United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 20-F

(Mark One)

[ ] Registration Statement Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

or

[ X ] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended August 31, 2013

or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________________ to ________________

or

[ ] Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of event requiring this shell company report _________________

Commission file number: 001-35307

Tasman Metals Ltd.

(Exact name of Registrant as specified in its charter)

Tasman Metals Ltd.

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

#1305 – 1090 West Georgia Street, Vancouver, British Columbia V6E 3V7

(Address of principal executive offices)

Nick DeMare, Chief Financial Officer, (604) 685-9316, (604) 683-1585,

ndemare@chasemgt.com,

#1305 – 1090 West Georgia Street, Vancouver, British Columbia V6E 3V7

(Name, telephone, e-mail and/or facsimile number and address of Company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of Each Class:

|

Name of Each Exchange On Which Registered:

|

|

Common Stock, no par value

|

NYSE MKT LLC

|

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Stock, No Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

¨Yes þNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þYes ¨No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files).

¨Yes ¨No (not required)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer þ

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ¨

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board þ

|

Other ¨

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.¨ Item 17 ¨ Item 18

-2-

General Information:

Unless otherwise indicated, all references herein are to Canadian dollars. References to US$ refer to United States dollars and references to SEK refer to Swedish Krona.

As used within this annual report, unless the context indicates otherwise, the terms “Tasman,” “we,” “us” or “our” refers to Tasman Metals Ltd. and our subsidiaries.

Glossary

|

NI 43-101 & Canadian Institute of Mining, Metallurgy and Petroleum Definitions

|

|

|

Mineral Reserve

|

The term “Mineral Reserve” refers to the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. The study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

|

|

Proven Mineral Reserve

|

The term “Proven Mineral Reserve” refers to the economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

|

|

Probable Mineral Reserve

|

The term “Probable Mineral Reserve” refers to the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

|

|

Mineral Resource

|

The term “Mineral Resource” refers to a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, rare earth elements and industrial minerals in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

|

|

Measured Mineral Resource

|

The term “Measured Mineral Resource” refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

|

|

Indicated Mineral

Resource

|

The term “Indicated Mineral Resource” refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced

|

-3-

|

|

closely enough for geological and grade continuity to be reasonably assumed. |

|

Inferred Mineral Resource

|

The term “Inferred Mineral Resource” refers to that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

|

|

Qualified Person(1)

|

The term “Qualified Person” refers to an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, has experience relevant to the subject matter of the mineral project and the technical report and is a member in good standing of a professional association.

|

|

SEC Industry Guide 7 Definitions

|

|

|

Reserve

|

The term “Reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study(2) done to bankable standards that demonstrates the economic extraction. (“bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined.

|

|

Proven (Measured) Reserve

|

The term “Proven (Measured) Reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well-defined that size, shape depth and mineral content of reserves are well-established.

|

|

Probable (Indicated) Reserve

|

The term “Probable (Indicated) Reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

|

|

Mineralized Material(3)

|

The term “Mineralized Material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

|

|

Non-Reserves

|

The term “Non-Reserves” refers to mineralized material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

|

|

Exploration Stage

|

An “Exploration Stage” prospect is one which is not in either the development or production stage.

|

|

Development Stage

|

A “Development Stage” project is one which is undergoing preparation of an established commercially mineable deposit for ore extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

|

|

Production Stage

|

A “Production Stage” project is actively engaged in the process of extraction and

|

-4-

| beneficiation of Mineral Reserves to produce a marketable metal or mineral product. |

|

(1)

|

Industry Guide 7 does not require designation of Qualified Person.

|

|

(2)

|

For Industry Guide 7 purposes, the feasibility study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

|

|

(3)

|

This category is substantially equivalent to the combined categories of Measured Mineral Resource and Indicated Mineral Resource specified in NI 43-101.

|

Additional Definitions

assay - a measure of the valuable mineral content.

bastnasite - a mixed-lanthanide fluoro-carbonate mineral (Ln F CO3) that currently provides the bulk of the world's supply of the light REEs. Bastnasite and monazite are the two most common sources of cerium and other REEs. Bastnasite is found in carbonatites, igneous carbonate rocks that melt at unusually low temperatures.

cerium (“Ce”) - a soft, silvery, ductile metal which easily oxidizes in air. Cerium is the most abundant of the REEs, and is found in a number of minerals, including monazite and bastnasite. Cerium has two relatively stable oxidation states, enabling both the storage of oxygen and its widespread use in catalytic converters. Cerium is also widely used in glass polish.

concentrate - a mineral processing product that generally describes the material that is produced after crushing and grinding ore, effecting significant separation of gangue (waste) minerals from the desired metal and/or metal minerals, and discarding the waste minerals. The resulting "concentrate" of minerals typically has an order of magnitude higher content of minerals than the beginning ore material.

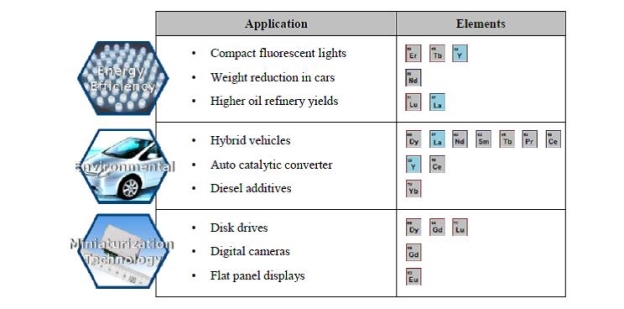

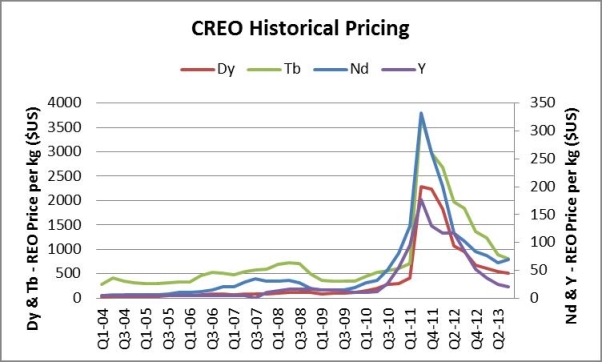

critical rare earth elements (“CREE”) - we consider CREEs to include Y and the rare earth elements of Nd, Pr, Eu, Tb and Dy which we believe are projected to have the greatest future demand, price growth and supply risk.

cut-off grade - when determining economically viable Mineral Reserves, the lowest grade of mineralized material that qualifies as ore, i.e. that can be mined and processed at a profit.

definitive feasibility study (“DFS”) - a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production.

dysprosium (“Dy”) - a soft metallic element of the lanthanide series. Dy has a high melting point and absorbs neutrons well and is therefore used to help control nuclear reactions and is also used in laser materials and as a neutron absorber in nuclear control rods.

erbium (“Er”) - is a soft, malleable, lustrous, silvery metal. It is very stable in air, it reacts very slowly with oxygen and water and dissolves in acids. Its salts are rose colored and it has a sharp adsorption spectra in visible, ultraviolet and infrared light. Some erbium is added to alloys with metals such as vanadium because it lowers their hardness, making them more workable. Due to its adsorption of infrared light, erbium is added to the glass of special safety spectacles for workers, such as welders and glass-blowers. It is used as a photographic filter as well, and to dope optical fibers at regular intervals to amplify signals. Finally, due to its pink color, erbium is sometimes used as a glass and porcelain enamel glaze colorant.

europium (“Eu”) - a very rare metallic element that is the softest member of the lanthanide series. It is used in making color television tubes and lasers and as a neutron absorber in nuclear research. It is desirable due to its photon emission. Excitation of the europium atom, by absorption of electrons or by ultraviolet radiation, results in

-5-

changes in energy levels that create a visible emission. Almost all practical uses of europium utilize this luminescent behavior.

fault - a surface or zone of rock fracture along which there has been displacement.

formation - a distinct layer of sedimentary rock of similar composition.

gadolinium (“Gd”) - is a malleable, ductile metallic element of the lanthanide series that has seven natural isotopes and 11 artificial isotopes. Two of the natural isotopes, Gd 155 and Gd 157, are the best known neutron absorbers. Gd is used to improve the heat and corrosion resistance of iron, chromium, and various alloys and in medicine as a contrast medium for magnetic resonance imaging and as a radioisotope in bone mineral analysis.

geochemical - the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

geophysical - the mechanical, electrical, gravitational and magnetic properties of the earth's crust.

geophysical surveys - a survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth's surface.

grade - quantity of metal per unit weight of host rock.

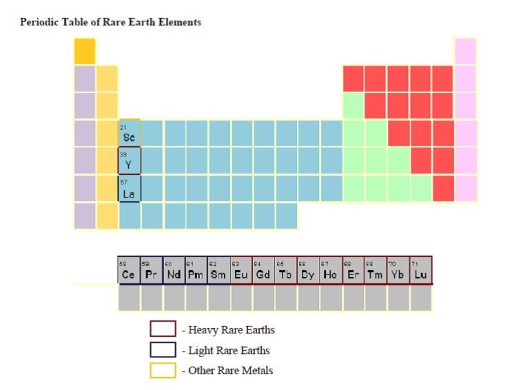

heavy rare earth elements (“HREEs”) - defined as the elements Tb, Dy, Ho, Er, Tm, Yb, Lu and Y.

heavy rare earth oxides (“HREO”) – includes the oxides: Eu2O3, Gd2O3, Tb2O3, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3, Y2O3

holmium (“Ho”) - is a melleable, soft, lustrous metal with a silvery colour, belonging to the lantanides series of the periodic chart of elements. It is slowly attacked by oxygen and water and dissolves in acids. It is stable in dry air at room temperature. Holmium alloys are used as a magnetic flux concentrator to create the strongest artificially-generated magnetic fields. It is also used in nuclear reactors for nuclear control rods. Holmium oxide is used as yellow gas colouring.

host rock - the rock in which a mineral or an ore body may be contained.

Iron (“Fe”) - is a ductile, gray, relatively soft metal and is a moderately good conductor of heat and electricity. It is attracted by magnets and can be readily magnetized. The pure metal is chemically very reactive and rusts readily in moist air, forming red-brown oxides. There are three allotropic forms of iron, known as alpha, gamma, and delta. Alpha iron, also known as ferrite, is the stable form of iron at normal temperatures.

lanthanum (“La”) - the first member of the Lanthanide series. Lanthanum is a strategically important rare earth element due to its use in fluid bed cracking catalysts and FCCs, which are used in the production of transportation and aircraft fuel. Lanthanum is also used in fuel cells and batteries.

lead ( “Pb” ) - is a bluish-gray, soft, dense metal that has a bright luster when freshly cut. It tarnishes slowly in moist air to form a dull gray coating. The metal is highly ductile and malleable. Lead is extremely resistant to corrosion and is a poor conductor of electricity.

life-of-mine - a term commonly used to refer to the likely term of a mining operation and normally determined by dividing the tonnes of Mineral Reserve by the annual rate of mining and processing.

light rare earth oxides (“LREO”) - includes the oxides La2O3, Ce2O3, Pr2O3, Nd2O3, Sm2O3.

lutetium (“Lu”) - pure metal lutetium has been isolated only in recent years and is one of the more difficult to prepare. It can be prepared by the reduction of anhydrous LuCl3 or LuF3 by an alkali or alkaline earth metal. The metal is silvery white and relatively stable in air. It is the hardest and the densest of the lanthanides. Lutetium is very

-6-

expensive to obtain in useful quantities and therefore it has very few commercial uses. One commercial application has been as a pure beta emitter, using lutetium which has been exposed to neutron activation. A tiny amount of lutetium is added as a dopant to gadolinium gallim garnet (GGG), which is used in magnetic bubble memory devices.

mineral - a naturally occurring inorganic crystalline material having a definite chemical composition.

mineralization - a natural accumulation or concentration in rocks or soil of one or more potentially economic minerals, also the process by which minerals are introduced or concentrated in a rock.

monazite - a reddish-brown phosphate mineral. Monazite minerals are typically accompanied by concentrations of uranium and thorium. This has historically limited the processing of monazite, however this mineral is becoming more attractive because it typically has elevated concentrations of mid-to heavy rare earth elements.

National Instrument 43-101 (“NI 43-101”) - standards of disclosure for mineral projects prescribed by the Canadian Securities Administrators.

neodymium (“Nd”) - a metallic element of the lanthanide series, occurring principally in monazite. Nd is a key constituent of NdFeB permanent magnets and an additive to capacitor dielectrics. NdFeB magnets maximize the power/weight ratio, and are found in a large variety of motors, generators, sensors and hard disk drives. Capacitors containing Nd are found in cellular telephones, computers and nearly all other electronic devices. A minor application of Nd is in lasers.

open pit - surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body.

ore - mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions.

ore body - a mostly solid and fairly continuous mass of mineralization estimated to be economically mineable.

ore grade - the average weight of the valuable metal or mineral contained in a specific weight of ore, i.e. grams per tonne of ore.

oxide - rare earth bearing ore which results from the oxidation of near surface sulfide ore.

ppm - parts per million

preliminary economic assessment (“PEA”) - a study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study.

praseodymium (“Pr”) - comprises about 4% of the lanthanide content of bastnasite and has a few specific applications, based mainly on its optical properties. It is a common coloring pigment, and is used in photographic filters, airport signal lenses, and welder's glasses. Because it chemically and magnetically is so similar to its neighbors neodymium and lanthanum, it is typically found in small amounts in applications where neodymium and lanthanum are popular, such as NdFeB magnets and catalysts. These latter applications are actually the largest uses for praseodymium because the magnet and catalyst markets are so large. Thus praseodymium plays an important role, in extending the availability of the more popular neodymium and lanthanum.

preliminary feasibility study or pre-feasibility study (“PFS”) - each mean a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve.

-7-

rare earth element (“REE”) - a group of metallic elements with unique properties: chemical, catalytic, magnetic, metallurgical and phosphorescent.

rare earth oxide (“REO”) - the oxide form of rare earth elements.

RC (reverse circulation) drilling - a drilling method using a tri-cone bit, during which rock cuttings are pushed from the bottom of the drill hole to the surface through an outer tube, by liquid and/or air pressure moving through an inner tube.

recovery - the percentage of contained metal actually extracted from ore in the course of processing such ore.

samarium (“Sm”) - predominantly used to produce Sm cobalt magnets. Although these magnets are slightly less powerful than NdFeB magnets at room temperature, Sm cobalt magnets can be used over a wider range of temperatures and are less susceptible to corrosion.

sampling and analytical variance/precision - an estimate of the total error induced by sampling, sample preparation and analysis.

strike - the direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal.

strip - to remove overburden in order to expose ore.

sulfide - a mineral including sulfur and iron as well as other elements; metallic sulfur-bearing mineral often associated with REE mineralization.

tailings - fine ground wet waste material produced from ore after economically recoverable metals or minerals have been extracted.

terbium (“Tb”) - is a soft, malleable, ductile, silver-gray metal member of the lanthanide group of the periodic table. It is reasonably stable in air, but it is slowly oxidised and it reacts with cold water. Terbium is rare and expensive, Some minor uses are in lasers, semiconductor devices, and phosphorous in colour television tubes. It is also used in solid-state devices and as a stabilizer of fuel cells which operate at high temperature.

thulium (“Tm”) - is a bright, soft, malleable, silvery-gray metal.It is a rare earth metal and is one of the least abundant. The metal tarnishes slowly in dry air to form the oxide and reacts with water to form the hydroxide and hydrogen gas. Tm3+ ions emit a strong blue luminescence when excited. When present in compounds, thulium exists usually in the trivalent state, Tm3+. It forms compounds – mostly green in color – with oxygen and the halogens. Radioactive isotope 170Tm is produced by bombarding thulium in a nuclear reactor. It has a half-life of 128 days and is used as a portable source of x-rays. Thulium is used to dope yttrium aluminum garnets (YAG) used in lasers. Thulium is also used in alloys with other rare earth metals. Thulium is used in euro banknotes for its blue fluorescence under UV light to defeat counterfeiters.

total rare earth oxide (“TREO”) - refers to the sum total of REEs present in a deposit.

vein - a thin, sheet-like crosscutting body of hydrothermal mineralization, principally quartz.

ytterbium (“Yb”) - is a soft, malleable and rather ductile element that exhibits a bright silvery luster. A rare earth, the element is easily attacked and dissolved by mineral acids, slowly reacts with water, and oxidizes in air. The oxide forms a protective layer on the surface. Compounds of ytterbium are rare.Ytterbium is sometimes associated with yttrium or other related elements and is used in certain steels. Its metal could be used to help improve the grain refinement, strength, and other mechanical properties of stainless steel. Some ytterbium alloys have been used in dentistry. One ytterbium isotope has been used as a radiation source substitute for a portable X-ray machine when electricity was not available. Like other rare-earth elements, it can be used to dope phosphors, or for ceramic capacitors and other electronic devices, and it can even act as an industrial catalyst.

-8-

yttrium (“y”) - is a soft, silvery metal used in television screens to produce the colour red. It is also employed in superconductors. The largest use of yttrium is in the form of yttrium(Ill) oxide, which is used to produce phosphors which give the red colour in colour television tubes. It is also used in the making of microwave filters. Yttrium is often used as an additive in alloys, and increases the strength of aluminium and magnesium alloys. It is also used as a detoxifier for non-ferrous metals. It has been used as a catalyst in ethylene polymerisation. Yttrium-90, a radioactive isotope, has a medical use in needles which have replaced the surgeon’s knife in killing pain-transmitting nerves in the spinal cord.

Zirconium (“Zr”) - is a strong, malleable, ductile, lustrous, grayish-white metal. When present in compounds, zirconium exists mostly in the oxidation state IV. Its oxide (ZrO2) is white, like many of its compounds and is generally exceptionally resistant to corrosion. It is however rapidly attacked by hydrofluoric acid, even at low concentrations. In an oxygen atmosphere, finely divided Zirconium burns with the highest known temperature for a metal flame: 4460 oC(4) Powdered zirconium can spontaneously ignite in air. Exposed surfaces of zirconium form a protective oxide layer. Zirconium tungstate (ZrW2O8) is an unusual substance: it shrinks when heated from near absolute zero to 780 oC(5).

Forward Looking Statements

This annual report, including any documents incorporated by reference herein, contains forward looking statements and forward looking information (collectively, “forward looking statements”) within the meaning of Canadian and United States securities laws relating to us that are based on the beliefs and estimates of our management as well as assumptions made by and information currently available to us. Such forward looking statements include, but are not limited to statements concerning:

• our plans for our mineral properties;

• the future price of rare earth elements;

• market events and conditions;

• the estimation of mineral reserves and mineral resources;

• estimates of the time and amount of future REE production for specific operations;

• estimated future exploration expenditures and other expenses for specific operations;

• permitting timelines;

• requirements for additional capital;

• litigation risks;

• the registration of the concessions comprising the various REE projects;

• the market and future price of commodities;

• the timing, cost and success of future exporation activities, including, but not limited to, our proposed

work programs;

• currency fluctuations; and

• environmental risks and reclamation costs.

When used in this annual report, any statements that express or involve discussions with respect to predictions, beliefs, plans, projections, objectives, assumptions or future events of performance (often but not always using words or phrases such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “strategy”, “goals”, “objectives”, “project”, “potential” or variations thereof or stating that certain actions, events, or results “may”, “could”, “would”, “might” or “will” be taken, occur, or be achieved, or the negative of any of these terms and similar expressions), as they relate to us or our management, are intended to identify forward looking statements.

Such forward looking statements reflect our current views with respect to future events and are subject to certain known and unknown risks, uncertainties, assumptions and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors and assumptions include, amongst others, the effects of general economic conditions, changing foreign exchange rates and actions by government authorities, uncertainties associated with negotiations and misjudgments in the course of preparing forward-looking statements. Many factors could cause actual results, performance, or achievements to be

-9-

materially different from any future results, performance or achievements that may be expressed or implied by such forward looking statements, including, among others:

|

|

•

|

risks relating to our ability to finance the exploration and development of our mineral properties;

|

|

|

•

|

risks relating to our exploration of our mineral properties and business activities;

|

|

|

•

|

risks and uncertainties relating to the interpretation of exploration results, geology, grade and continuity of our mineral deposits;

|

|

|

•

|

risks related to differences between United States and Canadian practices for reporting mineral resources and reserves;

|

|

|

•

|

risks related to title to our mineral properties and the ability to obtain the required mining leases and permits to develop our mineral properties;

|

|

|

•

|

risks related to mining operations in Sweden, Finland and Norway;

|

|

|

•

|

commodity price fluctuations;

|

|

|

•

|

currency fluctuations;

|

|

|

•

|

risks related to the price and volume volatility of our common shares;

|

|

•

|

risks related to governmental regulations, including environmental regulations and possible changes thereto;

|

|

|

•

|

risks related to possible reclamation activities on our properties;

|

|

|

•

|

our ability to attract and retain qualified management and our dependence upon such management in the development of our mineral properties and potential conflicts of interest involving such management;

|

|

|

•

|

risks related to the ability to maintain the listing of our common shares on the TSX Venture Exchange (the “TSXV”) and NYSE MKT Exchange (the “NYSE MKT”);

|

|

|

•

|

increased competition in the exploration industry; and

|

|

|

•

|

our lack of cash flow, history of losses and expectation of future losses.

|

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of our forward looking statements. Forward looking statements are statements about the future and are inherently uncertain, and our actual achievements or other future events or conditions may differ materially from those reflected in the forward looking statements due to a variety of risks, uncertainties and other factors, including without limitation, those referred to in this document under “Item 3. Key Information – Risk Factors.” The forward looking statements in this annual report are based on the reasonable beliefs, expectations and opinions of management on the date the forward looking statements are made, and, except as required by law, we do not assume any obligation to update forward looking statements if circumstances or our management’s beliefs, expectations or opinions should change.

For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward looking statements.

Additional risks and uncertainties relating to us and our business can be found under “Item 3. Key Information – Risk Factors” in this annual report.

Cautionary Note Regarding Reserve and Resource Disclosure

The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM. These definitions differ from the definitions in the United States Securities and Exchange Commission (the “SEC”) Industry Guide 7 (“SEC Industry Guide 7”) under the U.S. Securities Act of 1933 (the “U.S. Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

-10-

In addition, the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of an economic analysis, except a preliminary economic assessment provided certain additional disclosure requirements are met. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Unless otherwise indicated, all mineral resource estimates included in this annual report have been prepared in accordance with NI 43-101 and the CIM classifications system. Accordingly, information contained in this annual report containing descriptions of our mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

-11-

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

Not required.

Item 2. Offer Statistics and Expected Timetable.

Not applicable.

Item 3. Key Information.

Selected Financial Data

The following selected financial data is derived from our audited annual consolidated financial statements.

During fiscal 2013, we changed our accounting policy with respect to exploration and evaluation expenditures. In prior years, our policy was to expense mineral exploration and development costs as incurred until such time as either mineral reserves are proven or permits to operate the mineral resource property are received and financing to complete the development are obtained . We have elected to change this accounting policy to now capitalize by property all costs relating to the exploration and evaluation of mineral properties classified as exploration and evaluation assets, effective with the presentation of these consolidated financial statements, on a retrospective basis.

All comparative figures have been revised for the adoption of IFRS and the change in accounting policy.

The information in the following table was extracted from the more detailed financial statements and related notes included herein and should be read in conjunction with such financial statements and with the information appearing under the heading “Item 5. Operating and Financial Review and Prospects.”

To date, we have not generated any cash flow from operations to fund ongoing operational requirements and cash commitments. We have financed our operations principally through the sale of our equity securities. We believe we currently have sufficient funds to maintain operations at our current level of activity for the next twelve months from the date of this annual report. We will continue to rely on the sale of our equity securities to provide funds for our activities; however, there is no assurance that we will be able to do so.

|

For the Years Ended August 31,

|

|||||

|

2013

|

2012

|

2011 (1)

|

2010

|

2009

|

|

|

Operations:

|

|||||

|

Revenues

|

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

|

Mineral exploration costs

|

NIL

|

NIL

|

NIL

|

NIL

|

NIL

|

|

Expenses

|

($3,093,770)

|

($6,230,713)

|

($6,142,350)

|

($1,007,189)

|

($41,561)

|

|

Other items

|

($387,472)

|

$121,400

|

$753,180

|

$46,529

|

$743

|

|

Net loss before deferred income tax

|

($3,481,242)

|

($6,109,313)

|

($5,389,170)

|

($960,660)

|

($40,818)

|

|

Deferred income tax

|

-

|

($27,746)

|

$27,746

|

-

|

-

|

|

Net loss

|

($3,481,242)

|

($6,137,059)

|

($5,361,424)

|

($960,660)

|

($40,818)

|

|

Other comprehensive (loss) gain

|

($56,057)

|

($223,536)

|

$176,496

|

($7,922)

|

-

|

|

Comprehensive loss

|

($3,537,299)

|

($6,360,595)

|

($5,184,928)

|

($968,582)

|

($40,818)

|

|

Basic and diluted loss per share

|

($0.06)

|

($0.10)

|

($0.10)

|

($0.03)

|

($0.00)

|

|

Dividends per share

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Balance Sheet:

|

|||||

|

Working capital (Deficiency)

|

$5,094,986

|

$9,267,844

|

$14,961,243

|

$4,551,360

|

($130,022)

|

|

Total assets

|

$13,856,353

|

$16,549,682

|

$18,093,878

|

$5,486,429

|

$119,434

|

|

Total long-term liabilities

|

-

|

-

|

-

|

-

|

-

|

|

Total Shareholders' Equity

|

$13,210,861

|

$15,766,705

|

$17,712,399

|

$5,350,457

|

($22,589)

|

| Share Capital | $20,299,802 | $19,808,552 | $18,888,813 | $5,757,155 | $10,500 |

-12-

|

For the Years Ended August 31,

|

|||||

|

2013

|

2012

|

2011 (1)

|

2010

|

2009

|

|

|

Weighted Average Number of Shares Outstanding

|

60,635,585

|

59,042,266

|

54,884,348

|

34,701,602

|

10,500,000

|

(1) Balance Sheet items of September 1, 2011

Exchange Rate History

The following table sets forth the average exchange rate for one Canadian dollar expressed in terms of one U.S. dollar for the fiscal years ended August 31, 2013, 2012, 2011, 2010 and 2009, calculated by using the average of the exchange rates on the last day of each month during the period:

|

Period

|

Average

|

|

September 1, 2012 – August 31, 2013

|

0.9848

|

|

September 1, 2011 – August 31, 2012

|

0.9929

|

|

September 1, 2010 – August 31, 2011

|

1.0145

|

|

September 1, 2009 – August 31, 2010

|

0.9528

|

|

September 1, 2008 – August 31, 2009

|

0.8525

|

The following table sets forth high and low exchange rates for one Canadian dollar expressed in terms of one U.S. dollar for the past six months:

|

Month

|

High

|

Low

|

|

October 2013

|

0.9726

|

0.9566

|

|

September 2013

|

0.9768

|

0.9495

|

|

August 2013

|

0.9712

|

0.9475

|

|

July 2013

|

0.9748

|

0.9454

|

|

June 2013

|

0.9833

|

0.9495

|

|

May 2013

|

0.9977

|

0.9642

|

The noon rate of exchange on November 22, 2013, reported by the United States Federal Reserve Bank of New York for the conversion of Canadian dollars into United States dollars was CDN$1.0534 (US$0.9493 = CDN$1.00).

Exchange rates are based upon the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York.

Risk Factors

The exploration, development and mining of natural resources are highly speculative in nature and are subject to significant risks. The risk factors noted below do not necessarily comprise all those faced by our company. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business, activities and future prospects. If any of the following risks actually occur, our business may be harmed and our financial condition and results of operations may suffer significantly.

Industry Risks

Mineral resource exploration is a high risk, speculative business.

Mineral resource exploration is a speculative business, characterized by a high number of failures. Substantial expenditures are required to discover new properties and, where warranted, to develop the infrastructure, mining and processing facilities at any site chosen for mining. Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of recovery or mineral reserves will in fact be realized by us or that any identified mineral deposit identified by us will ever qualify as a commercially mineable (or viable) ore body which can be economically and lawfully exploited.

-13-

Metal prices have fluctuated widely in the past and are expected to continue to do so in the future which may adversely affect our ability to finance activities and may adversely affect the amount of revenues derived from any future production at our properties.

The commercial feasibility of our properties and our ability to arrange funding to conduct our planned exploration activities is dependent on, among other things, the price of REE. Depending on the price of REE, we may determine that it is impractical to commence or continue exploration or other activities on our mineral claims. A reduction in the price of REE may prevent our mineral claims from being economically explored or result in the write-off of assets whose value is impaired as a result of low REE prices.

The prices of REE fluctuate and are affected by numerous factors beyond our control, including, among others:

|

·

|

international economic and political conditions,

|

|

·

|

expectations of inflation or deflation,

|

|

·

|

international currency exchange rates,

|

|

·

|

interest rates,

|

|

·

|

global or regional consumptive patterns,

|

|

·

|

speculative activities,

|

|

·

|

levels of supply and demand,

|

|

·

|

increased production due to new mine developments,

|

|

·

|

decreased production due to mine closures,

|

|

·

|

improved mining and production methods,

|

|

·

|

availability and costs of REE substitutes,

|

|

·

|

inventory levels of REE maintained by producers and others, and

|

|

·

|

inventory carrying costs.

|

The effect of these factors on the price of REE cannot be accurately predicted. If the price of REE decreases, the value of our assets would be materially and adversely effected, thereby materially and adversely impacting the value and price of our securities.

Exploration activities are subject to geologic uncertainty and inherent variability.

There is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There may also be unknown geologic details that have not been identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining and processing operations.

Increased operating and capital costs may adversely affect the viability of existing and proposed mining projects.

Increases in the prices of labour and materials, to some extent caused by an increase in commodity prices, including the prices of the REE being mined by the industry, may lead to significantly increased capital and operating costs for mining projects. Increasing costs are a factor that must be built in to the economic model for any mining project. Significant increases in operating costs have had the effect of reducing profit margins for some mining projects. Accordingly increases in both operating and capital costs need to be factored into economic assessments of existing and proposed mining projects and may increase the financing requirements for such projects or render such projects uneconomic.

-14-

Company Risks

We are an exploration stage company with limited financial resources and if we are unable to secure additional funding and/or if our exploration programs are unsuccessful, our company may fail.

Mineral exploration involves significant risk and few properties that are explored are ultimately developed into producing mines. Substantial expenditures may be required to establish ore reserves through drilling, to develop metallurgical processes to extract the metals from the ore and to construct the mining and processing facilities at any site chosen for mining. Current exploration programs may not result in any commercial mining operation. Our interests in unproved mineral claims are without a known body of commercial ore and the proposed programs are an exploratory search for ore. We are presently carrying out exploration with the objective of establishing an economic body of ore. If our exploration programs are successful, additional funds will be required for the development of an economic ore body and to place it into commercial production. The only sources of future funds presently available to us are from the sale of equity capital, the exercise of warrants and options or the offering by us of an interest in our mineral claims to another party or parties. If we are unable to secure additional funding, we may lose our interest in one or more of our mineral claims and/or may be required to cease operations.

Our management lacks team lacks technical training and/or experience in starting and operating mines.

The officers, and certain directors, of our company have experience as officers and/or directors of public companies engaged in mineral exploration activities. Our management are involved in exploration activity supervision and direction, although we use contract engineering firms to directly conduct exploration activities. However, our management lacks technical training and experience with starting or operating a mine. As a result, their decisions and choices may not take into account standard engineering or managerial approaches that other mining companies commonly use, which could materially adversely affect our business, results of operations, and financial condition if we mature beyond the exploration stage. Consequently, our activities, earnings, and ultimate financial success could be negatively impacted due to management’s lack of experience in the mining industry, which could ultimately negatively impact the value of our investment in our properties.

Because we have limited financial resources and have not generated any revenue from our operations, we may not be able to continue our operations and an investment in our securities may be worthless.

We have limited financial resources, have a history of losses and have no source of operating cash flow. We have not generated any revenues from our mineral claims and do not anticipate any in the foreseeable future. Additional funding may not be available to us for further exploration of our mineral claims. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration of our projects with the possible loss of such interests. Historically, the only source of funds available to us has been through the sale of our common shares.

As of August 31, 2013, we held $5,601,492 in cash and had working capital of $5,094,986. We will need to raise additional capital to fund further exploration activities. We may not be able to raise the necessary funds, if any, and may not be able to raise such funds at terms which are acceptable to us. In the event we are unable to raise adequate finances to fund our proposed activities, we may have to abandon one or more of our projects. Any further additional equity financing we undertake may cause dilution to our shareholders.

We have a limited history as an exploration company and do not have any experience in putting a mining project into production.

We do not hold any mineral reserves and do not generate any revenues from production. Our success will depend largely upon our ability to locate and develop commercially viable mineral reserves, which may never happen. Further, putting a mining project into production requires substantial planning and expenditures and we do not have any experience in taking a mining project to production. As a result of these factors, it is difficult to evaluate our prospects, and our future success is more uncertain than if we had a longer or more proven history.

-15-

We have operated at a loss since inception, expect to continue to incur losses and may never achieve profitability, which in turn may harm our future operating performance and may cause the market price of our common shares to decline.

We have incurred net losses every year since our inception on August 29, 2007, and as of August 31, 2013 had an accumulated deficit of $16,034,024. We incurred a net loss of $3,481,242 for the year ended August 31, 2013 and $6,109,313 for the year ended August 31, 2012. We currently have no commercial production and have never recorded any revenues from mining operations. We expect to continue to incur losses, and will continue to do so until such time, if ever, as our properties commence commercial production and generate sufficient revenues to fund continuing operations.

The development of new exploration or, if warranted, mining operations will require the commitment of substantial resources for operating expenses and capital expenditures, which may increase in subsequent years as we add, as needed, consultants, personnel and equipment associated with advancing exploration, development and commercial production of our properties. The amounts and timing of expenditures will depend on the progress of ongoing exploration and development, the results of consultants’ analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture or other agreements with others in the future, our acquisition of additional properties, and other factors, many of which are unknown today and may be beyond our control. We may never generate any revenues or achieve profitability. If we do not achieve profitability we will have to raise additional funds through future financings or shut down our operations.

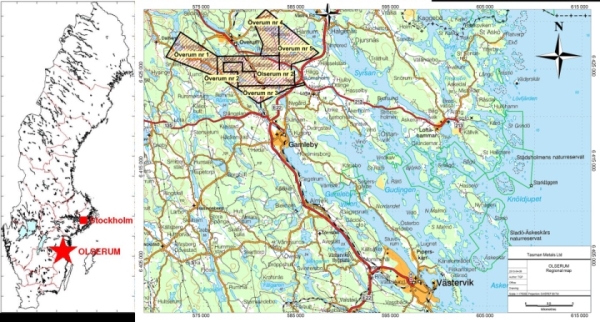

Our mining lease with respect to the Norra Kärr Project is currently under appeal and the loss of such mining lease would prevent us from developing the Norra Kärr Project.

Our ability to develop the Norra Kärr project requires us to hold a valid exploitation concession (referred to in this annual report as a “mining lease”). See “Item 4. Information on the Company – Description of Business of the Company – Foreign Operations – Swedish Mining Laws and Regulations” and “Item 4. Information on the Company – Property, Plant and Equipment – Significant Properties – Norra Kärr.” We have been granted a mining lease with respect to the Norra Kärr project, however, this decision of the applicable authorities is currently under appeal. In the event the appeal is successful and we are unable to overturn the appeal at a higher level, we will be unable to develop the Norra Kärr project.

We may not be able to obtain or renew government permits required for our operations.

In the ordinary course of business, we are required to obtain and renew government permits for our exploration activities and will require permits for the development, construction and commencement of any mining operations. Obtaining or renewing the necessary governmental permits is a time-consuming process involving numerous regulatory agencies and involving public hearings and costly undertakings on our part. The duration and success of our efforts to obtain and renew permits are contingent upon many variables not within our control including the interpretation of applicable requirements implemented by the permitting authority. We may not be able to obtain or renew permits that are necessary to our operations, or the cost to obtain or renew permits may exceed what we believe we can ultimately recover from a given property once in production. Any unexpected delays or costs associated with the permitting process could delay the development or impede the operation of a mine.

We have a small staff and rely upon outside consultants to provide services to our company.

We have a relatively small staff and depend upon our ability to hire consultants with the appropriate background and expertise as they are required to carry out specific tasks. Our inability to hire the appropriate consultants at the appropriate time could adversely impact our ability to advance our exploration activities.

-16-

Our activities are potentially subject to environmental liabilities, which would have an adverse effect on our financial condition and operations.

We are not aware of any claims for damages related to any impact that our operations have had on the environment but we may become subject to such claims in the future. An environmental claim could adversely affect our business due to the high costs of defending against such claims and its impact on senior management's time.

Our business activities are subject to exploration hazards and risks, which we may not be able to insure against and could subject us to substantial liabilities.

Natural resource exploration generally involves a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, but are not limited to, the following; environmental hazards, industrial accidents, third party accidents, unusual or unexpected geological structures or formations, fires, power outages, labour disruptions, floods, explosions, cave-ins, land-slides, acts of God, periodic interruptions due to inclement or hazardous weather conditions, earthquakes, delays in transportation, inaccessibility to property, restrictions of courts and/or government authorities, other restrictive matters beyond our reasonable control, and the inability to obtain suitable or adequate machinery, equipment or labour. Our activities are subject to all the hazards and risks normally incidental to exploration of precious and base metals, any of which could result in work stoppages, asset write downs, damage to or destruction of equipment and other facilities, damage to life and property, environmental damage and possible legal liability for any or all damages. We may become subject to liability for pollution, or hazards against which we cannot insure or against which we may elect not to insure. Any compensation for such liabilities may have a material, adverse effect on our financial position.

Our property, business interruption and liability insurance may not provide sufficient coverage for losses related to these or other hazards. Insurance against certain risks, including certain liabilities for environmental pollution, may not be available to us or to other companies within the industry at reasonable terms or at all. In addition, our insurance coverage may not continue to be available at economically feasible premiums, or at all. Any such event could have a material adverse affect on our business.

Our properties are without known reserves and our activities are exploratory in nature and we may never discover sufficient mineralization to justify commercial operations.

There is no known body of commercial ore on our mineral properties. Development of our properties will only follow upon obtaining satisfactory exploration results. The long-term profitability of our operations will be in part directly related to the cost and success of our exploration programs, which may be affected by a number of factors.

Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that the funds required for development can be obtained on a timely basis.

We may not be able to market any minerals that we acquire or discover.

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting minerals and environmental protection.

Recent market events and conditions may make it difficult for us to obtain financing and may increase the costs of any financing we undertake.

The unprecedented events in global financial markets since mid-2008 have had a profound effect on the global economy. Many industries, including the mining industry, have been affected by these market conditions. Some of the key effects of the financial market turmoil have included contraction in credit markets resulting in a widening of

-17-

credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets, and a lack of market liquidity. A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates, and tax rates may adversely affect our activities. Specifically the global credit/liquidity crisis has affected the volatility of precious and base metal prices, energy prices, commodity and consumables prices and currency exchange rates. These factors affect the valuation of our equity securities and the cost and availability of financing. As a result, these factors could have a material adverse effect on our financial condition.

The calculation of reserves and resources is subject to uncertainties which may result in inaccuracies.

There is a degree of uncertainty attributable to the calculation and estimates of mineral reserves and mineral resources and the corresponding grades to be mined and recovered. Until mineral reserves or mineral resources are actually mined and processed, the quantities of mineralization and metal grades must be considered as estimates only. Any material change in the quantity of mineral reserves, mineral resources, grades and recoveries may affect the economic viability of our properties. To date, we have not established reserves on any of our mineral properties. In addition, there can be no assurance that precious or other metal recoveries in small scale laboratory testing will be duplicated in larger scale tests under on-site conditions or during production.

Our activities are subject to government regulation which may increase our costs and subject us to fines and penalties in the event of non-compliance.

Our exploration activities are, and any development activities which we conduct in the future will be, subject to extensive federal, territorial and local laws and regulations governing such matters as environmental protection, management and use of toxic substances and explosives, management of natural resources, health, exploration and development of mines, production and post-closure reclamation, safety and labour, mining law reform, price controls, import and export laws, taxation, maintenance of claims, tenure, government royalties and expropriation of property. There is no assurance that future changes in such laws and regulations, if any, will not adversely affect our activities. Our activities require licenses and permits from various governmental authorities. The costs associated with compliance with these laws and regulations are substantial and possible future laws and regulations, changes to existing laws and regulations and more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expenses, capital expenditures, restrictions on or suspensions of our activities and delays in the development of our properties. Moreover, these laws and regulations may allow governmental authorities and private parties to bring lawsuits based upon damages to property and injury to persons resulting from the environmental, health and safety practices of our past and current activities, or possibly even those actions of parties from whom we acquired our properties, and could lead to the imposition of substantial fines, penalties or other civil or criminal sanctions. We retain competent and well trained individuals and consultants in jurisdictions in which we do business. However, even with the application of considerable skill we may fail to comply with certain laws. Such events can lead to financial restatements, fines, penalties, and other material negative impacts on our company.

Our activities are subject to environmental regulations and hazards which may subject us to liability and unknown costs.

All phases of our activities are subject to environmental regulation in the various jurisdictions in which we operate. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that any future changes in environmental regulation, will not adversely affect our operations. The costs of compliance with changes in government regulations have the potential to reduce the profitability of future operations. Environmental hazards that may have been caused by previous or existing owners or operators may exist on our mineral properties, but are unknown to us.

-18-

We may not have good title to our assets.

Our claims may be subject to prior unregistered agreements or transfers and title may be affected by unidentified or unknown defects. We have conducted as thorough an investigation as possible on the title of properties that we have acquired to confirm that there are no other claims or agreements that could affect our title to the concessions or claims. If title to our properties is disputed it may result in us paying substantial costs to settle the dispute or clear title and could result in the loss of the property, which events may affect our economic viability.

There is significant competition in the natural resource industry and we may not be able to sufficiently compete against other companies for properties.

Significant competition exists for natural resource acquisition opportunities. As a result of this competition, some of which is with large, well-established mining companies with substantial capabilities and significant financial and technical resources, we may be unable to either compete for or acquire rights to exploit additional attractive mining properties on terms we consider acceptable. There can be no assurance that we will be able to acquire any interest in additional projects that would yield resources or reserves or result in commercial mining operations.

We may not be able to recruit or retain employees.

Recruiting and retaining qualified personnel is critical to our success. We are dependent on the services of key executives including our President and Chief Executive Officer and other experienced executives and personnel focused on managing our interests. The number of persons skilled in acquisition, exploration and development of mining properties is limited and competition for such persons is intense. As our business activity grows, we will require additional key financial, administrative and mining personnel as well as additional operations staff. If we are not able to attract, hire and retain qualified personnel, our operations could be impaired.

If we participate in a joint venture our interests may be subject to competing interests of the other joint venture members.

If we participate in a joint venture, there is no assurance that our needs will receive priority in all cases. From time to time, several companies may participate together in the acquisition and exploration of natural resource properties, thereby allowing these companies to: (i) participate in larger properties and programs; (ii) acquire an interest in a greater number of properties and programs; and (iii) reduce their financial exposure to any one property or program. In determining whether or not we will participate in a particular program and the interest therein to be acquired, it is expected that our directors and officers will primarily consider the degree of risk to which we may be exposed and our financial position at that time.

Conflicts of interest may arise among the members of our board of directors and such conflicts may cause us to enter into transactions on terms which are not beneficial to us.

Several of our directors are also directors, officers or shareholders of other companies. Some of the directors and officers are engaged and will continue to be engaged in the search for additional business opportunities on behalf of other corporations, and situations may arise where these directors and officers will be in direct competition with us. Such associations may give rise to conflicts of interest from time to time. Such a conflict poses the risk that we may enter into a transaction on terms which could place us in a worse position than if no conflict existed. Conflicts, if any, will be dealt with in accordance with the relevant provisions of the Business Corporations Act (British Columbia) (the “BCBCA”). Our directors are required by law to act honestly and in good faith with a view to our best interests and to disclose any interest which they many have in any of our projects or opportunities. However, each director has a similar obligation to other companies for which such director serves as an officer or director. See “Item 6. Directors, Senior Management and Employees – Conflicts of Interest” for information concerning potential conflicts of interest of our directors and officers.

We may be subject to legal proceedings.

Due to the nature of our business, we may be subject to numerous regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of our business. The results of these legal proceedings cannot be predicted

-19-

with certainty due to the uncertainty inherent in litigation, including the effects of discovery of new evidence or advancement of new legal theories, the difficulty of predicting decisions of judges and juries and the possibility that decisions may be reversed on appeal. There can be no assurances that these matters will not have a material adverse effect on our business.

Management must rely upon certain assumptions and estimates in the preparation of our financial statements and those assumptions and estimates may prove to be incorrect.

We prepare our financial reports in accordance with accounting policies and methods prescribed by international financial reporting standards. In the preparation of financial reports, management may need to rely upon assumptions, make estimates or use their best judgment in determining our financial condition. Significant accounting details are described in more detail in the notes to our annual consolidated financial statements for the year ended August 31, 2013. If management’s estimates or assumptions are incorrect, our financial statements may not accurately reflect our financial position.

We have identified material weaknesses in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements.

In order to have a reasonable level of assurance that financial transactions are properly authorized, assets are safeguarded against unauthorized or improper use and transactions are properly recorded and reported, we have implemented and continue to analyze our internal control systems for financial reporting. Although we believe our financial reporting and financial statements are prepared with reasonable safeguards to ensure reliability, we cannot provide absolute assurance in that regard. See “Item 15. Controls and Procedures.”

Risks Related to Our Common Shares

An investment in our securities is speculative and you may lose your entire investment.

An investment in our securities is speculative and may result in the loss of an investor's entire investment. Only potential investors who are experienced in high risk investments and who can afford to lose their entire investment should consider an investment in our securities.

We will need to raise additional capital through the sale of our securities, resulting in dilution to the existing shareholders, and if such funding is not available, our operations would be adversely effected.

We do not generate any revenues from production and do not have sufficient financial resources to undertake by ourselves all of our planned exploration programs. We have limited financial resources and have financed our operations primarily through the sale of our securities such as common shares. We will need to continue our reliance on the sale of our securities for future financing, resulting in potential dilution to existing shareholders.

Further exploration programs will depend on our ability to obtain additional financing which may not be available under favourable terms, if at all. If adequate financing is not available, we may not be able to commence development or continue with our exploration programs.

Future sales of our common shares into the public market by holders of our options and warrants may lower the market price, which may result in losses to our shareholders.

As of August 31, 2013, we had 60,850,982 common shares issued and outstanding. In addition, as of August 31, 2013, 3,781,500 common shares were issuable upon exercise of outstanding stock options, all of which may be exercised in the future resulting in dilution to our shareholders. As of August 31, 2013 we may issue stock options to purchase an additional 2,303,598 common shares under our existing stock option plan, subject to receipt of necessary approvals from the TSXV and the NYSE MKT. See “Item 6. Directors, Senior Management and Employees – Share Ownership – Stock Option Plan.” In addition, as of August 31, 2013, there were 2,090,667 outstanding share purchase warrants to purchase our common shares at an exercise price of $1.85 per share, all of which have expired as of the date of this annual report. As of August 31, 2013, our senior officers and directors beneficially owned, as a group, 13,110,010 common shares (22%), including stock options and warrants to acquire an additional 1,638,583 common shares.

-20-

Sales of substantial amounts of our common shares into the public market, by our officers or directors or pursuant to the exercise of options or warrants, or even the perception by the market that such sales may occur, may lower the market price of our common shares.

We have no history of paying dividends, do not expect to pay dividends in the immediate future and may never pay dividends.

Since incorporation, we have not paid any cash or other dividends on our common shares and do not expect to pay such dividends in the foreseeable future. Our intention is that all available funds will be invested primarily to finance our mineral exploration programs.

The market price of our common shares is extremely volatile and can be affected by many factors.

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market prices of securities of many mineral exploration companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. The price of the common shares is also significantly affected by short-term changes in mineral prices or in our financial condition or results of operations as reflected in our quarterly financial reports. Other factors unrelated to our performance that may have an effect on the price of our common shares include the following: the extent of analytical coverage available to investors concerning our business may be limited if investment banks with research capabilities do not follow our securities; lessening in trading volume and general market interest in our securities may affect an investor’s ability to trade significant numbers of the common shares; and the market price of our common shares and size of our public float may limit the ability of some institutions to invest in our securities.

If we issue additional common shares, or securities convertible into common shares, our existing shareholders will experience dilution of their ownership interests.