the Expensify card.

Invoicing & Bill Pay

Key capabilities of our invoicing and bill payment features include:

•Payments made easy. With multiple payment options, including credit/debit card, ACH, check, Venmo and PayPal, customers across the globe have access to quick, easy and frictionless payment options.

•Eliminate manual entry. Bills sent to a company’s @expensify.cash address are automatically SmartScanned, which captures key details for easy review and processing.

•Real-time communication. Customers can leave comments or ask questions on the invoice and both parties can chat in real time directly in Expensify, or receive an email instantly.

•Extensive integrations. Companies can save time by exporting invoices and bills to QuickBooks, Xero, Sage Intacct, Oracle NetSuite and more. Invoices are automatically linked to the corresponding customer and exported as a receivable in the accounting system. Bills are automatically linked to the corresponding vendor and exported as a payable.

Expensify.org

We started Expensify.org to “create a just and generous world” with the belief that doing good is good for business. We aim to integrate the Expensify.org mission into everything we do. If nothing else, it's good for employee retention and morale, by framing our work in a more powerful context than it might otherwise seem. Everyone here knows that we cannot succeed as a business without also giving back and making the world a better place than we found it.

13

Though Expensify.org launched in January 2020 and is now a 501(c)(3) non-profit, the concept was set into motion before Expensify was founded when David Barrett, Expensify's founder and CEO, had an idea of how to help feed unhoused neighbors he passed every day walking through San Francisco. He developed a platform to load gift cards on-demand from his personal credit card to offer funds immediately for individuals in his neighborhood to purchase food. While this idea didn’t take off, David held onto the concept for more than a decade until it became a reality with the launch of Expensify.org and its corporate-card-fueled donations called Karma Points.

Through Expensify.org, we seek to empower individuals and communities to eliminate injustice around the world by making giving and volunteering more convenient, accountable, meaningful and collaborative. The foundation of Expensify.org was built on applying our expertise in expense management to increase the transparency of how funds are used, the convenience of how donations are gathered and — most importantly — the emotional connection between donors, volunteers and recipients. Donations route to one of our five funds related to tackling the biggest social injustices of our time: Housing Equity, Youth Advocacy, Food Security, Reentry Services and Climate Justice.

Our Compliance and Data Security

We are PCI-DSS, SOC1 Type II, and SOC2 Type II compliant, with external parties performing "grey box" testing to simulate nation-state level hacking capability. We are integrated with every major bank in the United States and our system and processes have been stress tested by each of them. We process billions of dollars in expense reimbursements every year and are audited annually by our processing bank. We take privacy and data security seriously and are in compliance with domestic and international data privacy regulations, which sometimes change faster than the wind.

Our Data

As of December 31, 2021, we have processed over 1.2 billion expense transactions for our customers. These expenses span across employees from all functions and layers in organizations of all sizes, industries and geographies. To process these expenses, our platform runs on our proprietary distributed and fully replicated technology architecture that is built to process many multiples of our current transaction volume. We also designed our platform to be deeply integrated and connected with a broad suite of back office systems, consumer applications and banking technology infrastructures that our customers use every day. The combination of the scale and diversity of the expenses we process, the breadth and depth of our integrations and the scalability of our infrastructure has enabled us to build a massive data asset that continually enhances the value of our platform.

We derive powerful insights from our data such as the unique buying behavior of our members, the spending trends of the businesses they work for and changes in the technologies businesses use for multiple back-office workflows. These insights provide continuous and real-time input into our product development and enable us to develop features that reflect the behavior and preferences of our members and the organizations they work for. Our data asset also benefits from significant network effects, with every new member and transaction adding incremental value to our platform. Every receipt we process through our OCR technology makes our SmartScan technology more accurate, every transaction we process and backtest enhances our fraud protection capabilities and every customer inquiry we resolve allows Concierge to answer future questions faster. We believe that our data asset will continue to expand the value of our platform and drive future growth.

Our Culture, Employees and Human Capital

At Expensify, our culture is deeply embedded in everything we do. We strive to create a diverse, inclusive and collaborative workplace that prioritizes and fosters the long-term happiness of our employees. We operate with a flat, generalist organizational structure, where everybody is encouraged to participate in every discussion and contribute to every decision they choose to. Our culture is

14

centered on the belief that a life well lived is one that enables you to achieve the following three goals, which we all work towards with a long-term mindset:

•Live Rich. This means we want to have ample means, and the time to enjoy it. We want to participate in a diverse, equitable, inclusive and fundamentally just society — both inside and outside our own walls. We want to have a “comfortable baseline,” where on a dull, ordinary day we wake up refreshed and excited to take on the day’s challenges, and go to bed each night fully satisfied in life well lived and a job well done.

•Have Fun. Sometimes, we want to do stuff that is awesome just for the sake of awesomeness. Not too often, but often enough to remind ourselves that we are living life to its fullest, and enabling others to do the same. For example, every year, we bring the whole company, plus families and kids, to a warm and sunny international location for a month-long "working vacation" to enable our employees to collaborate in person from a remote beach, build friendships with their colleagues, broaden their perspective and have a great time. These “Offshore” trips are productivity powerhouses that have resulted in some of our most impressive platform developments to date. Most recently, our team built the technology behind the Expensify Card as we hopped from cafe to cafe together in Hanoi, Vietnam.

•Save The World. We like the phrasing of this goal precisely because it is bombastic. We want to play an active role in unwinding the systemic bias that has prevented so many from living rich. We believe that even a small team with limited resources, given enough time and focus, can move the world. This is why we started Expensify.org, to “create a just and generous world”, and we are all wholly committed to its mission.

We believe that there are three common qualities critical to achieving these three goals and the success of our company:

•Talent. Each of us can learn without being taught, and can teach whatever we’ve learned.

•Ambition. Each of us has a genuine desire to accomplish something meaningful to us individually, to create more than we consume in this world.

•Humility. Each of us genuinely values the opinions and perspectives of others, and seeks above all to find the right solution to any given problem, no matter who came up with it.

Finally, our long-term commitment to our three life goals is guided by two simple rules:

•Get Shit Done. We have little-to-no internal hierarchy; nobody reports to anyone else. Everyone is responsible for their own time and empowered to spend it in the way they feel will best advance their own goals, and the goals of the company.

•Don’t Ruin It for Everyone Else. Whenever there is some complicated scenario with an unclear resolution, we always brainstorm the fairest possible solution -- and then put in the hard work to make that ideal solution our actual solution. Fairness rarely comes easy, and is typically far, far from the norm.

We believe that our unique culture and our employees’ happiness and long-term commitment to Expensify is a critical component of our success. As of December 31, 2021 we had 144 full-time employees. None of our employees are represented by a labor union or covered by collective bargaining agreements. We also engage third-party vendors to supply on-demand workers as needed to support our operations. We have not experienced any work stoppages, and we believe that our employee relations are strong. We remain relentlessly committed to reevaluating ourselves and continuing to foster a workplace environment that prioritizes the well-being of each and every Expensify employee.

We consider our culture and employees to be vital to our success. We strive to create a diverse, inclusive and collaborative workplace that prioritizes and fosters the long-term happiness of our employees. Our company operates with a flat, generalist organizational structure, united by a robust

15

set of common values focused on fostering the long-term happiness of our employees. Expensify’s culture is centered on the belief that a life well lived is one that enables you to achieve our three life goals: live rich, have fun and save the world.

We provide our employees with competitive compensation, comprehensive healthcare options and equity ownership across our organization. We encourage a balanced lifestyle by offering our employees the flexibility to work remotely and set their own schedules.

RESEARCH AND DEVELOPMENT

We have a product-led growth strategy, so our ability to scale our platform depends on our ability to innovate and continue to deliver quality and valuable features for members. As such, we prioritize our research and development above all other investments. Our Customer Success team works closely with our customers to identify our members’ greatest needs and act as our primary Product Managers to develop features that reflect their feedback. We build our software with the end user at the center of every decision, investing substantial time, energy and resources to ensure we have a deep understanding of our members’ needs.

CUSTOMER SUCCESS

Concierge is our customer support engine. Concierge is designed for speed and accuracy and optimized for cost. Concierge is powered by AI and trained by customer support agents, with different levels of skill and training, spread out across the world.

First Responders provide simple support that requires minimal training, with the primary requirement being English proficiency. Second Responders receive more in depth training and answer more complex questions, as well as those that require a deeper understanding of the platform. The costs of maintaining a team of First and Second Responders scales according to support volume, but thanks to Concierge, benefits from extraordinary economies of scale as well as consistency in speed and quality. First and Second Responders are employed and managed by vendors, which helps us efficiently scale up and down based on support volumes.

Success Coaches are full-time employees who manage the bulk of our product management. Approximately 75% of Success Coach time is spent on traditional product management activity (i.e., writing product proposals, engaging with the product development team, testing new functionality, updating documentation). The remaining approximately 25% is spent doing "supervised training" of the Concierge AI in response to edge case conversations escalated from Second Responders. We believe that by keeping our product managers involved with the customers we design and develop features that customers like to use - supporting our product-led growth.

MARKETING

Our members are our best marketers. They have adopted, championed and spread Expensify to their colleagues, managers and friends. We have empowered employees to simplify and streamline expense management and in the process we have created champions of our solutions who naturally demonstrate the value of Expensify to decision makers at their broader organizations.

We make our platform available for free trial online, which facilitates rapid and widespread adoption. The superiority of our solution and its user-friendly nature creates advocates of our platform and allows Expensify to spread virally, through word-of-mouth, across teams, departments and organizations. This word-of-mouth marketing increases organically as more individual members and teams discover our platform.

Our marketing efforts are designed to support the bottom-up viral nature of our platform by establishing our brand as the premiere option in preaccounting software. We invest in brand and platform promotion through partners, conference participation, thought leadership, direct marketing

16

and advertising and content development to educate the market about the benefits of our platform and create market consensus.

Creating market consensus requires a major investment to establish and requires ongoing commitment to our product to maintain. So long as the market agrees we are the best, it is relatively inexpensive to maintain that perception. This creates an asymmetric advantage against anybody who would seek to challenge our brand. This market consensus strategy ensures we get the lion's share of the best new customers in the market by default, without needing to pay a high marginal cost to acquire each new customer.

SALES

Our viral and word-of-mouth lead generation enables us to employ a self-service and inbound sales model. Potential customers are generally first introduced to Expensify when an employee submits an expense report using Expensify, when they hear of us through their networks, or indirectly through accountants and accounting platforms. Customers then seek out our mobile app and website to try, adopt and use our platform.

Our sales model focuses on enabling customer self-service and low-friction entry points enhanced with AI powered customer service. Our customers can access free and fully functional trials. When a member has completed their platform evaluation, purchasing is coordinated online through an automated, easy-to-use web or mobile based process. Any customer can get on the phone with our team during or after the sales process, but due to the segment of the market we serve, the overwhelming majority prefer to complete the sales and onboarding process online.

Our Competition

Our primary competition remains the antiquated manual processes that SMBs have been relied upon for decades. Other competitors include traditional horizontal platform solutions with basic expense management features, corporate card providers, and niche expense management point solutions. Because of the strength, flexibility and interoperability of our offering, many of our customers use Expensify in tandem with some of our competitors’ products. We differentiate ourselves from our competition by remaining hyper-focused on our members, continuing to innovate features that add value to our members and maintaining market consensus to facilitate word-of-mouth marketing and support our viral, bottom-up go-to-market motion.

We believe the principal competitive factors that drive leadership in the markets we compete in include the following:

•End user design focus;

•Ease of access, adoption, deployment and use;

•Platform functionality and ability to automate processes;

•Mobile access across devices;

•Ability to purchase without a sales representative;

•Viral, bottom-up business model supported by word-of-mouth adoption;

•High interoperability with internal and third party systems and consumer applications;

•Flexible, employee-centric legal terms regarding data ownership;

•Data security and privacy;

•Speed and scalability of architecture underlying the platform;

17

•Brand reputation and market consensus around platform superiority; and

•Customer service and support.

We believe we compete favorably with our competitors on the basis of the factors described above. We believe our unique approach, business model, and company culture drive significant competitive differentiation. We intend to continue our intense design focus on the employee experience, support our viral bottom-up business model to drive profitable growth, and nurture our one-of-a-kind company structure and culture to maintain this competitive advantage.

Intellectual Property

Our intellectual property is an important aspect of our business and helps us maintain our competitive position. To establish and protect our rights in our proprietary intellectual property, we rely upon a combination of patent, copyright, trade secret and trademark laws, and contractual restrictions such as confidentiality agreements, licenses and intellectual property assignment agreements.

As of December 31, 2021, we had 7 trademark registrations in the United States, including EXPENSIFY, SMARTSCAN and CONCIERGE and various other marks had been published, such as EASY MONEY, EXPENSIFY IS EASY MONEY, LAT* TALKS, LONG ASS TABLE TALKS, KARMA POINTS, CORPORATE KARMA, PERSONAL KARMA, EXPENSIFY THIS, EXPENSIFYTHIS and YOU WEREN’T BORN TO DO EXPENSES. We also had approximately 24 trademark registrations and approximately 67 applications in certain foreign jurisdictions. We will pursue additional trademark registrations to the extent we believe it would be beneficial and cost effective. We also own several domain names, including www.expensify.com, use.expensify.com, www.expensify.org and new.expensify.com.

As of December 31, 2021, we had 17 issued patents and 9 pending patent applications in the United States. Our issued patents expire between August 18, 2028 and September 4, 2032. We have 1 pending PCT international patent application. We continually review our development efforts to assess the existence and patentability of new intellectual property.

We control access to our intellectual property and confidential information through internal and external controls. We maintain a policy requiring our employees, contractors, consultants and other third parties involved in the development of intellectual property on our behalf to enter into confidentiality and proprietary rights agreements to control access to our proprietary information. Intellectual property laws and our procedures and restrictions provide only limited protection, and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed, or misappropriated.

For additional information about our intellectual property and associated risks, see the section titled “Risk Factors—Risks Related to Our Business.”

Government Regulation

Our business activities are subject to various federal, state, local and foreign laws, rules and regulations. Compliance with these laws, rules and regulations has not had, and is not expected to have, a material effect on our capital expenditures, results of operations and competitive position as compared to prior periods. Nevertheless, compliance with existing or future governmental regulations, including, but not limited to, those pertaining to global trade, business acquisitions, consumer and data protection and taxes, could have a material impact on our business in subsequent periods. For more information on the potential impacts of government regulations affecting our business, see “Risk Factors—Risks Related to Our Business.”

Corporate Information

18

We were incorporated on April 29, 2009 as Expensify, Inc. a Delaware corporation. Our principal executive offices are located at 401 SW 5th Street, Portland, Oregon 97204.

Available Information

Our website address is www.expensify.com. Information contained on, or that can be accessed through, our website does not constitute part of this Annual Report on Form 10-K. The U.S. Securities and Exchange Commission (“SEC”) maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) are also available free of charge on our investor relations website, investors.expensify.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

We webcast our earnings calls on our investor relations website. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases, as part of our investor relations website. The contents of these websites are not intended to be incorporated by reference into this report or in any other report or document we file.

19

Item 1A. Risk Factors

Our business involves a high degree of risk. You should carefully consider the risks described below, as well as the other information contained or incorporated by reference in this Annual Report on Form 10-K, including our consolidated financial statements and related notes, as well as our other filings with the SEC. The occurrence of any of the events or developments described below could materially and adversely affect our business, financial condition, results of operations and growth prospects. In such an event, the market price of our Class A common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently believe are not material may also impair our business, financial condition, results of operations and growth prospects.

Risks Related to Our Business

Our quarterly and annual results of operations have fluctuated in the past and may fluctuate significantly in the future and may not meet our expectations or those of investors or securities analysts.

Our quarterly and annual results of operations, including the levels of our revenue, deferred revenue, working capital and cash flows, have varied significantly in the past and may vary significantly in the future, such that period-to-period comparisons of our results of operations may not be meaningful. Our quarterly and annual financial results may fluctuate due to a variety of factors, many of which are outside of our control and may be difficult to predict, including, but not limited to:

•the level of demand across our platform and for individual features within our platform;

•our ability to grow or maintain our gross logo retention rate and net seat retention rate (each as described under the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Factors Affecting Our Performance—Retaining Existing Customers"), expand usage within organizations, retain and increase sales to existing customers and attract new members and customers;

•our ability to convert individuals and organizations using our free features or trial subscriptions into paying customers;

•our ability to predictably generate revenue through marketing and sales efforts;

•the timing and success of new features, integrations, capabilities and enhancements by us to our platform, or by our competitors to their products, or any other changes in the competitive landscape of our market;

•our ability to grow and maintain our relationships and/or integrations with our network of third-party partners, including integration partners, channel partners and professional service partners;

•our ability to regulate members and member interactions on an increasingly collaborative platform;

•our ability to grow revenue share and customer referrals from our partner ecosystem;

•our ability to attract new customers and retain existing customers;

•the success of our customers’ businesses;

•our ability to achieve widespread acceptance and use of our platform and features, including the Expensify Card and any new features we may introduce;

•our ability to retain customers on annual subscriptions;

20

•our ability to maintain and improve employee efficiency, and our ability to manage third party, outsourced or open source workers to provide value-added services like receipt processing, customer support and engineering;

•errors in our forecasting of the demand for our platform and features, which would lead to lower revenue, increased costs, or both;

•the amount and timing of operating expenses and capital expenditures, as well as entry into operating leases, that we may incur to maintain and expand our business and operations and to remain competitive;

•the timing of expenses and recognition of revenue;

•actual or perceived security breaches, technical difficulties, or interruptions to our platform and features;

•pricing pressure as a result of competition or otherwise;

•ineffective pricing strategies that could limit customer base expansion, revenue growth and subscription renewals;

•adverse litigation judgments, other dispute-related settlement payments, or other litigation-related costs;

•the number of new employees hired;

•the timing of the grant or vesting of equity awards to employees, directors, or consultants;

•declines in the values of foreign currencies relative to the U.S. dollar;

•changes in, and continuing uncertainty in relation to, the legislative or regulatory environment;

•legal and regulatory compliance costs in new and existing markets;

•costs and timing of expenses related to the potential acquisition of talent, technologies, businesses or intellectual property, and their integration, including potentially significant amortization costs and possible write-downs;

•health epidemics, such as the COVID-19 pandemic, or other conditions that impact travel and business spending; and

•general economic and market conditions in either domestic or international markets, including geopolitical uncertainty and instability and their effects on software spending.

Any one or more of the factors above may result in significant fluctuations in our quarterly and annual results of operations, which may negatively impact the trading price of our Class A common stock. You should not rely on our past results as an indicator of our future performance.

The variability and unpredictability of our quarterly and annual results of operations or other operating metrics could result in our failure to meet our expectations or those of investors or analysts with respect to revenue or other metrics for a particular period. If we fail to meet or exceed such expectations for these or any other reasons, the trading price of our Class A common stock would fall, and we would face costly litigation, including securities class action lawsuits.

We experienced rapid growth in recent periods prior to the COVID-19 pandemic, and those growth rates may not be indicative of our future growth, and we may not be able to maintain profitability.

We experienced rapid growth in recent periods prior to the COVID-19 pandemic. Our business has been impacted by the COVID-19 pandemic, with declines in revenue and paid members due to government-

21

imposed lock-downs, a decrease in business travel and other expense-generating activity, and SMBs downsizing or going out of business, among other things. While we have seen an increase in paid members and improvements in revenue since the low point of the pandemic, our growth rate may not return to pre-pandemic levels. Even if our revenue and paid members continue to increase in the near term, we expect that our growth rate will decline as a result of a variety of factors, including the maturation of our business. Further, as we operate in a new and rapidly changing category of preaccounting software, widespread acceptance and use of our platform and features, particularly our expense management feature, is critical to our future growth and success. We believe our growth depends on a number of factors, including, but not limited to, our ability to:

•attract new individuals and organizations to use our features, particularly our expense management feature;

•convert individuals and organizations using our free features or trial subscriptions into paying customers;

•grow or maintain our gross logo retention rate and net seat retention rate, and expand usage within organizations;

•price our subscription plans effectively and competitively;

•retain our existing individual and organizational customers;

•achieve widespread acceptance and use of our platform and features, including in markets outside of the United States;

•continue to successfully advance our bottom-up sales strategy as well as strategic relationships with our channel partners;

•continue to maintain and build a platform and brand that drives word of mouth exposure to new potential members;

•grow or maintain our brand through marketing, advertising campaigns, partnerships and other methods;