www.golubcapitalbdc.com GBDC Golub Capital BDC, Inc. Investor Presentation Quarter Ended September 30, 2014

Disclaimer Some of the statements in this presentation constitute forward - looking statements, which relate to future events or our future performance or financial condition. The forward - looking statements contained in this presentation involve risks and uncertainties, including statements as to: our future operating results; our business prospects and the prospects of our portfolio companies; the effect of investments that we expect to make; our contractual arrangements and relationships with third parties; actual and potential conflicts of interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other affiliates of Golub Capital LLC (collectively, "Golub Capital"); the dependence of our future success on the general economy and its effect on the industries in which we invest; the ability of our portfolio companies to achieve their objectives; the use of borrowed money to finance a portion of our investments; the adequacy of our financing sources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; the ability of GC Advisors to locate suitable investments for us and to monitor and administer our investments; the ability of GC Advisors or its affiliates to attract and retain highly talented professionals; our ability to qualify and maintain our qualification as a regulated investment company and as a business development company; the impact on our business of the Dodd - Frank Wall Street Reform and Consumer Protection Act and the rules and regulations issued thereunder; and the effect of changes to tax legislation and our tax position. Such forward - looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. We have based the forward - looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward - looking statements. Actual results could differ materially from those anticipated in our forward - looking statements and future results could differ materially from historical performance. Although we undertake no obligation to revise or update any forward - looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed or in the future may file with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10 - K, registration statements on Form N - 2, quarterly reports on Form 10 - Q and current reports on Form 8 - K. This presentation contains statistics and other data that have been obtained from or compiled from information made available by third - party service providers. We have not independently verified such statistics or data.

2 Summary of Quarterly Results Fourth Fiscal Quarter 2014 Highlights ▪ Net investment income for the quarter ended September 30, 2014 was $14.9 million, or $0.32 per share, as compared to $15.1 million, or $0.32 per share, for the quarter ended June 30, 2014. ▪ Net increase in net assets resulting from operations for the quarter ended September 30, 2014 was $20.2 million, or $0.43 per share, as compared to $16.3 million, or $0.35 per share, for the quarter ended June 30, 2014. ▪ Net realized and unrealized gains on investments and secured borrowings of $5.3 million for the quarter ended September 30, 2014 were the result of $10.3 million in realized gains on the sale of five equity investments and $5.0 million of net unrealized depreciation. The net unrealized depreciation was primarily related to the reversal of net unrealized appreciation on equity investments sold during the quarter which was partially offset by net unrealized appreciation on several middle - market debt and equity investments. ▪ New middle - market investment commitments totaled $331.5 million for the quarter ended September 30, 2014. Including a net investment of $1.1 million in Senior Loan Fund LLC (“SLF”), total new investment commitments were $332.6 million. Approximately 11% of the new investment commitments were senior secured loans, 81% were one stop loans, 6% were second lien, 2% were equity securities and less than 1% were investments in SLF. Overall, total investments in portfolio companies at fair value increased by approximately $22.7 million during the three months ended September 30, 2014.

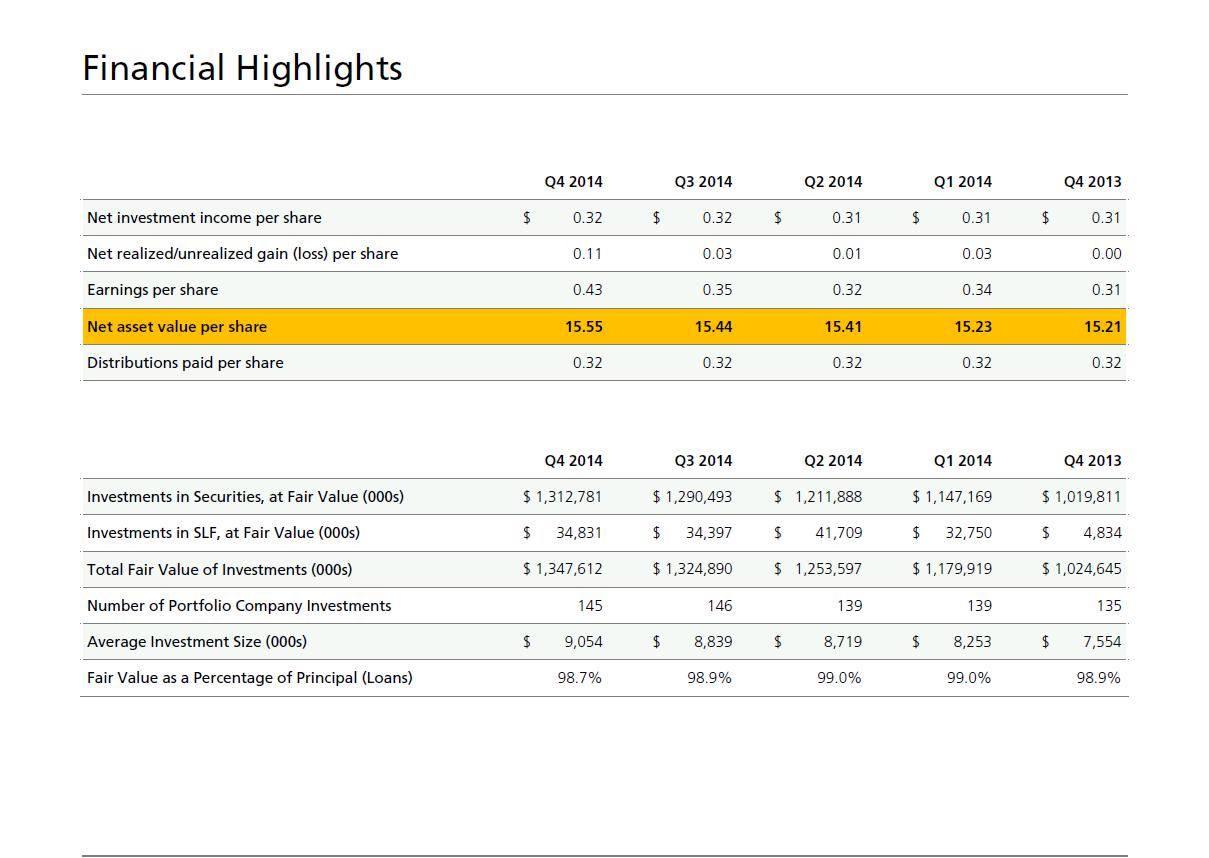

3 Financial Highlights Q4 2 014 Q3 2 014 Q2 2 014 Q1 2 014 Q4 2 013 Net investment income per share $ 0.32 $ 0.32 $ 0.31 $ 0.31 $ 0.31 Net realized /unrealized gain (loss) per share 0.11 0.03 0.01 0.03 0.00 Earnings per share 0.43 0. 35 0. 32 0. 34 0. 31 Net asset value per share 15.55 15.44 15.41 15.23 15.21 Distributions paid per share 0.32 0.32 0.32 0.32 0.32 Q4 2 014 Q3 2 014 Q2 2 014 Q1 2 014 Q4 2 013 Investments in Securities, at Fair Value (000s) $ 1,312,781 $ 1,290,493 $ 1,211,888 $ 1,147,169 $ 1,019,811 Investments in SLF, at Fair Value (000s) $ 34,831 $ 34,397 $ 41,709 $ 32,750 $ 4,834 Total Fair Value of Investments (000s) $ 1,347,612 $ 1,324,890 $ 1,253,597 $ 1,179,919 $ 1,024,645 Number of Portfolio Company Investments 145 146 139 139 135 Average Investment Size (000s) $ 9,054 $ 8,839 $ 8,719 $ 8,253 $ 7,554 Fair Value as a Percentage of Principal (Loans) 98.7% 98.9% 99.0% 99.0% 98.9%

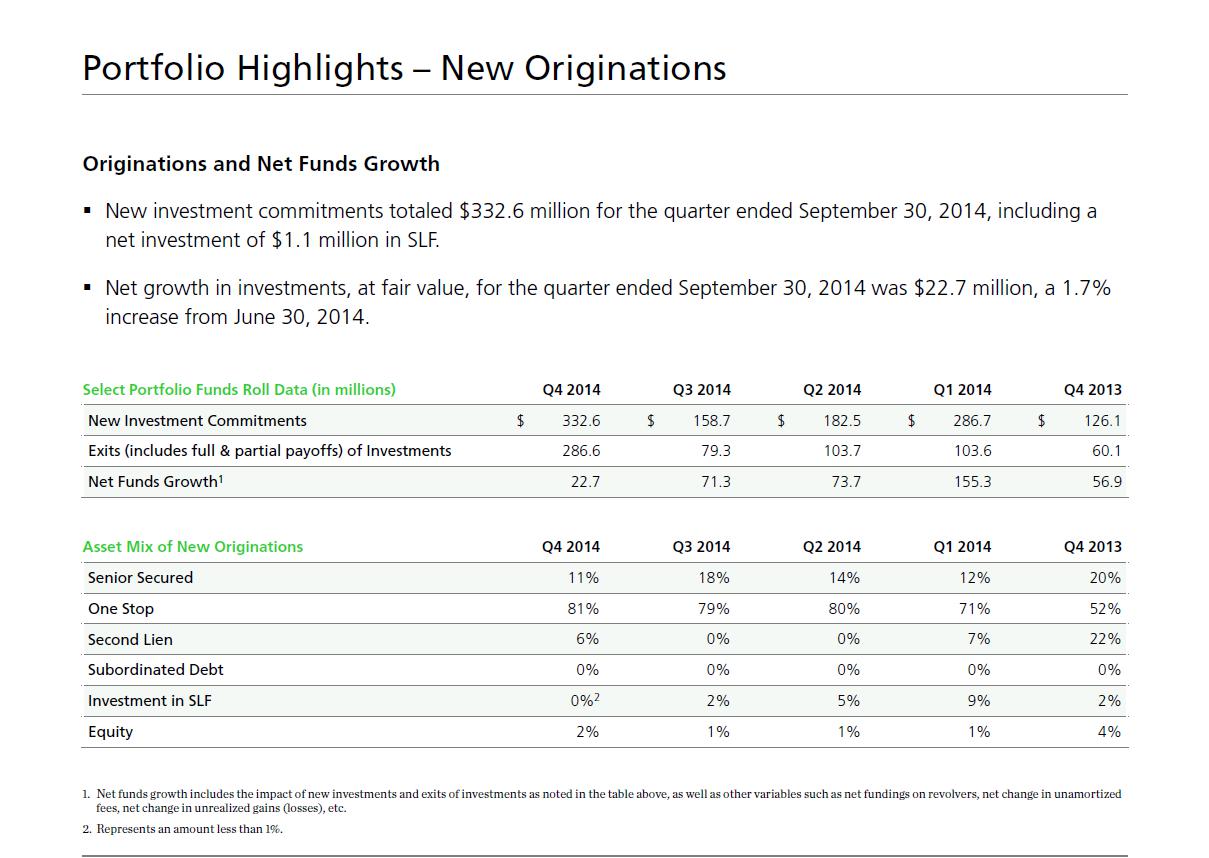

4 Portfolio Highlights – New Originations Originations and Net Funds Growth ▪ New investment commitments totaled $332.6 million for the quarter ended September 30, 2014, including a net investment of $1.1 million in SLF. ▪ Net growth in investments, at fair value, for the quarter ended September 30, 2014 was $22.7 million, a 1.7% increase from June 30, 2014. Select Portfolio Funds Roll Data (in millions) Q4 2 014 Q3 2 014 Q2 2 014 Q1 2 014 Q4 2 013 New Investment Commitments $ 332.6 $ 158.7 $ 182.5 $ 286.7 $ 126.1 Exits (includes full & partial payoffs) of Investments 286.6 79.3 103.7 103.6 60.1 Net Funds Growth 1 22.7 71.3 73.7 155.3 56.9 Asset Mix of New Originations Q4 2 014 Q3 2 014 Q2 2 014 Q1 2 014 Q4 2 013 Senior Secured 11% 18% 14% 12% 20% One Stop 81% 79% 80% 71% 52% Second Lien 6% 0% 0% 7% 22% Subordinated Debt 0% 0% 0% 0% 0% Investment in SLF 0% 2 2% 5% 9% 2% Equity 2% 1% 1% 1% 4% 1. Net funds growth includes the impact of new investments and exits of investments as noted in the table above, as well as othe r v ariables such as net fundings on revolvers, net change in unamortized fees, net change in unrealized gains (losses), etc. 2. Represents an amount less than 1%.

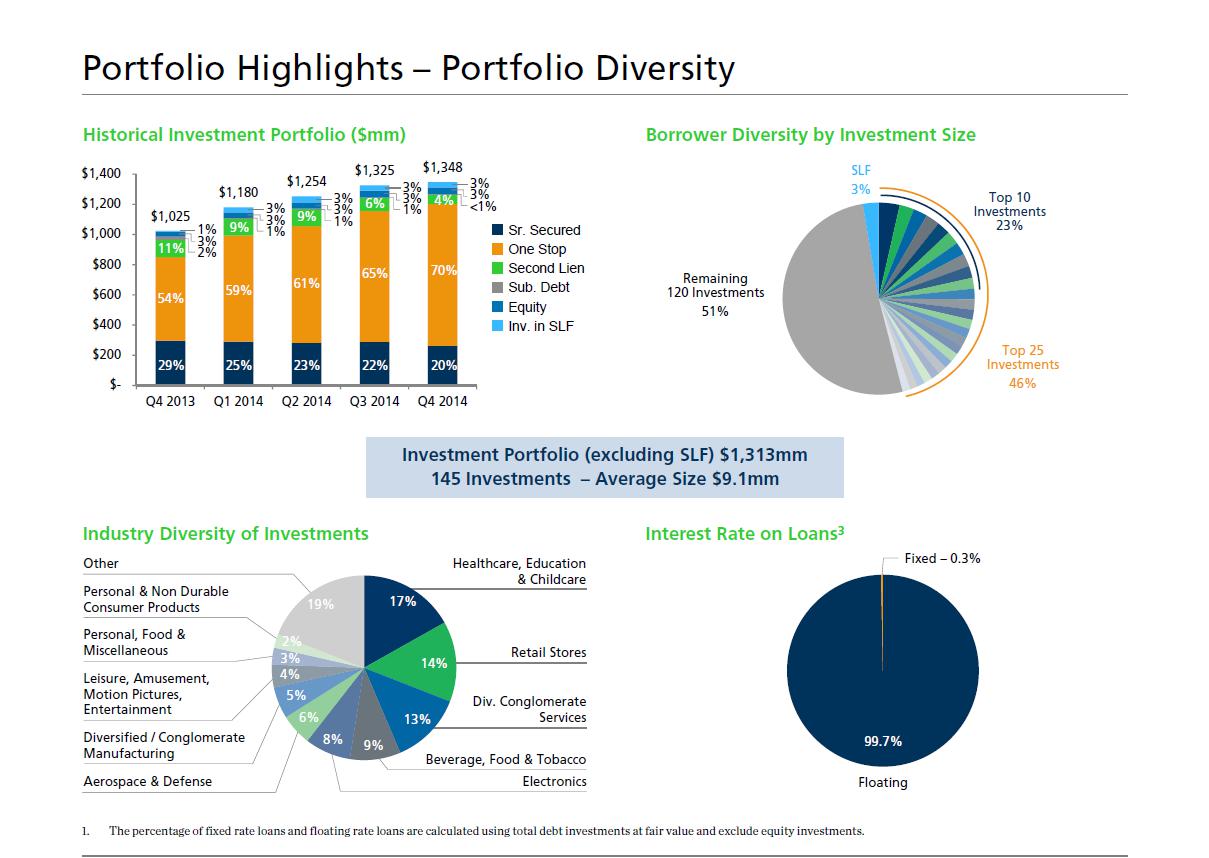

5 Portfolio Highlights – Portfolio Diversity Healthcare, Education & Childcare Retail Stores Div. Conglomerate Services Beverage, Food & Tobacco 1. The percentage of fixed rate loans and floating rate loans are calculated using total debt investments at fair value and excl ude equity investments . Borrower Diversity by Investment Size Industry Diversity of Investments Interest Rate on Loans 3 Electronics Aerospace & Defense Diversified / Conglomerate Manufacturing Leisure, Amusement, Motion Pictures, Entertainment Personal, Food & Miscellaneous Personal & Non Durable Consumer Products Other Investment Portfolio (excluding SLF) $1,313mm 145 Investments – Average Size $9.1mm Top 10 Investments 23% Top 25 Investments 46% SLF 3% Remaining 120 Investments 51% Fixed – 0.3% Floating 99.7% 17% 14% 13% 9% 8% 6% 5% 4% 3% 2% 19% Historical Investment Portfolio ($mm) $1,025 $1,180 $1,254 $1,325 $1,348 $- $200 $400 $600 $800 $1,000 $1,200 $1,400 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Inv. in SLF Equity Sub. Debt Second Lien One Stop Sr. Secured 29% 25% 23% 22% 20% 54% 59% 61% 65% 70% 11% 9% 9% 6% 4% 1% 3% 2% 3% 3% 1% 3% 3% 1% 3% 3% 1% 3% 3% <1%

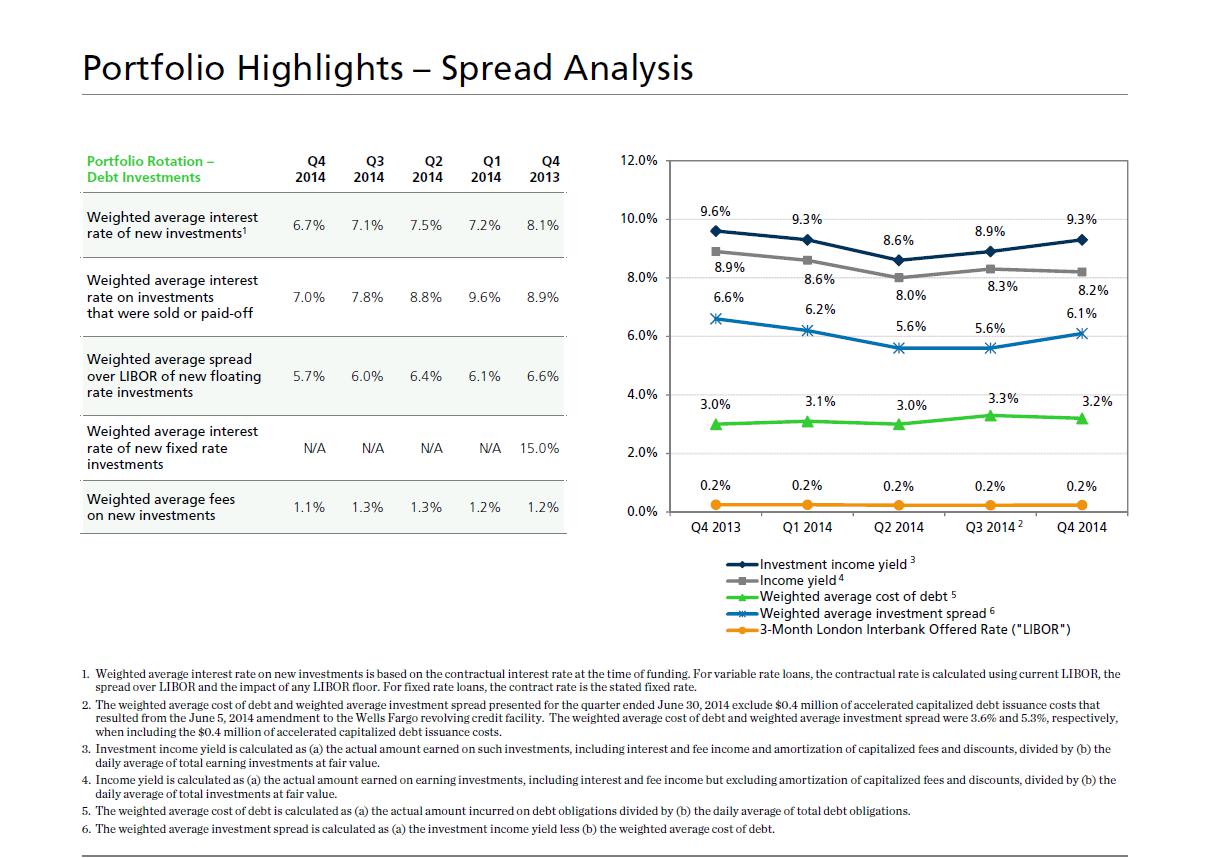

6 9.6% 9.3% 8.6% 8.9% 9.3% 8.9% 8.6% 8.0% 8.3% 8.2% 3.0% 3.1% 3.0% 3.3% 3.2% 6.6% 6.2% 5.6% 5.6% 6.1% 0.2% 0.2% 0.2% 0.2% 0.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Investment income yield Income yield Weighted average cost of debt Weighted average investment spread 3-Month London Interbank Offered Rate ("LIBOR") 3 5 4 6 2 Portfolio Highlights – Spread Analysis 1. Weighted average interest rate on new investments is based on the contractual interest rate at the time of funding. For varia ble rate loans, the contractual rate is calculated using current LIBOR, the spread over LIBOR and the impact of any LIBOR floor. For f ixe d rate loans, the contract rate is the stated fixed rate. 2. The weighted average cost of debt and weighted average investment spread presented for the quarter ended June 30, 2014 exclud e $ 0.4 million of accelerated capitalized debt issuance costs that resulted from the June 5, 2014 amendment to the Wells Fargo revol vin g credit facility. The weighted average cost of debt and weighted average investment spread were 3.6% and 5.3%, respectively, when in clu ding the $0.4 million of accelerated capitalized debt issuance costs. 3. Investment income yield is calculated as (a) the actual amount earned on such investments, including interest and fee income and amortization of capitalized fees and discounts, divided by (b) the daily average of total earning investments at fair value. 4. Income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income but excluding amortization of capitalized fees and discounts, divided by (b) the daily average of total investments at fair value. 5. The weighted average cost of debt is calculated as (a) the actual amount incurred on debt obligations divided by (b) the daily average of total debt obligations. 6. The weighted average investment spread is calculated as (a) the investment income yield less (b) the weighted average cost of debt . Portfolio Rotation – Debt Investments Q4 2 014 Q3 2 014 Q2 2 014 Q1 2 014 Q4 2 013 Weighted average interest rate of new investments 1 6.7% 7.1% 7.5% 7.2% 8.1% Weighted average interest rate on investments that were sold or paid - off 7.0% 7.8% 8.8% 9.6% 8.9% Weighted average spread over LIBOR of new floating rate investments 5.7% 6.0% 6.4% 6.1% 6.6% Weighted average interest rate of new fixed rate investments N/A N/A N/A N/A 15.0% Weighted average fees on new investments 1.1% 1.3% 1.3% 1.2% 1.2%

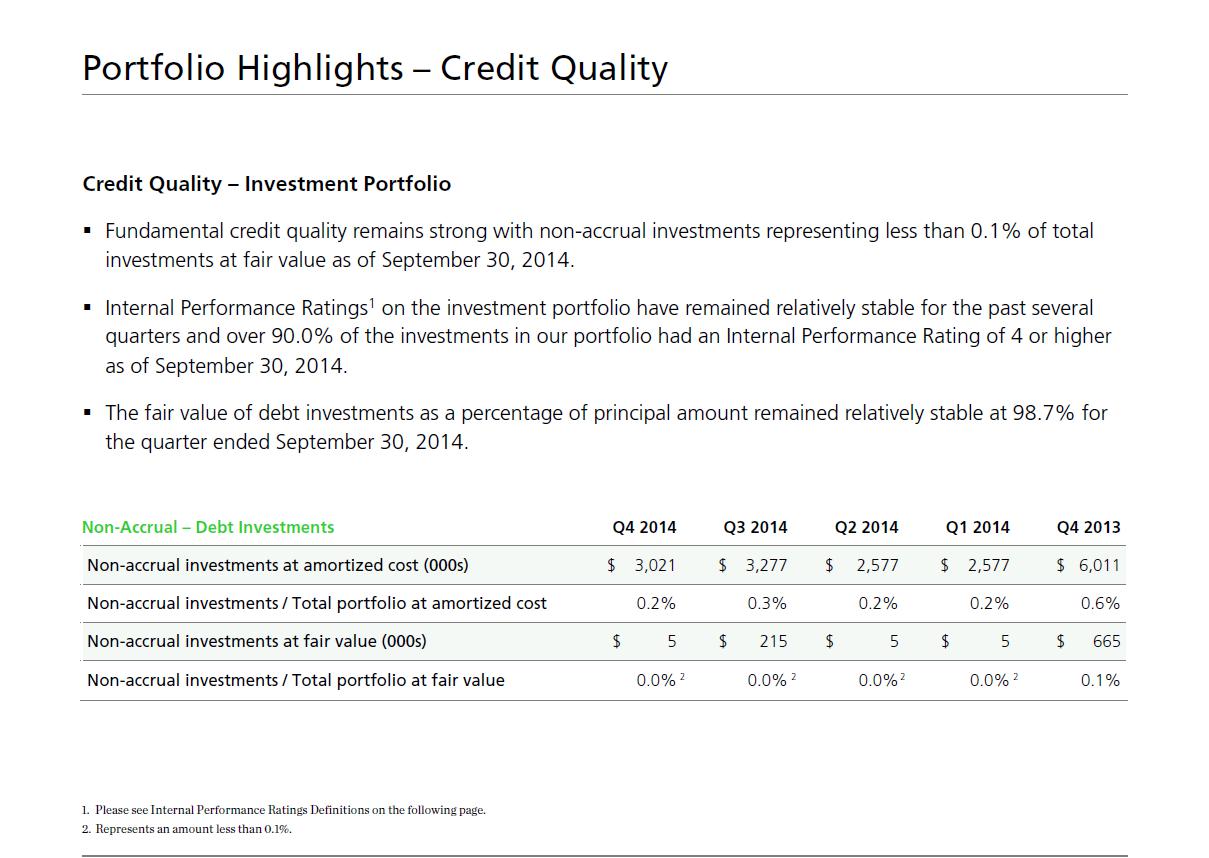

7 Portfolio Highlights – Credit Quality Credit Quality – Investment Portfolio ▪ Fundamental credit quality remains strong with non - accrual investments representing less than 0.1% of total investments at fair value as of September 30, 2014. ▪ Internal Performance Ratings 1 on the investment portfolio have remained relatively stable for the past several quarters and over 90.0% of the investments in our portfolio had an Internal Performance Rating of 4 or higher as of September 30, 2014. ▪ The fair value of debt investments as a percentage of principal amount remained relatively stable at 98.7% for the quarter ended September 30, 2014. Non - Accrual – Debt Investments Q4 2 014 Q3 2 014 Q2 2 014 Q1 2 014 Q4 2 013 Non - accrual investments at amortized cost (000s) $ 3,021 $ 3,277 $ 2,577 $ 2,577 $ 6,011 Non - accrual investments / Total portfolio at amortized cost 0.2% 0.3% 0.2% 0.2% 0.6% Non - accrual investments at fair value (000s) $ 5 $ 215 $ 5 $ 5 $ 665 Non - accrual investments / Total portfolio at fair value 0.0% 0.0% 0.0% 0.0% 0.1% 1. Please see Internal Performance Ratings Definitions on the following page. 2. Represents an amount less than 0.1%. 2 2 2 2

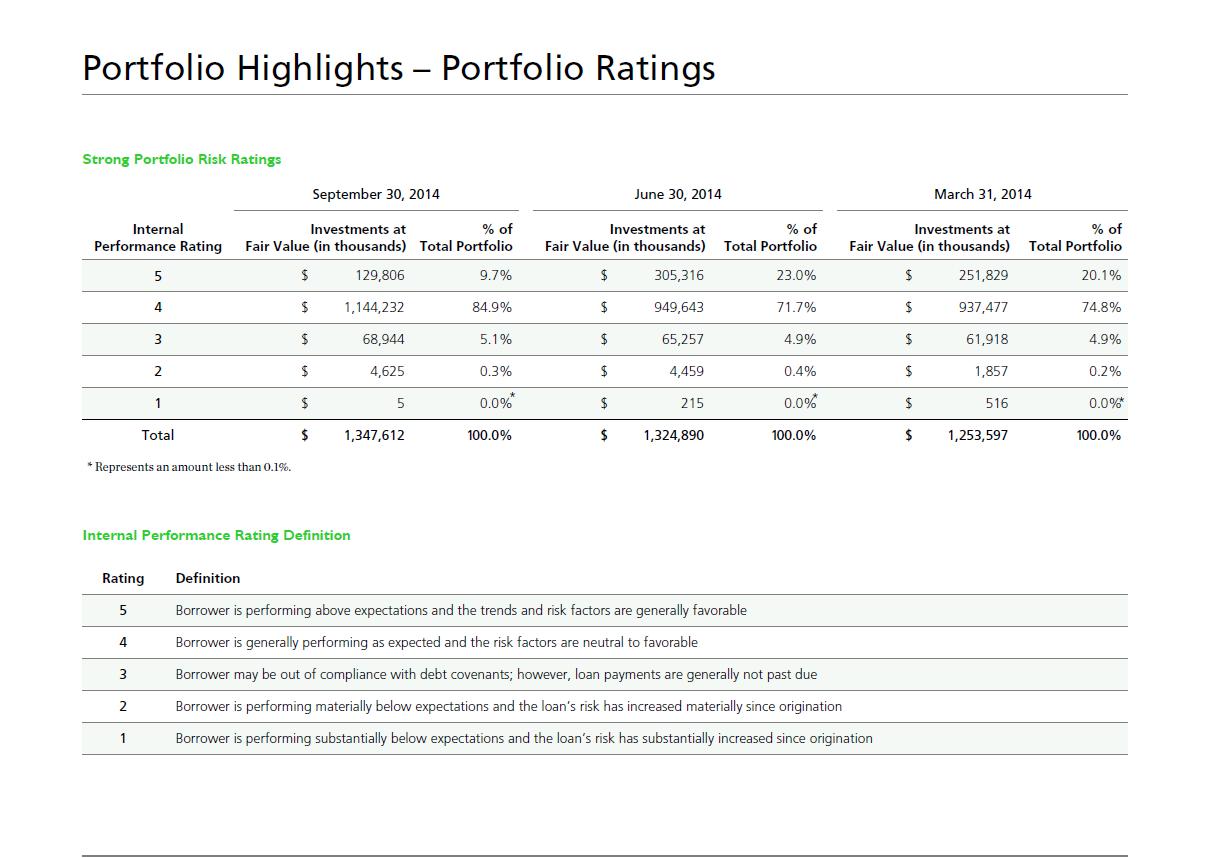

8 Portfolio Highlights – Portfolio Ratings Rating Definition 5 Borrower is performing above expectations and the trends and risk factors are generally favorable 4 Borrower is generally performing as expected and the risk factors are neutral to favorable 3 Borrower may be out of compliance with debt covenants; however, loan payments are generally not past due 2 Borrower is performing materially below expectations and the loan’s risk has increased materially since origination 1 Borrower is p erforming substantially below expectations and the loan’s risk has substantially increased since origination September 30, 2014 June 30, 2014 March 31, 2014 Internal Performance Rating Investments at Fair Value (in thousands) % of Total Portfolio Investments at Fair Value (in thousands) % of Total Portfolio Investments at Fair Value (in thousands) % of Total Portfolio 5 $ 129,806 9.7% $ 305,316 23.0% $ 251,829 20.1% 4 $ 1,144,232 84.9% $ 949,643 71.7% $ 937,477 74.8% 3 $ 68,944 5.1% $ 65,257 4.9% $ 61,918 4.9% 2 $ 4,625 0.3% $ 4,459 0.4% $ 1,857 0.2% 1 $ 5 0.0% $ 215 0.0% $ 516 0.0% Total $ 1,347,612 1 00.0% $ 1,324,890 1 00.0% $ 1,253,597 1 00.0% Strong Portfolio Risk Ratings Internal Performance Rating Definition * * * Represents an amount less than 0.1%. *

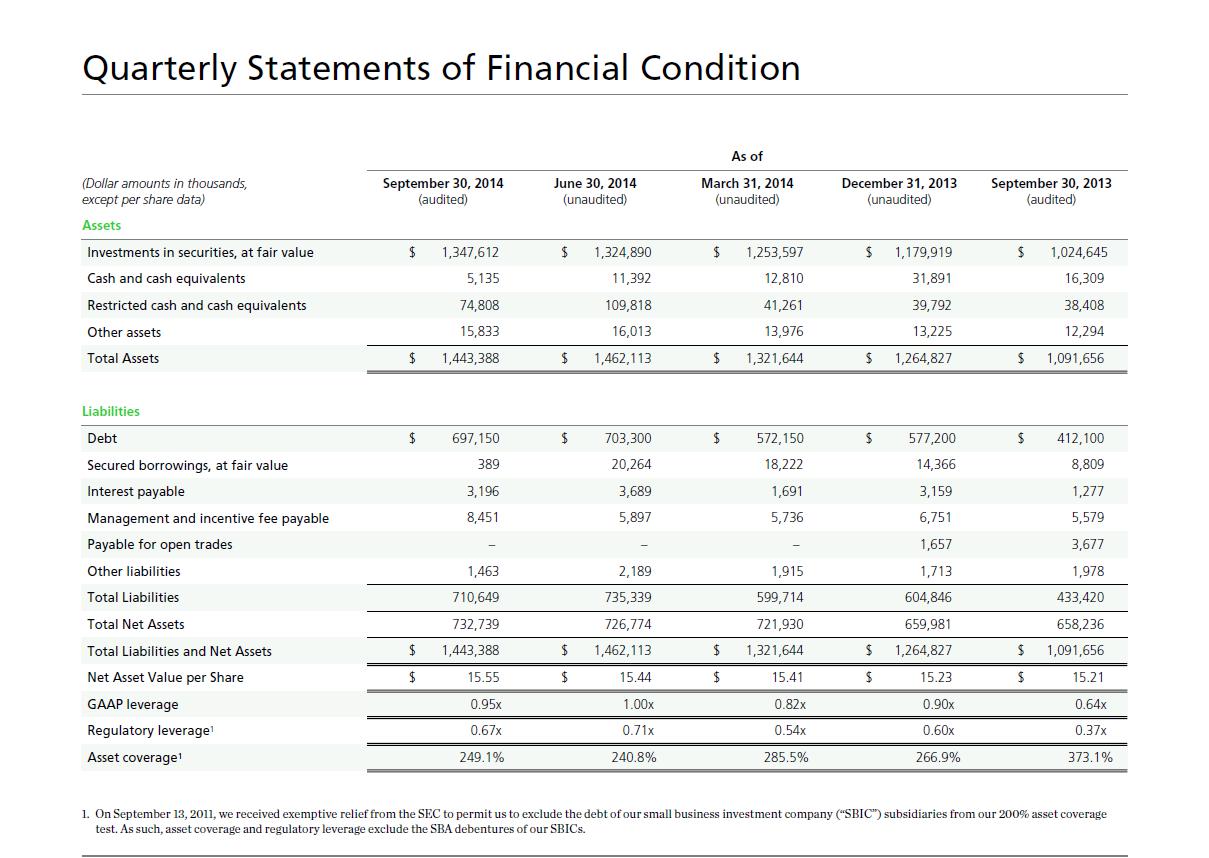

9 Quarterly Statements of Financial Condition As of ( Dollar amounts in thousands , except per share data) September 30, 2014 (audited ) June 30, 2014 (unaudited ) March 31, 2014 (unaudited ) December 31, 2013 (unaudited ) September 30, 2013 (audited ) Assets Investments in securities, at fair value $ 1,347,612 $ 1,324,890 $ 1,253,597 $ 1,179,919 $ 1,024,645 Cash and cash equivalents 5,135 11,392 12,810 31,891 16,309 Restricted cash and cash equivalents 74,808 109,818 41,261 39,792 38,408 Other assets 15,833 16,013 13,976 13,225 12,294 Total Assets $ 1,443,388 $ 1,462,113 $ 1,321,644 $ 1,264,827 $ 1,091,656 Liabilities Debt $ 697,150 $ 703,300 $ 572,150 $ 577,200 $ 412,100 Secured borrowings, at fair value 389 20,264 18,222 14,366 8,809 Interest payable 3,196 3,689 1,691 3,159 1,277 Management and incentive fee payable 8,451 5,897 5,736 6,751 5,579 Payable for open trades – – – 1,657 3,677 Other liabilities 1,463 2,189 1,915 1,713 1,978 Total Liabilities 710,649 735,339 599,714 604,846 433,420 Total Net Assets 732,739 726,774 721,930 659,981 658,236 Total Liabilities and Net Assets $ 1,443,388 $ 1,462,113 $ 1,321,644 $ 1,264,827 $ 1,091,656 Net Asset Value per Share $ 15.55 $ 15.44 $ 15.41 $ 15.23 $ 15.21 GAAP leverage 0.95x 1.00x 0.82x 0.90x 0.64x Regulatory leverage 1 0.67x 0.71x 0.54x 0.60x 0.37x Asset coverage 1 249.1% 240.8% 285.5% 266.9% 373.1% 1. On September 13, 2011, we received exemptive relief from the SEC to permit us to exclude the debt of our small business inves tme nt company (“SBIC”) subsidiaries from our 200% asset coverage test. As such , asset coverage and regulatory leverage exclude the SBA debentures of our SBICs.

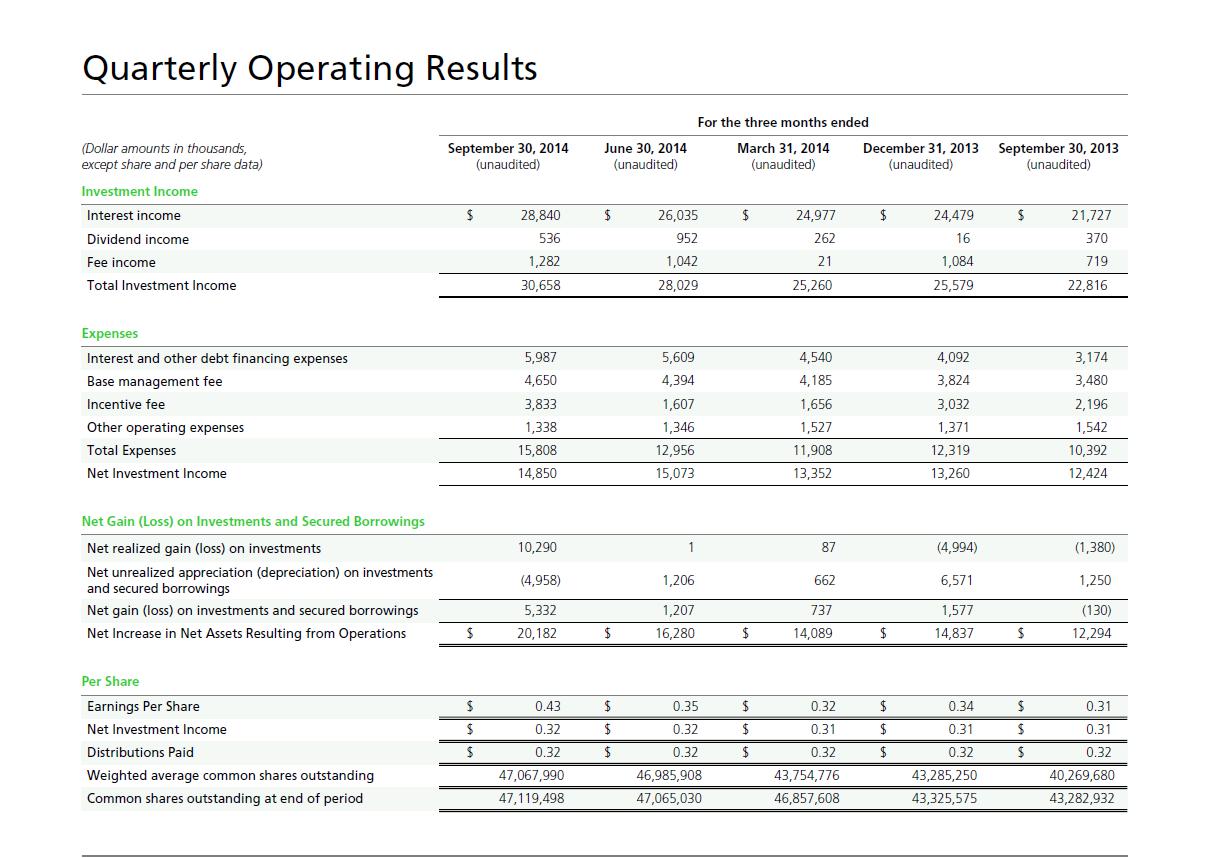

10 Quarterly Operating Results For the three months ended ( Dollar amounts in thousands , except share and per share data) September 30, 2014 (unaudited) June 30, 2014 (unaudited) March 31, 2014 (unaudited) December 31, 2013 (unaudited) September 30, 2013 (unaudited) Investment Income Interest income $ 28,840 $ 26,035 $ 24,977 $ 24,479 $ 21,727 Dividend income 536 952 262 16 370 Fee income 1,282 1,042 21 1,084 719 Total Investment Income 30,658 28,029 25,260 25,579 22,816 Expenses Interest and other debt financing expenses 5,987 5,609 4,540 4,092 3,174 Base management fee 4,650 4,394 4,185 3,824 3,480 Incentive fee 3,833 1,607 1,656 3,032 2,196 Other operating expenses 1,338 1,346 1,527 1,371 1,542 Total Expenses 15,808 12,956 11,908 12,319 10,392 Net Investment Income 14,850 15,073 13,352 13,260 12,424 Net Gain (Loss) on Investments and Secured Borrowings Net realized gain (loss) on investments 10,290 1 87 ( 4,994) ( 1,380) Net unrealized appreciation (depreciation) on investments and secured borrowings (4,958) 1,206 662 6,571 1,250 Net gain (loss) on investments and secured borrowings 5,332 1,207 737 1,577 (130) Net Increase in Net Assets Resulting from Operations $ 20,182 $ 16,280 $ 14,089 $ 14,837 $ 12,294 Per Share Earnings P er Share $ 0.43 $ 0.35 $ 0.32 $ 0.34 $ 0.31 Net Investment Income $ 0.32 $ 0.32 $ 0.31 $ 0.31 $ 0.31 Distributions Paid $ 0.32 $ 0.32 $ 0.32 $ 0.32 $ 0.32 Weighted average common shares outstanding 47,067,990 46,985,908 43,754,776 43,285,250 40,269,680 Common shares outstanding at end of period 47,119,498 47,065,030 46,857,608 43,325,575 43,282,932

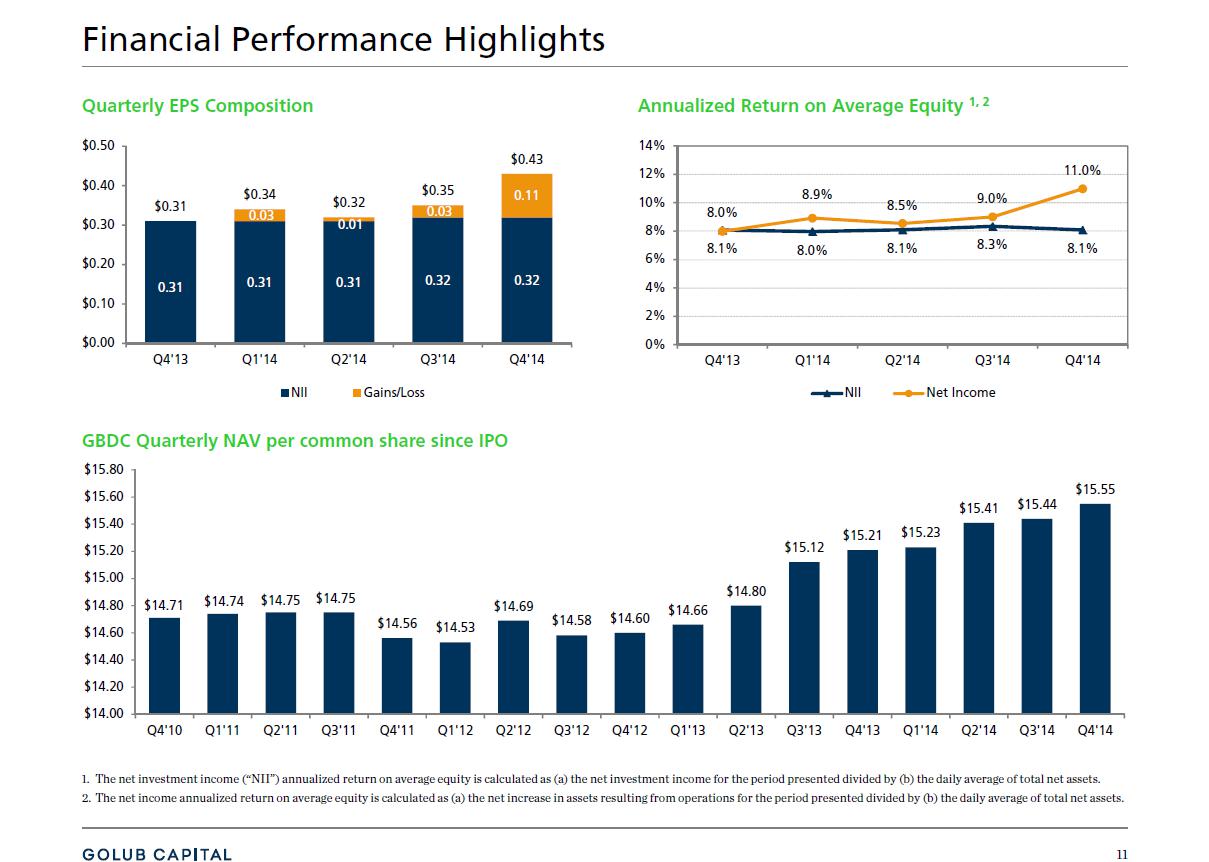

11 Financial Performance Highlights 0.31 0.31 0.31 0.32 0.32 0.03 0.01 0.03 0.11 $0.31 $0.34 $0.32 $0.35 $0.43 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 NII Gains/Loss 8.1% 8.0% 8.1% 8.3% 8.1% 8.0% 8.9% 8.5% 9.0% 11.0% 0% 2% 4% 6% 8% 10% 12% 14% Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 NII Net Income Quarterly EPS Composition Annualized Return on Average Equity 1, 2 GBDC Quarterly NAV per common share since IPO 1. The net investment income (“NII”) annualized return on average equity is calculated as (a) the net investment income for the per iod presented divided by (b) the daily average of total net assets. 2. The net income annualized return on average equity is calculated as (a) the net increase in assets resulting from operations for the period presented divided by (b) the daily average of total net assets. $14.71 $14.74 $14.75 $14.75 $14.56 $14.53 $14.69 $14.58 $14.60 $14.66 $14.80 $15.12 $15.21 $15.23 $15.41 $15.44 $15.55 $14.00 $14.20 $14.40 $14.60 $14.80 $15.00 $15.20 $15.40 $15.60 $15.80 Q4'10 Q1'11 Q2'11 Q3'11 Q4'11 Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14

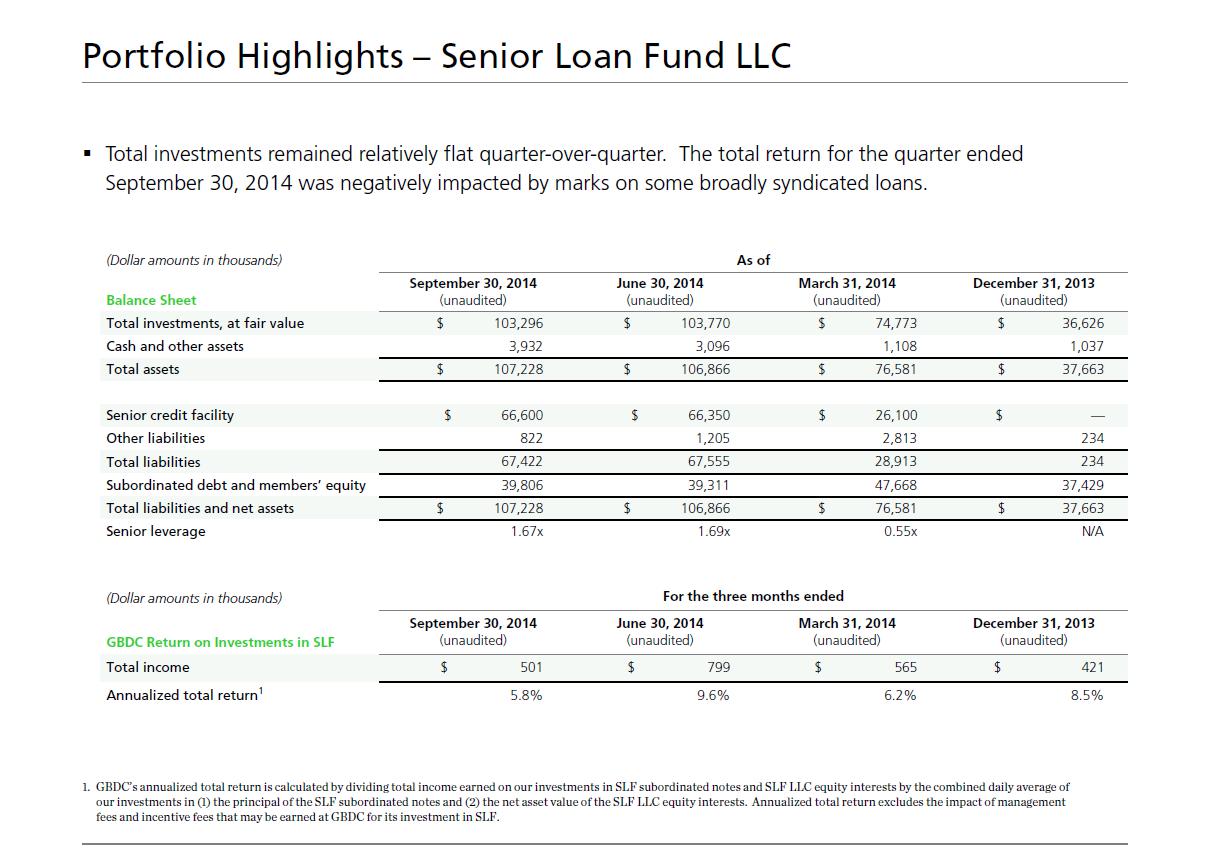

12 Portfolio Highlights – Senior Loan Fund LLC (Dollar amounts in thousands) As of Balance Sheet September 30, 2014 (unaudited) June 30, 2014 (unaudited) March 31, 2014 (unaudited) December 31, 2013 (unaudited) Total investments, at fair value $ 103,296 $ 103,770 $ 74,773 $ 36,626 Cash and other assets 3,932 3,096 1,108 1,037 Total assets $ 107,228 $ 106,866 $ 76,581 $ 37,663 Senior credit facility $ 66,600 $ 66,350 $ 26,100 $ — Other liabilities 822 1,205 2,813 234 Total liabilities 67,422 67,555 28,913 234 Subordinated debt and members’ equity 39,806 39,311 47,668 37,429 Total liabilities and net assets $ 107,228 $ 106,866 $ 76,581 $ 37,663 Senior leverage 1.67x 1.69x 0.55x N/A (Dollar amounts in thousands) For the three months ended GBDC Return on Investments in SLF September 30, 2014 (unaudited) June 30, 2014 (unaudited) March 31, 2014 (unaudited) December 31, 2013 (unaudited) Total income $ 501 $ 799 $ 565 $ 421 Annualized total return 1 5.8% 9.6% 6.2% 8.5% 1. GBDC’s annualized total return is calculated by dividing total income earned on our investments in SLF subordinated notes and SLF LLC equity interests by the combined daily average of our investments in (1) the principal of the SLF subordinated notes and (2) the net asset value of the SLF LLC equity interests. Annualized total return excludes the impact of management fees and incentive fees that may be earned at GBDC for its investment in SLF. ▪ Total investments remained relatively flat quarter - over - quarter. The total return for the quarter ended September 30, 2014 was negatively impacted by marks on some broadly syndicated loans.

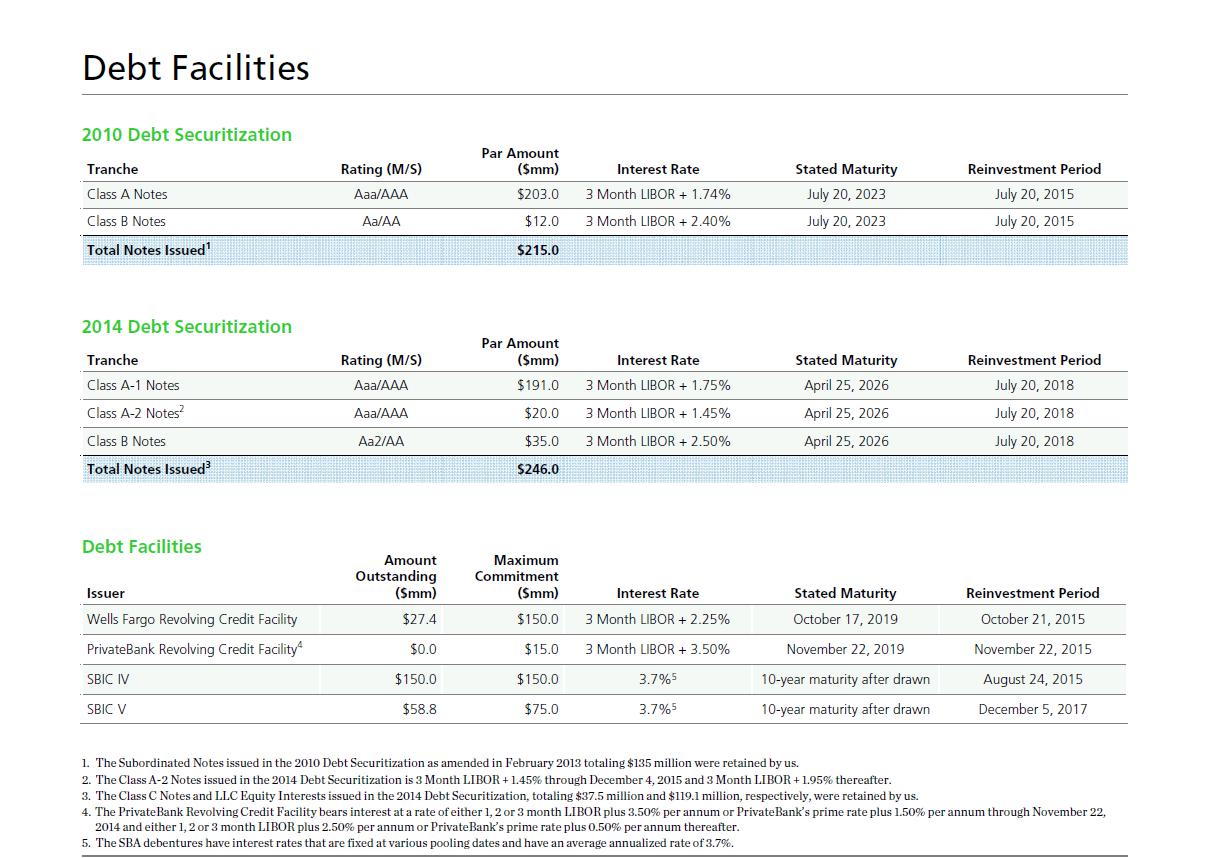

13 Liquidity and Investment Capacity Cash and Cash Equivalents ▪ Unrestricted cash and cash equivalents totaled $5.1 million as of September 30, 2014. ▪ Restricted cash and cash equivalents totaled $74.8 million as of September 30, 2014. Restricted cash was held in our securitization vehicles, SBIC subsidiaries and our revolving credit facilities and is available for new investments that qualify for acquisition by these entities. Debt Facilities ▪ Revolving Credit Facilities – As of September 30, 2014, subject to leverage and borrowing base restrictions, we had approximately $122.6 million of remaining commitments and $70.0 million of availability on our $150.0 million revolving credit facility with Wells Fargo. As of September 30, 2014, subject to leverage and borrowing base restrictions, we had approximately $15.0 million of remaining commitments and $1.2 million of availability on our $15.0 million revolving credit facility with PrivateBank . ▪ SBIC Debt – As of September 30, 2014, we had $16.2 million of additional debentures available through our SBIC subsidiaries, subject to customary U.S. Small Business Administration (“SBA”) regulatory requirements.

14 Tranche Rating (M/S) Par Amount ($mm) Interest Rate Stated Maturity Reinvestment Period Class A - 1 Notes Aaa/AAA $191.0 3 Month LIBOR + 1.75% April 25, 2026 July 20, 2018 Class A - 2 Notes 2 Aaa/AAA $20.0 3 Month LIBOR + 1.45% April 25, 2026 July 20, 2018 Class B Notes Aa2/AA $35.0 3 Month LIBOR + 2.50% April 25, 2026 July 20, 2018 Total Notes Issued 3 $246.0 Tranche Rating (M/S) Par Amount ($mm) Interest Rate Stated Maturity Reinvestment Period Class A Notes Aaa/AAA $203.0 3 Month LIBOR + 1.74% July 20, 2023 July 20, 2015 Class B Notes Aa/AA $12.0 3 Month LIBOR + 2.40% July 20, 2023 July 20, 2015 Total Notes Issued 1 $215.0 Issuer Amount Outstanding ($mm) Maximum Commitment ($mm) Interest Rate Stated Maturity Reinvestment Period Wells Fargo Revolving Credit Facility $27.4 $150.0 3 Month LIBOR + 2.25% October 17, 2019 October 21, 2015 PrivateBank Revolving Credit Facility 4 $0.0 $15.0 3 Month LIBOR + 3.50% November 22, 2019 November 22, 2015 SBIC IV $150.0 $150.0 3.7% 5 10 - year maturity after drawn August 24, 2015 SBIC V $58.8 $75.0 3.7% 5 10 - year maturity after drawn December 5, 2017 2010 Debt Securitization 2014 Debt Securitization 1. The Subordinated Notes issued in the 2010 Debt Securitization as amended in February 2013 totaling $135 million were retained by us. 2. The Class A - 2 Notes issued in the 2014 Debt Securitization is 3 Month LIBOR + 1.45% through December 4, 2015 and 3 Month LIBOR + 1.95% thereafter. 3. The Class C Notes and LLC Equity Interests issued in the 2014 Debt Securitization, totaling $37.5 million and $119.1 million, respectively, were retained by us. 4. The PrivateBank Revolving Credit Facility bears interest at a rate of either 1, 2 or 3 month LIBOR plus 3.50% per annum or PrivateBank’s prime rate plus 1.50% per annum through November 22, 2014 and either 1, 2 or 3 month LIBOR plus 2.50% per annum or PrivateBank’s prime rate plus 0.50% per annum thereafter. 5. The SBA debentures have interest rates that are fixed at various pooling dates and have an average annualized rate of 3.7%. Debt Facilities Debt Facilities

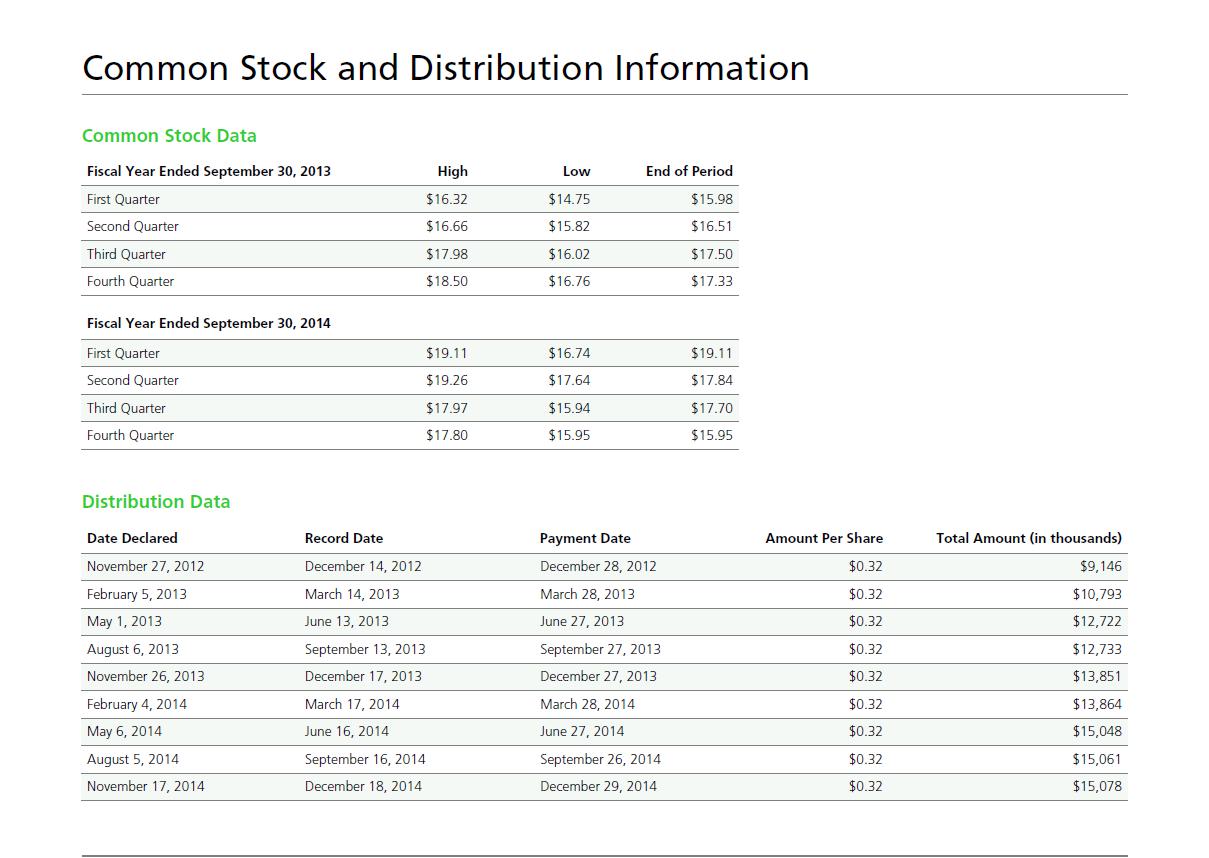

15 Common Stock and Distribution Information Common Stock Data Distribution Data Date Declared Record Date Payment Date Amount Per Share Total Amount (in thousands) November 27, 2012 December 14, 2012 December 28, 2012 $0.32 $9,146 February 5, 2013 March 14, 2013 March 28, 2013 $0.32 $10,793 May 1, 2013 June 13, 2013 June 27, 2013 $0.32 $12,722 August 6, 2013 September 13, 2013 September 27, 2013 $0.32 $12,733 November 26, 2013 December 17, 2013 December 27, 2013 $0.32 $13,851 February 4, 2014 March 17, 2014 March 28, 2014 $0.32 $13,864 May 6, 2014 June 16, 2014 June 27, 2014 $0.32 $15,048 August 5, 2014 September 16, 2014 September 26, 2014 $0.32 $15,061 November 17, 2014 December 18, 2014 December 29, 2014 $0.32 $15,078 Fiscal Year Ended September 30, 2 013 High Low End of Period First Quarter $1 6.32 $1 4 .75 $15.98 Second Quarter $16 .66 $15 .82 $16.51 Third Quarter $17.98 $16.02 $17 .50 Fourth Quarter $18.50 $16.76 $17.33 Fiscal Year Ended September 30, 2 014 First Quarter $19.11 $16.74 $19.11 Second Quarter $19.26 $17.64 $17.84 Third Quarter $17.97 $15.94 $17 .70 Fourth Quarter $17.80 $15.95 $15.95