Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

PHILLIPS EDISON & COMPANY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

Table of Contents

Dear Fellow Stockholder,

2021 was a remarkable year for Phillips Edison & Company, Inc. (Nasdaq: PECO) (“PECO,” “Phillips Edison,” “we” or the “Company”). We delivered strong results both at the property and corporate level, returning to, and in some instances exceeding, pre-COVID occupancy, collection, and income levels, as well as completing a $547.4 million underwritten initial public offering (“IPO”) and a $350 million debut investment grade bond offering. Our 2021 highlights include:

| • | Record Occupancy and Leasing Results. The demand for space in our grocery-anchored neighborhood shopping centers is better than we have seen in the 30 years of PECO’s history. The leased occupancy of our portfolio of 268 wholly-owned properties increased to an all-time high of 96.3%. Leasing activity remains strong, and our tenants (whom we call our “Neighbors”) are thriving with quarterly foot traffic surpassing both 2019 and 2020 levels. Net income increased to $17.2 million from $5.5 million for the year ended December 31, 2020. Net income attributable to stockholders totaled $15.1 million, or $0.15 per diluted share, compared to $4.8 million, or $0.05 per diluted share, during the year ended December 31, 2020. Same-Center Net Operating Income (“NOI”)* increased 8.2% to $346.8 million compared to $320.4 million during the year ended December 31, 2020. Same-Center NOI increased 3.9%, compared to the year ended December 31, 2019. Core Funds From Operations (“FFO”)* increased 16% to $255.0 million, or $2.19 per diluted share, compared to $220.4 million, or $1.98 per diluted share during the year ended December 31, 2020. We continue to be encouraged about our growth prospects. |

| • | Underwritten IPO and Inaugural Investment Grade Bond Offering. We successfully executed our underwritten IPO on July 19, 2021, where we generated $547.4 million of gross proceeds, including the full exercise of the over-allotment (“greenshoe”) option. The newly issued common stock began trading on Nasdaq on July 15, 2021, under the ticker “PECO,” completing the final step towards full liquidity for our existing investors in January 2022. In October 2021, we completed our debut investment grade bond offering, raising $350 million of 10-year unsecured bonds at a fixed coupon of 2.625%. We have received investment grade ratings from both S&P and Moody’s, underscoring the quality of our portfolio and business strategy. We have one of the strongest balance sheets in the shopping center REIT industry with substantial growth capital and balance sheet capacity to expand our portfolio and drive earnings. |

| • | Targeted External Growth. During our IPO, we laid out a strategy to grow our portfolio through net acquisitions of $1 billion over three years. In the second half of 2021, we achieved net acquisitions of over $175 million toward this goal. Due to our strong balance sheet, we believe we can continue to grow our portfolio over the next several years and achieve our goal. |

| • | Focused on Environmental, Social, and Governance (“ESG”). Being a responsible corporate citizen has always been integral to our corporate strategy, which is designed to drive accountability in all aspects of our business with the overarching goal of achieving long-term growth and value creation for our stakeholders. We participate in the Global Real Estate Sustainability Benchmark (“GRESB”) Real Estate Assessment and realized a 9% increase in our GRESB scoring from 2020 to 2021 assessments. As part of our ongoing commitment to ESG, in 2021, we established a dedicated cross-functional “ESG Team” to better quantify the qualitative components of our ESG goals and provide greater transparency to our stakeholders. Additionally, we encourage and strongly support associate-led programs that give our associates opportunities to effect positive change within PECO, our industry and our communities. The positive PECO culture contributed to the Cincinnati Enquirer recognizing PECO as a top place to work in Cincinnati for the fifth consecutive year. |

| * | See Annex A starting on page A-1 for definitions and reconciliations of non-GAAP (as defined below) metrics. |

Table of Contents

| • | Dividend Increase. On September 28, 2021, we announced that our Board of Directors (the “Board”) unanimously approved a 6% increase to the monthly distribution. The monthly dividend rate is now $0.09 per share, which, if annualized, equals a rate of $1.08 per share. We believe we can continue to grow our distribution as we grow the cash flow from our properties. |

As we look to 2022, we find ourselves returning to times of uncertainty. There is economic uncertainty around inflation and rising interest rates, along with global political instability. In challenging times, this further underscores the relevance and resilience of grocery-anchored shopping centers that deliver necessity-based goods and services to the average American.

PECO GROW has been a roadmap for us that we believe positions us to outperform as we look ahead.

G: Grocery-Anchored. Since our founding over 30 years ago, our exclusive focus has been owning and operating neighborhood grocery-anchored shopping centers. Our centers provide necessity-based goods and services, which drive regular and recurring foot traffic from customers in the 3-mile trade area.

R: Regular Income; Strong Returns. Our differentiated strategy and operational expertise have resulted in regular income and strong returns for our investors. We have distributed over $1.4 billion to our stockholders in the form of monthly distributions since 2010 and just increased the monthly distribution by 6%.

O: Omni-Channel Landlord. We are an omni-channel landlord, which allows us to capitalize on the future of retail real estate. Our grocery-anchored centers are complementary to e-commerce and are thriving in today’s omni-channel environment. Our brick-and-mortar centers are a critical component to both last mile delivery and buy-online and pick-up in store commerce for our retailers.

W: Well-Aligned & Established. Lastly, we are well-aligned with our investors. As of the date of this letter, our management team owns 8% of the Company, which represents over $315,000,000 invested alongside you. We have meaningful skin in the game and are committed to driving stockholder value. As PECO’s largest stockholder, it’s important for you to know that I have never sold a share of PECO stock, and I have no plans to sell my shares.

We appreciate your confidence in our team and your support. We could not be more excited about the future of PECO as we look towards 2022 and beyond, and we sincerely thank you for your investment.

As always, please do not hesitate to reach out if you have any questions.

|

Sincerely,

Jeff Edison Stockholder, Co-founder, Chairman & CEO Phillips Edison & Company, Inc.

|

Contact our investor relations team:

Transfer Agent - Computershare: (888) 518-8073

Phillips Edison & Company, Inc.: (833) 347-5717

Email Investor Relations: InvestorRelations@phillipsedison.com

Table of Contents

Notice of Annual Meeting of Stockholders

2022 ANNUAL MEETING INFORMATION

Dear Stockholder:

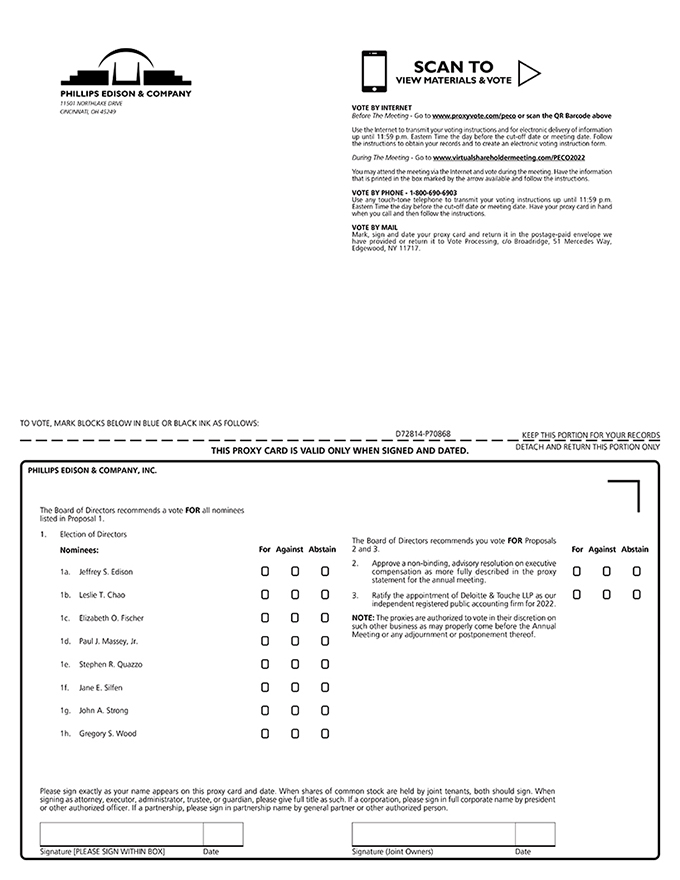

The 2022 Annual Meeting of Stockholders (“Annual Meeting”) of Phillips Edison & Company, Inc., a Maryland corporation (the “Company” or “PECO”) will be held solely via live webcast at www.virtualshareholdermeeting.com/PECO2022, on Thursday, June 16, 2022, beginning at 10:00 A.M. Eastern Time, to consider and vote upon the following matters:

|

1. Election of eight directors to serve until the 2023 Annual Meeting of Stockholders and until their respective successors are duly elected and qualify.

2. Approval, in a non-binding vote, of an advisory resolution approving executive compensation as described in the enclosed proxy statement.

3. Ratification of the appointment of Deloitte & Touche, LLP as our independent registered public accounting firm for fiscal year 2022. |

||

| DATE: Thursday, June 16, 2022 WHERE: www.virtualshareholdermeeting. TIME: 10:00 A.M. Eastern Time | ||

Holding the Annual Meeting via live webcast allows us to communicate in a more cost-efficient, environmentally conscious manner with a larger number of our stockholders and to promote greater stockholder participation in the meeting. To attend the Annual Meeting, you will need the 16-digit control number included on your Notice Regarding the Internet Availability of Proxy Materials, on your proxy card, or on the instructions that accompany your proxy materials. We will start the online check-in process at 9:45 A.M. Eastern Time. Please allow ample time to complete the online check-in procedures.

YOUR VOTE IS VERY IMPORTANT! You are entitled to vote and participate in the Annual Meeting if you were a stockholder of record at the close of business on March 18, 2022. If you own shares in a brokerage account, please instruct your broker on how to vote your shares. Under the rules of the New York Stock Exchange (“NYSE”), your broker is not allowed to vote your shares without your instruction (except for Proposal #3 above). Although our common stock trades on the Nasdaq Stock Market (“Nasdaq”), the NYSE rules affect us because most of the shares of common stock held in brokerage accounts are held with NYSE-member brokers. Stockholders have the following three options for submitting their votes by proxy:

|

ONLINE AT www.proxyvote.com/peco |

|

BY TELEPHONE AT 1-800-690-6903 |

|

BY MAIL Vote Processing, Edgewood, NY 11717 |

By Order of the Board of Directors,

Tanya E. Brady

General Counsel, Chief Ethics & Compliance Officer,

Executive Vice President and Secretary

Dated: March 25, 2022

|

2022 PROXY STATEMENT | |||||

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this proxy statement, other than historical facts, may be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995 (collectively with the Securities Act and Exchange Act, the “Acts”). These forward looking statements are based on current expectations, estimates and projections about the industry and markets in which we operate, and beliefs of, and assumptions made by, management of our Company and involve uncertainties that could significantly affect our financial results. We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in the Acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “can,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “focus,” “seek,” “objective,” “goal,” “strategy,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “long-term,” “once,” “should,” “could,” “would,” “might,” “uncertainty,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the Securities and Exchange Commission (the “SEC”).

Additional important factors that could cause actual results to differ are described in the filings made from time to time by the Company with the SEC and include the risk factors and other risks and uncertainties described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC on February 16, 2022, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements contained in this proxy statement.

|

2022 PROXY STATEMENT | |||||

Table of Contents

The following summary is intended to provide a broad overview of the items that you will find elsewhere in this proxy statement. As this is only a summary, we encourage you to read this proxy statement in its entirety for more information about these topics prior to voting.

| ANNUAL MEETING OF STOCKHOLDERS: |

PROPOSAL | BOARD’S VOTING RECOMMENDATION |

PAGE REFERENCES (for more detail) | |||

| DATE: Thursday, June 16, 2022

WHERE: www. virtualshareholdermeeting.com/ PECO2022

TIME: 10:00 A.M., Eastern Time

RECORD DATE: March 18, 2022 |

Election of Directors |

FOR EACH NOMINEE |

8 | |||

| Advisory Resolution to Approve Executive Compensation

|

FOR

|

61

| ||||

| Ratification of Independent Accountants

|

FOR | 62 | ||||

If at the close of business on March 18, 2022, you were a stockholder of record, you may authorize a proxy to vote in accordance with your instructions online, by telephone or by mail, if you have requested or received a paper copy of the proxy materials by mail, or you may vote at the virtual Annual Meeting. For shares held through a broker, bank or other nominee, please refer to information from your broker, bank or other nominee on how to submit voting instructions.

If you are a stockholder of record and are authorizing a proxy by internet, telephone or mail, as described below, your proxy must be received by 11:59 P.M. Eastern Time on June 15, 2022 to be counted.

To authorize a proxy if you are a stockholder of record:

|

ONLINE AT www.proxyvote.com/peco |

|

BY TELEPHONE AT 1-800-690-6903 |

|

BY MAIL Vote Processing, c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 |

YOUR VOTE IS IMPORTANT TO US. THANK YOU FOR VOTING.

THE ANNUAL MEETING WILL BE HELD ONLINE ON JUNE 16, 2022 AT 10:00 A.M. EASTERN TIME SOLELY VIA LIVE WEBCAST.

Stockholders will not be permitted to physically attend the Annual Meeting. You can access the virtual Annual Meeting at www.virtualshareholdermeeting.com/PECO2022. Holding the Annual Meeting via live webcast allows us to communicate in a more cost-efficient, environmentally conscious manner with a larger number of stockholders and to promote greater stockholder participation in the meeting. The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting.

To attend the Annual Meeting, you will need the 16-digit control number included in your Notice Regarding the Internet Availability of Proxy Materials, on your proxy card, or on the instructions that accompany your proxy materials. The Annual Meeting will begin promptly at 10:00 A.M. Eastern Time. Online check-in will begin at 9:45 A.M. Eastern Time, and you should allow ample time for the online check-in procedures.

|

2022 PROXY STATEMENT | 1 | ||||

Table of Contents

PECO is one of the nation’s largest owners and operators of omni-channel grocery-anchored shopping centers. As of February 28, 2022, we own, directly and indirectly, 291 shopping centers. Our portfolio primarily consists of neighborhood centers anchored by the #1 or #2 grocer tenants by sales within their respective formats by trade area. Our Neighbors are a mix of national, regional, and local retailers that primarily provide necessity-based goods and services.

Our goal is to create great grocery-anchored shopping center experiences and improve our communities, one center at a time.

We seek to achieve this objective by generating recurring cash flows, income growth, and capital appreciation for our stockholders through our differentiated and focused strategy, responsible balance sheet management, and integrated operating platform.

|

2022 PROXY STATEMENT | 2 | ||||

Table of Contents

2021 was a year of strong operational and financial performance for us, highlighted by our underwritten IPO. Our financial and operational achievements during 2021, as highlighted below, have us well-positioned to generate external growth and internal growth from our existing portfolio.

| $17.2M NET INCOME |

$547.4M UNDERWRITTEN IPO GROSS PROCEEDS | |||

|

|

||||

| $604.8M TOTAL LIQUIDITY AT DECEMBER 31, 2021 |

Baa3/BBB- INVESTMENT GRADE RATINGS | |||

|

|

||||

| 96.3% LEASED OCCUPANCY OF WHOLLY- OWNED PROPERTIES |

96.7% ABR FROM OMNI- CHANNEL GROCERY- ANCHORED SHOPPING CENTERS | |||

|

2022 PROXY STATEMENT | 3 | ||||

Table of Contents

|

Financial Highlights | ||||||||||||||||

| $17.2M net income; increase of $11.8M from a year ago |

$892.8M of capital raised from our underwritten IPO and issuance of senior notes due 2031 |

Baa3 and BBB- investment grade ratings achieved from Moody’s Investment Services and S&P Global Ratings |

$0.21 improvement to $2.19 of Core FFO per diluted share |

|||||||||||||

| 8.2% growth to $346.8M of Same-Center NOI |

6.0% increase in monthly distribution rate beginning October 2021 to $0.09 per month |

17.5% reduction in net outstanding debt obligations, including the pay down or refinancing of $1.1B in term loan debt |

5.6x net debt to Adjusted EBITDAre* - annualized compared to 7.3x a year ago |

|||||||||||||

| Portfolio Highlights | ||||||||||||||||

| 96.3% leased occupancy as of December 31, 2021, an increase of 160 basis points from a year ago |

96.7% ABR from omni-channel grocery-anchored shopping centers as of December 31, 2021 |

71.6% ABR from Neighbors providing necessity-based goods and services as of December 31, 2021 |

99% of monthly billings collected during the second half of 2021; returning to pre-COVID levels |

|||||||||||||

| Operational Highlights | ||||||||||||||||

| $307.6M of asset acquisitions in 2021 |

87.8% Portfolio Retention Rate of expiring leases |

8.0% comparable rent spreads for total executed new, renewal, and option leases compared to 5.4% in 2020 |

$59.2M of development and redevelopment projects completed or in process |

|||||||||||||

| * | See Annex A starting on page A-1 for definitions and reconciliations of non-GAAP metrics. |

|

2022 PROXY STATEMENT | 4 | ||||

Table of Contents

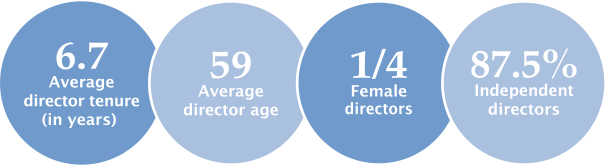

Our Board and executive management team are committed to excellence in corporate governance. Our Board has adopted Corporate Governance Guidelines that set forth the Board’s responsibility for oversight of the business and affairs of the Company as well as guidelines for determining director independence and consideration of potential nominees to the Board. These policies and guidelines can be found on the Company’s website at www.phillipsedison.com/investors/governance.

BOARD COMPOSITION

ONGOING BEST PRACTICES

Through the Nominating and Governance Committee, the Board directly and regularly reviews developments in corporate governance and best practices and makes modifications to the committee charters and other key governance documents, policies and practices as necessary or desirable. As part of our commitment to excellence in corporate governance, the following are examples of some of our policies that align more fully with current best practices:

|

2022 PROXY STATEMENT | 5 | ||||

Table of Contents

SUMMARY OF KEY CORPORATE GOVERNANCE FEATURES

|

2022 PROXY STATEMENT | 6 | ||||

Table of Contents

Environmental, Social and Governance Highlights

Being a responsible corporate citizen has always been integral to our corporate strategy, and we operate under a clear mission statement of “creating great omni-channel grocery-anchored shopping experiences and improving our communities, one shopping center at a time.” With the goal of better quantifying the qualitative components of our corporate responsibility values and providing greater transparency to our stakeholders, in 2021, we established an internal cross-functional ESG Team consisting of our department heads from Portfolio Management, Construction, Property Management, Leasing, Investor Relations, Marketing, Human Resources, and Legal. Our full Board oversees each of our corporate social responsibility, ESG and enterprise risk management programs, and our Audit Committee oversees our robust ethics and compliance program. We recently began participating in the GRESB Real Estate Assessment using the GRI reporting standards, and our Corporate Social Responsibility Report is designed to align with a number of the 17 United Nations Sustainable Development Goals. Emblematic of our ongoing commitment to sustainability, we highlight the following achievements:

| • | to further reduce energy consumption, the installation of over 3.5 million square feet of white reflective roofing was completed, resulting in over 900,000 kWh in savings and contributing to the minimalization of heat islands; |

| • | our exterior lighting program included the installation of 54 LED retrofits in 2021, bringing the total number of centers retrofitted to 249 and savings of 8.6 million kWH produced annually; and |

| • | since the inception of the smart water control program, realization of 285.3 million gallons of water saved by PECO. |

Additionally, we encourage and strongly support a number of associate-led programs that give our associates opportunities to effect positive change within PECO, our industry and our communities. Our local teams and property managers are passionate about the Neighbors they work with daily and the communities in which our properties operate, which helps drive great shopping experiences at our centers and improves the surrounding communities.

|

2022 PROXY STATEMENT | 7 | ||||

Table of Contents

Proposal 1: Election of Directors

You are being asked to elect eight director nominees to serve on our Board until the Company’s 2023 annual meeting of stockholders and until their respective successors are duly elected and qualify. Our nominees were selected by the Board, based on the recommendation of the Nominating and Governance Committee. All eight nominees currently serve on our Board. All nominees are willing to serve as directors, but if any of them should decline or be unable to act as a director, the individuals designated in the proxy cards as proxies will exercise the discretionary authority provided to vote for the election of such substitute nominee recommended by our Nominating and Governance Committee.

OUR DIRECTOR NOMINEES

The director nominees represent a broad diversity of experience, professions, skills, geographic representation and backgrounds, enabling the Board to lead and advise PECO on its most important matters. The majority of our director nominees have decades of leadership experience in real estate, finance and investment, including institutional experience with PECO and the real estate investment trust (“REIT”) industry, and those who have joined our Board more recently bring new perspectives and insights, including in areas like sustainability. This breadth of experience enables our Board to help guide our strategy and oversee its execution by management. Several of our director nominees have served on boards of other public companies, which we believe is valuable in our new stage as a publicly-traded company, and each of our director nominees has demonstrated prudent judgment and integrity in highly competitive businesses.

The names and ages of the director nominees, together with certain biographical information and the experience, qualifications, attributes, and skills that led the Board to nominate and recommend that the director nominees continue to serve as directors are set forth below.

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

|

|

2022 PROXY STATEMENT | 8 | ||||

Table of Contents

Proposal 1: Election of Directors

|

Jeffrey S. Edison Chairman

Director Since 2009 Age 61 |

Mr. Edison is our co-founder and has served as our Chairman of the Board and Chief Executive Officer since December 2009 and also served as President from October 2017 to August 2019. Mr. Edison also served as Chairman of the Board and Chief Executive Officer of Phillips Edison Grocery Center REIT III, Inc. (“REIT III”) from April 2016 through the date it merged with PECO in October 2019, and served as Chairman of the Board and Chief Executive Officer of Phillips Edison Grocery Center REIT II, Inc. (“REIT II”) from 2013 through the date it merged with PECO in November 2018. Mr. Edison co-founded Phillips Edison Limited Partnership (“PELP”) and has served as a principal of it since 1995. Before founding Phillips Edison, Mr. Edison was a senior vice president from 1993 until 1995 and was a vice president from 1991 until 1993 at Nations Bank’s South Charles Realty Corporation. Mr. Edison was employed by Morgan Stanley Realty Incorporated from 1987 until 1990, and was employed by The Taubman Company from 1984 to 1987. Mr. Edison holds a Bachelor of Arts in mathematics and economics from Colgate University and a Master of Business Administration from Harvard University. In determining that he should serve as a director, our Board considered Mr. Edison’s extensive experience of more than 30 years in the commercial real estate industry, his leadership skills, integrity and judgment and the deep knowledge of the Company and its assets he brings as our co-founder. |

|

Leslie T. Chao Lead Independent

Director Since 2010 Age 65

Committee • Audit Committee • Nominating and

|

Mr. Chao has served as a director since July 2010 and as Lead Independent Director since November 2017. He retired in 2008 as Chief Executive Officer of Chelsea Property Group, Inc., a New York Stock Exchange (“NYSE”) listed shopping center real estate investment trust (“REIT”) with operations in the United States, Asia and Mexico (now part of Simon Property Group, NYSE: SPG), previously serving as President and Chief Financial Officer. He has been a board member of London- based Value Retail PLC since 2009; and a co-founder and chairman of entities comprising Value Retail China, a privately-held owner/developer of retail properties, since 2012. From 2005 to 2008, he was an inaugural member of the board of Link REIT, the first publicly-listed and largest REIT in Hong Kong. Earlier in his career, Mr. Chao was with Manufacturers Hanover Corporation (now part of JPMorgan Chase & Co.), ending in 1987 as a Vice President in the bank holding company treasury group. He received an MBA from Columbia University and an AB from Dartmouth College, where he is a member of the President’s Leadership Council and the advisory board of the Hopkins Center for the Arts. He is based in New York City. In determining that he should serve as a director, our Board considered Mr. Chao’s extensive domestic and international commercial real estate expertise, accounting and financial management expertise, public company director experience, integrity, judgment, leadership skills, and independence from management and our affiliates. |

|

2022 PROXY STATEMENT | 9 | ||||

Table of Contents

|

Elizabeth O. Fischer

Director Since 2019 Age 62

Committee Membership: • Audit Committee • Nominating

and

|

Ms. Fischer joined Goldman Sachs & Co. LLC in 1998 and most recently served as Managing Director of the Bank Debt Portfolio Group from 2010 until her retirement in May 2019, where she managed Leveraged Finance led syndicated loans. She also served four years as co-head of Goldman Sachs’ firm-wide Women’s Network for the Americas. Prior to joining Goldman Sachs, she held various positions in the leveraged finance, syndications, and risk management group at the Canadian Imperial Bank of Commerce (CIBC). Ms. Fischer began her career at KPMG LLP. She holds a Bachelor of Arts from Colgate University and a Master of Business Administration from New York University. In determining that she should serve as a director, our Board considered Ms. Fischer’s extensive financial and investment expertise, leadership skills, integrity, judgment, and independence from management and our affiliates. |

|

Paul J. Massey, Jr.

Director Since 2010 Age 62

Committee • Nominating

and • Compensation Committee |

Mr. Massey began his career in 1983 at Coldwell Banker Commercial Real Estate Services, now CBRE, in Midtown Manhattan, first as the head of the market research department, and next as an investment sales broker. Together with partner Robert A. Knakal, he founded Massey Knakal Realty Services, which became New York City’s largest investment property sales brokerage firm, of which Mr. Massey served as Chief Executive Officer. With 250 sales professionals serving more than 200,000 property owners, Massey Knakal Realty Services was ranked as New York City’s #1 property sales company in transaction volume by the CoStar Group, a national, independent real estate analytics provider. With more than $4.0 billion in annual sales, Massey Knakal was also ranked as one of the nation’s largest privately-owned real estate brokerage firms. On December 31, 2014, Massey Knakal was sold to global commercial real estate firm Cushman & Wakefield, Inc., for which Mr. Massey served as President - New York Investment Sales through April 2018. In July 2018, Mr. Massey founded B6 Real Estate Advisors, a real estate brokerage firm in New York City, and currently serves as its Chief Executive Officer. In 2007, Mr. Massey was the recipient of the Real Estate Board of New York’s (“REBNY”) prestigious Louis B. Smadbeck Broker Recognition Award. Mr. Massey also serves as Chair for REBNY’s Ethics and Business Practice Subcommittee, was a director on the Commercial Board of Directors of REBNY, is Chairman of the Board of Trustees of the Roxbury Latin School, and serves as a chair or member of numerous other committees. He served as a director of REIT II from July 2014 to August 2017. Mr. Massey holds a Bachelor of Arts in economics from Colgate University. In determining that he should serve as a director, our Board considered Mr. Massey’s extensive experience in the commercial real estate industry, his integrity, judgment, leadership skills, and independence from management and our affiliates. |

|

2022 PROXY STATEMENT | 10 | ||||

Table of Contents

|

Stephen R. Quazzo

Director Since 2013 Age 62

Committee Membership: • Audit Committee |

Mr. Quazzo is co-founder and Chief Executive Officer of Pearlmark Real Estate, L.L.C. From 1991 to 1996, Mr. Quazzo served as President of Equity Institutional Investors, Inc., a subsidiary of investor Sam Zell’s private holding company, Equity Group Investments, Inc. Mr. Quazzo was responsible for raising equity capital and performing various portfolio management services in connection with the firm’s real estate investments, including institutional opportunity funds and public REITs. Prior to joining the Zell organization, Mr. Quazzo was in the Real Estate Department of Goldman, Sachs & Co., where he was a vice president responsible for the firm’s real estate investment banking activities in the Midwest. Mr. Quazzo holds a Bachelor of Arts and a Master of Business Administration from Harvard University, where he has served as a Director of the Alumni Association for the college and as a member of the Board of Dean’s Advisors for the business school. He is a Trustee of the Urban Land Institute (“ULI”), Trustee and past Chair of the ULI Foundation, a member of the Pension Real Estate Association, and a licensed real estate broker in Illinois. In addition, Mr. Quazzo currently serves a director of Marriott Vacations Worldwide (NYSE: VAC) and previously served as a director of ILG, Inc. (Nasdaq: ILG) until September 2018 and Starwood Hotels & Resorts Worldwide, Inc. (NYSE: HOT) until September 2016. He also sits on a number of non-profit boards, including Rush University Medical Center, the Chicago Symphony Orchestra Endowment, the Chicago Parks Foundation, and Deerfield Academy. In determining that he should serve as a director, our Board considered Mr. Quazzo’s extensive experience in the commercial real estate industry, together with his extensive investment management expertise, public company director experience, leadership skills, integrity, judgment, and independence from management and our affiliates. |

|

Jane E. Silfen

Director Since 2019 Age 36

Committee • Compensation

|

Ms. Silfen is the founder and owner of Mayfair Advisors LLC, which was founded in 2019 to advise clients on sustainability and clean technology investment opportunities. Since 2015, she also has served as Vice President at Mayfair Management Co., Inc., a New York City-based family office, where she is responsible for overseeing and making public and private investments. Ms. Silfen currently serves as a director of HercuTech, Inc. Ms. Silfen began her career in investment banking at Goldman Sachs and later served as Vice President at Encourage Capital, LLC. She holds a Bachelor of Arts from the University of Pennsylvania and a Master in Public Policy and Master of Business Administration from Harvard University. In determining that she should serve as a director, our Board considered Ms. Silfen’s investment experience, clean technology and sustainability expertise, integrity, judgment, and independence from management and our affiliates. |

|

2022 PROXY STATEMENT | 11 | ||||

Table of Contents

|

John A. Strong

Director Since 2018 Age 61

Committee • Compensation

|

Since July 2010, Dr. Strong has served as Chairman and Chief Executive Officer of Bankers Financial Corporation, a diversified financial services company for outsourcing solutions for claims, policy and flood products for insurers; insurance tracking for lenders; human resources solutions for small business; warranties for consumer electronics and new homes; insurance and maintenance services for properties, businesses and builders; and surety bonds for bail. From 2005 to 2010, he served as the President and Managing Partner of Greensboro Radiology. Since 2007, Dr. Strong has served as a board member of Bankers Financial Corporation. He previously served as a director of REIT II from May 2017 to November 2018 when it merged into PECO. Dr. Strong holds a Bachelor of Science in mathematics from Duke University and a Doctor of Medicine degree from Michigan State University College of Human Medicine as well as his residency and fellowship in radiology from Duke University. In determining that he should serve as a director, our Board considered Dr. Strong’s financial and management expertise, judgment, leadership skills, and independence from management and our affiliates. |

|

Gregory S. Wood

Director Since 2016 Age 63

Committee Membership: • Audit Committee |

Mr. Wood has been Executive Vice President and Chief Financial Officer of EnergySolutions, Inc., a leading services provider to the nuclear industry, since June 2012. Prior to that, Mr. Wood held the role of Chief Financial Officer at numerous public and private companies, including Actian Corporation, Silicon Graphics, Liberate Technologies, and InterTrust Technologies. Mr. Wood was a director of Steinway Musical Instruments, Inc. from October 2011 to October 2013, where he also served as Chairman of the Audit Committee. Mr. Wood, formerly a certified public accountant, holds a Bachelor of Business Administration in accounting from the University of San Diego and a Juris Doctor from the University of San Francisco School of Law. In determining that he should serve as a director, our Board considered Mr. Wood’s accounting and financial management expertise, public company director experience, integrity, judgment, and independence from management and our affiliates. |

|

2022 PROXY STATEMENT | 12 | ||||

Table of Contents

VOTE REQUIRED

Election of each of the nominees requires the affirmative vote of the majority of total votes cast with respect to his or her election (that is, the number of votes cast “FOR” the nominee must exceed the number of votes cast “AGAINST” the nominee). Votes cast include votes against but exclude abstentions and broker non-votes with respect to a nominee’s election, and abstentions and broker non-votes will have no effect on the election of any director. The majority voting standard does not apply, however, in a contested election where the number of director nominees exceeds the number of directors to be elected at an annual meeting of stockholders. In such circumstances, directors will instead be elected by a plurality of all the votes cast at the annual meeting at which a quorum is present. The election of directors at our Annual Meeting this year is not contested.

|

2022 PROXY STATEMENT | 13 | ||||

Table of Contents

The Board believes it should have the flexibility to periodically (i) determine the leadership structure that is best for the Company and (ii) review such structure to determine whether it continues to serve the Company and its stockholders. The current leadership structure of the Board features the following:

| CHAIRMAN OF THE BOARD |

Mr. Jeffrey S. Edison | |

| LEAD INDEPENDENT DIRECTOR |

Mr. Leslie T. Chao | |

| BOARD COMMITTEES |

Independent directors only | |

Since the Chairman of the Board is an employee of the Company, the Board also elects a Lead Independent Director from its independent directors. The Board believes this leadership structure provides a well-functioning and effective balance between strong management leadership and appropriate oversight by the Lead Independent Director. With Mr. Edison as both Chief Executive Officer and Chairman of the Board, Mr. Chao as the Lead Independent Director, and committees comprised exclusively of independent directors, the Board believes this is the optimal structure to guide the Company and maintain the focus required to achieve the business goals and grow stockholder value.

Chairman of the Board

As Chairman of the Board, Mr. Edison presides over stockholder and Board meetings, oversees the setting of the agenda for those meetings and the dissemination of information about the Company to the Board, and represents the Company at public events. Mr. Edison has served as our Chairman of the Board and Chief Executive Officer since December 2009.

Lead Independent Director

| Mr. Chao has served as our Lead Independent Director since November 2017. The Chairman and Chief Executive Officer consults periodically with the Lead Independent Director on Board matters, Board agendas, and issues facing the Company. In addition, the Lead Independent Director: (i) serves as the principal liaison between the Chairman of the Board and the independent directors; (ii) presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; and (iii) performs such other duties as may be assigned by the Board. |

||

|

The Lead Independent Director serves as the

| ||

|

2022 PROXY STATEMENT | 14 | ||||

Table of Contents

Director Independence

Currently, our Board consists of eight directors. Seven of our eight directors and all members of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee are “independent” as defined by the rules of Nasdaq. The Nasdaq independence standards provide that to qualify as an independent director, in addition to satisfying certain bright-line criteria, the Board must affirmatively determine that a director has no material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has determined that each of our non-employee directors is “independent” as defined by Nasdaq.

Executive Sessions of Independent Directors

| The independent directors hold regularly scheduled executive sessions of the Board and each of its committees without the presence of senior management and the non-independent director. The Lead Independent Director chairs the executive sessions of the Board, and the chairs of the applicable committees chair the executive sessions of the committee meetings. In 2021, the independent directors met in executive session at all regularly scheduled Board and committee meetings. |

||

|

In 2021, the independent directors met in executive session at all of the regularly scheduled Board and committee meetings held.

| ||

Attendance

The Board held 5 meetings in 2021. During 2021, each director attended 100% of the meetings of the Board and each committee of the Board on which he or she then served. Each of the directors then serving on the Board attended the 2021 annual meeting of stockholders. Each director is expected to make reasonable efforts to attend all meetings of the Board and committees on which the director serves, as well as the Company’s annual meeting.

|

2022 PROXY STATEMENT | 15 | ||||

Table of Contents

The table below provides certain highlights of the composition of our Board members and nominees as of March 25, 2022. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Rule 5605(f).

|

Board Diversity Matrix (As of March 25, 2022) |

| |||||||||||||||

|

Board Size:

|

|

|||||||||||||||

|

Total Number of Directors

|

|

8

|

|

|||||||||||||

| Gender: |

Male | Female | |

Non- Binary |

|

Gender Undisclosed | ||||||||||

|

Number of directors based on gender identity

|

|

6

|

|

|

2

|

|

||||||||||

|

Number of directors who identify in any of the categories below:

|

| |||||||||||||||

|

African American or Black |

||||||||||||||||

|

Alaskan Native or American Indian

|

||||||||||||||||

|

Asian

|

|

1

|

|

|||||||||||||

|

Hispanic or Latinx

|

||||||||||||||||

|

Native Hawaiian or Pacific Islander

|

||||||||||||||||

|

White

|

|

5

|

|

|

2

|

|

||||||||||

|

Two or More Races or Ethnicities

|

||||||||||||||||

|

LGBTQ+

|

||||||||||||||||

|

Undisclosed

|

||||||||||||||||

The Board has established three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. The current chairs and members of each committee are set forth below:

| Audit Committee

|

Compensation Committee

|

Nominating and Governance Committee

| ||||

| Leslie T. Chao

|

Chair

|

Member

| ||||

| Elizabeth O. Fischer

|

Member

|

Chair

| ||||

| Paul J. Massey, Jr.

|

Member

|

Member

| ||||

| Stephen R. Quazzo

|

Member

|

|||||

| Jane E. Silfen

|

Member

|

|||||

| John A. Strong

|

Chair

|

|||||

| Gregory S. Wood

|

Member

|

|||||

The principal functions of each committee are described briefly below. Additionally, our Board may from time to time establish other committees to facilitate our Board’s oversight of management of the business and affairs of our Company. Each committee’s charter is available on our website at www.phillipsedison.com/investors/governance.

|

2022 PROXY STATEMENT | 16 | ||||

Table of Contents

|

AUDIT COMMITTEE |

||||||||||

|

|

Total Members: |

|

4 |

|

✓ Mr. Chao, Chair, “audit committee financial expert” | |||||

| ✓ All members independent | ||||||||||

| 2021 Meetings:

|

|

4

|

|

✓ All members “financially literate” per Nasdaq rules | ||||||

Duties and Responsibilities:

| • | Oversee the reporting processes and financial exposure of the Company |

| • | Select and engage the Company’s independent registered public accounting firm |

| • | Monitor the integrity of the financial statements |

| • | Oversee our system of internal control over financial reporting established by our management, and our audit and financial reporting process |

| • | Review and monitor our compliance programs, and oversee our compliance with applicable laws and regulations |

| • | Oversee, review and periodically update the Company’s Code of Business Conduct and Ethics and the Company’s system to monitor compliance and enforce the Code of Business Conduct and Ethics |

Requirements:

| • | Mr. Chao, Audit Committee Chair, qualifies as an “audit committee financial expert” as defined by applicable SEC regulations |

| • | All members of the Audit Committee satisfy the independence requirements of Nasdaq and the independence rules for members of the Audit Committee issued by the SEC |

| • | Each member of the Audit Committee is “financially literate” within the meaning of the Nasdaq rules |

Audit Committee duties and responsibilities are set forth in further detail in the Audit Committee Charter, which may be found on our website: www.phillipsedison.com/investors/governance

|

2022 PROXY STATEMENT | 17 | ||||

Table of Contents

|

COMPENSATION COMMITTEE |

||||||||

|

|

Total Members: |

3 |

✓ Mr. Strong, Chair | |||||

| 2021 Meetings: | 6 | ✓ All members independent | ||||||

Duties and Responsibilities:

| • | Establish and preside over the overall compensation philosophy of the Company |

| • | Review and approve corporate goals and objectives relevant to the Chief Executive Officer and other executive officers’ compensation, including annual performance objectives, if any |

| • | Evaluate and approve director and executive officer compensation plans, policies and programs |

| • | Assess executive compensation risk and balance it so Company executives are not incentivized to take actions which create unnecessary risk for the Company |

| • | Review and discuss with management the Compensation Discussion and Analysis (‘‘CD&A’’) required to be included in our proxy statement for the annual meeting of stockholders |

| • | Make recommendations as to whether the CD&A should be included in such proxy statement |

| • | Review and monitor all employee retirement, profit sharing and benefit plans of the Company |

| • | Monitor executive compliance with the rules and guidelines of our equity-based plans |

| • | Provide a Compensation Committee Report in compliance with the applicable federal securities laws and regulations |

Requirements:

| • | No member of the Compensation Committee was an officer or employee of the Company during 2021 |

| • | No member of the Compensation Committee is a former officer of the Company or was a party to any related party transaction involving the Company required to be disclosed under Item 404 of Regulation S-K during 2021 |

| • | During 2021 none of our executive officers served on the board of directors or on the compensation committee of any other entity that has or had executive officers serving as a member of the Board or the Compensation Committee |

| • | All members of our Compensation Committee satisfy the independence requirements of Nasdaq and the independence rules for members of the Compensation Committee issued by the SEC |

Compensation Committee duties and responsibilities are set forth in further detail in the Compensation Committee Charter, which may be found on our website: www.phillipsedison.com/investors/governance

|

2022 PROXY STATEMENT | 18 | ||||

Table of Contents

|

Nominating and Governance Committee* | ||||||||

|

|

Total Members: |

3 |

✓ Ms. Fischer, Chair | |||||

| 2021 Meetings: | 1 | ✓ All members independent | ||||||

| * | Established in connection with our underwritten IPO. |

Duties and Responsibilities:

| • | Establish criteria and qualifications for new directors |

| • | Identify high-quality individuals with the skills and experience for nomination to the Board |

| • | Evaluate candidates for nomination to the Board, including those recommended by stockholders |

| • | Review and make recommendations concerning the size, structure and composition of the Board |

| • | Recommend members of the Board to serve on Board committees and, if required, recommend the removal of committee member(s) |

| • | Lead the annual Board performance review |

| • | Consider possible conflicts of interest of directors and executive officers and questions of director independence |

| • | Establish corporate governance practices, guidelines and policies to adopt for the Company |

Additional Item of Note:

| • | All members satisfy the independence requirements of Nasdaq and the independence rules for members of the Nominating and Governance Committee issued by the SEC |

Nominating and Governance Committee duties and responsibilities are set forth in further detail in the Nominating and Governance Committee Charter, which may be found on our website: www.phillipsedison.com/investors/governance

|

2022 PROXY STATEMENT | 19 | ||||

Table of Contents

Our Stock Ownership Policy (“SOP”) is designed to focus our directors and named executive officers (“NEOs”) on long-term stockholder value creation. Our SOP sets stock ownership targets for NEOs as a multiple of base salary and for non-employee directors as a multiple of their annual retainer. The stock ownership targets are to be achieved by directors and our NEOs over a maximum five- year period. If an SOP participant does not reach his or her target by the end of the required period, they must retain 100% of all equity held and subsequently awarded until they meet their target. Also, given that stock prices of all companies are subject to market volatility, our SOP requires that if a significant decline in our stock price occurs that causes a participant’s holdings to fall below their required threshold, such director or NEO must retain all shares until their target has again been achieved.

| Chief Executive Officer | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10x multiple of annual base salary |

|||||||||||||||

| Lead Independent Director | ● | ● | ● | ● | 4x multiple of retainer |

|||||||||||||||||||||

| Independent Directors | ● | ● | ● | ● | 4x multiple of retainer |

|||||||||||||||||||||

| Non-CEO Named Executive Officers |

● | ● | ● | 3x multiple of annual base salary |

||||||||||||||||||||||

POLICY PROHIBITING HEDGING AND PLEDGING OF OUR STOCK

Our Insider Trading Policy prohibits all directors, officers, and other employees from engaging in short- sales and certain hedging or monetization transactions with respect to the Company’s securities. The policy also prohibits all directors, officers and other associates from pledging our securities as collateral for a loan or as collateral in a margin account.

BOARD’S ROLE IN RISK OVERSIGHT

While day-to-day risk management is primarily the responsibility of PECO’s management team, the Board is responsible for strategic planning and overall enterprise-wide supervision of our risk management activities. A key aspect of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. Therefore, management provides periodic reports to the Board with respect to our operations, business strategies and the monitoring of related risks, and our Board discusses with management the appropriate level of risk for the Company. Our full Board oversees each of our corporate social responsibility, ESG and enterprise risk management programs. Management provides periodic updates on each such program to the Board.

The Board also delegates oversight to the Audit and Compensation Committees to oversee selected elements of risk. Our Audit Committee selects and engages our independent registered public accounting firm, from whom it receives regular periodic reports regarding various areas of potential risk and oversees

|

2022 PROXY STATEMENT | 20 | ||||

Table of Contents

its independence. Our Audit Committee also oversees other financial risk exposures by (i) monitoring the integrity of our financial statements and our internal control over financial reporting, (ii) overseeing financial credit and liquidity risk by working with management to evaluate elements of financial and credit risk and advising on our financial strategy, capital structure and long-term liquidity needs, (iii) overseeing our internal audit function, and (iv) meeting periodically with financial management, independent auditors and legal advisors for updates on risks related to our financial reporting function. Our Audit Committee also reviews and monitors our compliance programs, including the whistleblower program, and is tasked with overseeing, reviewing and periodically updating our Code of Business Conduct and Ethics and the systems in place to monitor compliance and ensure enforcement. The Compensation Committee is responsible for overseeing risks related to our compensation policies and practices, and specifically the design of executive compensation to create incentives appropriate to our business strategy and stockholder interests without incentivizing actions which create unnecessary or excessive risk for the Company.

CODE OF BUSINESS CONDUCT AND ETHICS

The Board has adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and associates, including our principal executive, principal financial and principal accounting officers. The Code of Business Conduct and Ethics is available on our website at www.phillipsedison.com/investors/ governance. The Company will disclose within four business days any substantive changes in or any waivers of the Code of Business Conduct and Ethics granted to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on our website.

The Code of Business Conduct and Ethics sets forth our policies and expectations on several topics, including diversity, equity and inclusion, workplace safety and health, business practices (including conflicts of interest), compliance with laws (including insider trading laws), use of our assets and interactions with outside parties and our community, and satisfies the SEC’s requirements for a code of ethics, as defined by Item 406 of Regulation S-K.

As described in our Code of Business Conduct and Ethics, the Company’s directors, officers and associates are provided with the following three avenues through which they can report violations or suspected violations of the Code of Business Conduct and Ethics, or any laws, rules, regulations or policies that apply to the Company: (1) speaking with their manager or department head, another trusted leader within the Company or our General Counsel, Chief Compliance Officer or Chief Human Resources Officer; (2) a toll-free phone number; and (3) a website. The toll-free phone number and website are available 24 hours a day, seven days a week. Associates can choose to remain anonymous in reporting violations or suspected violations. In addition, we maintain a formal non-retaliation policy that prohibits action or retaliation against any person who makes a report in good faith.

Prior to each annual meeting of stockholders, or if applicable, a special meeting of stockholders at which directors are to be elected or re-elected, the Nominating and Governance Committee will recommend to the Board for nomination such candidates as the Nominating and Governance Committee has found to be well-qualified and willing and able to serve. The Nominating and Governance Committee is not limited to any

|

2022 PROXY STATEMENT | 21 | ||||

Table of Contents

specific process in identifying candidates and will consider candidates suggested by other members of the Board, as well as candidates recommended by stockholders. In addition, the Nominating and Governance Committee is authorized to retain search firms and other consultants to assist it in identifying candidates and fulfilling its other duties.

Board Membership Criteria

As described in the Company’s Corporate Governance Guidelines, both the Nominating and Governance Committee, in recommending director candidates to the Board, and the Board, in nominating director candidates, will consider candidates who have a high level of personal and professional integrity, strong ethics and values and the ability to make mature business judgments. The Board and Nominating and Governance Committee both take into account many factors in recommending candidates for a director position. These factors include, but are not limited to, the following criteria set forth in our Corporate Governance Guidelines for all candidates:

| • | Corporate management experience, such as serving as an officer or former officer of a publicly held company; |

| • | Board member experience at another publicly held company; |

| • | Professional and academic experience relevant to the real estate industry; |

| • | Strength of leadership skills; |

| • | Finance and accounting and/or executive compensation practices experience; and |

| • | Ability to commit the time required for preparation, participation and attendance at Board meetings and committee meetings, if applicable. |

The Nominating and Governance Committee seeks nominees with a broad diversity of experience, professions, skills, geographic representation and backgrounds. The Nominating and Governance Committee does not assign specific weighting to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. The Nominating and Governance Committee and the Board monitor the mix of specific experience, qualifications and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of our business and structure.

Stockholder Nominees

Stockholders may directly nominate potential directors (without the recommendation of the Board) by satisfying the procedural requirements for such nomination as provided in Section 2.12 of our Bylaws. For stockholder nominees to be considered for nomination by the Board, recommendations made by stockholders must be submitted within the timeframe required to request a proposal to be included in the proxy materials. See “Stockholder Proposals and Director Nominations—2023 Annual Meeting of Stockholders” for more information. In evaluating the persons recommended by stockholders as potential directors, the Nominating and Governance Committee and the Board will consider each candidate without regard to the source of the recommendation and take into account those factors that the Nominating and Governance Committee and the Board determine are relevant.

|

2022 PROXY STATEMENT | 22 | ||||

Table of Contents

CORPORATE GOVERNANCE GUIDELINES

The Board has adopted Corporate Governance Guidelines, which are available on our website at www.phillipsedison.com/investors/governance.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee was an officer or employee of PECO during 2021, and no member of the Compensation Committee is a former officer of PECO or was a party to any related party transaction involving PECO required to be disclosed under Item 404 of Regulation S-K. During 2021, none of our executive officers served on the board of directors or on the compensation committee of any other entity that has or had executive officers serving as a member of the Board or the Compensation Committee.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

We have established several means for our stockholders to communicate concerns to the Board. If the concern relates to (i) our financial statements, accounting practices, or internal controls, then stockholders should submit the concern in writing directed to the Audit Committee Chair; (ii) our governance practices, business ethics, or corporate conduct, then stockholders should submit the concern in writing to the Lead Independent Director; and (iii) if uncertain as to which category a concern relates, then a stockholder should submit the concern in writing to the independent directors; in each case, by sending such communication or concern by mail to:

Phillips Edison & Company, Inc.

c/o Secretary

11501 Northlake Drive

Cincinnati, Ohio 45249

The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Board Communication” or “Director Communication,” and the letter should clearly state the intended recipient. The Secretary will make copies of all such letters and circulate them to the appropriate director or directors. Such communications may be done confidentially or anonymously.

|

2022 PROXY STATEMENT | 23 | ||||

Table of Contents

Environmental, Social and Governance

Being a responsible corporate citizen has always been integral to our corporate strategy, and we operate under a clear mission statement of “creating great omni-channel grocery-anchored shopping experiences and improving our communities, one shopping center at a time.”

We strive to have a strong corporate culture based on our core values – Do the Right Thing, Have Fun and Get it Done, Think Big Act Small, Always Keep Learning – which is designed to drive accountability in all aspects of our business with the overarching goal of achieving long-term growth and value creation for our stakeholders.

We recognize that successful corporate responsibility is both internally and externally focused. With the goal of being able to better quantify the qualitative components of our corporate responsibility values and provide greater transparency to our stakeholders, in 2021, we established an internal cross-functional ESG Team consisting of our department heads from Portfolio Management, Construction, Property Management, Leasing, Investor Relations, Marketing, Human Resources and Legal. Our General Counsel has overall responsibility for leading and managing our ESG Team, and reporting on our corporate responsibility and ESG matters to our Board, as more fully described below. Our ESG Team is tasked with conducting more detailed materiality and risk assessments and identifying opportunities with measurable key performance indicators and enhanced reporting, with the overall goal of driving long-term growth and value creation for our stakeholders.

|

2022 PROXY STATEMENT | 24 | ||||

Table of Contents

ENVIRONMENTAL STEWARDSHIP

We believe that sustainable business practices fit with our core value of “Do the Right Thing,” while at the same time being in the best interests of all our stakeholders by having a positive impact on our properties and the communities in which they are located. We recently began participating in the GRESB Real Estate Assessment using the GRI reporting standards, and our Corporate Social Responsibility Report is designed to align with a number of the 17 United Nations Sustainable Development Goals. Our sustainability initiatives include energy efficiency, alternative power sources, water conservation, sustainable design and waste management, among others. Through these initiatives, we continue to make progress towards mitigating the environmental impact of our shopping centers.

In our ongoing commitment to sustainability, we can highlight the following achievements:

| • | to further reduce energy consumption, the installation of over 3.5 million square feet of white reflective roofing was completed, resulting in over 900,000 kWh in savings and contributing to the minimalization of heat islands; |

| • | our exterior lighting program included the execution of 54 LED retrofits in 2021, bringing the total number of centers retrofitted to 249 and savings of 8.6 million kWH annually; and |

| • | since the inception of the smart water control program, realization of 285.3 million gallons of water saved by PECO. |

As noted above, we align with GRI reporting standards and have realized a 9% increase in GRESB scoring from 2020 to 2021 assessments.

Our team of seasoned professionals identifies opportunities in our redevelopment program, which includes outparcel development, footprint reconfiguration, anchor repositioning and anchor expansions, among others. These projects create attractive sustainability opportunities to increase the overall value of our properties, while improving the environmental impact on our communities. Our ESG Team has been, and will continue to be, focused on strategic sustainability initiatives to enhance resource efficiencies as part of that program.

|

2022 PROXY STATEMENT | 25 | ||||

Table of Contents

SOCIAL RESPONSIBILITY

Our culture is driven by our team’s connection to each other and the communities in which we live and work. Our associates are one of our most valuable resources, and we strive to have an outstanding culture that is collaborative, inclusive and that provides significant opportunities for professional and personal development. We encourage and strongly support associate-led programs, such as PECO MORE, PECO NOW and PECO Community Partnership (as described below). These groups give our associates opportunities to effect positive change within our Company, our industry and our communities.

PECO MORE (Multicultural Opportunities, Resources and Education) is dedicated to furthering diversity and inclusion within PECO, the communities we serve, and the commercial real estate industry, and uses a multi-pronged approach including education and awareness, community and industry partnerships, internal engagement, recruiting and metric-led accountability.

PECO NOW (Networking Opportunities for Women), whose mission is to provide leadership opportunities to women at PECO through advocacy, support, scholarship and development, is working to develop and spotlight women leaders in our industry. Since the group’s inception, the number of women in leadership at PECO has tripled. We also currently have nine women in roles at the VP level or higher–including three women in the C-Suite; we also have two women who are independent directors on our Board.

PECO Community Partnership is dedicated to encouraging community involvement and connecting associates to causes important to them, providing associates at every level and in different locations with an opportunity to participate. In 2021, the PECO Community Partnership sponsored six community service-focused events–that associates participated in–ranging from meal delivery, holiday giving, repair work and food pantry organization that resulted in over 200 hours of community service. In addition, the group sponsored two educational events for the Company on recycling and living our core value of “Do the Right Thing.”

|

2022 PROXY STATEMENT | 26 | ||||

Table of Contents

AS AN OUTWARD DEMONSTRATION OF OUR COMMITMENT TO AN INCLUSIVE CULTURE, IN 2021, JEFF EDISON, OUR CEO, SIGNED THE CEO ACTION FOR DIVERSITY & INCLUSION™ PLEDGE ON BEHALF OF THE COMPANY.

The pledge outlines a specific set of actions signatory CEOs will take to cultivate a trusting environment where all ideas are welcome and associates feel comfortable and empowered to have discussions about diversity and inclusion. Additionally, the role of our human resources leader was expanded to Chief People, Diversity & Inclusion Officer to further advance diversity, equity and inclusion (“DE&I”) within the Company. In 2021, we offered a series of interactive learning opportunities focused on unconscious bias, psychological safety, and communicating across cultures. Each of these sessions were designed to increase awareness, create dialogue, and lay a common framework for associates to build upon related to DE&I issues. As part of our external community efforts, in 2021, we also partnered with industry group ICSC (Innovating Commerce Serving Communities) and their Launch Academy, which was designed to recruit and prepare racially or ethnically diverse undergraduate students for a career in the commercial real estate industry. In addition to assisting with development of the Launch Academy curriculum, PECO hosted interns from the program in its Cincinnati and Atlanta offices.

Our local teams and property managers are passionate about the Neighbors with whom they work daily and engaging with the shoppers at our centers and the local communities. Their passion for their work and the communities in which our properties operate help drive great shopping experiences at our centers and improve the communities in which they are located.

|

2022 PROXY STATEMENT | 27 | ||||

Table of Contents

CORPORATE GOVERNANCE AND COMPLIANCE

We have a steadfast commitment to operating our business with the utmost integrity and the highest ethical standards as stewards of our investors’ capital. We believe our corporate governance structure closely aligns our interests with those of our stockholders. Notable features of our structure include: (i) each of our directors being subject to election annually; (ii) a charter that prevents us from classifying our Board unless we receive prior stockholder approval; (iii) we have opted out of the business combination and control share acquisition statutes in the Maryland General Corporation Law; (iv) no stockholder rights plan and

we will not adopt one without stockholder approval or stockholder ratification within 12 months of adoption of such a plan; (v) a Stock Ownership Policy that requires each director, our CEO and each other NEO to own a certain amount of our equity; and (vi) bylaws that permit our stockholders to alter or replace our bylaws upon the affirmative vote of a majority of the votes entitled to be cast.

We operate under the direction of our Board, which is comprised of eight directors, seven of whom are independent per applicable Nasdaq and SEC rules, and compliant with the diverse director requirements under Nasdaq’s Board Diversity Rule. Our Audit, Nominating and Governance and Compensation Committees are comprised solely of independent directors who complete annual self- assessments. Our Board has adopted Corporate

All of our associates are

required to complete

regular training on our

Code of Business Conduct

and Ethics and our Insider

Trading Policy, and provide

annual Code of Conduct

Compliance Certifications

to our Chief Ethics and

Compliance Officer.

Governance Guidelines that, among other things, establish criteria and expectations for our directors, and our Nominating and Governance Committee has responsibility for evaluating our Board. We are cognizant of “overboarding,” and none of our directors serves on more than two other public company boards.

Our full Board oversees each of our corporate social responsibility, ESG and enterprise risk management programs, and our Audit Committee oversees our robust ethics and compliance program. Management provides periodic updates on each such program to the Board.

All PECO associates are required to complete regular training on our Code of Business Conduct and Ethics and Insider Trading Policy, and we provide annual Code of Conduct Compliance Certifications to our Chief Ethics and Compliance Officer. We also encourage our associates to speak up when our ethics standards are not being met, including by maintaining a 24-hour ethics hotline and website for reporting concerns and keeping our Audit Committee apprised of all reported concerns.

|

2022 PROXY STATEMENT | 28 | ||||

Table of Contents

Below is certain information about our current executive officers as of the date of this proxy statement.

|

Jeffrey S. Edison

Chairman & Chief Executive Officer

Age 61 |

Mr. Edison has served as PECO’s Chairman of the Board and Chief Executive Officer since December 2009 and also served as President from October 2017 to August 2019. Mr. Edison also served as Chairman of the Board and Chief Executive Officer of REIT III from April 2016 through the date it merged with PECO in October 2019, and served as Chairman of the Board and Chief Executive Officer of REIT II from 2013 through the date it merged with PECO in November 2018. Mr. Edison co-founded PELP and has served as a principal of it since 1995. Before founding Phillips Edison, Mr. Edison was a senior vice president from 1993 until 1995 and was a vice president from 1991 until 1993 at Nations Bank’s South Charles Realty Corporation. Mr. Edison was employed by Morgan Stanley Realty Incorporated from 1987 until 1990, and was employed by The Taubman Company from 1984 to 1987. Mr. Edison holds a Bachelor of Arts in mathematics and economics from Colgate University and a Master of Business Administration from Harvard University. |

|

Devin I. Murphy

President

Age 62 |

Mr. Murphy has served as our President since August 2019. Prior to that, he served as our Chief Financial Officer from June 2013, when he joined the Company, to August 2019. Before joining Phillips Edison in 2013, Mr. Murphy worked for 27 years as an investment banker and held senior leadership roles at Morgan Stanley and Deutsche Bank. He served as the Global Head of Real Estate Investment Banking at Deutsche Bank. His Deutsche Bank team executed over 500 transactions of all types for clients representing total transaction volume exceeding $400 billion and included initial public offerings, mergers and acquisitions, common stock offerings, secured and unsecured debt offerings, and private placements of both debt and equity. Mr. Murphy began his banking career at Morgan Stanley in 1986 and held a number of senior positions including Vice Chairman, co-head of US Real Estate Investment Banking, and Head of Real Estate Private Capital Markets. He also served on the Investment Committee of the Morgan Stanley Real Estate Funds, a series of global real estate funds with over $35 billion in assets under management. During his 20 years with Morgan Stanley, Mr. Murphy and his teams executed numerous capital markets and merger and acquisition transactions including a number of industry-defining transactions. Mr. Murphy served as a Director of the NYSE-listed real estate services firm Grubb and Ellis prior to its sale to BGC Partners and of the S&P 500 company Apartment Investment and Management (AIV) prior to its spin off transaction. Mr. Murphy currently serves as an independent director of Apartment Income REIT Corp (AIRC), a NYSE-listed apartment REIT, and serves on the Audit, Compensation, and Nominating Committees of AIRC. He is also an independent director of CoreCivic (CXW), a NYSE-listed corporation that provides diversified government solutions in corrections and detention management. He serves on the Audit, Risk, and Special Litigation Committees at CXW. Mr. Murphy received a Bachelor of Arts in English and History with Honors from the College of William & Mary and a Master of Business Administration from the University of Michigan. |

|

2022 PROXY STATEMENT | 29 | ||||

Table of Contents

|

Robert F. Myers

Chief Operating Officer

Age 49 |

Mr. Myers has served as our Chief Operating Officer since October 2010 and Executive Vice President since August 2020. Mr. Myers joined PECO in 2003 as a Senior Leasing Manager, was promoted to Regional Leasing Manager in 2005 and became Vice President of Leasing in 2006 He was named Senior Vice President of Leasing and Operations in 2009, Chief Operating Officer in 2010 and Executive Vice President in 2020. Before joining PECO, Mr. Myers spent six years with Equity Investment Group, where he started as a property manager in 1997. He served as director of operations from 1998 to 2000 and as director of lease renegotiations/leasing agent from 2000 to 2003. He received his Bachelor of Science in Business Administration from Huntington College in 1995. |

|

John P. Caulfield

Chief Financial Officer, Executive Vice President & Treasurer

Age 41 |